Last Updated on April 11, 2024 by Chin Yi Xuan

Dividend Reinvestment Plan (DRP/DRIP) is a programme that allows investors to reinvest their cash dividends in the form of shares.

For investors, DRP is a convenient way to automate the compounding process of their investments, without having to manually reinvest their dividends every time they are paid out.

In this post, we’ll dive deep into DRP, its benefits and downsides, how to use DRP efficiently – and more!

RELATED POSTS:

- All you need to know about dividend withholding tax!

- Freedom Fund: My dividend income portfolio!

- My monthly dividend income update

p

Table of Contents

What is DRP + Why DRP?

DRP is a programme that certain companies will open for their investors when a dividend is announced.

Instead of paying investors in cash dividends, a DRP reinvests investors’ dividends by purchasing additional shares of the company.

Through DRP, investors are able to compound their dividend returns over time by turning them into additional shares. In return, these shares will then pay out more dividends to them.

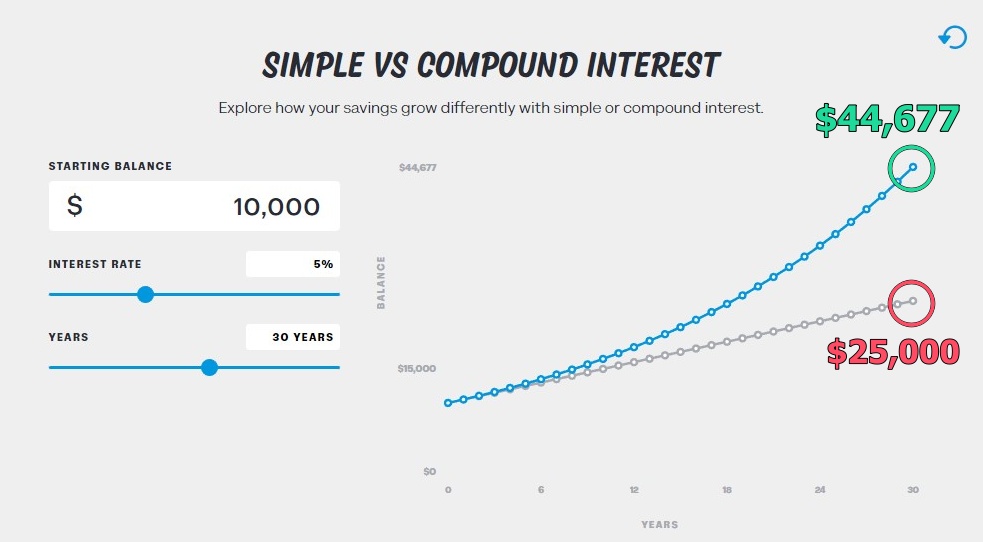

If an investor merely receives dividends without reinvesting them, there’ll be a huge difference in return in the long run. Consider a simple comparison below:

- Context: $10,000 investment with a 5% annual dividend over a period of 30 years.

- Simple return: Dividends are not reinvested. Turns into $25,000 in 30 years.

- Compounded return: Dividends are reinvested. Turns into $44,677 in 30 years.

Another huge benefit of DRP is that it automates the dividend reinvesting process. As a result, it lifts the manual effort away from investors and leaves the compounding process uninterrupted.

How to calculate DRP

As an example, if you own 1,000 shares of Company X and it announces a DRP for its upcoming dividend payout.

For this example, the DRP details are as follows:

- Distribution Per Unit (DPU): $0.20

- DRP units issue price*: $11.00

[*Issue price: It is common to see companies offer DRP units at a discounted price from the market price to entice investors to join the programme.]

Without DRP, you would receive $200 in cash dividends (1,000 shares x $0.20). What happens if you enroll in DRP?

- Step 1: If you choose to enroll in DRP, you will receive 18 additional shares at $11.00 share price (18 x $11 = $198). This increases your total holdings to 1,018 (1,000 + 18) shares in Company X.

- Step 2: Now, recall that your initial cash dividend is $200 and only $198 was used for the additional shares. What will happen to the remaining $2?

- Step 3: Since the remaining $2 is unable to purchase a whole unit of share ($11), it will (usually) be paid to investors in the form of cash dividends. That said, certain brokers may allow for fractional shares in DRP (ie. Shares smaller than 1 unit), which will convert your $2 dividend into 0.18 units of shares.

DRP Calculation Examples

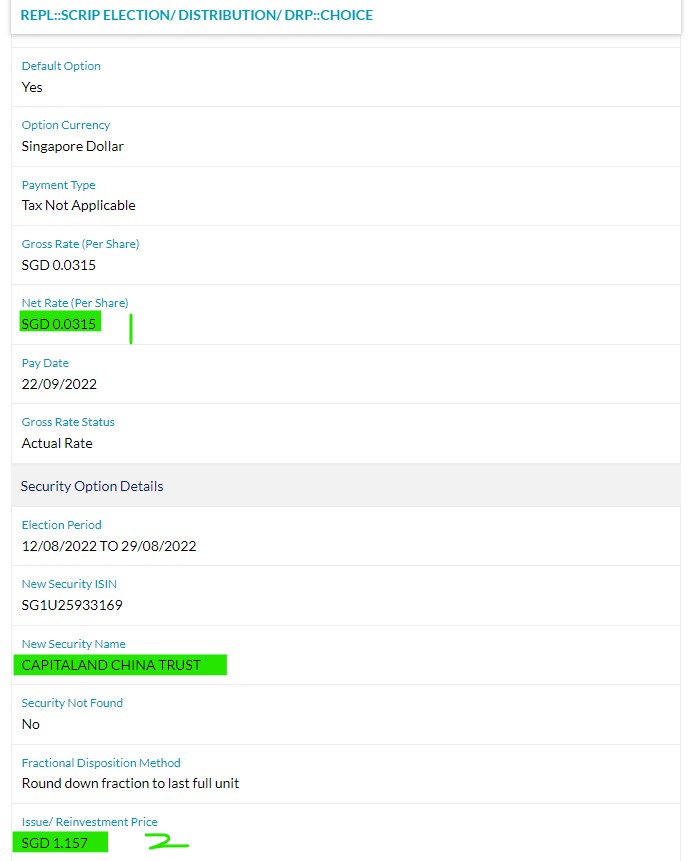

#1 CapitaLand China Trust (SGX: AU8U) Dividend Reinvestment Plan

AU8U is a Singapore-listed REIT that offers investors exposure to retail properties in China (eg. malls). Here’s how we can make our DRP calculation from the announcement below:

| (1) Distribution per unit (DPU) | SGD 0.0315 |

| (2) DRP issue price | SGD 1.157 |

- Step 1: Calculate the dividends that we are going to receive without DRP. In this case, we’ll be receiving SGD 15.75 in dividend payment.

500 units x SGD 0.0315 = SGD 15.75

- Step 2: Find out how many DRP units we are eligible for. Divide the dividend payment by DRP issue price and we are eligible for 13.6 units of shares.

SGD 15.75/ SGD 1.157 = 13.6 units

- Step 3: Since AU8U does not have shares in units less than 1, we are eligible for a maximum of 13 units of shares from this DRP (instead of 13.6 units).

- Step 4: If we opt for the maximum of 13 units for this DRP, any dividends that are not reinvested will be paid to us in the form of cash dividends. In this case, we will be getting SGD0.019 in cash dividends.

0.6 units x SGD 0.0315 = SGD 0.019

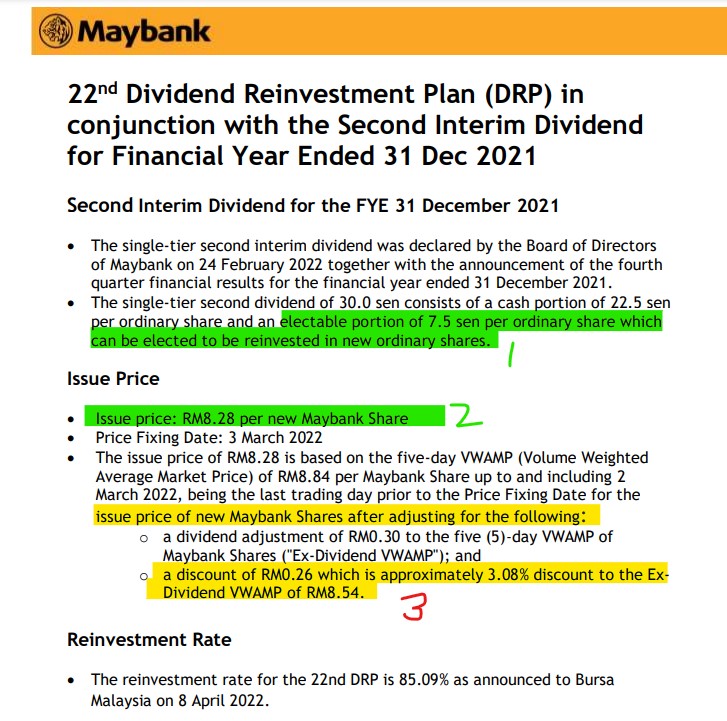

#2 Maybank (KLSE: 1155) Dividend Reinvestment Plan

Maybank is the largest Malaysia-listed bank. Here’s how we can make our DRP calculation from the announcement below:

| Distribution per unit (DPU) | RM0.30 |

| (1) DPU that is eligible for DRP | RM0.075 |

| (2) DRP issue price | RM8.28 |

- Step 1: Using the portion of DPU that is eligible for DRP (RM0.075/unit), calculate the dividends that we are going to receive from that portion. In this case, we’ll be receiving RM37.50 in dividend payment.

500 units x RM0.075 = RM37.50

- Step 2: Find out how many DRP units we are eligible for. Divide the dividend payment by the DRP issue price and we are eligible for 4.53 units of shares.

RM37.50/RM8.28 = 4.53 units

- Step 3: Since Maybank does not have shares in units less than 1, we are eligible for a maximum of 4 units of shares from this DRP (instead of 4.53 units).

When should you consider DRP + How to opt for DRP

You should consider opting for DRP when you are invested in a solid company and the company offers a DRP on its dividends.

Through DRP, you get to acquire additional shares in the company (most of the time, at a discounted rate), and this compounds your returns automatically.

Normally, you will be notified by your broker whenever you are eligible for a DRP after a dividend is announced. If you are eligible for a DRP, just proceed to log in to your brokerage account and agree to the DRP accordingly.

Benefits of DRP

- DRP allows you to automatically reinvest your dividends in the form of additional shares without interrupting the compounding process.

- Usually, companies will offer DRP units at a discounted price compared to the share price. This allows investors to acquire shares at a lower price than the market price.

- Moreover, when companies offer a DRP, investors usually do not have to pay additional brokerage fees/commissions to acquire the DRP units. As such, the cost of owning these additional units becomes lower.

Downsides of DRP

While there are many benefits to DRP, it is not all perfect and may not suit certain investors. Here are a few downsides to DRP:

#1 Fractional shares can be hard to sell

Investors that opt for DRP may, at times, end up with additional fractional shares. Fractional shares are units of shares that are not commonly transacted. (eg. 7 shares where the shares are transacted in 100-unit lots).

For certain stocks (especially ones with low volume), fractional shares may be harder to sell.

#2 No control over price & timing of DRP purchase

Since the terms of a DRP are decided by companies, investors do not have a say on the price and the timing of when a DRP purchase will happen.

No Money Lah Verdict

So there you have it! I hope this guide has been helpful in making DRP easy to understand!

For most investors, DRP is an amazing tool to automate the compounding process of their investments.

If you have any questions on DRP, feel free to leave your questions in the comment section under this post!

FAQ on DRP:

Q1: How can I enroll in a DRP?

When a company that you invest in announces a DRP, you will normally be notified by your broker. To enroll in the DRP, just log in to your brokerage account and there should be a corporate action section for you to enroll in it.

Q2: Is enrolling in DRP compulsory?

No, it is not compulsory for investors to enroll in a DRP. If you do not wish to reinvest your dividends into the company via DRP, you can choose to receive your dividends in cash.

Q3: Is DRP subjected to Dividend Withholding Tax (WHT)?

Yes, DRP is subjected to Dividend Withholding Tax, just like ordinary cash dividends.

LEARN MORE: What is dividend withholding tax (WHT) and how to deal with it?

Q4: Are there any fees to enroll for DRP?

If a company offers DRP, there is usually no extra cost for investors to enroll for the DRP. This means there’ll be no commissions and exchange fees involved.

Looking for a reliable global broker? ProsperUs has you covered!

This educational post is sponsored by ProsperUs by CGS-CIMB.

ProsperUs by CGS-CIMB is a regulated broker from Singapore that gives investors access to 30+ exchanges in more than 8 countries. (US, Hong Kong, China, Japan, UK, Singapore, Malaysia, Europe, and more!)

Now that you’ve learned about dividend withholding tax, you have the choice to invest in countries with a more efficient tax rule via ProsperUs!

In addition, ProsperUs offers multiple instruments from stocks, ETFs, futures, options, Forex, and CFDs. This is great for investors looking to diversify across different asset classes.

Exclusive ProsperUs Referral Code – MONEY20

If you are thinking to give ProsperUs a try, here’s something exclusive to No Money Lah readers – you will not find this anywhere else!

From today till 30/6/2024, key in my exclusive promo code ‘MONEY20’ while you register, and get FREE cash credits up to SGD100 when you open a ProsperUs account:

p

| Tier | Initial funding within 30 days of account set up | Trades Executed | Cash Credits |

|---|---|---|---|

| 1 | Minimum SGD500 – SGD2,999 | Minimum 3 trades executed | SGD10 |

| 2 | Minimum SGD3,000 – SGD14,999 | Minimum 3 trades executed | SGD20 (Deposit SGD3000 or more), OR SGD20 + SGD30 (Deposit SGD3000 or more + Min. trades fulfilled) |

| 3 | SGD15,000 or more | Minimum 3 trades executed | SGD20 (Deposit SGD3000 or more), OR SGD20 + SGD100 (Deposit SGD15,000 or more + Min. trades fulfilled) |

Click HERE to view the full T&C of this referral reward.

Open a ProsperUs Account Today!

Disclaimers

This article is brought to you in collaboration with ProsperUs by CGS-CIMB.

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.