Last Updated on April 2, 2024 by Chin Yi Xuan

In this post, I am going to show you the step-by-step guide on how to deposit and withdraw from Tiger Brokers via a Singapore bank account (CIMB SG), without having to pay any expensive bank fees.

The key benefits in using a Singapore bank account to do a deposit or withdrawal from overseas brokers like Tiger Brokers are obvious:

- For one, it gives us HUGE savings by skipping the intermediary banking fees (USD20 – 30) that are usually incurred during Foreign Telegraphic Transfer (FTT) via local bank.

p - Secondly, the deposit & withdrawal via a Singapore bank account is also faster as there is no need to go through a complex intermediary banking network.

—

[PROMO] Commission-free trades + Free stocks!

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 – USD888

Open A Tiger Brokers Account Today!p

p

Table of Contents

Opening a CIMB FastSaver SG Bank Account

Before we proceed, I gonna assume that you already have a Singapore bank account. If not, check out my step-by-step guide on how to open a CIMB FastSaver Singapore account online.

If you already have a CIMB FastSaver SG account, move on to the next section.

Tiger Brokers Deposit via CIMB SG

Important to note before depositing funds to Tiger Brokers:

- No minimum deposit amount.

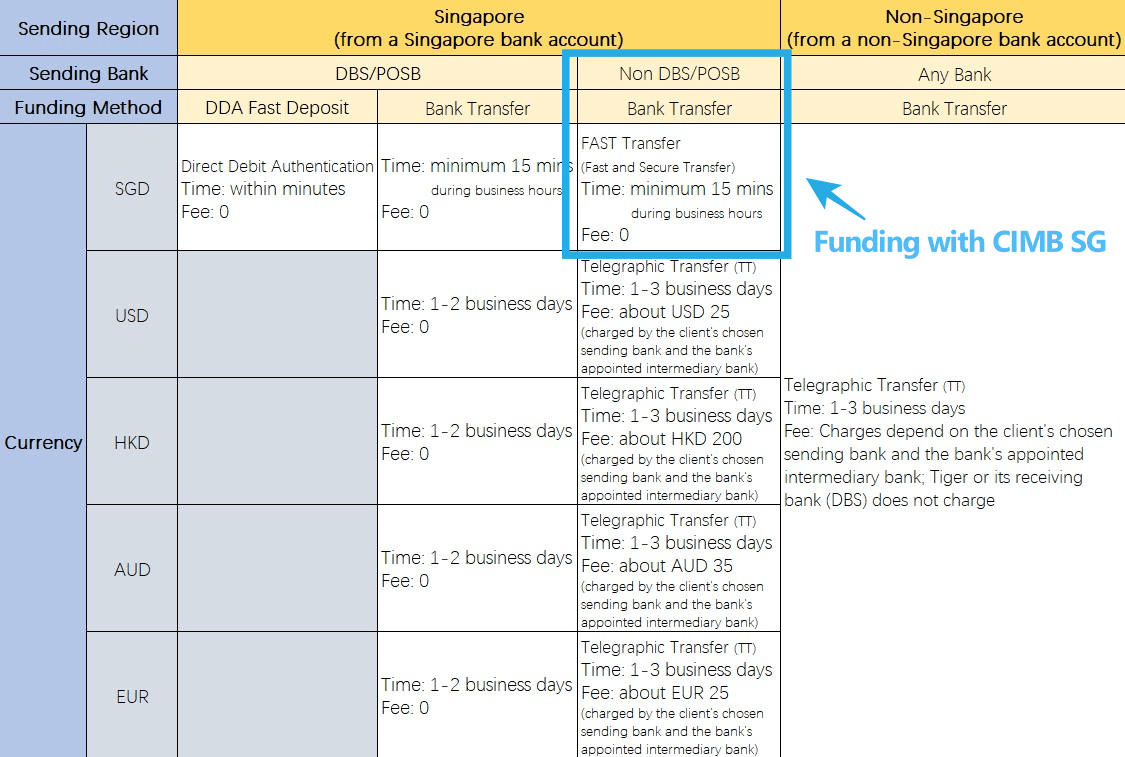

p - Tiger currently accepts the following methods of deposit:

Tiger Brokers funding methods p

- DBS Bank SG is the custodian bank for Tiger clients’ funds.

p - Time needed for funding via CIMB SG to be reflected: Minimum 15 mins during business hours. If the transfer is initiated during non-business hours, it will arrive on the next business day.

p - Any fees for funding via CIMB SG? No.

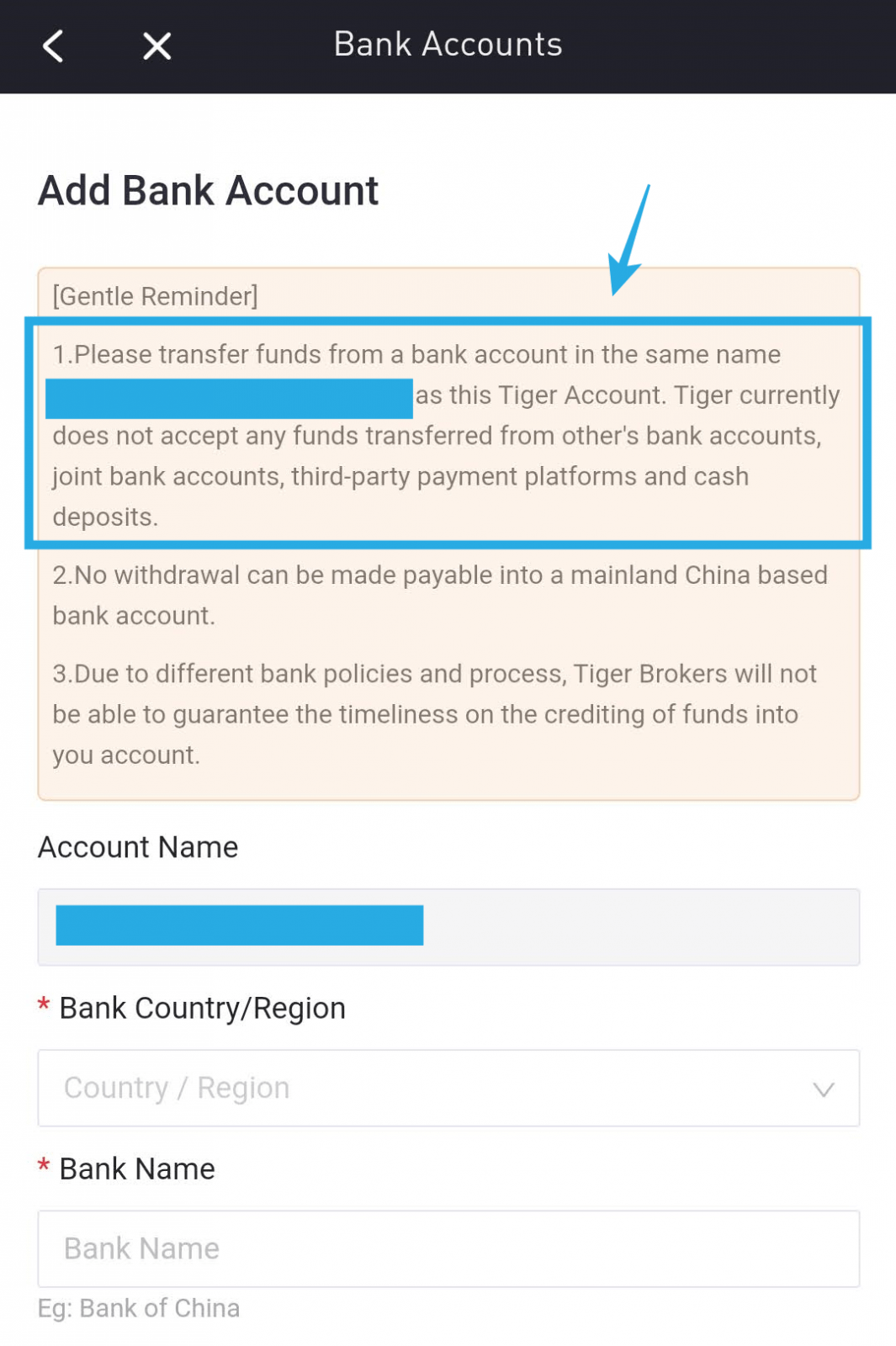

p - TAKE NOTE: Please transfer funds from a bank account under the same name as your Tiger Account. Tiger currently does not accept any funds transferred from/by other persons’ bank accounts, joint bank accounts, third-party payment platforms such as Wise and GrabPay.

Guide: Funding your Tiger Brokers account via CIMB SG

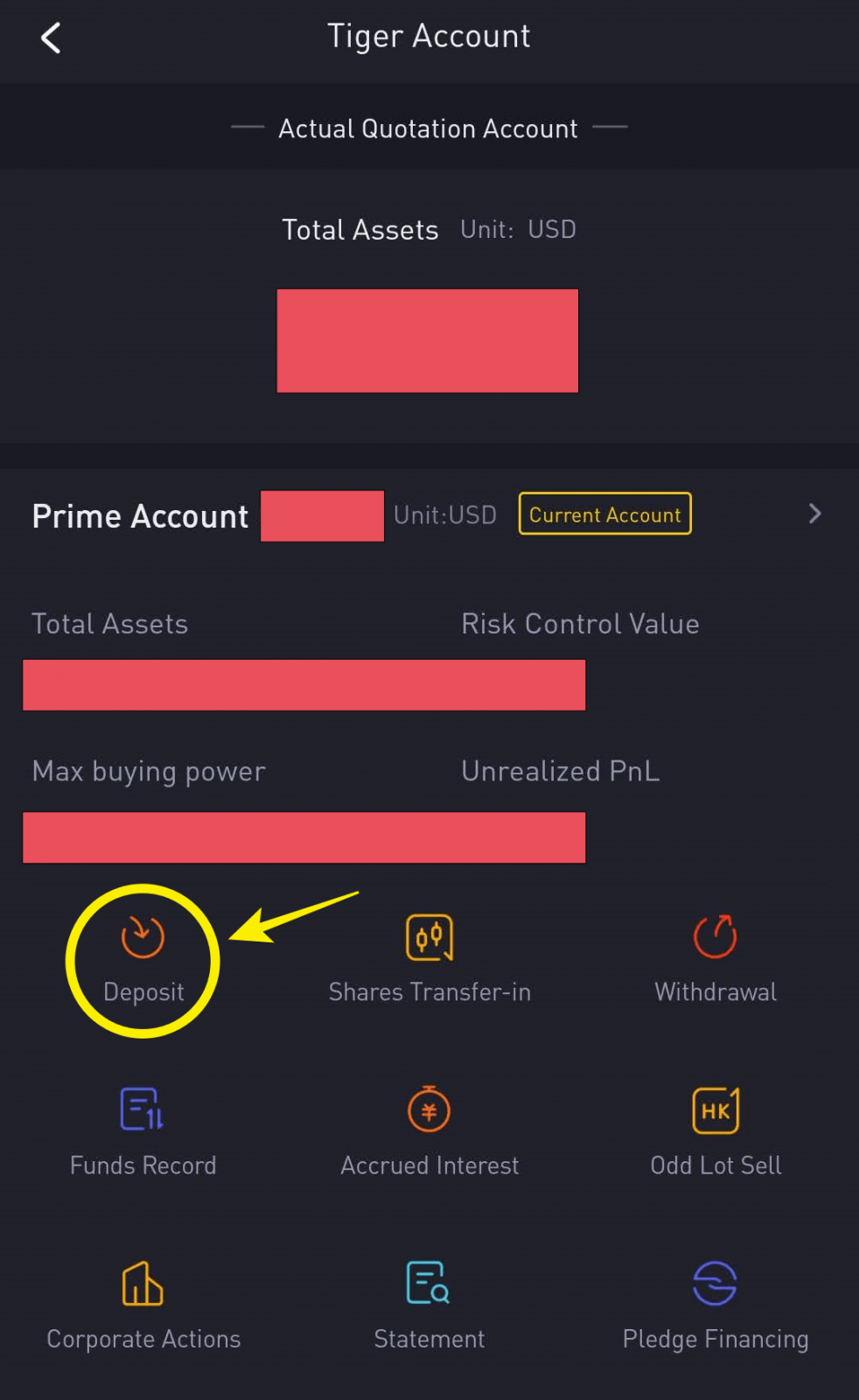

Step 1: Open your Tiger Trade app > Me > Tiger Account > Deposit.

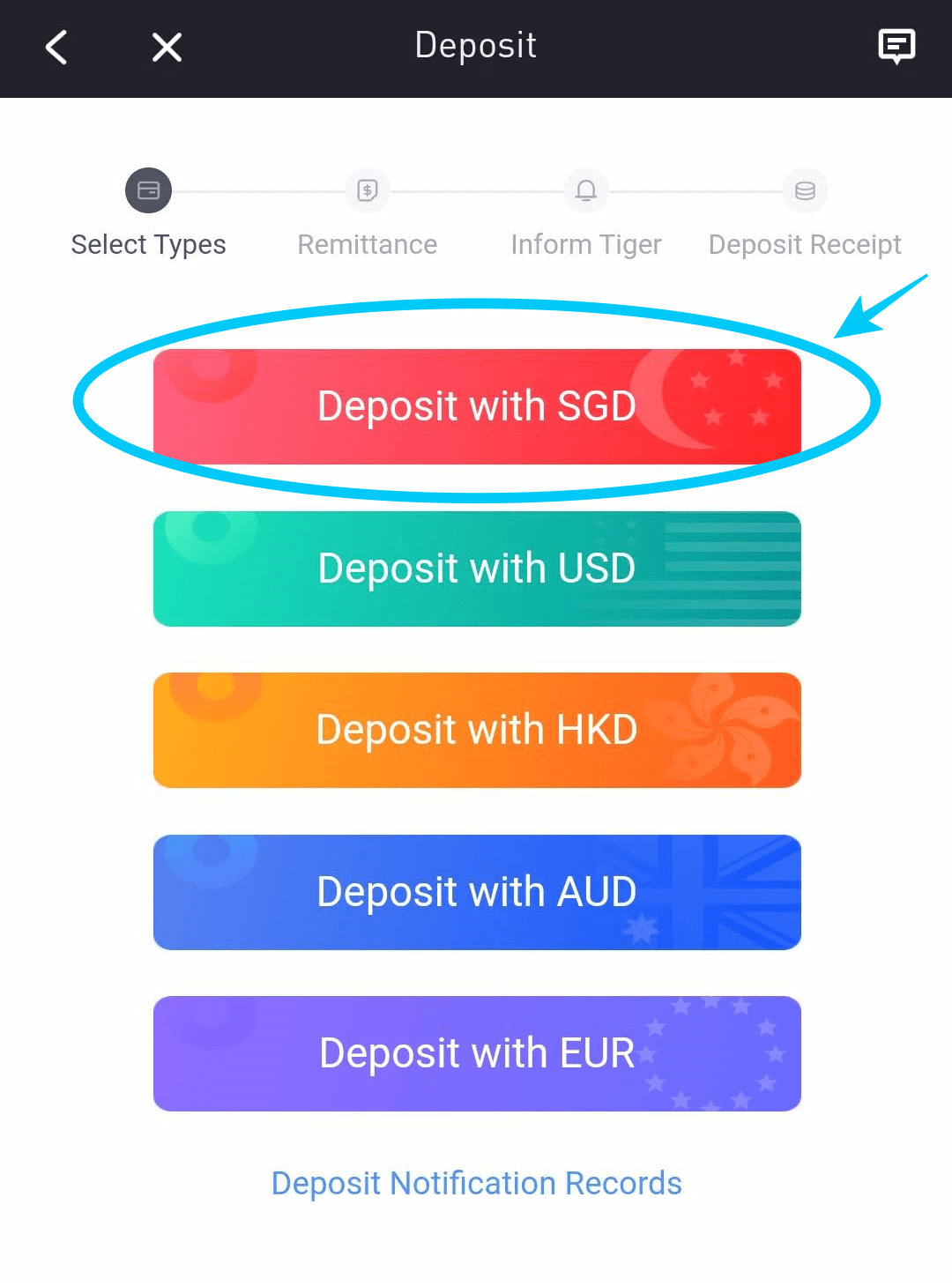

Step 2a: Select ‘Deposit with SGD’.

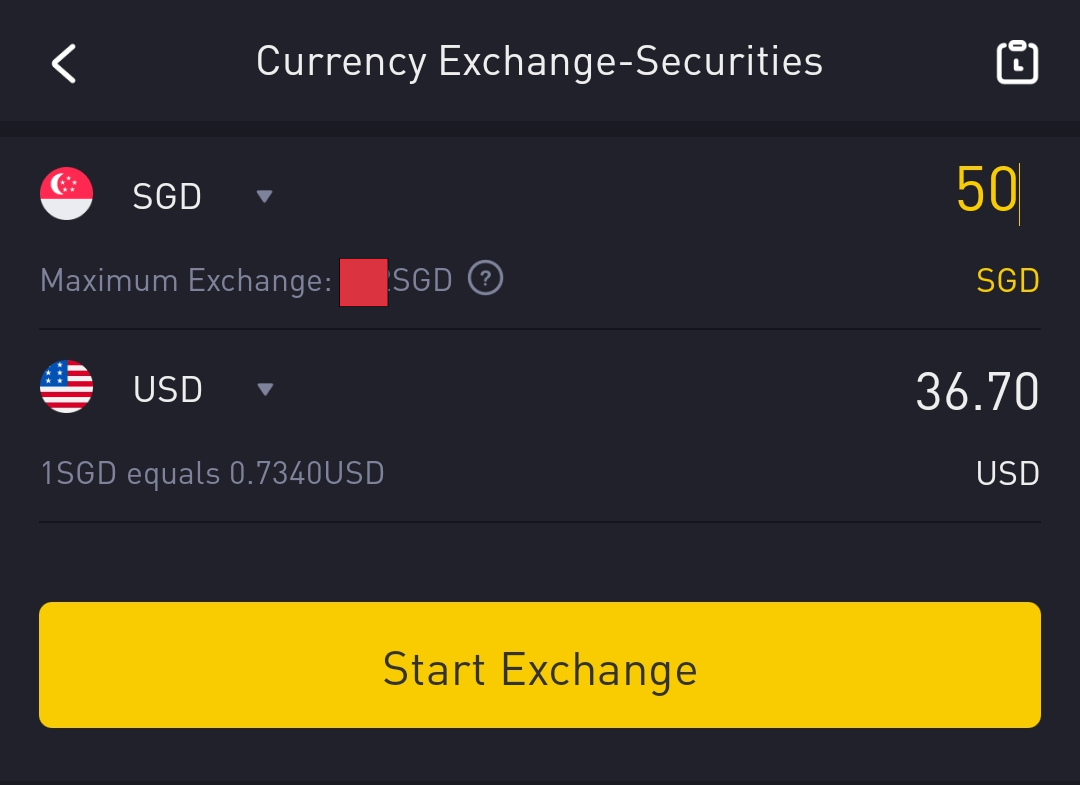

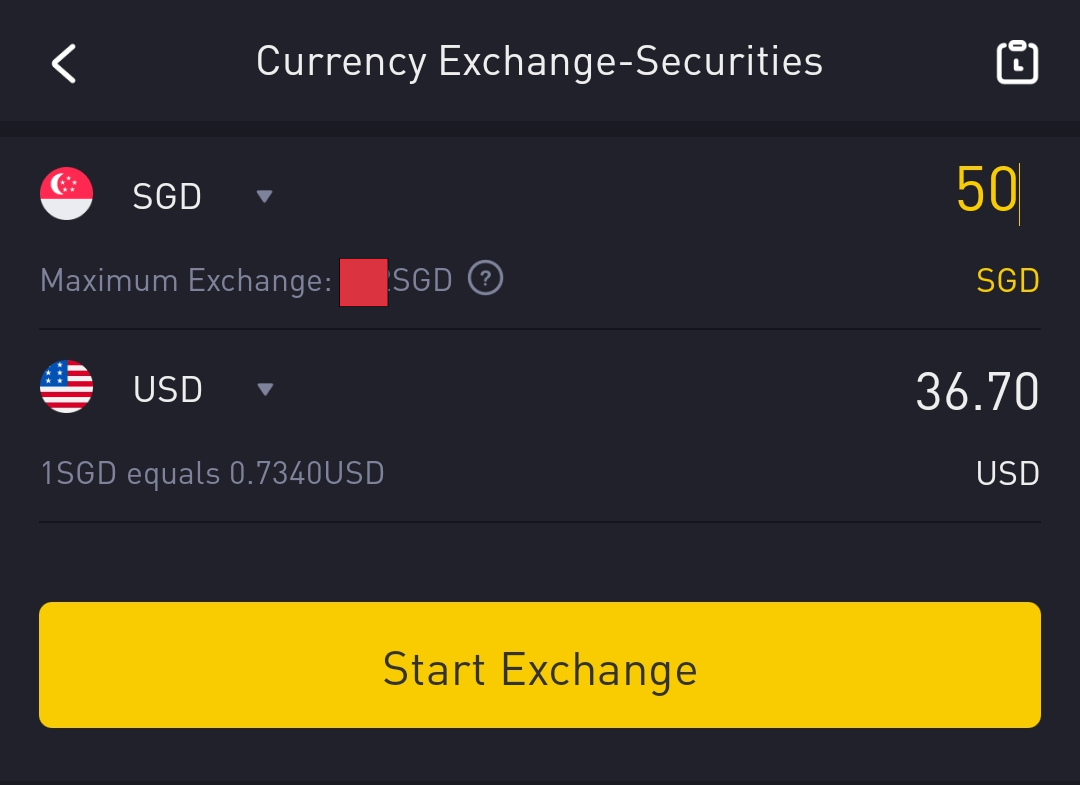

If you are looking to use USD to invest in the US market, don’t worry, because you can exchange your SGD into USD within the Tiger Brokers app at a decent rate easily. (‘Trade’ > ‘Currency Exchange’)

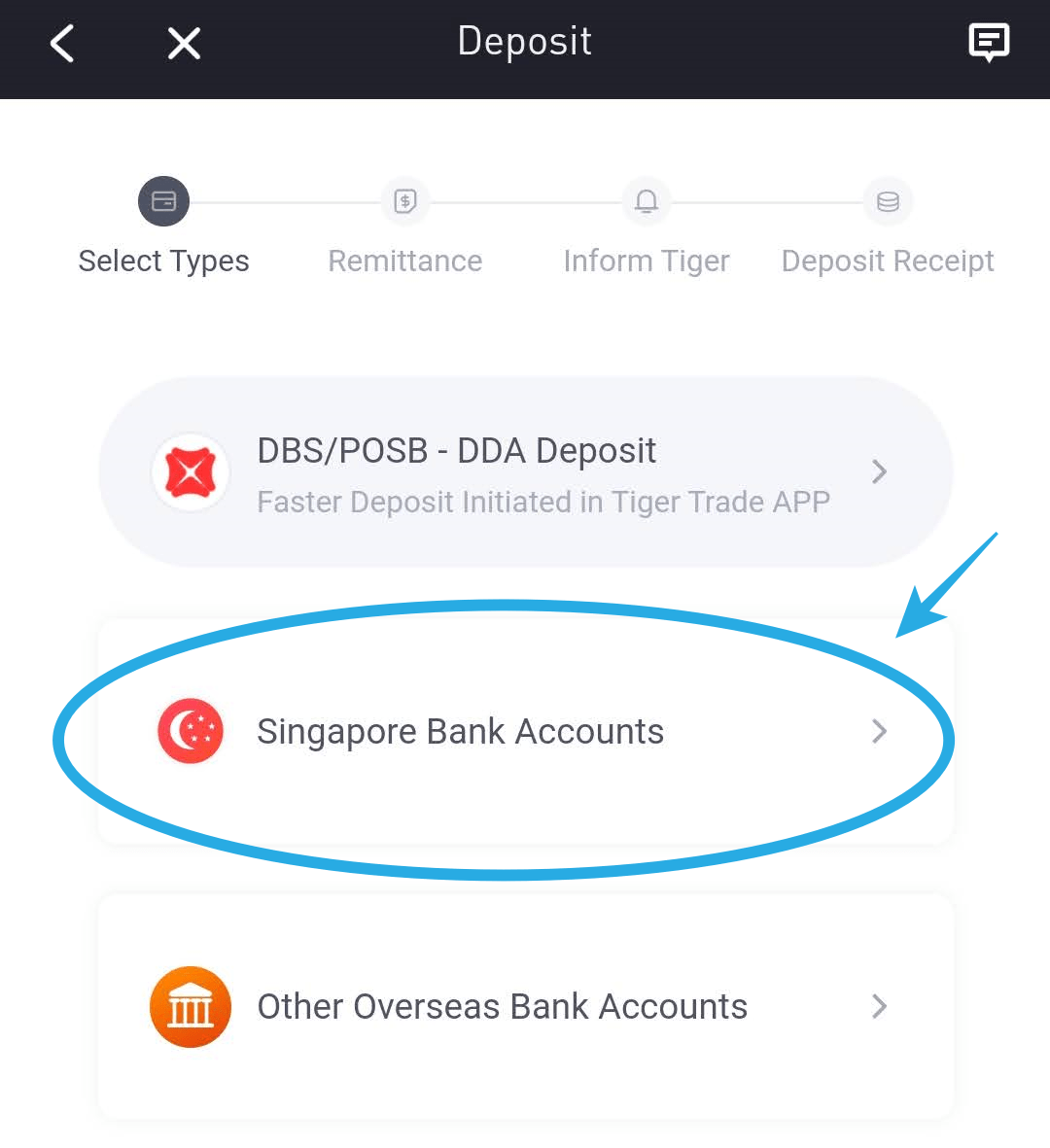

Step 2b: Then, choose ‘Singapore Bank Accounts’

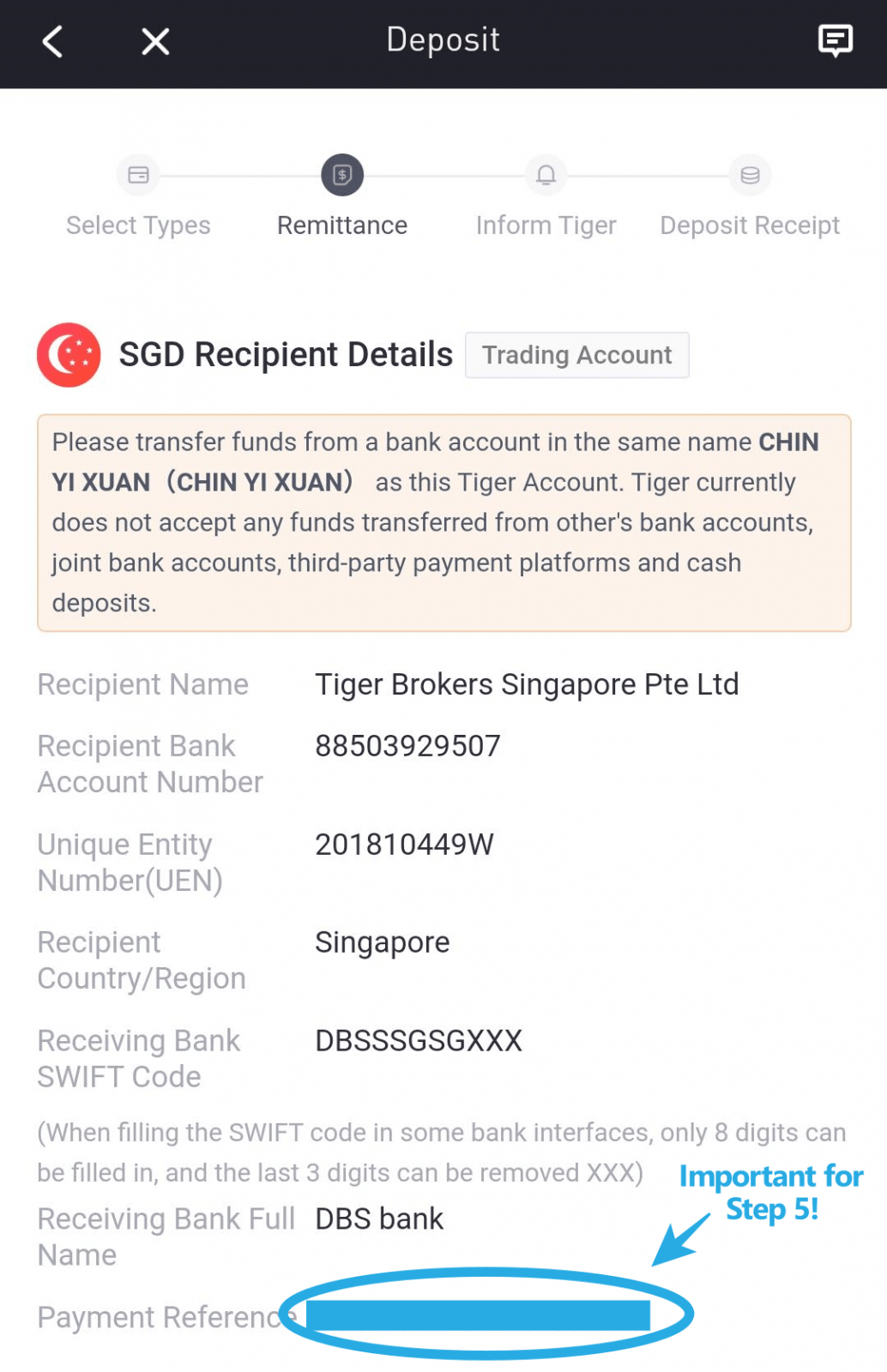

Step 3: You’ll receive the account details from Tiger Brokers.

Step 3: You’ll receive the account details from Tiger Brokers.

This is where you’ll need to transfer the funds via CIMB SG. Do not close this window, and take a screenshot of the details as you’ll need it in Step 5.

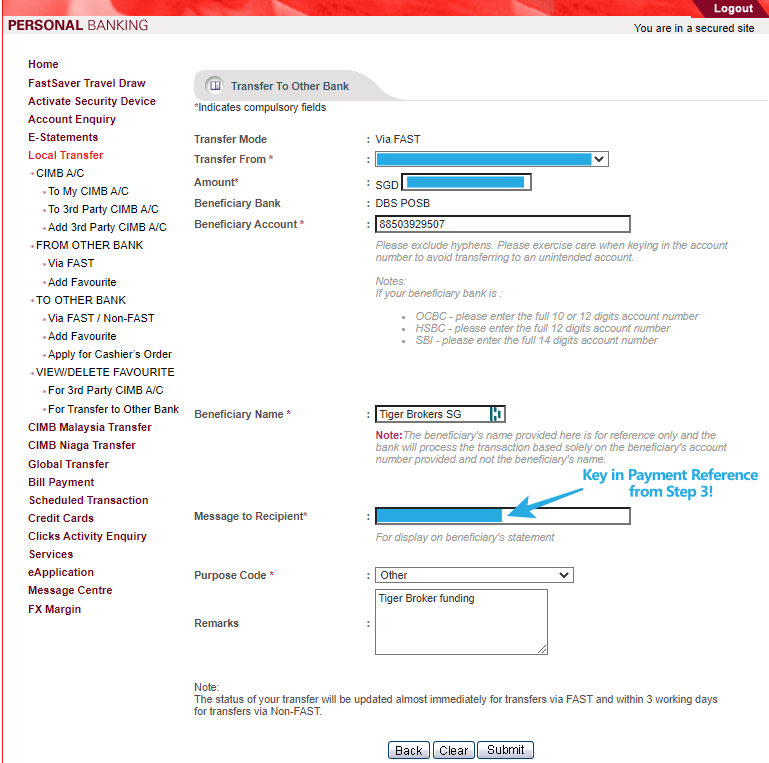

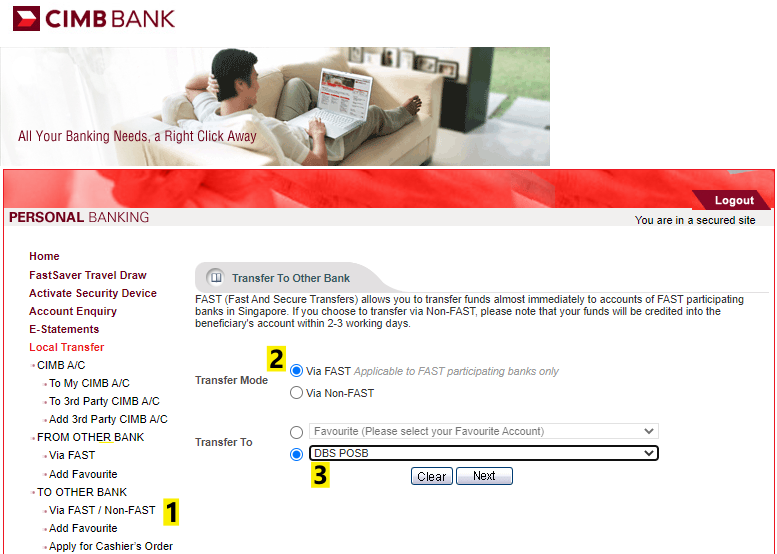

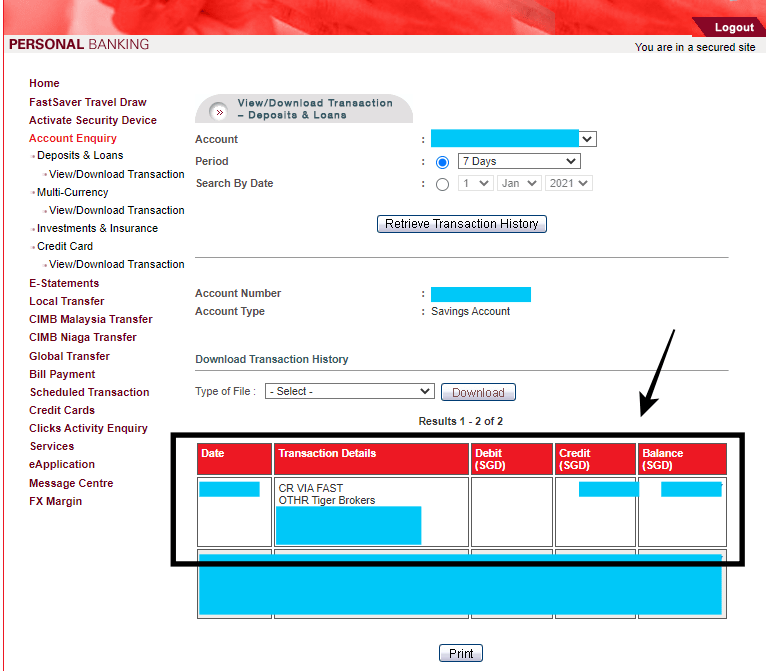

Step 4: Login to CIMB SG > Select ‘Local Transfer’ > ‘To Other Bank’ > ‘Via FAST’ > Transfer to: ‘DBS POSB’

Step 5: Key in Tiger Brokers’ bank details that you got in Step 3.

Remember to key in ‘Payment Reference’ from Step 3 under ‘Message from Recipient’ so Tiger Brokers know that the funding is from you!

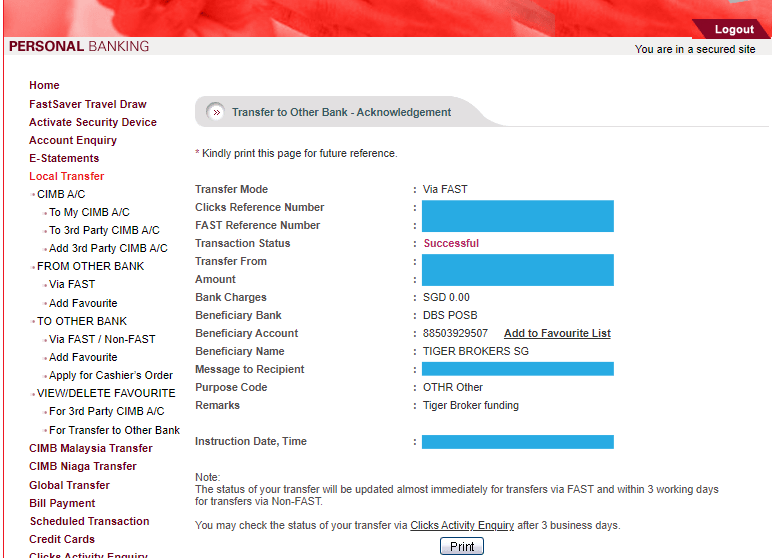

Step 6: Once you have done your transaction, take a screenshot and save the proof of transfer.

For ease of future transfer, consider adding Tiger Brokers’ account details into your favourite by clicking ‘Add to Favourite List’.

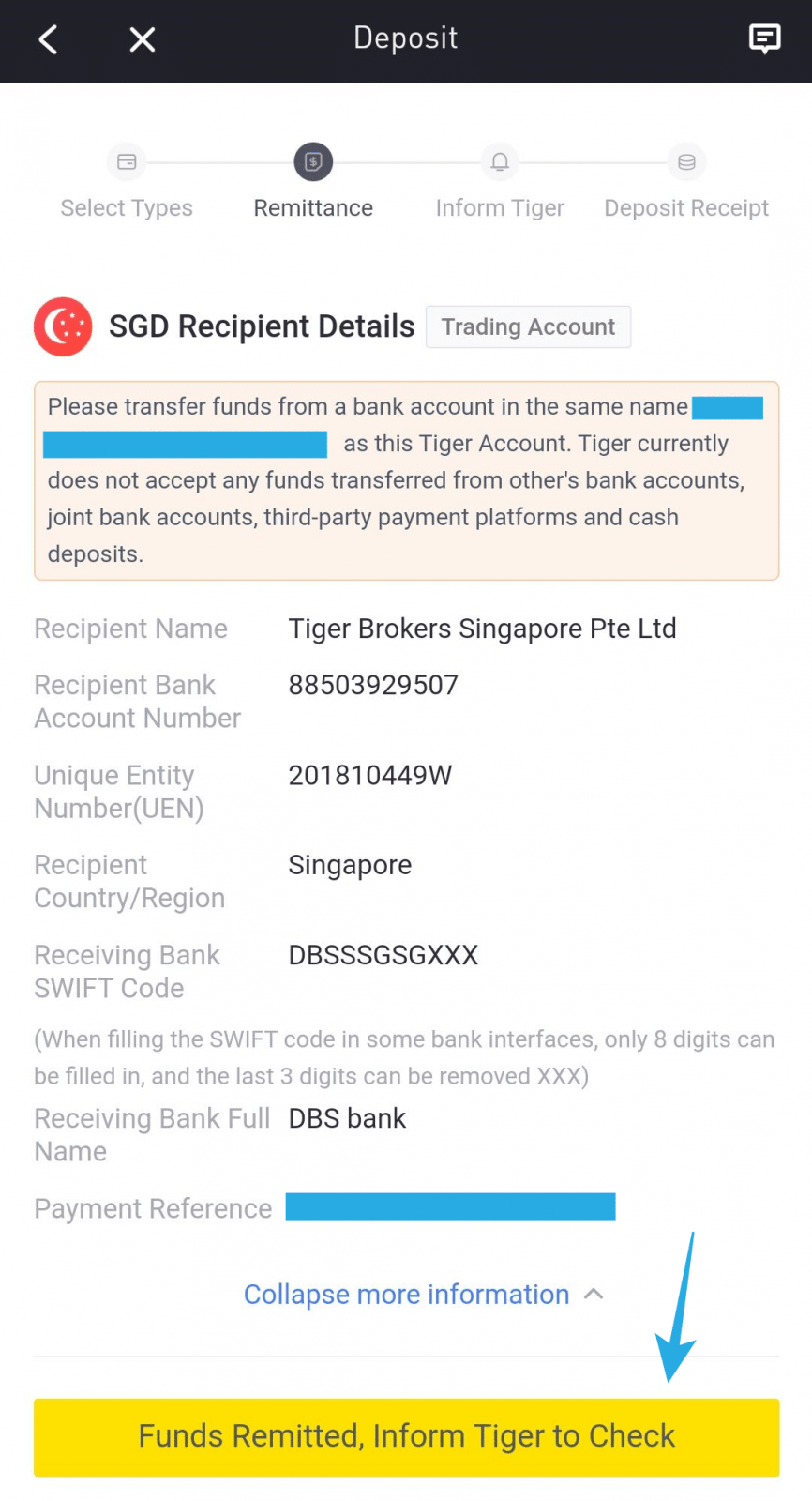

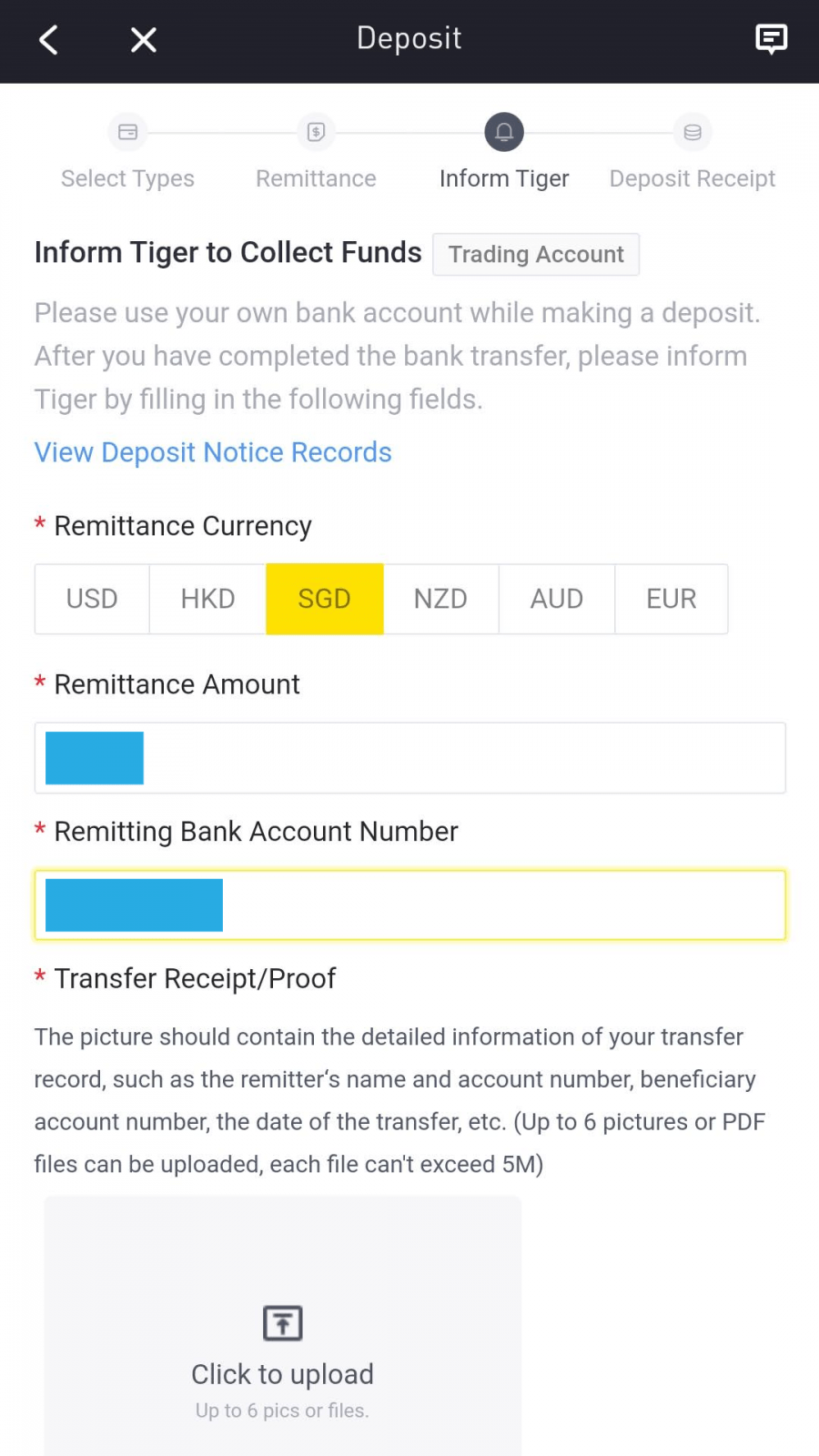

Step 7: After the fund transfer, go back to the Tiger Brokers app and click ‘Funds remitted. Inform Tiger to check’

Then, key in your CIMB SG account number and upload the proof of transfer from Step 6. This step is not mandatory but it minimises the time needed for the Tiger Brokers to process your funding.

Step 8: Funding success

The time needed for the deposit to go through should take about 15 – 40 minutes (during business hours) from my personal experience. You’ll receive an email once the deposit is successfully processed.

Tiger Brokers Withdrawal to CIMB SG

Important to note before withdrawing funds via Tiger Brokers:

- Singapore DBS Bank is the custodian bank for Tiger clients’ funds.

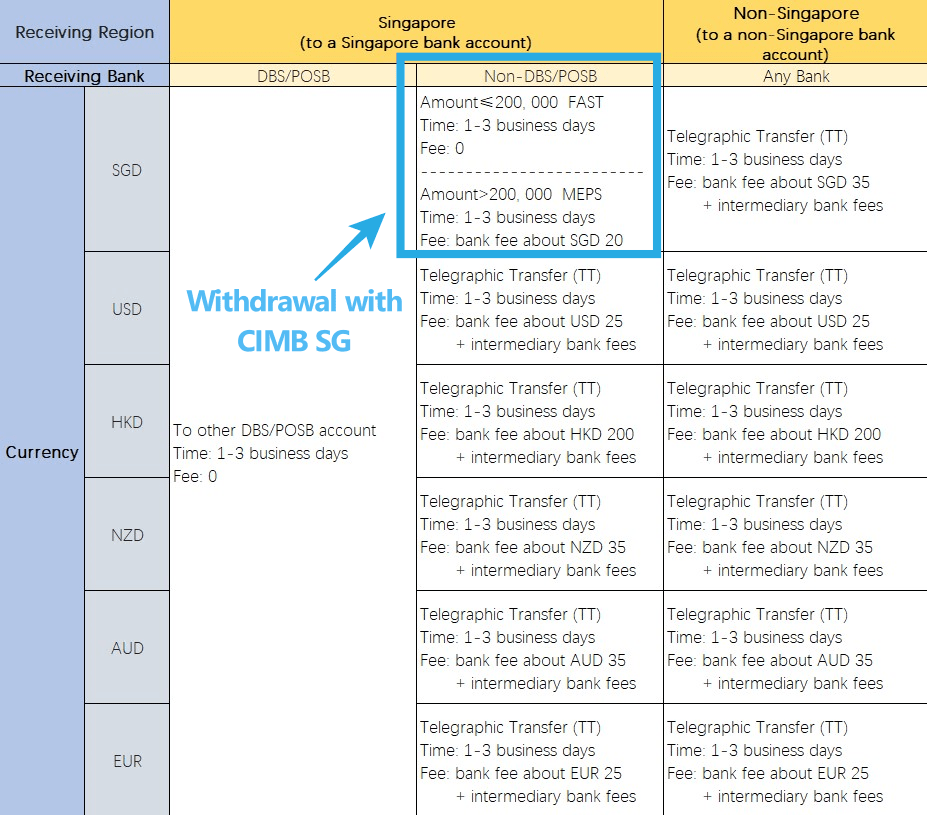

p - Tiger currently accepts the following methods of withdrawal:

[p

[p - Withdrawal time: The time depends on the processing bank(s). The minimum time for funds to arrive can be within the same business day.

p - Any fees for withdrawal via CIMB SG? No.

p - PLEASE NOTE: Transfer funds to a bank account in the same name as your Tiger Account. Funds cannot be withdrawn to other persons’ bank accounts, third-party payment platforms (eg. GrabPay), joint bank accounts or mainland China-based bank accounts.

Guide: Withdrawal from Tiger Brokers to CIMB SG

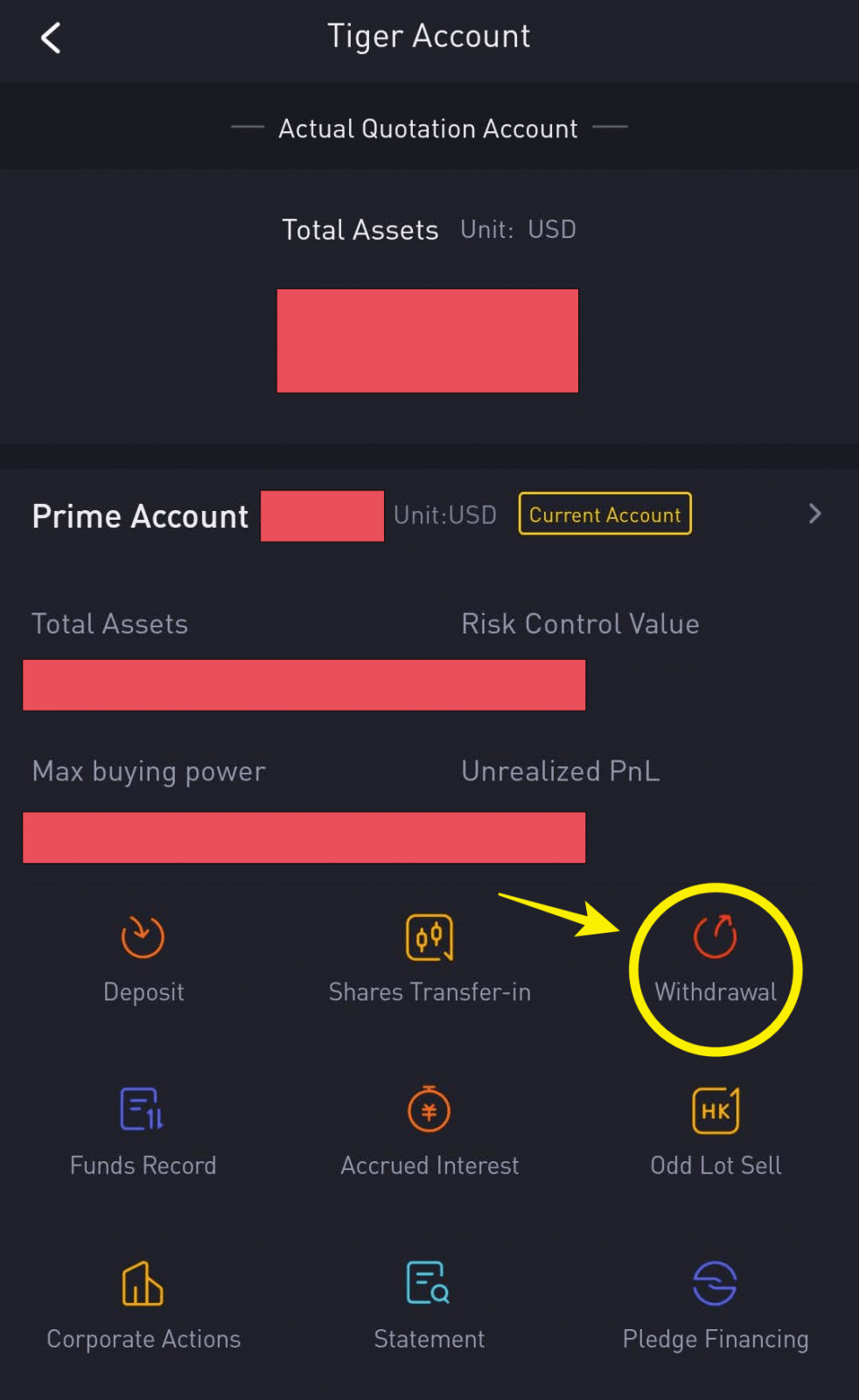

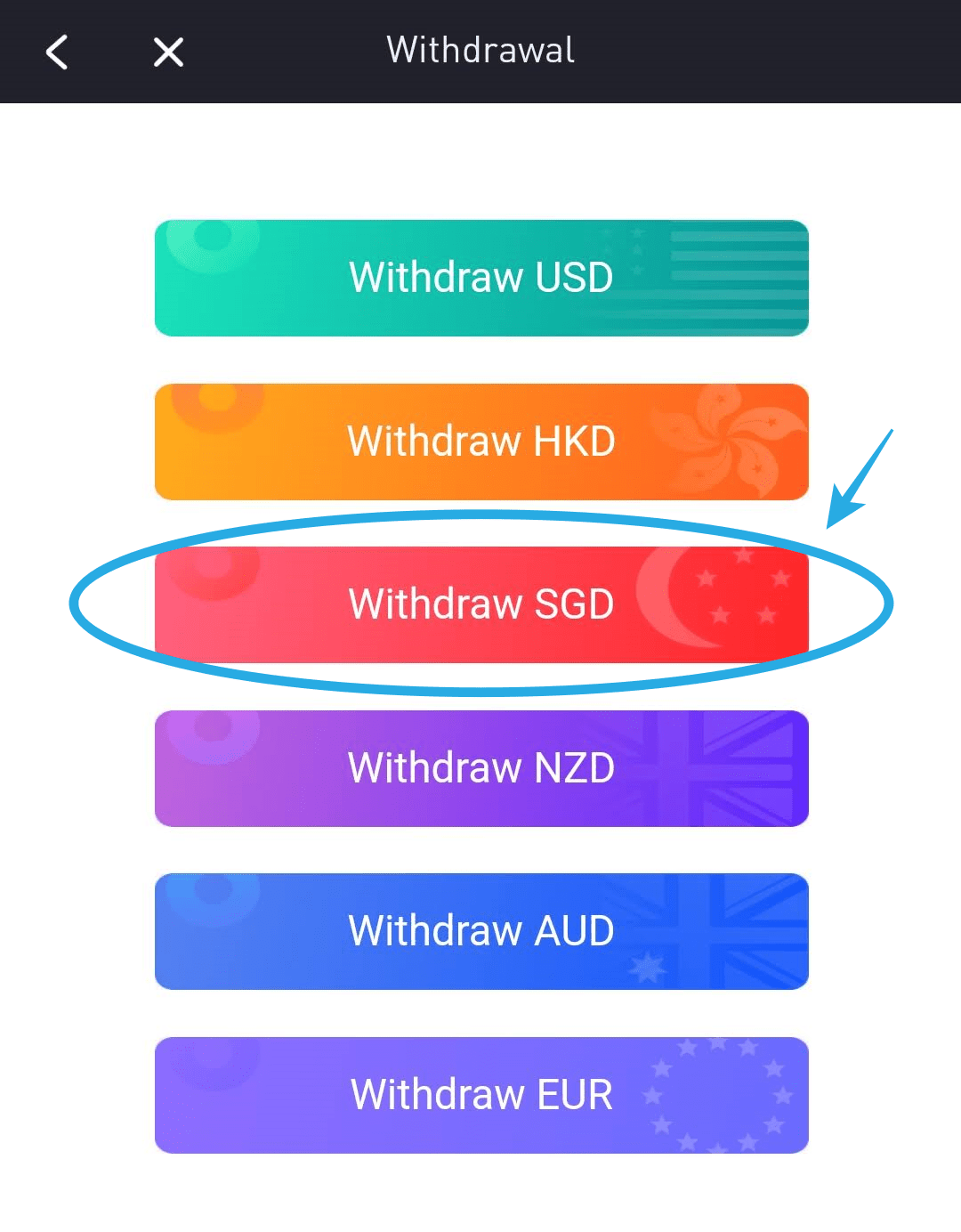

Step 1: Open your Tiger Trade app > Me > Tiger Account > Withdrawal.

If your account is mainly in other currencies like USD, don’t worry, because you can exchange your USD into SGD prior to withdrawal within the Tiger Brokers app easily. (‘Trade’ > ‘Currency Exchange’)

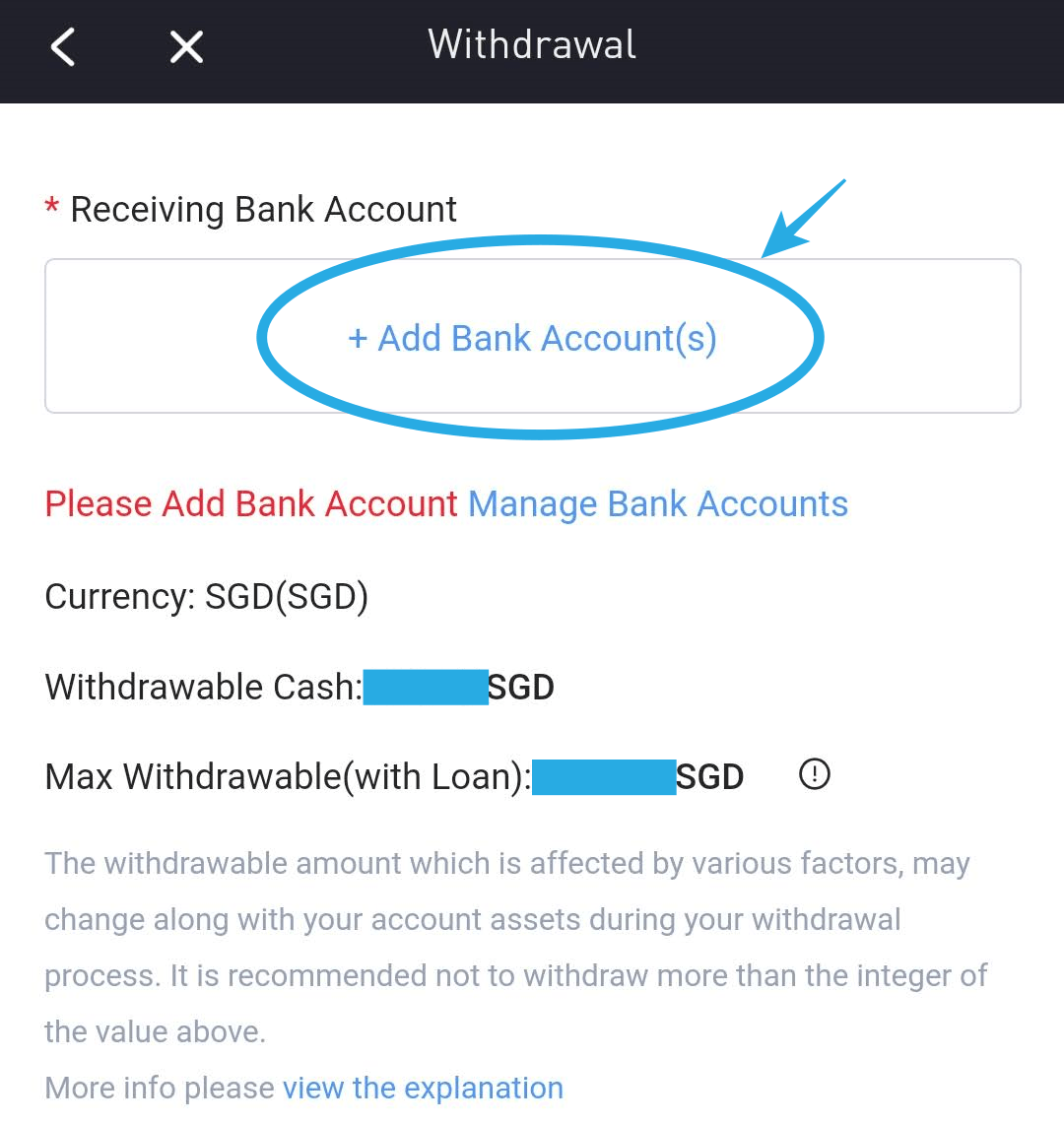

Step 3: If this is your first time withdrawing, add a bank account.

- Bank Country: Singapore

- Bank Name: CIMB Bank Berhad

- Branch Name: CIMB Bank Berhad

- Bank Account: Your CIMB SG Bank Account

- Bank Account Type & Currency: Single currency account & SGD

- Bank Swift Code: CIBBSGSG

- Contact Address: 50 Raffles Place Singapore Land Tower 09 01

- Click HERE for the latest Bank details.

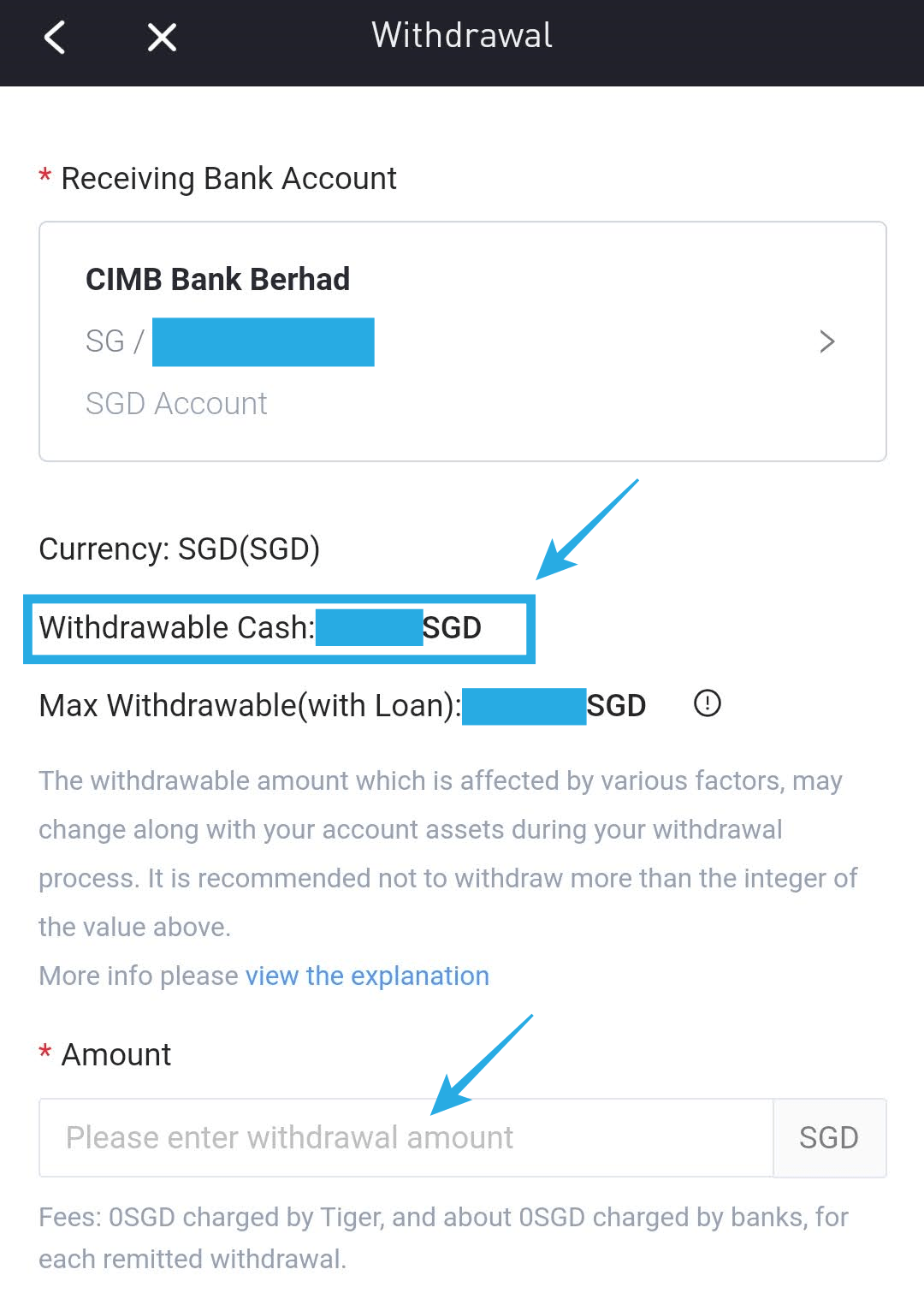

Step 4: Enter withdrawal amount

‘Withdrawal Cash’ is how much you can withdraw from your Tiger Brokers account.

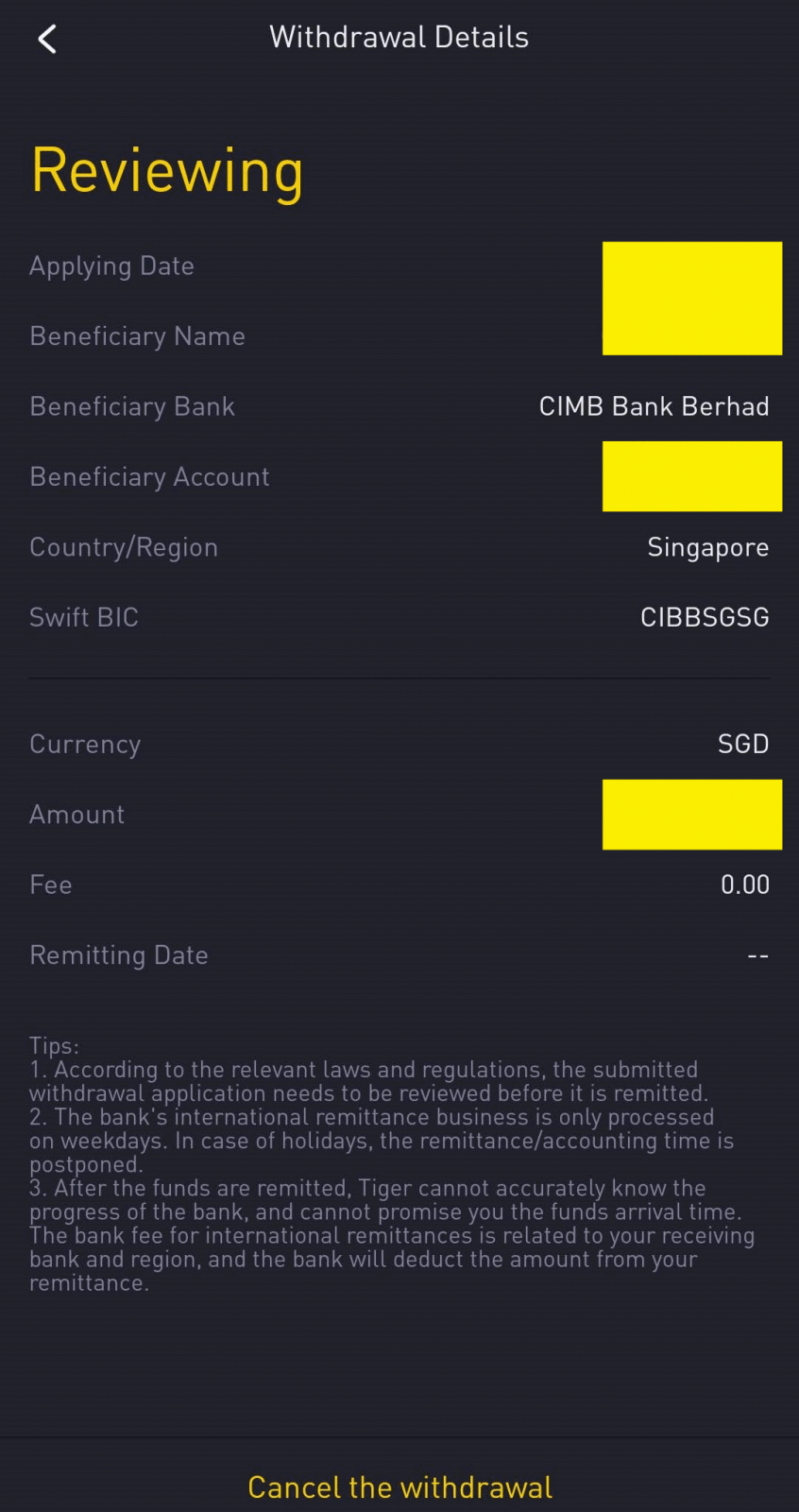

Step 5: Done and check the status of your withdrawal

Step 5: Done and check the status of your withdrawal

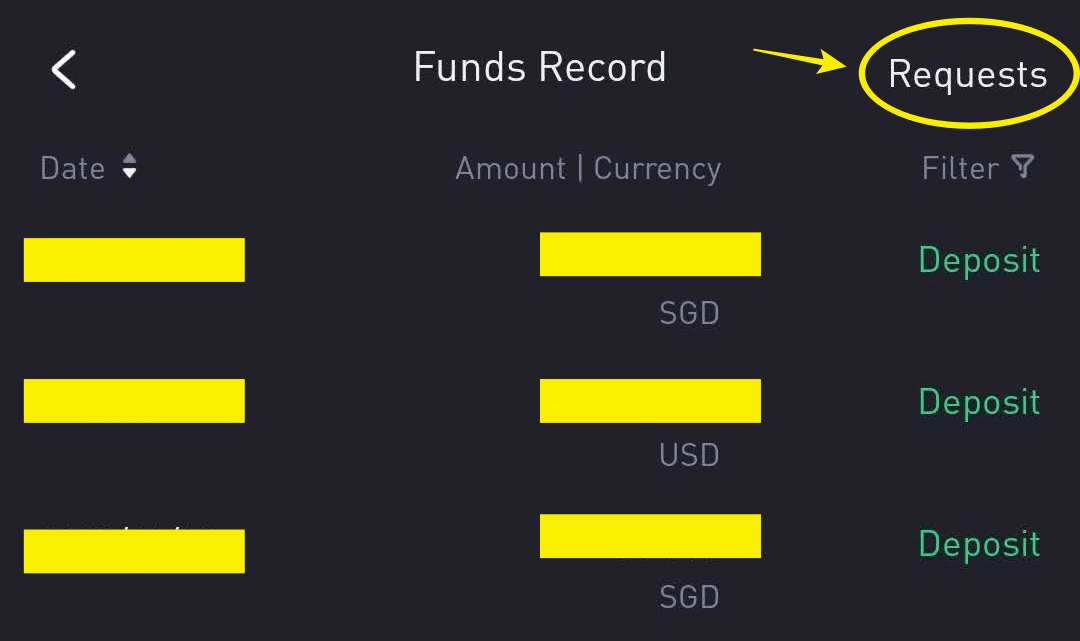

After the withdrawal request is submitted, you may go to [Tiger Trade mobile APP > Tiger Account > Funds Record > Request], to check the withdrawal request and processing status, or cancel the request.

Here are the statuses of withdrawals:

Here are the statuses of withdrawals:

- Reviewing: 1-2 business days are needed for the review, thanks for your patience. You may cancel the request when it’s under review.

- Rejected: The request didn’t pass the review, you may find the reject reason in the Tiger Trade APP.

- Awaiting withdrawal: The request passed the review.

- Bank Processing: The money was deducted from your securities account, and will be remitted out after the bank completes processing.

- Failed: We can’t remit the money out because the bank rejected it. The money is being returned to your securities account.

- Remitted: Your money was sent to your personal bank account.

- Refunded: The money was returned by the beneficiary bank and re-credited into your securities account.

- Cancelled: You have cancelled the withdrawal request.

Step 6: If everything goes smooth, the time needed for the withdrawal to be reflected should take within 1 – 3 business days.

You’ll receive an email once the withdrawal is successfully processed.

You can also log in to your CIMB SG account to check the transaction.

You can also log in to your CIMB SG account to check the transaction.

No Money Lah’s Verdict

So there you have it – a guide on how you can deposit to, or withdraw from Tiger Brokers via a CIMB SG bank account!

If you find this guide useful, consider clicking on the button below to use my Tiger Brokers referral link!

—

[PROMO] Commission-free trades + Free stocks!

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 – USD888

Open A Tiger Brokers Account Today!

Doing so will help support this blog, while entitling you to multiple account-opening rewards.

Disclaimer:

This post contains affiliate link(s). As always, I’d only recommend tools and financial solutions that I personally use AND/OR are interesting & provide unique value to my readers. Every article takes a long time and effort to write and when it comes to financial solutions, I’ll only invest time in writing about good and relevant products.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi, when I tried funding my TB account via CIMB SG but am stuck at Step 5 because CIMB SG asked for a OTP from a security device, which I don’t have. I’ve set up all the rest but got stuck here. Any solution?

Hi Kenny,

You may have missed out on a step while setting up your CIMB SG account. You should download the CIMB Clicks SG app to activate your Digital Token for OTP/TAC. More details can be found here (Step 5, #3): https://nomoneylah.com/2021/09/10/singapore-bank-account/#Opening_a_CIMB_SG_FastSaver_Account

Regards,

Yi Xuan

Thank you! Yes I missed that step, completed and now all’s good. 🙂

Just notice that Tiger has enabled Wise as one of the deposit method, after a few comparison (different timing etc.) it’s cheaper than transferring to CIMB SG.

Hi Jay!

Yes! Wise funding is now enabled for Tiger Brokers – I will update this article soon!

That said, you will still need a SG account for withdrawal because withdrawal to a Msia bank acc in MYR will be costly.

Regards,

Yi Xuan