Last Updated on May 15, 2023 by Chin Yi Xuan

Life only gets busier as we grow up.

In the final year of my 20s in 2023, I am occupied with work, family, and health matters (yeap, I’ve been sick for 4 months now) – not to mention A LOT of weddings to attend (8 for the year, so far).

Realizing that life only gets busier has changed how I approach investing compared to when life was more carefree in my early 20s:

Is there a way to build my own portfolio that I like, and automate my investments on a consistent basis (eg. monthly) – all while I focus on more important things in life?

In this post, I’d like to walk you through StashAway Flexible Portfolios, and why it makes much sense for busy investors!

Table of Contents

Highlights:

- StashAway Flexible Portfolio allows you to customize your own portfolios based on the large selection of Exchange-Traded Funds (ETFs) available on StashAway.

- Investors that value customization and making investment a regular routine will find Flexible Portfolios highly convenient.

- Compared to buying your own ETFs via stock brokers, Flexible Portfolios are more capital-friendly as there is no minimum investment amount required.

What is a StashAway Flexible Portfolio?

StashAway Flexible Portfolios is a feature by StashAway that allows you to customize your own portfolios based on the large selection of Exchange-Traded Funds (ETFs) available on StashAway.

StashAway’s ETF selection consists of more than 55 different asset classes ranging from US stocks, bonds, real estate, developed and emerging market stocks, and more.

In addition, there is no limit on the portfolios that can be created. As such, you can customize as many Flexible Portfolios as you wish.

In essence, with Flexible Portfolios, you can build one or more portfolios that belong entirely to you.

Here is a tip of the iceberg of ETFs that you can choose from to build your Flexible Portfolios:

| US Equities |

| S&P500: iShares Core S&P500 ETF (ticker: IVV) |

| Nasdaq 100: Invesco QQQ Trust Series 1 (ticker: QQQ) |

| Dow Jones: SPDR Dow Jones Industrial Average ETF Trust (ticker DIA) |

| Real Estate |

| US REITs & Real Estate: Vanguard REIT ETF (ticker: VNQ) |

| Global Equities |

| Total World Market: Vanguard Total World Stock ETF (ticker: VTI) |

| Asia excluding Japan: iShares MSCI All Country Asia ex Japan ETF (ticker: AAXJ) |

| China Tech: iShares Hang Seng Tech ETF (ticker: 09067) |

| Thematic |

| AI & Robotics: Global X Robotics & AI ETF (ticker: BOTZ) |

| Blockchain: Amplify Transformational Data Sharing ETF (ticker: BLOK) |

| Healthcare: iShares Global Healthcare ETF (ticker: IXJ) |

| Bonds |

| US aggregate bond: iShares Core US Aggregate Bond ETF (ticker: AGG US) |

| Investment grade bonds outside of US: Vanguard Total International Bond ETF (ticker: BNDX) |

| Commodity |

| Gold: SPDR Gold Trust (ticker: GLD) |

Check out the StashAway app or website for the full list of available ETFs.

3 Key Benefits of StashAway Flexible Portfolios

For investors, Flexible Portfolios offer the best of both worlds: Customization and Automation.

#1 Customize your portfolios – from scratch, or from readily available templates

With Flexible Portfolios, you are free to build an ETF portfolio that is entirely yours.

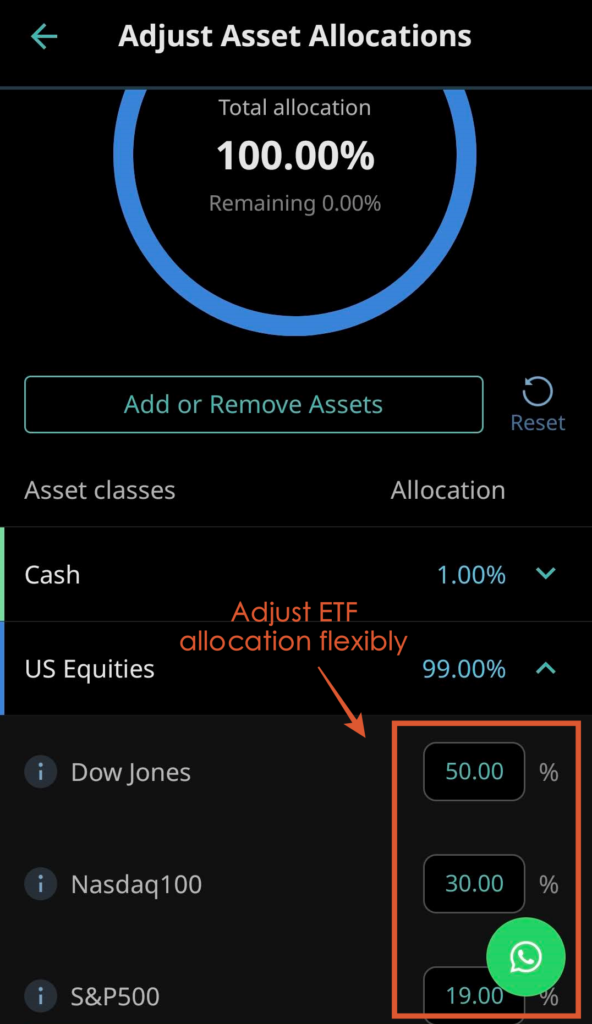

This means you have 100% control over what is invested, as well as the portfolio’s allocation.

Even better, you can tweak the asset allocation and even change the ETFs in your portfolio whenever you want, not just during the setup – that’s flexibility at its best!

Not quite sure how to start?

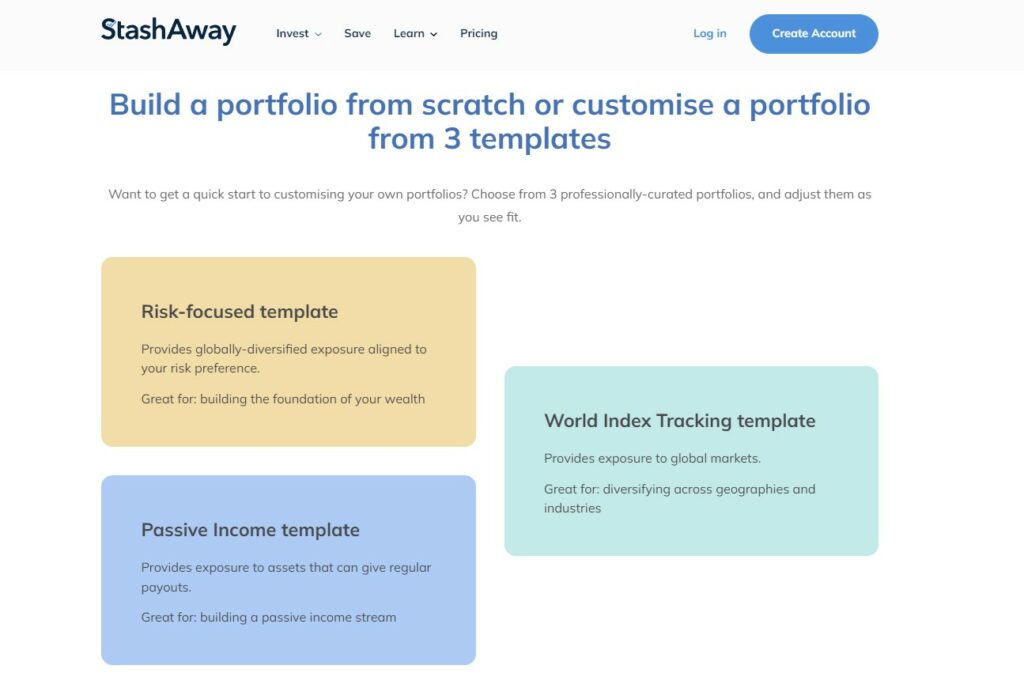

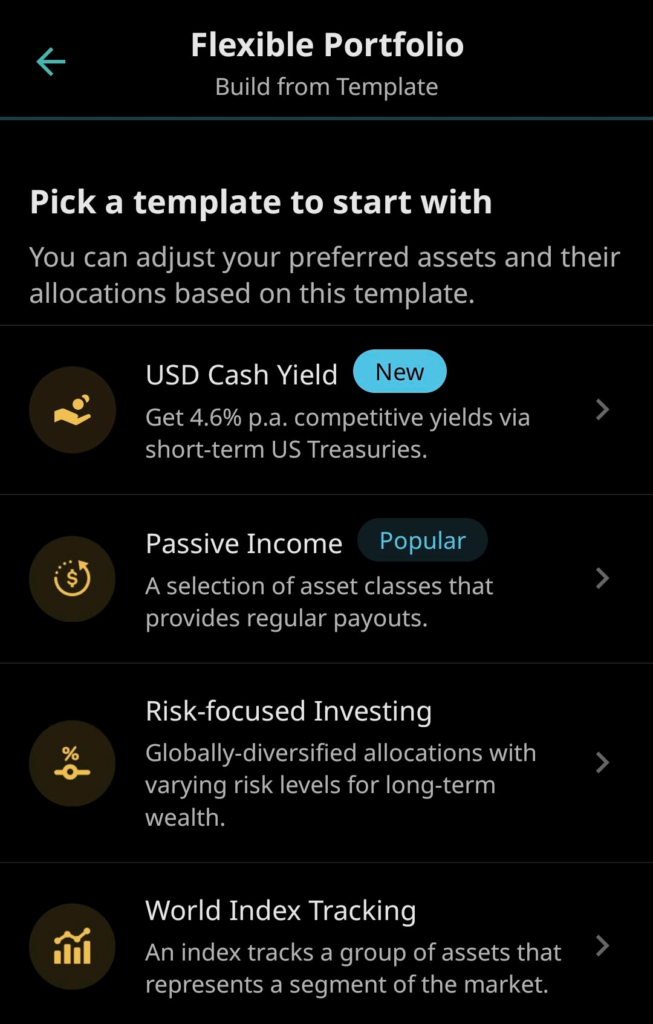

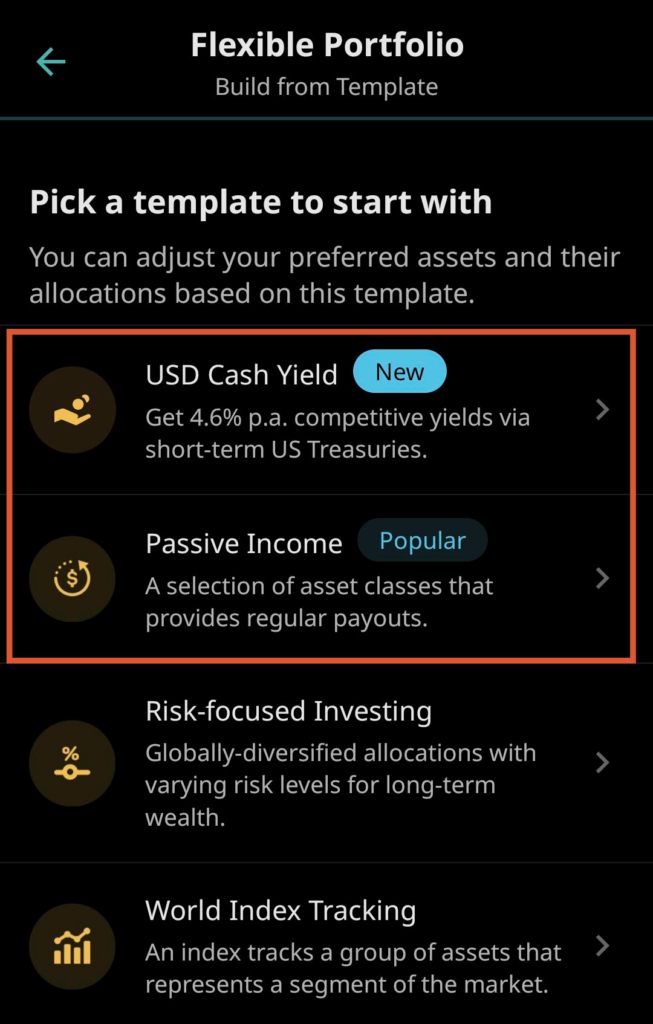

StashAway has prepared multiple readily made templates, such as a Passive Income template for passive income investors, a World Index Tracking template for global markets, as well as a Risk-Focused template for globally diversified exposure:

#2 Automate your investment

Personal or work life can be overwhelming at times, and many people tend to forget their investing routine.

Not anymore when you invest via StashAway.

With StashAway, you can plan for a regular investment schedule via direct debit from your bank account.

In other words, you can plan for your investment to be done automatically every month or quarter, all while you focus on important things in life.

#3 Invest with any amount. No minimum balance is required.

Another convenient feature of Flexible Portfolios is there’s no minimum amount required for you to invest and maintain.

So, be it RM50, RM500, or RM5,000 you can build an investment portfolio of your choice regardless of your capital.

4 steps to set up & automate your investment in Flexible Portfolios:

Step 1: Sign up for a StashAway account via my referral link below:

Existing StashAway users can proceed to Step 2.

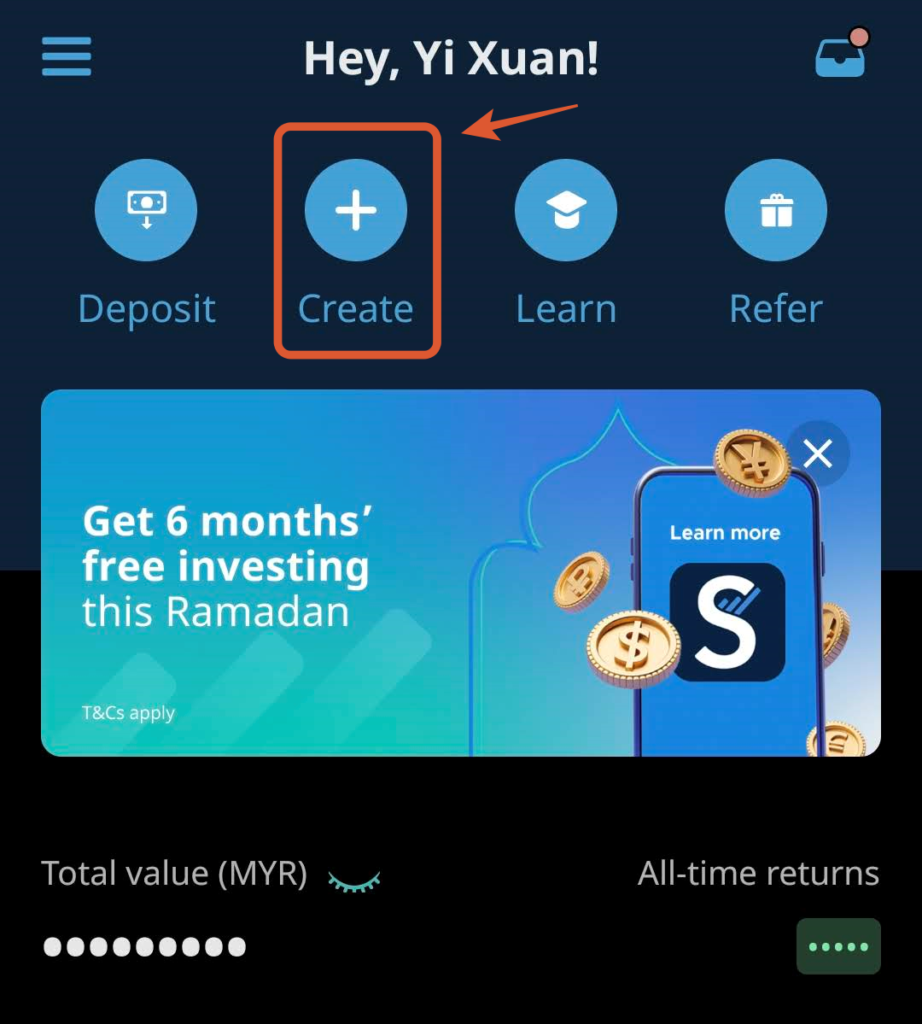

Step 2: Select ‘Create’ > ‘Customize a portfolio’

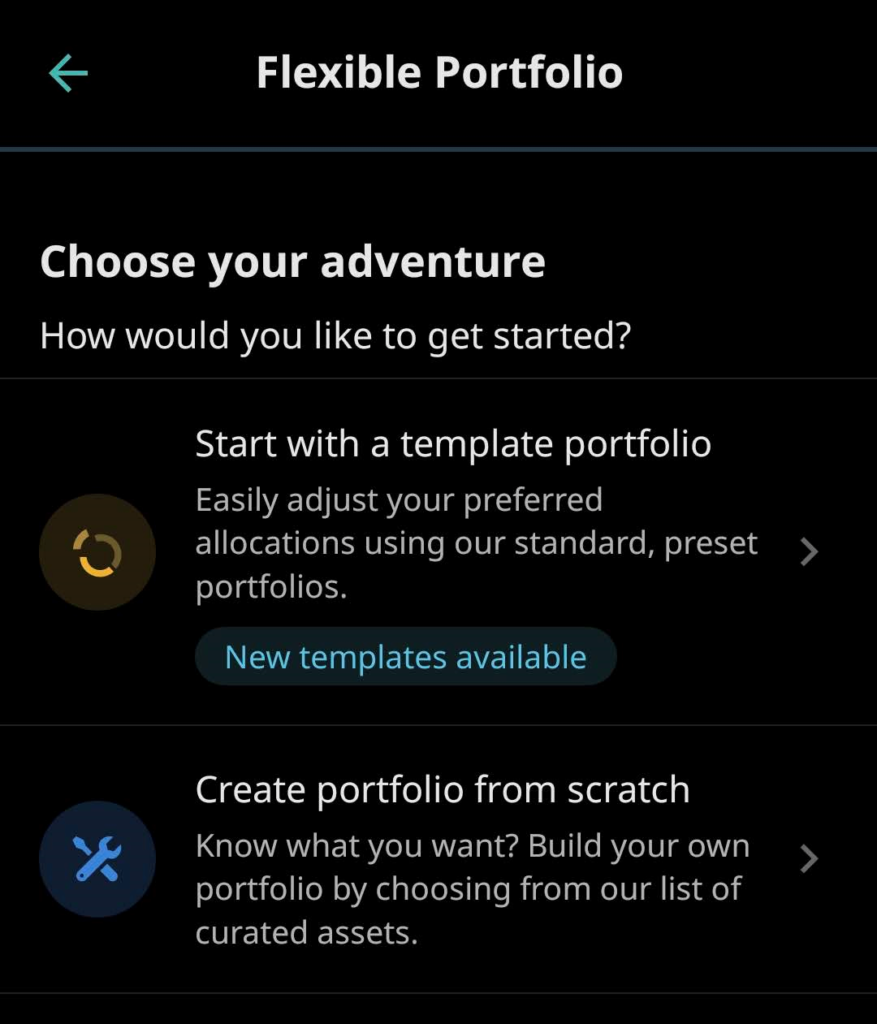

Step 3: Build your Flexible Portfolios from ready-made templates, or from scratch.

As a note, you can create multiple Flexible Portfolios as there is no limit on how many portfolios you can create.

(a) Ready-Made Templates:

There are 4 templates for you to get started with. You have absolute freedom to make adjustments to the templates.

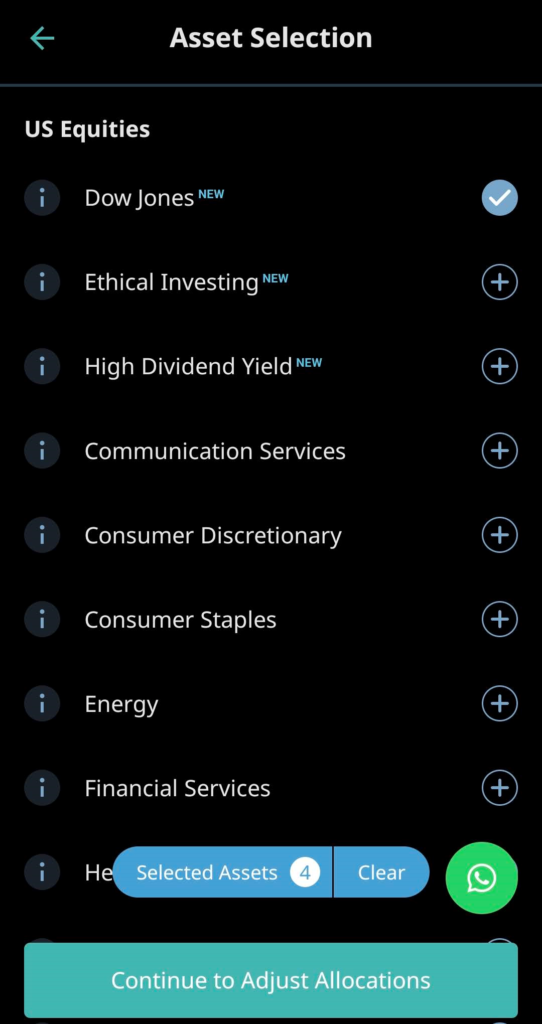

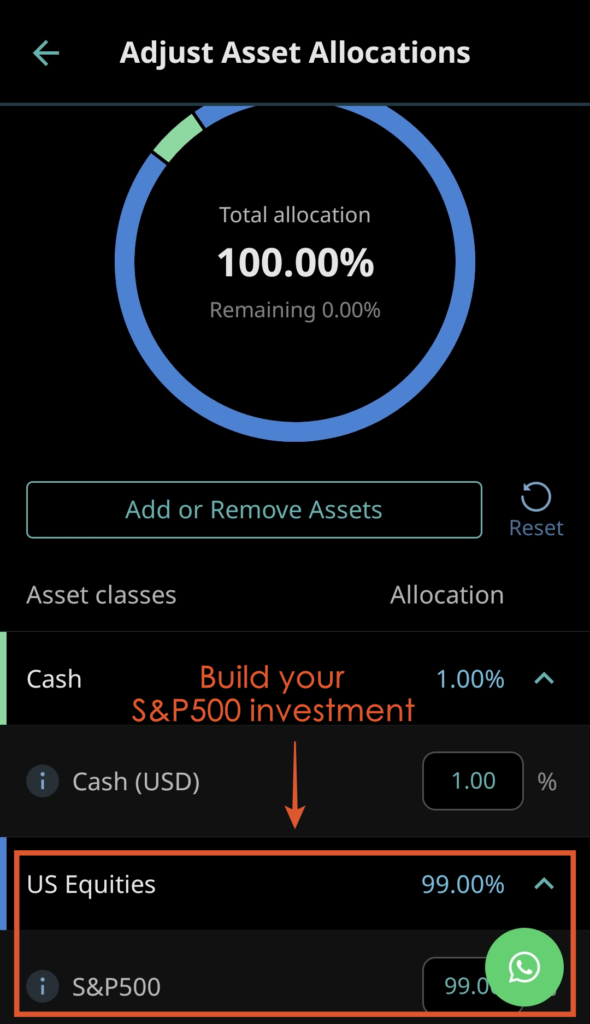

(b) Build your Flexible Portfolio from scratch:

- Start customizing your Flexible Portfolio from an ETF collection of over 55+ asset classes.

Note: 1% of your portfolio will be allocated to cash to handle portfolio rebalancing and platform fees.

- Adjust the allocations of each ETF in your portfolio:

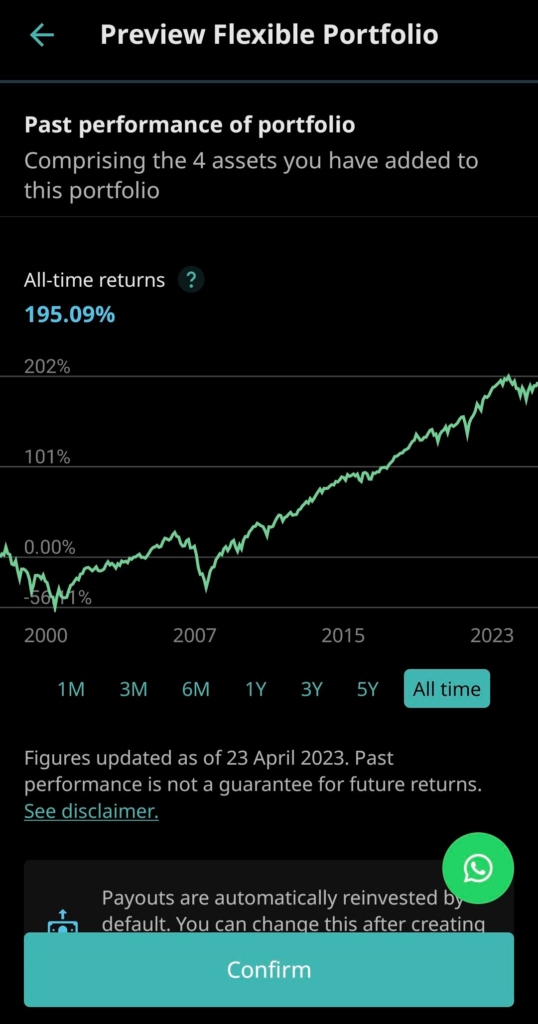

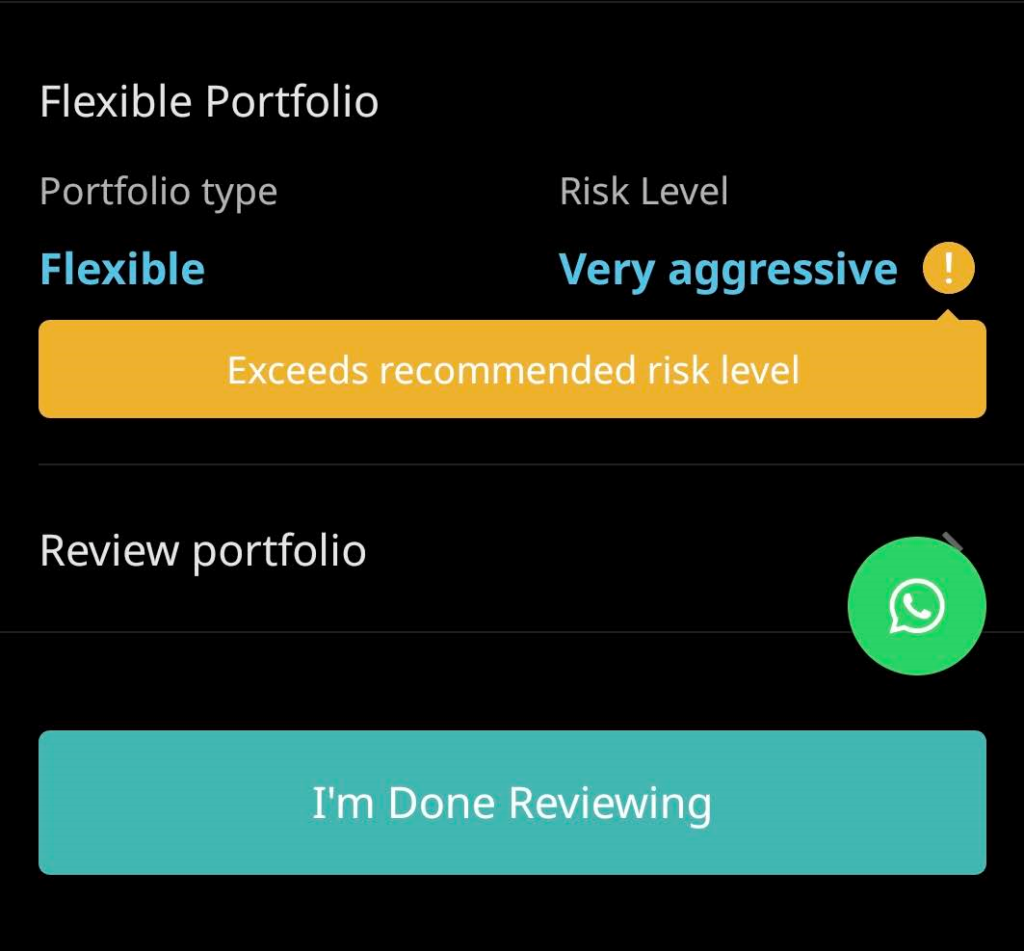

- Preview and confirm your Flexible Portfolio:

Check the risk, past performance, as well as sector & region exposure of your portfolio combination.

Note: You will get a reminder if the risk profile of your Flexible Portfolio exceeds the recommended risk level for you. Click ‘I Understand’ to proceed if you are okay with this, or go back to readjust your portfolio as you see fit.

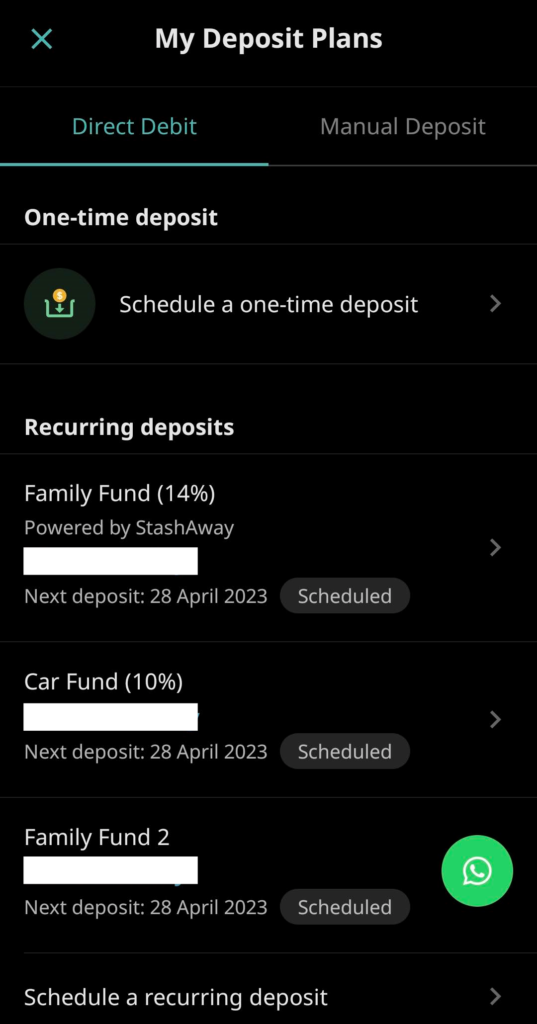

Step 4: Schedule a one-time or recurring deposit plan

You can set up a one-time deposit, or schedule a recurring deposit to your Flexible Portfolios via Direct Debit from your bank account.

If you want to automate your Flexible Portfolios’ investment, select ‘Schedule a Recurring Deposit’ and link your bank account accordingly.

You can schedule a monthly or quarterly automatic deposit plan at any amount you like.

StashAway fees + Flexible Portfolios fee waiver promotion

There are 3 fees that you need to take note of while investing with Flexible Portfolios.

These fees are deducted automatically from your portfolio value so there is no extra hassle on your end.

- Expense ratio charged by the fund manager (not StashAway) of the underlying Exchange-Traded Fund (ETF) that you invest in. (Approx. 0.2% per annum).

- Currency conversion fee of about 0.1% on the spot exchange rate for USD & GBP portfolios.

- StashAway management fees of 0.2% – 0.8% per year based on your total investment amount.

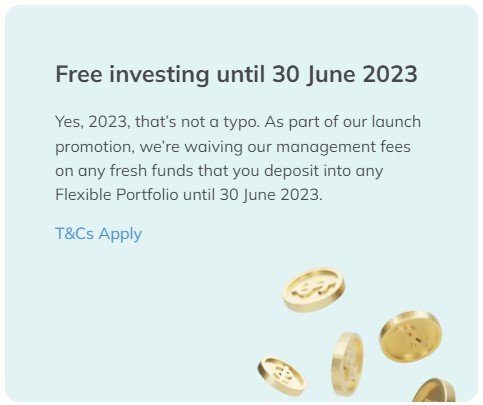

Flexible Portfolios Promotion: Free investing till 30 June 2023

StashAway is currently running a Free Investing promotion for Flexible Portfolios, where all StashAway management fees on all funds deposited are waived until 30/6/2023!

Invest on your own vs Flexible Portfolios

At this point, some investors may wonder:

“Why use Flexible Portfolios when I can invest in these ETFs myself through a stock broker?”

I think this is certainly a valid question. In my opinion, both approaches are meant for different types of investors.

Flexible Portfolio is meant for investors who value customization and the convenience of automation.

#1 Flexible Portfolios make it capital-friendly to invest in a custom ETF portfolio

There is no minimum investment requirement to invest via Flexible Portfolio.

So, let’s say I have RM200/m to invest, and I want to build a portfolio consisting of the S&P500 (IVV) and Nasdaq-100 index (QQQ).

With RM200/m, I can absolutely build and invest in an S&P500 + Nasdaq-100 portfolio on a Flexible Portfolio.

Meanwhile, investing via most stock brokers will require you to invest in 1 full unit for each ETF:

| ETF | Price/unit (USD) |

| iShares Core S&P500 ETF (IVV) | $414 (as of 21/4) |

| Invesco QQQ Trust (QQQ) | $317 (as of 21/4) |

| Total Required | $731 |

#2 You can automate your investment on Flexible Portfolios

It is easy to forget about investing regularly when life gets busy.

With Flexible Portfolios, you can automate your investment on a monthly or quarterly basis so your investment is done regularly – all while you focus on more important things in life (family, career etc).

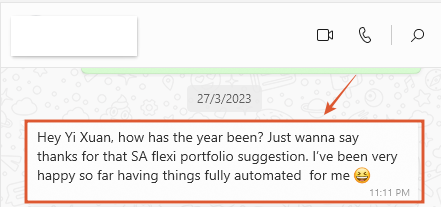

In fact, I’ve been recommending Flexible Portfolios to many close friends that are busy with life, and I think they love the convenience!

#3 Flexible Portfolios reinvest your dividends automatically

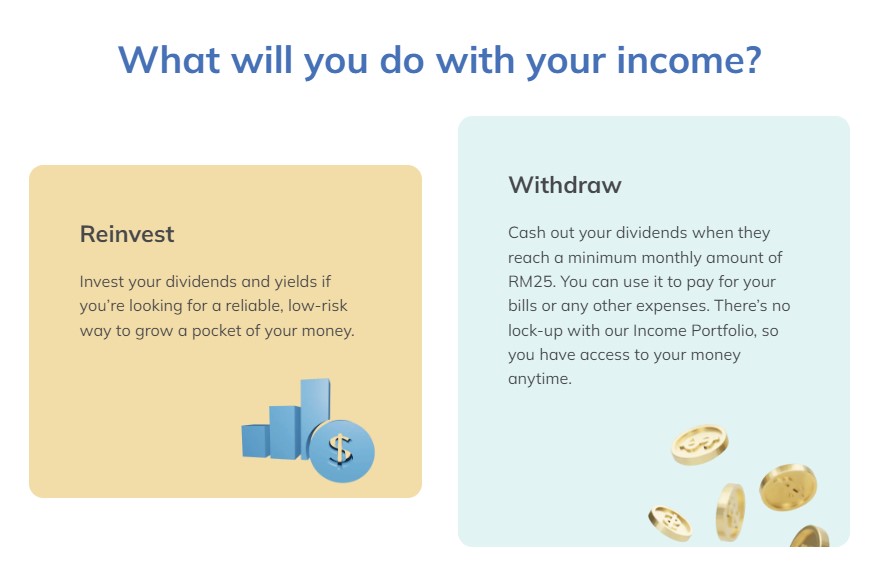

With Flexible Portfolios, your dividends are reinvested automatically on your behalf. In comparison, with a stock broker, you’ll have to do so yourself.

In addition, you have the flexibility to cash out your dividends when they reach a monthly amount of RM25 or more – so you have access to your dividends anytime!

#4 Flexible Portfolios maintain your portfolio allocation according to your preference

Let’s say you have set up a Flexible Portfolio to be 50% – 50% allocation between S&P500 (IVV) and Nasdaq-100 (QQQ), it will be maintained in that way while you invest.

Meanwhile, it is a hassle to maintain such a specific allocation on our own as market swings can lead to changes in the value of each ETF, which can cause the percentage allocation to go off our initial allocation.

#5 Fees: Brokerage vs StashAway management fee

When it comes to fee differences, you pay a brokerage fee while investing with a stock broker, while you are charged an annual management fee while investing through StashAway.

| Fee | StashAway Flexible Portfolio | Stock Broker |

| Annual management fee based on your total investment (0.2% – 0.8%) | Brokerage fee for each trade |

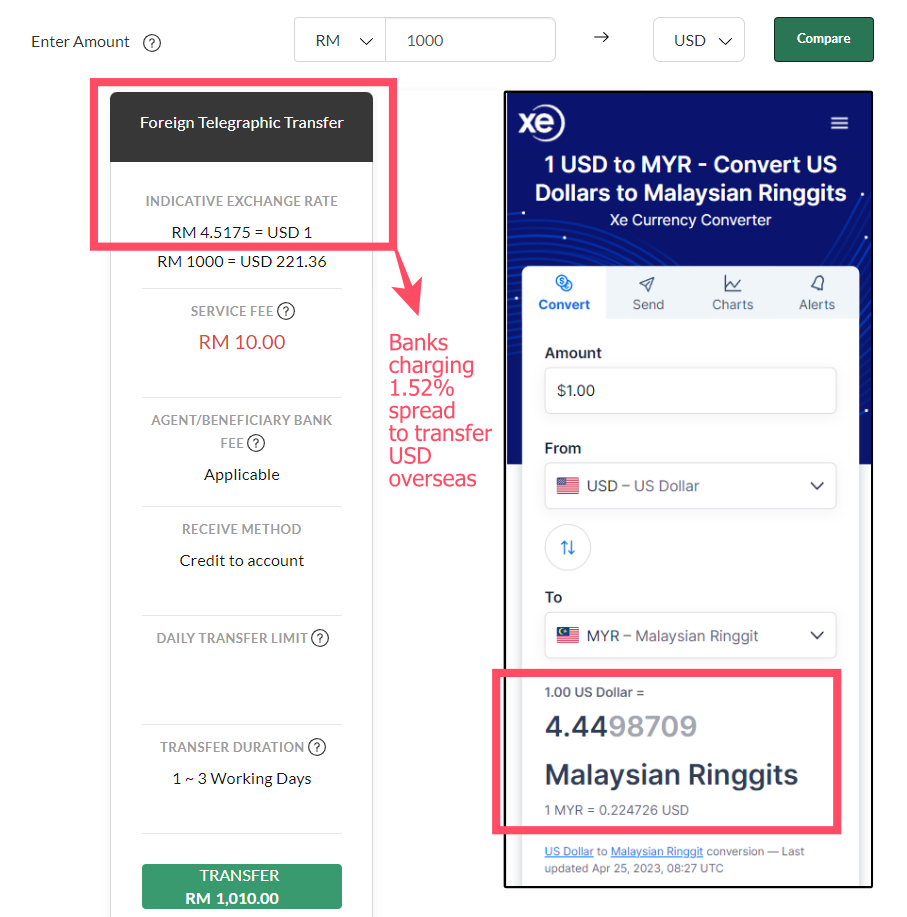

In addition, StashAway’s currency conversion fee (to USD or GBP) of about 0.1% on the spot exchange rate is more competitive compared to banks that may charge expensive fx spreads to transfer to overseas stock brokers.

To summarize, I think Flexible Portfolio is a good fit if:

- You are looking to customize your investment portfolios with a flexible investment amount.

- You want to automate your investment routine so you can invest regularly while being occupied in life.

Bonus – Flexible Portfolios Ideas:

Below, I list down a few practical ideas to use Flexible Portfolios:

Idea #1: Automate your investment in the S&P500 and/or Nasdaq-100 ETF via Flexible Portfolios

I am often asked by friends and readers how to invest in the S&P500.

One way that I’d usually recommend is to set up a pure S&P500 ETF (IVV) portfolio on a Flexible Portfolio, and automate their investment through recurring deposits.

In my opinion, this is the most convenient way to invest in the S&P500 regularly.

Idea #2: Build dividend income with Flexible Portfolios

Use Flexible Portfolios’ existing passive income templates, or tweak it to your liking:

StashAway Referral Link & Code: P-NOMONEYLAH-MY

No Money Lah is working with StashAway to bring new users an exclusive 50% off your fees for the first RM100,000 invested for 6 months.

To be eligible for this deal, sign up for your StashAway account through my referral link HERE (or apply code ‘P-NOMONEYLAH-MY‘). (or HERE if you are from Singapore)

Verdict – Build and automate your investment with StashAway Flexible Portfolios!

The beauty of StashAway Flexible Portfolios is it makes customizing an investment portfolio very simple regardless of your capital.

Even better, building a regular investment routine is also very convenient on StashAway via recurring debit.

Are you on Flexible Portfolios? If not, are you going to give it a try? Let me know your thoughts in the comment section below!

Disclaimers

This post is sponsored by StashAway. Past performance is not indicative of future performance.

This post is produced for general information purposes only. It is not intended to constitute professional advice, and should not be relied on or treated as a substitute for specific advice relevant to particular circumstances.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.