Last Updated on May 2, 2022 by Chin Yi Xuan

Okay, in this post, I am going to show you the breakdown & composition of my current Real Estate Investment Trusts (REITs) portfolio.

If you have been following my blog for some time now, you’d know that I am a big REIT enthusiast. As of November 2020, my stock portfolio makes up about 33% of my net worth and all of them are REITs.

Since REITs generally pay solid dividends, my investment goal is simple:

To build a solid REIT portfolio that pays me consistent dividend over time – a.k.a. passive income.

The thing is, this stream of dividend income will be small at the start – which hinders many investors as it may not look attractive. However, as you let the snowball roll and the time for compounding effect to take place, it’ll be a respectable amount one day.

HUGE DISCLAIMER: The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please (pleaseeee) do your own research AND/OR reach out to a licensed financial planner before making any investment decision!

With that, let’s start!

Related Read: Why REITs will play a crucial role in my journey to Financial Independence!

Table of Contents

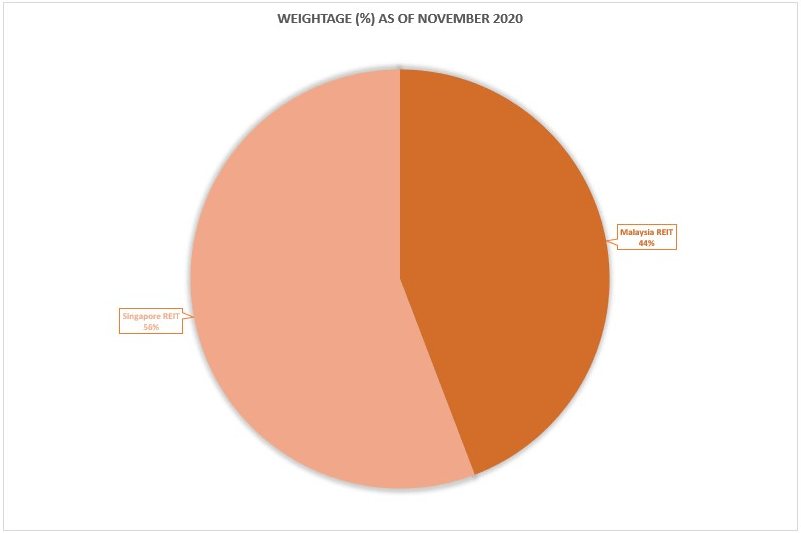

Part 1: REIT Composition by Country

As of time of writing, I have a pretty balanced weightage between local REITs (44%) and international REITs (56%).

While I was initially focused on local Malaysian REITs (MREITs), I have found great potential and opportunities in Singapore REITs (SREITs).

Why SREITs? In essence, SREITs are considered an international hub for REITs and it opens up the gateway for me to gain exposure to international income-generating real estate (eg. SG, China, US), as well as industries that I’d never own if I stay in the local scene (eg. Data centres).

Not only that, there is 0% tax on SREIT’s dividends so that’s pretty dope. In comparison, there are still 10% tax charged on part of MREITs dividend distribution (p.s. the tax is deducted before the dividend is paid to you, so don’t worry ‘bout it too much).

That said, I am not saying that MREIT is bad. In fact, it is quite the contrary as we have the advantage of being more familiar with the overall business environment and real estate quality of local REITs. This adds to my conviction & confidence as I invest in MREITs.

Related Read: The broker I use to invest in Malaysian REITs. The broker I use to invest in Singapore REITs.

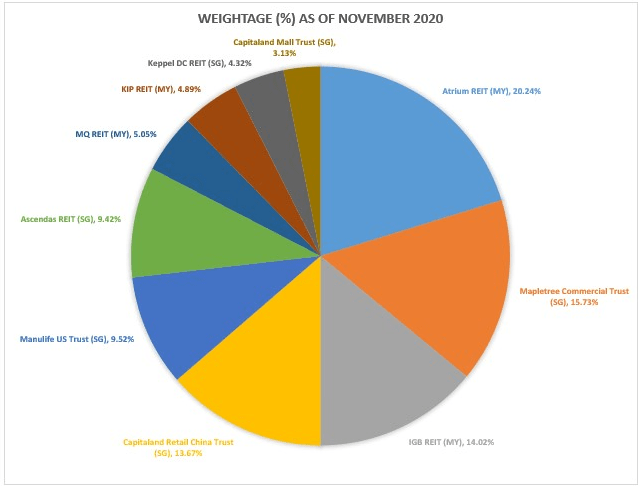

Part 2: REIT Composition by Individual Companies

For now, my REIT portfolio is made up of 10 companies.

Is this too many to manage? Frankly, I think this is stretching the upper limit of my own time & capacity to follow and update. In the near future, I could be reducing my holdings to between 6 – 8 companies so I can be more focused on my conviction, time, and resources.

That said, here are the REITs that make up my portfolio currently:

REITs in my portfolio:

- Atrium REIT (MY), 20.24%

- Mapletree Commercial Trust (SG), 15.73%

- IGB REIT (MY), 14.02%

- Capitaland Retail China Trust (SG), 13.67%

- Manulife US Trust (SG), 9.52%

- Ascendas REIT (SG), 9.42%

- MQ REIT (MY), 5.05%

- KIP REIT (MY), 4.89%

- Keppel DC REIT (SG), 4.32%

- Capitaland Mall Trust (SG), 3.13%

For this post, I won’t go into detail with every single REIT in my portfolio. However, be sure to check out my detailed thoughts on my MREITs holding HERE, and (hopefully) I’d be writing one on SREITs soon.

Briefly, you can see that my 4 biggest REIT holdings make up nearly 65% of my total REIT portfolio. They consist of Atrium REIT (MY), Mapletree Commercial Trust (SG), IGB REIT (MY), and Capitaland Retail China Trust (SG).

These are 4 REITs where I place my biggest conviction in. Putting this into a Pokémon game analogy, these would be 4 of my most confident Pokémon to put in a battle (haha please take this analogy with a pinch of salt lol).

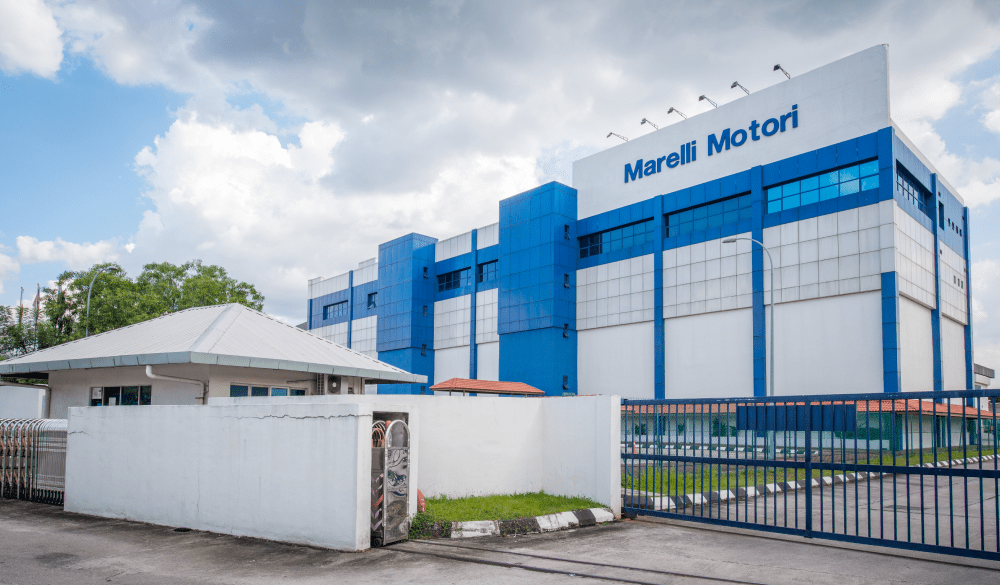

Atrium REIT is an industrial REIT which in my opinion, highly overlooked by investors and has a stable growth outlook even in times of pandemic.

Mapletree Commercial Trust owns the largest mall in Singapore (Vivocity), as well as quality business centres like Mapletree Business City (MBC) with solid occupancy & lease terms.

IGB REIT runs Mid Valley & The Gardens, which I think most of you know and recognize. Mid Valley and The Gardens are definitely one of the top malls in Klang Valley and historically, their occupancies have been solid.

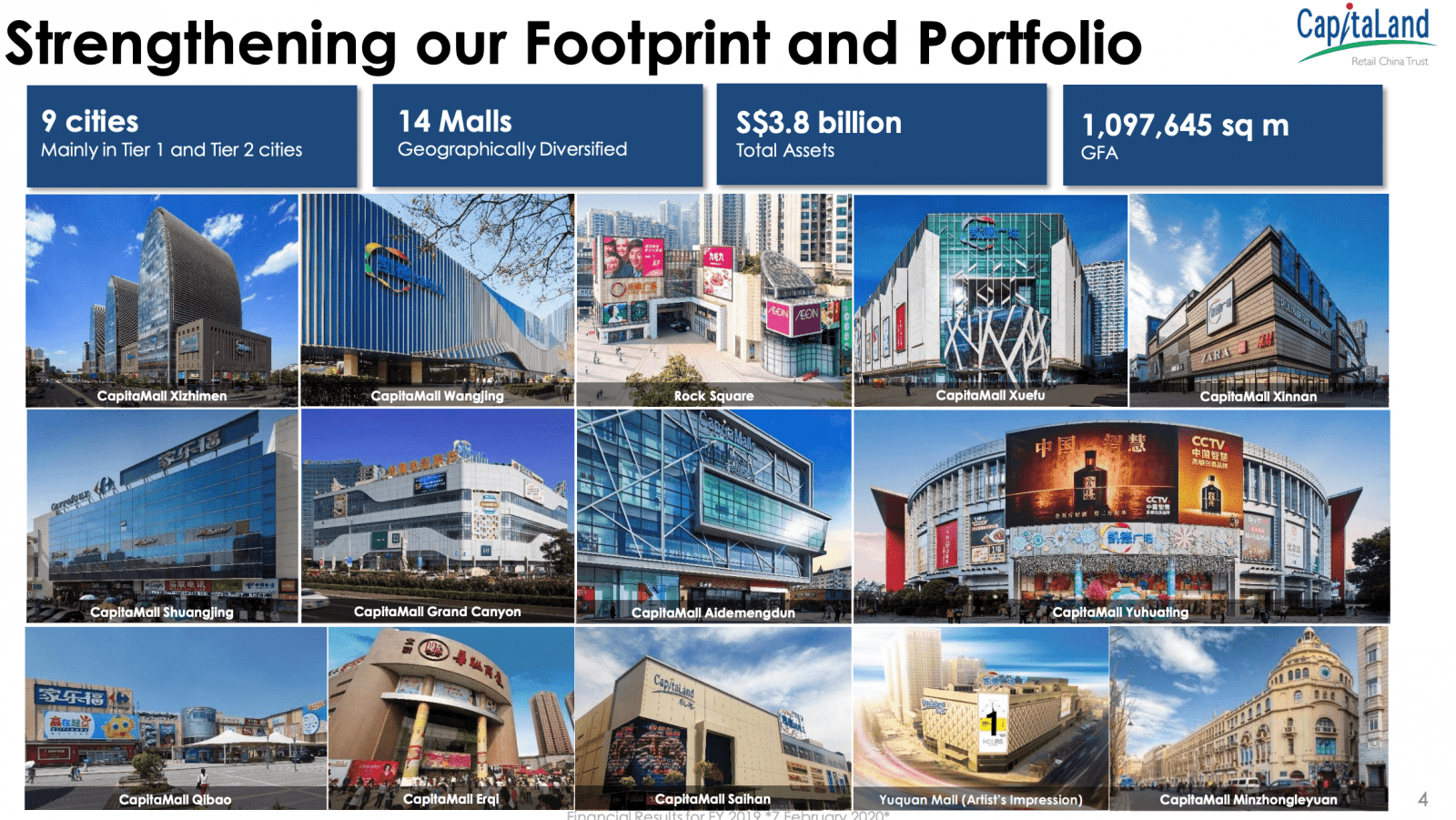

Investing in Capitaland Retail China Trust is my personal conviction in the spending power of the Chinese. CRCT owns malls in Tier 1 and Tier 2 cities in China (eg. Beijing, Shanghai, Guangzhou). Having stayed in China for a month last year, I’ve witnessed the crazy spending power of the Chinese middle class, plus China’s recovery from Covid-19 has been solid – what else can you ask for?

In addition, CMCT is also expanding into other industries like business parks which are accommodating tenants from the tech sector so that is certainly a development I’d be following closely.

As for the other smaller compositions, I have some fair share of exposure in REITs that give me exposure to the US offices market (Manulife US Trust), global data centres (Keppel DC REIT), and some other interesting REITs.

Feel free to check them out on your own, or wait for my future coverage on these SREITs!

Related Read: 5 Things that I look for when I invest in REITs!

Part 3: REIT Composition by Business Segments

If you observe closely, you’d see my conviction in 1 or 2 particular business segments.

To be precise, I have a strong conviction in the retail/commercial space in the middle to long term horizon. While the retail space may look muted at this moment (especially outside of China), I am confident that they are going to recover with strength in the near future.

In my opinion, people cannot stand prisoning themselves at home forever, and will very likely look to go out on a spending/entertainment spree once the pandemic tone down.

On the other hand, having shares in industrial/logistics REITs help balance my risk as these businesses remain stable even in this pandemic.

Related Read: Different types of REITs and WHY they matter!

No Money Lah’s Verdict

So here you go – my REIT dividend portfolio that keeps generates consistent income for me!

Hopefully, this sharing has been an interesting and insightful one, especially if you are also looking to build a passive income portfolio from the stock market!

What are your thoughts on my REIT portfolio? What REITs are you investing in right now (if any)? Have any questions? Feel free to share them with me in the comment section below!

Keen to build a reliable passive income foundation from the stock market?

If you are keen to learn how to invest in REITs for passive income, I organize REIT Investing Sharing Session where I go through the basics AND fundamentals of REIT investing, step-by-step. Click HERE for more info!

Related Posts

Subscribe to No Money Lah's Newsletter!

Get FREE updates to tips & ideas to live a better and more fulfilling financial life :)

Thank you!

You have successfully joined our subscriber list.

Chin Yi Xuan

Hi there! I am Yi Xuan. I am a writer, personal finance & REIT enthusiast, and a developing trader with the goal to become a full-time funded trader. Every week, I write about my personal learnings & discovery about life, money, and the market.

which brokerage do u use to buy SG REITS?

Hi Katrina,

I am using Tiger Brokers to invest in Singapore REITs.

If you are interested, feel free to check out my review on Tiger Brokers below:

https://nomoneylah.com/2020/10/30/tiger-brokers-review/

Yi Xuan

Hi Yi Xuan,

Just want to confirm, while opening Tiger’s account in my personal name.

However, for TT funding is from our banking account which is Joint name, will this arrangement permissible?? Appreciate your confirmation and advise. Thanks

Hi Foo Yin,

Tiger Brokers currently does not accept any funds transferred from/by other persons’ bank accounts, third-party payment platforms, joint bank accounts or checks.

Hope this clarifies things for you!

Yi Xuan

I’ve been interested in REITs too. What is your portfolio’s realistic expected nett dividend% range during and post pandemic?

Hi there!

Good to know that you are also interested in REITs! Just know that to benefit the most from dividends it’ll take time and patience to build up a meaningful capital yea!

For me, I try not to set much expectation for my REITs during this challenging time as I am aware that businesses are facing a hard time. Nevertheless, I think very conservatively I can get around 4% – 5% for the year. After pandemic, I think it’d a 5.5% min. dividend yield (not included capital gain) should be quite a conservative expectation.

Hope this helps!

Yi Xuan