Financial Independence: Is Increasing Your Income or Reducing Your Expenses More Helpful?

Imagine waking up tomorrow, and going to work because you enjoy the things that you do, not because of the paycheck every month?

Alternatively, you could also retire altogether, and head over to the beach if you feel like doing so.

Regardless of which option you choose, it feels amazing! The freedom of choice, action, and time are indeed the best things that can happen to any working adults.

This is what achieving Financial Independence (FI) can do for you:

FI is a state where your side/passive income (eg. investments, side businesses, rental properties) covers more than your expenses, that you do not have to financially rely on a full-time career anymore.

In this post, let’s explore how much do we need to achieve FI, PLUS a more interesting question:

Which is more helpful to achieve FI? Increasing your income OR reducing your expenses? (You’d be surprised!)

Part 1: How Much Do You Need to Achieve FI?

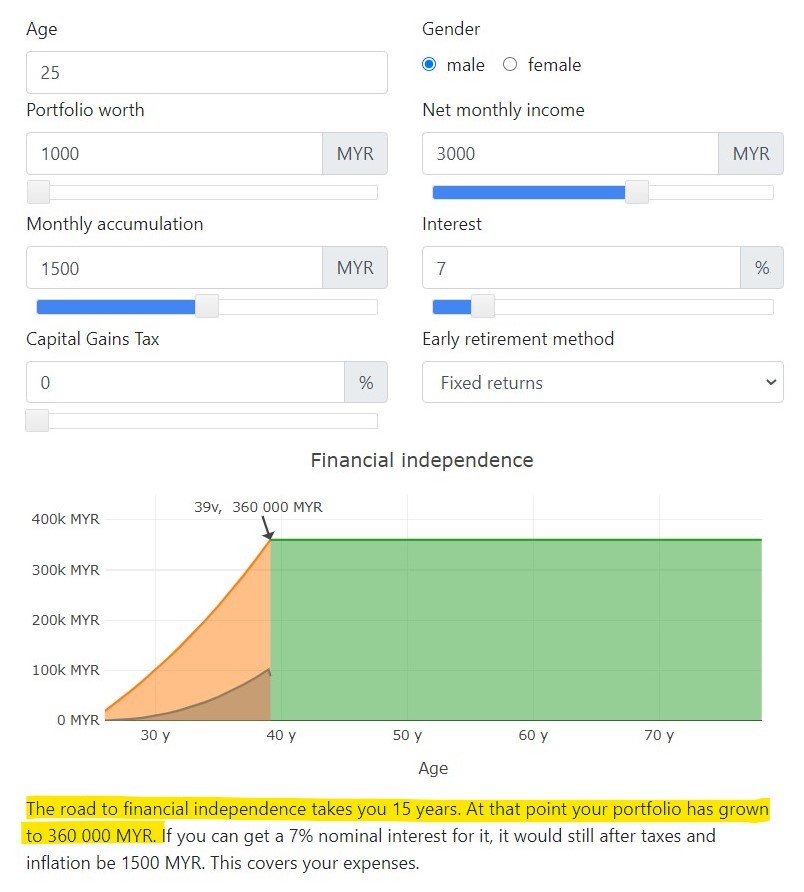

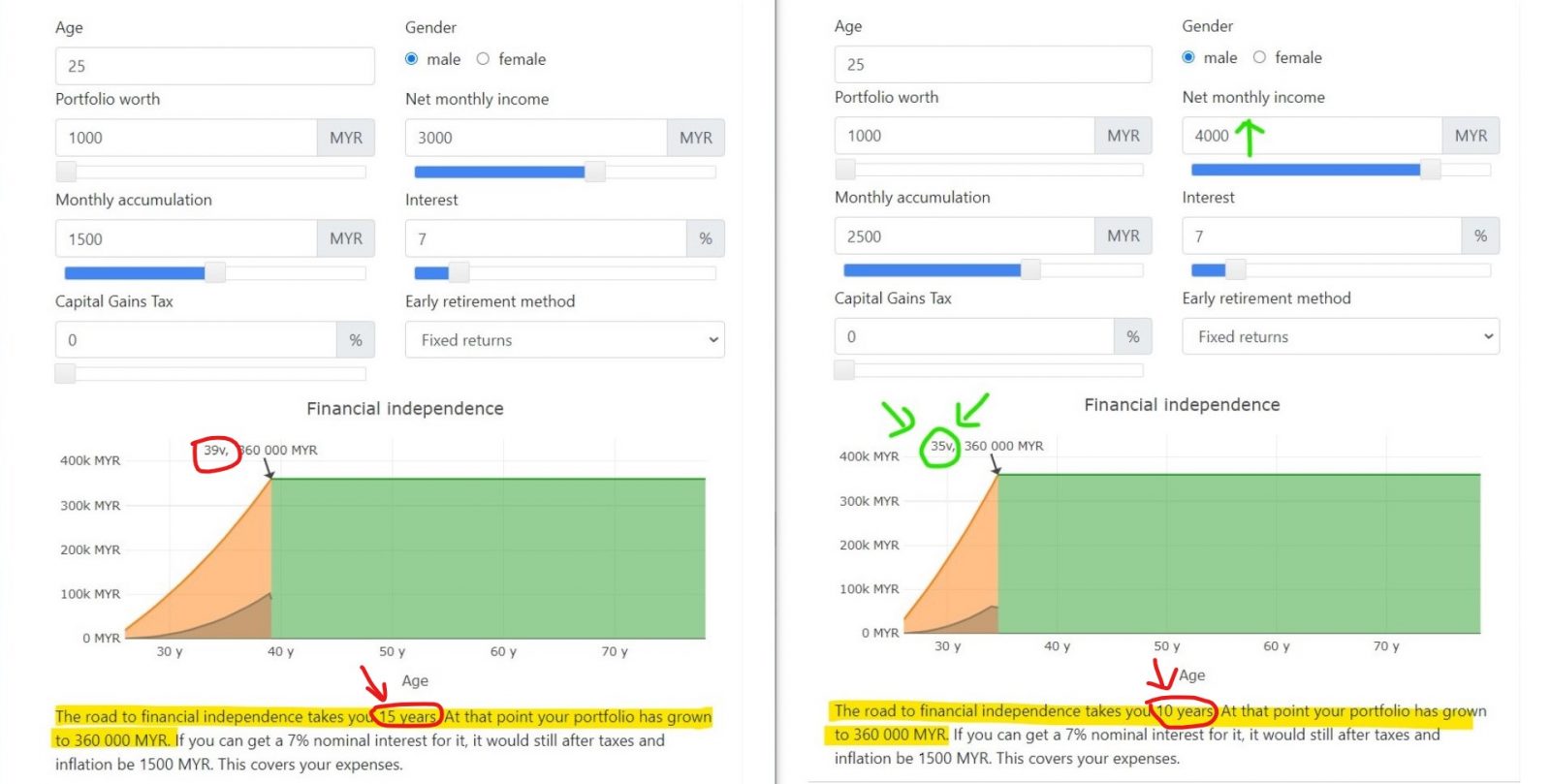

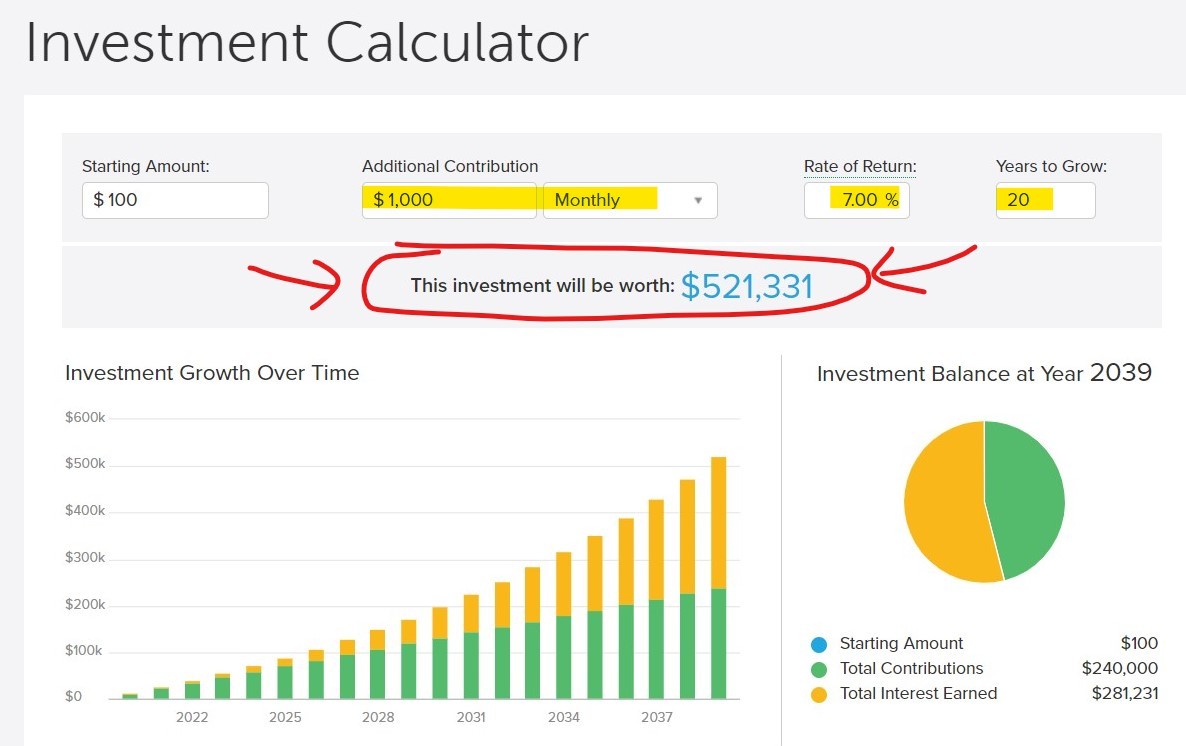

To calculate this, we’ll use a Financial Independence calculator HERE with several assumptions for this case study named Jake:

- Age: 25 y/o single male

- Starting capital to invest: RM1,000

- Net monthly income: RM3,000 (assuming no income growth for simplification)

- Average monthly expenses: RM1,500 (50% of income)

- Monthly allocation to invest: RM1,500

- Average annual return: 7%

- Retirement style: Fixed returns

- Inflation at 2%

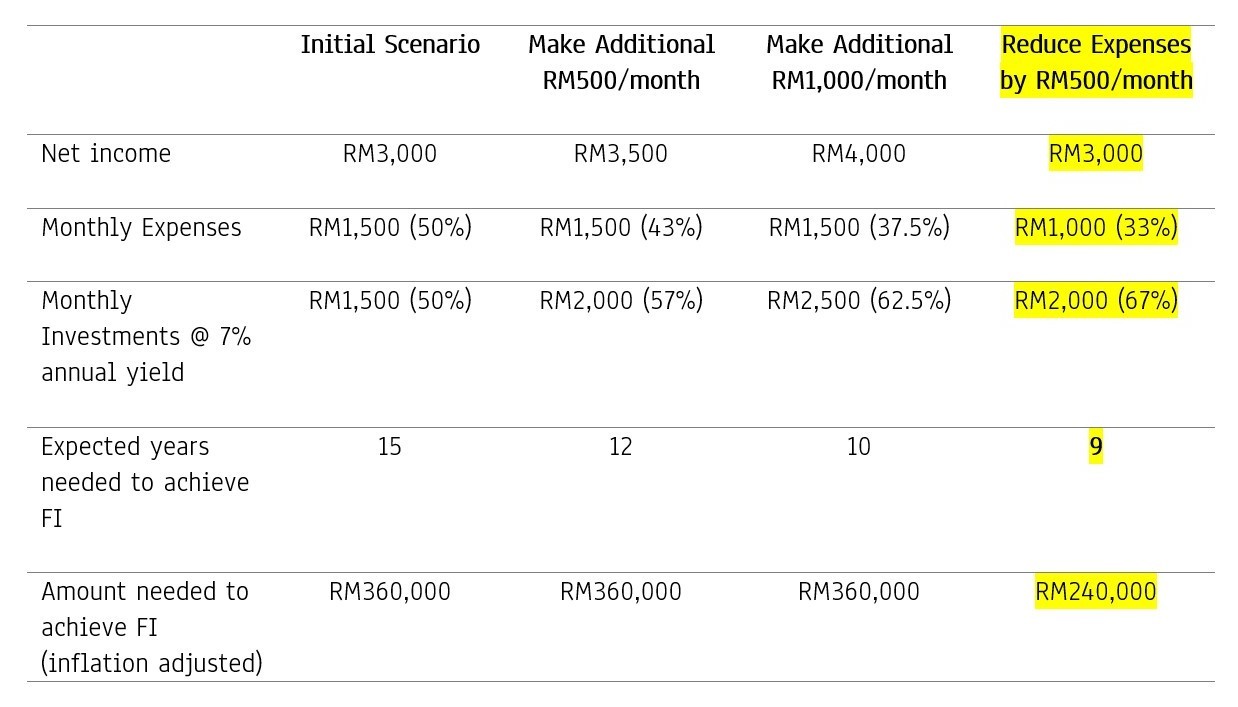

Now, keying in all the numbers into the FI calculator, Jake will be able to achieve FI (and retire if he wishes to do so) at 39 y/o with RM 360,000 worth of investments. Then, Jake can sit back and receive his 7% return every year, which would be enough to cover his expenses (inflation-adjusted).

Hey, of course, I understand that this is a rather simplified example with some variables that could change as Jake's life progresses (eg. Potential income growth with career progression, potential expenses increase due to starting a family). However, for anyone looking to gauge your FI journey, I think this calculator serves its purpose.

But wait, we are not even at the most interesting part of this discussion YET – read on:

Part 2: Increasing Your Income vs Reducing Your Expenses – which is more helpful?

Now, before you proceed, I want you to do a quick guess on your own:

Which one do you think is more helpful to achieve FI?

Let’s explore:

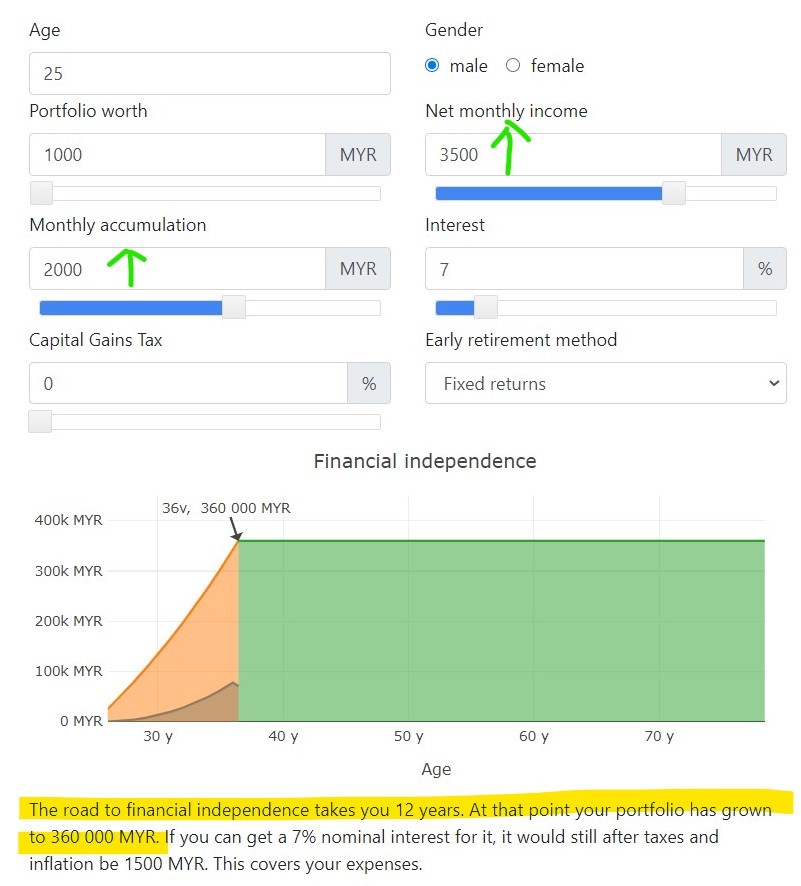

a. Increasing Income by RM500 (while still spending RM1,500/month) allows Jake to retire 3 years earlier.

- Age: 25 y/o single male

- Starting capital to invest: RM1,000

- Net monthly income: RM3,500 (initially RM3,000)

- Average monthly expenses: RM1,500 (43% of income)

- Monthly allocation to invest: RM2,000 (initially RM1,500)

- Average annual return: 7%

- Retirement style: Fixed returns

- Inflation at 2%

In the scenario above, Jake will be able to retire by 36 y/o (compared to the initial 39 y/o), with RM360,000 worth of investment assets.

To be frank, an RM500 increment in income is not super hard to achieve. This could be done by either striving for increment in his full-time job or using his downtime during the weekend to coach basketball or run an online store.

Not too shabby!

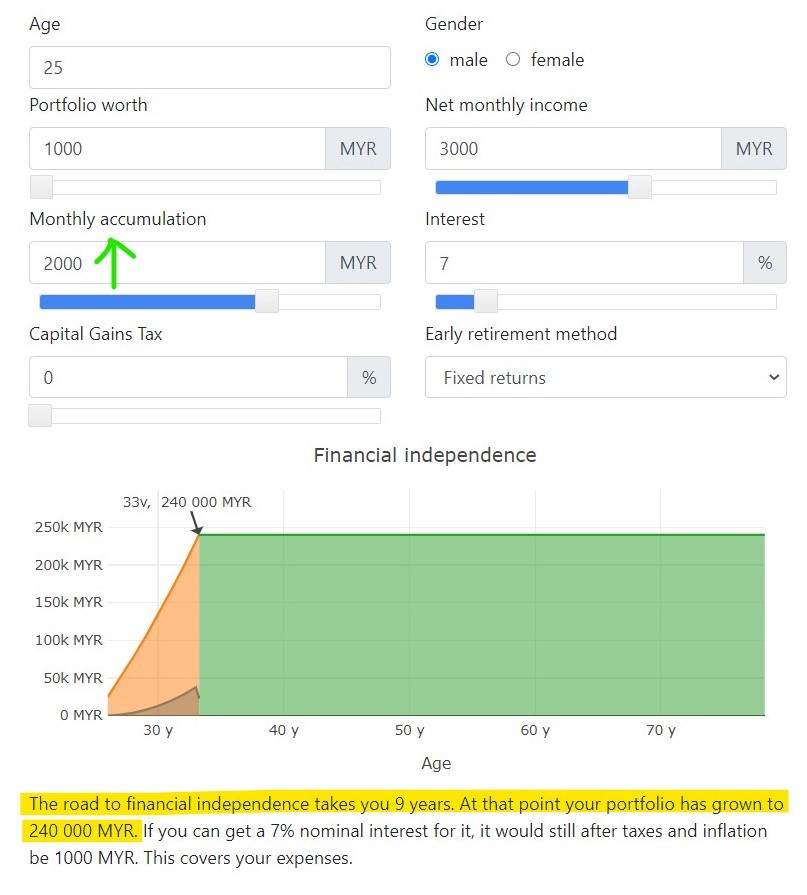

b. Reducing Expenses by RM500 (while still earning RM3,000/month) allows Jake to retire 6 years earlier.

- Age: 25 y/o single male

- Starting capital to invest: RM1,000

- Net monthly income: RM3,000 (stays the same with initial assumption)

- Average monthly expenses: RM1,000 (33% of income)

- Monthly allocation to invest: RM2,000 (initially RM1,500)

- Average annual return: 7%

- Retirement style: Fixed returns

- Inflation at 2%

In the scenario above, Jake could retire by 33 y/o (compared to the initial 39 y/o), with RM 240,000 worth of investment assets.

More surprisingly, compare this to the scenario above (increment in income of RM500), Jake could actually achieve FI (and retire if he wants) 3 years earlier!

Part 3: Lessons & Takeaways

The discovery above is quite refreshing to me, because my initial assumption was that an increment in income would always be more helpful than managing expenses.

Now, of course I did include some assumptions here:

- For both scenarios, income and expenses improve in the same proportion (ie. RM500).

- Whatever extra amount that’s earned/saved is invested.

Regardless, I think these case studies gave me 3 important takeaways, of which I’ll share them below:

Lesson #1: If you are keen to pursue FI, manage your expenses FIRST.

Managing your expenses is CRUCIAL. Reason being, how much you need to spend to live on DIRECTLY determines how fast you can achieve FI.

Mathematically speaking, your expenses have more impact over how much you earn when it comes to how long it'll take for you to achieve FI (refer photo below).

Yes, I agree with the fact that attempting to cut down RM500 in expenses is NOT going to be easy for most people.

That said, the key here is not about the absolute amount we manage to cut, BUT rather, the conscious effort to reduce unnecessary expenses in life.

If you have never look into your expenses before, you’d be surprised to find many expenses in life that could be cut down without having to sacrifice your overall happiness and fulfillment.

The best example is to bring along your bottled water while having lunch and skip that RM3 drink order. Just by adjusting this minor spending habit in life, you’d have an extra RM90 (RM3*30 days) to save/invest every month (equivalent to RM1,080/year) – pretty neat!

In short, if you are serious towards your long-term financial goals, try striking small wins by identifying & reducing all the minor & unimportant expenses in life.

Lesson #2: Increasing your income is also IMPORTANT.

Of course, there are only so many unnecessary expenses that you can cut in your life.

The next obvious step is to increase your earning power.

In the long run, the effort to increase income would be way easier compared to reducing expenses. Reason being, there is no upside to how much more you can make while there is a limit of how you can cut in terms of expenses.

In other words, unlike the scenarios above, you can definitely make more than RM500/month via a side hustle or a passion project.

Using our original case study above, if Jake can make an additional RM1,000 a month instead of RM500 (while still spending RM1,500/month), his journey to achieve FI is shortened from 15 years to 10 years.

The key here is all about your willingness to invest the extra time to work on your hustle.

Lesson #3: FI = 90%*(Habits + Consistency) + 10%*(Strategies)

This last takeaway is perhaps the most underrated, yet important point that I’ve learned:

Achieving any financial goals is 90% habits & consistency and 10% strategies:

Most people have access to free content about personal finance techniques via the internet. Most people know that adding unique value in their workplace leads to higher pay. Most people know that building a side hustle will increase their income.

But not everyone is willing to put in the work and practice to improve their financial lives.

Knowledge is one thing. Execution is another.

No Money Lah’s Verdict:

So, are you surprised to find that managing expenses are actually more helpful to achieve FI? (under some reasonable assumptions, of course)

Personally, I was pleasantly surprised, and this proves that I have much to learn when it comes to personal finances – adulting is indeed a life-long journey.

So that’s it for this week’s post! Did you learn or find some new inspirations from this article? Feel free to share with me at the comment section below! :)

Till next week!

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Simple: Understand Price Chart in 3 Mins (No Indicators Needed!)

How to Best Consume this Post:

Focus on the headers and bold sentences. If you want to explore more, read the explanation that follows the bold sentences.

--

Okayyyy the ‘3-mins’ thingy may be kind of clickbait-ish, but I am sure this post is going to be very helpful to you. That said, the ‘no indicators’ part of this post is 100% true.

This article is dedicated to friends & readers that are new in the market and may find stock charts intimidating.

First of all, unlike most charting books out there, I’ll not ask you to memorize all the crazy chart/candlestick patterns with ridiculous names.

Instead, let me use an example below to show you that you are already dealing with price charts everyday, even when you are not in the stock market.

Part 1: How does the Market Work?

First of all, I’ll need you to remember one thing:

The market is always seeking value.

This will make sense as you read through this article.

Next, let’s answer this crazily simple question:

Do You Know What Determines the Price of Bottled Water in the Marketplace?

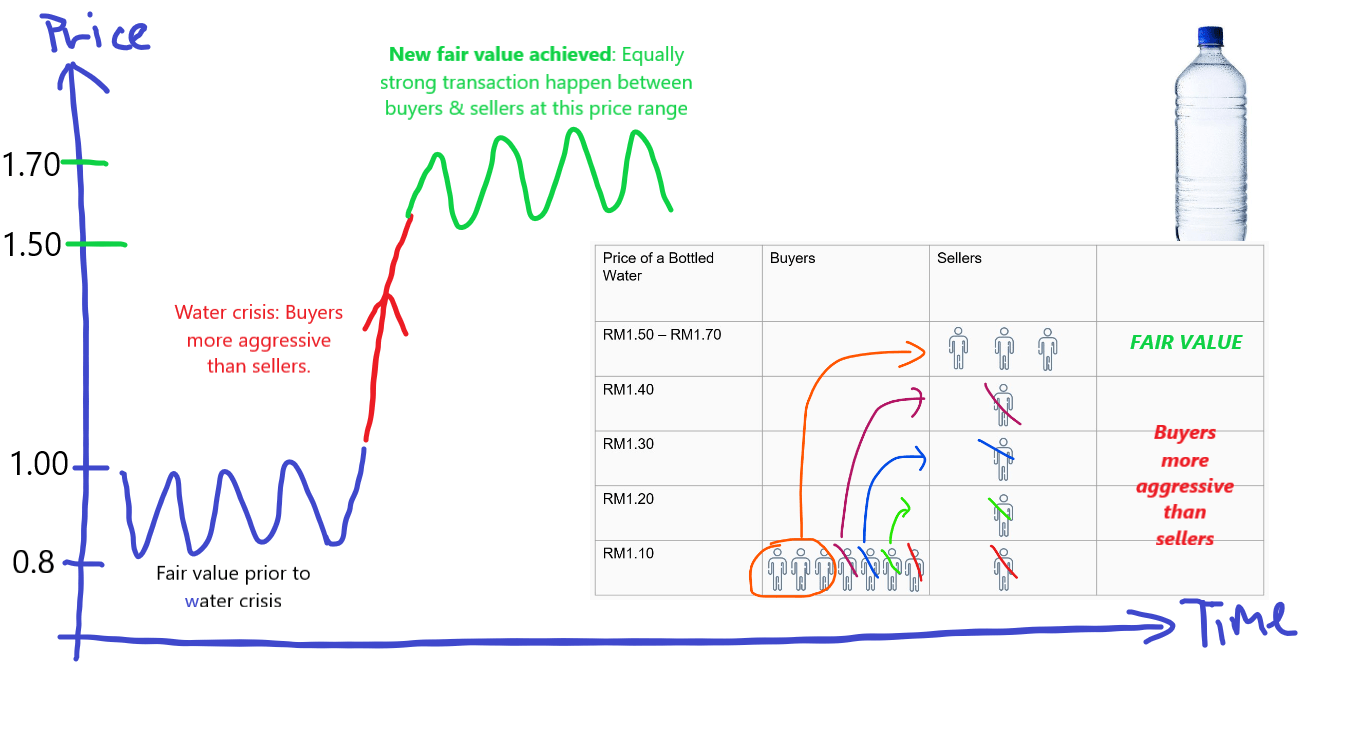

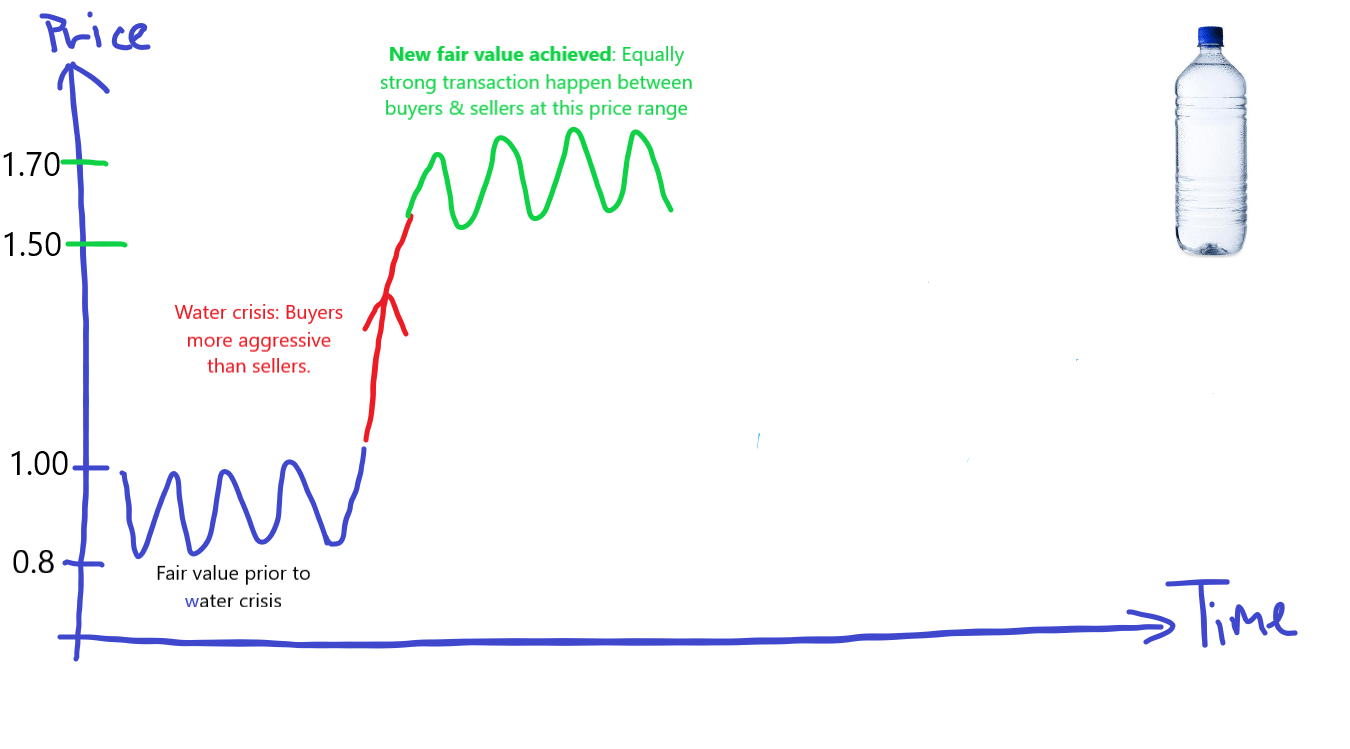

Let’s say the usual 500ml bottled water costs between RM0.80 – RM1.00. That’s the price that we have gotten used to and let’s call it the initial fair value range of a bottled water.

Fair value is the price where most buyers and sellers agree to transact on. In other words, RM0.80 – RM1.00 is the range that the majority market participants agree on as a fair transaction.

Now, I am pretty sure you can recall water disruptions – it’s no fun and causes a lot of trouble.

The worst thing in these incidents, assuming there’s no price control, is that the price of bottled water will go up in tandem with water disruptions.

So, WHAT caused the price of bottled water to go up in the marketplace during a water disruption?

Most people would say that it’s due to buyers more than sellers in the market (Buyers > Sellers).

However, this is far from the truth because for every buyer there’ll always be a seller (and vice versa) in the marketplace. Instead, the reason why bottled water increase in price is due to buyers being more aggressive than sellers in the market (Aggressive Buyers > Aggressive Sellers).

Understanding this seemingly minor difference is CRUCIAL.

In this case (refer figure below), buyers are way more eager to purchase bottled water below RM1.50, compared to the sellers that are willing to sell at price below RM1.50.

Hence, aggression from the buyers caused the available supply below RM1.50 (a.k.a. sellers that are willing to sell below RM1.50) to be cleared up extremely quickly – causing an imbalance state in the marketplace.

This state of imbalance turns balanced at the value range of RM1.50 – RM1.70. Meaning, RM1.50 – RM1.70 is the fair value that most buyers AND sellers are willing to transact during a fundamental marketplace shift like a water disruption.

In short, in this scenario of water disruption, the sellers are never lesser in number compared to the buyers. In fact, they exist, just that majority of them (the sellers) are only willing to transact at a higher value (RM1.50 – RM1.70).

The new fair value of RM1.50 – RM1.70 is where the MAJORITY buyers and sellers agree to be fair and are willing to transact for a bottled water with equal aggression.

So, what’ll happen when the government announces that the water disruption is resolved?

The price of bottled water will drop, this time sellers being more aggressive than buyers along with the drop. This will continue until a new fair value is achieved, where both parties are willing to transact with equal aggression.

But the question now is, where’s the most likely fair value of the bottled water now?

Most probably nearby the prior fair value of RM0.80 – RM1.00, right?

What you’ve read is part of what we called the Auction Market Theory (my simple summary, at least).

While the financial market may be more complex than a bottled water market, the same concept still applies.

If you understand the bottled water example, you are way closer to understand how a stock market price chart works than you think.

Part 2: Simple - Understand Price Chart without Indicators

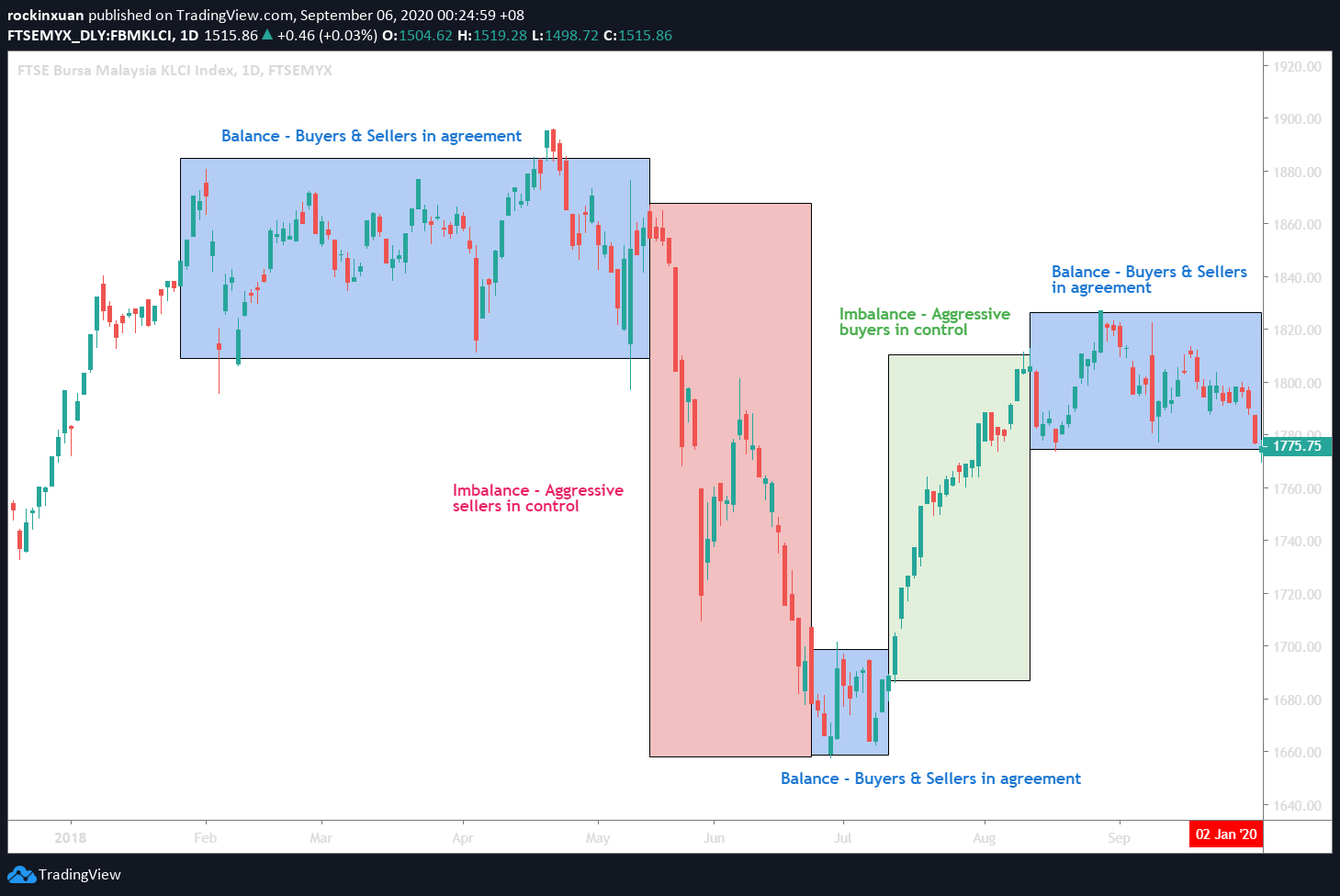

Essentially, there are only 2 states in the market – balance and imbalance.

Again, just a quick reminder that the marketplace is constantly seeking value.

--

What is a Balanced State?

We are in a Balance State when the market is trading in fair value range (remember RM0.80 – RM1.00 for bottled water?), where buyers and sellers transact with equal aggression.

At times, a balanced state is also known as a corrective pattern.

A balanced price chart indicates that the majority of buyers and sellers are happy to transact around the range of price that is deemed fair at that moment in time. Value is formed and none is stronger than another in terms of aggression.

What is an Imbalance State?

We are in an Imbalance State when the market is trading out of fair value.

At times, an imbalance state is also known as an impulsive or trending pattern.

Regardless, an imbalance state tells us that one side of the market participants is more aggressive than the other.

Knowing this is extremely powerful, as this means that we can understand what the market is trying to convey to us without using any crazy hoo-haa indicators.

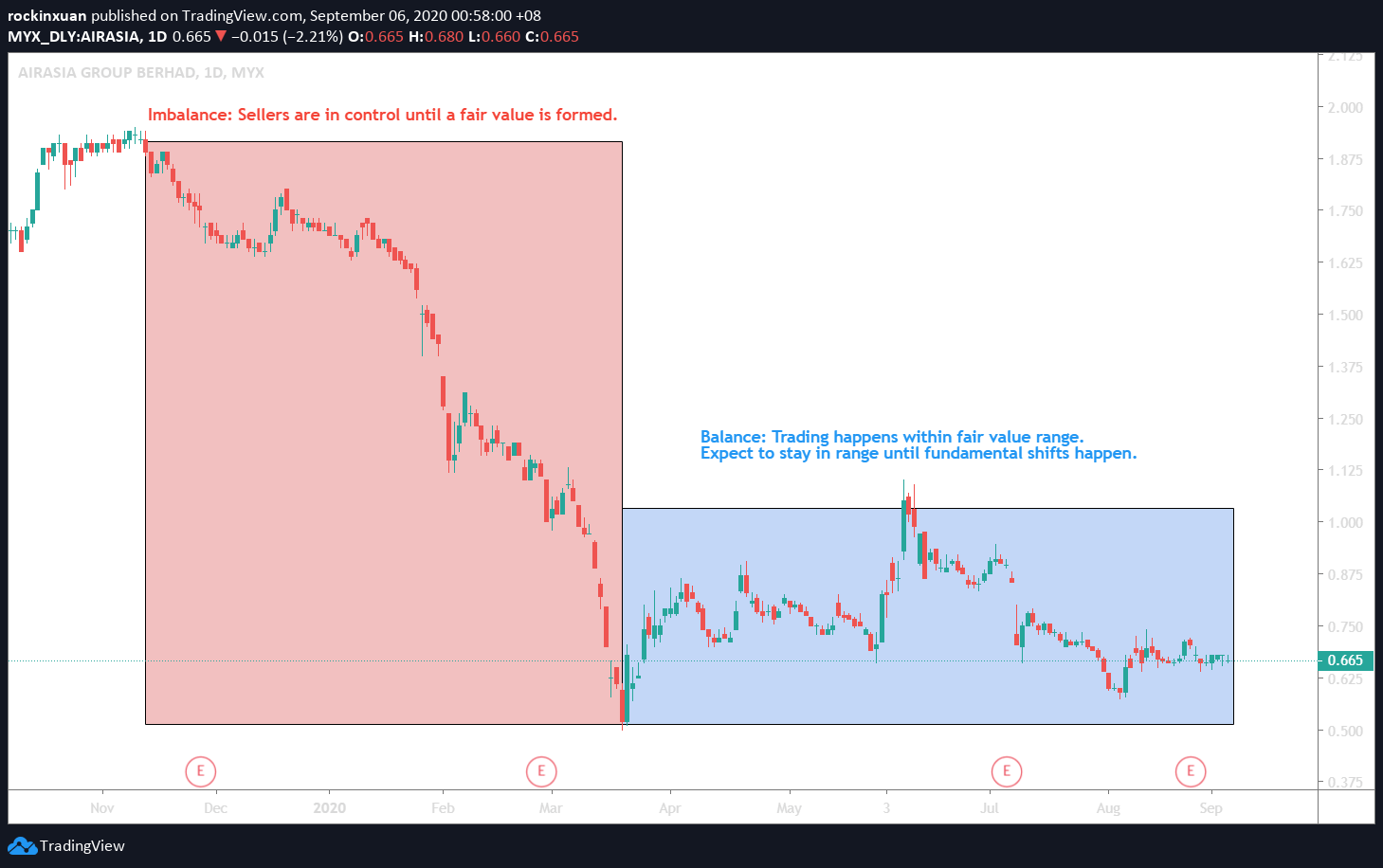

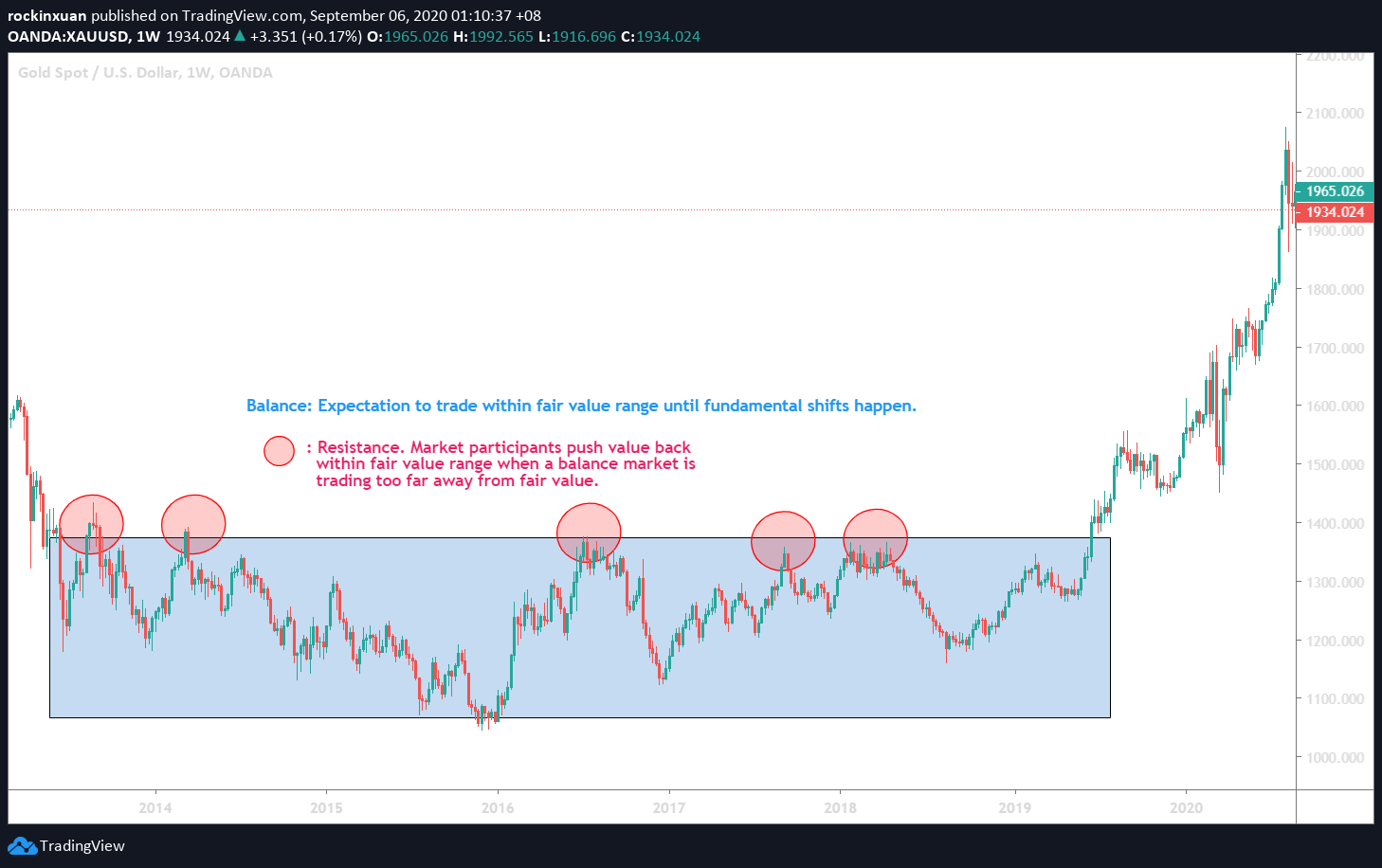

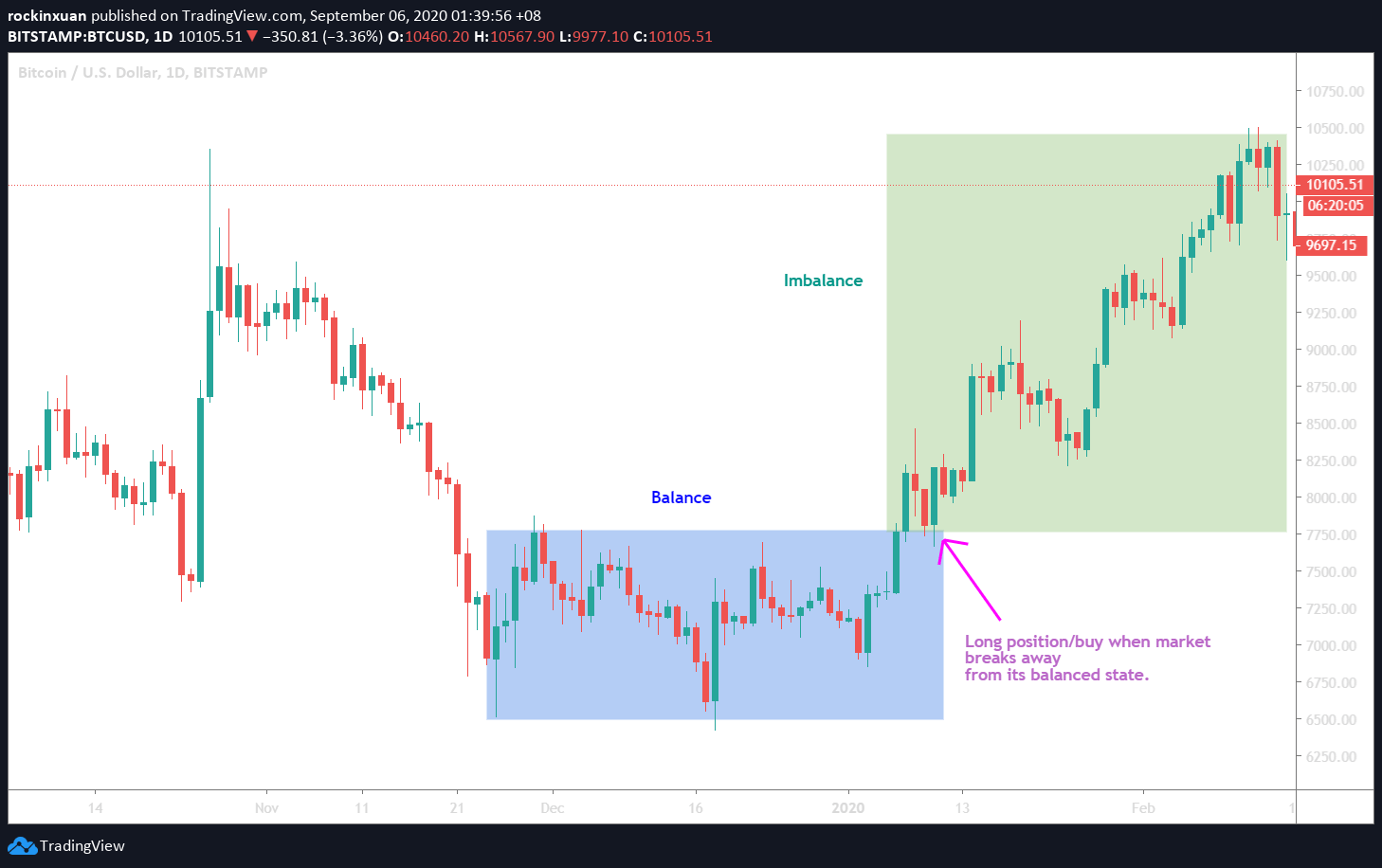

The next chart image is going to show you how close of a resemblance the stock market is to the bottled water example:

In short, the market, regardless of everyday items or the financial market works in an auction process where its participants (buyers & sellers) are constantly seeking value.

Part 3: How to Use This Knowledge to Your Favor?

Knowing how the market works (value-seeking via Auction Market Theory) and the 2 states of the market (balance & imbalance) is important.

Here are 3 things, among all, that you can do with this understanding of the market:

1. Identify the overall context and behavior of the market.

A balanced market shows us that market participants (buyers & sellers) are generally happy to be trading within the fair value.

Thus, we can expect them to keep doing so until there’s a fundamental shift in the market (like the bottled water example).

An imbalanced market tells us that either the buyers or sellers are acting more aggressively than the other in the market.

This means that one side is in control until a fair value area is formed. Hence, generally, we should not try to go against the side that is in control of the market. (eg. Stay away when sellers are obviously too aggressive and show no sign of forming fair value)

2. Identify potential support & resistance zone.

A support zone in the market is where buyers are willing the absorb the aggression of the sellers in order to hold a certain price zone.

A resistance zone is where sellers are willing to absorb the aggression of the buyers in order to hold a certain price zone.

Using the knowledge of auction market theory alongside balance/imbalance state, we can identify potential support & resistance in the market, as shown below:

3. Identify potential entry & exit opportunities.

Since the market will only behave in 2 states, ie. balance, and imbalance, this enables both longer-term investors and short-term traders to identify potential entry & exit opportunities:

Essentially, opportunities occur when (1) value moves away from balance to imbalance, or (2) when the value goes towards the edge of fair value in a balanced state:

No Money Lah’s Verdict:

Hopefully this article has been helpful and insightful to you!

At the end of the day, what I am trying to point out is that the chart is not intimidating. It is merely telling us what the market participants (buyers & sellers) are trying to do and behave.

With practice, anyone can use a pure price chart to their advantage to understand market behavior to a large extent.

That said, it should be noted that the Auction Market Theory is not the perfect holy grail to start milking money off the market.

It tells us how the market works, but it does not dive into details like volume and detailed price action structures. These are also crucial pieces of puzzles in a decision-making process, especially in deciding entry & exit, targets, and stops.

However, those are for future discussions and I believe this article serves as a good guide for anyone interested to learn more about charts.

--

How do you like this article? Do you have any burning questions to ask? Share with me at the comment section below! :)

Disclaimer: This article is written with my best understanding of the Auction Market Theory & price chart, and should not be seen as a buy/sell recommendation. Seek a licensed financial planner before making any investment decision.

--

Resources:

- Auction Market Theory: https://www.youtube.com/watch?v=y-0k8PaFYPM

- What Causes the Market to Move: https://ftmo.com/en/what-causes-markets-to-move-and-how-you-can-profit-on-it/

3 Ideas About Money & Consistency

3 IDEAS FROM ME:

#1:

It’s better to start investing at RM50 consistently every month, than to only start investing when you have RM100,000 in your account.

Making small, consistent progress is much better than doing nothing at all. (p.s. I recommend StashAway)

#2:

Building a RM30,000 emergency fund seems intimidating.

Much easier when you can save RM28 everyday for the next 3 years (36 months).

Huge financial goals can be crazy simple when we break them down into small, actionable steps over a long period of time.

#3:

Most people need consistency more than they need intensity.

Intensity:

- Trying to flip RM100 to RM5000 in the stock market in a short period of time (eg. 1 week)

- Trying to save 90% of income by living an extremely frugal lifestyle.

- 1-month of no-spend day.

Consistency:

- Save and invest a consistent amount every month.

- Review personal finances every month/quarter.

- Spend a healthy yet reasonable amount of money on personal growth and self-care every month.

Intensity makes a good story. Consistency makes progress.

A Simple Trick to Achieve Giant Goals

Hey friends,

One of the things that I’ve always wanted to do since starting my blog 2 years ago is to give it a visual and backend upgrade.

To me, just like how we’d present ourselves when meeting people in real life, my blog is a direct representation of my identity online.

Being a total stranger to web design, revamping my blog is truly the biggest project waiting for me to tick off in my to-do list.

Guess what?

I have been slacking on this project since the start of 2019, until things really take off this month (finally!).

In the month of August alone, I’ve managed to revamp my blog in progress that I’d love it to be. Currently, I’d say I am around 60% done from the ideal state of my blog (check out my homepage, About Me, and Useful Tools section!)

How did that happen?

What pushed me to finally make progress to my long-overdue blog revamp?

Here’s the trick that I used:

I call it the Slow Burn approach.

Essentially, the Slow Burn approach is where I spilt up a giant goal (eg. Blog revamp) into a clear workflow with multiple small tasks, over a long period of time.

In human words, it means instead of trying to achieve a huge goal in a day or two, we break down that goal into smaller tasks where we work on little chunks over, say, a month.

In the Slow Burn approach, we focus on the consistency of small effort (a.k.a. Slow Burn) instead of the intensity of a few huge blows (a.k.a. Burnout).

The reason is particularly simple: because it is way (wayyy) easier to get things rolling.

Before this, I recalled myself being intimidated by the whole website redesign project and got so disappointed in myself for not making any progress in one of those days.

Using the Slow Burn approach, I list down my workflow and break them down into small chunks of simple tasks (eg. looking for reference/inspiration, which Wordpress plugins to use) – now the whole project suddenly becomes reasonably actionable!

I really like this approach especially when it involves huge, intimidating goals because it helps me see those goals in a much simple manner.

If you are facing similar hurdles like myself, be it to start a business, Youtube channel, blog, or learning a new skill, I highly recommend using the Slow Burn approach.

Hopefully this helps and wishing you an awesome week ahead – Selamat Hari Merdeka!

Yi Xuan

Why REITs will Play a CRUCIAL Role in My Journey to Financial Independence (FI)

This is weird.

Even after 2 years of creating content in the personal finance & investment space, this is actually my first post focusing on financial independence (FI).

Essentially, FI is a stage of life where your passively-generated income is able to cover your monthly expenses (Passive Income > Monthly Expenses). Once you achieve FI, you are free to make life choices without having to worry about your monthly bills.

In this post, let’s talk about Real Estate Investment Trust (REIT) Investing, and how REITs are playing such a CRUCIAL role in my journey to FI.

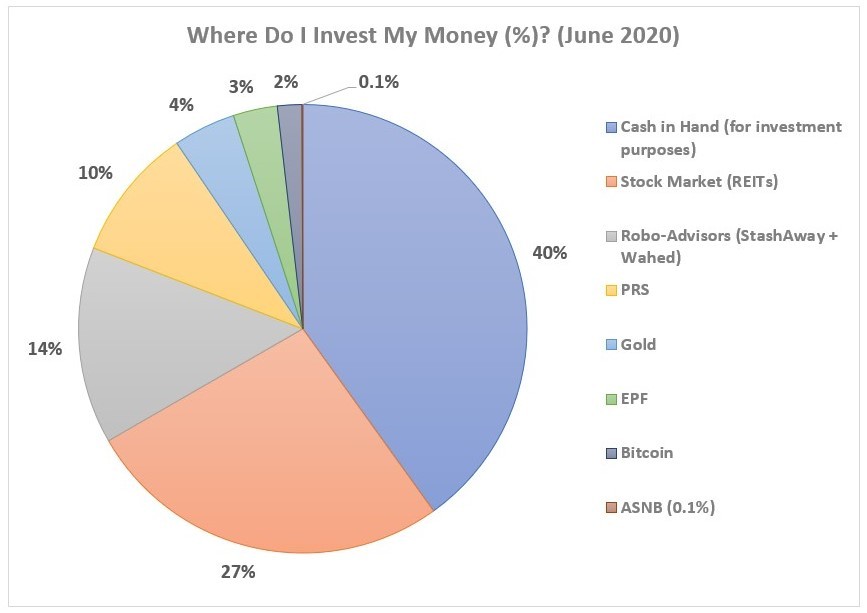

Related Read: How I invest my money as a self-employed person?

My vision on FI

If I can be honest, I do not have a hard, solidified end vision on my FI journey yet.

This is largely due to myself being self-employed which translates to potential income fluctuation (on the bright side, it also means I have huge, untapped income growth potential in my relatively early career path). Also, I do not have any commitments (eg. partner, children) in life (yet), meaning my life expenses will surely increase in the future.

Nevertheless, these make it extremely challenging for me to measure my FI journey in a conventional way (ie. Projecting income, investment returns & expected expenses over time), unlike other creators that have a stable-paying career in this space.

That said, even without a stable-paying job, that does not deter me from preparing myself towards FI*.

(*All 3 aspects of active income, minimal life expenses & solid investments play equally important roles towards FI. In this discussion, I’ll talk specifically about the investment side of the equation. )

Why will REITs Play a Crucial Role in My Journey to Financial Independence (FI)?

To be clear, there are many ways for us to achieve financial independence.

Some people do it via rental properties, some through businesses, and more. Personally, my current focus is to build a solid passive income foundation via REIT investing.

Here’re why:

#1 Consistent & Reliable Dividend Yield

Generally, REITs are loved for their consistent & higher than average dividend yield compared to other listed companies in the stock market.

Between 5 – 8% (sometimes more) in dividend yield per year, this makes REITs exceptionally well-received among investors seeking for a reliable realized income from the stock market (hey, that’s before accounting for potential capital gains).

Now, the part about ‘realized income’ is crucial for fellow FI pursuers.

This is because, for capital gains, your profit will always be in the form of unrealized (or paper) profit until you cash them out by selling your shares.

On the other hand, dividends from REITs are actual, realized profit that is paid to investors on a quarterly/biannual basis.

Meaning, given time and consistency, dividends compounded from REITs are actual passive income that I can actually spend & rely on to pay for my expenses if I ever decide to retire after achieving FI.

Personally, while small in the present, I am building my REIT portfolio so it’ll become a solid foundation of dividend income in years to come (read about ‘How’ below).

#2 Investing in REITs = a low capital option to get started in Real Estate Investment

It is in the blood of Asian families to own & invest in properties & real estate.

But here’s the problem:

Most young millennials (are we still young though?) are not able to afford one (confession: I am one of those), not to mention taking care of their own living expenses.

Hence, REITs become an excellent way for millennial FI pursuers to build a reliable passive income from listed commercial real estates at an extremely low barrier of entry.

At a few hundred bucks monthly, I invest in fundamentally solid REITs that’ll help me slowly build my dividend income foundation.

For me, investing in REITs every month is equivalent to me buying a piece of ownership, and becoming a ‘landlord’ of money-making assets like Mid Valley, Sunway Pyramid, KPJ hospitals, and more.

#3 Freedom of time

I do not know about you, but I have real bad experience seeing my close family members handling troublesome tenants and property maintenance related stuffs.

For me, I dislike doing all these and the whole idea about achieving FI is to live a life in our own terms.

Investing in REITs means I get to leverage on REIT managers’ expertise to handle all the dull & boring aspects of the business, while still getting paid consistent dividends by owning money-making real estate assets.

#4 For me, REITs are simple businesses that are easy to understand

Of course, I still have to do my research on the financial & earning report of REITs while picking which REIT to invest in.

That said, REITs financials are generally easy to understand as REITs are essentially just real estate companies that make money via rentals.

In short, suffice to say that investing in REITs long term is quite a low maintenance thing to do.

Related read: How REITs make money (and why it is important to you)

How I am Using REITs to Build My Passive Income Foundation:

Honestly, there’s nothing fancy about how I approach my REIT investments here.

To a lot of people chasing for headline stocks and excitement, what I do below would be boring & dull.

But hey, if you are interested in my dull routine, here you go:

1. Building up my holdings consistently

Generally, this is what I’d do with fundamentally solid REITs (ie. Healthy balance sheet, consistent/growth in income & distribution, favorable business condition).

As long as the particular REIT fulfill my criteria, I’ll accumulate its shares on a monthly basis.

Doing this consistently will help me build towards a respectable base of REITs holdings that pay good dividends in years time.

2. Reinvesting my dividends

For now, the dividends I received from my REIT investments are really peanuts.

Since they are so little in amount and I have no use of them, I’d reinvest the dividends into my REIT holdings.

Given time & patience, doing so will accelerate the compounding effect of the amount of dividends I’ll receive in the future.

3. Advanced: Entry & Exit on Price Action

On certain occasions where the situation is more complex, I’d use simple price action analysis to time my entry & exits.

That said, this is a personal preference and most people would not have to worry about this.

How much of REIT ownership is enough for me?

As I mentioned earlier, I do not have a specific end goal or vision on my FI journey currently.

My focus now is simply to get my dividend income foundation built up as much as possible with quality REITs.

Side note: As I give this article some thought, an RM500,000 worth of ownership in REITs shares would actually be quite decent as an initial goal. Assuming 7% in annual yield, that’d be an RM35,000 in dividend (or as I love to put it, around RM2900 in ‘rent’ per month!)

Challenges/Downside to REIT Investing in Pursuit of FI

Some people may take this section as a total downside of REIT investing. But for me, I take it as a positive challenge:

1. REIT investing can be boring compared to the hottest stocks in town

REITs are simple, real estate businesses.

In other words, it can sometimes be boring (but not as boring as property investing, personal bias hehe :P).

Coming from personal experience & observation of other young investors, this is dullness can be extremely hard to bear.

Instead, most young & new investors these days chase excitement in the market (no problem at all if they know what they are doing, but...). This makes investing in REITs more of an afterthought.

While the research does feel dull at times, but that’s totally okay since I am more than happy to exchange excitement for peace of mind.

2. Identifying quality REITs takes practice & experience

Like any investments, it’ll take time and effort to be good in REIT investing.

I started studying REITs when I was a university student, and it took years before I started to develop my skills & senses in the game.

Personally, even though I have broken down & simplified my whole research process, but time must be invested in financial statements & earning reports to really get the skills baked into ourselves.

3. Building up a respectable dividend yield from REITs take time, patience & consistency

This last point is the biggest challenge for most people.

The problem is, too many new investors go into investing with the mindset of making money, not accumulating assets.

The reality is, capital is built from our income, not from investments. We need money to make money.

To see meaningful monetary returns from investing, we’ll need capital from our income to accumulate income-generating assets.

Hence, many young FI pursuers with small starting capital gave up on REITs as they cannot accept the fact that It’ll take such a long time to build a reliable & respectable dividend income from REITs

Building a respectable dividend income from REITs will take patience & consistency.

Investors without these qualities will find this a downside of REITs.

No Money Lah’s Verdict

So here you go – Why and how REITs is playing a crucial role in my journey to financial independence (FI)!

If you are in the journey towards FI as well, hopefully, this post could be of inspiration to you to start the journey!

Just remember, there’s no right or wrong way to achieve FI, this post is just the way I am approaching my journey.

On that note, what are you doing with your investments in pursuit of FI? Feel free to share your insights with me at the comment section below!

--

p.s. If you are keen to learn about REITs, you will be interested in my REIT investing sharing session. Find out more HERE.

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Read this if You feel that Time Flies

Have you ever felt like time completely speed through the day, that you did not even notice it until you put down the work on hand?

I had a super busy work week last week. Guess what, the week just ended as if I have just snapped my fingers!

The crazy speed of time as we grow up can be daunting. It signifies that our time has become more and more valuable as we started to gain more responsibilities in life – family, career, personal finances, and more.

--

Most of us are the kind of people that realize that time flies, BUT do not embrace the reality that time REALLY flies.

Hence, while we know it’s impossible and not realistic, yet most of us would still pray for the time to pass slower.

On the other hand, the very few people that know that time flies, AND embrace the reality that time would be asking:

“What can I do to make the best out of my time right now?”

--

Time flies.

But the key here is not that time flies. The key here is to find people & things worth being occupied with our time, and goals worth pursuing for in our life.

We cannot control how we feel about the speed of time, but we definitely have a choice to decide our experience with time.

Wishing you a great week ahead :)

Yi Xuan

How to Lift Yourself Up Through a Tough Day?

Hey everyone.

I went through a super tough time last week battling against my self-doubt and productivity at work.

Working on my own means things like uncertainties and self-doubt will always be part of my life – and I acknowledge that.

But last week’s dose of self-doubt was way more intense than what I’d usually feel. Something beyond my coping mechanism.

If you were to ask me, it was due to the anxieties over my own career choices, ability, personal finances, and future – all the usual stuff that everyone worries about.

But that’s not the point.

The point is, it felt extremely heavy. Kind of like me dragging bags of sand while trying to sprint through the week.

Now, I do not claim to be a stress expert. But I believe what I did will be helpful to you, if you are having a tough day/week:

I Count My Little Wins

Yes, even during tough times or downright shitty day, I count all the little wins that I scored throughout the day:

- +1 Wrote a paragraph of my article!

- +1 Replied to an important email!

- +1 Able to focus for 30 mins w/o using social media!

- +1 Jogged for 15 minutes!

- +1 Learned how to do things differently!

That's 5 small wins in what seemed to be a bad day!

Yes, I may not be able to complete my intended article on that emotionally tough day, but hey, I managed to squeeze in a paragraph - not too shabby!

Here's the thing:

Most often, we tend to get overly critical on ourselves during tough times.

What if, instead of going through a seemingly bad day with the heavy baggage on your shoulder, try counting all the little wins that you score - the things that you manage to achieve even though you are emotionally drained/exhausted?

During tough times, ESPECIALLY during tough times, every little win matters.

Because they really do.

Wishing you the best! :)

Yi Xuan

Let’s REIT: How REITs Make Money (and why it is IMPORTANT to You!)

If you are looking to invest in Real Estate Investment Trusts (REITs), this will be extremely insightful to you.

In this post, I want to dive deep into the topic of how REITs make money, and why it is CRUCIAL for you to know this as a REIT investor.

3 Types of Income Streams for REITs

On the surface, most people know that REITs make money through rental that they collect from their tenants.

While this is true, knowing just this contributes little to nothing to an investment decision (side note: knowing that we must eat to beat hunger doesn’t mean we know WHAT to eat to be healthier, right?).

On the other hand, it’d be an amazing piece of information if we are able to go deep into understanding how a REIT makes money:

#1 Rental Income (short-term rental)

Rental income is the first kind of income that most REITs investors are familiar with.

Essentially, rental income is derived from rents collected from tenants under short-term rental (normally around 1-3 years).

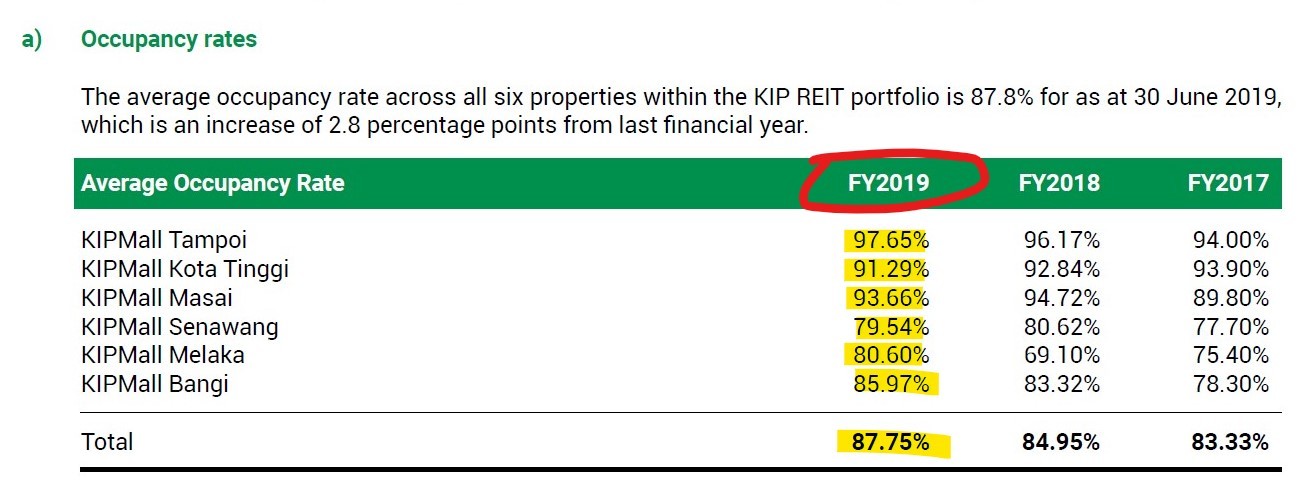

This is most commonly seen among REITs in the retail space (eg. IGB REIT – Mid Valley, The Gardens, KIP REIT – KIP Malls) & sometimes among offices and hospitality REITs as well.

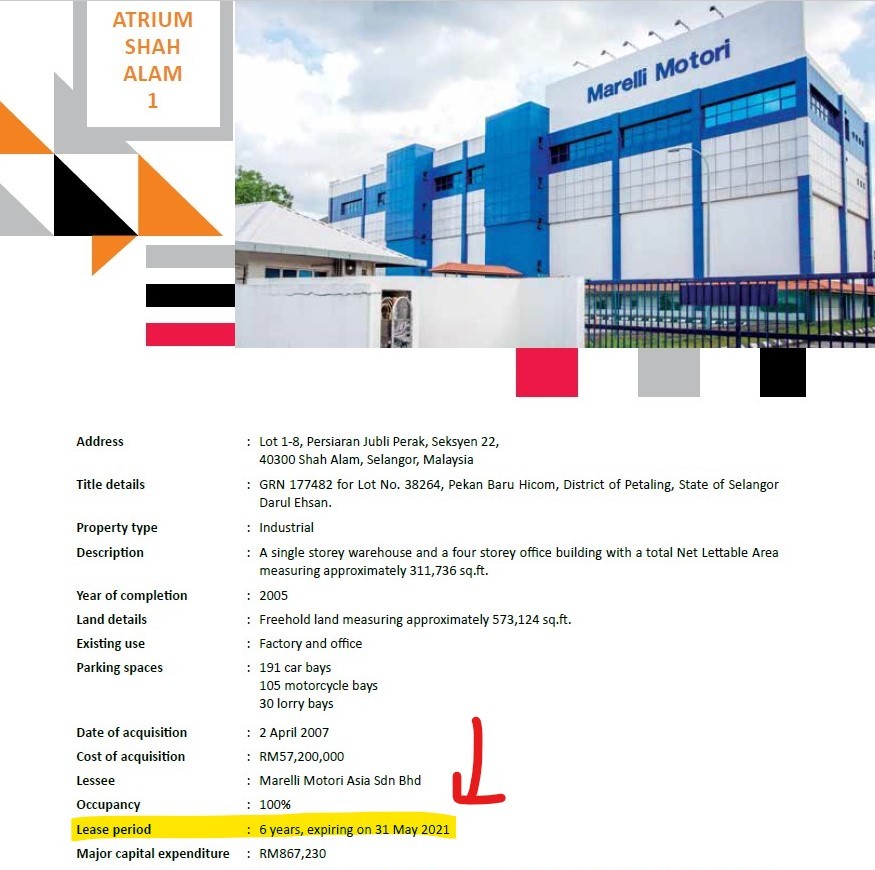

#2 Contract Revenue (long-term fixed lease)

However, not all REITs do their business via a short-term rental model.

For some REITs, a short-term rental is simply not viable. Imagine a REIT that manages hospitals having to renew their contract with the hospital operator (a.k.a. tenant) every year, or the operator would have to find another place to continue the business – that just doesn’t make any business sense.

Hence, for these REITs, a long-term fixed lease contract is adopted in their business model.

In short, this means that instead of signing a 1-2 year short-term rental, REITs will sign a multi-year long (usually 3-20 years) tenancy deal with their tenants.

Under a long-term fixed lease contract, REITs are paid an agreeable amount of rent from the tenant throughout the tenancy period regardless of the occupancy of the property.

This is most seen in healthcare REITs (Al-Aqar REIT), industrial (eg. Atrium REIT), office & hospitality REIT (eg. YTL REIT).

---

Side note: Rental Income and Contract Revenue are NOT mutually exclusive for a REIT.

Meaning, a REIT can have income from short-term rentals AND from long-term leases. A good example is YTL REIT of which its revenue is dependent on the occupancy rate (short-term stay) of its Australian hotels, while also enjoying the long-term lease income from its Malaysia & Japan hotels.

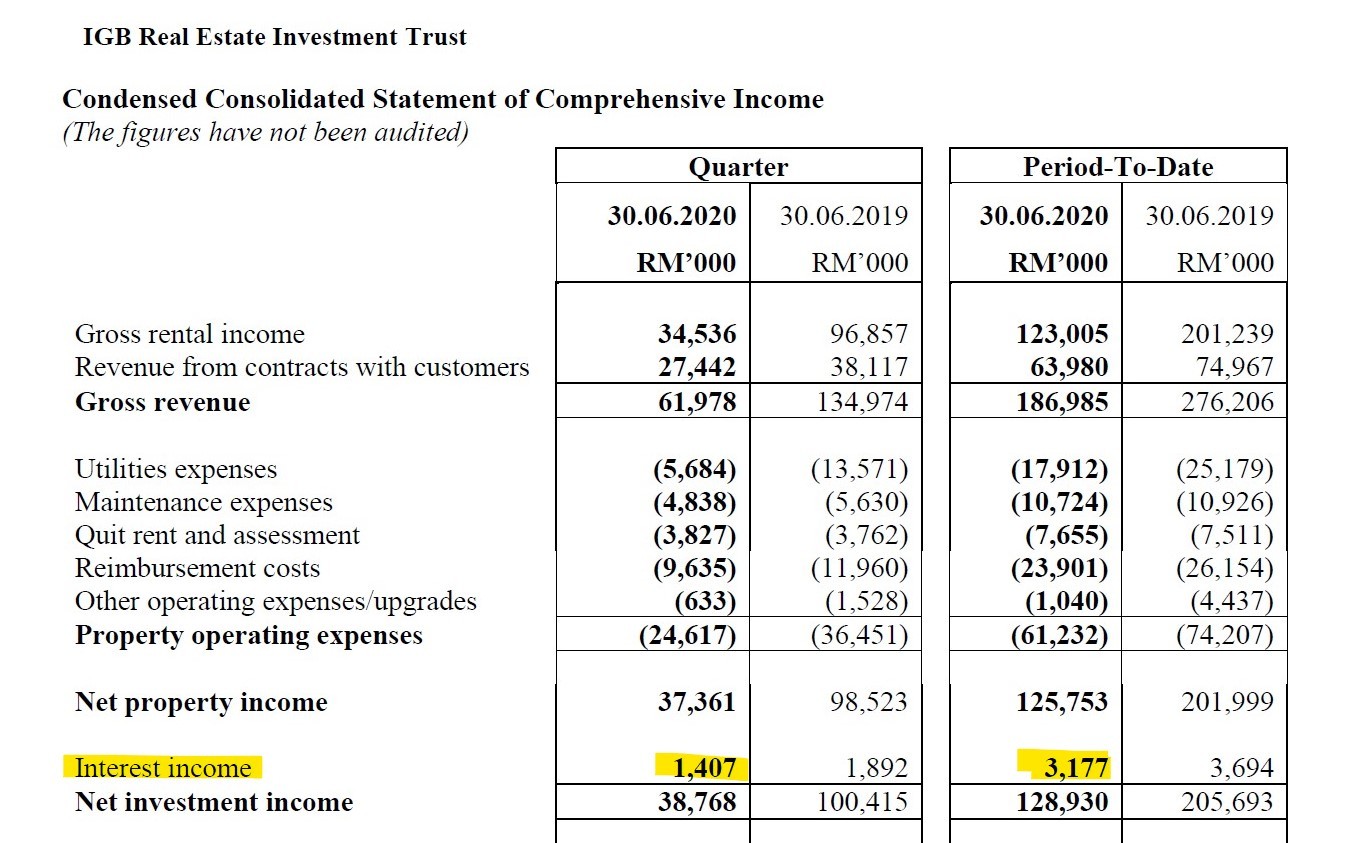

#3 Interest Income

The 3rd stream of income for REITs comes from the interest generated from the cash deposits in financial instruments like money market.

While this is a relatively small income stream for REITs, I thought I’d mention it for completion sake.

Pros & Cons of Different Rental Model

In this section, we are going to explore the benefits & risks involved with different REITs rental model.

#1 Rental Income (Short-term rental)

Pros:

+ Ability to be Nimble & Agile:

Short-term tenancy contracts mean REITs will be able to adapt their leasing strategy better to changing market demand & condition.

As an example, instead of leasing their mall space to non-essential businesses, retail REITs with short-term tenancy contracts can replace old tenants with the ones that supply daily essentials in order to adapt to the pandemic & improve their revenue.

+ Better Earning Potential:

Assuming a healthy & expanding market, REITs that adopt short-term rental models tend to be able to renew their tenancy contracts at an increasing rate.

The potential increase in rental is huge because the increment is usually not fixed & is (normally) decided on a yearly basis.

Cons:

- Challenges in Tenant Retention

Either a REIT that owns a sub-par property in a highly competitive environment (imo: Subang Parade, Sungei Wang), or simply a bad market condition (eg. Covid-19 Pandemic) will make it extremely challenging for REITs to retain their tenants.

This is especially true to REITs that own real estate that are on a short-term rental basis.

#2 Contract Revenue (Long-term fixed lease)

Pros:

+ Secured & Predictable Rental Income:

REITs that are engaged in long-term lease contracts (~3 – 20 years) mean their income is usually stable & secured for a significant period of time.

This provides additional peace of mind to the investors as the income of these REITs are generally ensured for a long time.

Cons:

- Relatively boring growth potential

Long-term lease contracts means that rental increment is usually fixed (eg. 3% rental increment every 3 years for a 15 years tenancy deal).

In other words, the potential income growth of these REITs tends to be relatively limited compared to properties in short-term leases as they are not able to increase rent flexibly as per the market condition.

- Dependent Risk

Generally, it is more challenging for a REIT to replace a tenant that is engaged in a long-term lease contract.

As an example, it is easier to replace a small tenant in Sunway Pyramid compared to the whole hospital operator of KPJ Healthcare Centre.

Simply put, REITs with properties under long-term lease contracts have the risk of being overdependent to one of two tenants.

What Does All of These Mean to You?

Knowing how a REIT makes money is essential as it gives us a super important piece of puzzle in our decision-making process:

-

Short-term rental vs Long-term lease contracts

Understanding how a REIT generates income can help us in identifying the underlying opportunities, strengths & risks when investing in a REIT.

For REITs with properties engaged in a short-term rental, the occupancy rate is extremely crucial. If the property (eg. Mid Valley) is not occupied, this will directly affect the revenue of the REIT.

On the other hand, investors should focus on the lease expiry period of REITs with properties engaged in long-term lease contracts (a.k.a. how long before the lease contract expires?)

-

Which income model is better?

In short, there is no right or wrong answer to this.

However, asking ourselves the right questions before investing in REITs could be of great help to our decision-making process:

- Could REITs running on short-term rentals able to retain their tenants next year?

- Could REITs running on long-term leases able to find a new tenant after the current lease expires?

Combining the questions above with the current market condition & some foresight, you’ll be able to discover different opportunities, strengths & risks before investing in a REIT.

No Money Lah’s Verdict

Tenancy, regardless of a short-term rental or long-term lease, is the lifeline of REITs.

Hence, it is crucial for a REIT investor to find out & understand how REITs make money before investing in them.

Well, I hope this simple article has been helpful to you! Any questions, however big or small, just leave your comment below!

--

p.s. If you are keen to learn about REITs, you will be interested in my REIT investing sharing session. Find out more HERE.

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

How I Customize My Own Savings Routine (that actually works)

Struggling to save money? Always caught off guard by huge one-time spending (laptop rosak, car battery dies out, receive random red-bomb from friends a.k.a. wedding invitation etc)?

Alright, in this post, I want to share how I develop my own savings routine that is actually pretty simple & effortless.

By the way, if you have any savings tips & tricks, do share with me at the comment section below too!

The Difference Between Savings and Emergency Fund

In this post, I will solely be focusing on savings and will not be talking about emergency fund.

Personally, the biggest difference between them is my mindset:

For my emergency fund, the goal is to NOT touch the money whenever possible. (well, unless true shit happens)

On the other hand, when I save, I am ready to deploy that money for the purposes that I save for.

Simply put, my savings routine actually helps me to avoid touching my emergency fund for essential-yet-highly-predictable expenses & goals in life.

--

You might be interested: How to Build an Emergency Fund?

The Effortless Savings Equation

From my personal observation, a solid savings routine is an equation with 3 simple elements:

Solid Savings Routine = Purpose + Automation + Mindset

Let’s discuss them one by one below:

Step 1: Note Down Your Predictable Expenses in Life (Purposeful savings)

Purpose is the first element in the equation.

Looking back, the main reason why I struggled to save money years ago was that I did not have a strong purpose in doing so.

However, I was always financially frustrated by huge one-off expenses (eg. Car battery dies off, phone rosak, traveling)

Hence, what I eventually do is to anticipate predictable expenses in my life (based on past expenses), then save for them in a frequency that I am comfortable with (eg. monthly), kinda like having multiple Piggybanks.

Example:

- 1. Saving RM125/month for a yearly solo backpack trip (around RM1,500/trip).

- 2. Saving RM50/month for car maintenance purposes (around RM600/year)

- 3. Saving RM150/month for guilt-free spending – a.k.a. Anything Fund (around RM1,800/year)

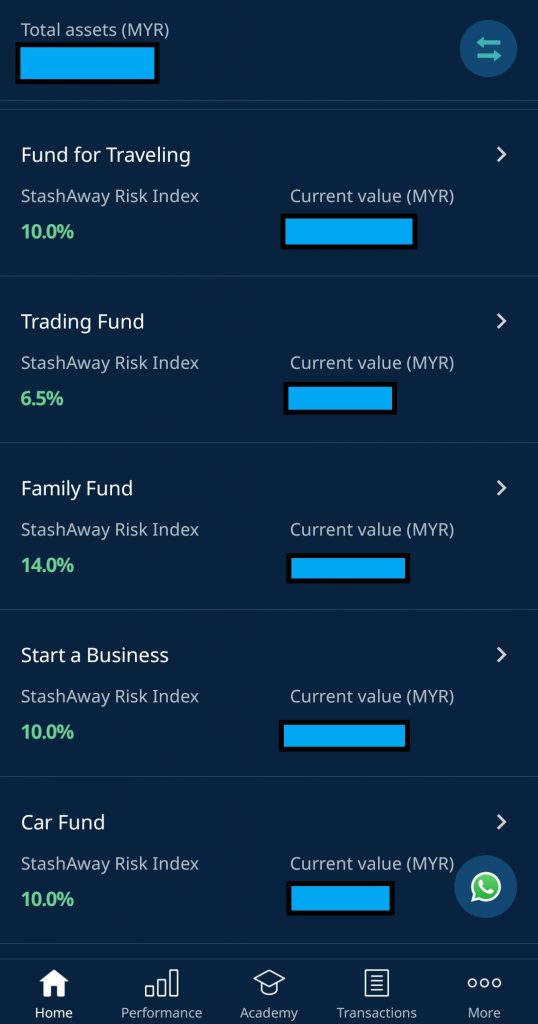

Here is a list of things/expenses that I am purposefully saving for right now:

- 1. Traveling

- 2. Yearly car insurance & maintenance

- 3. Family/parents fund

- 4. Capital for trading

- 5. Business capital

- 6. Anything fund

- 7. General savings (yes, I do allocate money for general savings purposes)

The one thing that I like about purposeful savings is that it helps me to comfortably save for an intended purpose at a small amount consistently.

By doing that, it lifts off the heavy burden & stress of me having to fork out a lump-sum amount when the time comes for me to really spend, which could feel more than a pinch sometimes.

Now, the key here to have a clear idea of your spending history & habits, and ask yourself:

“What are the goals/expenses that I’d want to start saving for?”

Side Note: What to Save For, and How Much Per Month?

There are no hard and fast rules here in my opinion.

What to save for: Essential expenses, then goal-based spendings

On regard to what to save for though, my suggestion is to first save for recurring, one-off essential expenses(eg. car-related expenses), then only go for goal-based spendings (eg. travel, gadgets).

How much to save for: it depends

How much to save for is a tricky one as everyone is different. Of course, the maths is rather simple for recurring (a.k.a. must-spend) expenses like car maintenance & insurance (total expected amount/12 months).

That said, for goal-based savings like travel fund or gadget fund, it makes a lot of sense to save within our means, where we are financially comfortable with the commitment. As an example, if you find saving RM420 per month (RM420*12 = RM5,040) to buy a new iPhone rather heavy in relative to your salary, perhaps you should consider lowering your expectation (maybe buy a mid-range phone?), or work harder to improve your earnings.

The point is: Save within your means and ability.

Step 2: Automate Your Savings Routine

Automation comes next in building a solid savings routine.

I love to make my savings routine as simple and as automated as possible – to get it out of my busy life.

For my own purposed savings, I opt for the convenience of various low-cost robo-investing platforms that we have nowadays.

Personally, I am currently using 3 robo-investing platforms for savings, namely StashAway, MyTheo, and BIMB’s BEST Invest, for some of the reasons below:

- 1. Ease of automation with automated direct debit order.

- 2. Low annual management cost.

- 3. Low barrier of entry, from as low as RM0 for StashAway (RM10 for BEST Invest & RM100 for MyTheo).

- 4. Convenient fund management (deposit & withdrawal) with respective apps.

Of all, StashAway turns out to be my personal favorite as it has a (1) simple (yet informative) user interface, (2) the lowest barrier of entry, and (3) the ease for opening multiple portfolios per user. This means that I can set up different StashAway portfolios for different saving goals – which is a low-key yet amazing convenience from StashAway.

Now, the key here is to spend some time (5 mins that’s all) to set up your intended savings portfolio and automated direct debit orders – and you are all set for your purposeful savings journey.

By the way, if you are curious about the settings/presets that I use for each platform, here you go:

- StashAway: 6.5%, 10% & 14% Risk Index (as recommended by StashAway)

- MyTheo: 8% Growth – 65% Income – 27% Inflation Hedge (as recommended by MyTheo)

- BEST Invest: Do-It-Yourself via BIMB Dana Al-Fakhim Money Market Fund

Note: The withdrawal process for all robo-investing platforms are not instant and have to be processed for a couple of days. Hence, in case of urgent usage, I always have some cash in my bank account to pay for the expenses upfront before withdrawing them from my savings.

--

Read: My StashAway Review

Step 3: Mindset: Purposeful Savings = Mindful, Guilt-Free Spending

Mindset is the last important piece for me when I am developing my savings routine.

Now, some of you might be thinking:

“What does mindset have to do for things like savings?”

Well, everything!

I used to feel very frustrated & guilty when I have to spend to replace my dead car battery and the sudden need for me to replace my spoilt mouse.

Also, I tend to over-micro-manage my traveling expenses in the past which sometimes really affected my overall experience (eg. thinking twice about trying some good, but slightly pricey food while traveling – which to be honest, really spoilt the mood)

Hence, setting up multiple mini piggybanks (eg. A StashAway portfolio) for different one-off yearly expenses & purpose in my life truly enhance my financial life.

Instead of being frustrated by these one-off spending, I embrace and accept the fact that things like a dead car battery to traveling are simply part of my life, and I am financially prepared for them.

In short, here’s my point:

We’ll always encounter random occasions & incidents in our life that require money here & there.

We could be financially caught off guard by them, or being extremely hesitant to spend for some truly awesome once-in-a-lifetime experience (eg. traveling).

On the other end, we also have a choice to save in anticipation of these events or occasions – it is really a matter of embracing the fact that these are simply part of life and we can, for most of the time, be financially prepared for them.

No Money Lah’s Verdict

So here you go – my personal savings routine that is automated and relatively effortless (plus a bit of my old-man mindset talk).

To be honest, I think the hardest part for many people is really just to take the first step and start planning for their savings – and if that’s being done, it’ll extremely simple moving forward:

Just start.

p.s. How do you plan your savings routine? Are there any unique purposes that you save your money for?

Share with me at the comment section below, would love to hear from you!

You might be interested:

1. How I Invest My Money as a Self-Employed Person?

2. 4 BETTER Ways to Save Your Money in a Low Interest Rate Environment!

--

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Living Intentionally

At the very core, I found that the habit of sleeping earlier, meditating, exercising, and yes, even becoming a better investor boils down to one thing:

Being intentional with the process.

To build towards a habit or a goal, the simplest way to actually be intentional is to start writing down our focus and intention daily. This needs to be extremely honest and something that we’d actually fulfill.

I like this particular quote from Brendon Burchard (author of High Performance Habits):

“First, it is an intention. Then a behavior. Then a habit. Then a practice. Then a second nature.

Then, it is simply who you are.”

Whatever habits or milestones that you want to achieve, participate in the process with great intent.

In other words, live intentionally.