Last Updated on May 2, 2022 by Chin Yi Xuan

I have spent the last 2 decades in formal education. Now that I think about it, there are so many things that schools should have taught us, but they didn’t do so.

Of all, how to manage money is one of the most crucial life tools that is unfortunately left out in our education system. As such, it is not without explanation that many of us tend to make irrational money mistakes in our 20s.

Being a 20s myself, and having observed my peers of the same age group and talking to people of older age, here are 5 money mistakes that I think should be avoided in our 20s:

p

Table of Contents

(1) Never bother to invest your money (AND learn how to do it properly)

One thing that I find particularly ironic about our generation is that we do not mind the hassle and time wasted lining up for milk tea, yet we never bother to spend time to improve our future lifestyle.

We love instant gratification, yet many do not really care about planning ahead for the future.

As a result, so many are either (i) finding excuses to NOT learn how to invest properly and/or (ii) becoming a victim of ‘Get-Rich-Quick’ money games and illegal MLMs.

In this case, investing is the total opposite of instant gratification. It is where an individual delays his or her current spending impulse and put that hard-earned money into an investment that will grow exponentially in the future – if done properly.

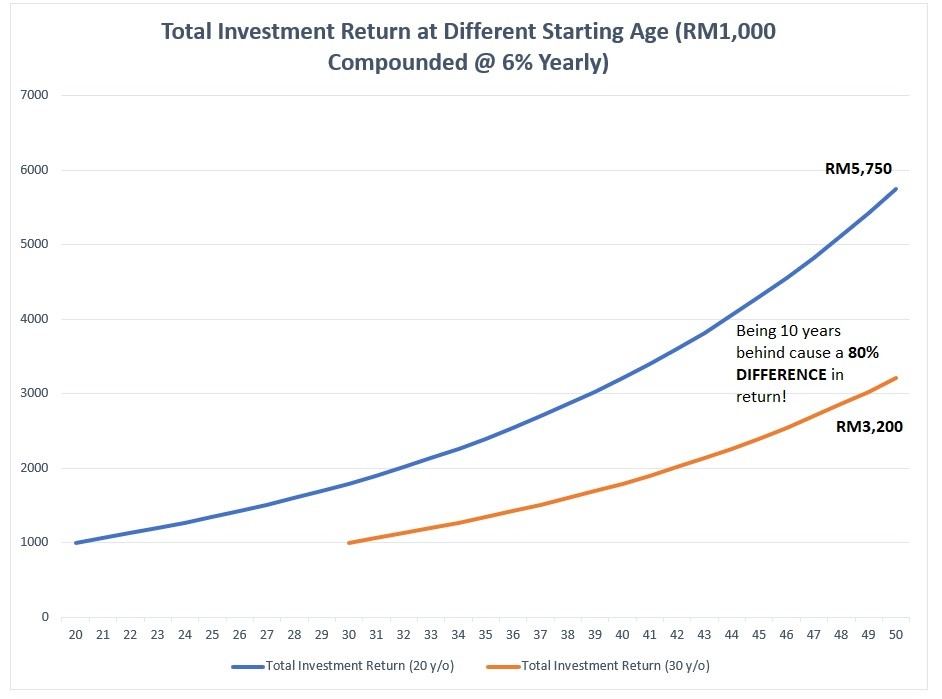

In other words, time is of the essence in determining your investment returns – the earlier you do it properly, the better. As shown in the example below, investing RM1,000 compounded at 6% yearly at 20 years old will make up to 80% MORE in total return when you reach 50 years old compared to investing the same amount at 30 years old.

In short, not learning how to invest your money properly at an earlier age is a costly money mistake that many tend to make in their 20s.

p

(2) Being ignorant about financial protection

Let’s be fair: regardless of your opinion towards the insurance industry, all of us need to be protected financially from unexpected life accidents and events.

Another personal observation is that my peers that are in their 20s have extremely little understanding and awareness of financial protection – even when it is one of the most important aspects of their life.

Being protected financially is like a financial defense line that all of us tend to pay the least attention in, and let’s be honest:

Most of us do not know how well-covered we are financially. You will know what I mean when you are trying to reject an insurance agent, yet you cannot answer their simplest question of:

What is your coverage right now?

That aside, you do know that insurance premiums get more expensive the older you get, right?

Hence, stop being ignorant. Be mindful of how well-protected you are by reassessing your coverages constantly with your financial planners.

p

(3) Acquiring assets (especially depreciating ones like cars) that you cannot afford

Having stayed in the Klang Valley for all my life, I know first-hand that not having a mode of transport like a car pose a huge inconvenience. As such, it is of no surprise when the first huge purchase by a lot of young adults is in fact, a car.

That said, many tend to overspend on the model of cars that they simply could not afford. In other words, instead of getting a car that they can financially afford, many young adults in their 20s tend to get a car that matches their IDEAL lifestyle.

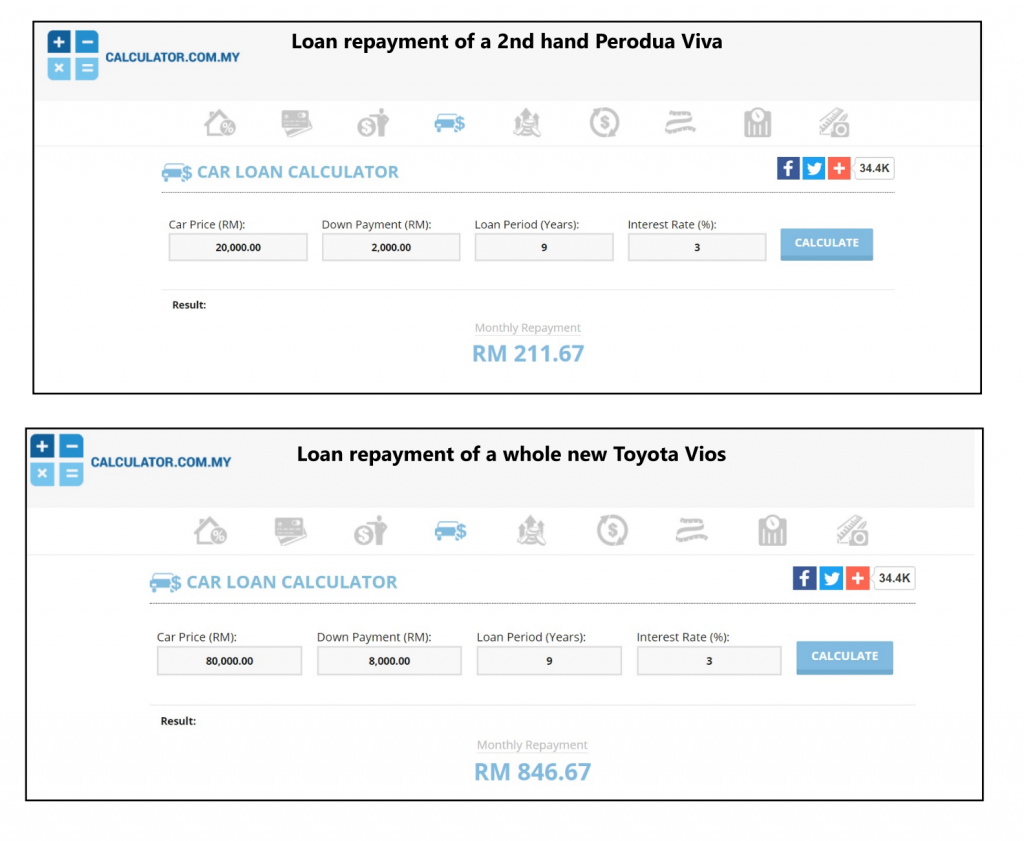

As an example, with a starting salary of RM3,000, a second-hand Perodua Viva may be a practical and financially rational car to own since the loan payment is still within a controllable range of less than 10% of your salary. Yet, if you go for a whole new Toyota Vios, you would be paying nearly 30% of your salary just for your car loan payment!

Do I have to mention that you got to pay for your petrol, road tax and maintenance (which, without doubt, become more expensive with the size of your car) aside from your loan payment?

No one really cares about the car that you drive, really.

p

(4) Obsessive spending on alcohol, drinks, and entertainment

Just scroll through your IG stories on Friday nights (or even other weekday evenings), you will always see the friend that will never miss his or her drinking or clubbing night.

You do know these stuffs are not cheap, right?

Being obsessive with drinking or any form of similar entertainment is one of the easiest ways for you to flush away your hard-earned money. While you are not mindful of it, these expenses could compile up to a huge amount – which could be used to buy yourself a better protection plan, to learn how to invest, and heck, even to pay a few months off your loans!

Look, I have no problem at all with young adults in their 20s having some form of entertainment or drinking once in a while. However, if those are the only things that you are looking forward to every week – to the point of being obsessed, perhaps you got to stand back and start reflecting on your life purpose.

p

(5) Poor money management and habits

Let’s go right into the point:

Not tracking your expenses, have no idea of where your money is being spent, weak control towards buying impulses – do any of these sound familiar to you?

Having a poor money habit and management is, without doubt, the most common money mistake that people tend to make in their 20s. That’s why, among the 100,000 people that were declared bankrupt from 2013 to 2017, 60% of them are aged between 18 to 44.

If you are in your 20s, it is still not too late to change your financial habit right now. Start with baby steps, at least by tracking your expenses on a daily basis (I recommend MoneyLover).

Stop looking for lame excuses for not taking your financial life in control just because you do not have time or have no background in finance or accounting – it is a matter of priority after all.

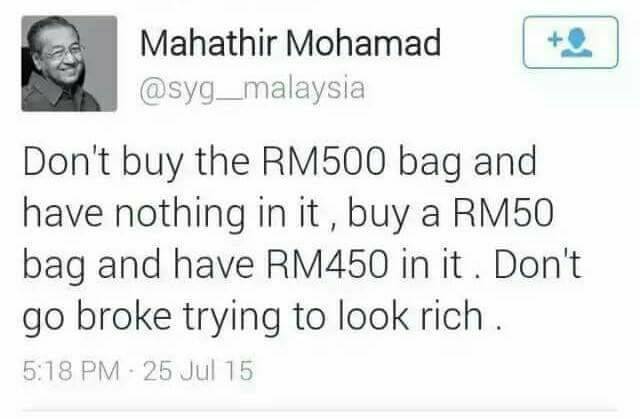

Remember, as Tun M said:

No Money Lah’s verdict:

If there is anything about adulting, managing money is definitely one of the biggest challenges in this process. However, it is a responsibility that we have to take on eventually regardless of how much we dislike the topic.

As such, I strongly urge you to stop making the money mistakes above and start taking action to reach your financial goals by managing your money habits, learning how to invest (and start young) and taking proactive steps to build the defense line of your financial protection.

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK! More details HERE.

Related Posts

April 10, 2019

5 Mistakes that I made in Stock Market Investment

November 28, 2018

4 Key Differences Between Investing in REIT and Rental Property

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.