Last Updated on March 17, 2024 by Chin Yi Xuan

Time flies and it has been 5 years since I graduated from university and went into the workforce officially.

A lot has changed in the past 5 years, especially when it comes to my finances. Of all, working with my financial planner, Stev, since 2020 has been a major decision in my journey.

In this post, I’d like to look back at my progress over the past 5 years, the lessons I learned along the way, and how my financial planner, Stev, has helped me in this journey!

Table of Contents

Progress in my finances (2018 – 2023): Dividends, Net-worth, Expenses

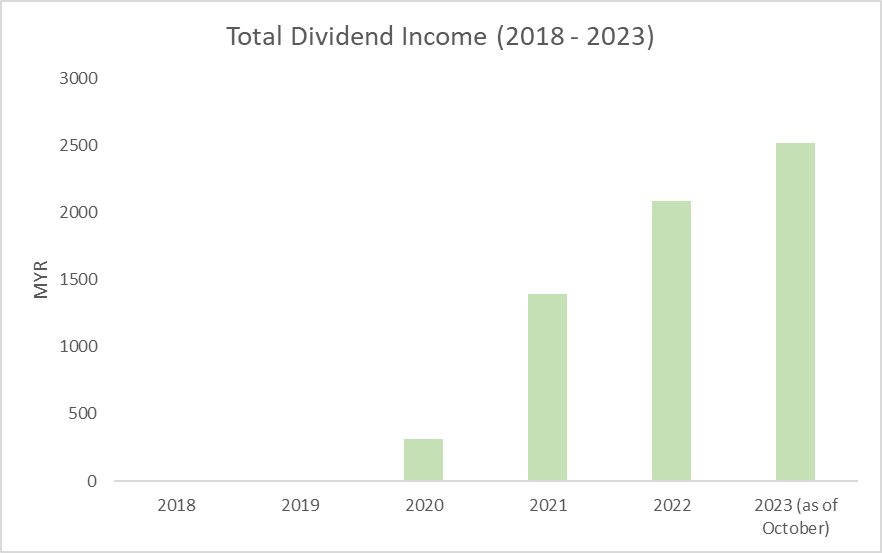

(i) Dividend Income

While not much, I am happy to share that the annual dividend income from my dividend portfolio has grown from nothing to a little bit more than RM2.5k in 2023.

In other words, my dividend portfolio has been paying me an average of RM250/m in passive income this year (not too bad!).

The idea of building a dividend portfolio is so that in 15 – 20 years’ time, the dividends could supplement my cashflow to prepare for things like aging parents, family commitments, or on a lighter note, traveling whenever I feel like it (fingers crossed!).

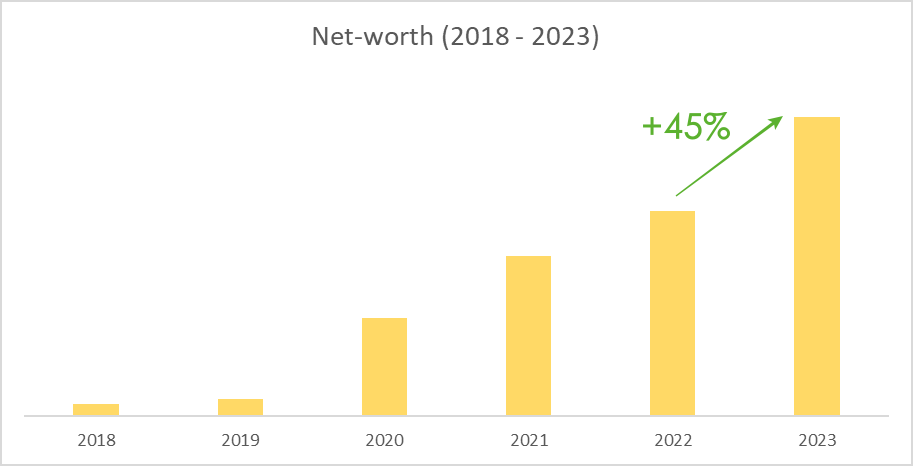

(ii) Net-worth

Thanks to the guidance of my financial planner, Stev, I have been fortunate enough to grow my net worth steadily in the past few years.

In 2023, as I saved and invested more as my income increased, my net worth grew about 45% compared to the previous year (2022).

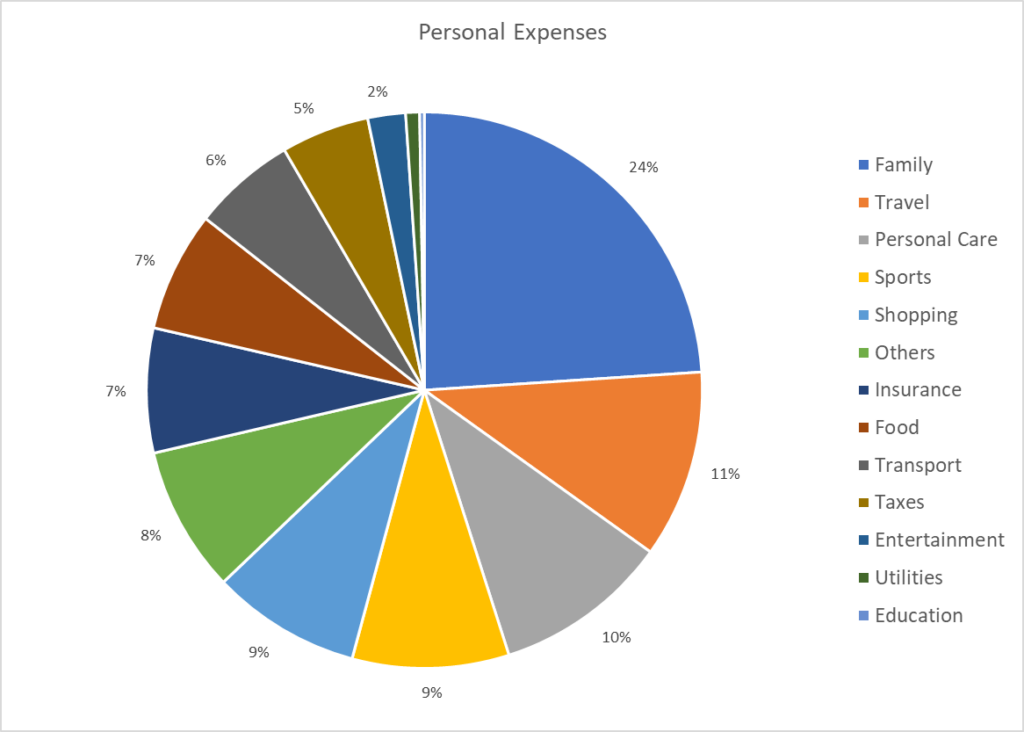

(iii) Personal Expenses

Being in my late 20s, single, with no expensive hobbies, and minimal commitments, I do not have many large personal expenses.

That said, I was sick for 4 months earlier this year so I spent a lot on Traditional Chinese Medicine (TCM) treatments. I also got more conscious of my health in 2023 so I’ve been getting chiropractic sessions, as well as personal trainers to help me with my fitness.

All in all, my key expenses are:

- Family expenses (eg. money to parents, miscellaneous family expenses): 24%

- Traveling: 11%

- Personal Care & Sports (TCM, Chiro, Personal Trainer): 10% & 9% respectively

How my financial planner helped transform my finances since 2020

Long-time readers would know that I’ve been working with my financial planner, Stev, since 2020.

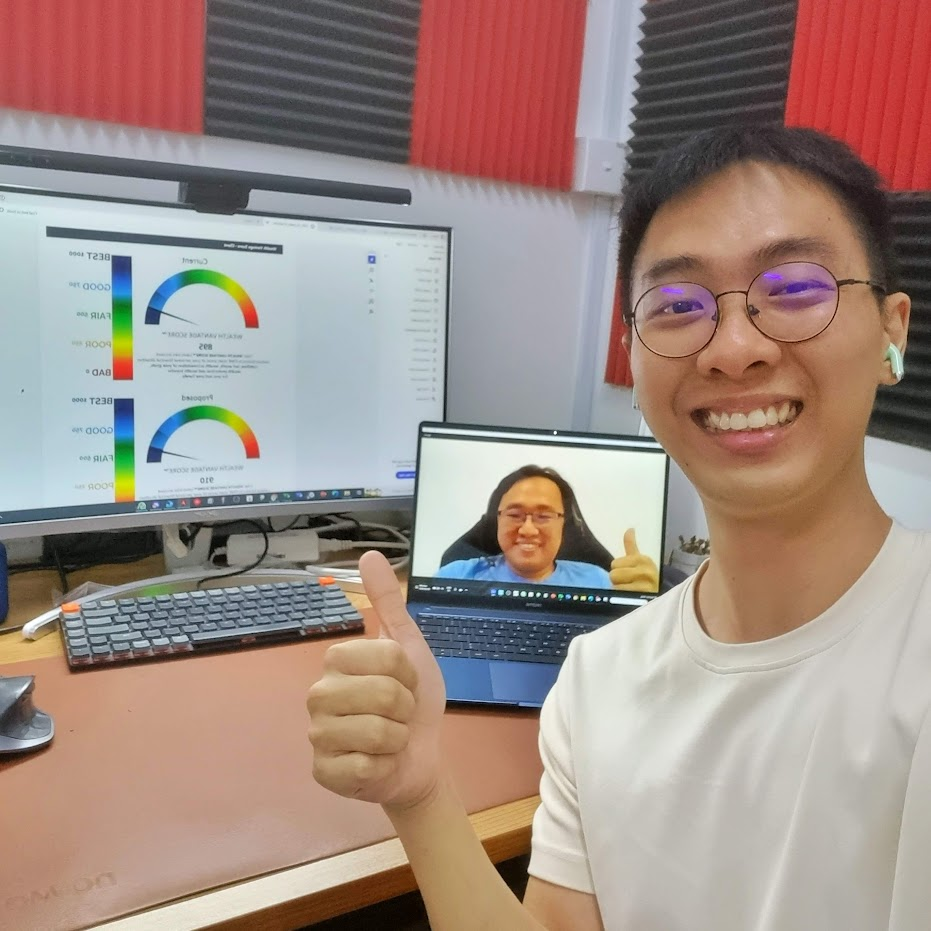

For newer readers, Stev is a licensed financial planner from WealthVantage, as well as the person behind personal finance blog, My Personal Finances (MyPF). With Stev’s help, my finances have never been more organized and this allows me to focus on important priorities in my life (eg. family and career).

You can follow my financial planning journey below:

Stev’s guidance is one of the crucial reasons why I managed to improve my finances to the way it is today.

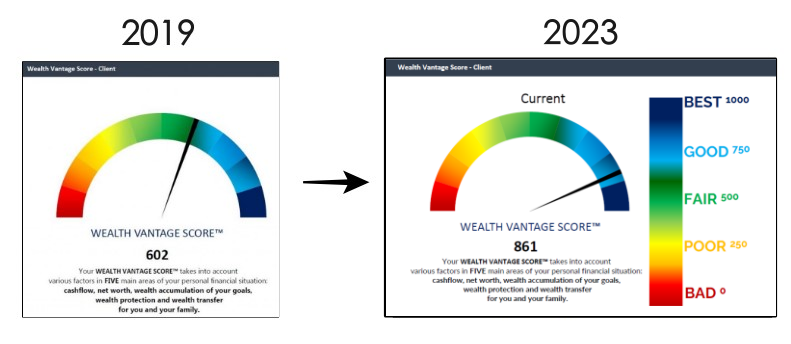

Since engaging Stev as my financial planner, my overall financial health (cashflow, net worth, protection) has made a major improvement in 2023 compared to late 2019, when I first started working with Stev.

Check out my Wealth Vantage Score – a visual of how Stev measures my overall financial wealth in 2019 vs 2023:

Several key aspects Stev has helped me massively are:

(i) Unbiased insurance planning

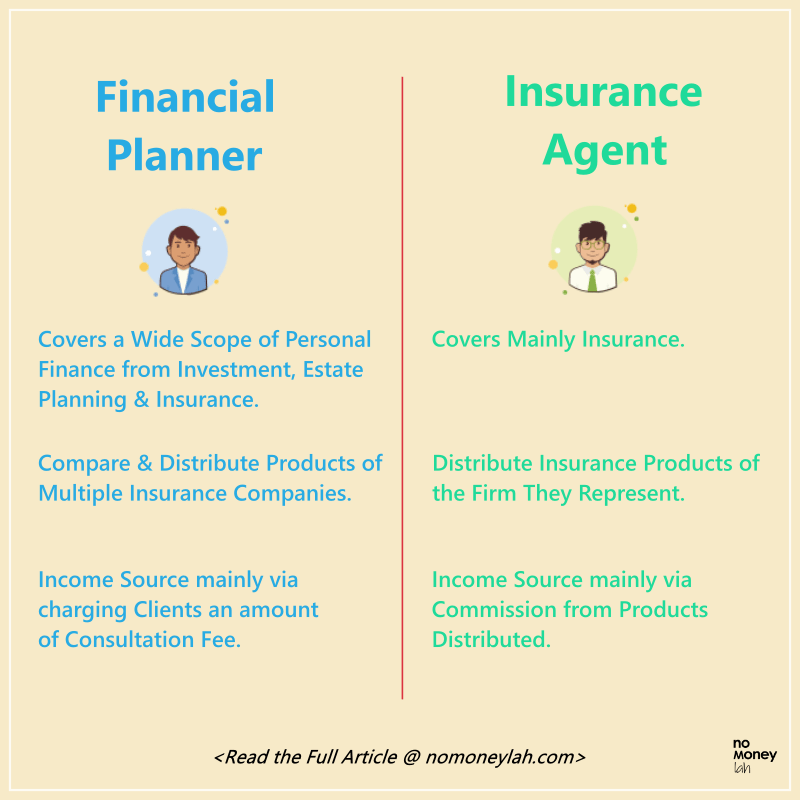

Unlike insurance agents that represent a specific insurance company, Stev is a financial planner which means he can source insurance products from different insurance companies.

In other words, Stev can be unbiased when it comes to customizing the best insurance solutions (life, medical, and critical illness coverage) for his clients.

Check out the key differences between a financial planner and insurance agent HERE.

(ii) Optimizing my taxes

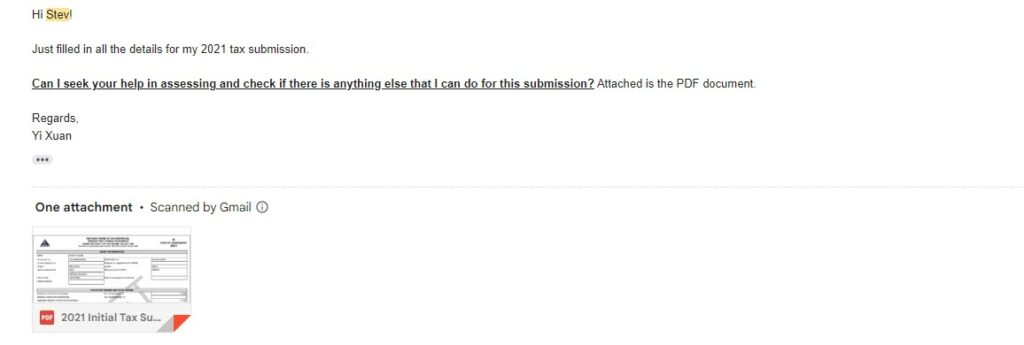

Stev has also been helping me in optimizing my taxes. For instance, Stev will filter for specific tax rebates that I can benefit from whenever a new Budget is announced each year.

In addition, I will always send my tax draft to Stev to go through before submitting it for payment every year, just to make sure I am benefitting from all the tax rebates that I am qualified for.

(iii) Retirement planning via savings and investment

Through working with Stev for the past few years, Stev has guided me in how to best allocate my savings and investments towards my retirement and other financial goals.

Some key things that Stev has guided me over the years include:

- Which PRS funds are the best for my risk appetite?

- How much should I contribute to EPF as a self-employed?

- How to improve my credit score, given my personal circumstances?

Whenever I felt discouraged or impatience about my wealth-building journey, Stev always made sure I saw what was possible if I stayed consistent in my journey.

(iv) Will-writing

As the value and variety of my assets increase, Stev has also guided me on writing my own will in 2022, so my assets will be distributed accordingly to my loved ones should something happen to me.

To find out why it is crucial to create a will + my experience, check out my will-writing experience HERE!

FIND OUT MORE: Why I write my will at 28, and my experience!

Top 4 most important financial decisions I made since I started working:

#1: Working with a financial planner

The decision to work with Stev has helped me improve every aspect of my finances, from insurance & will-writing, to investments, and retirement planning. I couldn’t have done it by myself without the help of licensed professionals like Stev.

Learn about how is it like to engage a financial planner in the next section!

I’d also like to thank Catherine and Gabriel, who both are currently financial planners for WealthVantage for assisting me in my financial planning journey as well for the past 4 years!

#2: Increasing and diversifying my income sources:

As someone running my own business, the idea of me losing everything I built still bugs me every now and then (though much less intense these days).

As such, I’ve been working on improving and diversifying my income sources over the past few years to ensure that my income remains relatively stable regardless of what happens to one specific revenue stream.

#3: Learning about the financial condition of my family:

I also took the initiative to find out about my family’s financial condition, such as existing mortgages, insurance coverages, and savings.

This helps me identify any potential financial risks in the family so I can take action earlier instead of being caught off guard.

For instance, just like myself, I convinced my mom to engage a financial planner to help organize her finances to live a more fulfilling retirement life.

#4: Saving for different purposes

With age, I noticed that there will be expenses that are best planned ahead.

Some expenses that I prepare ahead of time are travel/holiday, parents’ old-age expenses, and wedding angpau funds (I attended 9 weddings in 2023 lol, luckily, I saved for them).

How does engaging a financial planner work? (Packages & Pricing)

Depending on your needs, there are 2 ways you can work with a licensed financial planner from WVA, namely:

Package #1: Modular Financial Planning (MFP) [RM1,500]

Modular Financial Planning involves a comprehensive analysis of your financial state with action plans for improvement + your financial planner will support you in the implementation of ONE aspect of your finance (insurance, investment, estate planning) for 1 full year.

Package #2: Full Financial Planning (FFP) [RM3,000 for individual plan, RM4,000 for couple plan]

Full Financial Planning involves a comprehensive analysis of your financial state with action plans for improvement + your financial planner will support you in the implementation of ALL aspects of your finances (insurance, investment, estate planning) for 1 full year.

Below, you can find the whole flow of MFP and FFP:

Personally, I opted for the Modular Financial Planning (MFP) package (investment) back in 2020.

Since 2021, I have been on the Full Financial Planning (FFP) package. This is where my financial planner, Stev has guided me in all aspects of my finances (investment, insurance, and estate planning).

You can read about my experiences below:

Should you engage a financial planner in Malaysia?

Having Stev as my mentor and guide for the past 4 years has been massively fruitful.

With my finances in place, I can go on to pursue different life goals without worries – as there is always someone looking over my shoulder when it comes to my finances.

So, here’s a question for you:

Do you have important priorities in life that you want to pursue or dedicate time to without having to always worry about your financial status:

“Do I have enough insurance coverage?”

“Am I investing right?”

“Can I retire with what I am earning now?”

If yes, engaging a financial planner can bring massive benefits to your life.

Specifically, I am confident that a financial planner will add massive value to you if:

- You have tried to DIY your finances but still feel overwhelmed.

- You want to prepare your finances for the next phase in life (eg. marriage, retirement), but not sure how.

- You need help to organize your finances in place but you are unsure how or too busy to begin (investments, insurance, estate planning etc).

Yes, there are charges to engage a financial planner. But trust me, this will be an investment that’ll give you returns and peace of mind in multiple folds.

[EXCLUSIVE] Get Your First Financial Consultation Session – FREE OF CHARGE!

If you are keen to explore how a licensed financial planner can help with your finances, this is for you:

I am working together with WealthVantage to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

- When you sign up for this FREE consultation session, you will learn more about your overall financial state.

- Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

No Money Lah’s Verdict

So there is it – how my finances have evolved for the past 5 years since I started working!

An important lesson that I’ve learned is that wealth-building is a long process that requires patience and proper planning.

With Stev’s guidance, I’ve managed to improve my overall finances steadily – and I hope this convinced you to consider getting proper guidance if you feel overwhelmed or miserable about your finances!

Remember, you can always sign up for a FREE consultation session to see if it is a good fit for you before making a decision!

Disclaimer

This article is made possible through a collaboration with WealthVantage. Special thanks to Stev and the team for making this collaboration such an impactful one.

WealthVantage did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you.

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Related Posts

October 16, 2022

My will-writing experience in Malaysia

December 31, 2021

My 2-year experience with a Licensed Financial Planner in Malaysia

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.