Last Updated on February 28, 2023 by Chin Yi Xuan

Syfe is a robo-advisor based in Singapore with solid offerings for all investors alike.

Reason being, Syfe offers the simplicity of investing via its Core portfolios to passive investors. Moreover, Syfe allows users the ability to customize an entire ETF portfolio from the ground up via Select Custom.

As such, it goes without saying that I genuinely enjoy using Syfe.

In this guide, we’ll see how you can fund and withdraw from your Syfe account as a Malaysian:

ALSO READ: Syfe Review – The Most Complete Robo-Advisor

Table of Contents

Funding your Syfe Portfolio

As a whole, there are 3 ways for you to fund your Syfe portfolio:

Method 1: Foreign Telegraphic Transfer (FTT) from local bank account (Not recommended)

Since Syfe is regulated in Singapore, you will not be able to transfer money as simply as what we do with robo-advisors regulated in Malaysia (eg. StashAway Malaysia)

In this case, doing an FTT from a local bank account is the most straightforward way to fund your Syfe account. However, it is also the most expensive way to do so.

A typical FTT will incur FTT fees (~RM10), FX exchange rate (MYR to SGD), and intermediary banking fees (~SGD30-50), which are SUPER expensive and inefficient.

Personally, I do not recommend using FTT to fund your Syfe account. Instead, consider using remittance services like Wise or a Singapore bank account to fund your Syfe account.

Method 2: Fund your Syfe Portfolio via Wise

Wise is an app that provides low-cost remittance services. Using Wise is definitely one of the easiest (and cheapest) ways to fund your Syfe portfolio.

With Wise, you get better exchange rates compared to FTT. Even better, you get to save on the expensive intermediary banking fees from FTT as well.

BONUS: Use my Wise referral link HERE and get a fee-free transfer of up to 500 GBP (~RM2,900) in your first transfer!

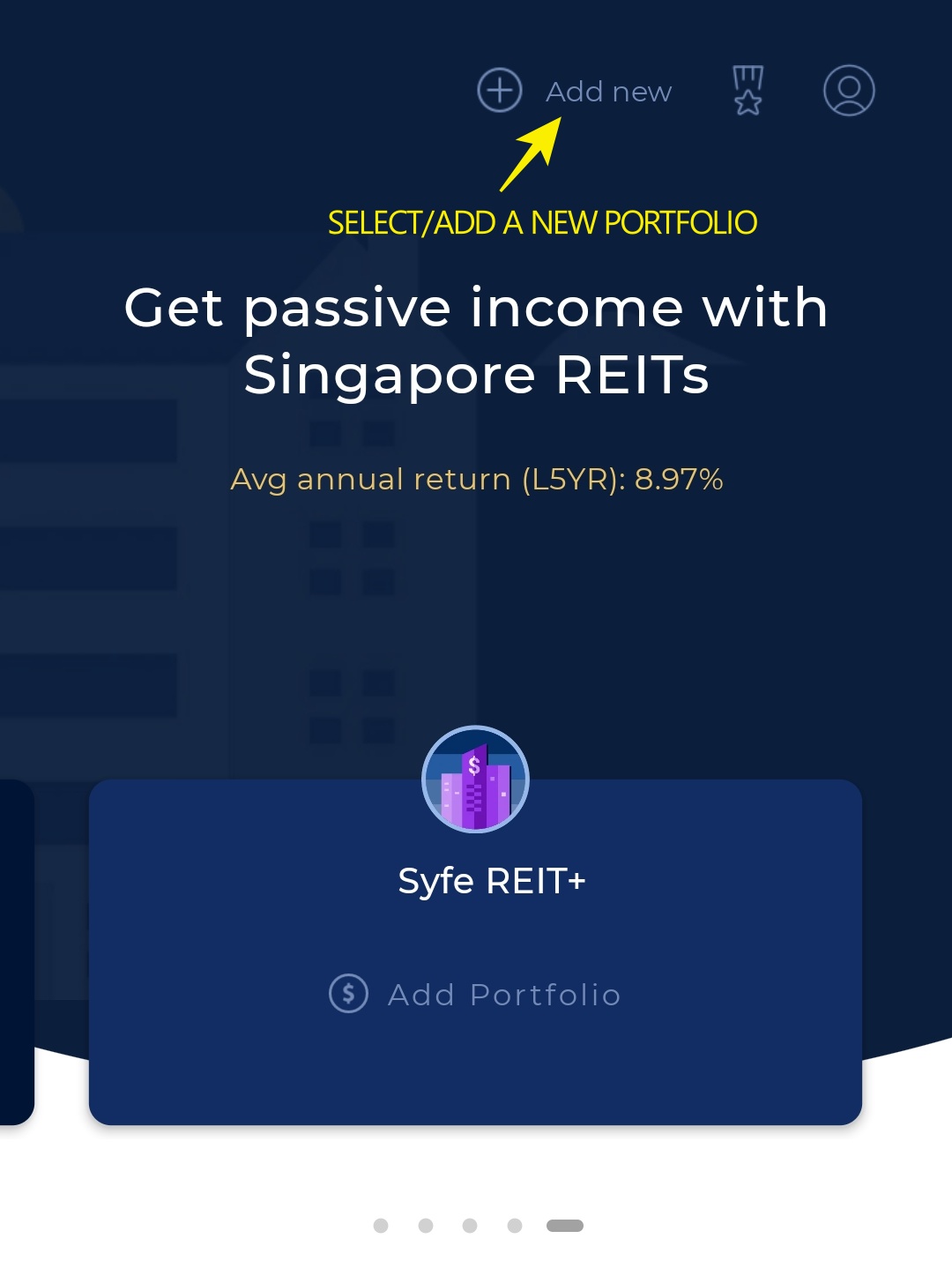

Step 1: Log in to Syfe, and create a new portfolio if you have yet to create one.

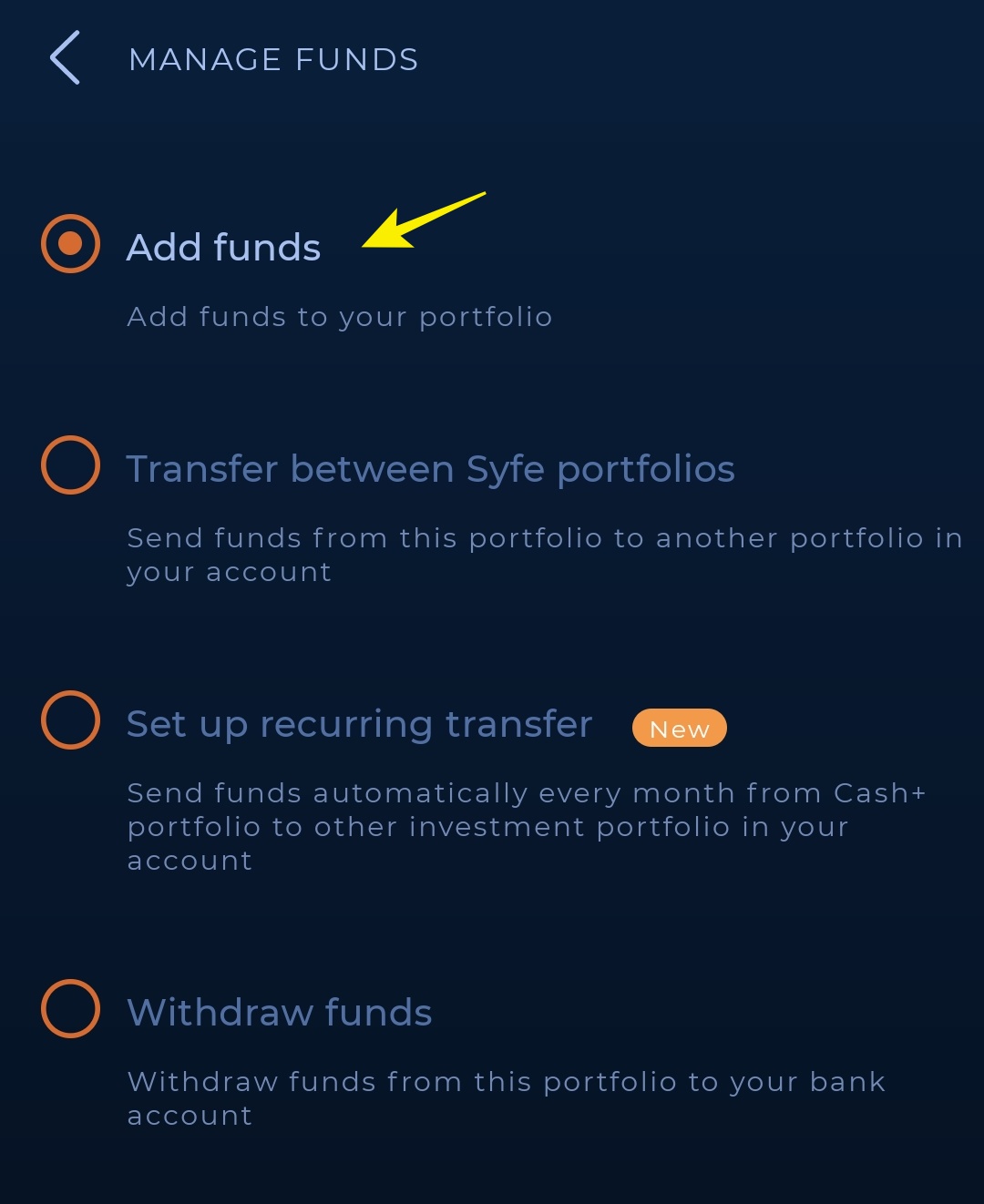

Step 2: Select your portfolio > ‘Manage Fund’ > ‘Add Funds’

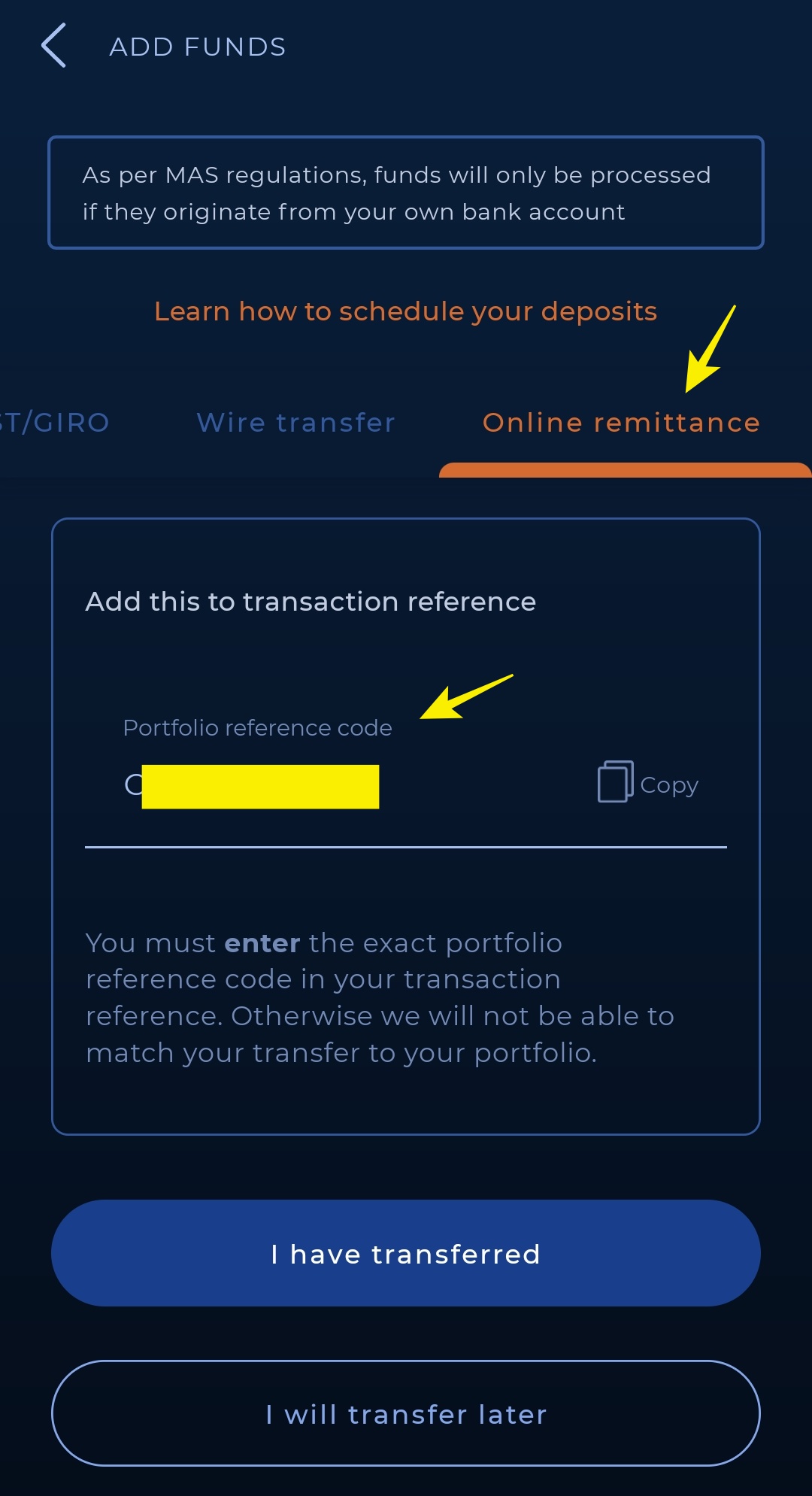

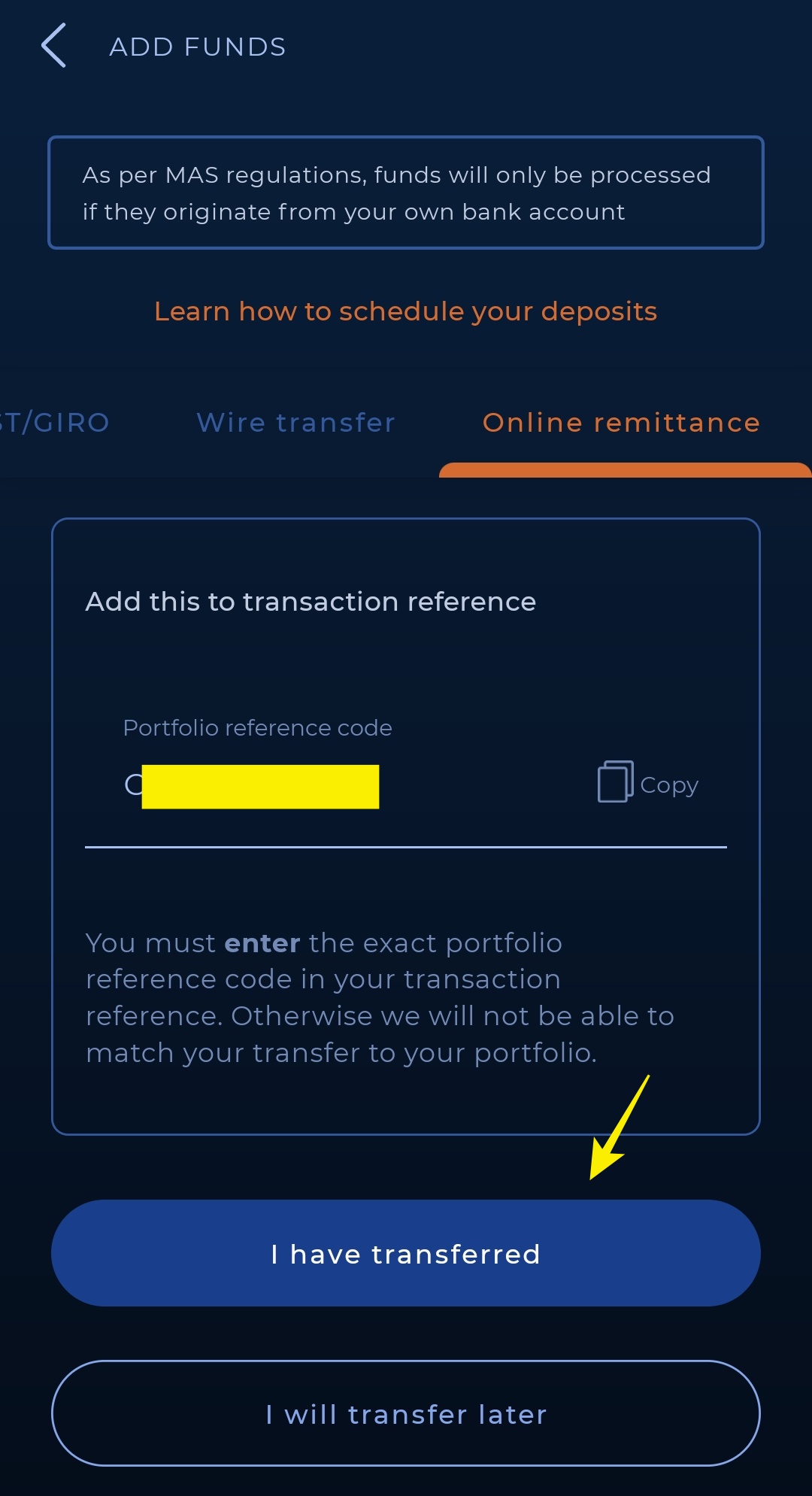

Step 3: Select ‘Online Remittance’.

Take note of the Portfolio Reference Code as you will need this code for Step 10 later.

Do not close the app as we’ll come back to the Syfe app later.

Step 4: Log in to your Wise account.

If you are new to Wise, you can sign up for a new Wise account using my referral link HERE, and get a fee-free transfer of up to 500 GBP (~RM2,900) in your first transfer!

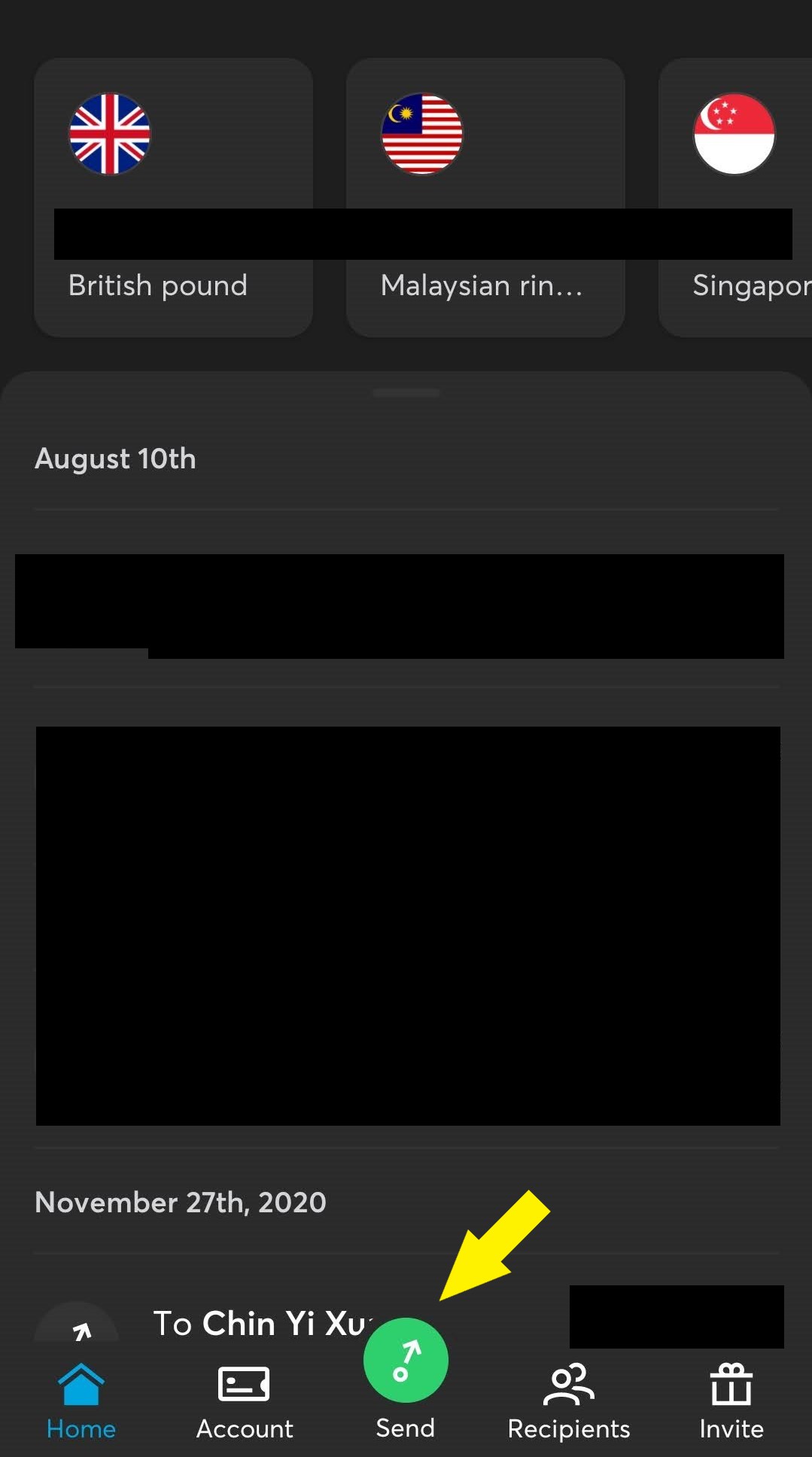

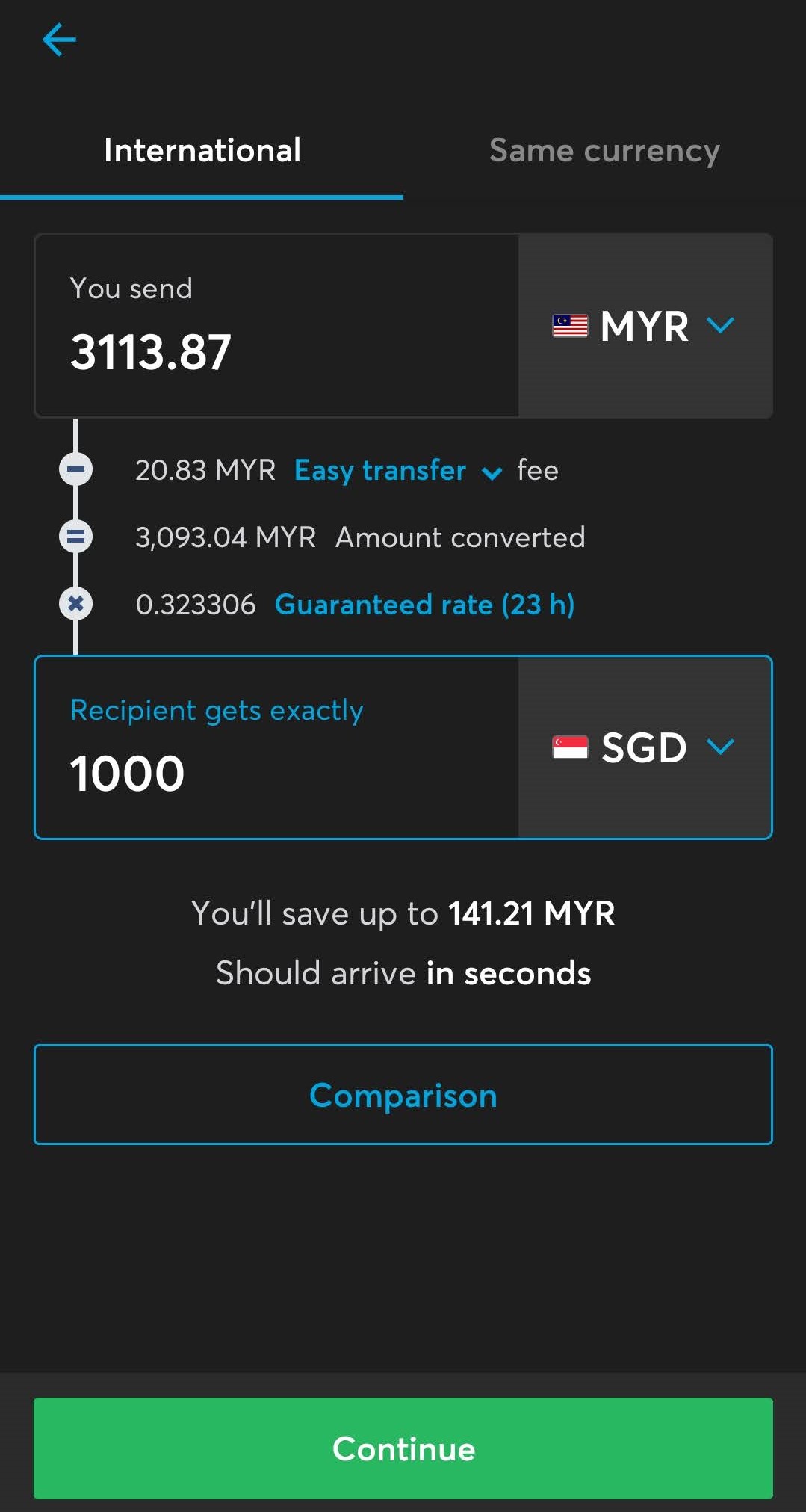

Step 5: Click on ‘Send’. Then, indicate the amount you would like to transfer to Syfe.

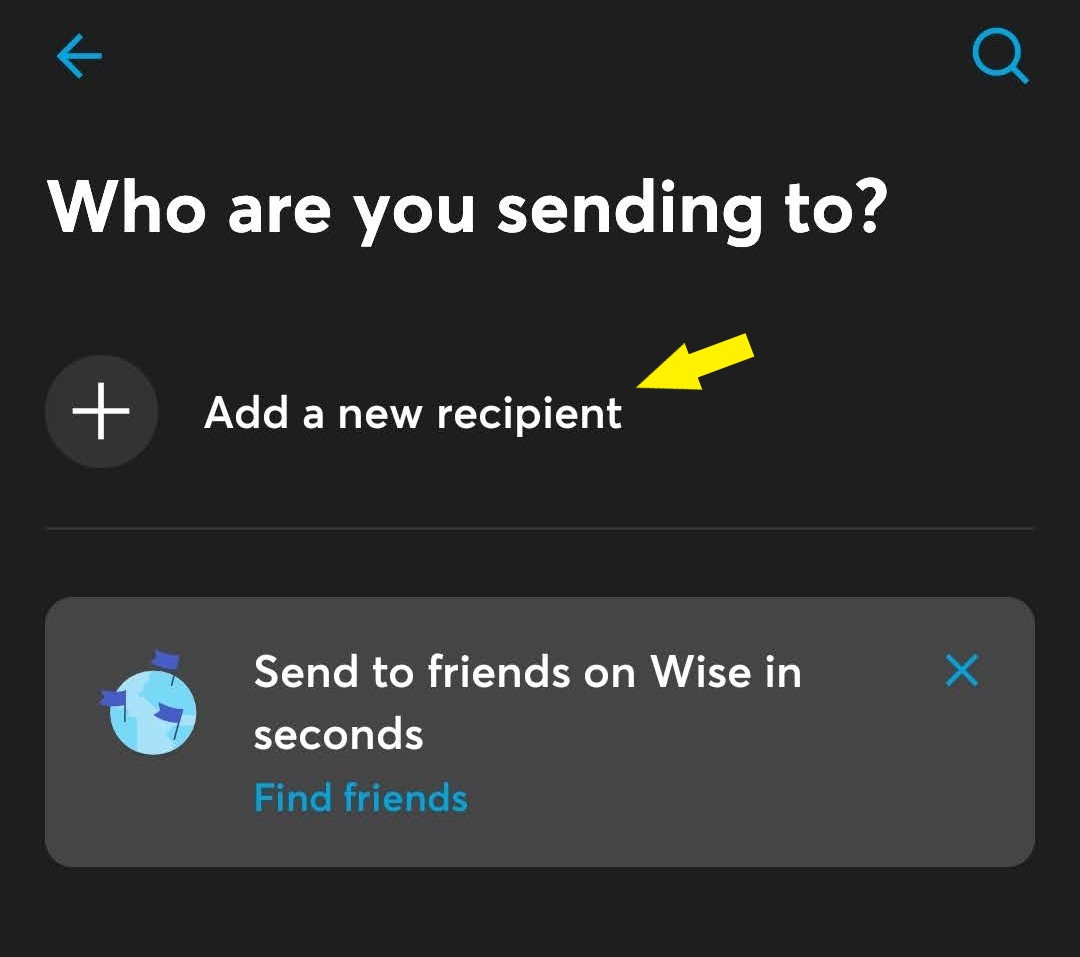

Step 6: Select ‘Add a new recipient’ if this is your first transfer to Syfe.

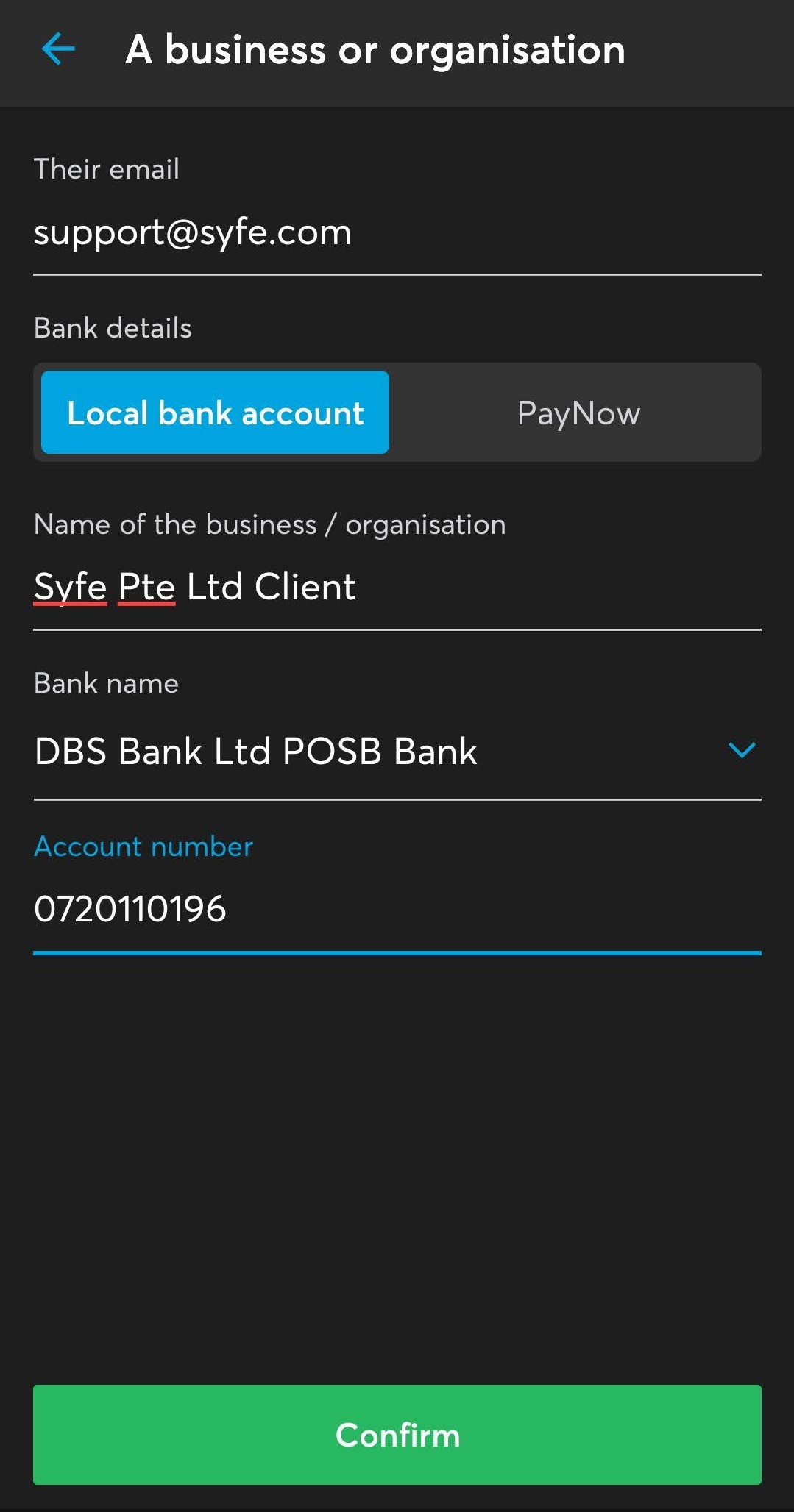

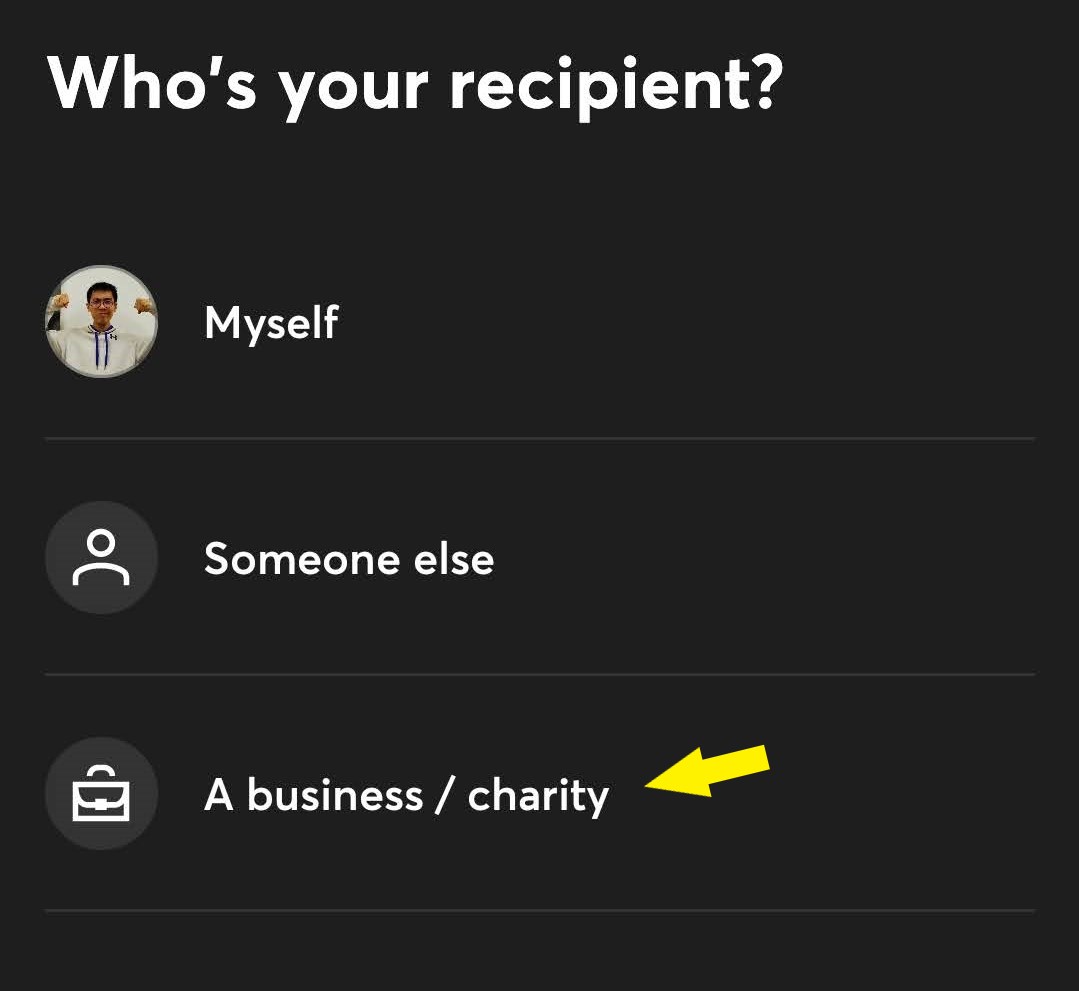

Step 7: Select ‘Business or charity’ as your new recipient.

Step 8: Enter Syfe’s account information as found below.

- Email: [email protected]

- Recipient name: Syfe Pte Ltd Clients AC

- Recipient bank: DBS Bank

- Account number: 0720110196

- Swift/BIC Code: DBSSSGSG

Step 9: Verification

If you are setting up a Wise account for the first time, follow the instructions on the screen to upload your ID document.

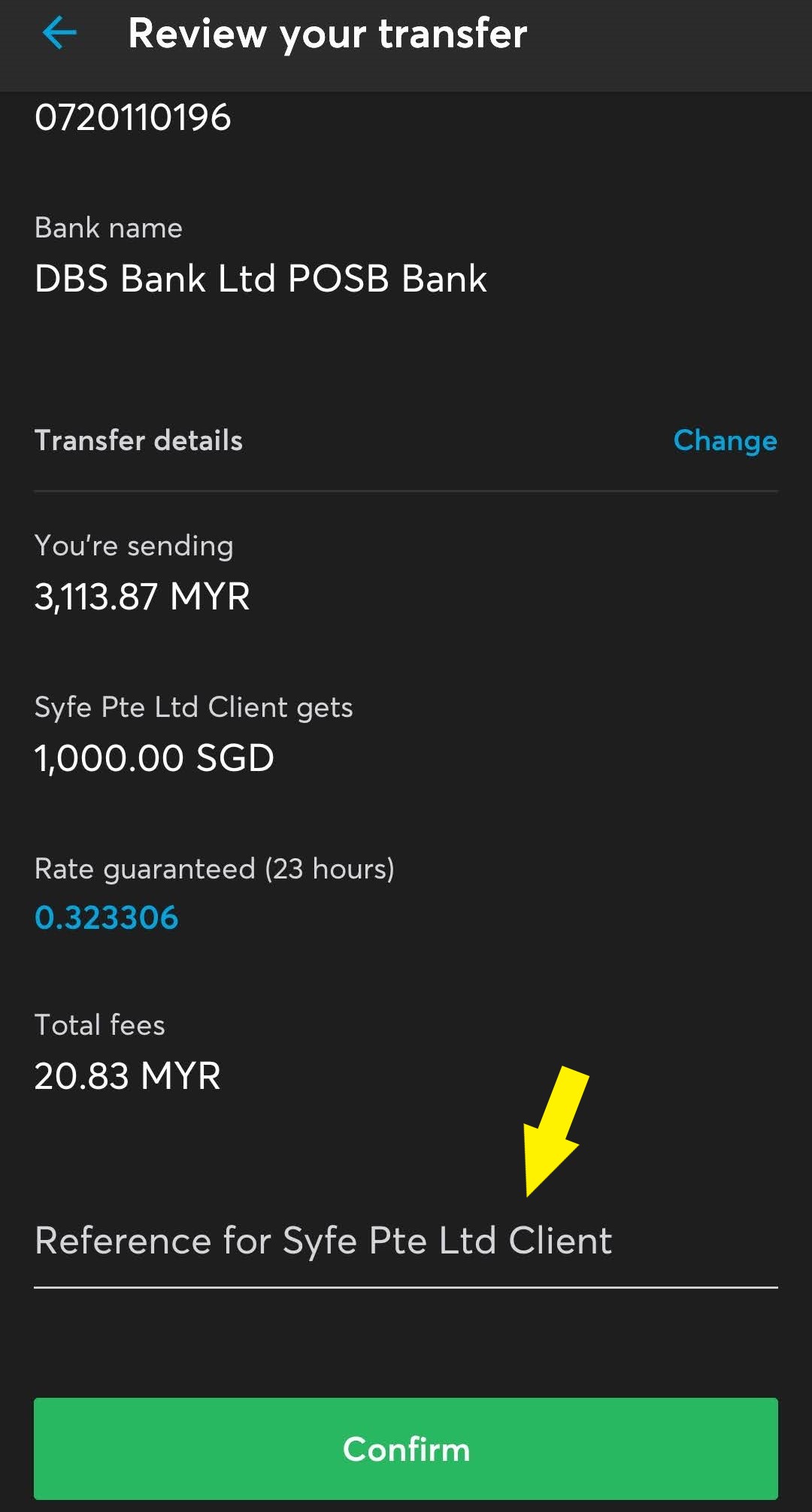

Step 10: Enter your Portfolio Reference Code (from Step 3) as the reference for Syfe.

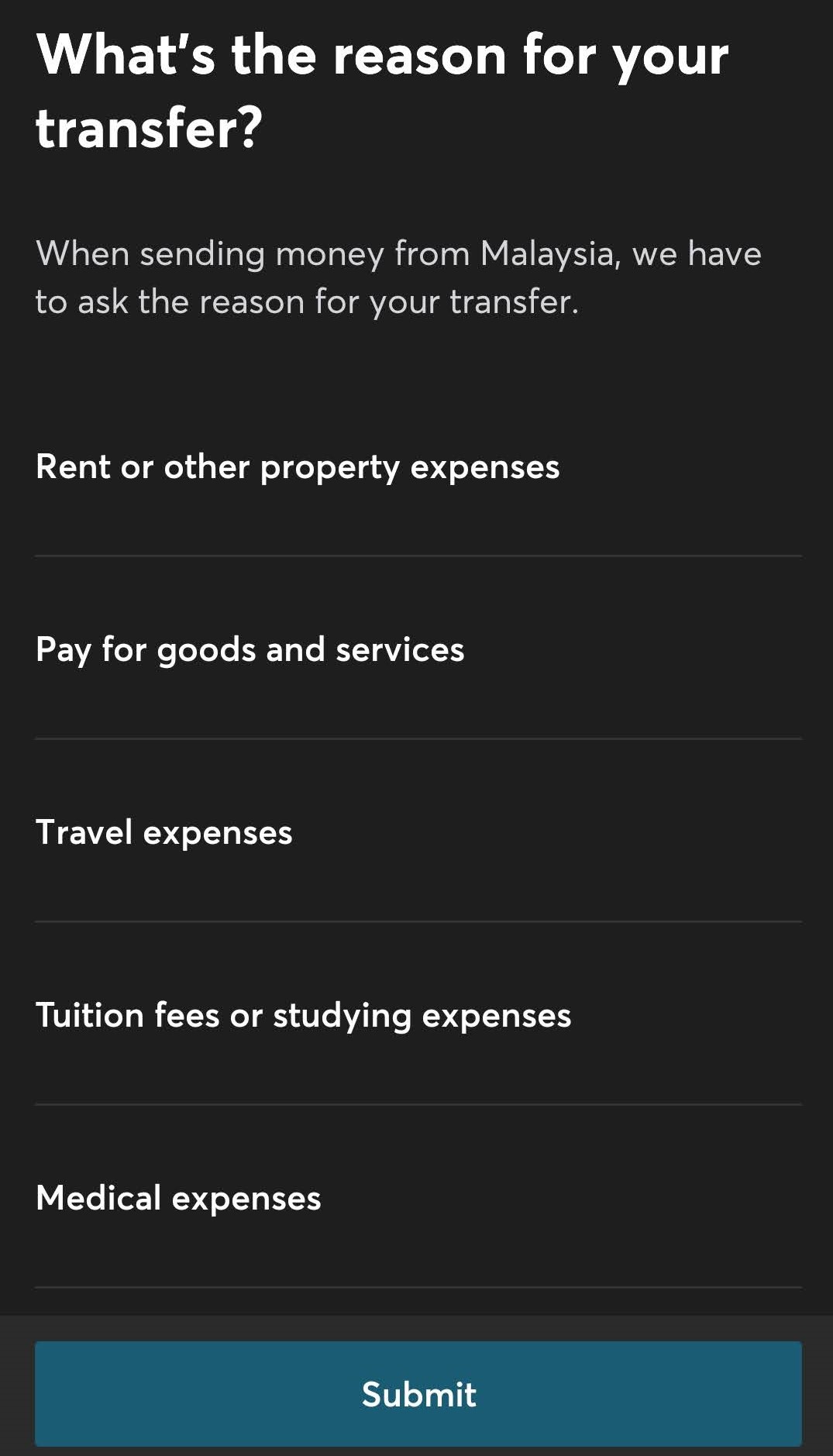

Step 11: Select the reason for transfer.

Any of the reasons should work equally fine.

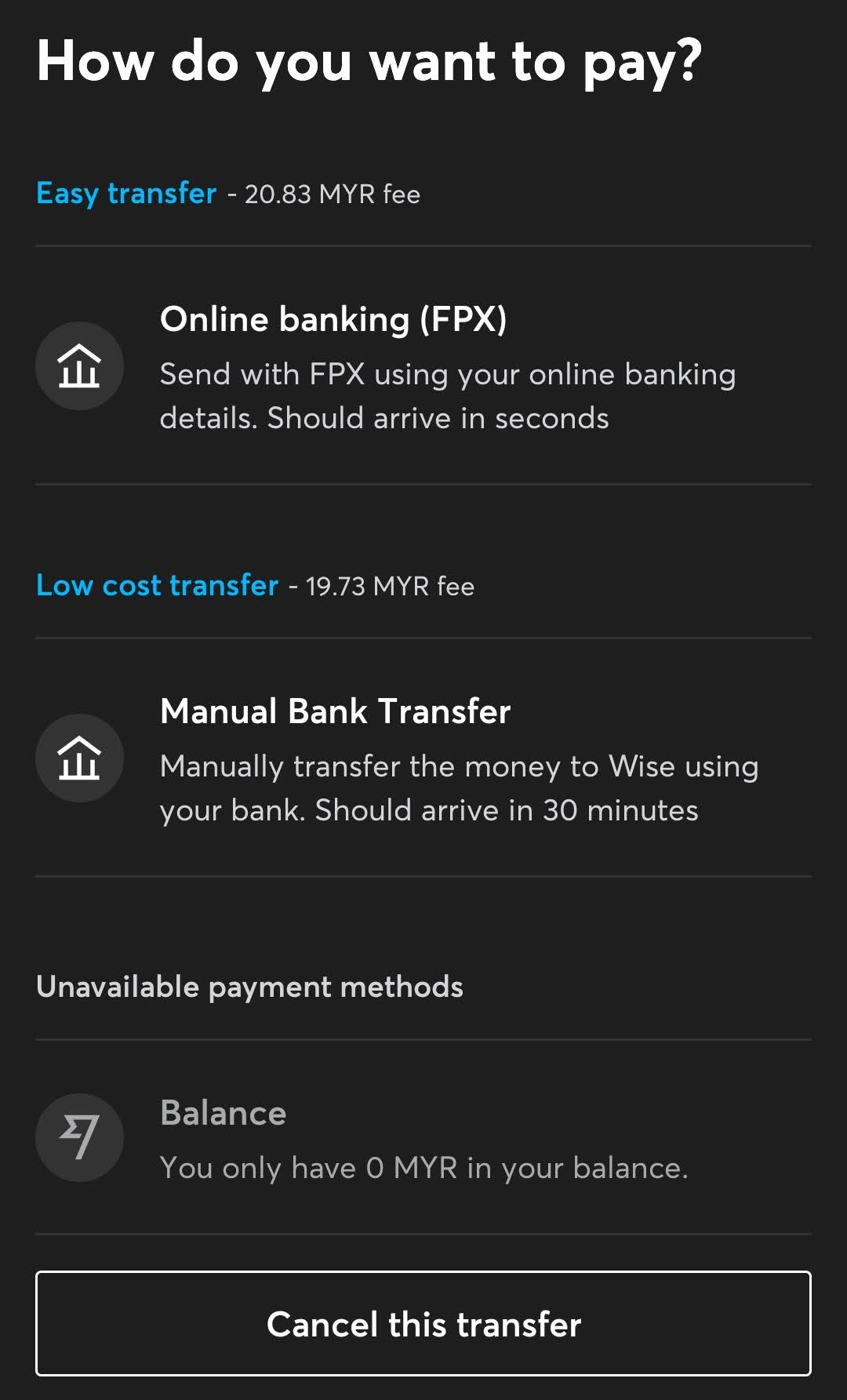

Step 12: Choose your transfer type and preferred payment method to complete your fund’s transfer.

Step 13: Go back to Syfe funding page and click ‘I have transferred’.

Step 14: You’ll receive a confirmation email once Syfe has received your funds.

The funds will be reflected on your portfolio within 1 to 2 working days.

Method 3: Fund your Syfe portfolio via a Singapore bank account (CIMB SG)

If you have a Singapore bank account, funding Syfe is free and effortless.

Whether you are planning to use Syfe, or to open a foreign stock broker to invest overseas (eg. US/HK/SG market), I’d highly recommend opening a Singapore bank account.

Check out my step-by-step guide on how you can open a CIMB SG account online. For the following steps, I’ll assume that you have already opened and funded your CIMB SG account:

Step 1: Log in to Syfe, and create a new portfolio if you have yet to create one.

Step 2: Select your portfolio > ‘Manage Fund’ > ‘Add Funds’

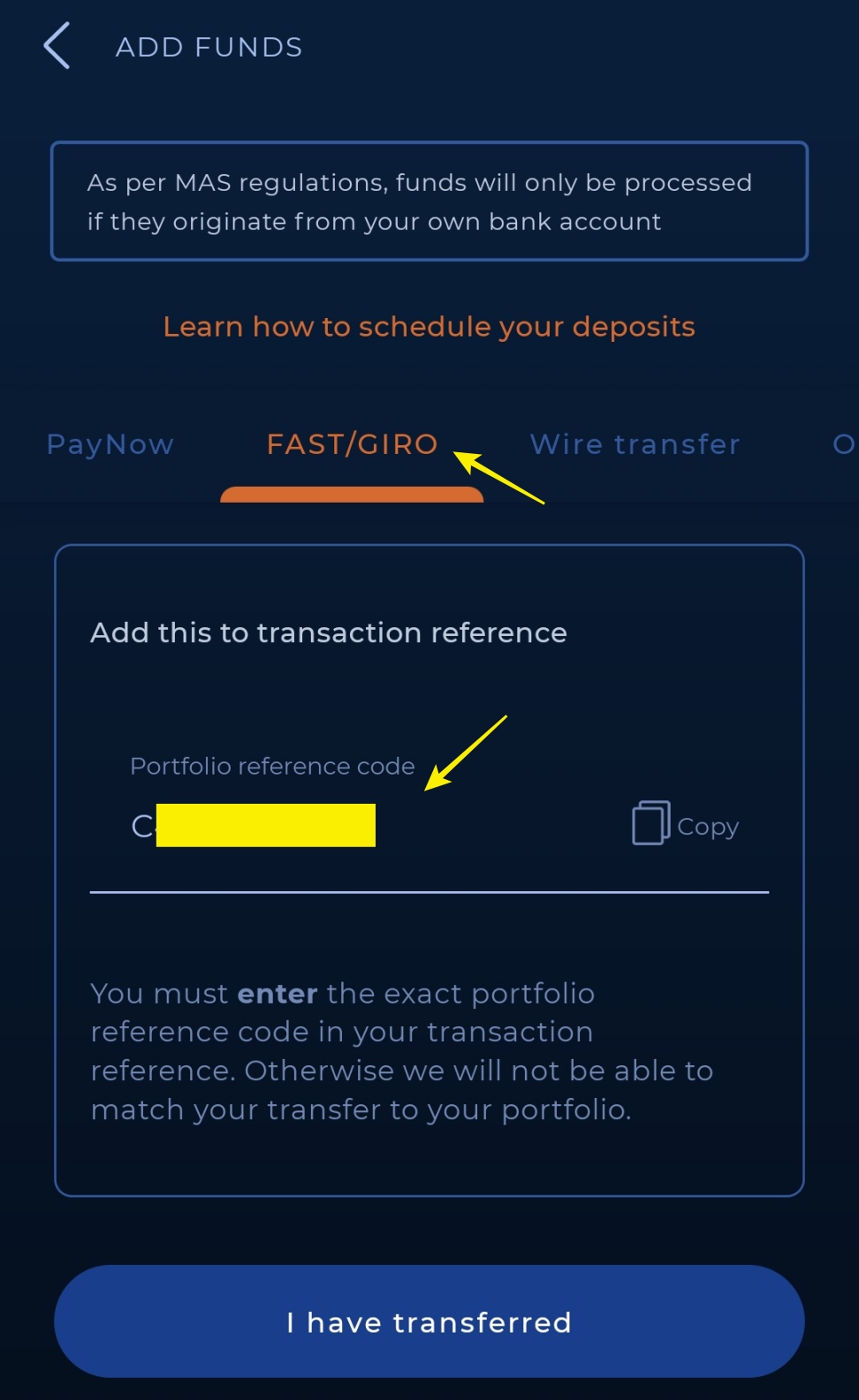

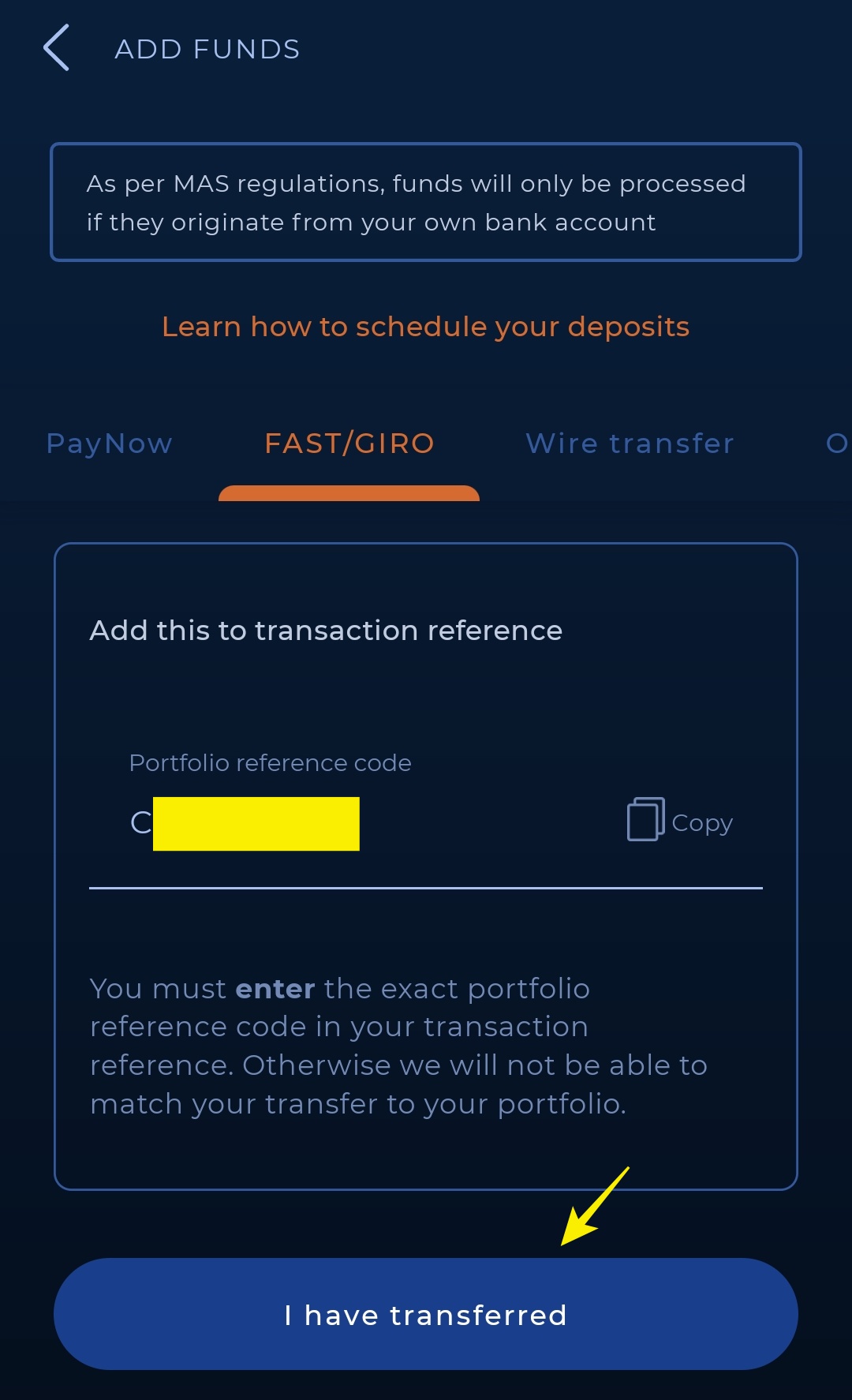

Step 3: Select ‘FAST/GIRO’.

Take note of the Bank details as this is where you’ll have to transfer your money to. Also, take note of the Portfolio Reference Code as you will need this code for Step 6 later.

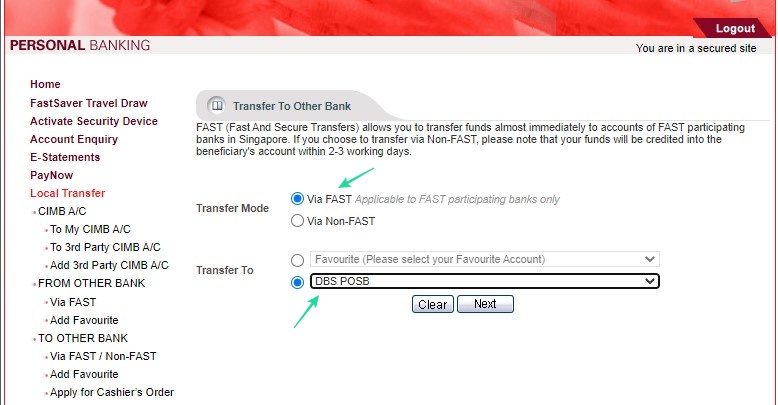

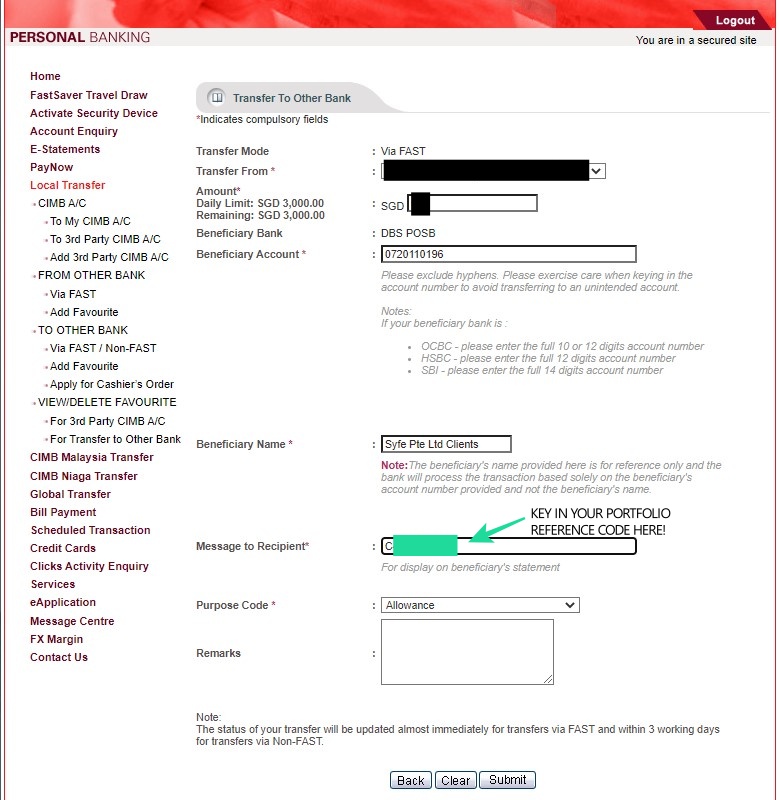

Step 4: Log in to your CIMB SG account > ‘Local Transfer’ > ‘To Other Bank Account’ > ‘Via FAST/Non-FAST’

Step 5: Select ‘Via FAST’, and choose ‘DBS POSB’ for bank

Step 6: Key in the Bank details that Syfe provided from Step 3.

Remember to Enter your Portfolio Reference Code as the reference for Syfe.

Step 7: Once you are done with the transfer, go back to Syfe funding page and click ‘I have transferred’.

Step 8: You’ll receive a confirmation email once Syfe has received your funds.

The funds will be reflected on your portfolio within 1 to 2 working days.

READ: How to open a CIMB SG account online

Withdrawal from your Syfe portfolio

There are 2 main ways to withdraw from your Syfe account:

Method 1: Direct withdrawal to a local bank account (Not Recommended)

The first withdrawal method is via Telegraphic Transfer (TT) from Syfe to your local bank account.

I do not recommend this method as it takes longer (5-7 business days). Moreover, there will be fees charged on both DBS bank’s side (Syfe’s trustee bank), as well as from our local bank:

- TT charges by DBS: Cable fee of SGD25 + Commission of 0.125% on the transferred amount

- FX rates + Intermediary banking fee from local bank

As you can see, this is an expensive withdrawal method and I highly recommend you to use the next method for withdrawal.

Method #2: Withdrawal from Syfe to a Singapore bank account (CIMB SG)

Withdrawal from Syfe is best done through a Singapore bank account as it is faster (2-4 business days). Furthermore, there are no charges on withdrawal.

In fact, I highly recommend that you open a Singapore bank account online if you are planning to fund Syfe, or to open a foreign stock broker to invest overseas. Reason being, many overseas brokers have the banking facilities to accept funding & withdrawal via a Singapore bank account.

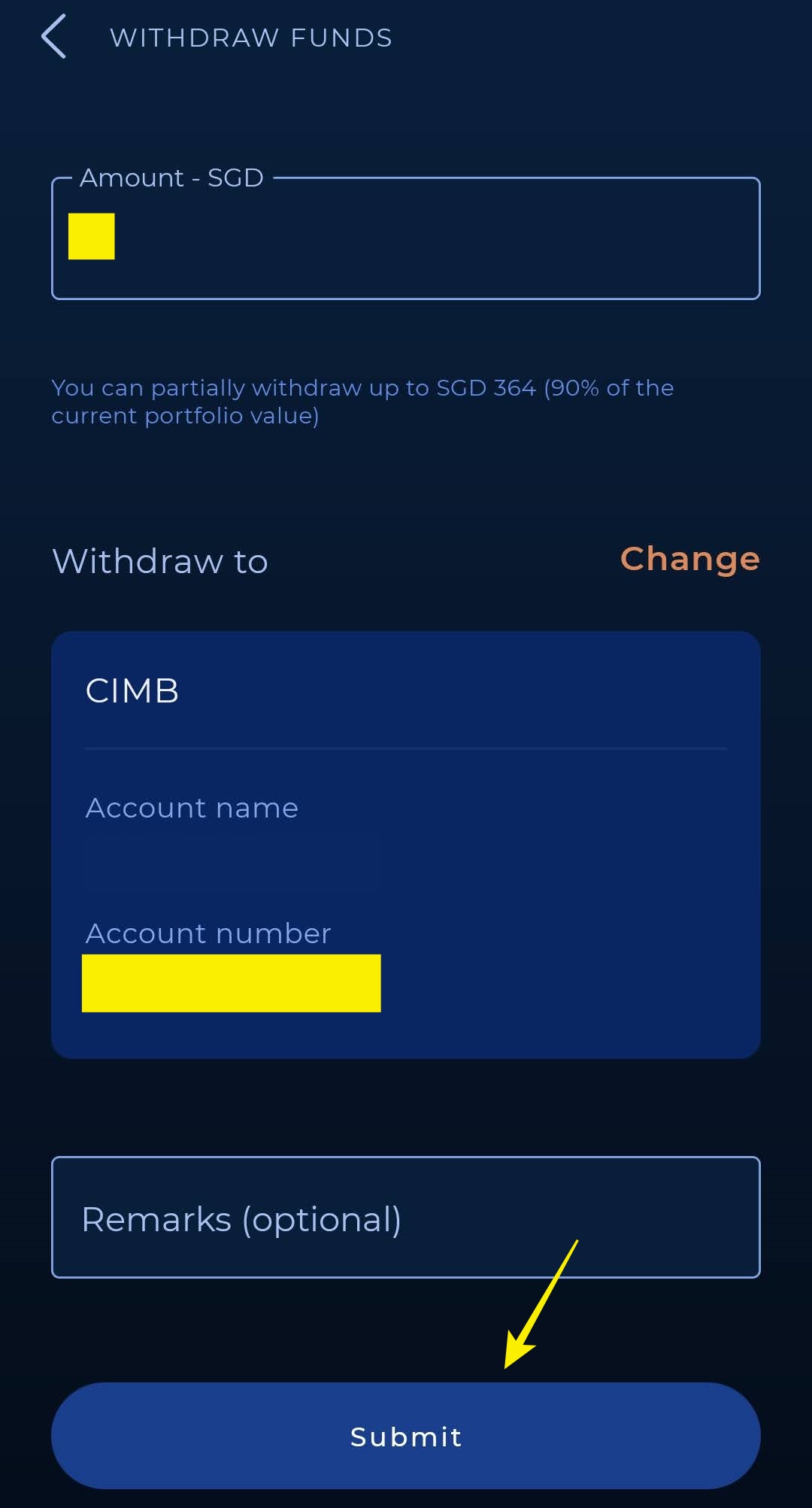

Below, you’ll find the steps to withdraw from Syfe to an SG bank account:

Step 1: Select the portfolio that you want to withdraw your fund from.

Step 2: Select ‘Manage Funds’ > ‘Withdraw Funds’

Step 2: Select ‘Manage Funds’ > ‘Withdraw Funds’

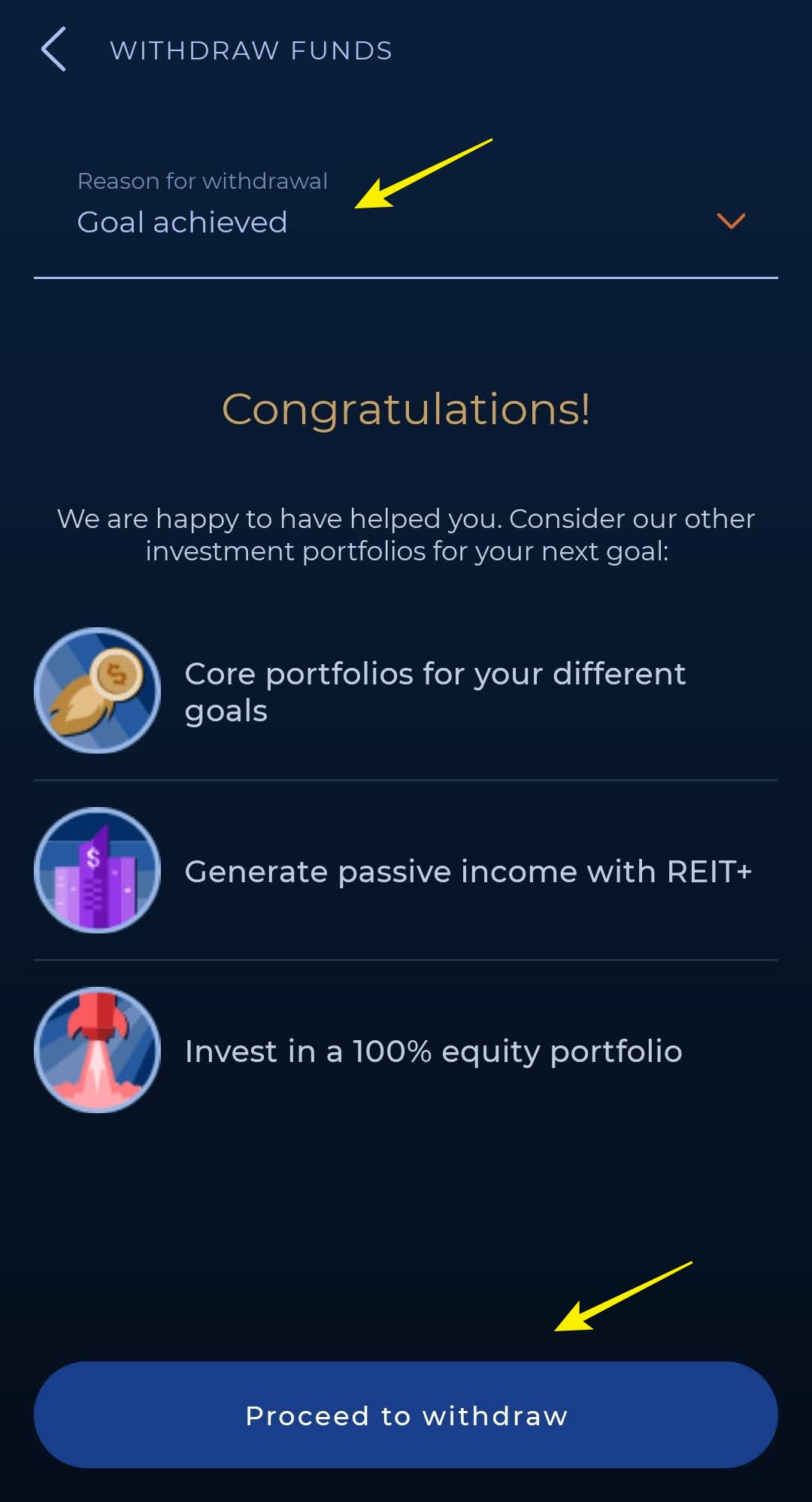

Step 3: Choose a reason for withdrawal.

It can be any from the list – it’ll not impact the withdrawal.

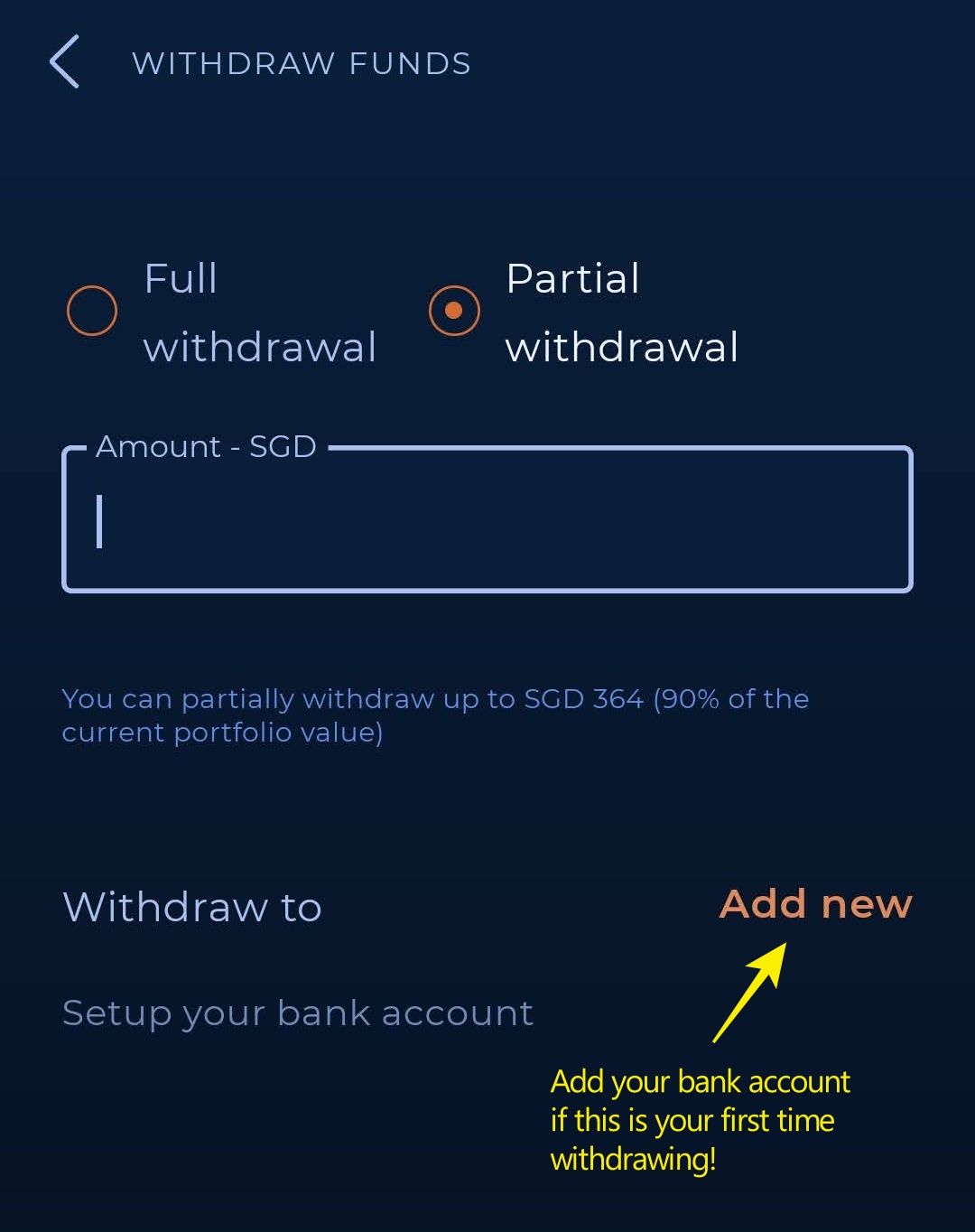

Step 4: Decide if you want to do a full or partial withdrawal.

If this is your first time withdrawing from Syfe, select ‘Add New’ to setup your bank account.

Step 5: Add the details of your SG bank account.

Note that the SG bank account must be under your own name.

Step 6: Click ‘Submit’ and you should be able to receive your funds in 3-4 business days.

Tips: Best way for Malaysian investors to use Syfe

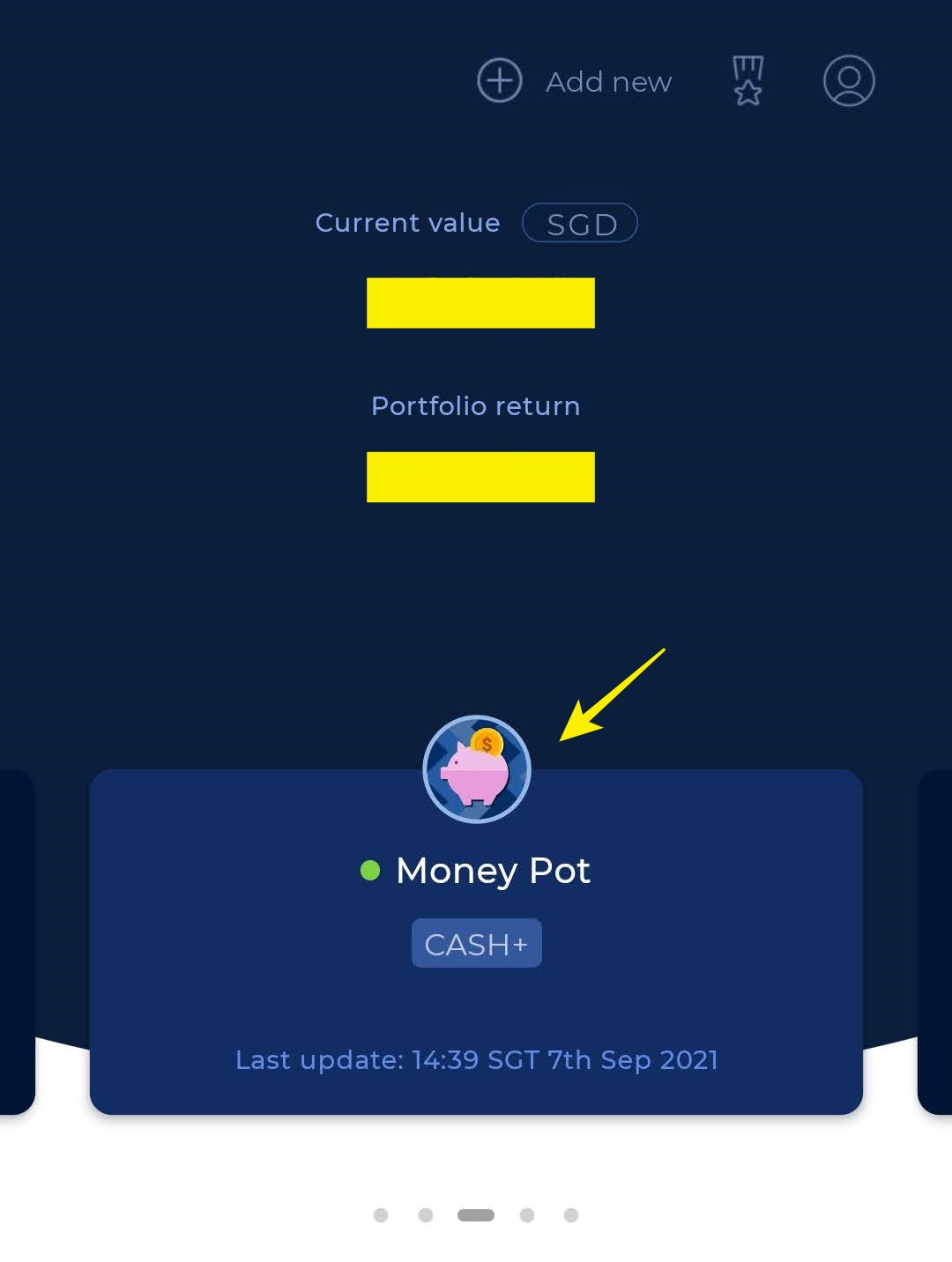

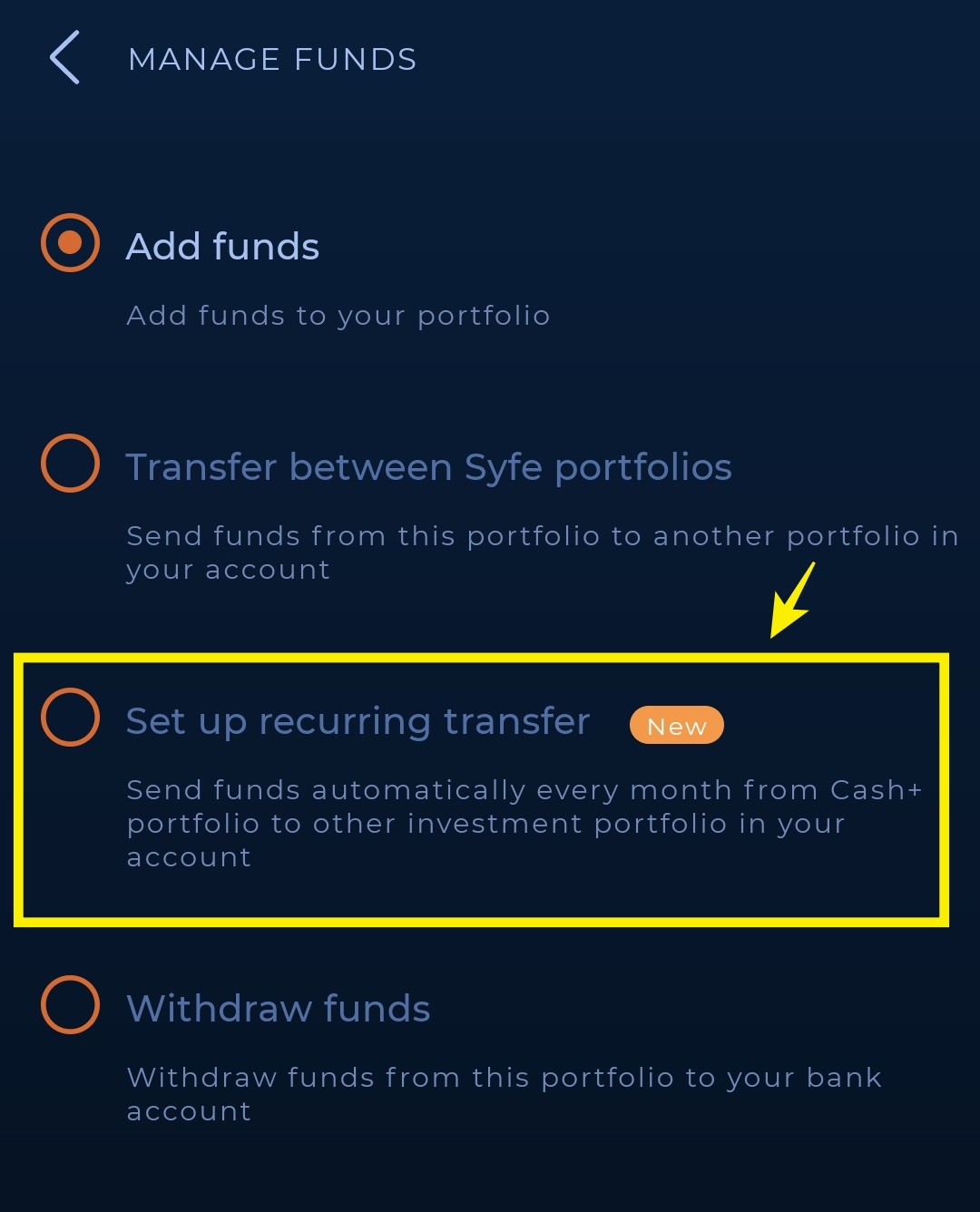

Through Syfe Cash+ portfolio, you can set up automated recurring transfers to & from other Syfe portfolios.

This is a convenient feature that’ll help you save on remittance fees if you are funding your Syfe portfolio via a local bank account or Wise.

As an example, you’d like to invest SGD200 per month in your Syfe Core Equity100 portfolio. The thing is, there are fees involved when you remit funds via a local bank account or Wise.

So, instead of transferring SGD200 per month, you can do a one-off SGD1,200 to Cash+ portfolio (with a projected 1.5% return per annum), and set up an automated recurring transfer to your Core Equity100 portfolio for the next 6 months.

Exclusive Syfe Promo Code – NOMONEYLAH

No Money Lah is now working with Syfe to bring the best deal for No Money Lah’s readers.

If you are keen to give Syfe a try, consider using my promo code ‘NOMONEYLAH’ to open a new account. Doing so, you’ll receive 100% off your management fees for up to 6 months!

[Disclaimer: If you use my promo code ‘NOMONEYLAH’, and make an initial deposit of SGD1,000 (or more) to your selected Syfe portfolio (Core/REIT+/Select/Cash+), No Money Lah will receive a small referral. This will help sustain the blog to keep producing quality content like this.

Of course, this is optional and you are free to use the promo code and deposit any amount you prefer.]

No Money Lah’s Verdict

As someone that has tried different robo-advisors in the past, Syfe is certainly the most complete robo-advisor when it comes to offerings and customizability.

Regardless of your investment needs & preferences, I am almost certain that you’ll find a portfolio that suits your need via Syfe.

If you don’t mind the slight hassle with the funding and withdrawal process, I can certainly recommend giving Syfe a try.

Disclaimers:

Past return is not indicative of future performance. Materials are not and should not be construed as financial advice nor an offer to sell or the solicitation of an offer to purchase or subscribe for any products or services. All forms of investment carry risks and you should independently assess whether the products and services are suitable for you based on your specific financial situation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

This post may contain affiliate links that afford No Money Lah a small amount of referral (and help support the blog) should you sign up through my referral link.

Related Posts

February 20, 2023

Syfe Review: The most complete & customizable robo-advisor. Period.

February 16, 2024

Guide: How to open a CIMB Singapore account for Malaysians

January 13, 2022

Malaysian’s Guide to Invest in ETF

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

What documents are needed for Malaysian to sign up for Syfe Trade ?

For Malaysians, you’ll need:

1. A picture (front & back) of your passport (must be a valid passport)

2. Utility bill (eg. Phone bill/water or electricity bill) as proof of residency.

3. Tax Identification Number (TIN)

More details: https://nomoneylah.com/2021/09/10/syfe-review/#How_to_open_a_Syfe_account_in_under_5_mins

Thanks for the info.

Is there any alternative for the passport? If not, does it mean that someone has to apply for one purposely for Syfe? 😅

Hi Chong,

Unfortunately for time being, passport is the only way to open a Syfe acc.

Yi Xuan

Would it be possible to transfer funds from the CIMB SG account to Wise? If yes, would I still be subjected to FX rates of CIMB SG?

Asking cuz I’m not a fan of FX rates offered by banks.

Thanks in advance!

Hi Alysha!

Yes it is possible to transfer funds to your Wise accoount/currency wallet. There should be no FX fees if you want to do SGD to SGD wallet transfer but there is certainly a FX fee from the bank if its a different currency.

Alternatively, you can try transferring SGD to Wise, THEN exchange for the currency of your choice within the Wise app.

Hope this is helpful!

Regards,

Yi Xuan

Thanks, Yi Xuan for the article. How to do withdrawal from Syfe to Wise, please? Thanks

Hi Nicole,

You cannot withdraw to your Wise acc from Syfe, the only way is to withdraw to a SG bank acc under your own name.

Regards,

Yi Xuan

oh… then I cannot use Syfe. Thanks.