Last Updated on January 12, 2024 by Chin Yi Xuan

Have you ever looked at a US stock (eg. Apple, Microsoft), and found it too expensive to buy for your budget?

Fred not, as Rakuten Trade is the FIRST Malaysia-regulated broker that released the much-awaited fractional share trading for US stocks! This is a rare feature even among global stock brokers these days.

This is a major news for investors as fractional share trading makes investing in US stocks more capital-friendly and flexible.

So, what is fractional trading all about? Should you consider buying fractional shares? Let’s find out!

RELATED POSTS:

Table of Contents

What is Fractional Share Trading?

Essentially, fractional shares allow investors to own a portion of a whole share of a stock. (imagine getting a slice of pizza, instead of the whole piece)

As an example, 1 full unit of Apple share may cost $170. With fractional trading on Rakuten Trade, you can buy Apple shares for as small as 0.01 unit for just $1.70 (0.01 units * $170).

When you invest in fractional shares, you receive the same benefits as the other investors with full shares.

In other words, you’ll make gains when the stock price rises, as well as dividends should the stock you own pay them.

Why should you consider fractional share trading?

#1 Own popular stocks regardless of your investing budget

When I first started investing, I was not able to buy the shares of US-listed companies like Apple and Microsoft as their share price were simply too high for me to afford.

With fractional shares, investors can now buy a portion of the full share regardless of their capital.

From as small as 0.01 units of fractional shares, owning the shares of big companies is easier than ever on Rakuten Trade!

#2 Build a diversified portfolio regardless of your capital

With fractional trading on Rakuten Trade, it is also possible to build a diversified portfolio even with small capital.

For instance, let’s say you have RM200/month (~USD 44.45)** to invest, you can easily build an Apple-Tesla-Microsoft portfolio with fractional trading:

| Stocks | Fractional Units | Share Price (USD)* | Capital (USD) |

| Apple | 0.08 | 175.05 | 14 |

| Tesla | 0.08 | 176.89 | 14.15 |

| Microsoft | 0.05 | 318.52 | 15.93 |

| Total (USD) | 44.08 |

*Share price as of 18/5/2023. **Assuming the USD-MYR exchange rate is 4.5.

As you can see, the sky is the limit when it comes to how you can use fractional share trading to form your ultimate portfolio!

3 things about fractional share trading on Rakuten Trade

#1 Fractional shares are offered for selected US stocks & ETFs

Users of Rakuten Trade can now buy fractional shares of selected US stocks and ETFs on Rakuten Trade.

This means fractional units of major names like Apple, Microsoft, Tesla, and ETFs like the S&P500 (VOO) and Nasdaq-100 (QQQ) are all available.

The slight limitation though, is that the list of fractional tradable share list is subject to change tentatively every quarter. Users can’t buy a particular share in fractions once it is removed from the list.

Note: US shares priced below USD 1/unit are only tradeable in a whole unit.

#2 Buy and sell in small units

Buy US stocks or ETFs from as small as 0.01 units and sell them at 0.0001 units.

#3 Tips: Earn & Use RT Points to offset your brokerage fees

While buying fractional shares on Rakuten Trade, it is also possible for you to offset your brokerage fee via RT points when you trade in MYR.

Meanwhile, for every RM1 brokerage fee spent, you will earn 1 RT Point (equivalent to RM0.01 brokerage fee)!

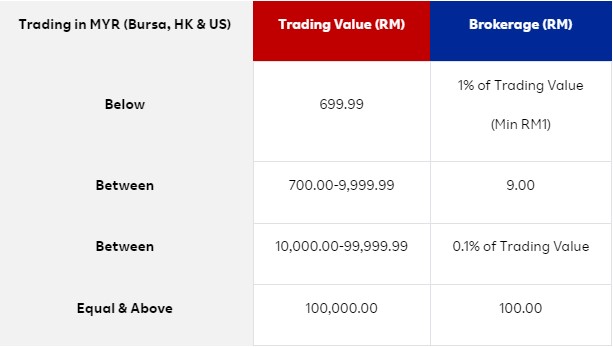

Fees while buying fractional shares on Rakuten Trade

In line with the launch of fractional shares, Rakuten Trade has adjusted its fee structure to make it more flexible and fee-friendly for users.

Rakuten Trade users have the flexibility to use either MYR or USD to trade US stocks:

Rakuten Trade brokerage fee in MYR:

Rakuten Trade brokerage fee in USD:

When to use MYR or USD to buy US stocks?

Whether to use MYR or USD to buy US stocks depends on your trading value.

I have compiled the different scenarios of trading value and which is a better currency to use to trade:

| Trading Value (RM/USD) | Fee (RM) | Fee (USD)* | Use |

| RM100 ($22.2) | 1.00 | 1.88 (RM8.46) | RM |

| RM500 ($111.1) | 5.00 | 1.88 (RM8.46) | RM |

| RM700 ($155.6) | 9.00 | 1.88 (RM8.46) | USD |

| RM1,000 ($222.2) | 9.00 | 1.88 (RM8.46) | USD |

| RM5,000 ($1111.1) | 9.00 | 1.88 (RM8.46) | USD |

| RM10,000 ($2222.2) | 10.00 | 2.22 (RM10) | RM or USD |

| RM20,000 ($4444.4) | 20.00 | 4.44 (RM20) | RM or USD |

*Assuming the USD-MYR exchange rate is 4.5.

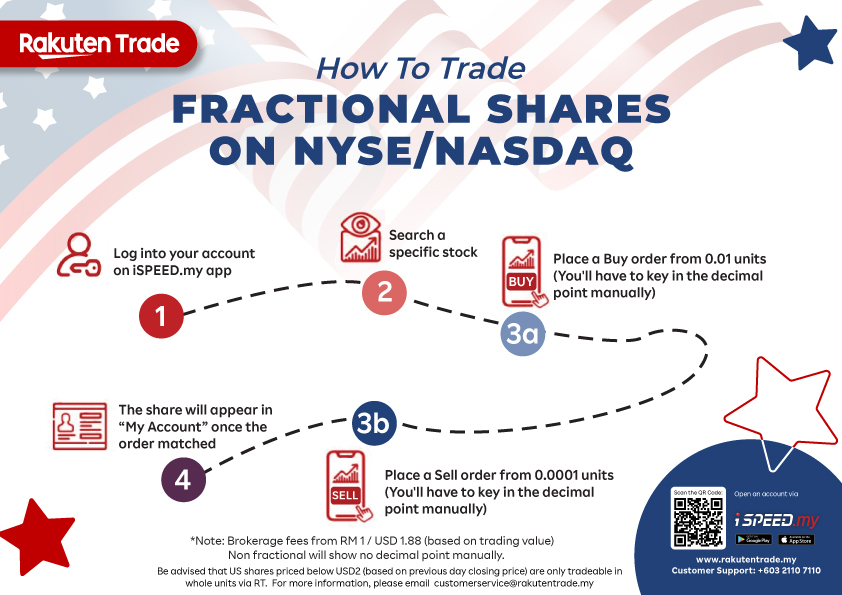

How to buy fractional shares on Rakuten Trade

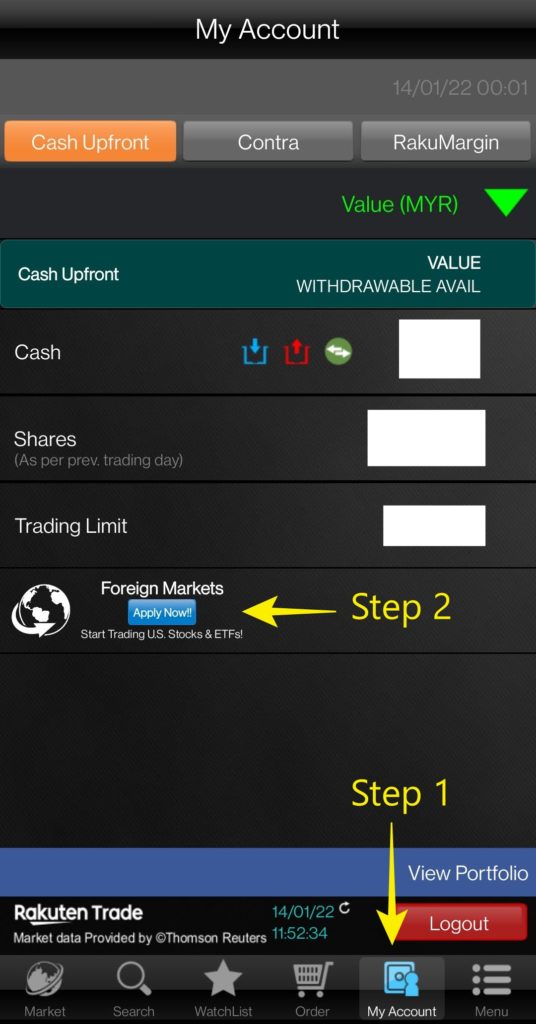

For new Rakuten Trade users OR users that HAVE NOT activated foreign share trading, proceed to Step 1.

For existing Rakuten Trade users, please proceed to Step 2.

Step 1: Register for a Rakuten Trade account & activate foreign stock trading

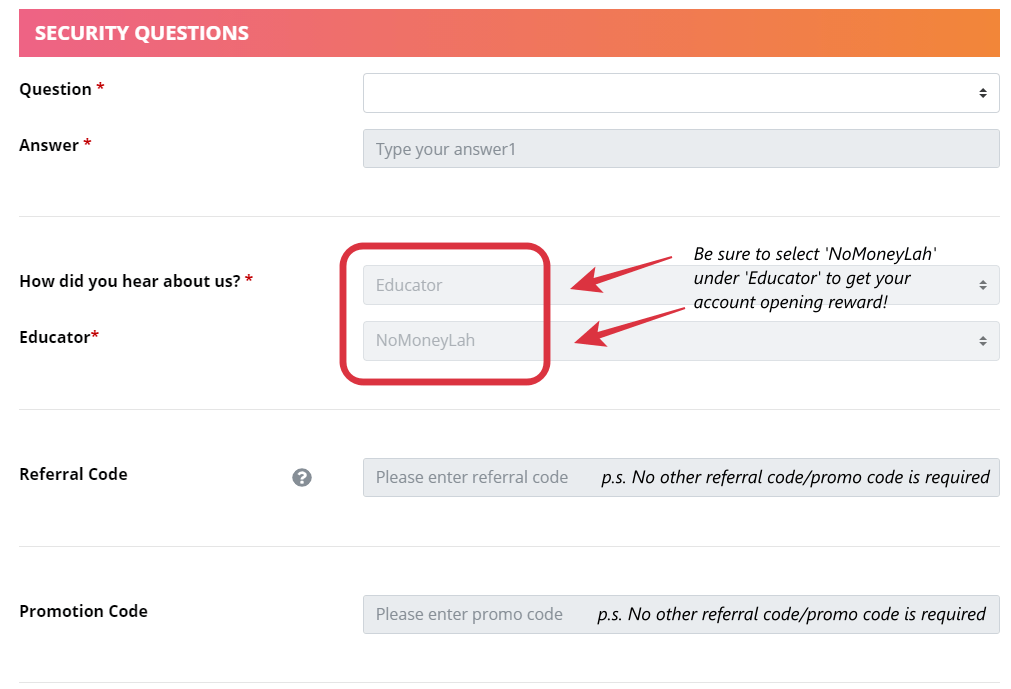

If you are new, you’ll have to sign up for a Rakuten Trade Cash Upfront account.

Consider using my Rakuten Trade referral link by clicking the button below, and you’ll get 1000 RT points (RM10) which can be used to offset your brokerage fee!

If you need help, click HERE for my step-by-step guide to open a Rakuten Trade account.

Step 1b: Activate foreign share trading on Rakuten Trade:

Once your account is activated, log in to your Rakuten Trade account either via the website or Rakuten Trade’s iSpeed app.

You can locate the Foreign Trading activation button easily within the Rakuten Trade platform.

If you need help, click HERE for my step-by-step guide to activate foreign share trading on Rakuten Trade.

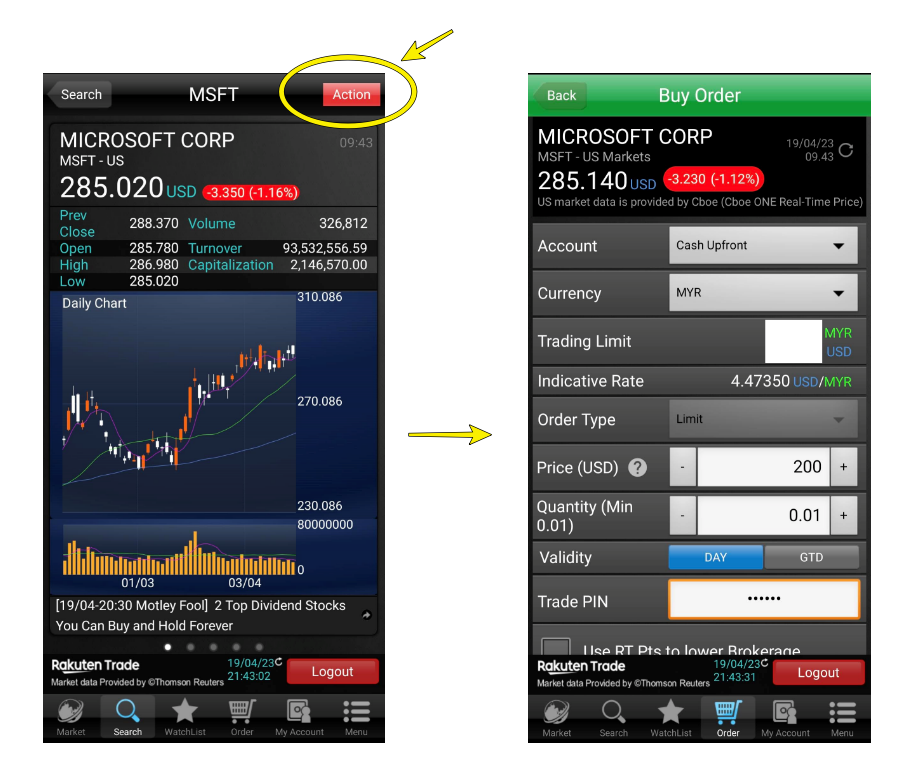

Step 2: Search for the US-listed stocks you want to buy

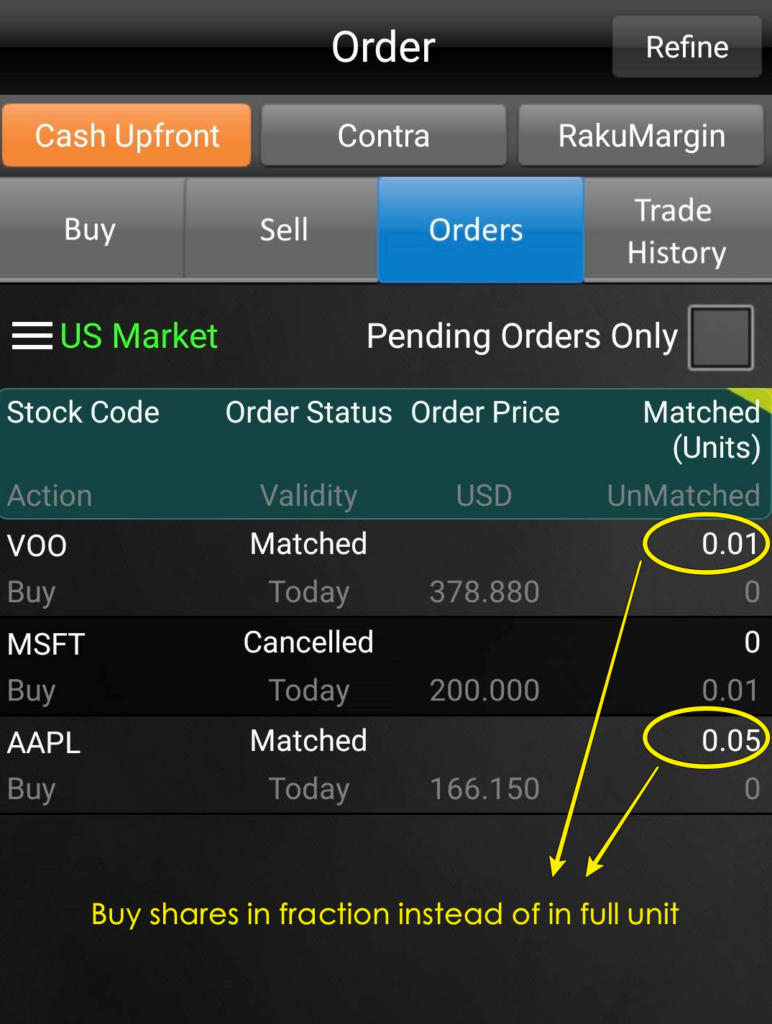

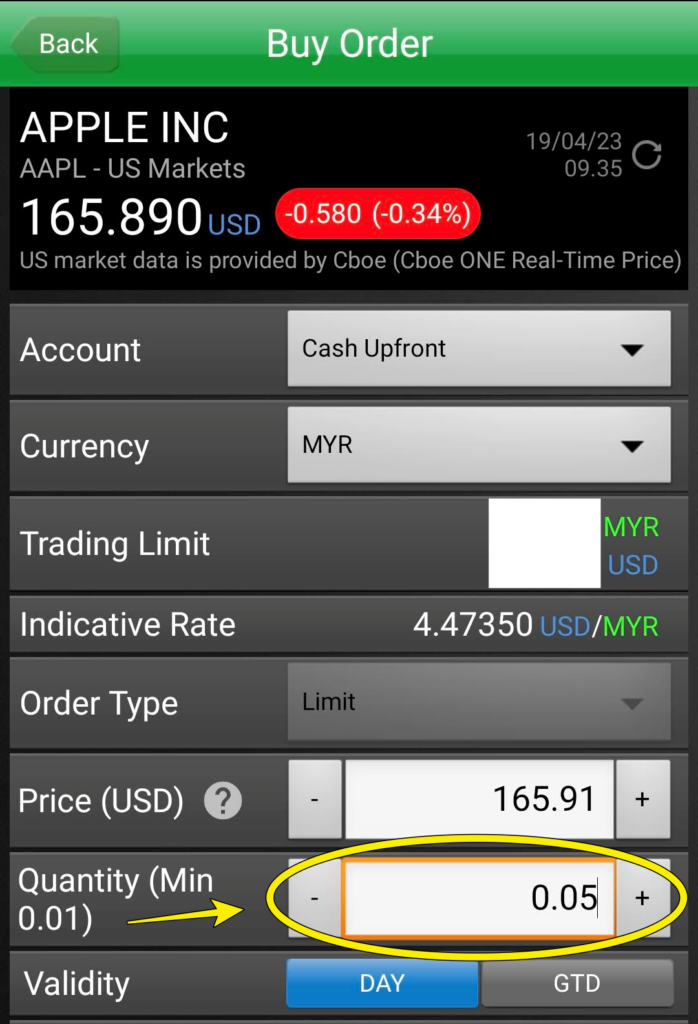

Step 3: Fill in the details of your trade

To know whether the stock you want to trade is eligible for fractional trading, just look at the ‘Quantity’ row – you will spot the lowest minimum unit is 0.01.

For a full guide (eg. what is ‘limit order’ and ‘validity’) on how to buy your first US share on Rakuten Trade, click HERE.

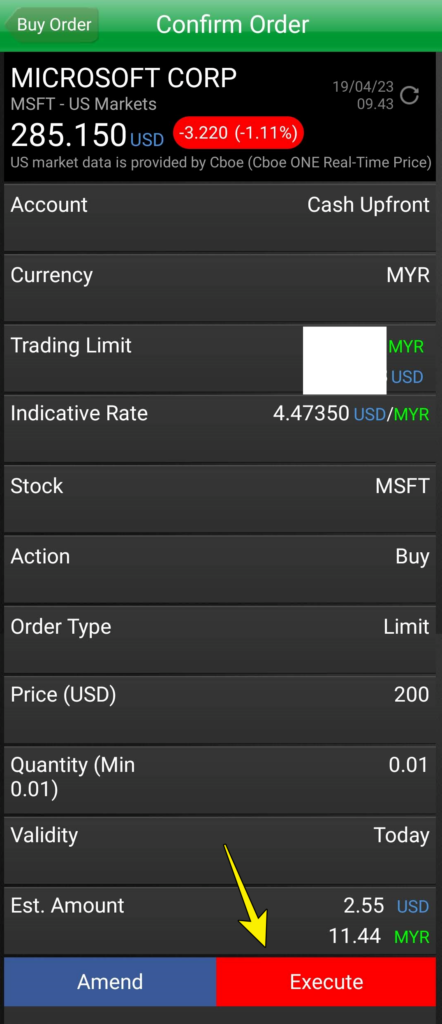

Step 4: Once done, confirm and execute your trade

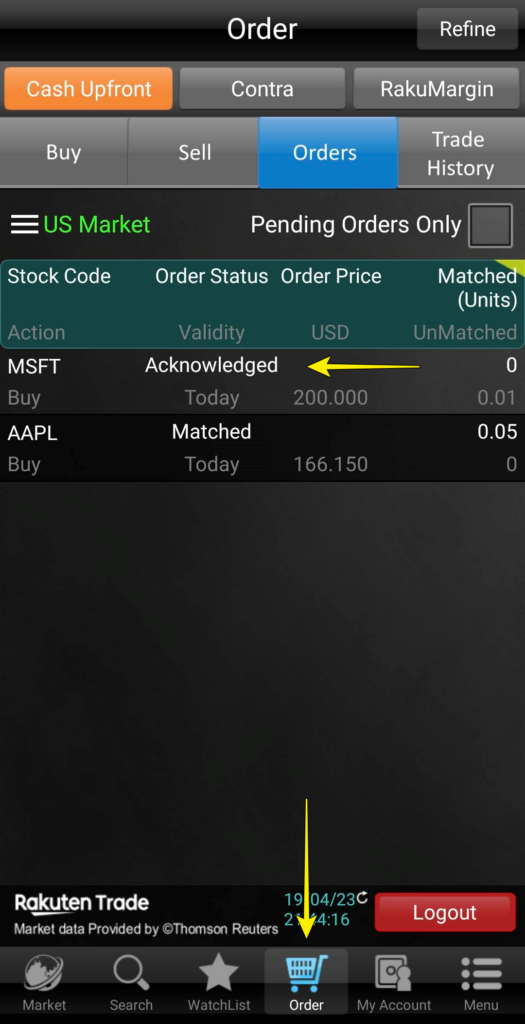

You can check the status of your order and/or amend them under the ‘Order’ section:

Summary: Build your portfolio with fractional trading on Rakuten Trade!

With the launch of fractional share trading, Rakuten Trade makes US stock investing more accessible, especially for Malaysians with small capital.

This is an amazing feature that I foresee more Malaysian investors will take advantage of in their investing journey!

Will you give fractional trading a try? Let me know in the comment section below!

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 1000 RT points when you deposit an initial deposit of RM500 or more.

- + 1 RT point for each RM10 share value when you transfer your shares from other brokers to Rakuten Trade.

- + 2800 RT points worth RM28 when you activate foreign share trading (US & HK market) feature (p.s. Promo ending 30/6/2024, and will revert to 1288 RT points thereafter).

- Free 0.01 unit of Nvidia share (NASDAQ: NVDA) when you activate foreign share trading (US & HK market) feature and make your first buy trade on the US market during the campaign period (Campaign Period: 1/4 – 20/4/2024, T&C applies)

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open A Rakuten Trade Account Today!

Related Post: Guide – How to activate US stock trading on Rakuten Trade

How can you use these RT points?

These RT points are amazing, as they can be converted into brokerage rebates, Air Asia rewards, Boost stars, and Bonuslink points which are redeemable for rewards.

p.s. Click HERE for the full T&C of your account opening reward.

Rakuten Trade Fractional Shares FAQ

Q1: Why invest in fractional shares?

Fractional shares make it possible for investors like you and me to own a fraction of popular US stocks that are usually too expensive to buy in full units.

Q2: Is fractional trading applicable to Exchange-Traded Funds (ETFs) on Rakuten Trade?

Yes. It is possible to invest in fractional units of popular ETFs available on Rakuten Trade such as VOO (S&P500) and QQQ (Nasdaq-100).

Q3: Can I receive dividends on my fractional shares?

Yes.

Q4: Can I sell my fractional shares?

Yes. The selling process is similar to the selling of a full unit of share.

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.