Last Updated on May 2, 2022 by Chin Yi Xuan

In my previous article, I shared about how and where I invest my money. When it comes to active investing, my niche and strength mainly in researching and identifying opportunities in the Real Estate Investment Trusts (REITs) sector in the stock market.

REITs are great options for investors looking to build a consistent dividend income portfolio, while also having exposure to the commercial real estate sector.

In this article, I would like to share 5 fundamental aspects that I consider when I invest in REITs.

These 5 aspects are also discussed in detail in my live REIT Income Investing Coaching Sessions, so if you are interested to build a consistent dividend income portfolio via REITs, be sure to click HERE and check it out!

Without further ado, let’s start!

Table of Contents

#1 Is the REIT’s business nature suitable to grow in this current environment?

Not all REITs are born the same.

As an example, IGB REIT is REIT that runs a retail business that runs the operation of Mid Valley and The Gardens. On the other hand, Al-Aqar REIT is in the healthcare business where they own and/or operate hospitals and healthcare centers like KPJ Hospitals.

In other words, while both companies are categorized as REITs, the opportunities and risks involved with both IGB REIT and Al-Aqar REIT are fundamentally different.

Hence, it is important for us to recognize the business nature of a REIT and identify whether the REIT is suited for growth current (and future) market & business environment.

Related: Pros and Cons of different REITs HERE

#2 Healthy Balance Sheet

For REITs, a healthy balance sheet is extremely crucial in the operation of the business.

In essence, the health of a balance sheet refers to how well a REIT is in managing its liabilities (mostly debt) in relative to its asset (ie. Cash).

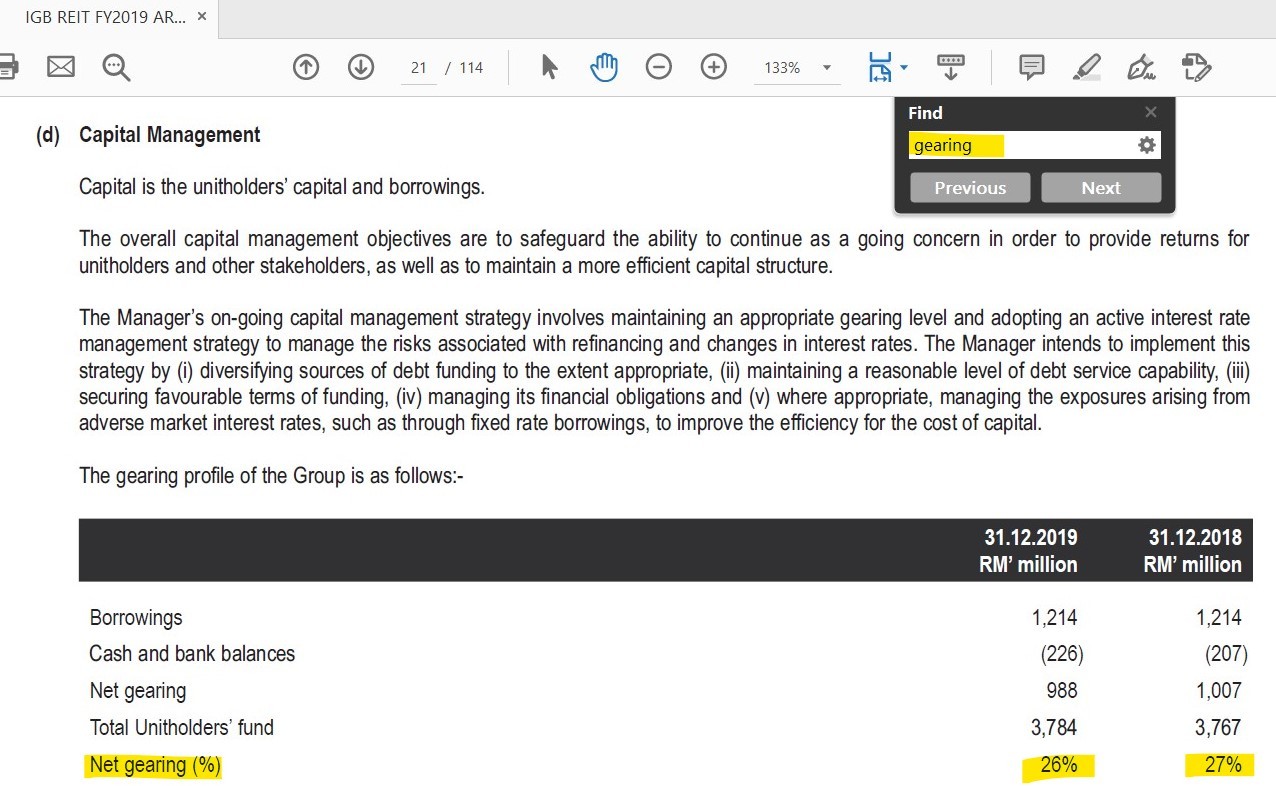

One very good measure of a healthy balance sheet is via Gearing Ratio. Gearing Ratio measures the company’s borrowings relative to the value of its assets.

This also means that Gearing Ratio is able to tell us whether a REIT is overborrowing. Generally, a REIT is required to maintain a gearing of 50% or less.

But personally, I like to be more stringent with my selection and will only go with REITs with gearing of 40% or less.

How to look for Gearing Ratio?

Method: On quarterly/annual report > Ctrl + F “Gearing”

p

#3 Income Growth

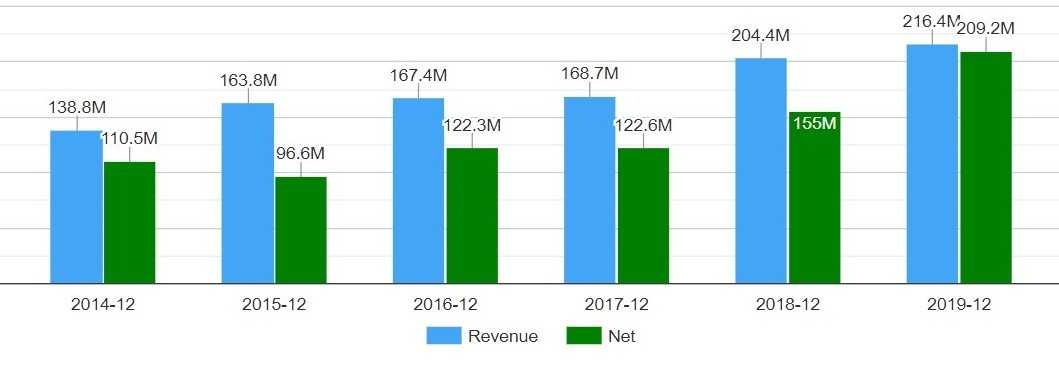

As an investor, of course I am always be looking to invest in a business that keeps growing.

This translates to past consistent growth in revenue & profit of a company. In REITs, this is no different.

As a real estate business that earns mainly on rental income, it is crucial that under normal circumstances, the income of the business keeps growing consistently.

A consistent growth in income will, for most of the time, ensure growth in dividend payout to investors.

How to look for the details of a REIT’s income?

Method: Via the income statement in quarterly/annual report, or via apps like KLSE Screener

#4 Occupancy

As a real estate business that depends on rental income, the lifeline of REITs is highly dependent on the occupancy rate of their properties.

As an example, IGB REIT’s income will be highly dependent on how well occupied the rental is in Mid Valley and The Gardens.

I will go more in-depth on this topic in future articles, but in general, there are 2 rental models of REITs:

The first rental model is around a short, normally yearly rental contract, where REITs’ management will have to renegotiate new contract terms on a yearly basis. This is usually seen among Retail REITs like IGB REIT and multi-tenant office building on Office REITs.

The second model is a longer, multi-year rental contract (or lease), where REITs’ management secure longer-term contracts (usually 3-5 years and even longer) with tenants. This is usually seen in Industrial REITs that run factories & warehouses, Hospitality REITs that manages hotels and Healthcare REITs that run hospitals.

How to look for a REIT’s Occupancy Details?

Method: On the annual report, Ctrl + F “Occupancy”

#5 Potential Acquisition

While investing in REITs, an important indicator to gauge potential income growth of a REIT is through potential acquisitions.

As a real estate business, the major way for a REIT to improve income is to acquire quality properties under its portfolio.

This will ensure longer-term rental income growth and translates to better dividend payout for investors.

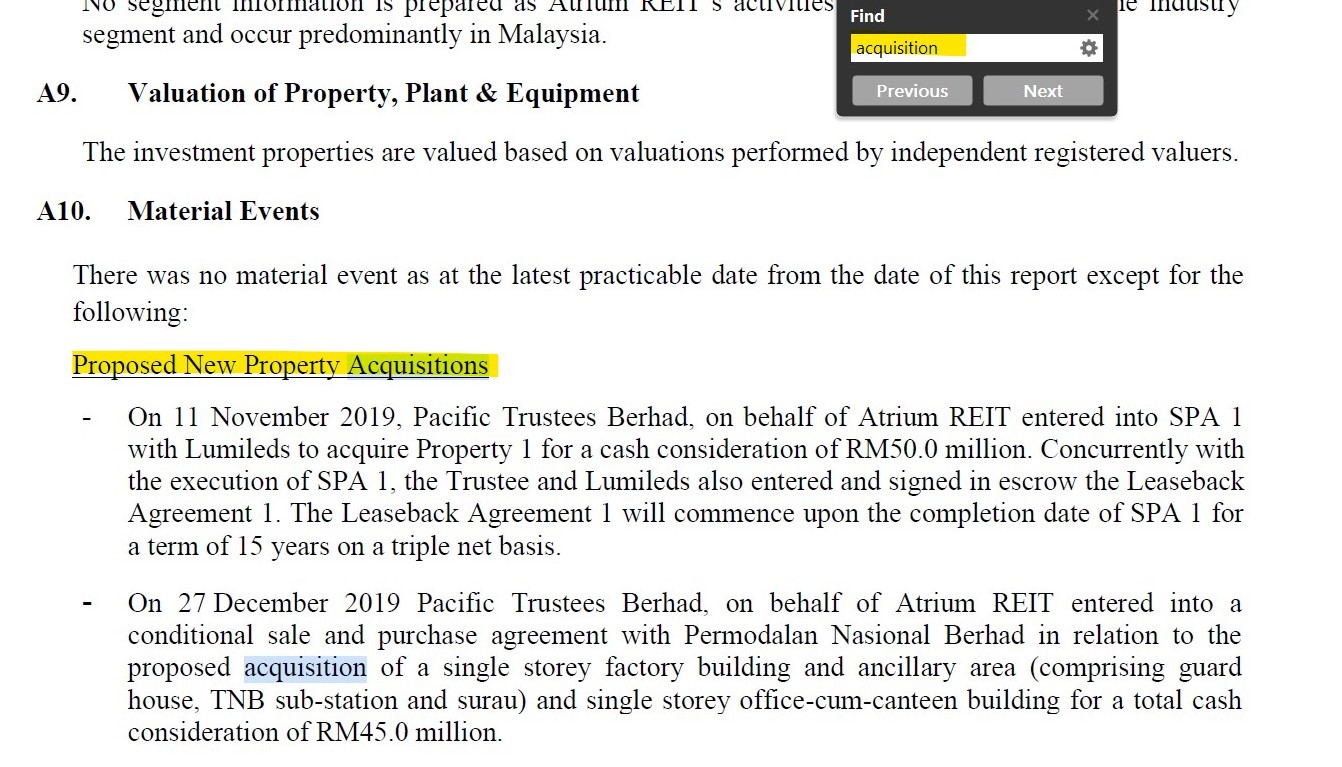

How to look for a REIT’s Acquisition Details?

Method: Now, this will be a little tricky but generally, under Quarterly/Annual Report, you can Ctrl + F “Acquisition”. Otherwise, I recommend reading through the Quarterly Report and you’ll easily spot any acquisitions under the pipeline.

p

No Money Lah’s Verdict

So here you go! These are 5 fundamental aspects that I look into when I invest in REITs.

For sure, there are several other little details that will help in my decision-making process, but these 5 aspects generally make up my initial impression of a company.

Are you investing in REITs as well? What other aspects do you look into a REIT before making your investment decision? Share with me at the comment section below!

Else, if you have any questions or things that you would like me to cover on REITs or investing in general, do let me know at the comment section too! 🙂

p.s. Keen to Learn More About How You Can Build a Reliable Dividend Income from REITs? Click HERE to Find Out More!

Related Posts

August 18, 2019

5 MUST-KNOW Terminologies Before You Invest in REITs

Gearing refers to the leverage of a…

November 28, 2018

4 Key Differences Between Investing in REIT and Rental Property

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.