What is Rights Issue and How to deal with it? (with Example Calculation)

So, you invested in a company in the stock market and one day, you received a notification about rights issue by the company. What exactly is a rights issue and what should you be doing with it?

Let’s address this in this article:

A rights issue is an action by companies to raise capital – be it for expansion, debt repayment, and so on.

Through rights issue, a company allows investors to purchase additional shares at a discounted price. The number of additional shares that can be bought depends on how many shares an investor owns.

p

Highlights of a Rights Issue

- Rights issue is a process where companies raise funds for various purposes (eg. acquisition) by offering equities at a discounted price. It is an alternative to methods like taking up debt which comes with interest payments.

- The number of additional shares that an investor can buy is in proportion to the investor’s existing shareholding.

- Rights issue is optional. This means that an investor can choose whether to take up the offer (a.k.a. subscribe), or to ignore the rights issue.

p

However, ignoring a rights issue will cause the investor’s existing share value to become diluted after the release of additional shares into the market. (Just imagine adding more water to your Ribena drink)

p

Example - How to calculate a Rights Issue?

Step 1: Before you proceed, find out the following details first:

- How many shares do you own in the company?

- What is your average acquisition price for this investment?

So, let’s use an example from Atrium REIT, an industrial REIT that manages warehouses and manufacturing facilities. Let’s say I own 1000 shares of Atrium REIT, with an average acquisition price of RM1.05 per unit.

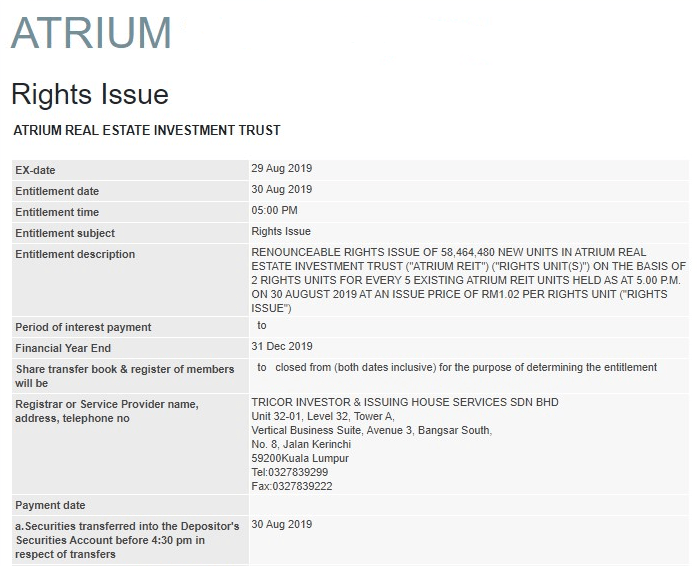

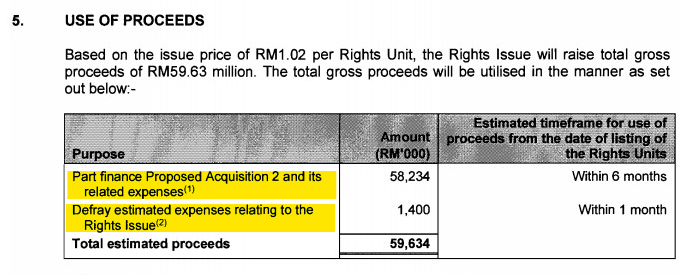

Then, Atrium REIT announces a rights issue, as seen below:

Step 2: Entitlement Ratio & Issue Price

At first glance, things seem to be a little intimidating, but don’t worry – you just need 2 pieces of info from the screenshot above:

- Entitlement Ratio: How many rights do investors get to subscribe in proportion to their existing shareholding?

p

In this example, the ratio is 2:5. Meaning, for every 5 shares you owned in the company, you are entitled to buy 2 additional shares.

p - Issue Price: At what price is the company offering the rights?

p

In this example, the issue price is RM1.02/unit. The issue price is usually offered at a discount relative to the market price to entice existing investors to subscribe to the rights issue.

p

Step 3: Now that we have all pieces of info that we need, we can proceed with the calculation.

a. What’s the initial value of my portfolio (before rights issue)?

= Total shares owned at the start x Average acquisition price

= 1000 shares x RM1.05

= RM1050

b. How many units of right am I eligible to subscribe?

= Total shares owned at the start x Entitlement Ratio

= 1000 shares x (2/5)

= 400 shares

c. How much do I need to subscribe to all 400 shares from this rights issue?

= Total shares I am eligible to subscribe x Rights offering price

= 400 shares x RM1.02

= RM408

d. Total portfolio value after rights subscription:

= Initial portfolio value + Value of Rights Issue

= RM1050 + RM408

= RM1458

e. Theoretical acquisition price after rights issue:

= Total portfolio value after rights subscription/Total shares owned after rights subscription

= RM1458/1400 units

= RM1.041

Notice that I mentioned the acquisition price per share as ‘theoretical’. This is because the market fluctuates up or down upon rights issue depending on market sentiment.

If the rights issue is received with positivity, then an increase in share price upon rights issue means that investors will benefit from capital appreciation. If the rights issue is not perceived well by the market, then the share price will drop and investors’ capital will depreciate.

In this example, I’ll need a total of RM408 to subscribe to all my rights issue. Subscribing to this rights issue allows me to prevent dilution to my existing share value. It is also a good way for me to dollar cost average into companies that I am already investing in.

(Note that you can also choose to subscribe partially to your rights. Meaning, for whatever reason (eg. lack of capital) if you do not want to subscribe to the full rights issue of 400 units, you can choose to only subscribe to 200 units, and so on.)

p

What’s the impact of not subscribing to the rights issue?

So, let’s say I decide not to subscribe to Atrium REIT’s right issue above, how would it impact my share value?

Total impact of not subscribing to the rights issue:

= (Theoretical acquisition price after rights issue x Initial shares owned) - Total portfolio value IF I subscribe to rights issue

= (RM1.041 x 1000 shares) – RM1458

= RM1041– RM1458

= - RM417

This means that the value of my shareholding on Atrium REIT would be diluted by RM417 if I do not subscribe to the rights issue.

p

Should You Subscribe to a Rights Issue? (+ tips)

Essentially, subscribing to a rights issue allows you to buy shares in the company that you are investing in at a discounted price.

If you are investing in a company for the long-term and the company requires additional capital for expansion, it’d be logical to take on the rights issue. Doing so will prevent the dilution of your existing shares in the company while preparing you to enjoy any potential reward from the expansion in the future.

As such, a tip here is to ALWAYS have additional cash prepared in your brokerage account so you can respond to a sudden rights issue in your investing journey.

On the contrary, if a company is under huge debt, and it announces a rights issue to repay the debt, it is wise to think twice before subscribing to the rights issue. If the market doesn’t perceive this rights issue positively, chances are you might lose more by taking up the rights.

p

How to Subscribe to Rights Issue?

Subscribing to a rights issue is a simple process. Just remember that you’d need to have enough funds in your brokerage account to subscribe to a rights issue!

Below are how you can do so via Rakuten Trade (Malaysia market) and Tiger Brokers (Singapore, US, HK, Australia, and China market):

a. Subscribing to Rights Issue via Rakuten Trade (Malaysia stock market)

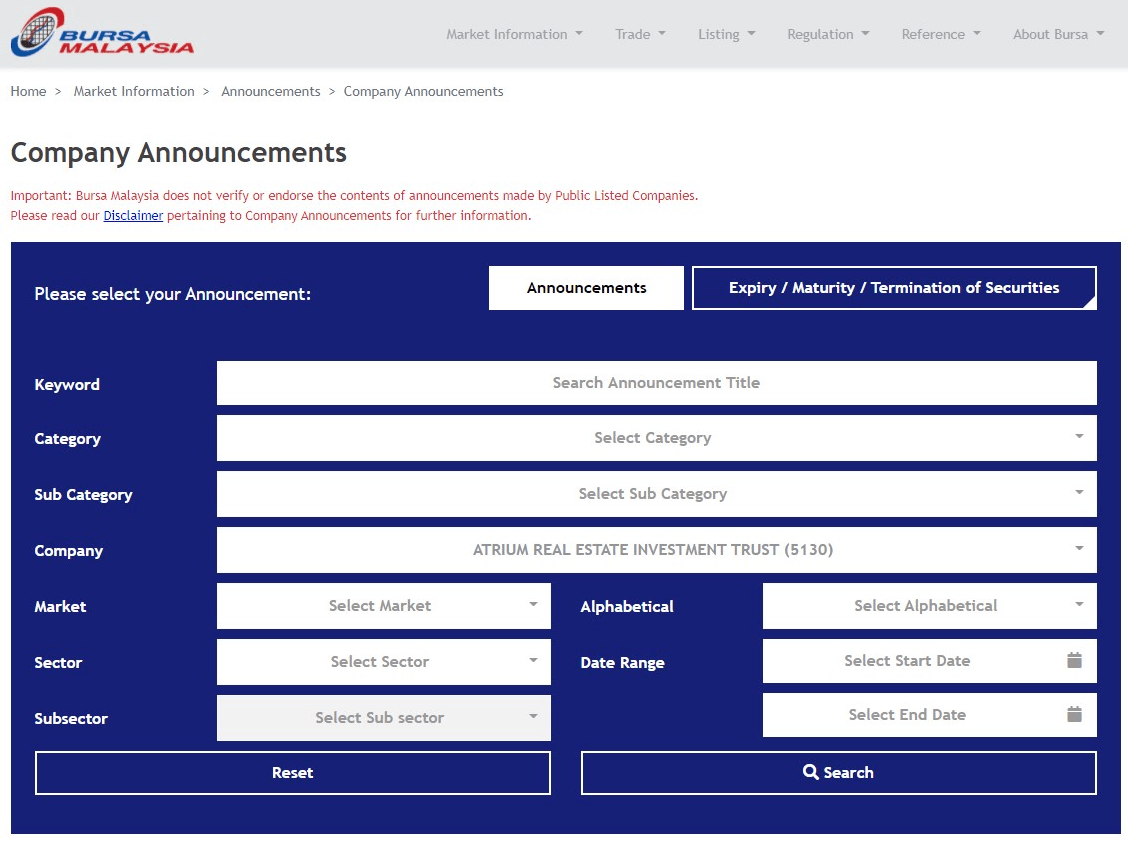

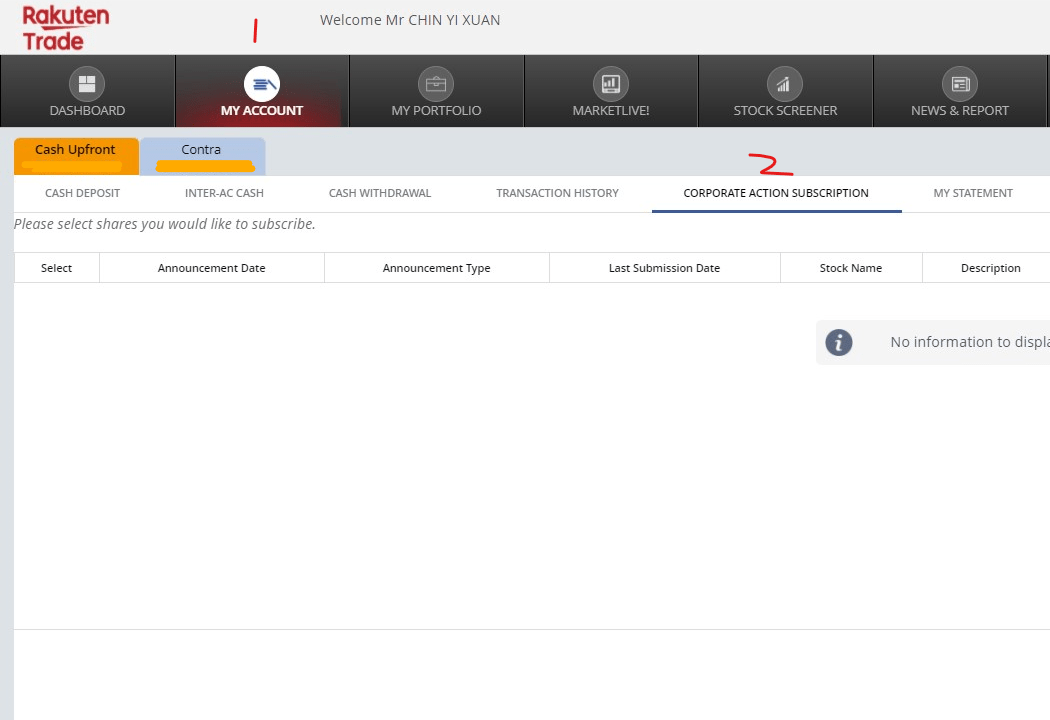

- Step 1: If you are eligible for a rights issue, you will receive an email notification from Rakuten Trade.

- Step 2: To subscribe to the rights issue, log in to your Rakuten Trade account. Then, under ‘My Account’, select ‘Corporate Action Subscription’.

- Step 3: Follow the instructions shown to subscribe to the rights issue.

- Step 4: You will receive your additional shares in your brokerage account on the stated entitlement date.

(eg. For the Atrium REIT example above, it’d be on 30th August 2019)

READ MORE: How to Build Your Powerful Bursa Stock Screener on Rakuten Trade?

p

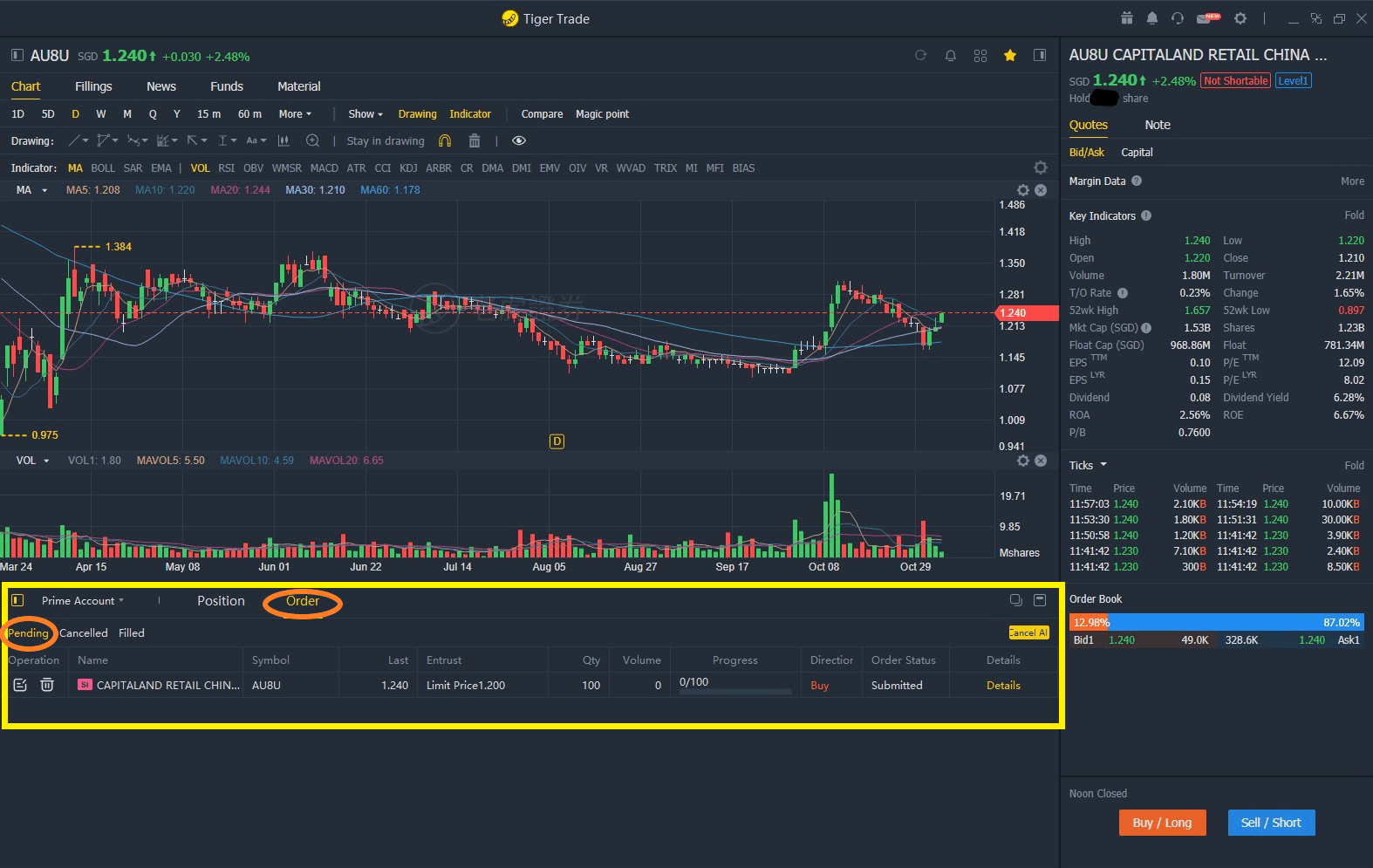

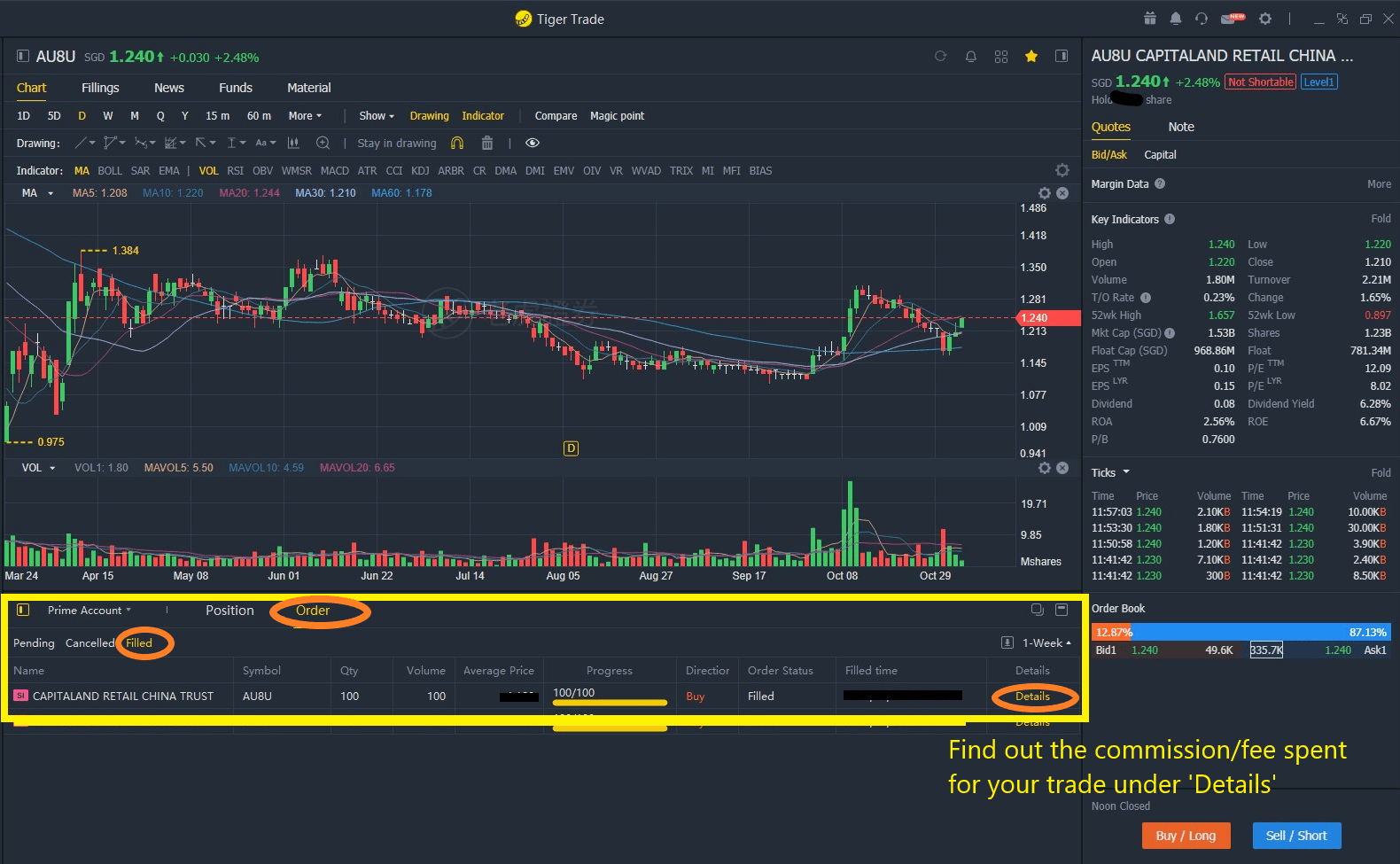

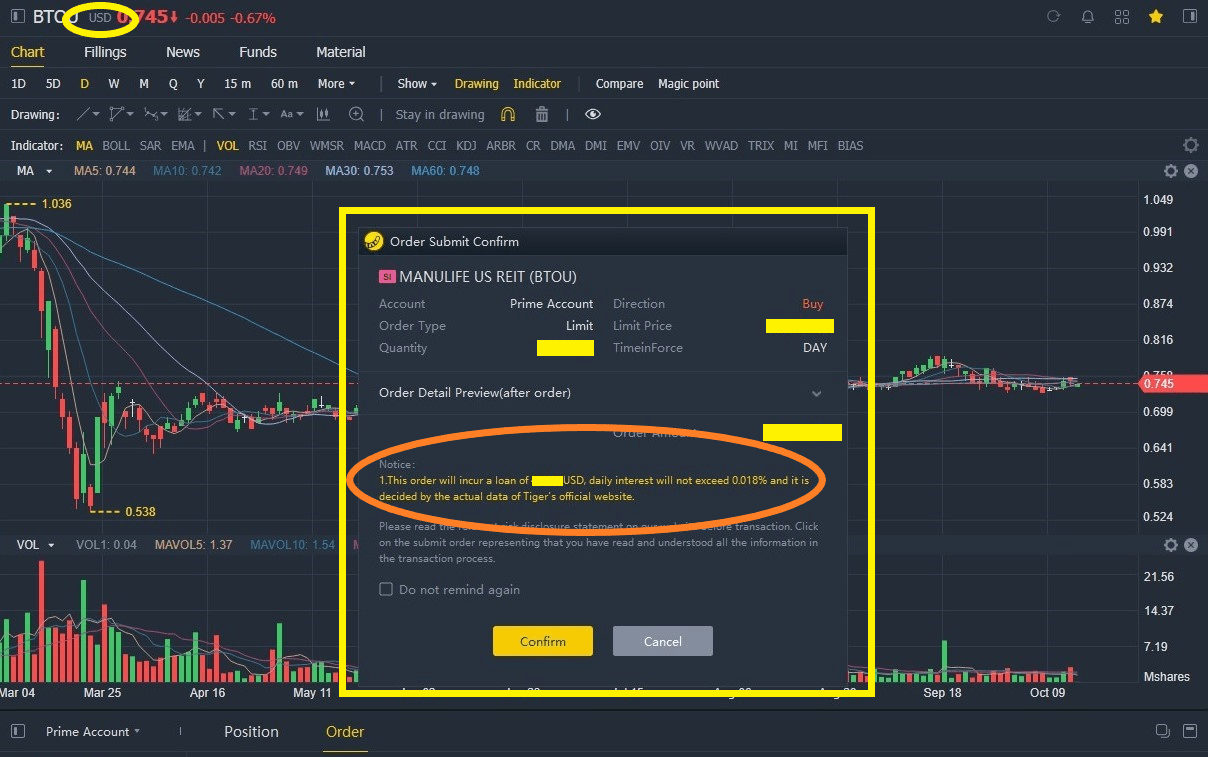

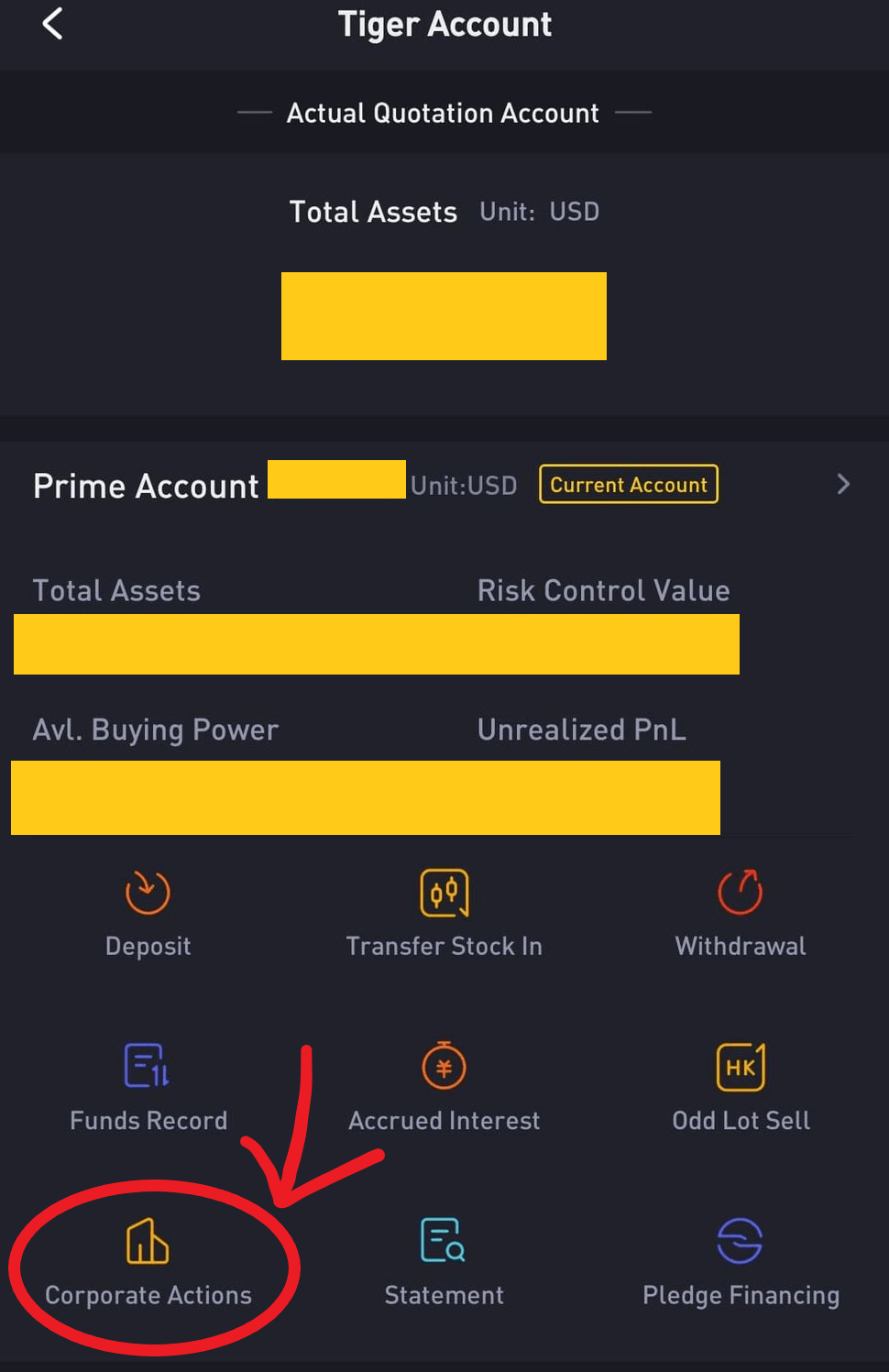

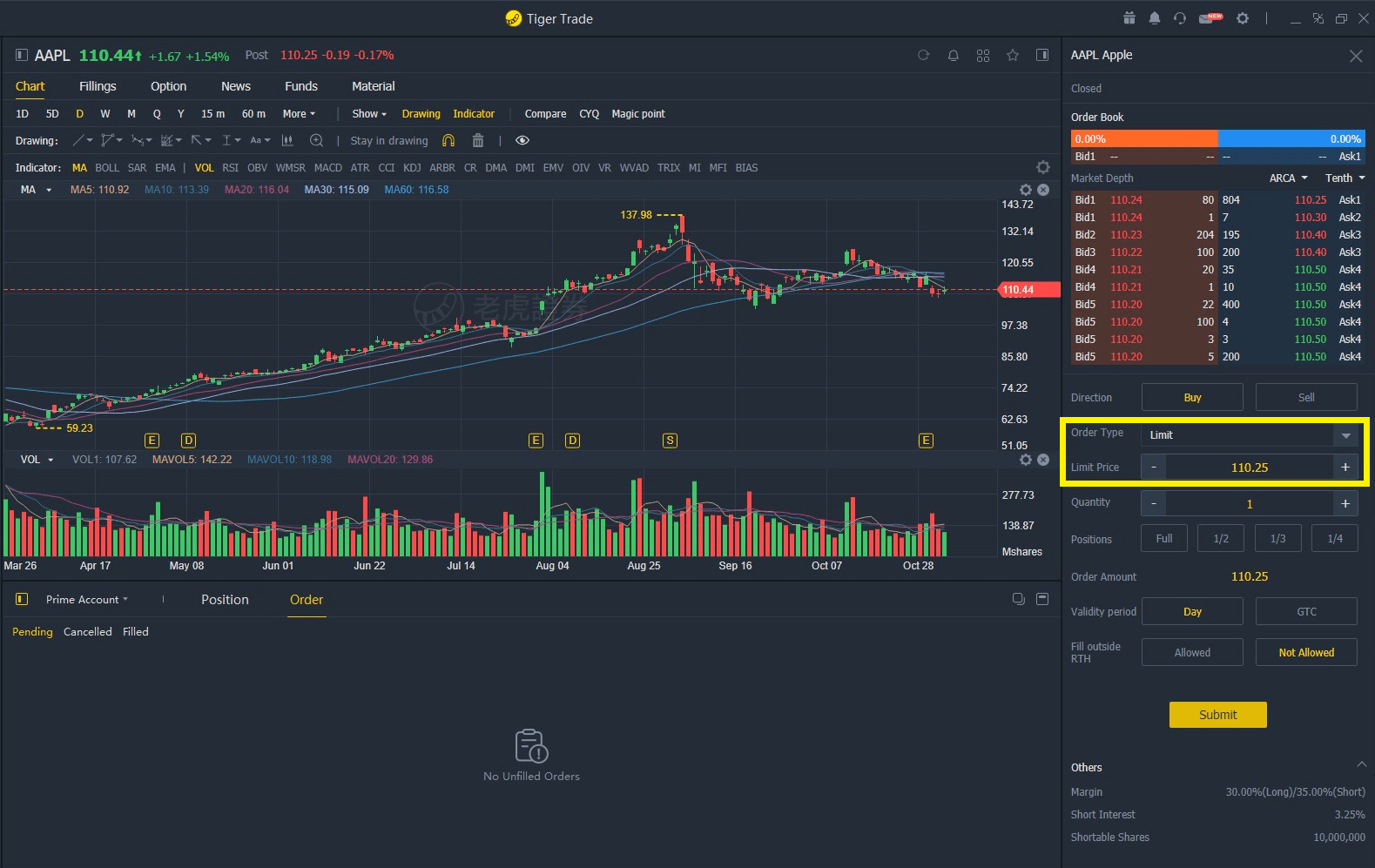

b. Subscribing to Rights Issue via Tiger Brokers (Singapore, US, HK, Australia, and China stock market)

- Step 1: If you are eligible for a rights issue, you will receive an email/app notification from Tiger Brokers.

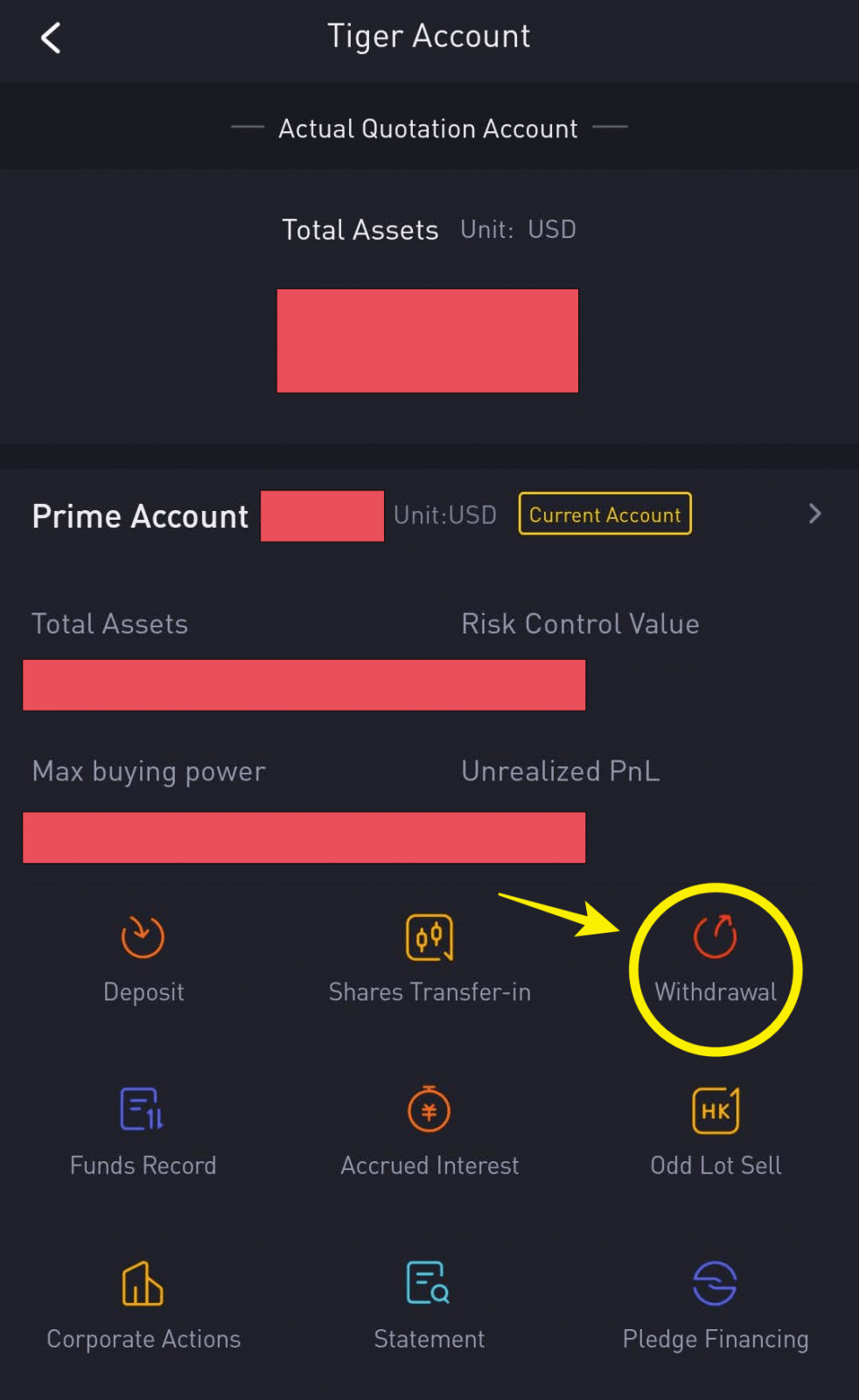

- Step 2: To subscribe to the rights issue, log in to your Tiger Brokers app. Then, under ‘Tiger Account’, select ‘Corporate Actions’.

- Step 3: Follow the instructions shown to subscribe to the rights issue.

- Step 4: You will receive your additional shares in your brokerage account on the stated entitlement date.

READ MORE: Tiger Brokers review - the broker I use to invest in the SG, US and HK stock market!

P

No Money Lah’s Verdict

Hopefully this article sheds some light for you about rights issue!

Ultimately, it is just one of the many ways companies raise funds for their business objectives. As an investor, it is important for us to know how to calculate and deal with rights issue when we are eligible it.

What are some other corporate actions that you want me to cover? Feel free to share with me in the comment section below!

Keen to Open Your First Stock Investing Account?

Check out my preferred brokers for the local and overseas market below:

a. The broker I use to invest in Malaysia stock market: Rakuten Trade (Read my review HERE)

(Use my referral link HERE with the code NOMONEYLAH to open an account, and receive 1000 RT points upon successful account activation!)

b. The broker I use to invest in the overseas stock market (SG, US): Tiger Brokers (Read my review HERE)

(Use my referral link HERE to open an account, and receive account opening rewards like commission-free trades and stock vouchers upon successful account activation and funding!)

Rakuten Trade Feature Guide: How to trade US stocks via USD or MYR

The best Malaysia-regulated broker to buy US stocks just got better!

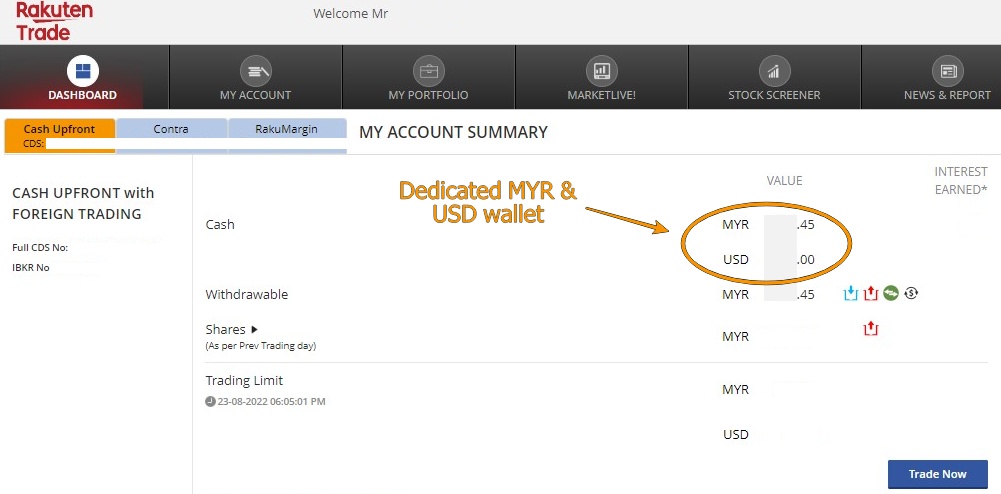

Rakuten Trade has just launched its new USD trading feature recently. This is fantastic news as Rakuten Trade users now have the choice to hold USD in their account.

Simply put, Rakuten Trade users now have the option to invest in US stocks using USD or MYR.

In this post, let’s explore the features of Rakuten Trade’s new USD trading. Also, check out the end of this post for a special account-opening & trading promo!

Related Posts:

3 Feature highlights of Rakuten Trade’s USD & MYR Trading:

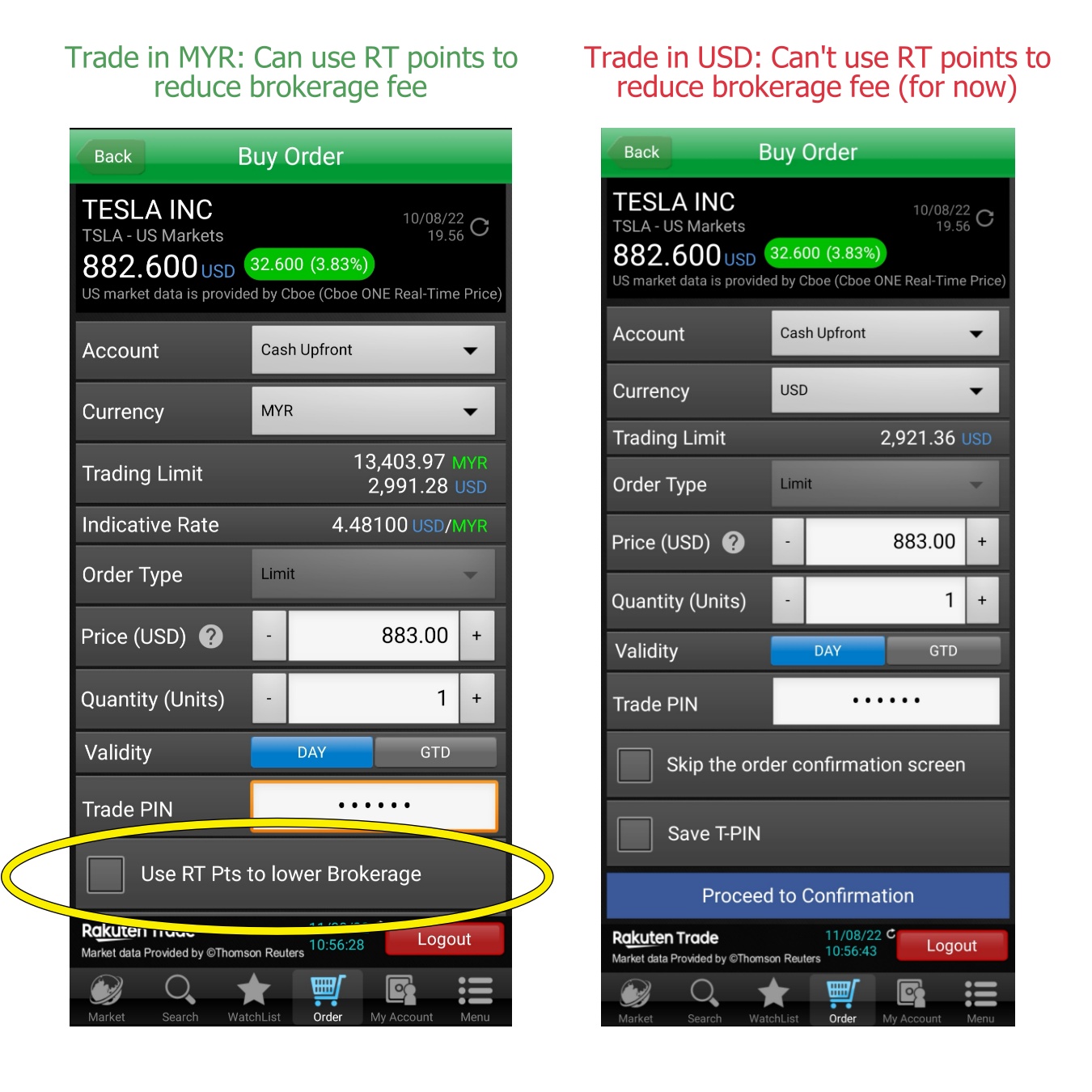

#1 The choice to buy and sell US stocks & ETFs in USD or MYR

As a Rakuten Trade user, now you have a dedicated USD wallet to store USD within your account.

This enables the flexibility to use either USD or MYR to buy US stocks and ETFs. Furthermore, users also have the choice to receive USD or MYR when selling their US stocks.

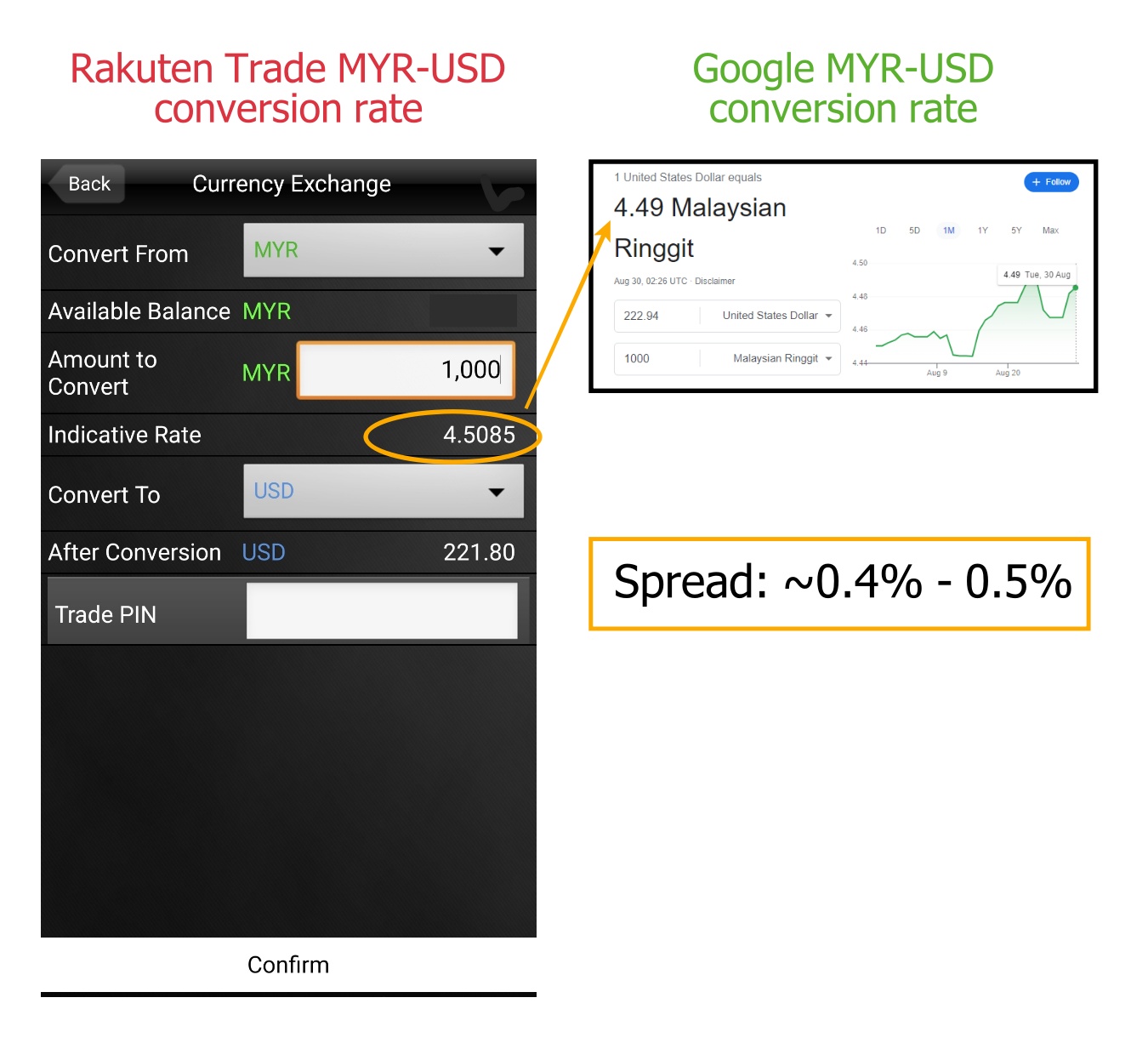

#2 Live conversion + tight MYR-USD currency conversion spread

Rakuten Trade offers a relatively tight MYR-USD spread for users to easily convert between both currencies within the platform.

Furthermore, the conversion process happens real-time, enabling users to convert MYR to USD (and vice versa) with the latest rate and trade right away.

Lastly, unlike certain brokers, there are no extra fees involved in currency conversion (aside from the spread) so there are no worries about hidden fees.

#3 Receive dividends in USD instead of MYR

Prior to the release of the USD trading feature, Rakuten Trade users who invest in US stocks will receive dividends in MYR.

This is not ideal for investors looking to reinvest their dividends because they’ll have to reconvert the MYR back to USD in order to do so.

Now, we will receive dividends directly in USD. This makes dividend reinvesting much more convenient.

USD vs MYR Trading: Rakuten Trade US Stocks Brokerage fees comparison

Below is Rakuten Trade’s brokerage fee structure for MYR trading and USD trading in the US stock market.

- MYR Trading

| Trading Value | MYR Trading |

| Below RM699.99 | 1% of Trading Value (min. RM1) |

| Between RM700 – 9999.99 | RM9 |

| Between RM10,000 – 99,999.99 | 0.1% of Trading Value |

| Equal of above RM100k | RM100 |

- USD Trading

| USD Trading |

| 0.1% of Trading Value, or a min. of USD1.88 – USD25 |

When to use USD, when to use MYR to trade US stocks?

In the section below, we will compare and explore when is best for you to use MYR or USD to trade US stocks on Rakuten Trade.

Firstly, let's take a look at several common trading amounts and the respective brokerage fee in MYR and USD:

| Trading Value | MYR Trading Brokerage Fee | USD Trading Brokerage Fee |

| RM500 (~USD113) | RM5 | USD1.88 |

| RM2,000 (~USD448) | RM9 | USD1.88 |

| RM5,000 (~USD1,118) | RM9 | USD1.88 |

| RM10,000 (~USD2,236) | RM10 | USD2.24 |

| RM50,000 (~USD11,176) | RM50 | USD11.18 |

| RM100,000 (~USD22,352) | RM100 | USD22.35 |

When to use MYR to trade US stocks:

- Use MYR when your trading value is below RM700 as the brokerage fee is cheaper (1% of trading value or min. of RM1 vs USD1.88).

- Keep your capital in MYR if you think MYR is going to strengthen against USD, and you want to get the most out of your conversion.

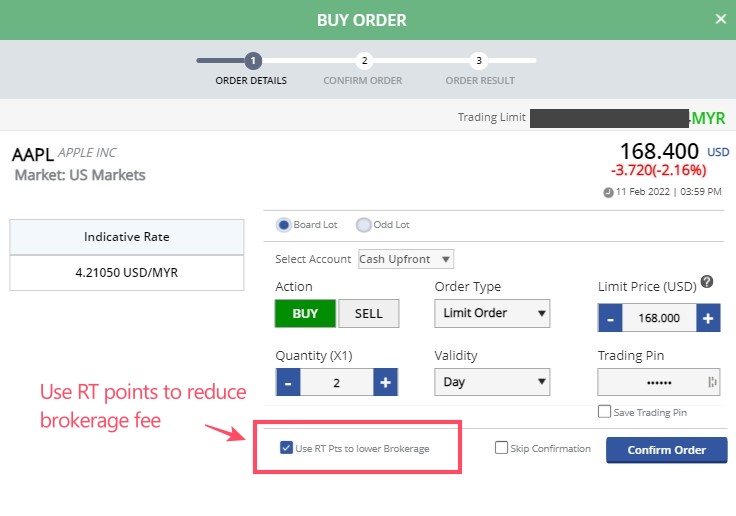

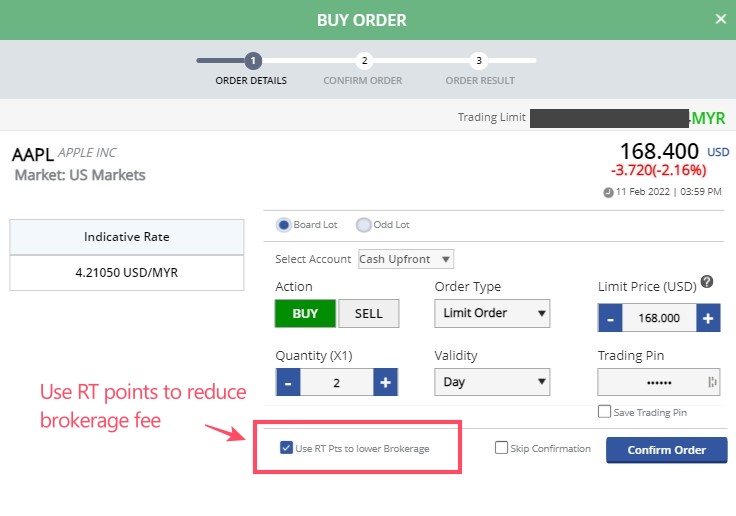

- Consider using MYR to buy/sell if you want to offset your brokerage fee using RT points (as of now, it is not possible to use RT points to offset brokerage fee while using USD to trade).

When to use USD to trade US stocks:

- Consider using USD when your trading value is over RM700.

- Convert your capital to USD if you think MYR is going to weaken further against USD, and you want to lock in the current conversion rate.

- Consider using USD if you make a lot of short to medium-term trades, so you do not have to go through currency conversion (from MYR to USD) everytime you make a trade. This reduces your exposure to the fluctuation in currency exchange.

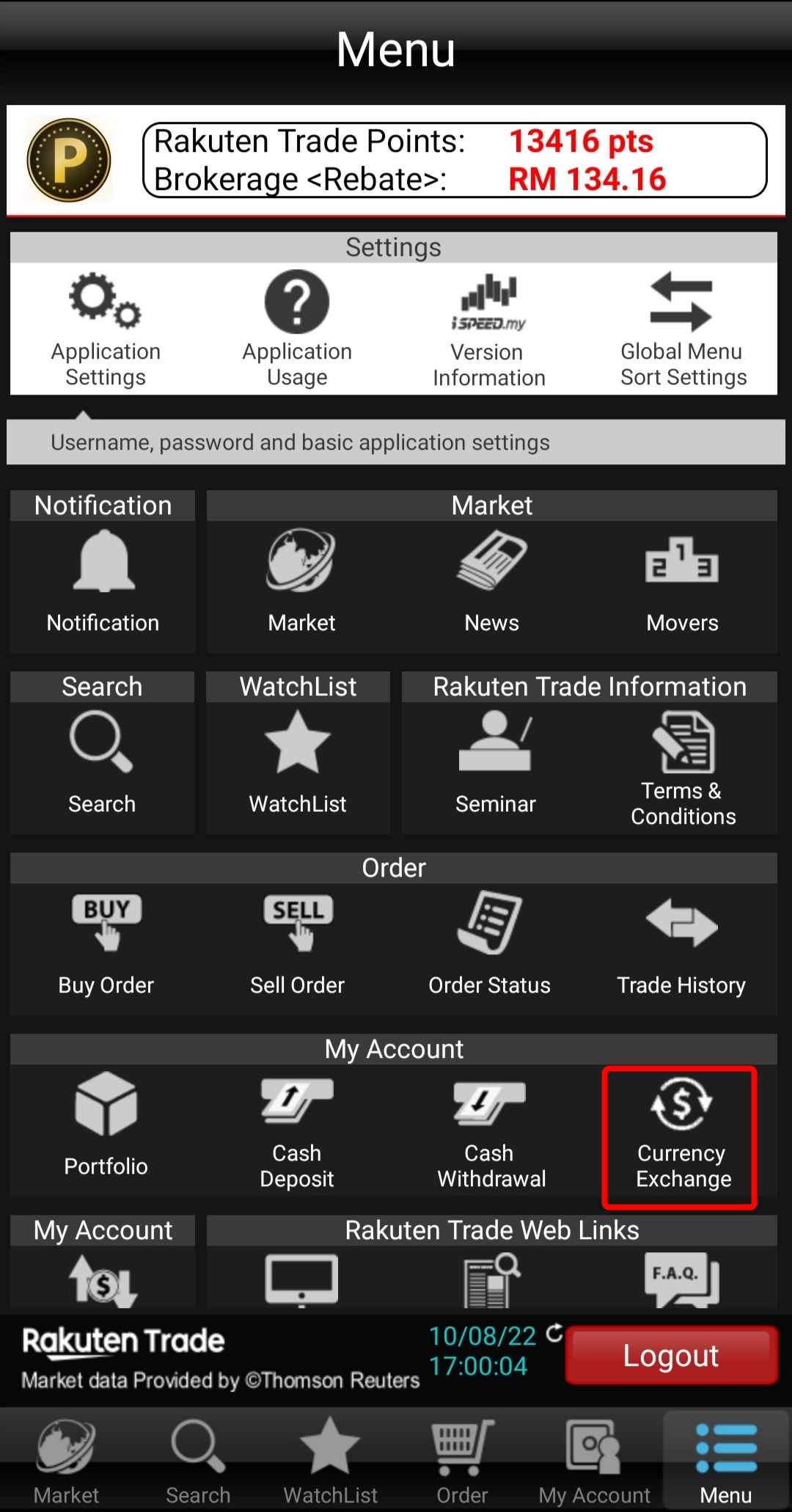

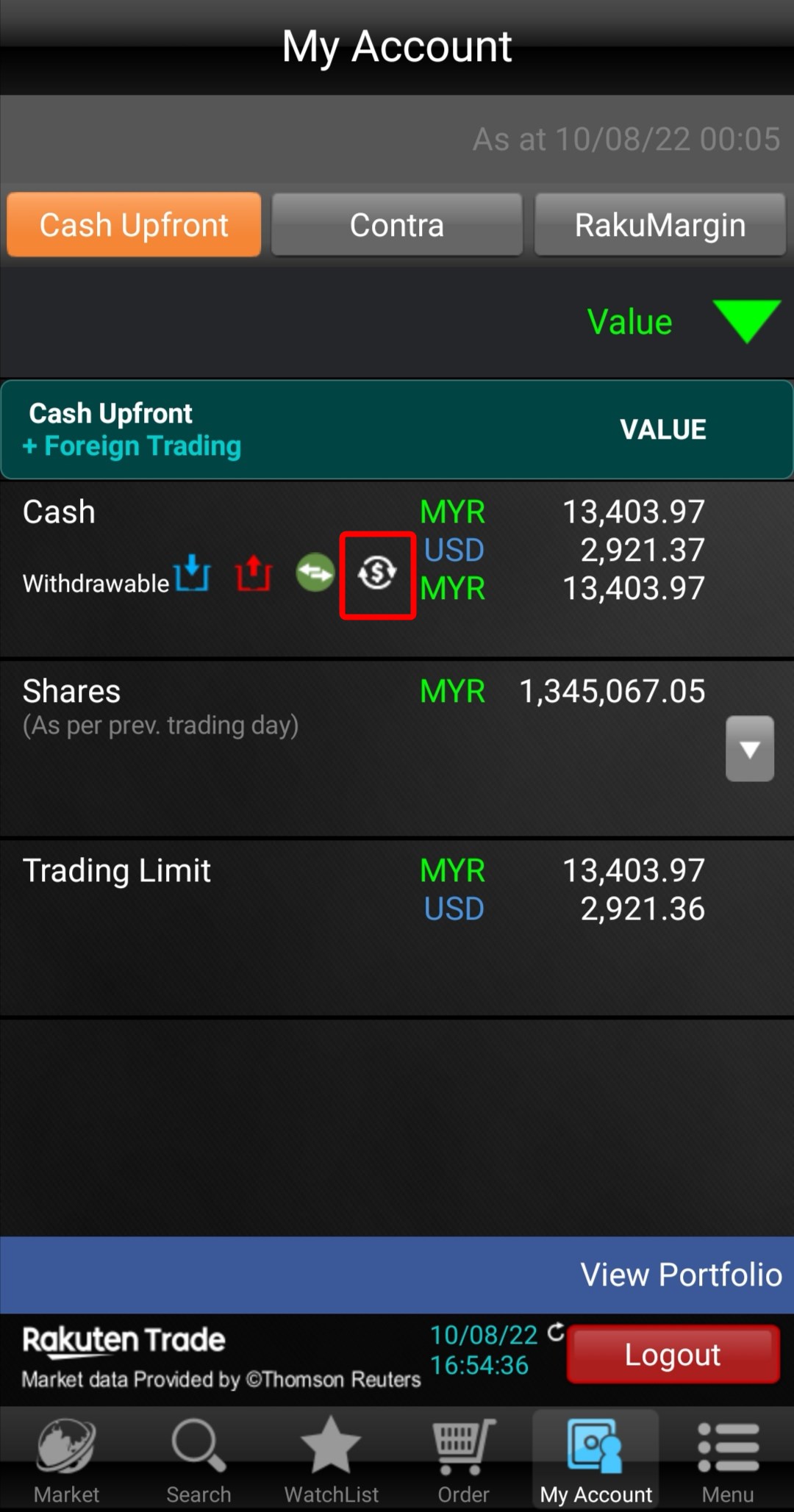

How to convert your MYR to USD (or vice versa)

Step 1: There are 2 ways to convert your currency within Rakuten Trade's iSpeed app, namely:

- Under Rakuten Trade’s iSpeed app, go to Menu > Select ‘Currency Exchange’, OR

- Under ‘My Account’ Select the Currency Exchange icon ($).

Step 2:

- Under ‘Convert From’, select MYR.

- Decide the conversion amount

- Under ‘Convert To’, select USD

- Enter your trading pin and click ‘Confirm’

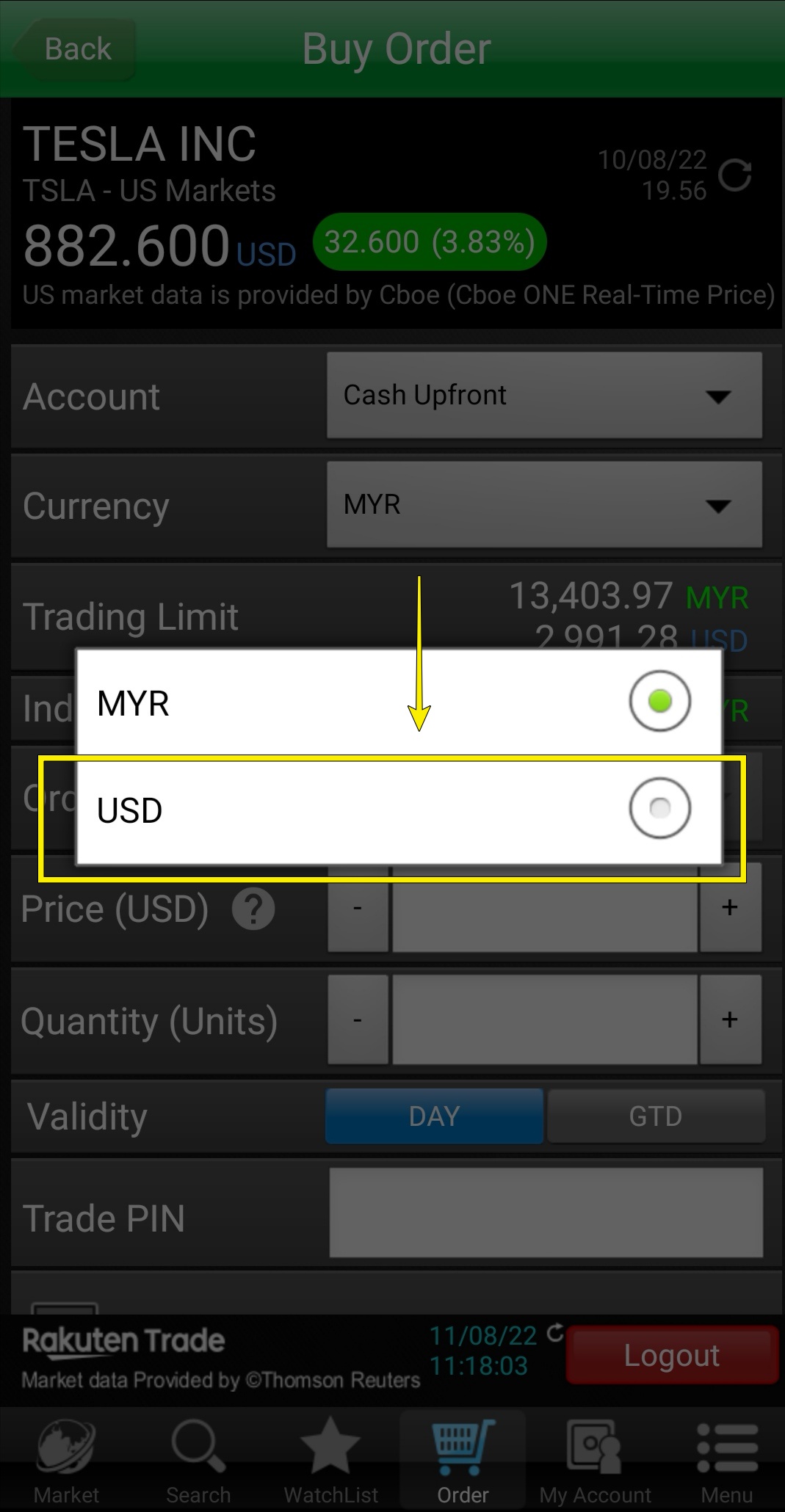

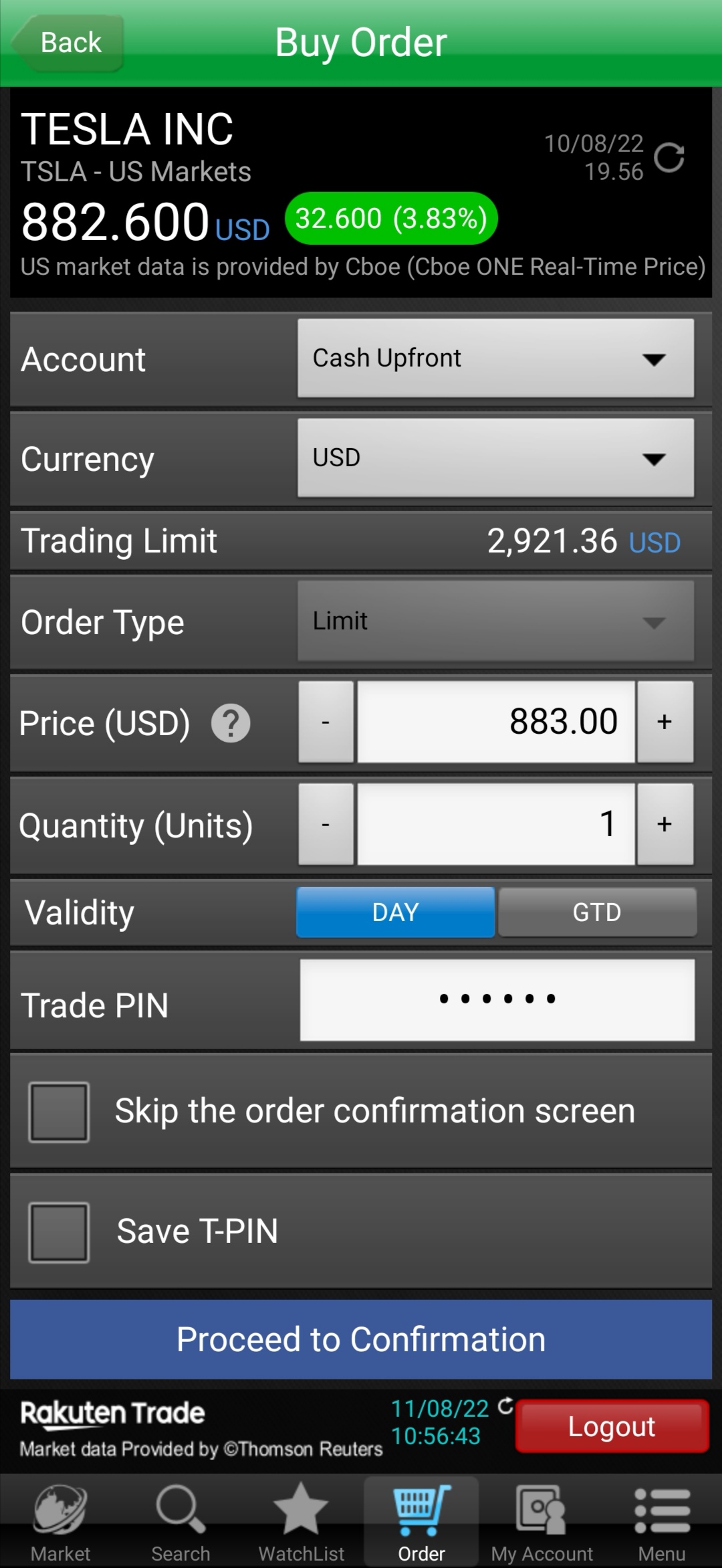

How to buy US stocks via USD

Step 1: Search for the stock that you want to invest in, and click ‘Buy’

Step 2: Under ‘Currency’, select ‘USD’. You’ll be shown your trading limit – make sure you have enough to execute your buy order!

Step 3: Decide the price of your limit order and quantity of shares to buy, key in your trading pin, and click ‘Proceed to Confirmation’ to confirm your buy order.

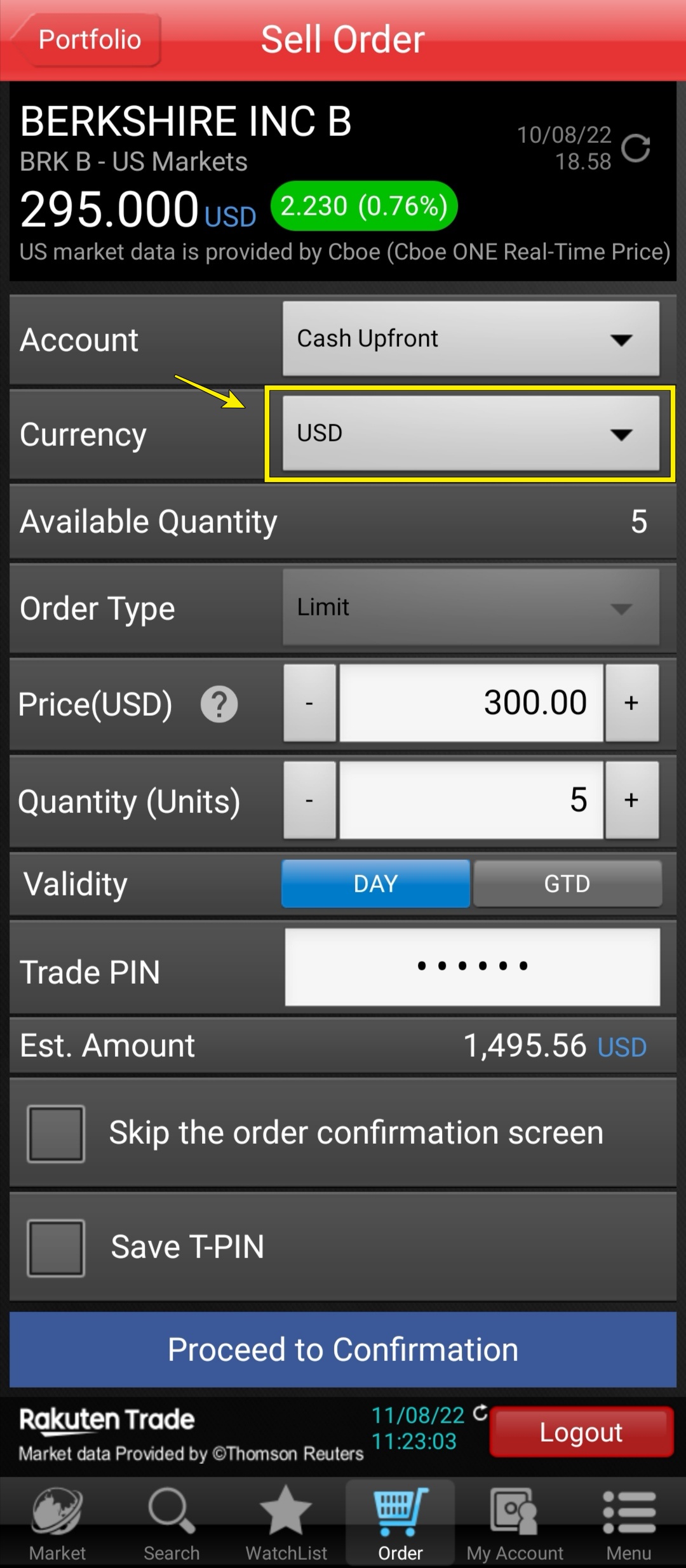

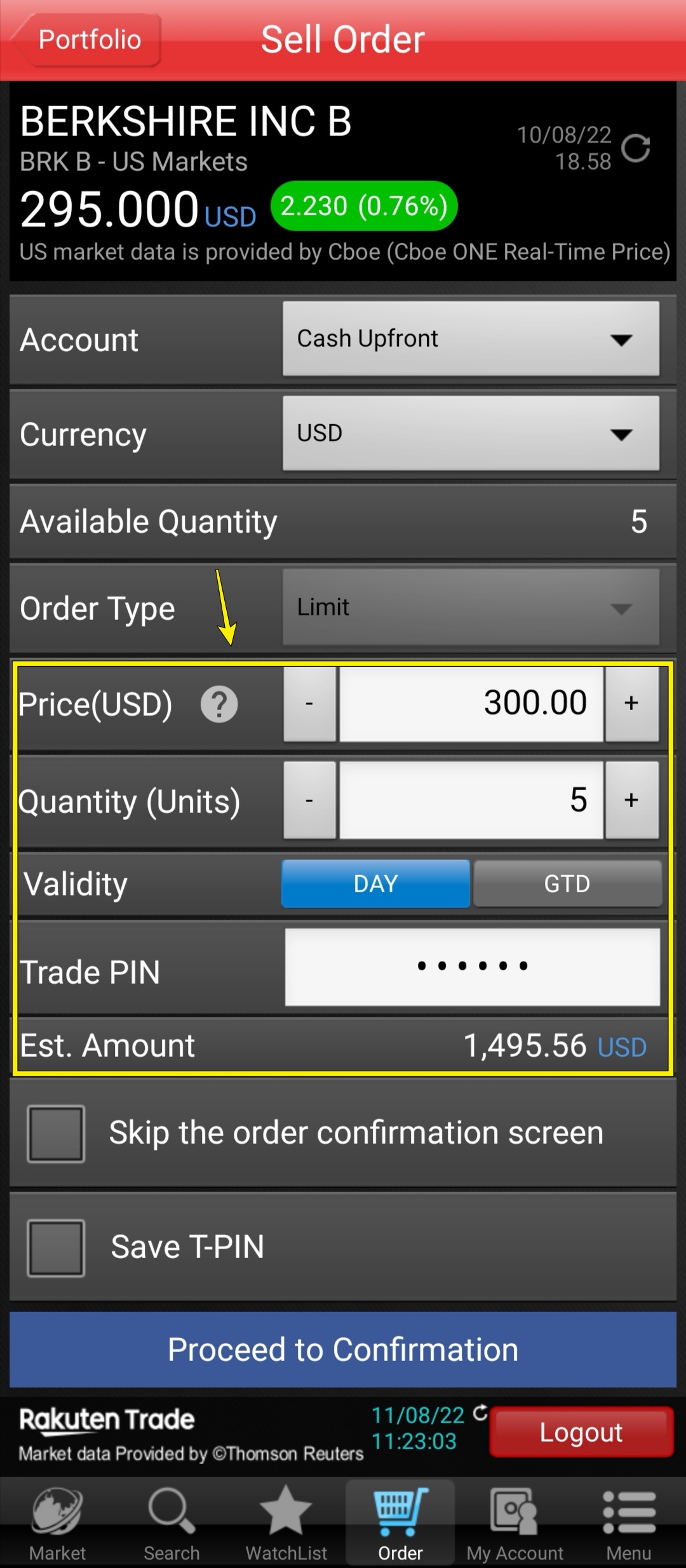

How to sell US stocks in USD

Step 1: Select a currency that you wish to receive upon selling your stocks (MYR/USD):

- MYR: Your holdings will be converted to MYR after being sold.

- USD: Your holdings will remain in USD after being sold.

Step 2: Decide the price of your limit order and the quantity of shares to sell. The ‘Est. Amount’ section displays how much you can expect to receive after you sell your holdings.

Step 3: Key in your trading pin and click ‘Proceed to Confirmation’ to confirm your sell order.

Rakuten Trade USD trading: What I wish could be better

Rakuten Trade’s move to introduce USD trading is a welcomed move as it allows greater flexibility and choice for users while investing in the US stock market.

That said, one aspect that I think Rakuten Trade could improve on is the streamlined implementation of its reward system – ie. Using RT points to offset brokerage fee.

As of now, we are not able to use RT points to offset brokerage fee if we were to trade using USD. However, it is possible to do so if we were to trade using MYR.

As a user, I’d like to see Rakuten Trade streamlining this reward system, as it would make the trading experience more complete for us as a user.

No Money Lah Verdict

So there you have it – a walkthrough of Rakuten Trade’s latest USD trading feature!

I hope this guide has been useful, and if you are looking for a Malaysia-regulated broker to trade US stocks, Rakuten Trade is certainly the way to go!

Open a Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

The REAL reasons why you need to invest in gold (not inflation) - Part 1

For the longest time, investors buy gold to preserve wealth as it is thought to be a stable investment.

In fact, when the Malaysian government granted users special withdrawals from EPF (our retirement fund) in the past few years, many Malaysians went on to - you guessed it - buy gold.

The question is: Is gold a good investment (it depends)? Is gold really stable (nope) and protects your wealth against inflation (...and nope)?

In this post, let's debunk a few myths about gold, and why I think most investors would still be better off investing in gold!

RELATED POST: 2 SECRET reasons that move gold price!

Highlights

- Gold is not a stable investment, and shows little signs that it is a good protection against inflation.

- That said, gold is a solid diversification from assets like stocks and bonds due to its low correlation with these assets.

- Holding gold in an investment portfolio helps with psychology as it helps reduce downside impact, and improve recovery time from a drawdown.

Interested? Slide down to learn more about why you need to invest in gold!

2 wrong reasons why people invest in gold:

Reason 1: "Because gold is a stable investment."

But is it really?

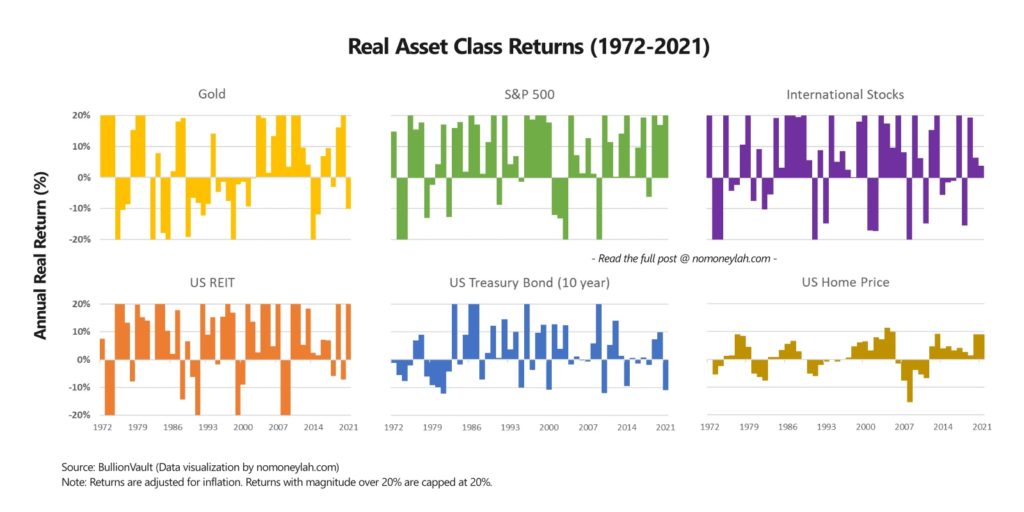

Check out the visual below where we compare the returns of different asset classes for the past 50+ years.

What can we learn from the visual:

- It is not hard to see that gold is actually pretty volatile over the years compared to bonds and home prices.

- If you observe closely, you'd also notice that gold tends to swing to the negative territory a lot more times than the S&P500 (US stocks), and Real Estate Investment Trust (REIT).

From this, we can debunk with confidence that gold is definitely not as 'stable' as most people assume.

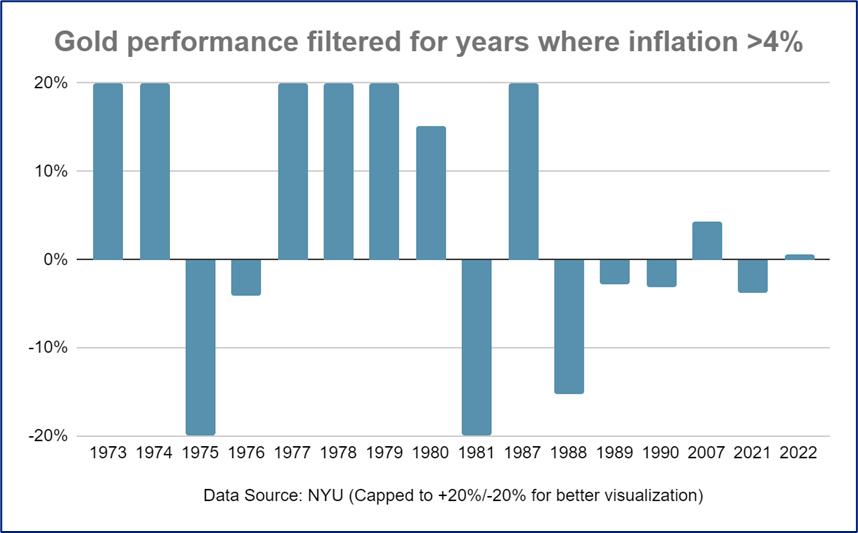

Reason #2: "Because gold protects my wealth against inflation."

Another common reason why people invest in gold is to protect themselves against inflation.

However, this perception is far from the truth in reality.

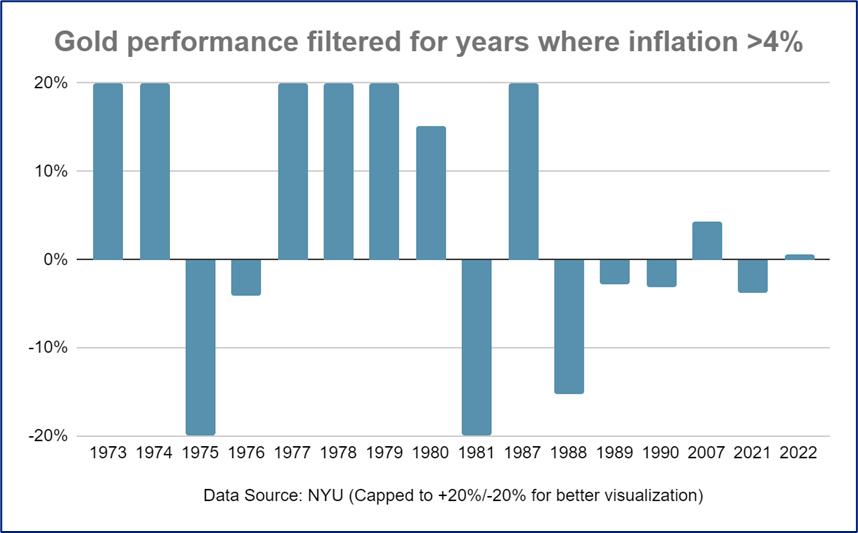

Below, check out how gold performed in the past when inflation in the US is over 4%:

From what you can see, buying gold to 'protect' your wealth against inflation depends largely on luck - because gold can fluctuate both ways EVEN when inflation is high.

So, what does this tell us?

Essentially, on its own, gold's performance is hardly impressive and it does not even protect investors well against inflation.

However, you should not dismiss gold because of the reasons above. In fact, when done right, investing in gold can help you sleep well at night - especially when things get tough.

2 REAL reasons why you (still) need to invest in gold:

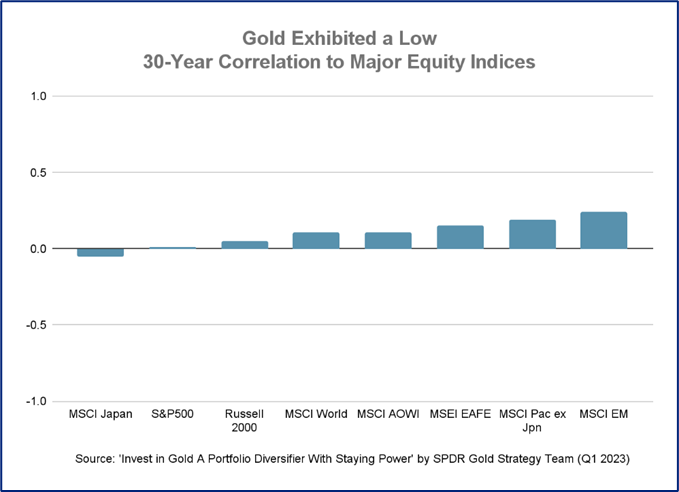

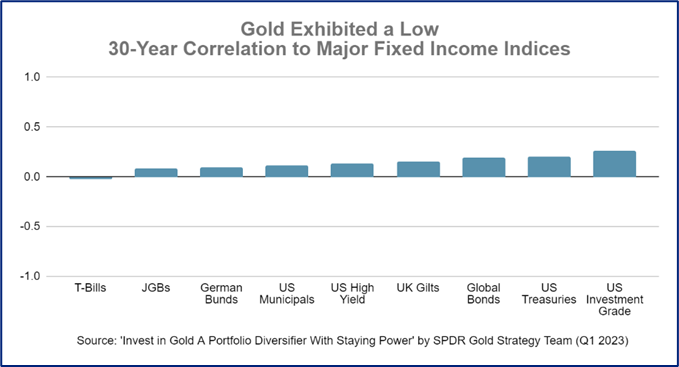

#1 Low correlation

Generally, gold has a low correlation when compared to major stocks and fixed-income assets.

In other words, this means when stocks or bond prices tumbled in price, gold tends to hold its ground well, or is faster to recover.

2022 is a solid example:

Check out how gold correlates to equities (stocks) and fixed-income assets (eg. bonds) below:

#2: Gold as a portfolio diversifier

Why is gold's low correlation with other assets important?

This is because while gold does not produce impressive returns on its own, it is an excellent risk diversifier in an investment portfolio consisting of stocks and bonds.

Simply put, gold is highly effective in helping to reduce the downside risk of your entire investment portfolio.

Let's look at an example below:

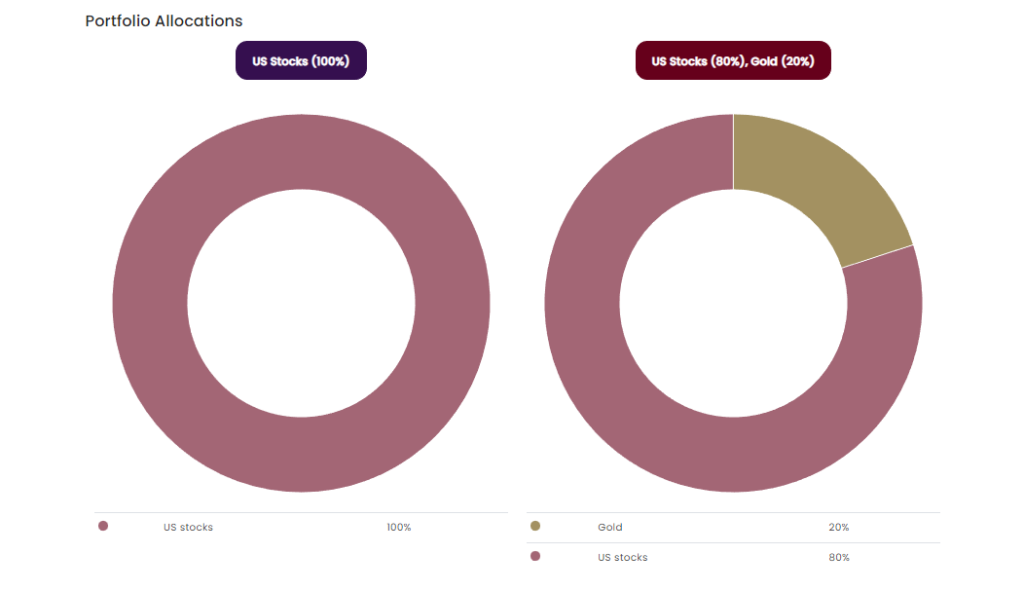

Scenario: Gold as a portfolio diversifier in a 100% stocks portfolio

In this example, let's imagine yourself investing in a 100% stocks portfolio against an 80% stocks-20% gold portfolio from 1972 - Jan 2023:

We will invest $500 every month in each of the portfolios and see what happens:

What can we infer from the table above?

- Surprisingly, there is only minimal difference in the annual returns (CAGR) between each portfolio in the long run. (22.68% vs 22.3%)

- However, having gold in a stock portfolio would help reduce the max drawdown you'd experience by a significant margin! (-50.57% vs -38.74%)

To give you a better perspective, check out how fast your investments would recover in the past 2 stock market crises (2007 - 2008, 2000 - 2002) if you have gold in your portfolio:

For instance, in the Global Financial Crisis (2007 - 2009), a 100% stock portfolio would need about 3 years and 1 month to recover, while having 20% gold in the portfolio would take 1 year and 10 months to recover.

As an investor that has gone through a tough year in 2022, I'm sure you'll know how valuable a 15-month faster recovery means to your confidence and mental health.

In other words, having some gold in your portfolio can help you sleep better at night, especially during difficult times!

3 recommended ways to invest in gold

Below, let me recommend 3 ways to invest in gold without having to store physical gold:

Method 1: Invest in local gold ETF via Rakuten Trade

The TradePlus Shariah Gold Tracker (code: 0828EA) is a Malaysia-listed Exchange-Traded Fund (ETF) that tracks gold price.

This gold ETF is shariah compliant, and is backed by physical gold bars, ensuring that it tracks the price of gold with precision.

At a low annual fee of 0.56% (trustee, management, custody fees), it is one of the most convenient ways for Malaysians to invest in gold without having to store physical gold!

You can start investing in the TradePlus Shariah Gold Tracker (code: 0828EA) via Rakuten Trade.

RELATED: Rakuten Trade long-term review

--

p.s. You can also invest in US gold ETF (Method 2) via Rakuten Trade as they also offer access to the US stock market!

Method 2: Invest in US gold ETF via Interactive Brokers (IBKR)

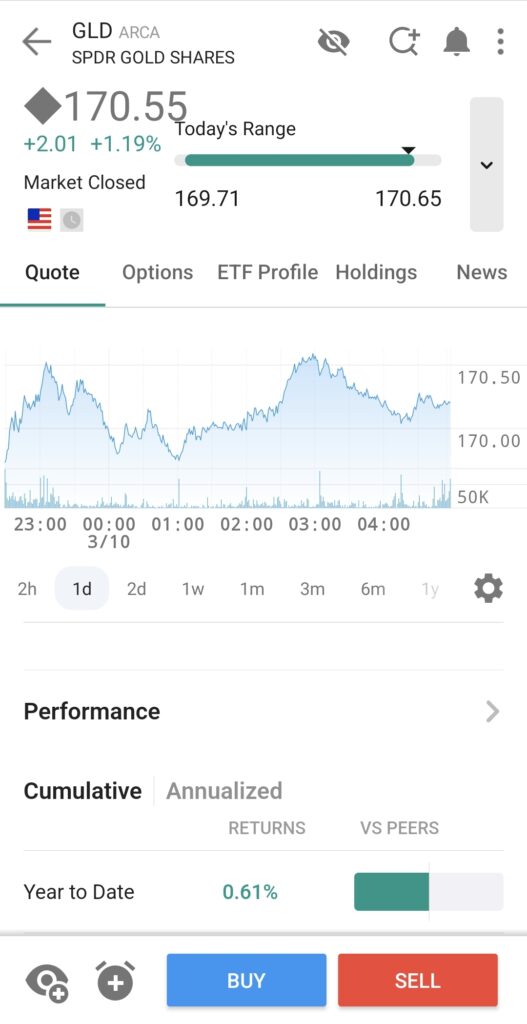

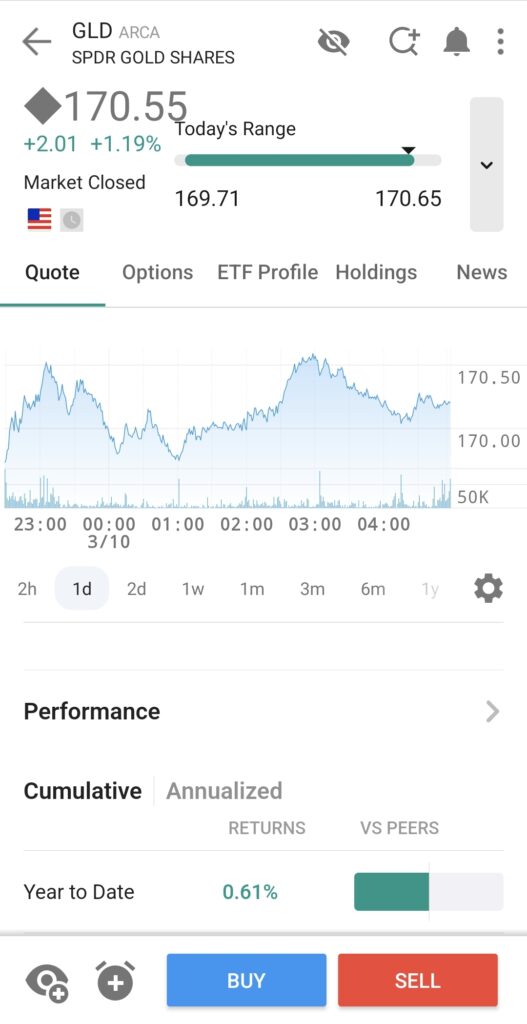

You can also invest in gold ETF that is listed in the US, such as the SPDR Gold Shares ETF (ticker: GLD).

GLD is also backed by physical gold so it can reflect the gold price in the closest presicion.

Compared to Malaysia-listed gold ETF, GLD is quoted in USD and has a lower annual estimated fee of 0.4%.

If you prefer to have your gold investments in USD, GLD is the way to go.

You can invest in GLD via Interactive Brokers, my preferred platform to buy global stocks:

READ MORE: Interactive Brokers Long-Term Review

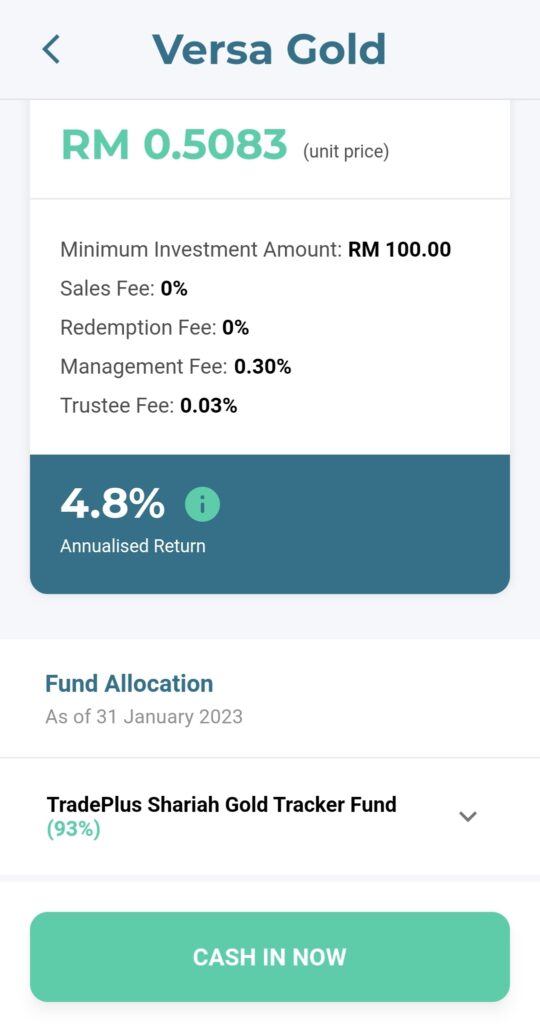

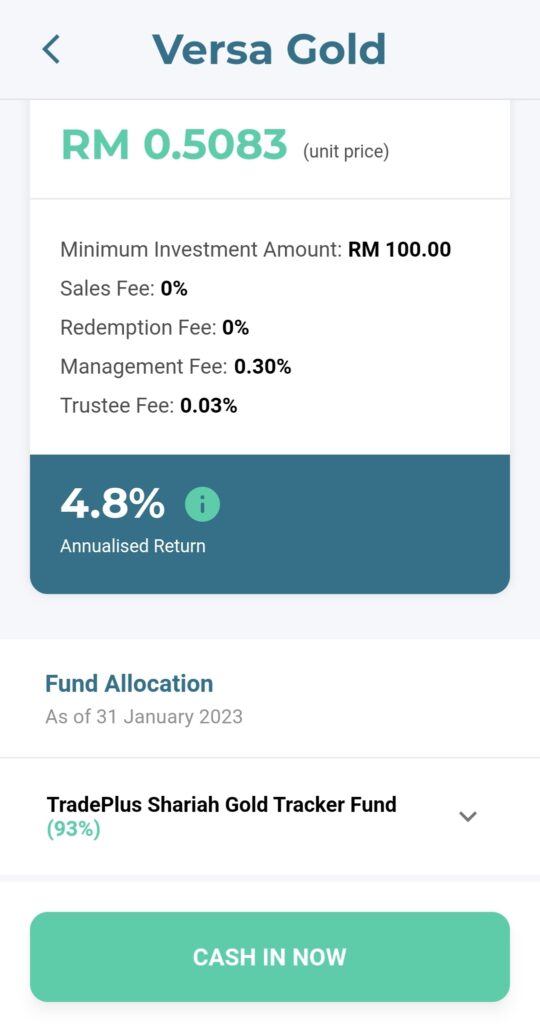

Method 3: Invest in gold ETF via Versa Gold

If opening a stock brokerage account overwhelms you, and you want a simple-to-use platform to buy gold, you can consider checking out Versa Gold from Versa.

With Versa Gold, you are essentially investing in TradePlus Shariah Gold Tracker from Method 1 above, but at a much simpler to use Versa app.

In addition, Versa Gold requires a low minimum investment amount of RM100, which is very beginner-friendly if you want to try investing in gold.

No Money Lah Verdict + Takeaways

- As an individual asset, gold's return is not impressive, and it does not protect against inflation.

- However, thanks to gold's low correlation with assets like equities and bonds, gold can be a solid diversification in a portfolio.

In my opinion, investing in gold is a form of insurance for a portfolio. While assets like stocks may tumble in fear or market uncertainties, investors tend to flock to gold in such times.

In a way, owning gold as part of your portfolio keeps you sane in tough market conditions.

So what do you think? Would you consider investing in gold with this new perspective from now on?

Feel free to share with me your thoughts in the comment section below!

Disclaimers

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

2 SECRET reasons that move gold price! - Part 2

Gold is one of the most precious commodities in the world.

Not only gold is rare, but it is also very durable. It doesn't rust, it doesn't tarnish, and you can bury your gold and come back in 50 years (or 5,000 years) and it would still be unchanged.

However, in my previous post, I used past data to prove that gold is not an ideal hedge against inflation, nor it is a stable investment:

That said, gold is an excellent insurance within an investment portfolio when major asset classes like stocks and bonds are tumbling. In other words, gold tends to hold up well when the market gets tough - just look at 2022:

In this post, I want to answer an important question:

If inflation has minimal impact on gold's performance, what actually moves gold price?

If you are looking to invest in gold, this will give you a solid insight into why gold price behaves the way it does!

RELATED POST: Part 1 - Why you need to buy gold (not inflation)

2 underrated indicators that drive gold price

The market is a complex place and there are many reasons that drive the price of gold.

In this post, I want to break down 2 less-talked-about (yet crucial) indicators that move the price of this precious metal:

#1 The health of the banking sector

Banks are an important part of the economy, as they create capital (eg. loans) and provide liquidity to the market.

Therefore, a healthy banking sector indicates a healthy economy.

In this case, the banking sector has an inverse correlation with gold prices. This is because investors tend to flock to gold when there is a negative perception towards the economy.

Check out how gold price has a tendency to move in the opposite direction against the banking sector:

Whenever the banking sector suffers, it has had a positive impact on gold prices as investors are prepared for economic weaknesses.

The health of the banking sector is, therefore, a leading indicator of gold prices.

Try this on your own:

Using my preferred charting platform TradingView:

- Firstly, search for the ticker for gold 'GLD'.

- Next, click the '+' symbol, and search for the ticker 'BANK' which represents the banking sector in the US.

- Right-click the price axis and change it from 'Regular' to 'Percent'.

RELATED POST: TradingView beginner's guide - my favourite charting platform!

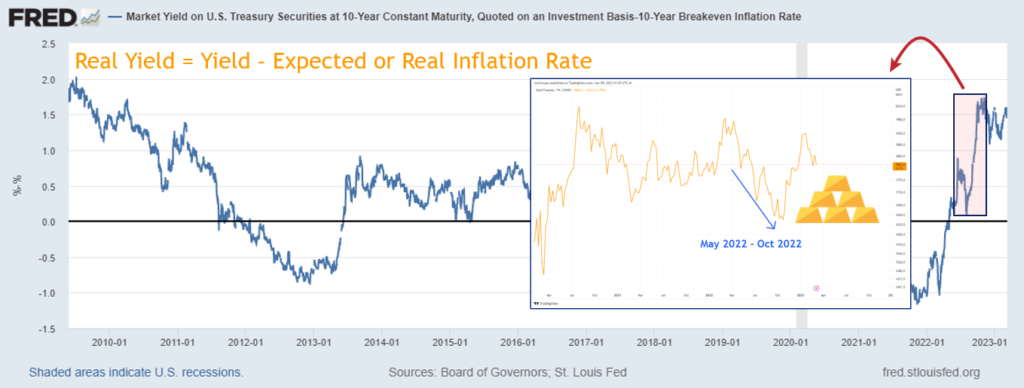

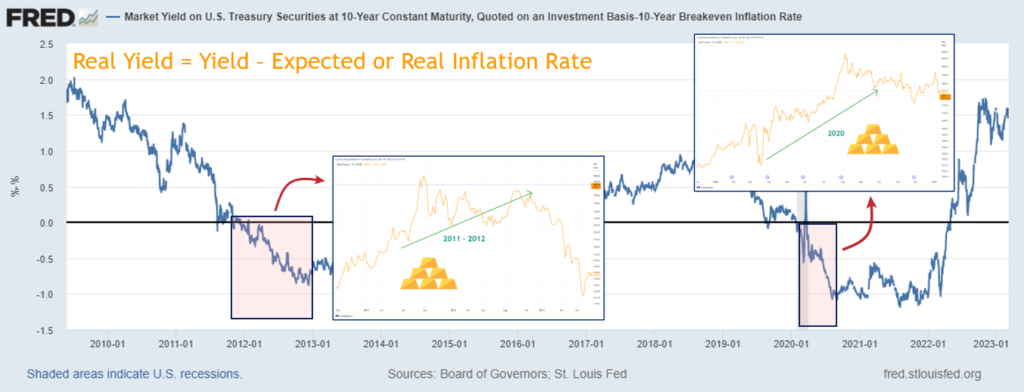

#2 Real Yield

Real yield refers to the interest that government bonds pay to investors, minus the expected/actual inflation rate:

Real Yield = Interest from government bonds - Expected or Actual Inflation Rate

A positive real yield means the interest from bonds beats inflation. A negative real yield implies that the interest from bonds is not able to cover inflation.

In this case, real yield tends to have an inverse relationship to gold.

Why so?

- Because when real yield is rising, there is an opportunity cost to investing in anything other than interest-paying assets like bonds.

- Since gold DOES NOT pay interest, that makes the opportunity cost of holding gold much higher, thus suppressing the price of gold.

- Meanwhile, when real yield is dropping, the returns from bonds become less attractive.

- As such, investors will be inclined to take more risks by investing in assets that do not pay interest, such as gold. This will usually push the price of gold in a positive direction.

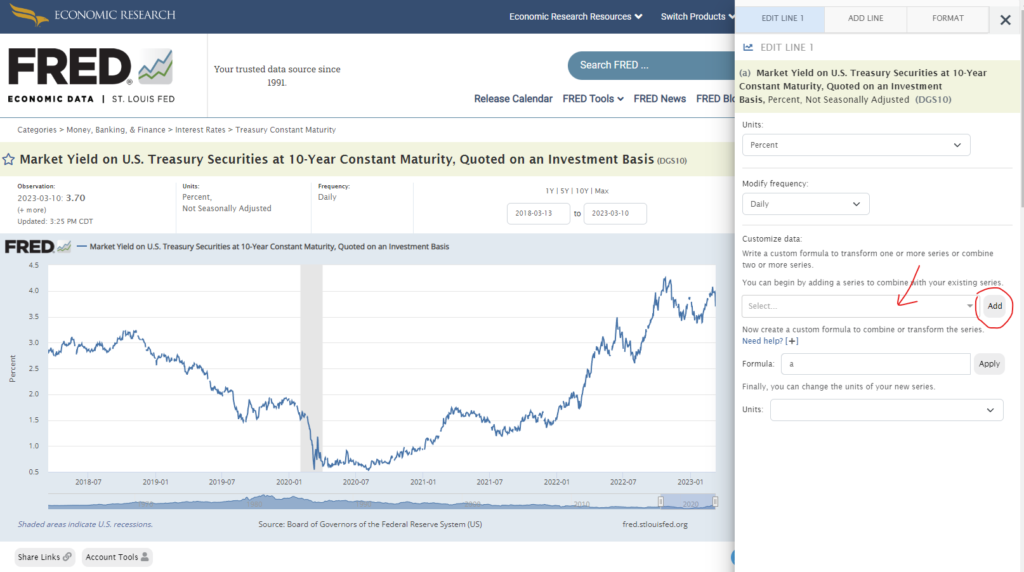

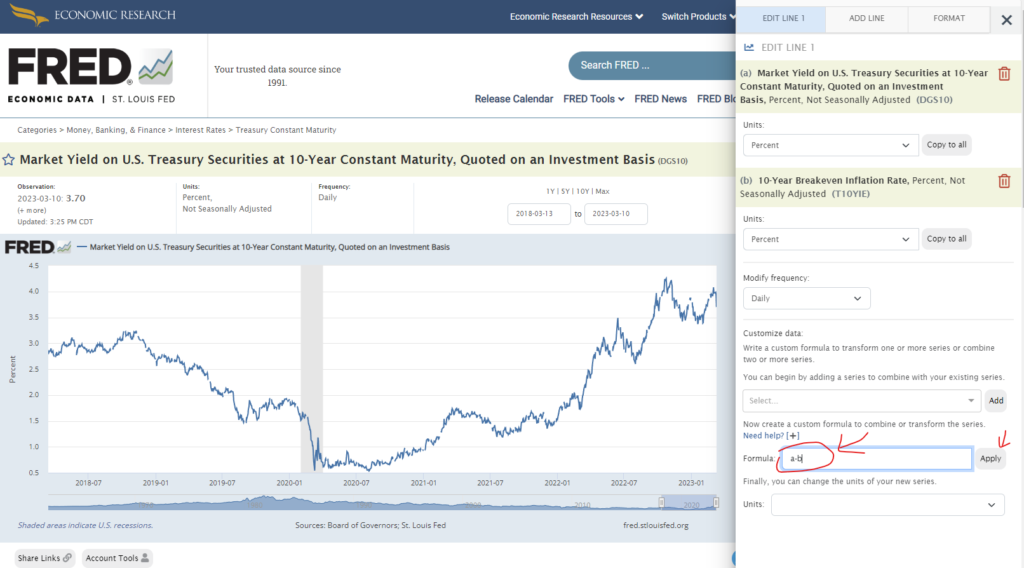

Try this on your own:

- To start, click HERE to access data for the 10-year US treasury yield graph.

- Select 'Edit Graph'

- Under 'Customize Data', select '10-Year Breakeven Inflation Rate', then click 'Add'.

- Under 'Formula', type 'a-b'. Then, click 'Apply'. You will get the graph I used in this post.

3 recommended ways to invest in gold

Below, let me recommend 3 ways to invest in gold without having to store physical gold:

Method 1: Invest in local gold ETF via Rakuten Trade

The TradePlus Shariah Gold Tracker (code: 0828EA) is a Malaysia-listed Exchange-Traded Fund (ETF) that tracks gold price.

This gold ETF is shariah-compliant and is backed by physical gold bars, ensuring that it tracks the price of gold with precision.

At a low annual fee of 0.56% (trustee, management, custody fees), it is one of the most convenient ways for Malaysians to invest in gold without having to store physical gold!

You can start investing in the TradePlus Shariah Gold Tracker (code: 0828EA) via Rakuten Trade.

RELATED: Rakuten Trade long-term review

--

p.s. You can also invest in US gold ETF (Method 2) via Rakuten Trade as they also offer access to the US stock market!

--

Method 2: Invest in US gold ETF via Interactive Brokers (IBKR)

You can also invest in gold ETF that is listed in the US, such as the SPDR Gold Shares ETF (ticker: GLD).

GLD is also backed by physical gold so it can reflect the gold price in the closest precision.

Compared to Malaysia-listed gold ETF, GLD is quoted in USD and has a lower annual estimated fee of 0.4%.

If you prefer to have your gold investments in USD, GLD is the way to go.

You can invest in GLD via Interactive Brokers, my preferred platform to buy global stocks:

READ MORE: Interactive Brokers Long-Term Review

Method 3: Invest in gold ETF via Versa Gold

If opening a stock brokerage account overwhelms you, and you want a simple-to-use platform to buy gold, you can consider checking out Versa Gold from Versa.

With Versa Gold, you are essentially investing in TradePlus Shariah Gold Tracker from Method 1 above, but at a much simpler to use Versa app.

In addition, Versa Gold requires a low minimum investment amount of RM100, which is very beginner-friendly if you want to try investing in gold.

No Money Lah Verdict + Takeaways

I hope this post is helpful in showing you what kind of fundamental indication tends to move gold price!

Having this knowledge can help you understand why gold moves and responds the way it does - and it is highly insightful as an investor.

So, would you consider investing in gold? Why or why not?

Feel free to share with me your thoughts in the comment section below!

Disclaimers

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Rakuten Trade Hong Kong Stock Trading Review: Affordable Way to Invest in HK!

Rakuten Trade is one of the best-regulated platforms in Malaysia that offers access to local and US stocks at an affordable fee.

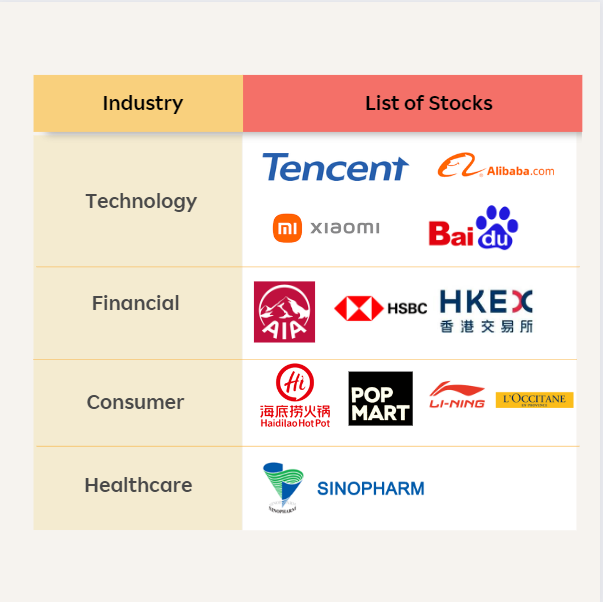

In late 2022, they launched access to the Hong Kong Stock Exchange (HKEX), which makes it easy and affordable for Malaysians to gain exposure to reputable Chinese and Hong Kong companies listed in Hong Kong.

In this post, let's dive into Rakuten Trade’s latest Hong Kong market offering, and see if this is something to try out!

Highlights of Rakuten Trade HK Stock Trading

- Affordable brokerage fee: Rakuten Trade offers access to the Hong Kong Stock Exchange (HKEX) at a highly competitive fee, from as low as RM1/trade (for MYR trading), or a min. of HKD35/trade (for HKD trading).

- Flexible: Invest in Hong Kong-listed stocks via Rakuten Trade in MYR or HKD, your choice.

Why invest in Hong Kong?

The HK stock market offers several distinct benefits compared to investing in the US stock market:

(i) 0% dividend withholding tax

A major benefit of investing in Hong Kong stocks is there is 0% dividend withholding tax.

Meanwhile, most non-US residents (eg. Malaysians, Singaporeans) will be charged a 30% dividend withholding tax while investing in US stocks.

In other words, if an HK stock in your portfolio pays HKD1.00 in Distribution Per Unit (DPU), you will get the full payout instead of having to deduct for withholding tax.

READ MORE: All you need to know about Dividend Withholding Tax

(ii) The easiest way to access prominent China-listed companies

Investing in HK is also the most direct and reliable way for investors to gain access to reputable Chinese companies, such as Xiaomi, Alibaba, Tencent, and more.

Compared to investing in Chinese American Depositary Receipts (ADRs) listed in the US that face constant threats of delisting, investing in HKEX equivalent stocks is a more reliable way to gain exposure to Chinese companies.

Competitive brokerage fees for the Hong Kong market

Unlike most local brokers that charge unbelievably high rates for their Hong Kong market, Rakuten Trade offers the HK market at a very competitive fee.

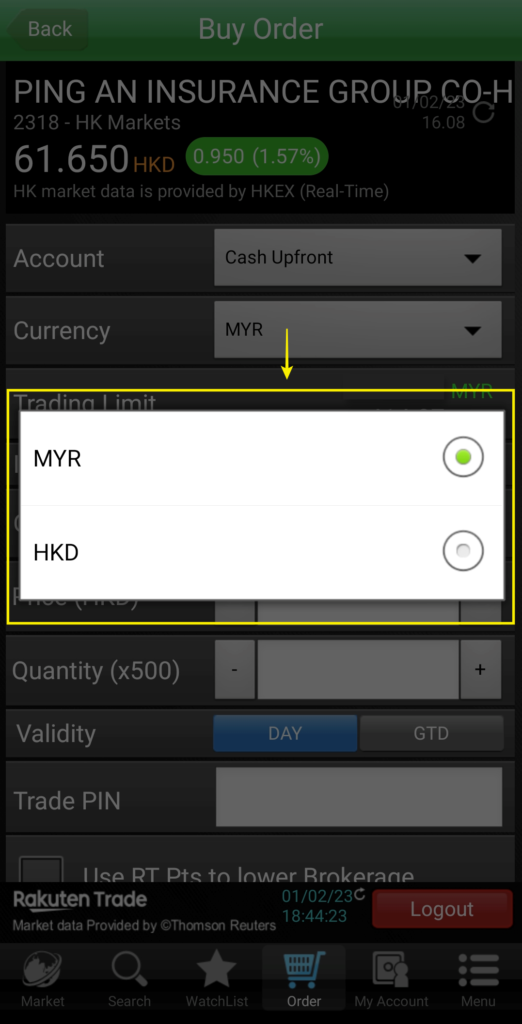

With Rakuten Trade, users are able to trade in Malaysian Ringgit (MYR) or Hong Kong Dollar (HKD).

[Note]: When you buy HK stocks in MYR, your MYR will be automatically converted to HKD as per Rakuten Trade's exchange rate.

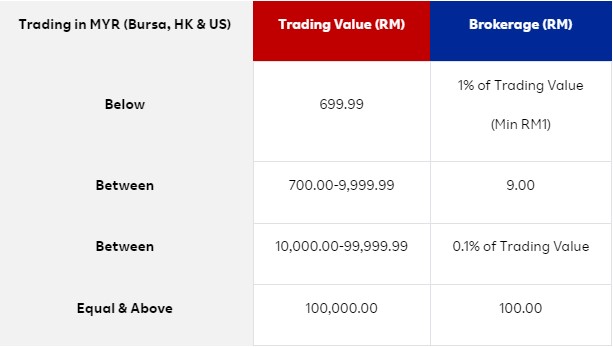

Below is Rakuten Trade's Hong Kong market fee structure for MYR trading and HKD trading:

Rakuten Trade brokerage fee for trading HK stocks in MYR

| Trading Value (RM) | Brokerage (RM) | |

| Below | 699.99 | 1% or a min. of RM1 |

| Between | 700-9,999.99 | 9.00 |

| Between | 10,000.00-99,999.99 | 0.10% of trading value |

| Equal & Above | 100,000.00 | 100.00 |

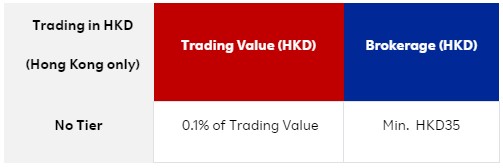

Rakuten Trade brokerage fee for trading HK stocks in HKD

| Trading Value (HKD) | Brokerage (HKD) | |

| No Tier | 0.10% of trading value | Min. HKD35.00 |

Generally, given how Rakuten Trade structure their fees, I'd personally invest using MYR as it is cheaper compared to the min. HKD35 fee for HKD trading.

Other fees while investing in the HK market:

Aside from that, please take note that there are other fees charged by the HKEX while you trade HK stocks, as seen below:

- Clearing fee: 0.002% of gross amount with a minimum of HKD2.00 per order or a maximum HKD100.00 per order

- Stamp duty (Stocks): RM1.50 for every RM1,000.00 gross amount, with a maximum of MYR 1,000.00

- Exchange fee: 0.00565% of gross amount per order

- HKEX Stamp Duty: 0.13% of gross amount and round up to nearest integer

- SFC Transaction Levy: 0.0027% of gross amount with a minimum of HKD0.01 per order

- FRC Transaction Levy: 0.00015% of gross amount with a minimum of HKD0.01 per order

Rakuten Trade vs Competitors – Brokerage Fees by Trade Value

How do Rakuten Trade fees compare to locally regulated competitors?

Below, I compare the brokerage fee of Rakuten Trade to FSMOne, which both offer access to the Hong Kong market:

| Trade Value | Rakuten Trade (RM trading/HKD trading) | FSMOne (HKD) |

| <RM699.99 (~HKD1,244) | 1% of trading value, min. RM1 or HKD35.00 | HKD50.00 |

| RM5,000 (~HKD9,260) | RM9 or HKD35.00 | HKD50.00 |

| RM10,000 (~HKD18,520) | RM10 or HKD35.00 | HKD50.00 |

From this, it is clear that Rakuten Trade is making foreign market access more affordable for Malaysians.

Trading experience & features:

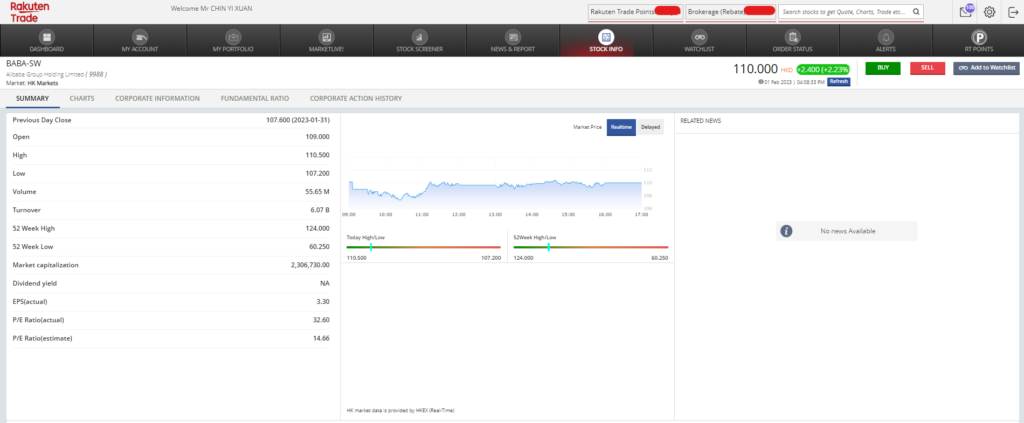

#1 User-friendly interface

Rakuten Trade built their Hong Kong stock trading service on top of their existing trading platform.

As a long-time user, I think this is good news because Rakuten Trade’s platform is really simple to use.

Either from Rakuten Trade’s website or iSpeed app, you can switch between Malaysia, US, and Hong Kong markets easily.

#2 FREE live datafeed*

In addition, Rakuten Trade offers users access to live datafeed of HK stocks for FREE.

In other words, all HK stock prices are quoted live (ie. Real-Time). For many platforms, you’ll usually have to pay for live data or you’ll only get a delayed datafeed.

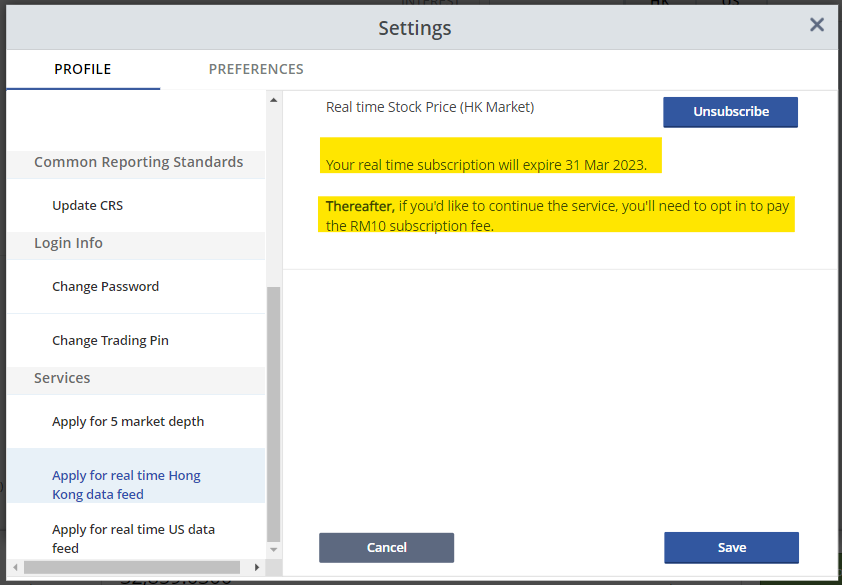

*Update 31/3/2023: End of free live datafeed for HK stock market

Starting April 2023, users that wish to get access to real-time datafeed will have to subscribe for it at Dashboard -> Setting -> 'Apply for real-time Hong Kong datafeed'. The price will be RM10/m.

#3 Buy HK stocks in MYR or HKD

As a Rakuten Trade user, you have the choice to store HKD in your account.

This allows for the flexibility to trade HK stocks in either MYR or HKD.

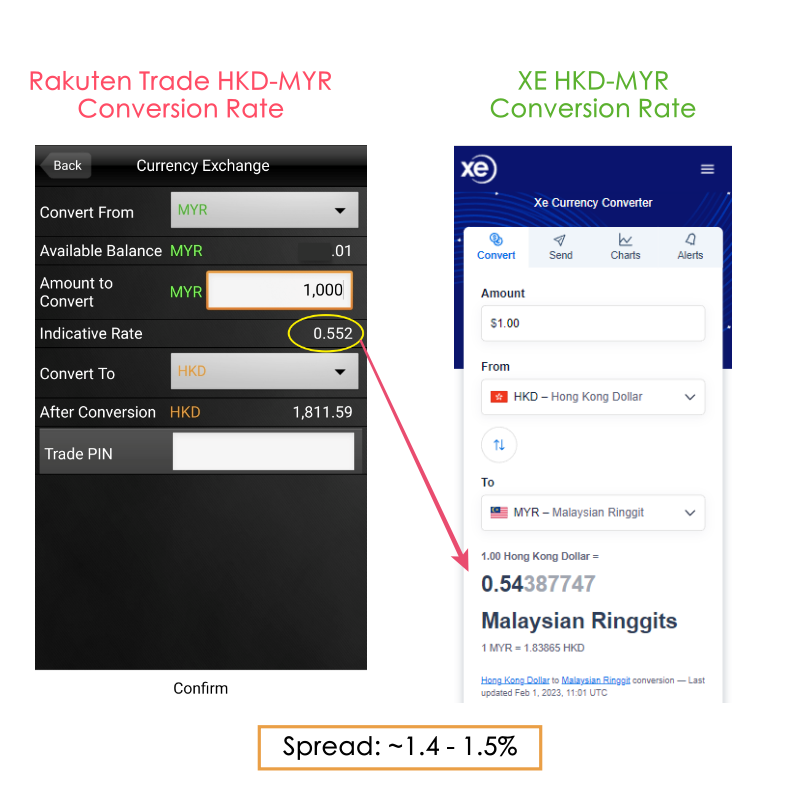

#4 Live Conversion + Tight HKD-MYR Exchange Rate

Rakuten Trade offers a relatively tight HKD-USD spread for users to easily convert between both currencies within the platform.

Furthermore, the conversion process happens real-time, enabling users to convert MYR to HKD (and vice versa) with the latest rate and trade right away.

Lastly, unlike certain brokers, there are no extra fees involved in currency conversion (aside from the spread) so there are no worries about hidden fees.

#5 No charges for corporate action

Furthermore, just like trading Malaysia stocks, Rakuten Trade handles any corporate action for your HK stock investments for FREE.

In other words, you do not have to pay Rakuten Trade in order to receive dividends or execute a right issue (you may have to pay for these on some other platforms).

What u need to know about the HK market

- HKEX Market hours

The HKEX market hour is slightly different from the Malaysia's market, as you can see below:

| Session | Time |

| Pre-Open | 9am – 9:30am |

| Trading Session | 9:30am - 12pm |

| Break | 12pm – 1pm |

| Trading Session | 1pm - 4pm |

For the pre-open session, you can begin placing your limit orders but they’ll not be filled until the market opens at 9:30am.

2 areas of improvement

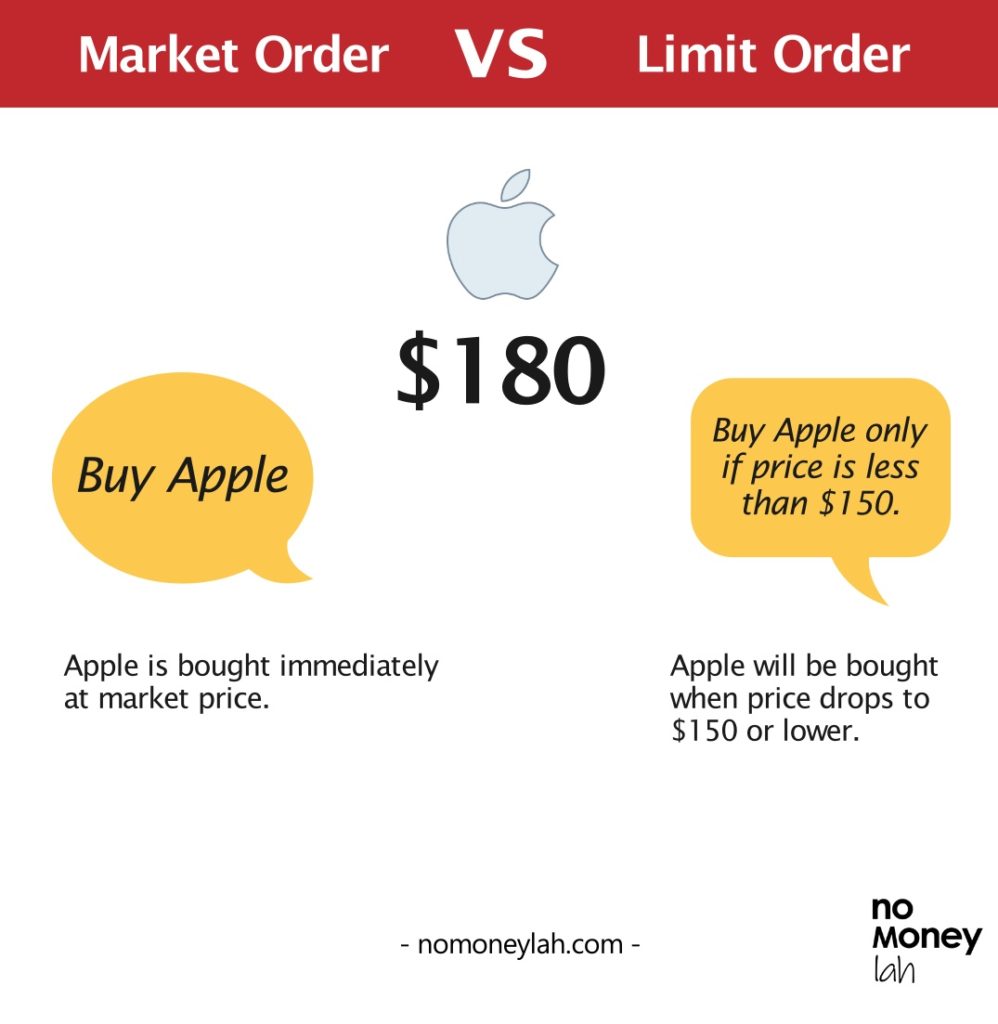

(a) Lack of basic order execution features

One thing that I found lacking while using Rakuten Trade to buy HK stocks is the missing of basic order execution features such as Market Order.

Unfortunately, the only trade execution option on Rakuten Trade is Limit Order.

- Market Order is an execution feature that allows investors to buy or sell shares at the immediate best price. As such, it is available in most stock trading platforms that I’ve used in the past (even Rakuten Trade’s own Bursa trading)

- Limit Order allows investors to line up their orders to buy or sell shares at a specific price or better.

While this may not be a huge issue for most investors, a lack of Market Order execution may turn off some investors that prefer not to wait for their orders to be matched, or day-traders that require immediate market execution.

(b) Limited Hong Kong stocks and no HK ETFs (but it’s improving)

Secondly, Rakuten Trade does not actually offer all of the stocks listed in the HK market. In addition, HK ETFs are not currently available on Rakuten Trade.

That said, Rakuten Trade will be gradually adding new HK stocks with time.

As of July 2023, Rakuten Trade offers about 340+ stocks listed on the Hong Kong Stock Exchange (HKEX).

While you may trade the most well-known HK stocks (eg. Xiaomi, Alibaba, Tencent) on Rakuten Trade, there are some other HK stocks that you may not find on Rakuten Trade.

[Note]: If you have a stock that you want to trade on Rakuten Trade, you can email your request to Rakuten Trade on the matter.

Who should use Rakuten Trade to buy HK stocks?

While not perfect, Rakuten Trade has offered something that all local brokers failed to do: Access to the HK stock market at a truly affordable fee via a Malaysia-regulated platform.

In my opinion, Rakuten Trade is a great option if you are:

- Seeking for a Malaysia-regulated broker to invest in the HK stock market.

- Looking to access the HK market at a truly affordable fee.

- Looking for a user-friendly platform to invest in the HK stock market.

At the same time, it may not suit people that are:

- Active day traders that require market execution (instead of limit order) or more advanced execution features.

- Investors or traders that want exposure to more exotic stocks which are not within Rakuten Trade’s list of tradable stocks.

In short, unless you are an active trader, chances are you’ll like what Rakuten Trade has to offer.

Summary: Is Rakuten Trade a good platform to invest in the HK market?

As a whole, I think Rakuten Trade has offered Malaysians a highly affordable choice to invest in the HK market via a locally-regulated broker.

A decent fee structure, user-friendly interface, and transparent conversion rate should convince many investors to forgo the need to open a foreign brokerage account (and experience all the hassle of funding & withdrawals).

Unless you are an active day trader or you require access to less familiar Hong Kong stocks, I am certain you’ll be happy with what Rakuten Trade has to offer.

How to sign up to trade HK stocks via Rakuten Trade

(A) How to sign up for US stock trading if you are new to Rakuten Trade:

Step 1: Sign up for Cash upfront account

If you are new, you’ll have to sign up for a Rakuten Trade Cash Upfront account.

Consider using my Rakuten Trade referral link by clicking the button below, and you’ll get 1000 RT points (RM10) which can be used to offset your brokerage fee!

If you need help, click HERE for my step-by-step guide to open a Rakuten Trade account.

Step 2: Get your Rakuten Trade account within 2 working hours

Your Rakuten Trade account will be activated within 2 working hours.

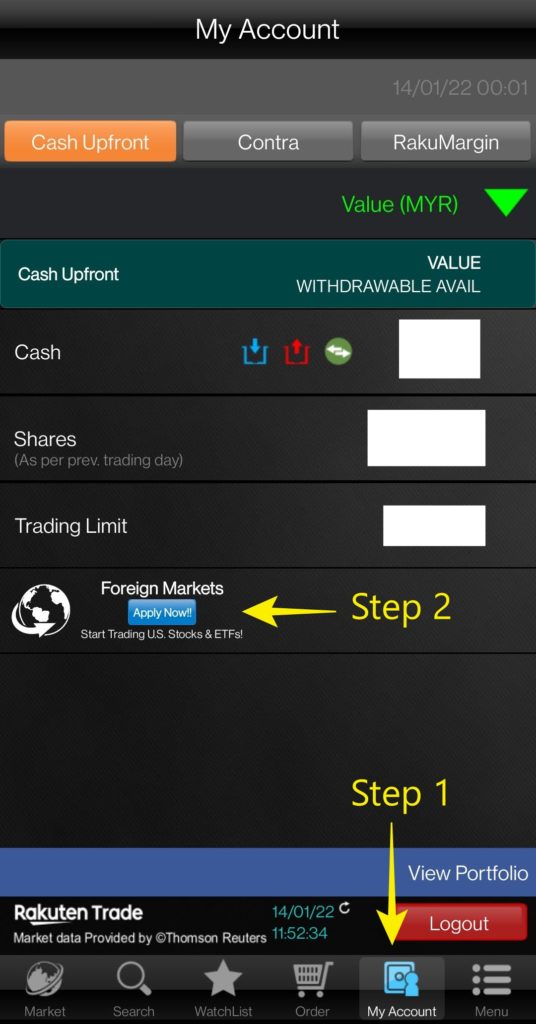

Step 3: Log in to your Rakuten Trade account and apply for Foreign Stock Trading

Log in to your Rakuten Trade account either via the website or Rakuten Trade’s iSpeed app. You can locate the Foreign Trading activation button easily within the Rakuten Trade platform.

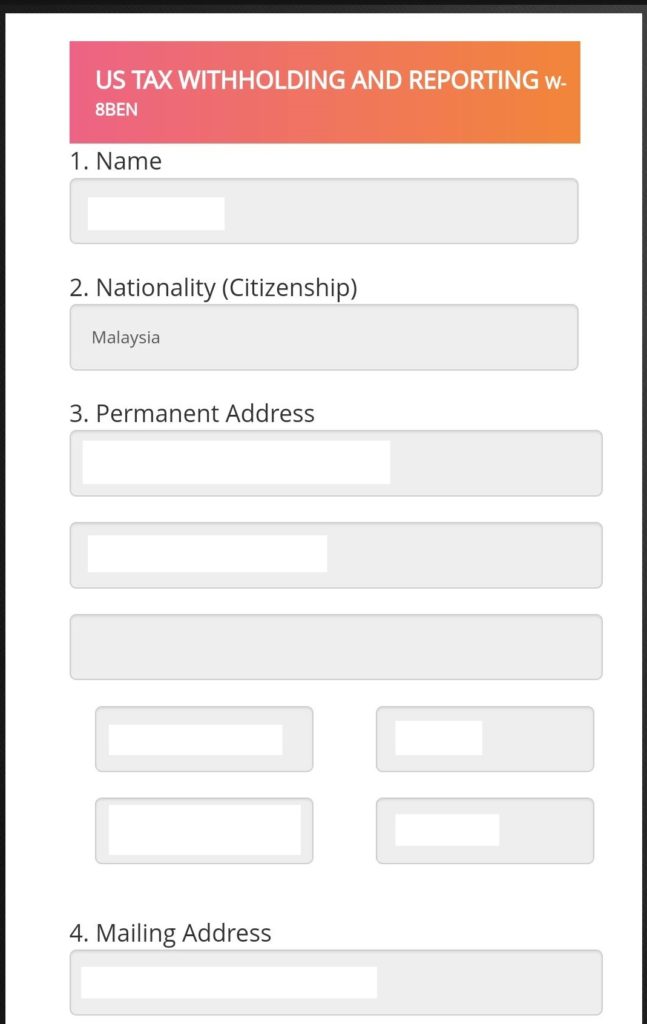

Step 4: Submit your application for US stock trading + agree to the T&C of foreign stock trading

Since you are activating foreign trading on Rakuten Trade, you will also gain access to the US market alongside HK.

Hence, spend 1 minute to share some info required to trade the US stock market (W8BEN form).

Then, agree to the T&C and submit your application.

Step 5: Your Foreign Trading account will be enabled within 2-3 working days

(B) How to sign up for foreign trading if you are an existing Rakuten Trade user:

If you are an existing Rakuten Trade user, just follow Step 3 to Step 5 above and you’ll be good to go!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Rakuten Trade Long-Term Review: 5 Reasons Why it is my Go-To Stock Broker!

Rakuten Trade has been my go-to broker to invest in the stock market for more than 4 years now.

As a long-term user, I have both good and to-be-improved experiences with the platform.

In this Rakuten Trade review, let’s learn more about this platform and whether they are the stock investing platform for you!

Before you proceed, here are some related posts that you might find useful:

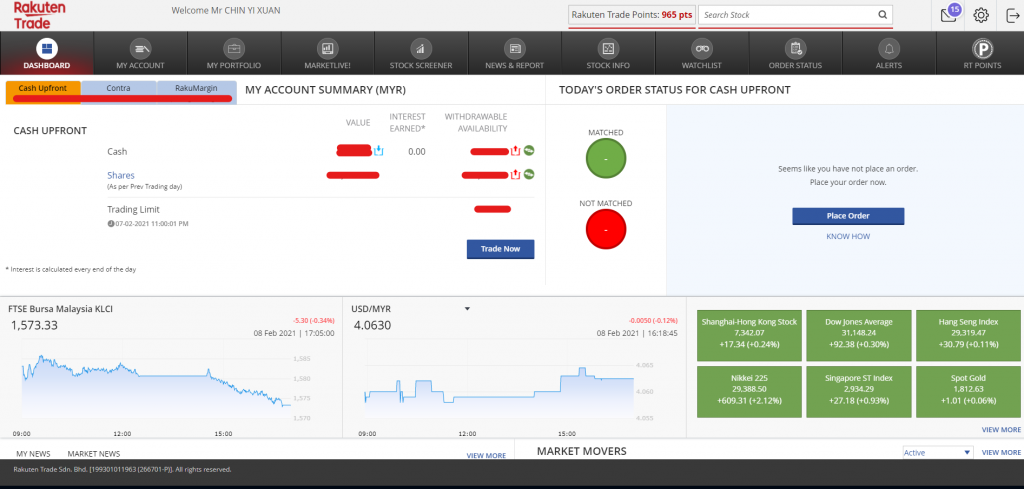

How I use Rakuten Trade

Personally, I use Rakuten Trade mainly for long-term investing. Meaning, I invest in stocks and hold them for years UNLESS there is a shift in business nature or fundamentals. This also means that:

- I do not actively trade in and out of the market.

- Also, I certainly do not need to be on the screen/app at 9am when the market opens in an attempt to get the ‘best’ stock entry price

- Plus, I definitely do not participate when the market is crazy over any particular stock – I invest in what I know best instead of following the herd.

Putting this ahead is CRUCIAL because this review is purely based on my personal experience and usage.

Depending on your participation in the market, you may find your experience differs from mine.

That said, if you are in for investing in quality companies for the long-term, I think this review will give you solid insights on Rakuten Trade as a stock investing platform.

Rakuten Trade Feature Highlights

- Rakuten Trade is a joint venture between Malaysia’s Kenanga Investment Bank Bhd. and Japan’s Rakuten Securities Inc. Established in 2017, Rakuten Trade is under the regulation of the Securities Commission (SC) of Malaysia and holds the Capital Markets Services License (CMSL) to deal with listed securities and provide investment advice

- Rakuten Trade offers a full online investing experience. From registration to funding/withdrawal, every process is done online at our convenience. Plus, get your account approved within 3 days (sometimes earlier). This is much more efficient compared to certain brokers that require weeks to approve an account.

- Rakuten Trade offers one of the most competitive commission rates in Malaysia. In other words, Rakuten Trade is a fee-friendly option, especially for new investors who are starting with a small capital – more below.

- Rakuten Trade offers users access to the US stock market and Hong Kong stock market at a highly affordable commission!

6 things I like about Rakuten Trade

#1 Competitive Fees for Malaysia & US Stock Market

Rakuten Trade offers one of the most competitive rates in the local brokerage scene, be it for Malaysia, the US, or Hong Kong stock market.

(a) Rakuten Trade Brokerage Fee for MYR trading (Bursa Malaysia, US, and HK stock market):

(b) Rakuten Trade Brokerage Fee for USD trading (US stock market):

(c) Rakuten Trade Brokerage Fee for HKD trading (HK stock market):

However, while looking for a broker, there are more things to consider than commissions alone. Let’s explore the additional value-added strengths that I like about Rakuten Trade in the next few points below.

RELATED READ: Rakuten US Stock Trading Review

#2 Nominee CDS Account = No Manual Paperwork Needed (+ FREE CDS Fee!)

Everyone has to open a Central Depository System (CDS) account while applying for a stock investing account. Most brokers make it part of the whole registration process already, so don’t worry too much.

What you need to know though, is that there are 2 types of CDS accounts: Nominee and Direct CDS account. In this case, Rakuten Trade is a Nominee CDS. The good things that come with this are:

- No need to manage the paperwork on corporate actions like rights issue and dividend reinvestment program (DRP). Everything about corporate action is handled by Rakuten Trade on behalf of the users, which is awesome because my time is too precious for (more) paperwork.

- While other brokers that offer Nominee CDS account charges a fee to handle corporate action for users, BUT specifically for Rakuten Trade, there are no additional charges on handling corporate action – yes, FREE.

- FREE CDS account opening: Typically, there is an RM10 fee imposed on opening a CDS account. However, Rakuten Trade has been waiving this fee for users too!

All being said, many have the concern that under a Nominee CDS, their share ownership is placed under a trustee instead of directly under their own name (this is done to avoid fraud).

For me, I think this is not a matter to be concerned with because (1) Rakuten Trade is regulated heavily by the SC and (2) in the event that the company does go bankrupt, our capital is protected as it is placed with a trustee instead of with Rakuten Trade.

READ: Direct and Nominee CDS, what’s the difference, and how to choose?

#3 Clean, Functional & User-Friendly Platform

Being a fully online broker, Rakuten Trade provides investors with a modern and clean trading experience. Personally, I have used several brokers in the past, and have seen the interface of other brokers.

There are 2 problems with many of these brokers:

- Obsolete design/complicated user interface like they are from the early 2000s. Beginners are overwhelmed with poor layouts and simply can’t find what they want to do easily.

- Non-functional – certain platforms are barebone (different from minimalist) without value-added features like stock screeners and so on.

In this regard, Rakuten Trade struck a decent balance between user experience and functionality. Its web platform is simple to navigate with solid value-added features like stock screeners and price alerts.

Coming from using several brokers in the past, I am sure new users will appreciate and be able to familiarize themselves with Rakuten Trade with little to no issue.

READ:How to buy your first stock on Rakuten Trade

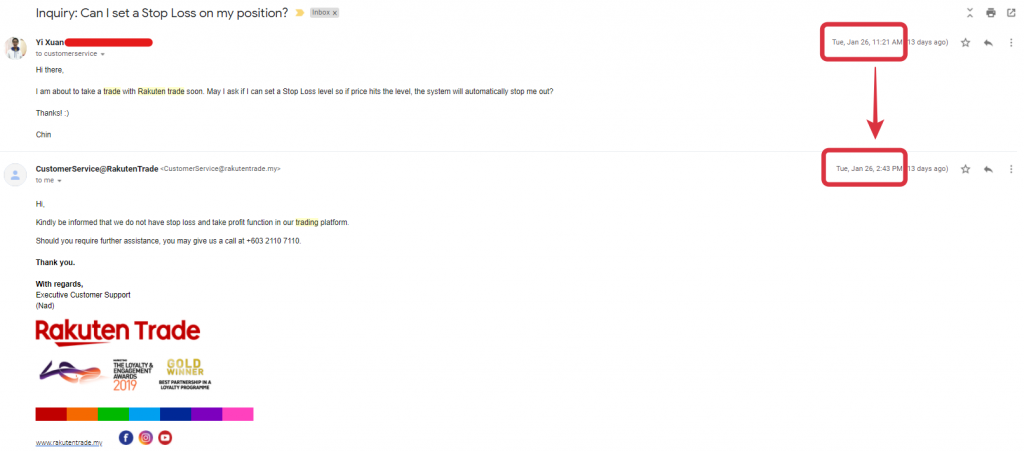

#4 Quick Response from Customer Service

Any company that tries to go digital today MUST have proper online customer service in place.

Generally, there are 3 ways a user can reach out for help: Facebook Chat, Email ([email protected]), and a Hotline.

With the exception of Hotline, I have reached out to Rakuten Trade with questions on several occasions in the past. Generally, the response from the Customer Service team is quick and I usually get my questions addressed.

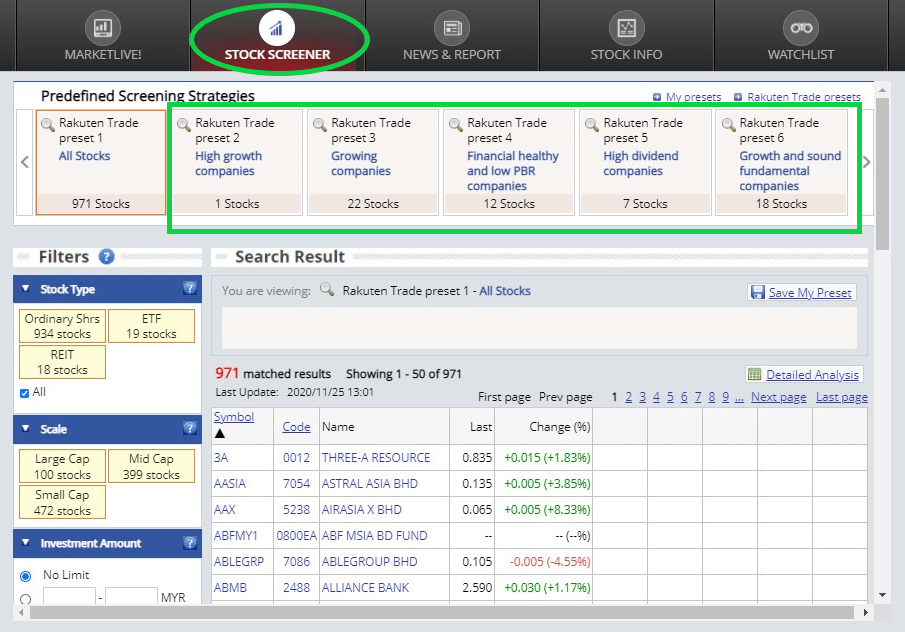

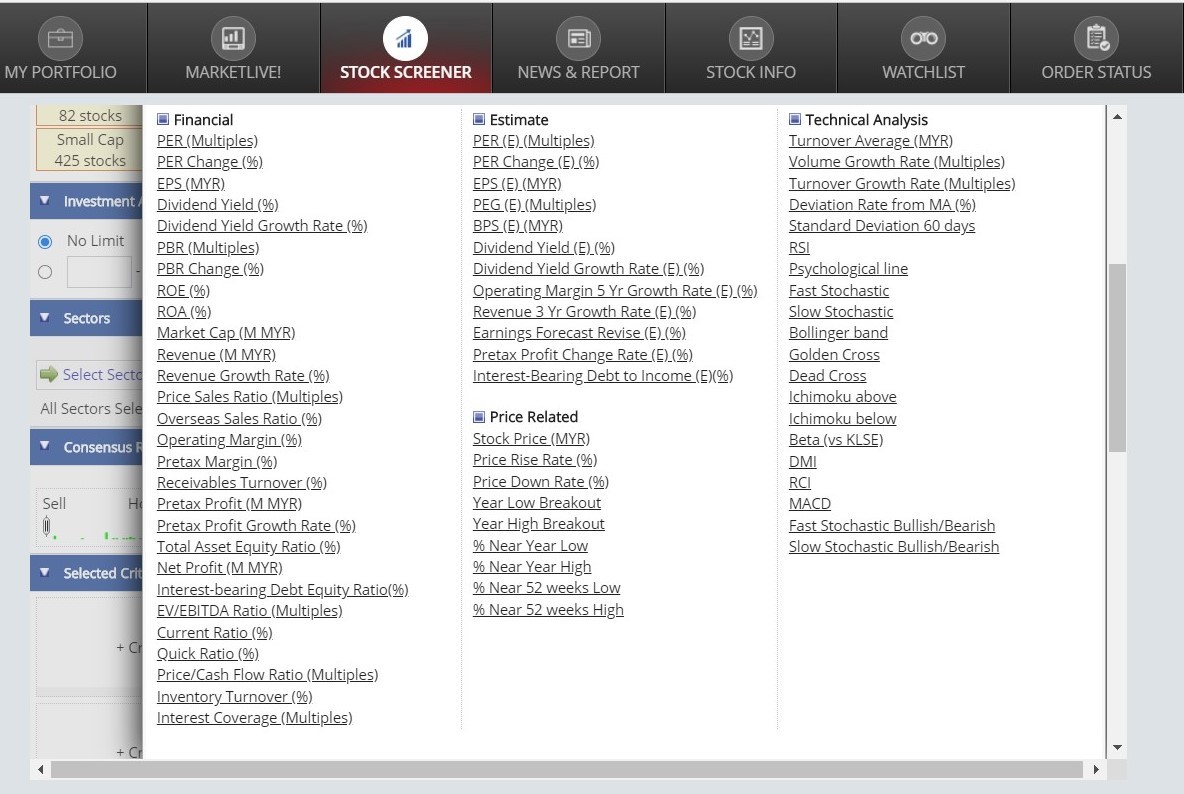

#5 Solid Value-Adding Features (eg. Powerful Stock Screener, earn interest on idle cash)

There are several features in Rakuten Trade that make investing a fruitful process for users. Namely, Rakuten Trade’s built-in stock screener is one of the most comprehensive FREE screeners around.

Powered by Thomson Reuters, there are many parameters that you can set up to filter for stocks. For new investors, this is certainly an awesome feature to have to reduce the time needed to research for stocks.

READ: How to build your own reliable Bursa stock screener.

And do you know with Rakuten Trade, you actually earn a 1.50% annual interest on the cash balance in your account?

I was not aware of this when I first used Rakuten Trade and was pleasantly surprised when I received interest on my cash balance.

READ: 4 Underrated Features on Rakuten Trade

#6 Fractional Trading for the US market

Starting May 2023, Rakuten Trade launched its Fractional Share Trading for US stocks and ETFs. This makes it more capital-friendly for Malaysians to own US stocks.

READ MORE: Rakuten Trade Fractional Share Trading review

Should You Open a Rakuten Trade Account? (+ How to open one?)

All in all, Rakuten Trade has been my go-to broker while investing in the stock market, and I have no problem recommending Rakuten Trade to:

- New investors with small capital that are looking to get started in the Malaysia & US stock market thanks to Rakuten Trade’s beginner-friendly commission.

- Investors that are looking to save time on paperwork and skip the handling fees for corporate action such as dividends and rights issue.

- Investors who are looking to open an account and manage their stock portfolio fully online during this pandemic.

- Investors who are looking for a modern, user-friendly stock trading platform without compromising on features.

If you fall into any one (or more) of these categories, check out my step-by-step guide to open your Rakuten Trade account online!

Awesome Feature: Use your RT Points as Brokerage Fee Rebate!

Not too long ago, Rakuten Trade released an exciting new feature: now you can convert your RT points as a discount to your brokerage fee!

In my opinion, this is the most practical use of the RT points for Rakuten Trade users. This is how it works:

Step 1: 1 RT Point = RM0.01 (ie. 100 RT points = RM1 Brokerage Fee.)

Step 2: Opt-in for brokerage rebate when you buy or sell shares on Rakuten Trade.

Step 3: Your brokerage rebate will be credited to your account by the end of the trading day (subject to your RT Point balance).

So let’s say you have 700 RT points (RM7), and the brokerage fee that you paid for a transaction is RM9. By the end of the trading day, Rakuten Trade will deposit RM7 back into your account, essentially offsetting the brokerage fee to just RM2.

You can find the full T&C here.

No Money Lah’s Verdict

So here you go – my long-term user review of Rakuten Trade!

For me, Rakuten Trade is a solid choice as it has the most balanced offering between value, functionalities, and rewards.

As the platform develops, I foresee Rakuten Trade will become even more user-friendly with time.

If you find this article useful, and would like to open your Rakuten Trade stock trading account, do consider using my referral link below to register for your account (or select ‘NoMoneyLah’ under ‘Educator’ when you register).

Open A Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. Rakuten Trade did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you.

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Rakuten Trade: 4 Underrated Features that'll Help You Make Better Investment Decisions!

When it comes to investing in our local Malaysian stock market, I have been a fan of Rakuten Trade as my main go-to broker.

Its highly competitive fee structure is just nice for me to Dollar Cost Average (DCA) on my positions, especially its industry-lowest commission for trading.

Aside from that, I also like the fact that Rakuten Trade’s platform interface is much more intuitive and user-friendly compared to some other local brokers that I have come across in the past.

However, we are just scratching the surface. In this post, I am going to share with you 4 underrated, yet very useful tools on Rakuten Trade’s platform that’ll help you analyze stocks and make better investment decisions.

Before this, here are some related posts that you may want to read:

p

#1 Comprehensive Rakuten Trade Stock Screener

Powered by Thomson Reuters, I think this is the most powerful, yet less talked-about feature on Rakuten Trade’s platform.

Essentially, what this Stock Screener does is it allows you to shortlist for stocks that fulfill a certain set of criteria. Doing this will save you time from stock-searching over hundreds of listed companies in the market.

There are plenty of Fundamental Analysis filters that you can set in this stock screener, from Financials like Dividend Yield, Return of Equity (ROE), Interest Coverage Multiples, to Estimates like Estimated Price-Earning-to-Growth (PEG), Estimated Dividend Growth Rate, and more.

There are also filters for Technical Analysis (eg. Golden Cross, MACD, RSI) if you are into that.

If you are totally new with no specific set of criteria, or simply looking for some fresh investment ideas, Rakuten Trade also has a couple of presets in place for you to get started.

Some of these presets include filters for High Growth Companies and High Dividend Companies.

Features:

- 1. One of the most comprehensive stock screeners with different filtering criteria.

- 2. Existing screening presets for investors to get started.

- 3. Did I mention that it is free for all Rakuten Trade users?

Suitable for:

- 1. Investors looking to filter for companies/stocks that fulfill a certain set of criteria.

- 2. Investors looking for fresh and new investing ideas.

Read Also: In-depth guide on how to build your own powerful stock screener via Rakuten Trade

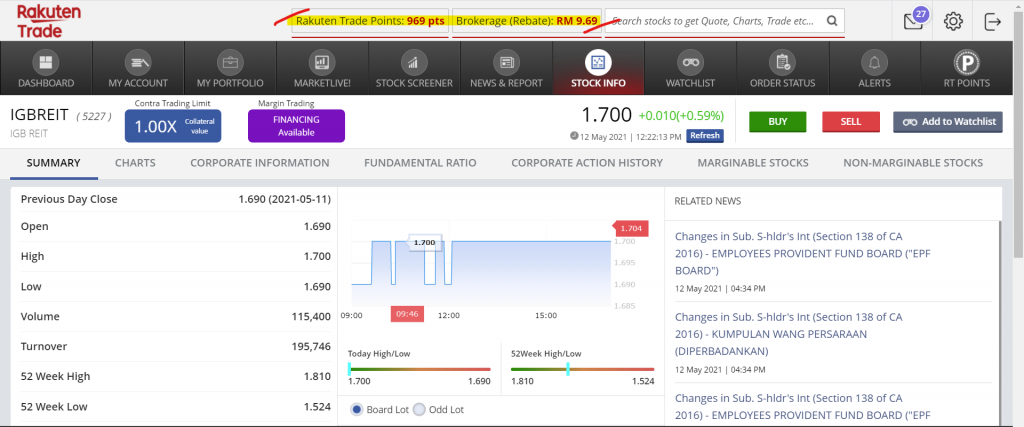

#2 Baked-In Stock Info

One thing that got me quite frustrated with the other broker platforms that I’ve used before is the lack of stock/company information on the platform.

While this may not be as significant as the Rakuten Trade stock screener, I find having information about a company readily available to me pretty handy.

Whenever I am in need of a quick glance, I can view the overall fundamental health of a company (eg. Beta, ROE, EPS) without having the need to go dig for them in the financial report.

Features:

- 1. Company info readily baked into the platform.

- 2. Quick fundamental ratios at a glance.

Suitable for:

- 1. Investors looking to do a quick research/initial filter on a company.

#3 Price Alerts on Multiple Channels

For price alerts, I have been using the alert function on KLSE Screener app for some time.

However, the downside to this is that I am only alerted via the app on my phone. While this may be fine for most people, for me, I keep my phone offline for most of the day while at work – resulting in me missing my alerts frequently.

The good thing with Rakuten Trade’s baked-in Alerts, is I can choose to get notified by both the iSpeed app AND email when my alerts are triggered. With this, I can get notified while I am working in front of my laptop.

For most investors (myself included), this price alert function can be used alongside entry, take profit, and cutting losses. As an example, since there is no automatic cut loss function on most local brokers (including Rakuten Trade) in Malaysia, I can set a price alert for me to manually cut my losses when the price hits a certain level.

Feature:

Get alerted when the price of your chosen company hits a certain level.

Suitable for:

- 1. Investors looking to be notified first-hand on both their phone and via email.

- 2. Investors with specific entry, target profit, and stop-loss levels.

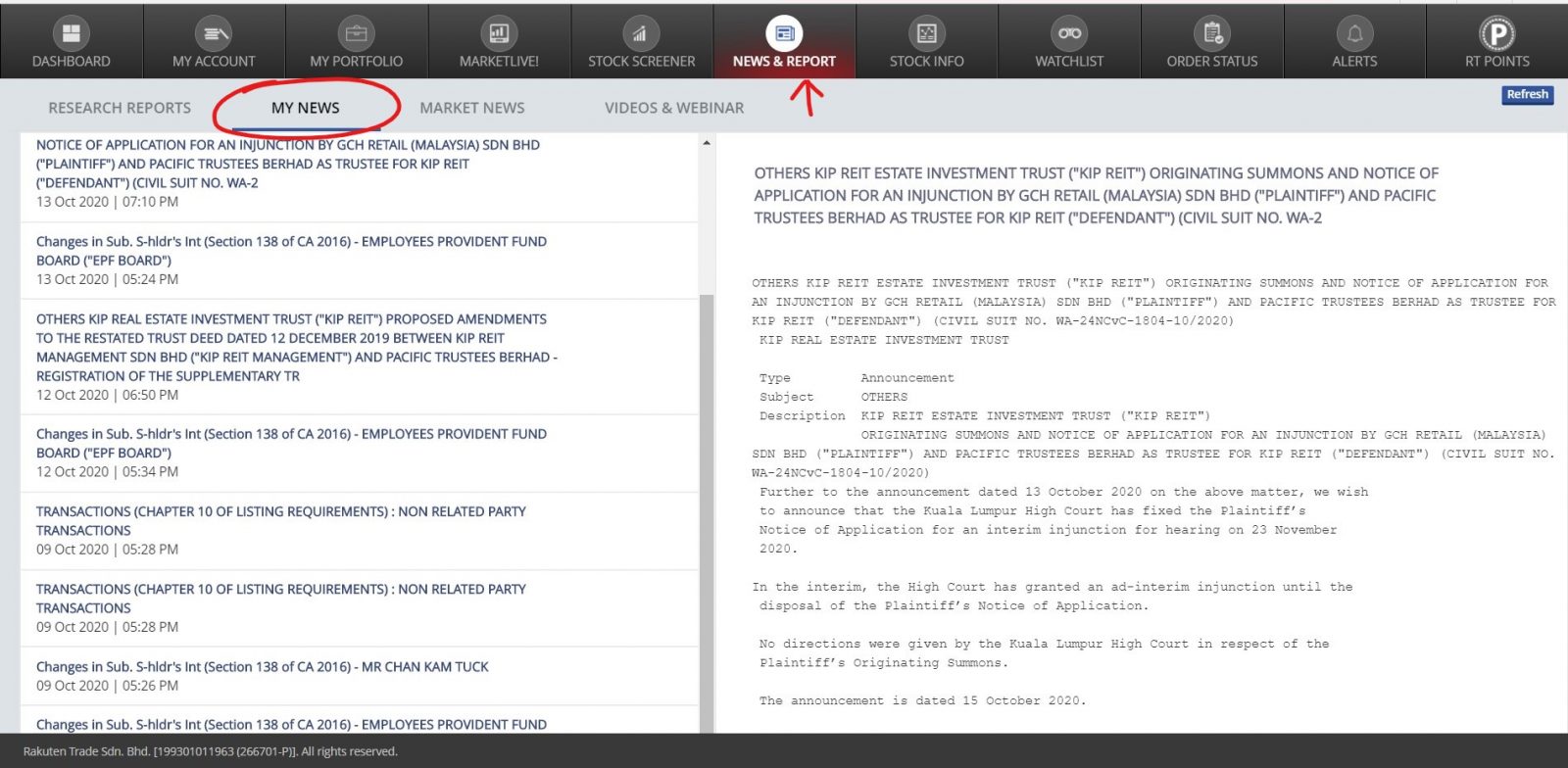

#4 News & Report on the Companies in my Portfolio

In the past, I find it hard to keep track of the news and updates of the companies that I invest in.

On Rakuten Trade’s platform, there are news and updates on the companies that I invest in readily available for me to view. Aside from that, there are also daily research reports & market news available if you need extra resources and input.

Personally, as a long-term REIT investor, I do not follow the updates every hour and everyday. However, it is good to have them all baked into the platform for me to check out whenever needed.

Feature:

Get updates on news and announcements for the companies that you invest in.

Suitable for:

Investors looking to have updates and announcements for their investments all available in one platform.

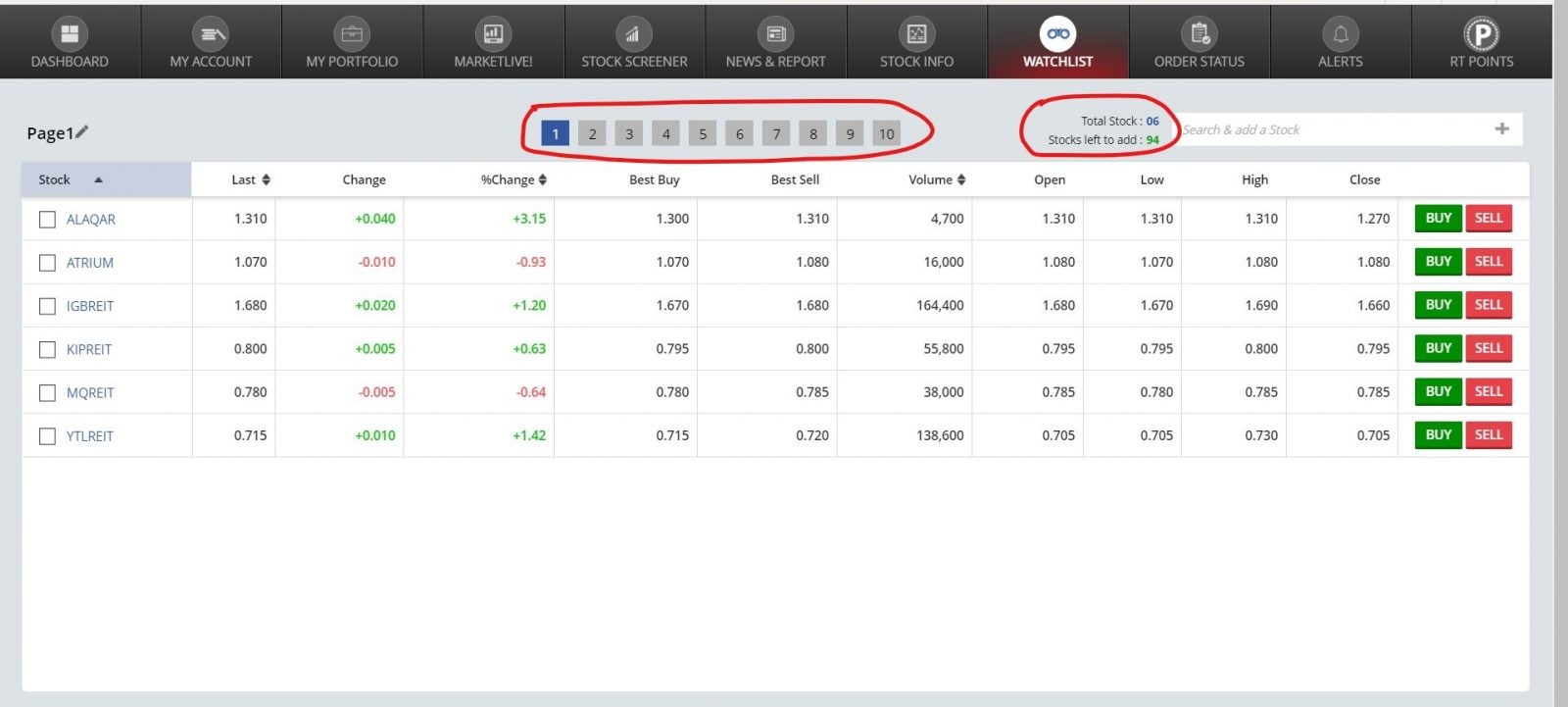

Notable Mention: Watchlist up to 100 stocks

These days, having a watchlist function is fairly common across the board. However, I’d still want to mention Rakuten Trade’s watchlist function in this post:

While certain apps or platforms have a fairly small limit on the number of stocks that you can add to your watchlist, Rakuten Trade allows users to create 10 watchlists and fit up to 100 companies in each of them.

For me, that’s definitely more than enough and I think this will work fine for most investors.

LATEST: Use your RT Points as Brokerage Fee Rebate!

Recently, Rakuten Trade has released an exciting new feature: now you can convert your RT points as a discount to your brokerage fee!

In my opinion, this is the most practical use of the RT points for Rakuten Trade users. This is how it works:

- 1 RT Point = RM0.01 (ie. 100 RT points = RM1 Brokerage Fee.)

- Opt-in for brokerage rebate when you buy or sell shares on Rakuten Trade.

Your brokerage rebate will be credited to your account by end of the trading day (subject to your RT Point balance).

So let’s say you have 700 RT points (RM7), and the brokerage fee that you paid for a transaction is RM9. By the end of the trading day, Rakuten Trade will deposit RM7 back into your account, essentially offsetting the brokerage fee to just RM2.

You can find the full T&C here.

No Money Lah’s Verdict

So here you go – the useful and underrated tools in Rakuten Trade that’ll help you analyze stocks and make better investment decisions!

Personally, I was not aware of all these little features until I took some time to explore the platform.

While the usefulness and practicality of each of these features/tools may be subjective according to each investor, I find having them baked right into the platform especially neat and handy.

What are some of the useful features in your broker that you are using yourself? Feel free to share with me in the comment section below!

p.s. If you find this article useful, and would like to open your Rakuten Trade stock trading account, do consider using my referral link below to register for your account (or enter ‘NoMoneyLah’ under ‘Educator’ when you register)!

Open A Rakuten Trade Account Today!

Disclaimer:

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

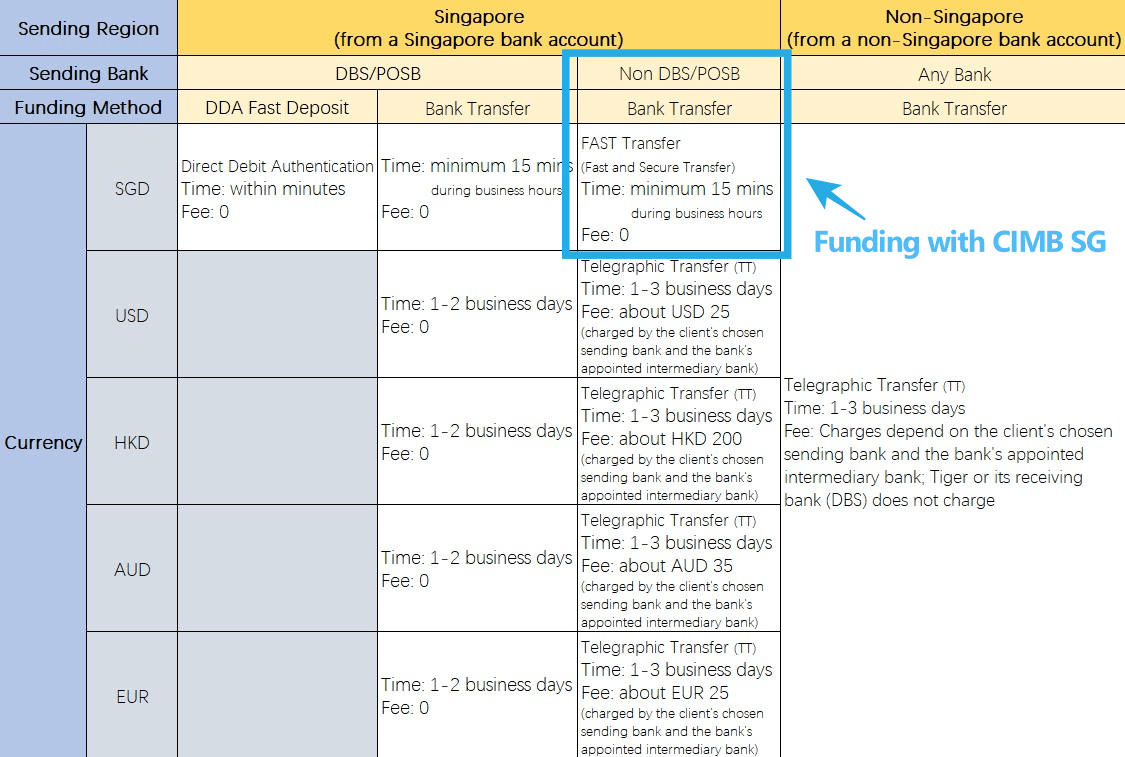

Tiger Brokers: Deposit & Withdrawal via CIMB SG

In this post, I am going to show you the step-by-step guide on how to deposit and withdraw from Tiger Brokers via a Singapore bank account (CIMB SG), without having to pay any expensive bank fees.

The key benefits in using a Singapore bank account to do a deposit or withdrawal from overseas brokers like Tiger Brokers are obvious:

- For one, it gives us HUGE savings by skipping the intermediary banking fees (USD20 - 30) that are usually incurred during Foreign Telegraphic Transfer (FTT) via local bank.

p - Secondly, the deposit & withdrawal via a Singapore bank account is also faster as there is no need to go through a complex intermediary banking network.

--

[PROMO] Commission-free trades + Free stocks!

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 - USD888

Open A Tiger Brokers Account Today!p

p

Opening a CIMB FastSaver SG Bank Account

Before we proceed, I gonna assume that you already have a Singapore bank account. If not, check out my step-by-step guide on how to open a CIMB FastSaver Singapore account online.

If you already have a CIMB FastSaver SG account, move on to the next section.

Tiger Brokers Deposit via CIMB SG

Important to note before depositing funds to Tiger Brokers:

- No minimum deposit amount.

p - Tiger currently accepts the following methods of deposit:

Tiger Brokers funding methods p

- DBS Bank SG is the custodian bank for Tiger clients' funds.

p - Time needed for funding via CIMB SG to be reflected: Minimum 15 mins during business hours. If the transfer is initiated during non-business hours, it will arrive on the next business day.

p - Any fees for funding via CIMB SG? No.

p - TAKE NOTE: Please transfer funds from a bank account under the same name as your Tiger Account. Tiger currently does not accept any funds transferred from/by other persons' bank accounts, joint bank accounts, third-party payment platforms such as Wise and GrabPay.

Guide: Funding your Tiger Brokers account via CIMB SG

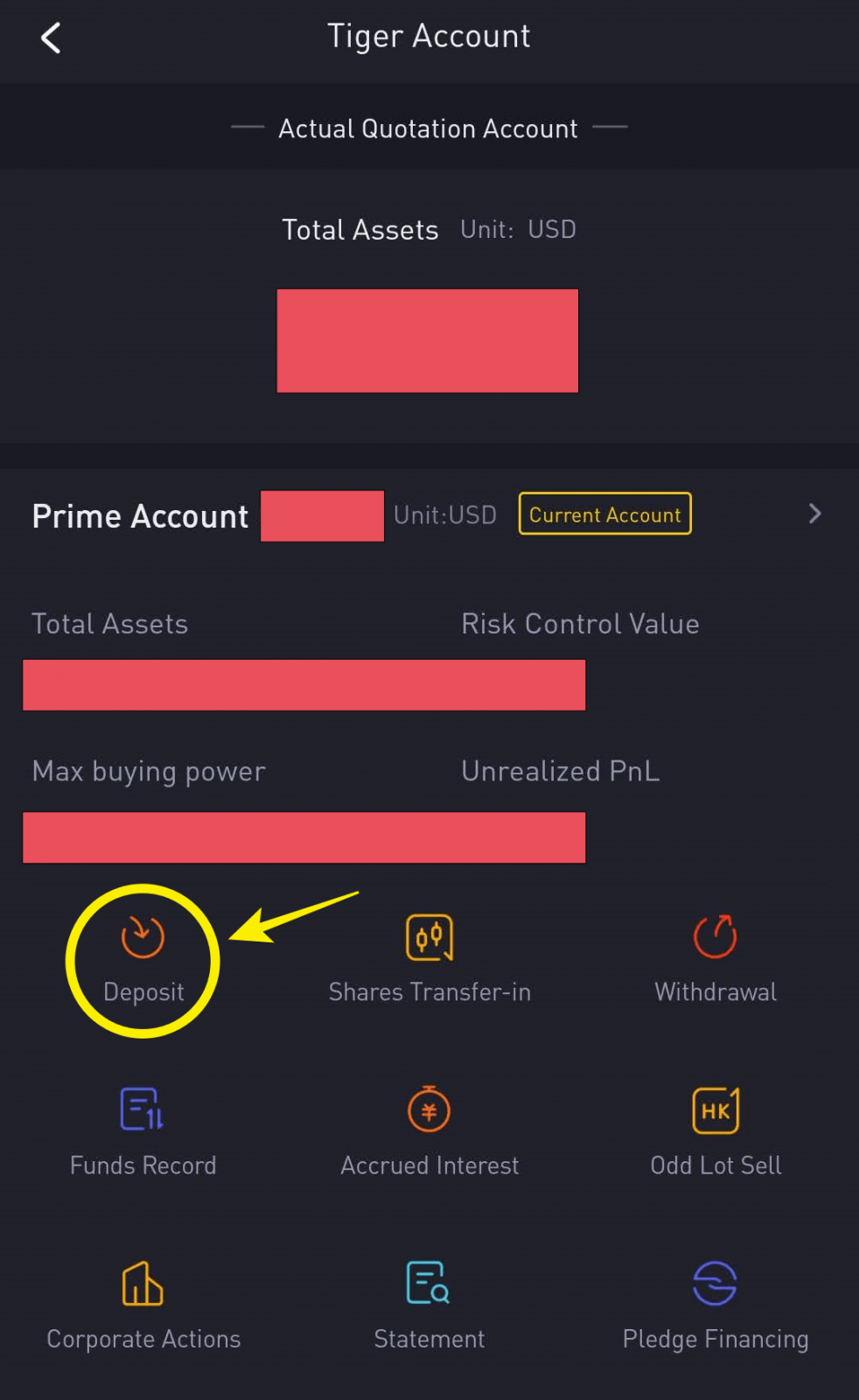

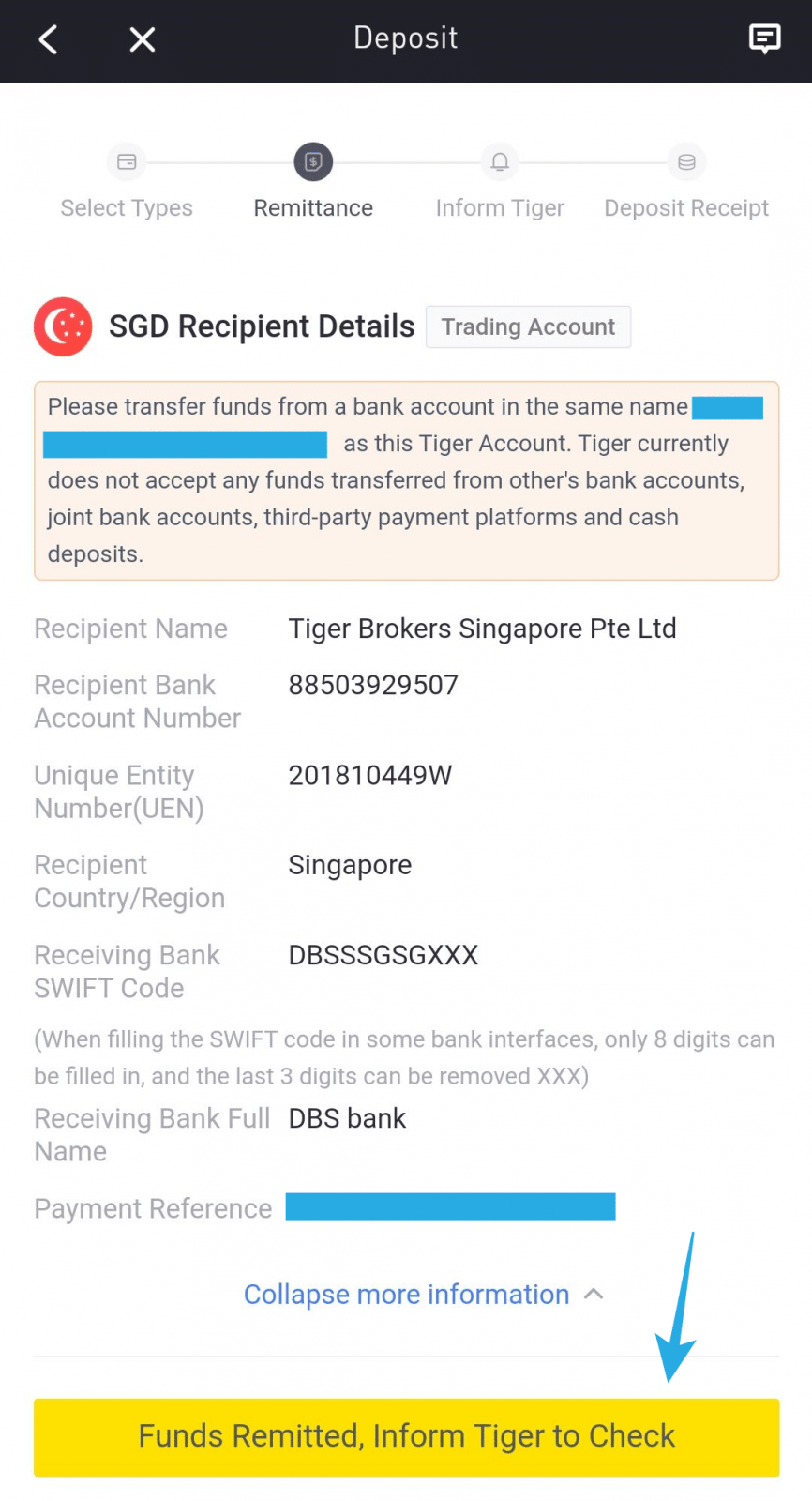

Step 1: Open your Tiger Trade app > Me > Tiger Account > Deposit.

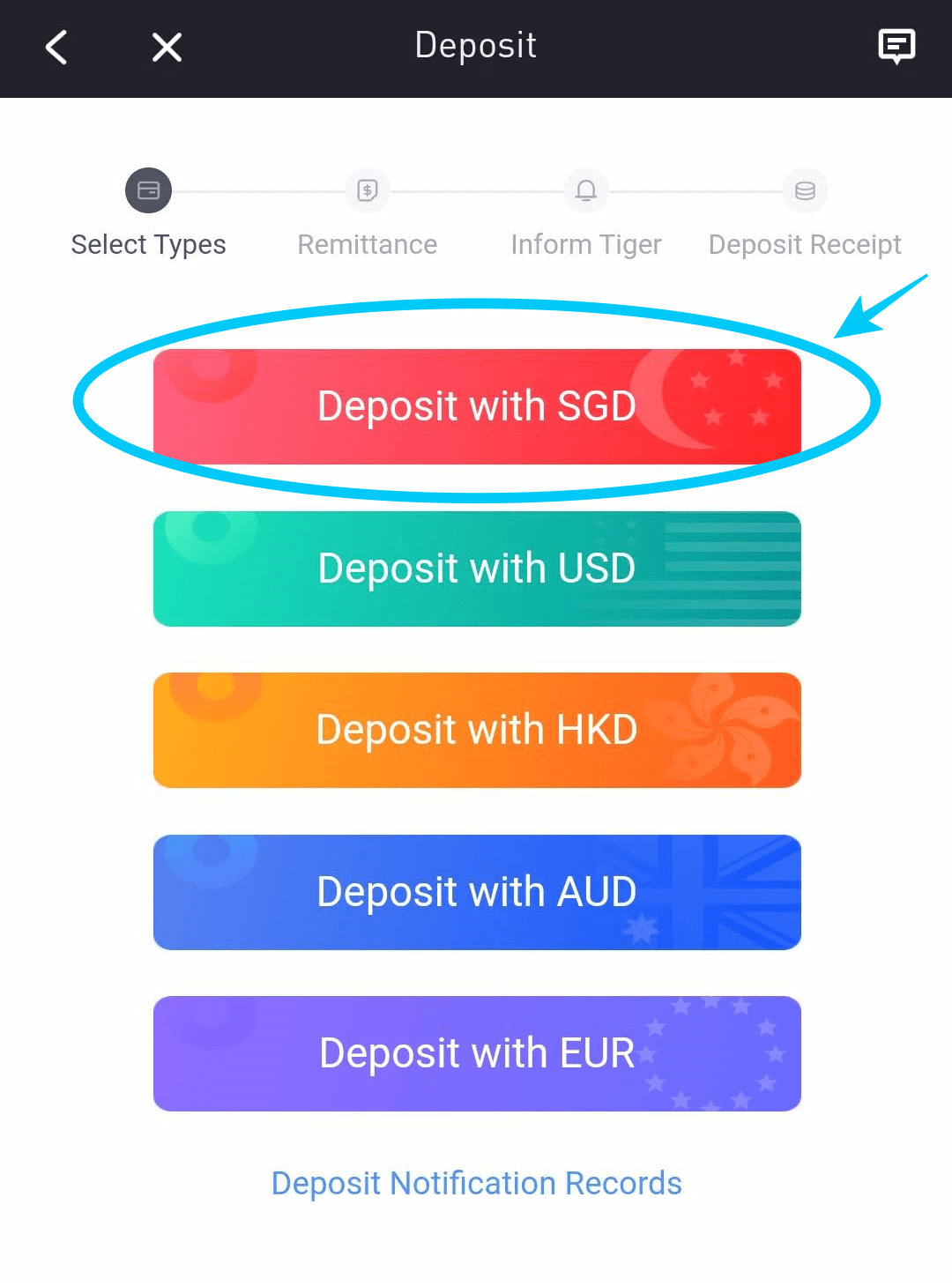

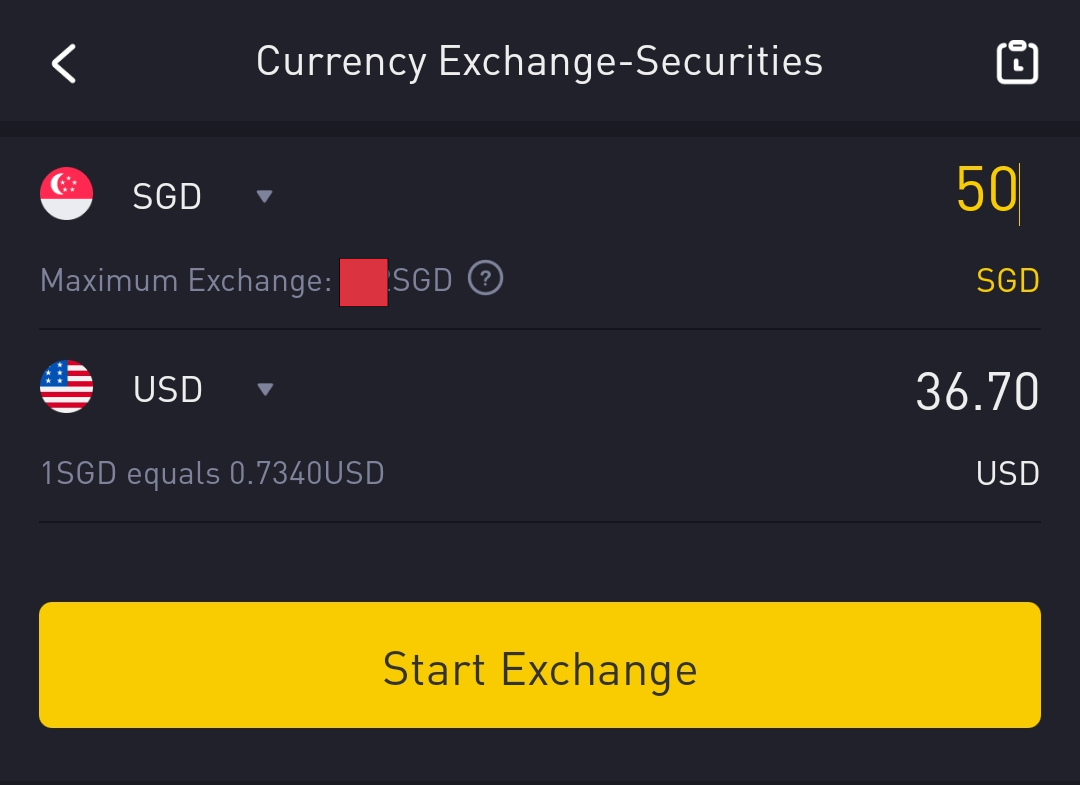

Step 2a: Select ‘Deposit with SGD’.

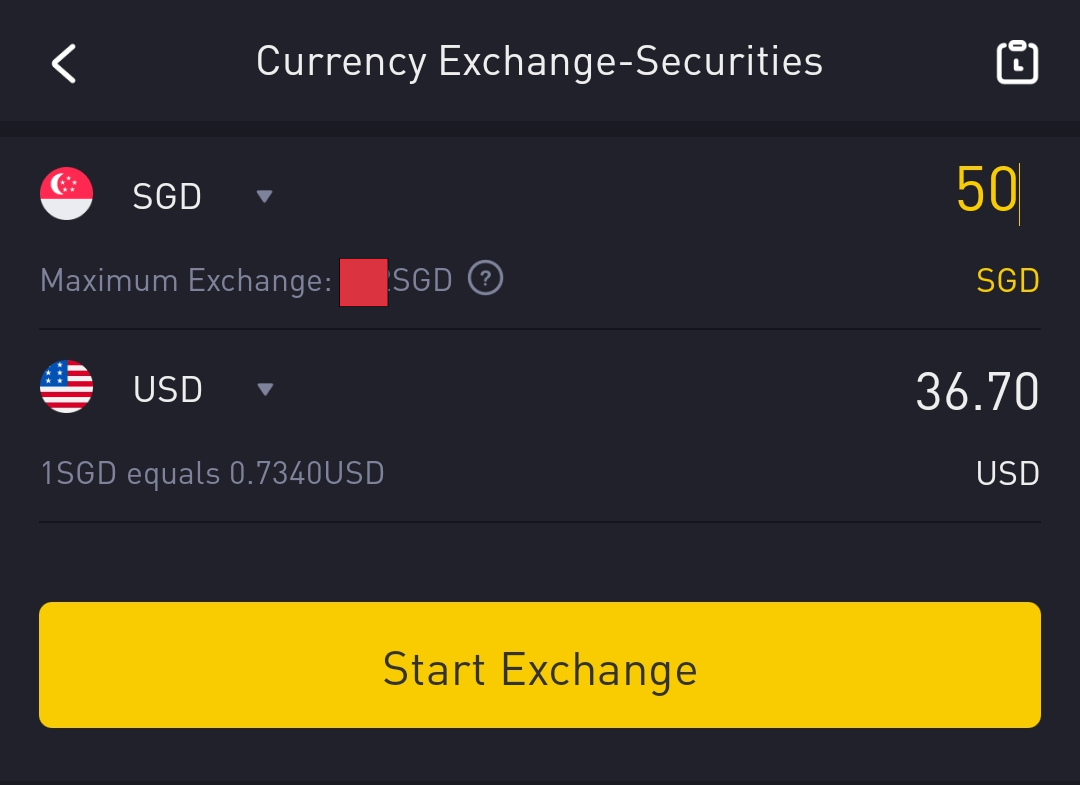

If you are looking to use USD to invest in the US market, don’t worry, because you can exchange your SGD into USD within the Tiger Brokers app at a decent rate easily. (‘Trade’ > ‘Currency Exchange’)

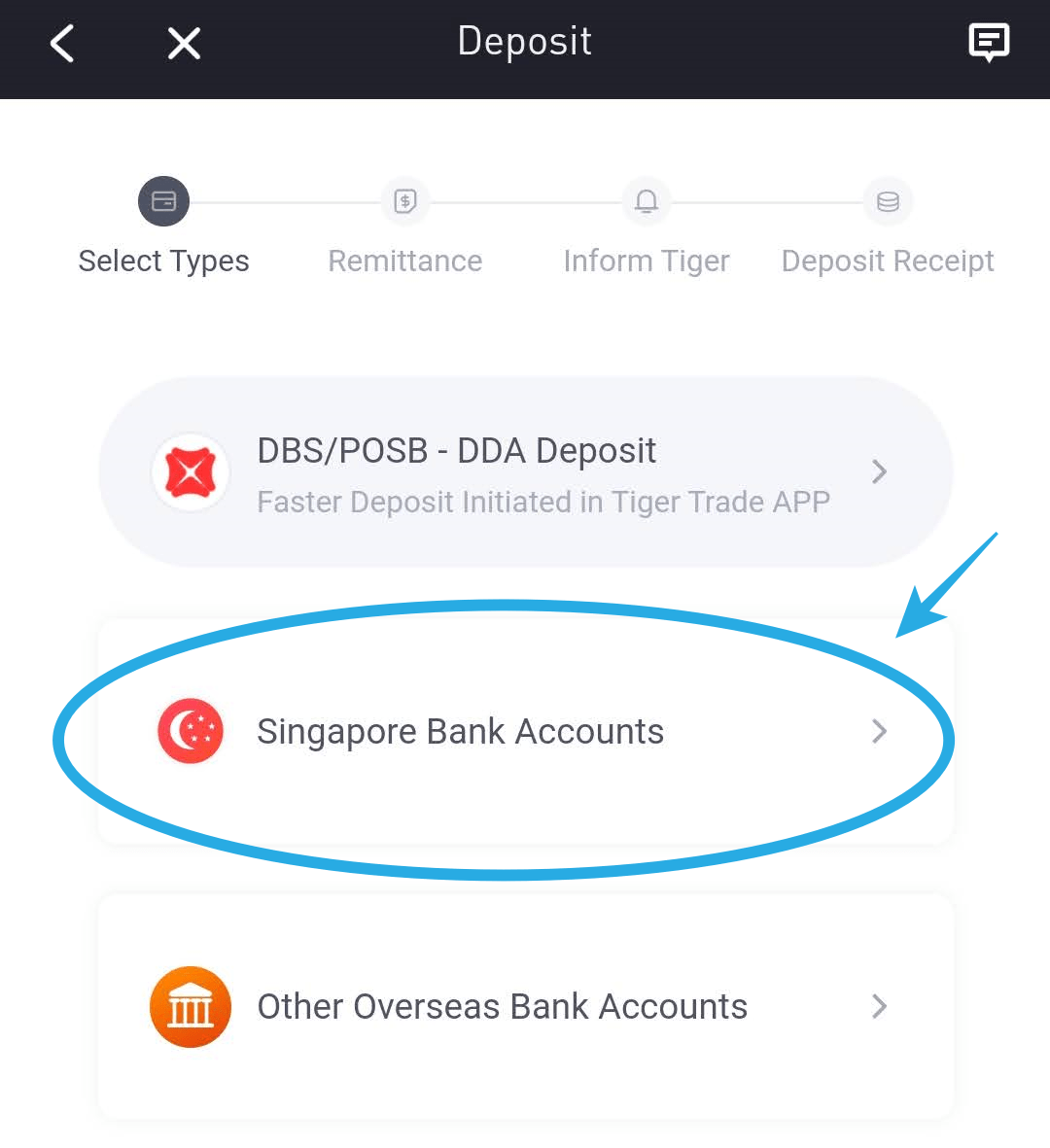

Step 2b: Then, choose ‘Singapore Bank Accounts’

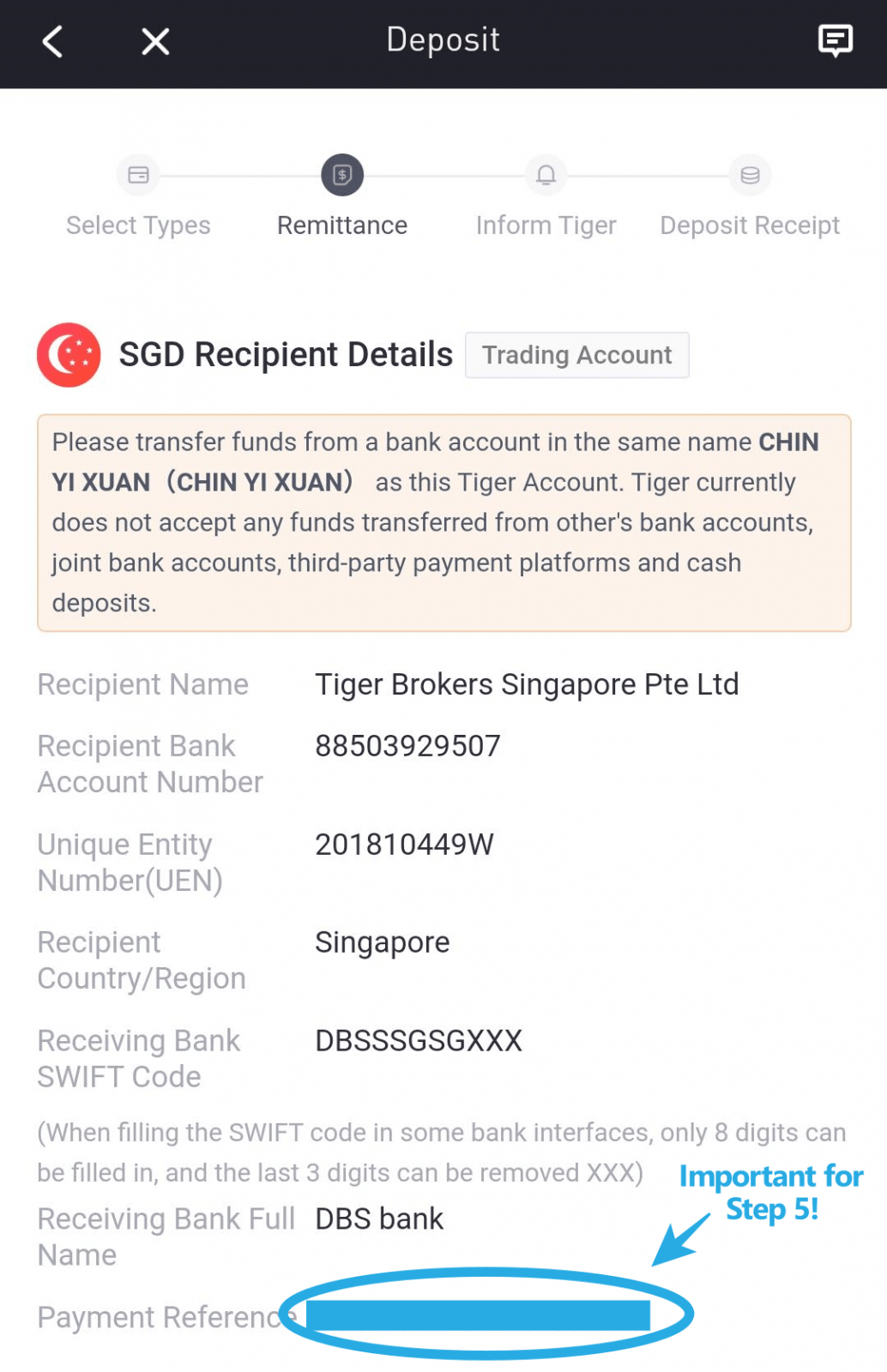

Step 3: You’ll receive the account details from Tiger Brokers.

Step 3: You’ll receive the account details from Tiger Brokers.

This is where you’ll need to transfer the funds via CIMB SG. Do not close this window, and take a screenshot of the details as you'll need it in Step 5.

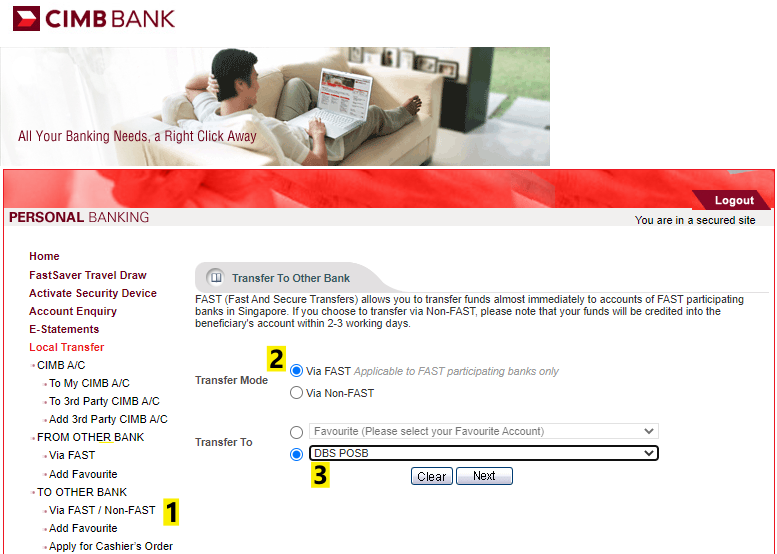

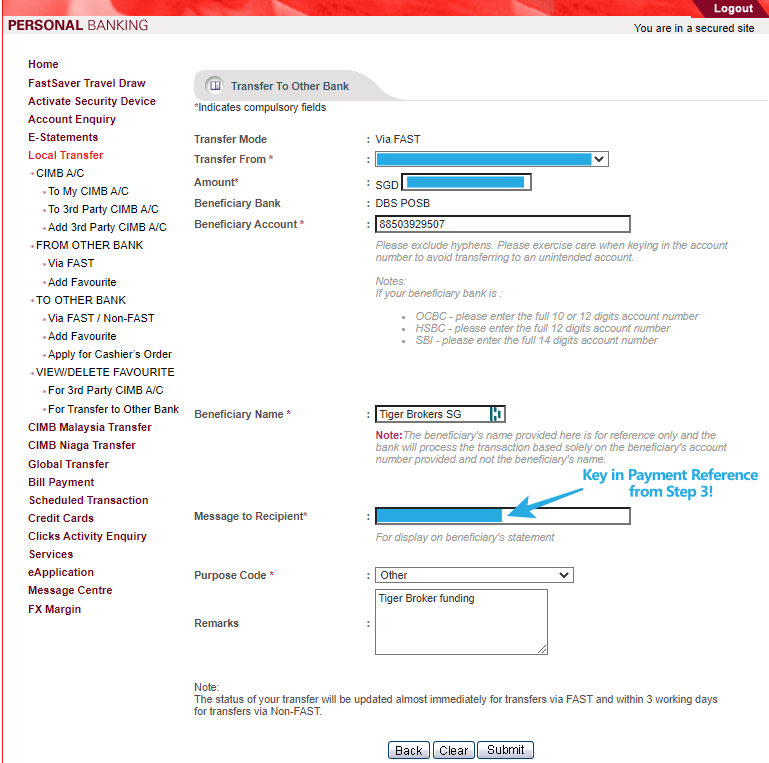

Step 4: Login to CIMB SG > Select 'Local Transfer' > 'To Other Bank' > 'Via FAST' > Transfer to: 'DBS POSB'

Step 5: Key in Tiger Brokers’ bank details that you got in Step 3.

Remember to key in ‘Payment Reference’ from Step 3 under ‘Message from Recipient’ so Tiger Brokers know that the funding is from you!

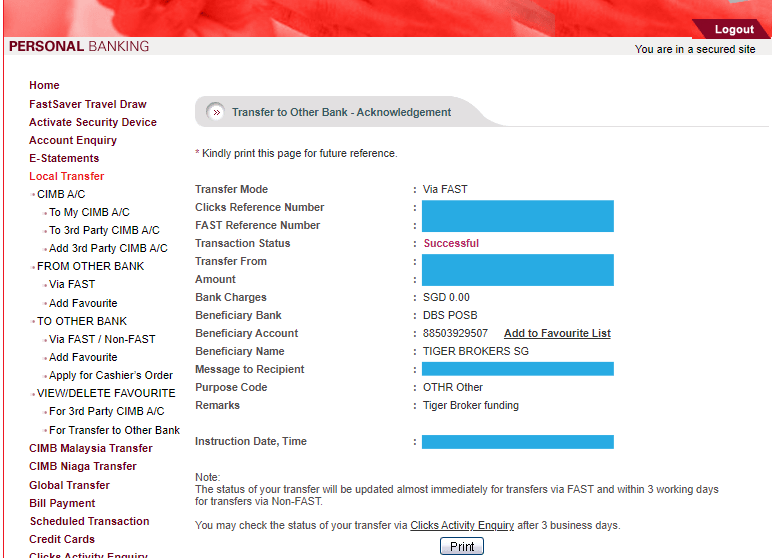

Step 6: Once you have done your transaction, take a screenshot and save the proof of transfer.

For ease of future transfer, consider adding Tiger Brokers’ account details into your favourite by clicking ‘Add to Favourite List’.

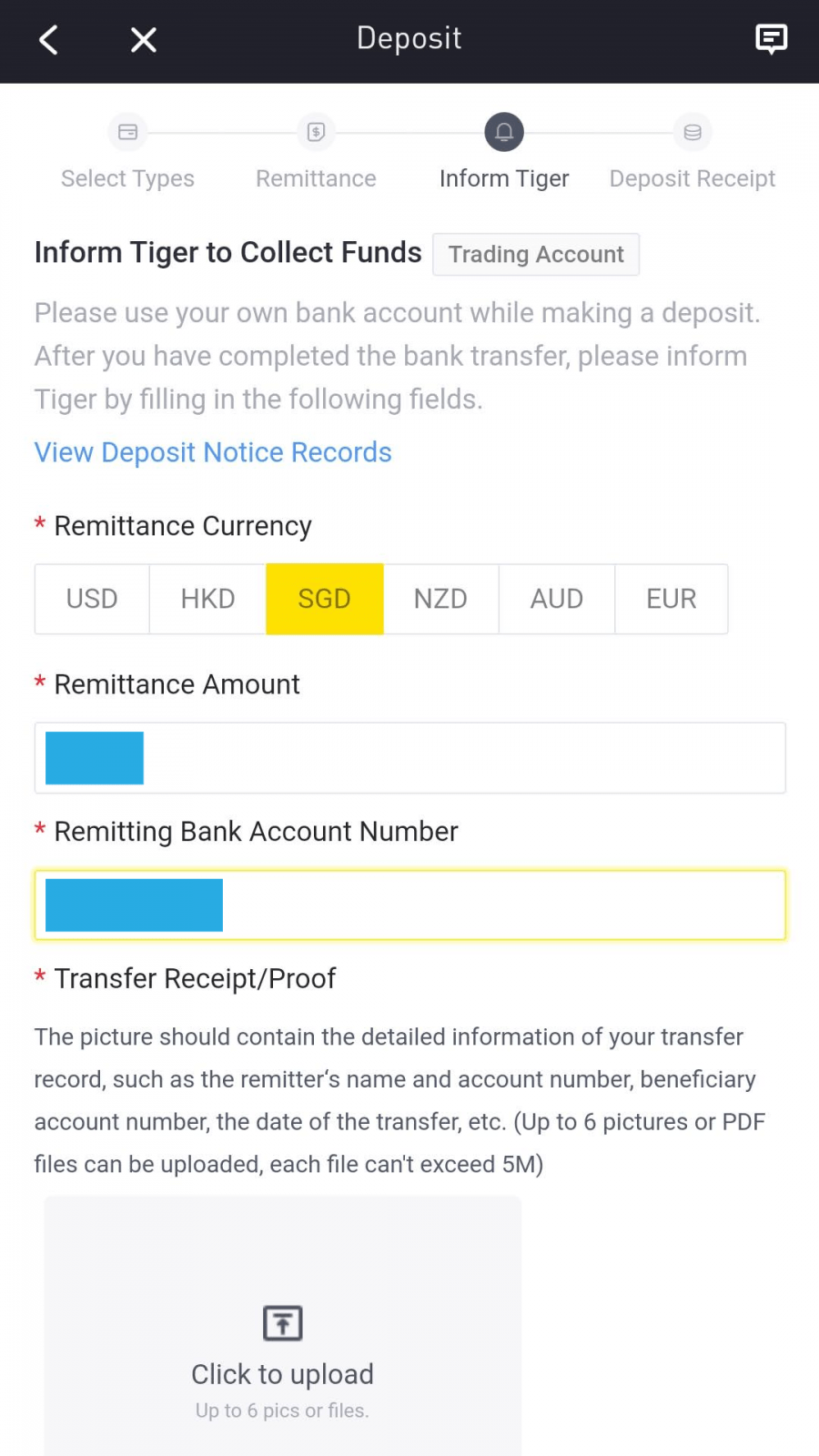

Step 7: After the fund transfer, go back to the Tiger Brokers app and click 'Funds remitted. Inform Tiger to check'

Then, key in your CIMB SG account number and upload the proof of transfer from Step 6. This step is not mandatory but it minimises the time needed for the Tiger Brokers to process your funding.

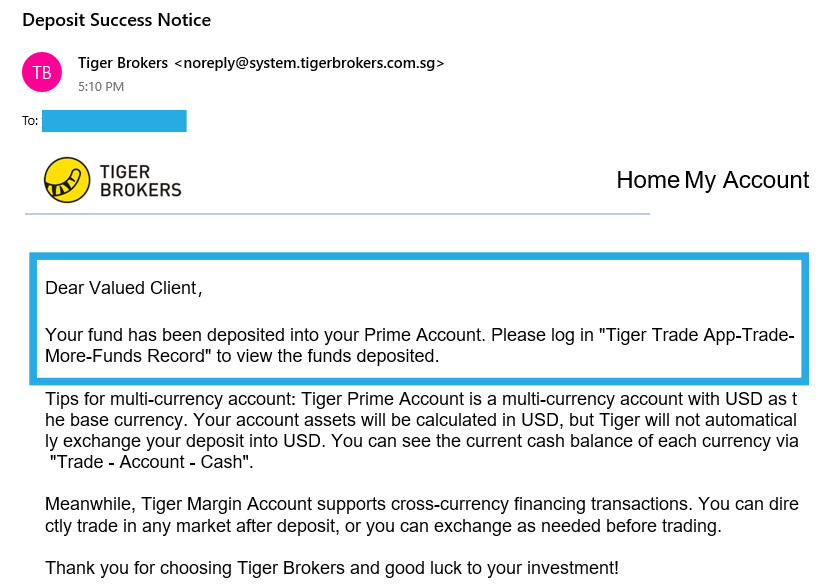

Step 8: Funding success

The time needed for the deposit to go through should take about 15 - 40 minutes (during business hours) from my personal experience. You'll receive an email once the deposit is successfully processed.

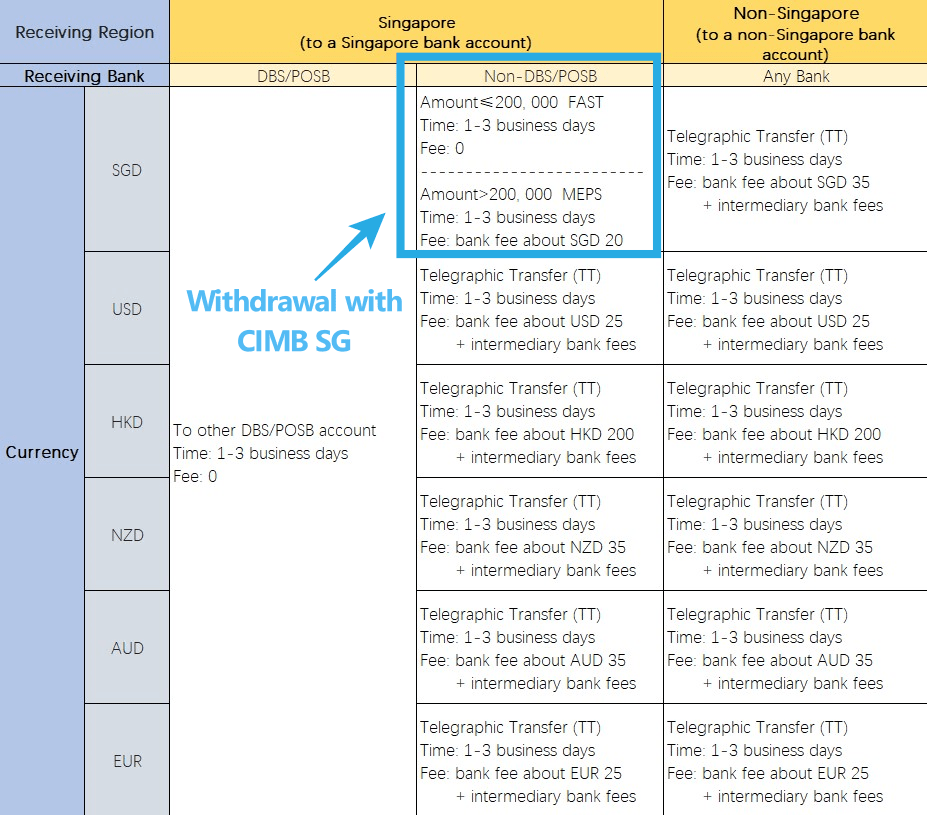

Tiger Brokers Withdrawal to CIMB SG

Important to note before withdrawing funds via Tiger Brokers:

- Singapore DBS Bank is the custodian bank for Tiger clients' funds.

p - Tiger currently accepts the following methods of withdrawal:

[p

[p - Withdrawal time: The time depends on the processing bank(s). The minimum time for funds to arrive can be within the same business day.

p - Any fees for withdrawal via CIMB SG? No.

p - PLEASE NOTE: Transfer funds to a bank account in the same name as your Tiger Account. Funds cannot be withdrawn to other persons' bank accounts, third-party payment platforms (eg. GrabPay), joint bank accounts or mainland China-based bank accounts.

Guide: Withdrawal from Tiger Brokers to CIMB SG

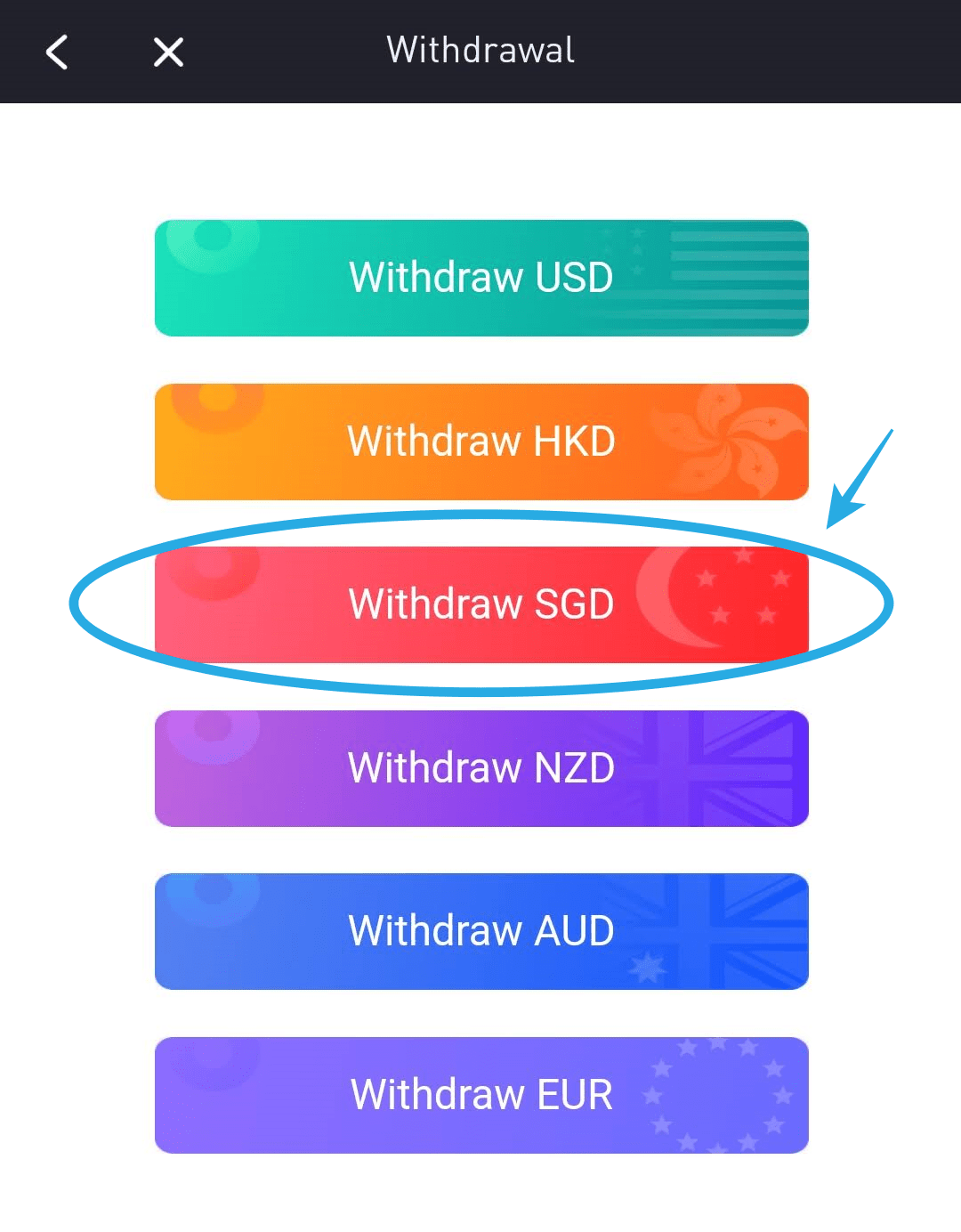

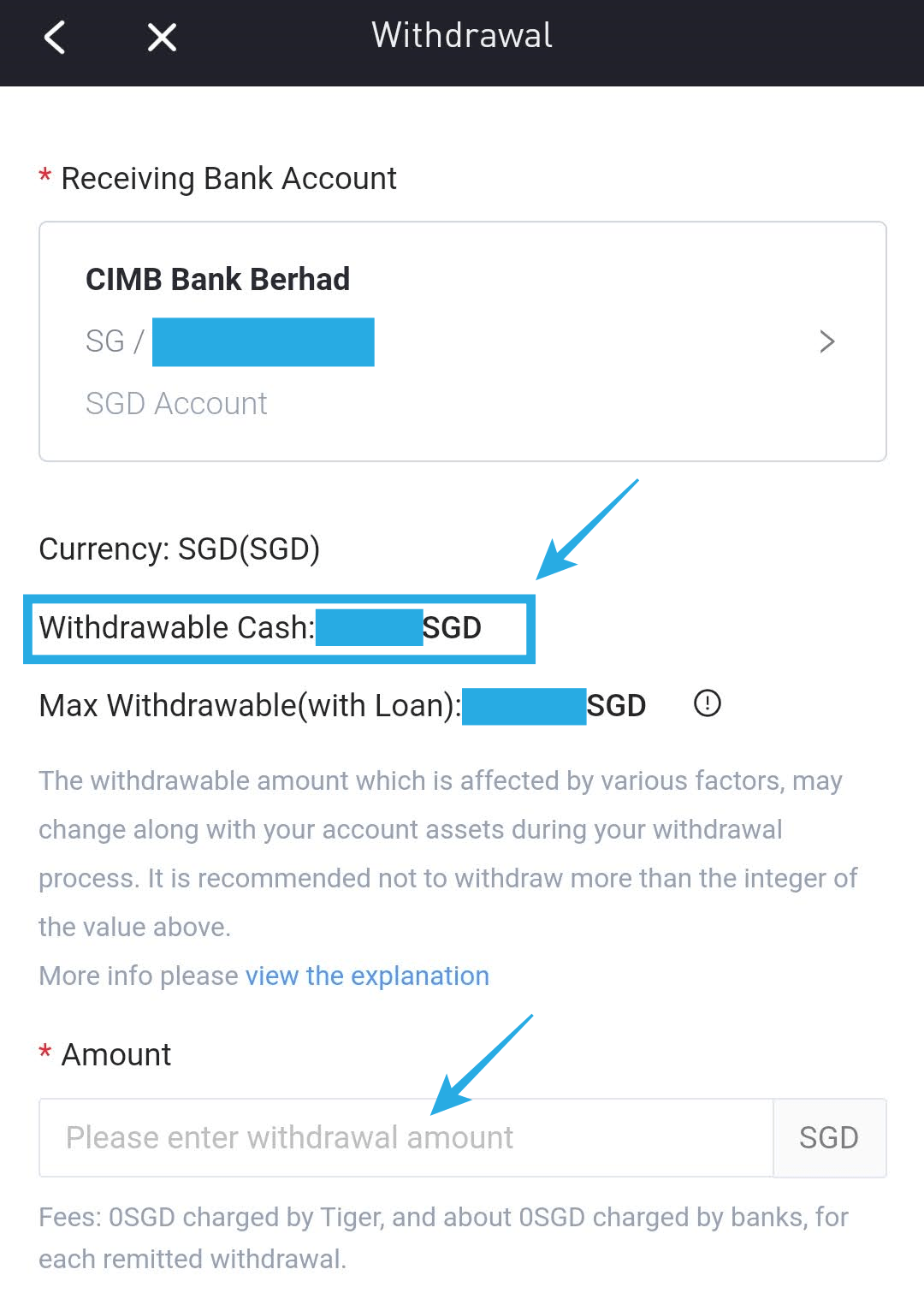

Step 1: Open your Tiger Trade app > Me > Tiger Account > Withdrawal.

If your account is mainly in other currencies like USD, don’t worry, because you can exchange your USD into SGD prior to withdrawal within the Tiger Brokers app easily. (‘Trade’ > ‘Currency Exchange’)

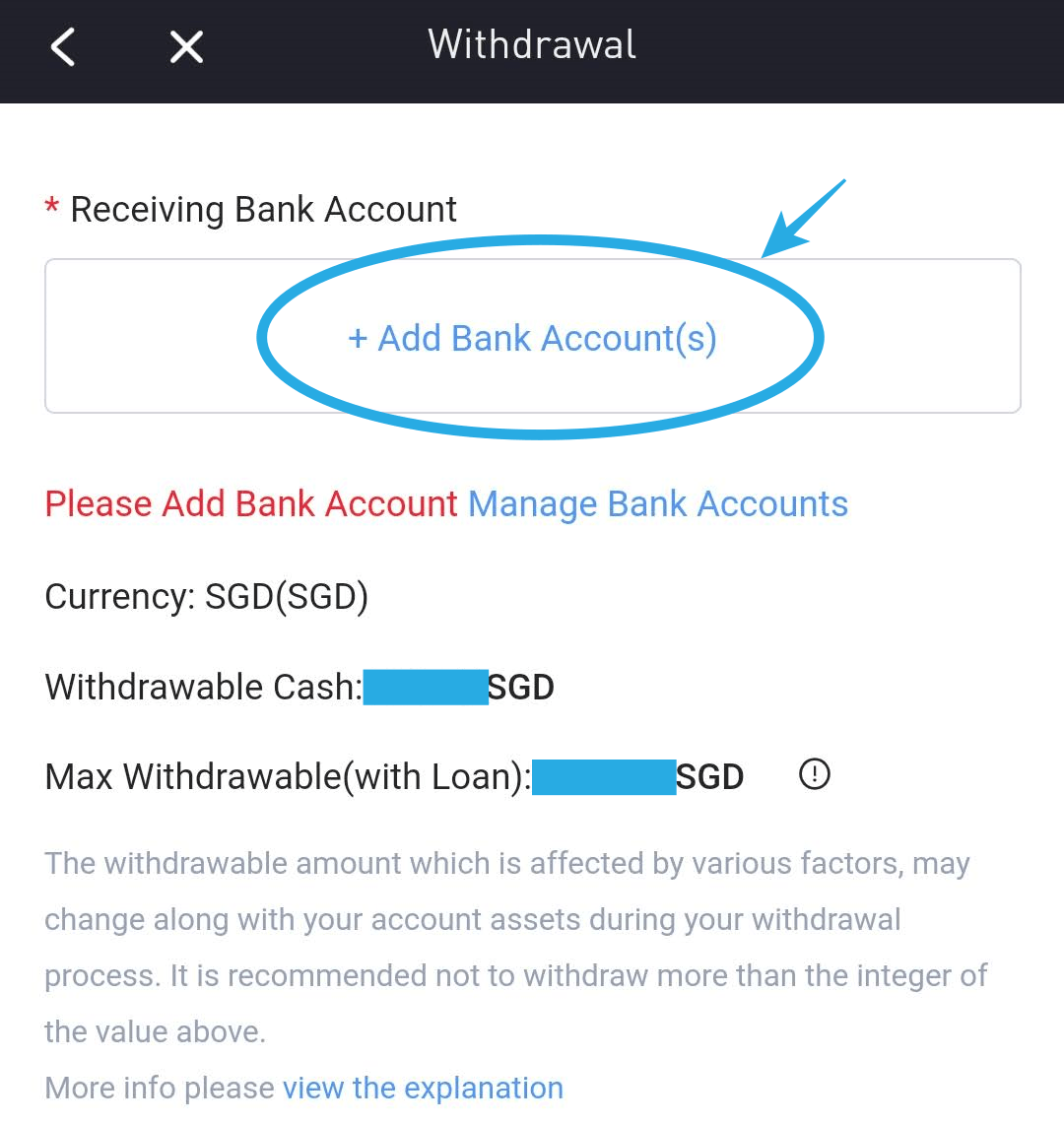

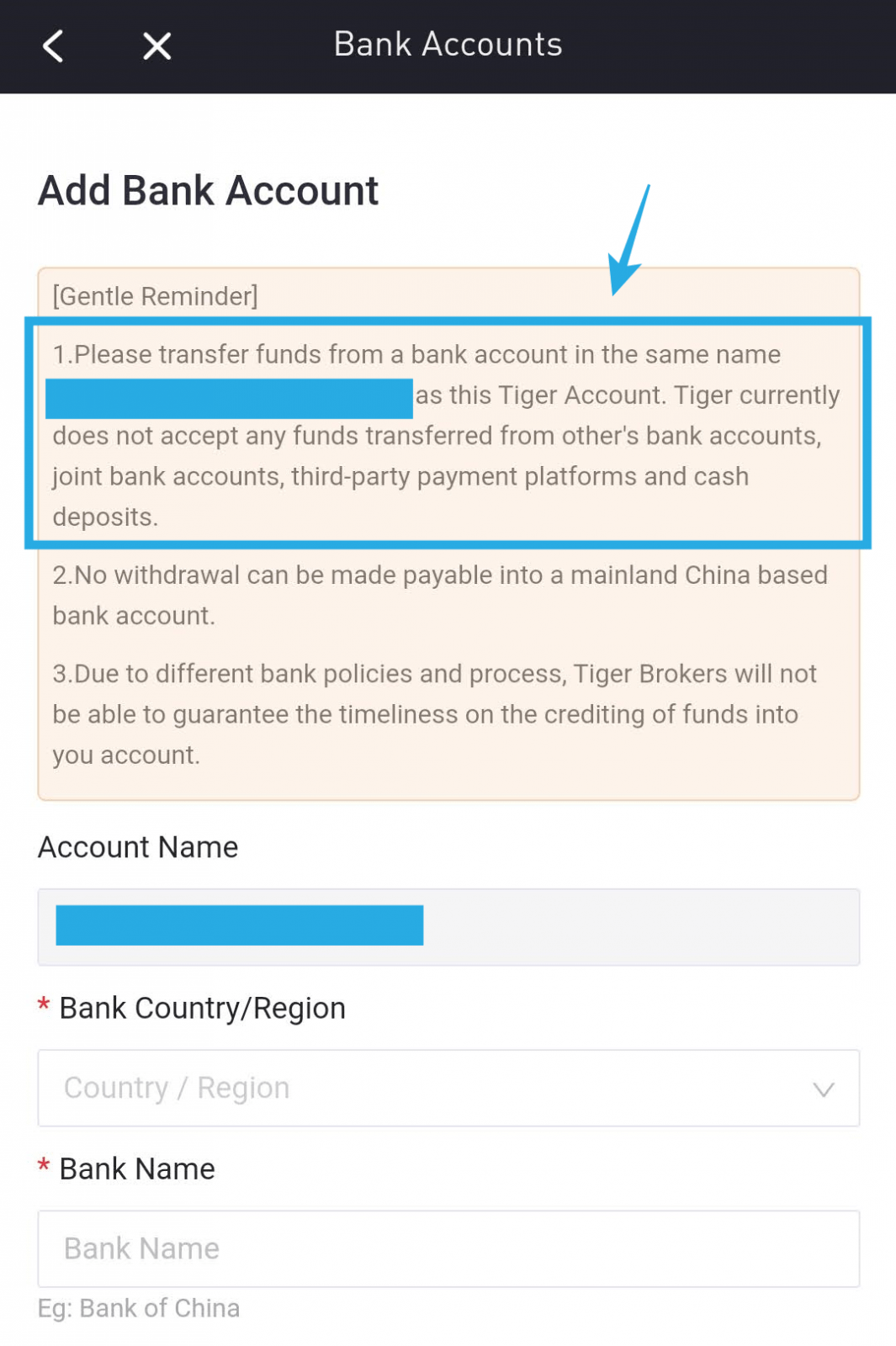

Step 3: If this is your first time withdrawing, add a bank account.

- Bank Country: Singapore

- Bank Name: CIMB Bank Berhad

- Branch Name: CIMB Bank Berhad

- Bank Account: Your CIMB SG Bank Account

- Bank Account Type & Currency: Single currency account & SGD

- Bank Swift Code: CIBBSGSG

- Contact Address: 50 Raffles Place Singapore Land Tower 09 01

- Click HERE for the latest Bank details.

Step 4: Enter withdrawal amount

‘Withdrawal Cash’ is how much you can withdraw from your Tiger Brokers account.

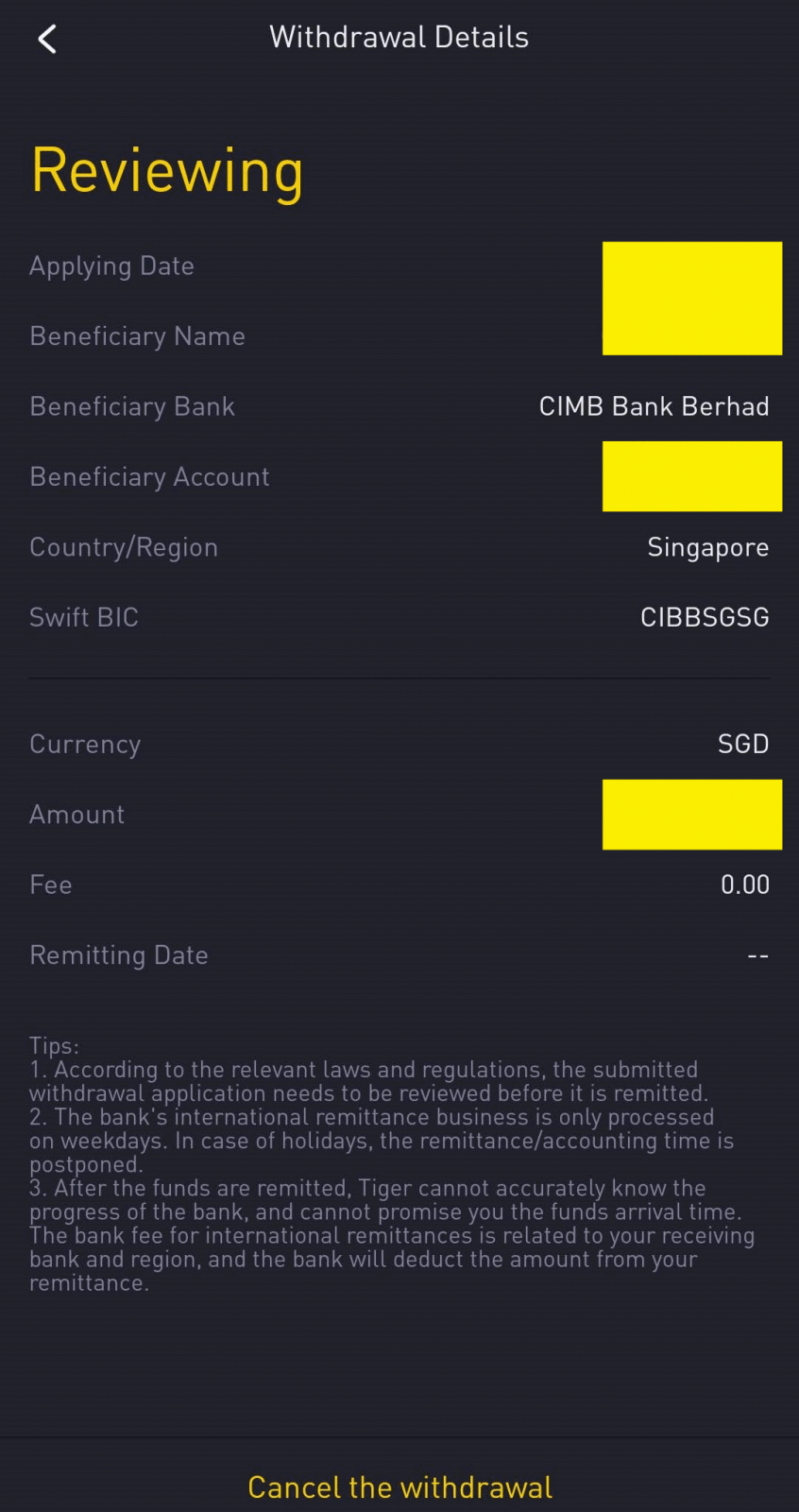

Step 5: Done and check the status of your withdrawal

Step 5: Done and check the status of your withdrawal

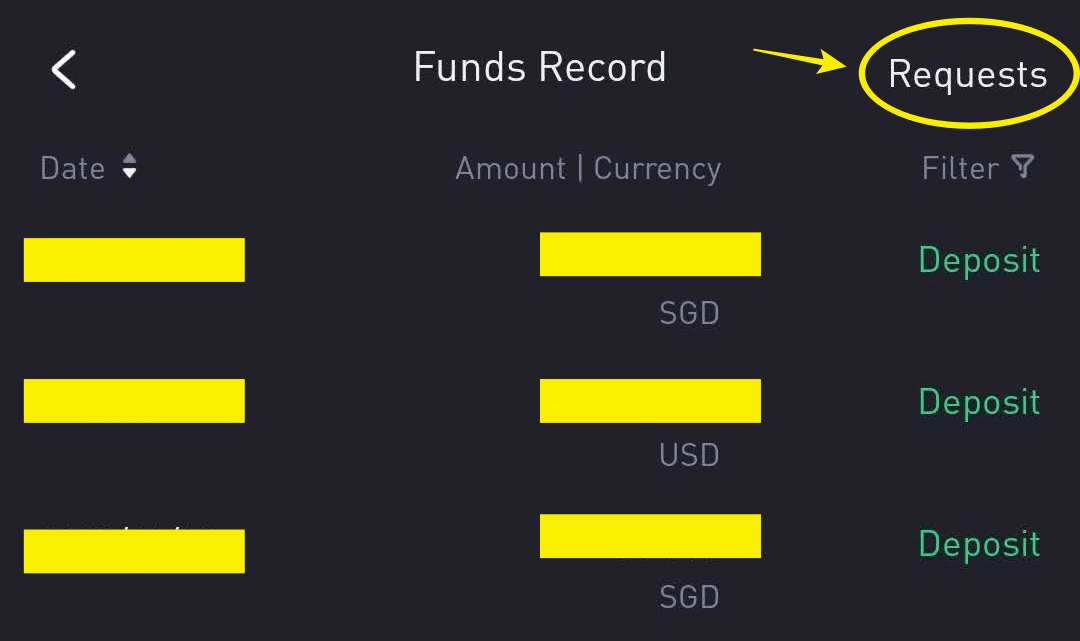

After the withdrawal request is submitted, you may go to [Tiger Trade mobile APP > Tiger Account > Funds Record > Request], to check the withdrawal request and processing status, or cancel the request.

Here are the statuses of withdrawals:

Here are the statuses of withdrawals:

- Reviewing: 1-2 business days are needed for the review, thanks for your patience. You may cancel the request when it’s under review.

- Rejected: The request didn’t pass the review, you may find the reject reason in the Tiger Trade APP.

- Awaiting withdrawal: The request passed the review.

- Bank Processing: The money was deducted from your securities account, and will be remitted out after the bank completes processing.

- Failed: We can’t remit the money out because the bank rejected it. The money is being returned to your securities account.

- Remitted: Your money was sent to your personal bank account.

- Refunded: The money was returned by the beneficiary bank and re-credited into your securities account.

- Cancelled: You have cancelled the withdrawal request.

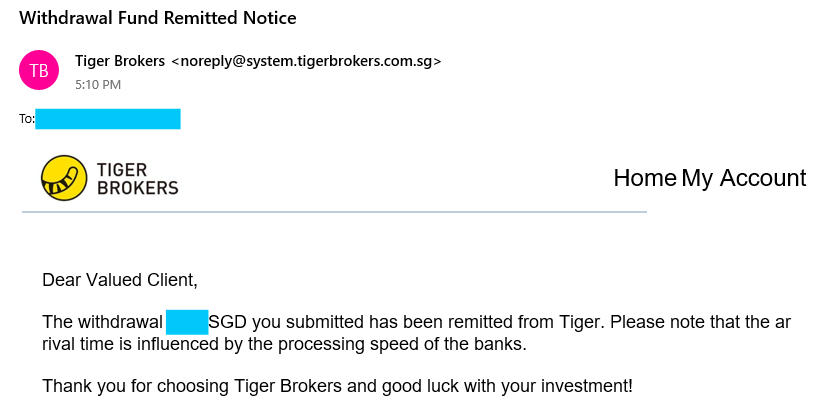

Step 6: If everything goes smooth, the time needed for the withdrawal to be reflected should take within 1 - 3 business days.

You'll receive an email once the withdrawal is successfully processed.

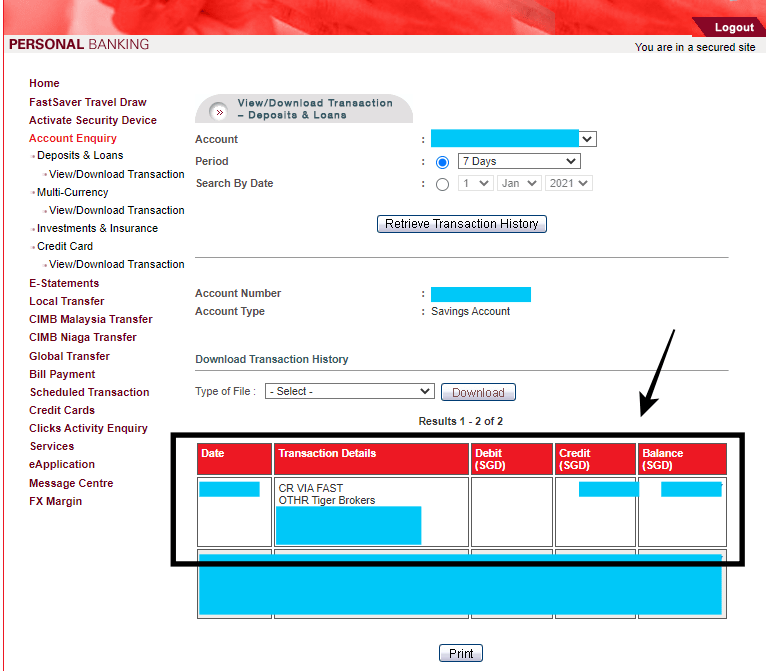

You can also log in to your CIMB SG account to check the transaction.

You can also log in to your CIMB SG account to check the transaction.

No Money Lah's Verdict

So there you have it - a guide on how you can deposit to, or withdraw from Tiger Brokers via a CIMB SG bank account!

If you find this guide useful, consider clicking on the button below to use my Tiger Brokers referral link!

--

[PROMO] Commission-free trades + Free stocks!

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 - USD888

Open A Tiger Brokers Account Today!

Doing so will help support this blog, while entitling you to multiple account-opening rewards.

Disclaimer:

This post contains affiliate link(s). As always, I’d only recommend tools and financial solutions that I personally use AND/OR are interesting & provide unique value to my readers. Every article takes a long time and effort to write and when it comes to financial solutions, I’ll only invest time in writing about good and relevant products.

How to Make Your First Trade on Rakuten Trade? (MY stocks)

Rakuten Trade is my go-to broker when it comes to investing in the Malaysia stock market. In addition, it has also introduced US stock trading for Malaysians in January 2022.

In this article, I am going to share a simple step-by-step guide on how to execute a transaction on Rakuten Trade, and explain some key terminologies along the way (Don’t worry it is very straightforward once you get it!).

Before this, here are some posts that you might find useful:

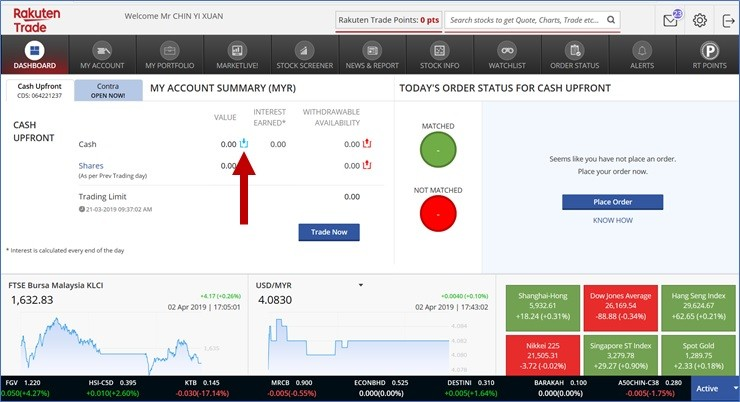

Step-by-Step Guide to Buy a Stock on Rakuten Trade

Upon logging in to your Rakuten Trade account for the first time, you will have to first fund your trading account using the funding methods available.

In short, the easiest method is to fund your account using your savings/current account.

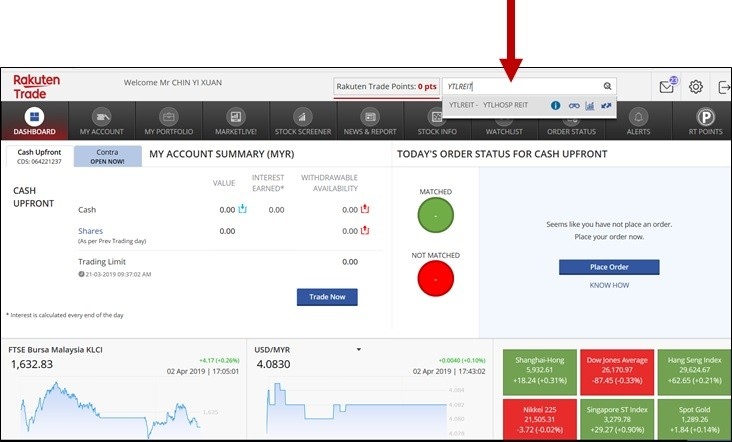

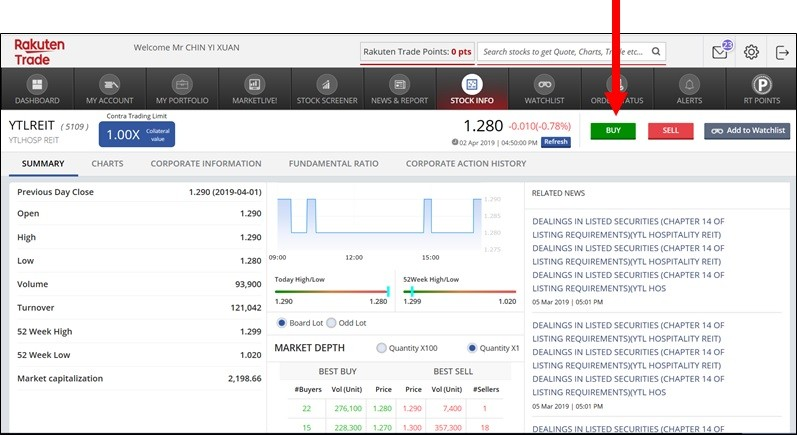

Step 1: Search for the stock that you want to buy at the search bar.

Step 2: Click ‘Buy’

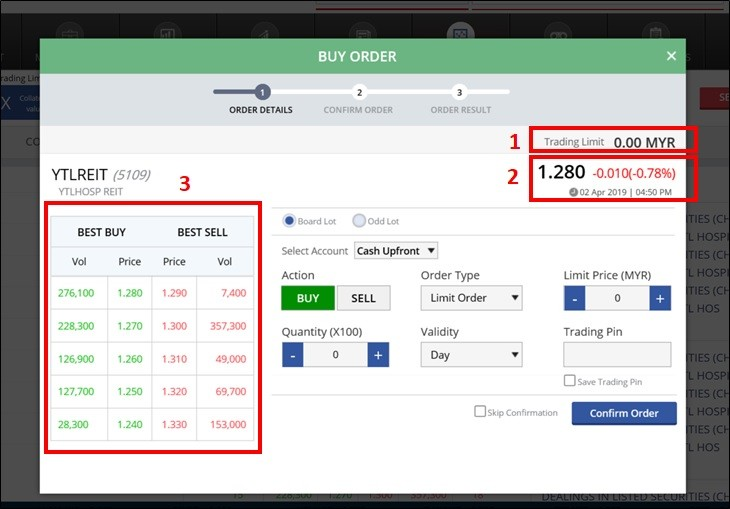

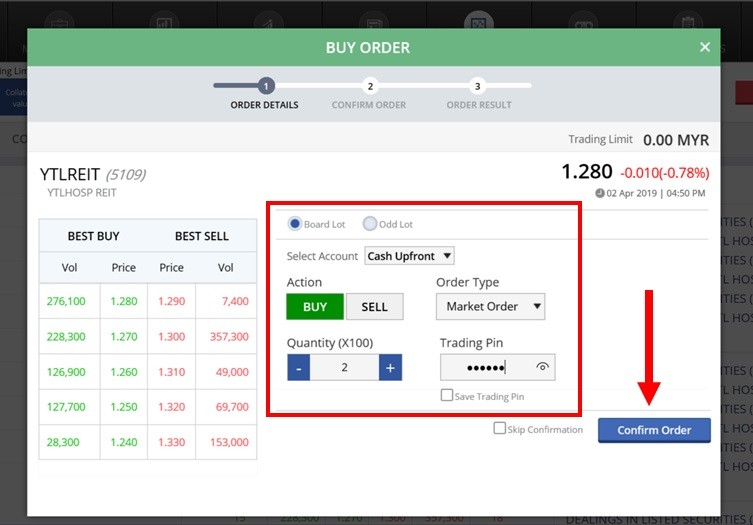

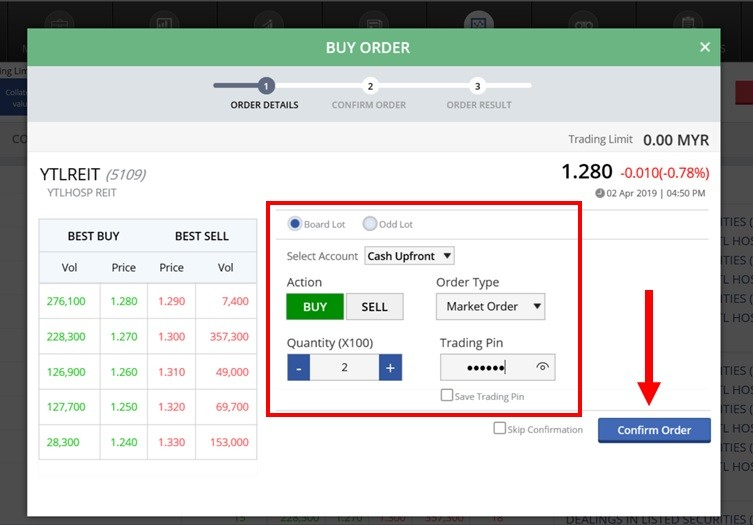

On the order page, there are a few key sections that you have to familiarize yourself with:

1 – Trading Limit: How much capital you have to invest.

2 – Market Price: The price where a share is traded most actively between buyers & sellers.

3 – Best Buy & Best Sell Table (Market Depth): This table shows us what is the price that the people are lining up to buy/sell and the volume.

The more volume it is for a price, it means that the faster you will be getting it once you execute an order. (eg. You will be able to buy at RM1.28 immediately compared to trying to buy at a lower price of RM1.27)

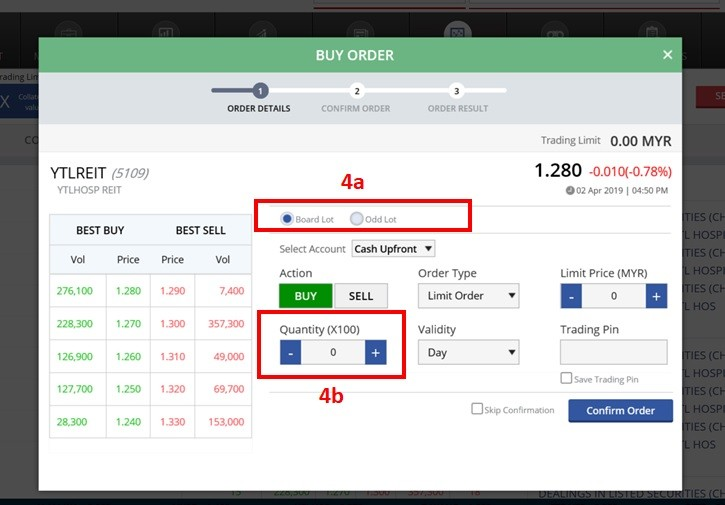

4a – Board Lot & Odd Lot:

•Board lot means you buy in a minimum multiple of 100 units. (1 Board Lot=100 units of shares, RM1.28*100=RM128)

•Odd Lot means you can buy in a multiple of 1 unit.

•Since more people will buy in Board Lot, your order will usually be filled more easily compared to buying in odd lots.

4b – Quantity:

•If you buy in Board Lot, your quantity will be in the multiple of 100. (eg. Put 2 if you want to buy 200 units of shares)

•Odd lot means you are free to key in any number of units that you want. (eg. Key in 88 if you want to buy shares in 88 units)

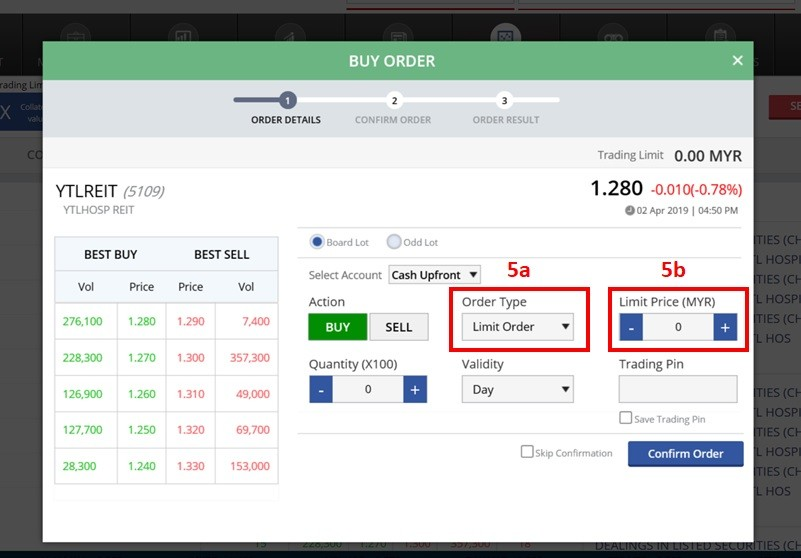

5a – Order Type:

- Limit Order: Queuing to Buy LOWER than market price. (if you are selling means you are queuing to Sell HIGHER than market price)

- Market Order: Buying or selling at MARKET PRICE. (order will be fulfilled almost instantly)

5b – Limit Price (not available if ordering at market price):

- The price you want to buy below the market price. (eg. Queuing to buy cheaper at RM1.26 instead of the market price of RM1.28)

- Note that buying below market price may not 100% guarantee that your order will be fulfilled.

6 - Validity (only available if buying/selling via Limit Order):

-

Day: Your order will be canceled if it is not fulfilled by day end (5pm). (eg. If you queued at RM1.26 but did not get fulfilled, then your order will be canceled by 5pm the same day)

-

Good-Till-Date (GTD): You can decide the validity of your order. (eg. You queue for the price of RM1.26 until X date)

7 – Trading Pin: Your numbered pin to approve your trade. (Set when you open your account.)

Step 3: Fill in the details of your trade, your Trading Pin and click Confirm Order.

Note:

1. Decide if you are buying Board Lot or Odd Lot.

2. Decide your Quantity.

3. Decide your Order Type.

4. Key in your trading pin.

5. Confirm Order.

6. Wait for your order to be filled.

And we are done! This is how exactly you can buy your first stock via Rakuten Trade.

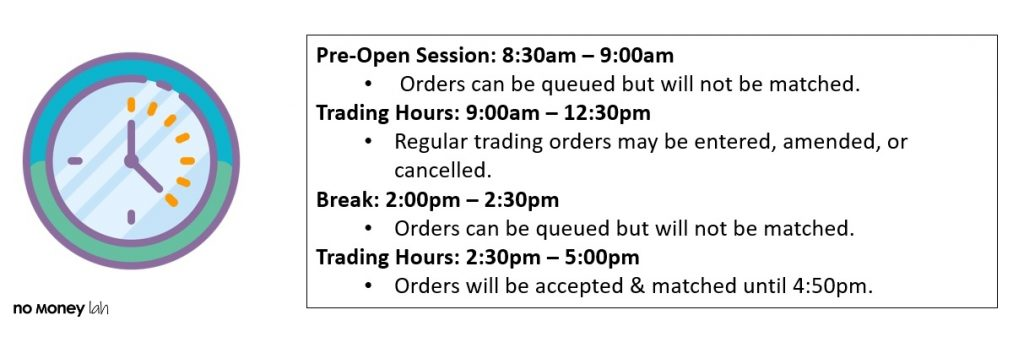

KLSE Market Operating Hours

The market is open from Monday to Friday, except for public holidays. Details on active market hours are as stated below:

No Money Lah Verdict

With a good understanding of the terminologies and functions, hopefully, you will not be so overwhelmed with these stock trading platforms!

If you are keen to open a Rakuten Trade account, consider using my referral link by clicking on the button below!

Open A Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link. The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

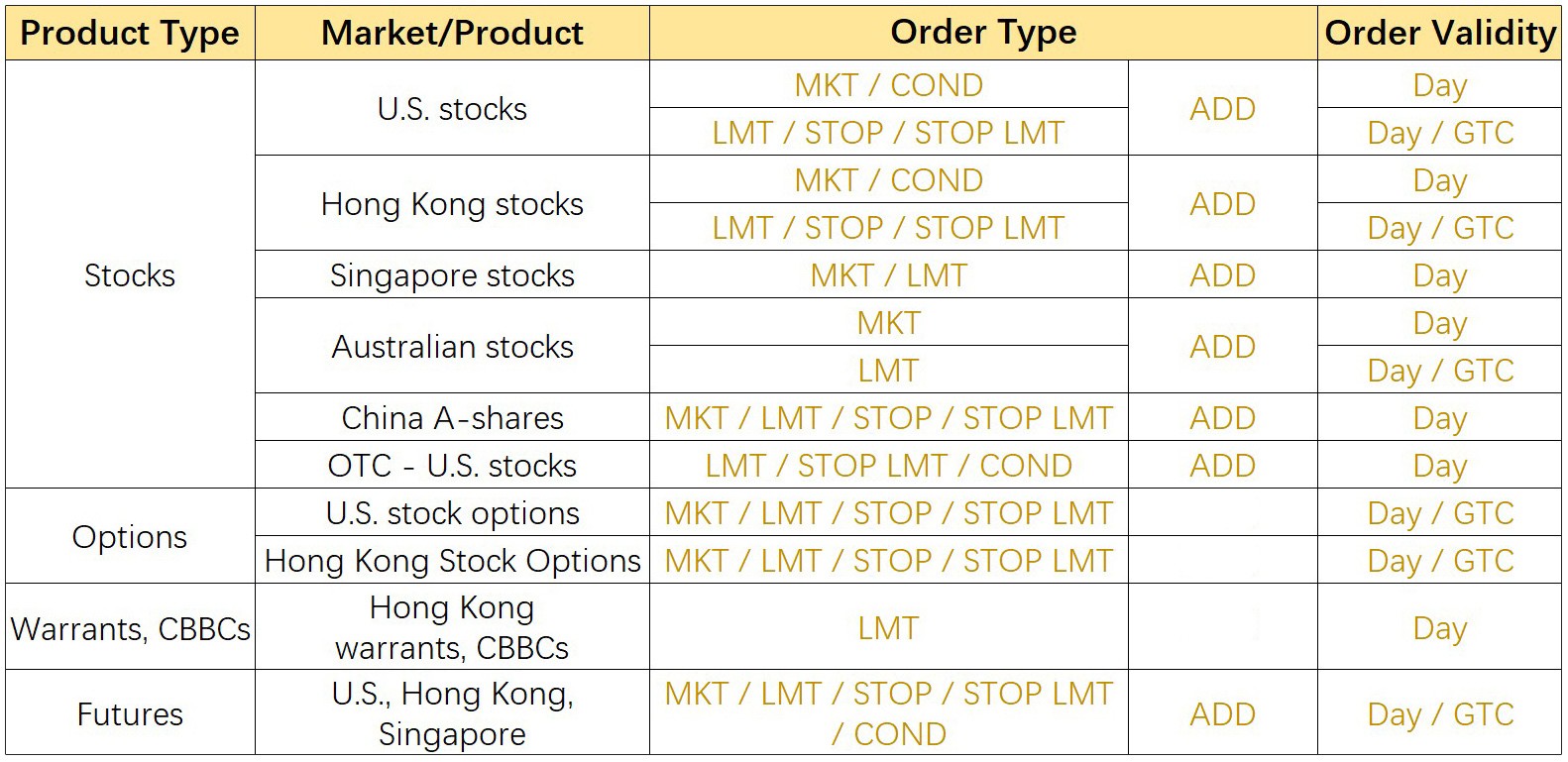

Guide: How to Buy Your First Overseas Share via Tiger Brokers

In this article, I am going to guide you step-by-step on how to navigate and buy your first overseas shares, be it from the US, Singapore, or Hong Kong stock market.

For this, I am going to demonstrate the process using Tiger Brokers, a broker that I am personally using to invest in the overseas market (SG, US, HK etc).

If you haven't done it yet, definitely check out my Tiger Brokers review for more info on fees, user experience, and how to open and fund your account.

--

[PROMO] Commission-free trades + Free stocks!

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 - USD888

Open A Tiger Brokers Account Today!

Alright, are you ready?

Let’s get started:

p

Fund your Tiger Brokers Account

Before we proceed, I'd assume that you have already funded your Tiger Brokers account.

If you have funded your account, proceed to the next section.

If not, check out my guide on how to fund your Tiger Brokers account without paying expensive intermediary banking fees (~SGD30/USD20).

Step-by-Step Guide to Buy a Stock on Tiger Brokers (US, Singapore & Hong Kong Stocks)

Read this before proceeding:

- For this guide, I’ll be using the desktop app (Tiger Trade) from Tiger Brokers. Call me old school or whatever, but I feel things like investing money in a stock deserve a proper execution on desktop.

You can download and install the Tiger Trade desktop app HERE.

- For the sake of simplicity, I WILL NOT go over trading on margin/leverage and shorting shares in this guide. Please read them up on your own if you are into these. For most people, I’d recommend investing with only the cash you have in your brokerage account.

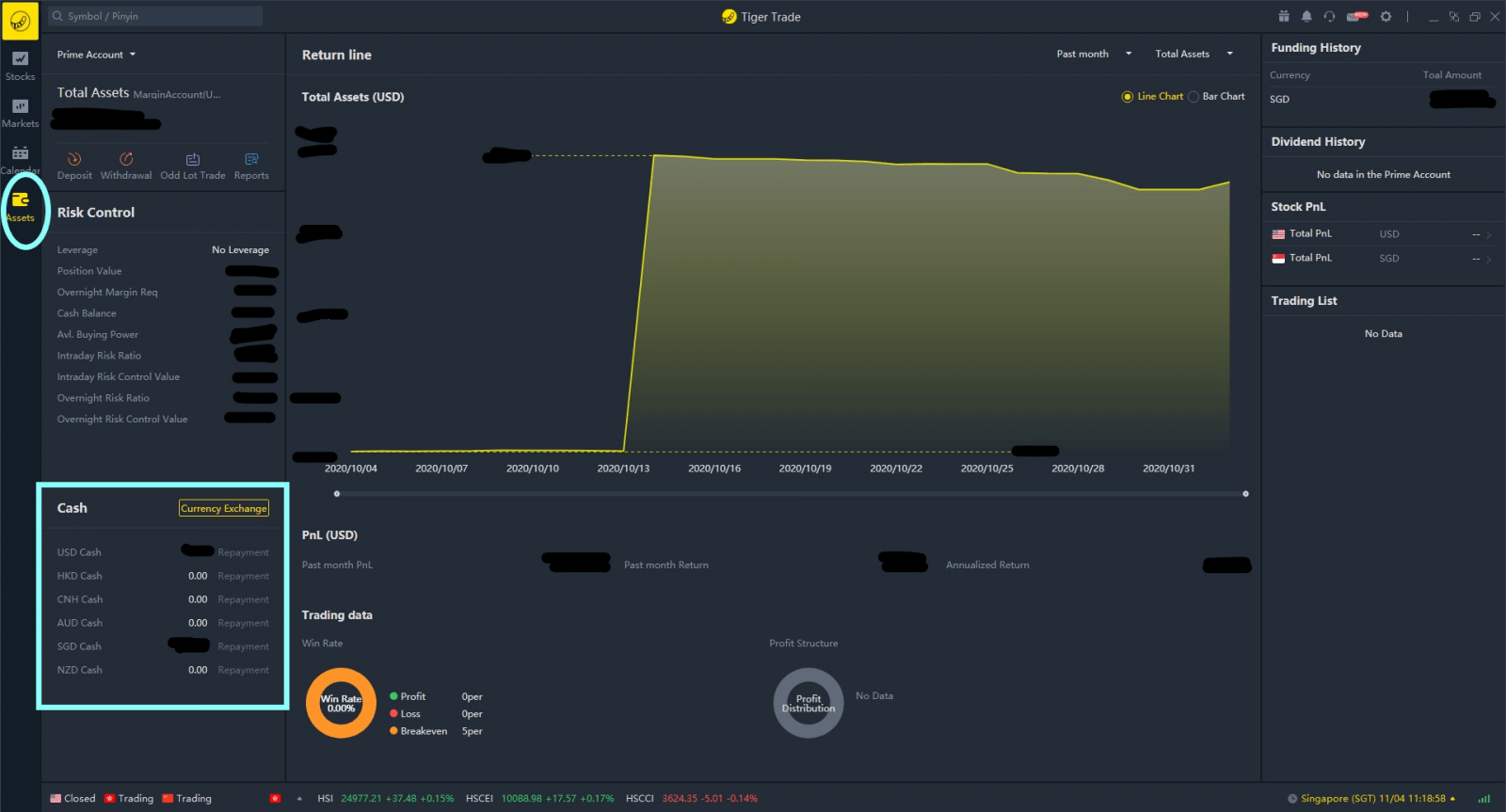

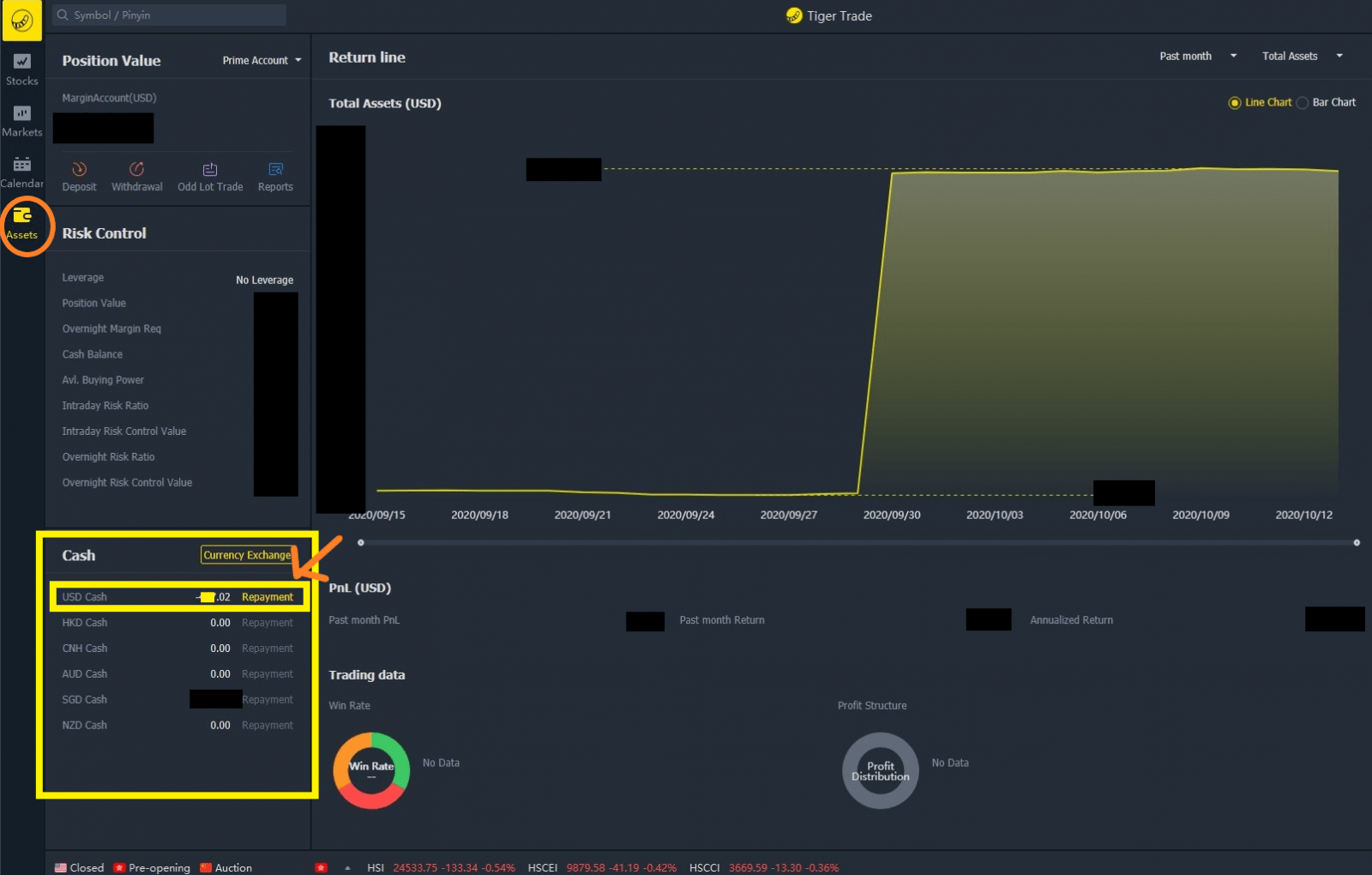

Step 1: Log in to your Tiger Trade desktop app.

Under ‘Assets’, proceed to check out your fund balance so you know how much you have to invest.

- Your fund balance should be reflected after successful funding. If you have not funded your Tiger Brokers account, click HERE for a comprehensive funding guide.

- If you fund your account with SGD, your fund balance will be reflected in SGD. If you fund your account with USD, that fund will be reflected under USD.

p

Step 2: Under the search bar, search for the stock that you want to invest in.

As an example, search for ‘Apple’ if you want to invest in Apple.

p

Step 3: Click ‘Buy/Long’

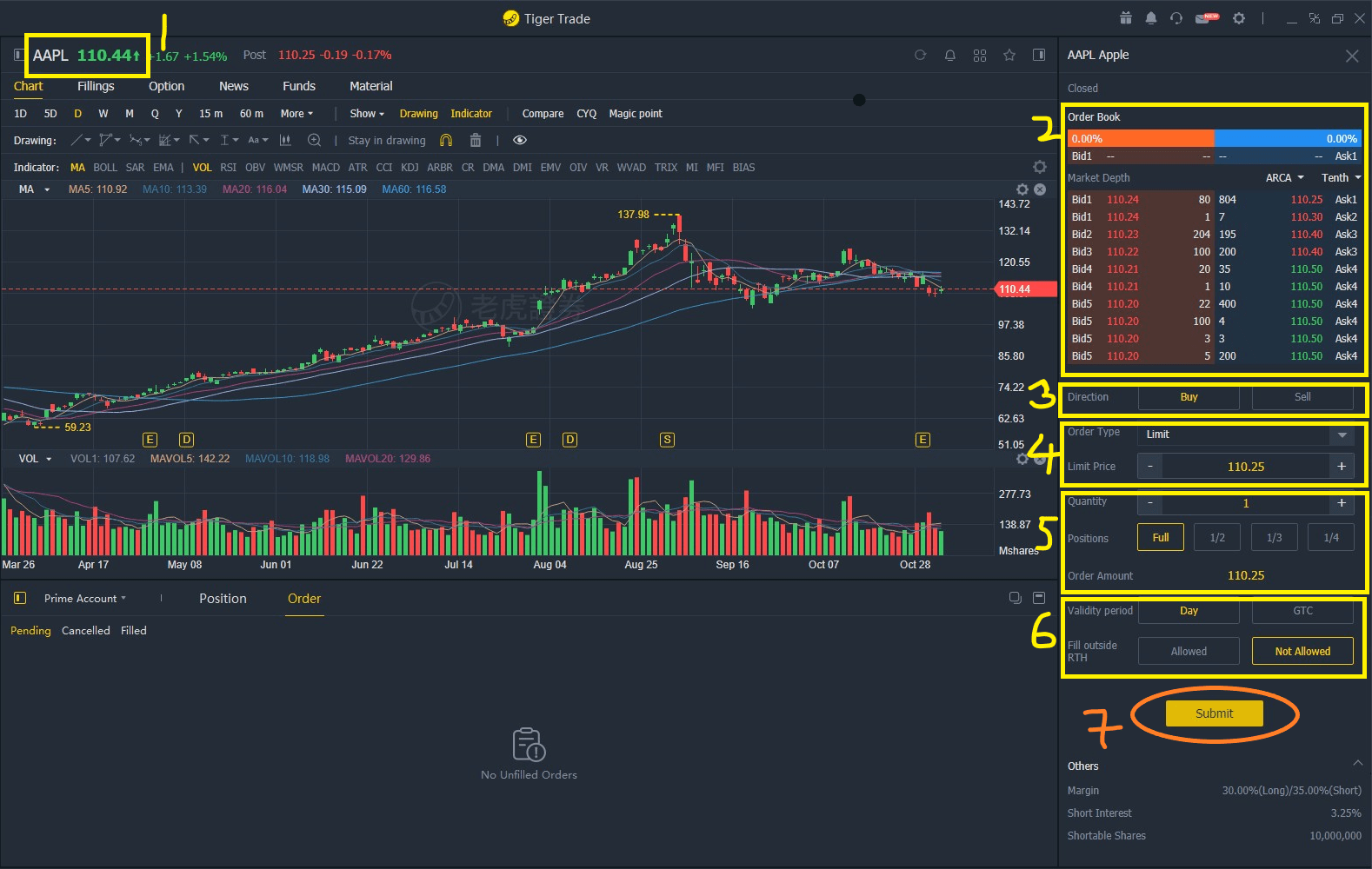

Step 3 (i): Familiarize Yourself with the Buy/Sell Interface in Tiger Brokers

- 1: Current market value of the share.

p - 2: Depth of market – shows you the order flow from buyers and sellers. (will write about how it works soon)

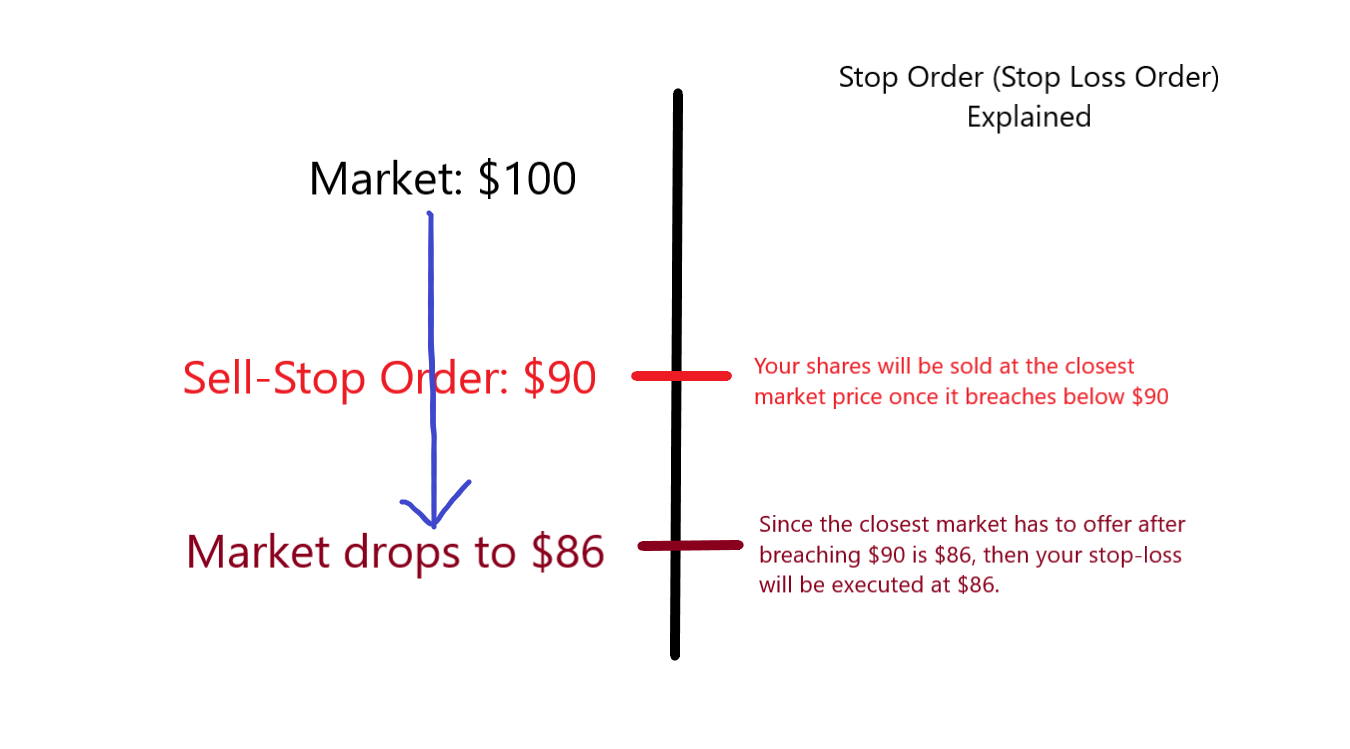

p - 3: Order direction – if you are buying a stock, then retain the direction at ‘Buy’.

p - 4: Order types – There 4 order types: Limit order, Market order, Stop-Loss Order & Stop Limit order. (more below)