Last Updated on January 12, 2024 by Chin Yi Xuan

Rakuten Trade has recently released their much anticipated US stock trading service.

In fact, thanks to Rakuten Trade’s affordable fee structure, it is the only Malaysia-regulated broker that I’d recommend for Malaysians who want to invest in the US stock market.

In this guide, let me share with you (step-by-step) how to buy your first US share on Rakuten Trade!

Also, I’ll show you some tips & tricks to familiarize yourself with the jargon on the platform!

Before you proceed, here are some related posts that might interest you:

Table of Contents

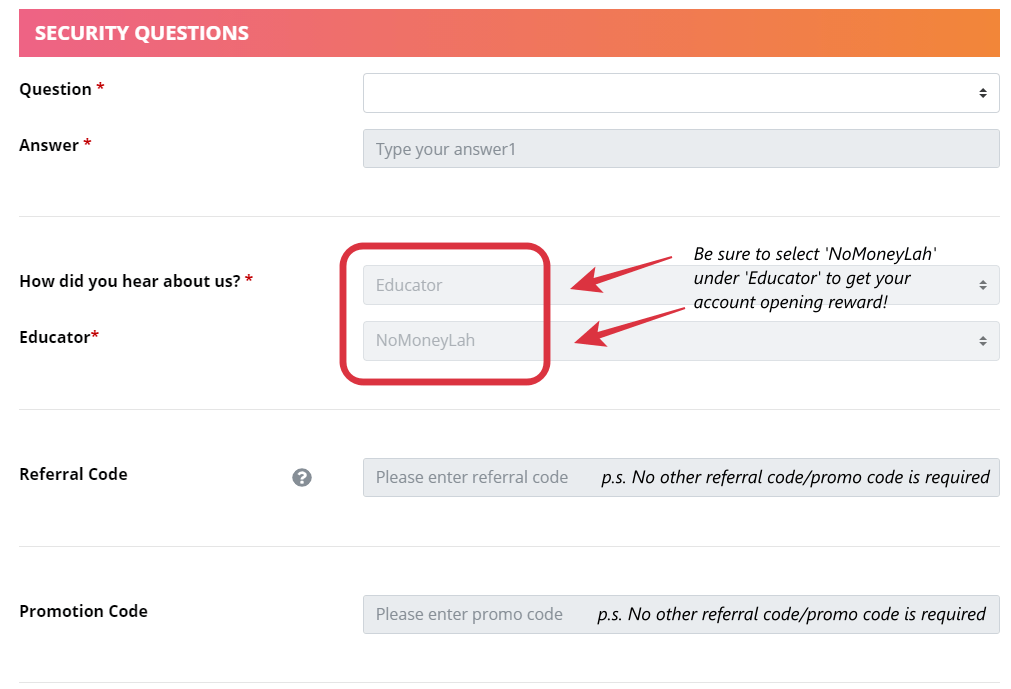

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 1000 RT points when you deposit an initial deposit of RM500 or more.

- + 1 RT point for each RM10 share value when you transfer your shares from other brokers to Rakuten Trade.

- + 2800 RT points worth RM28 when you activate foreign share trading (US & HK market) feature (p.s. Promo ending 30/6/2024, and will revert to 1288 RT points thereafter).

- Free 0.01 unit of Nvidia share (NASDAQ: NVDA) when you activate foreign share trading (US & HK market) feature and make your first buy trade on the US market during the campaign period (Campaign Period: 1/4 – 20/4/2024, T&C applies)

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open A Rakuten Trade Account Today!

Related Post: Guide – How to activate US stock trading on Rakuten Trade

How can you use these RT points?

These RT points are amazing, as they can be converted into brokerage rebates, Air Asia rewards, Boost stars, and Bonuslink points which are redeemable for rewards.

p.s. Click HERE for the full T&C of your account opening reward.

How to buy your first US share on Rakuten Trade (+tips)

Note: The following steps are the same regardless of whether you use Rakuten Trade’s web platform or iSpeed app to buy US stocks.

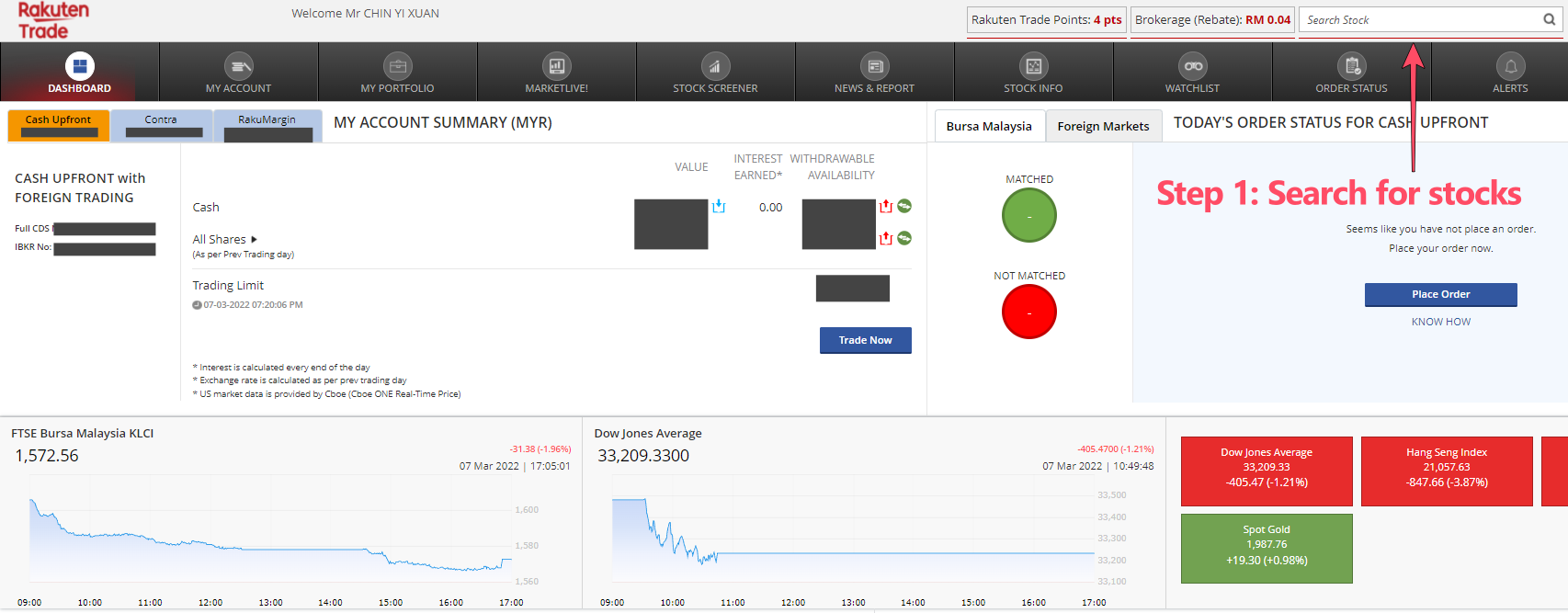

Step 1: Search for stock/ticker & decide to buy shares in MYR or USD

Log in to your Rakuten Trade account. Then, search for the name or ticker of the stocks/ETF that you want to invest in.

Then, decide if you want to execute your trade using MYR or USD. You can refer to my guide HERE to learn when is the best time to use MYR or USD.

READ MORE: Rakuten Trade USD trading feature – trade using MYR or USD!

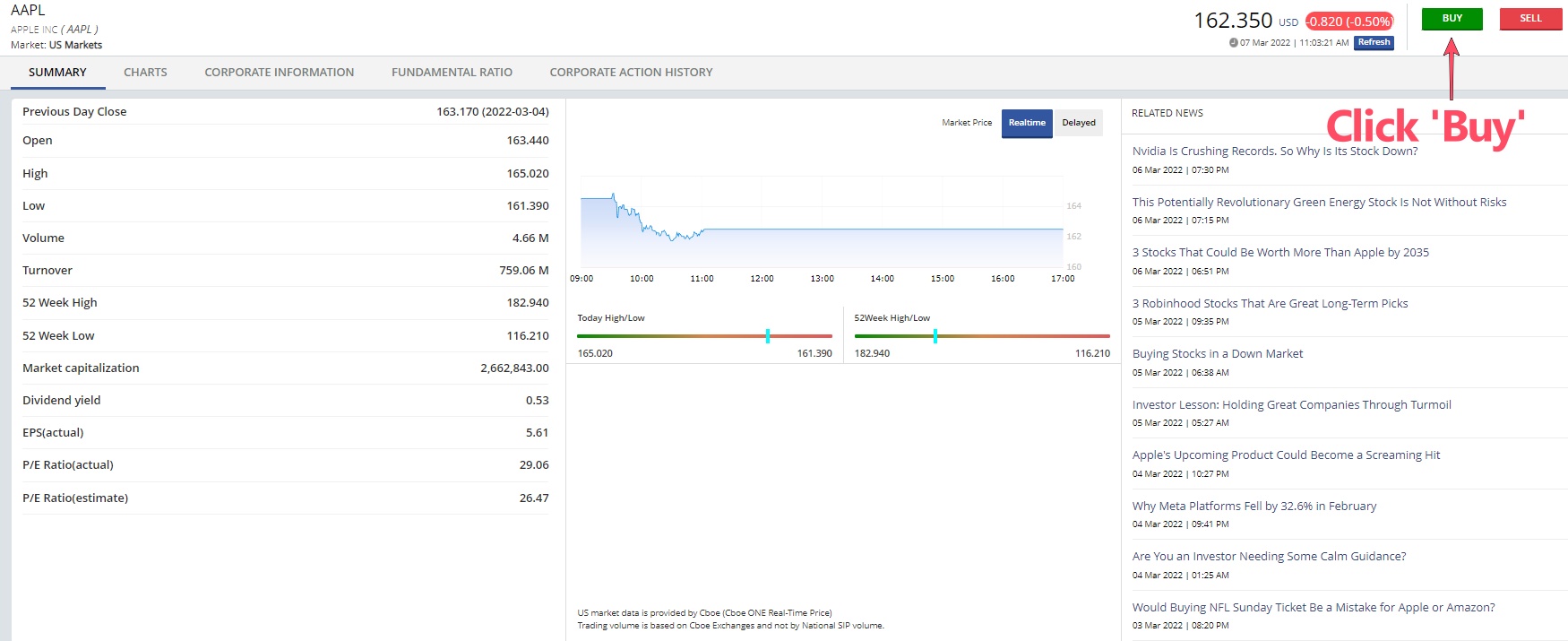

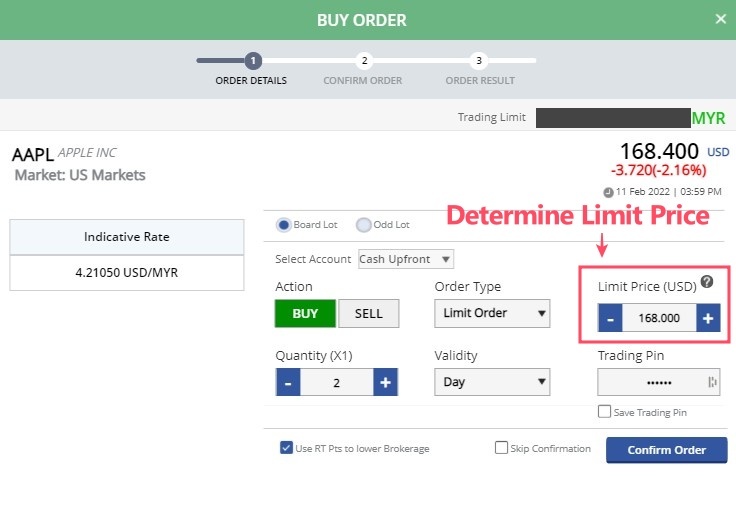

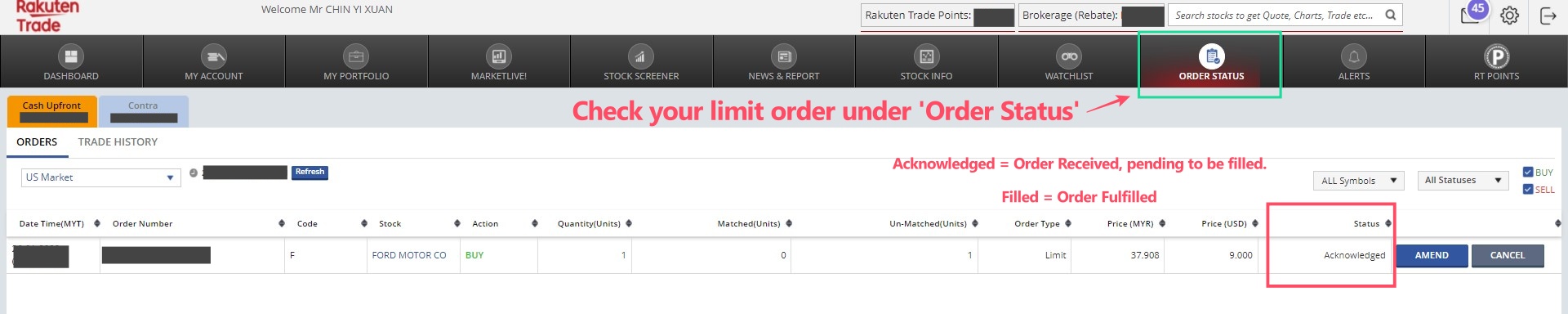

Step 2: Decide on your limit order price

Buy Limit Order allows investors to line up their orders to buy shares at a specific price or better. At the moment, it is the only execution method on Rakuten Trade.

Example: As shown in the screenshot, Apple’ share price is $168.40.

- If you want to buy Apple shares at a lower price, let’s say $168.00, then set your limit price to $168.00. Essentially, what you are doing is telling the system that ‘Execute Buy Order if the price drops to $168.00 or less’

- Tips: If you want to buy Apple shares directly at $168.40, then set your limit price at $168.40. Usually, for most shares with enough liquidity, you should most likely be able to buy at the price without issue.

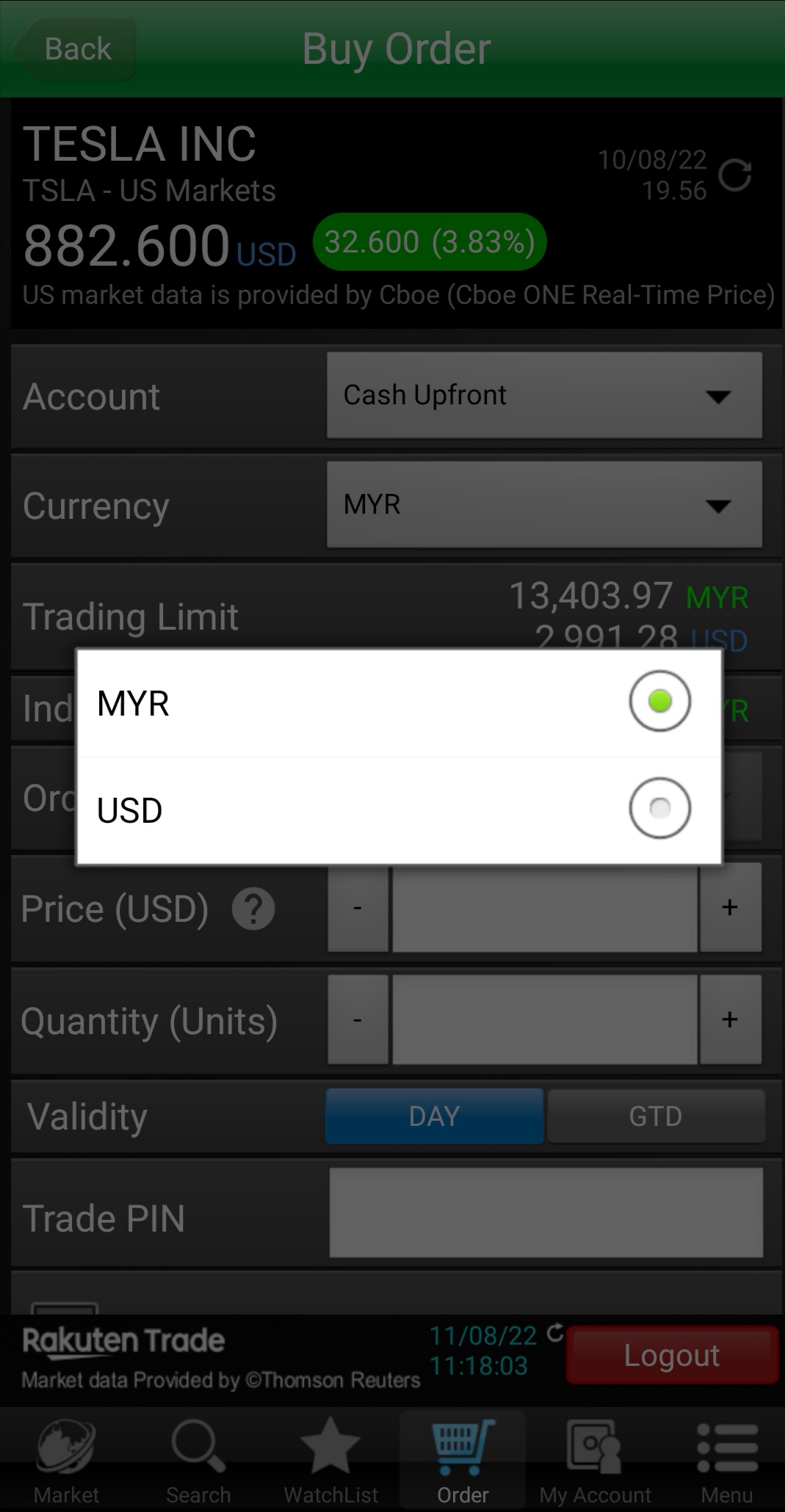

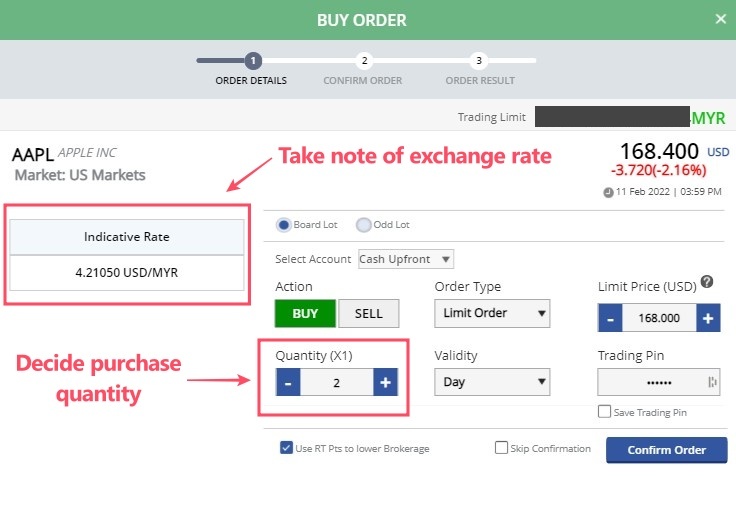

Step 3: Decide quantity to buy + mindful of the indicative exchange rate

Next, decide on the number of shares that you want to buy.

Tips: Some shares are denominated in x1 units, while some are in x100 units, so do be mindful of it! Before you execute your order, it is helpful to know that on Rakuten Trade, you can invest in US stocks using MYR or USD.

Hence, do take note of the exchange rate for your transaction. The rate is updated daily, quoted by Rakuten Trade’s foreign exchange provider. There is usually a minor spread between the rate offered compared to what you found on Google.

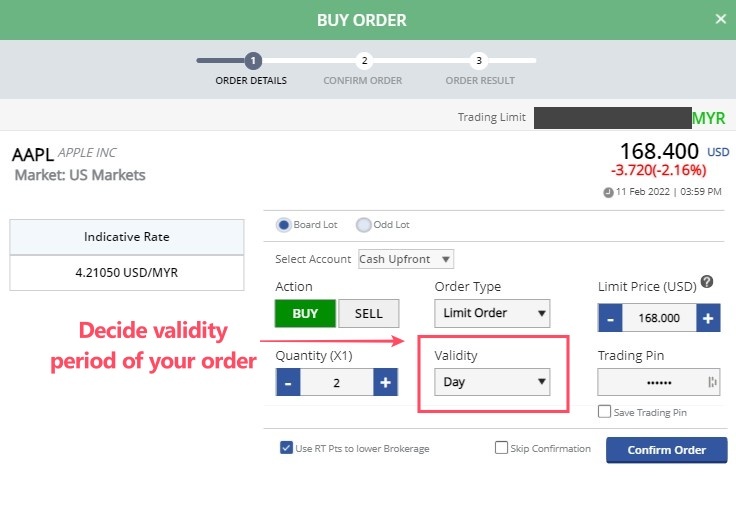

Step 4: Decide the validity period of your order

Validity decides how long your buy order will stay relevant until it expires. Under validity, there are 2 options:

- Day: Your limit order will be canceled automatically by the end of the trading day if it is not filled. No commissions will be charged for the canceled order.

- Good-till-date (GTD): Your limit order will remain active until a specified date of your choice. Select GTD if you want your limit order to stay active for a longer period of time.

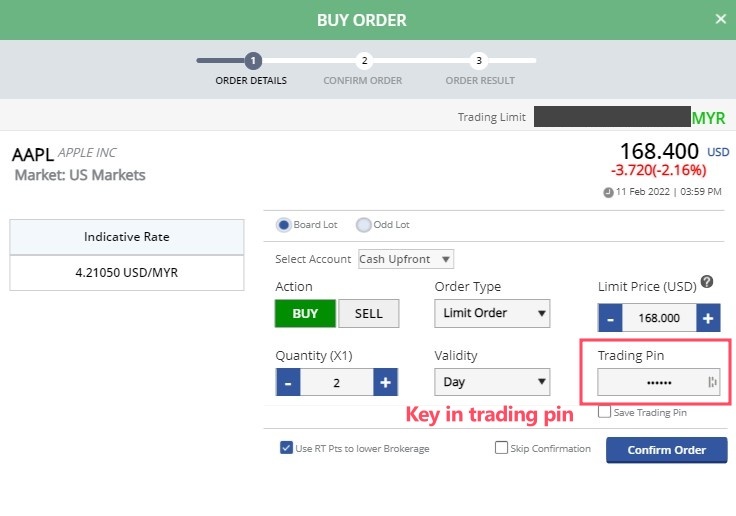

Step 5: Key in trading pin

Key in your Rakuten Trade trading pin to approve the order. Click ‘Confirm Order’ and your order will be processed – that’s it!

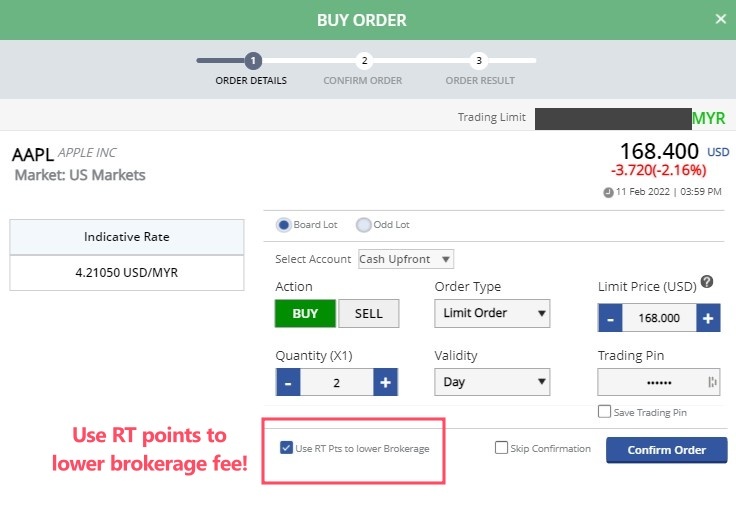

Tips: Use RT Points to offset brokerage fee

RT points are points that are rewarded when you open an account, fund your account, and place a trade.

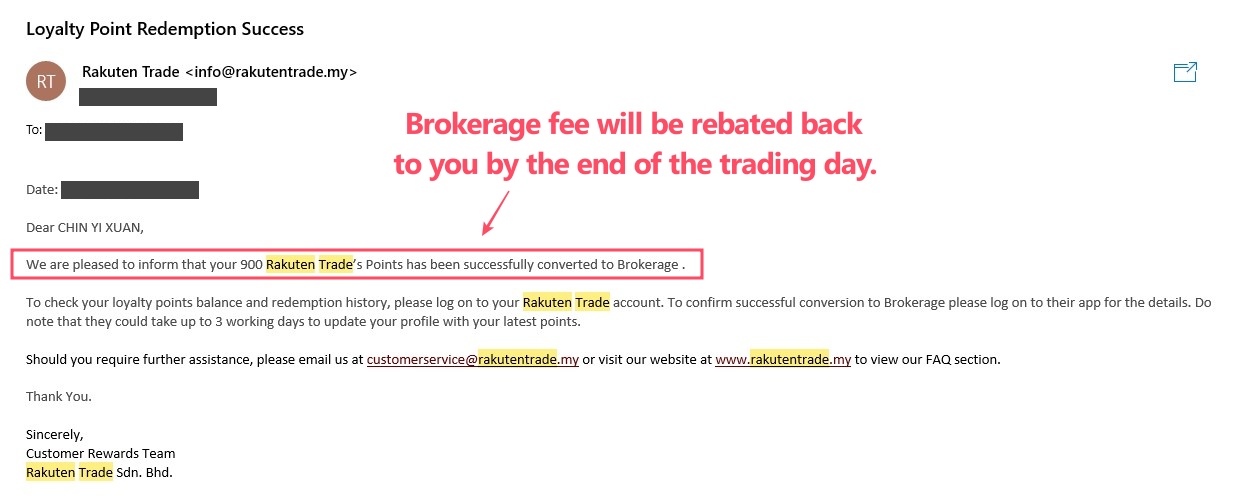

If you have existing RT points, you can select the option to use your points to offset the brokerage fee. This feature is only available if your limit order’s validity is set to Day instead of GTD.

Note: You’ll still pay for the brokerage fee when your order is filled, but it’ll be rebated back to your account by the end of the trading session.

p.s. If you are planning to open a Rakuten Trade account, definitely consider using my referral link by clicking the button below!

Open a Rakuten Trade Account Today!

Must-Know: US Stock Market Operating Hours

Barring holidays or special circumstances, the US stock market opens between 9:30am to 4:00pm eastern time (ET) in the US.

As Malaysians, there are 2 things that we need to know while investing in the US stock market:

- Malaysian time is 12 hours ahead of the US.

- Daylight Savings Time (DST): DST is the time of the year when the US market adjusts their clocks to move an hour of daylight from the morning to the evening.

What does DST mean to Malaysian investors?

- In 2024, DST will start on 10th March. During DST, the US stock market will begin at 9:30pm Malaysia time.

- Meanwhile, DST will end on 3th November 2024. After DST ends, the US stock market will begin at 10:30pm Malaysia time.

No Money Lah’s Verdict

So there you have it – how to buy your first US stock on Rakuten Trade!

If this is your first time investing in US stocks on Rakuten Trade, I hope this buying guide has been helpful to you!

For more personal finance and investing content, consider subscribing to my FREE newsletter.

Open a Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.The information stated above is based on my personal experience and for the purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan, as someone new to stocks would you recommend trading US stocks with rakuten or foreign brokers such as Tigerbroker etc? Are the brokerage fees comparable?

Hi John,

Rakuten Trade is more suitable for people that seek locally regulated broker in Malaysia to trade Us stocks. That said, pricing-wise, Tiger Brokers would certainly be more competitive. The flip side would be Tiger Brokers is not regulated in Msia, but instead in SG.

So the key here is to determine if u are comfortable with using a foreign regulated broker – if yes, Tiger Brokers is a better choice.

My tiger brokers review:

https://nomoneylah.com/2022/02/16/tiger-brokers-review/

Regards,

Yi Xuan