Last Updated on May 1, 2022 by Chin Yi Xuan

From creating mimics of other countries’ tech gadgets 1 – 2 decades ago, to becoming the world’s leading innovator today. Indeed, the Chinese tech scene has come a long, long (fruitful) way.

These days, almost everyone uses some form of tech products or services from China – be it a Xiaomi smartphone, WeChat, or even online shopping from Taobao.

All of us know that Chinese tech companies are here to stay, and more so – grow.

Hence, today, let’s explore the Hang Seng TECH Index, where we can invest in these top Chinese tech companies, all at once:

p

Table of Contents

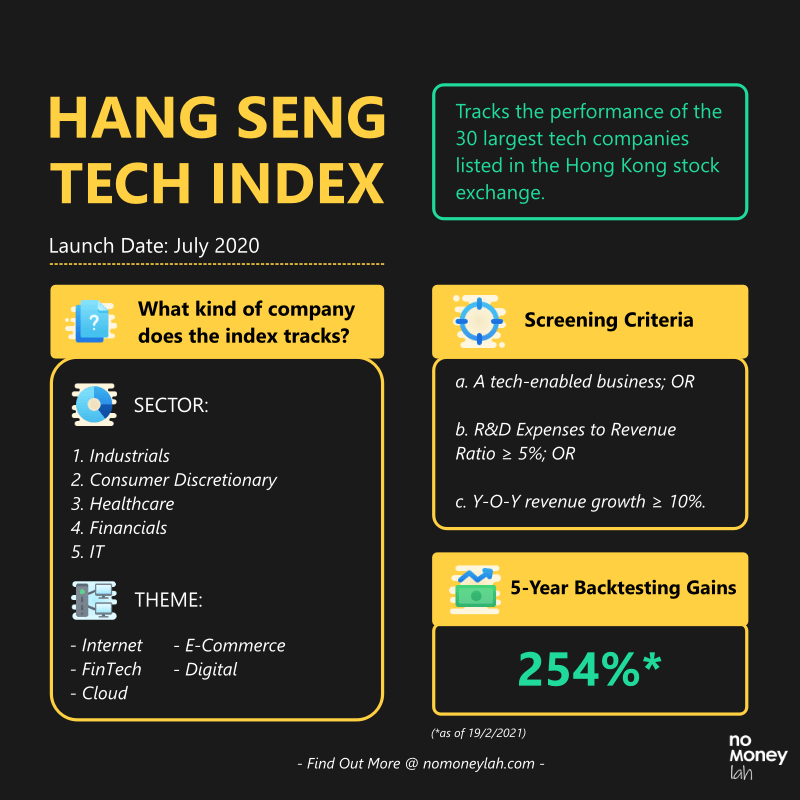

Introducing the Hang Seng TECH Index

Recently launched in July 2020, the Hang Seng TECH Index is an index that tracks the performance of the 30 largest technology companies listed in Hong Kong.

A. Highlights of the Hang Seng TECH Index:

- The Hang Seng TECH Index tracks the performance of the 30 largest technology companies listed in the Hong Kong stock exchange. In order to be part of the index, these companies also need to be incorporated in Greater China (ie. Mainland China, Hong Kong, Taiwan & Macau).

p - Some notable companies that made up the component of this index include Tencent, Alibaba, Xiaomi, Lenovo, and more.

p - One cannot invest directly at the index. Instead, we can do so via ETFs that track the index – such as the CSOP Hang Seng TECH Index ETF (ticker: 3033).

p

B. What goes into the Hang Seng TECH Index?

Now, not all tech companies listed in the Hong Kong stock exchange can be part of the index. To become a component of the index, a tech company needs to fulfill the following:

- A company must be part of the Industrials, Consumer Discretionary, Healthcare, Financials, or Information Technology sector.

p - The company must revolve around the theme of Internet, FinTech, Cloud Technology, E-Commerce, or Digital.

p - In addition, the company must be:

- A tech-enabled business (via mobile/internet platform); OR

- Has an R&D Expenses to Revenue Ratio of equal to or more than 5%; OR

- Has a year-on-year revenue growth of equal to more than 10%.

As a result, these screening criteria ensure that only tech companies with a respectable prospect & growth can become part of the index.

p

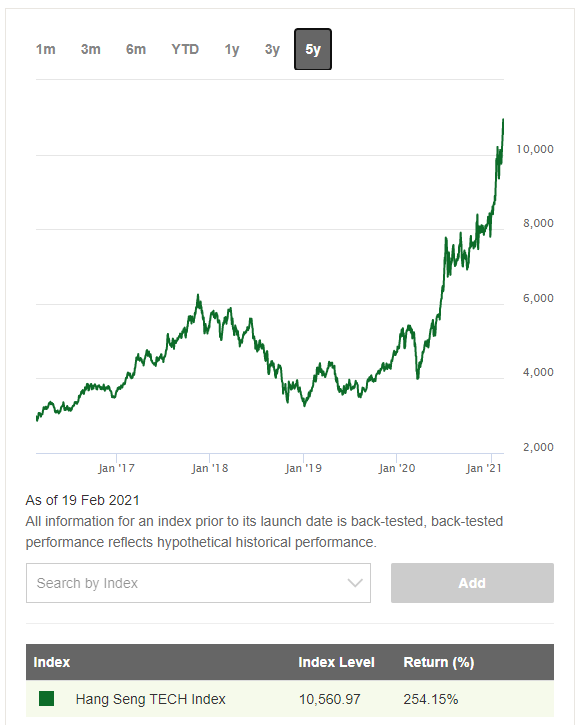

C. Hang Seng TECH Index Performance

Since the index is a newly launched index in 2020, there are not many details on its exact performance (yet).

However, based on the 5-year back-tested result of the index, it would have posted a gain of 254% – which I think is very respectable.

p

How to Invest in the Hang Seng TECH Index?

An index is not something that one can invest in directly. Instead, investors can invest in Exchange Traded Funds (ETFs) that track the performance of the index.

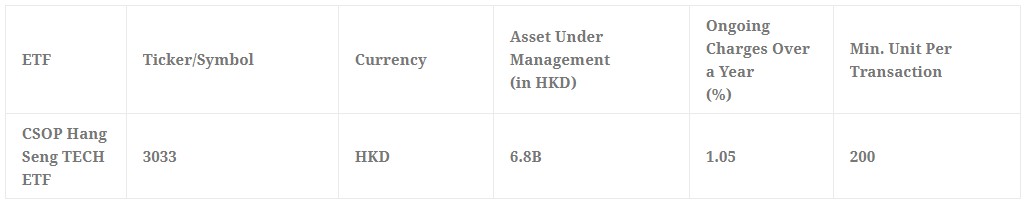

One such ETF is the CSOP Hang Seng TECH Index ETF. This is an ETF that tracks the performance of the Hang Seng TECH Index, where investors can invest even with small capital.

p

CSOP Hang Seng TECH Index ETF: Your Gateway to Invest in Top Chinese Tech Companies – All at Once

The CSOP Hang Seng TECH Index ETF (ticker: 3033) is the world’s 1st listed ETF to track the Hang Seng TECH Index.

To ensure the best performance tracking, the ETF uses a full-replication strategy. What this means is that the ETF will invest funds directly into the companies that make up the index.

As an example, if Company A makes up 8% of the Hang Seng TECH Index, then CSOP Hang Seng TECH Index will have about the same proportion of holdings on Company A’s shares.

One amazing thing about investing in this ETF is it allows investors to invest in a basket of Chinese tech stocks even with small capital.

Let’s say CSOP Hang Seng TECH Index ETF is trading at HKD9.85 (~RM5.15) per unit. Since this ETF only has a minimum entry barrier of 200 units, an investor only needs to have less than HKD2000 (~RM1050) to gain exposure to a basket of growing Chinese tech companies. [HKD9.85 * 200 units = HKD 1970 (~RM1027)]

READ MORE: CSOP Hang Seng TECH Index ETF Official Site

p

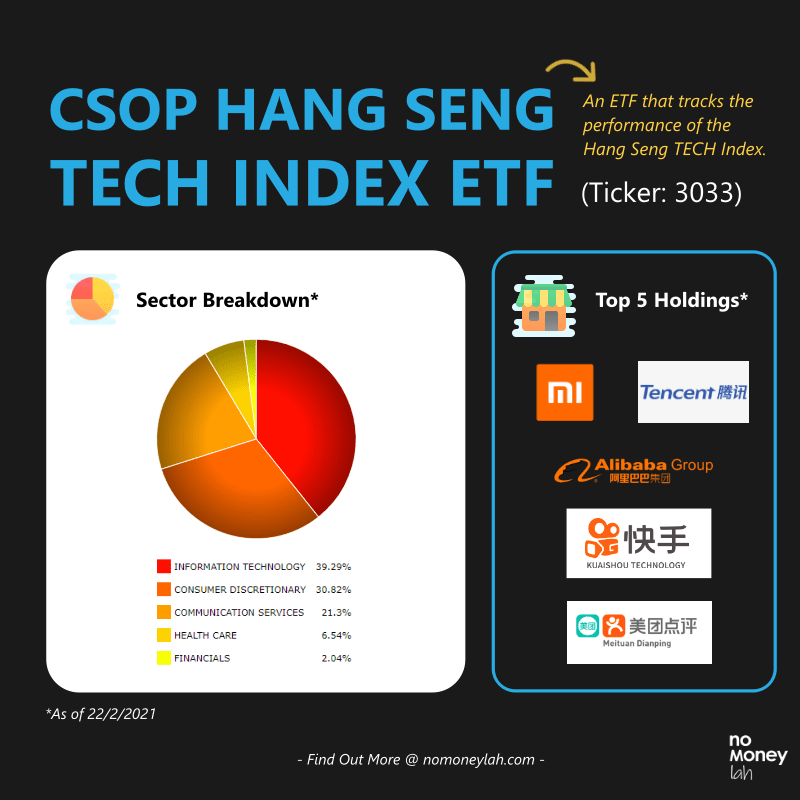

Top Holdings of the CSOP Hang Seng TECH Index ETF

The Hang Seng TECH Index is made up of tech companies mainly from the Information Technology, Consumer Discretionary, and Communication Services sector.

Here are the notable companies from the top holdings of the CSOP Hang Seng TECH Index ETF (as of 22nd Feb 2021):

#1 Xiaomi Corporation (Approx. Weightage: 8.59%)

All of us know Xiaomi as a major world’s smartphone brand. However, the company has been expanding its own brand ecosystem into products like laptops, smart home appliances, mobile apps, and more.

p

#2 Tencent Holdings (Approx. Weightage: 8.23%)

Tencent is a Chinese multinational tech conglomerate that is most known for owning WeChat, China’s top social mobile application.

But Tencent is MORE than that. Tencent is also one of the largest venture capital and game vendor in the world, with notable titles such as PUBG under its portfolio.

Tencent’s business also covers music, payment system, internet services, and more.

p

#3 Alibaba Group (Approx. Weightage: 8.21%)

Alibaba needs no extra introduction. Alibaba’s dominance in e-commerce and internet technology via platforms like Taobao, Tianmao, AliPay, and more truly propels the company to be one of the top tech companies in the world.

p

#4 Kuaishou Technology (Approx. Weightage: 7.96%)

I am sure you have heard of TikTok. Kuaishou is the rival of TikTok which has just become a publicly listed company in early 2021.

Through Kuaishou, the company’s 769 million monthly active users are able to post short videos and even do live-streaming on the platform.

With such a huge userbase, Kuaishou makes money through its live streaming business, ads & online marketing, and more.

p

p

#5 Meituan Dianping (Approx. Weightage: 7.75%)

Think of Grabfood/Foodpanda + Foursquare + TripAdvisor + Fave. Meituan Dianping is the Chinese version of all of these services – at a much larger scale.

Essentially, Meituan Dianping is made up of 2 apps (Meituan & Dianping). These are the must-have apps in China for food delivery, restaurant and destination reviews, and more. During my 1-month stay in Shanghai & Hangzhou in 2019, both Meituan and Dianping are my go-to app to order food, check out travel destinations, and more.

p

What You Need to Know + Risks of Investing in Hang Seng TECH Index

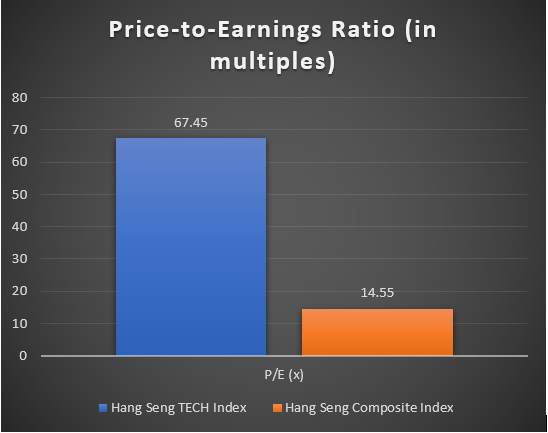

#1 Higher than Average Valuation

Since the companies in this index are generally growth companies, you should note that the index tends to trade at a higher valuation.

As of January 2021, the Hang Seng TECH Index has a price-to-earnings (P/E) ratio of 67.45x. In comparison, the Hang Seng Composite Index has a price-to-earnings (P/E) ratio of 14.55x during the same period.

In short, investors should be willing to pay a premium for investing in high-growth tech companies.

#2 Volatility of Business & Political Nature

Investors that are looking to invest in the Hang Seng TECH Index should also be aware of the volatile nature of the tech sector.

With stiff competition and the risk of Chinese government intervention, investors should take into account of higher than usual price fluctuation of the individual component companies and the index itself.

That said, the risks of investing in the index are lower relative to investing in the shares of individual Chinese tech companies.

Thanks to the screening requirement of the index, the components of the index are always updated with the most competitive Chinese tech companies, while leaving the obsolete ones out of the way.

p

Who Should Invest in Hang Seng TECH Index ETF?

The offering from the Hang Seng TECH Index ETF is certainly very appealing, but is it for you?

In my opinion, this ETF can be considered if you fall into either one of the categories below:

- Investors looking to diversify their portfolio into a basket of fast-growing Chinese tech sector.

p - Investors with limited capital (which makes it hard to purchase individual shares), but would like to gain exposure in the Chinese tech sector.

p

My Recommended Broker to Invest in CSOP Hang Seng TECH Index ETF (Ticker: 3033):

As you may have guessed by now, CSOP Hang Seng TECH Index ETF is not listed locally. Instead, it is being traded in the Hong Kong stock exchange in Hong Kong Dollar (HKD).

As such, you’ll need a reliable stock broker with access to the Hong Kong stock exchange in order to invest in this ETF.

If you do not have a stock broker, I’d highly recommend Tiger Brokers to you. Tiger Brokers is my go-to regulated stock broker that provides all-in-one access to markets such as the US, Singapore and Hong Kong stock market – all at a highly competitive fee.

Check out my full review on Tiger Brokers HERE.

ALSO READ: How to Invest in Your First Stock via Tiger Brokers

p

No Money Lah’s Verdict

So here you go! If you have been looking for an affordable way to invest in the top Chinese tech companies, I hope you find this article useful!

Personally, I had such a great time writing this article as I have always been interested to invest in the Chinese tech scene for a long time.

How ‘bout you? Do you have any questions on the Hang Seng TECH Index? Feel free to let me know your thoughts & questions in the comment section below!

About CSOP Asset Management

I first discovered the Hang Seng TECH Index through CSOP Asset Management (AM).

If you have been investing purely in the Malaysia or US market, it is likely that you have not heard of CSOP AM before. However, CSOP AM is huge in the China & Hong Kong market:

- Established in 2008, CSOP AM is the first offshore entity established by a regulated Chinese asset manager with Hong Kong’s Securities & Futures Commission (SFC) type 1 (dealing in securities), type 4 (advising on securities) and type 9 (asset management) licenses.

p - With this background, CSOP AM manages the biggest renminbi (RMB) equity & fixed income ETF listed in offshore China.

p - In late 2019, CSOP AM sets up their office in Singapore, with the goal to bring China’s gradually opening capital market to Southeast Asia’s investors (psst… that’s us).

In essence, through CSOP AM ETFs, foreign investors like you and me have the opportunity to gain exposure to China’s growing capital market.

Disclaimer

The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please do your own research AND/OR reach out to a licensed financial planner before making any investment decision.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan,

I hv a foreign brokerage with Hong Leong bank. Can I access this etf thrust HLB? How r the sales charges like in comparison?

Hi Mano,

Apologies but I am unclear about the commission/fees involved for Hong Leong’s foreign stock brokerage account. You have make sure that your broker has access to the Hong Kong Stock Exchange, then you should be able to access this ETF. 🙂

Regards,

Yi Xuan