Last Updated on January 12, 2024 by Chin Yi Xuan

The best Malaysia-regulated broker to buy US stocks just got better!

Rakuten Trade has just launched its new USD trading feature recently. This is fantastic news as Rakuten Trade users now have the choice to hold USD in their account.

Simply put, Rakuten Trade users now have the option to invest in US stocks using USD or MYR.

In this post, let’s explore the features of Rakuten Trade’s new USD trading. Also, check out the end of this post for a special account-opening & trading promo!

Related Posts:

Table of Contents

3 Feature highlights of Rakuten Trade’s USD & MYR Trading:

#1 The choice to buy and sell US stocks & ETFs in USD or MYR

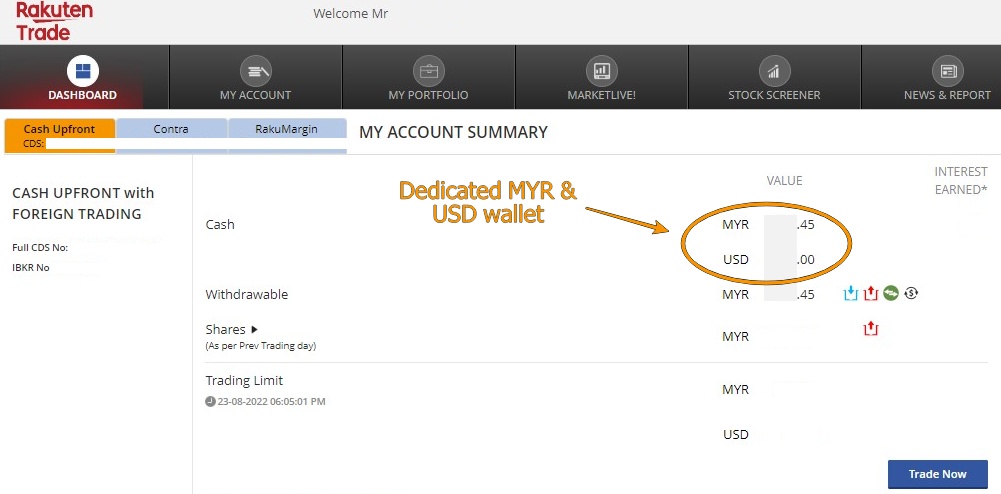

As a Rakuten Trade user, now you have a dedicated USD wallet to store USD within your account.

This enables the flexibility to use either USD or MYR to buy US stocks and ETFs. Furthermore, users also have the choice to receive USD or MYR when selling their US stocks.

#2 Live conversion + tight MYR-USD currency conversion spread

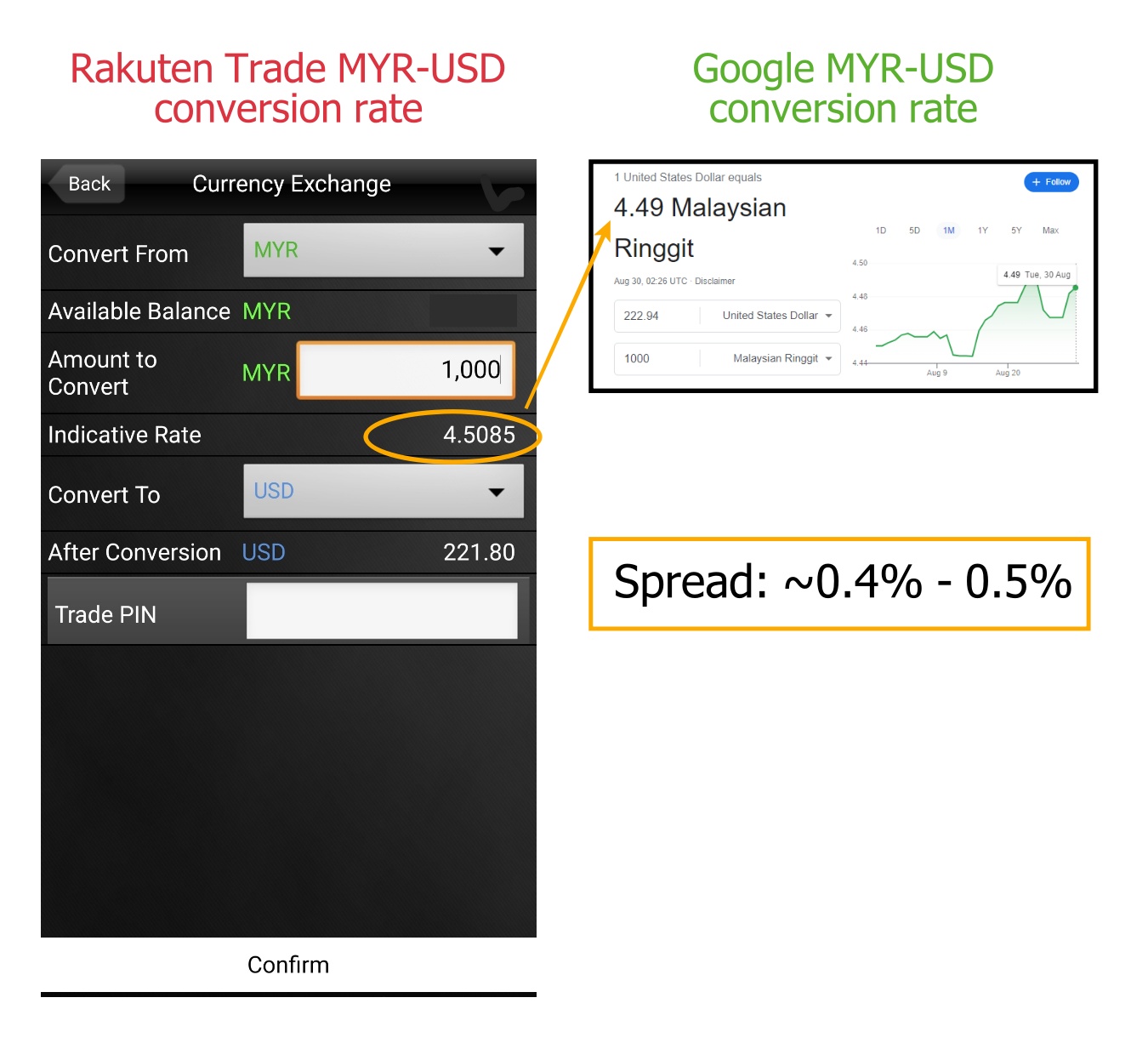

Rakuten Trade offers a relatively tight MYR-USD spread for users to easily convert between both currencies within the platform.

Furthermore, the conversion process happens real-time, enabling users to convert MYR to USD (and vice versa) with the latest rate and trade right away.

Lastly, unlike certain brokers, there are no extra fees involved in currency conversion (aside from the spread) so there are no worries about hidden fees.

#3 Receive dividends in USD instead of MYR

Prior to the release of the USD trading feature, Rakuten Trade users who invest in US stocks will receive dividends in MYR.

This is not ideal for investors looking to reinvest their dividends because they’ll have to reconvert the MYR back to USD in order to do so.

Now, we will receive dividends directly in USD. This makes dividend reinvesting much more convenient.

USD vs MYR Trading: Rakuten Trade US Stocks Brokerage fees comparison

Below is Rakuten Trade’s brokerage fee structure for MYR trading and USD trading in the US stock market.

- MYR Trading

| Trading Value | MYR Trading |

| Below RM699.99 | 1% of Trading Value (min. RM1) |

| Between RM700 – 9999.99 | RM9 |

| Between RM10,000 – 99,999.99 | 0.1% of Trading Value |

| Equal of above RM100k | RM100 |

- USD Trading

| USD Trading |

| 0.1% of Trading Value, or a min. of USD1.88 – USD25 |

When to use USD, when to use MYR to trade US stocks?

In the section below, we will compare and explore when is best for you to use MYR or USD to trade US stocks on Rakuten Trade.

Firstly, let’s take a look at several common trading amounts and the respective brokerage fee in MYR and USD:

| Trading Value | MYR Trading Brokerage Fee | USD Trading Brokerage Fee |

| RM500 (~USD113) | RM5 | USD1.88 |

| RM2,000 (~USD448) | RM9 | USD1.88 |

| RM5,000 (~USD1,118) | RM9 | USD1.88 |

| RM10,000 (~USD2,236) | RM10 | USD2.24 |

| RM50,000 (~USD11,176) | RM50 | USD11.18 |

| RM100,000 (~USD22,352) | RM100 | USD22.35 |

When to use MYR to trade US stocks:

- Use MYR when your trading value is below RM700 as the brokerage fee is cheaper (1% of trading value or min. of RM1 vs USD1.88).

- Keep your capital in MYR if you think MYR is going to strengthen against USD, and you want to get the most out of your conversion.

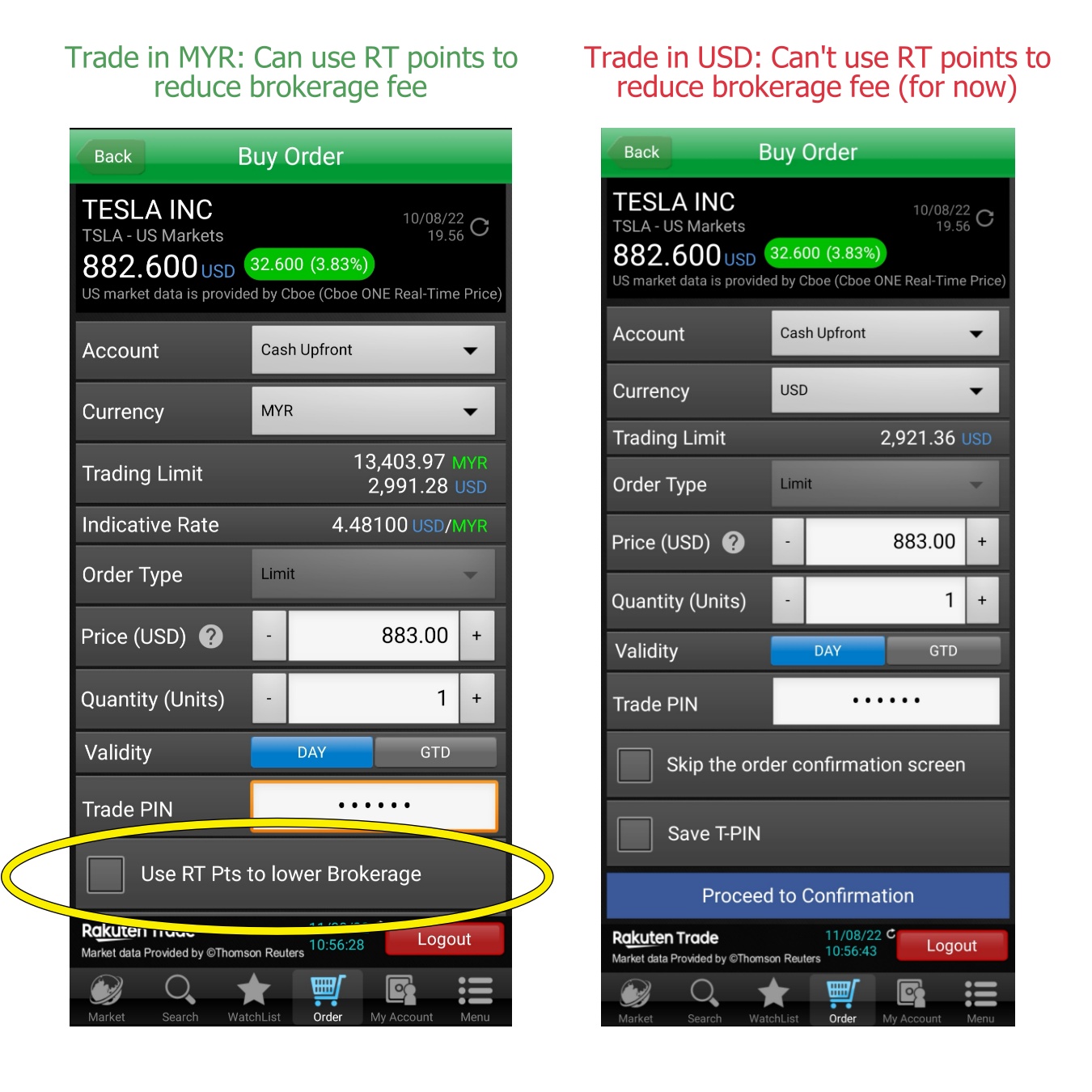

- Consider using MYR to buy/sell if you want to offset your brokerage fee using RT points (as of now, it is not possible to use RT points to offset brokerage fee while using USD to trade).

When to use USD to trade US stocks:

- Consider using USD when your trading value is over RM700.

- Convert your capital to USD if you think MYR is going to weaken further against USD, and you want to lock in the current conversion rate.

- Consider using USD if you make a lot of short to medium-term trades, so you do not have to go through currency conversion (from MYR to USD) everytime you make a trade. This reduces your exposure to the fluctuation in currency exchange.

How to convert your MYR to USD (or vice versa)

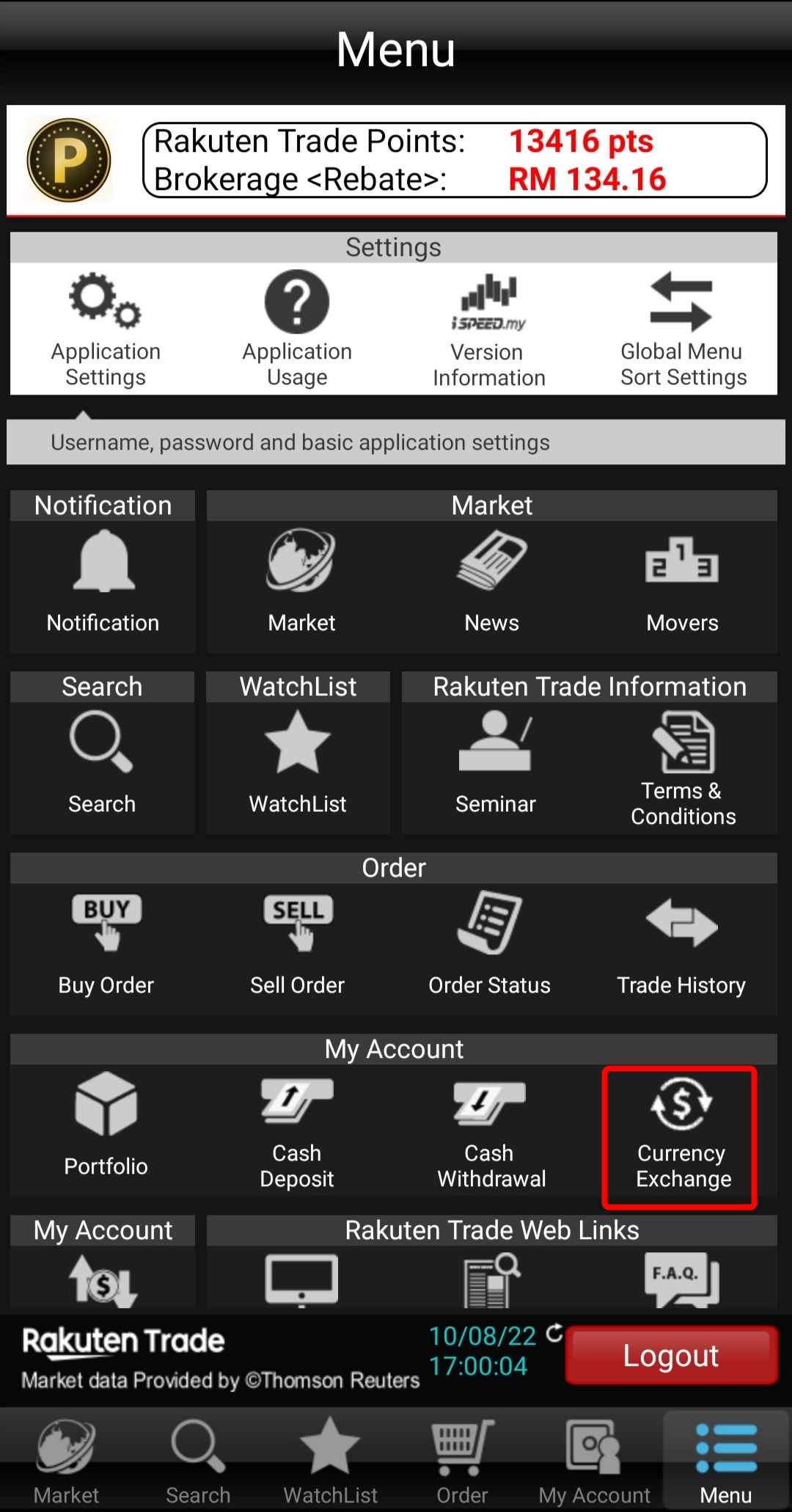

Step 1: There are 2 ways to convert your currency within Rakuten Trade’s iSpeed app, namely:

- Under Rakuten Trade’s iSpeed app, go to Menu > Select ‘Currency Exchange’, OR

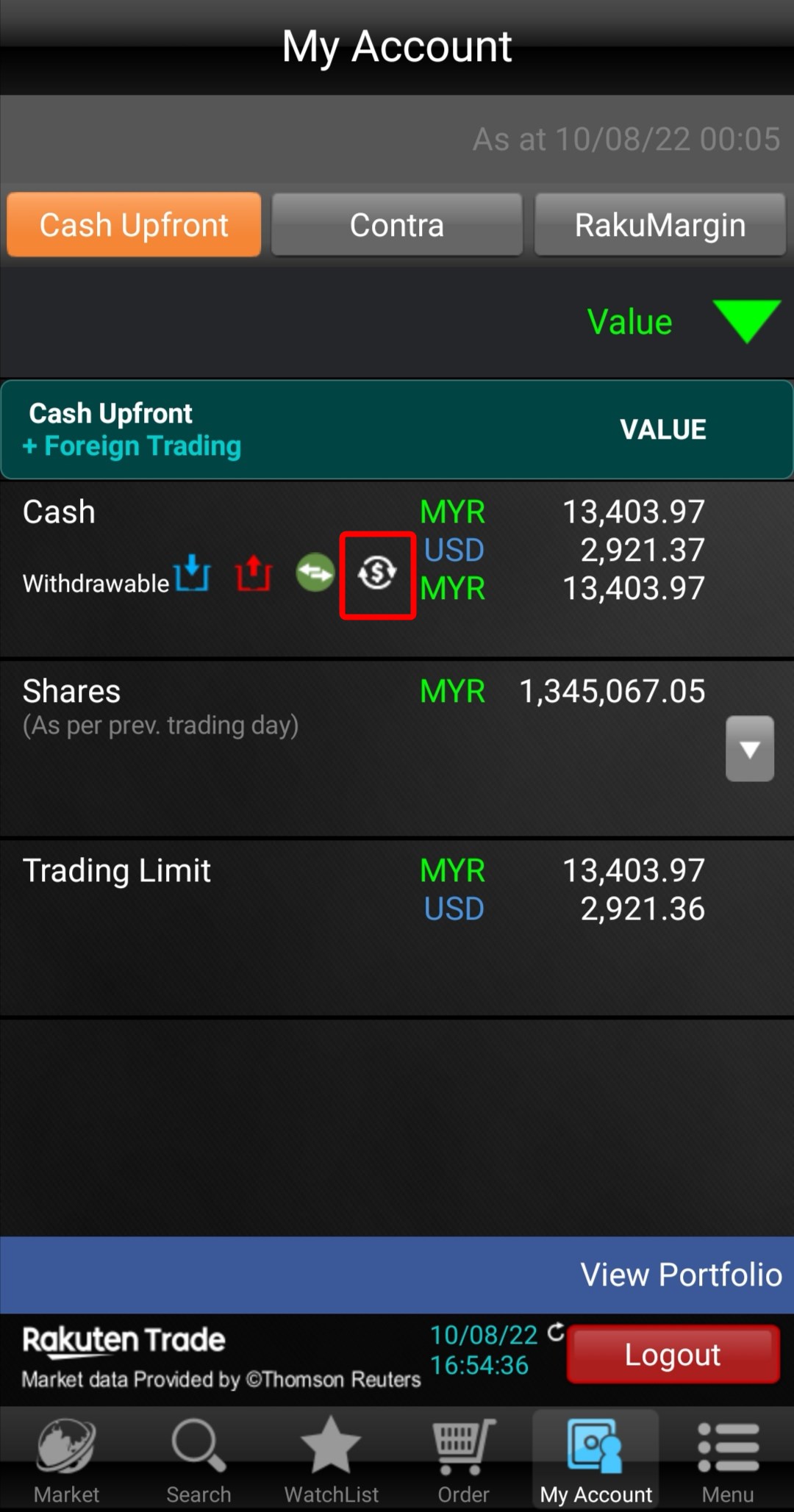

- Under ‘My Account’ Select the Currency Exchange icon ($).

Step 2:

- Under ‘Convert From’, select MYR.

- Decide the conversion amount

- Under ‘Convert To’, select USD

- Enter your trading pin and click ‘Confirm’

How to buy US stocks via USD

Step 1: Search for the stock that you want to invest in, and click ‘Buy’

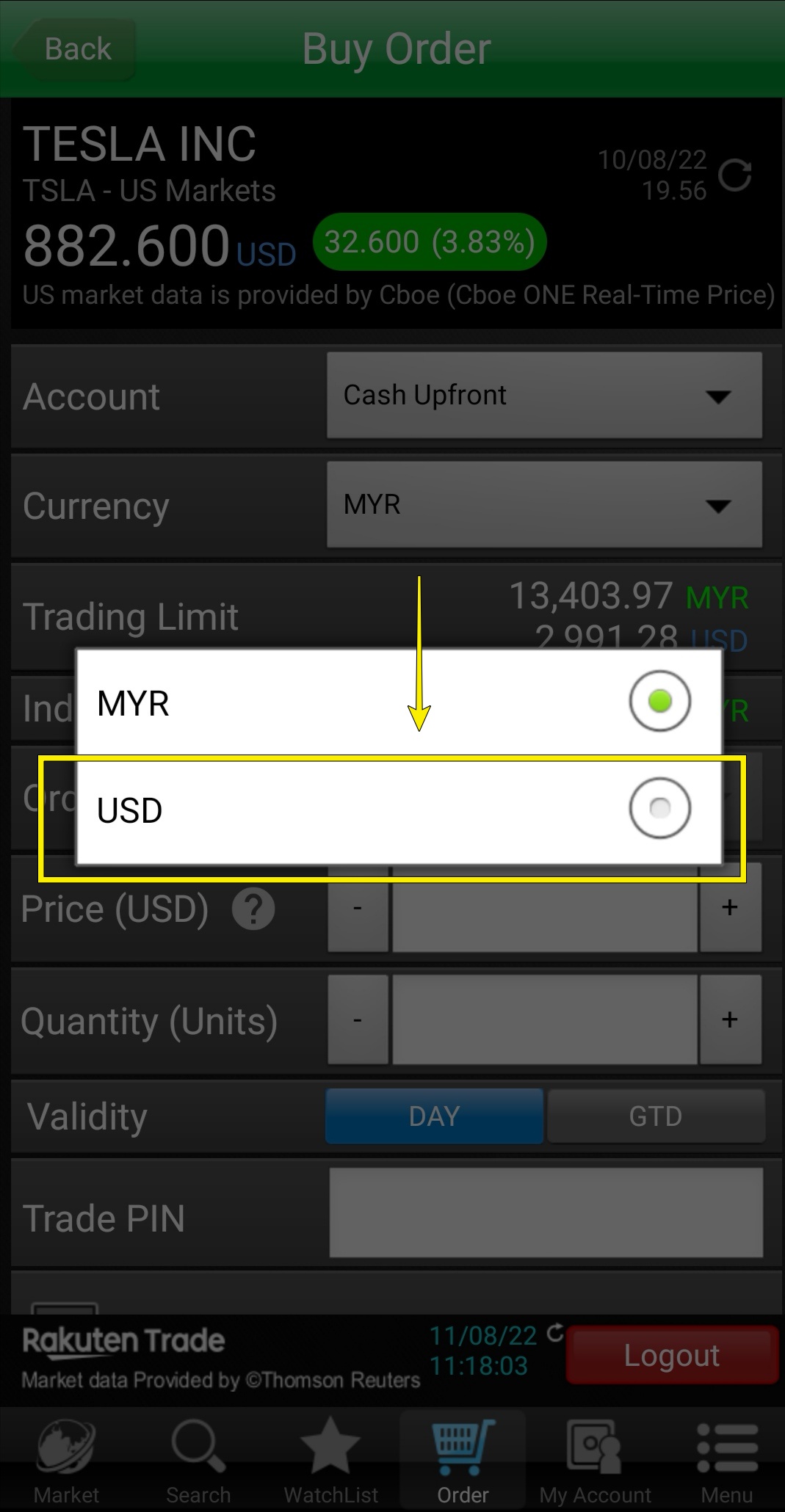

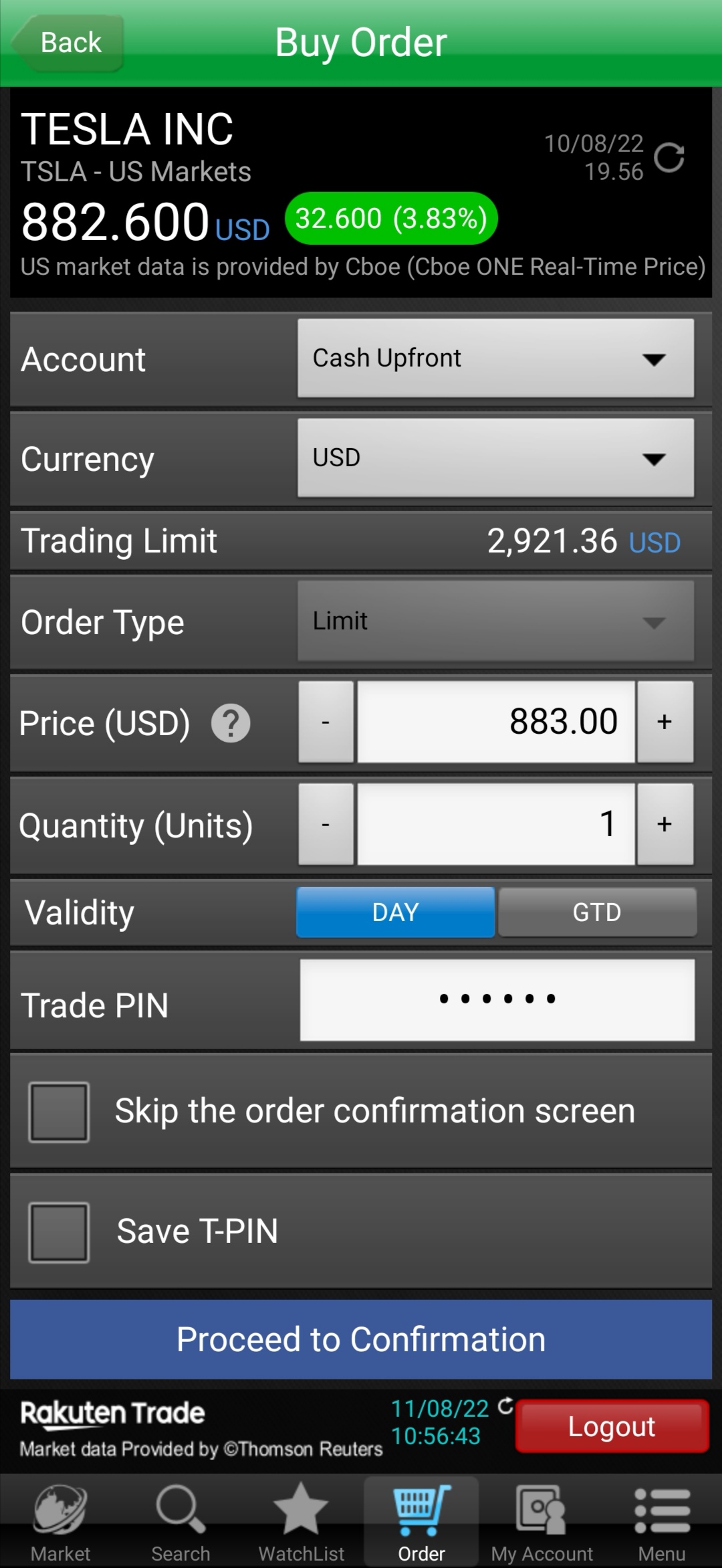

Step 2: Under ‘Currency’, select ‘USD’. You’ll be shown your trading limit – make sure you have enough to execute your buy order!

Step 3: Decide the price of your limit order and quantity of shares to buy, key in your trading pin, and click ‘Proceed to Confirmation’ to confirm your buy order.

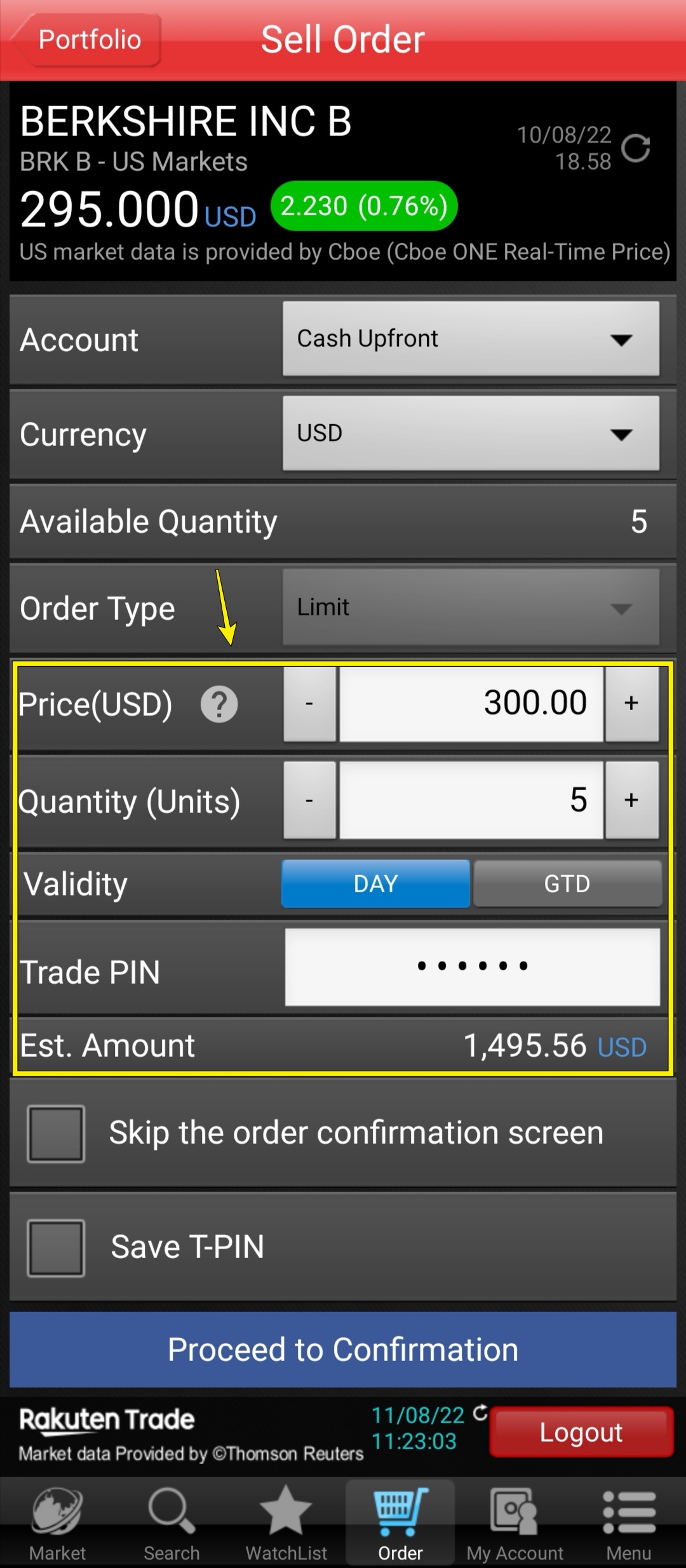

How to sell US stocks in USD

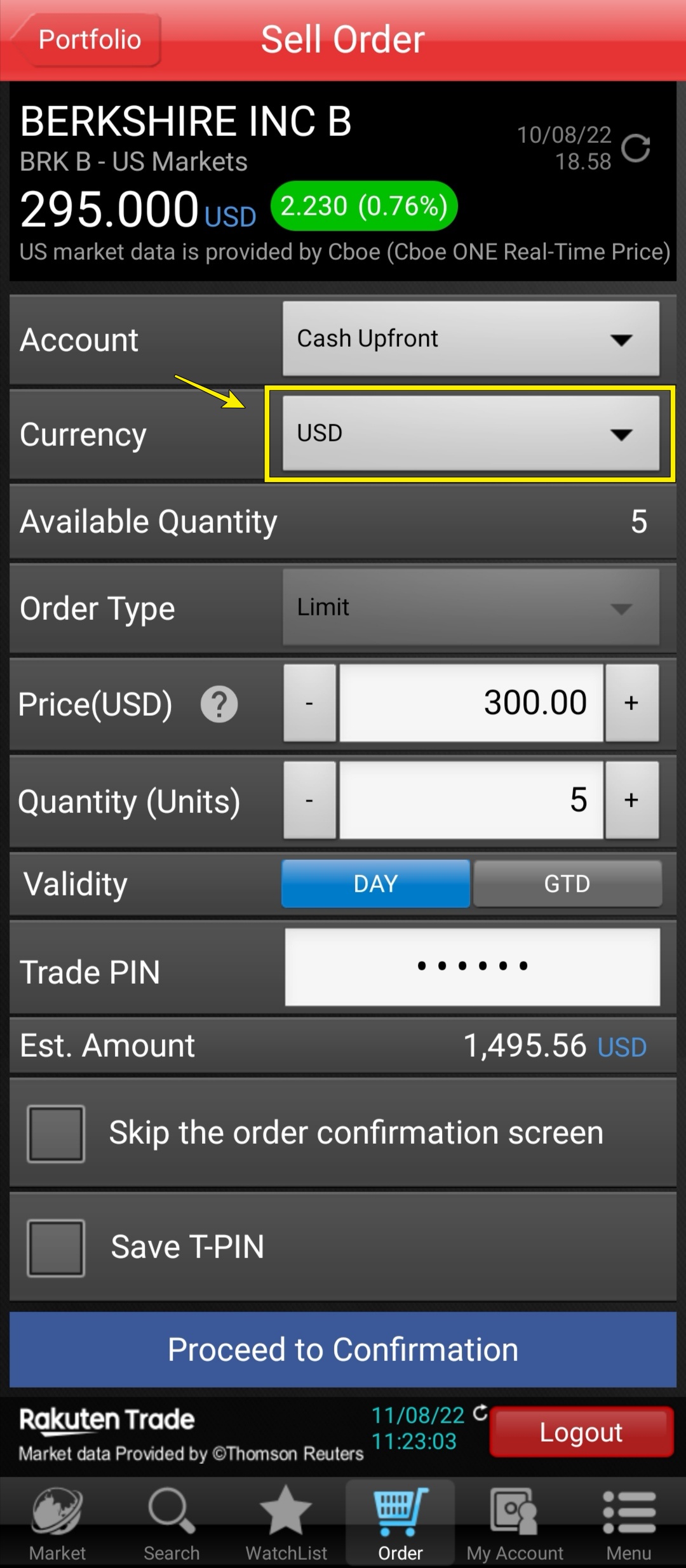

Step 1: Select a currency that you wish to receive upon selling your stocks (MYR/USD):

- MYR: Your holdings will be converted to MYR after being sold.

- USD: Your holdings will remain in USD after being sold.

Step 2: Decide the price of your limit order and the quantity of shares to sell. The ‘Est. Amount’ section displays how much you can expect to receive after you sell your holdings.

Step 3: Key in your trading pin and click ‘Proceed to Confirmation’ to confirm your sell order.

Rakuten Trade USD trading: What I wish could be better

Rakuten Trade’s move to introduce USD trading is a welcomed move as it allows greater flexibility and choice for users while investing in the US stock market.

That said, one aspect that I think Rakuten Trade could improve on is the streamlined implementation of its reward system – ie. Using RT points to offset brokerage fee.

As of now, we are not able to use RT points to offset brokerage fee if we were to trade using USD. However, it is possible to do so if we were to trade using MYR.

As a user, I’d like to see Rakuten Trade streamlining this reward system, as it would make the trading experience more complete for us as a user.

No Money Lah Verdict

So there you have it – a walkthrough of Rakuten Trade’s latest USD trading feature!

I hope this guide has been useful, and if you are looking for a Malaysia-regulated broker to trade US stocks, Rakuten Trade is certainly the way to go!

Open a Rakuten Trade Account Today!

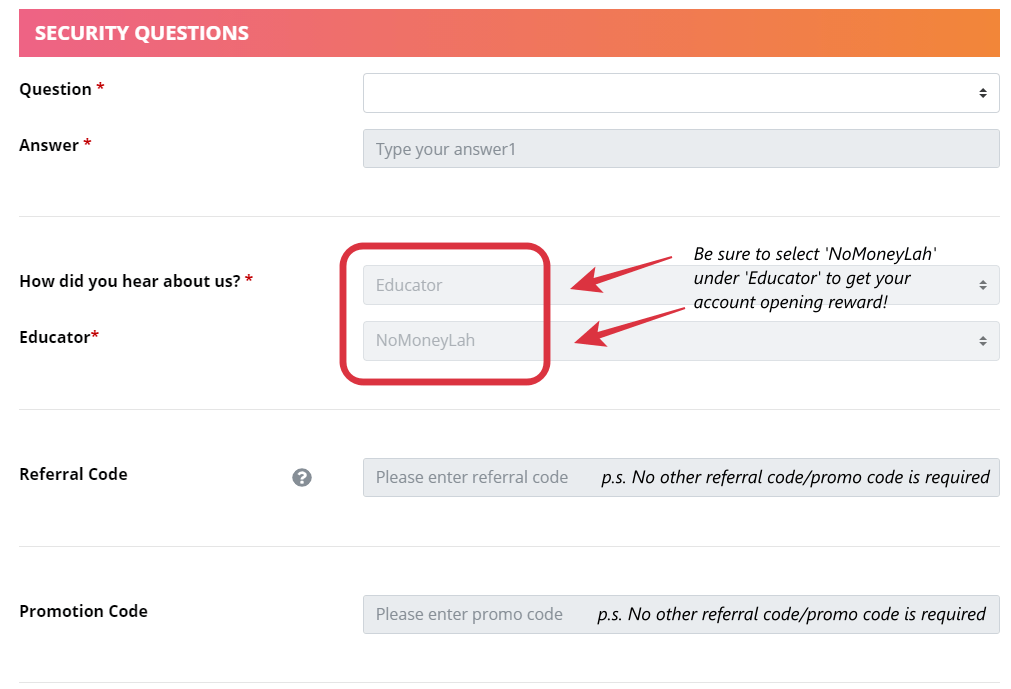

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you’ll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 1000 RT points when you deposit an initial deposit of RM500 or more.

- + 1 RT point for each RM10 share value when you transfer your shares from other brokers to Rakuten Trade.

- + 2800 RT points worth RM28 when you activate foreign share trading (US & HK market) feature (p.s. Promo ending 30/6/2024, and will revert to 1288 RT points thereafter).

- Free 0.01 unit of Nvidia share (NASDAQ: NVDA) when you activate foreign share trading (US & HK market) feature and make your first buy trade on the US market during the campaign period (Campaign Period: 1/4 – 20/4/2024, T&C applies)

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open A Rakuten Trade Account Today!

Related Post: Guide – How to activate US stock trading on Rakuten Trade

How can you use these RT points?

These RT points are amazing, as they can be converted into brokerage rebates, Air Asia rewards, Boost stars, and Bonuslink points which are redeemable for rewards.

p.s. Click HERE for the full T&C of your account opening reward.

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.