How I 5x My Investing/Trading Experience with Every Trade I Take

Huge Warning: If you are here thinking of looking for a shortcut to milk money out of the market, this article is NOT for you.

However, if you are looking for mini-routine hacks to help deepen and internalize your learning, I think you will find this post surprisingly helpful.

Regardless if you want to improve as a long-term investor or a short-term trader, it will require skill development. Skill development though, demand for our time and experience.

For most investors and traders, one trade* typically transpires into a single moment of experience.

What if there is a way for you to turn a single trade into 5 times worth the experience. Interested?

*The verb ‘trade’ is used in this article to reflect a position that you take in the market, regardless if you are investing for the long-term, or trading for the short-term.

You will be surprised that there is no secret recipe here.

The key to amplifying your experience from every single trade you take is through a systematic post-trade learning routine, all of which I will share with you below:

You did your pre-trade preparation and took a trade – that was 1x experience.

As a long-term investor, you placed a trade after doing your overall research on the fundamentals of a company.

As a short-term trade, you spotted this breakout pattern and placed the trade.

Either way, these transpired into ONE experience.

For most people, their journey ended right there – time to go and enjoy a good movie time, right?

What else is there for you to do?

Make detailed notes in your journal – that’s 2x experience

For me, I will write down WHY I took a particular trade.

As an investor, what are the characteristics and risks involved in the company that I’ve just invested in?

As a trader, what is the if-then context and price action setup that made me took that trade?

Putting my trades down into a journal makes doubled my experience with that particular trade.

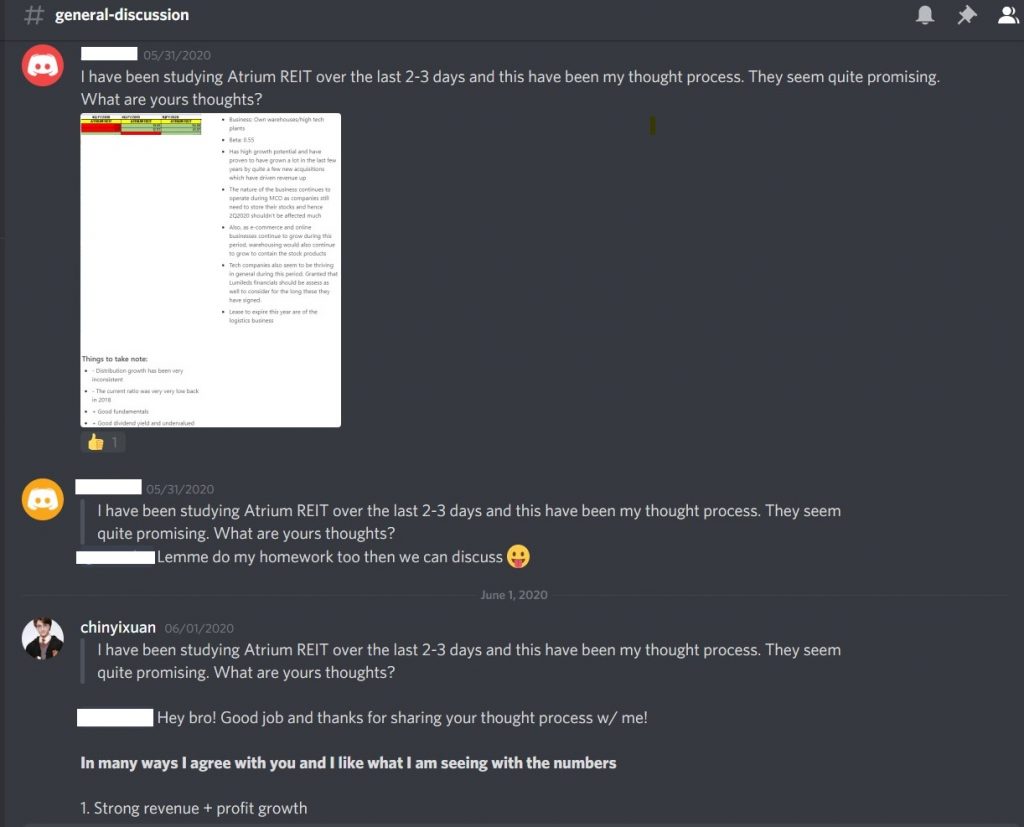

Discuss trades with like-minded people/community – that’s 3x experience

One thing that I like doing is to discuss the trades that I took with like-minded traders and investors.

These are the people and communities that, to a certain extent, understand how I make trading/investing decisions.

As an example, they might notice a certain part of the company’s fundamentals that I’ve missed out on in a financial report.

As a result, I can receive feedback on what I’ve missed or maybe a certain perspective that I’ve not considered in that trade – which is extremely helpful.

Visualize your trades – that’s 4x

I can’t emphasize how powerful this routine is to your experience accumulation.

Replaying a particular trade in my mind – what happened, what went right and what could’ve been done better, contributed to my growth tremendously.

Visualization helps in reinforcing the right habit & execution in my subconscious.

In return, this will make my execution better if there are any similar opportunities in the future.

End-Of-Month Review – that’s 5x

Many investors and traders have the impression that once a trade is taken then there’s nothing left to learn for the trade.

However, that’s clearly not the case.

For me, reviewing my past trades every end of the month/quarter has been extremely beneficial.

Reason being, it helped me to again reinforce the good trades that I’ve executed and how I can do better moving forward.

Now, I know what I can do better with my breakout trades.

No Money Lah’s Verdict – Multiply Your Growth with Systematic & Mindful Learning Routine

Now, I want to end this conversation by pointing out the obvious:

Investing and trading are not easy to master. More often than not, it involves a deep learning curve that’ll take time to develop.

Hence, you will need all the feedback from the market to help you deepen your learning experience.

Good or bad, winning or losing, every trade is a learning opportunity.

In fact, every trade can be more than ONE learning opportunity. Using the methods above, and you can 5x your experience for every trade you take.

All you need to do is to just tweak your routine a little. For a 5x growth of experience per trade, I’d say the effort is pretty worth it.

Part of this article is inspired by the book One Good Trade by Mike Bellafiore. Bella is the founder of SMB Capital, a proprietary trading firm in New York.

He is one of my favorite trading coaches that I follow online which has been giving back tremendous value to the online trading community.

I found that some of his approaches to trading improvement, which has inspired me to implement and write this article, are equally useful in one’s investing journey as well.

"Do You Have a Plan B?"

“Do you have a Plan B if you fail in what you are doing right now?”

I often get asked this question by well-meaning friends, seniors, and relatives when I left my first full-time job to do what I am doing right now.

To be honest, I suck when it comes to forming any ‘Plan B (or C or D)’ for the important things and goals in my life.

In fact, I’d still tell you that I do not have any Plan B if you were to ask me today.

My goal is to become a successful trader (I am not one, YET).

Whenever I hit a certain plateau in this business, I will tweak my approach, my mindset, my routine, and seek mentorship.

My passion is in sharing and words.

Whenever I feel stuck in my journey, I will adjust my perspective, ask better questions, and seek clarity.

I believe the mini little progress that I’ve been able to make today is not because I am anything better than anyone else.

It’s because I simply do not have any great ‘Plan B’ or ‘backup plan’ to fall back on if I fail.

If you put that chocolate bar in the fridge 'just in case' you get hungry at night during your diet, chances are the chocolate bar will not stay there for long.

If you pursue a goal with a well-defined backup plan in mind, you’ll almost always settle for the backup when shit happens.

In contrast, when there is nothing else to fall back on, the only way is to charge forward and make things happen.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

Your (Boring) Journey to Mastery

If there is a sport that China held clear superiority over every other country in this world, it’s table tennis.

By winning 28 out of all 32 available gold medals in the history of the Olympics, one can only assume that there must be a secret recipe with the training & drills that China athletes undergo in their daily routine.

Last year, I traveled to train with fellow athletes at the China Table Tennis College (CTTC) in Shanghai.

To my surprise, there’s no secret recipe at all in their training.

What they did with their drills, to a big extent, are exactly the same as the ones that I see being done in the local clubs in Malaysia.

The fundamental skills like serving, looping, and footwork are still being practiced every session.

If there’s no difference in the drills, what make China’s athletes different and so exceptional?

The answer lies in the consistency and intensity of their training.

In China, athletes are required to train repetitively for 2 – 3 sessions every day. Along with the guidance from the coaches, drills are done with great attention to detail and intensity.

My journey in China has reinforced my view of mastery.

The journey to mastery is boring.

It is the work that we do consistently behind the scene when no one is watching.

It is the repetitive routine that we still try to refine every day even if we have done it 100 thousand times.

It is the fundamentals that everyone thinks is monotonous, yet we still work on intensively every single day.

The journey to mastery is boring.

That’s what makes ‘exceptional’ extremely valuable and rare in this world.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

This is What I’d Do if I Had to Start My Investing Journey All Over Again

I started to expose myself to the world of investing as a university student 5 to 6 years ago.

Well, my ultimate masterplan back then was to crush the market like peanuts and make hell lot of money with it.

(p.s. Obviously, that intention did not end up well for me.)

It took me a long, long time before I eventually discover my sweet spot and investing style (more on this in future articles).

Looking back, I always wonder if I could have been much better with investing (and with money) if I were to put every piece of the puzzle in the right place – one by one, step by step.

Depending on how you look at it, this article can be more like hindsight, or more of a reflection.

But my goal for this article is simple:

If you are totally new and are thinking about getting started, I hope this post will be of great guidance & insight for you.

With that, this is what I would do if I were to start over my investing journey from zero:

Step 1: First, I'd learn about personal finance & build a strong habit around money

New investors be like:

Harr… but I just want to find the best stocks to buy wor…

Yes, boring, I know.

But this is exactly what I would do FIRST if I were to start over my journey, because honestly:

Who cares if you can spot the best stocks to invest in when you have no savings to invest?

Who cares if you have attended the best investing course when you still struggle to pay off your credit card debt every month?

Looking back, instead of splurging on food & entertainment in university, I would start tracking my finances and have a more consistent savings habit (regardless of how little it could be).

I’d also build a stronger foundation & understanding around money (ie. Financial independence, compounding effect, asset & liability) by reading more personal finance (not purely investing) related books.

With all these financial knowledge and habits in place, I am sure that I’d be in a better position to start learning how to invest at the age 21 years old.

Step 2: Instead of asking “What Stocks to Buy?”, ask “What Skills Do I Need?”

“Which company should I invest during this crisis ah?”

“Is now the right time to buy into the shares of XXX yaa?”

These are without a doubt the most asked questions by investors on investing forums, telegram chat & FB groups.

Looking back, I wasted my fair share of time indulging in discussions like these.

If I were to start again, I’d definitely spend NONE of my time consuming any content like this.

Instead, after building a sound financial habit, the next thing I’d do is to learn the skills needed for me to build a solid foundation in investing – be it from books or a mentor/coach.

Some crucial fundamental skills include, but not limited to:

- How to extract important data and information from a financial report?

- How to develop a set of investment rules on when to buy & sell?

- How to construct a decision-making framework & thought process?

- How to make independent investment decisions without succumbing to headlines and unnecessary news & content?

Can you see how these skills above, once mastered, will be able to answer your ‘What stocks to buy’ question?

Nowadays, most new investors yearn for shortcuts and/or the easy way to make money from the ‘exciting’ stock market – all without considering putting effort into building their foundational skills.

But hey, I get it. That was me once upon a time too.

Just telling you that, if you are new, you might really wanna consider building a solid foundation first before risking your hard-earned money.

The only short cut in sustainable and successful investing is effort and hardwork.

Step 3: Setting my initial vision with investing

If I were to start my journey from zero again, I’d want to spend some time constructing a vision for my investing journey: a sort of picture-like vision of the outcome of investing in my life.

This is the stage where I would learn more about different financial stages in life (eg. financial independence, abundance) and set a vision to motivate me to keep honing my skills.

Now, you may disagree with me, but I would not set a fixed goal at this stage (eg. Financial independence by 30 years old).

Reason being, as a university student, there is simply no way for me to know what kind of circumstances I would be upon graduation. Hence, any form of fixed estimation is really inaccurate at best.

That said, as a start, having a conceptual understanding of what’s possible (eg. vision towards financial independence) is important and should not be overlooked.

However, it should also be noted that our lives will change as we move on to different stages in life – hence it is essential to be flexible with the vision and ultimately discovering our goal along the way.

Step 4: Hone my skills in a simulated environment

Learning the fundamental investment skills & knowledge is a thing, but it doesn’t mean that it is the end of the journey.

In fact, it is only the beginning of the journey.

So, what I would do is I will set up a simulated investing account via platforms like Bursa Marketplace so I can test what I’ve learned in a risk-free environment.

Now, this could be a very boring stage for many. I used to do it (and gave up) too back then as there is no fun at all buying stocks in a simulated environment.

But if I were to start again, I would spend at least 6 months to a year in a simulated environment so I am sure that I can follow my entry and exit rules consistently whenever needed.

No fun, I know. But I’d cut short a lot of my learning curve if I persisted with the practice 5 years ago.

Step 5: Opening a Live Account (Finally!)

Now’s the time to finally worry about which brokerage account to open!

Or better, time to make some big money! *wink* *wink*

But is it so?

In the hindsight, what I would do as a beginner (regardless of my initial capital) is to set my intention right when opening a live account.

Instead of treating my initial few hundred bucks account as my immediate runway to become a millionaire, I would work on my ability to execute my plan/rules consistently without worrying about the returns as much.

By doing so in a small live account, it would build a very solid psychology foundation for me to handle my live account as it grows in the future.

Simply put, I would take my initial years of live investing journey to make mistakes and gain experience – not so much on making huge gains.

Step 6: Continuous Reflection & Self-Discovery + Receive feedback

Remember that I talked about setting an initial vision in Step 3?

Now, with more experience in the market (and assuming I already graduated and started my career), I’d start to find a more solid goal and focus in investing.

This is because, by this stage, I would be more familiar with my financial commitment. Hence, it is easier to calculate and come out with a proper financial goal and action plan.

It is also time for me to start reflecting and discovering my own investing style to accommodate my other commitments in life.

At this stage, joining a community of like-minded investors (not a general Facebook/Telegram group) is hugely beneficial. It serves as a great & efficient way to leverage on great investors' insights and receive feedback to accelerate learning.

No Money Lah’s Verdict

As I write this article, I am fully aware of my own investing style – income investing (article coming soon).

That said, I honestly think that if I were to follow the above steps diligently when I first started investing, I’d be discovering my preferred style much sooner.

But the journey of investing doesn’t end at Step 6.

As both life and market are dynamic, it is a must for me to keep refining my skills and goals as I continue in my investing journey.

Anyone that says that they’ve known and learned everything is just another egomaniac with little time left in the market.

Ultimately, while I may not be able to time-travel to change my journey, there is one thing that I can do:

Focus on the right mindset, strive to keep improving, and most importantly, stay humble.

We Can Still Win the 2nd Half of 2020

All the odds were against Liverpool on the 8th of May 2019.

The day was the 2nd leg of the 2019 Champions League semifinal with Liverpool hosting Barcelona.

The Reds were already down 0-3 against Barcelona in the first leg. To make things worse, the key men for the team – Salah and Firmino were not playing that night.

It seemed nearly mission impossible for the Reds to pull off a comeback.

But they still accomplished it – beating Barcelona on a 4-3 in aggregate to seal their place in the Champions League final (which, they eventually won).

p

For many, what Liverpool has experienced during the 1st leg is a direct reflection of their 1st half of 2020 – a huge 0-3 punch to the face.

Heck, even the start of the 2nd half of 2020 is eerily similar:

Some may have lost their job while many would have experienced a huge cut in income.

Simply put, many of us are likely not in the best condition as we head into the 2nd half of 2020.

But does that matter?

Can we change the fact that we step into the 2nd half of 2020 being handicapped in one way or another?

Can we change the fact that we are forced to start 2nd half of the year unfavorably?

Did Liverpool whine, complain, and give up?

Liverpool players persisted and they won.

Now, I am not guaranteeing that all of us will stage a huge memorable comeback as Liverpool did.

But one thing I do know, for sure, is that complaining, looking for excuses and expecting that it is the responsibility of the government/parents/[insert person here] to help you is definitely not going to bring you anywhere near to a comeback.

You are 100% in charge of your life.

You can give yourself a fighting chance.

You owe it to yourself to try.

Looking forward to seeing your comeback, wherever you are and whatever you are facing right now!

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

How to Know If You Are Improving?

Conceptually, many people know that making mistakes is part of the learning journey.

In practice, most people try to avoid it in any way possible:

You may be avoiding a leadership role because you do not want to be blamed when shit happens.

You may be looking for a high win-rate strategy in the market because you are sick of being wrong.

You may be staying away from a lifetime opportunity because you fear that it may be a wrong move.

Theoretically, we thought that improving means making fewer mistakes.

In reality, how would you know if you are actually improving?

First, you make bad mistakes.

Then, you make better mistakes.

It’s not the number of mistakes that determine the progress of our improvement. It’s the quality of mistakes that we make that decide the magnitude of our leap.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

Being Right in The Market

I used to have a bad tendency of wanting to be right in life. Sometimes, I still do.

In a debate, I want to prove my point right – and someone else’s opinion wrong.

In the stock market, I want to be right in the market direction so badly – that being right made me happier than making returns.

But here’s the thing:

This can work both ways.

Whenever I'm proved wrong in a debate, I felt ashamed.

Whenever the market doesn’t go in my favor, I felt frustrated.

The emotional baggage that I carried from trying to prove myself right is suffocating.

Here’s a lesson that I learned the hard way:

We live in a world that makes up of different personalities & agendas.

We invest in a market that makes up of different perspectives & emotions.

In the market, your opinion doesn’t matter. The market moves however it wants. The market is always right.

The key here is not trying to be right all the time. Rather, it’s having the humility to accept the lessons from different outcomes that’ll ultimately benefit you in the long run.

Be open with being right, AND be equally open on being wrong. There is more money to be made when you embrace both sides of the coin.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

How to Build Your Emergency Fund?

An emergency fund is one of the least discussed topics in personal finance. Yet, it is the most crucial aspect of our financial life that will save us in times of unexpected crisis, if prepared well.

In spite of Covid-19, if you are still earning an income, you should really consider to start building the foundation of your financials via an emergency fund.

Typically, most people would opt for Fixed Deposit (FD) to build their emergency fund. That said, if there is a better alternative in town, would you be interested to learn more?

What is an Emergency Fund?

An emergency fund is essentially the money that you allocate on the side in case of unexpected financial emergencies like unemployment or a loss of income.

As a minimum, one should aim to build a 3 to 6 months’ worth of emergency fund (ie. 3 - 6x Your Monthly Expenses).

Now, it is crucial for us to understand the mechanism around an emergency fund:

It is not about growing the fund like what we do with investing. Rather, with an emergency fund, we are trying to preserve the value of your emergency fund so it doesn't lose its value with time.

p

Where to Place Your Emergency Fund: Money Market Fund

Money Market Funds are funds that invest in low-risk assets such as government securities, treasury bills, commercial bonds, and other highly liquid securities.

This means that unlike stock market investments that are generally volatile, the low-risk assets in a Money Market Fund is relatively stable & consistent.

Reason being, most assets under a Money Market Fund have a maturity date where it almost always ensures a return.

Normally, most assets under a Money Market Fund matures in 1 year or less. This ensures the liquidity of funds that allow you to buy and sell relatively easily.

Money Market Fund vs Fixed Deposit (FD)

(1) Competitive Return

Money Market Funds generally pays a return of 3.0 – 3.5% annually. On the other hand, FD rates have been hovering in an average of 2%.

(2) Better Liquidity

Money Market Fund is generally more liquid than FD. This means that there is no lock-in period and you can deposit and withdraw whenever you want.

(3) Lower Barrier of Entry

Not only that, a Money Market Fund also has a relatively low barrier of entry compared to FD. This means that you can start investing in Money Market Funds from as low as RM10 and still enjoy the returns.

In comparison, there is a relatively high cap for FD deposits that ranges from RM10,000 to RM100,000.

What are the Risks of Investing in Money Market Funds?

Investing in a Money Market Fund is not without its risks, although it is quite minimal relative to the stock market.

(a) Interest Rate Risk

Interest rate risk refers to the impact of interest rate changes on the valuation of fixed income securities.

Essentially, when interest rates rise, fixed income asset prices generally decline. This may lower the market value of the Fund’s investment in fixed income securities, which will affect the net asset value (NAV) of the Fund.

The opposite may apply when interest rates fall.

(b) Credit/Default Risk

Credit/Default risk refers to the ability of issuers of fixed income assets (eg. a company’s bond) to make timely payment of interest or profit.

This means that if the issuer faces any challenges to make payment, it may impact the value as well as the liquidity of the fixed income assets of a Fund.

To manage the risks involved, a Money Market Fund will normally opt for high graded bonds and securities. This means that the chance of default will be relatively low and hence ensure peace of mind.

All in all, Money Market Fund’s investment in low-risk assets ensured it’s stability, making it a great FD alternative to build your emergency fund.

That said, please be reminded that it is NOT a capital and return guaranteed vehicle as there are still some risks involved in it.

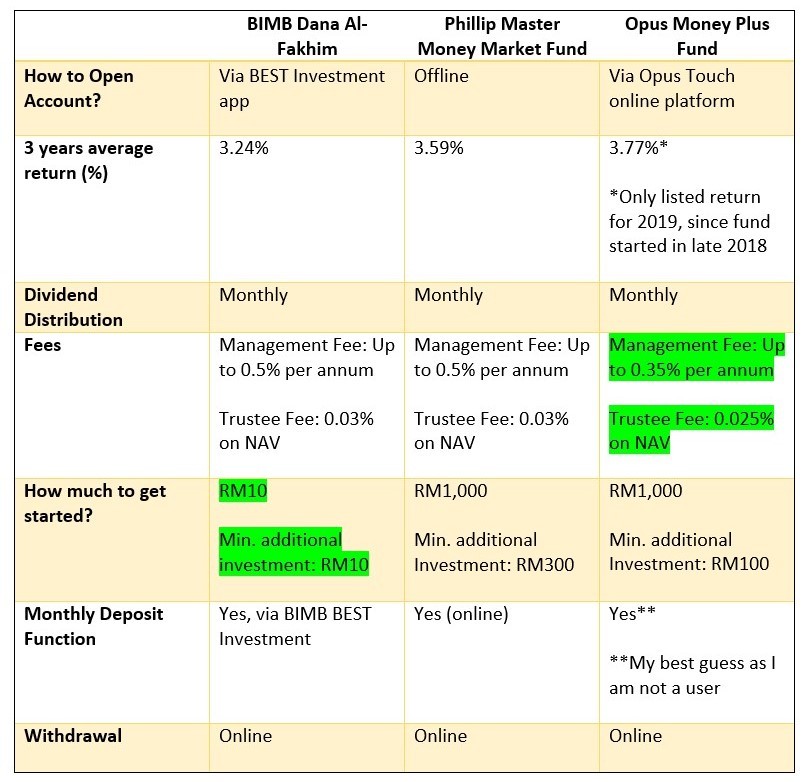

3 Money Market Funds Options

There are many money market options out there, varying in fees and deposit amount. For the options below, I am going to share with you 3 options out there which is suitable for most people.

The first money market fund that I think is a great option for most people is the BIMB Dana Al-Fakhim (Money Market Fund) via BEST Investment App.

Its low barrier of entry of just RM10 is the reason why I would recommend this to most people that are looking to build their emergency fund via money market.

To start, just go ahead and install the BEST Investment app on your phone (select Do It Yourself --> BIMB Dana Al-Fakhim), and start contributing to your emergency fund.

Install BEST Investment app HERE.

The reason why I feature Opus Money Plus Fund is due to its overall fee structure that is lower than other money market options out there.

Typically, most money market funds have a management fee of up to 0.5%/annum. In contrast, Opus Money Plus Fund features a maximum management fee of 0.35%/annum.

The final option that I am featuring here is Phillip Capital Money Market Fund.

The reason for this feature is because I am personally having my emergency fund parked with them.

That said, when it comes to ease of access, Phillip Capital is the least friendly one as it requires applicants to still fill up physical forms to open an account.

4. StashAway Simple (Updated 15/6/2020)

Newly launched in June 2020, StashAway Simple comes into the scene as a reliable alternative to Fixed Deposit (FD).

For an in-depth review of StashAway Simple, click HERE.

Money Market Funds Comparison

No Money Lah's Verdict

Hopefully this article gave you a good idea on how to get started to build your emergency fund!

Do you have any other suggestions on where to place your money for an emergency? Share with me below! :)

p.s. Already have an emergency fund in place? Wanna kickstart your investing journey for a new (& consistent) income stream?

Scroll below for more info!

Why You'll Not Make Money From that Hot Headline Stock?

Excited about the latest & hottest stock in town that everyone is talking about on Facebook groups, investing forums, and live webinars?

“Argh! I could’ve made 15% if I bought into that stock a few weeks ago when it was at RM1.00!”

Then, you either have a good whole day of self-blaming for not buying into that stock ‘a few weeks ago’ OR you rush in to chase the price in hope that you can catch the remaining up move of the stock.

Isn’t this familiar, kind of like a Déjà vu?

Because you have likely experienced it last week, and even the previous month too – how did that turn out for you?

Stocks or news that make it to the headline & social media, well, takes time to appear on the headline.

By then:

Skilled day-traders that know how to read price action & order flow have taken advantage of the move.

Experienced investors with foresight about the value of the stock have already secured their positions months before this headline.

When everyone in town is crazy and talking about a stock, you are probably too late - timing, mindset and skill-wise - into the party.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

Confession: I Experience Social Media Anxiety Attacks At Least Once Everyday Since MCO Started

Hey everyone! First of all, so sorry that I have not been able to come out with new articles/content for the past month during MCO.

Ever since MCO started, social media platforms like Facebook, YouTube, and Instagram have become the only place where people can get connected with each other.

As a result, there has been an influx of content on social media for the past few months.

Whenever I log on to social media, I felt like I am served with a buffet of marketing, financial and investment-related FB Lives, ads, YouTube videos, and content.

While it was exciting at the start, it eventually became very overwhelming to me.

Simply put, just like how most of us would overeat and become too full in a real-life buffet, I realized that I have been suffocating from the ‘content buffet’ on social media as well.

A Blogger with Social Media Anxiety

Aside from being stuffed with content as a social media user, I also experienced major anxiety swings when it comes to content creation:

I am losing out! I should come out with more content every week! (FOMO)

I should start making Youtube Videos! (FOMO)

I need to go Live because everyone is doing so! (FOMO)

I am afraid that people would not like to read about this topic. (Self-doubt)

I am worried that people would judge me for posting about a certain topic. (Fear over criticism/judgements)

Without me realizing, social media has become my main source of stress and anxiety during MCO.

Be it a content consumer or a creator, I am overwhelmed with the urge to consume more and create more.

Soon, I started to experience social media anxiety attacks whenever I log on to social media. Any form of new content from a fellow creator friend can become a trigger of breathing suffocation: HOW are they able to come out with content so fast! The Watch Party notification that I cannot make it becomes a daily dose of self-judgement and mental abuse.

Despite already being a Work From Home person for 2 years, it is crazy how my routine and mental clarity can be demolished by a change in social media lifestyle.

Creation Paralysis

Throughout the whole MCO period, there were many times where I attempted to write something, which ended up as drafts that went into the recycle bin due to fear of judgement and self-doubt.

I do not lack ideas, but I have slowly lost confidence in my own capability to create and share.

Honestly, I think I have done a bad job adjusting to the new norm and the pace of the social media lifestyle.

Short-Term Escape

If the internet is the escape from the real world 10 years ago, now it seems like the real world is the escape from the internet.

For the past weeks, I tried to stay away from my phone whenever I felt overwhelmed by the virtual space of social media. Disconnecting from the internet helped me find peace and give me space to breathe.

That said, this only worked as a short-term escape as anxieties tend to strike again when I am back on social media.

Long-Term Solution: Re-evaluating My Relationship with Social Media & Creation

As I took a break from creation and minimize my time from social media, I got the opportunity to reflect upon my relationship with social media & creation:

(1) You do not need to consume everything on social media

Just like many, I experienced the urgency and Fear of Missing Out (FOMO) to participate in as many FB Live and consume as much content as possible at the start of MCO. As a result, I ended up overwhelming myself with those contents.

Moving forward, it is important for us to understand that it is impossible to learn and consume everything by ourselves in a short time.

By all means, go pick up new knowledge or skills, BUT stay focused and have realistic expectations.

Do not expect yourself to master investing AND digital marketing together by binge-watching all the FB Lives and content out there during MCO.

If any, skills take time & practices to develop and it is definitely not within a few weeks of MCO.

Most importantly, be selective on the content you consume and learn to allow yourself to miss out on certain FB Live or content that is not of priority to you.

(2) Focus on value, quality & consistency, not a sudden burst in quantity

In hindsight, I realized that I have likely drawn into the urge to compete when it comes to content creation during the past month.

In other words, I judged my ‘performance’ by comparing myself to the speed of content output by other creators – which really drove me nuts.

Moving forward, I want to focus my energy to produce consistent quality content that I either genuinely enjoy sharing, or find great value to learn and share with my friends and community of readers.

It’s not about competing, it’s about creating the most value to the people that matter: me and my community of friends and readers.

(3) Be in peace & creative around my limit and boundaries

Ultimately, I am working on my own when it comes to content creation.

I love writing and sharing, but I can only produce and write so much content by myself.

This is a reality that I was not accepting the fact myself during MCO, which gave me a huge load of stress and anxiety.

As I take my time to reflect, I started to find peace with this fact. If I have all these boundaries, why not be creative around them?

(4) Specify Specific Time to Go On Social Media Daily

On a daily basis, set a consistent time for you to go on social media and participate in the virtual world.

I find this method extremely effective as it forces me to only engage what’s important to me in the virtual world, and filter out unimportant interaction and content on social media.

With that, I can spend more time in the work that truly matters to myself and my readers, while not overwhelming myself.

No Money Lah’s Verdict

Covid-19 has changed the way of living for many of us. If any, our relationship with social media in 2020 has definitely experienced a huge shift.

In one way or another, Covid-19 and an MCO lifestyle turned out to be a blessing in disguise as it forced me to re-evaluate my behavior with social media. As a creator, it also helped me recalibrate my purpose and mindset when it comes to writing and creation.

On the other hand, as social media takes up more of our attention & time in our life, I am very sure that health issues caused by social media are going to get more widespread and intense.

Like myself, I believe that more and more people are going to get overwhelmed with social media anxieties, which could lead to more problems if not handled properly.

Perhaps, another good question that we can think about is this:

Are you weak if you are experiencing anxiety issues due to social media?

No. You are not, and let no one tell you otherwise, including yourself.

What you need to do, is really to take your time, reflect, and re-evaluate your relationship with social media and online content.