Last Updated on May 2, 2022 by Chin Yi Xuan

This is weird.

Even after 2 years of creating content in the personal finance & investment space, this is actually my first post focusing on financial independence (FI).

Essentially, FI is a stage of life where your passively-generated income is able to cover your monthly expenses (Passive Income > Monthly Expenses). Once you achieve FI, you are free to make life choices without having to worry about your monthly bills.

In this post, let’s talk about Real Estate Investment Trust (REIT) Investing, and how REITs are playing such a CRUCIAL role in my journey to FI.

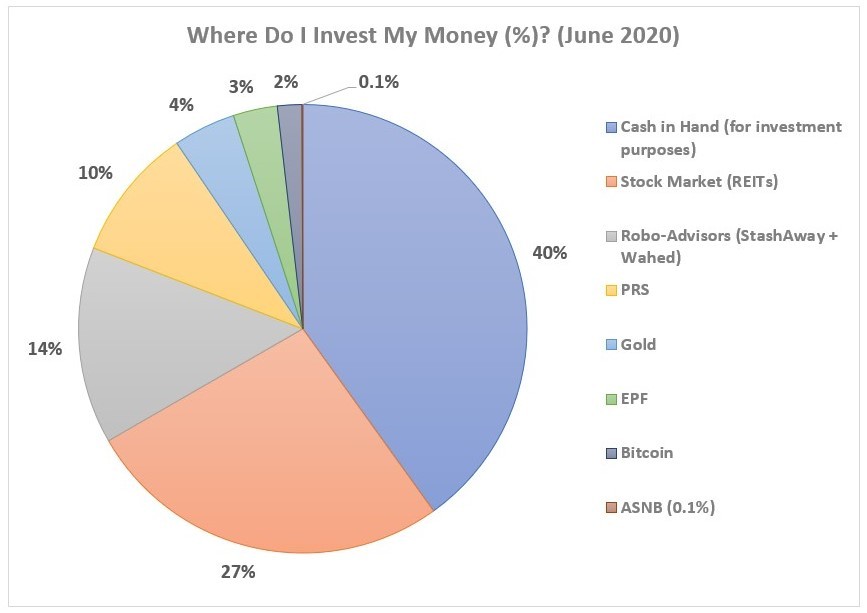

Related Read: How I invest my money as a self-employed person?

Table of Contents

My vision on FI

If I can be honest, I do not have a hard, solidified end vision on my FI journey yet.

This is largely due to myself being self-employed which translates to potential income fluctuation (on the bright side, it also means I have huge, untapped income growth potential in my relatively early career path). Also, I do not have any commitments (eg. partner, children) in life (yet), meaning my life expenses will surely increase in the future.

Nevertheless, these make it extremely challenging for me to measure my FI journey in a conventional way (ie. Projecting income, investment returns & expected expenses over time), unlike other creators that have a stable-paying career in this space.

That said, even without a stable-paying job, that does not deter me from preparing myself towards FI*.

(*All 3 aspects of active income, minimal life expenses & solid investments play equally important roles towards FI. In this discussion, I’ll talk specifically about the investment side of the equation. )

Why will REITs Play a Crucial Role in My Journey to Financial Independence (FI)?

To be clear, there are many ways for us to achieve financial independence.

Some people do it via rental properties, some through businesses, and more. Personally, my current focus is to build a solid passive income foundation via REIT investing.

Here’re why:

#1 Consistent & Reliable Dividend Yield

Generally, REITs are loved for their consistent & higher than average dividend yield compared to other listed companies in the stock market.

Between 5 – 8% (sometimes more) in dividend yield per year, this makes REITs exceptionally well-received among investors seeking for a reliable realized income from the stock market (hey, that’s before accounting for potential capital gains).

Now, the part about ‘realized income’ is crucial for fellow FI pursuers.

This is because, for capital gains, your profit will always be in the form of unrealized (or paper) profit until you cash them out by selling your shares.

On the other hand, dividends from REITs are actual, realized profit that is paid to investors on a quarterly/biannual basis.

Meaning, given time and consistency, dividends compounded from REITs are actual passive income that I can actually spend & rely on to pay for my expenses if I ever decide to retire after achieving FI.

Personally, while small in the present, I am building my REIT portfolio so it’ll become a solid foundation of dividend income in years to come (read about ‘How’ below).

#2 Investing in REITs = a low capital option to get started in Real Estate Investment

It is in the blood of Asian families to own & invest in properties & real estate.

But here’s the problem:

Most young millennials (are we still young though?) are not able to afford one (confession: I am one of those), not to mention taking care of their own living expenses.

Hence, REITs become an excellent way for millennial FI pursuers to build a reliable passive income from listed commercial real estates at an extremely low barrier of entry.

At a few hundred bucks monthly, I invest in fundamentally solid REITs that’ll help me slowly build my dividend income foundation.

For me, investing in REITs every month is equivalent to me buying a piece of ownership, and becoming a ‘landlord’ of money-making assets like Mid Valley, Sunway Pyramid, KPJ hospitals, and more.

#3 Freedom of time

I do not know about you, but I have real bad experience seeing my close family members handling troublesome tenants and property maintenance related stuffs.

For me, I dislike doing all these and the whole idea about achieving FI is to live a life in our own terms.

Investing in REITs means I get to leverage on REIT managers’ expertise to handle all the dull & boring aspects of the business, while still getting paid consistent dividends by owning money-making real estate assets.

#4 For me, REITs are simple businesses that are easy to understand

Of course, I still have to do my research on the financial & earning report of REITs while picking which REIT to invest in.

That said, REITs financials are generally easy to understand as REITs are essentially just real estate companies that make money via rentals.

In short, suffice to say that investing in REITs long term is quite a low maintenance thing to do.

Related read: How REITs make money (and why it is important to you)

How I am Using REITs to Build My Passive Income Foundation:

Honestly, there’s nothing fancy about how I approach my REIT investments here.

To a lot of people chasing for headline stocks and excitement, what I do below would be boring & dull.

But hey, if you are interested in my dull routine, here you go:

1. Building up my holdings consistently

Generally, this is what I’d do with fundamentally solid REITs (ie. Healthy balance sheet, consistent/growth in income & distribution, favorable business condition).

As long as the particular REIT fulfill my criteria, I’ll accumulate its shares on a monthly basis.

Doing this consistently will help me build towards a respectable base of REITs holdings that pay good dividends in years time.

2. Reinvesting my dividends

For now, the dividends I received from my REIT investments are really peanuts.

Since they are so little in amount and I have no use of them, I’d reinvest the dividends into my REIT holdings.

Given time & patience, doing so will accelerate the compounding effect of the amount of dividends I’ll receive in the future.

3. Advanced: Entry & Exit on Price Action

On certain occasions where the situation is more complex, I’d use simple price action analysis to time my entry & exits.

That said, this is a personal preference and most people would not have to worry about this.

How much of REIT ownership is enough for me?

As I mentioned earlier, I do not have a specific end goal or vision on my FI journey currently.

My focus now is simply to get my dividend income foundation built up as much as possible with quality REITs.

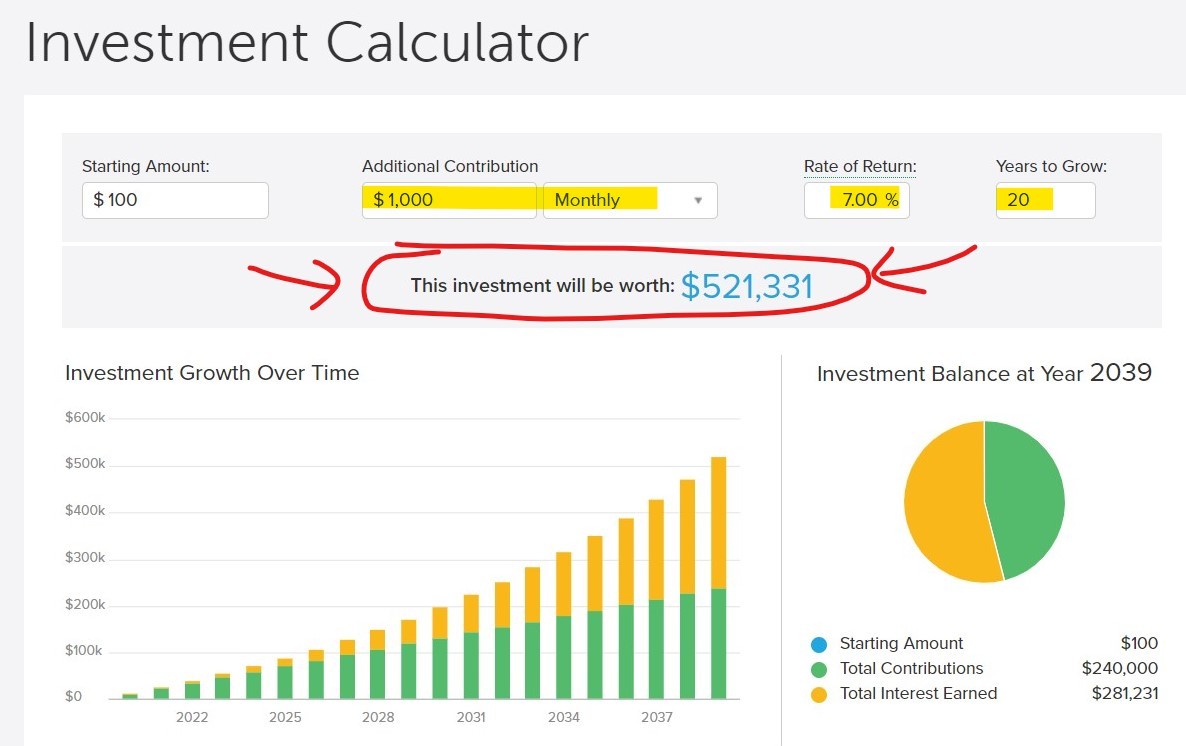

Side note: As I give this article some thought, an RM500,000 worth of ownership in REITs shares would actually be quite decent as an initial goal. Assuming 7% in annual yield, that’d be an RM35,000 in dividend (or as I love to put it, around RM2900 in ‘rent’ per month!)

Challenges/Downside to REIT Investing in Pursuit of FI

Some people may take this section as a total downside of REIT investing. But for me, I take it as a positive challenge:

1. REIT investing can be boring compared to the hottest stocks in town

REITs are simple, real estate businesses.

In other words, it can sometimes be boring (but not as boring as property investing, personal bias hehe :P).

Coming from personal experience & observation of other young investors, this is dullness can be extremely hard to bear.

Instead, most young & new investors these days chase excitement in the market (no problem at all if they know what they are doing, but…). This makes investing in REITs more of an afterthought.

While the research does feel dull at times, but that’s totally okay since I am more than happy to exchange excitement for peace of mind.

2. Identifying quality REITs takes practice & experience

Like any investments, it’ll take time and effort to be good in REIT investing.

I started studying REITs when I was a university student, and it took years before I started to develop my skills & senses in the game.

Personally, even though I have broken down & simplified my whole research process, but time must be invested in financial statements & earning reports to really get the skills baked into ourselves.

3. Building up a respectable dividend yield from REITs take time, patience & consistency

This last point is the biggest challenge for most people.

The problem is, too many new investors go into investing with the mindset of making money, not accumulating assets.

The reality is, capital is built from our income, not from investments. We need money to make money.

To see meaningful monetary returns from investing, we’ll need capital from our income to accumulate income-generating assets.

Hence, many young FI pursuers with small starting capital gave up on REITs as they cannot accept the fact that It’ll take such a long time to build a reliable & respectable dividend income from REITs

Building a respectable dividend income from REITs will take patience & consistency.

Investors without these qualities will find this a downside of REITs.

No Money Lah’s Verdict

So here you go – Why and how REITs is playing a crucial role in my journey to financial independence (FI)!

If you are in the journey towards FI as well, hopefully, this post could be of inspiration to you to start the journey!

Just remember, there’s no right or wrong way to achieve FI, this post is just the way I am approaching my journey.

On that note, what are you doing with your investments in pursuit of FI? Feel free to share your insights with me at the comment section below!

—

p.s. If you are keen to learn about REITs, you will be interested in my REIT investing sharing session. Find out more HERE.

Disclaimer: This post is written for sharing purposes and should not be taken as advice to make any form of financial decision. Please consult a licensed financial planner before making any important financial decisions.

Related Posts

July 29, 2020

5 Things that I Look for When Investing in REITs!

August 18, 2019

5 MUST-KNOW Terminologies Before You Invest in REITs

Gearing refers to the leverage of a…

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

hi yi xuan, it is a sincere and nice write up from you.

I have a question:

The current stock market is so unsteady and that includes REITS market too.

What do you think about investing into REITs at this moment? Low price entry is good, but how will u tell if REITs market will go up in future?

I aware u mention about the healthy balance sheet, but at this moment, none of the company will have healthy balance sheet…

Let’s say SunREITs…. Sunway is a big corporate yet, it is also making loss of billions since MCO started. So how is your perspective in REITS, will it still be your fundamental tool to achieve FI?

Hi Gliwan,

Thanks for writing in and happy to hear from you!

1. The current stock market is unsteady

Re: The stock market will always be ‘unsteady’, or as I’d like to call it – volatile. There is not time where the market is ‘steady’ in a sense that we can predict the movement with precision.

2. How can I tell if REITs market will go up in the future?

Re: Unlike what most people want to hear, to be honest I can’t tell for sure. Investing in anything, including REITs require foresight and confidence in the business and all these comes from experience and practice (plus mistakes).

The way forward to improve as an investor is to embrace uncertainties in the market and build up skills needed to invest the market – including foresight.

p.s. generally property price increases – which forms a basis on why REITs will likely increase in value over time, or at least maintain its fundamental value.

3. healthy balance sheet vs making losses

Re: A healthy balance sheet is generally different from making prodit/losses. A healthy balance sheet tells us how the company is managing its debt and liabilities in relative to its asset, while revenue/loss reflects whether the company is making money.

Both tells us a different story and perspective, and both are equally important in our analysis.

Hence, it is important for us to differentiate and understand how both report can contribute to our decision-making process.

4. Will I still invest on REITs for FI?

Re: Yes, of course 🙂

Hope this helps!

Yi Xuan

Thanks for sharing your thoughts and experiences in this post! I started building my REIT portfolio a couple of years ago as well because I’m not keen on owning a physical properties either — I don’t want to have to deal with tenants, maintenance and repair costs (which can be astronomical, as I’ve experienced first-hand in the maintenance of my family home), stress-inducing debt and potentially being stuck with a property I may not be able to sell when I need to. Looking forward to following your REIT investment progress 🙂

Thank you so much for your kind words and support!!

I think we can totally connect here because both of us are really not into the hassle of managing a property haha!

Wishing you the best in your FI journey too!

Jiayou together!

Yi Xuan

Hi there, what would u recommend for REITS company at the moment? Since everyone is at the low level now. Thanks!

Hey Kenneth!

Thanks for reaching out and happy to hear from you!

By law, I am not eligible to provide any investment recommendations as I am not a licensed financial planner.

That said, I can share some useful tips as a guide for you to get started:

1. Healthy Balance Sheet: A healthy balance sheet tells us how the company is managing its debt and liabilities in relative to its asset.

2. Resilient biz nature: The biz should be able to survive, sustain and even thrive during an economic crisis (especially now).

3. Secured tenancy for a longer period of time – especially in this current economic situation.

Read more here: https://nomoneylah.com/2020/07/29/5-things-when-investing-in-reits/

Hope this helps!

Yi Xuan