Last Updated on January 12, 2024 by Chin Yi Xuan

Rakuten Trade is my go-to broker when it comes to investing in the Malaysia stock market. In addition, it has also introduced US stock trading for Malaysians in January 2022.

In this article, I am going to share a simple step-by-step guide on how to execute a transaction on Rakuten Trade, and explain some key terminologies along the way (Don’t worry it is very straightforward once you get it!).

Before this, here are some posts that you might find useful:

Table of Contents

Step-by-Step Guide to Buy a Stock on Rakuten Trade

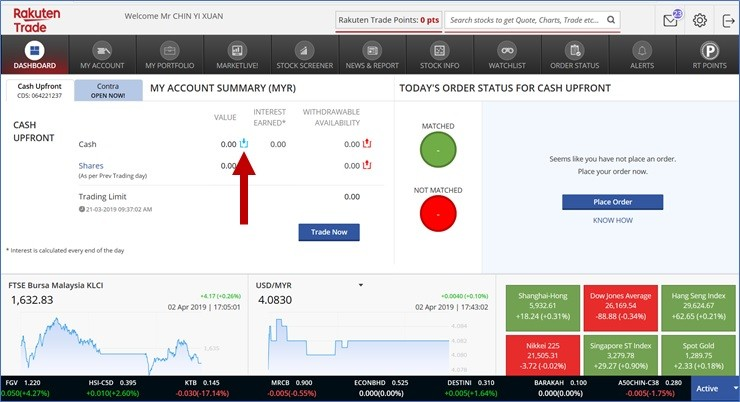

Upon logging in to your Rakuten Trade account for the first time, you will have to first fund your trading account using the funding methods available.

In short, the easiest method is to fund your account using your savings/current account.

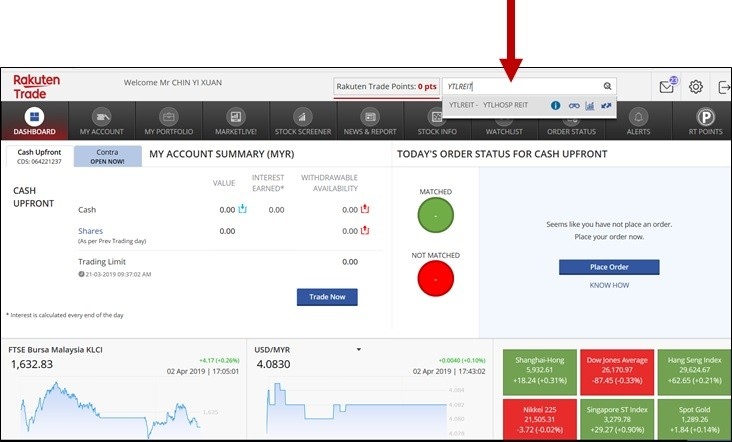

Step 1: Search for the stock that you want to buy at the search bar.

Step 2: Click ‘Buy’

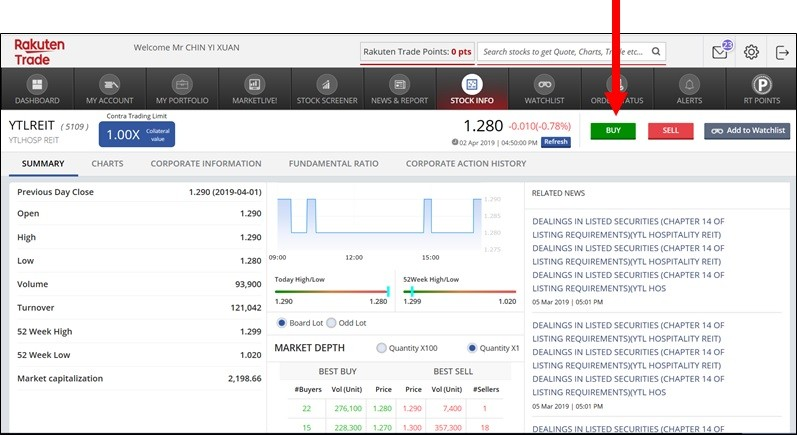

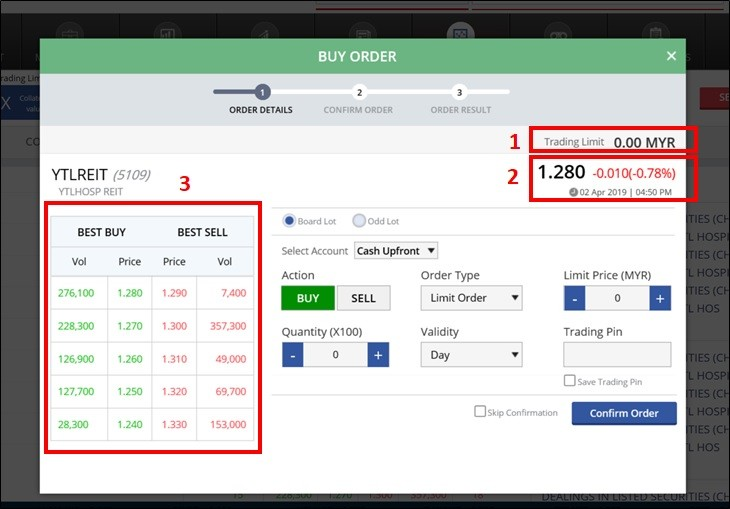

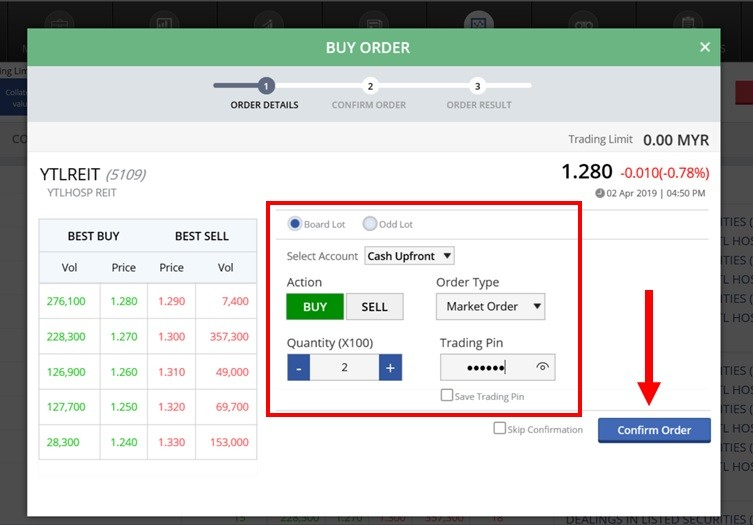

On the order page, there are a few key sections that you have to familiarize yourself with:

1 – Trading Limit: How much capital you have to invest.

2 – Market Price: The price where a share is traded most actively between buyers & sellers.

3 – Best Buy & Best Sell Table (Market Depth): This table shows us what is the price that the people are lining up to buy/sell and the volume.

The more volume it is for a price, it means that the faster you will be getting it once you execute an order. (eg. You will be able to buy at RM1.28 immediately compared to trying to buy at a lower price of RM1.27)

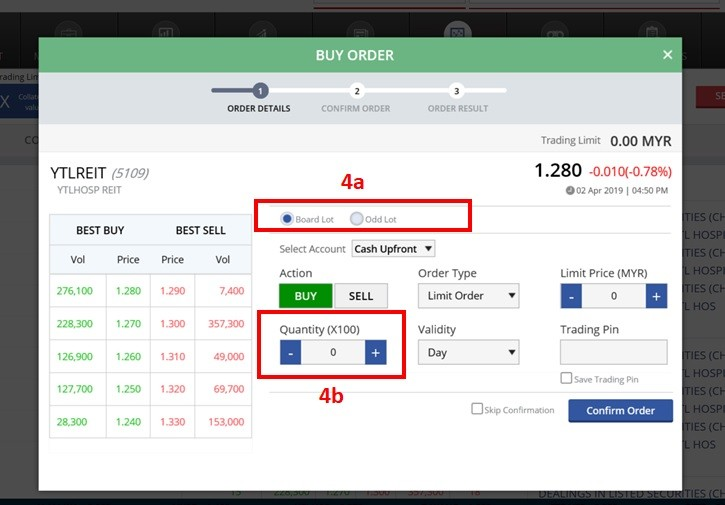

4a – Board Lot & Odd Lot:

•Board lot means you buy in a minimum multiple of 100 units. (1 Board Lot=100 units of shares, RM1.28*100=RM128)

•Odd Lot means you can buy in a multiple of 1 unit.

•Since more people will buy in Board Lot, your order will usually be filled more easily compared to buying in odd lots.

4b – Quantity:

•If you buy in Board Lot, your quantity will be in the multiple of 100. (eg. Put 2 if you want to buy 200 units of shares)

•Odd lot means you are free to key in any number of units that you want. (eg. Key in 88 if you want to buy shares in 88 units)

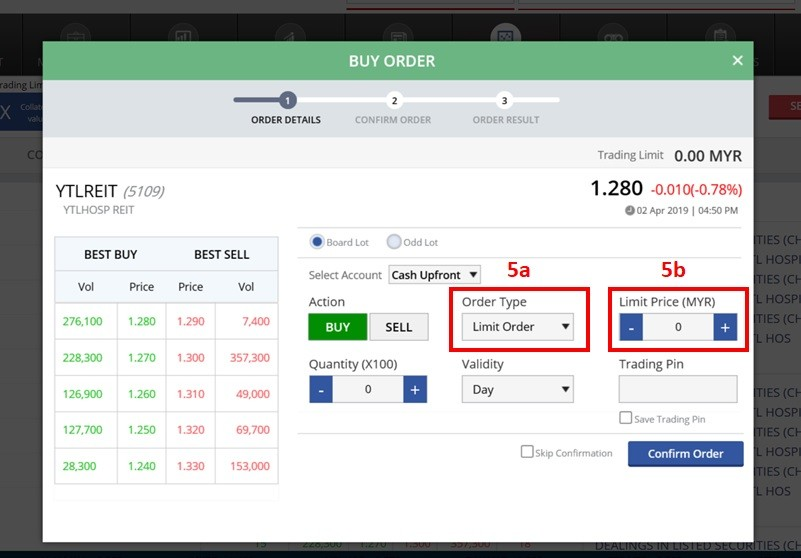

5a – Order Type:

- Limit Order: Queuing to Buy LOWER than market price. (if you are selling means you are queuing to Sell HIGHER than market price)

- Market Order: Buying or selling at MARKET PRICE. (order will be fulfilled almost instantly)

5b – Limit Price (not available if ordering at market price):

- The price you want to buy below the market price. (eg. Queuing to buy cheaper at RM1.26 instead of the market price of RM1.28)

- Note that buying below market price may not 100% guarantee that your order will be fulfilled.

6 – Validity (only available if buying/selling via Limit Order):

Day: Your order will be canceled if it is not fulfilled by day end (5pm). (eg. If you queued at RM1.26 but did not get fulfilled, then your order will be canceled by 5pm the same day)

Good-Till-Date (GTD): You can decide the validity of your order. (eg. You queue for the price of RM1.26 until X date)

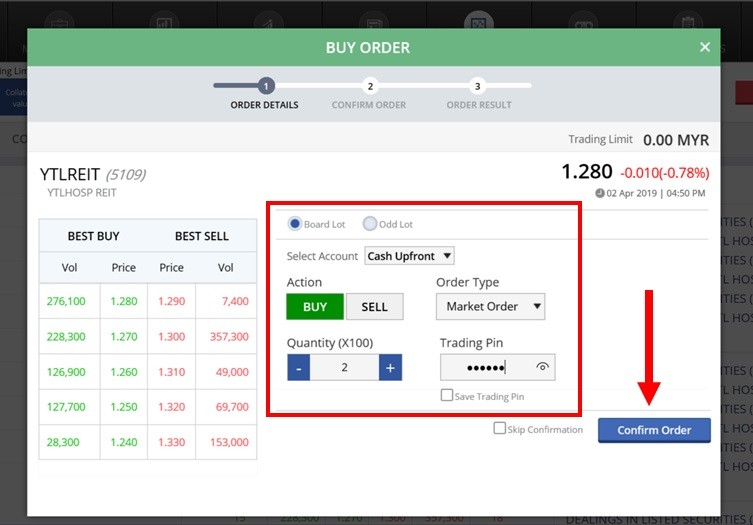

7 – Trading Pin: Your numbered pin to approve your trade. (Set when you open your account.)

Step 3: Fill in the details of your trade, your Trading Pin and click Confirm Order.

Note:

1. Decide if you are buying Board Lot or Odd Lot.

2. Decide your Quantity.

3. Decide your Order Type.

4. Key in your trading pin.

5. Confirm Order.

6. Wait for your order to be filled.

And we are done! This is how exactly you can buy your first stock via Rakuten Trade.

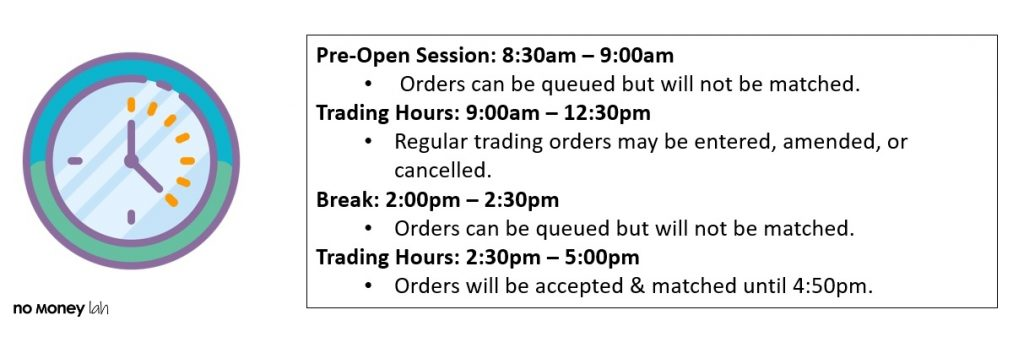

KLSE Market Operating Hours

The market is open from Monday to Friday, except for public holidays. Details on active market hours are as stated below:

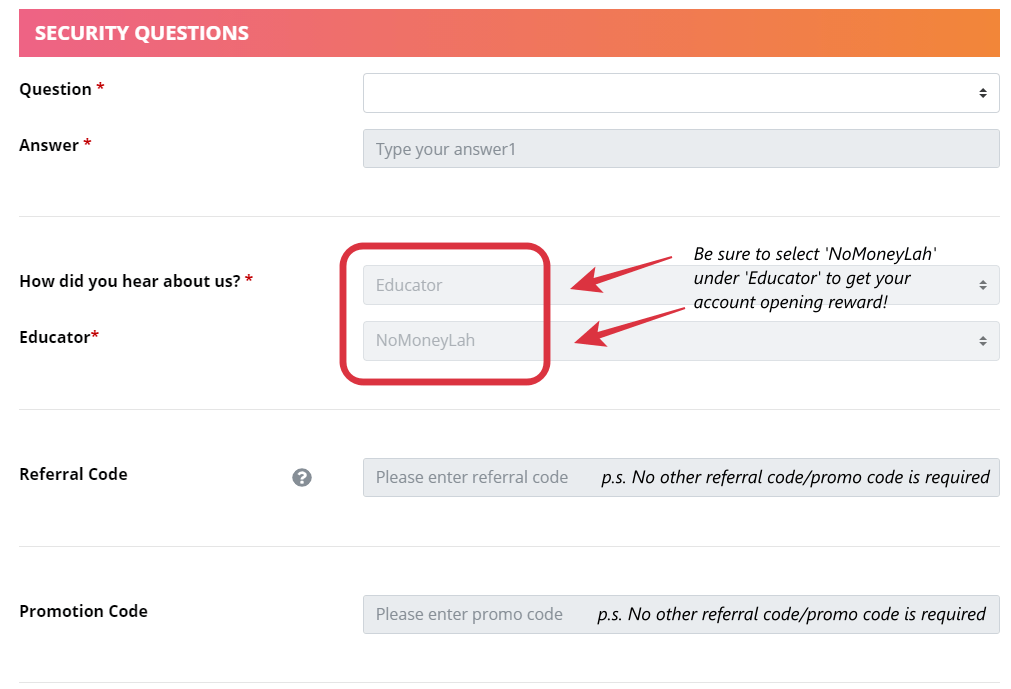

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 1000 RT points when you deposit an initial deposit of RM500 or more.

- + 1 RT point for each RM10 share value when you transfer your shares from other brokers to Rakuten Trade.

- + 2800 RT points worth RM28 when you activate foreign share trading (US & HK market) feature (p.s. Promo ending 30/6/2024, and will revert to 1288 RT points thereafter).

- Free 0.01 unit of Nvidia share (NASDAQ: NVDA) when you activate foreign share trading (US & HK market) feature and make your first buy trade on the US market during the campaign period (Campaign Period: 1/4 – 20/4/2024, T&C applies)

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open A Rakuten Trade Account Today!

Related Post: Guide – How to activate US stock trading on Rakuten Trade

How can you use these RT points?

These RT points are amazing, as they can be converted into brokerage rebates, Air Asia rewards, Boost stars, and Bonuslink points which are redeemable for rewards.

p.s. Click HERE for the full T&C of your account opening reward.

No Money Lah Verdict

With a good understanding of the terminologies and functions, hopefully, you will not be so overwhelmed with these stock trading platforms!

If you are keen to open a Rakuten Trade account, consider using my referral link by clicking on the button below!

Open A Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

NOW WHAT SHARE SHOULD I INVEST FOR ? IS WORTH TO BUY MAYBANK AND PUBLIC STOCK?

Hi Jenny!

It really depends on what your investing goal and risk tolerance is. There are simply too many factors that we have to consider in this question so I may not be able to give you a black and white answer.

My honest suggestion is to first seek knowledge (books, courses etc) on investing and you would be able to answer this question by your own 🙂

Yi Xuan

Hi Yi Xuan,

Do you know to put stop loss on the order? I have googled and searched on youtube but seems like Rakuten didn’t offer stop loss order?

Hi Aine!

There is no automatic SL order on Rakuten Trade. The next best thing you can do is to set alerts via the iSpeed app or KLSE screener app so you will be notified when the price is triggered and you can hence close your position yourself 🙂

Hope this helps!

Yi Xuan

Hi i already put u as educator during registration,but i did not see my RT point of 500

Hi Rman!

Thanks for bringing this up to me! Sometimes it may take time as your account opening is still under process.

p.s. Have you got your RT points now?

Yi Xuan

Hi,

Usually how people will buy stocks? Would they choose Market Order and just buy according to the market price or they choose limit order and queue for a lower price?

Sorry, first time buying stocks here!

Hi Vik!

There is no one right or wrong way. You can use Market Orders or Limit Orders depending on your situation.

As an example, if you want to enter a position quite urgently and /or you feel that the share price is reasonable, then you can use Market Order to enter right away.

Alternatively, if you feel that the share price could go lower, you can set to buy at a lower price via limit order. Of course, this means your order may or may not be fulfilled depending on whether the share price will reach your target entry price.

Hope this helps! 🙂

Yi Xuan

Hi there. when i buy shares at the market at certain price let say RM 0.160, why it appears as RM 0.168 on the trade history?? How to know what is actually the net buying price when we buy shares???

tq

Hi Salam!

Thanks for reaching out. Personally, I do not have the whole context of your situation so I am guessing that it could be due to the bid-ask spread of the share price that you are entering.

This means that the share price is being bid at RM0.16 but the ask price is RM0.168. I am not sure if that is the case but it could happen.

That said, please reach out to Rakuten Trade for help at [email protected] to get to know what’s happening.

Regards,

Yi xuan

Hello Handsome,

I’m very new to the stock market and have registered myself with rakuten after reading your posts. Now I have no idea about how these stuff works. I funded my account with RM150 for a trial run to see how it works and it’s way too complicated for me to understand anything at all. I tried buying but it gives me an error of exeeding amount or something like that so I’m back to 0 of not knowing anything at all. Any advice from your side will be much appreciated 🙂

Hi Parv,

While I do not have the whole picture of your issue, but I believe it could be because you entered the volume wrongly:

eg. if you want to buy 100 units of a RM1.00 stock, you should key in 1 in the units section instead of 100 because the volume is in hundredth of unit.

That said, looking at your reply, I am pretty certain that you are not quite ready to invest actively in the market YET. Please take some time to pick up the relevant skills and knowledge from books or other free resources online and even courses to ready yourself for the market.

Regards,

Yi Xuan

Hi,

Thank you for taking time to share with us the details. It really helps.

Hey Rajesh!

Thanks for the comment and words, glad that you find this article helpful! 🙂

Yi Xuan

Hi Chin,

I just made my first trade on Rakuten! I wanted to buy 15 lots of a particular share (share price was less than RM1) but Rakuten kept saying I exceeded my trade limit. So I was only able to buy 10 lots in the end, do you know why I had this issue?

Hey man!

RT has a price band in place in order to prevent users from exceeding trade limit (trade > capital) especially in volatile environment.

You can read more about it below:

https://nomoneylah.com/2020/07/15/rakuten-trade-faq/#%E2%80%98Order_amount_exceeded_trade_limit%E2%80%99_issue