Last Updated on May 1, 2022 by Chin Yi Xuan

Are you covered by your insurance company if you or your loved ones are infected with Covid-19?

With the pandemic hitting Malaysia harder than ever this year, our public healthcare system is under intense pressure. Packed quarantine centers, hospital rooms, and ICU are stressful to both the patients and front-liners. Treatment at private hospitals ain’t cheap either, ranging from RM10,000 to RM30,000 (or more).

Let’s be honest, it is painful and expensive to be infected by Covid-19 today.

Ironically, most people barely have any idea about their insurance coverage on Covid-19. Afterall, you are paying for your insurance every month so it should be paying for all your Covid-19 treatments…right?

Except it isn’t that straightforward – as you’ll learn about the nuances as you go through my article.

I planned for this article with the idea to compile the details of Covid-19 coverages from major insurance companies in Malaysia: AIA, Great Eastern, Allianz, Prudential, Manulife, Etiqa, and Hong Leong Assurance (HLA). The process was painfully tough as each insurance company has different coverage and terms – but I finally did it.

In this comprehensive Covid-19 insurance guide, let’s address the important questions that we have on Covid-19 insurance coverage:

- Do insurance companies offer any free Covid-19 coverage to policyholders? If yes, what are they?

- Are you covered from vaccines’ side effects?

- Does your medical card pay for Covid-19 hospital treatment, especially private hospitals? (READ THIS!)

- How to claim the fees for your Covid-19 test?

- What to do if you do not have enough Covid-19 coverage? (Free and paid options)

- What can the insurance industry do better for customers during the pandemic?

p

Table of Contents

FREE Covid-19 additional coverage by insurance companies

Due to the pandemic, insurance companies in Malaysia have introduced various Covid-19 protection to policyholders. As of the time of writing, these protections are complimentary to policyholders with no additional cost.

In short, most insurance companies offer respectable complimentary protection. However, I think these protections should be automatically available for existing policyholders without extra registration needed (ahem…Great Eastern and Allianz).

p.s. Best viewed on desktop

p

| Home Quarantine* | Quarantine @ Quarantine Centres* | Hospitalization* | Death | Eligibility | Extra Registration Needed? | Waiting Period to be eligible for claim | Deadline | Special Note | How to claim | |

|---|---|---|---|---|---|---|---|---|---|---|

| AIA | RM1,000 | RM1,000 | RM1,000 | RM5,000 for new clients/RM10,000 for existing clients. | New and existing clients with individual Life Insurance and/or Flex PA, or participate in a new individual Family Takaful plan. | No | Yes, 14 days after the new policy/certificate has been activated. | Updated 5/8/2021: 31/12/2021 or upon reaching the claim limit of RM3M, whichever is earlier. | New client = activated from 1/6/2021 to 31/8/2021. Online insurance and takaful plans are excluded. | Refer to Agent/Financial Planner for more info |

| Great Eastern | NA | NA | RM50/day | NA | For life assured with primary medical plan with exclusion clause on communicable diseases requiring quarantine by law | Not needed for eligible policyholders registered on e-connect | 14 days | Until payout of fund is reached | Not publicly stated on website | Refer to Agent/Financial Planner for more info |

| Allianz | NA | NA | NA | RM20,000 | Individual policyholders who purchased any personal insurance products of the Allianz Life or Allianz General issued from 1/7/2021 - 31/8/2021 | Yes | 14 days | Until 31/12/2021; OR until RM1M payout is reached | https://www.allianz.com.my/we-care-deathbenefitclaim | |

| Prudential | NA | NA | Refer to Hospitalization section for more info | NA | NA | NA | NA | NA | NA | NA |

| Manulife | RM200/day up to 30 days | RM200/day up to 30 days | RM200/day up to 30 days | RM10,000 Additional RM5,000 if the individual is a Medical Staff who works in a registered hospital in Malaysia or MOH designated screening facilities involved in the handling of COVID-19 cases in Malaysia. | A policyholder of Manulife, where the policy must be issued prior to or within the programme period | No | For policies issued/reinstated on or after 26/2/2020, Hospitalization Income Support will not be payable if the customer diagnosis of COVID-19 occurs within 14 days from the date of the policy issuance/reinstatement. | 30/6/2021, or until RM 1M payout is reached, whichever earlier [Update 16/6/2021: Fully Redeemed] | (1) not applicable to insured who is covered under any complimentary group policies offered by Manulife. | Refer to Agent/Financial Planner for more info |

| Etiqa | RM5,000 Cash Relief upon diagnosis of Covid-19 | (1) An individual customer of Etiqa Life Insurance Berhad or Etiqa Family Takaful Berhad. (2) Your plan must be in-force, active and non-delinquent (i.e. no outstanding premiums/contributions that are unpaid) at the point of diagnosis and claim submission. (3) You did not receive the RM5000 Cash Relief payout in 2020. | No | Unclear | 31/3/2021 | Group customers are excluded | www.eti.qa/livechat or email at [email protected] | |||

| Hong Leong Assurance | NA | NA | 1. RM200/day for up to 5 days 2. Medical Bill Reimbursement for private hospitals (referred by MOH): i. Cat 3: up to RM5,000 per life ii. Cat 4: up to RM15,000 per life iii. Cat 5: up to RM25,000 per life | RM10,000 | For HLA policyholders with an individual medical policy | No | No | Updated 5/8/2021: 16/7/2021 - 31/12/2021, or until payout of RM1M is reached. | Refer to Agent/Financial Planner for more info |

(1) This info is accurate as of 7/8/2021. Click on the name of each insurance company for more info.

(2) These coverages are complimentary to policyholders. As per my understanding, they do not impact the terms and payout of your existing policies.

(3) Need more info? Reach out to my financial planner for a free financial consultation session, or a list of reliable full-time agents from each insurance company at the end of this article!

(4) Insurance companies/representatives with the most updated info feel free to reach out to me at [email protected]

*Under the order from Ministry of Health/At MOH Designated Quarantine Centres or Hospitals

p

Vaccines’ Side Effects: Are they covered by your insurance company?

While the risk is minimal, some people may still experience side effects after getting their Covid-19 vaccination.

The question is, will your insurance company cover the fees if you or your loved ones require medical treatment due to the side effects of vaccines?

p.s. Best viewed on desktop

p

| Yes/NA | Death | Eligibility | Deadline | |

|---|---|---|---|---|

| AIA | Yes, RM100 daily up to 14 days due to hospitalization from vaccine side effects. | RM20,000 if death occurs within 30 days from vaccination date | All Malaysians aged 18 - 70 that signed up through AIA's microsite. | 31/12/2021, or until the total payout of RM3M, whichever is earlier. |

| Great Eastern | Yes, RM 200/day up to a maximum of 7 days for hospitalisation, due to adverse events following immunization (AEFI) within 14 days after receiving a COVID-19 Vaccine. | A lump sum of RM10,000 per life if death is related to AEFI within 30 days from receiving a COVID-19 Vaccine or from date of admission to hospital due to AEFI, whichever is later. | All life assured of Great Eastern Life who is a registered e-Connect user and whose policy is in-force during the Coverage Period (except for compulsory Group Employee Benefits and policies with coverage term of less than 1 year). | 25/2/2021 - 31/12/2021, or until the total payout of RM1M, whichever is earlier. |

| Allianz | Yes | Allianz medical plan cutomers. | Unclear | |

| Prudential | Yes, RM500 for hospitalization due to adverse effects from immunisation (AEFI) within 7 days after an approved COVID-19 vaccination | All Prudential Malaysia customers. | 8/2/2021 - 31/12/2021, or upon reaching payout of RM1M, whichever is earlier | |

| Manulife | Yes, serious adverse effect within 14 days after receiving an approved COVID-19 Vaccine, capped at maximum limit of RM5,000 per life. | Person covered under the medical plan offered by Manulife that does not cover post COVID-19 vaccination, i.e. medical plans that carry an exclusion which excludes any cost of hospitalisation due to preventive treatment/preventive medicines. | 24/5/2021 - 30/9/2021, or upon reaching payout of RM500k, whichever is earlier | |

| Etiqa | Yes | Included in all medical plans that cover hospital admissions | Unclear | |

| Hong Leong Assurance (HLA) | Yes, RM200/day up to 7 days | RM10,000 | Life assured of individual policy with medical coverage | 16/7/2021 - 31/12/2021, or upon reaching payout of RM1M, whichever is earlier |

(1) This info is accurate as of 5/8/2021. Click on the name of each insurance company for more info.

(2) Need more info? Reach out to my financial planner for a free financial consultation session, or a list of reliable full-time agents from each insurance company at the end of this article!

(3) Insurance companies/representatives with the most updated info feel free to reach out to me at [email protected]

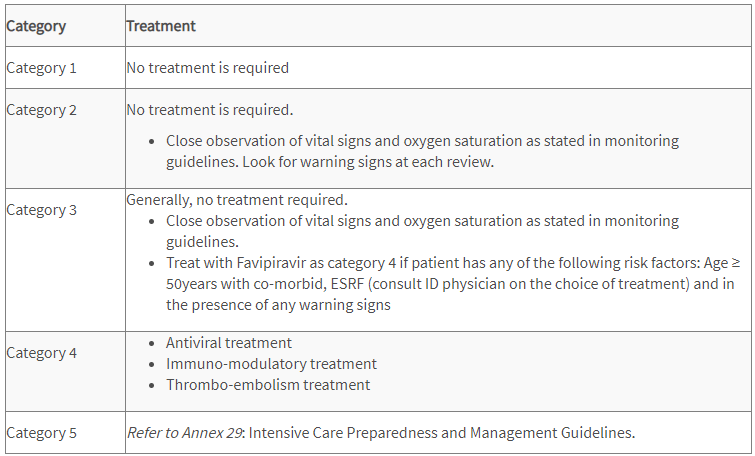

(4) By the way, here’s the meaning of different categories of Covid-19:

p

Hospitalization: Does your medical card pays for your Covid-19 treatment – especially at private hospitals?

With Covid-19 putting a heavy burden on our public healthcare system, many would choose to go for treatment in private hospitals – especially when there is no time to waste.

However, treatment in private hospitals is expensive, ranging from RM10,000 to RM30,000 (or more).

The question is, does your medical card covers your hospitalization treatment?

MUST-KNOW Side Info: Covid-19 & Medical Card

Did you know that most of the medical cards in the market today do not cover for communicable diseases/general pandemics like Covid-19?

It is likely in your medical card, there is a clause called ‘general pandemic exclusion’ (or wordings of similar meaning). Hence, insurance companies generally DO NOT cover your Covid-19 hospitalization treatment if your medical card holds such restriction.

As you’ll see in the table below, only AIA, Etiqa (for a limited time), and Prudential medical cards pay for your hospitalization treatment as per your medical card coverage. Other companies only offer protection on a goodwill basis (ie. very limited coverage with restrictions).

Of all, I’d say AIA and Prudential’s medical card is the most valuable medical card you can have right now. Whether you are an existing AIA or Prudential medical card holder, or you simply want to find out more, feel free to reach out to my recommended full-time AIA and Prudential agent for inquiry, contact HERE.

In contrast, if you are holding medical cards from other companies, it is best for you to seek additional hospitalization coverage for Covid-19 (eg. check out Etiqa e-Medical Pass below).

p.s. Best viewed on desktop

p

| Medical plan(s) with exclusion on communicable disease/general pandemic | Medical plan(s) without exclusion | Eligibility | Waiting Period? | Deadline | Special Note | How to register/claim | |||

|---|---|---|---|---|---|---|---|---|---|

| AIA | AIA Medical Plans pay for hospitalization. AIA Critical Illness Plans pay for your chosen sum covered if you are admitted to ICU due to Covid-19 | Need to be referred to private hospital by Ministry of Health (MOH) | Refer to agent/financial planner for more info | NA | Medical Plans: A-Plus Health A-Plus Total Health A-Plus Health Booster A-Life MedRegular A-Life Medik Famili A-Plus Health Guard Critical Illness Plans: A-Life Beyond Critical Care A-Plus Beyond Critical Shield | Pay first claim later. Refer to agent/financial planner for more info. | |||

| Great Eastern | i. Up to RM5,000 for Category 3 COVID-19 patient, or ii. Up to RM15,000 for Category 4 COVID-19 patient, or iii. Up to RM25,000 for Category 5 COVID-19 patient. | All life assured of Great Eastern Life who are registered e-Connect users and have any in-force primary medical plan(s) with exclusion on communicable disease requiring quarantine by law (except for compulsory Group Employee Benefits). | A waiting period of 30 days applies from the risk commencement date of new business policies or reinstatement date, whichever is later of the policy. | 27/3/2021 - 30/9/2021, or upon reaching maximum claims limit of RM1 million, whichever is earlier. | (1) Private hospital only. (2) The estimated timeframe to process a claim is within 10 to 20 working days upon receiving complete claim documents. | Pay first claim later. Refer to agent/financial planner for more info. | |||

| Allianz | RM6,000 (RM3,000 for self and additional RM3,000 for spouse/children) | Applicable to the eligible Allianz Life customers who registered for MyAllianz customer portal | 14 days after the Eligible Participant's Campaign registration date | 30/6/2021, or upon reaching payout of RM3 million, whichever earlier. | No medical plan needed to be eligible. You are qualified for this as long as you are an eligible Allianz Life customer. | Register at www.allianz.com.my/we-care#register | |||

| Prudential | Prudential reimburses charges incurred for medically necessary treatments when customer undergoes hospitalisation due to COVID-19 | Medical Plan issued by Prudential: PRUHealth PRUMedic Essential PRUFlexi Med PRUValue Med PRUMillion Med Medical Plan issued by Prudential Takaful: Takaful Health Takaful Health2 HealthEnrich HealthEnrich+ Medic Protector Health Protector Medic Essential | 30 days waiting period upon the commencement of the medical plan | 6/8/2021 onwards until announcement of end of coverage | Claims must be submitted within 3 months from the hospitalisation date. | Claim documents must be submitted via PRUServe Plus or cvia email at [email protected] or [email protected]. | |||

| Manulife | 30-Day waiting period waived for all medical plans | Individual who is covered under a medical plan with Manulife. | None | 24/5/2021 - 30/9/2021, or upon reaching payout of RM500k, whichever earlier. | Government hospitals designated by Ministry of Health ONLY! | Refer to customer service [email protected] | |||

| Etiqa | The coverage amount follows your current terms of your plan. | An individual customer of Etiqa Life Insurance Berhad or Etiqa Family Takaful Berhad. You must have a medical plan with Etiqa. | Waiting period applies | 31/12/2021 | Application to both Private & Government hospitals. This benefit to cover Covid-19 will utilize the allocations of your existing Etiqa plan. | Pay first claim later. submit a reimbursement claim to Etiqa via Livechat at www.eti.qa/livechat or email at [email protected]. | |||

| Hong Leong Assurance (HLA) | 1. RM200/day for up to 5 days 2. Medical Bill Reimbursement for private hospitals (referred by MOH): i. Cat 3: up to RM5,000 per life ii. Cat 4: up to RM15,000 per life iii. Cat 5: up to RM25,000 per life | HLA customers with an individual medical policy | None | 16/7/2021 - 31/12/2021, or until RM1M payout is reached | Applicable to public and private hospitals with special terms. | Pay first claim Refer to agent/financial planner for more info. |

(1) This info is accurate as of 7/8/2021. Click on the name of each insurance company for more info.

(2) Need more guidance? Reach out to my financial planner for a free financial consultation session, or a list of reliable full-time agents from each insurance company at the end of this article!

(3) Insurance companies/representatives with the most updated info feel free to reach out to me at [email protected]

p

What to do if you do not have proper coverage for Covid-19?

Then, there are 3 things you can do:

(1) Allianz and Great Eastern coverage for non-customers.

If you are not a Great Eastern or Allianz customer, you can register for the free coverage from the companies, details below. One thing though, is these free coverages are certainly not enough for emergency treatment (especially at private hospitals). But still, better than nothing.

i. Allianz Free Covid-19 Benefits for Non-Customers

| Home Quarantine with order from MOH | Quarantine at MOH Designated Quarantine Centres | Hospitalization at MOH Designated Hospitals | Death | Eligibility | Extra Registration Needed? | Waiting Period? | Deadline | Special Note | How | |

|---|---|---|---|---|---|---|---|---|---|---|

| Allianz | NA | NA | NA | RM8,000 | Individuals who have registered for Allianz We Care Community on and before 30/6/2021 and individual policyholders who purchased any personal insurance products of the Allianz Life or Allianz General issued from 1/7/2021 until 31/8/2021 and have provided NRIC number, valid mobile and email contact details. | Yes | Coverage Validity Period commences 14 days after the Eligible Participant's Campaign registration date. | 31/12/2021 or when the total payout reaches RM1M, whichever earlier. | https://www.allianz.com.my/we-care-deathbenefitclaim |

p

ii. Great Eastern Vaccine Fund for Non-Customers

| Hospitalization | Death | Eligibility | Deadline | Register | |

|---|---|---|---|---|---|

| Great Eastern Vaccine Fund | RM100/day up to 5 consecutive days | RM5,000 | Not a Great Eastern policyholder. Malaysian 18 y/o and above | 31/12/2021 | https://www.greateasternlife.com/my/en/personal-insurance/our-promotions-and-events/2021/covid19-vaccine-fund-enquiry-form.html |

(1) This info is accurate as of 20/5/2021. Click on the name of each insurance company for more info.

(2) Need more guidance? Reach out to my financial planner for a free financial consultation session, or a list of reliable full-time agents from each insurance company at the end of this article!

(3) Insurance companies/representatives with the most updated info feel free to reach out to me at [email protected]

p

(2) Get additional Covid-19 Coverage

For better coverage, consider going online to get these additional Covid-19 protections to better equip yourself or your family members:

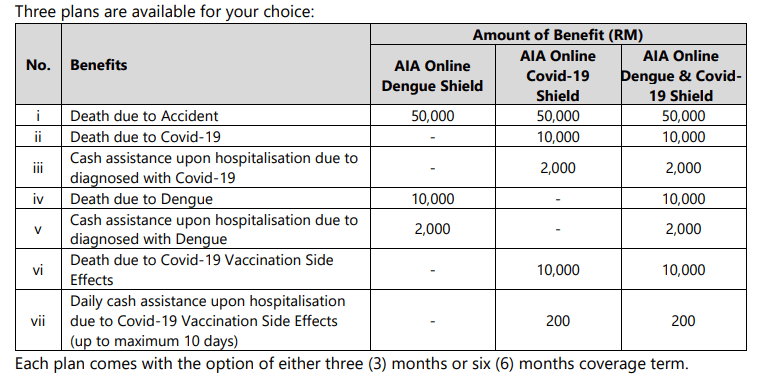

i. AIA Online Shield:

AIA Online Shield is an affordable short-term plan that provides compensation in the event of death caused by Covid-19, or Side Effects of Covid-19 Vaccination.

Coverage & Highlights:

- Affordable premium ranging from RM19.90 to RM59.90;

- Get covered easily without health declaration required;

- Claims process fast and easy.

To buy/for more info: https://www.aia.com.my/en/our-products/online-products/aia-online-shield.html

p

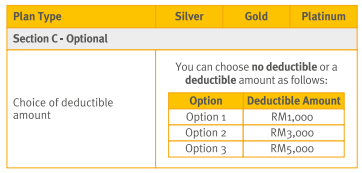

ii. Etiqa e-Medical Pass Insurance:

Covers for hospitalization at a Private or Government hospital for admission due to Covid-19.

Coverage**:

For more info, or to buy/get quotation: https://www.etiqa.com.my/v2/health-insurance-takaful/e-medical-pass-insurance

**Attention: This product has a 30-days waiting period. Meaning you’ll not be covered in the first 30 days upon the activation of your protection.

p

(3) Reach out to a trusted financial planner or agent for guidance.

Finally, if you are unsure or overwhelmed (which is normal: I was overwhelmed, too), I’d highly recommend you to seek help from insurance professionals:

-

Licensed Financial Planner

A licensed financial planner offers comprehensive financial planning from insurance, investment, and estate planning (eg. will-writing). If Covid-19 makes you realize the importance of reorganizing your finances, I highly recommend you to reach out to a licensed financial planner.

Find out my experience working with my financial planner HERE, and register for your free financial consultation session towards the end of the article!

-

Reliable, full-time insurance agents

If you need to get clarification for your questions fast, or have coverage inquiries for a specific insurance company, feel free to reach out to the list of full-time insurance agents below.

These are my personal connection, and they are ready to provide swift assistance with your inquiries. Just say that you are coming from No Money Lah’s article and they’ll attend to your questions.

p

| Insurance Company | Agent | Contact (Whatsapp) |

|---|---|---|

| AIA | Ashley | Click HERE for inquiry/assistance |

| Allianz | Brad | Click HERE for inquiry/assistance |

| Prudential | Khoh | Click HERE for inquiry/assistance |

| Hong Leong Assurance (HLA) | Rita | Click HERE for inquiry/assistance |

p

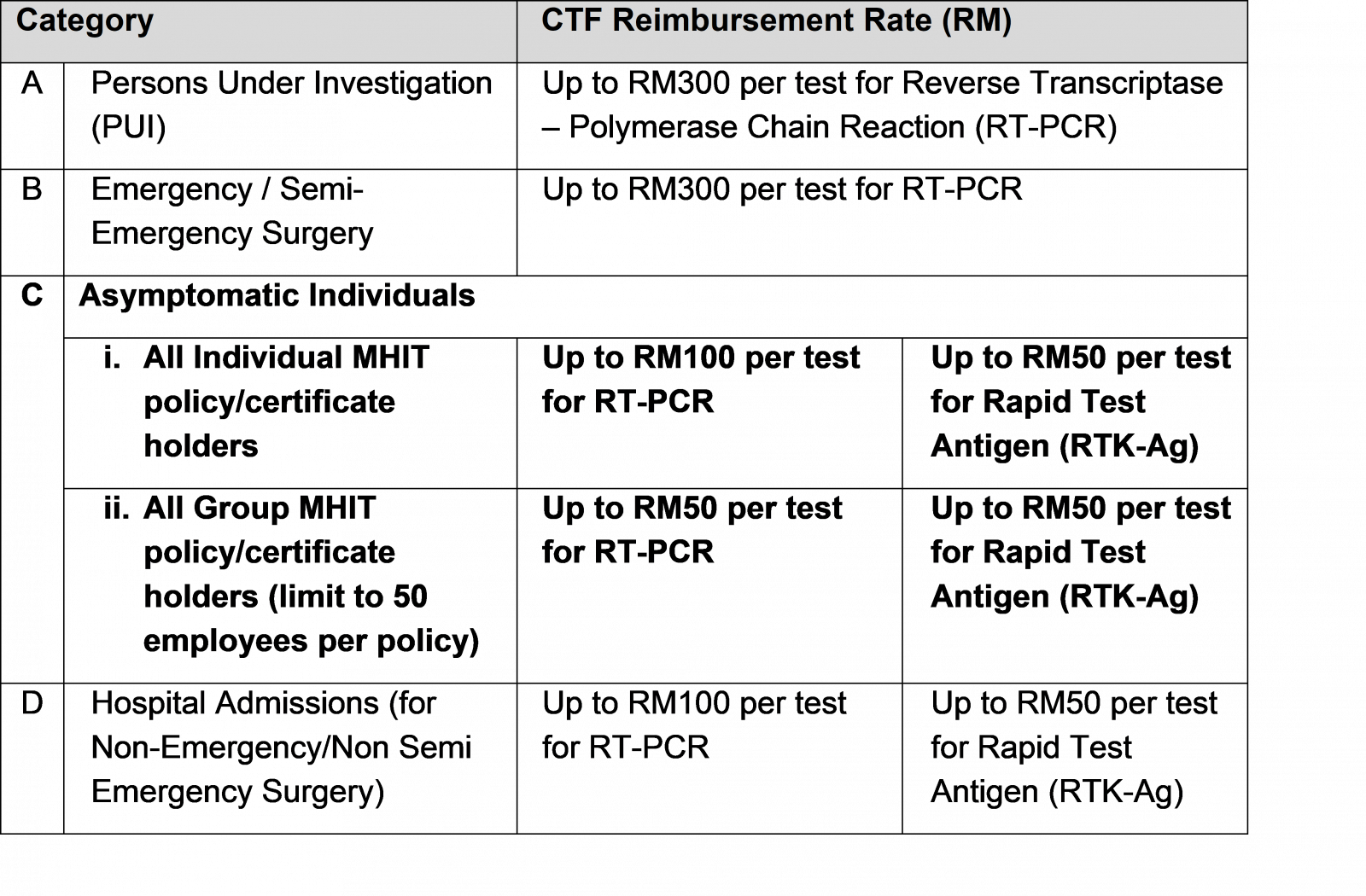

Covid-19 Test Fund (CTF): Claim your Covid-19 testing fee!

[Update 21/5/2021]: Unfortunately the RM10 mil CTF is fully claimed. I’ll update this section if the relevant parties are willing to add additional funds to CTF.

The Covid-19 Test Fund (CTF) is established by key insurance bodies in Malaysia to support the Ministry of Health’s (MoH) to conduct more COVID-19 testing.

Medical insurance policyholders and takaful certificate holders may apply for reimbursement up to a maximum of RM300 for COVID-19 testing (one reimbursement per individual).

Eligibility:

- Insurance policyholders and takaful participants with group/individual medical and health insurance policies and takaful certificates who undergo COVID-19 tests at recognized private labs listed on MoH’s COVID-19 website.

p - The CTF reimbursement is limited to one test per policy/certificate holder only and the reimbursement period is valid until 30/6/2021 or earlier, if the fund is fully utilized.

p - Persons Under Investigation (PUI) and any asymptomatic policy/certificate holder is entitled to claim as follows:

More info: https://www.myctf.my/ (p.s. Don’t worry if you can’t understand the requirements/eligibility on the website, because I couldn’t get it too lol, my advice: just apply)

p

What can the insurance industry do better for customers?

If you are reading this article, it is most likely you are unclear, or worse, uninformed about your Covid-19 coverage. Have you ever wonder why you are uninformed?

In my opinion, this is because insurance companies and many agents (not all) are doing a POOR job in updating customers about their Covid-19 coverages.

Personally, I have family members with insurances from Great Eastern, Prudential, Allianz, and AIA. NONE (TAK ADA, MEI YOU) of the agents have reached out and inform us about our coverage from the pandemic. I believe most of you have such experience too.

So let me make my statement here:

To people in the insurance industry, up your integrity and professionalism. Most of you say that insurance is about serving than selling. Prove your words with practical action, please.

(p.s. Kudos to the minority reliable & responsible insurance agents out there)

p

No Money Lah’s Verdict (+ how to support the blog?)

So here you go – the compilation of coverages of Covid-19 from major insurance companies in Malaysia.

I know how miserable it can get to live in this pandemic era. As such, I wish this compilation gives you clarity in your insurance needs or planning throughout this challenging period.

If you find my article helpful, there are a few ways you can do to support my blog:

- Stay at home and register for your Covid-19 vaccine!

p - Consider using my referral links for your personal finance/investment needs HERE. This helps me big time in sustaining the blog!

p - Subscribe to my FREE email newsletter HERE for weekly personal finance and investment content from me!

I am sure many of you have some burning questions, feel free to leave your comment in the comment section below – I’ll do my best to help! 👇

Disclaimer:

- This article is produced based on my best research. I may miss out on certain details so I cannot guarantee the full accuracy of this article. Please use this article only as a reference.

- This article is not meant to be financial advice. Please seek guidance from a licensed financial planner before making important financial decisions.

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Yi Xuan , this is well written, very informed and unbiased article . yes, insurance is very important in this time especially , most people dont know insurance is one of the most important assets and investment . with all the hype of cryptocurrency and short term gains, people need to know the fundamental of the pyramid. In HK, most insurance companies offer free covid protection since last year in march 2020 . Yes AIA is one of the best all rounder for medical insurance in Asia Pacific. Not the cheapest but still competitive, easiest to claim and least to worry about.

Thanks for the comment Gabriel! Financial protection is indeed the core of a proper financial planning.

Take care and stay safe.

Regards,

Yi Xuan