Related Posts

December 30, 2019

Would we ever be ready in the pursuit of life?

December 2, 2019

Are the Newly Listed Leveraged & Inverse ETFs for You?

TradePlus by Affin Hwang Asset…

November 1, 2019

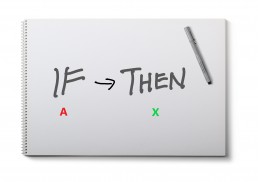

If/Then Mindset: How this Hugely Overlooked Mental Skill will Transform Your Investing Performance

Have you ever been in a situation,…

October 24, 2019

Why Are You Still Suck with Investing after Paying Thousands for Courses?

Have you ever attended any of those…

October 9, 2019

Always Remember: Live Your Own Life, Walk Your Own Pace (No Money Lah’s 1st Anniversary)

Always remember: Live your own life,…

September 1, 2019

Fundamental vs Technical Analysis (& How To Use BOTH of Them to Invest)

FA and TA are essentially 2 different…