Last Updated on March 16, 2024 by Chin Yi Xuan

In this post, let’s explore the cheapest and most efficient ways to deposit funds into your Interactive Brokers (IBKR) account.

This guide is suitable for non-US residents (eg. Singapore, Malaysia, and more) – any questions feel free to leave them in the comment section at the end of this post!

RELATED:

—

p.s. A word to fellow readers:

Dear friends, if you find this post helpful, I’d appreciate it if you can click on the button below to learn about IBKR via IBKR’s official site.

Doing so will help the earn the blog a small fee at no extra cost to you.

This will help supporting the blog in creating more useful content – thanks in advance my friends!

Table of Contents

Best ways to deposit/fund your IBKR account

There are 3 key ways to fund your IBKR account, namely through (i) Direct transfer from Wise balance, (ii) Direct ACH funding via Instarem, or (iii) Funding your IBKR account through a Singapore (SG) bank account.

Method #1: Funding your IBKR account from Wise balance (Easiest)

This is my preferred way to fund my own IBKR account as I find it the most straightforward method (though not necessarily the cheapest).

Fees incurred:

- Wise transfer fee

- Currency exchange rate

Pre-requisite: Open a Wise account and make a deposit to your Wise balance

Before you begin, be sure to open a Wise account first if you do not have an account.

Be sure to use my Wise referral link below and get a free transfer on your first 500 GBP (~RM2600) transfer!

Step 1: Fund your Wise account

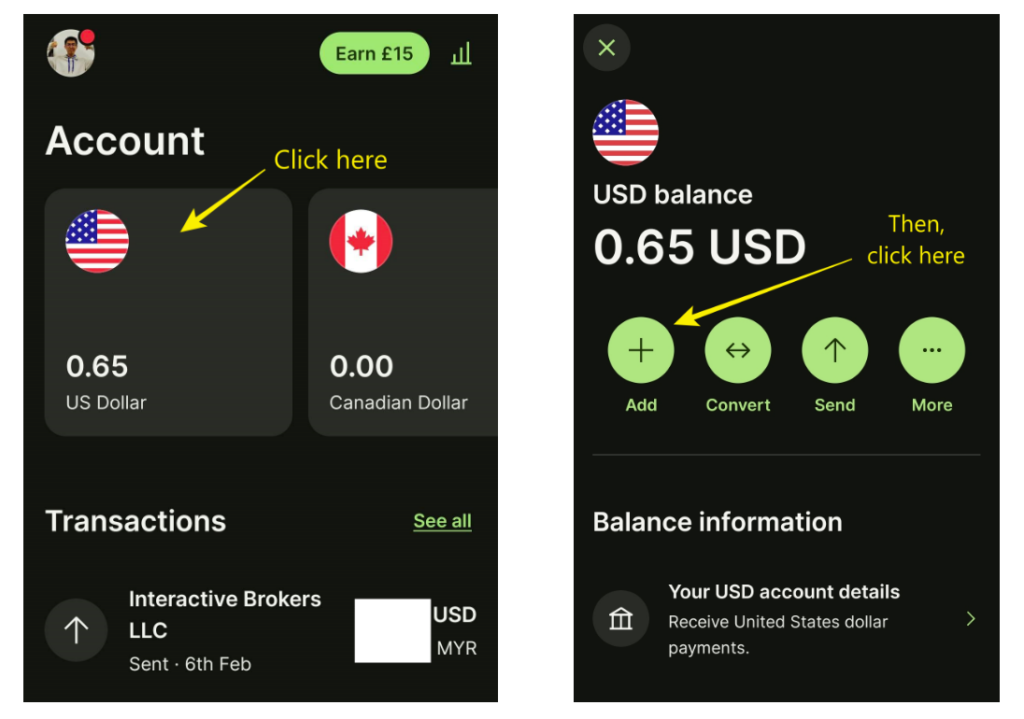

Firstly, log in to your Wise account. Select the currency that you’d like to fund your IBKR account and click ‘Add’.

Then, key in the amount you’d like to add, and proceed to fund your Wise account via FPX through your own bank account.

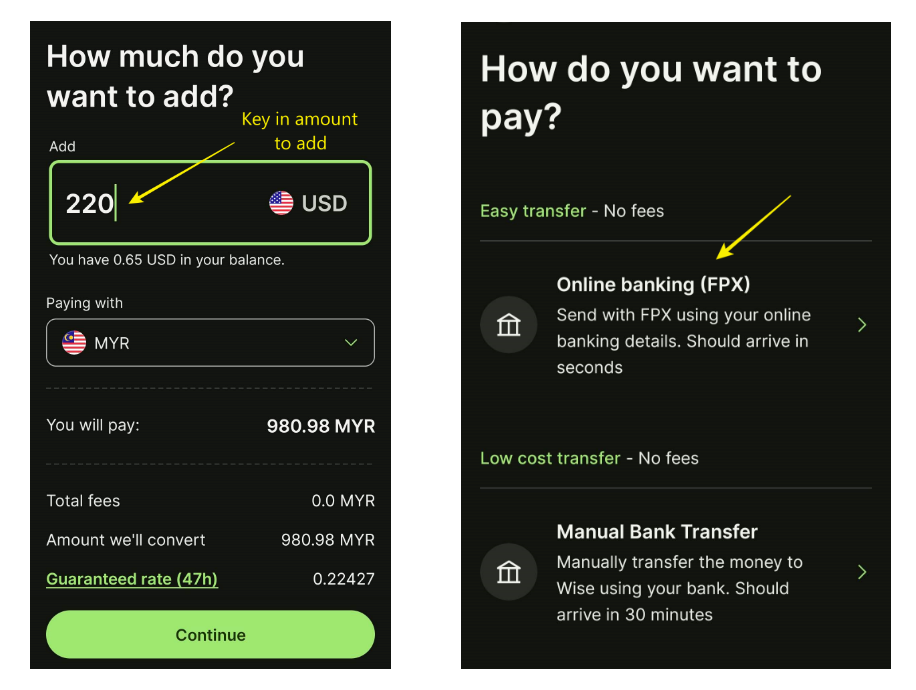

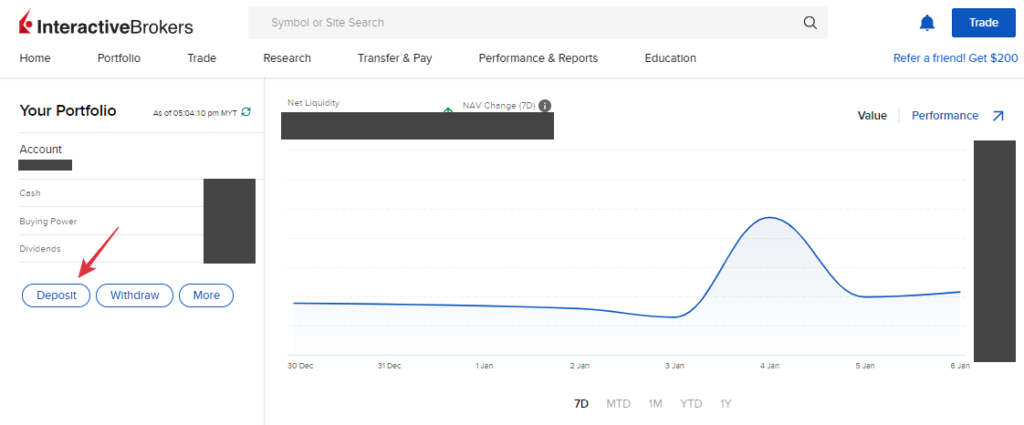

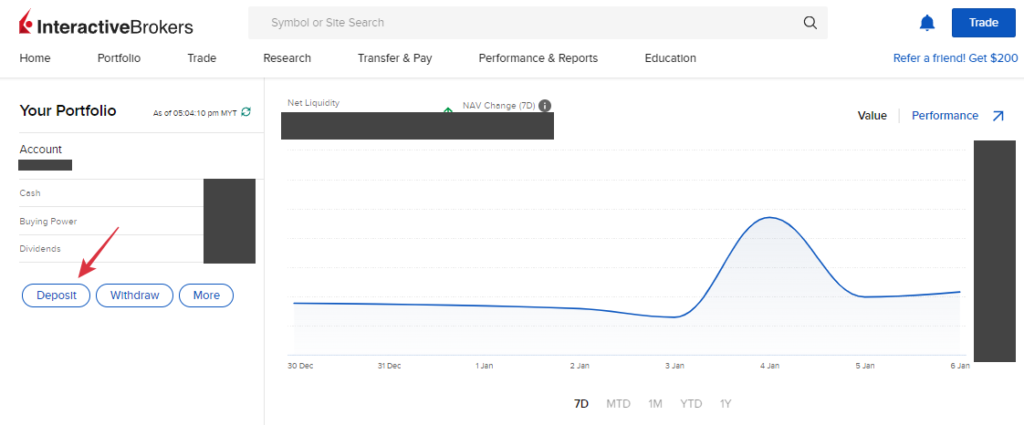

Step 2: Log in to your IBKR account, select ‘Deposit’

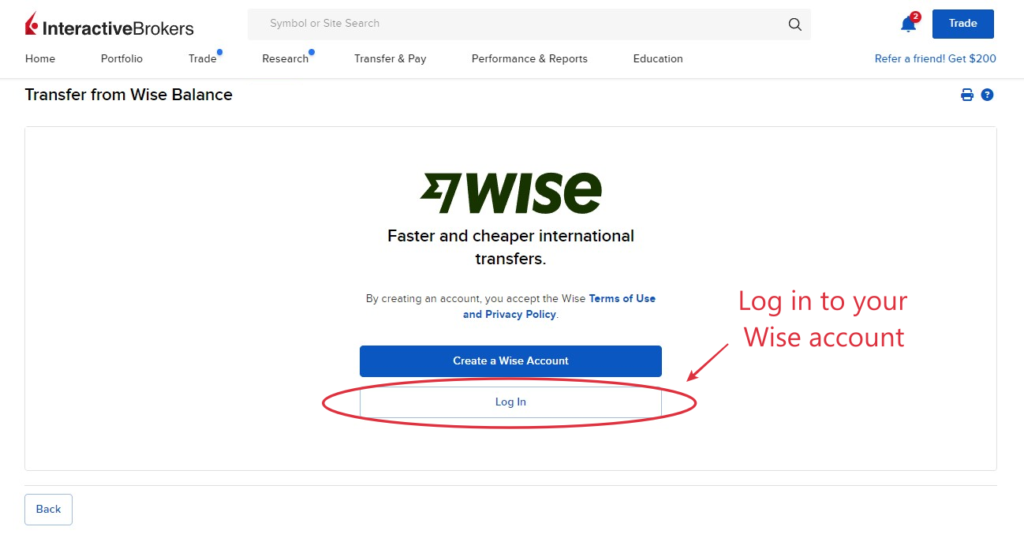

Select your deposit currency (for me, I choose USD), and select ‘Transfer from Wise Balance’.

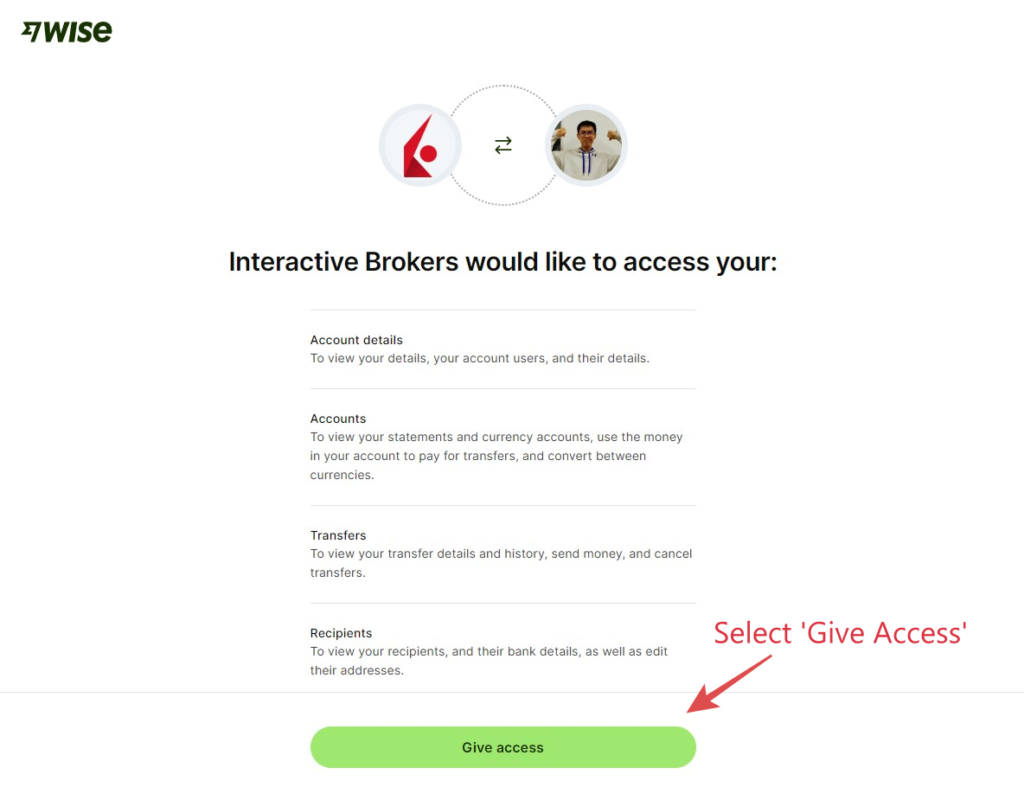

Step 3: Log in to your Wise account and proceed to transfer your funds

Once your Wise and IBKR accounts are linked, you can proceed with your fund transfer.

Step 4: Transfer done – now just wait for your funds to reach your IBKR account.

From personal experience, it usually takes about 1 working day for the funds to reach my IBKR account.

Method #2: Funding your IBKR account through direct ACH funding via Instarem (Cheapest)

Meanwhile, funding your IBKR account via Instarem is the cheapest option. Don’t worry, the funding steps are quite simple as well.

Fees incurred:

- Instarem transfer fee

- Currency exchange rate

Pre-requisite: Open an Instarem account

Before you begin, be sure to open an Instarem account first if you do not have an account.

Open an Instarem account via my referral link by clicking on the button below, and get 200 InstaPoints (worth RM12) which can be redeemed for your money transfer (no min. transaction amount required)!

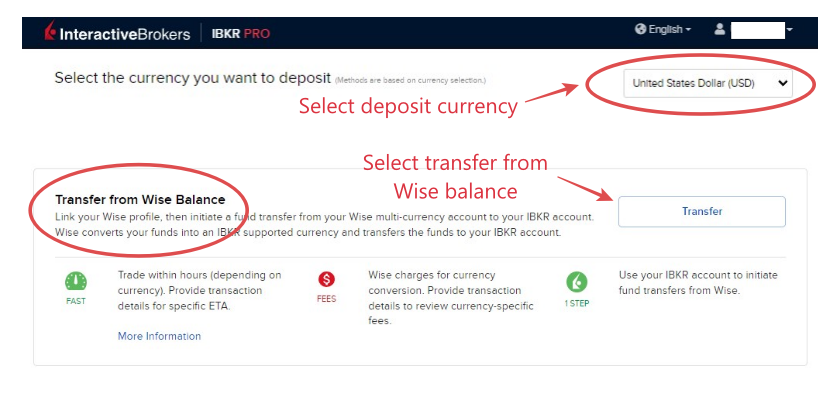

Step 1: Log in to your IBKR account, select ‘Deposit’

Step 2: Select your deposit currency, then opt for ‘Direct ACH Transfer from your Bank’

In this example, I am using USD as my deposit currency. But the method should work for other currencies.

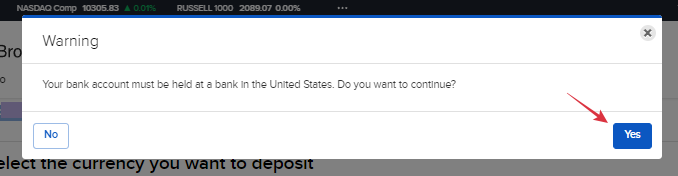

A warning pop-up will appear, saying that you must deposit from a US bank account – just proceed by choosing ‘Yes’.

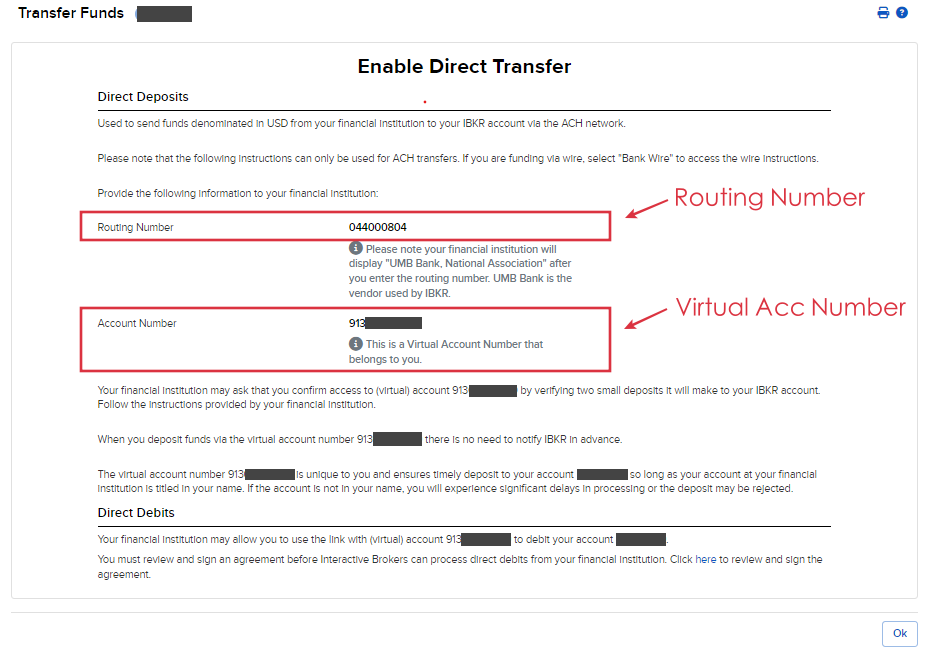

Step 3: You’ll get 3 key info – a Routing Number, Virtual Account Number, and IBKR’s address (address is not displayed in the screenshot below)

Take down these details. In the next step, you will need to use these details to initiate your Instarem transfer.

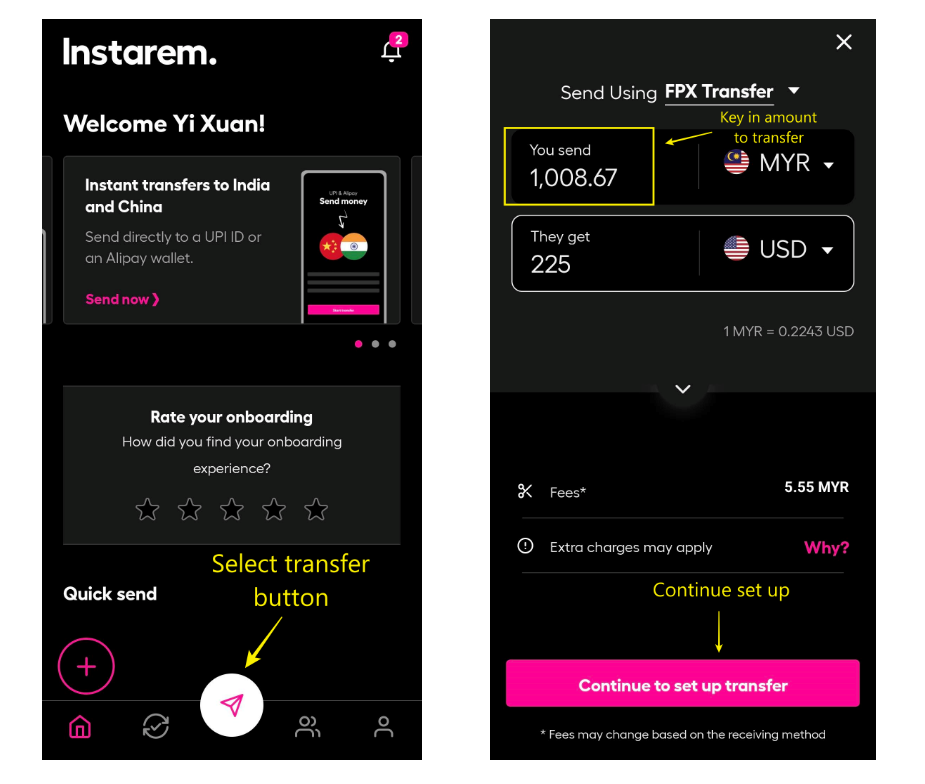

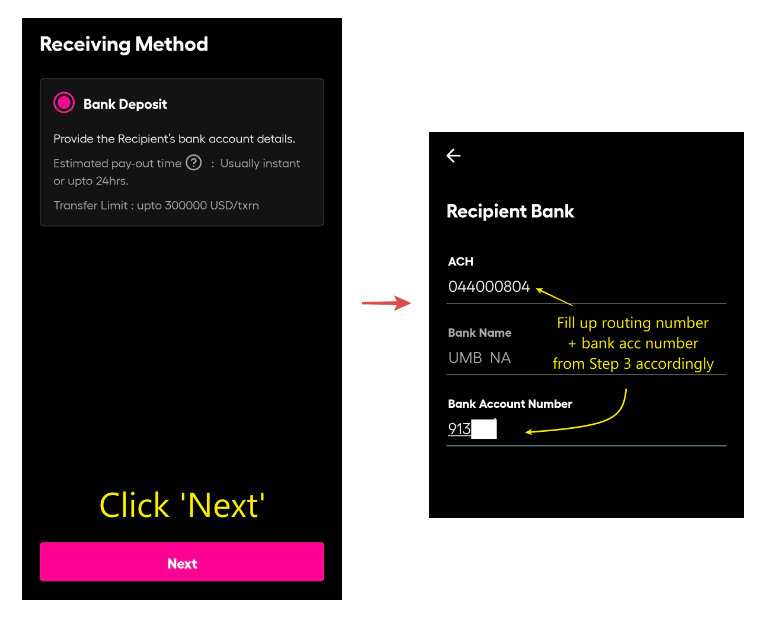

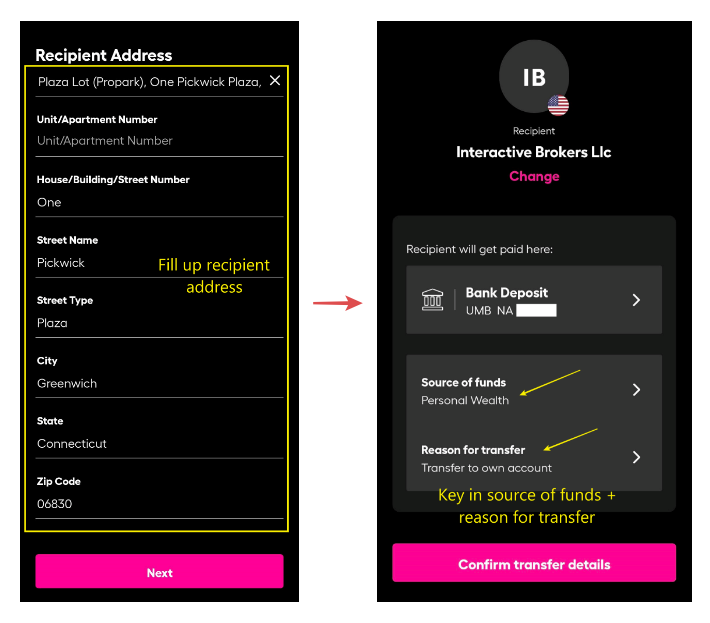

Step 4: Log in to your Instarem account and begin initiating your transfer

Step 5: Transfer done – now just wait for your funds to reach your IBKR account.

From personal experience, it usually takes about 1-2 working days (sometimes even faster) for the funds to reach my IBKR account.

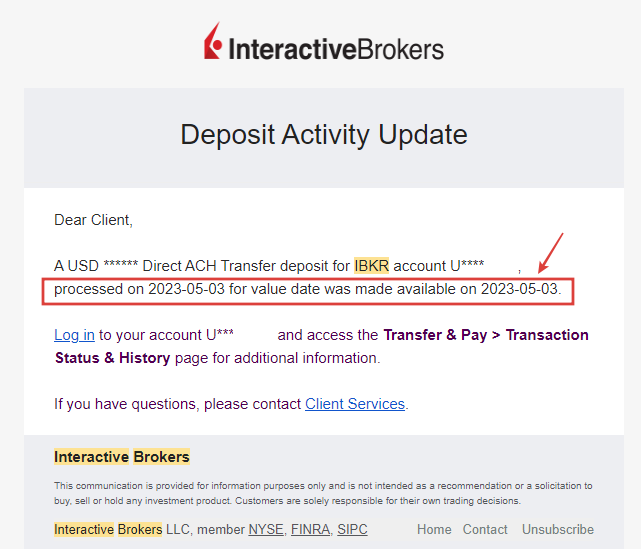

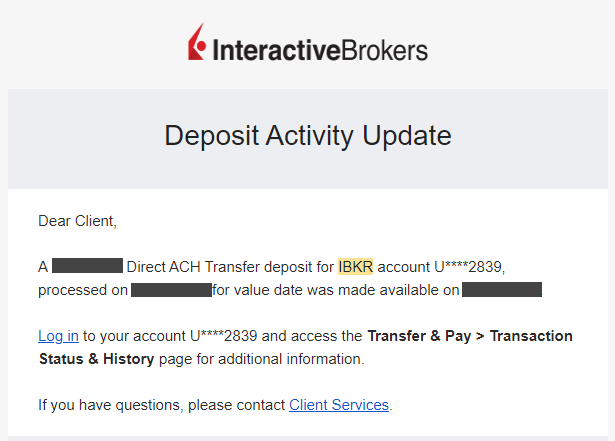

Once the funds are deposited in your IBKR account, you will receive an email update from IBKR.

Method #3: Funding your IBKR account through SGD via a Singapore Bank (eg. CIMB SG)

The 2nd method is an alternative for Singaporeans and Malaysian users with a Singapore bank account.

Fees incurred:

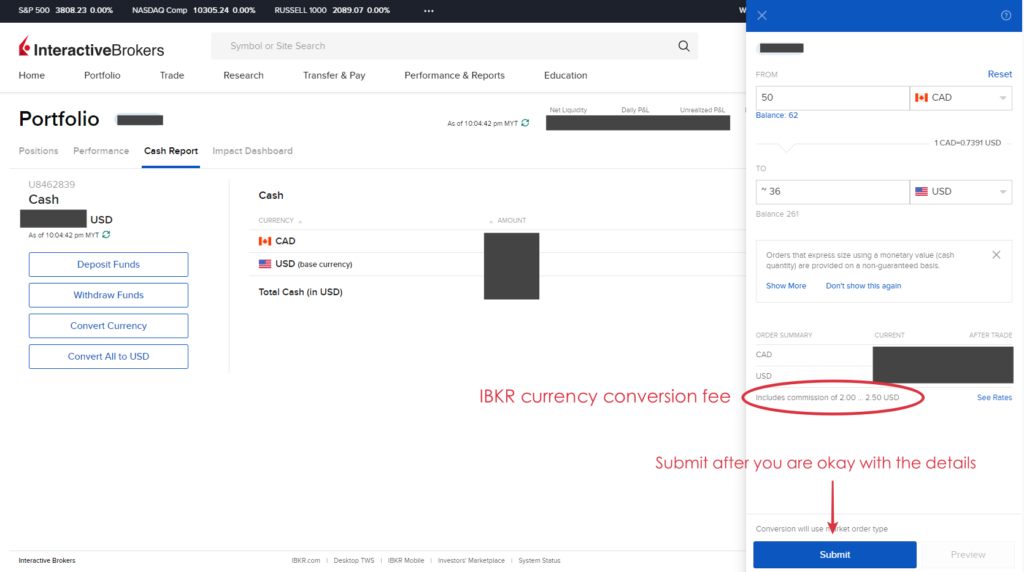

- IBKR currency conversion rate, if you want to convert your SGD to USD in IBKR

- IBKR currency conversion fee (~USD2.00 – 2.50), if you want to convert your SGD to USD in IBKR

Pre-requisite: Open a Singapore bank account (CIMB SG)

For Malaysians that wish to open a Singapore bank account, you can consider opening a CIMB SG account, which can be done 100% online.

RELATED: Guide – How to open a CIMB SG account online

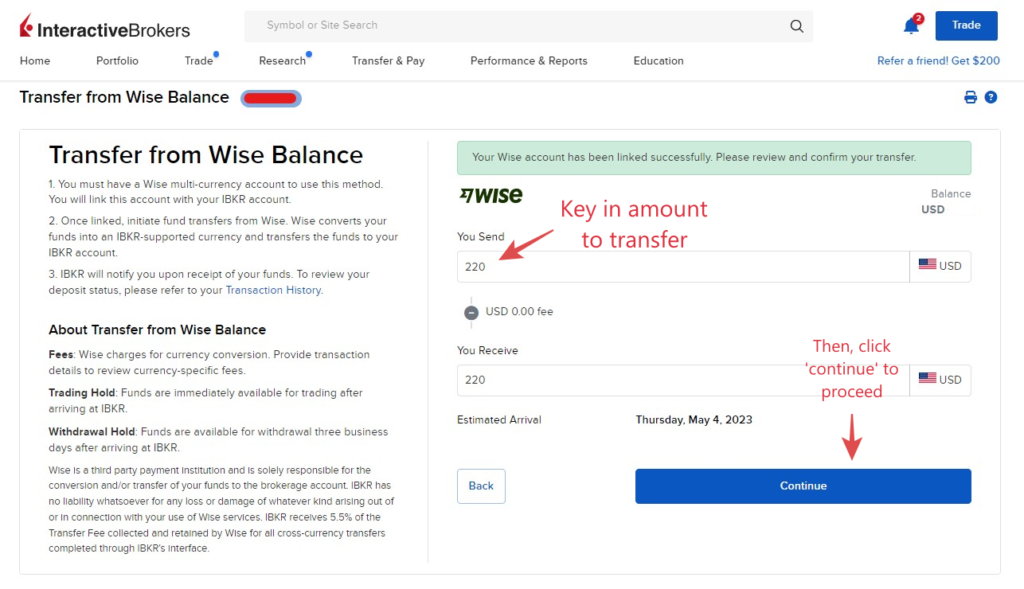

Step 1: Log in to your IBKR account, select ‘Deposit’

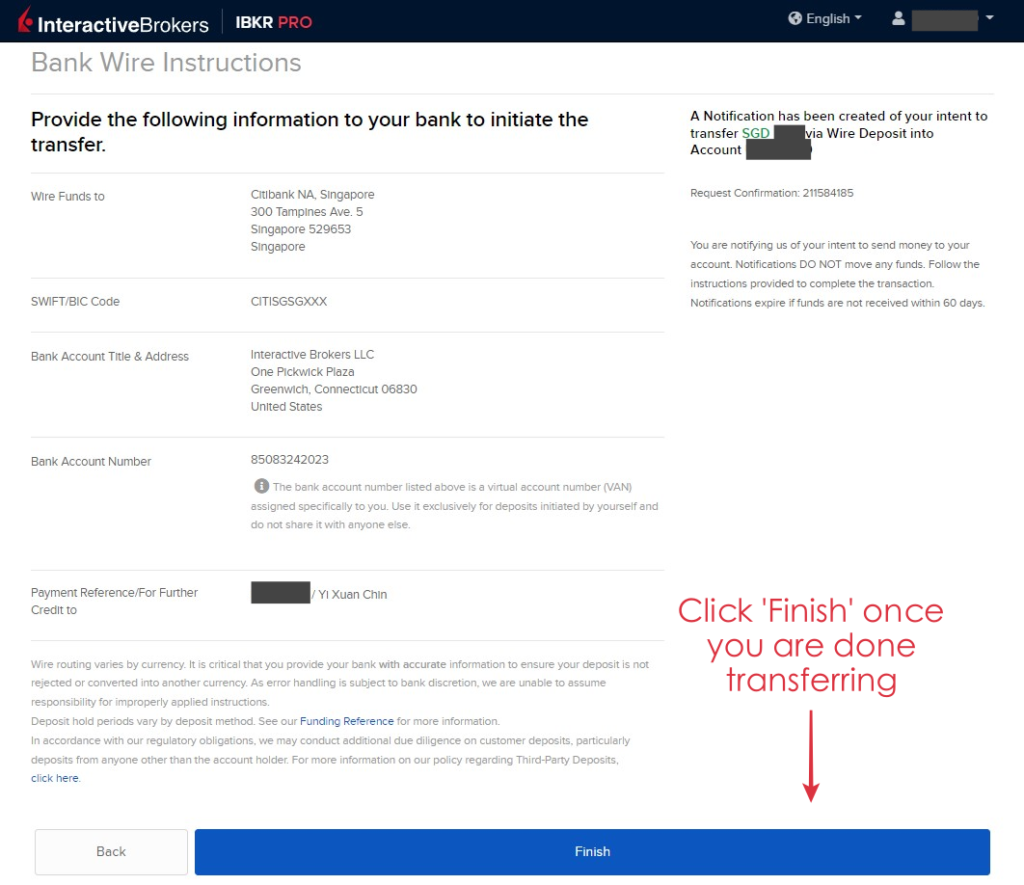

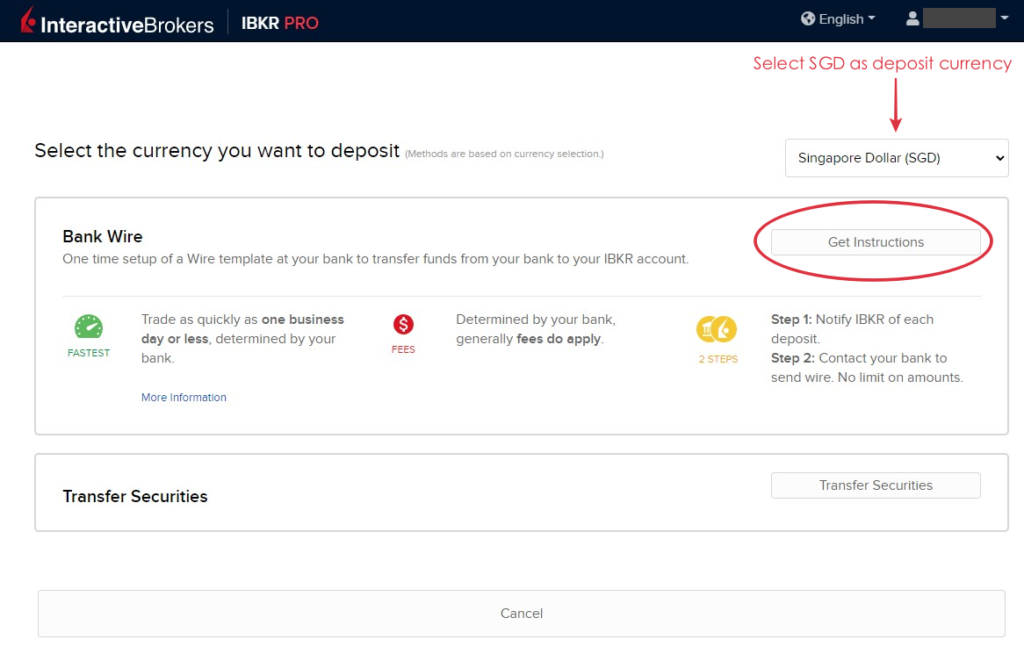

Step 2: Select SGD as deposit currency, and get instructions for ‘Bank Wire’

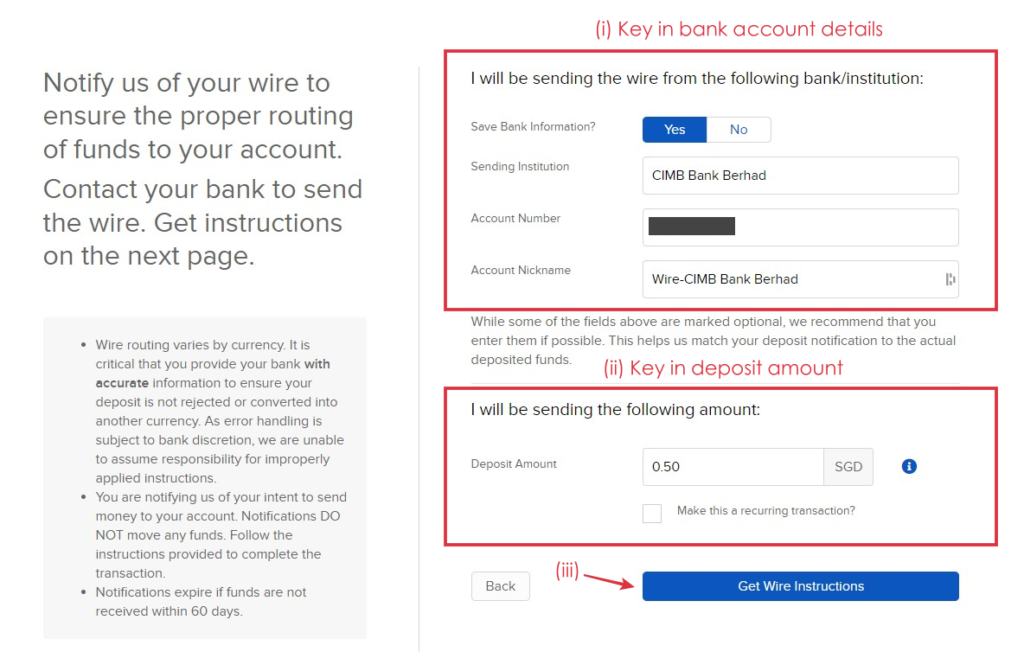

Step 3: Key in your SG bank account details and the amount you wish to deposit

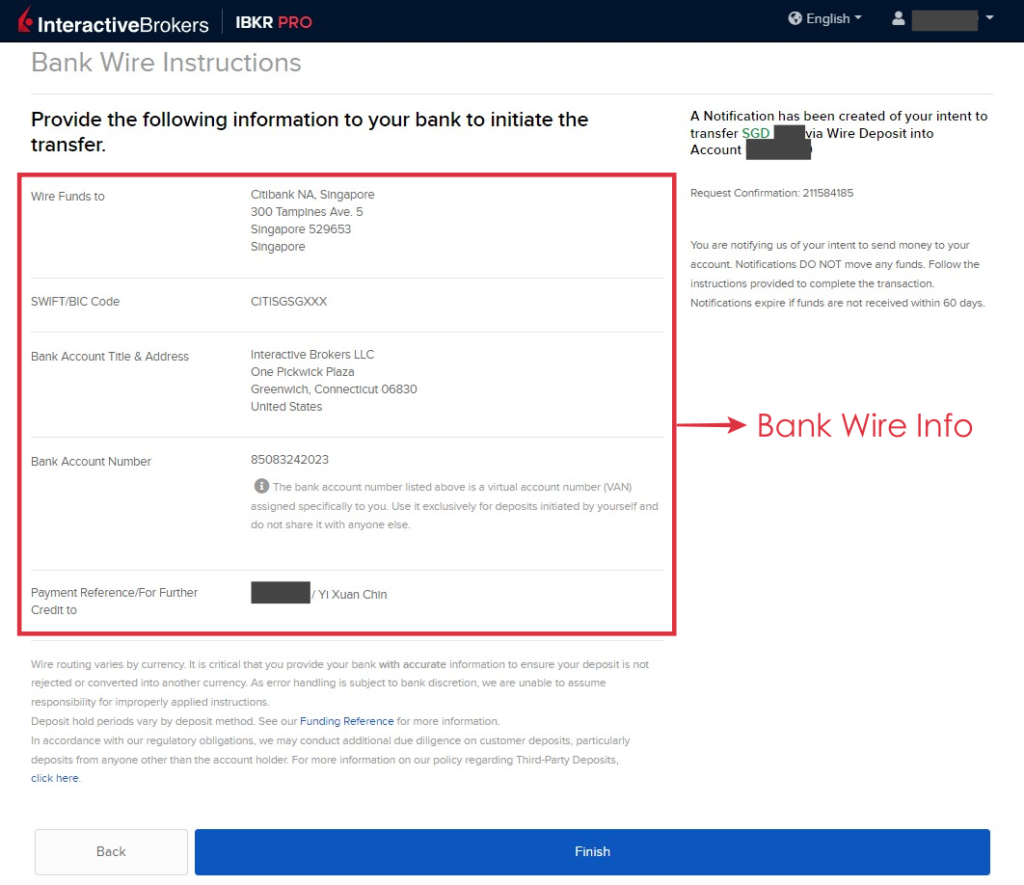

Step 4: Initiate transfer from your SG bank account

Use the bank wire instructions from IBKR to make your transfer from your SG bank account.

Log in to your bank account to initiate transfer.

Step 5: Return to your IBKR account and click ‘Finish’.

That’s all – now you just have to wait for your funds to arrive in your IBKR account.

From personal experience, it usually takes about 1-2 working days for the funds to reach my IBKR account.

Once the funds are deposited in your IBKR account, you will receive an email update from IBKR.

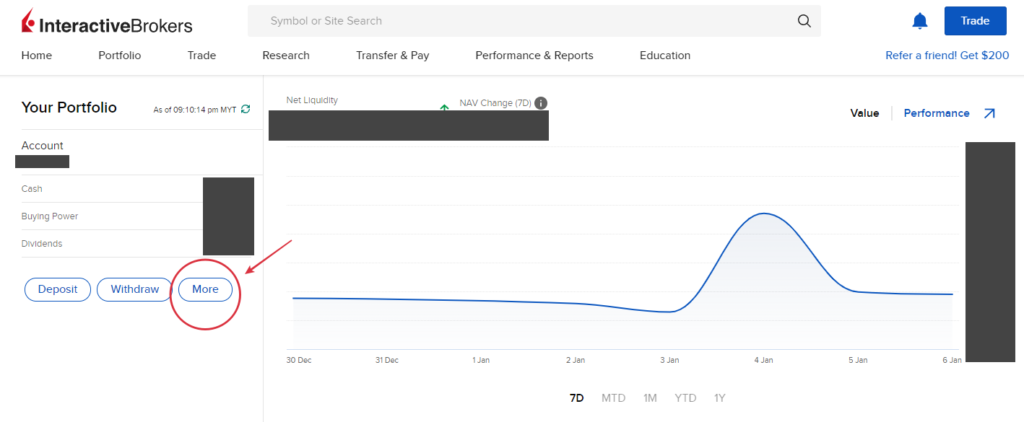

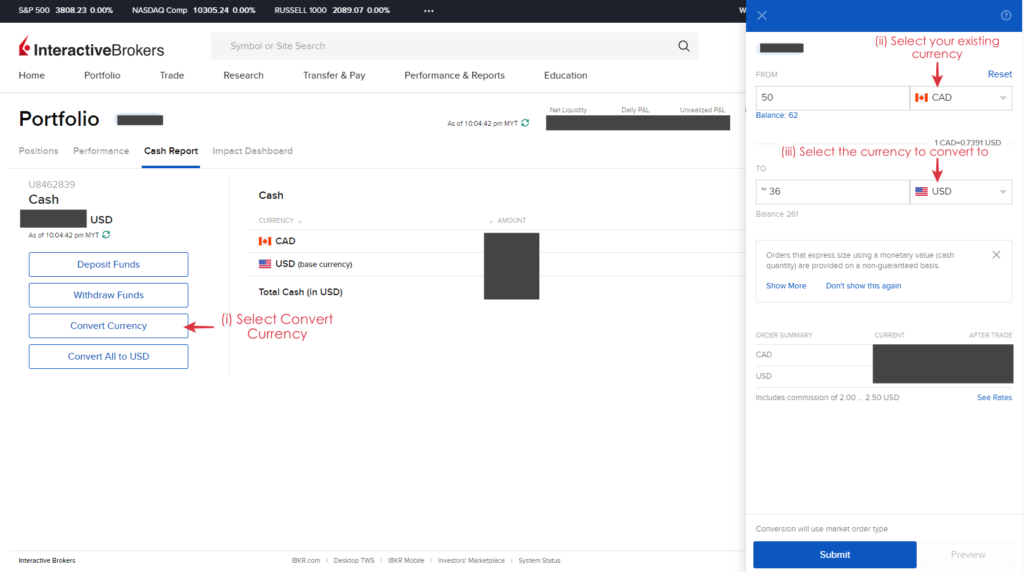

Step 6: Convert SGD to USD in IBKR

If you want to convert your SGD to USD in IBKR to trade USD-denominated stocks, you can do so with the currency conversion feature in IBKR for a small fee.

In your IBKR dashboard, select ‘More’.

Use your existing currency balance to convert to USD.

There will be a currency conversion fee/commission of around USD2.00 – USD2.50.

Verdict – Funding your IBKR account is never easier

With platforms like Wise and Instarem, it is extremely convenient to fund your IBKR account at a minimal fee.

Do you have any other tips on how to fund your IBKR account? Feel free to leave your tips and thoughts in the comment section below!

Disclaimer:

This review is purely based on my personal experience and is updated as of the time of writing.

This article may contain affiliate links that will earn the blog a small fee if you click on them. This comes at no extra cost to you as a reader.

Promotional Relationship Disclosure:

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan! May i ask how do i transfer money/top up money at my Wise acc via local msia banks? do i top up into Wise via FTT?

Hi Siu Ming,

You can do this easily via online FPX.

Regards,

Yi Xuan

Hi. Have you tried depositing large amount say USD50k to IBKR in one transaction using Instarem or Wise? IF not, what was the largest amount you have done in one transaction?

Hi Mike,

For me I usually transfer in thousands.

Regards,

Yi Xuan

Hi Yi Xuan! Do these methods (Wise and Instarem) still work for IBKR in 2024?

Hi Devan,

Yes, they still work perfectly fine.

Regards,

Chin

Also, what is the rate difference between depositing using Wise to using Instarem?

Hi Devan,

I find the fee for Instarem to be the cheapest, but Wise’s exchange rate to be better in general. For exact rates I suggest you to try out both.

Regards,

Yi Xuan

Hi Devan,

You can also refer to my Wise and Instarem comparison article HERE: https://nomoneylah.com/2024/01/13/wise-vs-instarem-ibkr-funding/

Regards,

Yi Xuan

Hi Yi Xuan, I am a complete beginner in trading but I have a Wise account as well as a DBS Singapore account already for a few years. I am Malaysian. I am keen to get started with the S&P 500 first and wanted to get your guidance.

1. Is there a difference with ETFs in the US (Vanguard VOO) or Ireland Domiciled (VUAA) besides the withholding tax? Do they both have somewhat the same capital gains value, especially if both are Vanguard?

2. I plan to use IBKR but in terms of total fees, would it be cheaper if I did a direct transfer from my DBS account to IBKR or will it be better I transferred money from DBS to Wise to IBKR?

Thank you!

Hi Shan,

1. Aside from dividend withholding tax, the difference should be minimal.

2. Hmm I am not able to give you an answer on this as I do not have a DBS account myself. I’d say Wise-IBKR is the most convenient way. But you can also consider using Instarem, of which if you are a new user you can to enjoy 50% off your first money transfer:

https://nomoneylah.com/2024/01/13/wise-vs-instarem-ibkr-funding/#Promotions_for_new_Wise_Instarem_users

Otherwise, my suggestion is to try both and see which one’s better for you.

Regards,

Yi Xuan

Thanks so much for quick response Yi Xuan! I’ll check out Instarem as well to see which one works best.

Hi Yi Xuan,

Happy Lunar New Year!!!

I have another follow-up question that I need your guidance. My funds are all in SGD. I tried transferring SGD from DBS Bank to IBKR and there is no fee involved. As such, is it better to convert SGD to USD in IBKR or would it be better if I transfer SGD to Wise first. Then convert SGD to USD in Wise, before transferring USD to IBKR? Because I could also transfer SGD to Wise without a fee I believe. Thanks so much!

Hi Shan,

Yes there is no fee to transfer SGD from your SG banks to IBKR, though there is an IBKR currency conversion fee (~USD2.00 – 2.50) if you want to convert your SGD to USD in IBKR.

So there are 2 things to take note of for this method (Transfer SGD frm SG bank to IBKR [FREE], then convert SGD to USD in IBKR):

1. IBKR currency conversion rate, if you want to convert your SGD to USD in IBKR

2. IBKR currency conversion fee (~USD2.00 – 2.50), if you want to convert your SGD to USD in IBKR

Personally, I’d go directly with the Wise-IBKR route instead of SG bank – IBKR route as for my use case the rates from Wise makes more sense, but I suggest that you give both a try and see which one is the best deal for your transfer amount and of course, most convenient for you.

Regards,

Yi Xuan

Hi Yi Xuan, thank for answering, super helpful! Btw, for IBKR, how do we track our dividends? I don’t know if there is a specific place this are loaded up, I tried the activity statements but it just stating dividends as whole and there are also dividend accruals which I don’t know what it is. Can you share any insights on how you keep track of monthly dividends on IBKR? Do you have any excel chart you personal use to track your portfolio? Thanks so much again.

Hi Shanti,

Good suggestion, let me work on a guide on how to track dividends on IBKR soon!

Regards,

Yi Xuan

Hi Yi Xuan, thank you for the detailed write up, it is fantastic! I have a question, when I transfer Wise balance to IBKR, Wise will charge a fee of USD 0.39. Eg. I transfer USD 20, but I will only receive USD 19.61 in IBKR. But from your snapshot above, the fee was USD 0.00, and you get USD 200 when you transfer USD 200. Can you share the trick or how do get USD 0.00 fee? Many thanks.

Hi Aric,

You get discount on your fees when you refer a friend to use Wise via your referral link.

Regards,

Yi Xuan