Last Updated on May 2, 2022 by Chin Yi Xuan

Say you’d want to start investing, but you have a few concerns below:

-

- You do not have much time and commitment to actively manage your investment.

- You are not familiar with reading financial reports from companies.

- You do not have a lot of capital to start investing.

If you belong to one or more of the descriptions above, learning about ETF WILL make your investing journey much easier and fruitful! Afterall, in my opinion, more Malaysians should certainly explore what ETF can offer in their investing journey.

p

Table of Contents

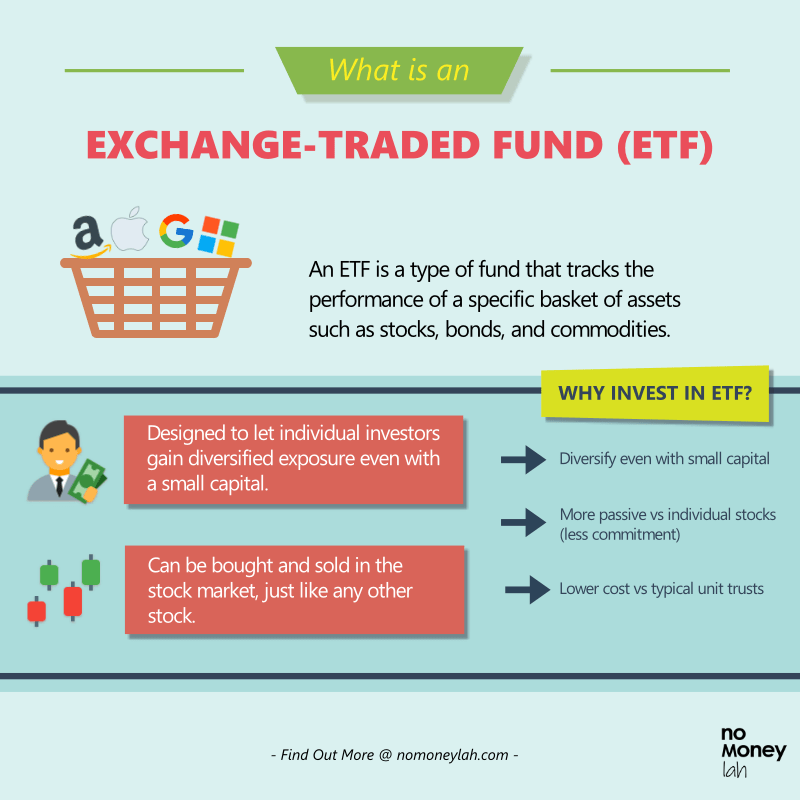

What is an ETF?

Exchange-Traded Fund, or ETF, is an investment vehicle that tracks the performance of a specific basket of asset classes such as stocks, bonds, and commodities:

- As an example, the CSPX or VUAA ETFs are ETFs that track the performance of the S&P 500 index. Since investors cannot invest in an index directly, investing in the CSPX or VUAA ETF allows investors to gain exposure to the S&P 500 index – ie. The performance of the 500 largest listed companies in the US.

p - An ETF is traded just like any stock in the stock market. This means that if you have a stockbroker, you can buy and sell ETF on your own during market hours.

Why Invest in ETF?

ETF is an amazing investing instrument for new and experienced investors alike, for several key reasons below:

#1 Diversified Exposure even with limited capital (vs individual stocks)

Unlike owning the shares of an individual company, ETFs hold a basket of assets mainly with the goal of tracking the performance of an index.

By doing so, ETFs allow investors to gain diversified exposure to the market even with a small capital.

As an example, say, an investor has a strong conviction towards the US stock market. Instead of buying up individual shares of companies like Microsoft, Apple, and Amazon (which can be capital demanding), one can invest in the CSPX or VUAA ETF instead.

This is because the CSPX or VUAA are ETFs that track the S&P500 index.

So, with 1 unit share of the VUAA ETF (~USD85.58/share as of the time of writing, equivalent to about RM360), an investor can now gain exposure to a basket of top US top listed companies.

p

#2 Passive in Nature – ie. Less Commitment (vs individual stocks)

Investing in individual companies is no easy task. Doing so requires active commitment from investors to keep up with the progress and financials of the particular company.

Let’s say if you are holding the shares of 20 individual companies. Assuming you are a (rare) responsible investor, then you’d always have to be aware of the financials and updates of the 20 companies – that’s a lot of work if you have a full-time work and family commitment!

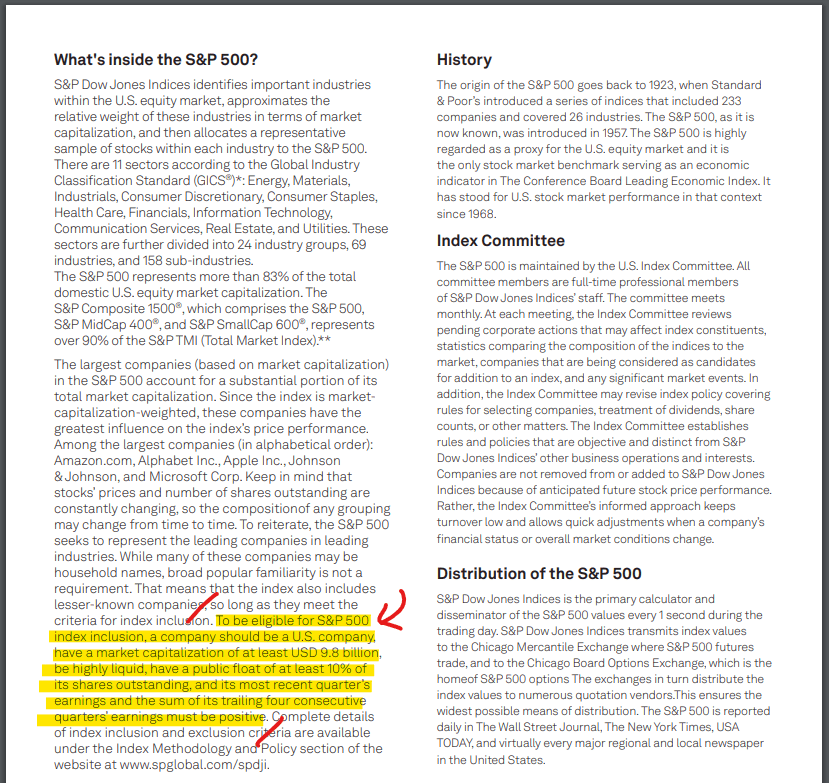

With ETF, investors can take a more passive approach towards their investment portfolio. Reason being, ETFs track the performance of an index (eg. S&P 500, KLCI). By nature, an index already has a set of selection criteria in place – where only certain companies can become a component of an index.

Hence, on a consistent basis, the index will rebalance itself by removing or adding new companies that fulfill the criteria into the component of the index.

As such, investors that invest in ETFs can take a more passive approach in their investing journey (and enjoy life) instead of having to keep up with the financials of individual companies.

p

#3 Competitive Cost (vs unit trust)

Generally, ETFs have low annual management fees when compared to unit trusts. This makes ETFs more affordable to invest in and maintain in the long run.

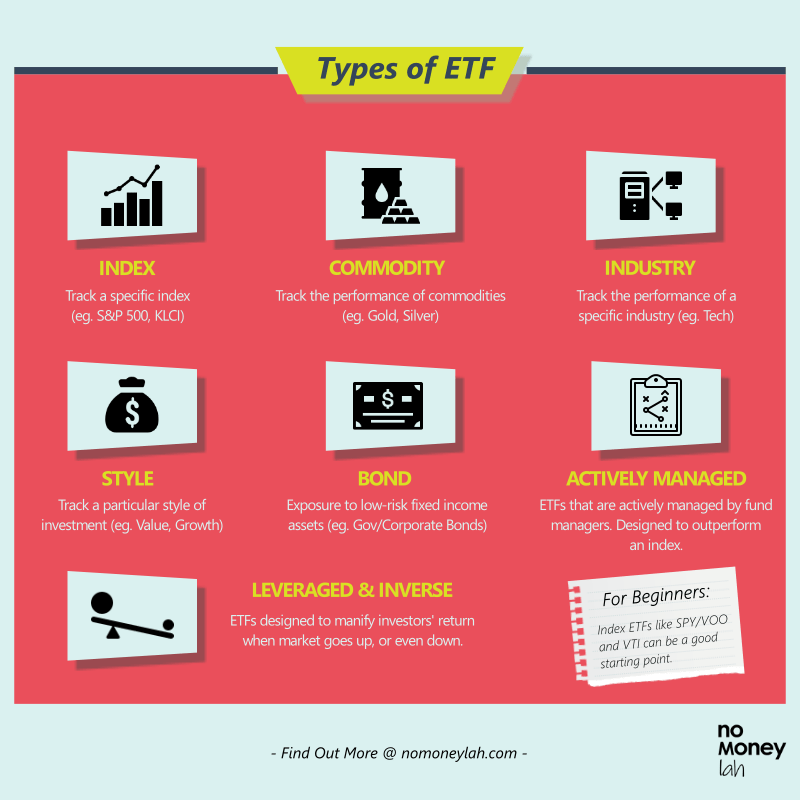

Different kinds of ETFs (+ Which one is for total beginners?)

An amazing thing about ETF is there are many types of ETFs in the market. Hence, depending on your conviction or interest, you can always find the suitable ETF investment for you in the market:

#1 Index ETF

An index ETF is an ETF that tracks the major index in the market (eg. S&P500, KLCI index).

An index ETF is the most well-known and easiest to understand ETF in the market. In my opinion, an index ETF that tracks a major index, is the most suitable for beginners to get started with.

A good example of an Index ETF is the iShares Core S&P 500 UCITS ETF (CSPX), or Vanguard S&P 500 UCITS ETF (VUAA). Both CSPX and VUAA track the S&P500 index, which reflects the performance of the 500 largest listed companies in the US.

More tips on things that you need to know while selecting an ETF later in this article.

p

#2 Commodity ETF

What if you want to have exposure to gold and/or silver in your portfolio – but have no interest to hold physical gold or silver bars at home?

A commodity ETF can do just that because it tracks the price of a specific underlying commodity, such as gold, silver, crude oil, and more.

Some examples are the TradePlus Shariah Gold Tracker (0828EA), SPDR Gold Shares ETF (GLD), and iShares Silver Trust (SLV).

p

#3 Industry ETF

Industry ETFs allow investors to gain exposure to a specific industry. It can be a broad-based industry diversification (eg. Tech sector), to a hyper-niche business segment exposure (eg. Work from home technologies).

Examples of industry ETFs are:

- Vanguard Information Tech ETF (VGT) – Exposure to the return of stocks in the information technology sector.

- CSOP Hang Seng TECH Index ETF (3033) – Exposure to the top 30 listed Chinese tech companies in the Hang Seng stock exchange.p

- Direxion Work From Home ETF (WFH) – Exposure to companies that stand to benefit from an increasingly flexible work environment. (eg. Cloud Technologies, Cybersecurity, Remote Communications)

p

#4 Style ETF

Style ETFs make it easy for investors to track a particular investment style.

Investment-style ETFs include value and growth. This is a great choice for investors that want to do a specific style of investing, but do not have time to study specific companies.

Examples of style ETFs are:

- TradePlus DWA Malaysia Momentum Tracker (MY-MOMETF) – Provide investors access to Malaysian stocks with high momentum movement in terms of pricing.

- Vanguard S&P Mid-Cap 400 Value ETF (IVOV) – Provide exposure to the US’s S&P MidCap 400 Value Index, an index made up of value companies from the S&P 400.

- Vanguard Growth ETF (VUG) – Provide exposure to US’s largest growth stocks (eg. Apple, Microsoft, Amazon).

p

#5 Bond ETF

Bond ETFs open up the opportunity for investors to invest in low-risk fixed-income assets like government or corporate bonds – even with a small capital size.

Examples of Bond ETFs are:

- ABF Malaysia Bond Index Fund (0800EA) – Provide exposure to Ringgit denominated government and quasi-government debt securities.

- Schwab Intermediate-Term U.S. Treasury ETF (SCHR) – Provide exposure to the low-risk US Treasuries with remaining maturities of 3 to 10 years.

p

#6 Actively Managed ETF

Unlike most ETFs which are passively managed (ie. Tracks an index), Actively Managed ETFs are ETFs that are actively handled by fund managers.

These ETFs are designed with the goal to outperform an index, but they also come with higher management fees as a result.

Examples of Actively Managed ETFs are:

- ARK Active ETFs from ARK Invest (ARKK, ARKQ, ARKW, ARKG, ARKF) – These are very popular ETFs among investors because they invest in highly innovative and future-proof industries.

p

#7 Leveraged & Inverse (L&I) ETF

L&I ETFs are unique and risky ETFs that allow investors to make the most out of an upside or downside move:

- Leveraged ETF like the Kenanga KLCI Daily 2x Leveraged ETF (0834EA) allows investors to make/lose around 2x the impact for every point that the KLCI moves.

- Inversed ETF like the Kenanga KLCI Daily (-1x) Inverse ETF (0835EA) allows investors to profit when the KLCI index goes down (and lose money when the KLCI index moves up).

For this, the L&I ETFs use leverage and derivative products (eg. Futures) to achieve their outcome/goal. Out of all the ETFs, I’d recommend novice/beginners to stay out of the L&I ETFs until they understand how leverage and derivative works.

What Do You Need to Know Before Investing in ETF?

#1 Must-Know: How does an ETF track its underlying index?

As you start to explore the world of ETFs, you’ll start to notice that there are many ETFs out there that track the same index. (eg. Both CSPX and VUAA ETFs track the S&P 500 index)

But why? Why are there so many ETFs that are doing the same thing in the market? We’ll explore several reasons, but one of them is due to the way these ETFs track their underlying index.

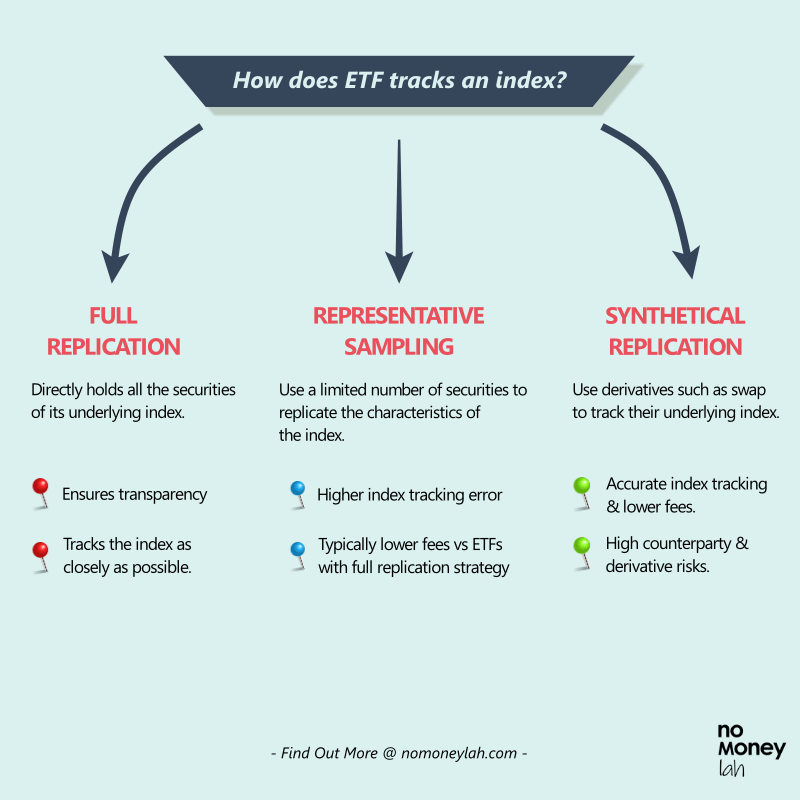

There are 3 major ways an ETF could track its underlying index:

a. Full/Physical Replication Strategy:

An ETF with a full replication strategy directly holds all the securities of its underlying index. This means that if an index has a 20% weightage in Apple, then the ETF will hold an equal proportion of Apple shares in its portfolio.

As a result, this transparent approach ensures that the ETF tracks the performance of the index as closely as possible. However, ETFs with a full replication strategy would normally incur slightly higher fees.

p

b. Representative Sampling Strategy

An ETF with representative sampling strategy creates a portfolio using a limited number of securities to replicate the characteristics of the index.

This approach is normally used due to taxation reasons, or when there’s limited liquidity in individual companies, making it hard for a full replication.

Compared to a full replication ETF, a representative sampling ETF tend to have a bigger margin of tracking error to its underlying index.

That said, the fees involved are usually more affordable too.

p

c. Synthetical Replication Strategy

Synthetic ETFs are handy when it is hard to directly gain access to the securities of a specific market. (eg. Developing countries’ stock market)

Instead of owning company shares directly, Synthetic ETFs use derivatives such as swap to track their underlying index. The benefits from this are (1) an effective tracking of the underlying index, and (2) the cost of investing in them is also lower.

However, without going too technical, Synthetic ETFs are relatively riskier than the other ETFs mentioned above due to counterparty and derivative risks.

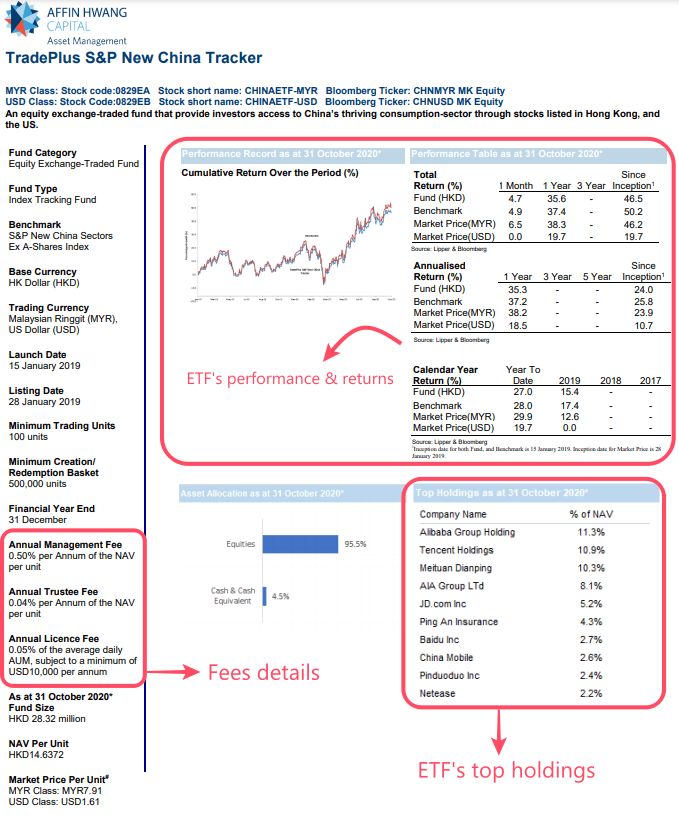

#2 Must-Know: Fees & Expenses (Expense Ratio)

While investing in ETFs, you have to be aware that there will be an additional annual fee involved aside from your usual brokerage fees and stamp duty while transacting in the stock market.

This fee is what we call an Expense Ratio. Usually expressed as a percentage (%), the expense ratio is a combination of management & operational fee required to maintain and rebalance the ETF.

That said, the expense ratio of ETF (0.05% – 1.00%) is usually lower compared to unit trusts (0.50% – 2.00%). Reason being, most ETFs are passively managed – ie. They track the index, hence there is no need for the fund manager to actively research or analyze stocks.

a. Another thing you need to know is how ETFs expense ratio is deducted:

As an example, let’s say an ETF has an annual expense ratio of 0.30. This means the ETF manager would deduct 0.30% from the ETF’s assets on an annual basis.

In other words, if the ETF’s total return during a year is 10%, then the net return for the investors would be 9.70% (or $3 for every $1,000 invested).

p

b. ETF Fees ≠ The lower the better

ETFs with the lowest expense ratio are not always the best ETF to buy. It is crucial for you to compare apples-to-apples.

For example, make sure you are comparing the ETF that tracks the same index. Also, do take note of the replication strategy used – a full replication ETF usually has a higher expense ratio compared to an ETF with representative sampling strategy.

#3 Must-Know: Read the ETF’s factsheet/prospectus before you invest

How can you find out if which replication strategy an ETF is using? Or what’s the expense ratio of the ETF? How about the latest stock holdings of the ETF?

To do so, the most straightforward way is to go to the ETF’s official website and download the ETF’s factsheet and prospectus.

How to Invest in ETF?

Method 1: Investing on your own

Investing in ETF requires you to have a stock brokerage account, because you can buy and sell ETFs in the stock market like any other listed company.

For Malaysia-listed ETFs, I’d recommend Rakuten Trade. Check out my full review on Rakuten Trade HERE.

For overseas-listed ETFs (eg. US, SG, HK), my go-to broker would be Tiger Brokers. Check out my full review on Tiger Brokers HERE.

As for overseas-listed ETFs in the UK and Europe (eg. Ireland-Domiciled ETFs), I’d be using ProperUs from CGS-CIMB. Check out my full review on ProsperUs HERE.

STEP-BY-STEP: How to invest in your first overseas stock via Tiger Brokers?

STEP-BY-STEP: How to invest in your first Malaysian stock via Rakuten Trade?

Method 2: Investing passively via Robo-Advisors

If you are tight on time, or are not interested to choose your own ETFs, then opting for robo-advisors like StashAway, Syfe, and Wahed are great investment alternatives.

Generally, robo-advisors invest utilize ETFs to help you construct your investment portfolio based on your risk profile. The good thing is once you set up everything then you can just deposit and let the platform does the investment on your behalf. The downside is you do not have much say over which ETF to buy after setting your initial risk profile.

READ: Wahed Robo-Advisor Review

READ: Syfe Robo-Advisor Review

Getting Started: Investing in Malaysia-listed ETFs

If you are just getting started with ETF investing, or are thinking to invest on a consistent basis, here’s a list of ETFs to get you started:

At the moment, there are 20 ETFs listed in the Malaysian stock market. These ETFs allow investors to diversify to not just local stocks, but also foreign stock markets (US, China, ASEAN), as well as commodities like gold. For more information on Malaysian listed ETFs, click HERE.

That said, for starters, consider finding out more on:

- Best dividend-paying ETFs listed in Malaysia!

- Best performing Malaysia-listed ETF (coming soon!)

- Best Malaysia-listed ETF to gain exposure in China

Getting Started: Investing in overseas-listed ETFs

There are hundreds and thousands of ETFs all over the world to choose from, and it can be overwhelming especially for new investors.

Hence, if you are new, I’d suggest starting out with index ETFs, such as ones that track the S&P500 index. Once you are more experienced, you can consider some other types of ETFs.

- How to invest in the S&P500 index for non-US residents

- Guide: Invest in Singapore REIT ETFs for consistent dividends!

Who Should Invest in ETF?

- New/novice investors looking to build a long-term investing routine, such as investing on a monthly basis. Index ETFs such as the CSPX or VUAA (Ireland-Domiciled S&P500 ETFs) are a great start.

p - Investors that are bullish towards certain sectors in the market can look to Industry ETF to add exposure to their portfolio. (eg. Tech sector ETFs – VGT, QQQ, 3033)

p - Investors with time constraints who would like to invest passively should definitely consider ETFs over individual stocks.

p - Investors with a small investment capital can look to diversify their investments via ETF.

No Money Lah’s Verdict

So here you go! If you are totally new and would like to start investing, I hope this article has been helpful!

In my opinion, new investors should absolutely consider ETF (especially major index ETFs) as it is a great solution for investors to get diversified exposure to the investing world at a small capital.

Are you planning to invest in ETFs soon? Or if any, do you have any questions about ETF?

Feel free to let me know in the comment section below!

Disclaimers

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

January 14, 2022

ETF: Best Dividend-Paying ETFs in Malaysia

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan, which platform do you think if safe to invest for foreign ETF such as VTI, etc for the long term say 10-20 years? Thanks

Hi Joe!

Personally for foreign stocks and ETFs, I am using Tiger Brokers, which is a broker regulated by the Monetary Authority of Singapore. Check out my full review below:

https://nomoneylah.com/2020/10/30/tiger-brokers-review/

Regards,

Yi Xuan

Very informative article, I definitely enjoyed reading it and learned from it.

Would like to get some advice, do you invest in multiple ETFs at the same time? Or do you just pick one and stick to it by doing DCA dollar cost averaging)?

Would really appreciate your reply! Thanks a bunch.

Hi Farhan,

I personally invest in only one ETF at the moment, and also getting ETF exposure via robo-advisor like StashAway and Wahed. So technically I have exposure to multiple ETFs and also doing DCA.

If you are less experienced with investing, can consider sticking to DCA on S&P500 ETF. 🙂

https://nomoneylah.com/2021/04/02/stashaway-review/

Regards,

Yi Xuan

Hi Yi Xuan,

Thank you for your reply!

Hi Yi Xuan,

Would be great to know the pros and cons or differences between investing in local ETFs and overseas ETFs. I’m not sure if you already have an article about this. If you do, would appreciate to have the link! Thank you.

Hello To Xuan,

I want to know if investing in S&P 500(Vanguard) is there any other fee than the main fee of 0.03%.

To make it simple, me buying part of Tesla and apple share, do these company take some fee. Thanks

Hi,

Aside from brokerage fee when you buy/sell, the 0.03% fee should be the only ETF fee involved for VOO.

Regards,

Yi Xuan

I’m a complete beginner. I heard that only Index Fund can be set automated monthly investment directly from our bank account. Is that true? I’m thinking to either buy QQQ or CSPX automatically every month.

Hi Adelia,

You can consider using StashAway Flexible Portfolio to build an ETF portfolio consisting of QQQ and/or S&P500 (IVV) + automate your investments monthly.

My review on Flexible Portfolio: https://nomoneylah.com/2023/05/01/stashaway-flexible-portfolios-review/

Regards,

Yi Xuan

Thanks for sharing. Is the minimum share we must buy is one unit of the said etf. Can we buy 0.5 unit of the said etf if the price is too high?

Hi Ronnie,

Most brokers usually offer ETF in 1 full unit. But brokers like Rakuten Trade and IBKR offer fractional shares which means you can buy ETF in less than 1 unit.

IBKR review: https://nomoneylah.com/2023/01/07/interactive-brokers-review/

Rakuten Trade review: https://nomoneylah.com/2023/04/17/rakuten-trade-us-trading-review/

Regards,

Yi Xuan