Last Updated on May 1, 2022 by Chin Yi Xuan

Over the past year, robo-advisors have been gaining popularity among Malaysian investors. Among all, StashAway is at the forefront of robo-advisors in the market.

I have been using StashAway since 2019, it is still my preferred robo-advisor to date.

In this review, let’s explore all the things that you need to know about investing with StashAway!

p

Table of Contents

How does StashAway Work?

StashAway is a regulated robo-advisor platform by the Securities Commission of Malaysia. It invests user’s funds through investing algorithms instead of typical fund managers.

They call their investing algorithm the Economic Regime-based Asset Allocation (ERAA). In essence:

- You select your risk profile (a.k.a. StashAway Risk Index – SRI)

p - StashAway will invest on your behalf into assets like equities, commodities, and bonds. This is mainly done through Exchange-Traded Funds (ETFs).

p - ERAA will readjust your portfolio according to your risk preference. This is done by considering things like market cycle, macroeconomic shifts, and so on.

p

StashAway Risk Index (SRI): Select Your Risk Profile

There are 12 different StashAway Risk Index (SRI) for users to choose from. Each Risk Index is made up of a combination of equities, commodities, bonds and cash.

By the way, what does SRI mean?

The lowest 6.5% risk index means that there’s a 99% chance that you won’t lose more than 6.5% of your capital in a given year. To achieve this, your portfolio will be made up mainly of low-risk assets like bonds and a minimal exposure to higher-risk equities.

As we move up the risk index, your portfolio will have less exposure to bonds and more on equities.

Hence, logically speaking, the higher your risk index (up to 36%), the more volatile your portfolio would be, while giving you a potentially higher return.

p

MUST KNOW: Time-weighted Return & Money-weighted Return

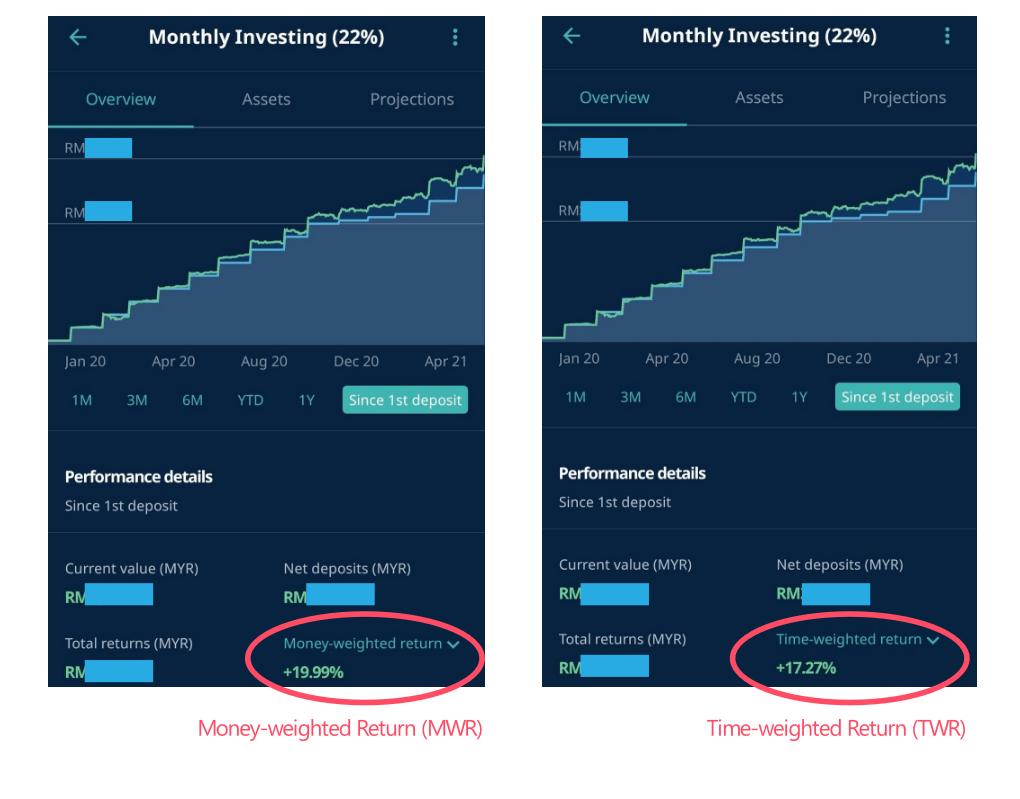

There are 2 metrics that StashAway uses to measure the performance of their portfolios.

Time-weighted Return (TWR)

TWR is the most commonly-used metrics, and it’s an easy metric to compare returns between different portfolios:

“By tracking the portfolio’s performance from your first deposit, a portfolio’s TWR removes the distortions that various cash inflows and outflows create. In essence, TWR measures the portfolio manager’s ability to generate returns, not the effects of an individual’s deposit and withdrawal behaviors.” – StashAway

In other words, if you invest on a consistent basis via StashAway (a.k.a. Dollar Cost Average ‘DCA’), then you should be looking at the TWR metrics. This is because TWR reflects how well StashAway is making returns without being distorted by the effect of deposits & withdrawals.

p

Money-weighted Return (MWR)

MWR assigns a weight to each of your deposits and withdrawals. So, if you make an RM1,000 deposit, it will have a lesser impact on your portfolio’s MWR than an RM100,000 deposit.

“This approach helps to gauge the impact and effectiveness of an individual’s timing of deposits and withdrawals. As a result, due to the emphasis of deposits and withdrawals, MWR may naturally overweight or underweight the returns.” – StashAway

In short, when we are talking about returns, we should be referring to TWR instead of MWR.

p

StashAway Performance

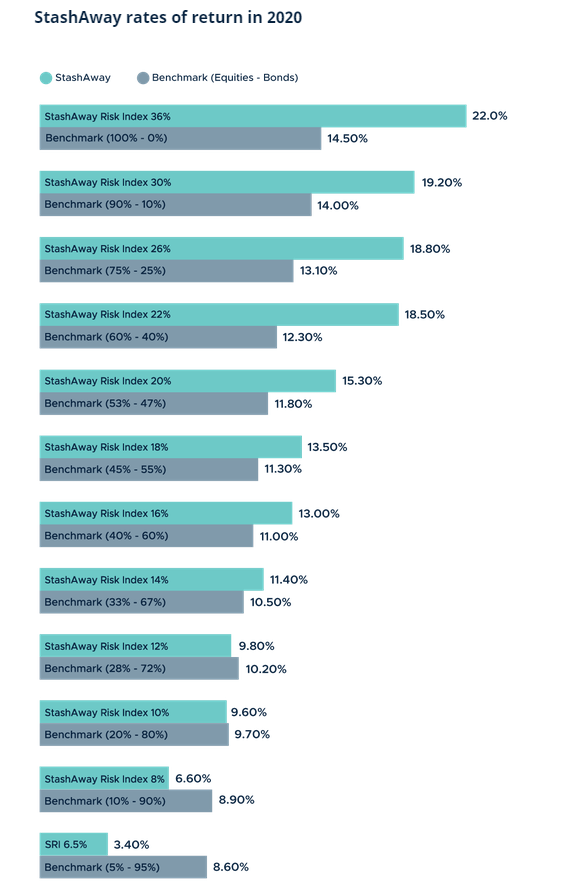

2020 was a unique and challenging year for investing due to the global pandemic.

That said, all StashAway’s portfolios posted a positive return in 2020. Of all, the majority of StashAway’s portfolios (especially higher risk portfolios) outperformed their benchmark by a significant run – impressive!

p

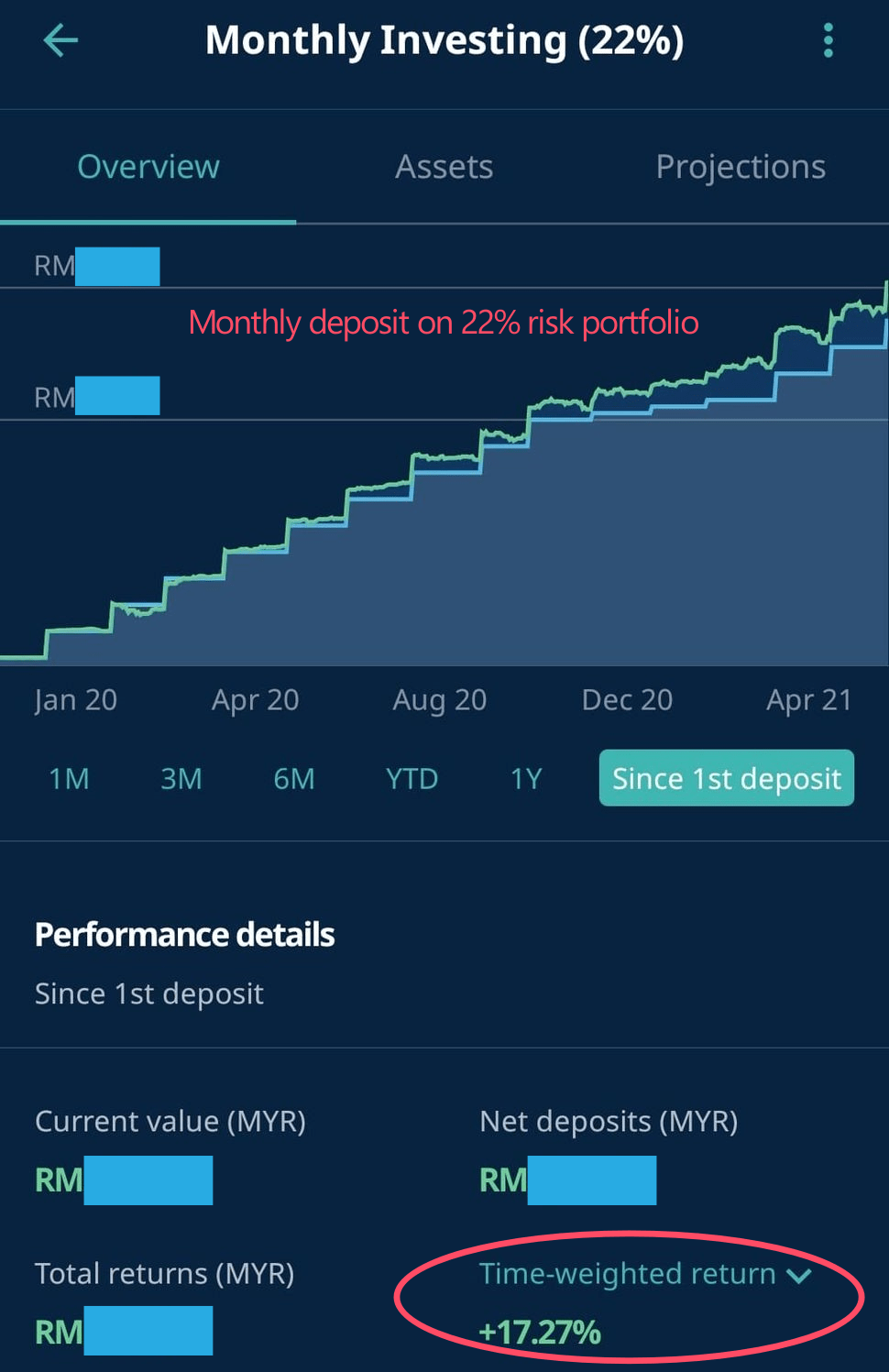

Translating to real life, below is the performance of my main 22% risk index portfolio to date (1st April). I started this portfolio in January 2020 and I’ve been investing in this portfolio monthly:

p

StashAway Simple: The Fixed Deposit (FD) Killer

In mid-2020, StashAway launched their cash management portfolio called StashAway Simple.

Simply put, StashAway Simple is a portfolio that invests users’ money in super low-risk money market fund.

With a projected return of 2.4% per annum, StashAway Simple is a great FD alternative for people that are looking to build up a savings or emergency fund!

READ MORE: StashAway Simple Review

p

StashAway Thematic Portfolios

Recently, StashAway has also released their thematic portfolio, which allows users to invest in niche industries with high potential growth:

- Technology Enablers: Focuses mainly on the behind-the-scene tech that powers the rapidly growing tech sector, such as AI, Blockchain, and Cloud Computing.

- Future of Consumer Tech: Exposure to the industries with huge growth potential, such as Fintech, e-commerce, and Gaming.

- Healthcare Innovation: Invest in the ever-important future of the healthcare industry such as Biotech and Pharmaceuticals.

In my opinion, this is certainly a welcoming addition. Investors can now get exposure to niche industries that they have conviction in.

READ: Check out my full overview of StashAway Thematic Portfolios HERE.

How do I use StashAway?

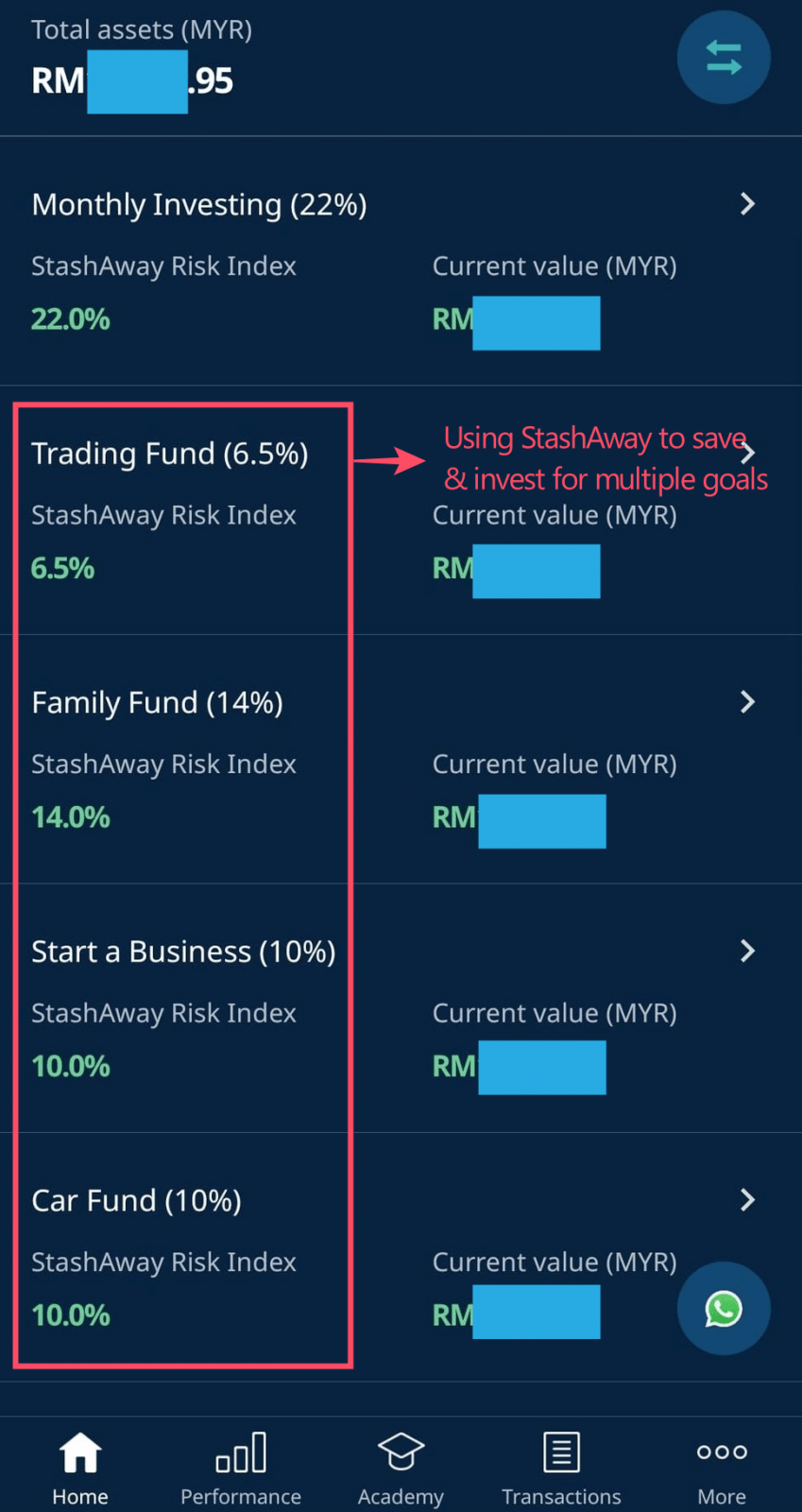

As a StashAway user, you have the freedom to open multiple portfolios for free. This means that if you have a 36% risk index portfolio, you can also open a 14% risk index portfolio at no extra charge.

Now, this is a perfect feature for busy people that want to automate their investment and savings.

For myself, I am mainly investing via the 22% risk index portfolio. This is where I automate my investments on a monthly basis. I also have money placed in the 30% and 36% higher-risk portfolios just to try things out.

In addition, I use StashAway’s low-risk portfolios (6.5%, 10%, 14%) and StashAway Simple to save for different goals of my life (eg. Car, Travel, Family).

p

5 Things I Like about StashAway

(1) Competitive Fees

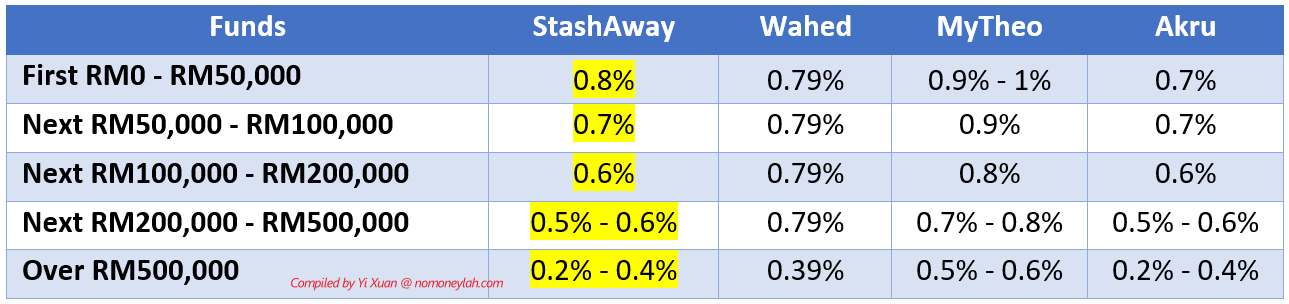

One huge advantage that robo-advisors have over conventional mutual funds is their fees.

In general, while typical mutual funds have an average fee of 3-5% per year, robo-advisors charge only a fraction of the fee (<1%).

Even with more robo-advisors coming up in Malaysia, StashAway is still one of the most competitive when it comes to fees:

As you can see, StashAway’s fee is highly competitive, and it gets even better as you invest more with them.

In terms of value for money, StashAway certainly nailed it – a perfect representation of ‘the more you invest, the less you pay’.

EXCLUSIVE: Click HERE to Get an EXCLUSIVE 50% OFF Your (already low) StashAway Fees today!

p

(2) No Minimum Investment Amount

A great feature of StashAway is there is no minimum on how much you need to start investing.

Even if you have RM1, you can start investing with StashAway.

As a result, StashAway is ridiculously beginner-friendly even for investors with a small capital!

p

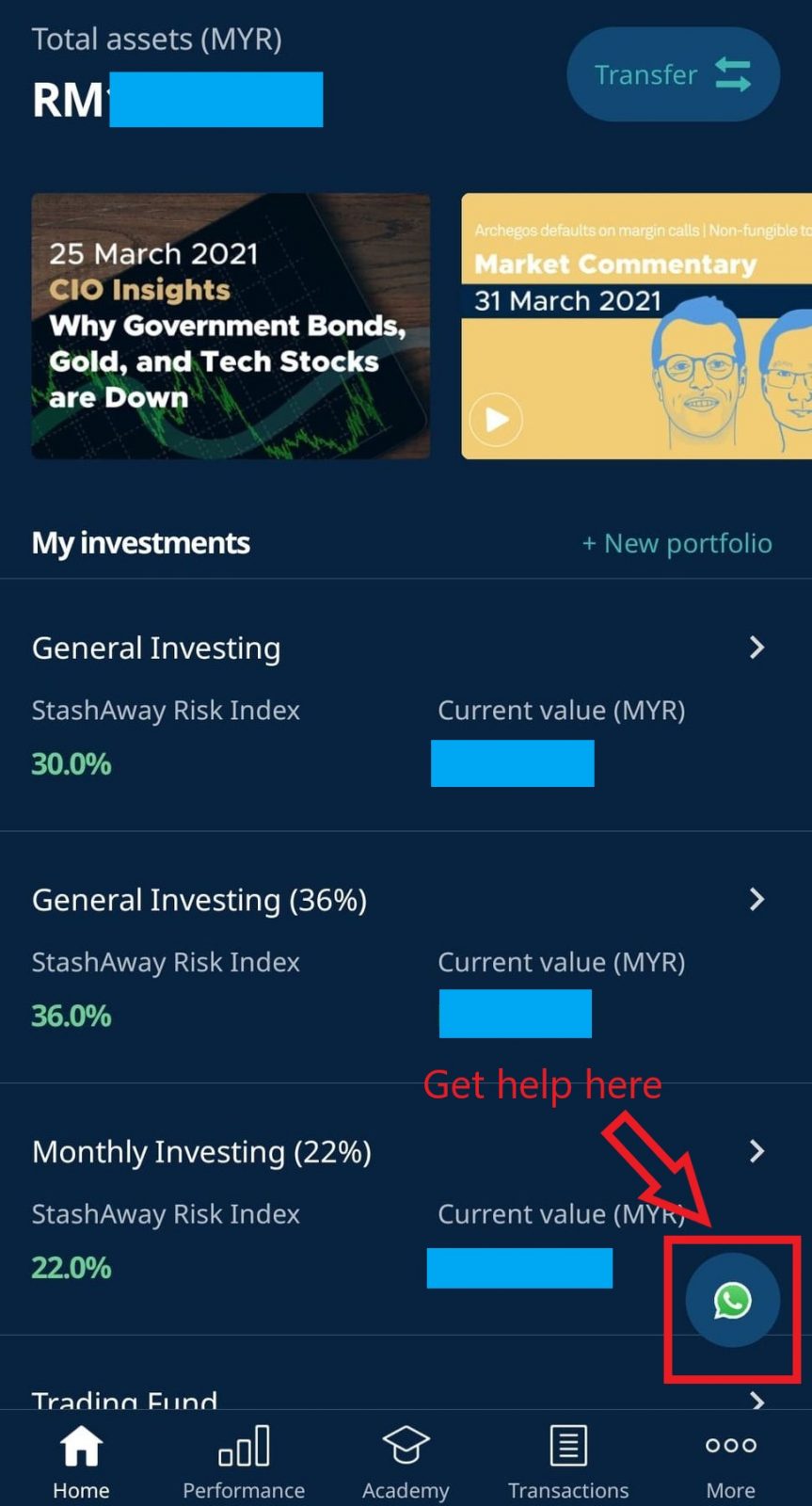

(3) Great Customer service

I don’t say this often, but StashAway is one of the rare companies that actually has awesome customer support.

Having been using StashAway for more than 2 years now, I hardly recall any bad memory dealing with their support team. From my experience, the support team in StashAway is well-trained and is actually helpful.

There are 4 channels of customer support available: Email, Phone, Messenger & WhatsApp. The easiest way to reach out for support is through WhatsApp, where you can easily find at the bottom right corner of the app.

p

(4) Large range of asset classes

Among all the robo-advisors in the market right now, StashAway has the largest range of asset classes available.

As of the time of writing, StashAway has a total of 62 ETFs across different asset classes, ranging from equities, commodities, and bonds.

In other words, StashAway has more flexibility and versatility to best preserve and invest customers’ funds in the face of market uncertainties.

p

(5) Community & Value Driven

Over the years, one thing that I really respect the StashAway team is their effort in adding value to the community (while building their brand awareness, of course).

I like how StashAway has been actively organizing talks on the theme of financial planning and investing for the community. These are little things that add value to the people, but require huge time and effort – kudos to the team again.

p

What Could be Better?

Bi-annual or Annual Portfolio Round-Up

As a user, there will be times where I wonder if there is any progress or changes made on my portfolio.

To improve the overall user experience, it would be great if StashAway could do a bi-annual or annual portfolio round-up so I have an idea of what was going on with my portfolios. (refer: Spotify Year in Review).

p

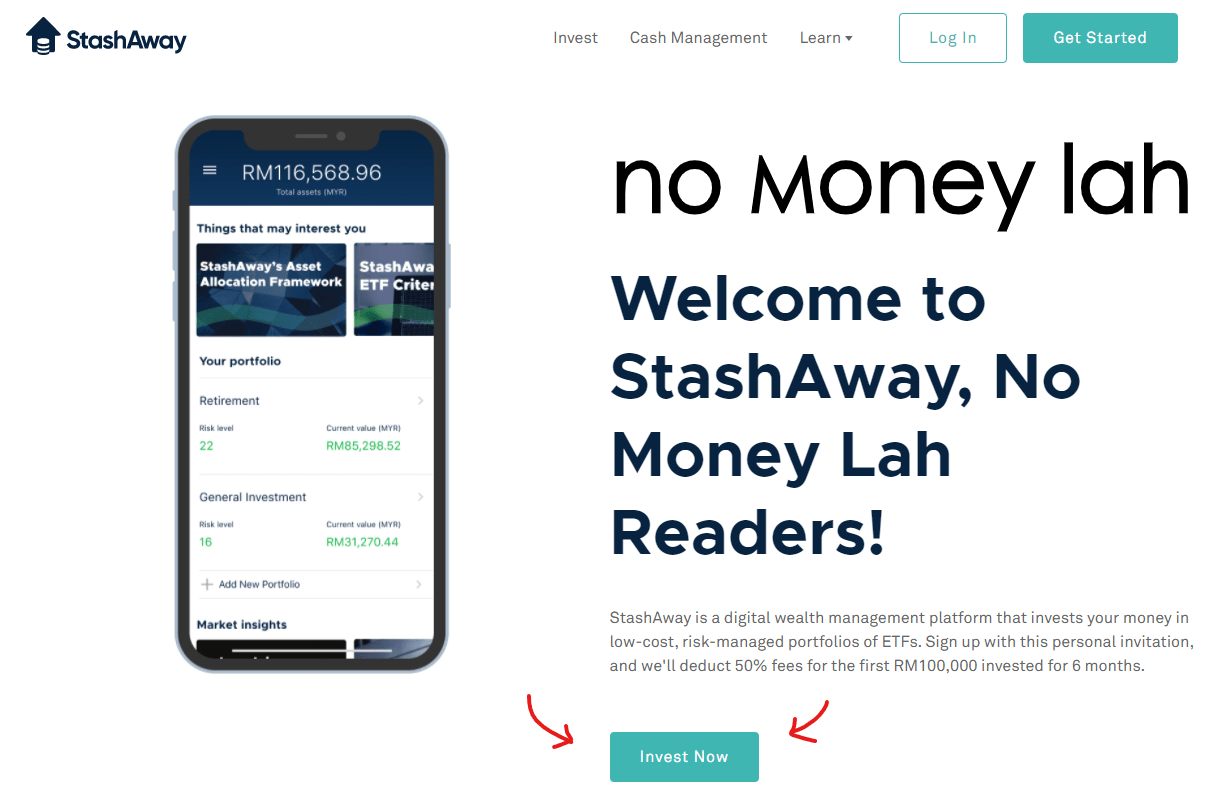

StashAway Referral Link

No Money Lah is working with StashAway to bring new users an exclusive 50% off your fees for the first RM100,000 invested for 6 months.

To be eligible for this deal, sign up for your StashAway account through my referral link HERE. (or HERE if you are from Singapore)

p

No Money Lah’s Verdict

One of the biggest conveniences that technologies have brought to us is the innovation in financial solutions & services, and robo-advisors are definitely one of them.

After using many other robo-advisors over the past year (Wahed, MyTheo, Akru), StashAway is still my preferred robo-advisor.

Given StashAway’s low-cost diversification and smart portfolio management, it is a no-brainer for people that are looking to start investing and/or diversify their investment portfolio – while not burning a hole paying expensive yearly fees.

Personally, I am a happy customer, that’s for sure.

If you find this review on StashAway useful, my suggestion is to get on board right now: The best time to invest is 20 years ago, the second-best time is NOW.

Click HERE and Claim Your EXCLUSIVE 50% OFF Your StashAway fees today!

Disclaimers:

Past return is not indicative of future performance.

This post may contain affiliate links that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

January 13, 2022

Malaysian’s Guide to Invest in ETF

April 20, 2023

StashAway Simple Review: The Fixed Deposit (FD) Killer?

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

hi would like to ask since the high risk portfolio did bring in returns what about the low risk index so far?

Hi Maple,

Your actual return depends on when you invest in the market.

For me, I am also on all 6.5%, 10% and 14% risk index since mid last year and the returns are around 0% – 5% respectively.

Will come out with a more detailed update on StashAway soon! 🙂

Regards,

Yi Xuan

Hi Yi Xuan, may I know how easy it is to withdraw from the risk index at anytime? If I like to grow my funds and withdraw for specific uses in 2-3years, should I consider risk index or StashAway Simple?

Hi Ming Wei!

Withdrawal is extremely simple and it takes about 3 – 5 days to be shown in your bank account. So let’s say if u are planning to use the money rmb to withdraw ahead of time yea!

For 2-3 years timeframe, I’d suggest to go for slightly higher risk index (12 or 14%) as the higher exposure to equities makes space for the fund to grow. That said the downside is you may experience drawdowns along the way if the market go the other way.

For StashAway Simple, the downside risk is very low so its perfect if you wish thay your fund experience minimal swings during the time period. Just the return may be lower as a result.

So it’s really what u wanna achieve that matter 🙂 I use both and enjoy using each of them.

Yi Xuan

That’s very clear and helpful. Thanks for your advice!

Glad that it helps! 🙂

Regards,

Yi Xuan

Hi Yi Xuan

Great explanations and review. All your tips are very useful especially for newbie like me.

I have just registered and are starting to fell my way around the app. Just one question, in case of emergency is there a way my next of kin are able to access the funds that i have invested in? Reason why i asked is that there are no such feature in the personal profile section to list your next of kin’s contact. Not sure if you are aware. but just curious

Hi William,

Great question.

In the case of user’s demise, StashAway will only recognize the executor or administrator of your will.

Your executor/ administrator will have to produce a grant of probate or letters of administration before the account can be liquidated to a designated account as instructed by the user.

Hope this helps!

https://www.stashaway.my/faq/900001773963-what-happens-if-the-account-holder-passes-away

Regards,

Yi Xuan

Hi Yi Xuan,

Upon withdrawal of our return/dividend, is it subject to any tax deduction? Is there any other hidden cost that we need to take note of when investing via StashAway?

Hi May!

1. Tax on dividends: Tax on dividends are already deducted prior to being distributed to us. This is same regardless if we are investing in robo-advisors or brokers. As an example, US charges 30% withholding tax for non-Us residents. So if a company or ETF declares $0.10 dividends then $0.03 will be automatically deducted prior to being paid to you.

Because of that, you do not have to pay taxes on your end on this matter.

2. Hidden costs: No. There are 4 key fees while investing with StashAway:

a. Platform fee charged by StashAway starting from 0.7% per year, and will go down as u invest more.

b. ETF fee charged by the ETF manager, this fee is automatically deducted from your portfolio.

c. Exchange fee charged by the exchange authorities: this fee is charged for transaction (buy/sell) of ETFs via the stock exchanges. Also deducted automatically during transaction.

d. FX fee: Conversion of MYR to USD.

Of all 4, only (a) is charged by StashAway. The other 3 will apply when you invest on your own too.

Regards,

Yi Xuan