Last Updated on May 1, 2022 by Chin Yi Xuan

Ethereum is the world’s 2nd largest cryptocurrency network, right behind Bitcoin. However, there is more to Ethereum aside from its market size – and in my opinion, a more appealing investment compared to Bitcoin.

In this article, let’s explore Ethereum, and why I am more excited about Ethereum over Bitcoin!

p

Table of Contents

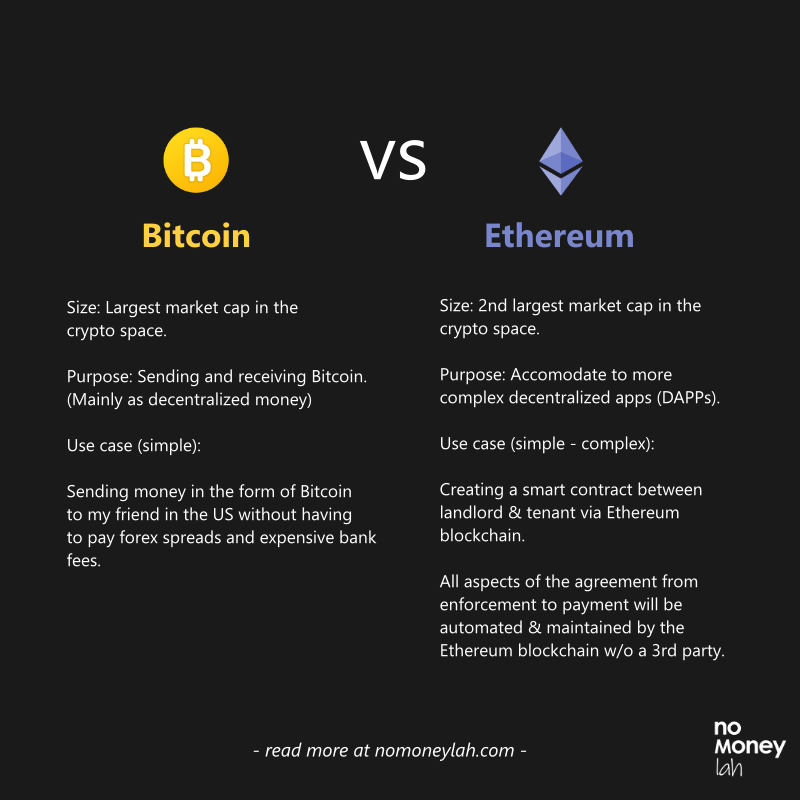

Bitcoin vs Ethereum – What’s the Difference?

The topic of Ethereum cannot start without talking about Bitcoin:

Bitcoin as we know it, is a form of decentralized money – ie. You can transact and send money without a central authority in place. This is done through the underlying technology – Blockchain.

With Bitcoin being the successful real-life application of Blockchain technology, this opens up to a lot of possibilities:

Aside from sending and receiving money, what are some other things that can be decentralized in our daily life?

-

- How about executing contracts’ clauses without a lawyer?

- How about buying & processing insurance claims without an agent?

- How about automating house rental agreements without any 3rd party in between?

- And basically, any processes that require a middleman in between!

The idea of removing a central party in all these scenarios comes with obvious consumer benefits, namely:

-

- Save money on intermediary fees across the board (which can be a huge sum).

- More efficient execution without delay and human errors.

However, there is a problem. The Bitcoin blockchain is designed around a programming language called Turing Incomplete, where it is built to only execute simple tasks – eg. A sends X amount of money to B, and nothing more.

Because of the programming limitation, building complex commands on the Bitcoin blockchain is extremely hard.

Here’s where Ethereum comes into the spotlight.

READ MORE: What is Bitcoin? (Explained in Simple English!)

p

What is Ethereum and How does it work?

Ethereum is the world’s 2nd largest blockchain network, first released in 2014 by a Russian named Vitalik Buterin. (p.s. we are both the same age hehe)

At its core, Ethereum is a Do-It-Yourself (DIY) platform for Decentralized Applications (DAPPs). This means that anyone can use the Ethereum blockchain to create their own decentralized solutions these days.

Why though? Why are people using the Ethereum blockchain to develop DAPPs instead of the Bitcoin blockchain?

Simply put, Solidity, the programming language behind the Ethereum blockchain, allows for more complex commands compared to the Bitcoin blockchain. This is what we call smart contracts.

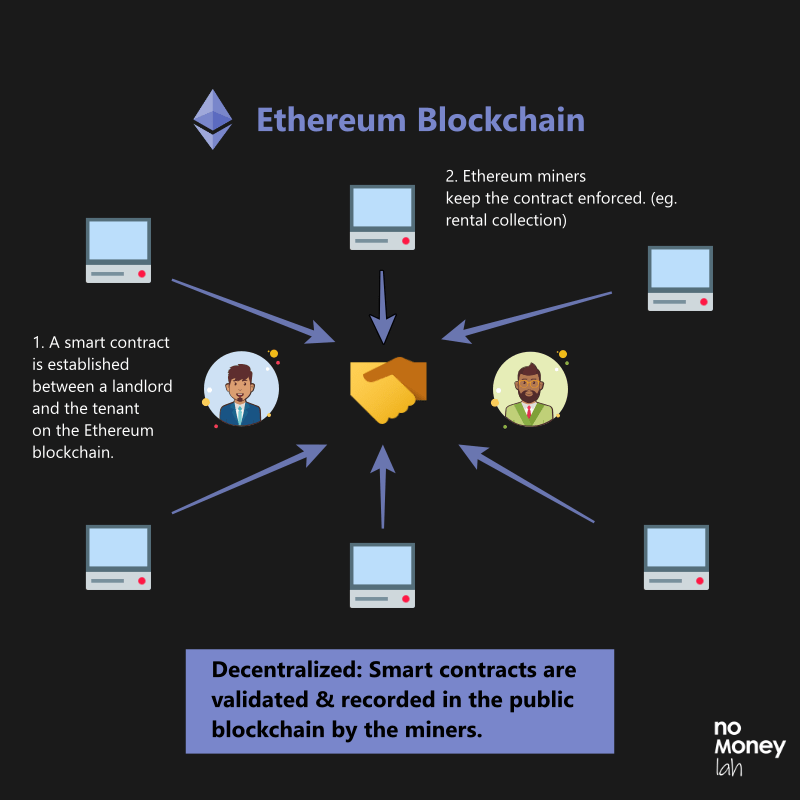

As an example, a landlord and tenant that want to automate the clauses of a house rental agreement without any 3rd party in between. Through the Ethereum blockchain, a smart contract can be created to do exactly that:

Tenant pays landlord X amount of rent every month.

IF tenant does not pay rent for 1 month, THEN deduct X amount of money from the initial rental deposits.

IF tenant does not pay rent for 3 months, THEN lock tenant out of the house.

And so on.

In essence, the smart contract deals with all aspects of the contract, from enforcement, management, and payment – effectively removing any middlemen in the process.

p

Ethereum as a Currency

When people talk about Ethereum’s price, they are essentially referring to the cryptocurrency Ether (ETH).

Just like Bitcoin (BTC) is the cryptocurrency that powers the Bitcoin blockchain, Ether (ETH) is the lifeblood of the Ethereum blockchain network.

Anyone that wants to send ETH cryptocurrency, or uses applications powered by the Ethereum blockchain has to pay a small fee in ETH. This small ETH fee is an incentive for miners to process and verify an activity within the Ethereum blockchain – this is a mechanism called Proof of Work (PoW).

Miners are computers that run the Ethereum blockchain protocol. Miners make up of a large network of computers that act like the record-keepers of the Ethereum blockchain – they check and prove that no one is cheating.

On the other hand, by ensuring the Ethereum blockchain is secure and free of centralized control, miners are incentivized with ETH in the process.

p

Potential & Risks of Investing in Ethereum

Opportunity #1: Huge Development of Decentralized Finance (DeFi) Initiatives

Decentralized Finance, or DeFi is probably the biggest reason why Ethereum appeals much more to me compared to Bitcoin as an investment.

Inspired by the Bitcoin blockchain that allows simple value transfer (eg. sending money), DeFi are initiatives that expand the use of blockchain into more complex financial use cases without a central authority.

Some example includes loans, insurance, crowdfunding and more. In short, imagine all the financial services that you are using today, but without the inefficiencies of a middleman – pretty neat!

While most people may not hear of DeFi before, but DeFi has been developing in a rapid manner for the past few years. In February 2020, the total value locked-in for DeFi initiatives were about $1 billion. As of Jan 2021, the total value locked-in for DeFi stands at over $19 billion. That is almost 20x growth over an 11-month period!

And guess which blockchain is driving the most DeFi initiatives in the world today? Yup, Ethereum.

p

Opportunity #2: The Development of Ethereum 2.0

Ethereum 2.0 is a major improvement to the current Ethereum 1.0 blockchain. The first phase of the Ethereum 2.0 launch happened at the end of 2020.

Ethereum 2.0 is an important milestone for the Ethereum blockchain. It is essentially an update with the final goal to remove miners from the Ethereum blockchain ecosystem.

In Ethereum 1.0, miners are the validation mechanism (a.k.a. Proof of Work, PoW) used, which requires unsustainable energy usage due to the mass computing power needed. Ethereum 2.0 aims to use a new validation approach call Proof of Stake (PoS).

Without going into too much technical stuffs, Ethereum 2.0 allows the whole blockchain to be more energy efficient. In return, this will enable better scalability and speed within the Ethereum blockchain.

This development is a huge milestone for Ethereum, because it allows the activities within the blockchain to happen in an efficient manner. This effectively future-proof Ethereum towards catering for larger scalability in the future.

p

Risk #1: Mainstream Adoption + Scalability Challenges

At this stage, while Ethereum’s potential has started to catch more eyes, it is hard to say that it has entered a mainstream adoption yet.

As an example, while it is possible to create an Ethereum smart contract between a landlord and tenant, but any disputes down the line would be hard to resolve via existing legal channels as smart contracts are not legally binding.

In my opinion, for Ethereum to start getting further momentum, more entities like the legal and financial sector have to start recognizing the legal status of smart contracts. Following that, relevant entities have to come up with standard procedures for dealing with disputes related to smart contracts as well.

As you can see, these are not easy challenges for Ethereum to overcome. Surely, we can see the potential future that Ethereum can offer, but the extent of these potentials truly depends on how far we are willing to embrace the changes to come.

Up next, price volatility.

p

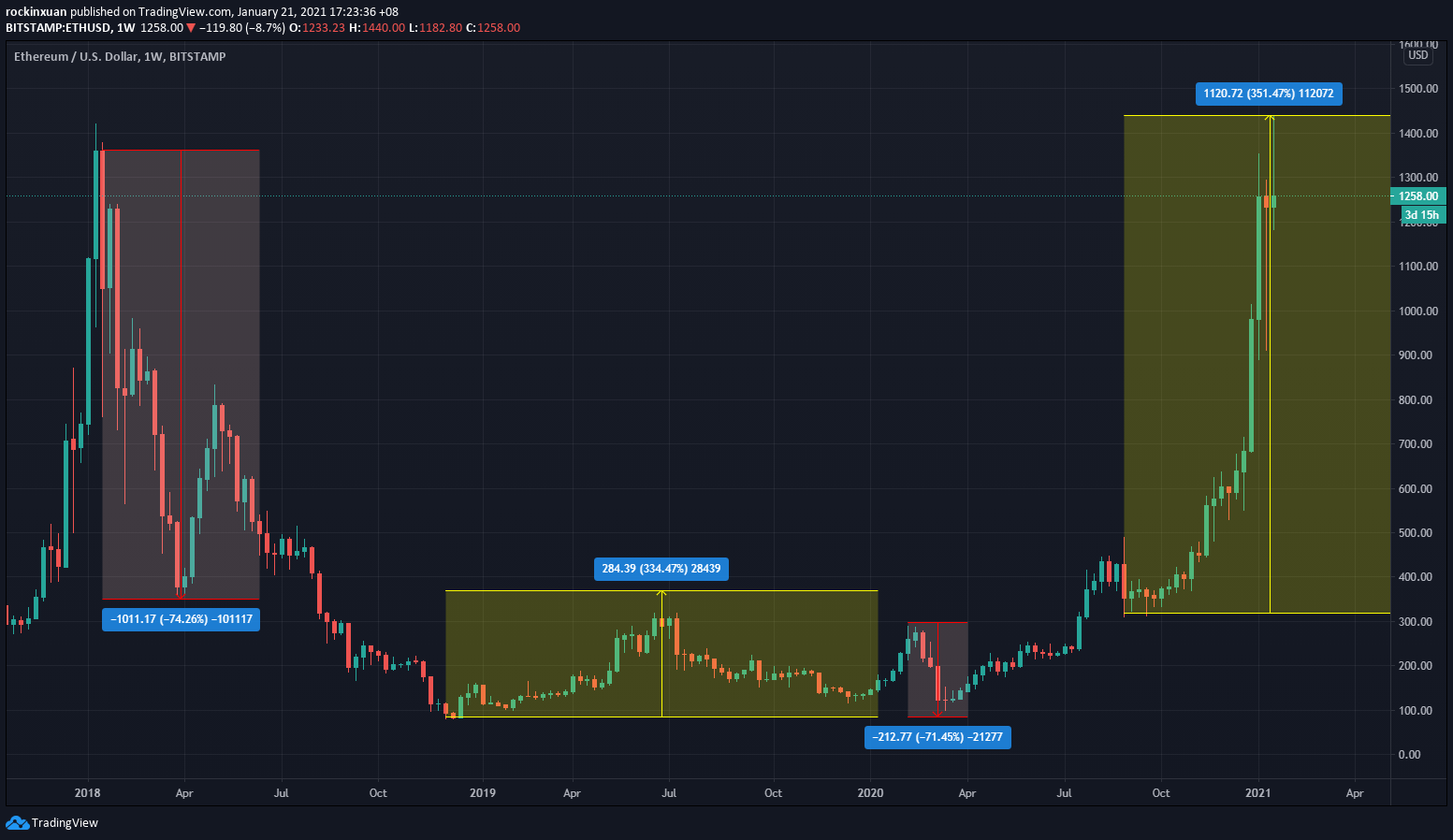

Risk #2: Volatile, volatile, volatile

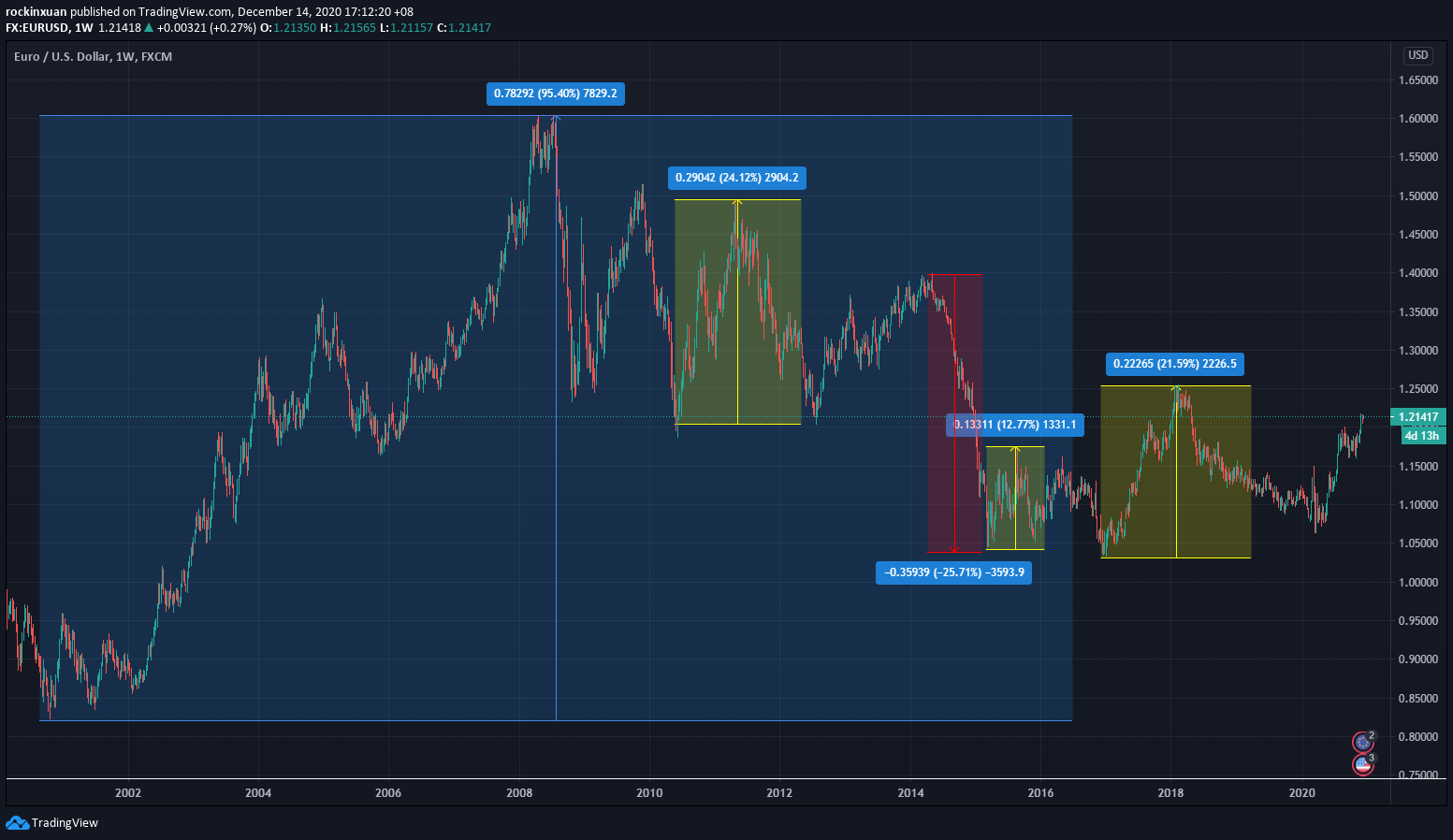

Just like Bitcoin, Ether (ETH) can extremely volatile compared to conventional investment assets.

In early 2021, ETH’s market cap (Market Cap = Total ETH in circulation * Price) has grown to over $100 million. In comparison, the market cap of ETH in August 2020 was half this amount.

However, relative to things like the gold market (~$3 trillion), ETH is a much smaller market. Even when compared to Bitcoin’s market cap (~$350 billion), ETH is still very much smaller.

This means that ETH is more easily affected by daily fluctuation in buying and selling – just like how a rock can cause bigger ripples in a small pond than the large sea.

As a result, ETH’s volatility makes it extremely hard to become a stable medium of exchange like our existing currencies.

ETH’s volatility also poses a challenge for its mainstream adoption and harder for most risk-averse investors to accept ETH as part of their portfolio.

p

Should You Invest in Ethereum?

For me, the decision of whether one should invest in Ethereum is very similar, yet different from Bitcoin’s.

For Bitcoin, it is about whether we are happy with how our existing central authority is treating the value of our money with the people’s interest in mind. This question is to some extent, an ideological question that is relatively simple to answer – ie. Should we decentralize our money?

Ethereum, on the other hand, is about decentralizing the existing system as well.

However, what makes this discussion more interesting is the depth of how Ethereum can explicitly change our life – from how we take loans, negotiate for agreements, buy insurance, and more.

So the question on Ethereum is this: Do you think we should decentralize anything else that involves a middleman?

Or rather, do you think your job is ready to face the disruptions brought upon by decentralization?

p

How to invest in Ethereum in Malaysia?

All in all, having seen both the upsides and risks of Ethereum, I hope you now have an additional layer of clarity towards your investing decision.

The next question: How can you invest in ETH and cryptocurrencies in Malaysia?

Presently, there are 3 cryptocurrency exchanges that are approved by Securities Commission (SC) to operate digital asset exchanges. This means that these are 3 regulated exchanges where Malaysians can buy and trade Bitcoin and other cryptocurrencies.

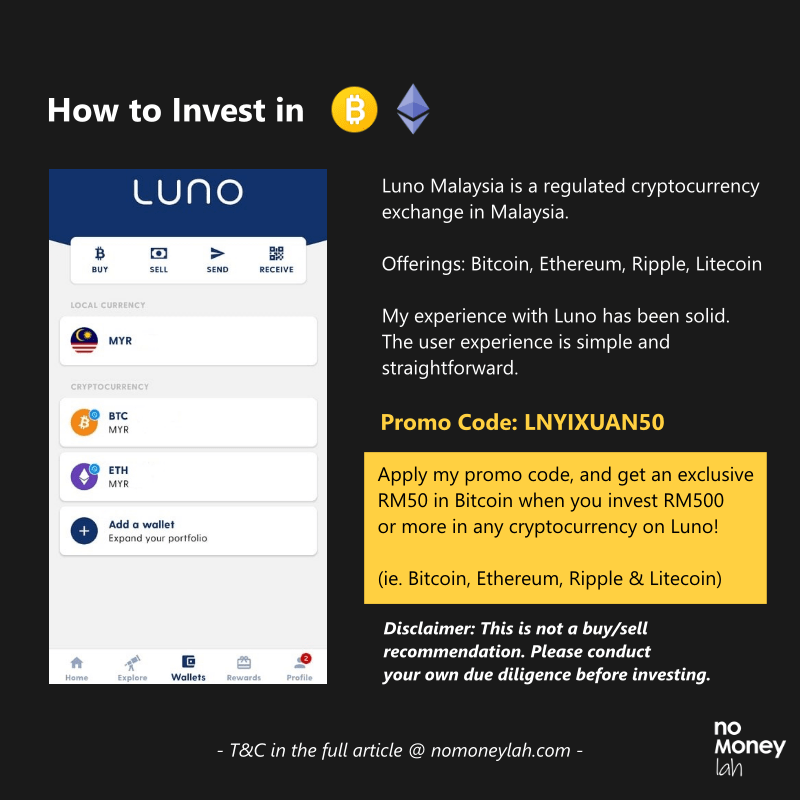

Personally, I have been using Luno, the largest of the 3 regulated exchanges since 2017 and I am more than happy to recommend Luno for investors looking to invest in cryptocurrencies safely.

I will work on a dedicated Luno review soon, but here’s a brief rundown of its features:

- Multiple Offerings: The biggest SC regulated cryptocurrency exchange which offers Bitcoin, Ethereum, Ripple, and Litecoin.

p - High Security: The majority of Luno’s customers’ cryptos are stored in a Deep Freeze storage – ie. A multi-signature wallet system, with private keys stored in different bank vaults. This means that no single person ever has access to more than one key, which translates to a high level of security of users’ cryptocurrency holdings.

p - Simple, user-friendly interface: Luno’s interface is exceptionally intuitive and simple to use. Every button and main functions are readily reachable and transacting ETH is straightforward.

p - PROMOTION: No Money Lah is now collaborating with Luno Malaysia to bring the best-in-town deal for new Luno users that are keen to invest in cryptocurrencies! Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more in any cryptocurrencies (Bitcoin/Ethereum/Litecoin/Ripple). That’s an instant 10% return on your investment.

p

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

p

No Money Lah’s Verdict

Wow, I hope you have enjoyed reading this article and found some useful insights in it!

For me, I had a good time writing this article as I have always been fonder of Ethereum over Bitcoin due to the potential impact that Ethereum can bring upon the future.

So now’s your turn:

What do you think about Ethereum? Are you planning to invest in Ethereum? If yes, why? If no, why? Let me know your thoughts at the comment section below!

Looking forward to hear from you soon!

Keen to Start Investing in Bitcoin, Ethereum, and Cryptocurrencies?

In collaboration with Luno Malaysia, No Money Lah is bringing the best-in-town deal for new Luno users that are keen to invest in cryptocurrencies!

Use my dedicated promo code – LNYIXUAN50, and you will get RM50 worth of Bitcoin when you invest RM500 or more in any cryptocurrencies (Bitcoin, Ethereum, Litecoin, Ripple). That’s an instant 10% return on your investment.

The full details of this promo can be accessed HERE. Please go through them so you are clear that you meet the criteria for this RM50 promo.

Open Your Luno Account HERE.

Disclaimer: This article produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Information in this article is accurate as of the time of production. Please consult a licensed financial planner before making any investment decisions.

Related Posts

September 6, 2020

3 Ideas About Money & Consistency

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

Hi, recently started learning more on Ethereum and the whole crypto market, and I’ve just bumped into this post of yours. Thanks a lot for the ‘humanized’ language on explaining about the entire crypto story! It helped me to understand a lot on it. Do you have a separate post about your point of view and your strategy on how you’re investing for crypto?

Hi Mina,

Thank you so much for your comments and glad that this article helps!

That’s actually a good topic to write about – will definitely do so in the near future! But briefly, I only invest in the top 2 largest cryptos by market cap – Bitcoin and ETH, and I do so on a small amount every month (ie. just buy). The max crypto I’d hold is generally capped at a max of 5% relative to my net worth.

Hope this helps!

Yi Xuan

Thanks Yi Xuan for this article! Like Mina said, I’ve understand it better with your help in explaining them in “humanized” language. I really enjoyed reading this.

With ETH now being at all time high, do you think this is mostly due to speculations?

Hi Audrey,

Thanks for your comment and glad that you like the article!

It is almost impossible to tell the ONE reason behind the price increase, be it stocks or crypto. This is because the market is made up of many participants with different timeframe and intentions.

Hence, I’d say don’t worry and avoid trying to nail down on the ‘why’ price increase or drop. As an investor, if you believe in the potential that Ethereum can continue to add value to people’s life, then the investment would be worth it in the long run.

Just me 2 cents 🙂

Regards,

Yi Xuan

Thanks for explaining in laymen’s terms. Can u recommend books/reference related to crypto if i want to dive deeper?

Hi Halim,

Since the crypto world moves so fast, I don’t recommend getting books on crypto as it can get outdated very fast. Instead, consider following Youtube channel like 99Bitcoins as they explain crypto topics extremely well.

Regards,

Yi Xuan