The Malaysian's Guide to CNY Angpau Rate (2019 Edition)

Chinese New Year is right around the corner! (I can’t wait!)

As an Angpau Giver in 2019, have you ever wondered how much to pack into the red envelope? As an Angpau Receiver, how much are you expecting to receive from your Angpau this year?

No matter which side you are in during this CNY, there will be something just for you in this article!

In conjunction with CNY 2019, a survey has been conducted to find out the Angpau ‘market rate’ among Malaysians across different relationships. Without doubt, while this survey has been a fun one to conduct, it is also first of its kind as it takes into account of not just the perspective of Angpau Givers, but also of the expectation of Angpau Receivers.

Without further ado, let's dive straight into the findings!

Note: This article serves merely as a guide for those who need it. In life, it is the heart that matters the most when it comes to CNY Angpau. With that in mind, I urge everyone to engage this article with curiosity and an open mind.

How many Angpau Givers and Receivers are there in this survey?

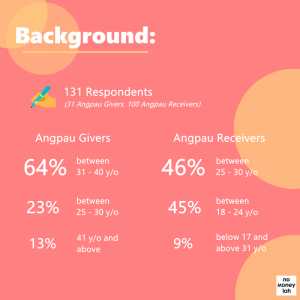

In total, this survey has collected a total of 131 responses (31 Angpau Givers, 100 Angpau Receivers) in a span of 7 days.

Among the Angpau Givers, a big majority of them are between the age of 31 to 40 years old, followed by 25 to 30 years old and 41 years old and above.

On the other side, 2 majority age groups for Angpau Receivers are between age 18 to 24 and age 25 to 30. Together, they make up to 91% of the Angpau Receivers in this survey.

Next, we are going to look into the responses from both Angpau Givers and Angpau Receivers according to their relationship to each other:

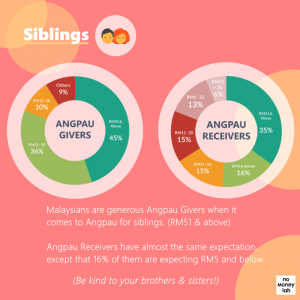

(1) Siblings

In this section, it is obvious that Malaysians are very generous when it comes to Angpau for siblings. As such, near to half (45%) of the Angpau Givers will be putting more than RM51 into the red envelope for their siblings. This is followed closely by RM31 to RM50 (36%).

As for Angpau Receivers, it seems that they are also not modest too as the majority of them (35%) are expecting RM51 and above from their siblings.

Surprisingly, this is followed by a distinct expectation of RM5 and below (16%). I guess these are the respondents that have cruel elder brothers or sisters since young haha!

p

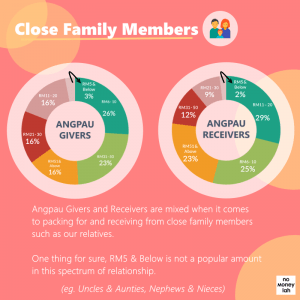

(2) Close Family Members (eg. Nieces/Nephews, Close Uncles/Aunties)

After our siblings, relatives within our close family are also considerably close to us in terms of relationship.

In this section, Malaysians are pretty split in terms of opinion.

As such, near to 50% of the Angpau Givers are more inclined to pack either between RM6 to RM10 and between RM31 to RM50 for their nieces or nephews. This is followed by the very balanced share of other amounts in the list (16% each).

On the other hand, 30% of Angpau Receivers are expecting to receive between RM11 to RM20 from their close uncles or aunties, followed closely by RM6 to RM10.

One thing for sure, anything below RM5 is certainly not popular in this spectrum of relationship.

p

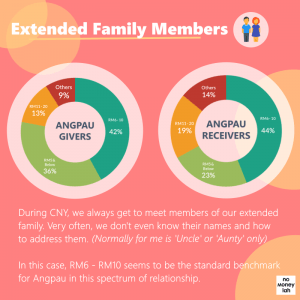

(3) Extended Family Members (the ones you normally don’t know how to address)

During CNY, we will often get to meet relatives from our extended family which we only see once a year. These are the people that we don’t even know how to address or call (for me it’s always Uncle or Aunty).

For this part, both Angpau Givers and Receivers displayed result that is almost identical.

In short, almost half of the people from both ends are looking at Angpau between RM6 to RM10, which in my opinion, is fairly reasonable. RM5 and below followed closely as the second most popular opinion from both ends.

p

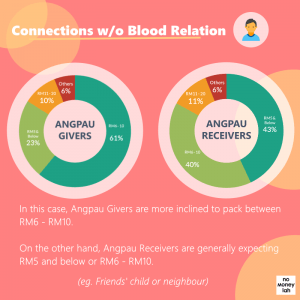

(4) Connections with no Blood Relation (eg. Friends’ child or neighbours)

In this case, we can see a slight difference in opinion between Angpau Givers and Receivers.

The majority Angpau Givers (61%) are looking to pack between RM6 to RM10, followed by RM5 and below (23%).

On the other hand, the expectations of Angpau Receivers are generally split between RM5 and below (43%) and between RM6 to RM10 (40%), albeit more are inclined towards the former.

p

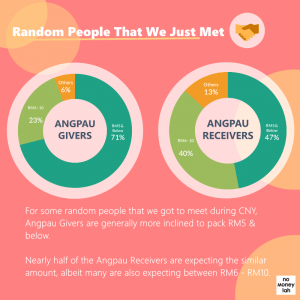

(5) Random People that We Just Get to Meet

So, say during CNY, your son’s friends pay you a visit. As an Angpau Giver, how much will you be packing for them? As an Angpau Receiver, how much are you expecting from these uncles and aunties?

While the general pattern of Angpau value is about the same from both sides, there is a big difference in terms of proportion. Let me explain:

For Angpau Givers, a huge majority (71%) are looking to pack RM5 and below in this scenario, followed with a distance second of between RM6 to RM10 (23%).

While most Angpau Receivers look into receiving RM5 and below, but the proportion is significantly lesser compared to Angpau Givers (48% vs 71%). As such, 40% of them are looking to receive between RM6 to RM10 in their red envelope.

p

No Money Lah’s Verdict

So here you go! It is a wrap for No Money Lah’s CNY 2019 Angpau Guide for Malaysians!

Are the outcomes something you’ve expected, or do you find something new while reading this guide?

All in all, this study only serves as a general Angpau guide for those who need it, and should not be taken as a must-follow rule.

Ultimately, no matter the amount, I think it is important for us to come back to the purpose of giving and receiving Angpau – for the blessings of health, luck and wealth for this amazing new year.

With this, wishing everyone a blessed and prosperous Chinese New Year!

To all of you that have been part of this study, thank you so so much! My biggest appreciation goes towards all No Money Lah readers and subscribers, friends and everyone in the Personal Finance & Investing Community Malaysia group! Also, special thanks to Suraya from Ringgit Oh Ringgit for the help in spreading the study!

Without all of you, this study would definitely not become a reality. Thank you!

How to Invest Using a Robo Advisor in Malaysia

[UPDATE 28/8/2019: Since my writing, StashAway has managed to raise USD12 million in Series B funding, and managed to deliver a 4% – 11% annual return since 2017]

—

Let’s get right into the topic:

We can now employ the service of a robo-advisor to invest on behalf for us in Malaysia, legally.

With the advancement of algorithms and data technology, there has been a rise of ‘robo-advisors’ designed to invest for the mass market consumers since the past few years around the region. In short, we can now depend on algorithm systems to help invest our money.

In this article, we are going to look into the particulars of a robo-advisor, and I’ll also share my thoughts on StashAway, Malaysia’s first robo-advisor platform.

But first thing first…

What is a robo-advisor & how does it work?

In its simplest form, robo-advisor is built on a system of algorithms and data to invest on behalf of customers.

Imagine Jarvis, the AI for Ironman, but specifically tailored to manage money and investment for retail investors like us (albeit not as advanced as Jarvis la).

In reality, how a robo-advisor work is simple. Simply put, robo-advisors will help you invest your money into different assets (normally via Exchange Traded Funds, ETFs*) based on your investment goals and risk preferences.

If this sounds too simple for you, it really is that simple.

The core idea of robo-advisors is to make investment simple and accessible to everyone. Normally, all you have to do is to identify your investment goals and how much risk you can take to get started. Then, just sit back, relax, and let the algorithms do the work for you!

*ETF is a marketable security that you can invest in where it tracks the performance of a group of securities such as stocks, commodities, and bond. (eg. FBMKLCI-EA is the ETF that tracks the performance of our very own Kuala Lumpur Composite Index, KLCI).

Enter StashAway, Malaysia’s first robo-advisor platform

p

First launched in July 2017 in Singapore, StashAway is the first robo-advisor platform that follows through with the momentum and entered the Malaysian market late last year.

As the first robo-advisor in Malaysia, I am very intrigued to find out what it is all about. So, without further ado, let’s dive straight into it!

How does StashAway invest your money?

This is the first question that came to my mind when I was told about robo-advisor. So it goes without saying that I have to get this answered right off the bat.

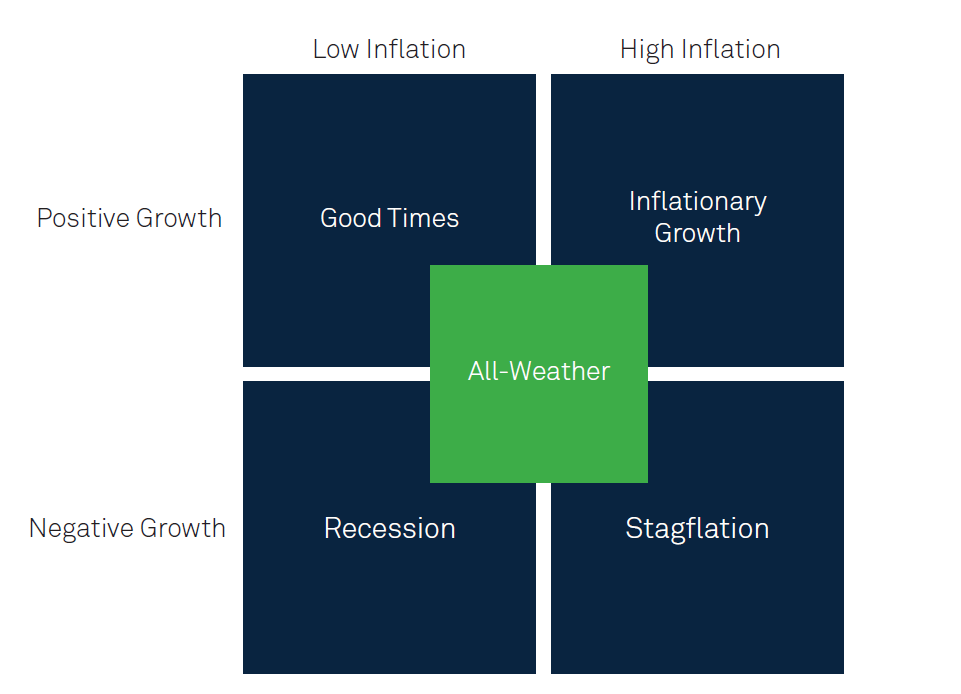

The framework that powers all the all the investment decisions behind StashAway is called the Economic Regime-based Asset Allocation (ERAA).

Essentially, ERAA is a set of algorithms that make all the investment decisions for you by considering 2 important factors, among all:

Ensuring constant customers’ risk exposure throughout different economic conditions, and

Optimizing customers’ returns under different economic conditions.

Under ERAA, your money will be invested into various Exchange Traded Funds (ETFs) in accordance with your risk appetite and investing goals. Not only that, the algorithms will also allocate the investments according to the economic condition at any moment.

If that’s not enough, ERAA will also track macroeconomics news and move your investments towards more defensive asset should the algorithm detects potential market crashes.

In short, StashAway’s ERAA framework is designed to ensure long term wealth creation within customers’ risk preference.

My StashAway Experience

To further my understanding about StashAway, I went on to try out the app itself. In general, I like the interface and the overall application process.

In essence, you get to select your investment goals and risk appetite. Then, StashAway will recommend an asset allocation for you. (eg. If you opt for a more conservative risk exposure, your investments will be focused towards Treasury Bond ETFs, which are relatively less volatile in nature)

Note that while you have the flexibility to readjust your risk appetite during the process, you cannot control the proportion of asset allocation that is suggested by StashAway. (eg. If StashAway suggests 15% weightage on Treasury Bond ETF, you cannot change the weightage to 10%)

Once you are done with the initial settings, you can transfer money to the fund and choose to set up a monthly transfer if you want to invest your savings monthly into the fund.

One of the good thing with StashAway is that there is no lock-up period. This means that you can choose to withdraw your investments at any time.

As a whole, I had a decent experience while checking out the app.

My Rant with StashAway and the Risk Involved.

(1) ERAA Framework not independently verifiable

This is my biggest and only rant with StashAway.

As mentioned above, the ERAA framework is able to recognize different economic conditions and allocate customers’ investments accordingly (they call it ‘Reoptimization’). By doing so, StashAway claims to be able to reduce the impact of a financial crisis.

All these explanations are backed by a whitepaper with backtesting charts that showed how the ERAA framework is able to perform better in relative to the S&P 500 Index and 60-40 Stock-Bond allocation strategy during the 2008 financial crisis.

However, the fact that StashAway’s ERAA framework and software is not released to the public means there is no way I can verify how true their claim is.

In short, this means that without any available tools to backtest StashAway’s claims, we will not only be investing our money with StashAway, but also our faith on the effectiveness of the framework to deliver its promises during the next crisis.

p

(2) Risk: Past performance does not reflect the future

Even if StashAway’s performance did outperform the S&P 500 index during the 2008 financial crisis in backtesting, this does not mean it will perform the same for the upcoming crises.

Reason being, every crisis is unique on its own and is triggered by different factors. Hence, what worked for StashAway’s framework in the past may not necessarily work in the future crises.

While I feel this is not something that StashAway can fully control, I think it is necessary for readers to understand that in any investment, past performance does not guarantee future performance.

What I Like About StashAway

But wait, let me clarify: I do not hate StashAway. In fact, in many aspects, I kinda like it a lot:

(1) StashAway is regulated by the Securities Commission (SC)

While checking out StashAway, what really gives me a peace of mind is to know that they are regulated by the SC.

This means that they have to go through the grueling procedures and paperwork to prove to the authority that they have the necessary consumer’s protection framework in place to ensure customers’ interest is covered in the case of events such as bankruptcy.

It is also worth noting that StashAway is just a party that manage your fund. This means that the actual assets (the ETFs) do not belong to them and are owned by StashAway’s broker, Saxo, where you are recognized as the rightful owner of the ETFs.

In short, StashAway is a legit business that helps you make investment decisions with your money and all your asset investments belong to you.

p

(2) Easy to use and low barrier of entry at just RM1

Another reason to like StashAway is that of how pleasant it is to use the app. Not only you have a feeling that you are in control of customizing your investments (of course to a certain extent only), but the overall experience just trumps in terms of user-friendliness.

Moreover, StashAway’s low barrier of entry at just RM1 means that anyone can afford to get their robo-advisor experience at a ridiculously low price. This is in stark contrast of conventional unit trusts that have the minimum initial investment of RM1,000.

Simply put, at just RM1, you get to kickstart your robo-investing journey with an intuitive user experience.

p

(3) Relatively low fees compared to Unit Trusts

When it comes to competition, robo-advisors such as StashAway compete head-to-head with conventional financial advisors and unit trusts.

In this case, what makes StashAway so appealing is its low fees relative to the fees charged by its direct competitors.

As an example, unit trusts will usually charge a sales fees of 5% (or more) and an average 1% annual fee for professional fund management. In comparison, StashAway charges no sales fees and an annual fee between 0.2% – 0.8%.

In the long term, a small savings in terms of fees make up to a lot of differences in terms of your return.

p

(4) Good Customer support

While you may expect robo-advisor like StashAway to cut corners on human interaction, but I’ve found their customer support to be quite decent.

One of my encounters with StashAway’s customer support is how quick they are to follow-up with you. Since I’ve just moved to a new place, I have yet to change my house address on my IC. Upon noticing the difference in the address in my application and IC, they have been very quick and helpful in assisting me on the issue via Whatsapp.

Hence, a plus point for StashAway!

No Money Lah’s Verdict

As a whole, I think the rise of robo-advisor such as StashAway does provide another good investment option for the public to build wealth on their hard-earned money.

The question now is this: Is robo-advisor for you?

If you have no prior experience with investing and are considering whether to invest passively via unit trust or robo-advisor, definitely check out robo-advisor due to its low barrier of entry and relatively low cost involved.

On the other hand, if you are a DIY investor that are more comfortable with managing your own investments (provided that you know what you are doing), a robo-advisor may not be for you as its annual fees is still a considerable cost for you as a DIY investor (you don’t pay yourself management fees when you do your own homework, right?).

Ultimately, it really boils down to your own preference and lifestyle.

For me, I think having control on my own investment is essential to achieving my financial goals. However, I have no problem recommending robo-advisor to those who are looking for alternative investment vehicles other than unit trusts.

If you are interested to check out StashAway, be sure to click below to get an exclusive 50% off the management fees for the first RM100,000 invested for 6 months.

p

Meanwhile, if you are keen to learn more about robo-advisor businesses around, do check out some other robo-advisors in Malaysia: Wahed (Promo Code for a FREE $10 Bonus: YIXCHI1) and MyTheo (Click HERE to claim Your FREE 3-months Referral Fee).

Note: This post may contain affilliate links that afford No Money Lah a small amount of commission should you sign up through the links.

Why Being A Little Lost In Your 20s May Not Be A Bad Thing: My Quarter-Life Crisis

And most important, have the courage to follow your heart and intuition. They somehow already know what you truly want to become. Everything else is secondary.

Steve Jobs

3 months. It was the month of June in 2018. It had been 3 months since I left my first full-time job that pays me comfortably above the market rate.

“So…what do I do now?”

At 24, I found myself lost in a pool of uncertainties. Here’s what happened:

Upon leaving my job, I went on to pursue a career in trading while building No Money Lah (this blog) on the side. The idea was to sustain myself by trading the market full-time while pursuing my passion for writing.

There was just one problem:

Nothing was going according to plan.

3 months into trading, I was making a loss on my capital. I underestimated the learning curve involved in a full-time trading career. Adding salt to the wound, the progress in designing No Money Lah was stagnant. As far as I enjoy writing, website designing was (and still is) not my forte.

As a result, not only I was not earning money from trading, I was losing my capital from it. Moreover, I have a semi-baked website that was not ready by any standard.

I was stressed out mentally. In the face of uncertainties, a side of me would blame myself for quitting my previous job with the urge to give up and get another 9-5 job.

However, the gritty side of myself (my friends would call it stubborn) refused to give in.

What followed was months of being drown in self-doubt and self-blame.

And that, was how I got lost into the miserable spiral of a quarter-life crisis.

While later life crises may be distinguished by the realization that we have failed to achieve our goals, quarter-life crises are rooted in the epiphany that we don’t have any goals, or that our goals are wildly unrealistic.

Caroline Beaton, Psychology Today

As much as this article is about me, it is also very much about you.

If you are in your 20s, currently lost in direction and miserable about what’s to come next in your adulting journey, you are not alone.

Just like me, you may feel miserable with your current (or future) career path and goals. In addition, other life aspects such as personal relationships, money, family and societal expectations may also get you confused and overwhelmed.

Some call this experience part of growing up. I think the term ‘quarter-life crisis’ sums it up the best.

Either way, going through quarter-life crisis is, without doubt, a challenging experience. In your 20s, you may find yourself in a career that you do not find fulfilling. You may also be in a relationship that is breaking down. Perhaps, you are also split between pursuing money or passion.

It is during these time that self-defeating thoughts like “I am not good enough”, “I cannot do this”, “I have no experience in this” started to crawl in and overshadow our self-confidence.

Then again, despite all these life disruptions during our 20s, experiencing quarter-life crisis does provide us with a valuable opportunity.

The Upside of a Quarter-Life Crisis

The fact that we are affected emotionally during our quarter-life crisis means that there is something within us that is unwilling to settle with our current situation.

In other words, being lost during our 20s present a great opportunity for us to reevaluate our values and purpose in life. Simply put:

“Is this it? Is this how I am going to live for the rest of my life?”

Knowing this, the crisis serves as a wake-up call for us to strive and change our miserable situation. Some may strive faster, some will struggle along the way.

But the point remains the same: Being in the 20s offers a precious window of opportunity to change for the better without carrying the similar burden of those in the 30s and 40s.

It is All About a Change in Perspective

I like to relate quarter-life crisis as an exploration sailor going through a rough sea storm.

The sailor could give up, turn around and go back to the peaceful land and be content with a mediocre life. Also, the sailor could brace the storm, screw up once in a while and become the founder of a whole new land of opportunity.

One thing for sure: No storm will last forever. Likewise, tough times will also bound to come to an end.

Trust Your Intuition to Guide You

Today, I shared about how I stumbled into my quarter-life crisis in my 20s. Since then, a transitional change in perspective has helped me brace through many storms and realign my focus in my trading and blogging adventure.

However, just like you, I do not have the full answer to every existing adulting challenge. As such, I still face my equal share of self-doubt and anxiety strikes on a daily basis. I guess we just have to pick up and learn along the journey in our 20s.

With that in mind, know that no matter your current situation, you are not alone in this journey.

It is okay to feel a little lost in our 20s. No one has everything figured out from the start. It’s all about the willingness to change our perspective towards problems in life and the courage to change for the better.

Take your time, have faith and patience in your intuition, and most importantly, never settle.

Share your #MyQuarterLifeCrisis story with No Money Lah!

If you are currently going through this phase in life and would like to share your experience and story with more people, I encourage you to write about your story! Then, I will share your story on No Money Lah to empower and support more people that are going through a similar experience like yourself.

Spread the love, send your story today to [email protected]! You can also reach out to me via the Contact Form below (Ideas & Feedbacks).

I cannot wait to hear from you!

5 Differences Between Investing & Trading That 'Experts' May Not Tell You

Ever since I started to learn about stocks, I’ve always come across Facebook and Youtube ads about courses where ‘gurus’ or ‘experts’ will teach you how to make money in stocks. haha

The problem is, the terms ‘stocks investing’ and ‘stocks trading’ have been so frequently used in these marketing ads, people are starting to mix and generalize them into the same thing*.

(*Skip to point 4 & 5 to read about how these 'experts' fail to deliver the proper idea of investing and trading)

In reality, ‘stocks investing’ and ‘stocks trading’ are very different in nature. Hence, it is of crucial for you to understand their difference before you start your investment or trading journey.

Note: Essentially, there are various financial derivatives (eg. ETF, futures, stocks) that you can invest or trade in. To simplify this article, I will use stocks in my explanation.

With that in mind, let’s get started:

(1) Investors invest in a business, traders trade the numbers. What do you want to do?

Imagine, today, you and your friend bought a bag of corn each.

The next day, your friend sells off the corn at a higher price to another person. He profits from the direct price difference of the corn.

This reflects how trading works.

On the other hand, you decided to grow the corn in your backyard. Although you may need to wait to reap the fruit of your hard work, your bag of corn will eventually grow into a land of fresh sweet corns where you can sell in the market over and over again.

And this, is how investing works.

Investing and trading both involved the goal of profiting from the stock market, but in a distinct manner.

Essentially, you are buying part of a business when you invest in the shares of a company. As such, you care whether the company you invest in can grow and deliver profitability in the long run.

On the other hand, stock traders look to profit from the market with the short-term price difference. As a stock trader, you do not put much emphasis on a company’s long-term growth prospects.

Investor build assets with their capital.Traders, on the other hand, earn income with their capital.

The question now is, what is your intention when you want to learn about stocks?

(2) Investors are in for the long run, traders operate in the short run

How long do a stock investor and trader hold on to their shares?

An investor will normally eye to hold the shares of a company for a long-term basis, normally for years. Hence, an investor pays a lot of attention to the fundamentals of a company (eg. Cashflow & debt status) in order to make sure the company continues to grow in the long run.

Moreover, an investor does not need to constantly monitor their investments. Short term market movements are not a big concern to investors with a long-term mindset.

Depending on one’s trading style, a trader may hold their shares from a few minutes, hours, days or weeks. This is relatively shorter in timeframe compared to investing.

With such a short timeframe, constant monitoring is needed to ensure one does not miss out on any significant market movement.

In short, investing require more prior effort (eg. Studying annual report) before making a move, while trading requires more constant effort at any point in time (price monitoring).

(3) Investors and traders make money differently

Investors profit from the stock market via capital appreciation (the increase in share price) and dividend (profit sharing by companies).

On the contrary, traders earn their wealth via price movement (price hitting target profit in traders’ desired direction) and/or short-term price difference (a.k.a scalping or arbitrage).

While dealing with the similar derivative (stocks), there is a significant difference between how an investor and a trader makes money.

(4) Investors and traders experience risks differently

Now, this is where many ‘experts’ or ‘gurus’ failed to explain or clarify enough.

Ultimately, you will need to deal with risk regardless if you are investing or trading. However, the risks involved in investing and trading are not the same.

As an investor, your major risks involved the sudden change of fundamentals (eg. Low debt to high debt status) and business nature of the company (eg. People switched from watching TV to Netflix).

As a trader, your major risks involved price not moving in your desired direction (eg. You buy into Facebook shares in hope that its price will go up, but it turns out otherwise) and capital mismanagement (eg. Placing too much of your overall capital in a trade and end up losing them).

Investors invest their confidence towards a business, traders trade probability for profit.

(5) Expectation Setting: Quick & high return! (Or is that the case?)

The biggest problem with ‘experts’ and ‘gurus’ that offer courses these days is this:

They tend to give unrealistic expectations to their target audiences in order to convert them into paying customers.

As an example, investing ‘experts’ use marketing gimmicks to portray how one or two students managed to get X% of return within 3 months after attending their investing course. However, they fail to convey that the true idea of investing is a long-term effort that requires time and patience to bear fruits.

Another example would be trading ‘gurus’ that boast potential high return monthly after attending their course. The other side of the story that they do not cover is the steep learning curve that requires a lot of mental strength and discipline (plus mistakes & failures) before achieving the return they promise.

In short, these ‘experts’ and ‘gurus’ entice potential customers with (1) Potential Fast Returns and (2) Potential High Returns. This is totally in line with the mindset of people nowadays that greed for a fast and high return with little effort.

Investing and trading is simple to learn, but not easy to master. Set realistic expectation that includes time to climb the learning curve before enrolling in this journey.

No Money Lah’s Verdict: Are investing and trading for you?

The short answer for investing is a big YES. The short answer for trading is no.

Investing is an art of asset-building with your existing wealth on a long-term basis. In my opinion, the knowledge of investing is a crucial skill to learn as a part of personal finance management.

In comparison, trading is a discipline that makes a profit from the knowledge of probability and proper risk management in a short-term timeframe. Moreover, it’s the nature of a shorter timeframe and emphasis on price movement means higher commitment and psychological discipline for a trader.

Hence, trading is not for everyone as not everyone can commit and have the mental discipline to trade the market.

The bottom line is this:

Have a clear intention before you embark on your investing or trading journey. Do you want to invest in a business, or do you want to trade a game of probability?

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK!

Now that you have a clear picture of investing and trading, it is also essential for you to know how to protect yourself during a market downturn. Check out how you can do exactly so HERE!

4 Books on Money That Will Transform Your Financial Lifestyle in 2019

Reading is to the mind what exercise is to the body.

Wanna get rich in 2019?

To many, the idea of getting rich or wealthy is to learn how to earn money in the quickest manner. Well, that is only half the truth on getting rich (in fact, just a

In order to achieve truly sustainable and long-lasting wealth, it is essential for us to first master the correct mindset about money and being rich.

To do so, the most effective way is none other than to explore the wisdom on money that can open our world to a new perspective about money and wealth.

Coming into a brand-new year, here are my 4 book recommendations on money that will transform your financial lifestyle in 2019:

(1) Think & Grow Rich by Napoleon Hill

When it comes to the ultimate book of money-making, Think & Grow Rich is the book that you have to read.

In Think & Grow Rich, author Napoleon Hill shares the money-making secrets that have made fortunes for more than 500 men, such as Thomas Edison and Henry Ford.

This secret, as stated by Hill, was inspired by Andrew Carnegie, one of the richest people in history that led the expansion of American steel industry in the late 19th century.

Not surprisingly, while being one of the most successful self-help

Instead, Hill shares about psychological barriers that prevent people from getting wealthy.

In this book, Hill also breaks down 13 money-making secrets to the readers, such as:

- Desire: The starting point of all achievement.

- Faith: Visualization of and belief in the attainment of desire.

- Autosuggestion: The use of affirmations to influence the mind to succeed.

- Imagination: Visualizing yourself into success.

- Persistence: Keep going until you achieve what you want.

- The Subconscious Mind: How to influence your mind with positive thoughts.

- And more!

For me, Think & Grow Rich is a classic that covers all aspect of life that ultimately set you to achieve the wealth that you deserve.

Definitely make this book your to-read book in 2019!

There is a difference between wishing for a thing and being ready to receive it. No one is ready for a thing, until he believes he can acquire it. The state of mind must be belief, not mere hope or wish.

Napoleon Hill, Think & Grow Rich

(2) Rich Dad, Poor Dad by Robert T. Kiyosaki

If you are not familiar already with Rich Dad, Poor Dad, it is a solid book that offers money concepts that will change how you look at money forever.

Essentially, the book goes around the difference between the ‘poor dad’ (the real father of the author), and the ‘rich dad’ (the author’s mentor) on handling wealth and money despite the ‘poor dad’ having a solid education background while the ‘rich dad’ has otherwise.

In this book, Robert Kiyosaki discusses key issues such as:

- The importance of financial education, and why most families are doing it wrong.

- Why the rich are getting richer, while the poor are getting poorer?

- The concept of assets and liabilities in financial planning.

In short, Rich Dad, Poor Dad is the textbook on the concept of money that everyone should read, and re-read.

Special mention: Aside from Rich Dad, Poor Dad, I also recommend reading Rich Dad’s Cashflow Quadrant by Robert Kiyosaki (click here to get 23% OFF YOUR PURCHASE!) where he introduces the famous 4-Quadrants concept that changes how people look at money and career!

Most people never study the subject [of money]. They go to work, get their paycheck, balance their checkbooks, and that’s it. On top of that, they wonder why they have money problems. Few realize that it’s their lack of financial education that is the problem.

Robert T. Kiyosaki, Rich Dad, Poor Dad

(3) The 4-Hour Workweek by Timothy Ferriss

If you ever thought of the idea of starting a business (be it you are working a full-time job or not) and how to get your work done by working fewer hours, The 4-Hour Workweek is definitely for you.

In this book, author Tim Ferriss offers a constructive guide on how he started his health supplement business to how he automates the business so he can go on to live a mini-retirement lifestyle.

Some of the key highlights of The 4-Hour Workweek include:

- The definition of ‘New Rich’: Those who have the time and mobility to enjoy life to the fullest.

- The secrets to live the life of ‘New Rich’.

- How to eliminate unnecessary work processes, automate effort and achieve liberation from our work.

For me, reading The 4-Hour Workweek was a mind-blowing experience, as I discovered fresh and new possibility towards a dream lifestyle without compromise on time and money.

Definitely a must-read!

If you are insecure, guess what? The rest of the world is, too. Do not overestimate the competition and underestimate yourself. You are better than you think.

Timothy Ferriss, The 4-Hour Workweek

(4) Secrets of Self-Made Millionaires by Adam Khoo

If you ever need a practical handbook about personal money management, Secrets of Self-Made Millionaires is no doubt the best book that you can learn from.

In this book, author Adam Khoo shares practical tips and hacks to improve your overall wealth and finances.

Some of the important lessons shared in this book are:

- Habits and steps to achieve financial abundance.

- Ways to manage your cash flow and expenses.

- How to create multiple streams of income online.

- How to build million-dollar net worth.

Personally, I've learned a lot from Adam’s books. As such, reading Secrets of Self-Made Millionaires has empowered me to take on my finances and wealth with confidence.

You see…none of us are ever taught how to make money, how to invest money or how to manage our wealth and yet money is the most important subject in our adult lives. Although many say that ‘money isn’t everything' that’s only a half-truth. The truth is that ‘everything is money’!

Adam Khoo, Secrets of Self-Made Millionaires

No Money Lah's Verdict:

So here's it! 4 books that you absolutely have to check out to transform your financial lifestyle in 2019!

Personally, reading the books above have totally changed my perspective towards money, and I have no problem at all to recommend all these books to you.

Plus, when you purchase these books through No Money Lah's link, you will also help support the daily operations of No Money Lah! If you do so, be sure to let me know and I would love to show my appreciation to you!

Do you have any good books recommendation for personal finance? Share with me at the comment below!

I cannot wait to hear from you!

I Spent Most of My 2018 Alone. Here’re Why It Was Not Necessarily a Bad Thing.

To many, being alone seems to be a negative thing. In fact, there is something about being alone that people just seem to be uneasy to be in this state.

Maybe this 5-minute read can change your mind.

2018 has been a very special year for me. I've finally graduated from university, got a high-paying first job and I quit the job after 3 months.

Then, I spent most of my 2018 discovering myself and build a career around things that I am interested in or keen to explore. Most of the time during this period, I spent it with myself.

And guess what? 2018 is by far the most fulfilling period in my life, and here’re why:

(1) I’ve learned to truly love myself

All our life, we’ve been taught to give love and care to others. Naively, many of us have built our happiness on the belief that the more love and care we give, the more we will receive in return.

Hence, we felt pain, sad, anger and all other negative emotions when the love and care that we give to the others do not return with the similar ‘amount’ of love.

In short, many of us have, in one way or another, built our happiness around the people around us. We only felt loved when people love us back.

All our life, we’ve been taught how to show love and care to the others, yet we spent so little time to love the person within – ourselves.

Being alone, I’ve learned to love myself.

I’ve started to be comfortable on my own. I’ve brought myself out for dates and movies that I really want to experience. Finally, I have the time to read the books that I’ve always wanted to read.

For a long time in years, I’ve come to appreciate my own company, and be genuinely contented and happy while being in this state.

Genuine happiness should not come from any external factors – not even from the people closest to us. Rather, true, genuine happiness should come from within – ourselves.

(2) I’ve learned to be in peace with myself

All these time, I’ve been living a life trying to fulfill the norm of the society: Study hard, get good results, enter a good university, graduate with first-class honor and get a stable and possibly high-paying job.

In the instances where I was not able to fulfill some of these norms, I felt terribly bad about myself. I felt that I was not good enough.

Surprisingly, quitting my high-paying first job was a liberation for me.

Since then, I have all the time alone to meditate, write, read and take life on my own pace.

I’ve started to really accept myself for who I am with all my existing traits and flaws.

Being alone, I’ve come to be in peace with myself.

Always take some time off to reconnect with your inner-self. In life, we tend to stray away from our heart and intuition due to work and other external matters. Hence, some alone time will really help us recalibrate and heal.

(3) I’ve learned to trust and depend on my intuition

Being able to be in peace with myself is by far one of the best

As such, it has given me the opportunity to consciously reach out to the deepest corner within myself and learn to trust the voice within – my intuition.

Many of the times in life, the answers and direction that we seek are already within ourselves. However, too many external voices are out there trying to tell us what is the right thing to do.

Being alone most of the time in 2018 has gave me a great opportunity to filter the external voices and follow my intuition.

By following my intuition, I’ve ventured into various interesting adventures that I’ve never thought of doing before.

Within this period, I’ve learned to trade the financial market, became a certified table tennis coach, joined Toastmasters to conquer my fear of public speaking and most importantly, started No Money Lah to inspire people around to live a more meaningful adulthood life.

Guess what? Thanks to my intuition, 2018 has the most fulfilling year in my life thus far.

Giving yourself occasional personal space helps tremendously in sharpening your intuition. Somehow deep within, you already have the answer to most of your questions. You just have to listen close (and deep) enough.

No Money Lah’s Verdict

At the beginning of this article, I’ve described my 2018 as ‘special’. Now that I give it a thought, 2018 has really been a year of conscious personal discovery for me.

It has always been a societal norm to regard being alone to be something negative, that if someone were to be alone, he/she is certainly having some issues (or a weirdo).

Ironically, a lot of the time, having the chance to be alone – to think, to read, to write, to meditate is just what people need to overcome miserable thoughts and rediscover themselves in life.

Have you been lost in a miserable path in life? Have you

been overwhelmed by the waves of voices that tell you what ‘you should do’?

Perhaps it’s time to be alone and reconnect with the person within, don’t you agree?

6 Morning Rituals That Have Transformed My Life in 2018. (Plus: The Best Christmas & New Year Gift??)

I used to have terrible self discipline.

This has cost me my productivity, focus

Luckily, it didn't take long for me to realize that I would need to develop a set of discipline, or rituals to hold myself in check.

Coincidentally, I came across the book 'The Miracle Morning' by author Hal Elrod, and it changed my life forever:

The tone of our morning has a powerful impact on the tone of the rest of our day.

Hal Elrod, the author of ‘The Miracle Morning –The 6 Habits That Will Transform Your Life Before8am’

In his book that has helped thousands of people around the world find fulfillment and purpose in life, Hal has proposed 6 rituals that will help you set the tone to your morning – and your day and subsequently, your life. He calls it the Life S.A.V.E.R.S:

(1) S is for Silence (5 – 10 minutes)

Silence, or purposeful silence in the morning, is what Hal described as ‘one of the best ways’ to reduce stress, build mindfulness and maintain clarity on our goals.

Typically, a working adult’s morning would be either sluggish or hectic. Starting the day with these moods would affect the rest of one’s day to be either unproductive or more impulsive.

As such, waking up 5 - 10 minutes earlier every morning and practice purposeful silence such as meditation would help to set a peaceful tone to our morning and day.

For me, meditation is a no-compromise daily ritual, where I will meditate for 5 - 10 minutes in the morning and before sleep improve my focus and sleep quality.

(2) A is for Affirmations (2 – 3 minutes)

“I am the greatest!” Muhammad Ali affirmed these words over and over again – and then he became them.

According to Hal, every individual has an internal dialogue that runs through our head, almost non-stop. The thing is, we do not choose these dialogues consciously as most of it happens unconsciously in our mind.

Our self-talks are either working for or against us, depending on how we use them. Hence, it is important to consciously design and choose our affirmations.

As such, Hal suggested 5 steps to help us design them:

- Step 1 – What do you really want?

- Step 2 – Why you want it?

- Step 3 – Who you are committed to being to create it

- Step 4 – What you are committed to doing to attain it

- Step 5 – Add inspirational quotes and philosophies

For me, I find self-affirmation extremely powerful. Being a full-time trader requires patience and confidence to overcome the steep learning curve.

By reaffirming myself every morning, it has helped me brace through the toughest days in this journey.

My trading affirmation goes like this:

I will become a successful trader, and I am committed to do so by being patient and discipline with all my trades. I am also committed to make quality decisions while executing all my trades.

Lastly, to feel the lasting impact of affirmations – you must be consistent! This means that you got to practice it daily – no shortcuts!

(3) V is for Visualization (2 – 3 minutes)

Visualization is a form of mental rehearsal that practitioners use to construct a mental picture of specific outcome from their actions in life.

As we visualize daily, we align our thoughts and feelings with our vision. This practice has been especially useful in helping me overcome self-limiting beliefs and habits.

(4) E is for Exercise (5 – 15 minutes)

In his book, Hal, a yoga practitioner, suggested exercise as a staple in our daily rituals.

Of all the benefits, exercising in the morning can help maintain our emotional well-being and concentrate better during the day.

For me, the least I would do is to go for a walk around my area in the morning.

(5) R is for Reading (5 – 15 minutes)

Reading is the fastest way to acquire the knowledge and methods needed for you to achieve what you want in life.

According to Hal, the idea is to learn from those who have already done what you want to do.

Even by just reading 10 pages a day, we would be 3650 pages better off than those who do not read in a year time!

(6) S is for Scribing (5 minutes)

Scribing is essentially the habit of keeping a journal in our daily life.

By building the habit of scribing, it will enable you to document your thoughts, ideas, breakthroughs

For myself, I keep a journal to record my daily To-Do’s, the things that I am grateful for during the day.

No Money Lah's Verdict

As far as I am concern, the S.A.V.E.R.S. morning rituals are the most effective way to live a fulfilling life.

With just 20 – 30 minutes of my time in the morning, I’ve been able to keep myself in check and focus on the important things in life in 2018.

I’ve find this book extremely helpful that I’ve lend this book to many close friends of mine. In fact, I frequently revisit the book to internalize the knowledge within.

For those who seek

The Best Christmas & New Year Gift: Purchase 'The Morning Miracle' by Hal Elrod at 31% Off Via Book Depository Through No Money Lah!

Personally, I believe that 'The Miracle Morning' would make an amazing Christmas and New Year gift to your loved ones and even yourself!

Hence, specially for No Money Lah's readers:

Get 'The Miracle Morning' at just RM36.82 (Ori. Price @ RM54.11) with free delivery when you purchase through my link today! Your purchase will help support No Money Lah in producing quality content like this.

Use These 3 Simple Hacks to Identify the Most Suitable PRS Fund for Yourself. (Yes, there is more than one!)

Private Retirement Scheme (PRS) is introduced as an additional retirement investment scheme (aside from EPF) to better prep Malaysians for retirement.

On top of that, the government has introduced the PRS Youth Incentive, a one-off RM1000 top-up for young adults between age 20 - 30 if he or she invests a minimum of RM1,000 into a PRS account.

In simple terms, you would have made of 100% return out of your initial investment with this incentive. With that in mind, the period of the incentive will be ending by 31st December 2018. Hence, it is the last window of opportunity for us to enjoy the incentive.

Note: This week, instead of my writing, I would like to pass the stage to my buddy, Varian Soong. He is currently a Credit Analyst in MCIS Insurance and he'll share 3 simple hacks that you can use to identify the fund that suits you the best! The floor is yours, Varian!

--

Hi fellow readers of No Money Lah! Here are 3 simple (and important hacks) that you can use to identify the most suitable PRS fund for yourself!

To start, PRS is somewhat a combination of EPF and unit trust.

Just like any investment, PRS does not guarantee return on your principal. This simply means that your final withdrawal amount will base purely on the fund’s performance. Hence, it is crucial for you to choose the fund that suits your age, lifestyle and risk appetite.

Another thing to note is you can only do a full withdrawal once you reach the age of 55 (or pre-withdrawal with a fee).

In the present, there are 8 PRS Providers in Malaysia, each with its own unique style of fund:

- Affin Hwang Asset Management

- AIA

- AmInvest

- CIMB-Principal

- Kenanga Investors

- Manulife Asset Management

- Public Mutual

- RHB Asset Management

In general, each provider offers three general categories of fund, which are conservative (mostly fixed-income assets like bonds and deposits), balanced (balanced proportion of fixed Income assets and equity) and aggressive (high proportion of equity).

Depending on your risk appetite and your target return, you can choose the fund that suits you the most. Some funds even invest overseas if you are looking into that.

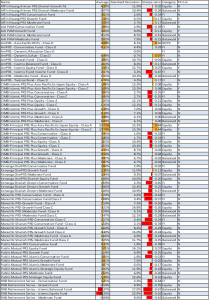

List of PRS Funds in Malaysia

Below is a list of PRS funds that you can choose to invest in when you open a PRS account, along with some useful benchmarks to guide you in your decision-making process:

(1) Average Annual Return*

The Average in the table refers to the average annual return you would get in a year.

Similar to any form of investments, PRS funds’ performance fluctuates with time. At times, it may go above the average return and below it or even negative occasionally. That said, if you hold it long enough, say until 55 years old, your average return should reflect the number.

Let’s say you opt for the fund with highest average return (CIMB-Principal PRS Plus Asia Pacific Ex Japan Equity - Class A). At 10.7% (and at age 24), your RM2,000 initial investment could be compounded to RM46,810 when you are 55! That is enough to buy yourself a new Myvi with CASH!

*Refers to the geometric means of annualized return which has incorporated compounding effect in it. I used 'average' for layman description.

(2) Standard Deviation

Next, the Standard Deviation reflects how risky the fund of your choice is.

Take the earlier example, the fund has a standard deviation of 15.3%. This means that your yearly return can sometimes fluctuate to up to 26% or down to a loss of -4.6%. Like the saying goes, high risk high return.

(3) Sharpe Ratio

Finally, let’s look into the last and most important benchmark, the Sharpe Ratio. The Sharpe Ratio is one of the most widely used benchmark to evaluate a fund’s performance.

In general, a positive number shows that capability of the fund to generate money for you. A negative number shows the fund took too much risk than the return could justify. This means that the higher the magnitude, the more reliable the ratio is.

Referring to the example, the fund is shown to have a Sharpe Ratio of 0.44. In other words, the fund is generating a solid return and not simply gambling our money away.

Conclusion

Not to mislead you, the example given is merely for convenience sake. Ultimately, you have the say on which fund that would suit your risk appetite.

For example, the AmPRS - Dynamic Sukuk - Class D is a safer investment as it offers an average return of 4.6%, which is more than the return from fixed deposit (FD).

An important note that the data used are from the period of 2013-2018 (annualized) and some are lesser than that. It means that the calculation would have some error as more data is needed to have a reliable measurement (minimum of 30 years). Therefore, take the number as a general guide and not an absolute deciding factor for your investment.

Back to you, Yi Xuan!

--

No Money Lah's Verdict

To be frank, I've never looked into PRS in detail and I was shocked when I realized that there are so many funds available for us to invest in!

For a young fresh graduate, if I were to invest in a PRS fund, I would opt for AmPRS - Asia Pacific REITs - Class D given its decent Sharpe Ratio and average return, plus a Standard Deviation that is still rather low compared to other performing funds.

Now that you have a clear idea on how to find your choice of PRS fund, which fund would you choose to invest in? Let me know in the comment section below! (remember to open a PRS account by end of this year to enjoy the youth incentive!)

--

About the contributor:

Varian Soong is an Economics graduate from University of Malaya. Being one of the brightest of his batch, he came in as the 1st runner-up in 2017 CFA Institute Research Challenge. Also, he has completed CFA Level 1 professional paper prior to his graduation. He is now pursuing his professional career as a Credit Analyst in MCIS Insurance.

Connect with him on LinkedIn here.

4 Key Differences Between Investing in REIT and Rental Property

One of the most amazing thing when it comes to real estate investment is its versatility. As such, 2 of the most common ways to invest in real estate are through investing in Rental Property and Real Estate Investment Trust (REIT) in the stock market.

If you are not familiar with REITs, just imagine yourself buying into shares of companies that own and manage real estate as their primary business activity.

Some REITs specialize in one specific asset class (eg. YTL REIT in hospitality) while some diversify into multiple asset classes (eg. Sun REIT in retail, hospitality and office space).

While both methods of investment allow investors to gain exposure in the real estate market, it is like comparing apples and oranges. Owning rental property represents direct ownership while investing in REITs is characterized by owning shares in a company whose sole purpose is to manage a portfolio of real estate assets.

In this article, let’s explore 4 key differences between both methods of real estate investment:

(1) Low Barrier of Entry (REIT) vs The Power of Leverage (Rental Property)

REIT:

With a minimum lot size of 100 units, almost anyone can afford to gain exposure in real estate by investing in REITs. As an example, at RM1.19/unit, one could start to invest in YTL REIT at just RM119 (RM1.19 x 100 units).

Rental Property:

Most often, one that intends to purchase a rental property would be eligible for 80% - 90% loan on the total value of the property. This means that one could purchase a property with just 10% to 20% of the total property value. If done right, it will enable one to leverage his/her wealth effectively.

As an example, if I were to invest in an RM200,000 rental property, I would just have to pay an upfront payment of RM20,000 and reap the gains of the entire asset appreciating over time.

(2) Capital Appreciation + Dividend (REIT) vs Capital Appreciation + Rental (Rental Property)

So, how do REIT and rental property investors profit from their investment?

REIT:

Typically, REIT investors could expect to earn through the price appreciation of REIT in the market, while enjoying dividend paid by REIT companies (normally by every quarter of the year).

REIT investing in Malaysia is especially attractive to long-term investors as it consistently returns an annual dividend yield between 5% - 7%, which is more than the return of most structured financial derivatives in Malaysia (eg. Fixed Deposit).

Rental Property:

On the other hand, investors of rental property would benefit from capital appreciation as well, while enjoying rental payment from their tenants which will help service their loans.

Not only that, with the rise of platform such as Airbnb, many are also making a fortune by converting their properties to accommodate to these platforms.

(3) No Fuss in Management (REIT) vs Direct Control (Rental Property)

REIT:

Investing in REIT means you are investing in a real estate business that is managed by professionals and field experts. In other words, the management team will oversee rent collection, property maintenance and acquisition decision in the business.

If you wish to earn passive income in the real estate business without much post-purchase issues, REIT is definitely a great option to consider.

Rental Property:

For many investors, having full control and outright ownership of their investment assets are of utmost importance.

In this case, one can decide what kind of property to invest in and when to sell those properties. Besides that, one makes all the decisions from how much rent to charge, the design of the property and more.

In short, if you own a rental property, you have full control over the asset, including the effort to maintain the condition of the property and rent collection from the tenants.

(4) Liquid & Diversified (REIT) vs Building Tangible Asset (Rental Property)

REIT:

Owning a REIT share is just like owning any other share in the market.

This means that you can buy and sell-off your REIT shares during the weekdays at any active trading hours. Not only that, this flexibility also means that you can afford to make mistakes and still recover at minimal losses (because all you have to pay is a minimal amount of commission when you sell).

Investing in REIT also allows one to diversify to different asset classes easily due to its low barrier of entry. As an example, at the very minimum, I can invest in YTL REIT (hospitality assets) at just RM119 (RM1.19 x 100 units) and KIP REIT (retail assets) at just RM80 (RM0.80 x 100 units).

Rental Property:

While owning rental property might not provide the liquidity and flexibility in diversification, one is continuously building ownership in a tangible asset (asset that has a physical form) when investing in rental property.

Owning tangible assets such as rental property will give you the ability to refinance your property over time and use the proceeds to purchase additional assets to grow your portfolio.

No Money Lah’s Verdict:

For me, REIT and rental property investing should not be an ‘either-or’ discussion, but rather two type of real estate investments that should be practiced by everyone. As mentioned above, both methods of real estate investment offer their pros and cons and varying degrees of risk and reward.

Young adults with low initial capital should look into investing in REITs to gain some real estate exposure, while using the gains to venture into rental properties. On the other hand, experienced rental property owners should also look into REITs investing as a means to ensure capital liquidity in their real estate investments.

Learn how I build PASSIVE INCOME in the stock market with MINIMAL RISK!

PTPTN: Is Settling PTPTN for 20% Off By 2018 a Good Idea? (It is more interesting than you think)

In this article, I will explain whether it’s a good idea (or not) to settle your PTPTN loan for 20% off by the end of 2018.

The short answer is: yes, and well, no. Depending on your perspective towards money, one’s answer may differ from one to another.

It is pretty simple, and let me explain why:

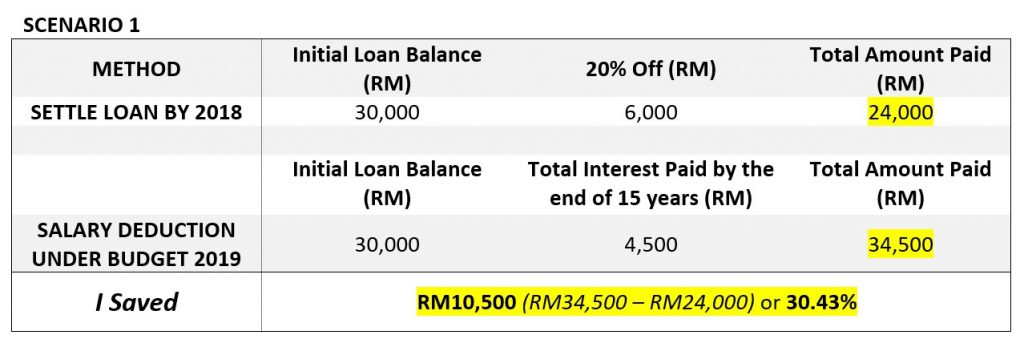

(1) The Savers Mindset

Let’s say I owe PTPTN a total of RM30,000, payable at a period of 15 years (180 months) at a fixed interest rate of 1%.

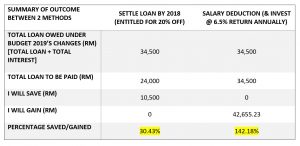

Compared to servicing my loan in the given period, if I were to settle the loan one-off by 2018, I would get a nice savings of RM10,500, or 30.43% lesser. Refer to the table below for more information:

Hence, with such a big difference in the amount paid, paying off my PTPTN fully before the end of 2018 is actually a pretty good idea.

But what if I tell you that there is an even better alternative? You will resonate well with this alternative if you have the…

(2) The Investor Mindset

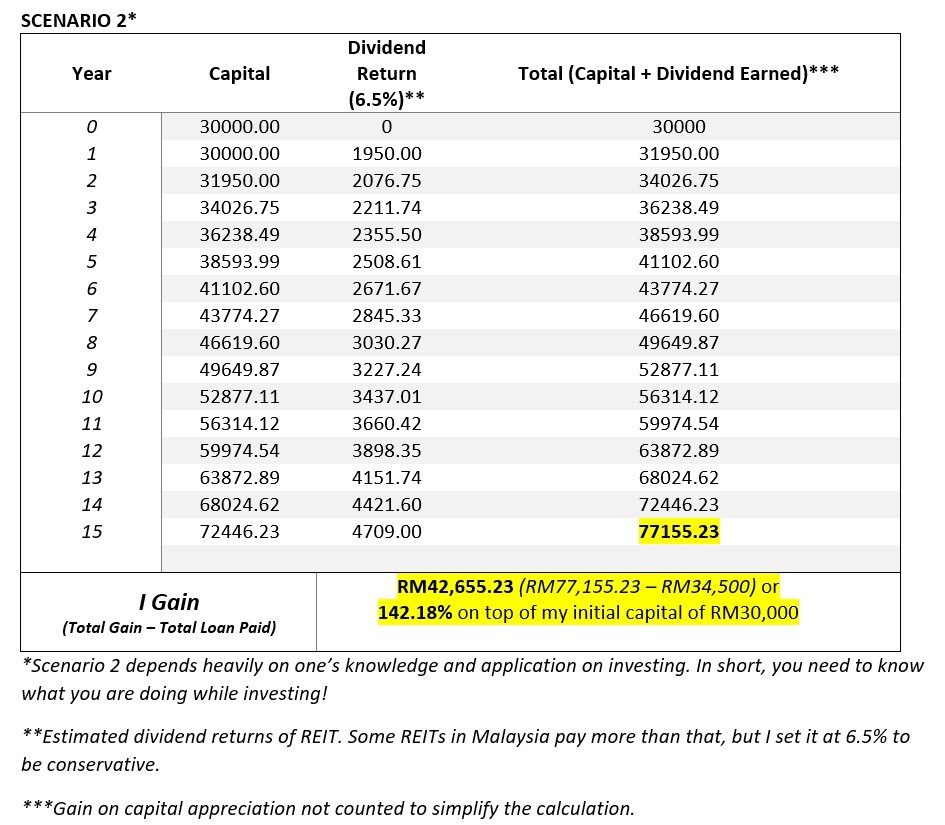

Let’s say I have RM30,000 and I am considering to pay-off my PTPTN loan or to invest the RM30,000 to earn a better return.

This time, I’ve chosen to service my loan through salary deduction as proposed under Budget 2019 and instead, invest the RM30,000 into the stock market, particularly REIT (due to its price stability), with a relatively stable interest return (dividend) of 6.5% annually.

By reinvesting all my interest returns, I would have a projected gain of more than 140% on my initial capital by the end of the 15th year (yes, even after factoring in the total payment for my PTPTN loan)! More details in the table below:

In simple terms, this means that by investing my initial RM30,000 into REITs, I would have paid off my PTPTN loan (RM34,500), and still have an additional RM42,655.23 by the end of the 15th year!

Below is a table of comparison between both scenarios:

No Money Lah’s Verdict

While there is no one right way to pay-off our PTPTN loan, I believe that there is definitely a better way to service the loan. I believe that this article has explained clearly the difference of outcome between one with a Saver’s Mindset or one with an Investor’s Mindset.

With this, I hope this article will help clear off the questions that you have in your mind, and I hope you can share this article with the friend that could benefit from it!

Do you have any personal experiences or tips on PTPTN that you would like to share? Let me know by leaving a comment at the very end of this article!

I cannot wait to hear from you!

--