Last Updated on September 28, 2022 by Chin Yi Xuan

2022 has thus far been challenging and we are beginning to feel the pinch.

So, I’m sure you have seen news of massive layoffs from Shopee lately.

In fact, retrenchments (or at least a slowdown in hiring) is now happening globally as companies look to cut cost in this uncertain time.

Companies like Shopify, Robinhood, and Snap have reduced their workforce by at least 10% in the past few months.

In this post, let’s explore 6 personal finance strategies that I think we should be prepared/mindful of in this uncertain time.

Table of Contents

Are we good? What can we do to prepare?

Personally, I am inclined to believe that most Malaysians are still financially sound – judging from the car sales figure from Proton.

However, I think the risk of more retrenchments coming in Q4 2022 & 2023 is getting higher as time goes by.

Question is, what can we do to prepare?

Play strong defense

#1 Have an emergency fund

Stash up cash to weather through at least 6 to 12 months of period without income.

Personally, I’d recommend putting your cash in very low-risk money market funds such as Versa Cash, KDI Save, or StashAway Simple. They offer interest on par with Fixed Deposit (FD), yet the flexibility to deposit & withdraw anytime without penalty – perfect in case of unexpected incidents.

#2 Protect your cashflow

Food for thought – Protecting your cashflow comes not from your current employment, but from knowing that you have the skills to make a living regardless of where you go.

Now’s a good time to reassess your edge in the workforce.

#3 Keep expenses low

With interest rate hikes not stopping anytime soon, it is crucial to keep our commitments (loans, debts) & expenses manageable.

This means taking into account of potential interest rate hikes + chances of short-term unemployment before taking up additional commitments.

Be aggressive (once your defenses are built)

#4 Invest

If you have extra gunpowder (ie. Cash), now’s a good time to start accumulating quality assets.

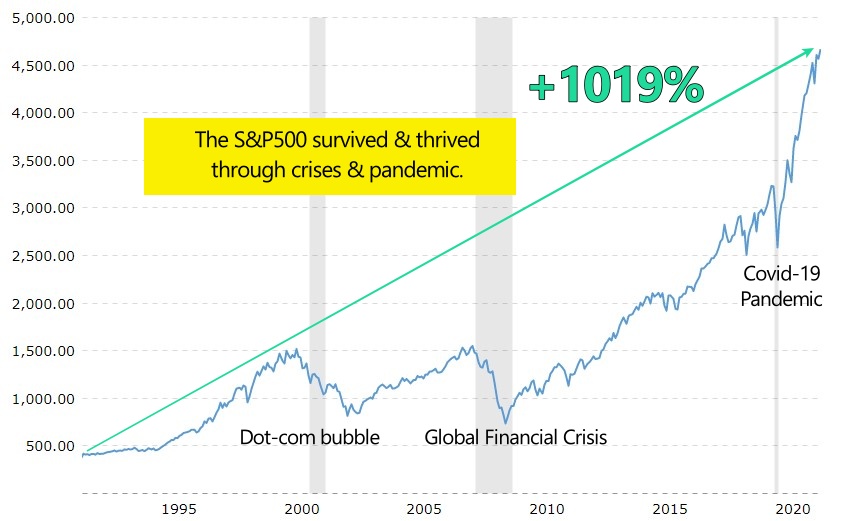

Since the stock market tends to rise with time, I’m decently confident that we’ll all reap the reward as a long-term investor.

I genuinely think that this is the time of our generation – be sure not to miss it!

LEARN MORE: What is S&P500 & how to invest in it?

#5 Start a project/business

Got a project or business idea that you always wanted to try?

You have nothing to lose if you begin – lay the foundation now, survive this challenging period, and watch it flourish with time.

#6 Learn/upskill

Never a bad thing to improve and equip ourselves with new skills, right?

Finding your edge in the workforce in challenging times

What is edge?

I think there is a misperception that having a Professional paper/Masters/PHD means one has an advantage over the others, and hence deserves higher pay.

The thing is, it is never about your academic qualifications. It is about how much VALUE you can bring to the table by having these qualifications.

Especially in challenging times, this USUALLY refers to how you can bring in more opportunities and/or profits to the team.

Let’s consider the paragraph above as we reflect on our role and contributions to our team & organization.

Highly recommendation books

3 books I’d highly recommend from our discussion today:

-

Linchpin by Seth Godin

A book talking about how to become indispensable in your career.

-

So Good They Can’t Ignore You by Cal Newport

A book on the mindsets and approaches to building a great career.

-

The 4-Hour Workweek by Tim Ferriss

A book that’ll change your perspective on conventional employment and career path.

No Money Lah’s Verdict

With the outlook becoming more uncertain with time, I think it is crucial for us to always be financially prepared for unexpected bumps in the months to come.

I am of the firm belief that every crisis offers us a chance to become a better person – be it in our career or finances.

We just need to prepare ahead.

As always, I hope you enjoy the read and if you have any questions, I am just a comment or email away!

Disclaimers

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

Related Posts

May 17, 2022

Delayed Gratification

November 1, 2020

Reality: Personal Finance is Never Really ‘Personal’

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.