5 Things that I Look for When Investing in REITs!

In my previous article, I shared about how and where I invest my money. When it comes to active investing, my niche and strength mainly in researching and identifying opportunities in the Real Estate Investment Trusts (REITs) sector in the stock market.

REITs are great options for investors looking to build a consistent dividend income portfolio, while also having exposure to the commercial real estate sector.

In this article, I would like to share 5 fundamental aspects that I consider when I invest in REITs.

These 5 aspects are also discussed in detail in my live REIT Income Investing Coaching Sessions, so if you are interested to build a consistent dividend income portfolio via REITs, be sure to click HERE and check it out!

Without further ado, let’s start!

#1 Is the REIT’s business nature suitable to grow in this current environment?

Not all REITs are born the same.

As an example, IGB REIT is REIT that runs a retail business that runs the operation of Mid Valley and The Gardens. On the other hand, Al-Aqar REIT is in the healthcare business where they own and/or operate hospitals and healthcare centers like KPJ Hospitals.

In other words, while both companies are categorized as REITs, the opportunities and risks involved with both IGB REIT and Al-Aqar REIT are fundamentally different.

Hence, it is important for us to recognize the business nature of a REIT and identify whether the REIT is suited for growth current (and future) market & business environment.

Related: Pros and Cons of different REITs HERE

#2 Healthy Balance Sheet

For REITs, a healthy balance sheet is extremely crucial in the operation of the business.

In essence, the health of a balance sheet refers to how well a REIT is in managing its liabilities (mostly debt) in relative to its asset (ie. Cash).

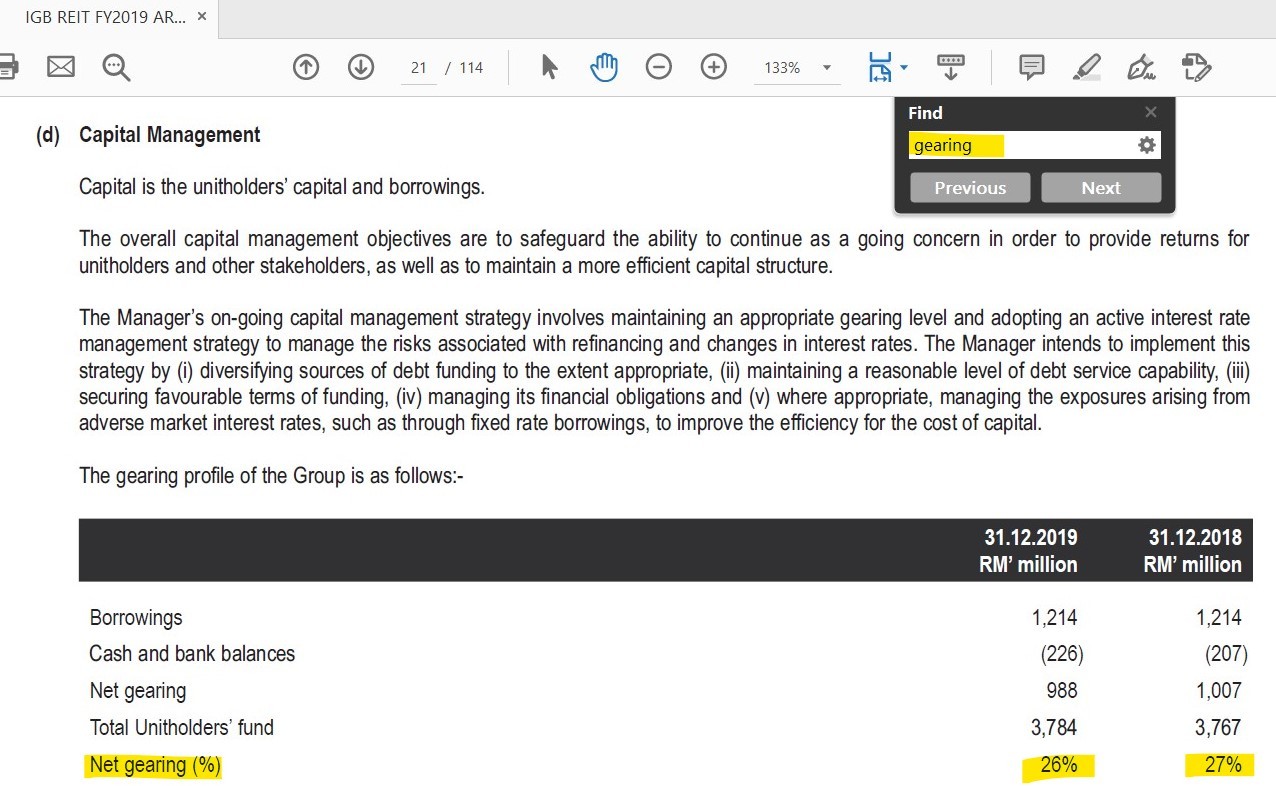

One very good measure of a healthy balance sheet is via Gearing Ratio. Gearing Ratio measures the company’s borrowings relative to the value of its assets.

This also means that Gearing Ratio is able to tell us whether a REIT is overborrowing. Generally, a REIT is required to maintain a gearing of 50% or less.

But personally, I like to be more stringent with my selection and will only go with REITs with gearing of 40% or less.

How to look for Gearing Ratio?

Method: On quarterly/annual report > Ctrl + F "Gearing"

p

#3 Income Growth

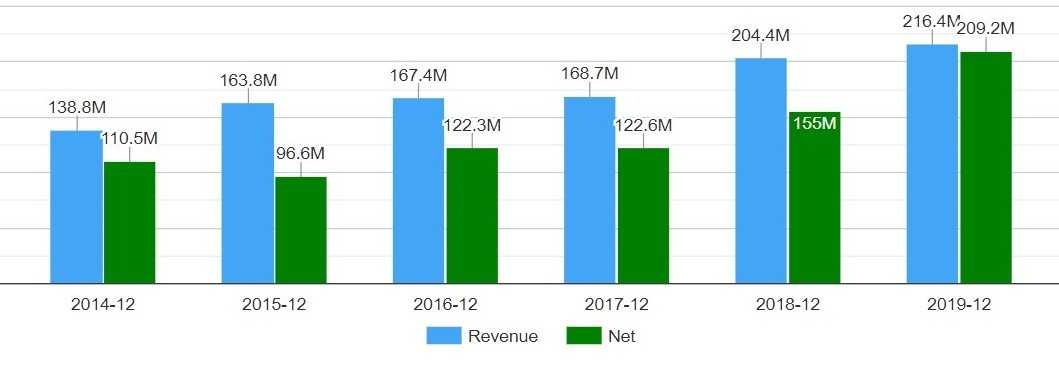

As an investor, of course I am always be looking to invest in a business that keeps growing.

This translates to past consistent growth in revenue & profit of a company. In REITs, this is no different.

As a real estate business that earns mainly on rental income, it is crucial that under normal circumstances, the income of the business keeps growing consistently.

A consistent growth in income will, for most of the time, ensure growth in dividend payout to investors.

How to look for the details of a REIT's income?

Method: Via the income statement in quarterly/annual report, or via apps like KLSE Screener

#4 Occupancy

As a real estate business that depends on rental income, the lifeline of REITs is highly dependent on the occupancy rate of their properties.

As an example, IGB REIT’s income will be highly dependent on how well occupied the rental is in Mid Valley and The Gardens.

I will go more in-depth on this topic in future articles, but in general, there are 2 rental models of REITs:

The first rental model is around a short, normally yearly rental contract, where REITs’ management will have to renegotiate new contract terms on a yearly basis. This is usually seen among Retail REITs like IGB REIT and multi-tenant office building on Office REITs.

The second model is a longer, multi-year rental contract (or lease), where REITs’ management secure longer-term contracts (usually 3-5 years and even longer) with tenants. This is usually seen in Industrial REITs that run factories & warehouses, Hospitality REITs that manages hotels and Healthcare REITs that run hospitals.

How to look for a REIT's Occupancy Details?

Method: On the annual report, Ctrl + F "Occupancy"

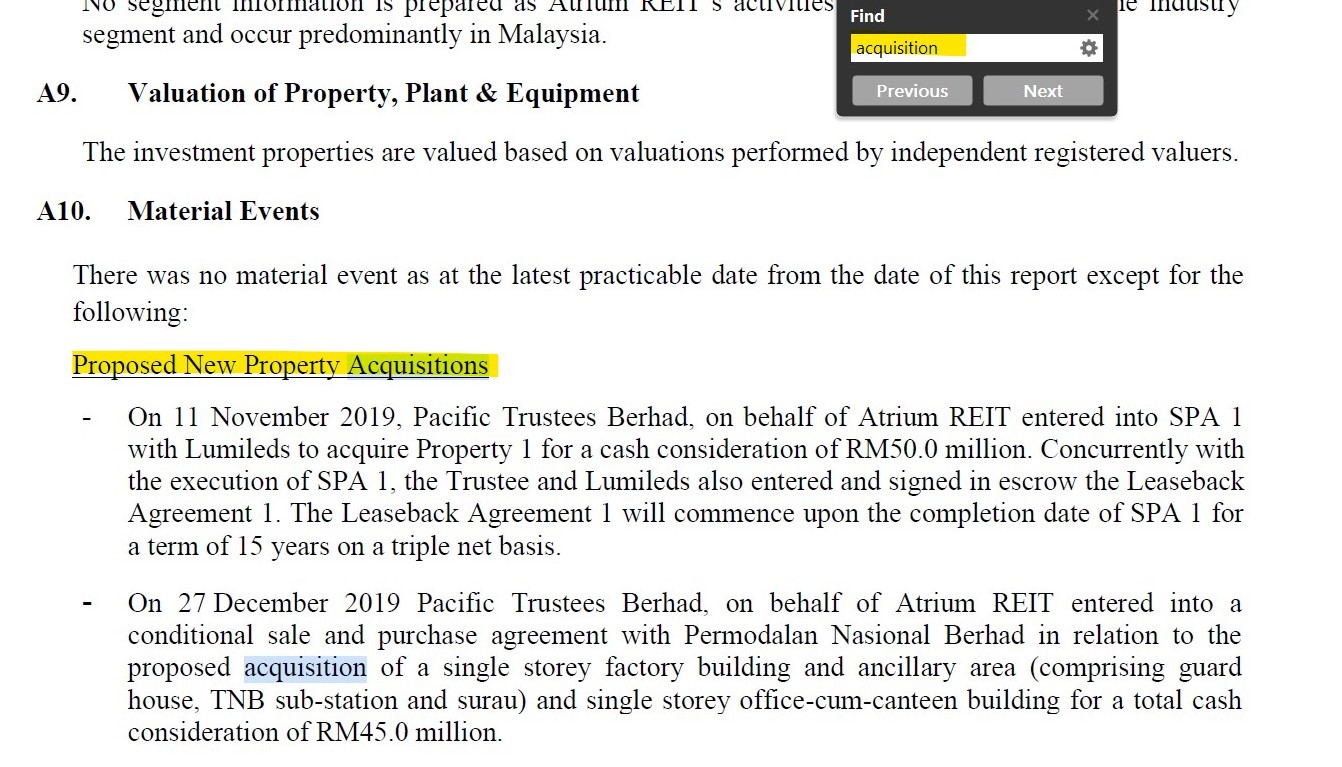

#5 Potential Acquisition

While investing in REITs, an important indicator to gauge potential income growth of a REIT is through potential acquisitions.

As a real estate business, the major way for a REIT to improve income is to acquire quality properties under its portfolio.

This will ensure longer-term rental income growth and translates to better dividend payout for investors.

How to look for a REIT's Acquisition Details?

Method: Now, this will be a little tricky but generally, under Quarterly/Annual Report, you can Ctrl + F "Acquisition". Otherwise, I recommend reading through the Quarterly Report and you'll easily spot any acquisitions under the pipeline.

p

No Money Lah’s Verdict

So here you go! These are 5 fundamental aspects that I look into when I invest in REITs.

For sure, there are several other little details that will help in my decision-making process, but these 5 aspects generally make up my initial impression of a company.

Are you investing in REITs as well? What other aspects do you look into a REIT before making your investment decision? Share with me at the comment section below!

Else, if you have any questions or things that you would like me to cover on REITs or investing in general, do let me know at the comment section too! :)

p.s. Keen to Learn More About How You Can Build a Reliable Dividend Income from REITs? Click HERE to Find Out More!

What's Your Edge?

What's the difference between a cook and a chef?

A cook prepares meals.

A chef, on the other hand, creates experiences.

Notice both are doing about the same thing, but the perceived (and charged) value is significantly different.

A cook could be extremely hardworking, following all the methods being taught and still be replaced by someone else that's even more hardworking. But it's way harder to replace a chef that creates a unique food experience (say, an omakase master).

In a world where almost everything is being automated or SOP-ed, you are rewarded by thinking and doing things differently.

In short, your edge lies in your unique thoughts and perspective, which led you to create your value and masterpiece in your work.

The next time you are in a position of the majority, consider this:

What can you think, do, and create differently?

How I Invest My Money as a Self-Employed Person (Detailed Breakdown!)

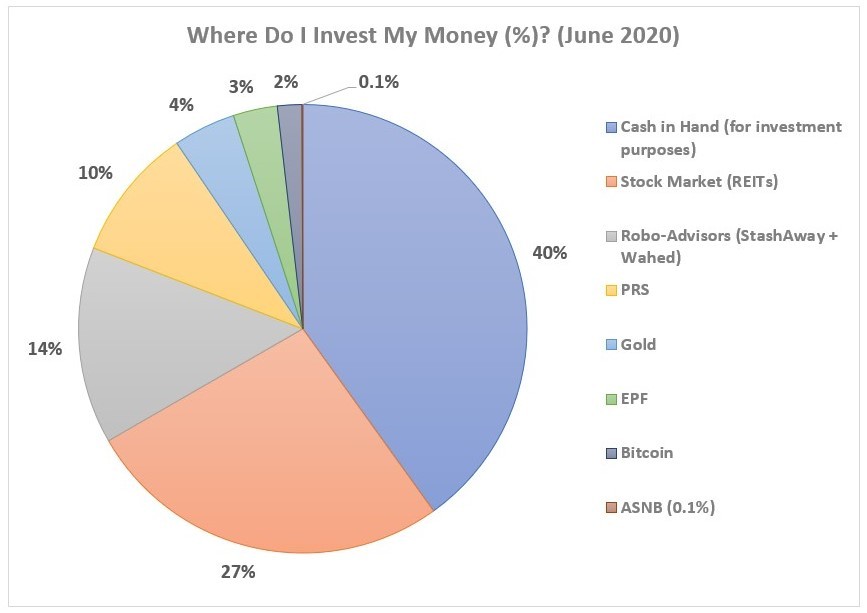

Where do I invest my money?

In this article, I want to talk a little bit about the breakdown of my (boring) investment portfolio. I’ll also shed some info on the asset classes involved and what I want to improve or refine further.

By the end, I’ll share some of my core investing mindsets (or principles, whatever you wanna call them) that I follow closely in my decision-making process.

Have a good read!

Now, a few caveats…

1. The market is dynamic (so is life). Our financial priorities change as we grow older. Hence, I am pretty sure how I invest today will evolve along with time and my priorities in life.

2. The focus of this discussion will be on my long-term investment portfolio. This means that invested assets will be focused 100% on achieving my financial goal (Financial Independence, or FI).

They will not be cashed out for other purposes other than portfolio rebalancing.

3. Money allocated for savings and emergencies will NOT be included in this discussion. This is because there is a high chance that these monies will be used for purposes other than to achieve my financial goals.

Read my articles on savings and emergency funds HERE and HERE.

4. Money allocated for short-term trading will not be included in this discussion. The nature & purpose between trading and investing are extremely different and there is no reason for me to add them to this discussion.

With that in mind, please approach this post with a pinch of salt. Your investment approach and style should be aligned with your own priorities in life, risk profile, and more.

Do consult a licensed financial planner if you are serious about building your own investment portfolio. I am also working with my personal financial planner and have written about my experience HERE.

No Money Lah’s Investment Portfolio + Breakdown Discussion – June 2020

#1 Cash in Hand for Investment Purposes

There are a few reasons why 40% of my portfolio is in the form of cash.

Reason #1: Risk of income fluctuation as a self-employed.

There are certain months where my income may be less than my intended average figure.

Hence, at this point in time (June), I have a 3-months cash buffer allocated for my monthly investment routine as you’ll read in this article.

Reason #2: Cash reserved for different opportunities.

We never know what’ll happen in the market tomorrow.

Especially in this current market condition, I have extra cash reserved to take advantage of any opportunities that may come knocking on the doorstep.

#2 Stock Market (REITs) – Active Income Investing

How I Invest: Every month, barring nothing special happens, I will pump a specific sum of money into my selected REITs.

When it comes to the stock market, I focus particularly on Real Estate Investment Trusts (REITs).

This is the part of my investing routine where I am involved actively to research and study what to invest.

The reasons why I focus on REITs are because REITs’ volatility is generally milder relative to other sectors in the market, and I like the idea of consistent dividend payout from REITs (something like collecting rent as a landlord).

Simply put, REITs are my niche and it is a sector that I can utilize my thought process & analysis skills with high competence to generate alpha (edge).

What I’d like to refine further: Starting to expose myself more to foreign REITs (ie. Singapore, HK & US REITs) for the 2nd half of 2020.

--

p.s. I am often asked if I feel ‘sayang’ for missing out on all the hot headline stocks. To be honest, I don’t.

For one, I do not have time to study these companies for long-term investment. Secondly, the moment you see a stock appear on the headline, you are probably way too late to join the game.

I focus on my niche and strength, and will not touch something that I am not familiar with.

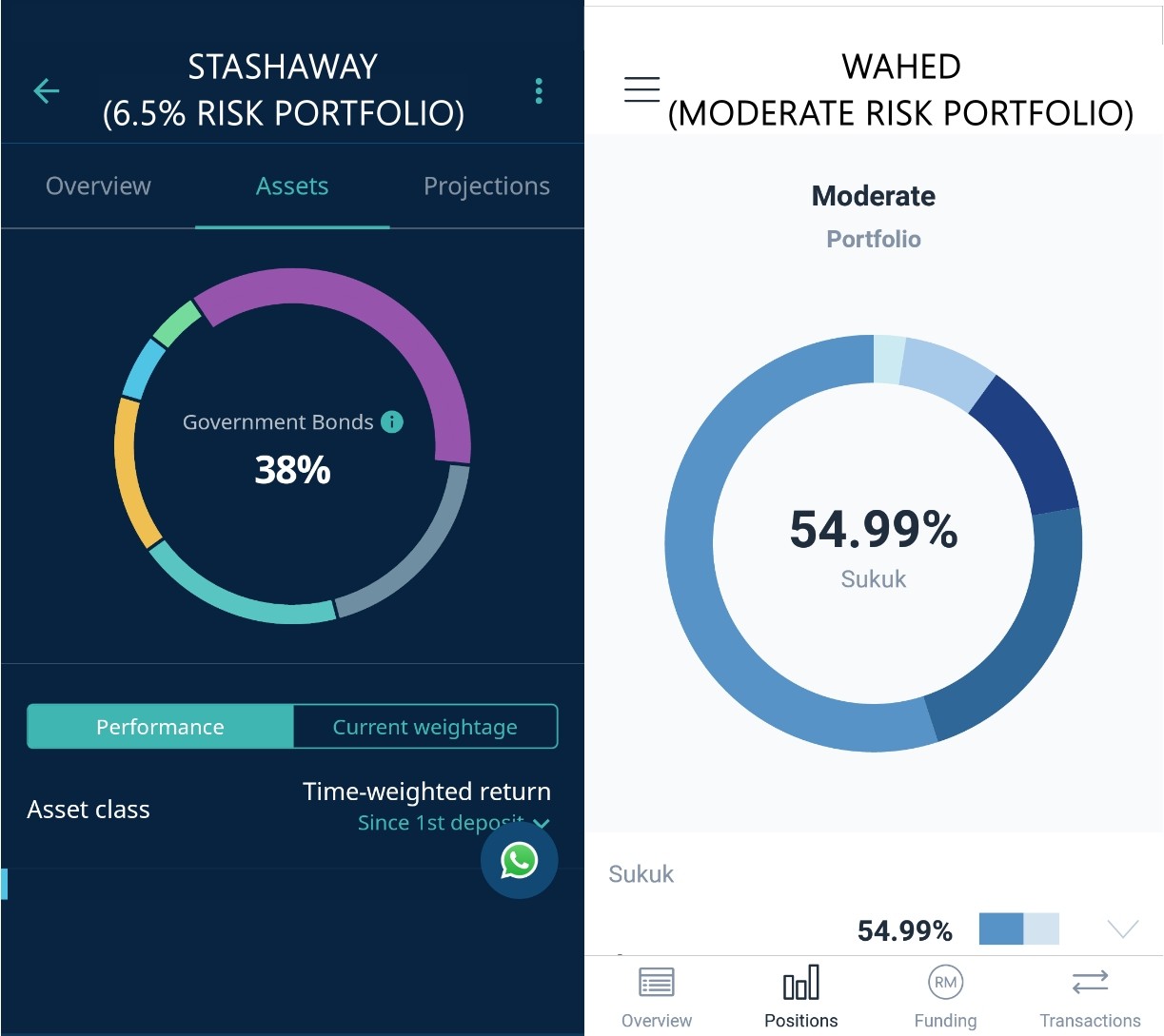

#3 Robo-Advisors (StashAway + Wahed) – Automated Passive Investing

How I Invest: Monthly automated debit order.

Yes, I am aware of the risk of overconcentration by just investing in REITs.

Hence, I am also passively invested in robo-advisors like StashAway and Wahed to diversify my portfolio into ETFs of various industries and other asset classes (ie. Bond, Commodities, Sukuk).

In terms of risk profile, I am mainly focusing on medium-risk portfolios from both platforms (StashAway: 14% Risk Index, Wahed: Medium Risk Profile).

The beauty of robo-advisors is that I can invest passively at a reasonably lower cost than conventional unit trusts.

What I’d like to refine further: Nothing.

p.s. Use my: StashAway Referral Code and get 50% off your management fees for 6 months, as well as Wahed Referral Code (Code: YIXCHI1) and get RM10 bonus fund!

#4 PRS – Passive Investing

Just to take advantage of tax and government’s previous incentive.

#5 Gold – Monthly manual debit order

How I Invest: Manual debit via HelloGold’s Smart Savers program

Personally, I think of Gold as a wealth preservation asset and a correlation hedge against overall market volatility.

The reason why I choose to stick with HelloGold is that it allows me to be extremely flexible with the purchase amount, whereas other platforms have a minimum purchase of 1g.

What I’d like to refine further: Increase monthly allocation in Gold, and start to have exposure in Silver in line with the increment of my income in the near future.

#6 EPF – Passive Investing

How I Invest: Monthly manual debit order

EPF is an interesting matter to me as a self-employed. This is because unlike normal employment where there is a standard to how much you and your employer will contribute to your EPF, I have to manage my own EPF account.

This is done by opening my own EPF i-Saraan account and manage my own EPF contribution.

What I’d like to refine further: Increase monthly allocation in line with the increment of my income in the near future.

#7 Bitcoin – Not adding any positions

Presently, most of my bitcoin positions are my unsold positions during my purchase in mid-2017.

They are relatively small as I was lucky enough to sell off the majority of my position nearly at the height of bitcoin’s $20,000 peak by the end of 2017.

That said, I am also eyeing to start increasing my holding on digital currencies moving forward. Just gotta dive in and do some research first.

What I’d like to refine further: Do deeper research into digital currencies.

#8 ASNB – No Luck

Seriously, if you can get your hands on Amanah Saham Fixed Price Funds, get it.

The consistency of return and the nature of ASNB unit price (fixed at RM1.00/unit) makes it a no-brainer if you are looking to invest passively.

Unfortunately, I never really got much luck to get many units since I’ve written my piece on Amanah Saham last year *sigh*

Context: My Situation

I am 26 this year. As a self-employed, I run this blog and actively organize live REIT Income Investing coaching sessions – both of which I have a lot of fun doing.

In my downtime prior to Covid-19, I am also an International Table Tennis Federation (ITTF) certified table tennis coach (though that stream of income is no more today).

More importantly, I am also passionately working behind the scene to become a full-time funded trader (*fingers crossed*). This part of my life requires a dedicated post, but suffice to say it is a very challenging, yet exciting journey.

I am single and currently living with my family (it’s a blessing). Hence, I am able to reduce my living expenses significantly which enables me to pursue my goals wholeheartedly, while maintaining a respectable savings ratio.

All in all, my situation is likely going to be very different from many people, as I do not have a fixed monthly income.

Financially, my situation requires me to be extremely disciplined with money. It also pushed me to think 2 to 3 steps ahead in terms of my income streams, which is why you’ll see things like cash buffer in place for my monthly investment routines.

My Investing Mindset + Approaches

1. Create a disciplined financial and investing routine. For me, I review my financials and investments every month-end, so I am always aware of my financial state.

2. Take time to discover your investment style. Not everyone has the time & commitment to pick individual stocks. Not everyone can invest in volatile businesses. Everyone is different.

For me, a hybrid routine of active REIT income investing coupled with low-cost passive investing makes the most sense to my personality, time, and commitment.

3. Foundational skills like how to analyze a financial report is a MUST in active investing. I think there’s really no shortcut here.

4. A stock investing plan without an exit strategy is NOT a plan. Market and businesses are too dynamic to buy and hold forever.

5. 99% of headlines are mostly for entertainment purposes. Until you know what you are looking for, headlines and news can be extremely overwhelming.

p.s. I don’t really care about the hottest stock in town.

6. Leverage on technology. Low-cost passive investing platforms like StashAway and Wahed helped complement my investment routine so I am always diversified in other industries.

7. Avoid investing with borrowed money. I avoid leveraged accounts and invest only with the money I have (ie. Cash Upfront account on Rakuten Trade).

8. Learn to make independent investment decisions. I use various resources to help me gather insights, but ultimately, I make my own investment decisions.

Nothing helps me improve more than taking ownership of how I invest my own wealth.

9. Focus on the process – keep learning and stay humble. Whenever I feel like I know everything, the market will prove me otherwise. A little humility goes a long way in the market.

10. In the long run, successful financial goals and investing depend on one’s habits, mindset, and skillsets. And yes, it’ll take time.

No Money Lah’s Verdict

Oh my, this is a long article! Thanks for reading till the end, and hopefully you find this post an insightful one!

Ultimately, it is crucial for us to acknowledge that investing is a very personal matter. How I invest will likely be very different from you, and there is really no right or wrong approach here.

Either way, personal finance and investing is a life-long journey. Our money and investment routine have to evolve as we step into different stages of life.

Hence, keep learning, stay humble.

p.s. Curious, where do you invest your money in? Feel free to share with me at the comment section below!

Talk soon! :)

This is an article that I’ve always wanted to write about. In fact, I have several drafts for this topic, yet I never really landed on an approach to this article.

Big thanks to Mr-Stingy’s article on 'How I Invest My Own Money' (check it out!), which has helped me decide how I should approach this topic. You can also check out a similar topic from Ringgit Oh Ringgit HERE.

You Might be Interested: What'd I do If I Were to Start Investing All Over Again?

Do This When You are Feeling Small or Not Good Enough in Life

We are creatures that love to compare.

It’s easy to look at someone else’s achievement & possession and feel that we are not good enough (especially if the person is our peer).

It’s in our sub-conscious to peg our current situation with our goals and target in life and feel that we are too small for our goals.

It’s as if we have never made any progress forward, right?

To be honest, I felt like that most of the time.

Comparing myself to the friend that is earning much more than I do. The friend that seems to be traveling and eating good food all the time. The friend that seems to have won it all in his/her life.

I think there’s no way for me to ever run away from these emotions as we progress in life.

But what I’d do whenever I sense these self-defeating emotions, is to stop comparing myself to them.

Yet we are creatures that love to compare, right?

At some of my worst days, I'd lift myself up by comparing myself today to the person I was a few months ago, or even a few years ago.

Whenever I feel small, I'll compare myself to the person I am in the past.

Likely, I’ve found better clarity in certain aspects of my life. Certainly, I’ve learned some new skills. Surely, I’ve grown past the most challenging times of my life thus far.

I may not have all the answers and achieve my major goals (yet), but I am definitely making progress.

I give a good pat to myself on the back.

We are creatures that love to compare.

Do that with other people and we’ll be a miserable human being. Do that with the little progress that we made a few months/years ago and we’ll always find liberation.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

Answered: Your Most-Asked Questions About Rakuten Trade!

Rakuten Trade is my main stockbroker when it comes to investing in local stocks due to it being one of the lowest-priced commission brokers in town.

For quite some time now, I have been receiving emails and various questions under my stockbroker and Rakuten Trade articles about the platform. Since the questions are quite commonly seen, I thought why not compile them in one article to address them.

Please note that this is not an exhaustive list. Hence, if you do not find the answer to your questions in this article, feel free to leave a comment at the end of this article and I will update the list of questions accordingly!

Anyways, have a good read!

READ: Rakuten Trade Long-Term User Review: 5 Reasons Why it is My Preferred Stock Broker!

"What to do if I forgot my Trading Pin?"

Please login to the members' page via www.rakutentrade.my/login and then click “Settings”, select “change trading pin” and proceed accordingly.

'Order amount exceeded trade limit’ issue

To address extraordinary market volatility in the equity market, Rakuten Trade has implemented a market order mechanism (price band) that will prevent trades to exceed customer's available trading limits. The cost of trading will be calculated at 30% higher than the current market price.

*Price band percentages will be 30% above the market price, as such customer trading limit should have a minimum of RM138.50 in order to purchase 1 board lot of 100 units of shares.

"Can I transfer my shares from other brokerage accounts to Rakuten Trade?"

Yes, you can.

To initiate a share transfer from another broker to Rakuten Trade, you will have to reach out to the broker where your shares are currently deposited in to fill up the shares transfer form. The shares will be reflected in your Rakuten Trade account upon successful transfer from the previous broker.

What are the Charges?

It'll be RM10.00 per stock charged by Bursa Malaysia Depository regardless of quantity.

How long will the transfer take?

If the instruction is received before 10:00am, the transfer will be done on the same business day. If the instruction is received after 10:00am, the transfer will be done by the next business day.

Note: This is subject to when the transfer is accepted and acknowledged by Bursa Malaysia Depository.

"Can buy foreign-listed shares with my Rakuten Trade account?"

No

Potential RT Platform issue/System Down Issue

Since MCO started, the market condition as attracted a huge influx of retail investors into the marketplace. This resulted in an increase in brokerage account activations across the board regardless of brokers.

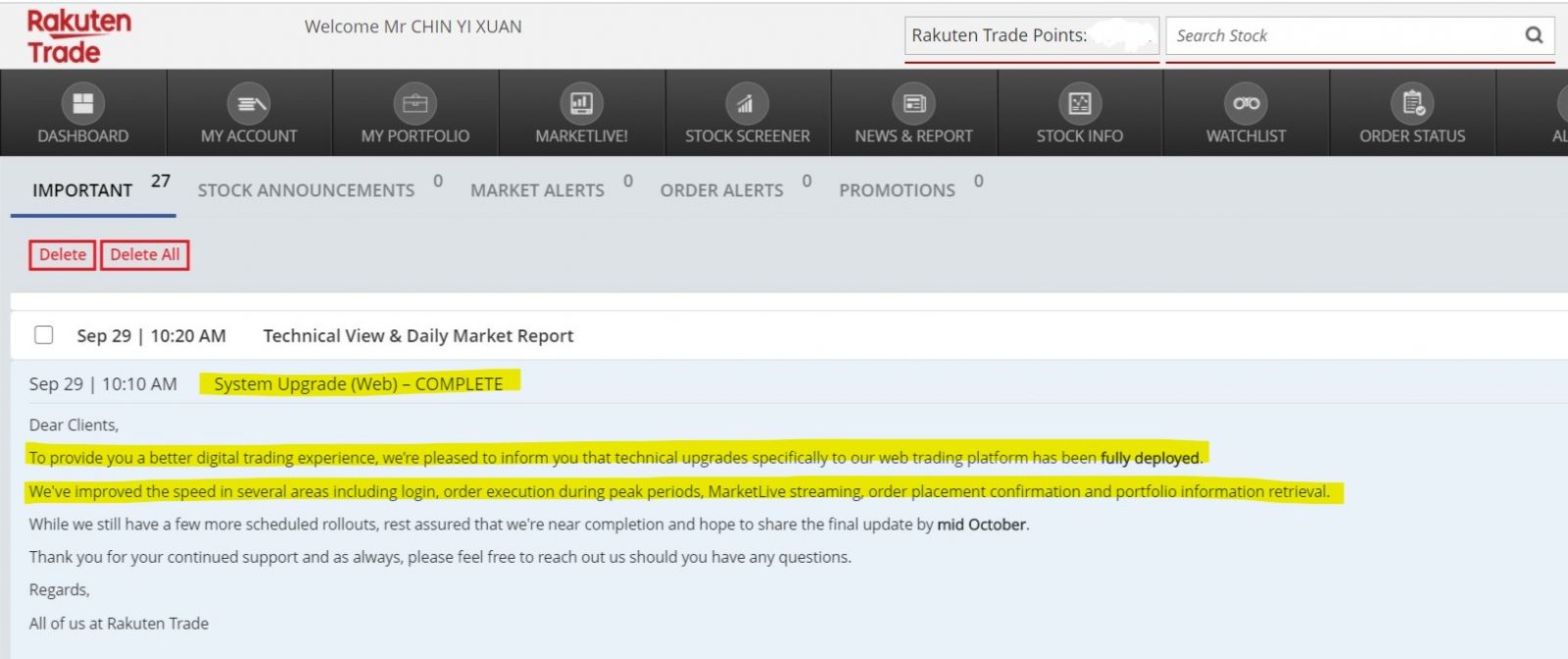

Indeed, I have heard feedback from people about system down issues on various brokers including Rakuten Trade. Hence, I have reached out to Rakuten Trade in hope to get some clarification on their approach to resolve the sudden influx of investors.

As per my knowledge, Rakuten Trade acknowledges and is mindful of the issue. In return, they are currently pushing updates to the platform in phase in order to improve the overall user experience.

Update October 2020: As per October 2020, Rakuten Trade has completed the deployment of updates to their platform which includes login and execution speed during peak hours. This means that there should be lesser glitches moving forward and a generally smoother experience. Personally, I've tried executing orders during peak hours and it has worked well for me. That said, should you face any issues feel free to share with me in the comment section below!

"Do I have to open an extra CDS account in order to use my Rakuten Trade account?"

First of all, if you are not a Rakuten Trade user prior to this, you will need to open a CDS account specifically for Rakuten Trade (just like when you open a new brokerage account with anyone else as well).

But worry not, as your CDS account will be opened for you when you apply for a Rakuten Trade account.

"What are the differences between Cash Upfront, Contra & RakuMargin accounts?"

Cash Upfront:

Works like a debit card. The limit of how much you can invest is based on the amount you have in your account.

I would suggest most people, especially new investors to stick with a Cash Upfront account unless you have extensive knowledge and understanding of how a Contra or Margin account works and the risks involved.

Contra:

Works like a charge card. You can have a trading limit of up to 5x the money and existing share value that you have in your Contra account (limit differs from the type of shares and warrant expiry period we plan to buy).

That said, you will have to fully settle your transaction within 2 days. Failure to fulfill the settlement will cause force selling to an account from the 3rd day onwards.

Suitable for experienced active investors & day-traders.

RakuMargin Account:

Works like a credit card. Essentially, you are given a credit facility to invest in shares.

The margin of financing of a RakuMargin account is 180%. Simply put, this means that in order to secure an RM10,000 credit facility, you will need to have collateral (ie. existing cash and shares value) of RM18,000 in your RakuMargin account.

The main difference between a RakuMargin and a Contra account:

RakuMargin: There’s no fixed settlement period for RakuMargin account, but there’s an interest of 6.8%/annum on your outstanding balance (ie. Shares financed by margin, Losses from shares financed by margin).

Contra Account: Fixed settlement date of T+2. Meaning, you will have to settle your transaction within 2 days.

Market Transaction Hour

1st Session

Pre-opening: 8:30am

Opening and continuous trading: 9:00am

Closing: 12:30pm

2nd Session

Pre-Opening: 2:00pm

Opening and continuous trading: 2:30pm

Pre-closing: 4:45pm

Trading at last: 4:50pm

Closing: 5:00pm

"Does Rakuten Trade has an automatic Stop Loss Function?"

Yes, it is possible to set a stop loss on Rakuten Trade. After you bought a stock, you can add a sell stop or sell limit order which will act as your stop loss if price were to drop below the set price level.

Click HERE for more info on Rakuten Trade's Stop orders.

"Why I can’t view my Rakuten Trade CDS account on Bursa Anywhere?"

Bursa Anywhere is an app launched by Bursa to allow users to consolidate and facilitate their CDS accounts.

That said, this is only applicable to direct CDS accounts. Since Rakuten Trade is a nominee CDS account, it is not viewable on Bursa Anywhere.

"What to do if I want to attend the AGM of the company that I invest in?"

To attend AGM/EGM, simply email your request to Customer Service ([email protected]) ten (10) working days before the AGM/EGM

"How long will it take for me to receive my dividends?"

Your dividend(s) will be credited into your Rakuten Trade account in at least five (5) working days after the official payment date.

"My cash balance is not immediately updated for withdrawal upon selling my shares, why ah?"

As per Rakuten Trade's explanation:

However, your cash withdrawal available still need T+2 to reflect.

Do note that, if you keep trading (buy & sell) after that, it will take your previous order T+2 trading limit which means it will lower your withdrawal limit.

Below is the scenario to provide a better explanation to you:

- 3 Aug Sold Stock A RM1,000: Should be reflected on 5 Aug (T+2)

- 4 Aug Purchase Stock B RM600, Sell Stock B on 4 Aug RM800. Should be reflected on 6 Aug (T+2)

On 5 Aug, your cash withdrawal for stock A will be RM400 (after minus stock B RM600).

On 6 Aug, your cash withdrawal for stock B will be RM800.

All of these scenarios are based on RM0.00 withdrawal limit as default.

Have more questions about Rakuten Trade?

This article is not an exhaustive list, but it comprises of the common questions that are asked by my readers for the past few months.

That said, if you have any other questions that are not in this article, feel free to leave a comment below and I will do my best to help you out! :)

Disclaimer: The content of this article is written purely based on my personal research and experience, and is NOT an official document from Rakuten Trade. I'll do my best to keep the content of this article relevant but for the most updated support and solution, please reach out to Rakuten Trade's official support team.

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Related Posts:

(1) Check this out before opening your stock trading account!

(2) How to make your first trade on Rakuten Trade?

(3) 4 Powerful Features on Rakuten Trade that’ll help you invest better!

(4) How to Build a Reliable Bursa Stock Screener via Rakuten Trade?

(5) NEW: Rakuten Trade Long-Term User Review: 5 Reasons Why it is My Preferred Stock Broker!

Disclaimer

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

The 24-Hour Asset

Generally, we are quick to spot when the price of certain food or items are raised.

But for most of us, we are extremely slow to realize the increasing value of our time.

A simple lunch meetup in university times could just mean skipping a boring lecture. But today, it could be the time that we can use to work on a side hustle, get a well-deserved rest from work, learn to invest, and more.

Clearly, our time has become more valuable – and yet we are still giving them out like free candies.

Time is truly an asset that appreciates with age. 24 hours today means so much more than 24 hours when we were a kid.

Hence, protect your time. Spend them with people that truly matter, invest in goals that’ll drive you forward in life.

But to do that, you’ll need to first identify who are the people that truly matter to you (make it less than 5), and the opportunities that are significant in your journey of life (don’t have more than 3).

Most of you know how to do fundamental analysis for companies. Now, do a fundamental analysis for your time.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

4 BETTER Ways to Save Money in a Low Interest Rate Environment! (detailed comparison)

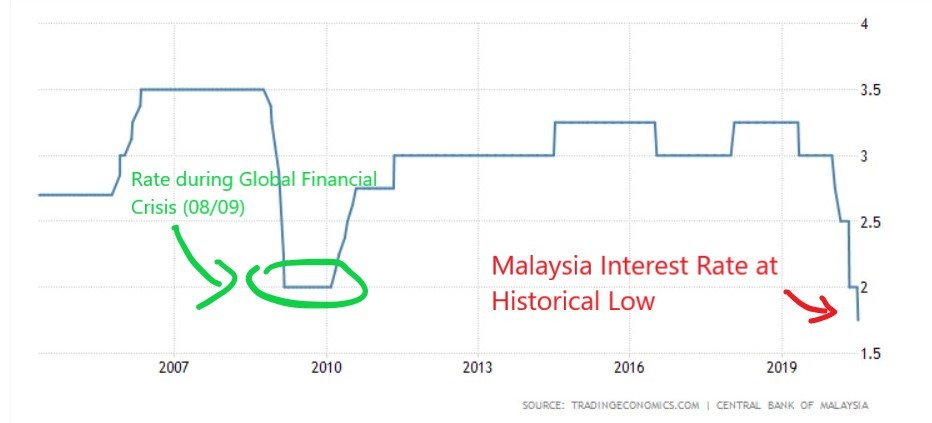

Since the Covid-19 pandemic started earlier this year, central banks across the world have been lowering interest rate in hope to spur the economy with increased consumption & borrowings.

On the flip side, under a low interest rate environment, the yield of conventional financial vehicles like Fixed Deposit (FD) are affected negatively.

In fact, Bank Negara Malaysia (BNM) has just announced the lowering of interest rate from 2% to 1.75% this month (July), which is never seen even during the Global Financial Crisis in 2008/09.

Simply put, savers suffer in this historically low interest rate environment.

The question is obvious:

Is there anywhere we can place or save our money in this low interest rate environment?

Let’s find out together.

Firstly, Our Goals & Criteria:

What I intend to achieve with this article is to share what I think are suitable alternatives to FD for most people to place their money.

The main goal here is to seek options that can allow most people to PRESERVE the value of their wealth.

Hence, please approach this article from a wealth & value preservation mindset, NOT from an investment mindset.

Since we are talking about potential FD alternatives here, there are a few criteria that I consider while planning for this article:

- #1 The majority exposure of these financial vehicles must be limited to low-risk asset classes.

- #2 Ideally, we’ll want to have a low barrier of entry to these options. Meaning, we can start even with a small amount of capital.

- #3 A flexible deposit & withdrawal feature would be a plus point.

- #4 No troublesome tiering conditions where I must spend up to some amount or swipe my card X times a month to be eligible for the yield. (too mafan)

Now, a huge disclaimer (confirm people will mention): NONE of the options mentioned below are insured by PIDM and NONE of them have guaranteed yield or return. So if that’s your thing, this article is not for you.

With that in mind, let’s start!

1. Money Market Funds

Money Market Funds are mutual funds that typically invest in cash equivalent short-term debt instruments with short maturity (normally around 1 – 2 years, sometimes even shorter).

In other words, Money Market Funds place your money in instruments like government treasuries, corporate, and bank securities. Also, Money Market Funds' managers typically attempt to keep the price of the funds fixed (ie. RM1/unit), so only the yield will fluctuate.

In nature, Money Market Funds are considered lowest in risk within the fixed income asset classes as the short maturity (a.k.a. expiry) of the instruments invested lower the risk of default and reduce exposure to long-term risk in the market.

Generally, yields are paid out in the form of dividends either monthly or quarterly.

Personally, I have most of my money placed with BIMB Dana Al-Fakhim (via BIMB’s BEST Invest) and Phillip Capital Money Market Fund for non-investment related purposes.

Average Past Return: Around 3 – 4%/annum

Pros:

+ Higher return than FD;

+ Low barrier of entry (RM10 for BEST Invest);

+ No lock-in period (deposit & withdraw anytime).

Cons:

- Funds’ return can be impacted by low-interest rate, albeit they are still better than FD.

- Minimal amount of management & trustee fees will incur.

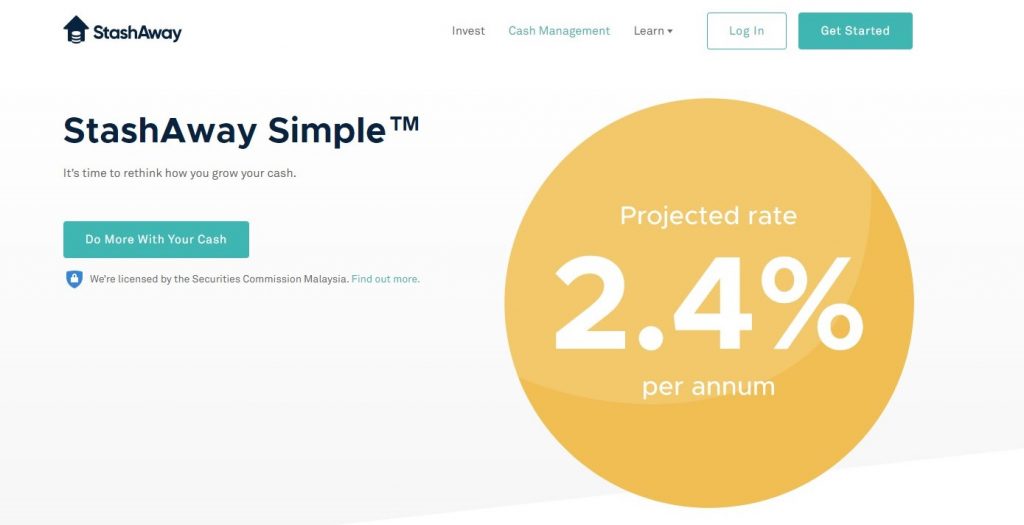

2. StashAway Simple

StashAway Simple is a cash management service from robo-advisor StashAway.

Essentially, StashAway Simple is also invested in Money Market Fund. However, I think it deserves its own place in this article due to its unique value proposition as shown below:

Historical Return: Between 3.6 - 3.7%/annum (data taken from the historical performance of Eastspring Investments Islamic Income Fund*)

Projected Return: About 2.4%/annum (this is an estimated potential return and SHOULD NOT be compared to the historical returns of other funds)

Pros:

+ Lower fee structure compared to typical Money Market Funds (~0.165% vs ~0.5%/annum). There’s no management fee from StashAway though there’s a minor fee charged by the underlying fund manager.

+ Zero barrier of entry. You can literally start using StashAway Simple at any amount you want.

+ No lock-in period (deposit & withdraw anytime).

Cons:

- The cons listed under Money Market Funds.

*The underlying fund of StashAway Simple is Eastspring Investments Islamic Income Fund that invests in Islamic debt instruments offered by financial institutions. You can find out more about the fund HERE.

3. Bond Funds

Bond Funds are mutual funds that mainly invest in bonds (okay haha what am I doing here).

Essentially, when we invest in a bond fund, the money collected from investors will be pooled together to buy various bonds (ie. debts from governments and corporations) with different yields & maturities.

Unlike Money Market Fund where the unit price is typically fixed, the value of Bond Fund units generally fluctuates inversely with interest rate.

In short, this means that the lower the interest rate, the higher the value of the bonds invested in a Bond Fund, which may lead to an increase in the value of the Bond Fund.

However, the opposite can also be true, where an increase in interest rate (which will definitely happen in the future) will lead to a drop in the value of bonds.

Return: Around 3-8%/annum, depending on the type of Bond Fund you invest in.

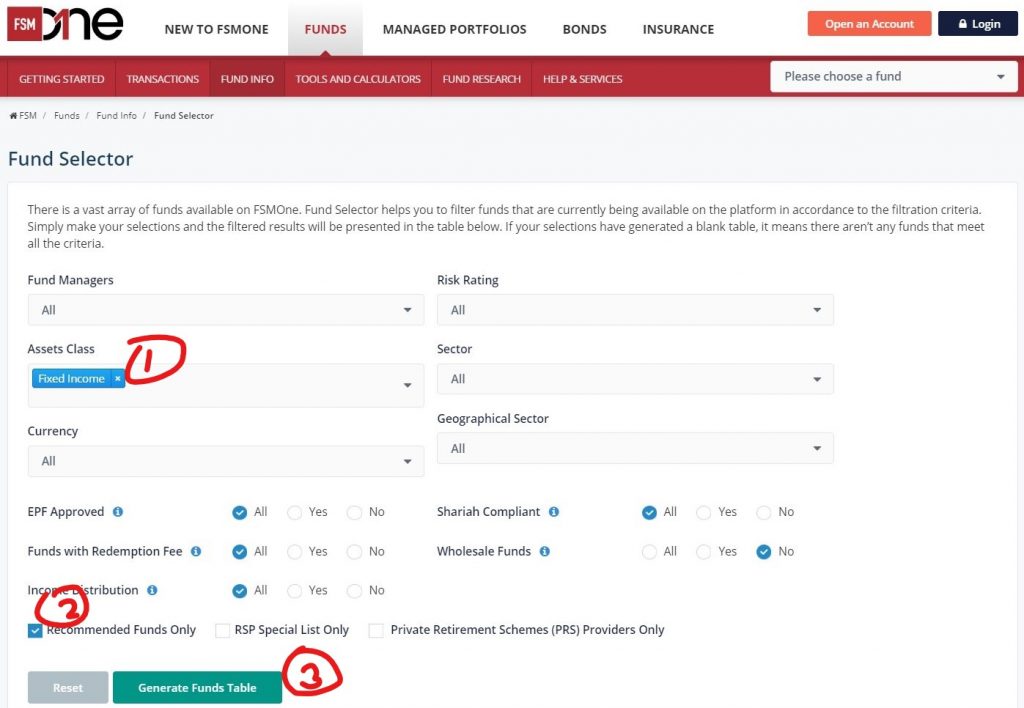

How to buy: Fund SuperMart (FSM)

Under FSM’s fund selector, select ‘Fixed Income’ under Assets Class. Then, if you want to filter your selections further, tick ‘Recommended Funds Only’ and click ‘Generate Funds Table’.

You’ll see a list of FSM’s recommended fixed income Bond and Sukuk Funds, and you can dive deeper into the particulars of the funds.

Note: Let me know in the comment section below if you want me to write more about Bond Funds!

Pros:

+ Lower interest rate generally increases the value of bonds within a Bond Fund.

Cons:

- The opposite of pros can also be true.

- Higher min. investment of RM1,000 for most bond funds.

- Typical management & trustee fees apply.

p.s. In terms of risk, Money Market Funds are considered to be less risky compared to Bond Funds, but it also offers a lower yield in return.

4. Low to Medium Risk Portfolio on Robo-Advisors (eg. StashAway, Wahed, MyTheo)

If you are looking for something more diverse, putting your money in low to medium risk portfolio on Robo-Advisor platforms like StashAway, Wahed or MyTheo may be a good option.

Typically, in a low to medium risk portfolio, robo-advisor platforms will allocate the majority of the funds towards bonds and money market instruments, alongside a minimal allocation to equities and commodities.

In short, a low to medium risk robo-advisor portfolio will give you a good bond-focused allocation, with a dose of exposure to asset classes like equities and commodities.

Pros:

+ Potentially higher returns due to exposure to the equity market.

+ Low barrier of entry

+ No lock-in period (deposit & withdraw anytime)

Cons:

- Potentially higher volatility and risk due to exposure to the equity market.

p.s. Use my: StashAway Referral Code and get 50% off your management fees for 6 months, Wahed Referral Code (Code: YIXCHI1) and get RM10 bonus fund and MyTheo Referral Code and get 100% off your management fees for 3 months!

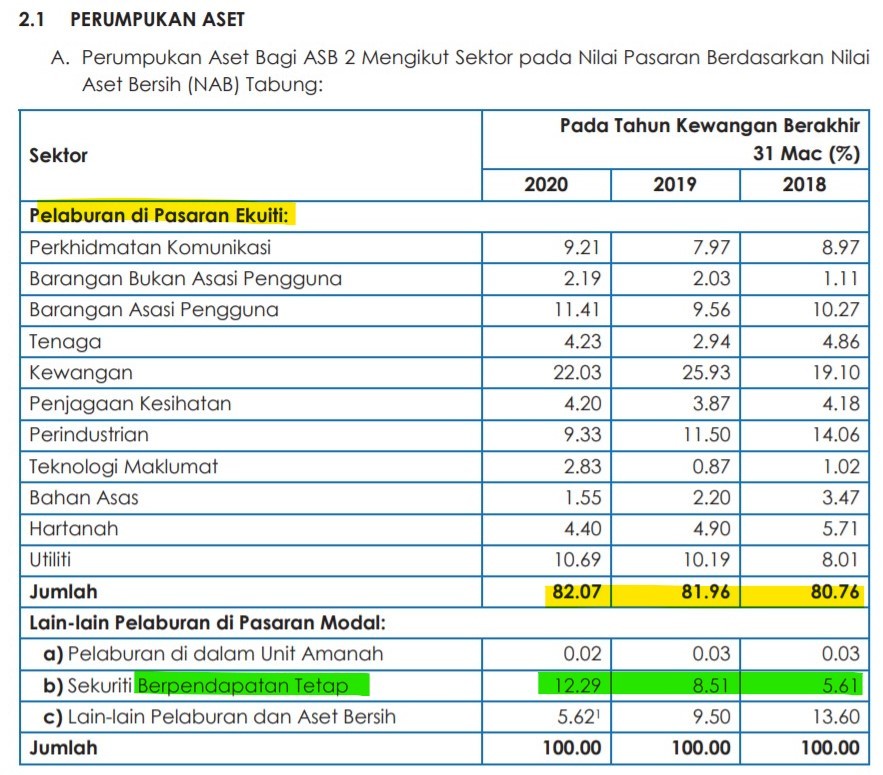

But hey, What About Amanah Saham Fixed Price Funds?

Now, some of you may have Amanah Saham Fixed Price Funds in mind, but there is ONE key reason why I’ll not include them in this discussion:

Reason: High exposure to equities (risky asset class)

One of the criteria that I mentioned earlier in this article is that the options must have the majority of its exposure in low-risk assets.

As such, Amanah Saham Fixed Price Funds (ASB, ASB2, ASB3, ASM, ASM2, ASM3) do not fulfill the criteria as the majority of these funds are parked with equities.

This simply means that the actual risk involved while putting our money in ASB is actually higher and hence in my opinion NOT a suitable choice for wealth preservation purposes.

No Money Lah’s Verdict: Explore Your Options in this Low-Interest Rate Environment

With the low interest rate environment that we are living in right now, it is crucial for us to explore alternatives beyond FD to preserve the value of our hard-earned money.

Be it for emergency or savings, I think the options mentioned in this article will be suitable for most people to get started.

Have you start placing your money with any of the options mentioned above? Did I forget to mention any other options in this article?

Let me know in the comment section below – can’t wait to hear from you!

Disclaimer: This article is produced for informational purposes only and SHOULD NOT be viewed as a buy/sell advice. Please seek financial professionals before making a financial decision.

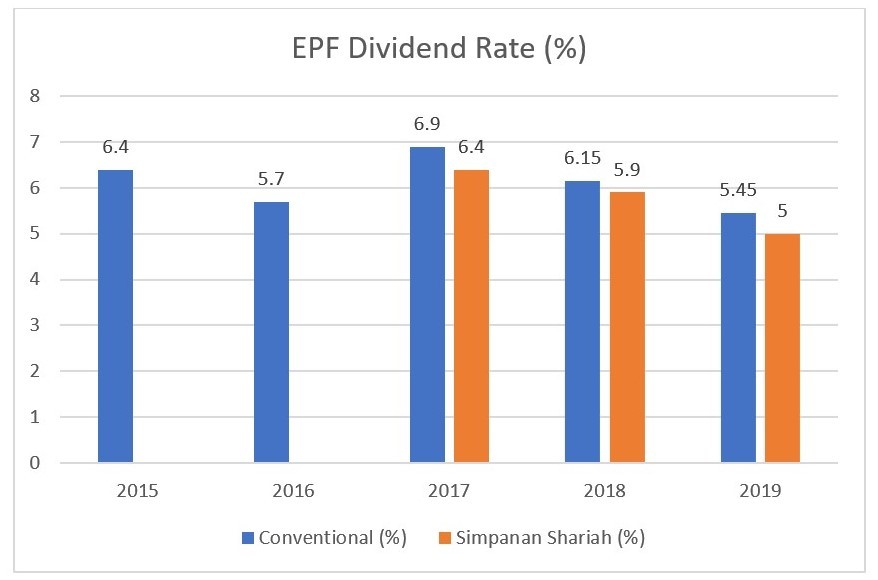

How to Diversify & Grow Your EPF Savings? (psst.. Tell your parents about it too!)

Retirement supposed to be a phase in life where we finally put down our burden in life and start enjoying life, right?

However, according to EPF, 70% of members who withdraw their savings at age 55 use up their savings in less than a decade after retiring.

Simply put, for most people, having a good retirement life seems to be a huge challenge.

The challenge, though, is to figure out ways for us all to retire comfortably in the norm of the rising cost of living and stagnant wage growth.

Now, to be fair, for you to better prepare for your retirement, you probably should contribute more to EPF.

Considering that is done, is there any other way for you to diversify & grow your EPF savings beyond the boundaries of returns that you are getting from EPF themselves?

(Yes, there is a way – share this with your parents too!)

EPF Members Investment Scheme (MIS)

EPF MIS is an initiative by EPF to allow eligible members (eligibility details below) to invest in EPF-approved unit trust funds in order to allow members to diversify and potentially grow their retirement savings.

There are essentially 2 ways for a qualified EPF member to take advantage of the MIS initiative.

One of them is via a Fund Management Institution (FMI) agent that’ll conduct face-to-face advice while aiding members with fund selection & document submission.

On the other hand, the alternative way is via EPF’s latest i-Invest online platform.

Introducing EPF i-Invest

EPF i-Invest is an initiative introduced by EPF in August 2019 to allow fellow EPF members to diversify their EPF savings into EPF-approved unit trusts under the Members Investment Scheme (MIS) – all at the convenience of our very own devices.

Under EPF i-Invest, eligible members can diversify up to 30% of the amount in excess of the basic savings in Account 1 into EPF-approved unit trust funds.

Simply put, we now have more flexibility over where their EPF funds are being invested.

Source: EPF

Okay, Which Fund Manager Should I Use? (hint: Principal Asset Management Berhad)

As of now, there are 10 financial management institutions that you can choose from to invest via EPF i-Invest.

Of all, Principal Asset Management Berhad (“Principal”) is an established fund manager that has been running award-winning funds since 1994.

One of the highlights of investing your EPF funds with Principal EPF i-Invest is that there will be no sales charge (a.k.a. 0% sales charge!*).

Simply put, you can save up on your upfront fee to invest in EPF-approved unit trusts!

But personally, I think the biggest opportunity here is the chance for members to DIY their EPF investments (ie. research, buy & sell anytime) all at the convenience of their devices.

EPF-Approved Funds from Principal Asset Management

As of the time of writing, there are 30 EPF-approved funds (both conventional & shariah-compliant) that are being offered by Principal for members to invest via EPF i-Invest.

I can’t go through every single one of them, but these are 5 highlighted funds by Principal Asset Management that you can check out.

- Principal Greater China Equity Fund | 7-year Annualized Return (31/12/2012 – 2019): 13.56%

- Principal Global Titans Fund | 7-year Annualized Return (31/12/2012 – 2019): 12.59%

- Principal Asia Pacific Dynamic Income Fund | 7-year Annualized Return (31/12/2012 – 2019): 11.87%

- Principal Asia Titans Fund | 7-year Annualized Return (31/12/2012 – 2019): 10.56%

- Principal Islamic Asia Pacific Dynamic Equity Fund | 7-year Annualized Return (31/12/2012 – 2019): 7.35%

Source: Principal

Are You Eligible to Invest Your EPF Fund using EPF i-Invest?

For one to take advantage of the investment using EPF i-Invest, you’ll have to be:

- A Malaysian, OR a Permanent Resident (PR), OR a Non-Malaysian that is registered as EPF Member before 1 August 1998

- Have sufficient savings with the EPF (more below)

How would we know if we have sufficient savings with EPF?

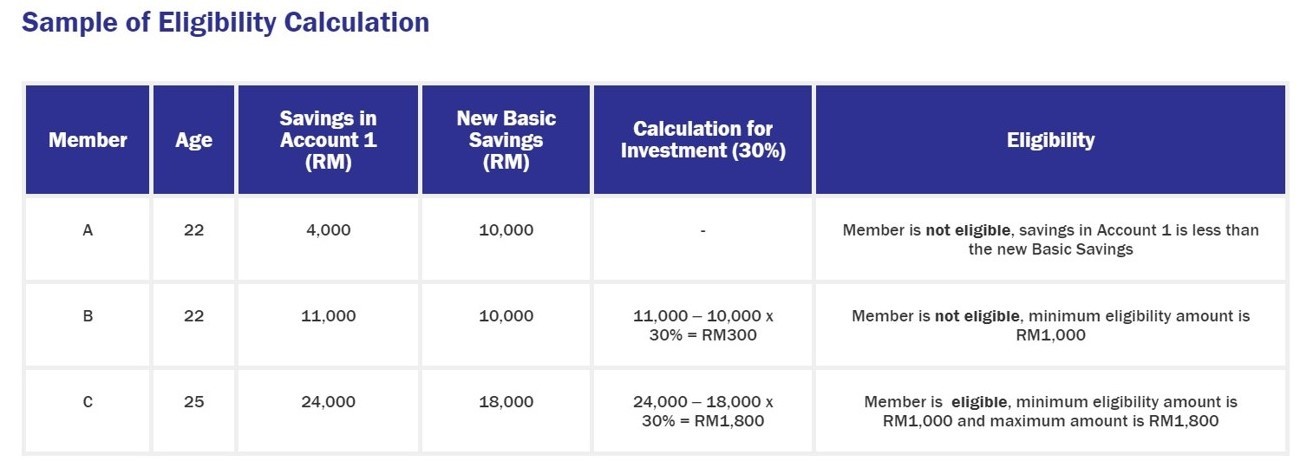

Essentially, for an EPF member to be considered to have ‘sufficient’ savings to invest via EPF i-Invest, one will have to have an excess of savings in Akaun 1, beyond the basic savings amount set by EPF according to a member’s age.

Then, a member will be able to use 30% out of the excess savings (minimum RM1,000) in Akaun 1 to invest in unit trusts through EPF i-Invest.

Below is a sample of eligibility calculation:

To get more information on EPF’s basic savings requirement, check out the link HERE. Otherwise, you can also view, at a glance, the amount that you are eligible to invest by logging in to EPF i-Invest.

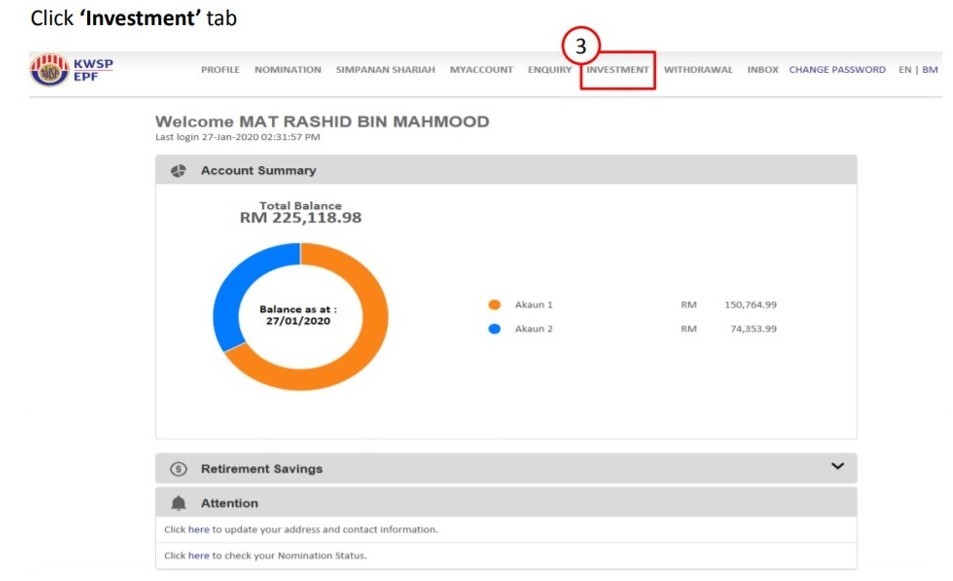

How to Invest via EPF i-Invest?

EPF i-Invest is essentially a feature under EPF’s digital platform – EPF i-Akaun.

Hence, to get started to invest with Principal Asset Management via EPF i-Invest, an EPF member will first have to get an EPF i-Akaun.

If you (or your parents) do not have one, be sure to head over to your nearest EPF office to open your account.

Once you are done with that, just follow these 4 simple steps:

Step 1: Login to Your EPF i-Akaun

Step 2: In the main menu, click ‘Investment’, then select ‘Transaction’, followed by ‘Buy’.

Step 3: Select “Principal Asset Management Bhd” as your Financial Management Institution (FMI) and choose your preferred fund.

Step 4: Checkout with “Principal Asset Management Bhd” and complete your transaction.

Principal EPF i-Invest New Investor Promo (yay!)

Principal is now rewarding new EPF i-Invest’s investors with a special reward!

From 10/9/2020 to 31/12/2020, receive RM50 Touch ‘n Go eWallet reload pin when you start investing with Principal through EPF i-Invest.

Terms & conditions apply. You may refer to the T&C here.

No Money Lah’s Verdict

With technology enabling innovation in the financial industry, I am happy to see that we have more flexibility to use our retirement savings in EPF to gain access to different investment solutions to diversify and grow our savings – all at the convenience of our fingertips via EPF i-Invest!

Now, are you or any of your family members eligible to invest using EPF i-Invest?

Be sure to check it out, and start growing your retirement fund today!

Disclaimer: Investment involves risk. As a general rule, you should only trade in financial products that you are familiar with and understand the risk associated with them. Click HERE to find out the specific risk and details of the funds mentioned in this article.

p.s. This article is kindly sponsored by Principal Asset Management.

Is Demo/Paper Trading a Mistake?

Imagine yourself being the manager of an airline company.

Would you allow a junior flight school student to fly a real plane for you, even though this student may have read and understood the theories on how to operate a plane?

By now, you may be thinking:

“Ridiculous, of course no!”

Hey, I figured the same too.

I’d throw this fella into multiple flight simulations and make sure that this flight school student is able to follow standards & procedures for a flight.

More importantly, I’d not want this soon-to-be pilot crashing my real planes if he/she can’t even handle landing the plane safely in a simulated environment.

Make sense, right?

I hope I have made my point of this article by now, but if not, here it goes:

Putting a junior flight school student into simulations is exactly the same as you going through the demo or paper trading phase when you first started investing or trading.

Essentially, you are doing yourself a HUGE favor by making sure that you can follow the rules and strategies consistently in a risk-free environment.

Here’s the thing:

At the beginning of your investing or trading journey, it’s not about making a lot of money. It’s not even about having a ‘feel’ with putting in real money into the market.

It’s about you having the discipline to follow the rules and processes and learn the foundation properly without additional emotional baggage.

Honestly, if you can’t land a plane safely in a simulated environment, what makes you think that you can land a real plane in reality – before crashing a few costly planes and hurting yourself (and others) badly in between?

I believe I’ve made my point clear.

p.s. Related Read: Here's What I’d Do if I Had to Start My Investing Journey All Over Again

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.

The Art of Working for Yourself

A lot of people have the dream of firing their boss and start working for themselves.

There’s nothing wrong with the dream.

What’s wrong is their unrealistic expectation on this matter, especially at the start:

Sleep and wake up anytime you want.

No deadlines.

Freedom of time.

Unfortunately, these ideals are far from the truth.

Instead, these are what’s going happen when you start working for yourself:

The constant guilt of waking up late and realizing that you have lost half of your workday.

Trying to squeeze multiple deadlines into a week, and/or feeling totally useless when you are not doing anything.

You have the FLEXIBILITY of time, not the FREEDOM of time. This means that working on weekends is totally normal.

Working for yourself is an art.

The art of self-discovery.

The art of self-discipline.

The art of finding structure when none exists.

p.s. Art takes time.

Rogue One is a new weekly 1-min article series where I share my random thoughts and ideas.