Last Updated on April 16, 2024 by Chin Yi Xuan

The highly anticipated Moomoo MY is finally launched in Malaysia in late February 2024, allowing Malaysians to trade the US and Malaysia stock market at a highly competitive fee.

Personally, I’ve been looking forward for Moomoo MY to be launched in Malaysia as they have been offering great pricing for investors in their Singapore counterpart.

So, what is it like to invest through Moomoo MY? How’s their pricing/fees like compared to other local brokers?

Let’s find out!

Table of Contents

Highlights of Moomoo MY

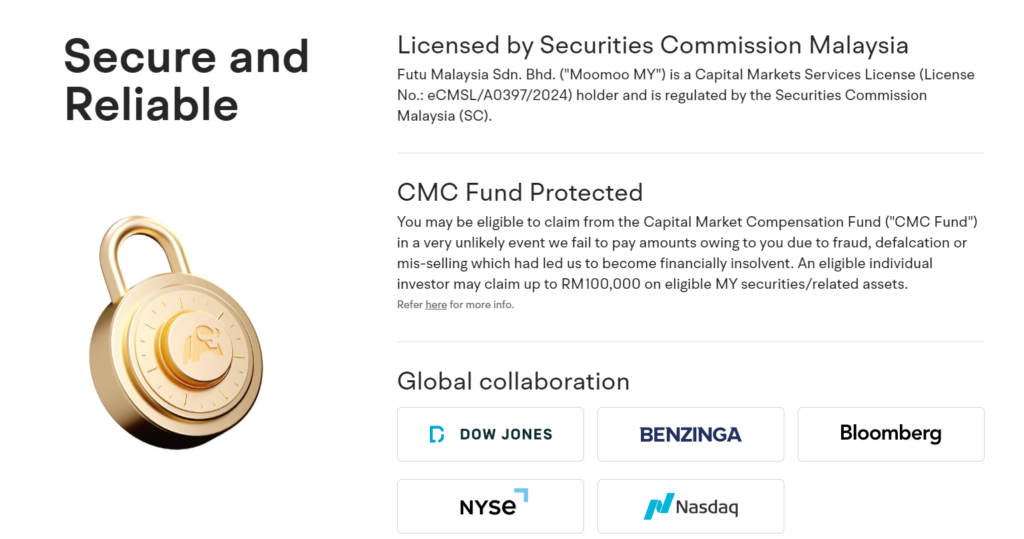

- Locally-regulated broker: Moomoo MY is regulated by the Securities Commission Malaysia (SC). This ensures that Moomoo MY’s operation and business are conducted within the rules set by the authority to protect Malaysian investors.

- Access to US and Malaysia stock markets: Invest in the US and Malaysia stock markets within the moomoo app.

- Best fee structure for Malaysia-regulated brokers: Moomoo MY offers the most competitive fees for the US and Malaysia stock markets among Malaysia-regulated brokers, with 0 commission trading for all moomoo users for the first 180 days.

- Powerful features: Investors of all levels and experience will appreciate the useful features that will alleviate their investing experience, such as a powerful stock screener, 24/7 news, Moo community, and more.

- Room for improvements: No fractional shares for US stocks (for now), lack of HK and SG market, and a rather lackluster Help section in the app, where you would not be able to find answers to many important questions.

How is Moomoo MY regulated + Safety of Funds

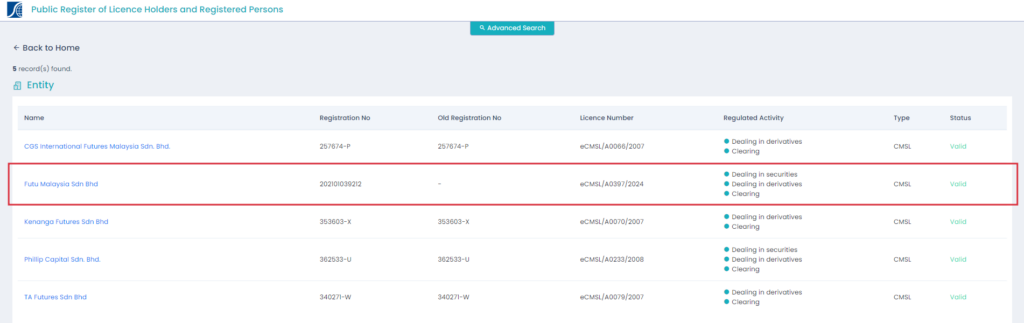

In terms of regulation, Moomoo MY (registered under the name Futu Malaysia Sdn. Bhd.) is regulated by the Securities Commission Malaysia (SC), with a Capital Markets Services License to operate a legal brokerage business:

This ensures Moomoo MY is operating under the best practices and guidelines set by the Malaysian authority.

In addition, clients’ funds are kept separately from Moomoo MY’s finances through a custodian bank account. Moomoo MY will not have access to your funds and assets, ensuring clear transparency to avoid fraud. This also ensures that if something happens to Moomoo MY (eg. Bankruptcy), your funds & assets will not be affected.

Furthermore, Moomoo MY clients’ fund is protected by Capital Market Compensation Fund (CMC Fund), where clients can claim up to RM100,000 on eligible Malaysia securities/assets in the unlikely event that Moomoo MY is not able to pay clients due to bankruptcy.

Moomoo MY fees & pricing for the US and Malaysia stock markets

One of the reasons why Moomoo MY took the investing community by storm is its highly competitive pricing for both the US and Malaysia stock markets.

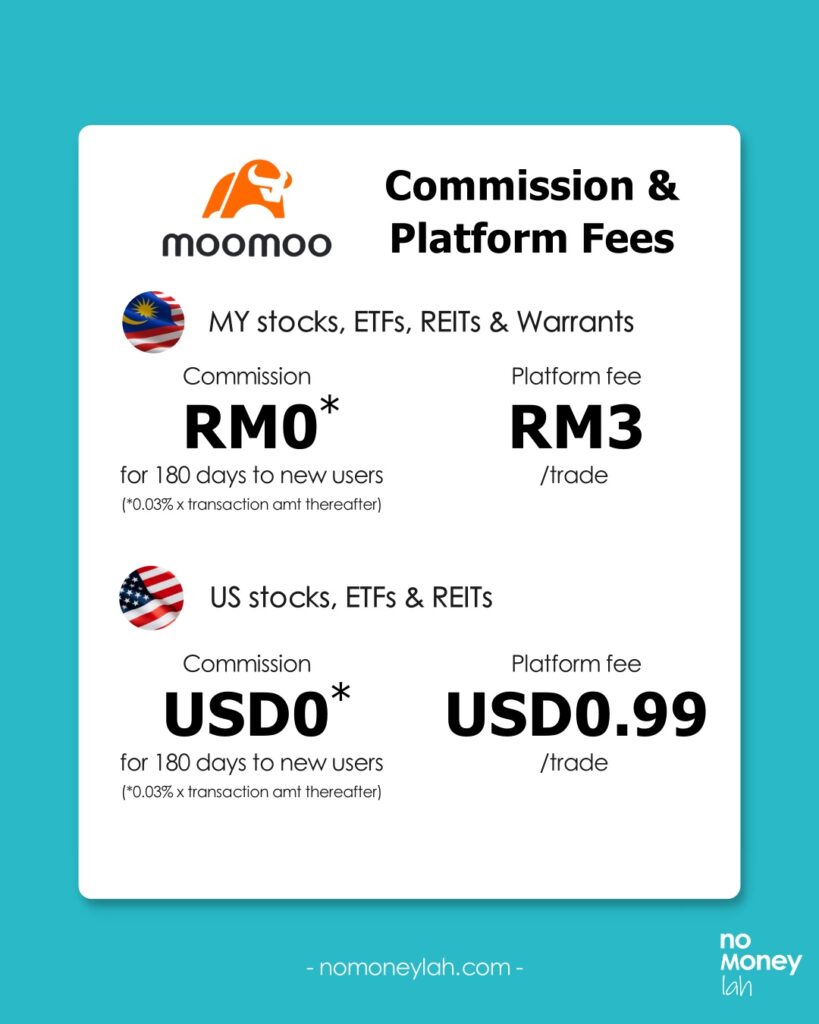

For pricing, Moomoo MY charges a commission and platform fee respectively. The great news is, new Moomoo MY users will enjoy 0* commission for the first 180 days:

(a) Moomoo MY pricing for Malaysia stocks, ETFs, REITs, and Warrant:

| Moomoo MY pricing for Malaysia stocks, ETFs, REITs, and Warrant | |

| Commission | RM0* for the first 180 days to new users (*0.03% x Transaction Amount thereafter) |

| Platform Fee | RM3/trade |

(b) Moomoo MY pricing for US stocks, ETFs, and REITs:

| Moomoo MY pricing for US stocks, ETFs, and REITs | |

| Commission | USD0* for the first 180 days to new users (*0.03% x Transaction Amount thereafter) |

| Platform Fee | USD0.99/trade |

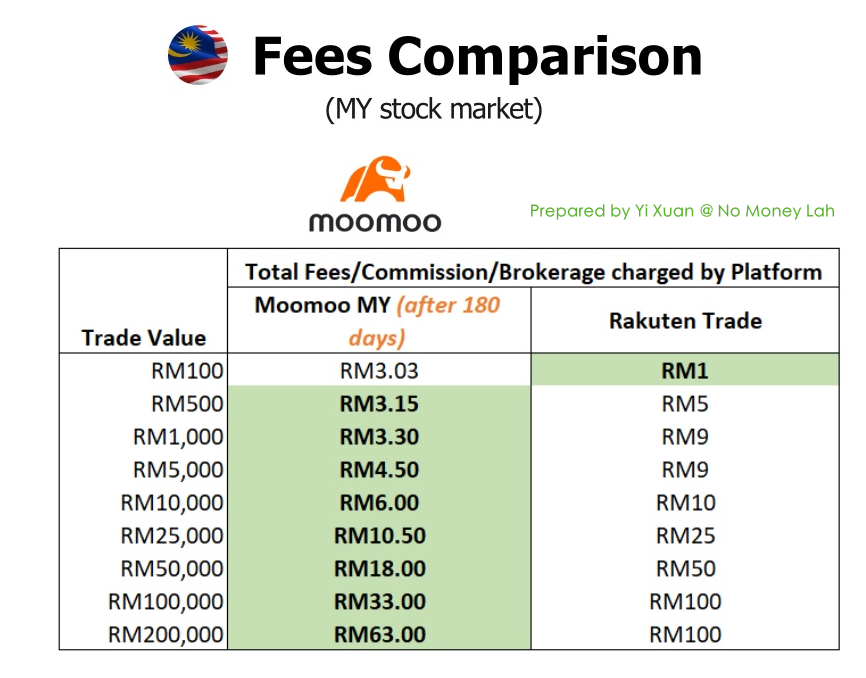

Moomoo MY pricing vs other locally-regulated brokers:

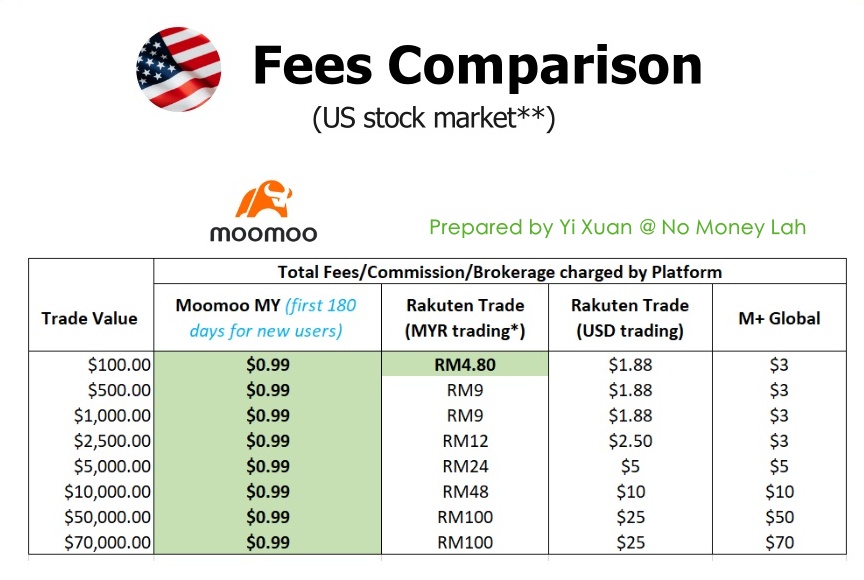

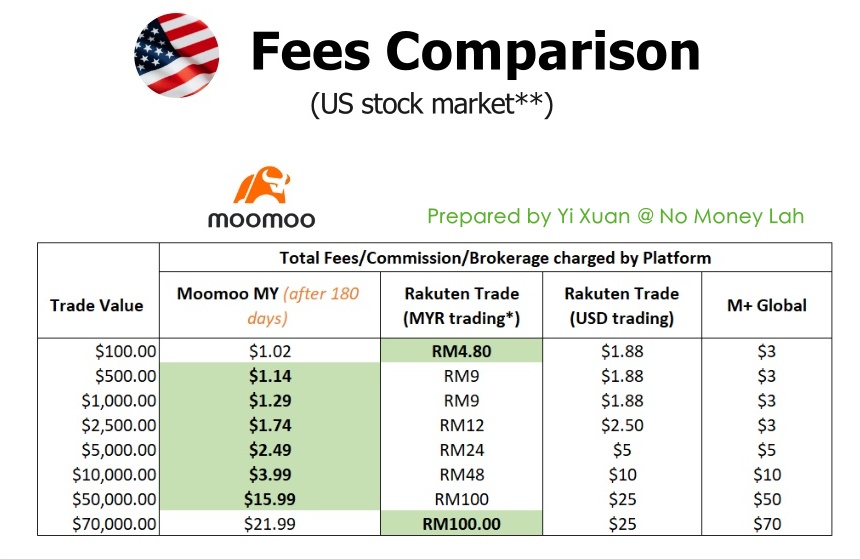

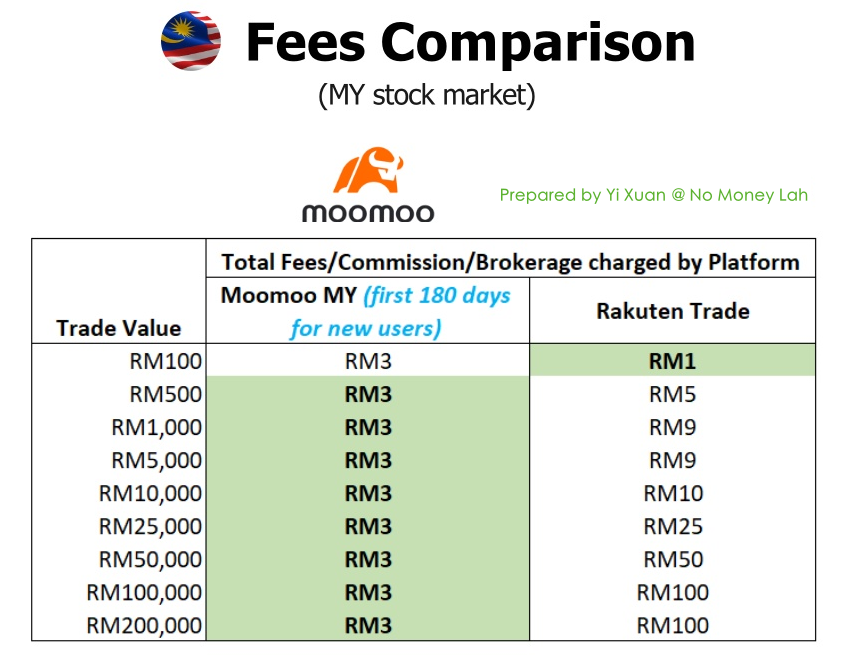

In my opinion, Moomoo MY pricing structure offers the best value for Malaysian investors compared to the likes of Rakuten Trade and M+ Global:

(i) Moomoo MY vs Rakuten Trade fee comparison for the Malaysia stock market (Promo: First 180 days 0 commission trades for new users):

(ii) Moomoo MY vs Rakuten Trade fee comparison for the Malaysia stock market (after 180 days):

(iii) Moomoo MY vs Rakuten Trade vs M+ Global fee comparison for the US stock market (Promo: First 180 days 0 commission trades for new users):

(iv) Moomoo MY vs Rakuten Trade vs M+ Global fee comparison for the US stock market (After 180 days):

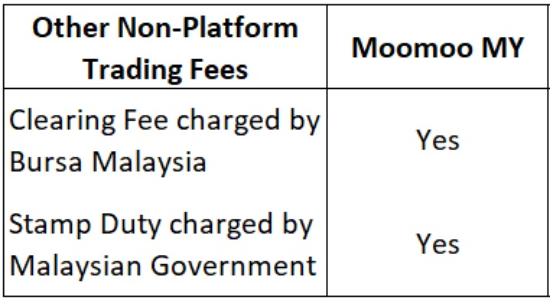

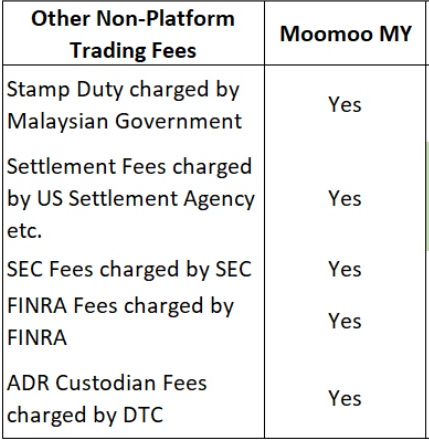

Also, take note of other non-platform trading fees that are NOT charged by Moomoo MY while you trade the stock market:

- Malaysia stock market

- US stock market:

My experience investing via Moomoo MY (Features):

The moomoo app is one of the most well-designed investing apps that I’ve used, which managed to combine useful features without compromising much on ease of use.

Below are some of my personal favourites while using the moomoo app to invest in stocks:

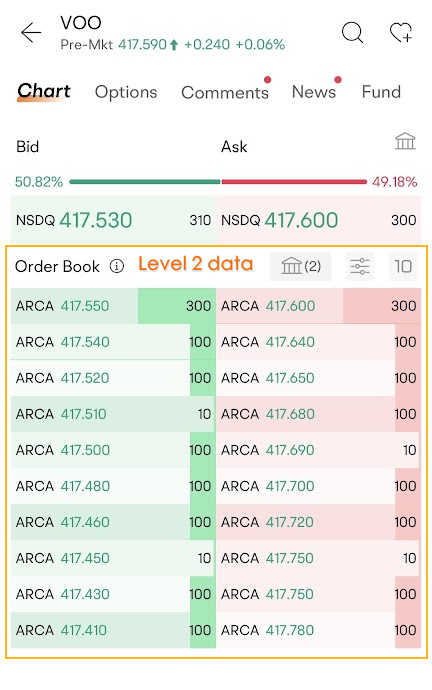

#1 Real-time US and Malaysia price quotes (or price feed)

Moomoo users will be happy to learn that moomoo offers real-time level 2 US market data for FREE (where you usually have to pay on other trading platforms), as well as FREE level 1 MY market data.

What exactly is Level 2 market data?

Essentially, Level 2 market data allows you to see transaction details (ie. Buy & sell activities) across multiple price levels:

Having level 2 market data is equivalent to having an aerial view of the market. For instance, with Level 2 market data, you can detect in real-time if buyers are buying aggressively (or vice versa) and make better entry decisions.

In short, with level 2 market data, you can get a better gauge of market strength.

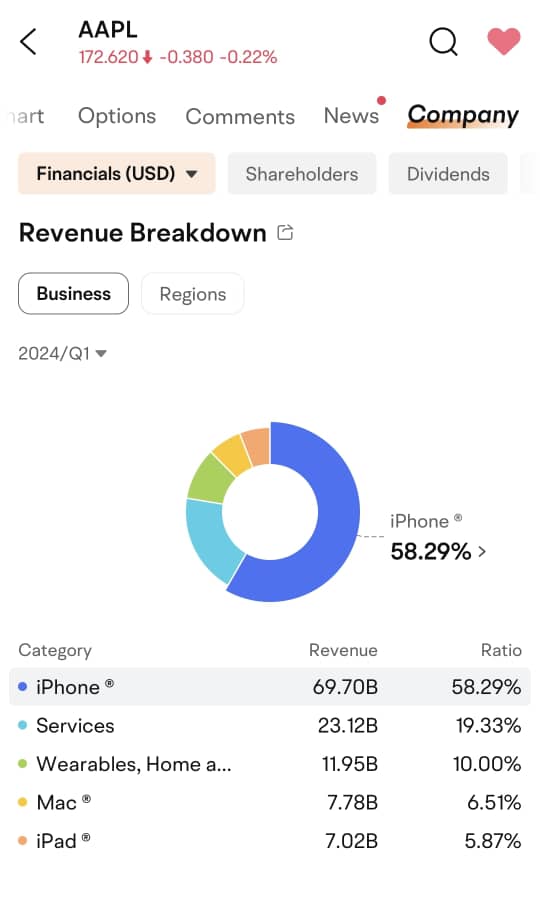

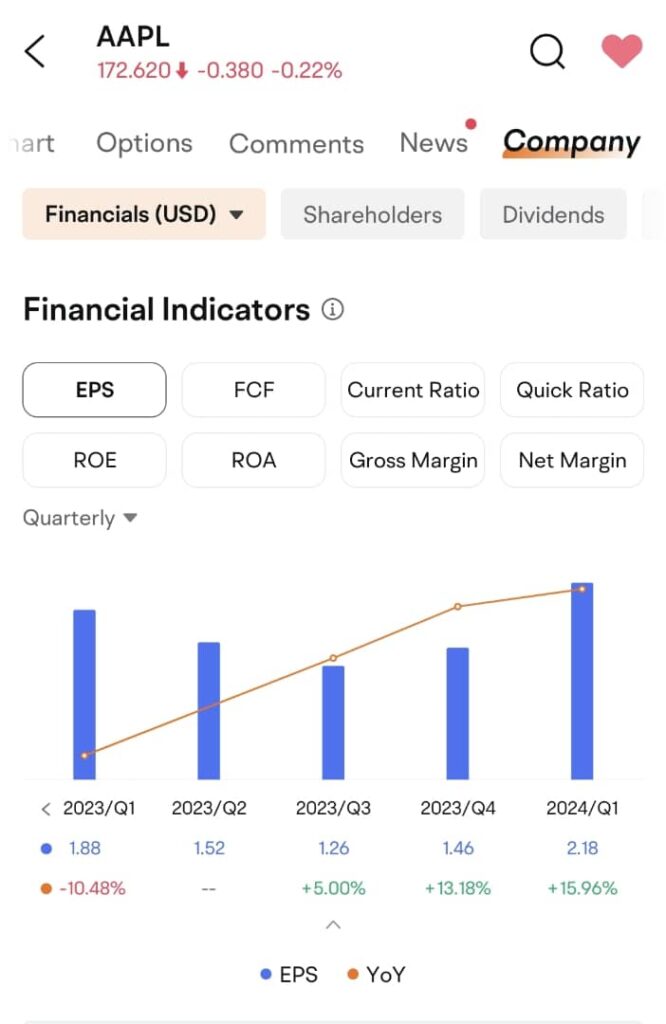

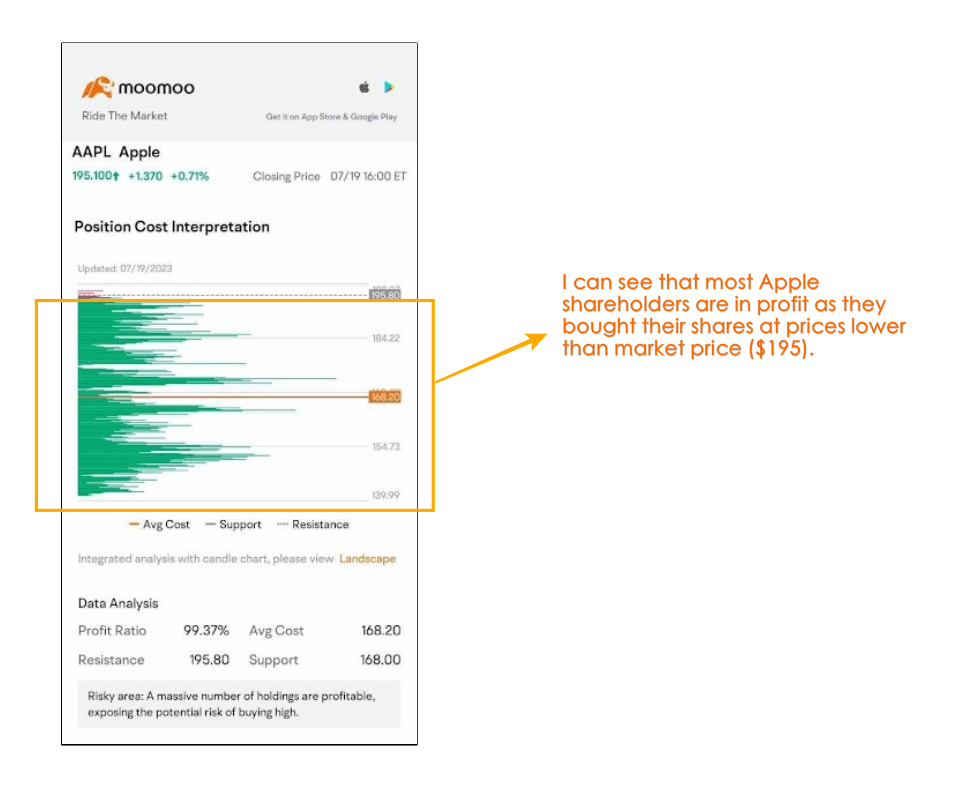

#2 Visual information on stocks or ETFs within the app

In terms of app design, the moomoo app is also the best stock investing app I’ve tried so far which puts financial information into easily understandable visuals & charts.

From revenue breakdown, shareholders, dividends, and more, I can get a clear picture of a stock without having to visit other external websites:

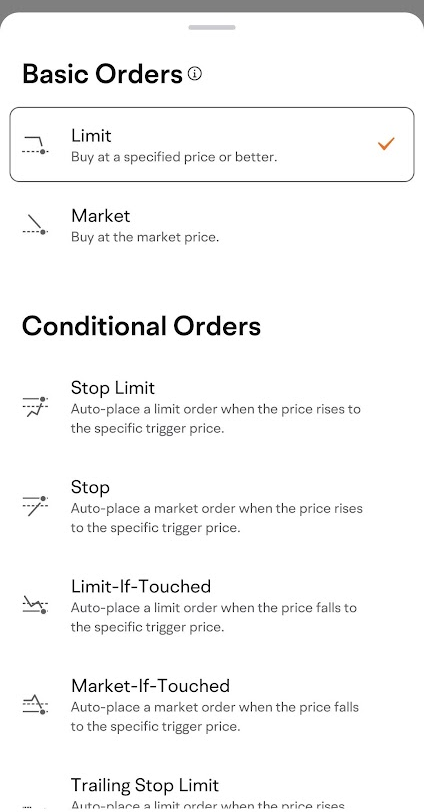

#3 Complete trade order execution features, from basic to advanced executions

Having tried many locally-regulated brokerages, I come to appreciate the different trader order execution features that Moomoo MY is offering to users on the moomoo app.

Aside from the basic market and limit orders, I discovered various order execution features (eg. Stop order, Limit-if-Touched), which makes trade execution more versatile for investors and traders alike, regardless of style.

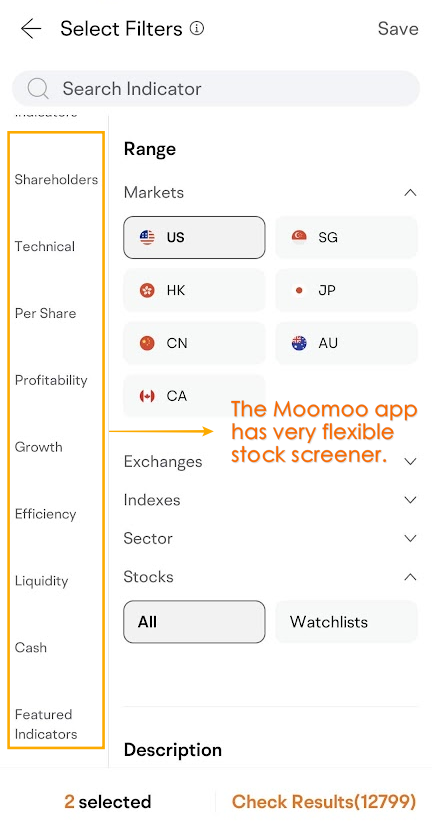

#4 Powerful screener & 24/7 news update

The stock screener within the moomoo app also impressed me. This screener can be super simple, or as sophisticated as you want.

From fundamental to technical filters, you can filter for stocks based on your preferred criteria:

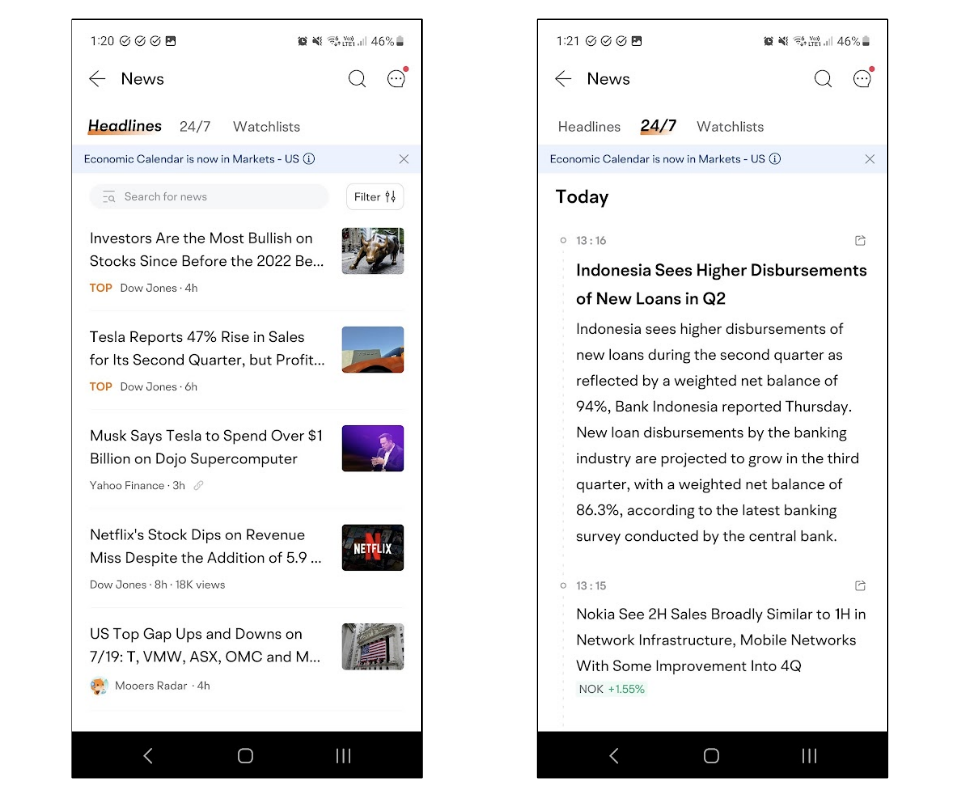

It is also extremely convenient to get the latest financial news in the moomoo app.

Even better, the news is real-time and updated 24/7, making it easy for you to get in touch with the latest updates of the market and the companies that you are investing in.

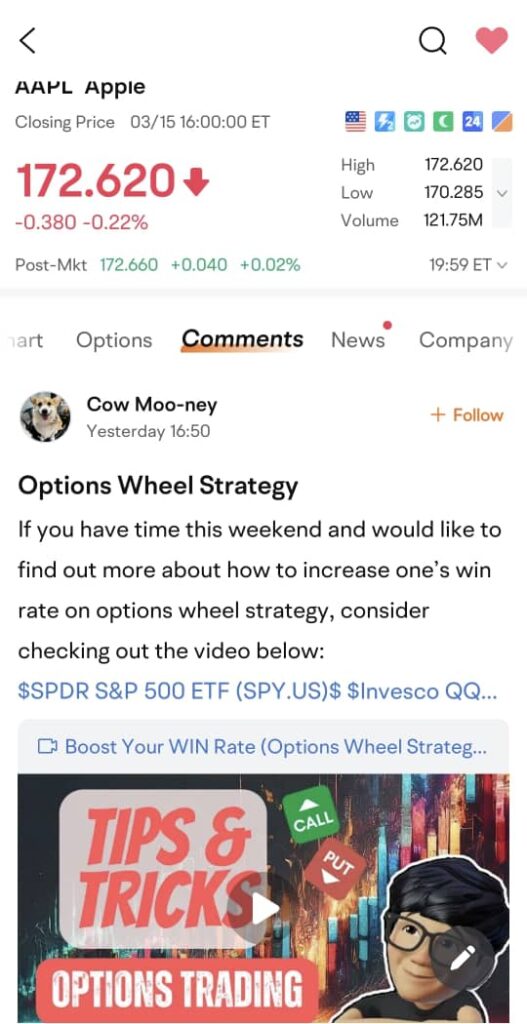

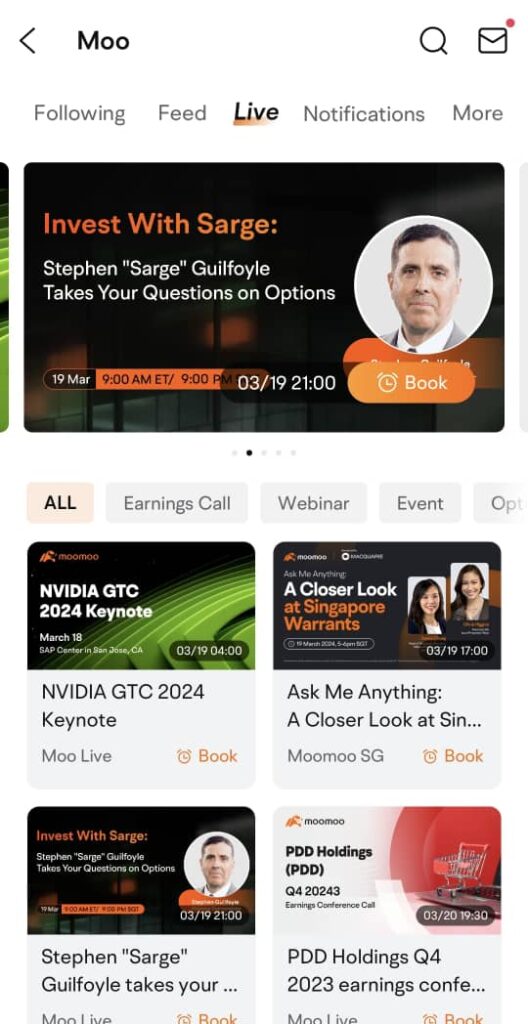

#5 Moo community

Within the moomoo app, you’ll find a vibrant Moo community, comprised of global moomoo users sharing their thoughts and insights on the market.

Not to mention various live webinars that allow you to keep up with the most happening events in the market:

#6 Earn 2% per annum on your cash for 90 days (Enrollment Period: 19/3/2024 – 30/4/2024. T&C applies)

Moomoo MY clients who have opened an account and have assets over or equal to RM6,000 at any point in time during the enrollment period will be eligible to enroll for moomoo’s 90-day 2% p.a. Cash Return campaign.

To enroll, open a Moomoo MY universal account HERE, then click HERE to enroll.

Explore many more exciting and useful features that moomoo has to offer!

Aside from the features that I mentioned above, there are MANY more useful gems waiting for you and me to discover on moomoo!

Some other useful features include Market Position Overview, ‘Concepts’, and Short Sale Analysis, which I covered in my Moomoo MY feature review.

Personally, I am always discovering new features as I explore the moomoo app, and I will update this review as I come across features that I really like!

What I wish could be improved

From my time using the moomoo app, there are a few things that I wish could be improved:

#1 Lack of several important features such as:

- No fractional shares (ie. ability to buy smaller units, a.k.a. fractional share, such as 0.5 units) for the US stock market (for now).

- No FPX instant deposit (for now). Only bank transfer is available for the time being, which makes depositing to my Moomoo MY universal account a tad slower.

- No access to Hong Kong and Singapore stock markets (for now).

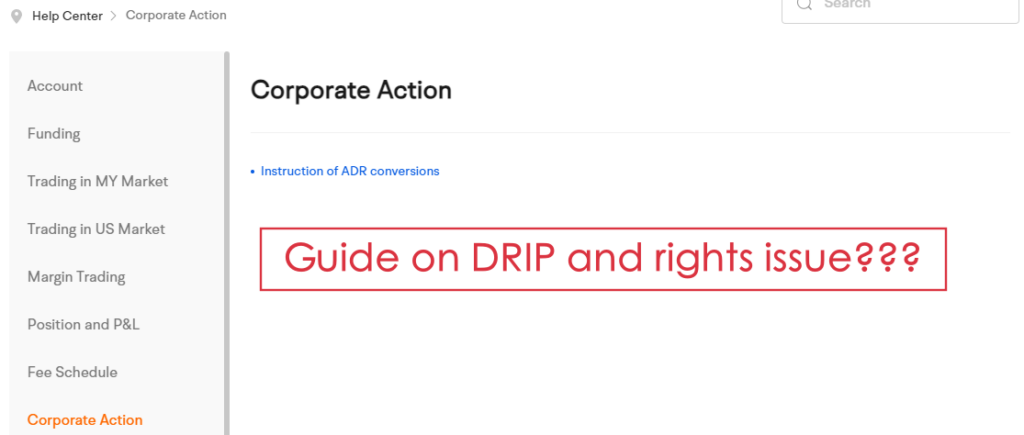

#2 Lackluster ‘Help section’

As an online stock investing platform, I find the ‘Help’ section of moomoo’s app to be lacking in important information compared to other competitors.

Simply put, I couldn’t find answers to many commonly asked questions, such as:

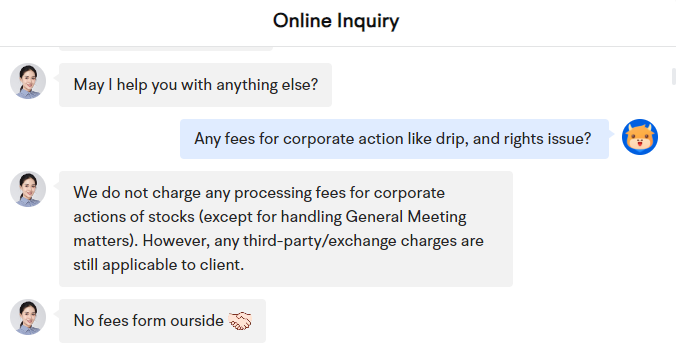

Are there fees to corporate action, such as Dividend Reinvestment Plan (DRIP) and rights issue? What to do if I want to subscribe to corporate action?

How is Moomoo MY regulated? Who/which bank is the custodian bank that Moomoo MY has appointed to hold customers’ funds?

Is Moomoo MY a nominee or direct CDS account for investing in the Malaysia stock market?

Can I apply for an IPO? If yes, how?

Can I apply to join an AGM? If yes, how?

As such, from my time using moomoo, I find myself reaching out to Moomoo MY’s customer support for help – which is a mixed-bag experience on its own – more in the next point.

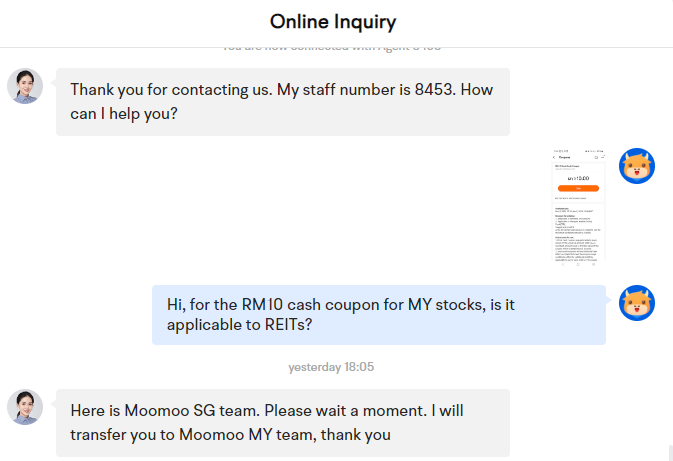

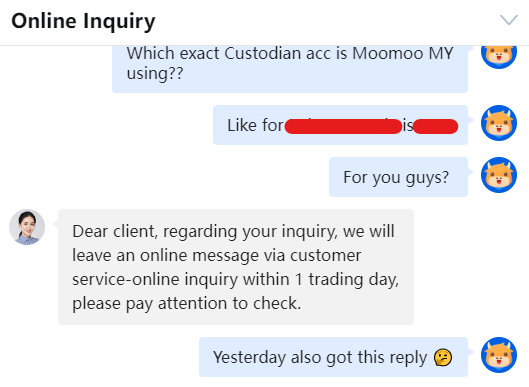

#3 My experience with Moomoo MY’s customer support is rather hit-or-miss

Thanks to a half-baked ‘Help’ section, I spent a fair amount of time reaching out to Moomoo MY’s 24/5 customer support for help and clarification.

Moomoo MY offers 3 channels for users to reach out for help, namely: Livechat, Phone support (03-9212 0708), and email ([email protected]).

What I appreciate about Moomoo MY customer support:

- Multiple channels to reach out for help.

- 24-hour support for live chat and phone support on working days.

- Simple questions that require standard answers are addressed quickly.

What I wish could be better with Moomoo MY customer support:

- As an existing Moomoo SG and Moomoo MY user, I am always directed to Moomoo SG chat agent before I am redirected to Moomoo MY support, where I’ll need to readdress my questions. I wish Moomoo could streamline the system for both Moomoo MY and Moomoo SG users so it is easier for us to get help.

- I also faced a difficult time trying to get answers to certain questions, such as which exact custody bank/trust is Moomoo MY using to store clients’ assets (eg. funds, stocks).

As a whole, as an online investing/trading platform, I wish to see more improvements in Moomoo MY’s Help section and customer support, as they are the only way users can seek assistance when they need help.

Regardless, since Moomoo MY is still relatively new to the local market, I shall revisit their Help section and customer support in the coming months and see if there are any improvements.

🎁 Account Opening & Deposit Promotion (ending 13/5/2024)

Moomoo MY is constantly running promotions for new users:

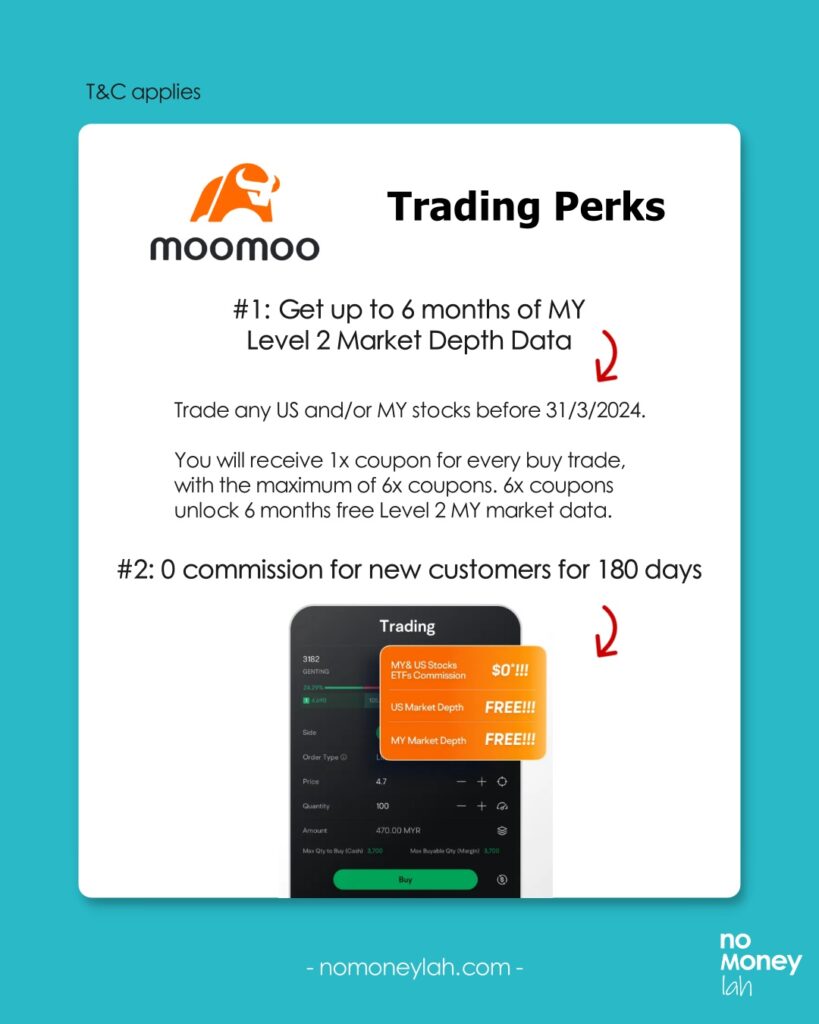

#1 Trading perks:

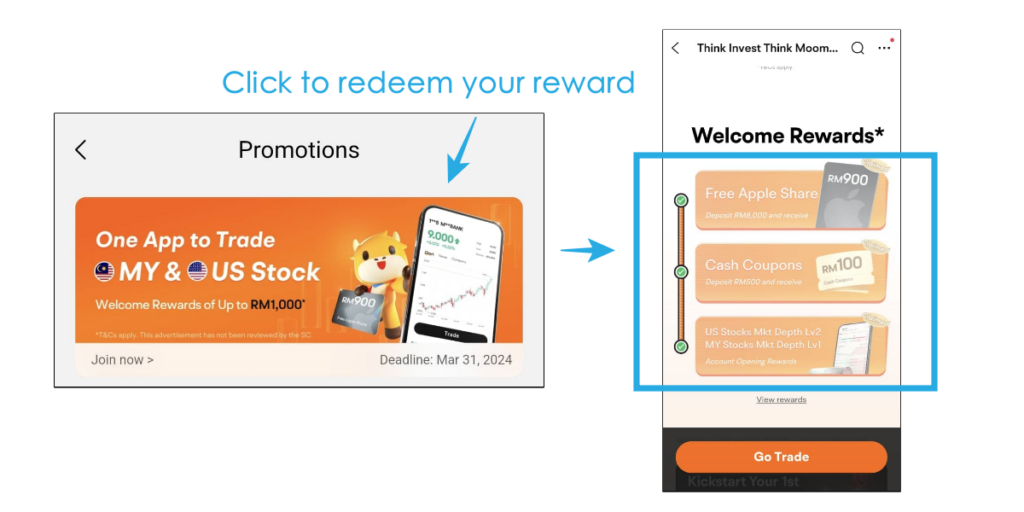

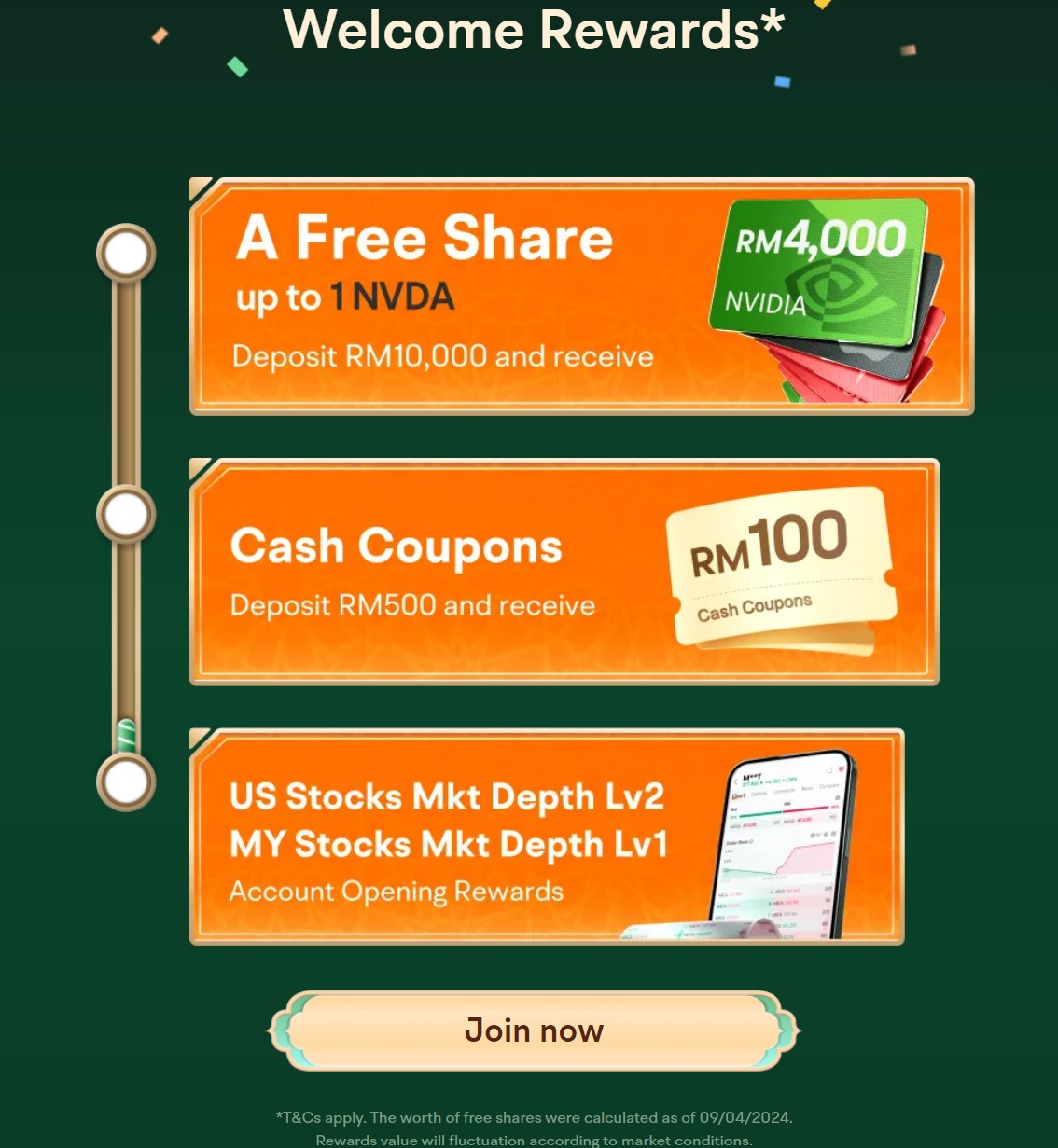

#2 Account Opening and funding promotion* (*ending 13/5/2024. T&C applies)

- Open a Moomoo MY universal account and receive FREE US Level 2 Market Depth Data, and MY Level 1 Market Depth Data.

- Deposit a cumulative amount of at least RM500, and get 1x RM50 and 2x RM25 stock cash coupons. Reward will be activated if you maintain at least RM500 or more in assets (cash, stocks, and other assets included) for 60 days.

- A 1x chance to spin-the-wheel and get the share that the wheel lands on – either Grab, Under Armour, Coca Cola, Apple, Tesla, or NVIDIA share. Reward will be activated if you maintain at least RM10,000 or more in assets (cash, stocks, and other assets included) for 60 days. Note: You are free to trade stocks during the lock-in period, and the value fluctuations of your holdings after depositing will not affect the unlocking of rewards – the key is to maintain a minimum net deposit of RM10,000 throughout the 60 days.

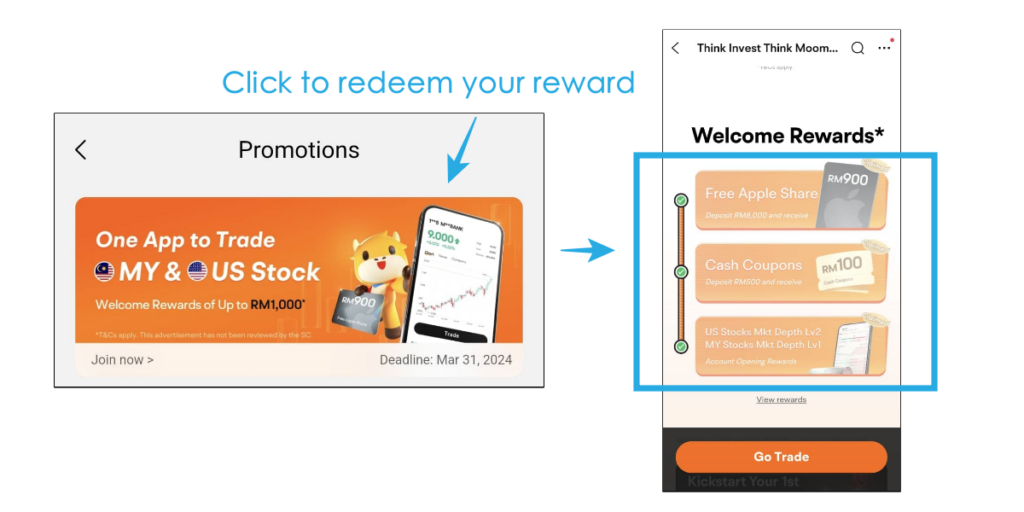

[Reminder] Remember to claim your account-opening perks! (Under ‘Me’ > ‘Promotion’ > Click to redeem your account opening and deposit reward)

Verdict: Moomoo MY is providing the best value for money for Malaysia investors

The launch of Moomoo MY in Malaysia has certainly disrupted the brokerage industry with its attractive pricing & fee offering, coupled with a featureful investing platform.

Now, it is even more affordable for Malaysians to get access to the US and Malaysia stock markets thanks to Moomoo MY.

Despite missing a few features and a slightly lackluster customer support (which I think could be improved with time), I think all these are not dealbreakers for me to recommend Malaysians to give Moomoo MY a try.

Step-by-step: How to open a Moomoo MY universal account & make your deposit

Opening a Moomoo MY universal account is one of the smoothest I’ve experienced among all the other investing platforms I’ve tried.

Step 1: Use my referral link HERE to open your Moomoo MY universal account, where you’ll get to enjoy various account-opening perks.

Step 2: Fill in your personal details

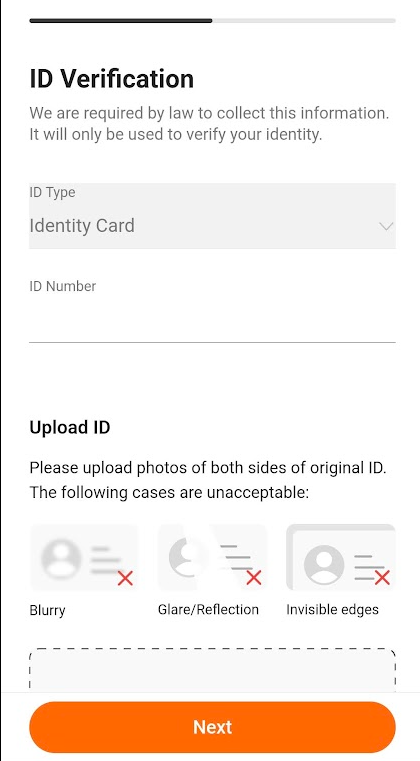

Step 3: Verify your identity through your IC

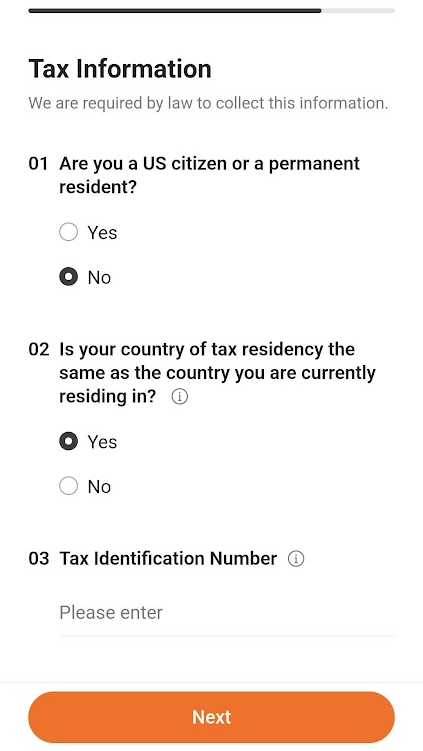

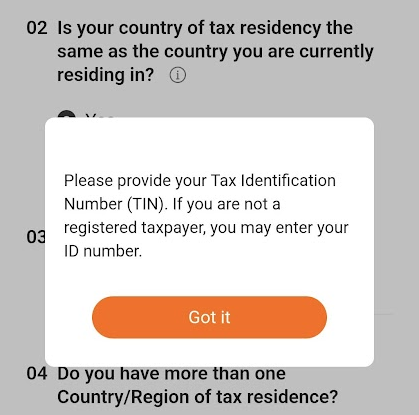

Step 4: Provide your tax information, including your Tax Identification Number (TIN) (ie. LHDN number).

Alternatively, if you do not have a TIN number (eg. you are a student), you can enter your IC accordingly.

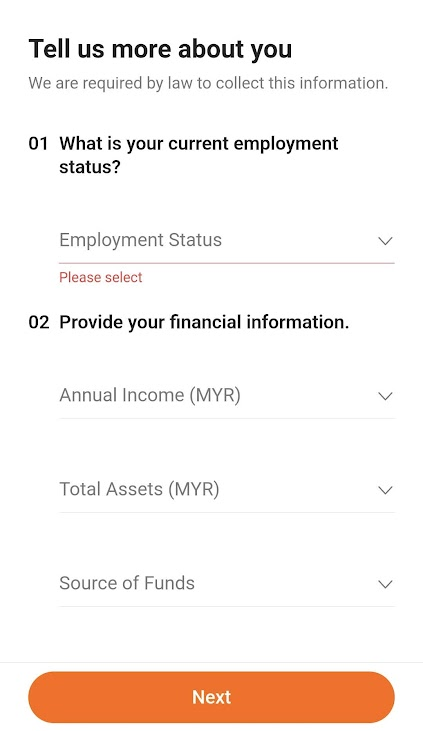

Step 5: Enter your employment details and financial information:

Step 6: You’ll be required to scan your face for verification purposes.

Step 7: Read through the Customer’s Declaration and proceed should there be no issue

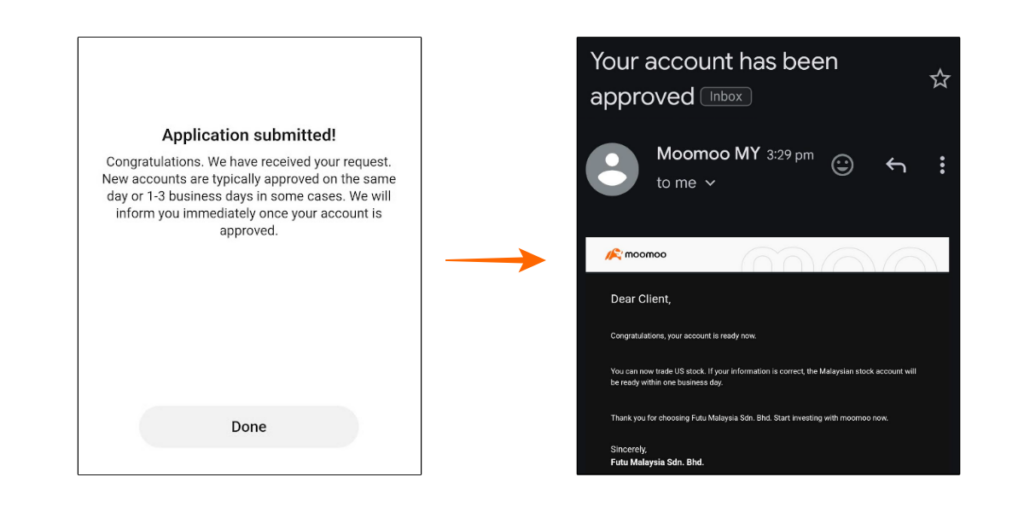

Step 8: If the application goes smoothly, your account should be approved within 1 – 3 business days. At the same time, you’ll also receive an email once your account is approved.

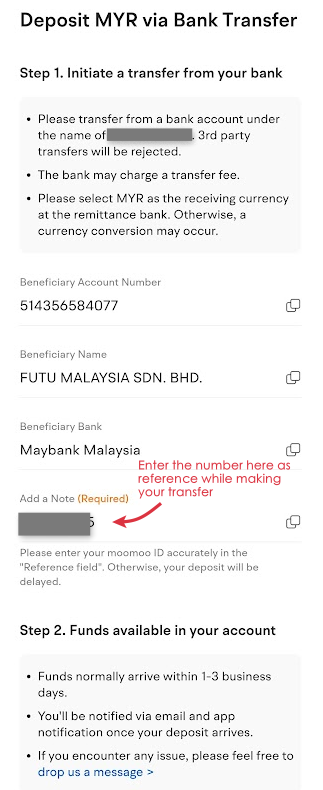

Step 9: Head over to ‘Account’ > ‘More’ > ‘Deposit’ to get instructions on how to make your deposit.

Essentially, the deposit process is through bank transfer, simply log in to your bank account and make the transfer to the Moomoo MY bank details as shown to you.

[Reminder] Remember to claim your account-opening perks! (Under ‘Me’ > ‘Promotion’ > Click to redeem your account opening and deposit reward)

Moomoo MY FAQ (Answers extracted directly from customer support)

Ques: Can I attend AGM for the MY and US stocks that I invest in?

Answer: AGM for US stocks: Moomoo MY does not currently support US Shareholders Meeting

AGM for MY stocks: If you want to attend the MY Shareholders Meeting, kindly drop Moomoo MY an email at least 10 business days before the Shareholders Meeting date at [email protected], the email needs to include: 1. A description of the content: Live voting or E-voting. 2. Your Name, Moomoo ID, Contact Number, and Stock code for the meeting. 3. The address of current status quo residence. (in English) Upon receiving your email, Moomoo MY will reply to you with any details.

Ques: I am an existing Moomoo SG user, can I still use my Moomoo SG universal account after opening my Moomoo MY universal account?

Answer: Moomoo MY and Moomoo SG are two different independent brokerage, will not affect each others

Ques: Any fees for corporate actions like DRIP, and rights issue?

Answer: Moomoo MY does not charge any processing fees for corporate actions of stocks (except for handling General Meeting matters). However, any third-party/exchange charges are still applicable to client.

Ques: Is Moomoo MY a nominee or direct CDS account for investing in Malaysia stocks?

Answer: Nominee CDS account

Disclaimers:

All views expressed are the independent opinions of myself, which are not shared by Futu Malaysia Sdn. Bhd. (“Moomoo MY”). No content shall be considered financial advice or recommendation. Moomoo MY links are included in this post, through which referrals are made and I may receive certain commissions. Please contact Moomoo MY for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

3 Comments

Comments are closed.

Thanks for your informative blog review of MooMoo MY. It covers the details I was looking for, like the idle cash feature. Unlike MooMoo SG Cash Plus, there are no interest for idle cash in MooMoo MY. Also, MooMoo MY is a nominee CDS account and highlighted the RM100,000 fund protection for clients. It was helpful to read about your experience with Moomoo MY’s customer support.

Glad you find the review helpful, William!

Regards,

Yi Xuan

you are the best