If you are looking to invest in the stock market in Malaysia, the first thing that you got to do is to open a CDS account & stock trading account.

Opening a CDS and stock trading account is actually pretty simple. In this article, we are going to cover all the things that you should know before opening your stock trading account, and HOW to open one!

Before this, here are some posts that you might find useful:

- Rakuten Trade long-term user review: Why it is my go-to platform to buy stocks!

- Guide: How to buy your first stock on Rakuten Trade

- The best dividend-paying ETFs in Malaysia

Table of Contents

Step 1: Decide if you are opening a Direct CDS or a Nominee CDS account

A Central Depository System (CDS) account is an account that records the ownership of your stock holdings and any of your transaction history whenever you buy or sell shares. Take it as an electronic safe box that keeps your shares.

In Malaysia, all CDS accounts are maintained and operated by the Bursa Malaysia Depository. As such, you will receive a monthly account statement if there is any transaction made in your CDS account during the preceding month.

As a side note, you need to be 18 years old and above to open an account. Also, there is an RM10 fee for CDS account opening. In addition, your broker will help you to open your CDS account simultaneously when you register for your stock trading account.

There are 2 types of CDS account – Direct CDS and Nominee CDS account.

| Description | Direct CDS | Nominee CDS |

| Account holder’s name | Shareholder (You – Mr./Ms.) | Broker’s name (eg. Rakuten Trade Nominees for Mr./Ms.) |

| Eligibility for IPO application | Yes | No |

| Dividend Payment | Credited directly into registered bank account. | Credited into your brokerage account |

| Paperwork on corporate actions (eg. Rights issue, dividends) | Managed directly by the shareholder. | Managed by the broker on behalf of shareholder with a service charge*. [*Free on Rakuten Trade] |

| Annual reports & dividend vouchers | Received directly from the Registrar. | Will not receive directly from the Registrar. [Annual reports can be easily downloaded from Bursa] |

| Rights to attend AGM | Yes | Yes, with broker's consent letter. |

| Shares transfer | Transferable to family members’ accounts. | Transferable to own account only. |

Which is better, Direct CDS or Nominee CDS Account?

Generally, choosing to go with either Direct CDS or Nominee CDS will not affect your investment journey significantly.

That said, if you are just getting started with stock investing, my suggestion is to open a Nominee CDS account (specifically Rakuten Trade), because:

- Convenience: Your broker will manage all the necessary paperwork on your behalf in the event of corporate actions such as dividends and rights issue. This is a huge convenience as the paperwork process can be overwhelming to new investors.

Some Nominee CDS brokers may charge a small handling fee on this but it’s free on Rakuten Trade (yup, no charges!).

The only obvious downside of a Nominee CDS account is users are not able to apply for Initial Public Offering (IPO) for soon-to-be listed companies. Honestly, I don’t think this is a big letdown because most investors should be looking to invest in companies with a long track records and financial data.

READ: Rakuten Trade Long-Term User Review: 5 Reasons Why it is my preferred stockbroker

Rakuten Trade Nominee CDS vs Typical Nominee CDS Account

Just a quick note: Not all Nominee CDS Accounts are created the same. Personally, I am using Rakuten Trade Nominee CDS Account over the others because:

|

|

Rakuten Trade Nominee CDS Account |

Typical Nominee CDS Account |

|

Corporate Action Fees |

Free |

Small Handling Fee |

|

Share transfer |

Yes, transferable to family members |

Yes, transferable to own account only |

|

Rights to attend AGM |

Yes, simply email your request to Customer Service 10 working days before the AGM |

Yes, requires consent letter from bank/broker |

|

CDS Account Opening Fee |

Waived |

RM10 |

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Step 2: Choose a Stock Broker

Now that you know what a CDS account is, the next thing is to choose a stock broker. Essentially, a stock broker provides you with the platform to buy and sell stocks.

Recap: When you sign up for a stock brokerage account, your broker will open a CDS account for you. Hence, the key here is to choose the right broker for yourself.

There are 2 main things that you have to consider before opening a brokerage account, namely the (1) brokerage fees and (2) whether you are opening a Cash Upfront or Margin/Contra account.

i. Malaysia Stock Brokers Fee Comparison

The brokerage fee is an important consideration for an investor, especially if you are starting with small capital. Below is a list of stockbrokers in Malaysia and their brokerage fee:

|

Transaction Value & Commissions |

< RM699.99 |

RM700 – 9999.99 |

RM10,000 – 50,000 |

RM50,000 – 100,000 |

|

Rakuten Trade |

1%/RM1, whichever higher |

RM9 |

0.10% |

0.10% |

|

M+ Silver Cash Upfront Account |

0.08%/RM8, whichever higher |

0.05% |

||

|

Hong Leong HLE Value Trade Account |

0.10%/RM8, whichever higher

|

|||

|

Maybank |

0.42%/RM12, whichever higher

|

|||

|

UOB UTrade |

0.42%/RM28, whichever higher

|

|||

|

CIMB Clicks Trader |

0.0388%/RM8.88, whichever higher |

|||

p

As you can see in the above picture, there is a difference in how brokers charge their fees. If I were to buy into 100 units of shares at RM1.00 per unit:

Maybank Investment Account (0.42% or RM12, whichever is higher): Total Cost = RM100 + RM12 = RM112

Rakuten Trade (0.1% or RM7): Total Cost = RM100 + RM1 = RM101

Also, do note that the brokerage fee is charged twice: when you buy and when you sell your shareholdings. Hence, it is crucial for you to choose a stockbroker with a low brokerage fee!

LATEST: Get discounts on your brokerage fee on Rakuten Trade! Click HERE to find out more.

p

ii. Cash Upfront or Margin/Contra Account

Next, consider if you need a Cash Upfront or a Margin/Contra account.

Essentially, Cash Upfront is pretty straightforward: you only invest the money that you have in your account (imagine a prepaid card).

In contrast, with a Margin account, you get to buy shares with a total value higher than your available cash. In other words, you can borrow money from your broker to buy shares using your Margin account.

When you buy shares on margin, your profit will be amplified when the share price goes up. On the flip side, your losses will also be amplified when the share price goes down.

On a personal note, I do not recommend new investors to buy shares on margin, unless you really know what you are doing and you can handle the risk involved.

READ: What's the difference between cash upfront and margin account?

Opening Your CDS & Stock Trading Account Online via Rakuten Trade

Rakuten Trade is a joint venture between Kenanga Investment Bank (Malaysia) and Rakuten Securities (Japan), which is regulated by Malaysia's Securities Commission (SC).

- It is my go-to broker to invest in the stock market in Malaysia.

- Rakuten Trade offers one of the most competitive commission rates in Malaysia. In other words, Rakuten Trade is a fee-friendly option, especially for new investors that are starting with a small capital – more below.

- Launched in January 2022, Rakuten Trade now offers users access to the US stock market at a highly affordable commission!

Let’s dive deeper and find out more about Rakuten Trade:

#1 One of the lowest brokerage fees around

Rakuten Trade offers one of the lowest brokerage fees among the brokers in Malaysia – hence making it one of the most affordable options for new and experienced investors or traders alike.

|

Transaction Size |

Brokerage Fee |

| < RM699.99 | 1% (min. RM1) |

| RM700 – RM9,999 | RM9 flat fee |

| RM10,000 – RM99,999 | 0.1% |

| > RM100,000 | RM100 flat fee |

p

#2 Open CDS Account & Stock Trading Account at the same time

When you apply for a stock trading account through Rakuten Trade, your CDS account will also be opened automatically on your behalf.

It took me about 15 minutes to register for a Rakuten Trade share trading account. The best part is that your application will be processed extremely quickly and you can start investing after your account has been activated.

[Recap: Rakuten Trade stock trading accounts are Nominee CDS. Meaning, you do not have to deal with all the related paperwork in your investing or trading journey.]

p

#3 Trade both Malaysia & US Stock Market via Rakuten Trade

Starting 2022, Rakuten Trade users can trade the US stock market at a highly affordable price! It is the BEST platform to invest in the US market in Malaysia.

Check out my in-depth review on Rakuten Trade US stock trading below:

READ: Rakuten Trade Us stock trading review

Step-by-Step Guide to Open a Rakuten Trade Stock Trading Account (Cash Upfront account)

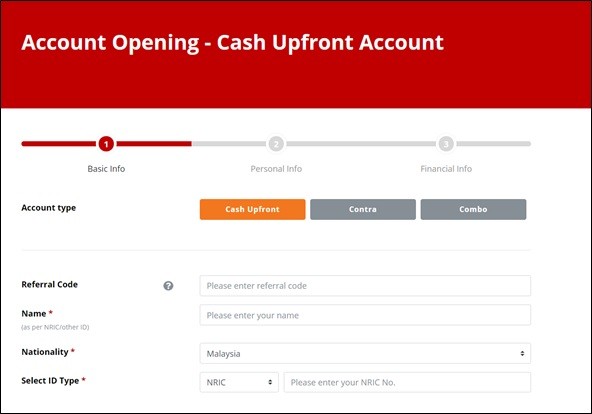

Step 1: Click the button below to open Rakuten Trade's registration page. Select ‘Cash Upfront’ as your Account Type.

Open A Rakuten Trade Account Today!

p

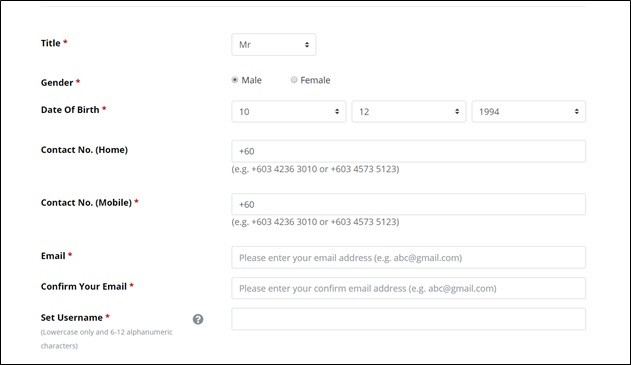

Step 2: Key in your Name, Nationality & IC

Step 3: Upload the front & back snapshot of your IC.

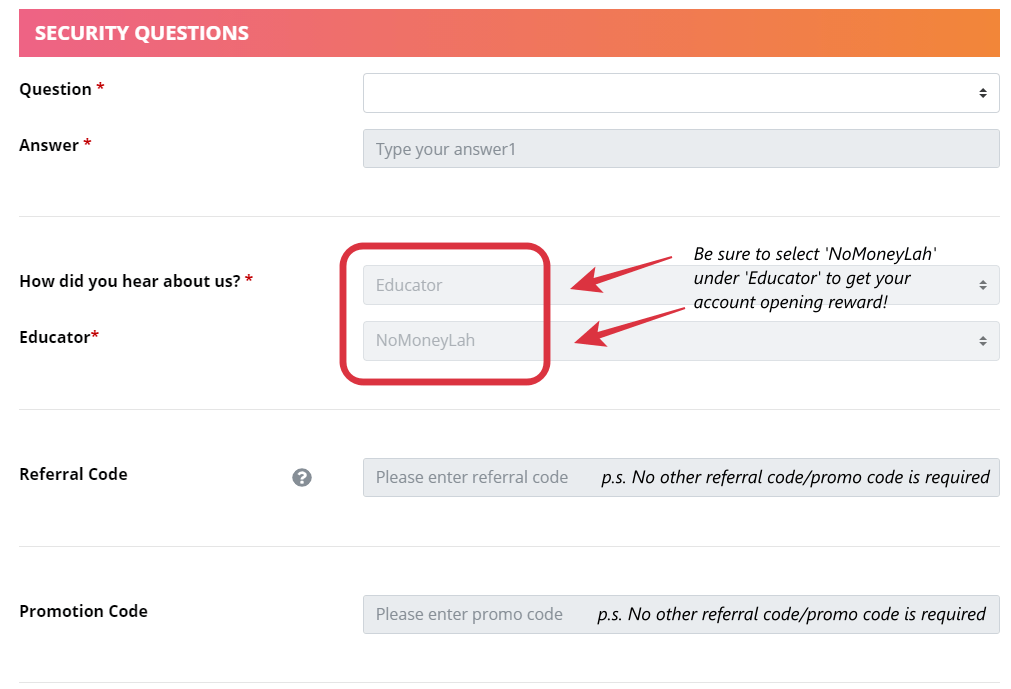

p.s. Select 'NoMoneyLah' under 'Educator', and you will get a free 1000 Rakuten Trade points (worth RM10) that can be used to reduce your brokerage fees and/or converted into Big Points or Boost Coins!

Step 4: Key in your Contact, Email, Username and Security Question.

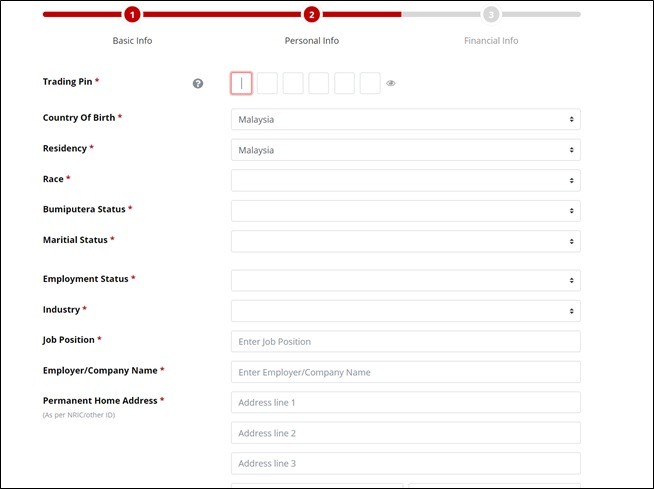

Step 5: You have to set a 6-digit trading pin to execute any transaction for buying or selling shares. This pin is VERY important as you need to key in this pin for all your transaction on Rakuten Trade!

Step 6: Key in your personal particulars in the next few sections.

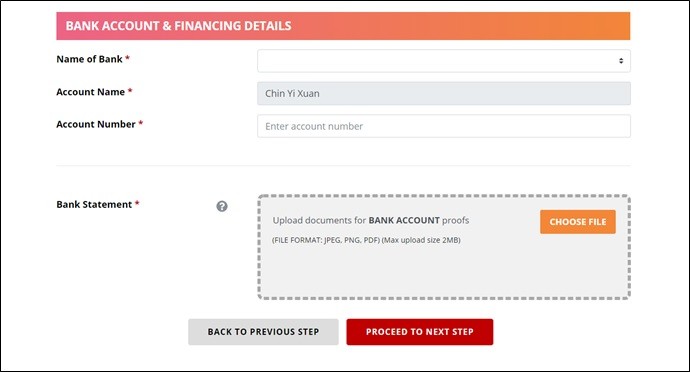

Step 7: Update your bank account details & upload your Bank Statement.

Step 8: Answer the few remaining questions for profiling purposes.

Step 9: Update your bank account details & upload your Bank Statement.

Step 10: Pay RM10 for your CDS account opening (p.s. Currently waived by Rakuten Trade).

Step 11: Upon payment, you will receive an email in your inbox asking you to verify your email.

Step 12: Done! You will be notified once your Rakuten Trade account is approved. Next, you can start to fund your account and start investing or trading!

No Money Lah Verdict

To start investing or trading the stock market, choosing a reliable stock trading platform is important, and I have no problem recommending Rakuten Trade due to its ease of application and additional perks (eg. Using RT points to reduce brokerage fee, converting RT points to BIG Points for every transaction.)

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Disclaimers:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

Last Updated on April 17, 2023 by Chin Yi Xuan

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi, how do I transfer the shares in my mbb inv account to rakuten cds account?

Hi Aizzat,

To initiate a share transfer from another broker to Rakuten Trade, you will have to get the broker your shares are currently deposited in to fill up the shares transfer form.

The shares will be reflected in your Rakuten Trade account upon successful transfer the previous broker.

Hope this helps!

Yi Xuan

Hi, Is Rakuten has stop loss function?

hi Gin Lin!

Nope there is no automated SL function in RT.

Yi Xuan

Hi Chin

I have an account with uobkayhian. I notice the brk rate they chrg is 0.6% , min chrg is RM40 per transaction. Tis is much higher compare with your sharing. May i know why?

Hi Winnie!

As I am not a UOB Kay Hian user, I can’t comfirm the exact rate with you. But I have helped you done some research online where some platform retain the data/fee structure as per my article, but UOB’s Utrade website indicate a minimum commission of RM28 (or 0.21%) for trades below RM100k. [Source: https://www.utrade.com.my/public/faq_local%5D

My suggestion is to reach out to them to get their latest pricing structure.

Let me know how it goes!

Yi Xuan

Hi there! Great article! I’m very new to this and I am still a bit confused about all of these accounts. Hope you can answer my silly questions here.

1. As a new investor, is it compulsory to have both CDS (stock trading account) and the brokerage account (Cash upfront / Margin)?

2. I understand the difference between these two account. But, which account am I gonna use to trade?

3. If I intended to purchase IPO, I would need to open an direct CDS account and use the CDS number of the said account to do so. Correct?

4. Why are the brokerage fees so different from the banks in the list? Why some brokerage / banks charge higher and why some lower? Does it imply the quality of the brokers in any of these brokerage? Higher brokerage fee, better brokers to help you invest?

5. For those with low brokerage fee, is there any expense ratio or any hidden fees that has to pay annually or any other processing fee?

6. What do you think about eToro?

Thank you! 🙂

Hi Jac! Glad that you reach out and all the best in your investing journey! Always feel free to reach out to me at [email protected] if you ever need any help in your journey! 🙂

1. If you want to invest in stocks, you will need to have a CDS account. But please don’t worry about this as when you open an account with RT your CDS account will be opened for you automatically.

2. I have shared the difference between Cash Upfront, Contra and RakuMargin account in this article below, Definitely check it out! 🙂

https://nomoneylah.com/2020/07/15/rakuten-trade-faq/

3. Yes, to subscribe to an IPO you’ll need a direct CDS account.

4. Fees can differ due to the extra service involved. It could be a dedicated account manager that’ll serve you or stuffs like that (which I personally don’t quite care). But as a new investor with small capital, my suggestion is to be very cost-sensitive as commissions can eat in to your profits significantly.

5. Nope.

6. etoro is not under the legislation of Securities Commission so the local regulations would not be able to protect you should anything happen with your account. This is a risk that you need to be aware of when using etoro.

Hope this helps!

Yi Xuan

Hey Yi Xuan,

I am totally new to investment and I find your article really helpful.

Thanks for that. It’s really easy to understand for a complete noob like me. 🙂

Follow up to Jac’s #3,

So RT will create an account for me automatically when I sign up with them correct?

If I want to subscribe to an IPO, can I use the same CDS account created by RT or will the bank will create another CDS account for me?

As per my understanding, 1 person can only have 1 CDS account right?

Cheers.

Hi HH!

Happy to help and glad that you find this article useful!

1. Yes, Rakuten Trade will create a CDS account for you upon successful registration.

2. No, since Rakuten Trade is a nominee account, you cannot subscribe to an IPO via Rakuten Trade. Then again, I think for most investors, IPO should not be their focus as newly listed companies do not have enough data and financials history to conduct any proper fundamental analysis – do stick back to companies that are listed long enough so you have enough data to back your research and conviction.

3. Nope, one person can have multiple CDS accounts. eg. With RT you have one and maybe with Maybank you can have another one too.

Hope this helps!

Yi Xuan

Hi! I just made a CDS account in Bursa Anywhere apps and the authorised depository agents that I choose is M+. It is a success. But now I want to now whether I still need to register a trading account in M+ or I can directly login? If I can, how? Because in M+, it said that I have not make any account?

Hey Malek!

I am not super familiar with Bursa Anywhere. you can check out the Bursa Anywhere video by Suyin here:

https://www.youtube.com/watch?v=xOVmbREIreE

Hi, any plan to trade internationally?

Hi YYH!

Yeah! Am researching and will write about it soon! 🙂

Yi Xuan

Hi Chi Yuan, how is your experience after selling your stock (with profit) using Rakuten? i am just so frustrated the profit after selling my stock takes longer time to reflect in my account. This lagging (more than a day) has refrained me to buy another stock

Hi NZ!

This could be because the system is taking some time to reflect your profit/loss (they are upgrading their services btw). Have you reach out to the customer service and ask about it?

Regards,

Yi Xuan

Hi, how many days it take for Rekutan to approve the opening account?

Hi Mag!

Normally within 72 hours if the documents are complete.

Regards

Yi Xuan