Last Updated on May 1, 2022 by Chin Yi Xuan

Opening a savings account in Malaysia has always been a troublesome experience. At some point, you’ll have to visit the bank to activate your account and collect your debit card.

Luckily, that’s not the case anymore with CIMB OctoSavers Account-i, where we finally get a 100% digital online account-opening experience.

In this quick guide, let’s go through all you need to know about CIMB OctoSavers Account-i, and how to open an account online!

Table of Contents

Highlights of CIMB Octosavers Account-i

CIMB OctoSavers Account-i was launched by CIMB Bank Bhd and CIMB Islamic Bank Bhd in August 2021. It is the bank’s first all-digital Islamic savings account that comes together with the new CIMB OctoDebit MasterCard.

In other words, with CIMB OctoSavers Account-i, you do not need to visit a physical bank branch to open a savings account at all!

- Fully digital: Account opening & onboarding process of Octosavers Account-i are done entirely online, while the debit card will be mailed to customers.

- Annual fee waiver: No annual fees for Debit Card

- Eligibility: Malaysians 18-year-old and above with MyKad can open an account

- Protected by PIDM up to RM250,000

- Profit rates of 0.30% per annum for account balances above RM3,000

- Shariah-compliant

How to open a CIMB Octosavers Account-i for new CIMB customers:

[Update 17/2/2022: It seems like CIMB has reactivated the online account opening of CIMB Octosavers Account-i for non-CIMB customers (it was paused prior to this). Feel free to proceed and open your account online!]

Step 1: Download the CIMB Apply app HERE

Step 2: Select ‘Open a new account and fill in your contact details

Step 3: Fill in the account opening application form

For identification purposes, you’ll be required to scan your IC and do a simple facial recognition process.

Aside from that, you need to provide personal details (eg. Address, employment details), which is a normal procedure for the application of most financial services.

Step 4: Transfer a minimum initial deposit of RM20

Please note that this RM20 transfer needs to be from another bank account under your own name.

Step 5: Create your CIMB Clicks login credentials

CIMB Clicks is CIMB’s platform where you activate your OctoDebit Mastercard and manage your transactions to and from your savings account.

In this final step, you’ll need to create things such as your CIMB Clicks user ID and password.

Step 6: Successful account creation!

Once you have completed all the steps, you will have your CIMB OctoSavers account created. You will receive an SMS upon successful application.

Within 7 – 14 working days, your Octo Debit Mastercard will also be mailed to the mailing address that you filled in during the application process.

Until then, you will not be able to operate your new account as you’ll need to activate your debit card first.

How to activate Octo Debit Mastercard

Once you receive your Octo Debit Mastercard, it is time to activate your Debit Card.

- Step 1: Firstly, you must sign on the signature panel at the back of the Octo Debit Card

- Step 2: Download the CIMB Clicks app

- Step 3: Log in to CIMB Clicks using your Clicks ID and password

- Step 4: Click ‘Yes, activate now’ when you are prompted to activate your debit card. Or under ‘Current/Savings, click ‘Activate Card’

- Step 5: Enter the 16-digit number of the Octo Debit card

- Step 6: Create your 6-digit Debit Card PIN and re-enter your 6-digit Debit Card PIN.

- Step 7: Request and enter the TAC code sent to your mobile number via SMS

Once you are done with the steps above, you can now use your CIMB Octosavers Account-i for online transactions!

Link your Octo Debit MasterCard to savings account for ATM cash withdrawals

There could be times where you will need to withdraw cash from ATM. Before you do so, be sure to link your debit card to your CIMB Octosavers Account-i:

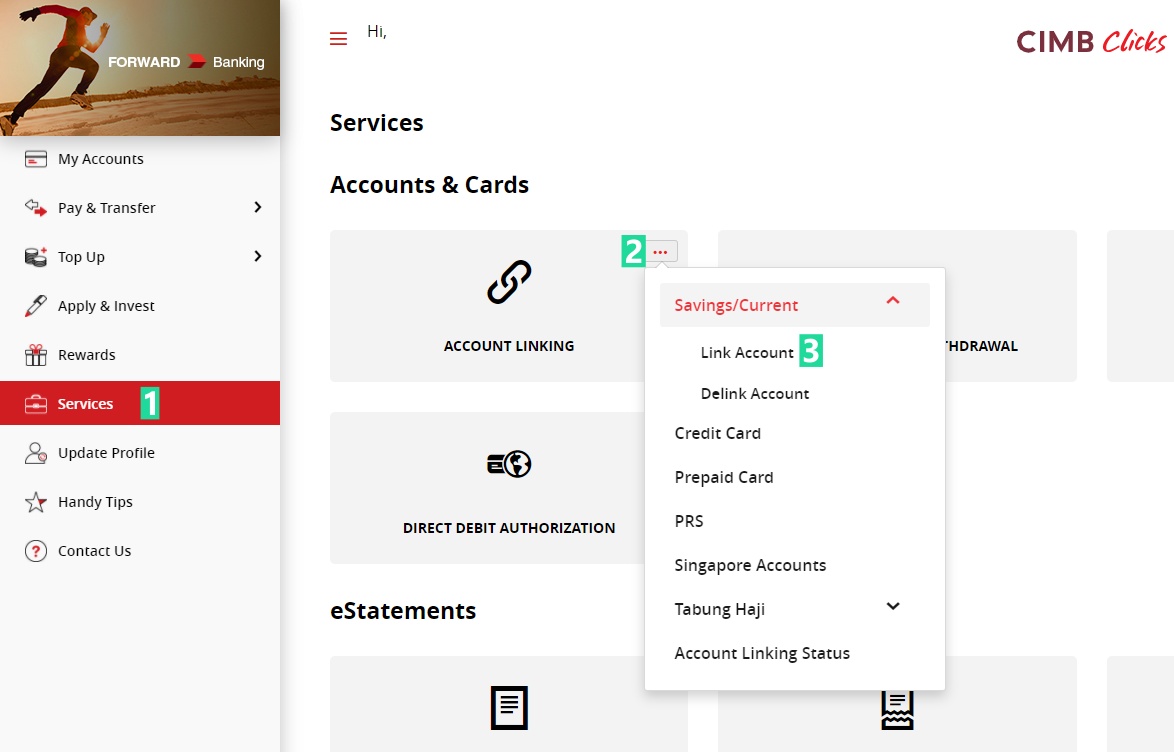

- Step 1: Log in to CIMB Clicks

- Step 2: Go to ‘Services’

- Step 3: Select ‘Account Linking’. Under ‘Savings/Current’, select ‘Link Account’

- Step 4: Select your CIMB Octosavers Account-i account and click the ‘Submit’ button

Truly 100% online account-opening experience for CIMB SG

In the past, for Malaysians to open a Singapore bank account via CIMB SG (the easiest way), you’d have to first have a CIMB Malaysia account. If not, you’ll have to visit a physical CIMB branch to activate your CIMB Malaysia account and collect your debit card.

Now, with the ability to open a CIMB Malaysia savings account online, you can complete all the processes at your own convenience at home!

READ: Step-by-step guide on how to open a Singapore bank account -100% online.

No Money Lah’s Verdict

Having to open a savings account online is a much-needed innovation in the financial services sector.

As such, I am glad to see CIMB stepping up its game to offer users a fully digital online account opening experience. I certainly hope to see other banks follow suit to offer a more digital experience within their services.

Meanwhile, do let me know your experience opening a CIMB Octosavers Account-i!

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi cannot open online already?

Hi Jess,

It seems like CIMB has temporarily disabled the account opening function of OctoSavers Account-i for new customers (as of 21/10/2021). If you need to open a CIMB savings account you can consider other savings account from the link below:

https://openaccount.cimb.com.my/retail/casa-onboarding/#/products

Will update this article once acc opening online is possible again yea!

Yi Xuan