Last Updated on May 1, 2022 by Chin Yi Xuan

Trading is a business that requires skills and knowledge. Moreover, what you choose to trade is also equally important, as every market offers different opportunities over another.

In this article, I’d like to share why I purely trade futures over stocks, and how you can learn to trade futures risk-free via Kenanga Futures ‘Experience Futures Today’ campaign!

p

Table of Contents

Highlights of Futures

- Futures represent an agreement to buy or sell an asset at a future date at an agreed-upon price.

p - For everyday traders like ourselves, our goal is to seek value & profit from price changes in the futures market, which is very similar to stock trading. (ie. Buy high sell higher/short-selling)

p - There are many types of futures products to trade such as Indices, Commodities, Metals, and Energy.

p - From today to 23rd May 2021, you can learn how to trade futures risk-free via Kenanga Futures ‘Experience Futures Today’ campaign! Experience perks like weekly webinars, 1-on-1 coaching, and virtual trading game to win prizes up to RM13,000!

p

What are Futures?

Let’s start by answering an important question: What are futures?

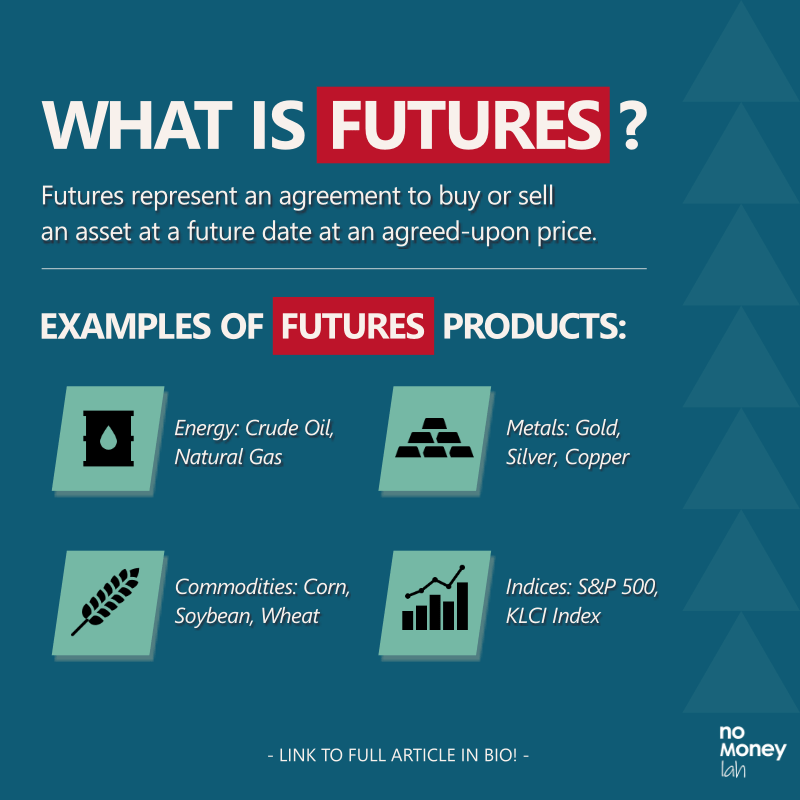

Futures represent an agreement to buy or sell an asset at a future date at an agreed-upon price.

Let’s imagine you run a bakery business and your main ingredient is flour. Logically, any price fluctuation in flour would affect your profit margin. So, if you foresee a potential increase in flour price in the near future, what can you do?

One way you can protect yourself (a.k.a. hedge) against this is by entering into an agreement with a flour supplier today. In this agreement, you and the supplier would agree to transact flour one year from now (May 2022) with today’s price (May 2021).

Hence, if the price of flour does increase a year from now, you are protected against the price hike as you have secured your flour with a cheaper price – neat business decision!

p

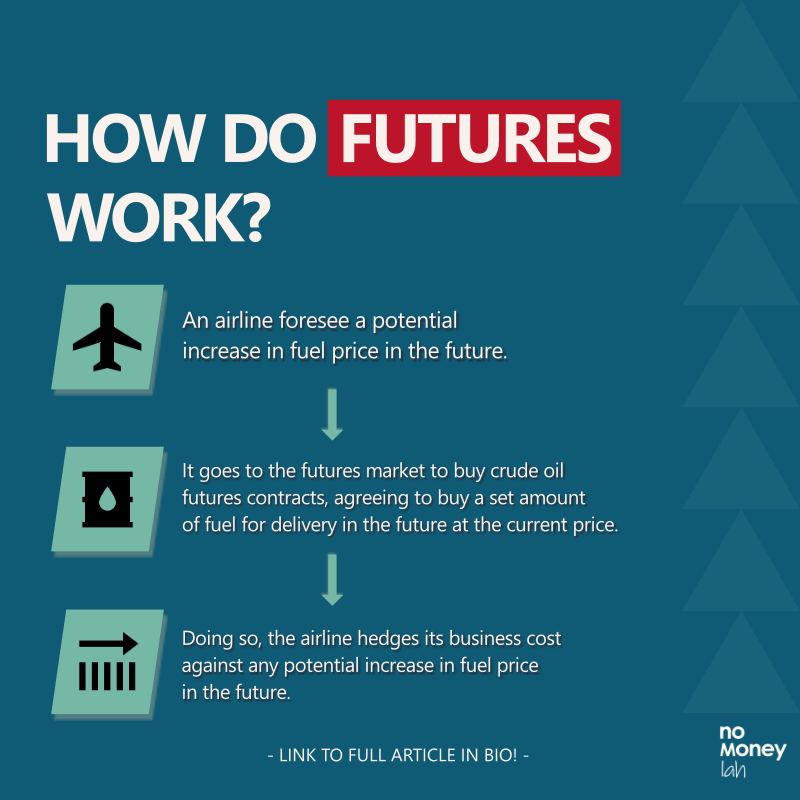

How do Futures work?

The example you have just read above is an extremely common practice among businesses.

Consider companies like AirAsia and its fuel supply:

Let’s say AirAsia wants to lock in its fuel prices to avoid an unexpected increase in price. So, what they’ll do is to buy a contract in the futures market, agreeing to buy a set amount of fuel for delivery in the future at a specified price.

In this case, AirAsia uses the futures market to protect themselves from unexpected risk and price swings in fuel supply.

p

What does the Futures market mean for everyday traders like you and me?

While the futures market is often used for hedging by businesses, it is also a great market for traders to participate in to express their trade ideas.

In other words, we do not participate in the futures market to exchange for a product in the future.

Instead, our role is simple: to seek value & profit from price changes in the futures market itself (eg. Buy high sell higher/short-selling). If the price of crude oil rises, the futures contract itself becomes more valuable, and traders could sell it for more in the futures market.

Through the futures market, traders gain access to various types of products, such as:

-

- Energy: Crude Oil, Natural Gas etc.

- Metals: Gold, Silver, Copper etc.

- Commodities: Soybean, Corn, Wheat etc.

- Indices: S&P 500, NASDAQ, Dow Jones Industrial Average, KLCI Index etc.

As an example, a trader could be anticipating a rise in gold price in the near future. Instead of buying physical gold (which can be troublesome), the trader can express his/her opinion by buying a gold contract via the futures market. Soon, if the price of gold does go up, the trader can sell off the contract in the futures market and make a return with the difference in price.

p

Futures vs Stock Trading: Why I purely trade Futures over stocks

Usually, most people would relate trading to stocks. That was my initial assumption too when I was first exposed to trading.

That said, if you are embarking on your trading journey, you should really consider checking out the futures market as well. Below are 5 reasons why I purely trade futures over stocks:

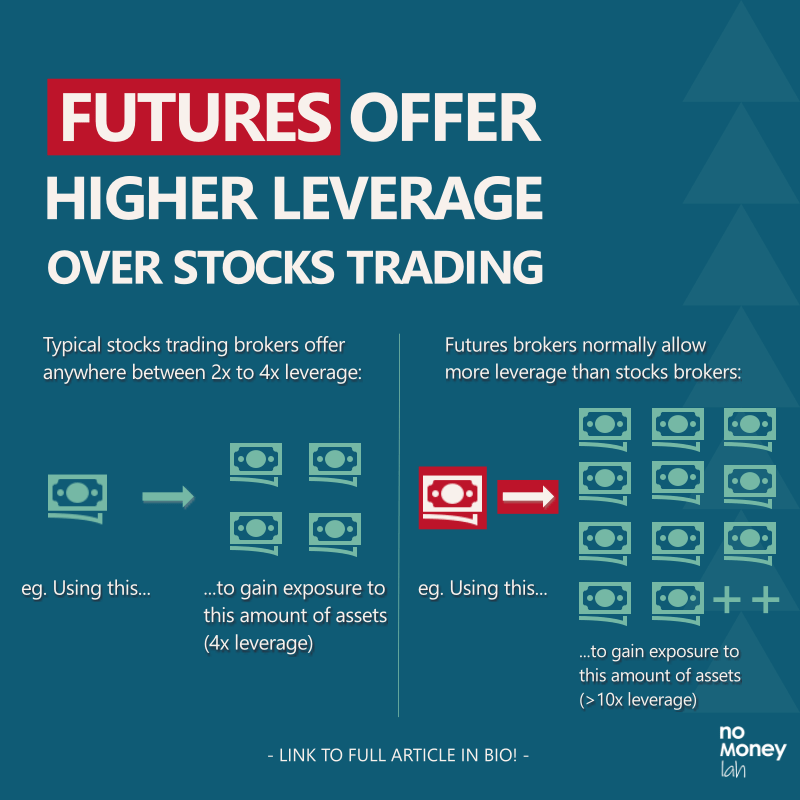

#1 Futures offer Higher Leverage

Leverage is the buying or selling of an asset by paying only a portion of the price, while the remainder is covered by a lender (ie. Our brokers). While I do not recommend people to invest using leverage, but when it comes to trading, having and knowing leverage well can be very powerful.

Generally, typical retail stock trading brokers offer traders anywhere between 2:1 to 4:1 leverage. So, let’s say a stock trader wants to trade 100 units of Apple shares ($130/share), which sum up to $13,000. With a 2:1 leverage, the trader will need to fork out $6500, which is half the capital needed in order to trade.

On the contrary, the leverage offered in the futures market is more generous. Most futures broker normally offers a margin requirement between 3% – 12%. So, let’s say I want to trade an E-Mini S&P 500 futures contract that’s worth $205,000 ($50 Multiplier * 4100 Index Price), I’ll only need $10,250 (assuming 3% margin) in my account to execute my trade.

In other words, my leverage is 20:1, where I’ll need only $10,250 capital to trade $205,000 worth of asset.

Through the futures market, traders can trade a large futures contract with a relatively small amount of capital.

One important thing before we proceed: Leverage is a financial tool that comes with its advantages and risks. Please learn and understand both the upsides and downsides of leverage before using it in trading.

p

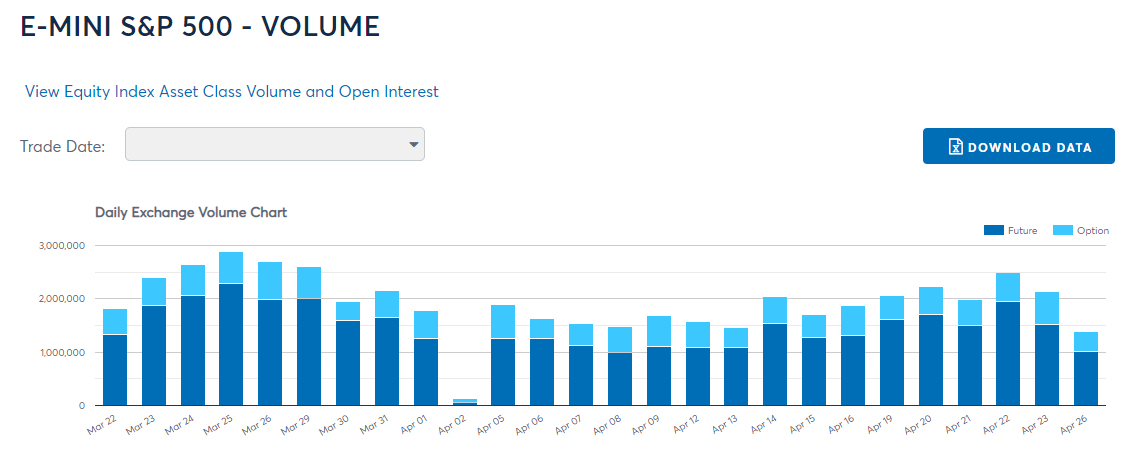

#2 Liquidity & Transparency

The stock market is a relatively fragmented market compared to the futures market. As an example, there are 13 stock exchanges in total in the US.

On the other hand, the futures market is very consolidated. In the US, there are 2 major futures exchanges (The CME Group & Intercontinental Exchange (ICE)). Hence, all futures transactions must go through these exchanges, leading to concentrated liquidity and volume.

As a result, concentrated futures liquidity allows buyers and sellers of futures contracts to be matched at the desired price easily & accurately.

In addition, important indicators such as volume, open interest, and bid/offer spread are transparent and available readily for traders. Having these data is crucial as they offer better clarity to traders to make better trading decisions.

p

#3 Less Restriction Compared to Stock Trading

As traders, having the freedom to express our opinions into a trade idea is crucial. Meaning, I’d want to have the least friction on when and how I should long or short the market.

However, the stock market is embedded with rules that may not be best in favor of traders. As an example, the Regulated Short Selling (RSS) program only has limited securities that traders can short. Furthermore, limits are imposed to prevent excessive short-selling activities.

In comparison, there is no such restriction in the futures market and traders are free to express their trade ideas in any direction.

p

#4 Better Focus

In stocks trading, traders would need to go through hundreds of stocks in search of the ones that’d actually move in accordance with their strategies. It is common to see stock traders having multiple stocks that they are monitoring. The combined effort of filtering and monitoring multiple stocks can be overwhelming.

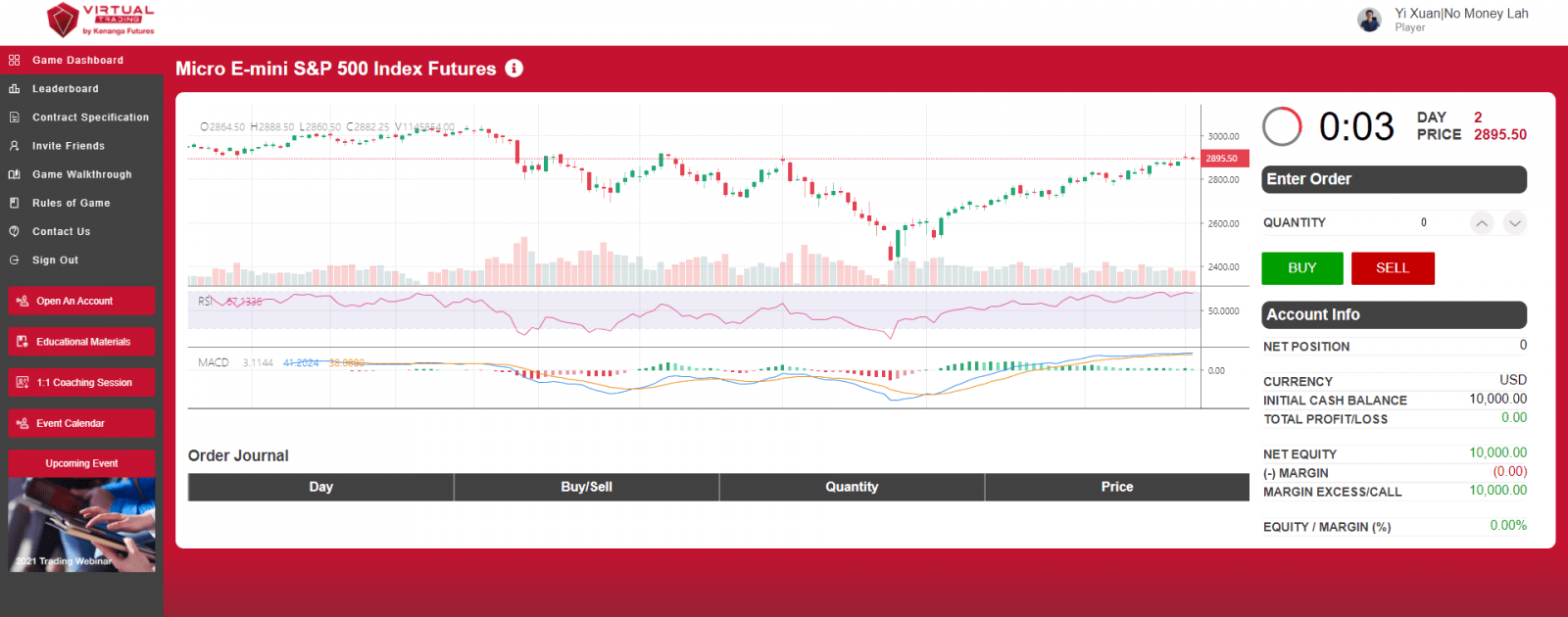

On the other hand, most futures traders usually need to focus on only 1 or 2 futures products to trade. More so, I have seen traders trade only 1 to 2 products, and make a full-time living out of it. Personally, I am trading purely the E-Mini S&P 500 futures, which gives me enough movement and volatility to execute trades most of the day.

p

Experience Futures Today by Kenanga Futures: Learn futures trading risk-free (& get rewarded!)

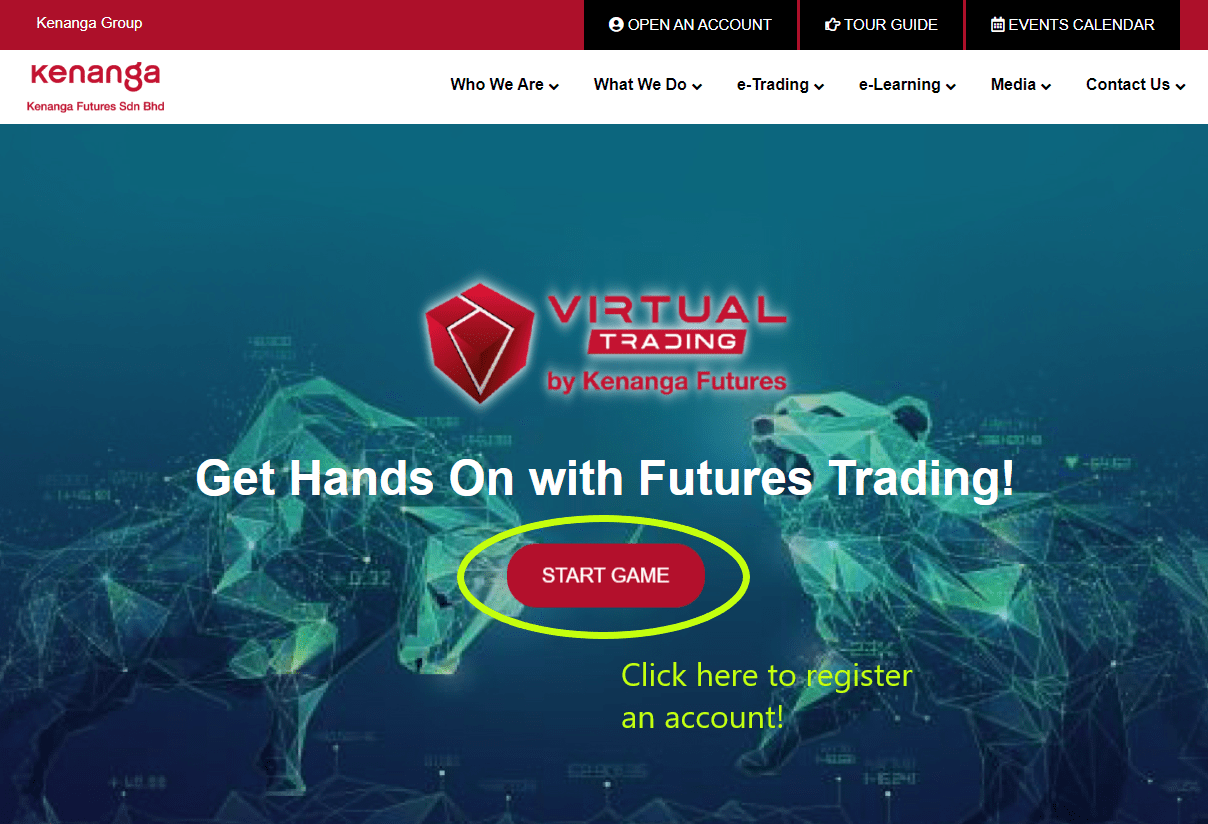

Now, it is impossible for me to go through futures trading in detail in a short article like this. But don’t fret, because now you can learn about futures trading risk-free via the ‘Experience Futures Today’ campaign by Kenanga Futures!

From today until 23rd May 2021, the ‘Experience Futures Today’ campaign by Kenanga Futures allows traders to learn about futures trading. In my opinion, it is great for people that are keen to start trading, but not quite sure how. Below are the highlights of the campaign:

p

Part 1: Virtual Futures Trading Game with total prizes worth RM13,000 to be won!

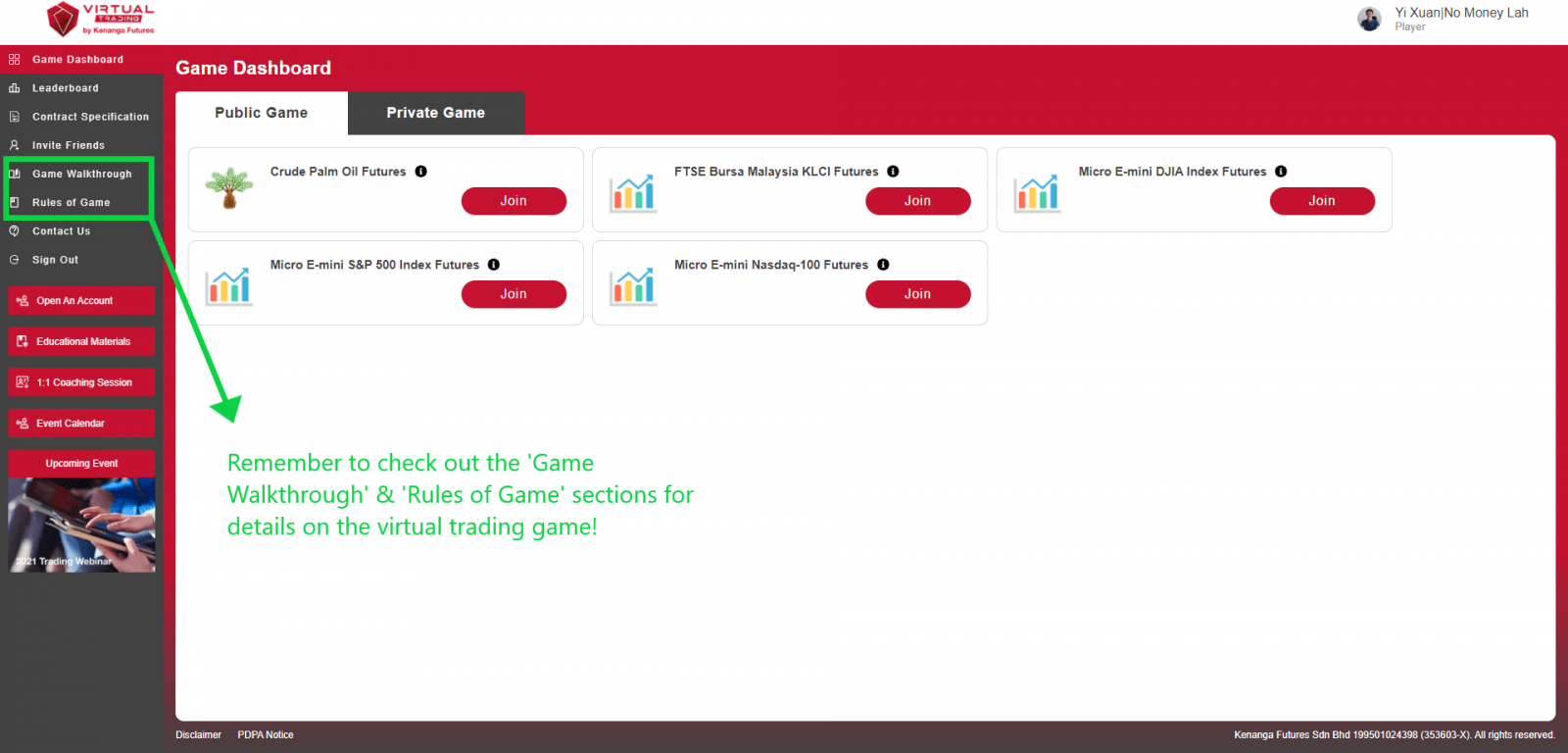

To start, Kenanga Futures has created a virtual trading game for you to get a taste of futures trading.

On a weekly basis (until 23rd May 2021), you’ll be able to participate in a virtual trading game for different futures products:

- 3rd – 9th May 2021: Gold, Silver, and Copper Futures

- 10th – 16th May 2021: Soybean, Soybean Oil, Corn, and Wheat Futures

- 17th – 23rd May 2021: Hang Seng Index and Hang Seng China Enterprises Index Futures

p

Before you start, be sure to click on the ‘Game Walkthrough’ and ‘Rules of Game’ sections as they provide guides on how to play the game and execute your trades virtually.

After reading the guide, you can now pick any futures product and start your virtual trading game!

p

Every week, the top 10 ranking players with the highest accumulated Return of Investments (ROI) in the leaderboard for each futures product will win up to RM200 worth of Grab food vouchers. Even better, you can participate in trading more than one futures product so you can win even more Grab food vouchers!

For the full terms & conditions, click HERE.

p

Part 2: Weekly Webinars on Futures Trading

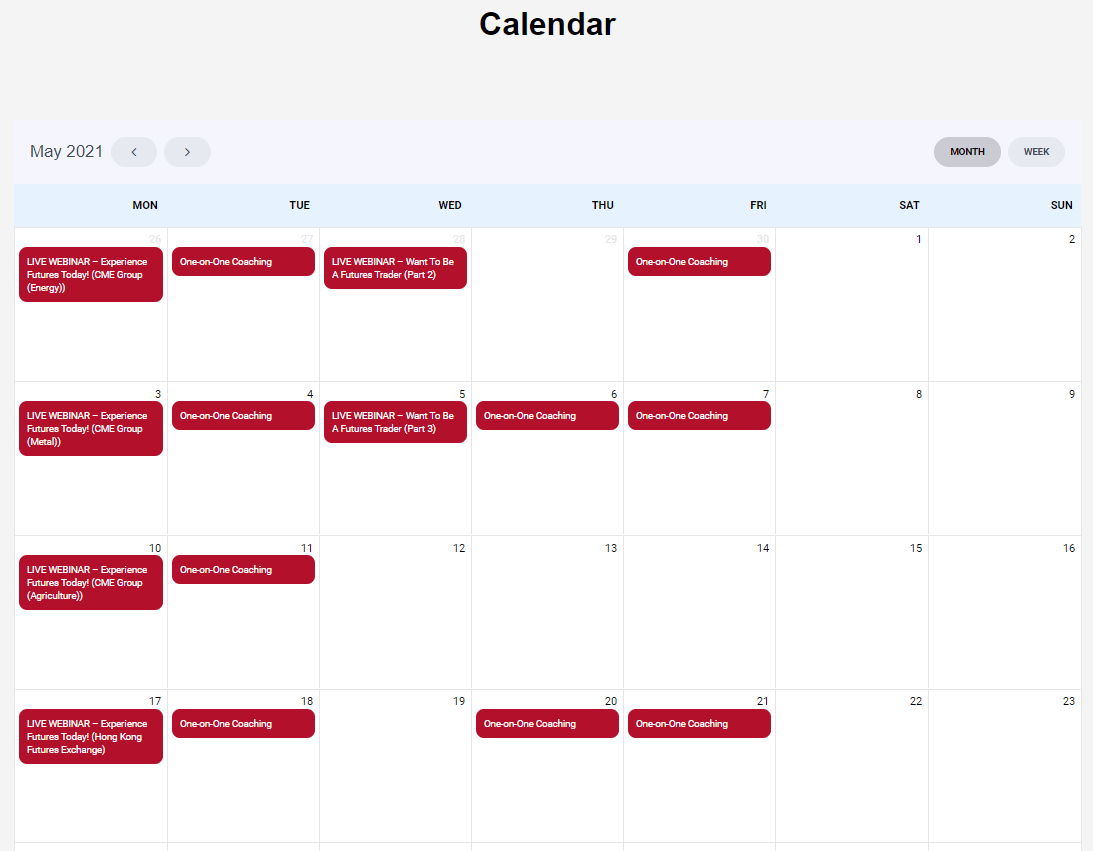

Every Monday and alternate Wednesday, the ‘Experience Futures Today’ campaign will also organize webinars on futures trading and products.

Through these webinars, you can learn more about futures trading and the characteristics of specific futures products such as metal and agriculture futures.

p

Part 3: Free 1-on-1 Coaching on Futures Trading

Perhaps my favorite perk of this campaign, is you can book a free 1-on-1 coaching session to learn more about futures trading.

These sessions happen every Tuesday, Thursday, and Friday on a first-come, first-serve basis.

During the coaching session, you can learn about risk management, fundamental & technical analysis in the futures market, and how to use Kenanga Futures’s proprietary KDF TradeActive Platform.

p

How to Join the ‘Experience Futures Today’ Campaign?

The ‘Experience Futures Today’ Campaign by Kenanga Futures is open to all Malaysians above the age of 18, including permanent residents living in Malaysia.

To participate, just register an account at www.kenangafutures.com.my/kfvt/. Once you have completed your registration, you will have full access to the virtual trading game and all the other perks that come with this campaign!

If you are looking to learn about the potential of futures market to your trading journey, certainly check out what the campaign has to offer!

p

Final words on Futures Trading

As a trader that is working to improve my craft everyday, I can firmly say that trading is not easy. However, with proper guidance on how futures work, as well as deliberate practice, one can increase his/her odds of succeeding in the markets.

The key here is to treat trading as a serious business that takes time to grow, and not a shortcut to make you rich fast. Learn well, trade well!

Disclaimer:

This article is kindly sponsored by Kenanga Futures. The timing for this article is perfect because as a futures trader myself, I have always wanted to share about futures trading with you all.

For the full terms & conditions of the ‘Experience Futures Today’ campaign, click HERE.

Leverage is a financial tool that comes with its advantages and risks. Please learn and understand both the upsides and downsides of leverage before using it for trading.

Related Posts

January 3, 2024

How to Make Your First Trade on Rakuten Trade? (MY stocks)

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.