PTPTN: Take Advantage of these 5 Ways to Pay Off Your Student Loan!

PTPTN student loan: No more full-scholarship conversion for first class degree holders. Automatic loan deduction between 2% to 15% for fresh-graduates earning RM1000 and above.

These are the two of the most important highlights of PTPTN during the presentation of Budget 2019.

Well, it seems like there is no running away from it anymore, eh? No matter the outcome, the new government has enforced a way to ensure Malaysian students pay back their PTPTN loans.

The thing is, while we can definitely spend our time on social media to play the blame game, we might as well put our mind together to figure out a solution for those who are impacted by this, yes?

So here it is! Here are some ways that you can (or still can) repay your PTPTN loan faster and more effectively under the new changes in Budget 2019:

Now You Can...

(1) Get Your Employer to Repay the PTPTN Loan on Your Behalf

With the newly announced Budget, any company that settles their employees’ PTPTN loan will be offered a tax break.

That said, this tax break will only apply to loans that are settled by the end of 2019.

Hence, if you are working and there is still a loan balance, or if you are graduating before the end of 2019, it is best that you take advantage of the tax break window.

Take the initiative to negotiate or look for a company that would help pay off your PTPTN loan. The best bet for this strategy to succeed is none other than to offer value to the company where you are working or applying to.

(2) Get First Class and Qualify for PTPTN Loan Rebate

For students under the B40 background, you are still qualified for a loan rebate if you graduate with First Class.

While this differs significantly from a full-scholarship conversion, it is still a legit way to reduce your burden in repaying the loan once you started working:

[A RM30,000 PTPTN loan payable in 15 years at 1% fixed interest would cost you RM191.67/month. Meanwhile, a 30% discount means your total loan would be RM21,000 and it would cost significantly lesser at RM134.17/month!]

And need I not tell you that your total interest paid by the end of payment period would be RM3150 compared to RM4500?

You Still Can...

(3) Enjoy Up to 20% Discount on Loan Settlement

While there will be no more discount on loan settlement starting 2019, those who are still currently owing their PTPTN loan should repay the balance before the end of 2018 to enjoy up to 20% off the balance. (Source: The Star)

You Should...

(4) Apply for Your University’s Tuition Fees Discount/Waiver* & Start Investing! (*Source: Lite)

An extra financial support during your university times will always come handy. This means that you can now save up more (not spend more) and invest the money!

My suggestion in terms of the priority of where to invest your savings are as follow:

- Financial education – If you have extra savings, it is always best to start investing in your financial education as the top priority. Learn how to invest before you graduate!

The knowledge of compounding return will always triumph any kind of short-term Fixed Deposit gains in the long run.

- Invest in the Stock Market – Once you have gained the knowledge on investing, apply it and invest it in the financial market such as stocks!

Invest in a fundamentally sound company at the right timing will allow you to earn a decent return via capital appreciation and dividend income. As a start, I would recommend investing in less volatile stocks such as Real Estate Investment Trust (REIT) that pays a decent dividend between 6% to 8% annually.

6% to 8% dividend annually. You do realize that the interest rate for PTPTN loan is fixed at just 1% annually, right?

- Fixed Deposit (FD) – My least favorite way to grow savings. But still, at an average return of 3% annually, it is better than putting your savings in any standard savings account.

(5) Develop Side Hustle(s) While You are still Studying

Another solid way to ease your burden in paying off your PTPTN loan is to develop one or multiple side hustles while you are still studying.

Start a business. Offer to teach people what you know. Monetize on your passion.

Who knows? By the end of your university life, you might already have all the fund needed to clear your PTPTN loan!

No Money Lah Verdict

Depending on your status (graduate or current student), there will be a solution that suits your situation in this article. My wish is that we stop finger-pointing. Instead, we should start to think of ways to support each other in the matter of PTPTN loan.

Do you have any personal experiences or tips on PTPTN that you would like to share? Let me know by leaving a comment at the very end of this article!

I cannot wait to hear from you!

--

Meditation: 5 Simple Things I Do for A Focused Mind & Better Sleep

“So…do I just close my eyes and think of nothing during meditation?”

That was exactly what I thought when I first started to learn meditation 3 years ago. I was looking for a way to overcome stress and being less reactive (impulsively) towards the things and incidents around myself.

As a start, I’ve tried many ‘conventional methods’ as marketed by media (eg. Listening to voice-guided meditation apps, using Delta soundwaves to help in concentrating). However, the outcome was on and off until I attended a 10-days meditation retreat organized by Vipassana Meditation. It is where I dedicated my time to learn and practice the simple and practical ways to meditate.

Fortunately, it works. The more I practice (even if it's just for 10 minutes daily), the more mindful and focused my mind becomes. Even better, I started to experience better quality of sleep. In short, meditation transformed my life for the better.

No need for voice-guided apps. No need for Delta soundwaves. If there is any takeaway that I’ve gotten from the retreat, it is the fact that meditation is as simple as it is!

Here are 5 simple steps to kickstart your meditation practice, even with just 5 minutes daily:

(1) Sit Comfortably and Close Your Eyes

It is important to be seated in a position where you are comfortable before you meditate. That said, refrain from lying against something (eg. wall, pillow) to prevent you from dozing off.

Hence, maintain an upright sitting posture. It is totally fine to cross your legs against each other normally, instead of having one leg above another in the movies. Relax your shoulders and arms, and rest your hands on your thighs.

Then, close your eyes.

(2) Start With a Few Deep Breathes

Notice how the air flow in the area between your nostrils and upper lips. Doing so, it will help you to enter a mindful state faster and more effectively. This is especially useful for beginners and those who just have 5 minutes to meditate.

Moving on, continue with smaller breathes until you are breathing normally.

(3) Focus on Your Breathing

Focus your attention as you breathe in and out of your nostrils.

As you enter the meditative state of mind, you might start to feel the air that you inhale into your nostrils is cooler in relative to the air that you exhale.

(4) Let Your Thoughts Pass By

While meditating, it is extremely common to have thoughts lingering around your mind.

It's fine, but learn not to attach to these thoughts. Instead, treat them like a passerby - let them come and go. Embrace all the emotions (happiness, excitement, anger, frustration), yet train yourself to let go of these thoughts.

At the same time, be mindful of your sitting posture as you might start to find yourself out of your upright posture.

(5) End with the Practice of Gratitude

Before this, how do you know if it is the time to end the meditation session?

Some would set an alarm for the duration of practice, but personally, whenever I started to feel impatience during a meditation session, I will hang on for a little more for the sense of impatience to pass-by before I proceed for Step 5 (a way for me to be mindful and be less reactive towards my emotions).

Finally, I would end my meditation session with a gratitude practice. This is where I would visualize the people around me to be healthy and happy, while internalizing that moment of gratitude.

And that’s it!

Meditation is really that simple, as it is a breathing exercise at its simplest form. Its simplicity is what makes it the simplest form of mindfulness practice that you can apply anytime during the day, regardless if you have just 5-minutes to spare during lunchtime or 30-minutes in the morning.

I’ve seen how meditation contributed to the recovery of cancer patients, and I’ve witnessed how this habit has made a lady at her 50s look just like in her early 40s.

For myself, this habit has transformed my life. Not only that it has helped me sleep better, it has also enabled me to be more mindful of my own emotions in times of stress and anxiety.

Hence, I strongly recommend you to at least commit to try meditation daily for at least a month, preferably in the morning and before you sleep. Trust me, you will notice the difference!

--

About Vipassana Meditation:

I've been a meditation practitioner for 3 years, and this habit has transformed my life significantly better in many ways. All of these would have not been possible without the amazing 10-days meditation course organized by Vipassana Meditation, one of India's most ancient techniques of meditation (and simplest to learn, in my opinion).

Vipassana Meditation has a history of more than 2500 years, and have been taught to people of all ages, races and religions in the world. The best thing? This 10-days course is totally free of charge! My experience with their 10-days course in Kuantan (they have centers at Kulim and Johor as well) was amazing, with students having a personal accommodation with washroom and decent vegetarian meals daily.

For those who are really keen to learn and experience meditation, I highly recommend Vipassana Meditation to you. Check out their course schedule here.

--

Do you have any questions or personal experience on meditation or other mindfulness practices? Do share with me at the contact box below or leave a comment at the very end of this article! I cannot wait to hear from you!

p.s. Aside from meditation, check out how you can transform your last few months of 2018 here!

--

3 Practical Ways to Protect Ourselves during a Market Downturn!

In this post, I will address one issue: How to protect ourselves from a market downturn. But firstly, a little bit of context:

Look, I know the country’s state of economy is not in a good shape right now.

But seriously, how bad are we at the moment?

Looking back at the KLCI index, we’ve been enjoying strong growth since the end of 2016 towards the peak of 1896.03 points in April 2018. That was right before our election in 509. As such, we enjoyed a whopping 17% growth for more than a year!

That said, weakened investor confidence after 509, coupled with trade war and other internal and external geopolitical uncertainties have impacted our market heavily. This is especially true among the construction and tech sector.

A simple chart analysis (purple circle) in October will show that we are indeed heading towards a market downturn (or bear market), at least for a medium to long-term period. In simple word, a general sign of a market shifting towards a downward trend can be observed when the 200MA (black line) crossed above the 150MA (yellow line) and 50MA (green line), and all 3 of them are sloping down.

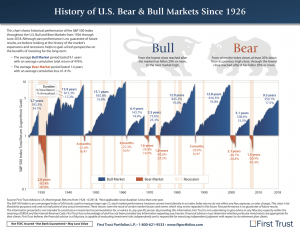

Some facts on bear market:

- In the U.S., an average Bear Market lasted for a period of 1.4 years, with an average cumulative loss of 41%.

- This will be followed by the Bull Market which on average, lasted for 9.1 years with an average cumulative return of 476%.

In short, for months to come, there is a need to brace ourselves for any punches from the local and global economy before the eventual rebound.

Here are 3 practical ways to protect ourselves in the event of a market downturn:

(1) Diversification of Income Streams

In any period of downturn, there will be unavoidable lay-offs.

Unfortunately, the good old time of working one stable job forever is now obsolete. Anyone and everyone is replaceable in a bad market condition and changing political landscape (read: our infrastructure projects after 509).

The safest bet is not to expect your boss (and government) to be loyal to you during the bad times.

Hence, it is important to start diversifying our income streams. In other words, we should not just depend on our current job as the only source of money.

Instead, spend your free time (and potentially time you would waste in social media anyway) to generate side income through existing passion and skills (eg. Piano, Photography, Marketing). Look around, the demand for your skill and passion is everywhere!

Also, it is equally important to learn to invest (not just relying on your mutual fund agent!) as another stream of income via capital appreciation (the profit when the price rises from the price you bought) and dividend income. It always feels safer when you are fully in control with your investments!

(2) Rational Investing*

In a market downturn, even the best stock investor loses money. But what differentiates these investors and layman is their discipline to admit to their losses and sell off their holdings.

In a bear market, low prices could go even lower. This is true even for fundamentally sound companies.

Hence, it is important to protect yourself by being rational during a market downturn. Grab your profit, even if it is lesser than what you’ve wished for. Stop losses if necessary, even if it hurts your ego while doing so.

Essentially, it is crucial to make decisions rationally during a market downturn.

*The key to making rational investment decisions in a market downturn is to know what you are doing! If you are not familiar with the stock market, it is wise to stay out from the market during a downturn. (Even better, follow No Money Lah on Facebook to keep yourself updated!)

(3) Manage Your Debt and Expenses!

Just like any businesses, we will be in trouble if we do not manage our debt and expenses properly in the time of a market downturn.

Hence, cut down on unnecessary expenses. Track your daily and monthly expenses, cut off the fats. Cancel the Astro and Hypp TV subscriptions already if you don’t even watch them anymore!

Also, don’t take on debt that you cannot handle or would suffocate yourself to service. It is fine to not have a beautiful car or gorgeous house now. Everyone’s pace in life is different, so are yours.

No Money Lah's Verdict

Unfortunately, we are slowly stepping into the spiral of downturn as you read this. This economic downturn might last for a few months, or if it got worse, years.

Just like how spring and summer will always follow after a cold winter, fingers crossed that we will see a change of season in the market soon. However, we are not in place to decide when this winter will end.

What we have the ability to control, though, is to prepare ourselves to face any situation to come in the market and the economy.

I wish all of us the best!

Interested in learning to make informed investment decisions regardless of market condition?

No Money Lah organizes investing workshops and gatherings for individuals and communities that are keen to learn.

KIP REIT Review (2018): 7 Things About The Highest Dividend-Paying REIT in Malaysia!

KIP REIT is a relatively new player in the scene of Malaysian REIT. It was listed in Bursa on 6th February 2017. In this article, I am going to present an in-depth analysis of KIP REIT and share my thoughts on this up and rising REIT.

1. Background

KIP REIT is a Malaysia REIT that focuses on the neighborhood and community-centric retail assets. Unlike many REITs with retail assets located in major big cities (eg. Sunway Pyramid by SunREIT & Mid Valley by IGB REIT), KIP REIT’s retail assets are located close to communities at developing and suburban towns.

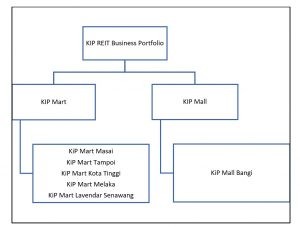

2. Business Structure and Portfolio Analysis

KIP REIT’s retail assets are all concentrated within the central and southern region of Semenanjung Malaysia, namely the state of Selangor, Negeri Sembilan, Melaka, and Johor.

In terms of business structure, it has a portfolio consisting of 5 KiP Marts and 1 KiP Mall.

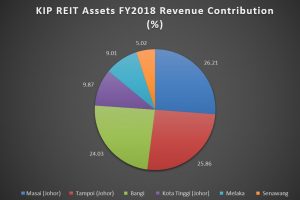

In FY2018, KIP REIT’s biggest source of revenue contribution comes from KiP Mart Masai (26.21%), follows by KiP Mart Tampoi (25.86%) and KiP Mall Bangi (24.03%).

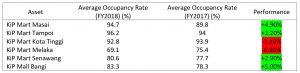

For a retail REIT, occupancy rate is an important indicator of how well the business is and would perform. Below is a comparison of the assets’ occupancy rate for FY2017 and FY2018:

Every KIP REIT’s retail assets recorded an increase in average occupancy rate, except for KiP Mart Kota Tinggi and KiP Mart Melaka. To improve the occupancy rate of KiP Mart Melaka, the management has sourced 20,000 square feet of its area to a permanent operator. With this, KiP Mart Melaka’s occupancy rate will further increase to about 80%.

3. Overall Financial Performance, Debt Status

KIP REIT earnings come mainly from rental income and other smaller business activities such as the rental of its promotional area to other parties.

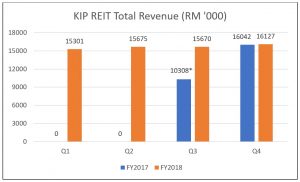

In FY2018, KIP REIT recorded a total revenue of RM62.77 million. As it was listed in Bursa on the Q3 of its FY2017, we can only effectively compare its Q4 financial data. Here is the breakdown of KIP REIT’s revenue for FY2017 and FY2018:

In its short period of enlistment, it is hard to evaluate the financial performance of KIP REIT. As such, we will return to check on its financial performance in the near future.

For FY2018, KIP REIT recorded a gearing ratio of 15%, which is way below many listed Malaysian REITs. This means that there is a lot of room for the company to acquire capital to expand its business.

4. Dividend Yield

For FY2018, KIP REIT recorded at Distribution Per Unit (DPU) of 6.83 sen, which translates to a Dividend Yield of 8.72% (base on the closing price of the last day of FY2018). This put the yield of KIP REIT as the highest among Malaysian REITs at the time of writing.

5. Income Visibility & Potential Acquisitions

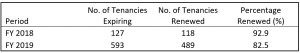

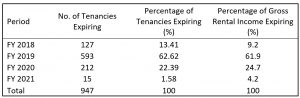

For KIP REIT, having a stable tenancy renewal is vital in keeping the business running. For tenancies due on FY2018 and FY2019, KIP REIT has managed to renew the tenancies with most of its tenants, as shown below:

As an extra, below is KIP REIT’s Tenancy Expiry Profile:

In terms of acquisition, KIP REIT is exploring the possibility to acquire 5 more KiP retail assets, namely KiP Mall Kota Warisan, KiP Mart Sendayan, KiP Mart Sungai Buloh, KiP Mart Kuantan and KiP Mart Sungai Petani.

With the release of KIP REIT’s latest Q1 FY2019 report, it is also revealed that it is currently working on the acquisition of AEON Kinta City Mall, Ipoh which will contribute a gross yield of 7.8%/annum to the company.

6. Current Valuation

At a closing price of RM0.83/unit (19th October 2018), KIP REIT still has a space for potential upside as it is well below its Net Asset Value Per Unit (NAVPU) of RM1.003/unit.

7. Potential Risk

One major risk that KIP REIT is facing is the problem of mediocre occupancy rate in its assets such as KiP Mart Melaka (69.1%), KiP Mart Senawang (80.6%) and KiP Mall Bangi (83.3%). For me, 85% is the benchmark of a decent occupancy rate for retail assets.

In fact, KiP Mart Bangi as KIP REIT’s largest asset in terms of lettable area (260,046 square feet) only managed to generate 24% of the company’s revenue in FY2018. This is in comparison to KiP Mart Masai (247,990 square feet) and KiP Mart Tampoi (163,587 square feet) that respectively contributed 26.21% and 25.86% of the company’s revenue.

No Money Lah’s Verdict

KIP REIT caught my eye at first as it generates generous dividend to its investors. With its niche in owning community-centric malls in suburban towns and its low gearing (more space for acquisition), this new retail REIT will be observed closely on my REIT watchlist.

p.s. This article is purely a review of the company’s fundamental status and DOES NOT serve as a buy recommendation.

Always wanted to learn to invest but do not know where to start? No Money Lah provides personal coaching sessions and investing workshops for individuals, organizations, and communities to learn practical investing techniques and knowledge!

5 Simple Social & Networking Hacks for Introverts

"Gosh. I wish I never step out from home just now."

I was at a networking dinner a few years ago and I felt extremely awkward. As a born introvert, I often felt uneased in a big crowd. To make thing worse as an introvert, all the socializing and conversations got me super drained up by the end of the day.

"I must really suck in this socializing thingy." I sighed.

Or do I?

As time goes by, with more socializing events that I have to attend (willingly or unwillingly), I've discovered a set of social and networking hacks that any introverts can pick-up immediately.

As such, here are 5 simple social & networking hacks that I've been using over the years that have helped me established relationships and overcome my awkwardness with people:

(1) Before any social/networking event - Do a mental warm-up.

Introverts (myself included) have the tendency to be uncomfortable and awkward with crowd and people. Hence, it is important to be mentally prepared before we head out to socialize.

Of all, one mental warm-up that I would practice before any networking event/gathering is to visualize myself being confident when walking into any of these events.

Next, I will make a self-commitment to connect and establish X number of new relationships in the event. Setting this self-commitment will provide me the momentum needed to kickstart any conversation.

With time (and practice), you will find it easier and less intimidating to build new relationships with prior mental warm-up.

Remember, every successful relationship building starts before the networking event itself. It is all about preparation, preparation and preparation.

(2) Meeting new people - Never ever forget that firm handshake!

The firm handshake.

Such important detail in any relationship building, yet often taken lightly by people. If there is one thing that 2 strangers do before any spoken words, it is the handshake between them.

A firm handshake shares a lot about one's level of confidence and trustworthiness - all before any exchange of spoken words!

No matter how uncomfortable or nervous you are, you can always fake a firm handshake. As an introvert, I often find it easier to fake my confidence with a firm handshake before any conversation with a stranger.

Not too light. Not too hard. Just a firm handshake to start an amazing conversation with any stranger.

(3) Starting a conversation - THE question that leads to limitless possibilities!

How are you?

"I'm fine, thank you. How are you doing?" I replied as I just got to meet this man called Jason in a networking event.

"Likewise." Jason replied, and we got into an awkward situation instantly as no one knew how to continue the conversation.

The thing is, asking the right question at the start of any conversation will heavily influence the outcome of the conversation. Learning to ask specific questions over open-ended questions (eg. How are you doing?) and meaningless questions (eg. How's the weather/traffic today?) will almost definitely prevent any awkwardness and conversation stutter.

Instead, try asking this next time at the start of any conversation:

"Anything interesting that you are working on right now?"

By asking this question, you trigger one's mind to look specifically for interesting projects/initiatives that they are working on, and share it with you (Instant conversation starter!).

We never know, the opportunity that you've been looking for all these while might be discovered just by asking this question.

(4) During a conversation - Listen attentively to the person you are talking to.

People love to share their personal stories. In other words, humans love to talk about themselves.

And people love it even more when there is someone that is willing to listen to them.

As an introvert, the skill of listening will prove extremely useful when it comes to socializing and networking. In fact, knowing how to listen is THE key to get what you want from any person you meet, not talking.

By listening attentively when a person shares their interesting work/projects with us, we effectively build trust with the person we are talking to. Little details while listening such as constant eye contact, reaffirming a statement to simple action like nodding your head while you are listening will make people feel comfortable talking to you.

Hence, never underestimate the power of listening!

(5) Ending a conversation - Always make it a habit to leave an impression.

By leaving an impression, what I am trying to say is to make people remember you after the conversation.

After listening to the interesting things that one does, always remember to share the one thing that you would like the person to remember you for. As an example, if I know Jason could use some information in investing, I would share about my investment articles on No Money Lah.

In addition, make it an effort to offer help such as "Let me know if you need any help in your projects". While people might not need your favor right away, but they will appreciate your offer and remember you for this. Just make sure that you are truly genuine to help when you ask the question.

By the end of any conversation, be sure to stay in touch with the person by either exchanging name-cards or get connected in social media.

Dear introverts...

In life, as much as we feel uncomfortable and uneasy with big crowds and people, it is without a doubt that we will come across a time where we will need to be out there building relationships.

Hence, instead of avoiding them, my experience has taught me to embrace every social and networking opportunities that I would attend.

Again, the key to a fruitful conversation with people in any social events is to prepare, prepare and prepare! Even now, I still follow the 5 hacks above whenever I am attending any kind of social and networking events.

If this 5 social hacks could help introvert like myself to overcome my uneasiness with big crowds and people, I am confident that it will help you as well!

With this, I wish you a fruitful experience in all your future social and networking events!

Stay awesome!

Yi Xuan.

---

Leave a comment at the bottom of this post or write to me via the contact box below if you have any thoughts and feedback on this topic! I cannot wait to hear from you.

---

YTL REIT Review (2018): Know This 7 Things Before Investing in YTL REIT!

YTL REIT is a Malaysian REIT that stands on its very own niche in the industry. In this article, I am going to present an in-depth analysis of YTL REIT and share my thoughts on this company as an investment.

1. Background

YTL REIT is a Malaysia REIT that runs purely on hotel and hospitality-related assets. As such, it is a pure hospitality REIT in Malaysia that owns iconic investment assets such as JW Marriott Hotel Kuala Lumpur and The Majestic Hotel Kuala Lumpur, among many.

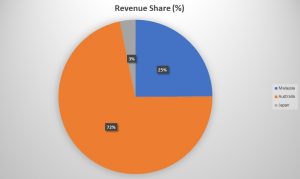

YTL REIT is also one of the few Malaysian REITs that owns a diverse portfolio of assets in foreign countries. As of the latest financial year ended 2018 (FY2018), YTL REIT’s Australia portfolio has been contributing near to 72% of total revenue, followed by 24.9% from their Malaysia portfolio and 3.3% from their Japan portfolio.

2. Portfolio Breakdown

(1) Malaysia Portfolio

In Malaysia, YTL REIT owns 10 hotel and hospitality assets. The company leases them out on a fixed lease basis to ensure income stability. As such, these assets are: JW Marriott Hotel KL, The Majestic Hotel KL, The Ritz-Carlton KL Hotel, The Ritz-Carlton KL Suite, Vistana KL, Vistana Penang, Vistana Kuantan, Pangkor Laut Resort, Tanjong Jara Resort, and the Cameron Highland Resort.

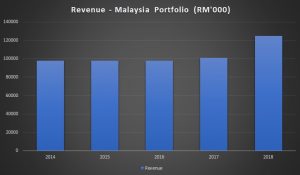

The question is, how did their Malaysian portfolio perform over the years?

Pretty consistent, actually. In fact, revenue for the past 4 financial years (2014 – 2017) has been rising steadily. In FY2018, there is a significant increase in revenue as YTL REIT has completed the acquisition for The Majestic Hotel KL and it provided a boost of income to the company.

(2) Japan Portfolio

YTL REIT owns Hilton Niseko Village located in Hokkaido, Japan. Like its Malaysian portfolio, it operates under a fixed lease basis to ensure a stable return for the company.

Over the past 5 financial years, the company’s business in Japan has produced steadily rising revenue for the company thanks to Hilton Niseko Village’s reputation as one of the most well-known ski resorts in Japan.

On 14th August 2018, a proposed acquisition is announced by YTL REIT for the acquisition of The Green Leaf Niseko Village for 6.0 billion Yen (equivalent to RM222.5 million, based on an exchange rate of 100 Yen : RM3.7078)

Upon completion of the Proposed Acquisition, it will be leased out for a lease period of 30 years, with an option granted to the vendor to renew the lease for a further term of 30 years.

With an initial annual rental payment for 315 million Yen for the first 5 years with a step-up provision of 5% every 5 years, this will ensure an increase in revenue contribution to the company from its Japanese portfolio.

(3) Australia Portfolio

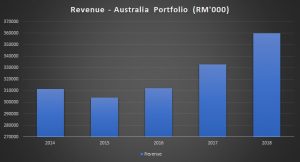

Unlike the investment assets from Malaysia and Japan, YTL REIT profits directly from the operation of their investment assets in Australia.

With the likes of Sydney Harbour Marriott, Brisbane Marriott and Melbourne Marriott, YTL REIT has been enjoying stable and consistent revenue growth for the past few financial years.

Occupancy rate is an important benchmark for real estate operation and performance. In FY2018, Sydney Harbour Marriott has enjoyed an average occupancy rate of 89.31% while Melbourne Marriott followed closely at an average of 87.09% and Brisbane Marriott at 85.06%.

3. Overall Financial Performance & Debt Status

Thanks to the steady performance of its portfolios, YTL REIT has registered a healthy revenue growth for the past 5 financial years.

For FY2018, YTL REIT recorded a gearing ratio at 37%, which is a respectable number among Malaysian REITs. This translates to a healthy borrowing status within the company.

4. Dividend Yield

Distribution per unit (DPU) for the past 5 financial years for investors was at its highest in FY2014 (8.46 sen) and remained between 7.8 sen to 8.08 sen for the following financial years.

For FY2018, YTL REIT paid a DPU of 7.868 sen, which translates to a Dividend Yield of 6.84% (base on the closing price of the last day of FY2018). This put the yield of YTL REIT well above famous Malaysian REITs such as SunREIT and IGB REIT.

5. Income Visibility

For a big chunk of its business (Malaysia & Japan portfolios), YTL REIT obtains its profit from leasing its investment assets to various operators and collect a fixed lease. This mitigates the fluctuation of potential low seasons in its hotel businesses and ensures a stable income flow for the company.

Below is a compilation of the lease details of YTL REIT’s investment assets:

The table above shown a healthy lease expiry period, and this ensures stability in income source at least for the next 5 financial years.

6. Current Valuation

At a closing price of RM1.24/unit (5th October 2018), YTL REIT is close to its 52-Weeks high of RM1.28/unit. That being said, YTL REIT still has a space for potential upside as it is well below its Net Asset Value Per Unit (NAVPU) of RM1.595/unit.

7. Potential Risks

One of the major risk that YTL REIT may face is interest rate risk. With a 20% to 80% fixed-floating debt interest structure, YTL REIT is exposed to the risk of potential interest hikes in the economy. A hike in interest rate will increase the operating expenses of the business and impact its earnings.

Another risk faced by YTL REIT in its business is forex risk. With near to 72% of revenue contribution from its Australian business, any fluctuation in foreign exchange between the Malaysian Ringgit and the Aussie Dollar will impact their earnings as well.

No Money Lah’s Verdict

I’ve long looked into YTL REIT as one of the better REIT investment for passive income purpose in Malaysia.

Its track record in income stability and manageable gearing (despite running a seasonality inclined hotel business), coupled with a decent dividend yield in comparison to the other Malaysian REITs make YTL REIT a good REIT to invest in for capital appreciation and passive dividend income.

p.s. This article is purely a review of the company's fundamental status and DOES NOT serve as a buy recommendation.

Always wanted to learn to invest but do not know where to start? No Money Lah provides personal coaching sessions and investing workshops for individuals, organizations, and communities to learn practical investing techniques and knowledge!

How Can You Make The Best Out of The Last 90 Days of 2018?

"Great, the last 3 months of 2018 and I have barely achieved much."

I was a little frustrated looking at the calendar knowing that September 2018 is coming to an end. Early this year, I had so many plans.

According to plan, I was supposed to finish the design and launch No Money Lah back in March/April 2018. Yet, I only managed to launch and get everything done by late September.

According to plan, I was supposed to achieve a certain return for my trades by August/September 2018. Yet, I am still far away from my target by September.

According to plan, I was supposed to speak fluently in my Toastmasters speeches by now. Yet, I still trembled and went blank when I was out on the stage last week.

According to plan...kononnya.

The thing is, it is not just me that feels the same way

In fact, many lost their direction towards the end of the year. Typically, the only thing that many would be looking forward instead is their long vacation when they clear their annual leaves.

I refuse to submit.

For those who have yet to give in and refuse to settle for 2018, this one is for you

And you know what? It is totally fine if you messed up the past 9 months of 2018 - as long as you are keen to do something from now on. There is still time to make 2018 your best year ever.

If you feel that you can achieve and do so much more for the remaining 90 days, keep reading. This is my game plan for the next 90 days and here are what I am going to do:

(1) Focus on specific goals. Be concise.

For the remaining 90 days of 2018, set a specific goal for important parts of your life - career/studies, health, relationship, and finance. Write down your 90-Day Goals, and scope it down to Monthly Goals and a Weekly Action Plan.

The key here is to be extremely specific with the goals. Start small and move on from there. If your plan is to get more rest by sleeping before 12:00 am everyday, and you've been sleeping at 2:00 am all these while, it is only rational to have a marginal progress instead of a sudden change of your sleeping routine so your body can adapt better.

As such, here is how one of my 90-Day Goal (Habit & Health) looks like:

- 90-Day Goal - Sleep by 12:30 am everyday. (I've been sleeping around 1:30 am for quite some time)

- Monthly Goal (October) - Sleep by 1:00 am for the month of October. (Marginal progress: 30 minutes earlier from the initial 1:30 am)

- Weekly Action Plan (1/10/2018 - 7/10/2018) - No more social media by 12:30 am to ensure better sleep quality.

Be concise with when and what you are going to do. If you are to sleep by 12:30 am, then be sure that you are already at bed by the time specified.

(2) Start journaling. Plan ahead and end your day with gratitude.

Ever had a long day filled with unproductive work, meetings, and meaningless networking, only to feel overwhelmed and exhausted at the end of the day?

Start the habit of journaling. Wake up 10 minutes earlier everyday (yes, even weekends!) and plan your day ahead. In fact, there're only 90 days left in 2018 and we do not want to waste any moment on unfulfilling and unproductive tasks that do not contribute to our goals.

Again, be specific. Write down what you are doing to do for the day at each session (morning, afternoon, evening) and tackle the hardest task in the morning. With that, you will feel more productive and efficient, and the day would be less daunting and overwhelming.

At the end of the day, before you sleep, take some personal moment to reflect on the day and write down things around you that you are grateful for. With time, the practice of gratitude will boost your happiness without you realizing as you will start to see things with gratitude and appreciation.

The best thing about journaling? It is a super effective way to boost the day and the habit only takes up 15 minutes of your day (10 mins in the morning, 5 mins at night)!

(3) Weekly & Monthly Goals Review is a must.

The reason why people tend to divert away from their goals is the fact that many do not look back and review on their progress once the goals are set. Hence, many lost their way while pursuing the goals.

It is super important to keep track of our progress as we pursue our goals. Keeping track of our progress on a weekly and monthly basis keep ourselves in check and make sure that we have a clear macro view on this 90-Day journey.

Every end of the week and month, take note of what has been done and not done. What could be done better? Celebrate progress, even the little ones. Embrace mistakes and failures along the way. Own your mistakes and set an action plan to do better next week/month!

(4) Commitment & Consistency are the (open) secrets.

Ultimately, plans and goals will always remain on paper unless we are committed in executing them.

In this last 90 days of 2018, strive to commit to the cause that you've planned to pursue and let nothing diverts your precious attention. Be committed to strike consistency in what you are doing. One of my 90-Day Goal is to not use social media for entertainment before 12:00 pm on weekdays. Wouldn't it be meaningless if I do it only when I feel like doing so?

The 90-Day Game Plan starts today!

The best time to invest was 30 years ago. The second best moment is now! I believe the similar message applies to not just money, but ourselves as well.

Look, we might have made mistakes in the early part of 2018. We might have procrastinated for the past few months. But let's not have our past judge and decide our moves for the remaining 90 days of 2018.

Start with the believe and desire that you will make the last 90 days of the year the best days ever, and kickstart your 90-Day Game Plan now! Be patient, stay committed, strive for consistency.

Potentially, this might be our turning point for an amazing year ahead, and I cannot wait to see the best from us all!

Stay awesome!

Yi Xuan.

Why is it So Important to Talk About Adulthood Issues? (and Why So Few Talk About Them)

It's funny how I am graduating from university in a month time, yet I am of mixed feelings about graduating.

Seriously, what did we learn in school?

We spent near to 20 years in schools, yet these education institutions have failed to educate us how to manage adulthood issues - How do I manage stress (properly)? How do I manage my monthly income? How can I structure my spending and investments to manage my student loans and afford a house by my 30s?

Keep diving into this and we will come to realize that we have learned close to minimal life skills in the lecture hall. Due to the lack of formal discussion on adulthood challenges, we tend to dismiss (proper) conversations about them in our life.

As an example, it is so hard for people to acknowledge that they are having issues (stress/depression, money, relationship etc), and it is even harder for them to seek help and guidance - because the society, in general, does not embrace these conversations openly.

The purpose of No Money Lah

That's why it is so important to write and talk openly about adulthood issues, or rather the journey of having these challenges and facing them one at a time.

No Money Lah is about my journey in this new chapter of life - but it is more than that.

No Money Lah is where I share my new findings in life. No Money Lah is where I share my greatest life challenges. No Money Lah is where I share my deepest failures.

The most important of all, No Money Lah is where you know you are not alone in this adulthood journey.

I am graduating in a month time. I am fearful of the uncertainties, yet I am excited for what's to come.

Till the next article!