Last Updated on February 28, 2023 by Chin Yi Xuan

Syfe is an established robo-advisor in Singapore that I’ve been wanting to try for some time.

From my research and time using Syfe, I can attest that Syfe is the most complete robo-advisor that I’ve come across so far. Regardless if you are a beginning investor, or one that requires complete control & customization, Syfe has something just for you.

In this post, let’s have a detailed look at Syfe, and whether it is a robo-advisor that you should be trying out!

Table of Contents

Highlights of Syfe

- Regulated: Syfe is a robo-advisor based in Singapore, regulated by the Monetary Authority of Singapore (MAS).

- Unique offerings: Syfe offers a diverse selection of Exchange-Traded Fund (ETF) portfolios for different investors. Of all, Syfe’s Core Equity100, REIT+, and Select portfolios are truly unique and definitely worth checking out.

- Flexible: Anyone 18 year-old and above can open a Syfe account. There is no minimum investment amount for Syfe. In addition, users can deposit & withdraw anytime without any fees and lockup penalties.

READ: What is ETF and how to invest in it?

Regulation & Security: Is Syfe safe?

- Syfe is regulated by the Monetary Authority of Singapore (MAS). This ensures that Syfe is operating under the best practices and guidelines set by the Singaporean authorities.

- In addition, Syfe takes the security of funds seriously. All users’ funds in Syfe account are held in a Trust Account in DBS Bank. Meanwhile, the investments are kept in a Custodian Account through Saxo Capital Markets.

- Most importantly, all of these are held separately from Syfe’s assets. Meaning, Syfe will not have access to users’ funds and assets, ensuring clear transparency to avoid fraud.

Syfe Portfolios (& Which Portfolio Should You Choose)

In this section, let’s look at the offerings from Syfe:

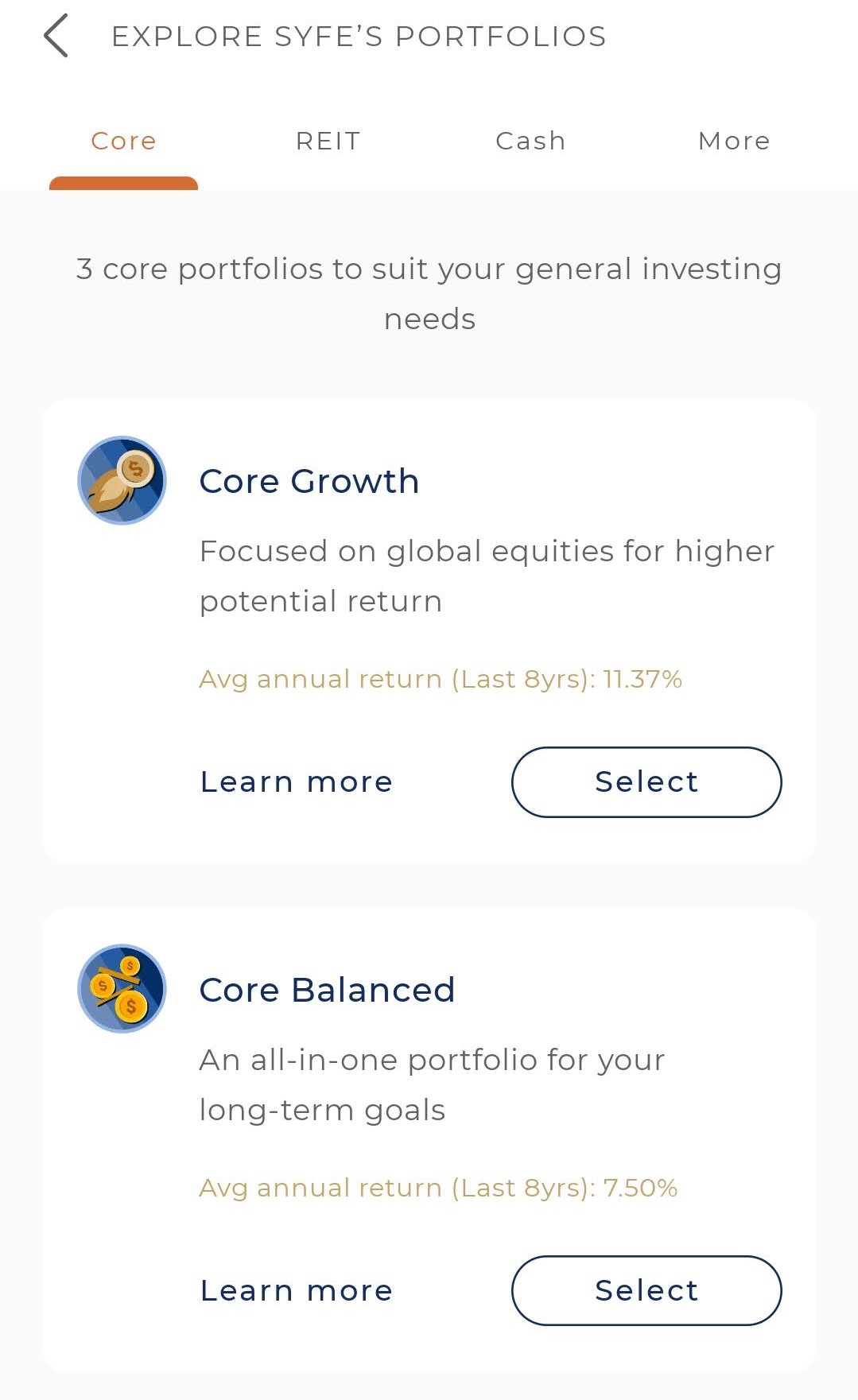

#1 Syfe Core Growth, Core Balanced, Core Defensive

The first offering from Syfe is the Core Growth, Balanced, Defensive portfolios.

Essentially, these Core portfolios are made up of a combination of Equities, Bonds, and Gold.

From how I see it, the Core Growth, Balanced, Defensive portfolios are very similar to what’s usually offered by other robo-advisors like StashAway and Wahed.

Generally, the more risk you are willing to take, the more allocation will be placed on equities within the portfolio (Core Growth). On the other hand, lower risk portfolios (Core Balanced & Core Defensive) will have more allocation towards bonds.

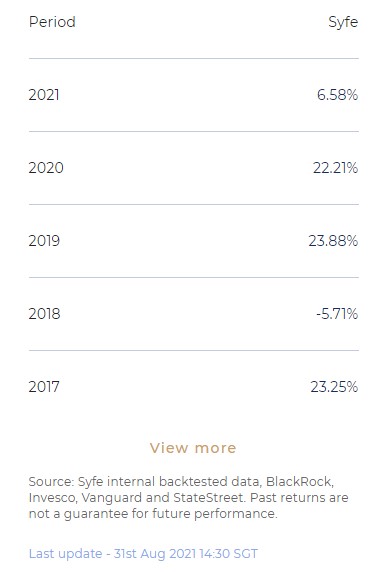

(i) Core Growth Portfolio Overview (I am investing in this):

- Higher allocation to equities (~69%). Key allocations to equity ETFs such as the QQQ (tracks the NASDAQ 100 index) and RSP (tracks the S&P500 index with equal weightage).

- Mainly invested in the US market (~75%), followed by China (~9%)

- For who: Investors that are looking to grow their investment, and is willing to withstand bigger fluctuations along the way.

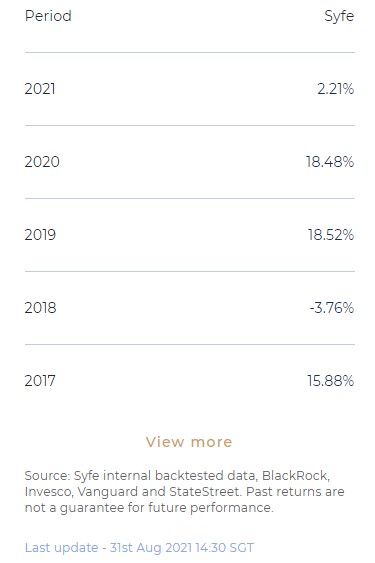

(ii) Core Balanced Portfolio Overview:

- A balanced allocation between equities (~39%), bonds (~50%), and gold (~11%). Key allocations to bond & gold ETFs such as TLT (US gov. bond) and GLD (tracks the price of gold).

- Mainly invested in the US market (~73%), followed by China (~5%)

- For who: Investors that are looking to grow their investment with less volatile swings in returns during the process.

(iii) Core Defensive Portfolio Overview:

- Heavy allocation to bonds (~71%) to ensure stable returns. Key allocations to bond ETFs such as TLT and IEF (US gov. bonds).

- Mainly invested in the US market (~71%), followed by Japan (~3%) and China (~2.5%)

- For who: Investors that are looking to grow their investment consistently with the least fluctuations, but do not mind an overall lower return.

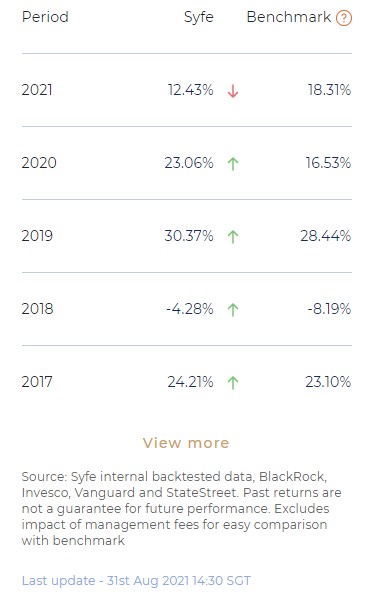

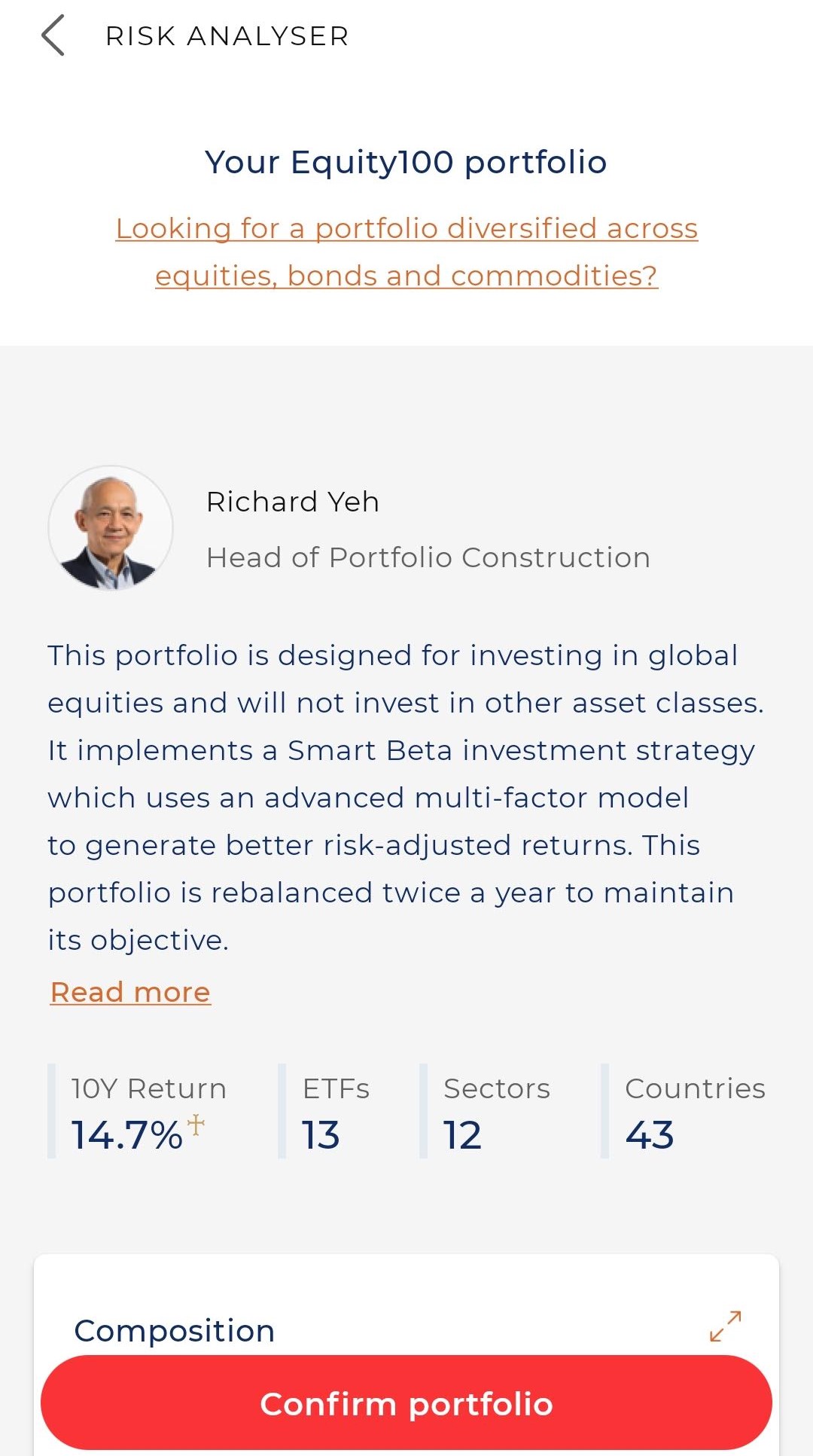

#2 Syfe Core Equity100 (I am investing in this)

The Core Equity100 portfolio is a unique offering from Syfe, as you get a portfolio with 100% allocation to equities.

This is truly different from other robo-advisors which, even at their most aggressive portfolios, still have some allocation to low-risk instruments like bonds and gold.

- The Core Equity100 gives investors a 100% exposure to equity ETFs.

- Key allocations to QQQ (tracks the NASDAQ 100 Index), RSP (tracks the S&P500 index with equal weightage), CSPX (tracks the S&P500), and more.

- Mainly invested in the US market (~76%) and China (~13%)

- For who: Investors that are looking to aggressively grow their investment, and do not mind taking bigger than usual swings in the market.

With the Core Equity100 portfolio, Syfe employs a smart beta methodology. This methodology optimizes for outperformance by considering different factors and risk elements.

Simply put, the Core Equity100 portfolio is the most aggressive (and risky) among all Core portfolios from Syfe.

#3 Syfe REIT+ Portfolios

REIT+ is another offering unique from Syfe. Through Syfe REIT+ portfolios, investors get to invest in a basket of Singapore’s Real Estate Investment Trusts (SREITs).

- REIT+ tracks the SGX’s iEdge S-REIT Leaders Index, which measures the performance of the most liquid SREITs.

- REIT+ invests in the 20 largest SREITs, such as Mapletree Commercial Trust and Ascendas REIT.

- For who: Singapore’s REIT market is one of the most mature REIT markets in Asia. SREIT’s 0% withholding tax on dividends is especially attractive for dividend investors. In other words, investors that seek consistent passive income via dividends can consider giving REIT+ a try.

Another thing to note is there are 2 REIT+ offerings from Syfe:

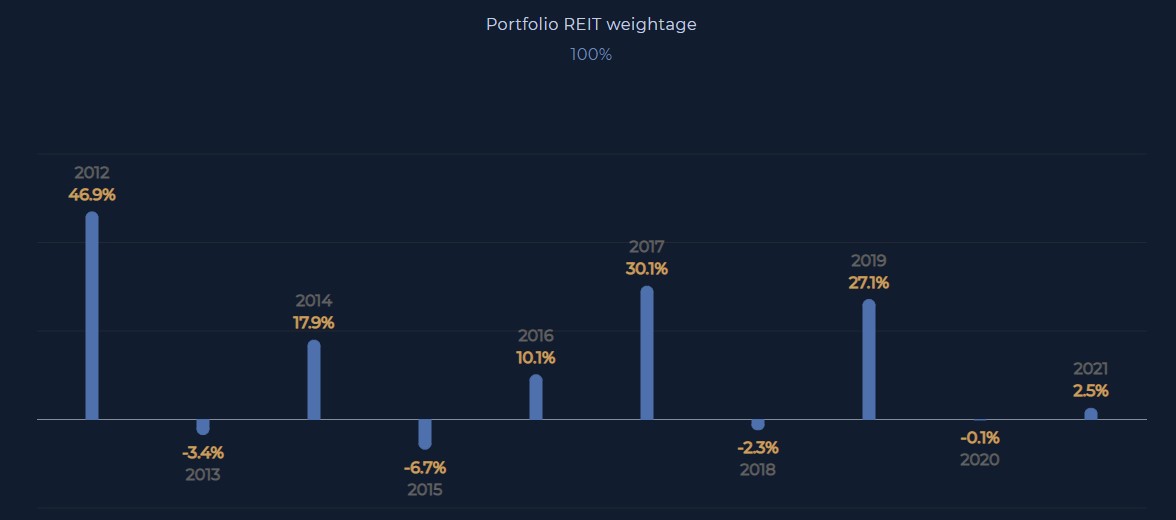

(i) 100% REIT portfolio:

100% allocation on SREITs.

- 2020 Dividend Yield: 4.5%

- Performance from 2012 – 2021 (year-to-date)

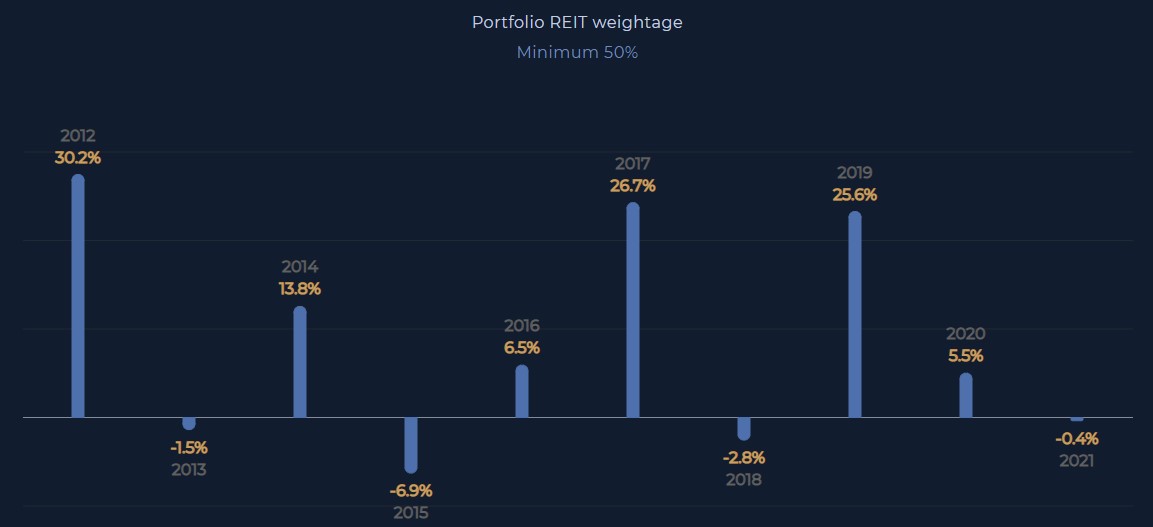

(ii) REITs with Risk Management:

A minimum 50% allocation to SREITs, while the rest is being allocated to Singapore Gov. Bonds (Nikko AM’s ABF Singapore Bond Index Fund) to cushion for market fluctuations.

- 2020 Dividend Yield: 3.3%

- Performance from 2012 – 2021 (year-to-date)

READ MORE: What is REIT and why invest in it?

READ MORE: Introduction to Singapore REIT (SREIT)

#4 Syfe Cash+

Syfe Cash+ is extremely similar to the likes of StashAway Simple and Versa in Malaysia. It is a flexible alternative to conventional Fixed Deposit (FD), with a projected return of 1.5% per annum.

- Cash+ is a portfolio made up of low-risk instruments like Money Market Funds and Bonds.

- No management fee: Unlike other portfolios, Syfe does not charge a management fee to save your money on Cash+.

- Automated Recurring Transfer: Through Cash+, investors can set up automated recurring transfers to & from other Syfe portfolios. This is very convenient for investors with a sum of money, but prefer to dollar-cost average instead of invest one-off into their Syfe portfolios.

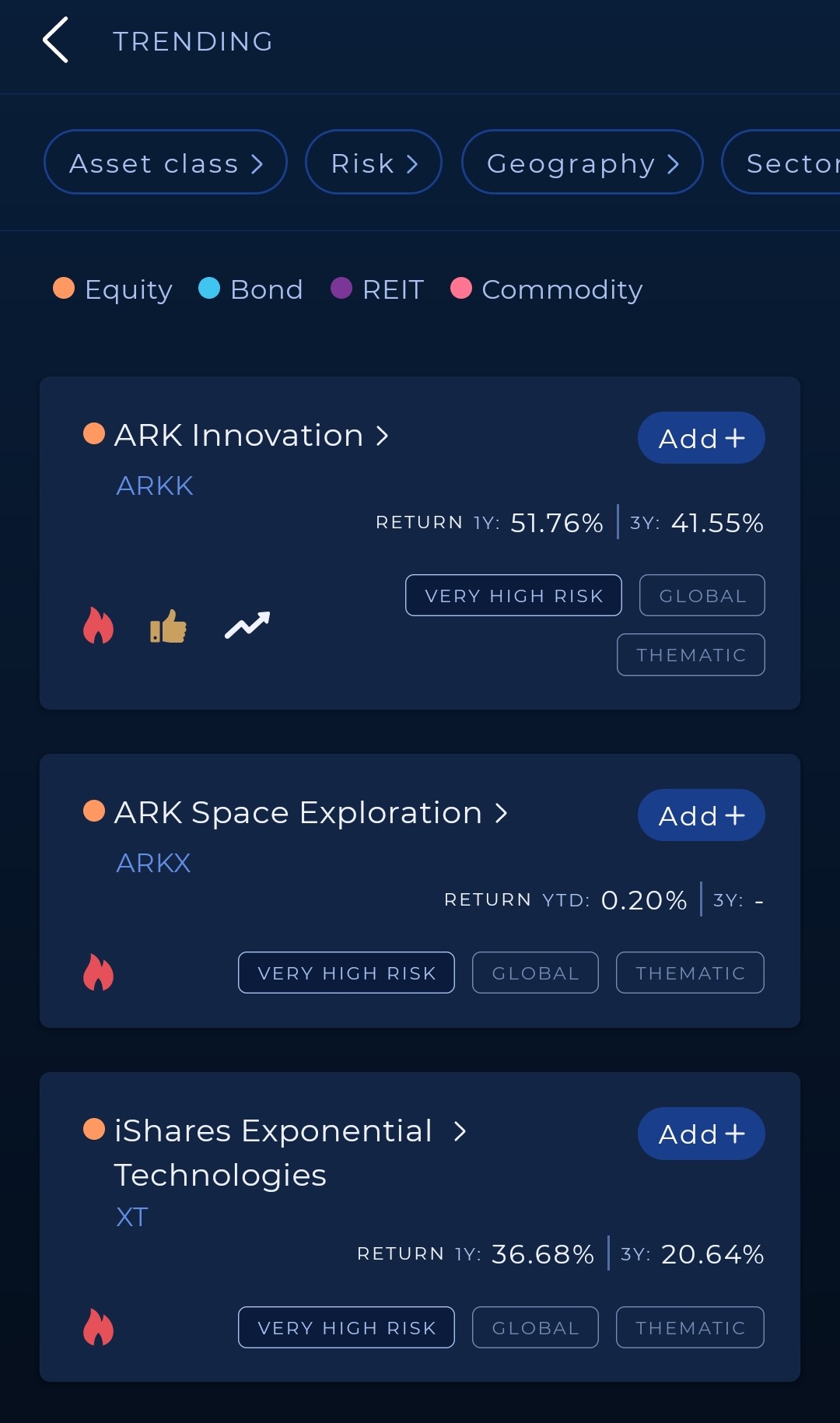

#5 Syfe Select (Themes)

Syfe Select Themes allow investors to choose a portfolio around specific themes, namely:

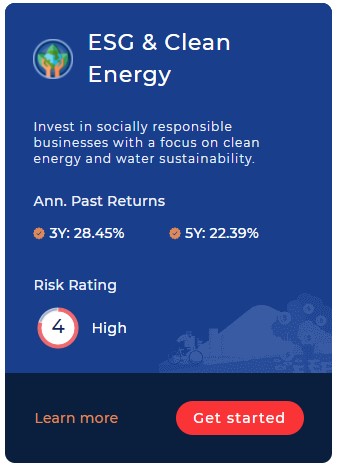

(i) ESG & Clean Energy:

Invest in companies that are at the forefront of all environmental, social, and corporate governance (ESG) criteria. ETFs aligned to clean energy and water sustainability make up half of the portfolio.

- Annual Returns over the past 5 years: 20.23%/year

- Key Allocations: ESGE (exposure to large & mid-cap ESG companies in emerging markets), ESGD (exposure to ESG companies in developed markets), and more.

- Risk rating: 4 (High)

- For who: Investors looking to tap into the trending awareness towards ESG companies.

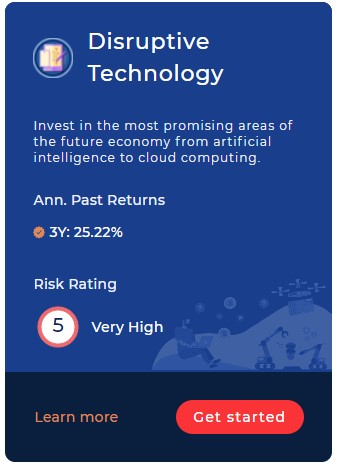

(ii) Disruptive Technology:

Invest in companies with leading-edge technologies such as AI, robotics, cloud computing, and more.

- Annual Returns over the past 3 years: 25.22%/year

- Key Allocations: ESPO (exposure to companies involved in video game & eSports development), BOTZ (exposure to companies involved in robotics & AI), and more.

- Risk rating: 5 (Very High Risk)

- For who: Investors looking to ride the huge growth potential of the disruptive tech industry, while do not mind taking larger risks.

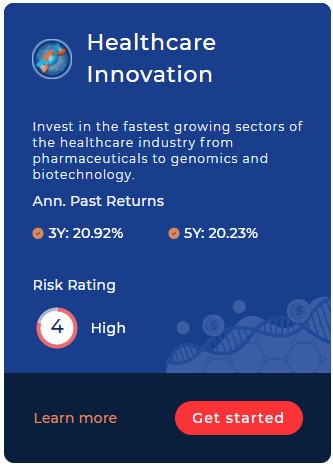

(iii) Healthcare Innovation:

Invest in companies that are at the forefront of healthcare technologies such as genomics, biotech, and more.

- Annual Returns over the past 5 years: 20.23%/year

- Key Allocations: XLV (exposure to companies involved in healthcare equipment, biotech, and more), IBB (exposure to companies involved in biotech for new cures for diseases), and more.

- Risk rating: 4 (High Risk)

- For who: Investors looking to tap into the increasing demand of health/medical tech advancement.

(iv) China Growth:

Invest in the huge growth potential of China consumer & tech sectors.

- Annual Returns over the past 5 years: 17.23%/year

- Key Allocations: CNYA (exposure to domestic Chinese companies traded on Shanghai or Shenzhen Stock Exchange), MCHI (exposure to companies in the top 85% in market cap of the Chinese equity market), and more.

- Risk rating: 4 (High Risk)

- For who: Investors looking to tap into the huge growth potential in China, while also accepts the risks involved in investing in China.

(v) Global Income:

Invest in high-yield bonds for consistent income.

- Annual Returns over the past 5 years: 5.01%/year

- Target gross dividend yield of 4.25% per annum

- Key Allocations: CEMB (exposure to emerging market corporate bonds), SHYG (exposure to US short-duration corporate bonds), and more.

- Risk rating: 3 (Moderate Risk)

- For who: Investors looking to generate consistent income from the market.

#5 Syfe Select (Custom)

If you are looking to 100% take charge of your ETF selections, then you are going to love Syfe Select Custom.

Essentially, you get to construct your own portfolio by choosing 8 ETFs out of 100+ ETFs offered by Syfe. In addition, you get to decide on the weightage/% allocation of each ETF in the portfolio.

In other words, this is as close as you can get to construct your own ETF portfolio without opening a broker!

You may be wondering:

Why not just open a broker and build my portfolio myself?

I’ve reached out to Syfe to inquire about this. Apparently, Syfe invests our funds into the institutional share class of the underlying funds, which retail investors do not normally have access to. Essentially, the institutional share class of these funds has lower management fees and expense ratios.

In other words, when you construct your portfolio via Syfe, your investing cost should be lower compared to buying your own ETFs via a broker. (according to Syfe)

Both Syfe Select Custom and Themes are new offerings from Syfe and they totally deserve an expanded discussion in my future articles.

Syfe Pricing & Fees

Syfe pricing is clear and transparent: the more you invest, the more affordable it gets. These fees are deducted monthly from a small cash component set aside by Syfe when you deposit your funds.

|

Pricing Tier |

Blue |

Black |

Gold |

Private Wealth |

|

Min. investment sum |

< SGD 20,000 |

SGD 20,000 |

SGD 100,000 |

SGD 500,000 |

|

Management fee per year |

0.65% |

0.5% |

0.4% |

0.35% |

Some other perks include:

- No additional charges are needed to open a new portfolio.

- No charges on deposits and withdrawals.

- Dividends are automatically re-invested.

Aside from Syfe management fee, there are 4 other fees that you should be aware of. These fees are not charged by Syfe, but by 3rd parties (it’s the same for all other robo-advisors too):

- ETF management fee by ETF providers (0.15 – 0.24%/year)

- Currency conversion fees

- US SEC charges during sell transactions

- SGX clearing & trading access fees for REIT+ portfolios

3 things I like about Syfe

#1 Diverse selection of portfolios

One thing that’s truly unique to Syfe is you are almost certain to find something that suits your investing needs:

- For beginners, or investors that would like to have a hands-off approach to investing, Syfe’s Core portfolios are a great start.

- For investors looking to invest for passive income, Syfe REIT+ and Global Income thematic portfolios are perfect.

- For investors with higher risk preferences, Syfe Core Equity100 and thematic portfolios can be a good choice.

- If you are looking to have some or complete customization, you’ll like Syfe Select’s Theme and Custom portfolios.

Of all the robo-advisors that I’ve used and reviewed, Syfe is no doubt at the forefront when it comes to offerings and customizability.

p

#2 Flexible & Low Barrier of Entry

With Syfe:

- There is no restriction on the minimum investment amount. This means Syfe is especially beginner-friendly to investors with small capital.

- Syfe is also extremely flexible. There is no lockup on your investments and you are free to deposit & withdraw at any time.

- Furthermore, there is no limit on how many Syfe portfolios that you can open.

This gives great flexibility for users to invest or save for different financial goals using multiple portfolios on Syfe.

As an example, you may want to invest in a travel fund and also a car fund, but you do not want to mix these funds up. With Syfe, you can create multiple portfolios to differentiate the funds from each other.

p

#3 Affordable fees

Investing via Syfe is affordable. The management fees charged by Syfe is much lower relative to conventional unit trusts.

3 things I wish Syfe could improve on:

As much as I like Syfe, it is not perfect. There are things that I hope they can improve on when it comes to convenience for Malaysian users.

#1 Malaysians can only open an account with a valid passport

Since Syfe is a Singaporean-based company, Malaysian users will have to use a valid passport to open an account (or Employment Pass (EP)/S Pass/Work Pass if you work in Singapore).

There is no option to open an account via a Malaysian IC (I hope they allow this in the future).

p

#2 It’s expensive to fund Syfe with a local bank account (Use Wise/CIMB SG instead)

Funding Syfe account via local banks’ Foreign Telegraphic Transfer (FTT) can be expensive.

A typical FTT will incur FTT fees (~RM10), FX exchange rate (MYR to SGD), and intermediary banking fees (~SGD30-50), which is SUPER expensive and inefficient.

Nevertheless, I have come out with a guide on how you can fund your Syfe account via Wise, or a Singapore bank account, where you can skip the expensive intermediary banking fees.

READ: Detailed guide on how to fund your Syfe account via Wise or a Singapore bank account.

p

#3 It’s expensive to withdraw from Syfe directly to a local bank account

Likewise, withdrawing from Syfe directly to a local bank account is also expensive. FX exchange rate (SGD to MYR) and Telegraphic Transfer fees will be charged (SGD35 Cable fees + 0.125% commission), which is not a good deal by any means.

In addition, while it is possible to fund your Syfe account with Wise, it is not possible to withdraw funds from Syfe to Wise.

The only free alternative here is to execute withdrawal to a Singapore bank account, and if required, initiate a transfer back to your Malaysia bank account.

READ: How to withdraw your funds from Syfe to a Singapore bank account

READ: Detailed guide on how to open a CIMB SG bank account online

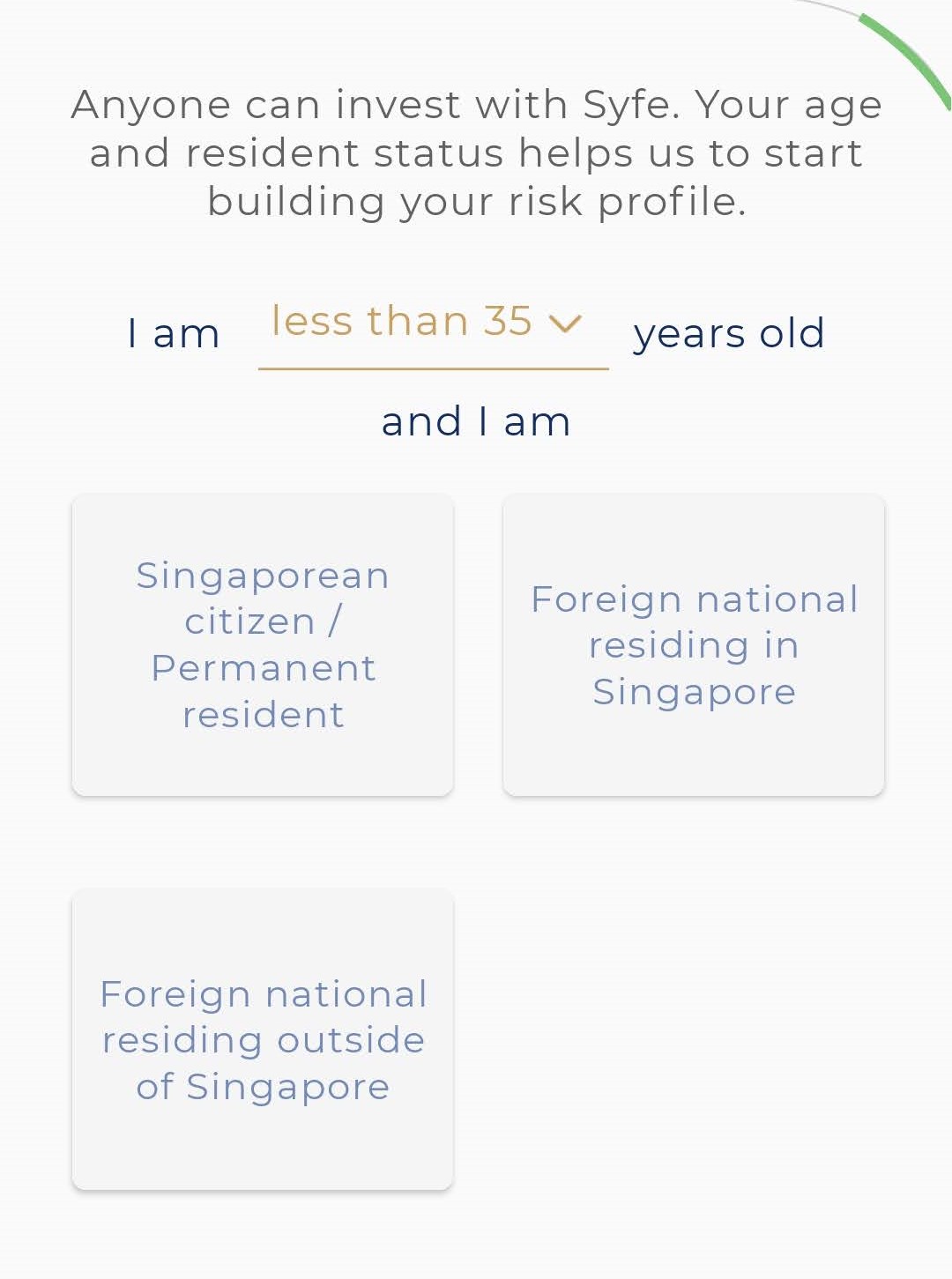

How to open a Syfe account in under 5 mins

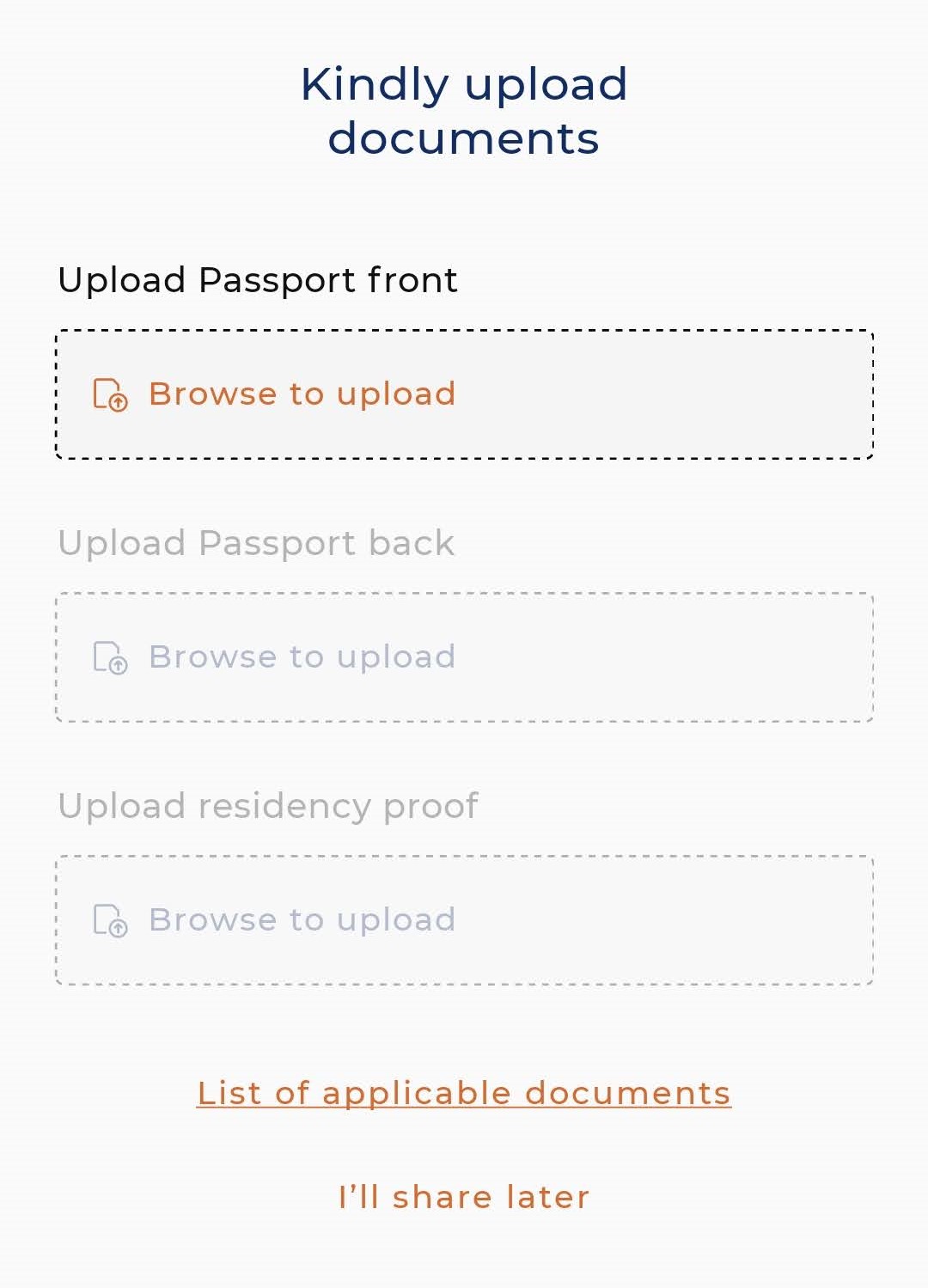

Opening a Syfe account is simple and straightforward. To start, prepare the documents below to make the account opening experience smoother:

- For Malaysians, you’ll need a picture (front & back) of your passport (must be a valid passport)

- Utility bill (eg. Phone bill/water or electricity bill) as proof of residency.

- Tax Identification Number (TIN) (if you don’t have one you can justify why – more on this in Step 7).

Step 1: Install the Syfe app

Click HERE to install the Syfe app. Once you are done, open the Syfe app and you’ll be prompted to open an account.

Step 2: Start by selecting a portfolio of your choice.

Don’t worry if you haven’t made up your mind as you can still change the portfolio after that.

Step 3: You’ll be asked for your personal info (eg. Age) and investment preferences (investment goal).

Step 4: You’ll be shown the details of your chosen portfolio.

Again, don’t worry as you can always set up a new portfolio after opening your account.

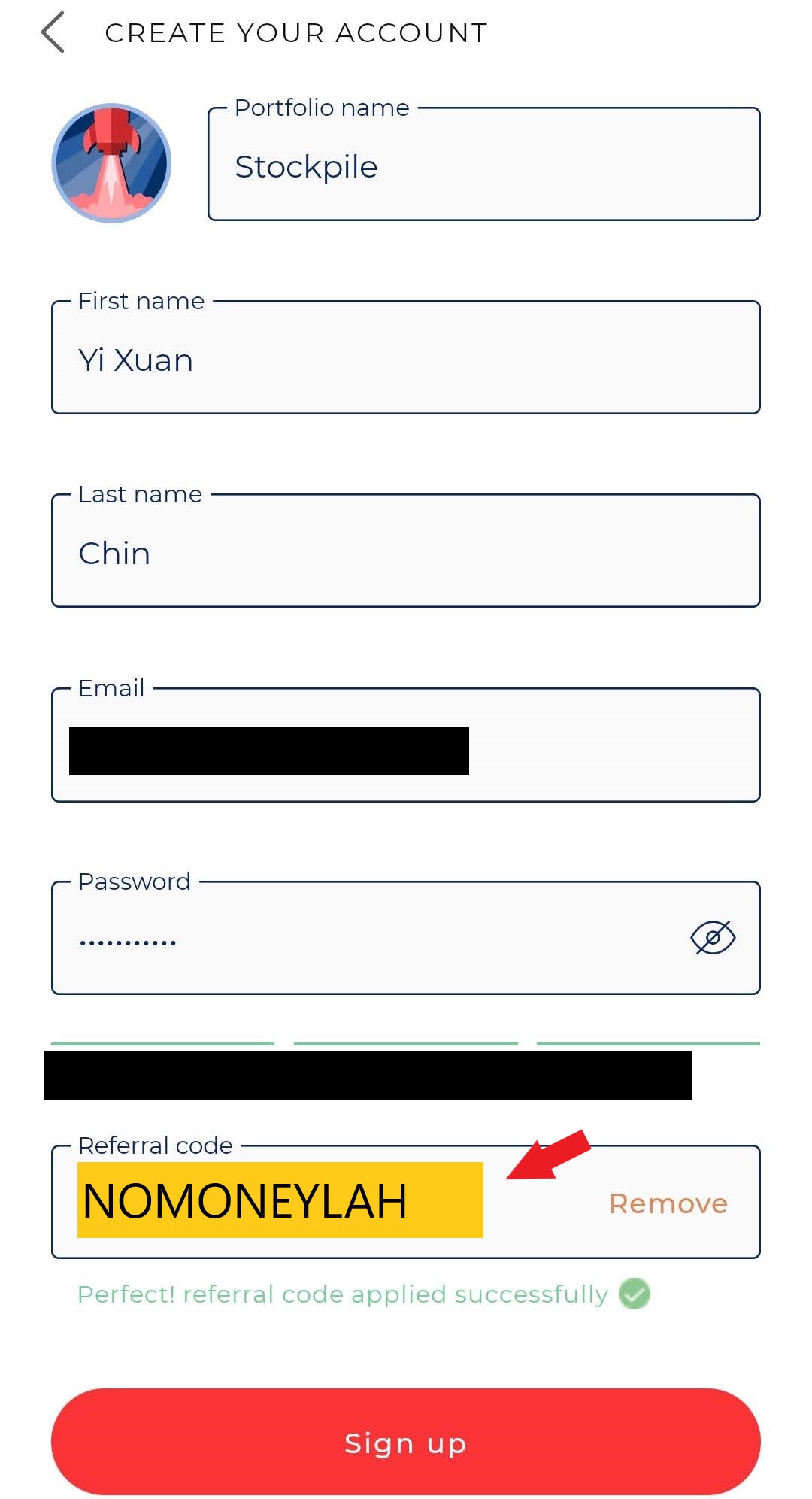

Step 5: Create an account and click ‘Sign Up’

p.s. Use my exclusive promo code ‘NOMONEYLAH‘ and enjoy 100% off your management fees for the first 6 months!

Step 6: Key in your personal details (name, address, employment status, income details)

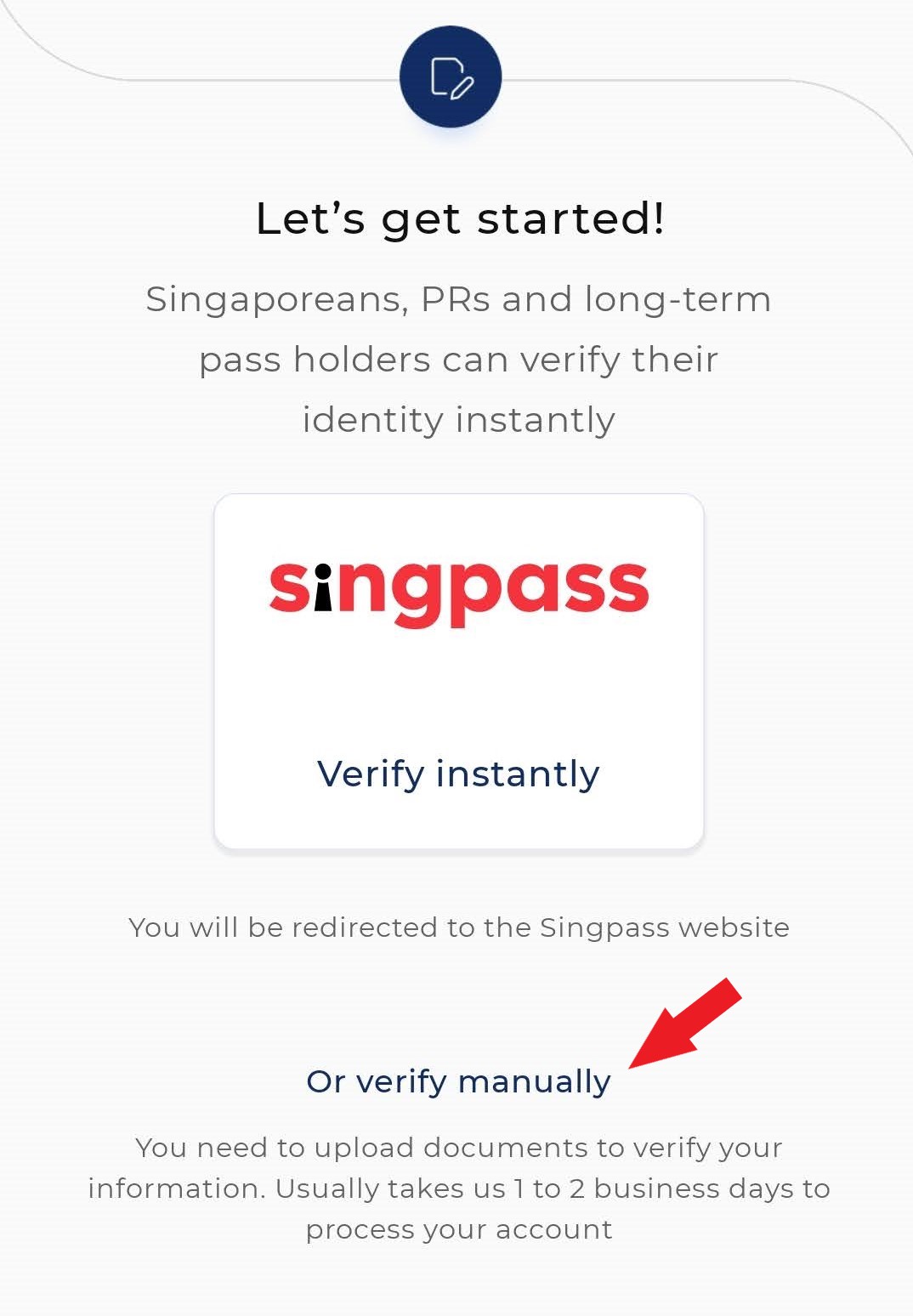

Step 7: Upload documents & provide your Tax Identification Number (TIN)

Don’t worry if you do not have a TIN number. Let’s say you are a student, just justify that you are still a student and you are not required to have a TIN number.

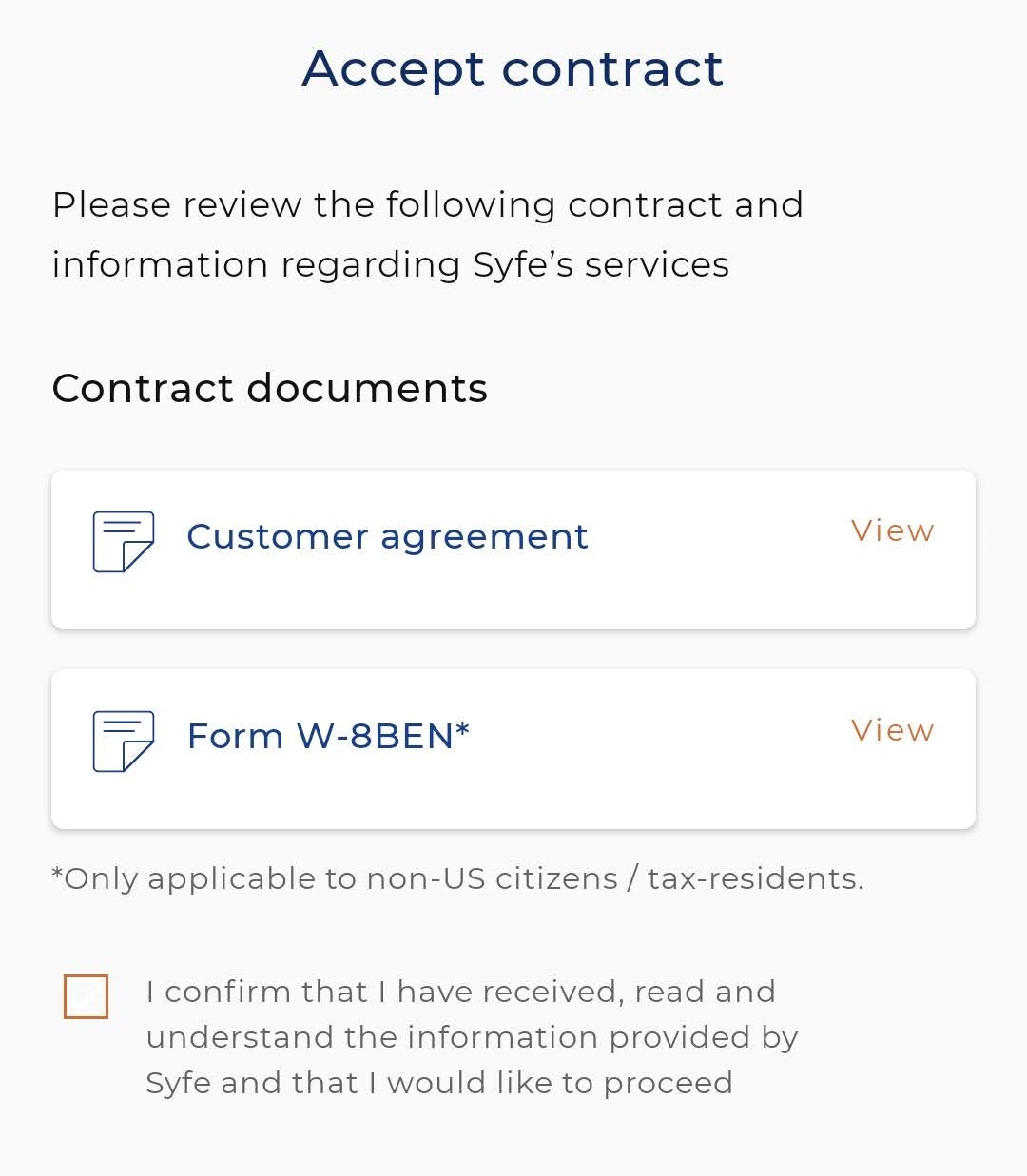

Step 8: Sign Customer agreement and W-8BEN* form

*W-8Ben form: Filling in the W-8 Form is a requirement by the US Inland Revenue Service for account holders to declare that the beneficiary owner of the amount received from US sources is not of US origin. For clients who want to trade the U.S. markets, they will need to complete this form.

And that’s it! You have opened your Syfe account. In the next section, I’ll share a step-by-step guide on how to fund your Syfe portfolio.

How to Fund & Withdraw Funds from Syfe

Funding and withdrawing from your Syfe account can be done either via your local bank account (not recommended), Wise (funding only), or a Singapore bank account.

Check out my step-by-step guide on how to fund your Syfe account, and how to withdraw funds from Syfe.

Exclusive Syfe Promo Code – NOMONEYLAH

No Money Lah is now working with Syfe to bring the best deal for No Money Lah’s readers.

If you are keen to give Syfe a try, consider using my promo code ‘NOMONEYLAH’ to open a new account. Doing so, you’ll receive 100% off your management fees for up to 6 months!

[Disclaimer: If you use my promo code ‘NOMONEYLAH’, and make an initial deposit of SGD1,000 (or more) to your selected Syfe portfolio (Core/REIT+/Select/Cash+), No Money Lah will receive a small referral. This will help sustain the blog to keep producing quality content like this.

Of course, this is optional and you are free to use the promo code and deposit any amount you prefer.]

No Money Lah’s Verdict

So, what do you think? Are you impressed by the offerings from Syfe?

I sure do! As someone that has tried different robo-advisors in the past, Syfe is certainly the most complete robo-advisor when it comes to offerings and customizability.

Regardless of your investment needs & preferences, I am almost certain that you’ll find a portfolio that suits your need via Syfe. Personally, I am starting to invest a consistent amount into my Syfe portfolios (Core Growth and Core Equity100) monthly – so I will certainly follow up with any new updates moving forward!

If you don’t mind the slight hiccup with the funding and withdrawal process, I am sure you will find Syfe extremely flexible and reliable.

Disclaimers:

Past return is not indicative of future performance. Materials are not and should not be construed as financial advice nor an offer to sell or the solicitation of an offer to purchase or subscribe for any products or services. All forms of investment carry risks and you should independently assess whether the products and services are suitable for you based on your specific financial situation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

This post may contain affiliate links that afford No Money Lah a small amount of referral (and help support the blog) should you sign up through my referral link.

Related Posts

February 21, 2023

Syfe: Deposit & Withdrawal via CIMB SG or Wise

September 27, 2021

StashAway Malaysia Review: A Solid Robo-Advisor that You Can Depend On

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi Yi Xuan, thank you for the informative article! One question about the CIMB SG account, if we use this account to fund Syfe from MYR to SGD, does it mean it is a currency conversion fee of 0%?

Hi Ivan!

Welcome and glad that you like the article!

If you fund your Syfe account with CIMB SG, it’d be in SGD so there’ll be no currency conversion involved. The only time when currency conversion takes place is when you fund your Syfe acc with Wise, or when you fund your CIMB SG account in SGD.

Hope this is clear, anything feel free to let me know!

Regards,

Yi Xuan