Last Updated on May 1, 2022 by Chin Yi Xuan

Real Estate Investment Trusts, or REITs are unique companies in the stock market that allow investors to earn dividends by investing in income-generating properties.

These properties can range from shopping centers, offices, factories, warehouses, data centers and more!

By investing in REITs, we are able to receive stable and (usually) higher-than-average dividends on a regular basis.

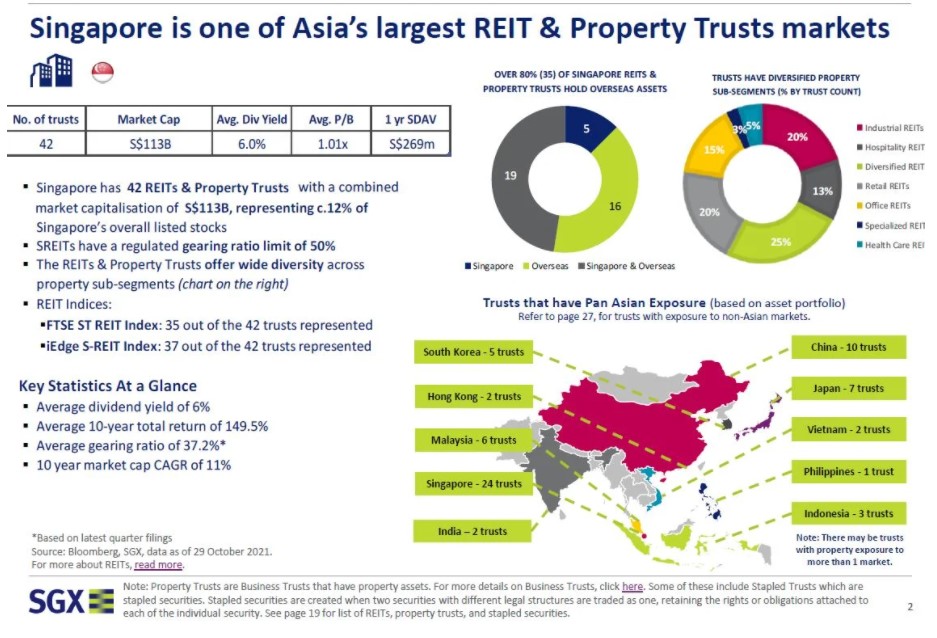

When it comes to REITs, the Singapore REIT market is one of the most established REIT markets in Asia with 42 listed REITs generating an annualized growth of 11% in the past 10 years.

p

Table of Contents

What is a REIT ETF + 5 REIT ETFs listed in Singapore

There are 2 main ways to invest in REITs. One is to invest in individual REITs, and the other is to invest in REIT Exchange-Traded Funds (ETFs).

Both REITs and REIT ETFs are listed in the stock market and can be bought just like ordinary shares.

For this post, I’ll focus on the REIT ETFs listed in Singapore.

ETF is an instrument that tracks the performance of an index. In this case, a REIT ETF tracks the performance of a REIT index.

There are 5 Singapore-listed REIT ETFs, namely:

- Phillip SGX APAC Dividend Leaders REIT ETF (SGD: BYJ | USD: BYI)

- NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI)

- Lion-Phillip S-REIT ETF (SGD: CLR)

- CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU)

- UOB APAC Green REIT ETF (SGD: GRN | USD: GRE)

Why Singapore-listed REIT ETF?

In general, investing in REIT ETFs brings several advantages to investors compared to investing in individual REITs:

#1 Investors get to invest in a diversified REIT portfolio via REIT ETFs.

This helps to mitigate individual company risk.

p

#2 Investors get to invest passively via REIT ETFs.

A REIT ETF will rebalance on a regular basis to include quality REITs and exclude REITs that do not fulfill the filtering criteria (or methodology) of the index.

As such, investors do not have to spend time picking individual REITs. By design, REIT ETFs will filter for quality REITs based on their methodologies.

p

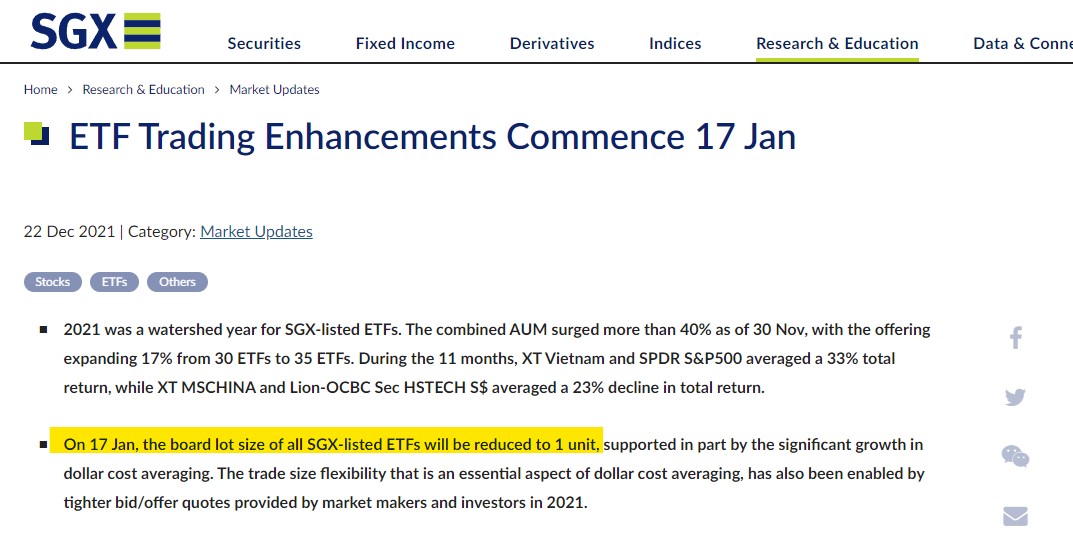

#3 NEW: Start investing in REIT ETFs from as small as 1 unit!

Starting 17th January 2022, investors can invest in all Singapore-listed ETFs starting from just 1 unit!

Previously, there is a minimum purchase requirement of 5 to 100 units of shares.

This is an initiative from the Singapore Stock Exchange (SGX) to provide more flexibility to investors to invest in ETFs, and this is certainly welcoming.

So, let’s say Lion-Phillip S-REIT ETF is priced at SGD 1.05/share, our minimum investment would be 1 unit, which is a total capital requirement of SGD 1.05.

In the following section, let me do an overview of all 5 REIT ETFs in Singapore:

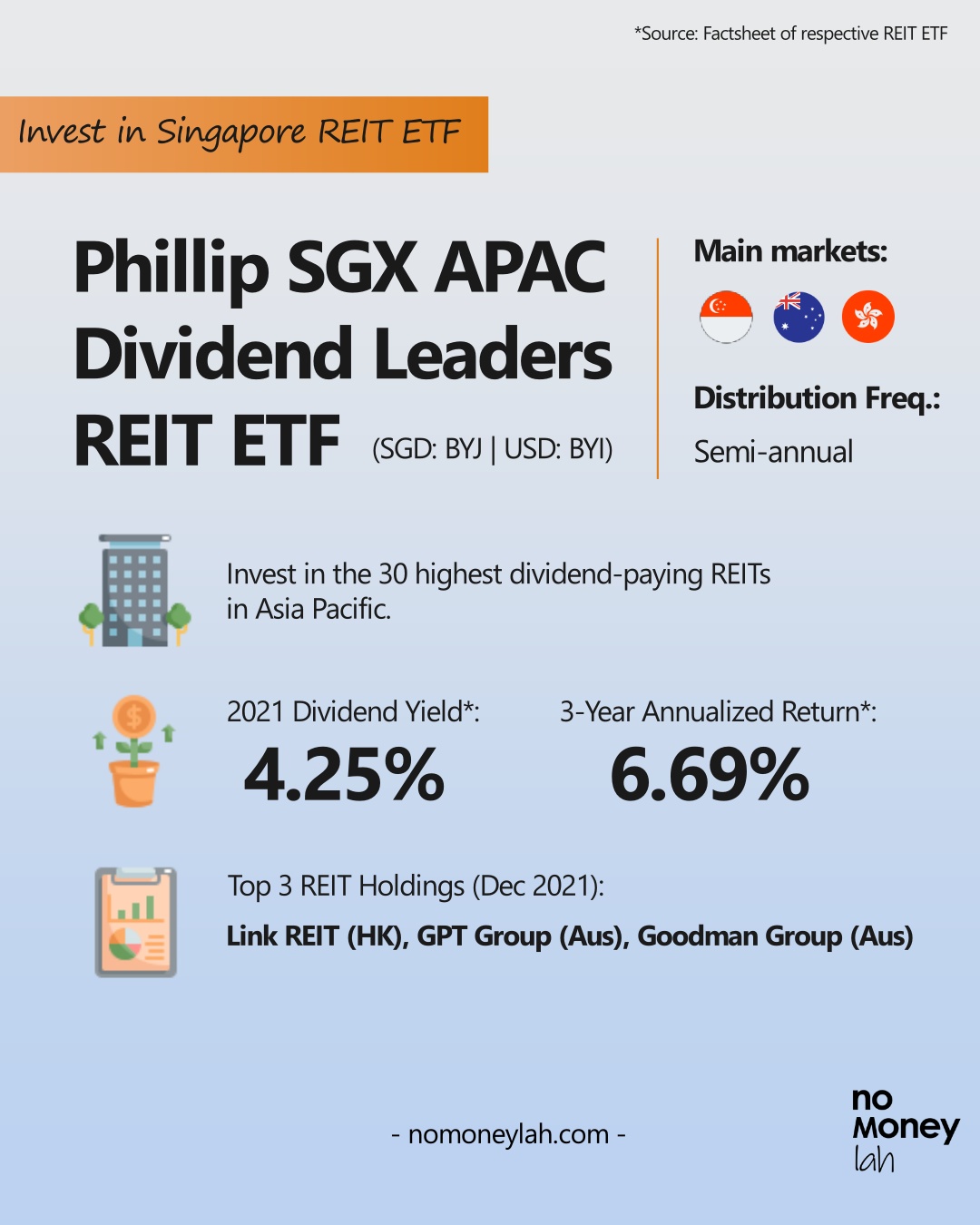

#1 Phillip SGX APAC Dividend Leaders REIT ETF (SGD: BYJ | USD: BYI)

The Phillip SGX APAC Dividend Leaders REIT ETF is an ETF that tracks the iEdge APAC ex Japan Dividend Leaders REIT Index. It is an index that comprises of the 30 highest dividend-paying REITs in the Asia Pacific.

The Phillip SGX APAC Dividend Leaders REIT ETF is listed in October 2016. It is the oldest among the 5 REIT ETFs in Singapore.

In terms of methodology, this ETF filters and weights REITs according to the total dividends paid in the past 12 months. By doing so, it aims to enhance the returns of conventional market-cap weighted ETFs.

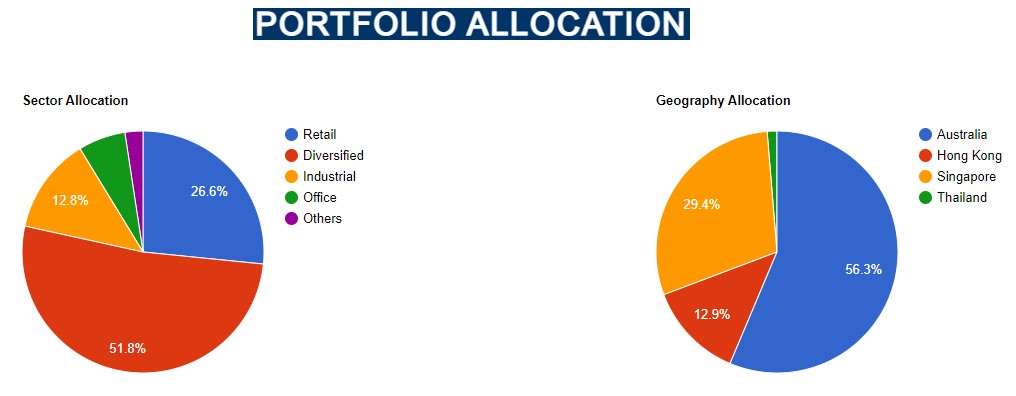

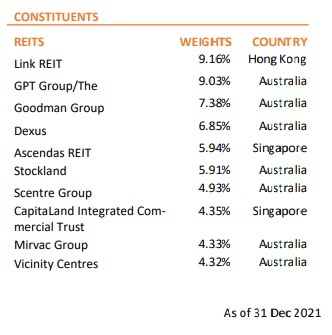

Phillip SGX APAC Dividend Leaders REIT ETF tracks 30 REITs, mainly from Australia, Singapore, and Hong Kong.

As for section allocation, Diversified REITs formed about half of the ETF allocation.

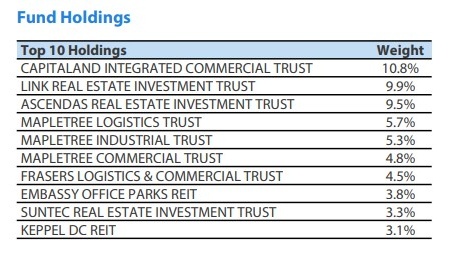

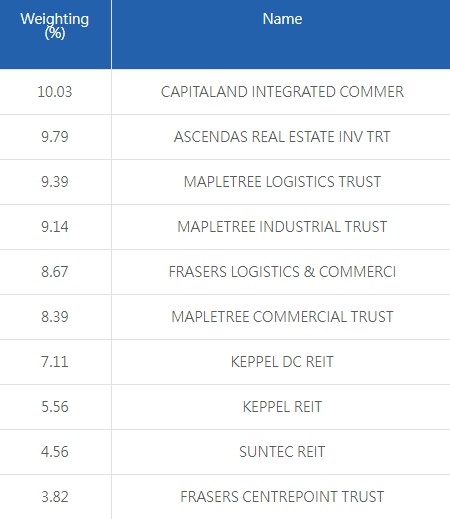

The table below shows the top 10 REIT holdings of the Phillip SGX APAC Dividend Leaders REIT ETF:

#2 NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI)

NikkoAM-StraitsTrading Asia Ex Japan REIT ETF is an ETF that tracks the FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index.

It is an index that tracks the performance of qualifying REITs from China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, and Thailand.

That said, as of November 2021, most of the REIT holdings of this ETF are focused on Singapore and Hong Kong REITs, with retail and industrial REITs forming the majority.

Below are the top 10 REIT holdings of NikkoAM-StraitsTrading Asia Ex Japan REIT ETF:

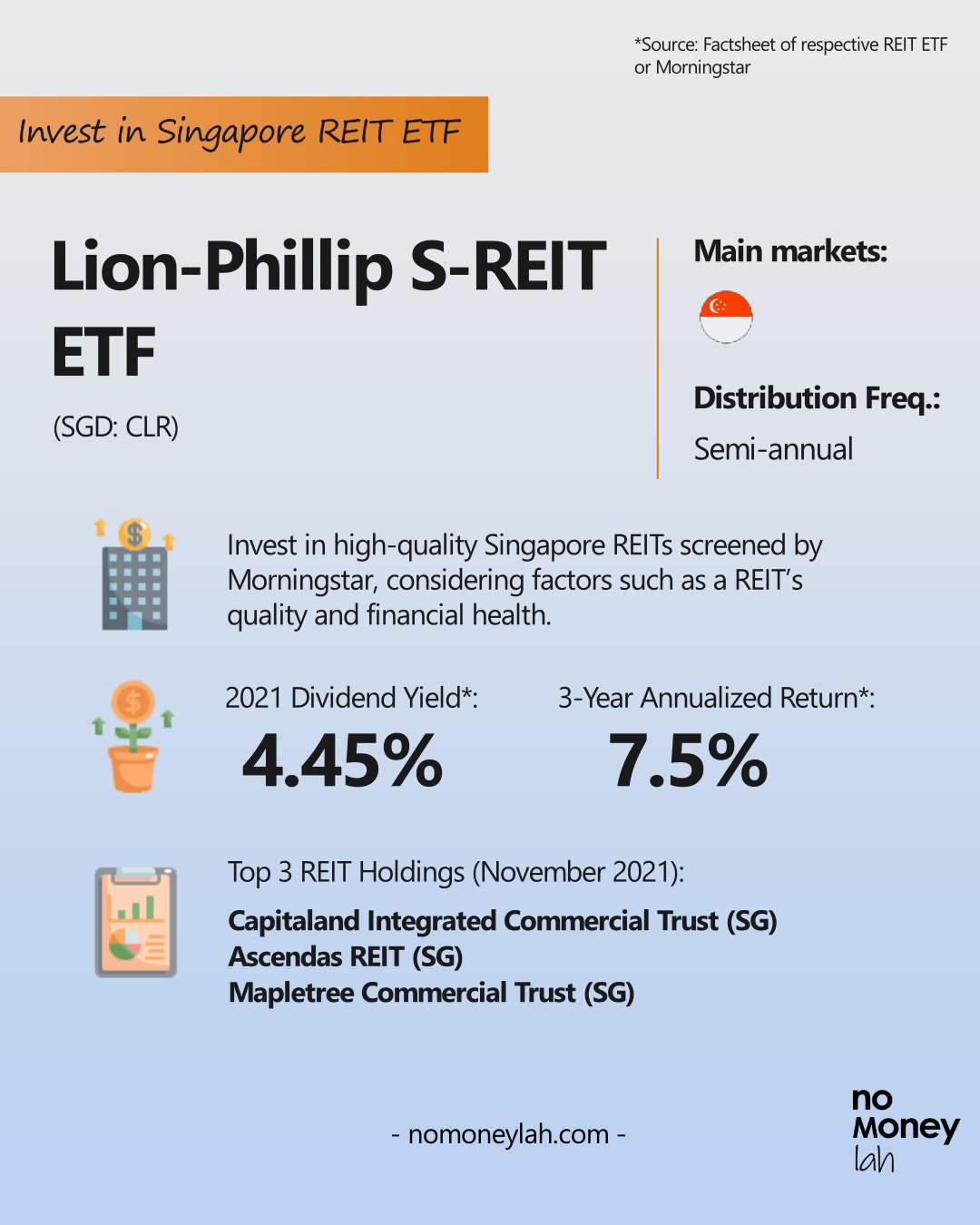

#3 Lion-Phillip S-REIT ETF (SGD: CLR)

The Lion-Phillip S-REIT ETF is an ETF that tracks the Morningstar Singapore REIT Yield Focus Index. It is an index that invests in high-quality Singapore REITs (S-REITs) screened by Morningstar.

In terms of methodology, the index is designed by Morningstar Research Pte. Ltd. to screen for high-yielding REITs, taking into account of factors such as a REIT’s quality and financial health.

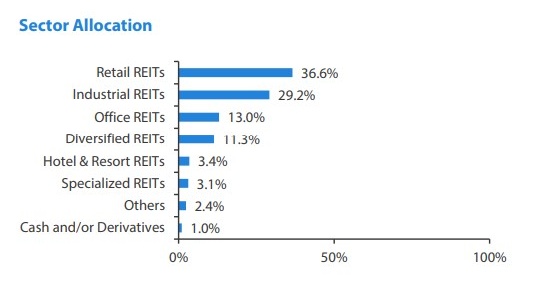

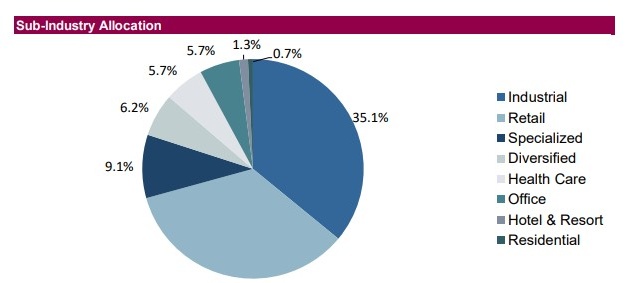

As for the sector breakdown, the ETF is mainly made up of industrial and retail REITs (as of Nov 2021).

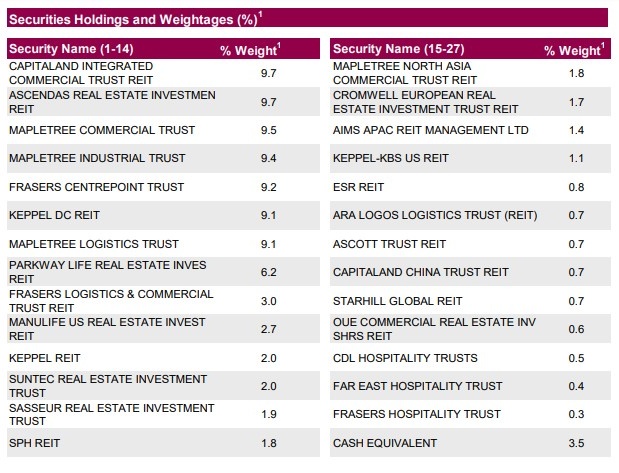

The table below shows the S-REIT holdings of the Lion-Phillip S-REIT ETF (as of Nov 2021):

#4 CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU)

CSOP iEdge S-REIT Leaders Index ETF is a S-REIT ETF that tracks the iEdge S-REIT Leaders Index. It tracks the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange (SGX).

As for the methodology, this ETF employs a liquidity-adjustment strategy.

Essentially, what this strategy does is it’ll only capture S-REITs with high investors’ interest, fund flows, and REITs that are most relevant to the latest sector rotation.

As such, the REITs tracked by the ETF are always the most relevant REITs according to the market condition.

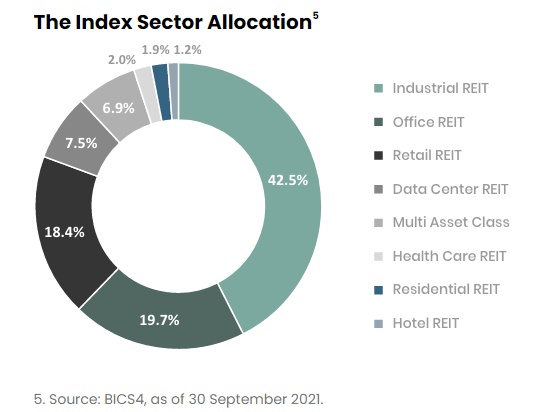

As for the sector breakdown, the ETF is mainly made up of industrial REITs.

Below are the top 10 REIT holdings of the CSOP iEdge S-REIT Leaders Index ETF:

READ: Check out my detailed writeup on CSOP iEdge S-REIT Leaders Index ETF HERE

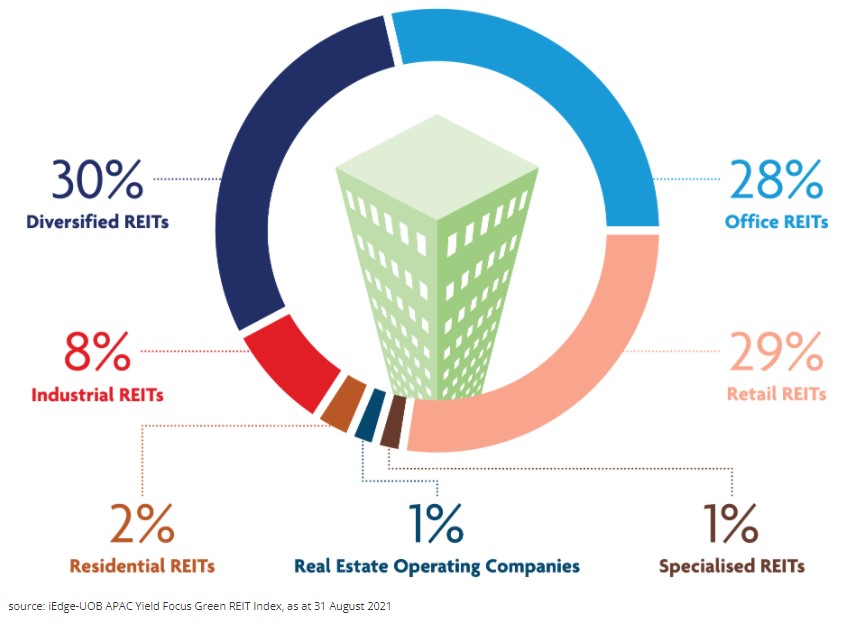

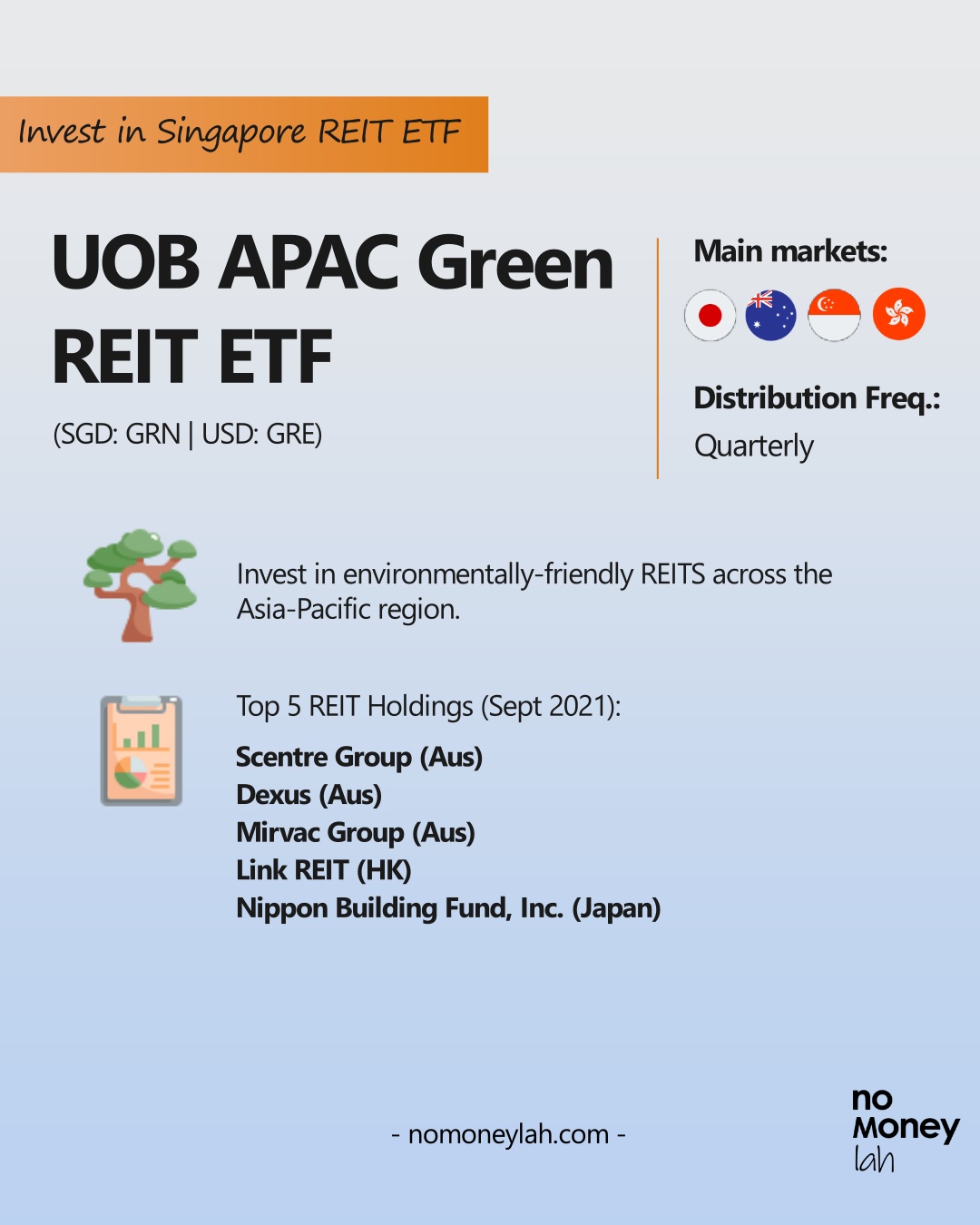

#5 UOB APAC Green REIT ETF (SGD: GRN | USD: GRE)

The UOB APAC Green REIT ETF mirrors the iEdge-UOB APAC Yield Focus Green REIT index, which aims to allow investors to invest in environmentally-friendly REITS.

Listed in the SGX on 23rd November 2021, this REIT ETF is the newest addition to the REIT ETFs in Singapore.

The UOB APAC Green REIT ETF contains 50 REITs listed across the Asia-Pacific region, with Japan (40%), Australia (36.6%), and Singapore (15.7%) REITs being the majority REIT holdings.

Below are the top 10 holdings of the ETF, as of 30th September 2021:

Singapore-listed REIT ETFs comparison

| Phillip SGX APAC Dividend Leaders REIT ETF | NikkoAM-StraitsTrading Asia Ex Japan REIT ETF | Lion-Phillip S-REIT ETF | CSOP iEdge S-REIT Leaders Index ETF | UOB APAC Green REIT ETF | |

|---|---|---|---|---|---|

| Ticker | BYJ (SGD), BYI (USD) | CFA (SGD), COI (USD) | CLR (SGD) | SRT (SGD), SRU (USD) | GRN (SGD), GRE (USD) |

| Underlying Index | iEdge APAC ex Japan Dividend Leaders REIT Index | FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index | Morningstar Singapore REIT Yield Focus Index | iEdge S-REIT Leaders Index | iEdge-UOB APAC Yield Focus Green REIT Index |

| Main REIT market exposure | Australia, HK & Singapore | Singapore & HK | Singapore | Singapore | Japan, Australia, Singapore & HK |

| Listing Date | 20/10/2016 | 29/3/2017 | 30/10/2017 | 18/11/2021 | 23/11/2021 |

| Unit Price (18/1/2022) | SGD 1.396 | SGD 1.061 | SGD 1.05 | SGD 0.953 | SGD 0.956 |

| Fund Size (18/1/2022) | SGD 18.31 million | SGD 341.87 million | SGD 236.23 million | SGD 82.10 million | SGD 82.24 million |

| No. of Holdings | 30 | 43 | 27 | 28 | 50 |

| Expense Ratio | 1.16% | 0.60% | 0.60% | 0.60% | Management fee: Currently 0.45% p.a.; Maximum 2% |

| Distribution Frequency | Semi-annual | Quarterly | Semi-annual | Semi-annual | Quarterly |

| 2021 Dividend Yield (Respective factsheets/Morningstar) | 4.25% | 4.27% | 4.45% | N/A** | N/A** |

| 3-year annualized return* | 6.69% (SGD) | 4.45% (SGD) | 7.5% (SGD) | N/A** | N/A** |

**Info not available as this REIT ETF is newly listed.

How to choose the best REIT ETF?

From the table above, it seems like each REIT ETF is closely similar to each other. Below, let me share with you some personal pointers that I think one should consider when selecting a REIT ETF:

-

REIT exposure

Do you want a REIT portfolio that is focused on Singapore REITs (S-REITs), or REIT exposure across Asia (eg. Singapore, Australia, Hong Kong, Japan)?

Certain REIT ETFs such as Lion-Phillip S-REIT ETF (SGD: CLR) and CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU) offer dedicated exposure to S-REITs, while the remaining offer exposure to REITs across Asia.

p

-

Fund size

In general, an ETF with a larger size fund size is a good indicator of the ETF’s durability as well as its popularity.

Larger ETFs can also make use of economies of scale to lower their costs.

In this aspect, ETFs like NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI) and Lion-Phillip S-REIT ETF (SGD: CLR) are the obvious winner here.

p

-

Expense Ratio

ETF providers charge a small annual management fee for their ETFs. In this case, most ETFs have a low expense ratio (<1.00%) so the difference is negligible.

Of all, Phillip SGX APAC Dividend Leaders REIT ETF has the highest expense ratio of 1.16%, which is a tad higher than the other REIT ETFs in the list.

p

-

Methodology

How a REIT ETF select and filter for REITs is also important.

As an example, the Lion-Phillip S-REIT ETF (SGD: CLR) screens for high-yielding REITs by taking into account of factors such as a REIT’s quality and financial health.

Selecting the right REIT ETF methodology will require investors to go through the prospectus of the REIT ETF.

p

-

Consistency/Growth in Distribution (DPU)

A key benefit of investing in REIT ETF is to receive consistent dividends.

As such, it is healthy to find out if the Distribution Per Unit (DPU) of each REIT ETF has been consistent, or better, growing over the past years.

The table below displays the DPU of each REIT ETF from 2018 to 2020:

| Phillip SGX APAC Dividend Leaders REIT ETF (USD) | NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD) | Lion-Phillip S-REIT ETF (SGD) | |

|---|---|---|---|

| 2021 | 0.03069 | 0.0468 | 0.048 |

| 2020 | 0.0273 | 0.0578 | 0.0499 |

| 2019 | 0.0492 | 0.0494 | 0.0492 |

| 2018 | 0.0341 | 0.04691 | 0.0348 |

Note:

(1) Dividend Yield = (DPU/Price)*100

(2) The remaining REIT ETFs do not have historical DPU as they are newly listed in late 2021

Kickstart your investment in REIT ETFs today!

To start investing in Singapore-listed REIT ETFs, you will have to use a broker with access to the Singapore stock market. Check out my full review on ProsperUs by CGS-CIMB HERE for more details.

Disclaimers

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

Related Posts

January 14, 2022

ETF: Best Dividend-Paying ETFs in Malaysia

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan,

I knew some Singapore REITs will issue right issue to share holders (to raise fund), do you know how this right issue will affect these Singapore REITs ETF (e.g. will it affect NAV, dividend yield of these ETF?) Thank you

Hi KF,

Sorry for the late reply! ETF managers will usually decide if they want to take up the right issue or not based on the situation. So if the particular REIT holding is large in the ETF portfolio, then it may impact the overall yield and NAV as well.

Hope this is helpful!

Regards,

Yi Xuan

Hi Yi Xuan,

Interesting article. Do you invest in SG REITs via IBKR?

Hi devan,

Currently I am using Syfe’s REIT+ to get exposure to SG REIT.

Regards,

Yi Xuan