Last Updated on April 3, 2024 by Chin Yi Xuan

For the past few years, investing in the global stock market has become more accessible to Malaysians.

M+ Global is one of the latest locally-regulated platforms that offers Malaysians convenient access to the US and Hong Kong stock market.

In this post, check out my review on M+ Global, and see whether you should consider using M+ Global to invest!

Table of Contents

Highlights:

- Backed by Malacca Securities with over 60 years of experience, M+ Global is a stock trading platform that allows Malaysians to invest in the US and Hong Kong (HK) stock markets. M+ Global (global stocks) is not to be confused with M+ Online, which offers access to the Malaysian stock market.

- Regulated in Malaysia: M+ Global is regulated locally by the Securities Commission (SC) of Malaysia. This means M+ Global has to adhere to the best practices set by the local authority to ensure the safety of clients’ funds from fraud and other illegal activities.

- M+ Global makes global investing seamless for Malaysians by introducing features like FREE real-time price data to users, 24/7 real-time news and customer support, Shariah-screener, and more.

My short verdict:

I like that the M+ Global app is very beginner-friendly to invest in the US and HK stock market. Features offered are essential and are not overwhelming, such as the implementation of Shariah screener that is especially helpful for Muslim investors.

However, the 24-hour customer service is a hit-or-miss. No fractional shares (yet) and the fee is not the cheapest compared to competitors like Rakuten Trade.

In short, M+ Global shines via a simple-to-use app, but has much to do in improving its fee structure and customer service.

🎁 Meanwhile, consider using my M+ Global referral link (via the button below) to open your M+ Global account and get a guaranteed FREE trading voucher or 1x share (worth up to RM1,200) when you open and fund your account!

5 Must-Know Features of M+ Global (The Good)

#1 Invest in a wide selection of US & Hong Kong stocks

M+ Global offers access to over 10,000 US and 2500 Hong Kong stocks & Exchange-Traded Funds (ETFs).

As such, Malaysians can now find and invest in big names like Tesla, Microsoft, Apple, Google, Nvidia, and more.

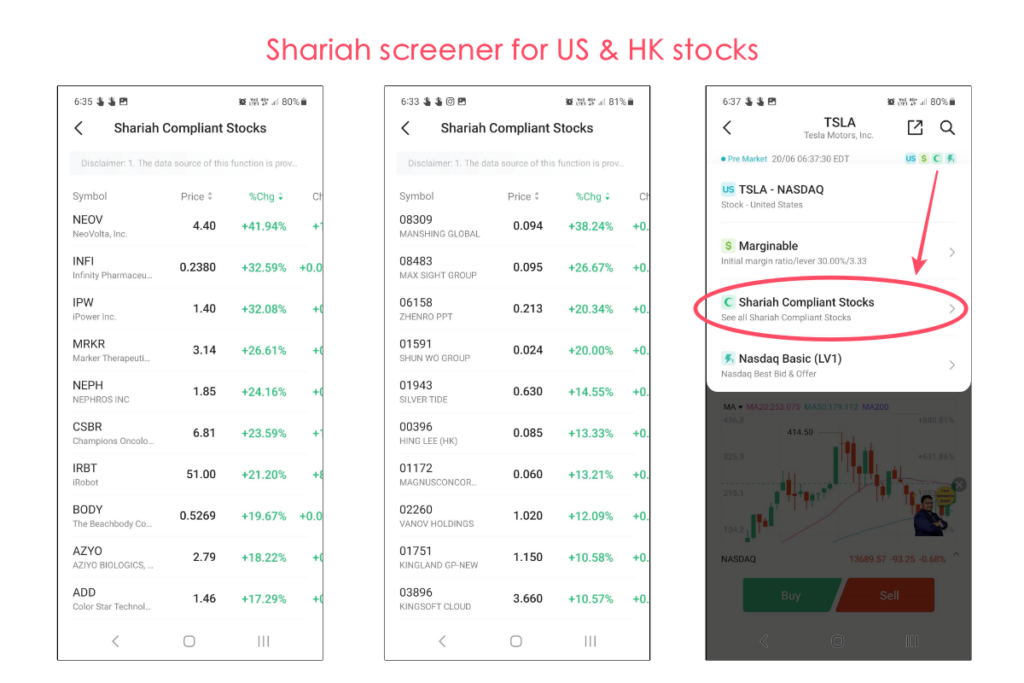

#2 Shariah-screener

M+ Global is the first digital trading platform in Malaysia to offer shariah screener for both the US and Hong Kong markets. This allows Muslim investors to search for Shariah-compliant stocks to invest in.

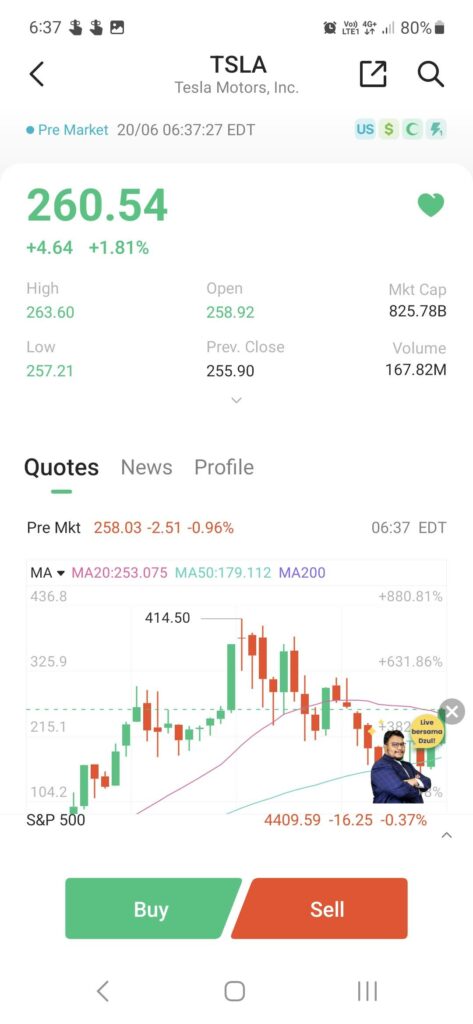

#3 Beginner-friendly user experience and real-time data

In my opinion, M+ Global is the most practical implementation of how a stock trading app should be: Easy to navigate and straightforward.

i. Placing trades in M+ Global is straightforward

For one, placing a trade in the M+ Global app is a breeze.

For a trading app, I prefer an interface that is not over-cluttered with features that are too small to fit on a small screen, so M+ Global got a thumbs up here when it comes to the cleanliness of the app.

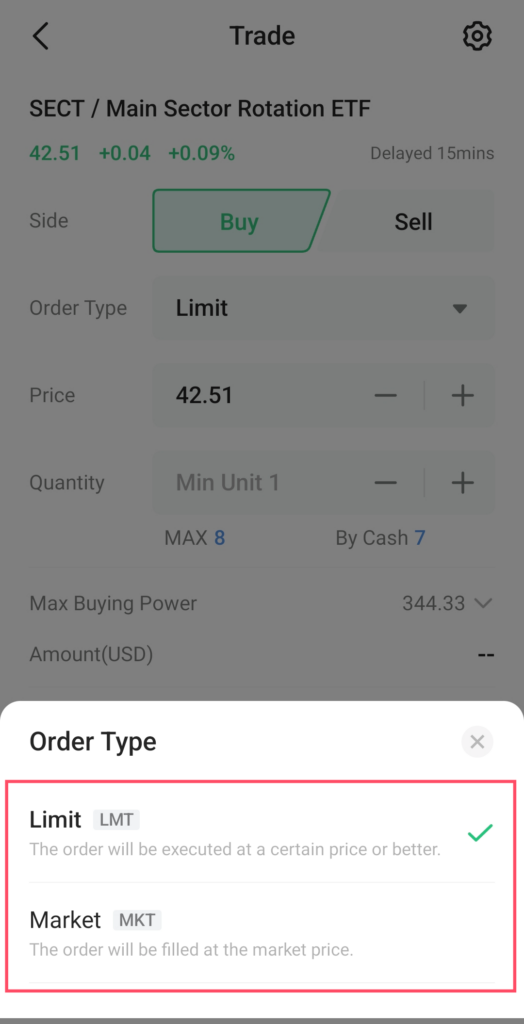

ii. Complete execution order types

Unlike rival Rakuten Trade which only offers ‘Limit Order’, M+ Global offers both Limit and Market Orders, which makes it more versatile for different investors & traders:

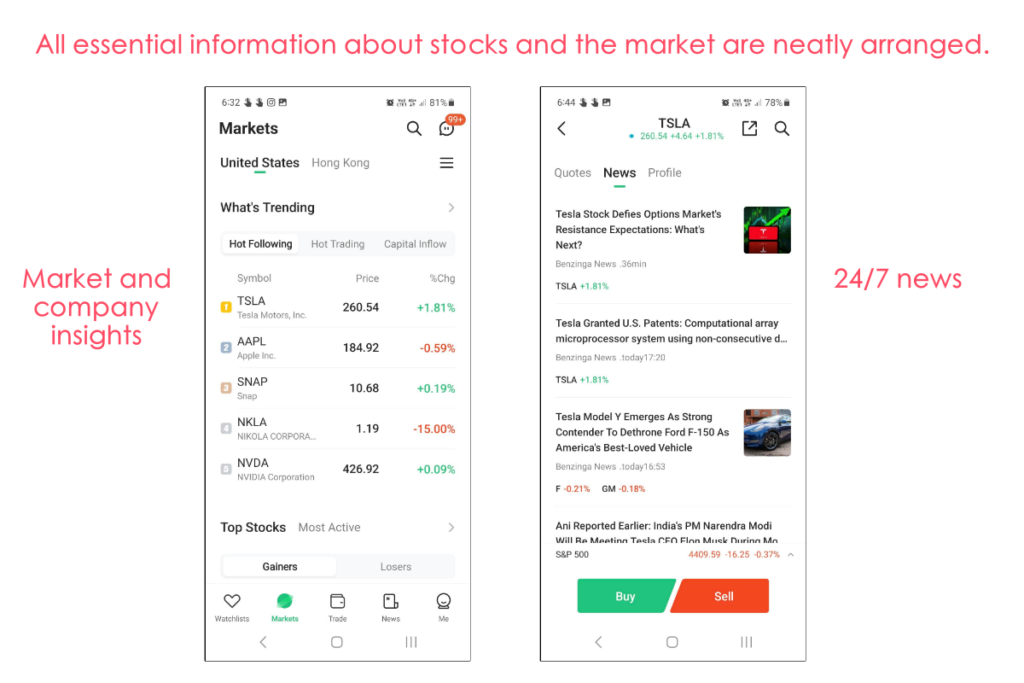

iii. Stock and ETF information + 24/7 news sources

While clean, the M+ Global app provides essential information about a stock or ETF.

From price charts, analyst ratings & price targets, fundamental data, and fund holdings (for ETFs), the app has everything conveniently arranged in a way that it doesn’t overwhelm me while making an investment decision.

Not to mention, M+ Global also provides 24/7 news updates around the markets and the stocks that you are focusing on:

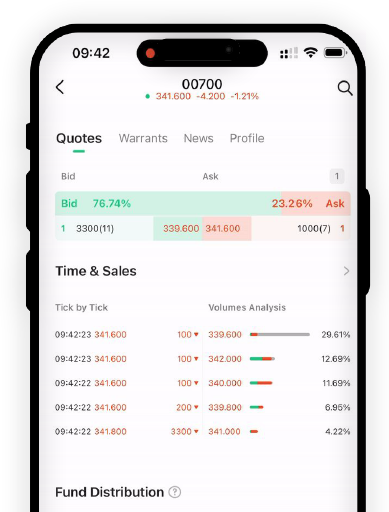

iv. Real-time price datafeed of stocks

New M+ Global users will also gain access to real-time (level 1) price feed for US and HK stocks for 30 days as they sign up for an account.

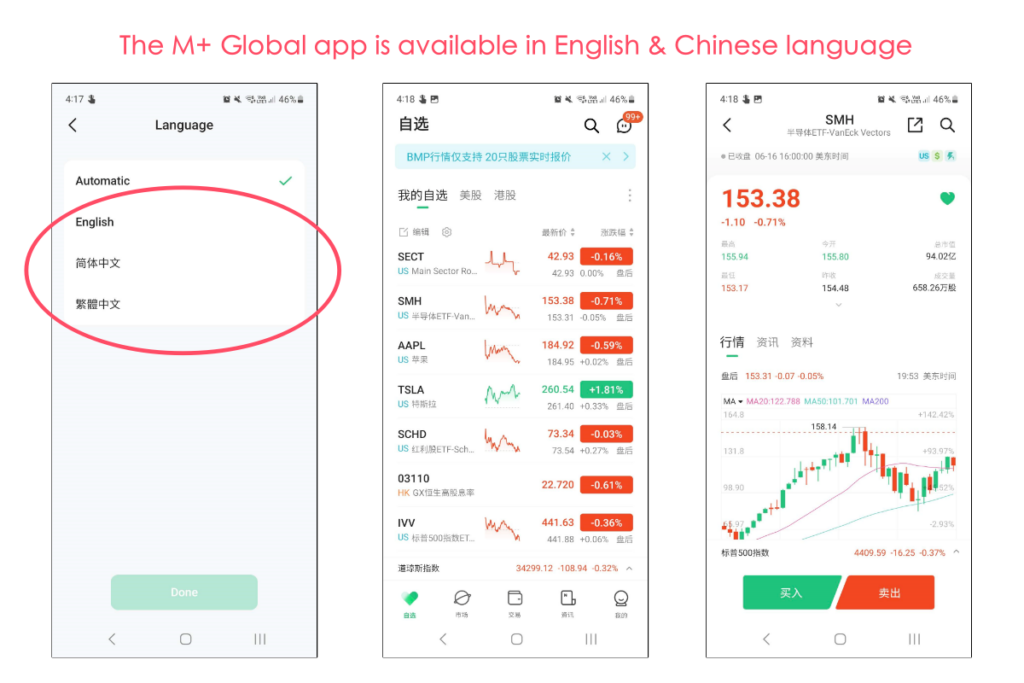

v. App in English & Mandarin

On a side note, did you know that the M+ Global app is available in English and Mandarin language?

#4 Margin Trading

Unlike rival Rakuten Trade which offers purely Cash-Upfront account for trading US and Hong Kong stocks, M+ Global allows users to trade on margin.

This is especially helpful for shorter-term traders that may require additional leverage in purchasing power to trade.

#5 1.85% Interest on cash (MYR)

For cash deposits in MYR, M+ Global offers a 1.85% per annual interest. It is calculated and credited to users’ accounts at the end of each month.

What I wish could be better (The so-so)

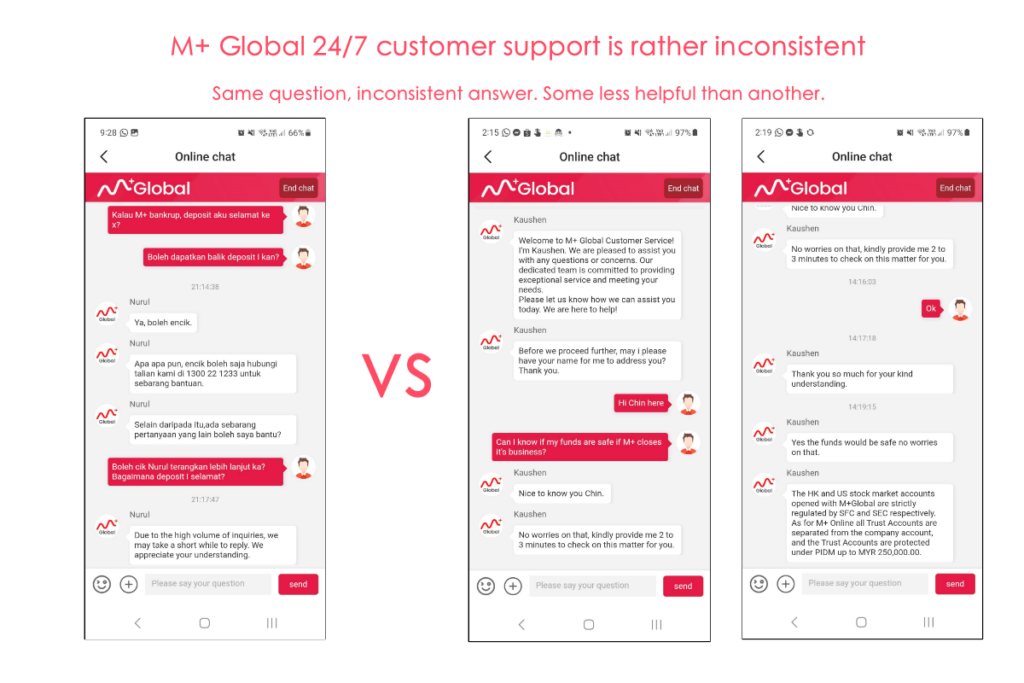

#1 24-hour customer support is a hit-or-miss

M+ Global offers 24-hour customer support (CS) with the intention to assist users whenever help is required.

While the idea is good, I find the actual experience rather mixed-bag.

For one, I find that not all customer service (CS) associates are equally trained. As an example, while testing the M+ Global app, I directed a similar question to 2 different CS, and got a different outcome each time.

As a whole, I think the M+ Global team has to invest more into building their CS team. That said, M+ Global is a relatively new app in the market, and I am informed that they are upgrading their CS team – hence I will be revisiting their CS in the near future.

#2 M+ Global fee structure is just…”OK”

With more competition in the brokerage space, it is hard not to compare M+ Global’s fee structure to other locally-regulated brokers that offer access to similar US and HK markets.

In this regard, I think M+ Global’s fee structure is OK, but definitely not the best:

| M+ Global Fee Structure | Fees |

| US Stocks & ETFs | 0.1% of Trade Value, min. USD3.00 |

| HK Stocks & ETFs | 0.1% of Trade Value, min. HKD18.00 |

Many might compare M+ Global to close rival Rakuten Trade, which has one of the most competitive fee structures (among Malaysia-regulated platforms) at the moment:

| Trading Value | M+ Global Fee | Rakuten Trade Fee (MYR trading) |

| USD100 (~RM467) | USD3 | RM4.67 (Better) |

| USD500 (~RM2336) | USD3 | RM9 (Better) |

| USD1,000 (~RM4671) | USD3 | RM9 (Better) |

| USD2,500 (~RM11,680) | USD3 | RM11.68 (Better) |

| USD10,000 (~RM46,715) | USD10 | RM46.72 (Same) |

| USD20,000 (~RM93,580) | USD20 | RM93.58 (Same) |

| USD30,000 (~RM140,370) | USD30 | RM100 (Better) |

With competition setting such a high bar, I am sure the M+ Global team is aware of this, and hopefully will make changes to their fee structure in the near future.

#3 Exchange Rate could be better

As a platform offering access to global stocks, it is crucial that M+ Global users are able to exchange their MYR for USD or HKD (and vice versa) at a good rate while investing.

From my personal experience, I noticed M+ Global’s exchange rate tends to be less ideal most of the time compared to the likes of Rakuten Trade:

Check out the exchange rate comparison on the days below for RM1,000 to USD or HKD:

| Date | M+ Global (USD) | Rakuten Trade (USD) | M+ Global (HKD) | Rakuten Trade (HKD) |

| 12/6/2023 | USD214.60 | USD215.08 | HKD1681.60 | HKD1675.04 |

| 14/6/2023 | USD214.40 | USD214.94 | (Forgot to collect data) | (Forgot to collect data) |

| 29/6/2023 | USD211.90 | USD212.56 | HKD1660.00 | HKD1661.13 |

#4 Cannot hold foreign currency (USD, HKD) (… for now)

Another minor complaint I have about M+ Global is that it is not possible (for now) to hold other currencies aside from MYR.

In other words, if you were to buy US stocks, your MYR deposits would be exchanged for USD as you make your trade.

Meanwhile, brokers like Rakuten Trade allow users to exchange to their preferred currencies (USD or HKD) anytime, so they can lock in a favorable exchange rate.

The good news is, from my understanding, this is a feature that will be introduced to M+ Global in the near future – so stay tuned!

#5 No fractional shares (… for now)

Fractional shares refer to the ability to buy shares at a fraction of a unit (eg. 0.1 unit instead of 1 unit). This makes it convenient for users with small investment capital to own relatively expensive shares like Tesla.

For the time being, there are no fractional shares available on M+ Global – all while rival Rakuten Trade has launched fractional shares not too long ago.

That said, from my understanding, this is a feature that will be introduced to M+ Global in the near future – so stay tuned!

Who should consider using M+ Global to invest?

While far from perfect, M+ Global has offered something that many local brokers failed to do: Access to the US & Hong Kong stock market via a truly user-friendly platform.

In my opinion, M+ Global is a great option if you are:

- Seeking for a Malaysia-regulated broker to invest in the US & Hong Kong stock market.

- Looking for a user-friendly platform to invest in the US & Hong Kong stock market.

- Require margin facility to invest or trade the US & Hong Kong market.

🎁 LIMITED-TIME Promo: Get FREE shares & FREE live datafeed when you open a M+ Global account! (Ending: 30/6/2024)

Give M+ Global a try and receive a guaranteed FREE share or trading voucher worth up to RM1,200 and FREE live price feed for US & HK stocks!

How to be eligible:

Step 1: Open an M+ Global account

Step 2: Make a minimum first deposit of RM2,000.

Step 3: Claim 1x guaranteed FREE share or trading voucher worth up to RM1,200, such as Tesla, Apple, and more within 7 working days.

Check out the full T&C here.

In addition, you can also claim FREE access to 30-days Level 1 live price feed for US and HK stocks!

No Money Lah Verdict: Big room for improvements for M+ Global

As an investor, I really enjoy using the M+ Global app, as the app is so easy to navigate around (Rakuten Trade, take note).

However, aside from a nice app, it is hard to give more points to M+ Global currently. This is especially true when we compare the relatively less favorable fee structure and exchange rate, alongside a lack of important features like fractional shares trading to rival Rakuten Trade.

That said, it is important to note that M+ Global has just been launched (since May 2023), and there is always space to make upgrades to the app in the near future.

For that, I am actually excited to see M+ Global coming to the global investing space, and I look forward to seeing more improvements with time!

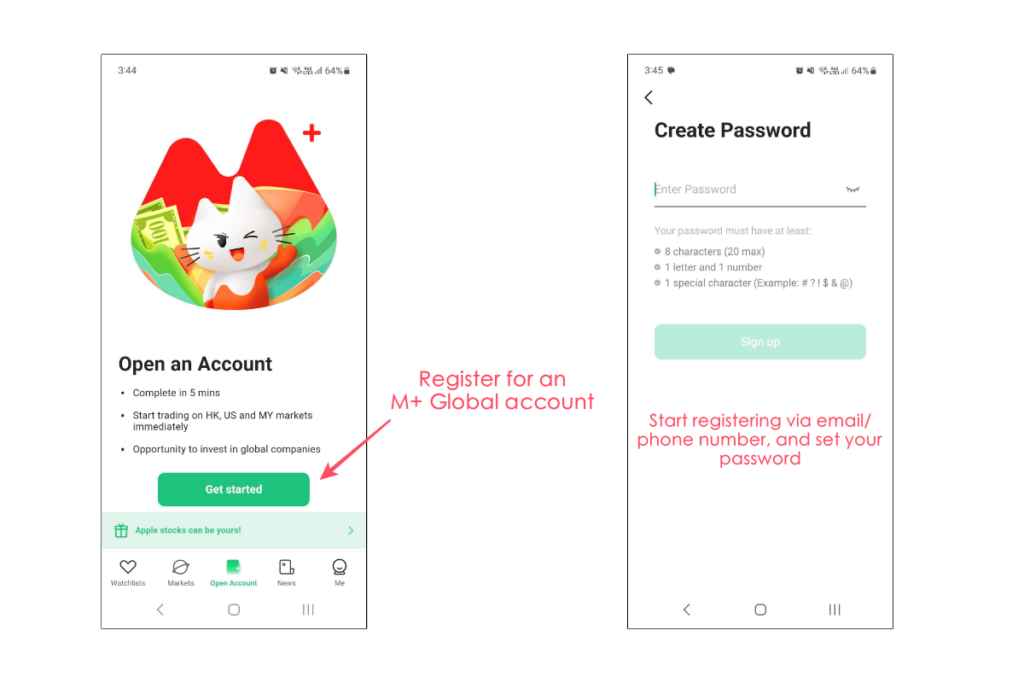

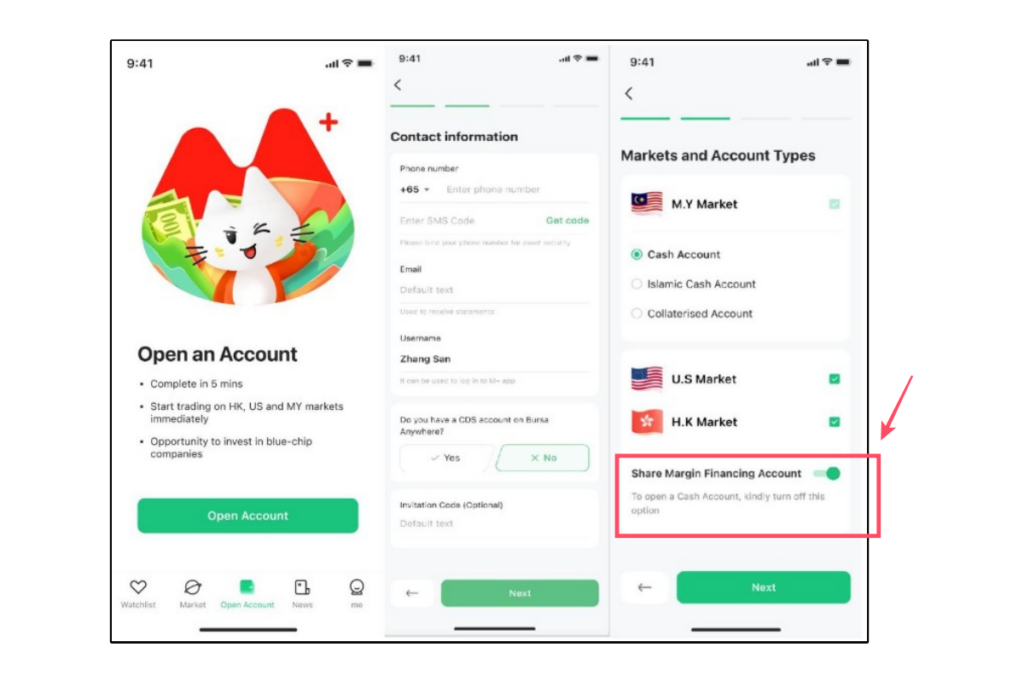

Step-by-step: How to open an M+ Global account

Step 1: Download the M+ Global app by using my referral link (via the button below):

Step 2: Register for an account and set up your password

Step 3: Begin your application by entering your basic details, and determining the markets you want to trade.

If you do not require margin (ie. borrow money from the broker) to trade, you can choose to untick the ‘Share Margin Financing Account’ option.

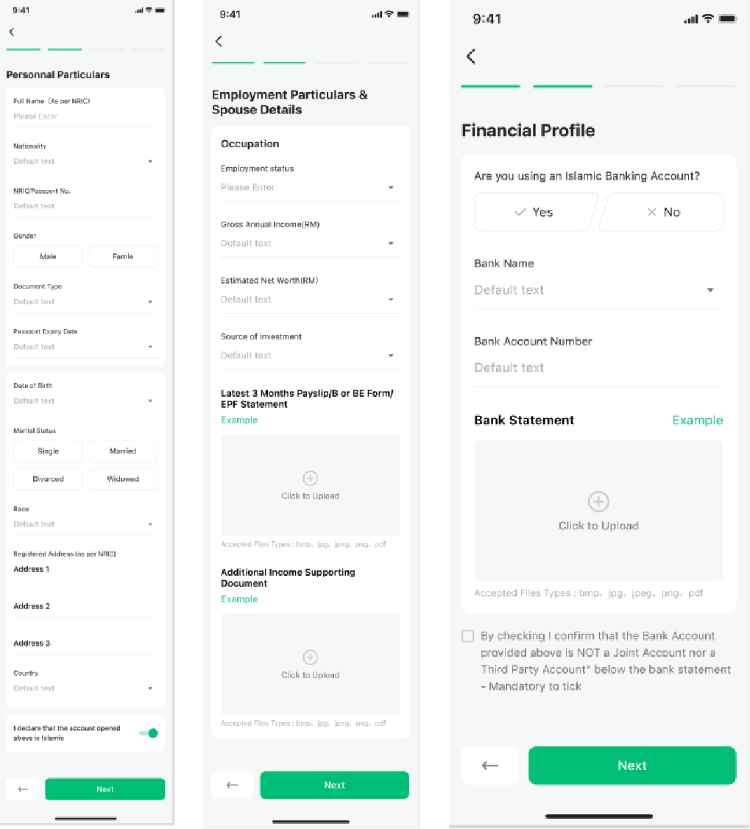

Step 4: Provide the necessary details such as your employment details, financials, and tax details

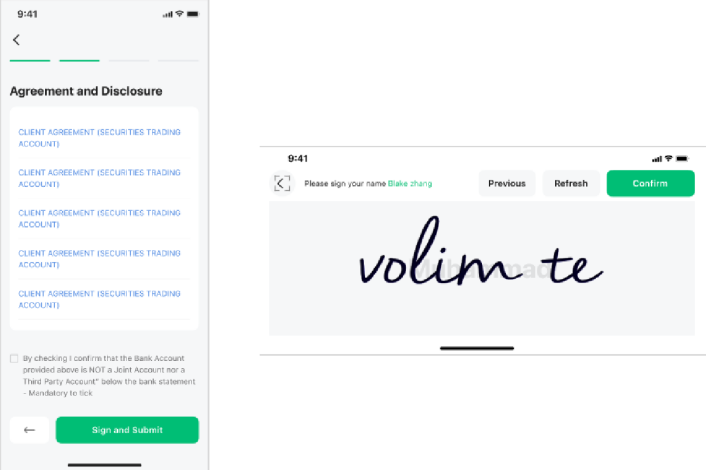

Step 5: Review, accept, and sign the agreements

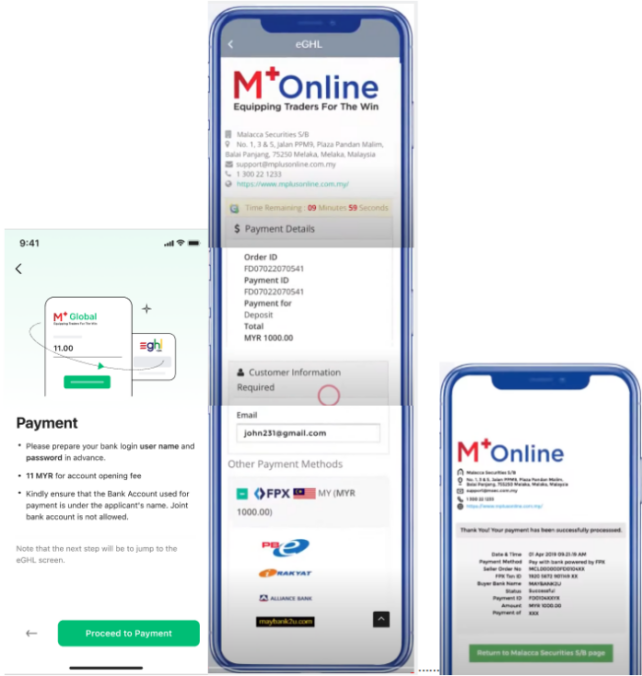

Step 6: New M+ Global users will have to pay a CDS account opening fee of RM11. Existing M+ Online users who are opening an M+ Global account do not have to pay this fee since they already have a CDS account under M+.

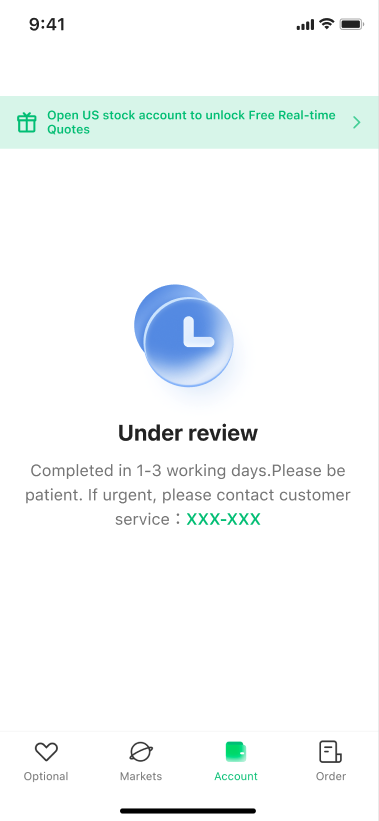

Step 7: Your application will be reviewed within 1 – 3 working days. Once approved, you can start trading.

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact M+ Global for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.