Last Updated on May 2, 2022 by Chin Yi Xuan

Struggling to save money? Always caught off guard by huge one-time spending (laptop rosak, car battery dies out, receive random red-bomb from friends a.k.a. wedding invitation etc)?

Alright, in this post, I want to share how I develop my own savings routine that is actually pretty simple & effortless.

By the way, if you have any savings tips & tricks, do share with me at the comment section below too!

Table of Contents

The Difference Between Savings and Emergency Fund

In this post, I will solely be focusing on savings and will not be talking about emergency fund.

Personally, the biggest difference between them is my mindset:

For my emergency fund, the goal is to NOT touch the money whenever possible. (well, unless true shit happens)

On the other hand, when I save, I am ready to deploy that money for the purposes that I save for.

Simply put, my savings routine actually helps me to avoid touching my emergency fund for essential-yet-highly-predictable expenses & goals in life.

—

You might be interested: How to Build an Emergency Fund?

The Effortless Savings Equation

From my personal observation, a solid savings routine is an equation with 3 simple elements:

Solid Savings Routine = Purpose + Automation + Mindset

Let’s discuss them one by one below:

Step 1: Note Down Your Predictable Expenses in Life (Purposeful savings)

Purpose is the first element in the equation.

Looking back, the main reason why I struggled to save money years ago was that I did not have a strong purpose in doing so.

However, I was always financially frustrated by huge one-off expenses (eg. Car battery dies off, phone rosak, traveling)

Hence, what I eventually do is to anticipate predictable expenses in my life (based on past expenses), then save for them in a frequency that I am comfortable with (eg. monthly), kinda like having multiple Piggybanks.

Example:

- 1. Saving RM125/month for a yearly solo backpack trip (around RM1,500/trip).

- 2. Saving RM50/month for car maintenance purposes (around RM600/year)

- 3. Saving RM150/month for guilt-free spending – a.k.a. Anything Fund (around RM1,800/year)

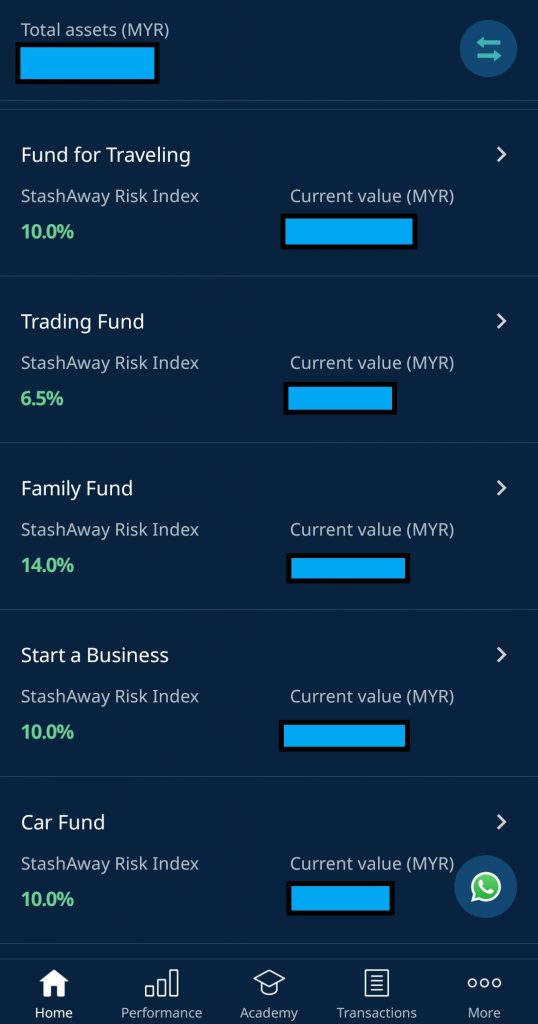

Here is a list of things/expenses that I am purposefully saving for right now:

- 1. Traveling

- 2. Yearly car insurance & maintenance

- 3. Family/parents fund

- 4. Capital for trading

- 5. Business capital

- 6. Anything fund

- 7. General savings (yes, I do allocate money for general savings purposes)

The one thing that I like about purposeful savings is that it helps me to comfortably save for an intended purpose at a small amount consistently.

By doing that, it lifts off the heavy burden & stress of me having to fork out a lump-sum amount when the time comes for me to really spend, which could feel more than a pinch sometimes.

Now, the key here to have a clear idea of your spending history & habits, and ask yourself:

“What are the goals/expenses that I’d want to start saving for?”

Side Note: What to Save For, and How Much Per Month?

There are no hard and fast rules here in my opinion.

What to save for: Essential expenses, then goal-based spendings

On regard to what to save for though, my suggestion is to first save for recurring, one-off essential expenses(eg. car-related expenses), then only go for goal-based spendings (eg. travel, gadgets).

How much to save for: it depends

How much to save for is a tricky one as everyone is different. Of course, the maths is rather simple for recurring (a.k.a. must-spend) expenses like car maintenance & insurance (total expected amount/12 months).

That said, for goal-based savings like travel fund or gadget fund, it makes a lot of sense to save within our means, where we are financially comfortable with the commitment. As an example, if you find saving RM420 per month (RM420*12 = RM5,040) to buy a new iPhone rather heavy in relative to your salary, perhaps you should consider lowering your expectation (maybe buy a mid-range phone?), or work harder to improve your earnings.

The point is: Save within your means and ability.

Step 2: Automate Your Savings Routine

Automation comes next in building a solid savings routine.

I love to make my savings routine as simple and as automated as possible – to get it out of my busy life.

For my own purposed savings, I opt for the convenience of various low-cost robo-investing platforms that we have nowadays.

Personally, I am currently using 3 robo-investing platforms for savings, namely StashAway, MyTheo, and BIMB’s BEST Invest, for some of the reasons below:

- 1. Ease of automation with automated direct debit order.

- 2. Low annual management cost.

- 3. Low barrier of entry, from as low as RM0 for StashAway (RM10 for BEST Invest & RM100 for MyTheo).

- 4. Convenient fund management (deposit & withdrawal) with respective apps.

Of all, StashAway turns out to be my personal favorite as it has a (1) simple (yet informative) user interface, (2) the lowest barrier of entry, and (3) the ease for opening multiple portfolios per user. This means that I can set up different StashAway portfolios for different saving goals – which is a low-key yet amazing convenience from StashAway.

Now, the key here is to spend some time (5 mins that’s all) to set up your intended savings portfolio and automated direct debit orders – and you are all set for your purposeful savings journey.

By the way, if you are curious about the settings/presets that I use for each platform, here you go:

- StashAway: 6.5%, 10% & 14% Risk Index (as recommended by StashAway)

- MyTheo: 8% Growth – 65% Income – 27% Inflation Hedge (as recommended by MyTheo)

- BEST Invest: Do-It-Yourself via BIMB Dana Al-Fakhim Money Market Fund

Note: The withdrawal process for all robo-investing platforms are not instant and have to be processed for a couple of days. Hence, in case of urgent usage, I always have some cash in my bank account to pay for the expenses upfront before withdrawing them from my savings.

—

Read: My StashAway Review

Step 3: Mindset: Purposeful Savings = Mindful, Guilt-Free Spending

Mindset is the last important piece for me when I am developing my savings routine.

Now, some of you might be thinking:

“What does mindset have to do for things like savings?”

Well, everything!

I used to feel very frustrated & guilty when I have to spend to replace my dead car battery and the sudden need for me to replace my spoilt mouse.

Also, I tend to over-micro-manage my traveling expenses in the past which sometimes really affected my overall experience (eg. thinking twice about trying some good, but slightly pricey food while traveling – which to be honest, really spoilt the mood)

Hence, setting up multiple mini piggybanks (eg. A StashAway portfolio) for different one-off yearly expenses & purpose in my life truly enhance my financial life.

Instead of being frustrated by these one-off spending, I embrace and accept the fact that things like a dead car battery to traveling are simply part of my life, and I am financially prepared for them.

In short, here’s my point:

We’ll always encounter random occasions & incidents in our life that require money here & there.

We could be financially caught off guard by them, or being extremely hesitant to spend for some truly awesome once-in-a-lifetime experience (eg. traveling).

On the other end, we also have a choice to save in anticipation of these events or occasions – it is really a matter of embracing the fact that these are simply part of life and we can, for most of the time, be financially prepared for them.

No Money Lah’s Verdict

So here you go – my personal savings routine that is automated and relatively effortless (plus a bit of my old-man mindset talk).

To be honest, I think the hardest part for many people is really just to take the first step and start planning for their savings – and if that’s being done, it’ll extremely simple moving forward:

Just start.

p.s. How do you plan your savings routine? Are there any unique purposes that you save your money for?

Share with me at the comment section below, would love to hear from you!

You might be interested:

1. How I Invest My Money as a Self-Employed Person?

2. 4 BETTER Ways to Save Your Money in a Low Interest Rate Environment!

—

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

I strongly agree that automation part is the key in building a solid saving routine! It helps me less worried and I know I am prepared for everything I want, so I can focus on learning income skills to boost my income! Thanks for sharing Yi Xuan!

Haha yeahh!! Automation is the key!

Thanks for your comment Sin Lee! 🙂

Why do you use 3 robo-investing platforms instead of one, counter-party risk?

Hey man!

Haha just me being curious and wanna try different platforms.

Yi Xuan