Last Updated on May 1, 2022 by Chin Yi Xuan

‘Personal’ finance is never personal. It’s not just about us, but the people we cared about the most: our parents.

One thing is certain as we grow up: our parents are getting older at the same time.

Inevitably with aging, the risks and occasions where money is needed increases – retirement, physiotherapy, medical treatments, and so on.

In my opinion, here are 6 money decisions that you must do for your parents before it’s too late:

p

Table of Contents

#1 Find out the insurance coverage of your parents

Insurance is a taboo among most Asian families.

Ironically, we do not talk about insurance until it’s too late. Another problem that I experienced personally is many of my parents’ agents have a poor track record of follow-up over a long period of time (some are not even in the business anymore).

As such, don’t be surprised if our parents:

- Do not know with clarity what kind of coverage they have, and;

- Assume that they have enough protection with the policy they bought in the early 2000s.

Generally, there are 3 things that you need to know:

- Life Insurance: Do your parents have any existing loans/financial commitments at hand? If yes, having adequate life insurance is important! In case of death, life insurance can help in lifting the financial burden off for the family (while also paying for the funeral).

p - Critical Illness (CI) Protection: Are your parents still actively working and supporting the family’s everyday expenses? If yes, then having proper CI protection is crucial as an income replacement to support the patient’s recovery and family expenses in case of illness like cancer.

p - Medical Coverage: This is perhaps the most important protection that you need to make sure your parents have as they age. Medical coverage comes in handy in the event of hospitalization or any critical medical conditions that usually require expensive treatment.

Action Plan:

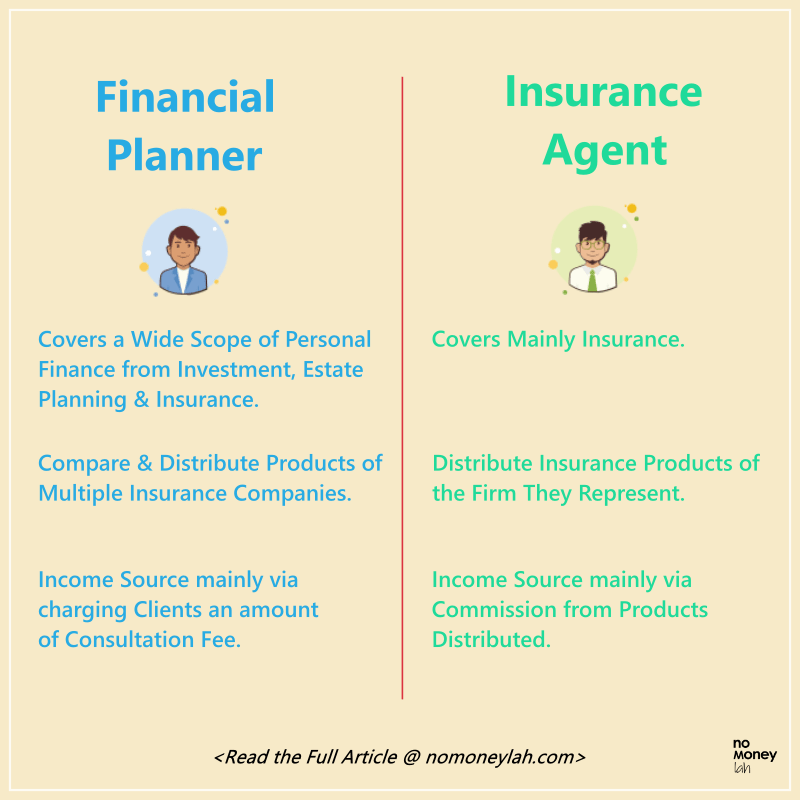

Get help from either a licensed financial planner or a trusted insurance agent, do not attempt to do this alone.

- If your parents have their policies, go get a financial planner/insurance agent to do a policy review for you. Alternatively, get in touch with your parents’ insurance agents for this (Tip: Keep their contact!).

p - Find out the existing insurance coverage of your parents. Which policies have lapsed, and what kind of coverage is still in-forced?

p - Find out if your parents’ coverage is relevant to their age and financial condition. Then, do whatever you can according to your own financial capability.

Now, dealing with this can be overwhelming especially if you are not familiar with insurance. I know this because I felt the same when I was finding out my parents’ coverage – and I have some basic understanding of insurance.

But this is not something you can delay any further. The longer you delay this, the more expensive it gets for you to address the underlying issue especially if your parents are under-protected.

READ: How is it like to engage a licensed financial planner in Malaysia?

p

#2 Do your parents have enough for retirement?

After working for nearly 3 decades of their life, it’s only natural to assume our parents have a decent saving for retirement, right?

Honestly, you’d never know. Some of you may even be surprised by your discovery.

Things like the money needed for you and your sibling’s university education, money that was taken out of EPF as the down payment for your home, monthly mortgage repayment – these are just the tip of the iceberg of the kind of expenses that can eat into your parents’ retirement savings.

Action Plan:

Regardless, it’s important to find out if your parents have enough for a comfortable retirement. The less financial literate your parents are, the more important it is for you to do this ASAP.

When overwhelmed about this, get help from a financial planner (p.s. NOT insurance agents, because many of them do not do holistic financial planning).

READ: How my financial planner helped improved my finances!

p

#3 Do your parents have too much cash stashed in their bank account?

Many parents may have worked very hard in their career, but they neglected an important part of personal finance: investing.

Again, don’t be surprised to discover that your parents have a huge sum of cash just sitting there in their bank account over the years.

In this case, it is crucial for you to encourage your parents to invest their cash to beat inflation and generate yield.

Action Plan:

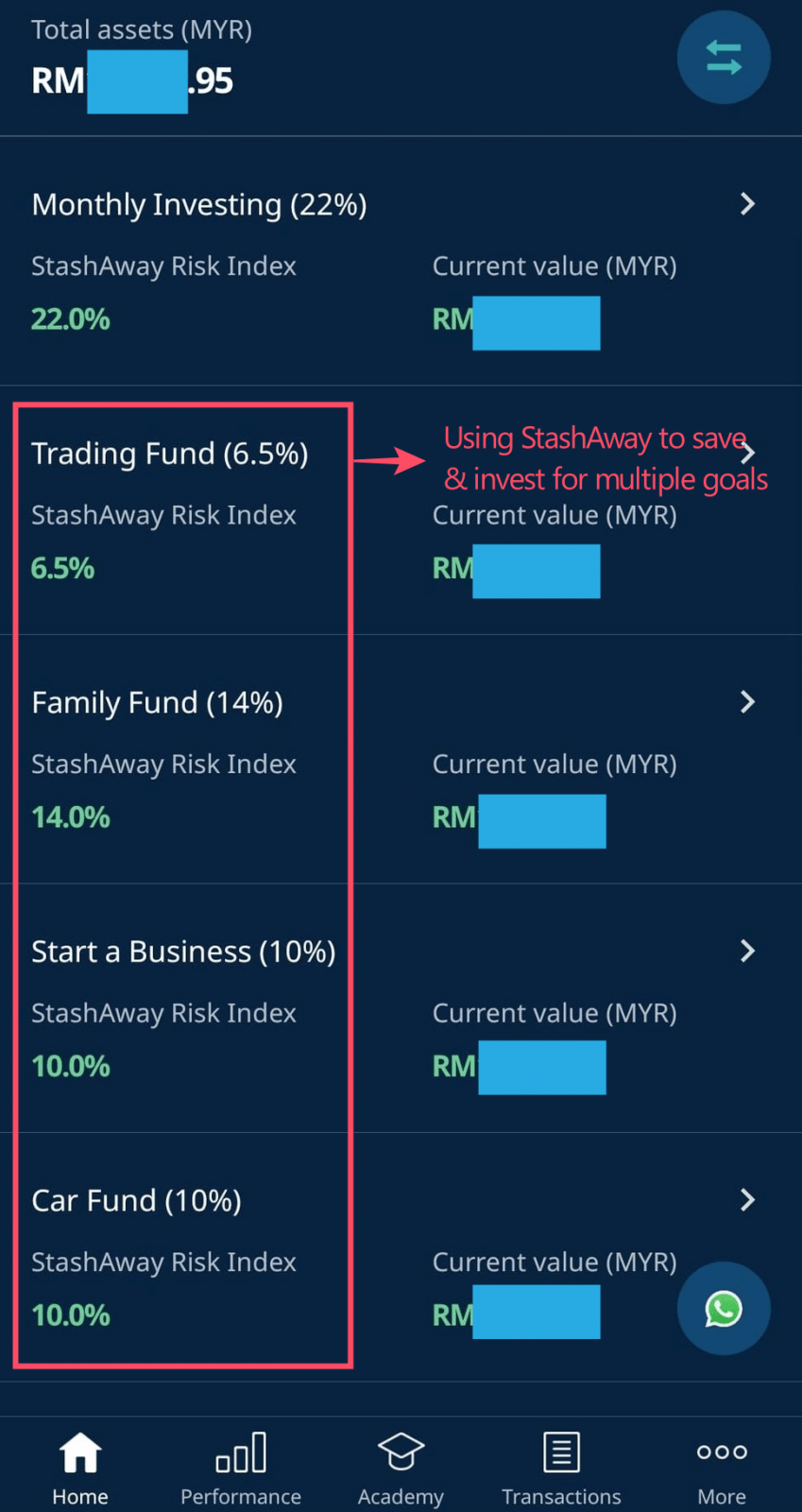

Depending on the risk tolerance of your parents, robo-advisors like StashAway and Wahed are great as they can adjust to their risk profile and invest accordingly into a combination of equities, commodities, and bonds.

Otherwise, at the very least, consider shifting the cash to low-risk money market funds through StashAway Simple, BEST Invest Money Market Fund, or Versa to enjoy FD-like returns, without the troublesome lock-in period.

FIND OUT MORE: StashAway Review, StashAway Simple Review, Wahed Review, BEST Invest Money Market Fund

p

#4 Do your parents have a will?

Will is another taboo that most families rarely talk about until it’s too late.

The problem is, without a will, you’d have a lot of issues when it comes to managing assets upon the demise of a family member. From claiming the assets to the allocation of assets, things can get very complicated without a will.

For your own sake, go ask your parents to set up a will.

Action Plan:

Contrary to what most people think, setting up a simple will is not hard. In fact, anyone can set up a will through Maybank online will-writing service for a small fee easily.

However, if your parents have more assets in possession (eg. Stocks, bonds, real estate), it is best for you to get a professional estate planning service instead.

FIND OUT MORE: What is Estate Planning, and how to set up a proper will through a licensed financial planner?

(EXCLUSIVE: In this link, use referral code ‘nomoneylah30’ and get a FREE estate planning consultation session via the form at the bottom of the page!).

p

#5 Save for Family-specific expenses

Even if your parents are in a good financial state, it is wise for you to allocate some savings specifically for family purposes.

Saving specifically for family allows you to spend on the people that truly matter to you, without feeling additional financial pressure.

Nothing comes close to buying your parents’ a good pair of jogging shoes, right? 🙂

Action Plan:

Personally, I save for family-related expenses through my favorite robo-advisor, StashAway. By setting up a dedicated portfolio, I automate my savings on a monthly basis which can be withdrawn anytime for family-related expenses.

Referral Code: Open a StashAway account using my StashAway referral link HERE and get an exclusive 50% off your fees for the first RM100,000 invested for 6 months.

p

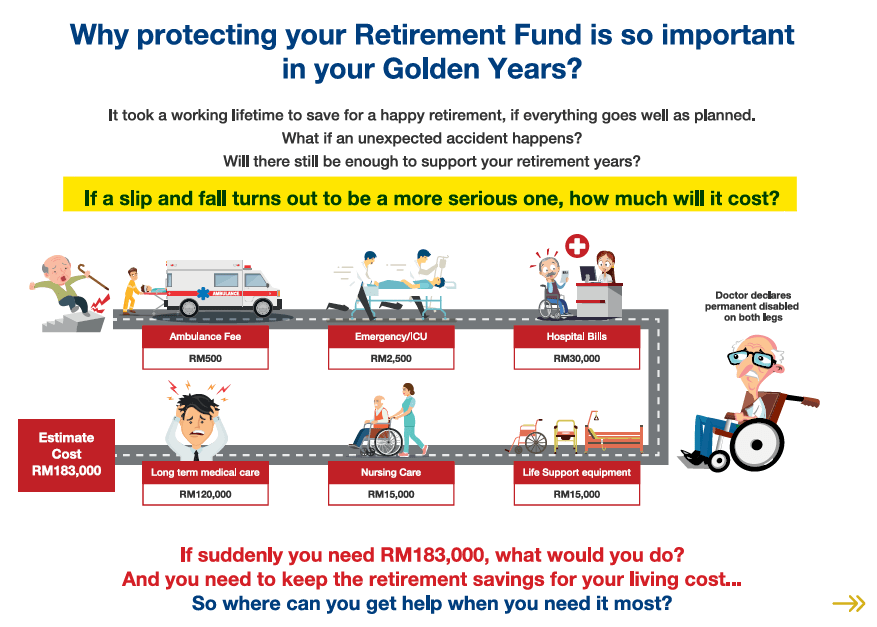

#6 Get personal accident insurance for your parents

Lastly, if your financial capacity permits, consider getting personal accident (PA) insurance for your parents. ESPECIALLY if your parents do not have medical insurance at old age!

Having PA protection can be handy, since elderly adults tend to have more risks of getting injured from their daily routine. Fingers crossed, but injuries from slipping and falling are not uncommon and the treatment can be financially demanding.

Action Plan:

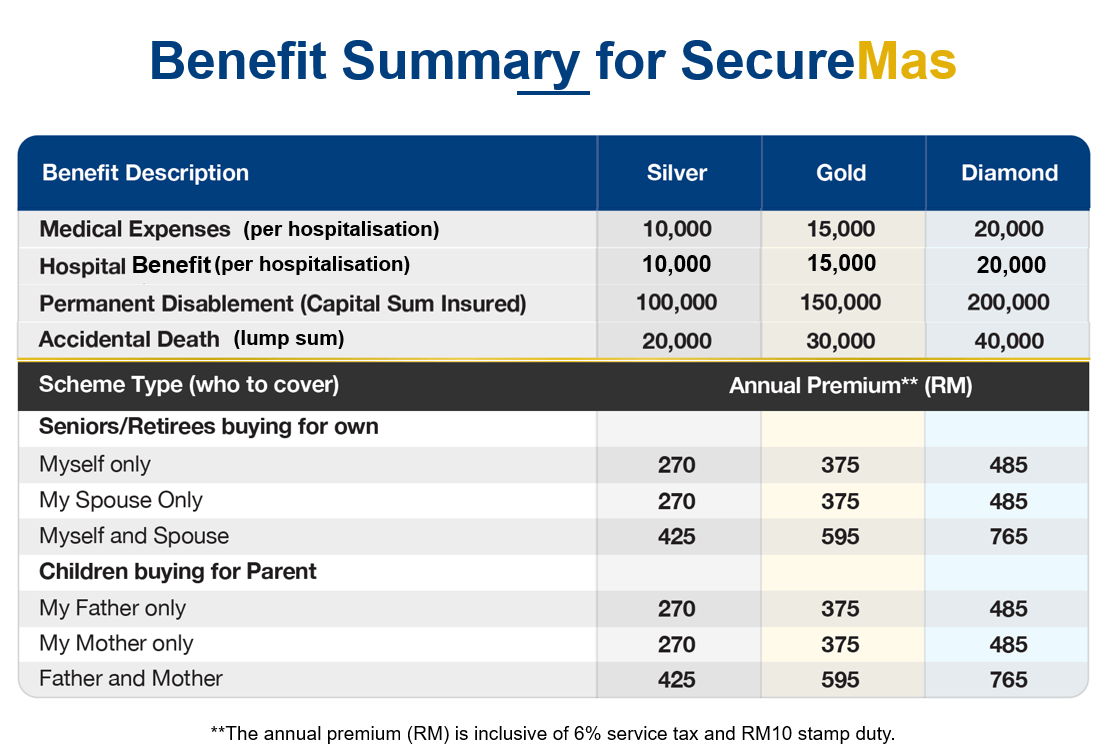

Luckily, PA protection for elderly adults is very affordable. From RM270/year (RM22.50/month) for dad/mom, or RM425/year (RM35.40/month) for both parents, you can get comprehensive PA coverage for both your parents.

This particular PA insurance is the SecureMas PA Insurance from Lonpac Insurance (which I am planning to get for my parents soon). Some of the key benefits include:

FIND OUT MORE: SecureMas PA from Lonpac Review (Benefits, How to Apply and Claim)

p

My Tips & Action Plan Summary (+ useful links)

First of all, thanks for making it till the end of this post. Things can be overwhelming if you are unaware of these money decisions that you have to make for the people you care (it was for me too!).

But without sugar-coating the reality, these are money decisions that you have to make ASAP because time is certainly not in your favor. More so if your parents are not as financially literate when it comes to money.

My advice: Take a deep breath. These are urgent things but don’t rush them. Take things step-by-step and when overwhelmed, seek help from licensed professionals.

Action Plan Summary + Useful Links:

- #1 Get an insurance coverage review for your parents

Try to reach out to your parents’ agents for this (assuming they are still in business la).

Else, get help from a trusted insurance agent or a licensed financial planner.

P

- #2 Do your parents have enough to retire?

If you want to deal with #1 and #2 together, I’d recommend engaging a licensed financial planner. Reason being, they provide more holistic financial planning services compared to an insurance agent.

READ: How is it like to engage a licensed financial planner in Malaysia? (+Find out how you can get a FREE financial planning consultation session in the article!).

P

- #3 Too much cash stashed in your parents’ bank account?

If this is the only issue to solve, then consider using robo-advisors like StashAway or Wahed to invest on behalf of your parents.

For more risk-averse parents, consider investing in low-risk money market funds via StashAway Simple for returns similar to FD, without the annoying lock-in period.

Else, if you want to solve #1, #2, and #3, seek help from a licensed financial planner.

P

- #4 Do your parents have a will?

For simple cases: you can help your parents to set up a will through Maybank online will-writing service for a small fee easily.

IF your parents have multiple asset possessions (eg. Stocks, Bonds, Real Estate): It is best for you to get a professional estate planning service instead.

FIND OUT MORE: What is Estate Planning, and how to set up a proper will through a licensed financial planner?

(EXCLUSIVE: In this link, use referral code ‘nomoneylah30’ and get a FREE estate planning consultation session via the form at the bottom of the page!).

P

- #5 Start saving for family-specific expenses

Personally, I use StashAway and set up a dedicated portfolio for this.

You can read more about my review on StashAway HERE.

Referral Code: Open a StashAway account using my StashAway referral link HERE and get an exclusive 50% off your fees for the first RM100,000 invested for 6 months.

P

- #6 Get personal accident (PA) coverage for your parents, especially if they do not have medical insurance at old age.

I recommend checking out Securemas PA protection from Lonpac Insurance. You can find out more about this insurance HERE.

Disclaimers:

This post is merely my personal opinion and experience, and should not be taken as a financial advice. Please consult a licensed financial planner before making any important financial decisions. This post may contain affiliate links that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Related Posts

September 6, 2020

3 Ideas About Money & Consistency

September 27, 2021

StashAway Malaysia Review: A Solid Robo-Advisor that You Can Depend On

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.