In-Depth Look: 6 Fixed Price Funds in Amanah Saham (Part 2)

In Part 1 of my Amanah Saham article, I talked about what is Amanah Saham and a brief overview of the benefits and risks of investing in Amanah Saham’s Fixed Price Funds.

For Part 2, let’s zoom in a little and have an in-depth look into the 6 Amanah Saham’s Fixed Price Funds that everyone is talking about:

(A) Before we start, a little recap…

Amanah Saham’s Fixed Price Funds are funds of which its fundamental value is fixed at RM1/unit regardless of the market condition. These funds are famous due to their 0% sales fees, a track record of bringing in consistent return, and its nature that serves as an excellent capital preservation investment option. More about this in Part 1.

As mentioned, there are 6 Fixed Priced Funds by Amanah Saham, namely:

|

Bumiputera-Only |

Open to all Malaysians |

| Amanah Saham Bumiputera (ASB) | Amanah Saham Malaysia (ASM) |

| Amanah Saham Bumiputera 2 (ASB 2) | Amanah Saham Malaysia 2 - Wawasan (ASM 2) |

| Amanah Saham Bumiputera 3 - Didik (ASB 3) | Amanah Saham Malaysia 3 – 1 Malaysia (ASM 3) |

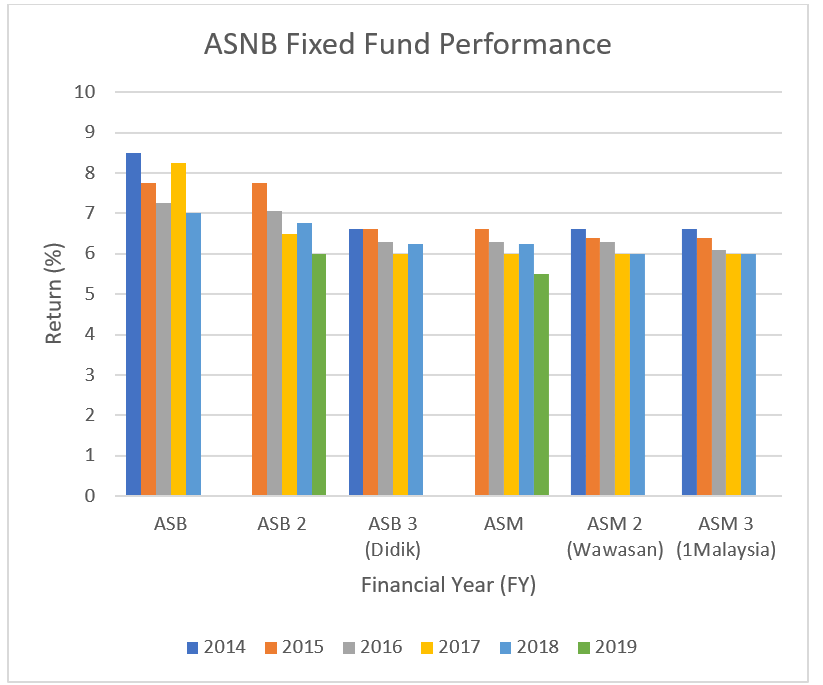

(B) Summary of each Funds’ return (%) over the past 5 Financial Years (FY)

As you can see from below, each fund has been reasonably consistent in their performance, albeit some funds’ return has slid down for a little – in line with the overall market performance.

(C) Deep Dive into all 6 Fixed Price Funds

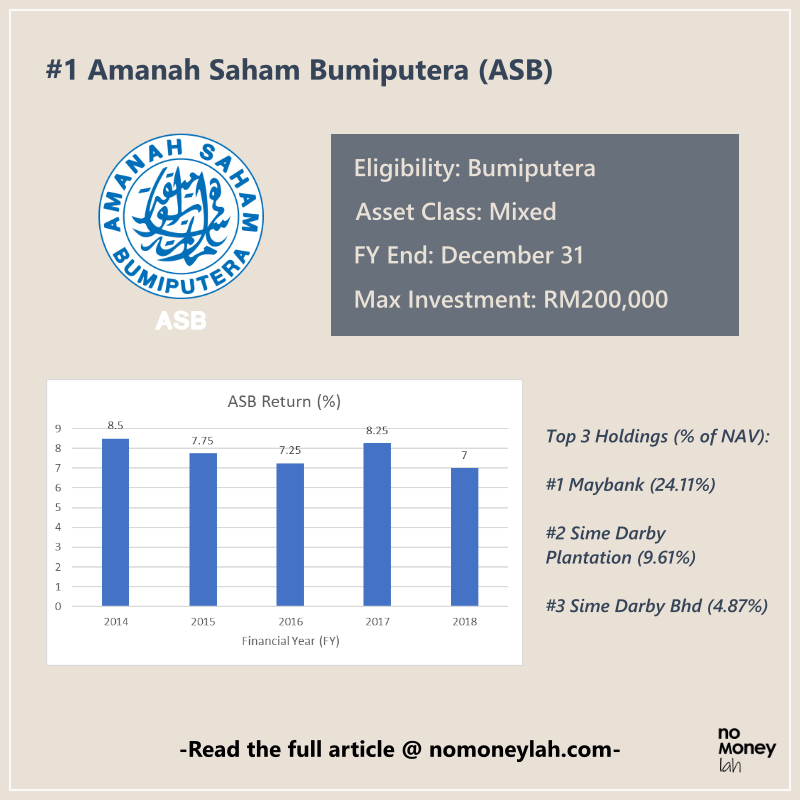

#1 Amanah Saham Bumiputera (ASB)

Established in 2nd January 1990, ASB is the first Fixed Price Fund by Amanah Saham. In terms eligibility, ASB is only open to Bumiputera, with a maximum investment of RM200,000.

ASB is a fund with a mixed portfolio of assets such as equities (73.56%) and other capital market instruments such as fixed income securities and bonds (26.44%). With more than half of its total capital invested in equities, it is important to find out which sector ASB has been investing in:

|

Top 3 Sectors (FY 2018) |

Top 3 Holdings (FY 2018) |

| Financial (27.55%) | Maybank (24.11%) |

| Services (21.01%) | Sime Darby Plantation (9.61%) |

| Plantation & Agriculture (11.58%) | Sime Darby Bhd (4.87%) |

What we can tell from above is that ASB is pretty heavily invested in the financial sector of the country, namely Maybank, and rightfully so as banks generally give out a decent dividend.

#2 Amanah Saham Bumiputera 2 (ASB 2)

ASB 2, which is also a Bumiputera-only fund, was launched in 2014 with a maximum investment of RM200,000.

In terms of the nature of the fund, ASB 2 is also managing a mixed asset of equities (81.96%) and some other instruments from the capital market (18.04%). What makes ASB 2 stands out among other Fixed Price Fund is that ASB 2 is the ONLY fund with more than 80% of its capital invested in equities.

|

Top 3 Sectors (FY 2019) |

Top 3 Holdings (FY 2019) |

| Financial (25.93%) | Maybank (9.93%) |

| Industrial (11.5%) | CIMB (6.03%) |

| Utilities (10.19%) | TNB (5.91%) |

Without surprises, ASB 2 is also heavily invested in the financial sector.

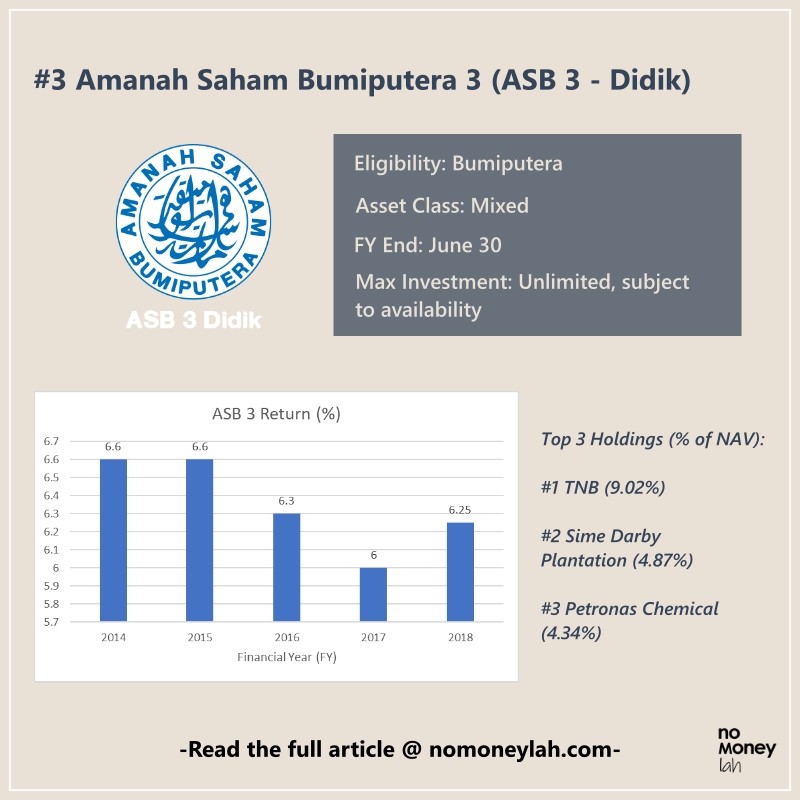

#3 Amanah Saham Bumiputera 3 - Didik (ASB 3)

Another Bumiputera-only fund, what makes ASB 3 different from ASB and ASB 2 is that there is no cap to the maximum investment of each person but instead is subjected to the availability of units.

Similar to ASB and ASB 2, ASB 3 handles a mixed portfolio of assets, with 76.11% on equities and 23.89% on other capital market instruments.

|

Top 3 Sectors (2Q FY 2019) |

Top 3 Holdings (2Q FY 2019) |

| Services & Trade (30.6%) | TNB (9.02%) |

| Plantation (12.31%) | Sime Darby Plantation (4.87%) |

| Industrial (6.74%) | Petronas Chemical (4.34%) |

Unlike the funds before, ASB 3 focused its capital mainly on services & trade sector.

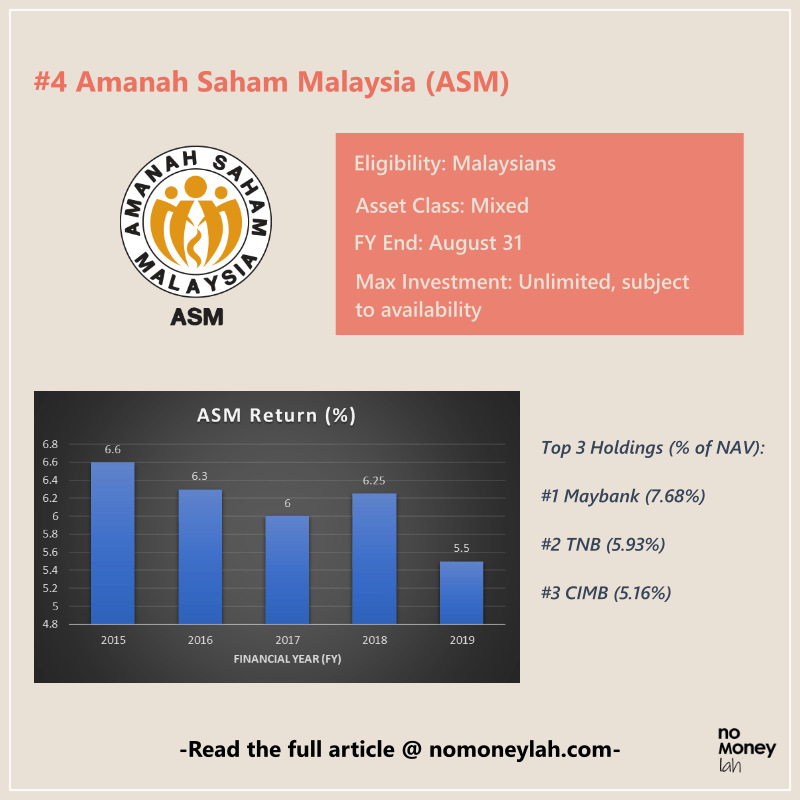

#4 Amanah Saham Malaysia (ASM)

ASM was launched in 20th April 2000, and it is one of the Fixed Price Fund in Amanah Saham that is open to all Malaysians. It has no cap when it comes to maximum investment, yet it depends on the availability of units for purchase.

As a fund that manages a mixed asset class, ASM has a 73.08% breakdown in equities and 26.92% in other market instruments.

|

Top 3 Sectors (FY 2019) |

Top 3 Holdings (FY 2019) |

| Financial (20.78%) | Maybank (7.68%) |

| Services (10.29%) | TNB (5.93%) |

| Utilities (9.59%) | CIMB (5.16%) |

Just like most of the Fixed Price Funds, ASM places a big emphasis of its funds into the financial sector, with Maybank and CIMB being 2 of its largest holdings for the 2019 Financial Year. One thing to note is that ASM is the only fund that performed less than 6% return (5.5%) in its latest financial year – the first to slip under 6% among all 6 funds.

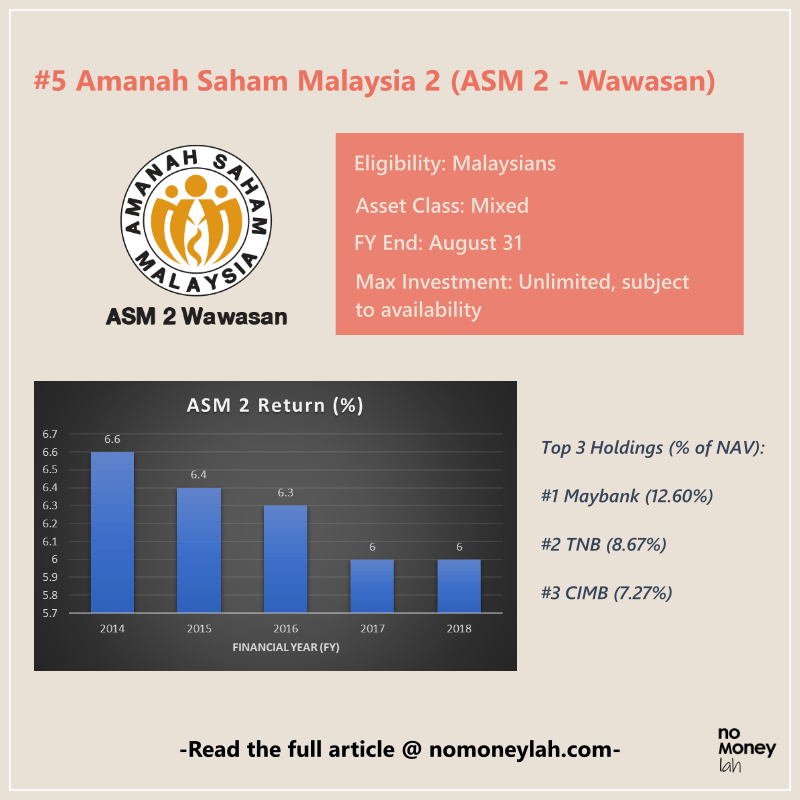

#5 Amanah Saham Malaysia 2 - Wawasan (ASM 2)

Launched in August 1996, ASM 2 is the first Fixed Price fund that is open to all Malaysians public to buy. Just like ASM, ASM 2 has no cap to its maximum investment, yet to purchase you got to depend on the availability of units of the fund.

In terms of asset breakdown, ASM 2 manages 79.39% of equities and 20.61% of other market instruments – making it the 2nd largest equity holding among all 6 funds (the 1st being ASB 2).

|

Top 3 Sectors (FY 2019) |

Top 3 Holdings (FY 2019) |

| Financial (27.85%) | Maybank (12.60%) |

| Services (23.83%) | TNB (8.67%) |

| Plantation (10.12%) | CIMB (7.27%) |

In terms of sector breakdown, ASM 2 is both heavily invested in the financial and services sector, hence any form of performance fluctuation in these sectors would definitely affect the performance of ASM 2.

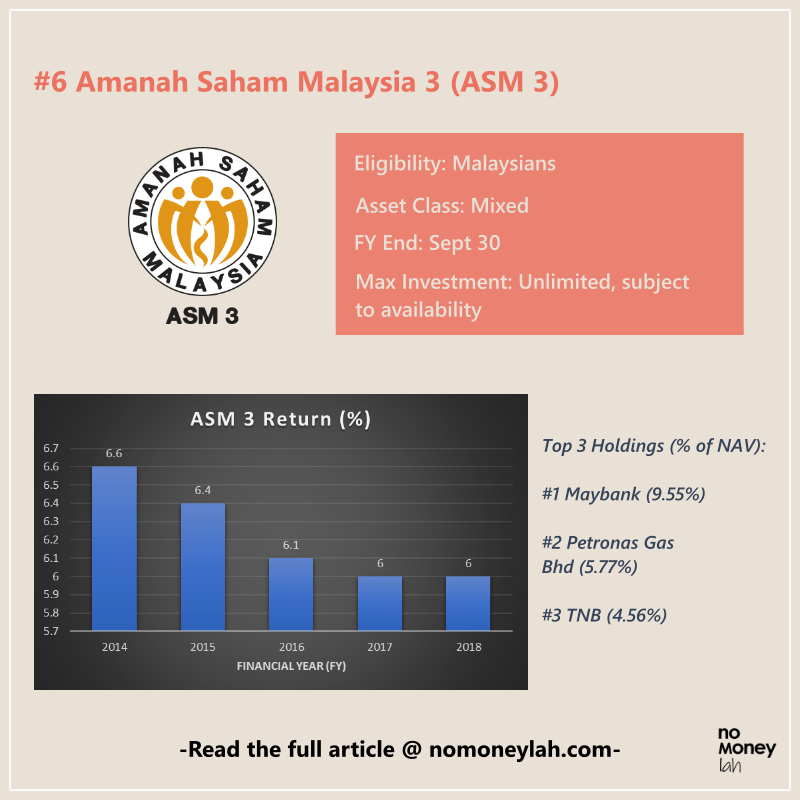

#6 Amanah Saham Malaysia 3 – 1 Malaysia (ASM 3)

Being the latest addition of all-Malaysians Fixed Price Fund (2009), ASM 3 also has no cap to its maximum investment.

Just like all other Fixed Price Funds, ASM 3 manages 73.5% of equities and 26.5% of other capital market instruments in its portfolio.

|

Top 3 Sectors (FY 2018) |

Top 3 Holdings (FY 2018) |

| Services & Trade (22.88%) | Maybank (9.55%) |

| Financial (21.36%) | Petronas Gas Bhd (5.77%) |

| Industrial (7.27%) | TNB (4.56%) |

For ASM 3, Services & Trade sector is one of the main holdings of its entire equity portfolio, followed closely by investments in the Financial sector.

(D) Sector & Company Specific Risks

From the fund description above, it is not hard to spot that there are a lot of similarities between all 6 funds, namely:

Most of the funds either have a big and/or heavily invested in the financial and (some in the) services sector. This means that any news or fundamental changes in these sectors’ performance will affect the return of these Fixed Price Funds.

Of all, interest rate fluctuation is no doubt one of the major risks of banks (financial sector), as any changes in interest rate will impact the revenue of the banks.

Aside from that, there are companies that will always be in the podium of Top 3 Holdings of these funds, such as Maybank and TNB. While these are very reliable blue-chip stocks, any company-specific news could also affect the return of the Fixed Price Funds. (especially ASB and ASM 2 that have a huge holding of Maybank shares)

(E) So…Which Fund Should I Pick?

Firstly, from a pure return perspective, I personally think that any of the funds are okay as they have been giving pretty consistent return throughout the past 5 Financial Years (FY). That said, ASB is likely the favorite as it has been giving not only consistent, but also the highest return among all 6 Fixed Price Funds available.

However, your available options really depend on, well, your race. If you are a non-Bumi (like me), your options are mainly ASM, ASM 2 and ASM 3.

Another catch of these Fixed Price Funds is they are really, really hard to buy. In short, what you WANT to buy may not be what you COULD buy. Reason being, for each fund, a quota is allocated specifically to each race and once the quota is used up, you can only purchase the units if someone else is selling their holdings.

Essentially, you got to have some luck and keep trying if you want to buy into any of these funds (more on this in Part 3).

No Money Lah’s Verdict

So here you go, the in-depth view into all 6 Amanah Saham’s Fixed Price Funds! These are, in every means, some of the best long-term investment options available to Malaysians if you can get your hand on them.

In Part 3 (the final part of this Amanah Saham series), I will share my experience and personal thoughts on Amanah Saham investment with you – so stay tuned and subscribe if you haven’t already!

Do SHARE this article out with your friends and family if you find it useful, would ya’? :)

If you have yet to check out Part 1 of my Amanah Saham investing, be sure to check it out HERE!

Disclaimer: The accuracy of this content is based on the best effort by myself and at the time of writing. I do not guarantee the validity of this content as details and performance of ASNB and its funds will change over time. This article is also not a buy/sell recommendation. Please seek professional financial planner’s advice on this matter.

5 Money Mistakes to Avoid in Your 20s

I have spent the last 2 decades in formal education. Now that I think about it, there are so many things that schools should have taught us, but they didn’t do so.

Of all, how to manage money is one of the most crucial life tools that is unfortunately left out in our education system. As such, it is not without explanation that many of us tend to make irrational money mistakes in our 20s.

Being a 20s myself, and having observed my peers of the same age group and talking to people of older age, here are 5 money mistakes that I think should be avoided in our 20s:

p

(1) Never bother to invest your money (AND learn how to do it properly)

One thing that I find particularly ironic about our generation is that we do not mind the hassle and time wasted lining up for milk tea, yet we never bother to spend time to improve our future lifestyle.

We love instant gratification, yet many do not really care about planning ahead for the future.

As a result, so many are either (i) finding excuses to NOT learn how to invest properly and/or (ii) becoming a victim of ‘Get-Rich-Quick’ money games and illegal MLMs.

In this case, investing is the total opposite of instant gratification. It is where an individual delays his or her current spending impulse and put that hard-earned money into an investment that will grow exponentially in the future – if done properly.

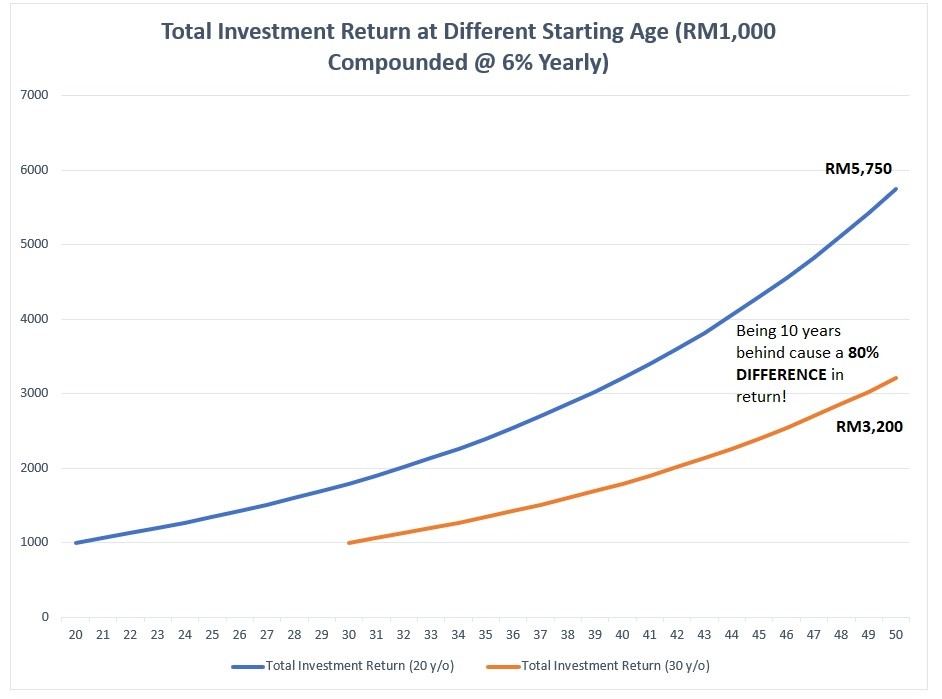

In other words, time is of the essence in determining your investment returns – the earlier you do it properly, the better. As shown in the example below, investing RM1,000 compounded at 6% yearly at 20 years old will make up to 80% MORE in total return when you reach 50 years old compared to investing the same amount at 30 years old.

In short, not learning how to invest your money properly at an earlier age is a costly money mistake that many tend to make in their 20s.

p

(2) Being ignorant about financial protection

Let’s be fair: regardless of your opinion towards the insurance industry, all of us need to be protected financially from unexpected life accidents and events.

Another personal observation is that my peers that are in their 20s have extremely little understanding and awareness of financial protection – even when it is one of the most important aspects of their life.

Being protected financially is like a financial defense line that all of us tend to pay the least attention in, and let’s be honest:

Most of us do not know how well-covered we are financially. You will know what I mean when you are trying to reject an insurance agent, yet you cannot answer their simplest question of:

What is your coverage right now?

That aside, you do know that insurance premiums get more expensive the older you get, right?

Hence, stop being ignorant. Be mindful of how well-protected you are by reassessing your coverages constantly with your financial planners.

p

(3) Acquiring assets (especially depreciating ones like cars) that you cannot afford

Having stayed in the Klang Valley for all my life, I know first-hand that not having a mode of transport like a car pose a huge inconvenience. As such, it is of no surprise when the first huge purchase by a lot of young adults is in fact, a car.

That said, many tend to overspend on the model of cars that they simply could not afford. In other words, instead of getting a car that they can financially afford, many young adults in their 20s tend to get a car that matches their IDEAL lifestyle.

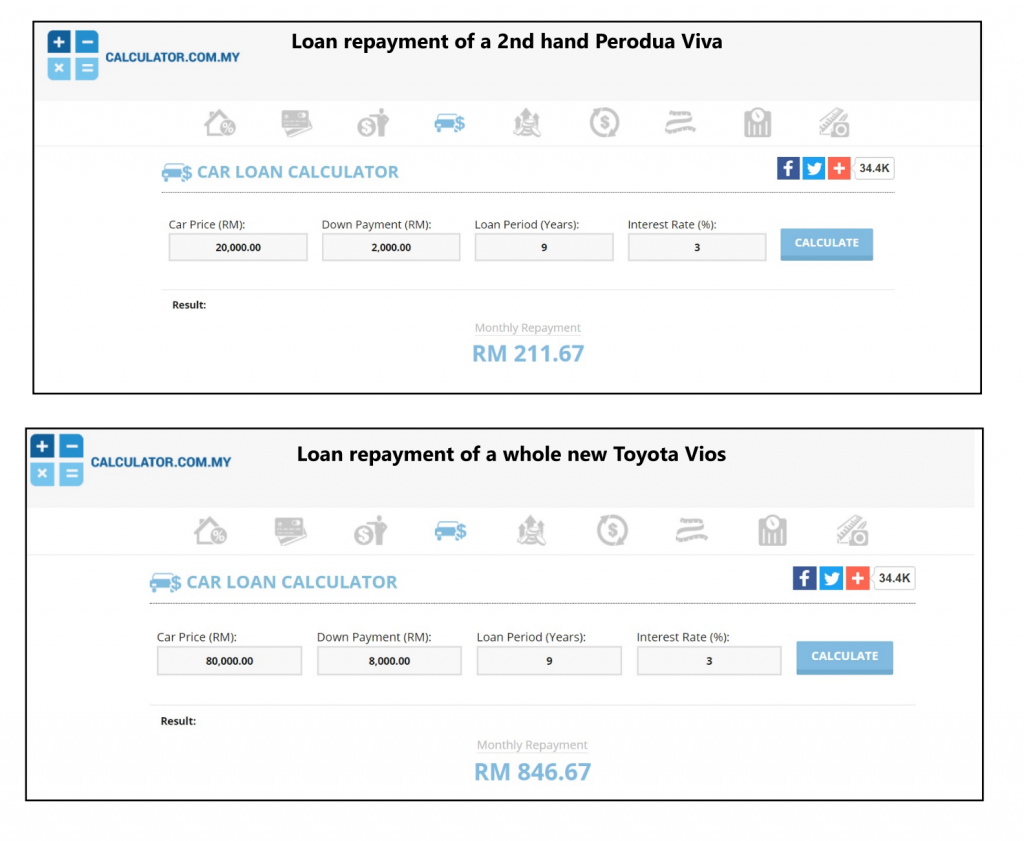

As an example, with a starting salary of RM3,000, a second-hand Perodua Viva may be a practical and financially rational car to own since the loan payment is still within a controllable range of less than 10% of your salary. Yet, if you go for a whole new Toyota Vios, you would be paying nearly 30% of your salary just for your car loan payment!

Do I have to mention that you got to pay for your petrol, road tax and maintenance (which, without doubt, become more expensive with the size of your car) aside from your loan payment?

No one really cares about the car that you drive, really.

p

(4) Obsessive spending on alcohol, drinks, and entertainment

Just scroll through your IG stories on Friday nights (or even other weekday evenings), you will always see the friend that will never miss his or her drinking or clubbing night.

You do know these stuffs are not cheap, right?

Being obsessive with drinking or any form of similar entertainment is one of the easiest ways for you to flush away your hard-earned money. While you are not mindful of it, these expenses could compile up to a huge amount – which could be used to buy yourself a better protection plan, to learn how to invest, and heck, even to pay a few months off your loans!

Look, I have no problem at all with young adults in their 20s having some form of entertainment or drinking once in a while. However, if those are the only things that you are looking forward to every week – to the point of being obsessed, perhaps you got to stand back and start reflecting on your life purpose.

p

(5) Poor money management and habits

Let’s go right into the point:

Not tracking your expenses, have no idea of where your money is being spent, weak control towards buying impulses – do any of these sound familiar to you?

Having a poor money habit and management is, without doubt, the most common money mistake that people tend to make in their 20s. That’s why, among the 100,000 people that were declared bankrupt from 2013 to 2017, 60% of them are aged between 18 to 44.

If you are in your 20s, it is still not too late to change your financial habit right now. Start with baby steps, at least by tracking your expenses on a daily basis (I recommend MoneyLover).

Stop looking for lame excuses for not taking your financial life in control just because you do not have time or have no background in finance or accounting – it is a matter of priority after all.

Remember, as Tun M said:

No Money Lah’s verdict:

If there is anything about adulting, managing money is definitely one of the biggest challenges in this process. However, it is a responsibility that we have to take on eventually regardless of how much we dislike the topic.

As such, I strongly urge you to stop making the money mistakes above and start taking action to reach your financial goals by managing your money habits, learning how to invest (and start young) and taking proactive steps to build the defense line of your financial protection.

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK! More details HERE.

How I got into the verge of breakdown & self-rescued myself out of it.

Last month (March 2019) was a really challenging period for me. I was in the midst of preparing for my very first Breakthrough Your Wealth (BYW) – REIT Investing Workshop for 20 of my close friends and readers, and it was not easy by any means.

p

Let me explain why:

First of all, since the workshop was (and still is) a one-man show, I got to handle everything from syllabus design, agenda planning, communication, marketing, logistics (food & venue) and printing on my own. Besides that, I also had to spend time to practice what I got to say during the full-day (9am – 6pm) workshop.

To add on to the challenges, the progress in designing the workshop syllabus was also slower than my initial expectation, and they were for obvious reasons: Instead of pouring everything that I know out into the PowerPoint slides (like any classic university tutorial presentation), I have to approach this process from the participants’ point of view:

“If I say X, would they understand?” “Would they be confused if I use Y jargon during the workshop?”.

As a result, the initial workflow of getting my syllabus design done during the Chinese New Year week became a month-long project (obviously, I underestimated the process).

p

Stress Piled Up as Time Went By

As March came by, the need to get everything perfectly prepared for the day (the workshop was going to happen on the 30th of March) was overwhelming. Every day, I can literally feel the urge to fulfill every participant’s expectation piling up on my shoulder, and it almost drove me to the verge of breaking down.*

In short, I was way out of my comfort zone and was pretty damn stressed up.

(*Everything happened while I was also juggling between my full-time trading activities and producing content on No Money Lah)

Luckily for me, with some personal hacks and methods, I managed to brace through the stressful month and the workshop ended up pretty good – according to the participants. In this article, I want to share the 5 practices that I used to keep myself from screwing up while I was on the verge of breaking down:

p

(1) Whenever you feel overwhelmed, take 3 long, deep breaths.

The earliest symptom that you are experiencing a panic attack or about to breakdown is the feeling of being overwhelmed with the work in hand. Hence, whenever I felt overwhelmed (or the tension on my shoulders), I will go for 3 long, deep breaths.

As common as this hack is, taking long, deep breaths are extremely useful. As such, taking mindful, deep breaths help in activating part of the brain to release neurohormones that inhibit stress-producing hormones, thus triggering a relaxation response throughout the body.

In other words, long, deep breaths help to calm your nerves.

(2) Whenever you feel stuck, plan & write things down.

In my work with syllabus design for the workshop, I was often met with times where I got clueless and stuck on how to proceed with some sections.

Whenever I felt like hitting a wall and not sure what to do, I will take out a piece of paper and start writing. I will always start with my end goal and start working backward.

eg. In my case, my end goal always starts with the question of “What do I want my participants to learn from a particular section?”. Then, I will derive an approach to achieve my end goal on paper.

Identifying your end goals and planning them recalibrate your mind back to the mission/project, while writing things down on paper gives your mind a clearer picture of what you should do.

p

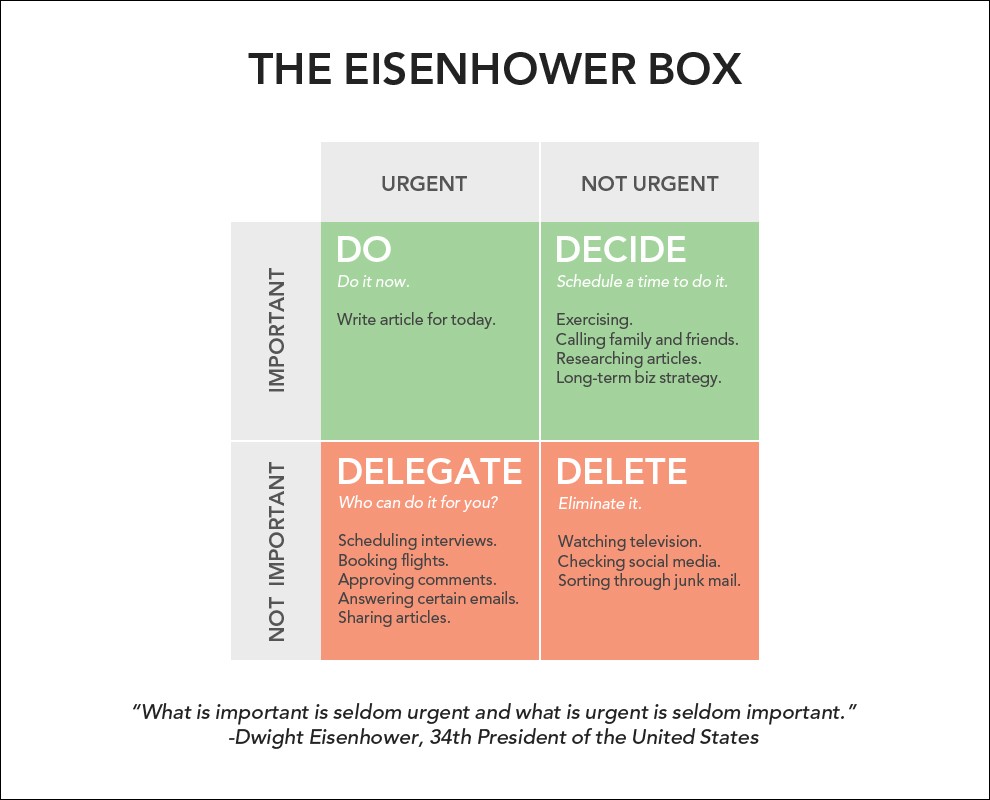

(3) Whenever you feel as if your mind is messy & overloaded, focus on one thing at a time.

There will be times when you may feel like there are too many things to be done. In this case, try method (2) by listing down the tasks that you have to do.

In addition, use the Eisengrade Box to grade those tasks with 4 different priorities:

p

p

Then, focus on doing the one thing that is the most urgent and important to you, then only proceed to other tasks after you are done with them.

Another tip is to stay away from social media while you are overloaded – you will only distract yourself and wasting your time while not getting productive in your work.

(4) Whenever you feel unorganized, commit to at least one health-related routine.

When you are overstressed and overworked, chances are your life will start to go upside down. If this happens, you will start breaking down sooner than you expect.

For me, no matter how stressful the day or month might be, I will always organize my life around a set of morning and night routine – so regardless of how chaos my day is, I will always start and end my day in a positive note.

So if you are feeling unorganized in your life, try to pick up and commit to ONE health-related routine (eg. Exercising, meditation, yoga)

Surprisingly, my daily meditation practice (morning & night) has kept my life from falling apart many times, especially during the workshop preparation.

p

(5) Whenever you feel that you cannot do this alone, get help.

I remembered fondly at the night before the workshop, I had to get all the printed notes hole-punched and filed properly. At the same time, I have to rehearse what I am going to say the next day during the workshop.

At that moment, I got really tight in time and resources. Hence, I got 2 of my best buddy – Eddie and Victor to help me out with the files.

No matter how good you think you are, there will be instances where you cannot get everything done on your own. So, put down that stupid ego (or ‘Asian Paiseh-ness’) of yours and go get help!

P

BONUS: At any moment of time, always remind yourself on your purpose and goals

In the toughness of time, always remind yourself of your purpose and goal.

Why do you do what you do?

Keeping your purpose and goal intact will help you endure even the most challenging moments in your work and life. Just like how petrol fuels our cars, having a solid vision and purpose fuel our actions and keep us going at the lowest point and the steepest hill in life.

If these practices saved me at the verge of a breakdown, I am pretty sure it will help you too! All the best!

5 Mistakes that I made in Stock Market Investment

I first got exposed to the stock market investing back in 2015 through like-minded university friends and investment books. However, without proper guidance and experience with the market, I made tons of mistakes in my early investment journey.

Looking back, while it did not feel good at all to lose money during that time, I am glad that I’ve made those mistakes because it was those experiences that shaped me into a more diligent and careful investor today.

Here are 5 mistakes that I’ve committed, some of which are extremely common among experienced and new investors alike:

p

(1) Making investment decisions based on ‘Hot Tips’ and ‘Analyst Recommendations’

One of the regrettable mistakes that I’ve made in my early investing journey was to rely on ‘Hot Tips’ and ‘Analyst Recommendations’ that were shared with me.

I remembered putting a few hundred bucks into a local stock and ended getting out at a lost just because of a ‘Hot Tips’ from my friend which went like this:

“The boss of the company is very confident that they will do great for the next quarter onwards.”

Dumb me, dumb me.

Depending solely on ‘Analyst Recommendations’ is also extremely dangerous. While you may make money on some ideas, you may also lose a substantial amount in it. The bottom line is, you would never really know the reason of you winning or losing as you’ve not done the necessary due diligence yourself – thus lack the understanding towards the particular company or industry.

p

Key lesson: Always take ‘Hot Tips’ and ‘Analysts Recommendations’ in with a pinch of salt. Even if those insights are true, they would probably have gotten through multiple parties before it reaches you – the final victim of the market.

p

(2) Invest based on Gut Feeling & Impulse without Sufficient Research

Investing based on gut feeling and impulse is another mistake that I have done in my early investing journey. (Confession: I still make this mistake every now and then).

One of my vivid memory of buying on impulse was when my friend was participating in a case study competition and got Inari (a local semiconductor company that works with Apple) to research. As such, I’ve always heard about the company from my friend and hence developed a positive interest towards Inari.

With the very limited information that I got from my friend, I started to formulate my own theory:

“After all, if iPhone sales have (had) been doing so good, Inari should be a great buy, right?”

And you can have a smart guess on my investment outcome.

p

Key lesson: Refrain from investing based on feelings and limited knowledge. If you wouldn’t risk your health by buying a packet food without first checking its expiry date, why gamble your hard-earned savings or money purely on your feelings and limited knowledge?

p

(3) Too Afraid to Cut Losses and Taking Profit too Early

Now, I see this not just in myself, but also among many friends that invest as well.

Some of the biggest frustrations in my early investing journey was NOT so much on deciding WHAT company to buy (I already had ‘Hot Tips’ and ‘Analyst Recommendation’ for that), but rather WHEN to SELL my positions.

With no prior investing experience in the market, I tend to be extremely emotional regardless if price rises or drops.

Reason being, when the price drops, I would be too afraid to cut my losses in hope for a rebound (even worse, some inexperienced investors add-on to their positions while prices are dropping to ‘average’ down their losses).

On the other hand, when price rises, I also have the tendency to sell at little profit in fear of the market reverses later. As a result, some of my profits were cut short when prices move straight up just after I sold my positions.

p

Key lesson: Understand your intention when you enter a position. Are you in for the long-term, medium-term or short-term? Then, set your target profit (TP) and stop loss (SL) accordingly. Most importantly, stick religiously to your TP and SL.

p

(4) Ego to be Right

Well, well. Look at that newbie that tries to brag about his first few winning streaks and try to predict where would the market move in the future.

Chances are, we were in the position of that newbie before. We felt extremely ‘syiok’ or pumped whenever we were right and our positions hit our targeted profit.

Then, we moved on to brag about how easy it is for us to make money from the market. Even worse, we denied every difference in opinion by others.

Not long after that, market trend changes, bringing our beginners luck to an end as well. Guess what? It hurts so much to be wrong.

p

Key Lesson: No one is right 100% of the time. No method or strategy will be victorious 100% of the time. Be humble, if not the market will humble you.

p

(5) Never keep track of my investment

When I first started to invest, the idea of keeping track of my investments never came to my mind. As a result, I kept making the same mistakes over and over again.

Not only that, without a clear record of my investments, I couldn’t even track my profits or losses back then.

Now that I think about it, keeping an investing journal is, in my opinion, the most important habit that every new investor must pick up in order to make it in this journey.

p

Key Lesson: Pick a notebook or journal (or excel), keep track of all your stock investments – the entry and exit price, mistakes and lessons. You may not see the benefits now, but you will soon be glad that you did it in the first place.

--

p.s. Get the Template of My Stock Investment Journal for FREE! More details at the end of this article.

p

No Money Lah's Verdict

So there's it! 5 of the biggest mistakes that I've made in my investing journey and the key lessons that I've learned from them.

All in all, investing for me is more of an art than science. In order to be a successful investor, we have to understand not just the numbers and strategies behind it, but also to master the psychology and discipline as well. It is the discipline and emotional control that separates profitable investors from the herd.

What are your some of your biggest mistakes (and the lessons learned) in investing? Share with me in the comment section below! I cannot wait to learn from you :)

#1 BONUS: Get the Template of My Stock Investment Journal for FREE!

Journaling is the most important habit that an investor must build. If you are keen to build this discipline, I want to support you!

Just click HERE to download my personal investing journal template, and I am sure that you will thank yourself for building this journaling habit!

#2 SPECIAL: Learn how to generate passive income in the stock market!

Click HERE for more details.

What Steve Jobs taught me about Life & Death

If there is one defining individual that has a heavy influence towards some of my biggest life decisions, it would be Steve Jobs.

If there is a trigger point, it was Steve Jobs’ 2005 Stanford Commencement Address and his last words that have helped me made up my mind to pursue the realm of uncertainties as a learn to trade full-time and start No Money Lah.

With that, here are some key pearls of wisdom that I’ve picked up from the legendary Steve Jobs:

p

(1) Death is a destination shared by everyone.

If you know that you are going to die tomorrow, what would you spend your last remaining day doing?

As hypothetical this question might be, this may be the hardest question that you’ve ever have to answer in life.

And if you have this question answered without a second doubt, chances are you have found the most important purpose in your life – the answer to your miseries and doubts all this while, may be just right within you.

The moment when we truly acknowledge and embrace the fact that we are going to die, our priorities in life will change drastically:

All of a sudden, the morning jam to work isn’t so frustrating anymore.

All of a sudden, getting a new luxury car may not be so important anymore.

All of a sudden, expressing your feelings towards the important someone (with the chance of getting rejected) may not be as intimidating anymore.

All of a sudden, having to have dinner with your family members every day become a precious moment in your daily life.

Once you embrace death as a part of life, things that you used to think were important aren’t as big anymore. In contrary, things and people that you have taken for granted all these while become the most important thing in life.

If knowing that death is a destination that we all share together, what would you do differently compared to what you are doing right now?

p

No one wants to die. Even people who want to go to heaven don't want to die to get there.

And yet death is the destination we all share. No one has ever escaped it. And that is as it should be, because Death is very likely the single best invention of Life.

Steve Jobs

(2) When in doubt, follow your heart and intuition.

The irony of all misery is, deep down, we already have a decision or answer within, yet we still do the exact opposite in reality:

When you do something that you truly have no faith in, you will suffer within.

When you sell a product or services that you do not believe in, you will not find fulfillment within.

When you go for a career or degree that does not connect with you, you will not be happy within.

If you are struggling between your inner voice and what you are doing in real life, always follow your heart and intuition. They somewhat already know what you truly want to become. Everything else is secondary.

p

For the past 33 years, I have looked in the mirror every morning and asked myself: "If today were the last day of my life, would I want to do what I am about to do today?"

And whenever the answer has been "No" for too many days in a row, I know I need to change something.

Remembering that I'll be dead soon is the most important tool I've ever encountered to help me make the big choices in life. Because almost everything — all external expectations, all pride, all fear of embarrassment or failure — these things just fall away in the face of death, leaving only what is truly important. Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose.

You are already naked. There is no reason not to follow your heart.

Steve Jobs

(3) Embrace love.

At the final moments of death, the only thing that we can bring with us are the memories precipitated by love, not all our physical riches and wealth gained throughout our lifetime.

Hence, be generous with love.

Love the people that are important to you. Spend time with them. Talk to them. Listen to what they say. Never take the people that you love for granted.

Even more important, love yourself. Be genuinely happy inside and out. Take care of your health. Fill your heart with purpose and fulfillment. Make self-love your biggest priority in life.

p

Nonstop pursuing of wealth will only turn a person into a twisted being, just like me. God gave us the senses to let us feel the love in everyone’s heart, not the illusions brought about by wealth.

The wealth I have won in my life I cannot bring with me. What I can bring is only the memories precipitated by love. That’s the true riches which will follow you, accompany you, giving you strength and light to go on. Love can travel a thousand miles. Life has no limit. Go where you want to go. Reach the height you want to reach. It is all in your heart and in your hands.

Steve Jobs

Side note...

This week’s article is truly a hard piece to produce. Seeing the tragedies happening around the world (Shootings, Plane Crashes, Earthquakes) saddened me, and I can genuinely feel the fragility of life in the moments of death and crises.

If you are reading this, I hope that this article could ease some of the pain and misery that you are going through in life. If you feel any better, even by a little, it would be the happiest thing in my life.

By any chance, do SHARE this article with your friends and family members if you find that they could benefit from it!

Read This if You Feel Miserable in Life

Do you feel miserable in your life most of the time?

As a SPM/STPM leaver, don’t you feel directionless while deciding your next pursuit in life?

As a university student, don’t you feel that you do not belong to the degree that you are pursuing?

As someone in the workforce, don’t you feel that work is, well, just work?

No matter which stages of life you are in, let me ask you this question:

Why do you do what you do?

This sounds like a question so simple that people would have simply shrugged it off with a standard:

“Nah…no specific reason.”

Or… is it so?

If, for most of the time, you have been miserable with life, chances are, if you have yet to ask this question enough – and not being honest enough to face the right answer within.

So let me ask you this question again:

WHY do you DO what you DO?

Are You Doing This for Others, or for Yourself?

For a big part of our early life, many of us have been living it in a pre-arranged manner.

Remember the piano classes on Monday? How about those badminton lessons on Saturday morning? Don’t even mention the drawing classes on my beautiful Sunday mornings (of which, I still got a ‘D’ in my Art (Seni) in my high-school years).

School was even more rigid – “Ah, you scored well in PMR/PT3, off you go to the science stream.”

If any, I hated science subjects more than ever!

Wait, there is more:

“Wow, you did a great job in SPM/STPM, you gonna do well studying law!”

If you haven’t noticed yet, we have been living our early life that is very much planned or as according to our parents’ arrangements and societal norms. Here’s a problem with this way of living:

While it may have helped us established a sense of how to live our life, it may not be the best way to live it – for the rest of our life.

Hence, for most of us, it goes without saying that a lot of our life choices that got us miserable is heavily influenced by the norms (or expectations) set by our parents and the society.

Look, careers like lawyers or doctors may be prestigious in the eyes of society, but are you in your career because of societal status? Or are you pursuing your career because it is your passion to uphold justice and save lives?

Are you doing what you do for the sake of meeting people’s expectation on you, or are you doing it because that is what you truly want to do?

Be Selfish with Your Purpose

Now, this may sound counterintuitive but hear me out:

p

You have to be selfish when it comes to the purpose of doing what you do.

p

Too many of us, when asked of the reason for pursuing certain life choices, we put too much weight on societal norms and expectations.

“I studied dentistry because my whole family is in the business.”

“I work as a consultant in Big 4 because all my peers are doing the same thing.”

“I got to find a partner and get married by 28, because that’s usually the case for most people.”

If your primary purpose in doing what you do is to fulfill your family and society’s expectations, it is hard not to feel miserable especially when routine gets boring and when times are tough.

Having a purpose that comes within yourself make tough times and repetitive routines more bearable. You know that you are in charge of making things work. You know that you make a particular choice willingly.

You know that you are doing it for yourself.

“I studied Chinese Medicine because I want to help to treat more people.”

“I become a comedian because I enjoy putting smiles on people’s face.”

“I agreed to Joel’s proposal because I wish to build a family with him.”

Whatever you do, do it for yourself. Having a selfish purpose in what we do prevents us from burning out of societal expectations.

The question is: WHAT do you REALLY WANT to do?

p

Be Selfless with Your Goals

This is weird. You’ve just asked us to be selfish with our purpose, yet now you are asking us to be selfless with our goals?

You see, while your purpose or intention should come from what you want or desire to do, but your actions and goals could be as big as making the world a better place. In other words:

p

You can be selfish with your purpose, yet selfless in your goals.

p

Of course, a selfless goal does not mean that you have to change the world. It could be to make the community around you - your workplace, your local club/society, your home, a better place to live in.

It could be as small as sharing your recycling knowledge online to help raise more awareness towards the environment, or even as big as a global movement to encourage race and gender equality all around the world – all because you WANT to do so.

If having a selfish purpose prevents you from unnecessary burnout, then having selfless goals give you a sense of fulfillment in what you do – something that many miserable people do not find in themselves.

The key to getting out of misery

To be honest, it is simple to say whatever I’ve said than actually doing them in real life.

This is because whenever we try to move out and do something out of the norm, we would normally be met with resistance, not just externally but also within ourselves. Changes, well, are never meant to be comfortable.

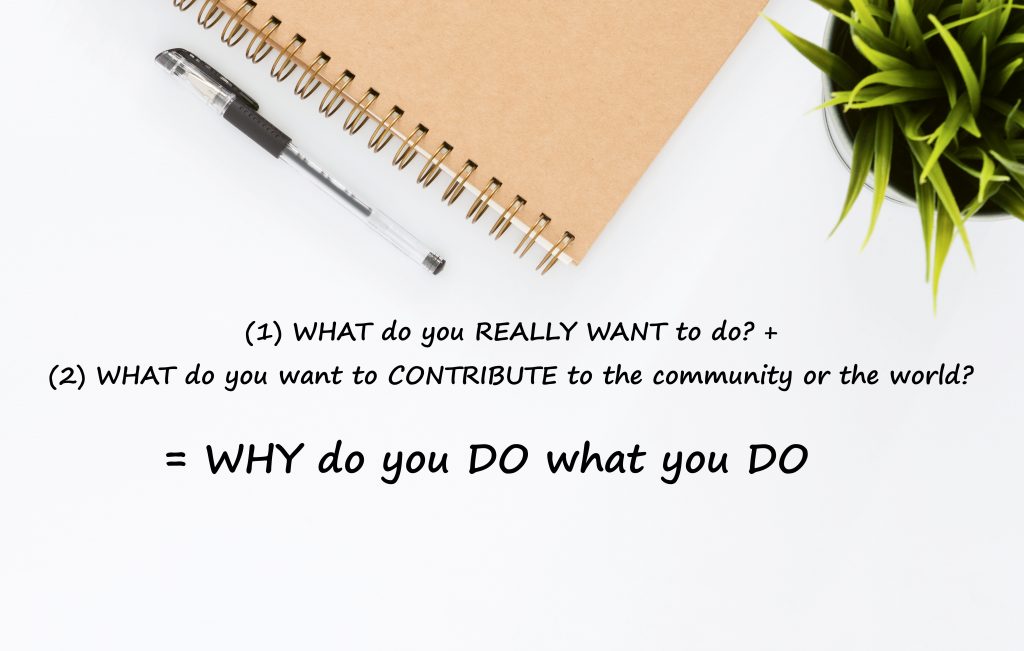

In this instance, some people turn back to their comfort zone and continue to live their miserable life, while some break out of the zone to find their WHY in life. For you that need help in finding your WHY, I leave you with this formula:

p

Remember: Be selfish with your purpose, be selfless with your goals.

Compounding Effect: The Art of Getting Rich

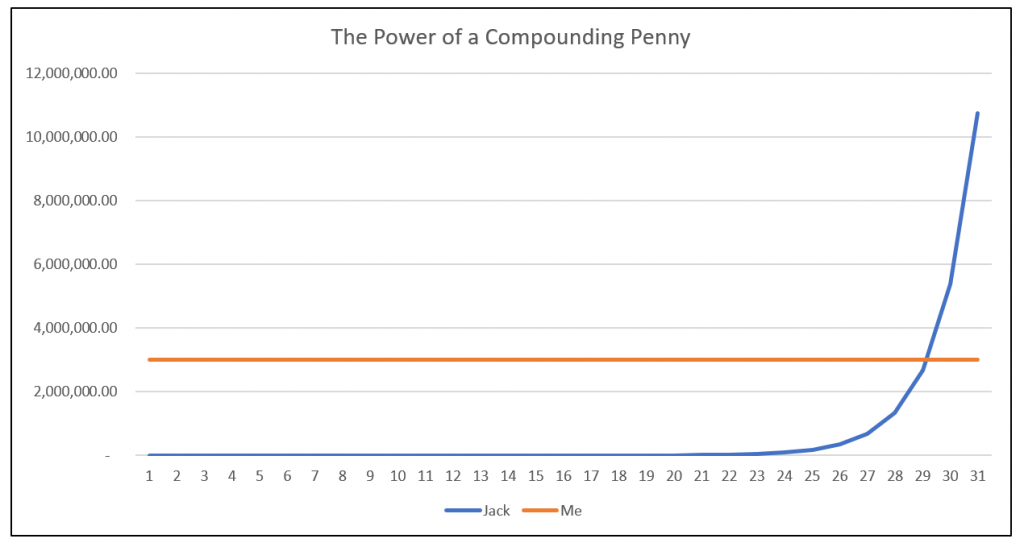

Let’s say you were given an option to choose between taking RM3 million (RM3,000,000) in cash this very instant and a single cent (RM0.01) that doubles in value every day for 31 days, which option would you choose?

p

The Incredible Story of a Compounding Penny

When I first encountered this question in a book, picking RM3 million seemed like a no-brainer. After all, how would a single cent make any difference in my bank account?

Now, let’s say I eventually chose to take RM3 million in cash, and my friend, Jack, chose the latter:

p

Day-5: I would feel sorry for Jack because he only has 16 cents (RM0.16) compared to my gigantic RM3 million.

Day-10: I would be laughing at Jack because he only managed to accumulate RM5.12 in his pocket.

Day-20: With only 11 days left, Jack has only RM5,243 with him compared to my RM3 million. In that instant, it is easy to dismiss and conclude that Jack has made a poor decision in life.

However, it is not until the final days of the 31-days bet that we finally witness the magic of a doubling cent.

Day-29: Jack has managed to accumulate RM2.7 million. Close enough, but still lesser than my RM3 million.

Then, by Day-30, Jack finally surpassed me and accumulated RM5.3 million on hand. Finally, on Day-31, Jack won the month-long bet by making RM10.7 million (vs my RM3 million) merely from a single cent that doubles in value.

p

This would have put me into shame and regret with my decision, but more importantly, we see why being consistent over time is so crucial.

p

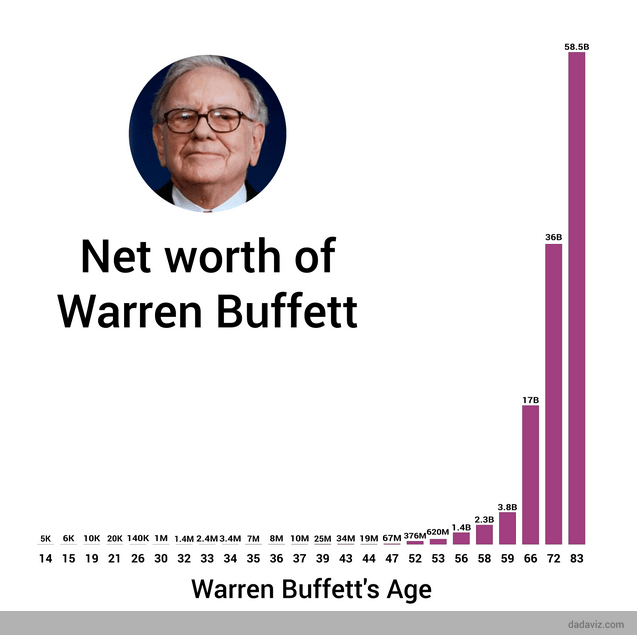

How did Warren Buffett Become So Rich?

It may seem crazy how a single cent that doubles in value can grow into such extend given consistency and time.

This is the Power of Compounding Effect. It is the idea that given time, with the consistency in effort (eg. Investments, Habits), the payoff will eventually compound and return to us in an exponential rate (as seen in the previous chart).

Warren Buffett, one of the richest figure in the world, built his wealth mainly via interest from the companies that he invested in. At age 56, his net worth was $1.4 billion. If this looks like a lot to you, his wealth grew more than 1000% to $17 billion by the age of 66!

If you observe the image below carefully, you will realize that the vast majority Warren Buffett’s fortune is acquired later in life. In fact, it is the power of compounding that triggered such an exploding growth, very much alike with the story of the Compounding Penny above.

p

Great. So What Does That Mean for You and Me?

(1) Positive behaviors and habits, no matter how small they are, given time, will become a formidable push of success via Compounding Effect:

Hence, start now.

You may not see the immediate effect of jogging 2km daily, but you will be surprised by how healthy your life will become if done consistently.

You may not become financially free right after learning new investing knowledge, but you will be surprised by how continuous learning will lead you to your goals if done consistently.

You may not become rich instantly after investing, but you will be surprised by how an RM1,000 investment into the right company can grow by more than 470% in 30 years (at a conservative 6% dividend return a year) if you have the patience to let your wealth grow via Compounding Effect.

Again, start now.

p

(2) The idea behind Compounding Effect is simple and powerful. And it can work both ways:

You could either take control and work consistently towards your life and financial goals from now on, OR you could choose to do, well, nothing.

Taking charge of your life with consistent life and money habits may not be the most comfortable option at the beginning (well, isn't that always the case with making changes in life?). But given time, persistence and the right strategies, your path to success is only a matter of time:

A matter of time before momentum takes off and the power of compounding effect starts rewarding you with exponential returns.

On the contrary, sticking with your current life and financial status with no intention to improve may be the best option at the moment. After all, we ain’t have time for this, right?

But if you choose to do so, just do not regret with the fact that mediocrity will always be part of your life. Period.

The Conversation Between 2 of the Richest Men on Earth

Jeff Bezos once had a conversation with Warren Buffett, and I think this conversation would bring a very on-point end to this article. The conversation went on like this:

Now that you understand the Art of Getting Rich, here are 4 Financial Goals in life and how to achieve them!

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK!

9 Simple Ways to Build Better Relationship with People (Part 2)

In Part 1 of this article, we've discussed 4 key people skills as outlined in the amazing personal development classic: How to Win Friends & Influence People by Dale Carnegie.

In Part 2, let's explore 5 more important (yet surprisingly simple) people skills mentioned in this book!

p

(5) Admit your mistakes

We all understand how hard it is to put down our ego to admit our mistakes upon making them sometimes.

At times, although we realized that we've made a mistake, many of us tend to choose to be arrogant, stubborn and persistent in the same standpoint which may results in an endless argument.

Here's a good commercial example of admitting to mistakes:

A customer found a dead lizard in the Salted Egg Snacks sold by the Singapore-based food company Irvins. Rather than avoiding this incident or trying to cover it up, Irvins conducted their apology and offered refunds.

They chose to face it, learn from it and move on to provide a better experience to all customers. Learning from their integrity and honesty, let's practice the courage to admitting our mistakes and making it a habit.

(6) Make them say "Yes, Yes, Yes!"

As taught in the book, the moment you start to say "No", all your pride and ego demands that you remain consistent with your "No".

It takes a huge effort, facts and action for a person who've said "No" in the very beginning to turn into affirmative.

Hence, the next time when you need something, try to ask using questions like "Wouldn't you", "Don't you think" to get people to reply your questions with a "yes".

You will experience the differences as you have set the tone of the conversation to be a positive one.

(7) Make it a point to give credit to others

As mentioned above, people in general like the feeling of being important.

As such, we tend to take full credit to ourselves for all the achievements accomplished by saying things like "That was my idea" or "We succeeded because I did XXX in the process".

The irony is, no one enjoys the feeling of being sold something or asked to do something, unless it is something they have initiated or created.

Looking from a salesperson's perspective, instead of pushing hard to sell a product, why not let the potential customers use for free and get their feedback or ideas?

Doing so, the customer does not have to be sold and will buy it when he is credited by the salesman because of giving such insightful feedback and ideas to improve.

This principle is so easy to apply in different areas. As a start, you could try it with your team members, sincerely praise your partner in front of everyone etc.!

(8) Talk about our own mistakes first before pointing out others' mistakes

We often condemn, complain and criticize whoever that did something which made us unpleasant or uncomfortable.

However, let's take a step back and reflect on this.

Why do we do this?

Because it makes us feel great as if we have won over the person. Yes, you may have won the argument but not the person's heart.

To gain creditability for your words, you will need to talk about your own mistakes first. For instance, use sentences like "You have made a mistake, but it is not as bad as the one I made when I was at your age".

Bringing up your past mistakes can help change one's behavior, because it shows them the reasoning of your statement and it makes full sense to stop repeating your mistakes

(9) Ask questions instead of giving direct orders

"Do this and do that". "Do not do this and do not do that".

No one likes getting orders in this manner, because they do not have a say in the decision-making process.

However, using a different approach, in this case asking questions can help you to achieve the same objective of conveying instructions.

Imagine that you already have a plan in mind but to give people the sense of appreciation and help spur their creativity, you could ask questions like "what do you think", "what would you suggest", "Can anyone think of XXX".

That is the point when the team starts contributing ideas, which could lead to a better solution that is agreed among all the team members. Everyone wins.

Here you go! 5 more simple ways to build better relationships with people! If you have missed out on Part 1, definitely check it out HERE!

What you have learned from above are only 9 out of the 30 principles taught in How to Win Friends & Influence People by Dale Carnegie.

Meanwhile, if you want to discover all the essence of this book, definitely GRAB A COPY of this book at the link below! If you have read this book, do share your view in the comment section below! I cannot wait to hear from you!

Before we part ways, be a social butterfly and make 2019 your year, would you?

p

About Guest Writer:

Xi Rong’s enthusiasm with books started back in 2016. It is hard to imagine someone who used to hate reading actually could find books as his best companion. If you believe in it, a book is the best teacher and a priceless commodity for every reader. He reads a huge spectrum of books, ranging from financial, management, self-help, business, marketing, communication and more! Check out his Instagram Stories Highlight here for his amazing collection of book reviews!

Also, you can also connect with Xi Rong via LinkedIn.

9 Simple Ways to Build Better Relationship with People (Part 1)

Andrew Carnegie, also known as the Steel King, is one of the richest man in history. Yet, don’t be surprised that he, in fact, had just very little understanding of steel manufacturing.

With that in mind, how did he actually build his legendary business empire? The key answer (which always seemed underrated): PEOPLE SKILL.

He knew how to handle people, and that is what made him rich.

The Carnegie Mellon Foundation & Stanford Research Institute International conducted research with Fortune 500 CEOs in 2015 and discovered that 75% long-term job success depends on people skills, while only 25% on technical knowledge.

Given that you are still reading this post shows how curious and eager you are to discover this skill even further. Well, people skill is not rocket science as you think it is and I’ve found you a quickest and effective way!

I’ve read over 30 books in 2018, but this one stands out among the rest: “How to Win Friends & Influence People”. An ever-classic self-help book written by Dale Carnegie in 1936. Here are the top 9 simple hacks about people-skill in the book that I find interesting:

p

(1) Give honest & sincere appreciation

Deep inside, everyone desires the feeling of being important.

The feeling comes in different forms.

As an example, people like Warren Buffett and Bill Gates got their feeling of importance by contributing most of their wealth to philanthropic causes. On the other hand, an employee who worked super hard got the same feeling the moment he got promoted.

The next time someone makes a mistake, whether at work, school or home, you should never kill off their ambition or enthusiasm by criticizing the person.

Instead, try giving them appreciation and praise. They will cherish, treasure and repeat it.

This is how simple words can change one's life.

(2) Smile

To get someone to like you instantly, a smile is probably the easiest thing to do that requires minimal effort.

It is a magical force that will help you in building a positive first impression and shows others how easy-going you are as a person. Of course, it is impossible to fake a genuine, warm smile as it depends on our inner condition.

How do we think and control our thoughts will ultimately determine our level of happiness.

Next time, when you are afraid to network, nervous for a job interview or having a bad day, a smile is always something that you can do to help you overcome these hurdles.

P

(3) Remember the names

Have you ever experienced a conversation where you just got to know someone new, and proceed to forget his/her names the next moment after a good conversation?

Just like how people appreciate the feeling of importance, everyone likes their names to be remembered as well. The ability to remember names is as important in business and social contacts.

Starting from today, try saying "Hi John" instead of just "Hi bro". Even if you do not recall the new acquaintance’s name, just ask again (with no awkwardness) and write it down if necessary.

Want to start winning win friends? First, you would have to remember their names.

(4) Be genuinely interested in others

Being genuinely interested in the people around you are essential to develop long-lasting relationships!

Often, unless those who are important to us (eg. future wife, potential business partner), we tend to care about ourselves more than others.

Believe it or not, according to Dale Carnegie, you can make more friends in 2 months by being interested in other people than you can in 2 years by trying to get others to be interested in you.

Ask yourself these 2 questions, "Are you genuinely interested in ones' life story?" and "Do you care or curious about what they are struggling, enjoying or thinking?".

5 More Useful & Simple People Skills in Part 2!

What you have learned from above are only 4 out of the 30 principles taught in How to Win Friends and Influence People by Dale Carnegie. In the next post, you will learn 5 more useful and simple principles outlined in this amazing book.

Meanwhile, if you want to discover all the essence of this book, definitely GRAB A COPY of this book at the link below! If you have read this book, do share your view in the comment section below! I cannot wait to hear from you!

Stay tuned for Part 2!

p

About Guest Writer:

Xi Rong's enthusiasm with books started back in 2016. It is hard to imagine someone who used to hate reading actually could find books as his best companion. If you believe in it, a book is the best teacher and a priceless commodity for every reader. He reads a huge spectrum of books, ranging from financial, management, self-help, business, marketing, communication and more! Check out his Instagram Stories Highlight here for his amazing collection of book reviews!

Also, you can also connect with Xi Rong via LinkedIn.

4 Ultimate Financial Goals in Life & How to Achieve Them

Look, you are now a working adult with a decent monthly income. However, no matter what you how hard you work every month, your money in the bank doesn’t seem to grow much, at least not at the extent you desire.

They (the society) says that you got to have a house by 30, and you are looking to marry the girl of your life by the age as well. Damn, what about the expenses with having kids after that?

Where will all this money come from?

You see, many of us know the importance of money. However, only a few know how to manage money.

Coincidentally, the people that know how to manage money are the ones are financially better off in life. Heck, they may not even earn as much as you every month, but they are wealthier than you in the end.

Why is it so?

One of the reason is that they have clear and precise financial goals, and they work towards it with commitment and discipline no matter their current financial condition.

If you want to make the most out of your hard-earned money, here are 4 ultimate financial goals in life that you got to strive to achieve:

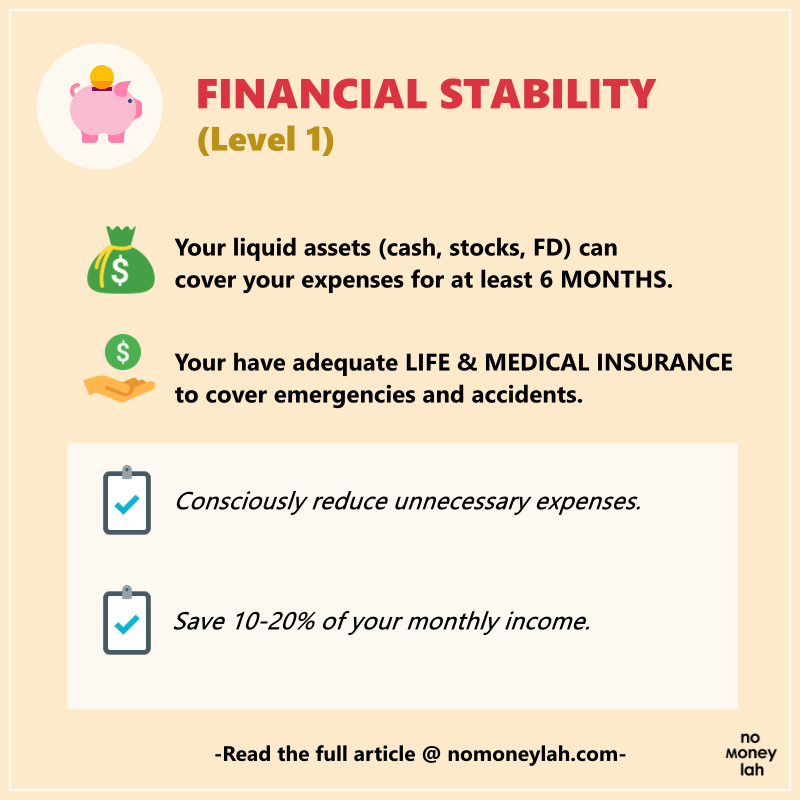

Level 1: Financial Stability

To achieve any sort of financial successes in life, you must first aim to achieve Financial Stability.

Essentially, you have attained Financial Stability when:

- Your existing liquid assets* are 6 times your monthly expenses, and,

- You have life and hospitalization insurance to cover you and/or your family’s expenses should anything happen to you.

In short, attaining Financial Stability will give you peace of mind knowing that your current lifestyle is in good hands should unexpected events such as retrenchment and accidents happen to you.

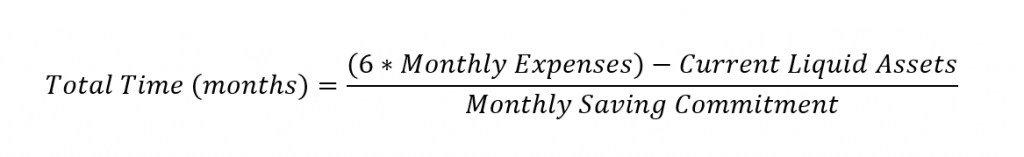

How to achieve Financial Stability?

Step 1: Identify your current monthly expenses.

Step 2: Identify your current status of liquid assets.

Step 3: Identify the total liquid assets needed to cover your monthly expenses for 6 months. (6 x Monthly Expenses – Current Liquid Assets)

Step 4: Commit to save at least 10% - 20% of your net income every month to fill up the differences.

Step 5: Identify how long you will take to achieve Financial Stability given your saving commitment:

Step 6: Last but not least, make sure you have enough insurance coverage for you and your family members!

*Liquid assets are things such as cash or assets that can be readily converted into cash. (eg. Fixed Deposit, Stocks, Unit Trusts)

p

Level 2: Financial Security

Financial Security is the level of wealth where you have attained income-generating assets and investments to generate passive income enough to cover your most basic expenses.

At this level, you can stop working and still live a very basic lifestyle. It also means that if you continue to work, all your active income will go towards building other income streams and investments and this will further compound your overall asset value.

A list of basic expenses is:

- Personal/family expenses (eg. Food, groceries)

- House and car loans

- Transportation (eg. Petrol, Touch & Go)

- Utilities (eg. Water and electricity bill, phone bill)

- Credit card interest repayment

- Insurance premium

How to achieve Financial Security?

Step 1: Identify your basic expenses (monthly) and multiply by 12 months to find out your basic expenses per year.

Step 2: Identify your current passive income per month. How much more do you need to fill in the balance to cover your basic expenses?

Step 3: Think of all the potential income streams and income-generating assets that could generate the passive income needed to cover your basic expenses.

Step 4: Execute and build those income streams and assets.

As an example, you could focus on building your passive income via intellectual properties (eg. Books, Courses) and investment in dividend-generating stocks (eg. REITs). As a rule of thumb, focus on building at least 3 – 5 streams of income-generating assets.

p

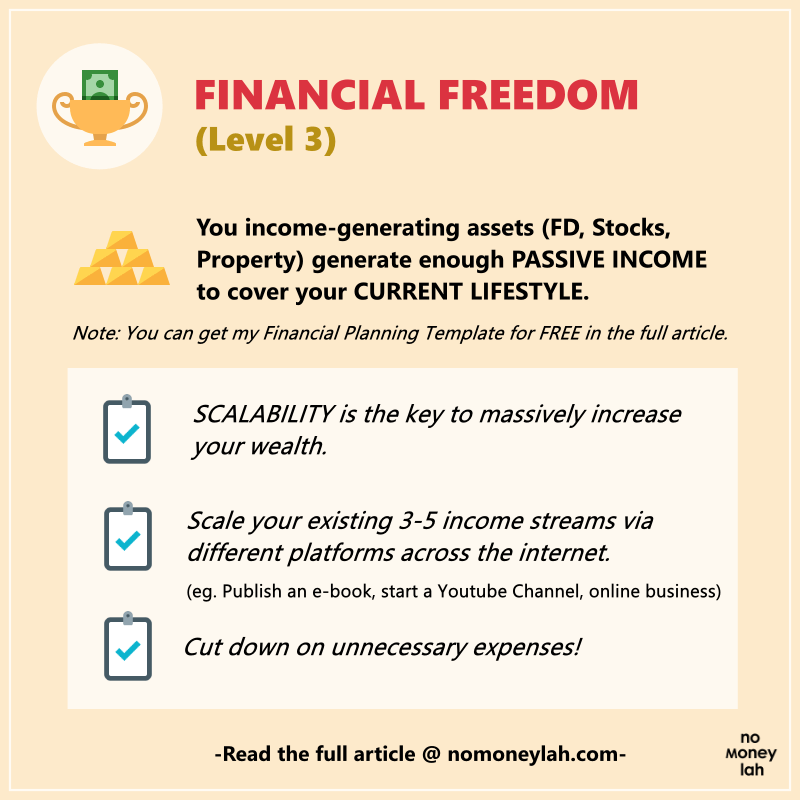

Level 3: Financial Freedom

You have achieved Financial Freedom when your level of passive income is able to sustain your current lifestyle. This may include things like going for vacation abroad once every year and a decent birthday meal for your loved ones a few times a year.

Achieving Financial Freedom is one of the most enlightening moment in life, as you continue working not because you have to, but because you choose to do so.

Again, depending on your lifestyle (how you spend), you may achieve Financial Freedom earlier or later than others. Hence, to achieve Financial Freedom, it is also essential for you to cut down unnecessary expenses.

How to achieve Financial Freedom?

Once you have built at least 3 – 5 income-generating assets and achieve Financial Security (Level 2), you have to learn how to scale them to influence more potential customers and increase your return.

As an example, if you have written a book, now you can write an e-book or online course to teach people your knowledge. Having your products online have a higher scalability factor that could reach out to more potential customers.

Likewise, you could start a YouTube channel or blog to reach out to more customers within your niche area.

p

Level 4: Financial Abundance

Financial Abundance is a level higher compared to Financial Freedom. It is a stage where your passive income is able to sustain your dream life. This is the level that is achieved by people such as Warren Buffett and Bill Gates.

How to achieve Financial Abundance?

As the popular saying goes: In general, every millionaire has an average of 7 income streams. Hence, it is essential for you to expand your income streams in order to achieve Financial Abundance.

Some of it may include investments into high-yield businesses and stocks, high scalability online business, investments into real estate, network marketing and more.

p

Financial Plan to Achieve Financial Security, Financial Freedom and Financial Abundance

An example below is a template that you can use to plan your financial goals.

Remember, while some income-generating assets do need certain capital to start, many can be started without much capital in hand. The most important thing is to just START and give your 101% in effort.

Also, do note that income-generating assets that produce passive income does domean that you got to sit there and wait for the money to flow in. In general, most passive income streams require your attention and utmost effort to build and sustain, especially during the early years.

p

No Money Lah’s Verdict

So here you go! To ensure financial success in life, here are 4 financial goals that you should strive to attain, stage by stage.

Before we part ways in this article, do understand that no one stage is easier to achieve that the other. Do not feel depressed if you haven’t achieved any of these goals yet (I myself is working towards Level 1 too!).

Rather, let's devise plans and call-to-actions to make sure we commit and work towards these goals!

I wish you an amazing financial journey and I look forward to hear your financial success stories some day in the future!

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK!

p.s. This post is inspired by Adam Khoo's book 'Secrets of Self-Made Millionaires'. You can get this book at any local bookstores near you.