Hang Seng TECH Index: Invest in Top Chinese Tech Companies – ALL AT ONCE!

From creating mimics of other countries’ tech gadgets 1 – 2 decades ago, to becoming the world’s leading innovator today. Indeed, the Chinese tech scene has come a long, long (fruitful) way.

These days, almost everyone uses some form of tech products or services from China – be it a Xiaomi smartphone, WeChat, or even online shopping from Taobao.

All of us know that Chinese tech companies are here to stay, and more so – grow.

Hence, today, let's explore the Hang Seng TECH Index, where we can invest in these top Chinese tech companies, all at once:

p

Introducing the Hang Seng TECH Index

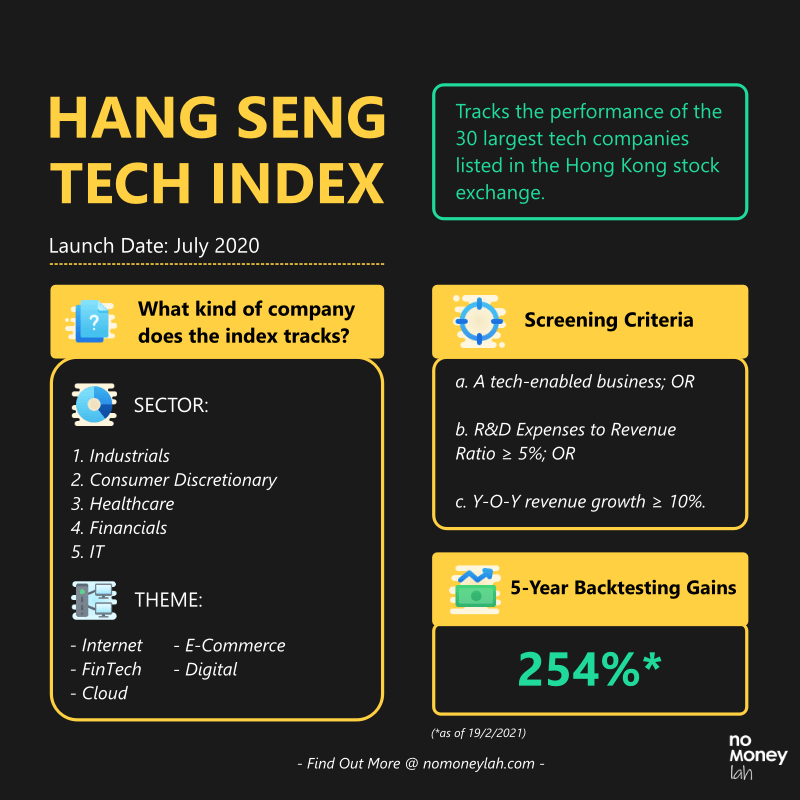

Recently launched in July 2020, the Hang Seng TECH Index is an index that tracks the performance of the 30 largest technology companies listed in Hong Kong.

A. Highlights of the Hang Seng TECH Index:

- The Hang Seng TECH Index tracks the performance of the 30 largest technology companies listed in the Hong Kong stock exchange. In order to be part of the index, these companies also need to be incorporated in Greater China (ie. Mainland China, Hong Kong, Taiwan & Macau).

p - Some notable companies that made up the component of this index include Tencent, Alibaba, Xiaomi, Lenovo, and more.

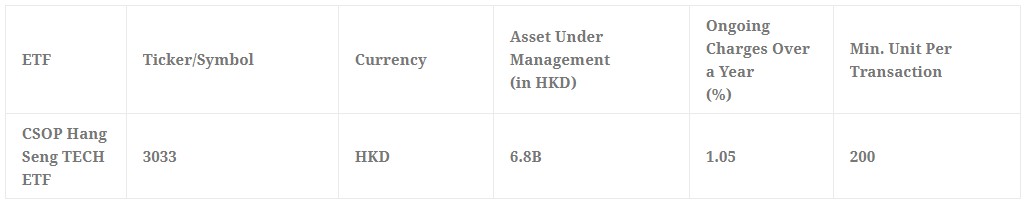

p - One cannot invest directly at the index. Instead, we can do so via ETFs that track the index – such as the CSOP Hang Seng TECH Index ETF (ticker: 3033).

p

B. What goes into the Hang Seng TECH Index?

Now, not all tech companies listed in the Hong Kong stock exchange can be part of the index. To become a component of the index, a tech company needs to fulfill the following:

- A company must be part of the Industrials, Consumer Discretionary, Healthcare, Financials, or Information Technology sector.

p - The company must revolve around the theme of Internet, FinTech, Cloud Technology, E-Commerce, or Digital.

p - In addition, the company must be:

- A tech-enabled business (via mobile/internet platform); OR

- Has an R&D Expenses to Revenue Ratio of equal to or more than 5%; OR

- Has a year-on-year revenue growth of equal to more than 10%.

As a result, these screening criteria ensure that only tech companies with a respectable prospect & growth can become part of the index.

p

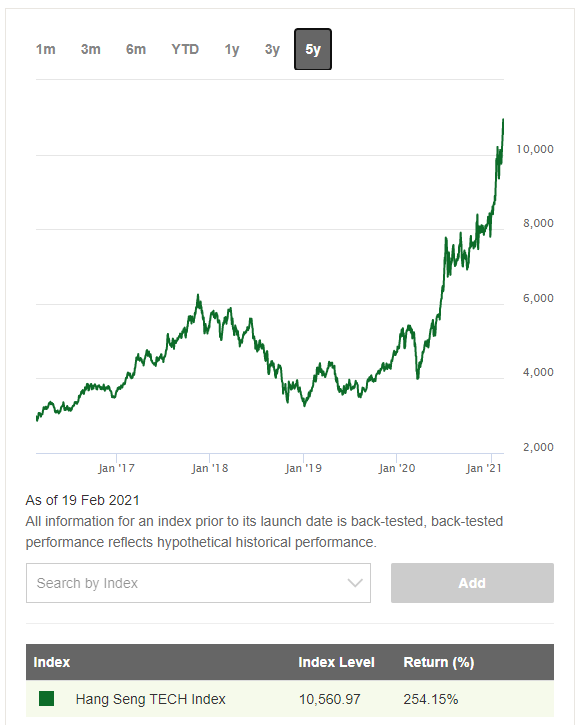

C. Hang Seng TECH Index Performance

Since the index is a newly launched index in 2020, there are not many details on its exact performance (yet).

However, based on the 5-year back-tested result of the index, it would have posted a gain of 254% - which I think is very respectable.

p

How to Invest in the Hang Seng TECH Index?

An index is not something that one can invest in directly. Instead, investors can invest in Exchange Traded Funds (ETFs) that track the performance of the index.

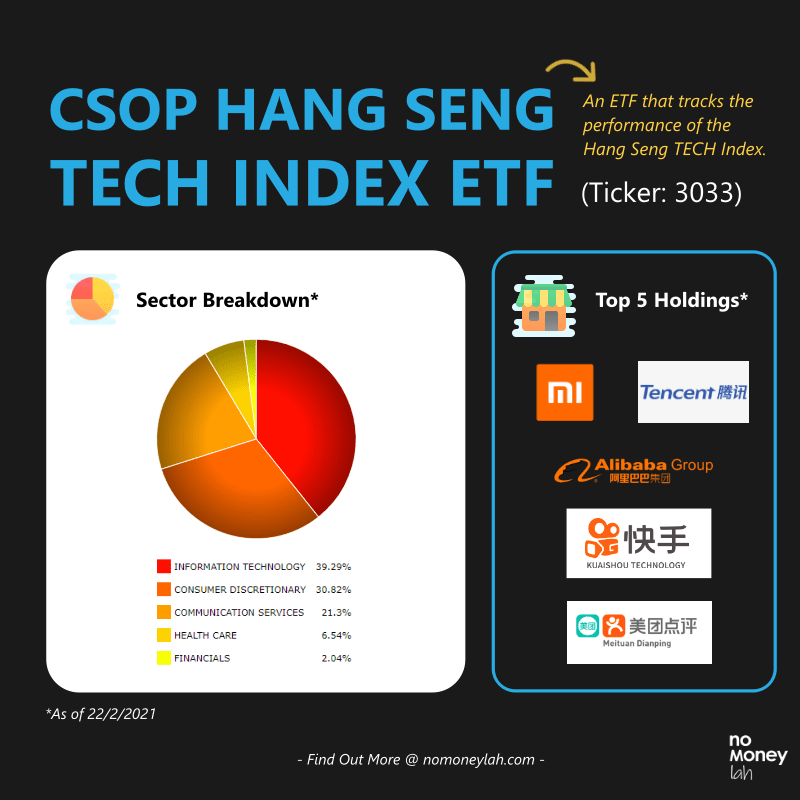

One such ETF is the CSOP Hang Seng TECH Index ETF. This is an ETF that tracks the performance of the Hang Seng TECH Index, where investors can invest even with small capital.

p

CSOP Hang Seng TECH Index ETF: Your Gateway to Invest in Top Chinese Tech Companies - All at Once

The CSOP Hang Seng TECH Index ETF (ticker: 3033) is the world’s 1st listed ETF to track the Hang Seng TECH Index.

To ensure the best performance tracking, the ETF uses a full-replication strategy. What this means is that the ETF will invest funds directly into the companies that make up the index.

As an example, if Company A makes up 8% of the Hang Seng TECH Index, then CSOP Hang Seng TECH Index will have about the same proportion of holdings on Company A’s shares.

One amazing thing about investing in this ETF is it allows investors to invest in a basket of Chinese tech stocks even with small capital.

Let's say CSOP Hang Seng TECH Index ETF is trading at HKD9.85 (~RM5.15) per unit. Since this ETF only has a minimum entry barrier of 200 units, an investor only needs to have less than HKD2000 (~RM1050) to gain exposure to a basket of growing Chinese tech companies. [HKD9.85 * 200 units = HKD 1970 (~RM1027)]

READ MORE: CSOP Hang Seng TECH Index ETF Official Site

p

Top Holdings of the CSOP Hang Seng TECH Index ETF

The Hang Seng TECH Index is made up of tech companies mainly from the Information Technology, Consumer Discretionary, and Communication Services sector.

Here are the notable companies from the top holdings of the CSOP Hang Seng TECH Index ETF (as of 22nd Feb 2021):

#1 Xiaomi Corporation (Approx. Weightage: 8.59%)

All of us know Xiaomi as a major world’s smartphone brand. However, the company has been expanding its own brand ecosystem into products like laptops, smart home appliances, mobile apps, and more.

p

#2 Tencent Holdings (Approx. Weightage: 8.23%)

Tencent is a Chinese multinational tech conglomerate that is most known for owning WeChat, China’s top social mobile application.

But Tencent is MORE than that. Tencent is also one of the largest venture capital and game vendor in the world, with notable titles such as PUBG under its portfolio.

Tencent’s business also covers music, payment system, internet services, and more.

p

#3 Alibaba Group (Approx. Weightage: 8.21%)

Alibaba needs no extra introduction. Alibaba’s dominance in e-commerce and internet technology via platforms like Taobao, Tianmao, AliPay, and more truly propels the company to be one of the top tech companies in the world.

p

#4 Kuaishou Technology (Approx. Weightage: 7.96%)

I am sure you have heard of TikTok. Kuaishou is the rival of TikTok which has just become a publicly listed company in early 2021.

Through Kuaishou, the company’s 769 million monthly active users are able to post short videos and even do live-streaming on the platform.

With such a huge userbase, Kuaishou makes money through its live streaming business, ads & online marketing, and more.

p

p

#5 Meituan Dianping (Approx. Weightage: 7.75%)

Think of Grabfood/Foodpanda + Foursquare + TripAdvisor + Fave. Meituan Dianping is the Chinese version of all of these services – at a much larger scale.

Essentially, Meituan Dianping is made up of 2 apps (Meituan & Dianping). These are the must-have apps in China for food delivery, restaurant and destination reviews, and more. During my 1-month stay in Shanghai & Hangzhou in 2019, both Meituan and Dianping are my go-to app to order food, check out travel destinations, and more.

p

What You Need to Know + Risks of Investing in Hang Seng TECH Index

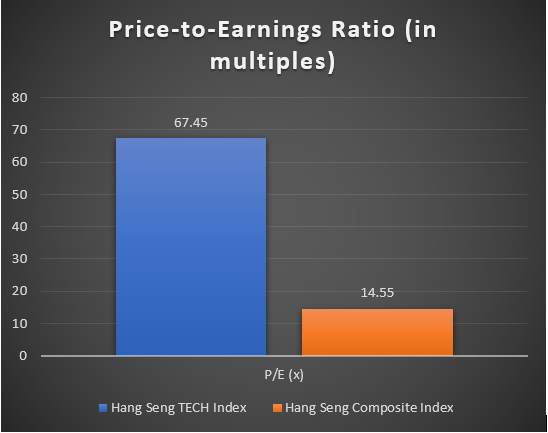

#1 Higher than Average Valuation

Since the companies in this index are generally growth companies, you should note that the index tends to trade at a higher valuation.

As of January 2021, the Hang Seng TECH Index has a price-to-earnings (P/E) ratio of 67.45x. In comparison, the Hang Seng Composite Index has a price-to-earnings (P/E) ratio of 14.55x during the same period.

In short, investors should be willing to pay a premium for investing in high-growth tech companies.

#2 Volatility of Business & Political Nature

Investors that are looking to invest in the Hang Seng TECH Index should also be aware of the volatile nature of the tech sector.

With stiff competition and the risk of Chinese government intervention, investors should take into account of higher than usual price fluctuation of the individual component companies and the index itself.

That said, the risks of investing in the index are lower relative to investing in the shares of individual Chinese tech companies.

Thanks to the screening requirement of the index, the components of the index are always updated with the most competitive Chinese tech companies, while leaving the obsolete ones out of the way.

p

Who Should Invest in Hang Seng TECH Index ETF?

The offering from the Hang Seng TECH Index ETF is certainly very appealing, but is it for you?

In my opinion, this ETF can be considered if you fall into either one of the categories below:

- Investors looking to diversify their portfolio into a basket of fast-growing Chinese tech sector.

p - Investors with limited capital (which makes it hard to purchase individual shares), but would like to gain exposure in the Chinese tech sector.

p

My Recommended Broker to Invest in CSOP Hang Seng TECH Index ETF (Ticker: 3033):

As you may have guessed by now, CSOP Hang Seng TECH Index ETF is not listed locally. Instead, it is being traded in the Hong Kong stock exchange in Hong Kong Dollar (HKD).

As such, you’ll need a reliable stock broker with access to the Hong Kong stock exchange in order to invest in this ETF.

If you do not have a stock broker, I’d highly recommend Tiger Brokers to you. Tiger Brokers is my go-to regulated stock broker that provides all-in-one access to markets such as the US, Singapore and Hong Kong stock market – all at a highly competitive fee.

Check out my full review on Tiger Brokers HERE.

ALSO READ: How to Invest in Your First Stock via Tiger Brokers

p

No Money Lah’s Verdict

So here you go! If you have been looking for an affordable way to invest in the top Chinese tech companies, I hope you find this article useful!

Personally, I had such a great time writing this article as I have always been interested to invest in the Chinese tech scene for a long time.

How ‘bout you? Do you have any questions on the Hang Seng TECH Index? Feel free to let me know your thoughts & questions in the comment section below!

About CSOP Asset Management

I first discovered the Hang Seng TECH Index through CSOP Asset Management (AM).

If you have been investing purely in the Malaysia or US market, it is likely that you have not heard of CSOP AM before. However, CSOP AM is huge in the China & Hong Kong market:

- Established in 2008, CSOP AM is the first offshore entity established by a regulated Chinese asset manager with Hong Kong’s Securities & Futures Commission (SFC) type 1 (dealing in securities), type 4 (advising on securities) and type 9 (asset management) licenses.

p - With this background, CSOP AM manages the biggest renminbi (RMB) equity & fixed income ETF listed in offshore China.

p - In late 2019, CSOP AM sets up their office in Singapore, with the goal to bring China’s gradually opening capital market to Southeast Asia’s investors (psst... that’s us).

In essence, through CSOP AM ETFs, foreign investors like you and me have the opportunity to gain exposure to China’s growing capital market.

Disclaimer

The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please do your own research AND/OR reach out to a licensed financial planner before making any investment decision.

What is Ethereum? (& Why I am More Excited about Ethereum over Bitcoin!)

Ethereum is the world's 2nd largest cryptocurrency network, right behind Bitcoin. However, there is more to Ethereum aside from its market size - and in my opinion, a more appealing investment compared to Bitcoin.

In this article, let's explore Ethereum, and why I am more excited about Ethereum over Bitcoin!

p

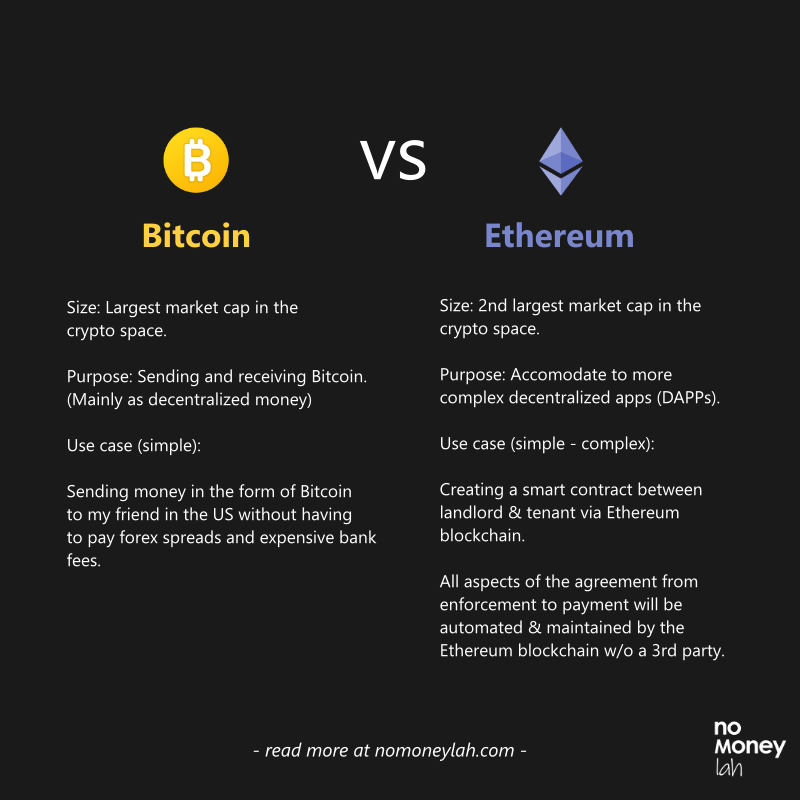

Bitcoin vs Ethereum – What’s the Difference?

The topic of Ethereum cannot start without talking about Bitcoin:

Bitcoin as we know it, is a form of decentralized money – ie. You can transact and send money without a central authority in place. This is done through the underlying technology – Blockchain.

With Bitcoin being the successful real-life application of Blockchain technology, this opens up to a lot of possibilities:

Aside from sending and receiving money, what are some other things that can be decentralized in our daily life?

-

- How about executing contracts’ clauses without a lawyer?

- How about buying & processing insurance claims without an agent?

- How about automating house rental agreements without any 3rd party in between?

- And basically, any processes that require a middleman in between!

The idea of removing a central party in all these scenarios comes with obvious consumer benefits, namely:

-

- Save money on intermediary fees across the board (which can be a huge sum).

- More efficient execution without delay and human errors.

However, there is a problem. The Bitcoin blockchain is designed around a programming language called Turing Incomplete, where it is built to only execute simple tasks – eg. A sends X amount of money to B, and nothing more.

Because of the programming limitation, building complex commands on the Bitcoin blockchain is extremely hard.

Here’s where Ethereum comes into the spotlight.

READ MORE: What is Bitcoin? (Explained in Simple English!)

p

What is Ethereum and How does it work?

Ethereum is the world’s 2nd largest blockchain network, first released in 2014 by a Russian named Vitalik Buterin. (p.s. we are both the same age hehe)

At its core, Ethereum is a Do-It-Yourself (DIY) platform for Decentralized Applications (DAPPs). This means that anyone can use the Ethereum blockchain to create their own decentralized solutions these days.

Why though? Why are people using the Ethereum blockchain to develop DAPPs instead of the Bitcoin blockchain?

Simply put, Solidity, the programming language behind the Ethereum blockchain, allows for more complex commands compared to the Bitcoin blockchain. This is what we call smart contracts.

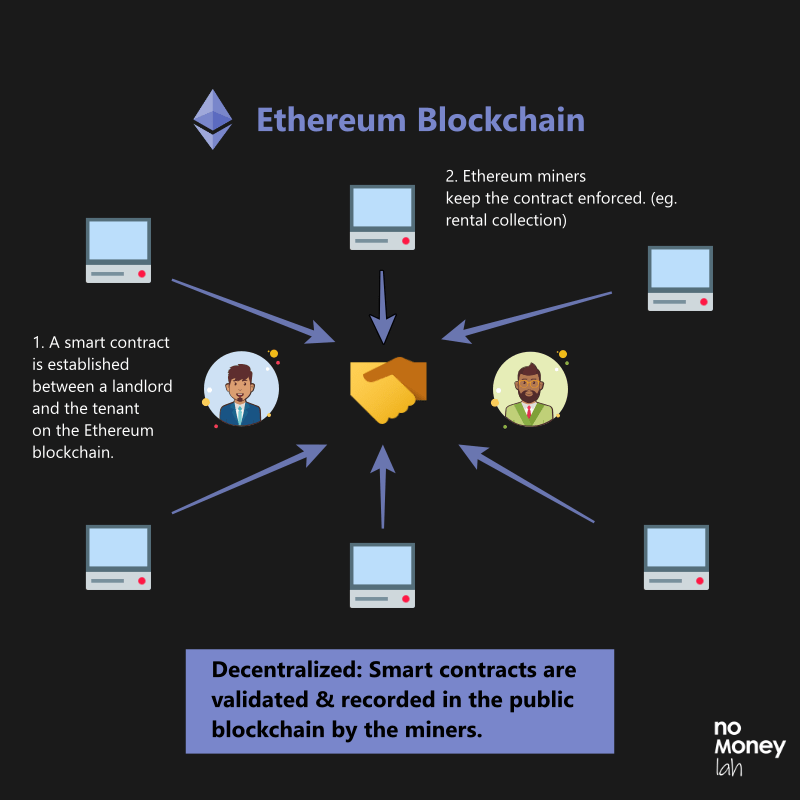

As an example, a landlord and tenant that want to automate the clauses of a house rental agreement without any 3rd party in between. Through the Ethereum blockchain, a smart contract can be created to do exactly that:

Tenant pays landlord X amount of rent every month.

IF tenant does not pay rent for 1 month, THEN deduct X amount of money from the initial rental deposits.

IF tenant does not pay rent for 3 months, THEN lock tenant out of the house.

And so on.

In essence, the smart contract deals with all aspects of the contract, from enforcement, management, and payment – effectively removing any middlemen in the process.

p

Ethereum as a Currency

When people talk about Ethereum’s price, they are essentially referring to the cryptocurrency Ether (ETH).

Just like Bitcoin (BTC) is the cryptocurrency that powers the Bitcoin blockchain, Ether (ETH) is the lifeblood of the Ethereum blockchain network.

Anyone that wants to send ETH cryptocurrency, or uses applications powered by the Ethereum blockchain has to pay a small fee in ETH. This small ETH fee is an incentive for miners to process and verify an activity within the Ethereum blockchain – this is a mechanism called Proof of Work (PoW).

Miners are computers that run the Ethereum blockchain protocol. Miners make up of a large network of computers that act like the record-keepers of the Ethereum blockchain - they check and prove that no one is cheating.

On the other hand, by ensuring the Ethereum blockchain is secure and free of centralized control, miners are incentivized with ETH in the process.

p

Potential & Risks of Investing in Ethereum

Opportunity #1: Huge Development of Decentralized Finance (DeFi) Initiatives

Decentralized Finance, or DeFi is probably the biggest reason why Ethereum appeals much more to me compared to Bitcoin as an investment.

Inspired by the Bitcoin blockchain that allows simple value transfer (eg. sending money), DeFi are initiatives that expand the use of blockchain into more complex financial use cases without a central authority.

Some example includes loans, insurance, crowdfunding and more. In short, imagine all the financial services that you are using today, but without the inefficiencies of a middleman – pretty neat!

While most people may not hear of DeFi before, but DeFi has been developing in a rapid manner for the past few years. In February 2020, the total value locked-in for DeFi initiatives were about $1 billion. As of Jan 2021, the total value locked-in for DeFi stands at over $19 billion. That is almost 20x growth over an 11-month period!

And guess which blockchain is driving the most DeFi initiatives in the world today? Yup, Ethereum.

p

Opportunity #2: The Development of Ethereum 2.0

Ethereum 2.0 is a major improvement to the current Ethereum 1.0 blockchain. The first phase of the Ethereum 2.0 launch happened at the end of 2020.

Ethereum 2.0 is an important milestone for the Ethereum blockchain. It is essentially an update with the final goal to remove miners from the Ethereum blockchain ecosystem.

In Ethereum 1.0, miners are the validation mechanism (a.k.a. Proof of Work, PoW) used, which requires unsustainable energy usage due to the mass computing power needed. Ethereum 2.0 aims to use a new validation approach call Proof of Stake (PoS).

Without going into too much technical stuffs, Ethereum 2.0 allows the whole blockchain to be more energy efficient. In return, this will enable better scalability and speed within the Ethereum blockchain.

This development is a huge milestone for Ethereum, because it allows the activities within the blockchain to happen in an efficient manner. This effectively future-proof Ethereum towards catering for larger scalability in the future.

p

Risk #1: Mainstream Adoption + Scalability Challenges

At this stage, while Ethereum’s potential has started to catch more eyes, it is hard to say that it has entered a mainstream adoption yet.

As an example, while it is possible to create an Ethereum smart contract between a landlord and tenant, but any disputes down the line would be hard to resolve via existing legal channels as smart contracts are not legally binding.

In my opinion, for Ethereum to start getting further momentum, more entities like the legal and financial sector have to start recognizing the legal status of smart contracts. Following that, relevant entities have to come up with standard procedures for dealing with disputes related to smart contracts as well.

As you can see, these are not easy challenges for Ethereum to overcome. Surely, we can see the potential future that Ethereum can offer, but the extent of these potentials truly depends on how far we are willing to embrace the changes to come.

Up next, price volatility.

p

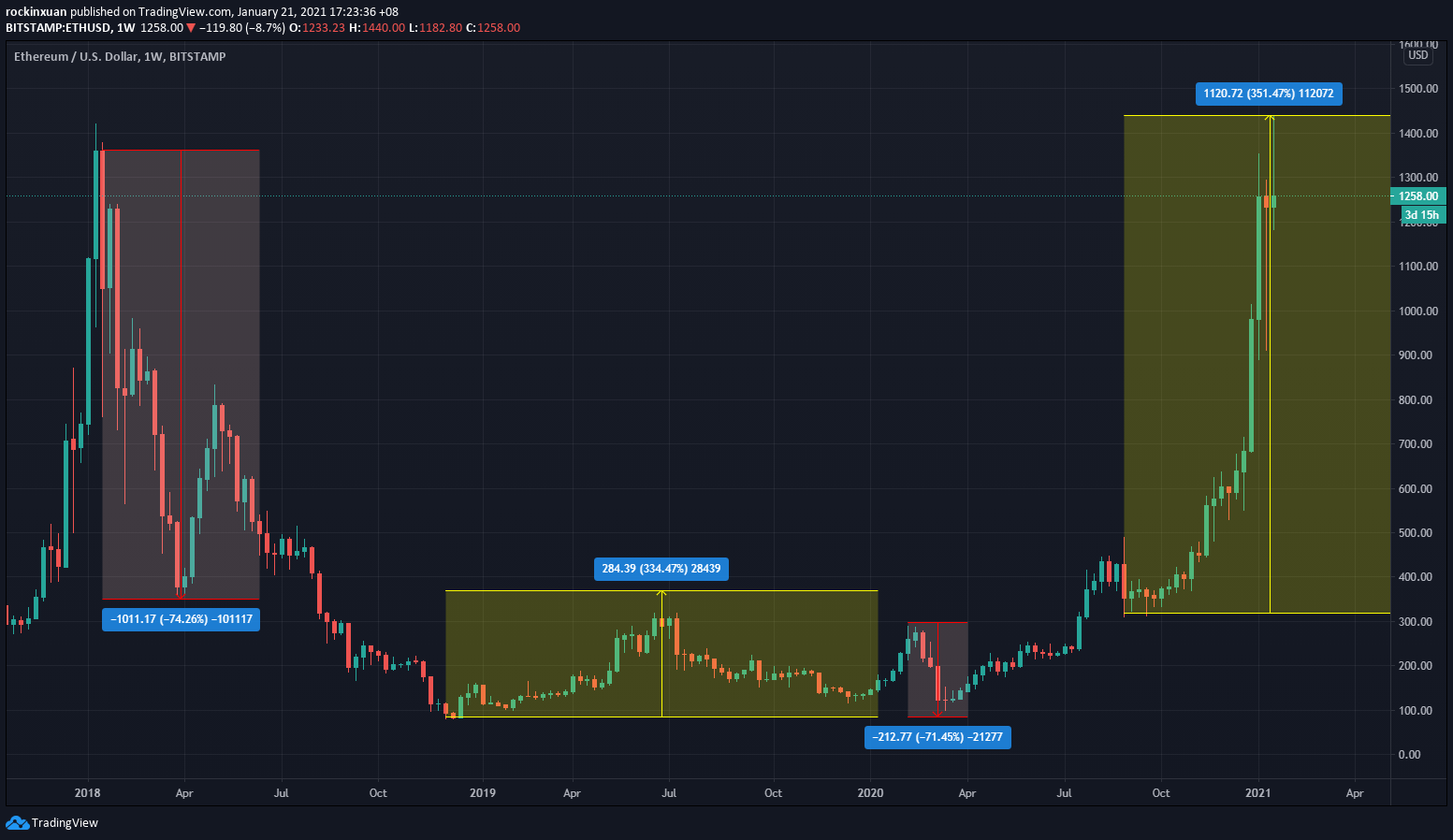

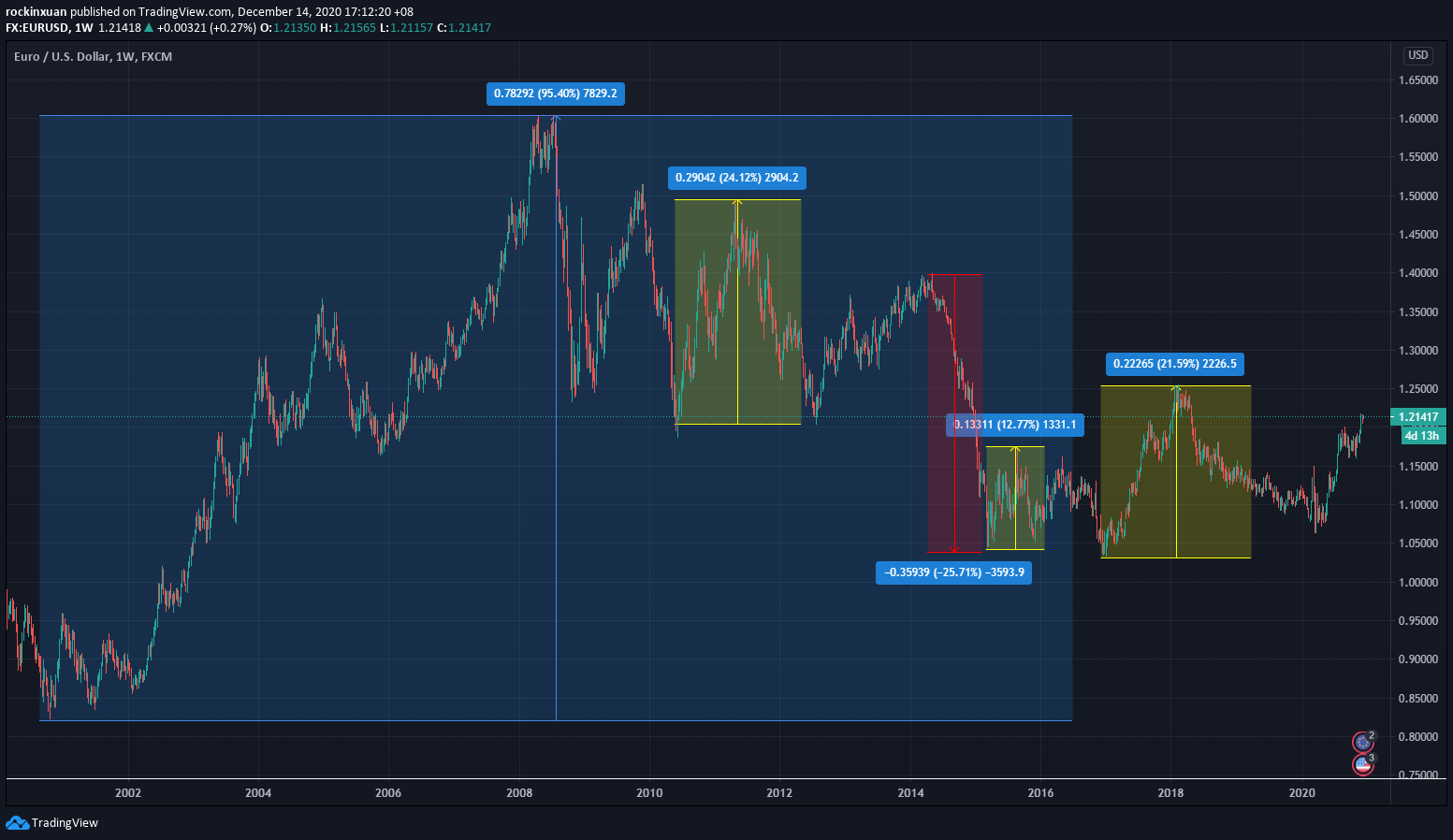

Risk #2: Volatile, volatile, volatile

Just like Bitcoin, Ether (ETH) can extremely volatile compared to conventional investment assets.

In early 2021, ETH’s market cap (Market Cap = Total ETH in circulation * Price) has grown to over $100 million. In comparison, the market cap of ETH in August 2020 was half this amount.

However, relative to things like the gold market (~$3 trillion), ETH is a much smaller market. Even when compared to Bitcoin’s market cap (~$350 billion), ETH is still very much smaller.

This means that ETH is more easily affected by daily fluctuation in buying and selling – just like how a rock can cause bigger ripples in a small pond than the large sea.

As a result, ETH’s volatility makes it extremely hard to become a stable medium of exchange like our existing currencies.

ETH’s volatility also poses a challenge for its mainstream adoption and harder for most risk-averse investors to accept ETH as part of their portfolio.

p

Should You Invest in Ethereum?

For me, the decision of whether one should invest in Ethereum is very similar, yet different from Bitcoin’s.

For Bitcoin, it is about whether we are happy with how our existing central authority is treating the value of our money with the people’s interest in mind. This question is to some extent, an ideological question that is relatively simple to answer – ie. Should we decentralize our money?

Ethereum, on the other hand, is about decentralizing the existing system as well.

However, what makes this discussion more interesting is the depth of how Ethereum can explicitly change our life – from how we take loans, negotiate for agreements, buy insurance, and more.

So the question on Ethereum is this: Do you think we should decentralize anything else that involves a middleman?

Or rather, do you think your job is ready to face the disruptions brought upon by decentralization?

p

How to invest in Ethereum in Malaysia?

All in all, having seen both the upsides and risks of Ethereum, I hope you now have an additional layer of clarity towards your investing decision.

The next question: How can you invest in ETH and cryptocurrencies in Malaysia?

Presently, there are 3 cryptocurrency exchanges that are approved by Securities Commission (SC) to operate digital asset exchanges. This means that these are 3 regulated exchanges where Malaysians can buy and trade Bitcoin and other cryptocurrencies.

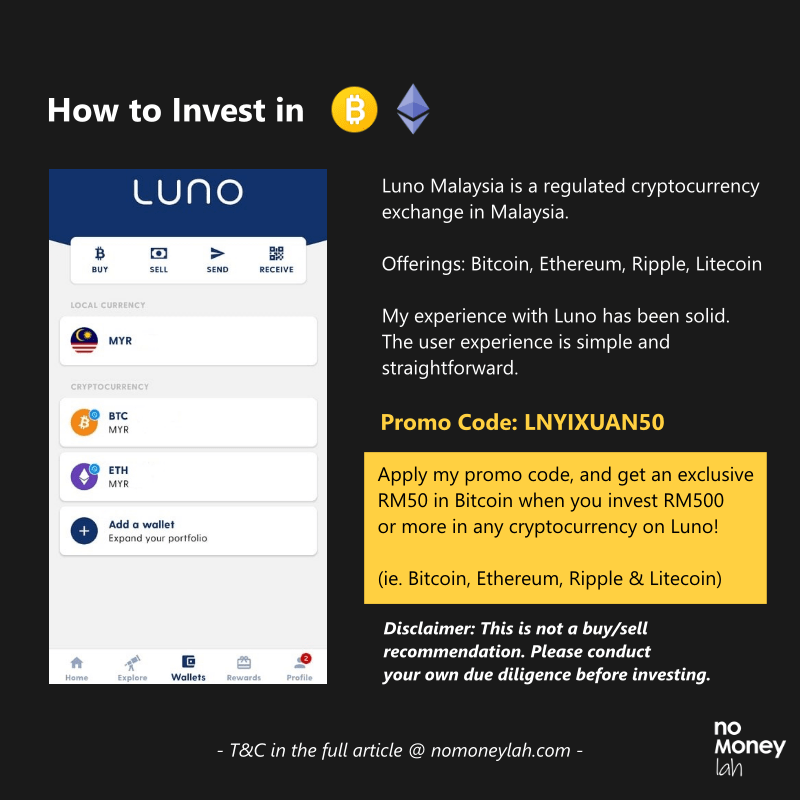

Personally, I have been using Luno, the largest of the 3 regulated exchanges since 2017 and I am more than happy to recommend Luno for investors looking to invest in cryptocurrencies safely.

I will work on a dedicated Luno review soon, but here’s a brief rundown of its features:

- Multiple Offerings: The biggest SC regulated cryptocurrency exchange which offers Bitcoin, Ethereum, Ripple, and Litecoin.

p - High Security: The majority of Luno’s customers’ cryptos are stored in a Deep Freeze storage – ie. A multi-signature wallet system, with private keys stored in different bank vaults. This means that no single person ever has access to more than one key, which translates to a high level of security of users’ cryptocurrency holdings.

p - Simple, user-friendly interface: Luno’s interface is exceptionally intuitive and simple to use. Every button and main functions are readily reachable and transacting ETH is straightforward.

p - PROMOTION: No Money Lah is now collaborating with Luno Malaysia to bring the best-in-town deal for new Luno users that are keen to invest in cryptocurrencies! Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more in any cryptocurrencies (Bitcoin/Ethereum/Litecoin/Ripple). That’s an instant 10% return on your investment.

p

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

p

No Money Lah’s Verdict

Wow, I hope you have enjoyed reading this article and found some useful insights in it!

For me, I had a good time writing this article as I have always been fonder of Ethereum over Bitcoin due to the potential impact that Ethereum can bring upon the future.

So now’s your turn:

What do you think about Ethereum? Are you planning to invest in Ethereum? If yes, why? If no, why? Let me know your thoughts at the comment section below!

Looking forward to hear from you soon!

Keen to Start Investing in Bitcoin, Ethereum, and Cryptocurrencies?

In collaboration with Luno Malaysia, No Money Lah is bringing the best-in-town deal for new Luno users that are keen to invest in cryptocurrencies!

Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more in any cryptocurrencies (Bitcoin, Ethereum, Litecoin, Ripple). That’s an instant 10% return on your investment.

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

Open Your Luno Account HERE.

Disclaimer: This article produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Information in this article is accurate as of the time of production. Please consult a licensed financial planner before making any investment decisions.

The Law of Large Numbers

Dear readers,

Over the span of 2 years, I have written more than 100 blogposts on No Money Lah.

Out of these 100 posts, 10 drive the most traffic to my site.

--

In 2013, Warren Buffett said that he has owned 400 – 500 stocks in his life.

Out of all the stocks he owned, most of the money he made comes from just 10 of them.

--

In a world where the outcome is so easily seen on social media, we often overlook the everyday (hard) work and (good & bad) decisions behind the scene.

Here are my takeaways:

- Show up, and do the work – even when it doesn’t make sense right away. You never know if one of the many decisions/works that you make on a random day would propel the trajectory of your career/life forever.

p - 90% of things that happen to us (good or bad) are the result of the 10% of choices that we make in life.

p - Big wins are rare. Focus on making consistent small wins while keeping losses even smaller – so you can stay in the game long enough for the big breakthrough to happen.

p - Or maybe I’m just a noob blogger? (haha!)

Talk soon!

Yi Xuan

The Best Place to Store Your Emergency Funds in 2021

Dear readers,

We started 2021 off with a worrying note.

Last week, the number of pandemic infections has been hitting historical highs. Today (11/1), it is likely that the prime minister will announce restrictive measures in hope to improve the situation.

If anything, this pandemic has taught us 2 solid money lessons:

- Lesson #1: Anything can happen in life. That’s why it’s crucial for us to have an emergency fund in place.

p - Lesson #2: We can never tell for sure how long a challenging period will continue to drag on. That’s why 3-month of emergency fund is better than none, 6 is better than 3, 12 is better than 6, and so on.

Regardless, it doesn’t seem like 2021 is getting any better (yet) from the pandemic. Hence, it is only wise that you have several months of funds in place to support your expenses if anything were to happen.

Best place to store your emergency funds?

#1: FRANK by OCBC high-interest savings account

FRANK by OCBC is a one-of-a-kind savings account that was released in 2020.

What makes this savings account by OCBC unique from the others is that it offers a straightforward and competitive interest of 1.80% annual interest. This means that users can enjoy the stated interest without the troublesome restrictions/conditions imposed by conventional savings accounts.

Some of the highlights of FRANK by OCBC are:

- Save Pot & Spend Pot feature: Adjust your money accordingly when you want to save or spend.

- Earn interest up to 1.80% per annum for money saved on Save Pot + 0.3% per annum for money in Spend Pot.

- No typical FD lock-in period & withdrawal penalty. Minimum account balance & initial deposit of RM20 (extremely low barrier of entry).

- Debit card & online banking function. Withdraw money at no extra charges from any ATM by OCBC (Malaysia, SG, Indonesia, HK & Macau)

- Capital is protected by PIDM up to RM250,000.

Downsides:

- You’d need to visit an OCBC branch to complete your account-opening process.

- Relatively lower interest than money market solutions (eg. StashAway Simple)

Personally, I have been using FRANK by OCBC since November last year and I enjoy the no-hassle yield on my savings.

I highly recommend FRANK by OCBC to you if you are looking for a straightforward high-interest account to place your emergency funds.

Read my full review on FRANK by OCBC HERE.

p

#2 StashAway Simple

StashAway Simple one of my favorite financial products that was released in 2020.

Essentially, it is an investment solution that invests in money market funds (eg. High-credit-rating short-term debt by institutions and governments) with a projected annual yield of 2.4%.

Some of the highlights of StashAway Simple are:

- Account opening process is all done online.

- Earn a projected yield of 2.4%/year. (p.s. Maybank 12-month FD rate is at 1.85%)

- No minimum balance required – you can start using StashAway Simple at any amount, anytime you want.

- No lock-in period like FD – deposit & withdraw anytime you want.

Downsides:

- No capital protection by PIDM.

- Withdrawal takes around 3 – 4 working days to be processed. This could be an issue if you really need the money in a rush.

I have been using StashAway Simple since June 2020 and I have no problem recommending it to anyone looking for a more flexible FD alternative.

Read my full review on StashAway Simple HERE.

Hopefully the timing of this week’s newsletter is just right for you because it is always a good time to start examining the state of your emergency fund!

Talk soon,

Yi Xuan

Disclaimer: This is just a general sharing. You should always find the financial solution that fits your needs the most. Always seek a licensed financial planner for guidance and professional advice.

The Only Thing that Matter IF You Want to Grow Your Wealth in 2021

Which option would you choose?

Starting the year with RM100,000 (assuming you can’t use it for further investments), or getting RM0.01 that’ll double itself for every week for the rest of 2021?

The person that chooses the latter option will end up with RM22,517,998,136,852.50 by the end of the year (52 weeks) – thanks to the power of compounding.

In hindsight, making a choice doesn’t seem hard at all – and it is such irony that this is an easy decision to make.

Well, here’s the thing – you may have heard various versions of the story above about the power of compounding, but they are barely a true reflection of real-life situation:

- WHAT IF you were not told about the outcome ahead of time?

p - WHAT IF you’d need to put in consistent time and effort in growing the 1 cent, BUT you are not guaranteed the outcome?

p

- WHAT IF you’d need to change your money habits and routine for something that might not happen?

Suddenly, making a decision doesn’t seem to be that straightforward anymore.

Not everyone can live with uncertainties. Not everyone is willing to take action. Not everyone is far-sighted enough to change for the better.

Knowledge without courage = 0

Knowledge without action = 0

Knowledge without foresight = 0

When it comes to wealth building, knowledge is common. Courage is precious. Action is rare. Foresight is invaluable.

Here’s to a new year filled with possibility.

How My Finances Improved with the Help of a Licensed Financial Planner!

Since the end of last year (2019), I have been able to work with my first ever licensed financial planner to improve my overall finances.

Now that it’s the end of the year, and I would like to give you all an update on how this decision has impacted my financial life in 2020.

p

What exactly is a Licensed Financial Planner?

No kidding, the word ‘financial planner’ has been abused in so many ways to mislead everyday people like ourselves.

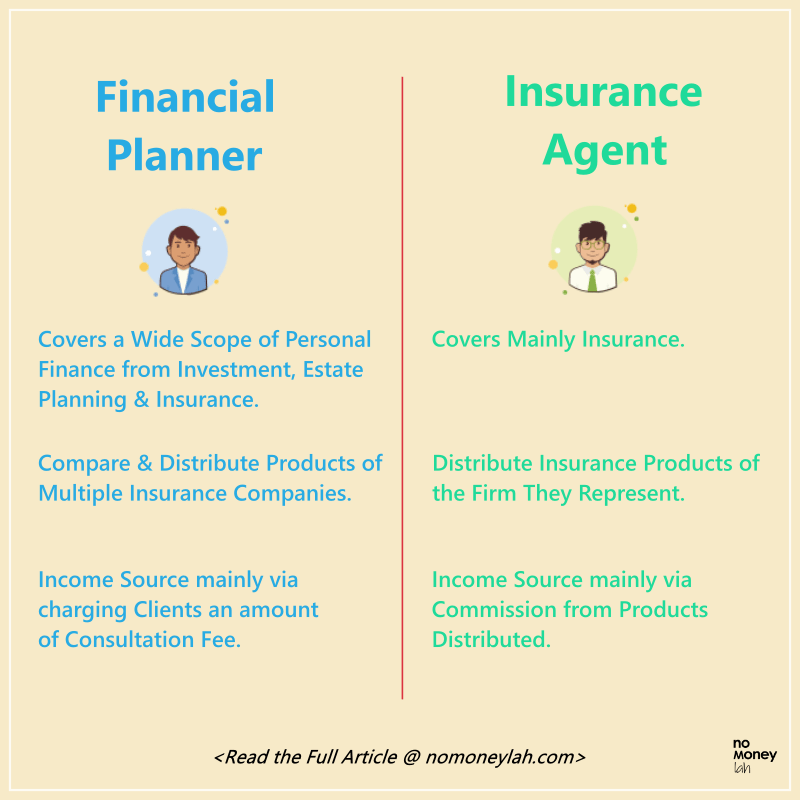

The thing is, not everyone can legally call themselves a financial planner. And there is actually a big difference between a licensed financial planner and an insurance agent.

So, what is a licensed financial planner, and who is qualified to be called a licensed financial planner?

Essentially, a licensed financial planner has more in-depth qualifications, namely:

- Capital Market Service Representative License, issued by Securities Commission (SC): Having this license allows a financial planner to conduct licensed financial planning in Malaysia – as such, be called a ‘financial planner’.

o - Financial Adviser Representative (FAR) License, issued by Bank Negara Malaysia (BNM): Having this license allows a financial planner to recommend insurance products from any insurance company.

On the other hand, the qualification of most insurance agents would stop at the Pre-Contract Examination for Insurance Agents (PCEIA) and Certificate Examination in Investment-linked Life Insurance (CEILI) papers. These are the papers that insurance agents have to take in order to start offering insurance solutions for one particular insurance company.

All of these qualification differences effectively separate a licensed financial planner and an insurance agent:

- A licensed financial planner can cover comprehensive aspects of personal finance from insurance, investment, budgeting, asset management, taxation, and estate planning. An insurance agent can only cover insurance.

p - A licensed financial planner can recommend insurance solutions from different insurance companies – truly representing the client & ensuring minimal conflict of interest. An insurance agent can only offer the solutions from the company that he/she represents.

p - A licensed financial planner earns mainly from the consultation fee that they charge to their client. An insurance agent earns from the commission of the insurance solutions sold.

Added together, working with a licensed financial planner ensures that the service provided is fully in the interest of the clients and no one else. That said, there is no one-size-fits-all solution when it comes to financial planning. One should go for the best-suited services by considering what’s best for him/her under their personal needs.

p

Alright, so how has working with a financial planner improved my finances?

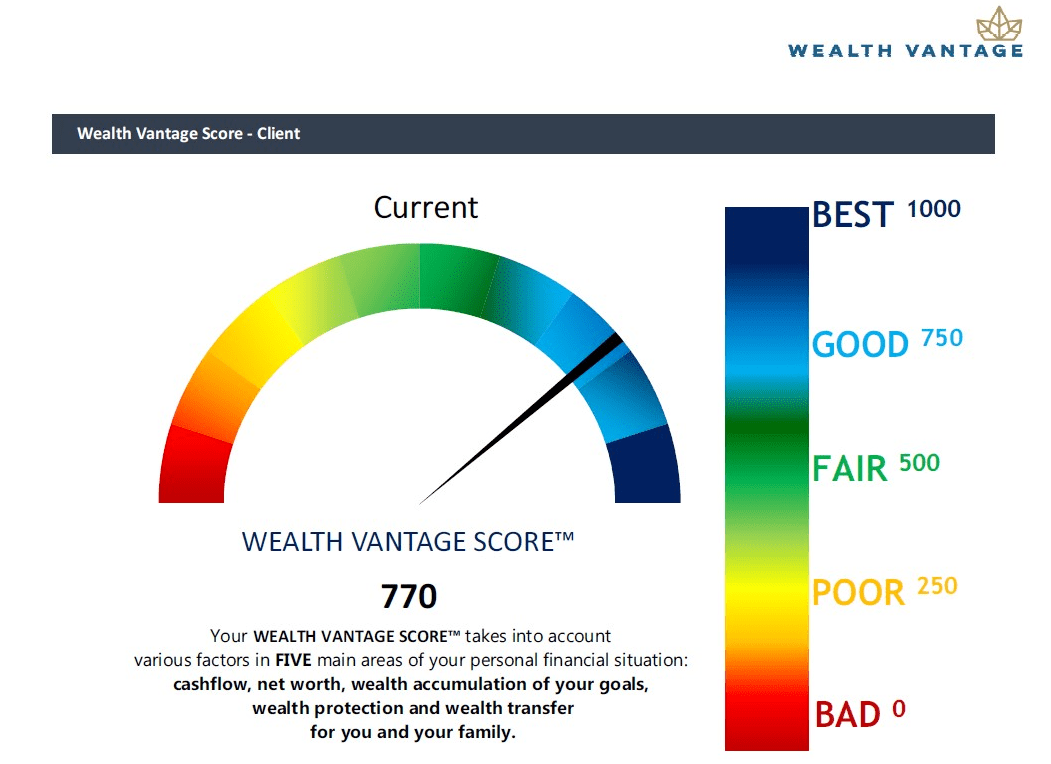

During the financial planning process with my financial planner last year, I was given a score to represent the overall state of my finances.

Last year, I got a score of 602 (borderline of ‘Good’). This score is a combination of my personal finances like cashflow, net worth, and other wealth accumulation factors. Since then, my financial planner, Stev recommended several action steps for me to improve my finances, such as:

- Establishing my emergency fund in money market fund.

- Optimizing my monthly contribution to EPF as a self-employed.

- Optimizing my proportion of cashflow to investment.

Fast forward to 2020, even with the pandemic hitting hard, I’ve managed to lift my overall financial score from 602 (borderline of ‘Good’) to 770 (‘Good’)! This means that my cashflow, net worth, and other wealth indicators improved in 2020 despite the whole Covid-19 crisis – not too shabby!

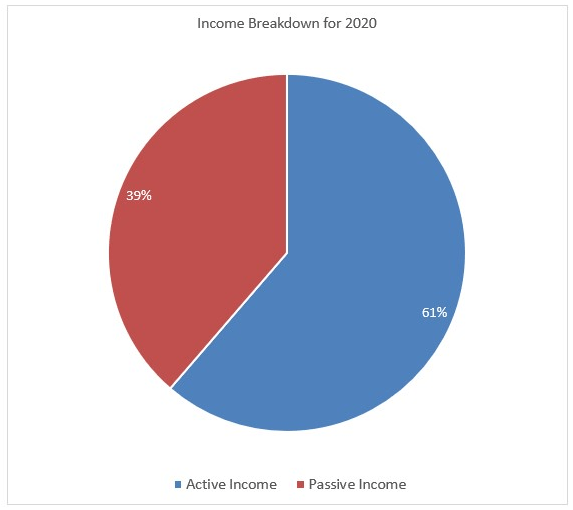

With the combination of working hard (correction: I worked like mad) and the guidance from my financial planner throughout the year, I managed to 2x my monthly income in 2020 while optimizing every penny of my hard-earned money to work for me.

Just for personal sharing, below is my income breakdown composition for 2020:

One achievement that I am quite satisfied with is that my passive income makes up nearly 40% of my overall income. These are monthly passive income that requires relatively less effort & commitment from my end, which consists of dividends, affiliates, and more.

Read Also: How is it like to work with a financial planner?

p

What I've Learned After Engaging a Financial Planner for 1 Year

For sure, people can certainly DIY their own finances. However, I’ve learned and benefitted a ton from my experience working alongside the guidance of a financial planner. Here’s a summary of the things I’ve learned/benefitted from the process:

#1 Perspective & Optimization

As a person, there is only so much we can learn from our own lenses when it comes to our personal wealth.

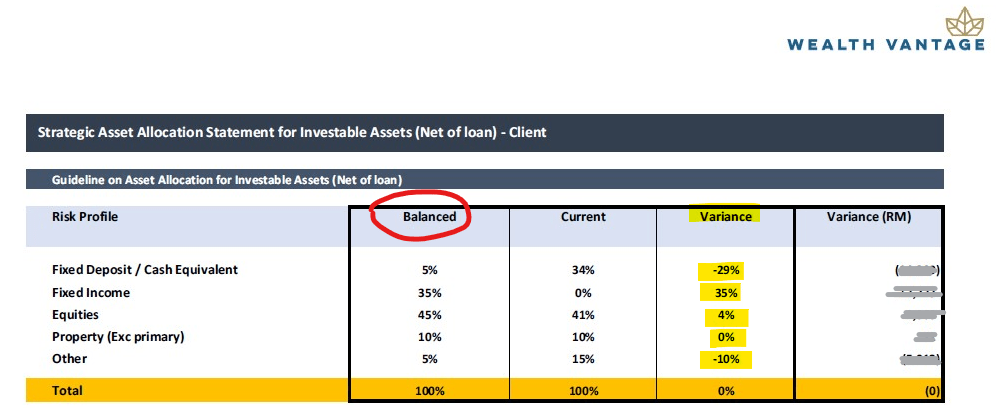

As an example, I was actually quite content with how I allocate my assets. However, upon in-depth review by my financial planner, we’ve discovered that my allocation is not well-optimized. In return, I was recommended a better allocation according to my risk profile.

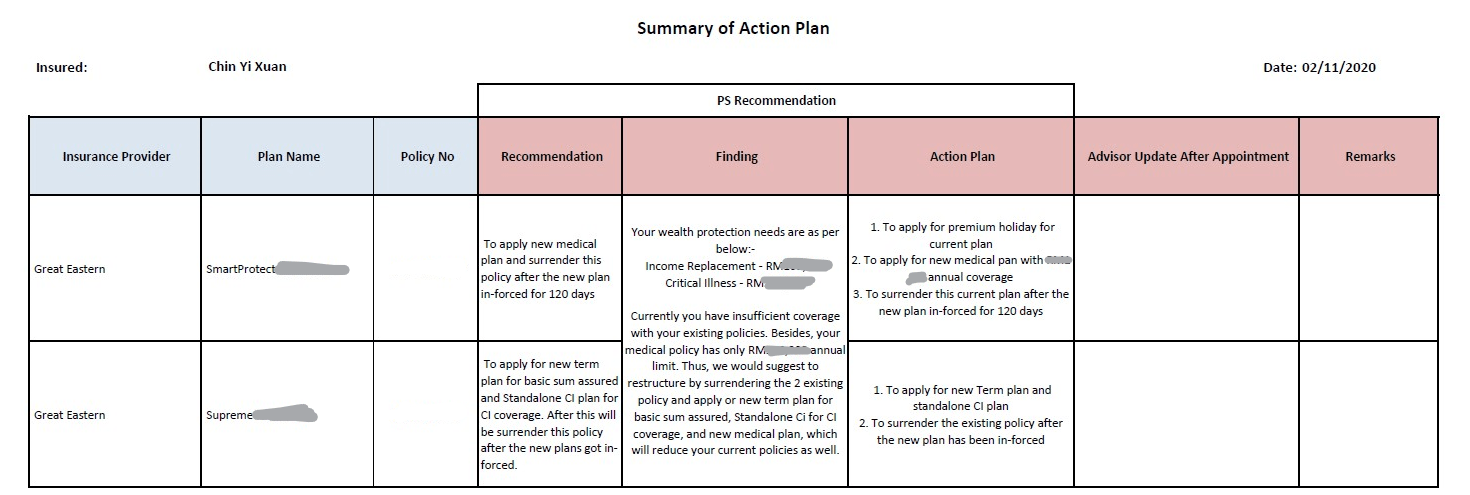

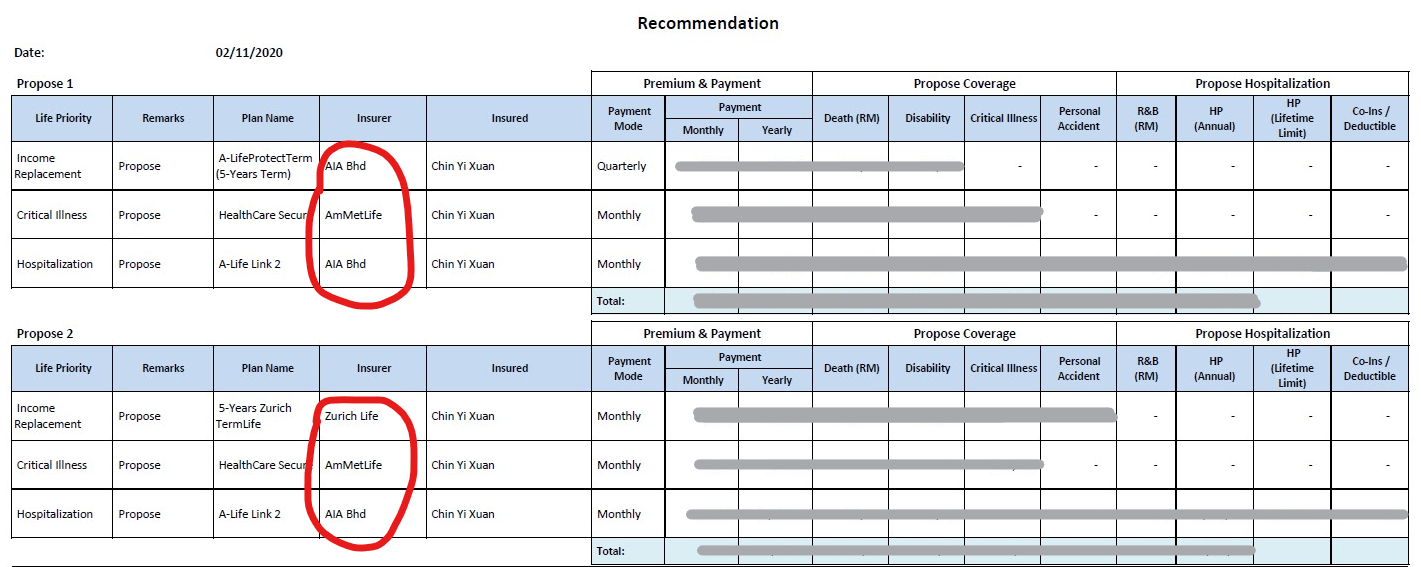

In addition, I am also grateful that I got the zero-bias analysis I need when it comes to insurance. As a personal finance enthusiast, I still find insurance extremely complicated to study on my own as there is simply no well-organized info online.

As such, I’ve always assumed that I have the best and appropriate coverage until Stev, my financial planner informed me otherwise.

It turns out that I can actually get MORE protection by paying even LESS than what I am paying presently. This is done by getting the best solutions from multiple insurance companies, plus a combination of term products (usually more affordable) and conventional investment-linked protection.

Seriously, how would I know this if I do not have a financial planner to guide me on this?

#2 Financial Accountability & Mindfulness

Another good thing about having a financial planner is that it creates a sense of mindfulness & accountability on my own finances.

Having a clear action plan devised by my financial planner, I am always aware of what to do about my finances in 2020. All of these combined, I know that I’d always be on track towards my financial milestones in this journey.

#3 Getting personal finance questions addressed by Licensed Professionals

Lastly, having a financial planner is like having access to a reliable personal finance encyclopedia.

When it comes to complex money or any personal finance related questions (eg. taxes, insurance), I am always grateful that my financial planner is just a message or email away.

Instead of searching the internet for scattered pieces of incomplete info, I can get my questions addressed by a licensed professional super fast – neat!

p

The Flow: How is it like working with a financial planner? (and charges)

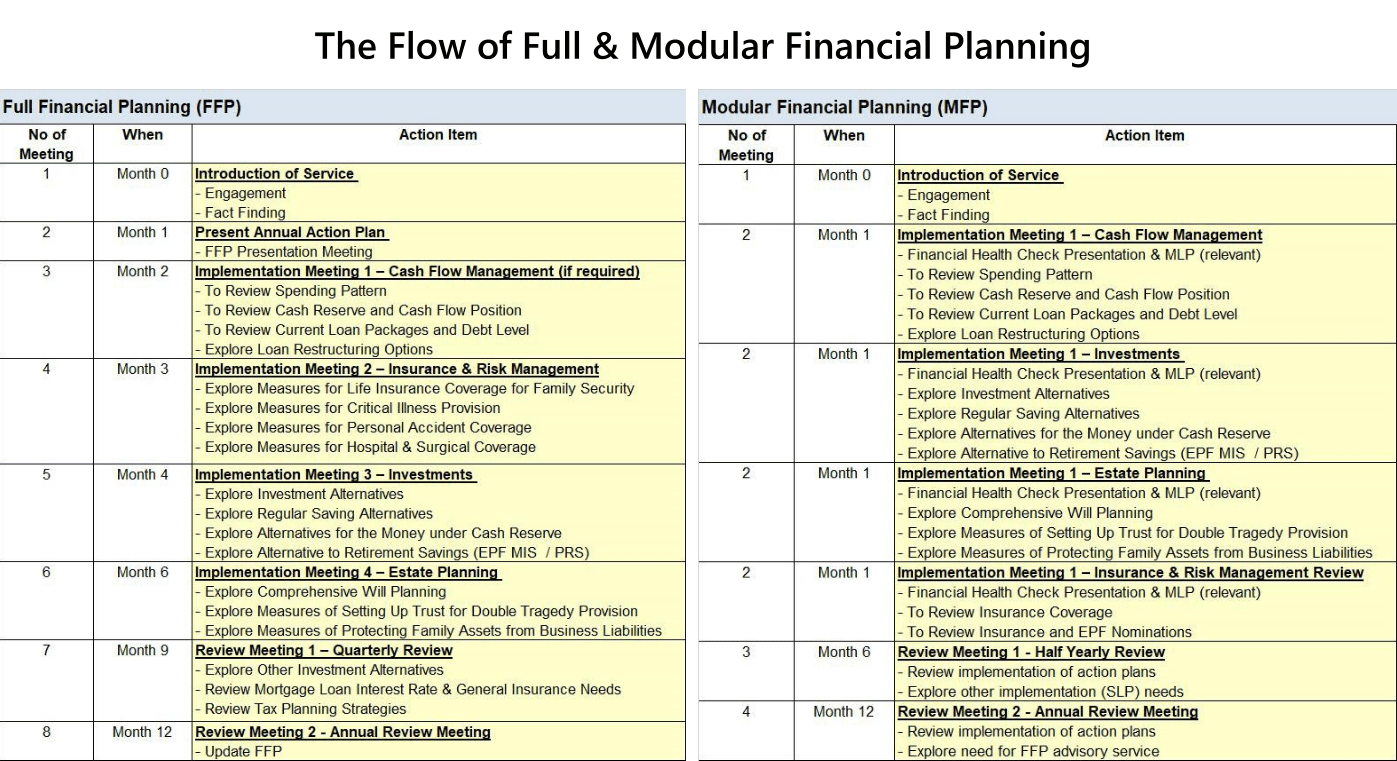

Engaging a financial planner is a simple process that involves several stages: Fact-finding, Implementation, and Follow-Up Review Meetings.

Do check out my detailed writing on the whole flow of engaging a financial planner HERE.

Personally, I have been working with my personal financial planners – Stev and Catherine from Wealth Vantage Advisory (WVA) for a year now. Depending on your needs, there are 3 ways you can work with a licensed financial planner from WVA, namely:

- Comprehensive Financial Health Check (FHC) [RM300]: You’ll go through a comprehensive fact-finding process with your financial planner. Then, you'll be presented with an analysis and report of your overall financial state with recommendations for improvement.

p - 1-year Modular Financial Planning (MFP) [RM 1,500]: You’ll get everything from the Comprehensive Financial Health Check above. PLUS, you can choose to focus on EITHER Investment/Insurance/Estate Planning and your financial planner will support you in the implementation for 1 full year.

p - 1-year full financial planning (FFP) [RM 3,000]: You’ll get everything from the Comprehensive Financial Health Check. PLUS, your financial planner will support you in the implementation of ALL aspects of your personal finances (Investment + Insurance + Estate Planning) for 1 full year.

For me, I am on the MFP package (investment) in 2019 and opted for an FFP package in 2020.

p

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

If you were to ask me, financial clarity & confidence are the biggest takeaways that I got after engaging a financial planner for a year. For every follow-up, I get clear actionable steps from Stev and Catherine to improve my finances. Knowing my overall financial health is improving with time boosted my confidence in pursuing my passion for blogging, investing, and trading.

For me, it is, without doubt, the best financial decision that I’ve made last year!

To be clear, I DO NOT want you to pay for a Financial Planner unless you are convinced that they are able to add value to you.

That said, I also want you to give yourself the chance (like what I did) to put your hard-earned money to the best use and achieve your financial goals in life.

Hence, I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals – regardless, you are doing yourself a favor for the year to come!

You can sign up for your FREE financial consultation session HERE.

Disclaimer

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Check this Out Before You Invest in Bitcoin! (Explained in Simple English)

Bitcoin and cryptocurrencies have been picking up steam in recent months. This leads to a problem: I’ve noticed that people would jump on the bandwagon without truly understanding what they are doing.

So, what is cryptocurrency exactly? How do they work and why should you consider investing (and not investing) in them? Is cryptocurrency legal in Malaysia? How to invest in Bitcoin in Malaysia?

In this article, let’s cover all these questions so you are better informed and hopefully able to make a better investment decision:

p

Disclaimer: My Personal Experience with Bitcoin, Cryptocurrencies & Blockchain

Personally, I’ve started to research and presented topics on Bitcoin & crypto in assignments & student forums way back in early 2017, when I was still a university student. This was a time when Bitcoin & cryptocurrencies were still alien to most Malaysians.

Before graduation, I have also interned in an insurance technology startup where I was involved in developing blockchain solution for insurance (p.s. it was eventually put on hold as we were (and still are) way ahead of our time for the dinosaur-age insurance industry)

Nevertheless, I am not by any means an expert with cryptocurrency and blockchain (the technology behind Bitcoin).

Given how fast the cryptocurrency space has evolved since I parted ways with any of these, I have to redo my research and update my knowledge as I prepare for this article.

The point is, having involved in this space not just as an investor, but one working on a (potential) viable solution, I hope I can give you a different perspective into the cryptocurrency space – and hence make better investment decisions.

With that, let’s start!

The BIG Picture: How well do you know about money?

The topic of bitcoin or cryptocurrency cannot start without a talk on money. Yep, how well do you know money?

Money, as we know today, is a medium of exchange for products and services that we use everyday. As an example, if I want to buy a Happy Meal, I’d pay for it using cash.

In other words, money is a store of value. But have you ever asked yourself: who decides that a banknote of RM1 is worth RM1, and a banknote of RM100 is worth RM100 and so on? What determines the value of money as we know it today???

Over human history, one thing that human commonly used for transactions is gold. Everyone recognizes gold and hence there is a general consensus of value around gold.

Then, because it is hard to bring gold around, humans eventually moved on to paper cash as a proxy to gold. This part is CRITICAL to our discussion because each paper cash WAS essentially backed by gold. (ie. People can redeem gold using their paper cash)

This gold-backed paper cash relationship ended in the 1970s, when the then-US president (Nixon) scrapped this relationship altogether. Since then, the governments and central banks decide the value of money.

Why is this important? Glad you asked.

This is because as we end the relationship between paper cash and gold, humans essentially entrust the value of money from someTHING (gold) to someONE (the government & central banks).

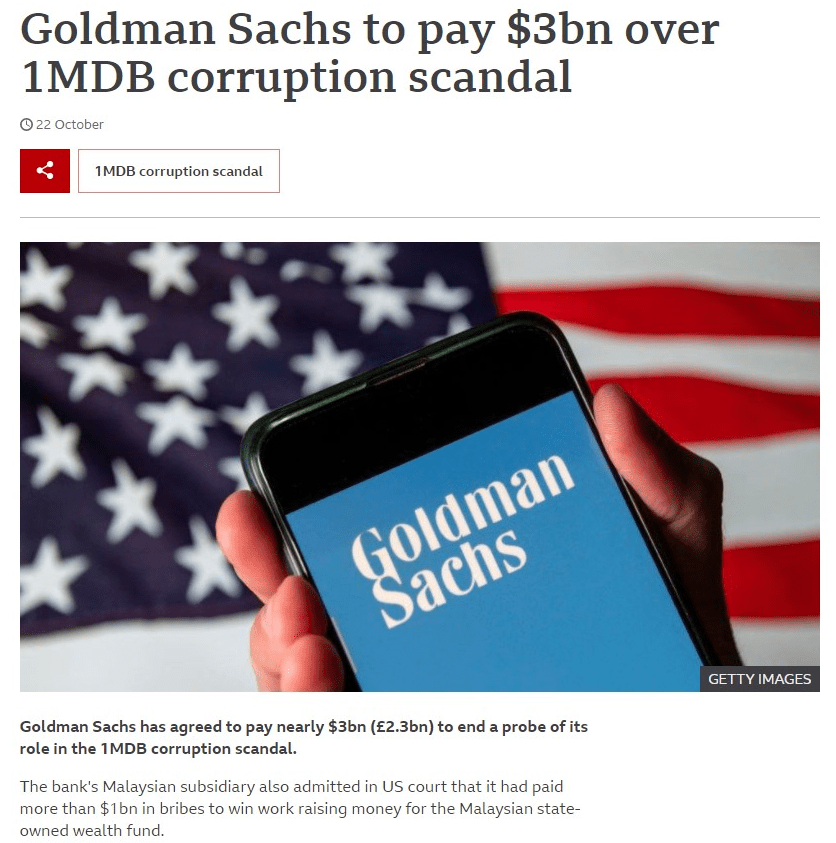

The impact? An almost-absolute power given to the government and central banks to manipulate the supply and value of money around the world by printing money – causing INFLATION.

Not only that, because of how the monetary system is centralized, there is a huge chance for white-collar crimes like corruption, internal frauds, and forgeries to happen.

The Potential Solution? Enter Bitcoin

As the people’s trust towards the centralized monetary system gets weaker, cryptocurrencies like Bitcoin enter the scene as a potential solution to the flaws of this existing system.

Bitcoin at its core, is a transparent ledger without a central authority, created by an anonymous party (or person) call Satoshi Nakamoto back in 2009.

Now, to help you understand the concept above better, let’s compare Bitcoin to our conventional centralized banking system:

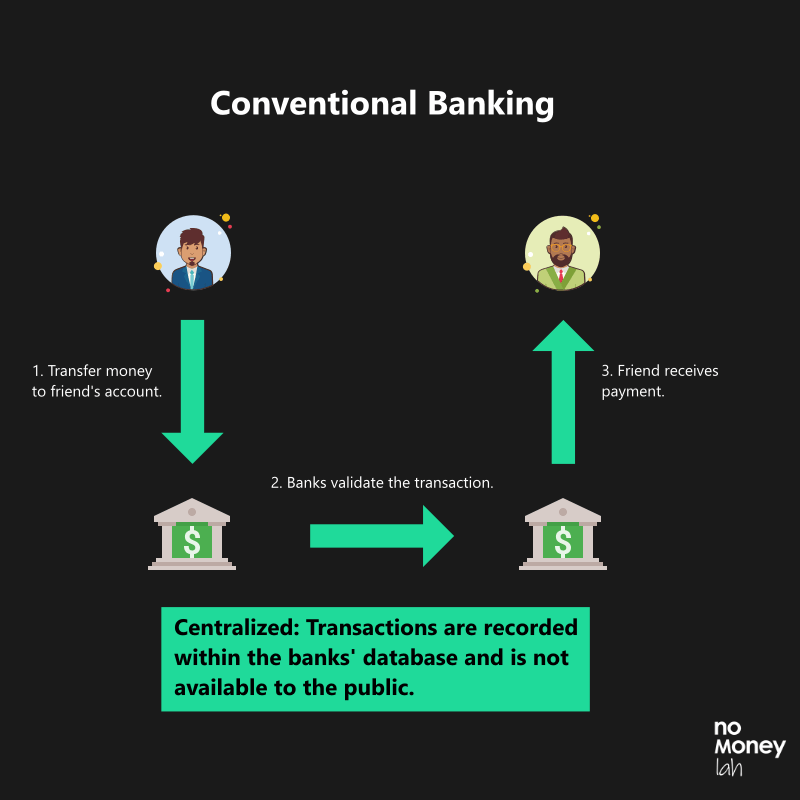

Conventional banking happens in a closed and centralized manner.

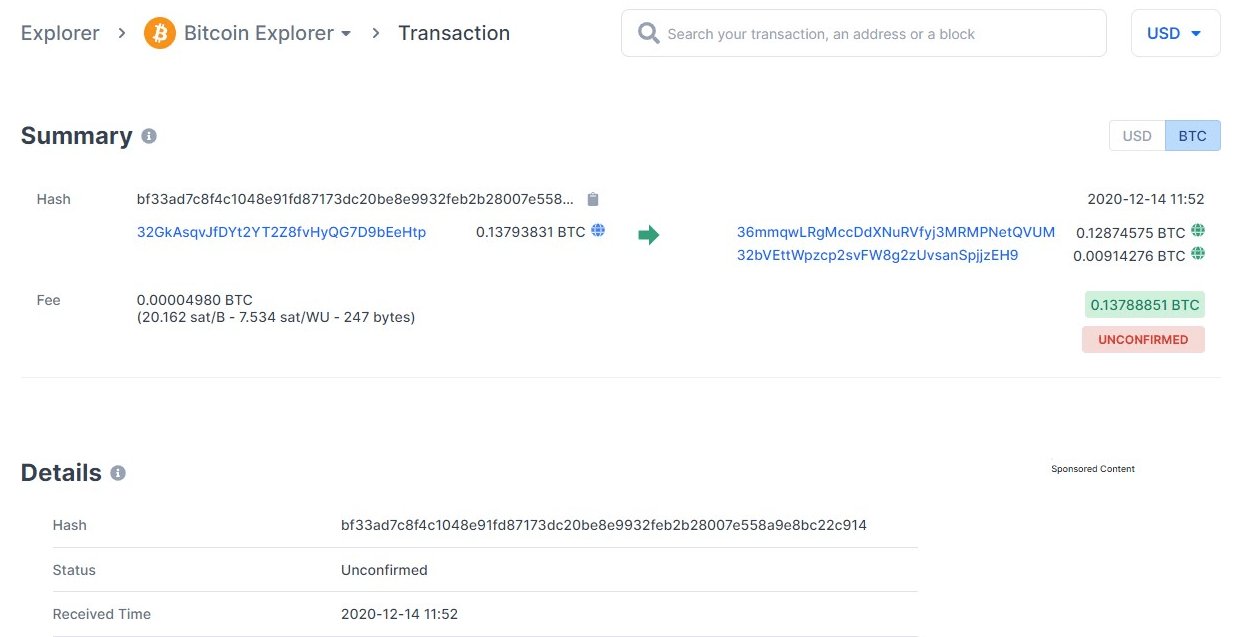

If we were to transact through banks today (eg. Sending money to my friend’s Maybank account via my own CIMB account), the transaction record (1) needs to be approved by the banks involved, AND (2) is NOT transparent as it is being kept in the central computer of the banks.

This means that for a bank transaction to happen, it needs to be validated by the banks (centralized). As the record is recorded in a centralized manner (ie. Not transparent to outsiders), the whole process is easily exposed to hacking and any transactional record can be potentially manipulated without being noticed by outsiders.

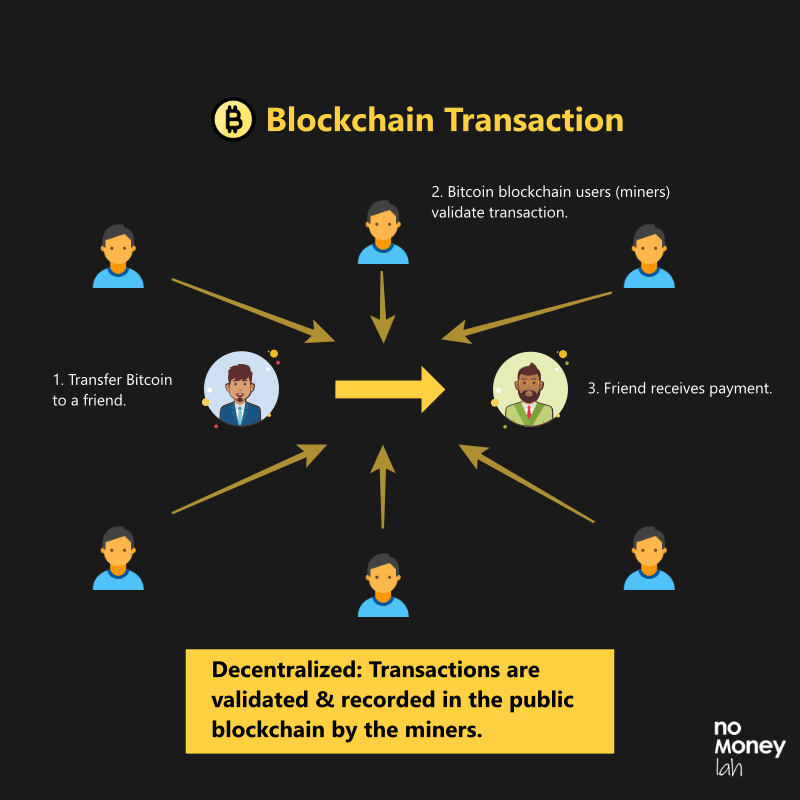

In contrast, transactions via Bitcoin happen in a transparent and decentralized ledger, called the Blockchain. This means that in a Bitcoin blockchain, (1) all transactions are trackable and (2) need to be approved by the computers participating in the Bitcoin blockchain (a.k.a. the miners).

Simply put, any transaction via Bitcoin is decentralized and transparent. In order for hackers to hack through a transaction, they’ll need to target thousands of computers in the blockchain network at the same time which is almost impossible to execute.

The Advantages of Bitcoin

Bitcoin presents many direct advantages to our present centralized monetary system:

#1 For one, because Bitcoin is decentralized by nature, you and you alone have access to your Bitcoins.

No one (ie. The government or banks) can have access to your Bitcoins, hence do not have the right to freeze your account or confiscate your holdings.

#2 Secondly, due to its decentralized nature, Bitcoin eliminates the middlemen (erhem… Banks) when it comes to transactions.

This effectively lower down the cost of transaction compared to traditional wired and telegraphic transfer. Also, this eliminates crimes like banking frauds and corruption altogether.

Put it another way, Bitcoin and its underlying technology Blockchain literally removed the fragile trust issue that people have towards the existing banking system.

#3 Lastly, Bitcoin opens up transactional capability to all people around the world that do not have access to conventional banking facilities due to where they live.

These are people that are underbanked. With Bitcoin, they can now transact with each other with just a smartphone without additional permission.

The Risks/Downside of Bitcoin

The ideals behind Bitcoin as a replacement for our existing form of transaction is amazing. However, there are several issues that investors may have to be aware of about Bitcoin:

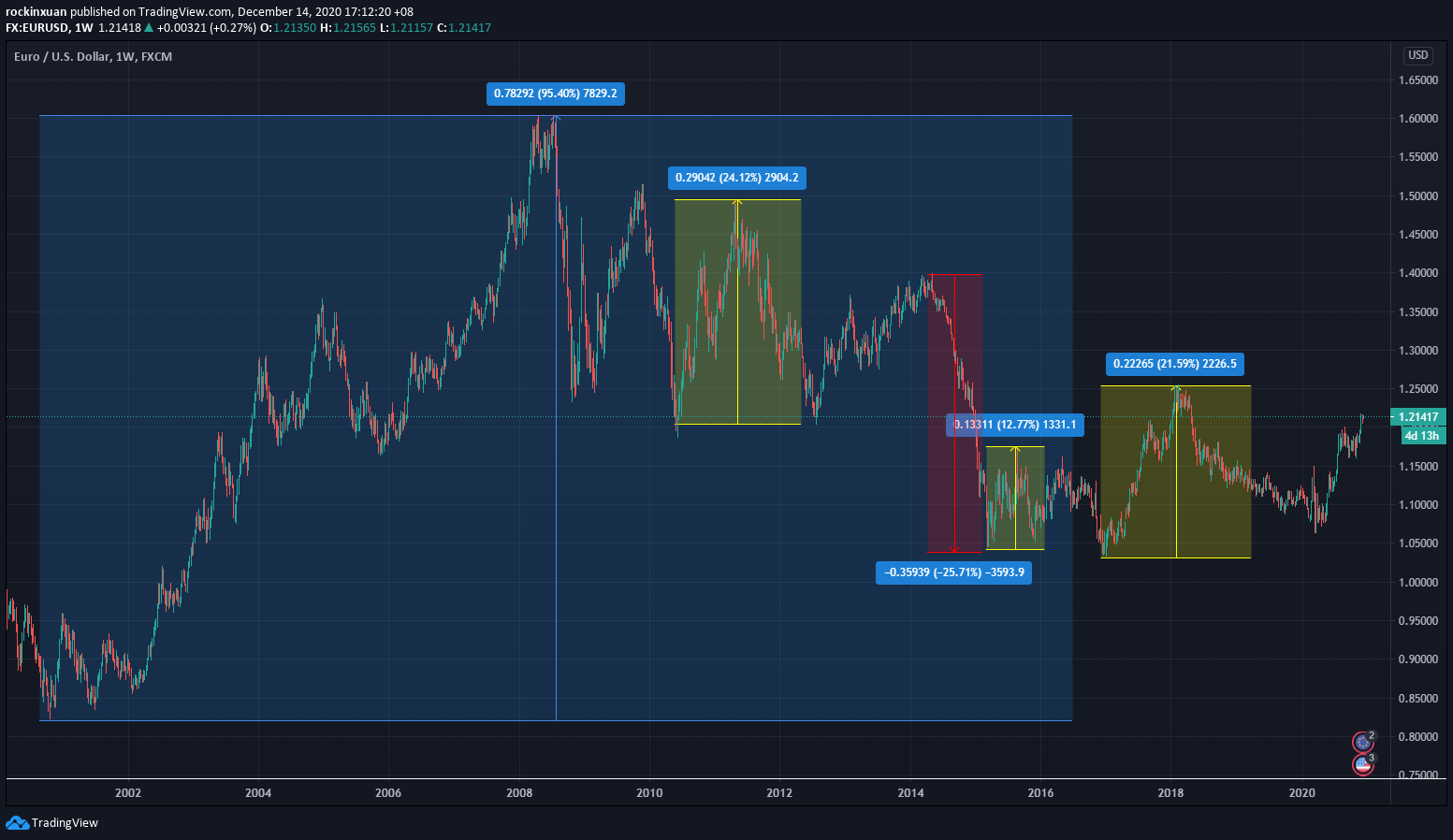

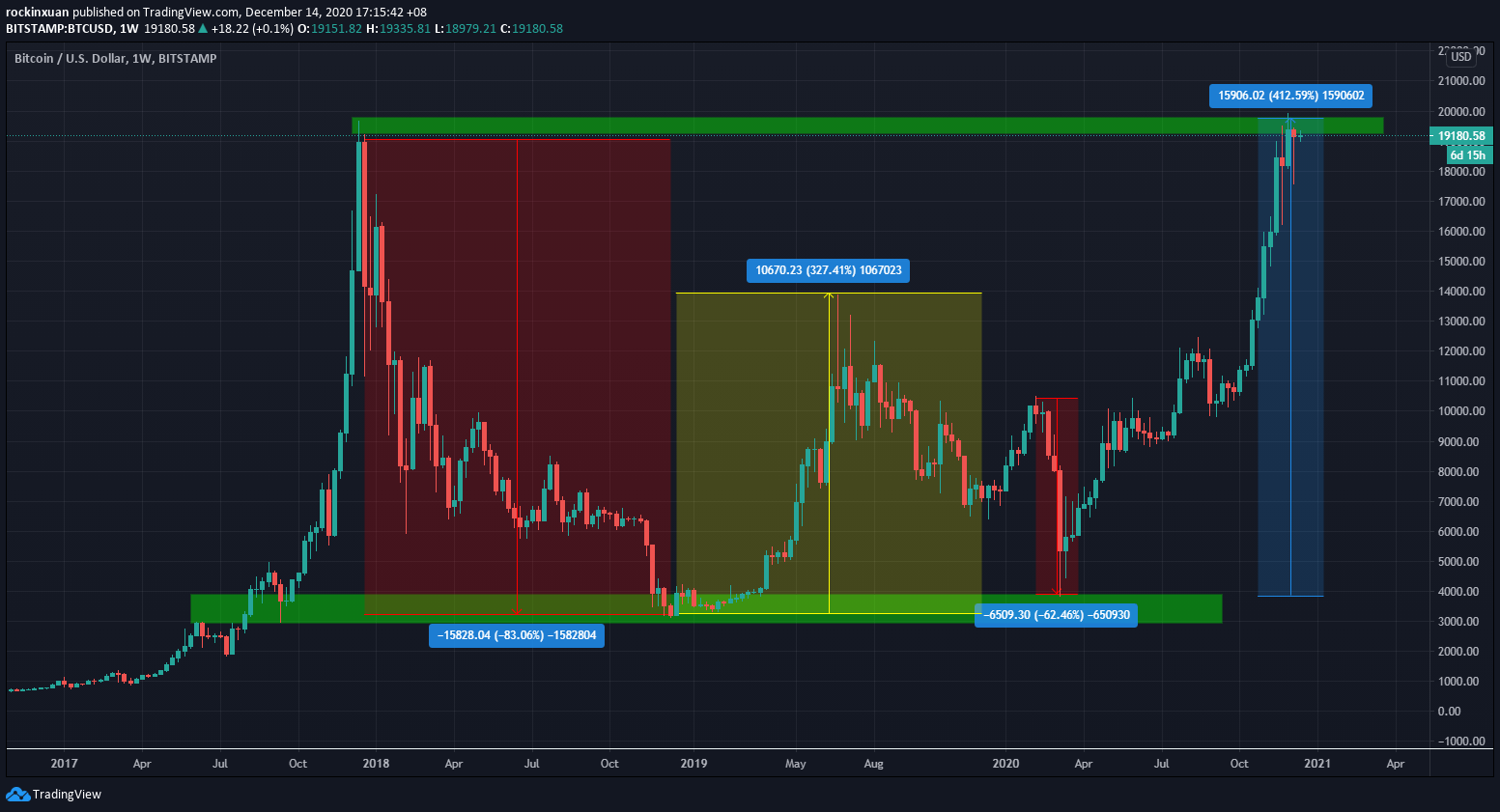

1. Volatility of Bitcoin and cryptocurrencies

As of today, Bitcoin’s market cap (Market Cap = Total Bitcoin in circulation * Price) is around $350 billion. Relative to things like the gold market (~$3 trillion), Bitcoin is a much smaller market.

This means that Bitcoin is more easily affected by everyday’s fluctuation in buying and selling – just like how a rock can cause bigger ripples in a small pond than the large sea.

As a result, Bitcoin’s volatility makes it extremely hard to become a stable medium of exchange like our existing currencies. Imagine that a burger cost X unit of Bitcoin today, then suddenly Bitcoin just does its thing (ie. Fluctuate like nobody’s business) – and you have to pay 2X the Bitcoin for the same burger the next day.

As such, Bitcoin’s volatility poses a challenge for its mainstream adoption and harder for most risk-averse investors to accept Bitcoin as part of their portfolio.

2. Using Bitcoin for Crimes(?)

Due to the anonymous nature of Bitcoin, the debate around how hackers and crime-lords use Bitcoin as a manner of ransom is common every now and then.

Again, I do not have much knowledge on crypto-crimes so here’s what’s I’ve found in my research:

Since all the transactions behind the Bitcoin blockchain can be traced, committing any form of ransom via Bitcoin is actually not that easy. In fact, in 2019, only $829 million in bitcoin has been spent on the dark web. This is a mere 0.5% of all bitcoin transactions for the year.

Does this mean that Bitcoin can be cleared off its reputation as a ransom-heaven for criminals?

Not really. In this interview piece by the Wall Street Journal, it mentioned how criminals can (still) use Bitcoin as a manner to get off the radar despite the transactions being traceable in the blockchain network.

In short, we live in a complex world and as long as humans exist, greed exists. This means that there’s no perfect system and there’ll be greedy humans that will always try to outsmart the system.

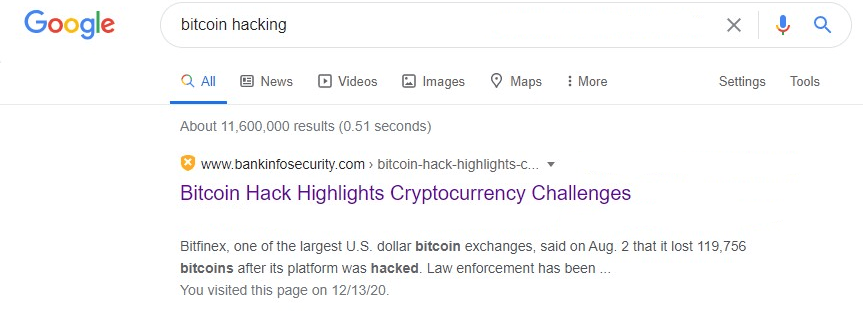

3. Hacking Incidents revolving around Bitcoin Exchanges

As a whole, hacking the Bitcoin blockchain itself is extremely hard due to the decentralized nature of the blockchain itself. Meaning, hackers would have to hack into thousands of computers within the bitcoin blockchain at the same time to do what they intended to do.

If that’s the case, why is the news of cryptocurrency hacking so common every now and then?

While Bitcoin blockchain on its own is designed to be hard to penetrate, BUT many exchanges that facilitate cryptocurrency trading are NOT. Security flaws that exist especially among unregulated crypto exchanges give hackers the opportunity to hack into the exchange to steal users’ cryptocurrency holdings.

A search on Google for ‘Bitcoin Hacking’ usually revolves around cryptocurrency exchanges being compromised, not so much of the Bitcoin blockchain itself being hacked.

Hence, it is crucial that you choose a well-regulated cryptocurrency platform with tight security features in place before investing – more below.

Should You Invest in Bitcoin?

Ultimately, it all comes back to a question – should you invest in Bitcoin, or any cryptocurrencies for that matter?

In my opinion, making this decision ultimately comes back to your faith and trust towards our current monetary & banking system:

- Are you confident that the existing governments and central banks are making monetary policies with the people’s benefit in mind?

. - Are you happy with how the value of your hard-earned money is today compared to 10, 20 years ago?

.

- Do you trust that the policymakers are going to preserve the value of your hard-earned money in the next 10, 20 years?

Once you have these questions answered for yourself, investing in Bitcoin for the long-term is actually not a very hard decision to make.

With the recent news of Paypal adopting Bitcoin transaction, and Singapore’s DBS Bank being the world’s first traditional banks to launch its cryptocurrency exchange, it is only rational to think that the cryptocurrency world is here to stay and disrupt.

Are Bitcoin and cryptocurrencies legal in Malaysia?

In Malaysia, the state of Bitcoin or cryptocurrencies is, to be frank, not exactly clear. I feel that Bank Negara Malaysia (BNM) has been vague in their stand towards cryptocurrencies.

This can be seen in their official announcements on cryptocurrencies (example HERE), where they stated that they want to promote ‘transparency among digital currency activities in Malaysia’, but ‘there will not be any elements of consumer protection or avenues for redress made available in the event of complaints or losses and damages incurred by any parties dealing in digital currencies.’

Translating to everyday human language, I think their tone reflects an obvious “If you want to invest, no problem. But if shit happens don’t come and kacau us.”

In short, in Malaysia, you bear the full risk if you want to invest in Bitcoin or other cryptocurrencies – so keep this in mind!

How to invest in Bitcoin as a Malaysian?

All in all, having seen both the upsides and risks of Bitcoin, I hope you now have an additional layer of clarity towards your investing decision.

The next question: How can you invest in Bitcoin and cryptocurrencies in Malaysia?

Presently, there are 3 cryptocurrency exchanges that are approved by Securities Commission (SC) to operate digital asset exchanges. This means that these are 3 regulated exchanges where Malaysians can buy and trade Bitcoin and other cryptocurrencies.

Personally, I have been using Luno, the largest of the 3 regulated exchanges since 2017 and I am more than happy to recommend Luno for investors looking to invest in cryptocurrencies safely.

I will work on a dedicated Luno review soon, but here’s a brief rundown of its features:

- Multiple Offerings: The biggest SC regulated cryptocurrency exchange which offers Bitcoin, Ethereum, Ripple, and Litecoin.

P - High Security: The majority of Luno’s customers’ cryptos are stored in a Deep Freeze storage – ie. A multi-signature wallet system, with private keys stored in different bank vaults. This means that no single person ever has access to more than one key, which translates to a high level of security of users’ cryptocurrency holdings.

P - Simple, user-friendly interface: Luno’s interface is extremely intuitive and simple to use. Every button and main functions are readily reachable and transacting Bitcoin is straightforward.

P - PROMOTION: No Money Lah is now collaborating with Luno Malaysia to bring the best-in-town deal for new Luno users that are keen to invest in Bitcoin! Use my dedicated promo code - LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more. That’s an instant 10% return on your investment.

P

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

No Money Lah’s Verdict

Personally, Bitcoin and Ethereum (another crypto) make up roughly 5 – 6% of my personal portfolio.

Having researched and worked on blockchain-related projects in my past student and work life, I am certain that cryptocurrencies are here to stay and disrupt. In particular, Bitcoin and Ethereum will be the forerunners of the cryptocurrency disruption due to them being the 2 cryptos with the largest market cap, and Ethereum being the backbone of decentralized finance (DeFi) development (more on Ethereum in future articles).

That said, I tried my best to reflect both the upsides and risks of Bitcoin & cryptocurrency in this article. As such, hopefully this article is able to give you a neutral overview of this topic and help you make a more informed investment decision!

Do you have any other questions on Bitcoin or cryptocurrency? If you are investing in this, what cryptocurrencies are you holding at this moment? Feel free to share with me in the comment section below! :)

Keen to Start Investing in Bitcoin and Cryptocurrencies?

In collaboration with Luno Malaysia, No Money Lah is bringing the best-in-town deal for new Luno users that are keen to invest in Bitcoin!

Use my dedicated promo code - LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more. That’s an instant 10% return on your investment.

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

Open Your Luno Account HERE.

A Simple Hack to Make Things Happen

Wanna achieve something significant or important in life (but nothing is really moving forward)?

If that's the case, start being explicit with your rules, intention, and goals:

- If you want to live healthier, this means making it specific to yourself that 6pm everyday is workout time and honor it with discipline.

- If you want to invest better, this means having a crystal-clear stock selection & management process that you religiously follow.

- If you want to achieve breakthroughs in your career, this means formulating a detailed plan to consciously improve & add value to your stakeholders.

Being explicit with your intentions may not necessarily imply that you have to let the whole world know about your intention (although you can, if you want). For most people, being explicit can be as simple as writing your intent and/or rules down in a journal and review it everyday or week.

Why though – why should you make your rules/intention/goals explicit to yourself?

Because if you don’t (like what you most probably have *not* been doing), then when things go against your favor, the stress starts kicking in, and when the road forward starts getting bumpy – you’d very, very likely going to choose the easy way out (does the sentence "I’ll do it tomorrow" sounds familiar?).

Here's the thing:

You can't follow a discipline that you never formulated in the first place. The clearer the intention/rules, the stronger they'll serve as brakes to your impulses and guides to your best behavior.

Simply put, making your intention explicit provides you with a reason – an additional layer of support when you ever consider taking the easy out by procrastinating or giving up. Remember, the best performers are rule-governed.

What's your biggest intention/goal that you have not made significant progress in 2020? How refined are your intention/plans/rules? Certainly think about this over the week.

Till next week (and happy December)!

--

p.s. This week’s newsletter is the rational me nagging on the procrastinator me. But since we are nearing year-end, I feel that some of you may need this little push so hope this helps!

Simple vs Easy

One thing that I’ve often see people misinterpret is the words ‘Simple’ and ‘Easy’.

Don’t get me wrong, certain things in life are simple AND easy. Eating and falling asleep during a boring meeting are some of them.

But not everything in life is like that.

Here are things that are simple BUT not easy:

- Exercise is a simple life routine to grasp but not easy to practice consistently for most people.

- Saving for emergencies is a simple concept to understand but not easy to implement for many people.

- Investing in stocks is a simple thing to comprehend but is not easy to execute properly.

On the contrary, there are things that seem easy BUT not simple:

- Get-rich-quick schemes seem easy BUT it is certainly not that simple.

(Just need to bring a few friends in, right? Or is it really the case?)

- Buying stocks based on gurus/influencers/friends/family tips seems easy BUT it is definitely not that simple.

(Okay, you solved your entry. How long are you holding it? When would you exit?)

- Being content with doing only what your job description entails you to do (and receiving a stable income for doing so) seems easy BUT it is really not that simple.

(Are you adding value to your job? You sure you wouldn’t be replaced if your boss can find someone that can do whatever listed in the job description at a cheaper price?)

Here are the takeaways:

Most things that are beneficial to us in life are usually simple BUT not easy. You’d want to do them as much and as consistently as possible.

On the flip side, the things that are detrimental to us are most likely impulsive acts that may seem easy from the surface, but certainly not as simple as you assumed. You’d want to stay away from them as far as possible.

In life, don’t mix up 'simple' and 'easy'. On the surface, they may look similar, but they are definitely not the same.

Revealing My REIT Passive Income Portfolio!

Okay, in this post, I am going to show you the breakdown & composition of my current Real Estate Investment Trusts (REITs) portfolio.

If you have been following my blog for some time now, you’d know that I am a big REIT enthusiast. As of November 2020, my stock portfolio makes up about 33% of my net worth and all of them are REITs.

Since REITs generally pay solid dividends, my investment goal is simple:

To build a solid REIT portfolio that pays me consistent dividend over time – a.k.a. passive income.

The thing is, this stream of dividend income will be small at the start – which hinders many investors as it may not look attractive. However, as you let the snowball roll and the time for compounding effect to take place, it’ll be a respectable amount one day.

HUGE DISCLAIMER: The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please (pleaseeee) do your own research AND/OR reach out to a licensed financial planner before making any investment decision!

With that, let’s start!

Related Read: Why REITs will play a crucial role in my journey to Financial Independence!

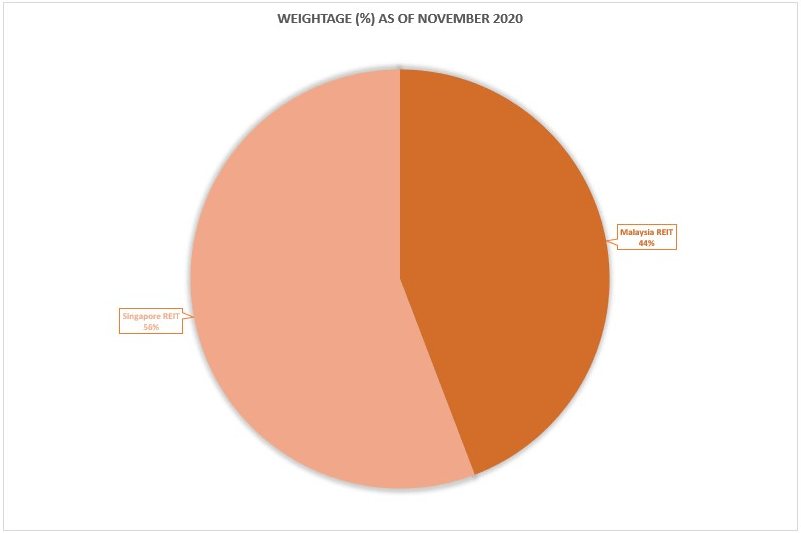

Part 1: REIT Composition by Country

As of time of writing, I have a pretty balanced weightage between local REITs (44%) and international REITs (56%).

While I was initially focused on local Malaysian REITs (MREITs), I have found great potential and opportunities in Singapore REITs (SREITs).

Why SREITs? In essence, SREITs are considered an international hub for REITs and it opens up the gateway for me to gain exposure to international income-generating real estate (eg. SG, China, US), as well as industries that I’d never own if I stay in the local scene (eg. Data centres).

Not only that, there is 0% tax on SREIT’s dividends so that’s pretty dope. In comparison, there are still 10% tax charged on part of MREITs dividend distribution (p.s. the tax is deducted before the dividend is paid to you, so don’t worry ‘bout it too much).

That said, I am not saying that MREIT is bad. In fact, it is quite the contrary as we have the advantage of being more familiar with the overall business environment and real estate quality of local REITs. This adds to my conviction & confidence as I invest in MREITs.

Related Read: The broker I use to invest in Malaysian REITs. The broker I use to invest in Singapore REITs.

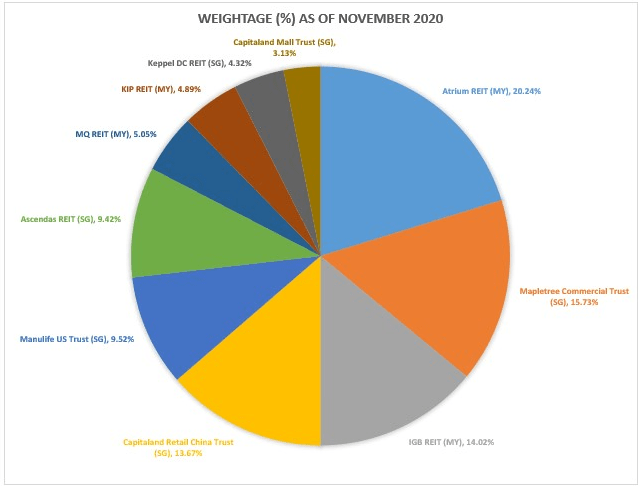

Part 2: REIT Composition by Individual Companies

For now, my REIT portfolio is made up of 10 companies.

Is this too many to manage? Frankly, I think this is stretching the upper limit of my own time & capacity to follow and update. In the near future, I could be reducing my holdings to between 6 – 8 companies so I can be more focused on my conviction, time, and resources.

That said, here are the REITs that make up my portfolio currently:

REITs in my portfolio:

- Atrium REIT (MY), 20.24%

- Mapletree Commercial Trust (SG), 15.73%

- IGB REIT (MY), 14.02%

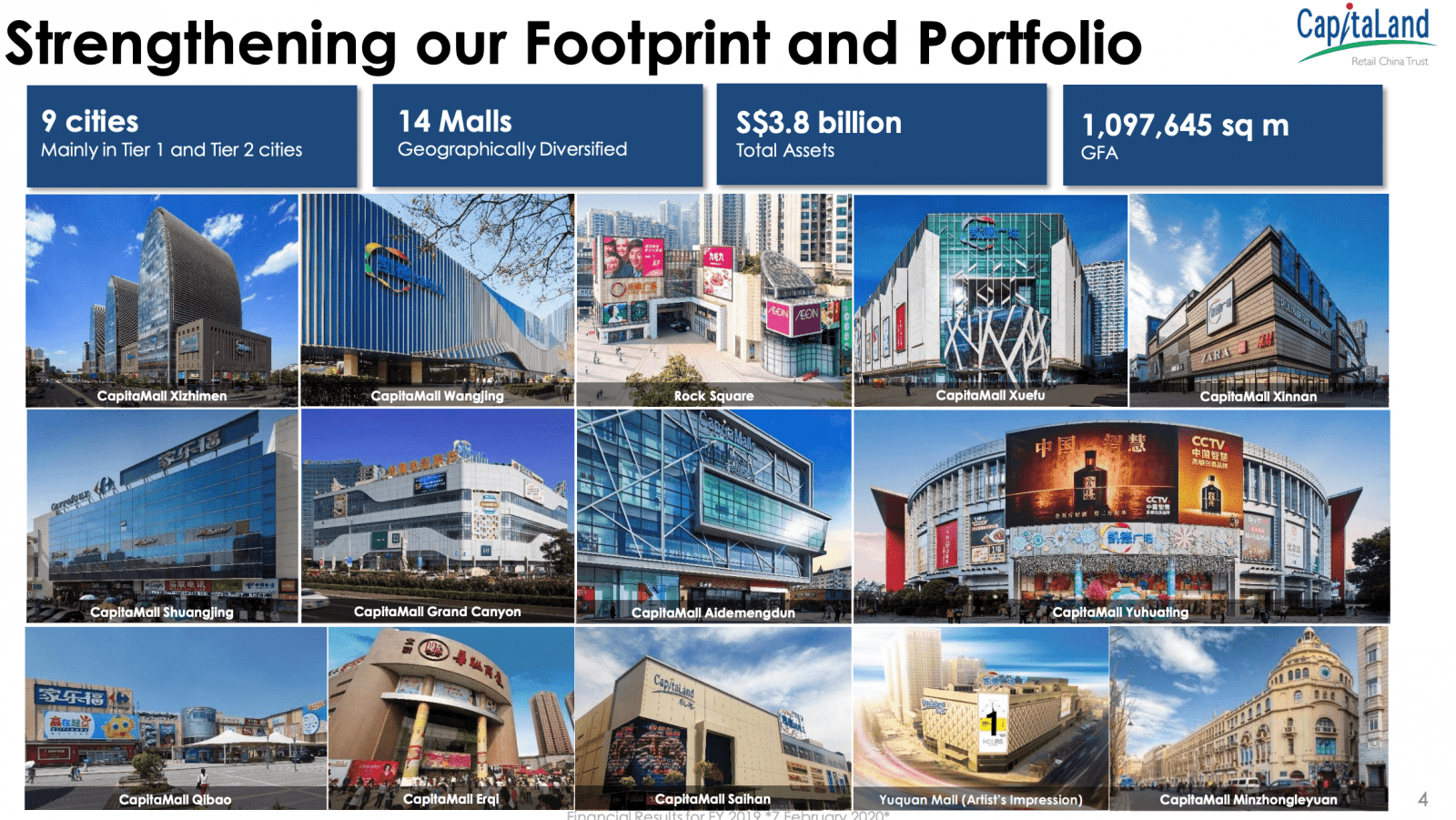

- Capitaland Retail China Trust (SG), 13.67%

- Manulife US Trust (SG), 9.52%

- Ascendas REIT (SG), 9.42%

- MQ REIT (MY), 5.05%

- KIP REIT (MY), 4.89%

- Keppel DC REIT (SG), 4.32%

- Capitaland Mall Trust (SG), 3.13%

For this post, I won’t go into detail with every single REIT in my portfolio. However, be sure to check out my detailed thoughts on my MREITs holding HERE, and (hopefully) I’d be writing one on SREITs soon.

Briefly, you can see that my 4 biggest REIT holdings make up nearly 65% of my total REIT portfolio. They consist of Atrium REIT (MY), Mapletree Commercial Trust (SG), IGB REIT (MY), and Capitaland Retail China Trust (SG).

These are 4 REITs where I place my biggest conviction in. Putting this into a Pokémon game analogy, these would be 4 of my most confident Pokémon to put in a battle (haha please take this analogy with a pinch of salt lol).

Atrium REIT is an industrial REIT which in my opinion, highly overlooked by investors and has a stable growth outlook even in times of pandemic.

Mapletree Commercial Trust owns the largest mall in Singapore (Vivocity), as well as quality business centres like Mapletree Business City (MBC) with solid occupancy & lease terms.

IGB REIT runs Mid Valley & The Gardens, which I think most of you know and recognize. Mid Valley and The Gardens are definitely one of the top malls in Klang Valley and historically, their occupancies have been solid.

Investing in Capitaland Retail China Trust is my personal conviction in the spending power of the Chinese. CRCT owns malls in Tier 1 and Tier 2 cities in China (eg. Beijing, Shanghai, Guangzhou). Having stayed in China for a month last year, I’ve witnessed the crazy spending power of the Chinese middle class, plus China’s recovery from Covid-19 has been solid – what else can you ask for?

In addition, CMCT is also expanding into other industries like business parks which are accommodating tenants from the tech sector so that is certainly a development I’d be following closely.

As for the other smaller compositions, I have some fair share of exposure in REITs that give me exposure to the US offices market (Manulife US Trust), global data centres (Keppel DC REIT), and some other interesting REITs.

Feel free to check them out on your own, or wait for my future coverage on these SREITs!

Related Read: 5 Things that I look for when I invest in REITs!

Part 3: REIT Composition by Business Segments

If you observe closely, you’d see my conviction in 1 or 2 particular business segments.

To be precise, I have a strong conviction in the retail/commercial space in the middle to long term horizon. While the retail space may look muted at this moment (especially outside of China), I am confident that they are going to recover with strength in the near future.

In my opinion, people cannot stand prisoning themselves at home forever, and will very likely look to go out on a spending/entertainment spree once the pandemic tone down.

On the other hand, having shares in industrial/logistics REITs help balance my risk as these businesses remain stable even in this pandemic.

Related Read: Different types of REITs and WHY they matter!

No Money Lah’s Verdict

So here you go – my REIT dividend portfolio that keeps generates consistent income for me!

Hopefully, this sharing has been an interesting and insightful one, especially if you are also looking to build a passive income portfolio from the stock market!

What are your thoughts on my REIT portfolio? What REITs are you investing in right now (if any)? Have any questions? Feel free to share them with me in the comment section below!

Keen to build a reliable passive income foundation from the stock market?

If you are keen to learn how to invest in REITs for passive income, I organize REIT Investing Sharing Session where I go through the basics AND fundamentals of REIT investing, step-by-step. Click HERE for more info!