[Freedom Fund] 2023 Monthly Dividend Income (Jan Update!)

In this post, you'll see my monthly dividend income updates for 2023.

My goal is to invest a portion of my funds to build a RM1,000/month passive income portfolio (and eventually RM4,000/month).

Through this journal, you'll see my progress month by month - and I wish you will find inspiration to start your dividend investing journey too! Let's go!

Related Post: If you like reading my journey, I'm sure you'll like the posts below as well:

If you enjoy following my dividend investing journey and would like to learn more, subscribe to my FREE newsletter and I'll be sending you the most updated content every week!

January 2023 Dividend Income Update

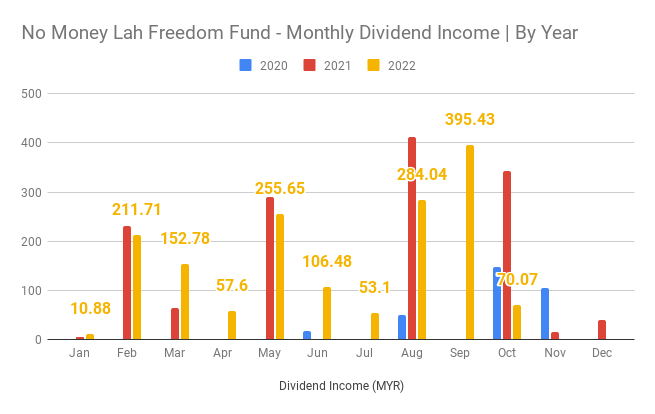

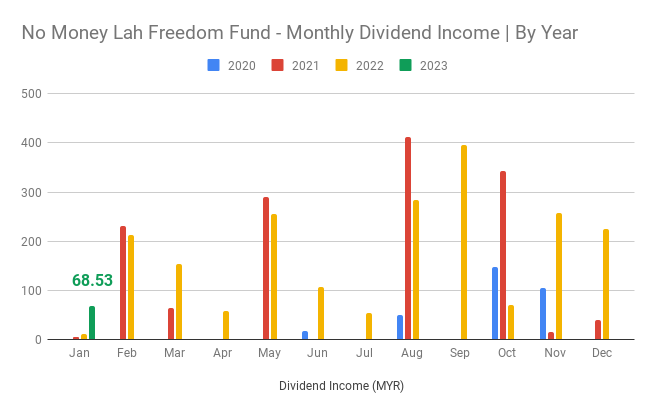

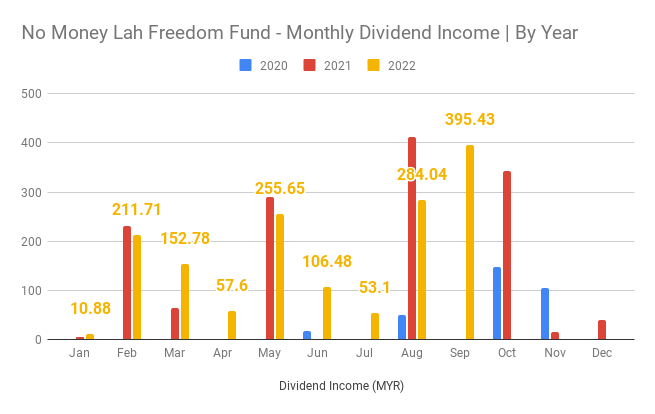

For the first month of 2023, I received RM68.53 in dividend income, which is a decent increase over the RM10.88 that I received last year!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

|---|---|---|---|

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.68 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM14.60 |

| Purpose Bitcoin Yield ETF | BTCY | CAD1.79 | RM5.69 |

| Purpose Ether Yield ETF | ETHY | CAD1.96 | RM6.23 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD6.21 | RM26.33 |

| Total Dividends Received | RM68.53 |

[Note] Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.24

- SGD1 = RM3.23

- CAD1 = RM3.18

- HKD1 = RM0.54

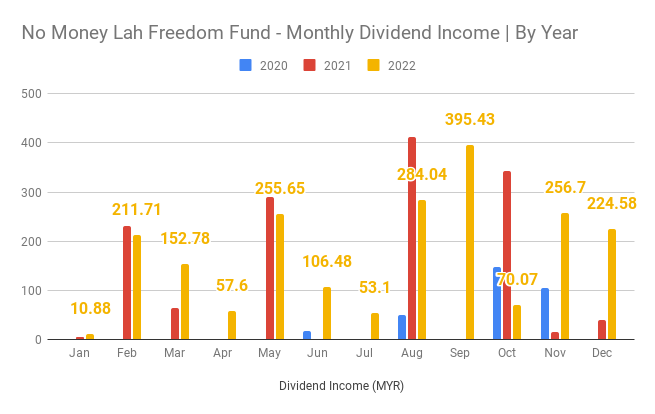

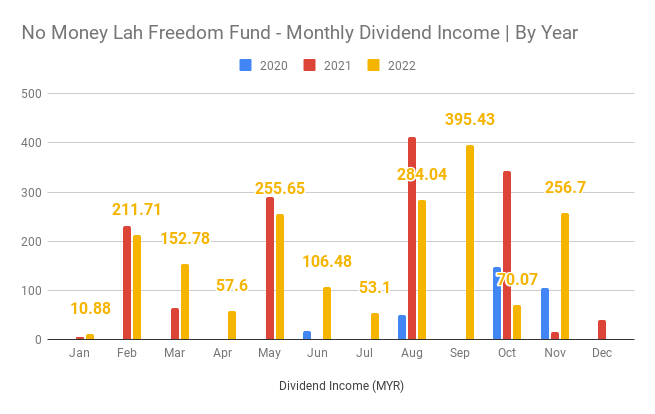

Dividend breakdown by month & year:

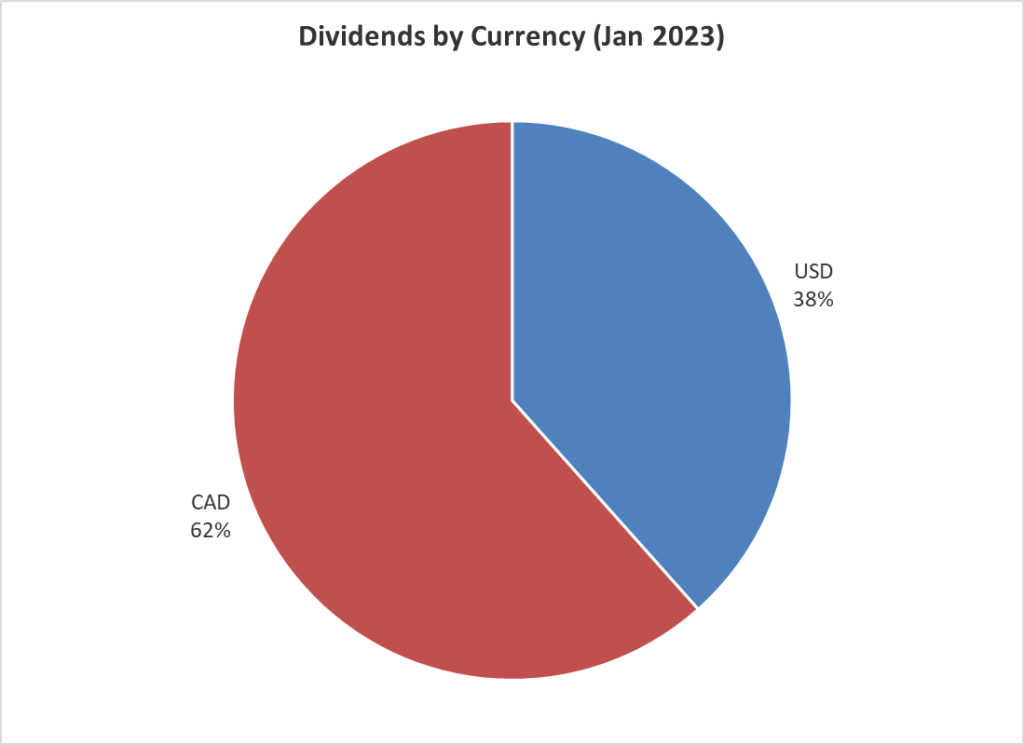

Dividend breakdown by currency:

Jan 2023 Wrap-Up + Thoughts:

The new year has been very eventful thus far.

My grandma passed away the week before CNY (peacefully) and the unusually chilly weather of this CNY got me sick for the rest of the month.

In times like this, my conviction to build a low-maintenance dividend income portfolio (ie. my Freedom Fund) only grew stronger.

Why? Because life is full of unexpected incidents. With income automation, it helps relieve the stress and anxiety that I need to rush back to work during difficult moments in life.

Having choices in life is a luxury that one needs to intentionally prepare for as it does not come without prior effort.

Regardless, thanks for reading and I hope you'll continue following my journey and find value in my content!

p.s. You can check out my latest Freedom Fund portfolio HERE.

- Dividend Income (Jan): RM68.53

- Dividend Income (2023): RM68.53

[Freedom Fund] 2022 Monthly Dividend Income Update (Complete Update!)

In this post, you'll see my monthly dividend income updates for 2022.

My goal is to invest a portion of my funds to build a RM1,000/month passive income portfolio (and eventually RM4,000/month).

Through this journal, you'll see my progress month by month - and I wish you will find inspiration to start your dividend investing journey too! Let's go!

Related Post: If you like reading my journey, I'm sure you'll like the posts below as well:

- The Freedom Fund: My whole dividend investing portfolio!

- Dividend+: Learn how to build a low-maintenance dividend portfolio!

If you enjoy following my dividend investing journey and would like to learn more, subscribe to my FREE newsletter and I'll be sending you the most updated content every week!

p

December 2022 Dividend Income Update

We are at the final dividend income update of 2022!

As a whole, I received RM224.58 in December 2022, which is a decent increase over RM39.92 last year!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Axis REIT | 5106 | RM61.64 | RM61.64 |

| Syfe REIT+ | SGD11.57 | RM38.07 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM14.92 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.02 |

| Purpose Bitcoin Yield ETF | BTCY | CAD1.79 | RM6.37 |

| Purpose Ether Yield ETF | ETHY | CAD1.96 | RM6.37 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD6.21 | RM27.32 |

| Schwab US Dividend Equity ETF | SCHD | USD10.83 | RM47.65 |

| SPDR S&P US Dividend Aristocrats UCITS ETF | UDVD | USD1.54 | RM6.78 |

| Total Dividends Received | RM224.58 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.40

- SGD1 = RM3.29

- CAD1 = RM3.25

- HKD1 = RM0.56

Dividend breakdown by month & year:

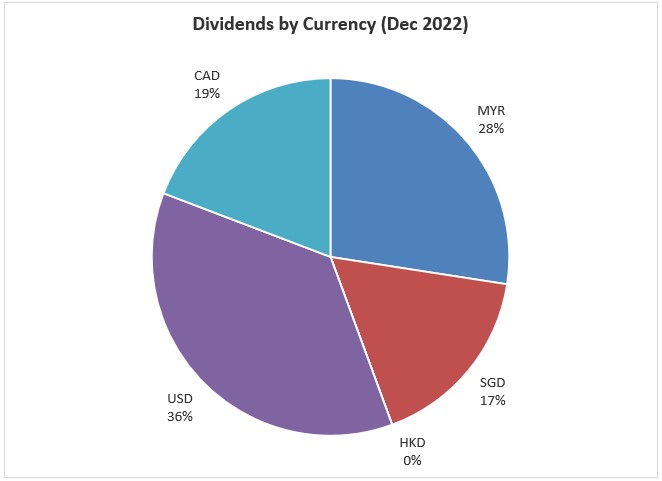

Dividend breakdown by currency:

Dec 2022 Wrap-Up + Thoughts:

Time flies and we are ending the year already!

Personally, I am happy with my progress in 2022. Income automation is a key revelation in my investing journey and I am glad that I am building toward it via the Freedom Fund.

In the new year, I will continue to build on the Freedom Fund, and let's hope 2023 will be a good year for us all!

- Dividend Income (Dec): RM224.58

- Dividend Income (2022): RM2063.46

November 2022 Dividend Income Update

Time flies and we are almost coming to the end of 2022! With this, let's check out my November 2022 dividend income update!

As a whole, I received RM256.70 in November 2022, which is a decent increase over RM15.09 last year! Key contributions come from the final dividend payment from my REIT investments for the year.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Atrium REIT | 5130 | RM31.64 | RM31.64 |

| Axis REIT | 5106 | RM72.97 | RM72.97 |

| IGB REIT | 5227 | RM57.17 | RM57.17 |

| Syfe REIT+ | SGD4.89 | RM15.89 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.28 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.42 |

| Purpose Bitcoin Yield ETF | BTCY | CAD1.96 | RM6.53 |

| Purpose Ether Yield ETF | ETHY | CAD1.96 | RM6.53 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD4.76 | RM21.32 |

| Fidelity US Quality Income UCITS ETF | FUSD | USD2.89 | RM12.95 |

| Total Dividends Received | RM256.70 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.48

- SGD1 = RM3.25

- CAD1 = RM3.33

- HKD1 = RM0.57

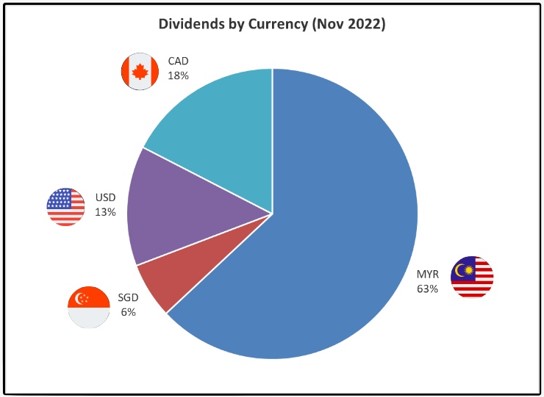

Dividend breakdown by month & year:

Dividend breakdown by currency:

New additions:

Added to my existing holdings as I seek to increase my exposure in the US stock market.

- SCHD: One of my favorite dividend ETFs to buy & hold long-term. Managed to add more units of SCHD prior to price pushing back to near all-time high this month. With a solid history of dividend increments every year for the past 10 years, SCHD is a no-brainer for long-term dividend investors. Check out my newly released SCHD review HERE.

- HTA.U: Added to HTA.U for the attractive yield in USD as tech still looks very attractive to me.

You can check out my latest Freedom Fund portfolio HERE.

Nov 2022 Wrap-Up + Thoughts:

Personally, I am pretty happy with my progress in 2022. I continue to build my portfolio despite the market selldown and fears & noise in the market.

- Dividend Income (Nov): RM256.70

- Dividend Income (2022): RM1853.21

October 2022 Dividend Income Update

October 2022 dividend income update is back!

This month's dividend is slightly toned down as I've received my many quarterly payouts last month. As always, the goal is to continue building the dividend portfolio - focus on the long-term game and process!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD0.56 | RM1.86 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.88 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM17.06 |

| Purpose Bitcoin Yield ETF | BTCY | CAD2.68 | RM9.27 |

| Purpose Ether Yield ETF | ETHY | CAD2.52 | RM8.72 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD3.66 | RM17.28 |

| Total Dividends Received | RM70.07 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.72

- SGD1 = RM3.33

- CAD1 = RM3.46

- HKD1 = RM0.60

Dividend breakdown by month & year:

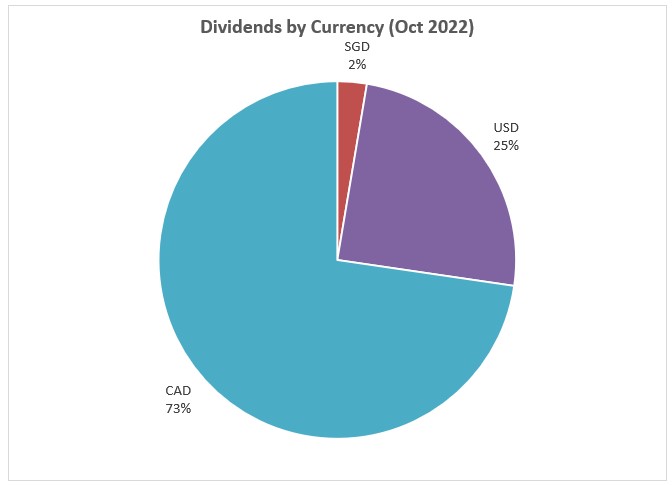

Dividend breakdown by currency:

New additions:

Added to my existing holdings as I seek to increase my exposure in the US stock market.

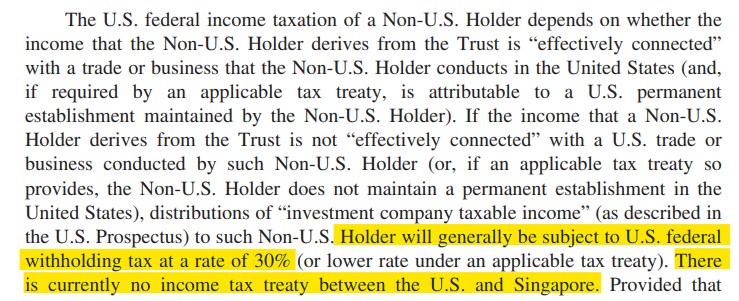

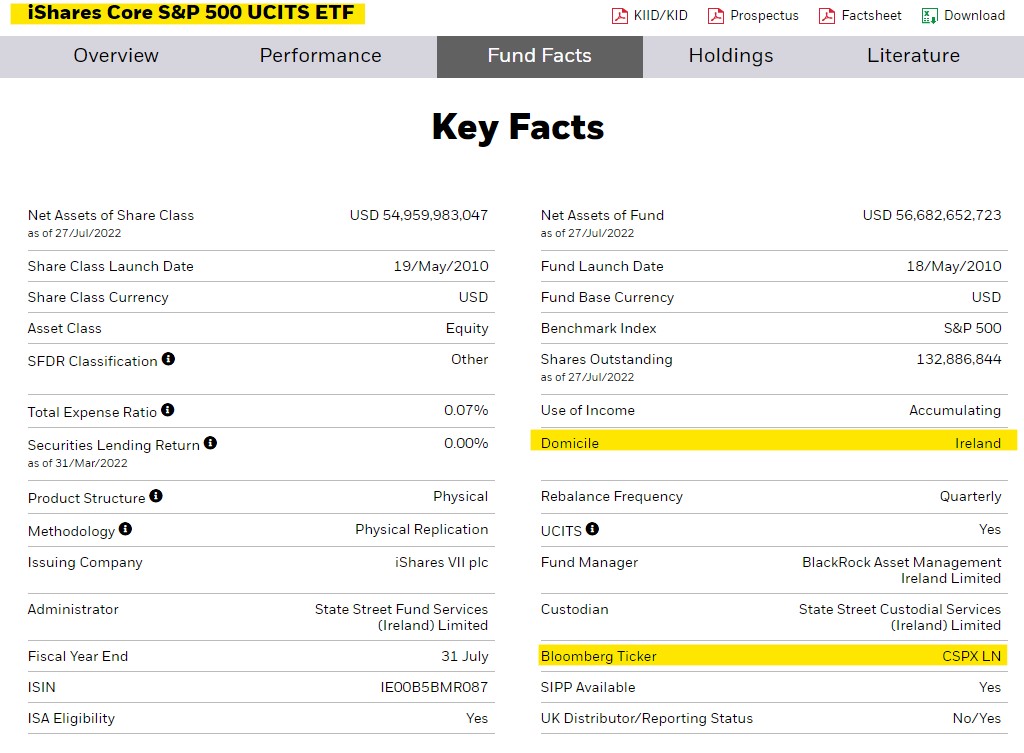

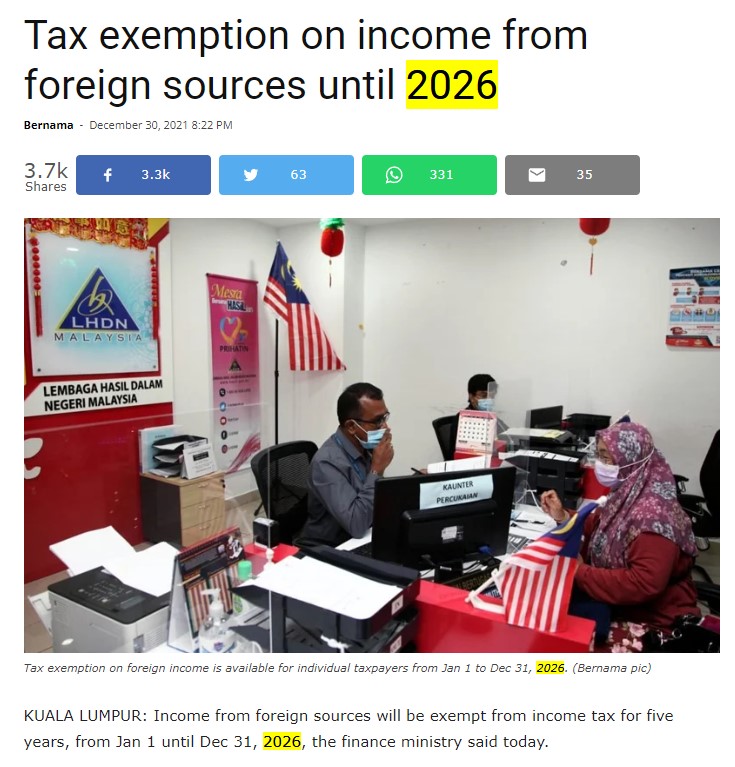

- SCHD: Despite having to incur a 30% dividend withholding tax (WHT) for all US-domiciled ETFs, SCHD got really attractive in line with market selldown - hitting a yield of over 3% in October. Combined with a solid history of dividend increments every year, SCHD is a no-brainer for long-term dividend investors.

You can check out my latest Freedom Fund portfolio HERE.

Oct 2022 Wrap-Up + Thoughts:

- Dividend Income (Oct): RM70.07

- Dividend Income (2022): RM1633.39

“The man who can do the average thing when everyone else around him is losing his mind.”

September 2022 Dividend Income Update

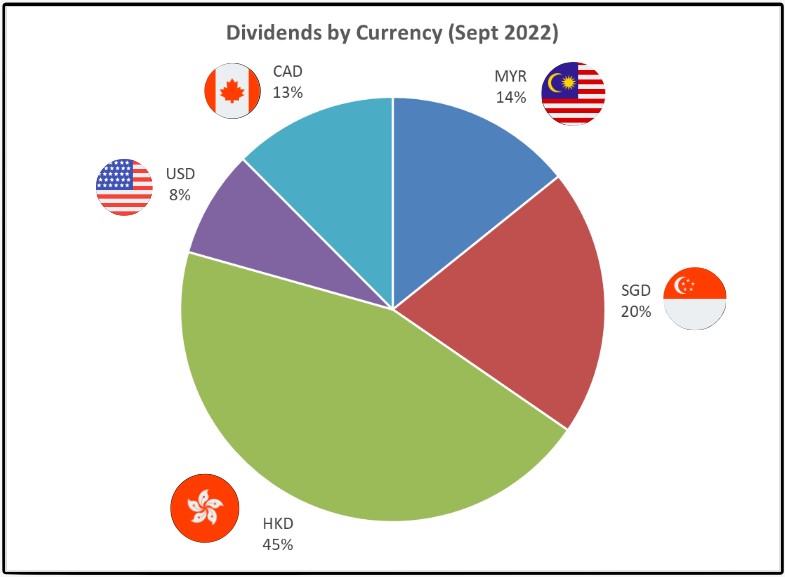

We are back with September 2022 dividend income update! *DRUM ROLLS*

Despite the market being in the red this month, I actually received my highest dividend income for 2022 (so far) of RM395.43 ($86)!

The highest contribution comes from the bi-annual distribution of 3110, a dividend ETF from Hong Kong. This is followed by dividend income from Syfe REIT+, my go-to way to invest in Singapore REIT.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD24.86 | RM80.55 | |

| Maybank | 1155 | RM56.28 | RM56.28 |

| Global X Hang Seng High Dividend Yield ETF | 3110 | HKD300 | RM177 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.38 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.52 |

| Purpose Bitcoin Yield ETF | BTCY | CAD2.68 | RM8.98 |

| Purpose Ether Yield ETF | ETHY | CAD2.52 | RM8.44 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD3.66 | RM16.98 |

| Schwab US Dividend Equity ETF | SCHD | USD1.78 | RM8.26 |

| SPDR S&P US Dividend Aristocrats UCITS ETF | UDVD | USD1.52 | RM7.05 |

| Total Dividends Received | RM395.43 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.64

- SGD1 = RM3.24

- CAD1 = RM3.35

- HKD1 = RM0.59

Dividend breakdown by month & year:

Dividend breakdown by currency:

New additions:

Nothing fancy in September. Added to my existing holdings as I seek to increase my exposure in the US stock market.

- HTA.U: Now generating a yield of over 10% with a track record of stable dividend payout.

- FUSD: Track record of growing dividends in the past 3 years.

- Syfe REIT+: Automated monthly investment.

You can check out my latest Freedom Fund portfolio HERE.

Sept 2022 Wrap-Up + Thoughts

- Dividend Income (Sept): RM395.43

- Dividend Income (2022): RM1539.58

One of my biggest decisions in 2022 is when I finally decided to commit to dividend investing.

Why so?

Due to certain family issues this year, I’ve come to realize that cashflow is crucial.

As such, I aim to automate my income so, in 15 to 20 years, I have the choice to focus on what’s important in life without having to worry about actively working for income.

Knowing the context behind WHY I go for dividend investing helps massively because I’ll not be affected by short-term market swings, and other people’s opinions on dividend investing.

For friends who are reading this, I encourage you to figure out your investment goal/direction. Knowing your WHY will help you filter out a lot of noise and stay consistent in your journey.

August 2022 Dividend Income Update

Hey hey! Despite heavy market sell-off, we are back with the dividend update for August! In August, I received RM284.04 in dividend income!

The dividend in August is the highest of the year so far since I got my quarterly payout from my REIT holdings alongside monthly dividend payout from my ETFs.

As for new addition, I've added the USD version of Harvest Tech Achievers Growth & Income ETF (HTA.U) as I'd like to focus on more dividends in USD moving forward.

You can check out my latest Freedom Fund portfolio HERE.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD12.37 | RM39.71 | |

| Atrium REIT | 5130 | RM38.48 | RM38.48 |

| Axis REIT | 5106 | RM75.84 | RM75.84 |

| IGB REIT | 5227 | RM57.38 | RM57.38 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.74 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM16.91 |

| Purpose Bitcoin Yield ETF | BTCY | CAD3.4 | RM11.66 |

| Purpose Ether Yield ETF | ETHY | CAD2.99 | RM10.26 |

| Harvest Tech Achievers Growth & Income ETF (USD) | HTA.U | USD2.21 | RM9.88 |

| Fidelity US Quality Income UCITS ETF | FUSD | USD1.83 | RM8.18 |

| Total Dividends Received | RM284.04 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.47

- SGD1 = RM3.21

- CAD1 = RM3.43

- HKD1 = RM0.57

August 2022 Wrap-Up

- Dividend Income (August): RM284.04

- Dividend Income (2022): RM1150.05

July 2022 Dividend Income Update

We are back with the dividend update for July! In July, I received RM53.10 in dividend income!

July closed on a positive note after months of bearish sentiment. That said, I don't think the market is clearly bullish yet. Inflation is still high and interest rate hikes have not proved effective in pushing inflation down.

For the month, I've added more units of HTA, alongside 2 Ireland-domiciled dividend growth ETFs - FUSD and UDVD to the Freedom Fund. These ETFs:

- Provide exposure to the US market at a lower dividend withholding tax (WHT) at 15% instead of 30% from typical US-listed equities.

- They also have a history of growing dividends and should serve as a great long-term holding to the portfolio.

An interesting note on FX rate. So far in 2022, our beloved MYR has:

- Dropped more than 4% against SGD.

- Lost close to 5% against CAD.

- Lost over 6% in value against USD.

If any, investors should absolutely consider diversifying their income into different major currencies (eg. SGD, CAD, USD) to hedge against a weak MYR. A dividend portfolio with foreign exposure is certainly the easiest way to do so.

You can check out my latest Freedom Fund portfolio HERE.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.97 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.93 | RM17.16 |

| Purpose Bitcoin Yield ETF | BTCY | CAD3.4 | RM11.83 |

| Purpose Ether Yield ETF | ETHY | CAD2.34 | RM8.14 |

| Total Dividends Received | RM53.10 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.45

- SGD1 = RM3.22

- CAD1 = RM3.48

- HKD1 = RM0.57

July 2022 Wrap-Up

- Dividend Income (July): RM53.10

- Dividend Income (2022): RM869.50

June 2022 Dividend Income Update

We are back with the dividend update for June! In June, I received RM97.96 (update: RM106.48) in dividend income!

June was a pretty tough month for the market as a whole. We've entered a bear market, inflation is hitting hard across the globe, and measures to raise interest rate did not seem to be effective in cooling things down.

I was quite busy with some research and work in June, so I did not do anything crazy other than adding additional 2 units of SCHD.

That said, I've probably made a mistake with buying SCHD from the start due to dividend withholding tax reasons (where non-US residents are taxed 30% of their dividend income) - which makes the long-term prospect of this US dividend ETF less attractive.

Will decide what I'd do with this soon but it's a good lesson nevertheless. You can check out my latest Freedom Fund portfolio HERE.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD14.59 | RM46.10 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.70 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.25 | RM14.54 |

| Purpose Bitcoin Yield ETF | BTCY | CAD3.4 | RM11.63 |

| Purpose Ether Yield ETF | ETHY | CAD2.34 | RM8.00 |

| Schwab US Dividend Equity ETF | SCHD | USD1.97 | RM8.69 |

| Total Dividends Received | RM104.66 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.41

- SGD1 = RM3.16

- CAD1 = RM3.42

- HKD1 = RM0.56

June 2022 Wrap-Up

- Dividend Income (June): RM106.48

- Dividend Income (2022): RM804.17

May 2022 Dividend Income Update

In May, I received RM255.65 in dividend income!

May is generally a nice month for dividends as quarterly distributions from REITs come in.

While MYR weakened against other currencies, dividends from foreign currencies also increased in MYR terms.

If you live in Malaysia, it is important to expand your income streams into stronger currencies (eg. USD, SGD) and dividend investing is a great way to go.

Took the chance to add SCHD, a US-listed ETF into the Freedom Fund as well.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD3.99 | RM12.73 | |

| Atrium REIT | 5130 | RM37.62 | RM37.62 |

| Axis REIT | 5106 | RM71.65 | RM71.65 |

| IGB REIT | 5227 | RM37.62 | RM37.62 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.59 | RM15.79 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.25 | RM14.62 |

| Purpose Bitcoin Yield ETF | BTCY | CAD6.38 | RM21.95 |

| Purpose Ether Yield ETF | ETHY | CAD6.55 | RM22.53 |

| Total Dividends Received | RM255.65 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- USD1 = RM4.38

- SGD1 = RM3.19

- CAD1 = RM3.44

- HKD1 = RM0.56

May 2022 Wrap-Up

- Dividend Income (May): RM255.65

- Dividend Income (2022): RM708.12

April 2022 Dividend Income Update

In April, I received RM73.32 in dividend income!

April is generally a slow month despite many REITs announcing their earnings. Reason being, the dividend ex-date for my MREIT holdings (Atrium REIT, Axis REIT, IGB REIT) is happening in May.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Syfe REIT+ | SGD0.33 | RM1.04 | |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD4.08 | RM13.87 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD4.25 | RM14.45 |

| Purpose Bitcoin Yield ETF | BTCY | CAD6.38 | RM21.69 |

| Purpose Ether Yield ETF | ETHY | CAD6.55 | RM22.27 |

| Total Dividends Received | RM73.32 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.15

- CAD1=RM3.40

- HKD1=RM0.54

April 2022 Wrap-Up

- Dividend Income (April): RM73.32

- Dividend Income (2022): RM448.69

March 2022 Dividend Income Update

This month, I received RM152.78 in dividend income!

I revamped my dividend portfolio by adding in new dividend-paying stocks & ETFs (3110). Unique Covered Call ETFs (HBF, HTA, BTCY, ETHY) that pay monthly dividends were also added.

As a whole, this month’s dividend income is a fantastic 142.7% increase over March 2021 (RM62.94). That’s RM71.84 more dividend income than last March - not a lot by absolute means, but progress is progress!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Maybank | 1155 | RM60.00 | RM60.00 |

| Syfe REIT+ | SGD5.46 | RM16.93 | |

| Global X Hang Seng High Dividend Yield ETF | 3110 | HKD22 | RM11.88 |

| Harvest Brand Leaders Plus Income ETF | HBF | CAD3.06 | RM10.28 |

| Harvest Tech Achievers Growth & Income ETF | HTA | CAD3.40 | RM11.42 |

| Purpose Bitcoin Yield ETF | BTCY | CAD5.74 | RM19.29 |

| Purpose Ether Yield ETF | ETHY | CAD6.84 | RM22.98 |

| Total Dividends Received | RM152.78 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.10

- CAD1=RM3.36

- HKD1=RM0.54

March 2022 Wrap-Up

- Dividend Income (March): RM152.78

- Dividend Income (2022): RM375.37

March is when I decided to concentrate more funds to build up my passive income portfolio. Various incidents in my family led me to realize the importance of consistent cashflow - and dividend investing is one, if not the best way to build consistent cashflow.

I will continue to focus more funds to build this Freedom Fund so you'll certainly see more growth down the line!

February 2022 Dividend Income Update

In February, I received RM211.71 in dividend income.

Since it's Chinese New Year break, I took the chance to 'slim down' my REIT portfolio by letting go of all my individual Singapore REITs (SREITs) and several Malaysia REITs (KIP REIT, Sentral REIT). For Malaysia REITs, I only sold them off after ex-date so I am still eligible for the dividends.

I've been wanting to slim down my REIT portfolio as I have no capacity to manage individual REITs and now I finally got it done!

As a replacement, I transitioned to Syfe's REIT+ portfolio, which is essentially something like a REIT ETF that tracks a basket of SREITs. I truly like the ease of automatic dividend-reinvestment without the hassle to deal with corporate actions (eg. rights issue, DRIP) etc!

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Atrium REIT | 5130 | RM82.62 | RM42.00 |

| Axis REIT | 5106 | RM12.16 | RM12.16 |

| IGB REIT | 5227 | RM50.81 | RM50.81 |

| KIP REIT | 5280 | RM17.59 | RM17.59 |

| Sentral REIT | 5123 | RM43.51 | RM43.51 |

| Syfe REIT+ | SGD1.62 | RM5.02 | |

| Total Dividends Received | RM211.71 |

[Note] Rotate your screen if you cannot view the full table in portrait mode. Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.10

February 2022 Wrap-Up

- Dividend Income (February): RM211.71

- Dividend Income (2022): RM222.59

February is usually a high dividend month as most Malaysian REITs announce their Q4 dividends in late January with the following month as the ex-date. Now that I've sold many of my individual REITs, things may change a little moving forward.

January 2022 Dividend Income Update

As a REIT investor, January has been a relatively slow month for me. All in all, I received RM10.88 from Keppel DC REIT, a small Singapore REIT (SREIT) holding in my portfolio.

I've received my dividends from many of my Singapore REIT holdings late last year and most Malaysian REITs have yet to pass their dividend ex-date after their Q4 2021 earnings report - hence the quiet month.

| Stocks/ETF | Ticker | Dividends Received | Dividends Received (RM) |

| Keppel DC REIT | AJBU | SGD3.51 | RM10.88 |

| Total Dividends Received | RM10.88 |

[Note] Dividends are considered received as per dividend ex-date.

Exchange Rate:

- SGD1=RM3.10

January 2022 Wrap-Up

- Dividend Income (January): RM10.88

- Dividend Income (2022): RM10.88

My 3-Year Experience with a Licensed Financial Planner: Helpful or not?

So, 2022 marks my 3rd year working with my financial planner, Stev.

Engaging a financial planner has been a major decision in my adulthood.

Stev is a licensed financial planner from Wealth Vantage Advisory (WVA). With Stev's help, my finances have never been more organized and this allows me to focus on important priorities in my life (eg. family, career).

So, what is it like to do comprehensive financial planning in Malaysia, and is it really useful?

In this post, let me walk you through my 2022 financial planning experience with you - check it out!

--

Note: Before we proceed with my journey in 2022, please note that this is my 3rd year working alongside Stev in my finances. Feel free to follow my journey from my very first year so you’ll have a better picture of my journey:

- My initial experience engaging a financial planner

- 2020: My 1st year engaging a financial planner

- 2021: My 2-year experience with a financial planner

p.

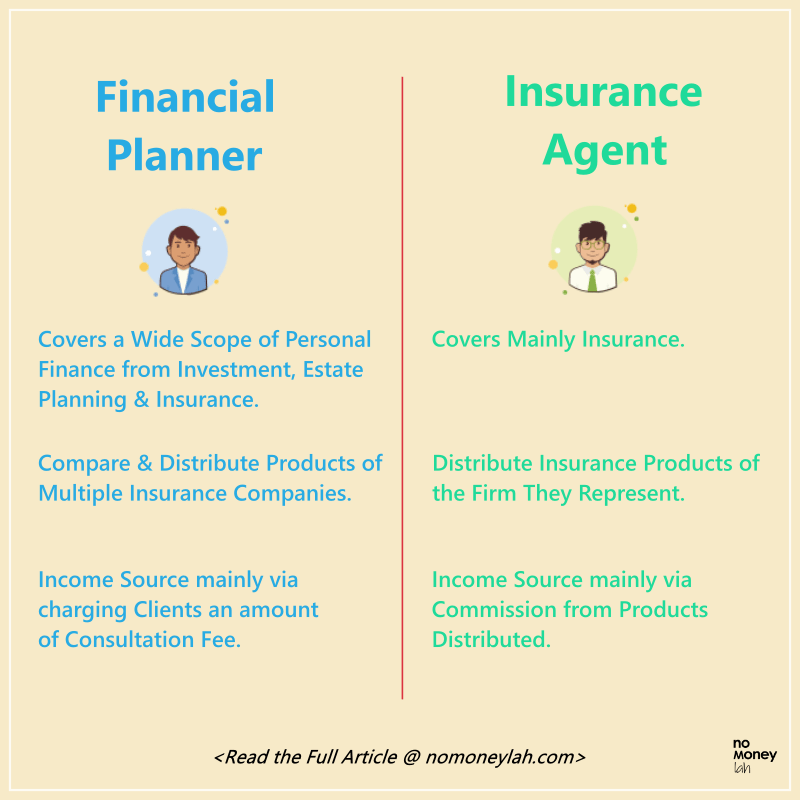

Quick recap: What is a financial planner

So, what is a licensed financial planner, and who is qualified to be called a licensed financial planner?

Essentially, a licensed financial planner has in-depth qualifications, namely:

- Capital Market Service Representative License:

Issued by the Securities Commission (SC): To conduct licensed financial planning in Malaysia – as such, be called a ‘financial planner’.

- Financial Adviser Representative (FAR) License:

Issued by Bank Negara Malaysia (BNM): Allows a financial planner to recommend insurance products from any insurance company.

On the other hand, the qualification of most insurance agents would stop at the Pre-Contract Examination for Insurance Agents (PCEIA) & Certificate Examination in Investment-linked Life Insurance (CEILI) papers.

These are the papers that insurance agents have to take in order to start offering insurance solutions for one particular insurance company.

In essence, a financial planner offers a holistic & comprehensive service in all aspects of personal finance relative to an insurance agent.

My financial planning progress in 2022

Engaging a financial planner is a process that involves 3 key stages: (A) Fact-finding, (B) Implementation, and (C) Follow-Up Review Meetings.

This is also how I begin my financial planning journey every year with my financial planner, Stev, for the past 3 years.

(A) Engagement/Fact-Finding phase (September - December 2021):

My 2022 financial planning journey actually started in Q3 2021, when I sat down with Stev to review my year and plan for the year ahead.

This is where we come together to learn my overall financial status such as my cashflow, income, investments, insurance, and so on.

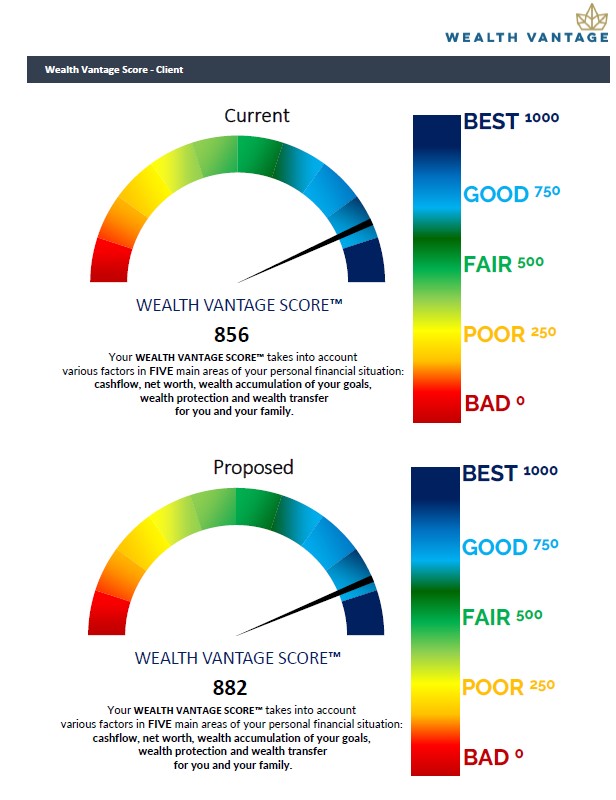

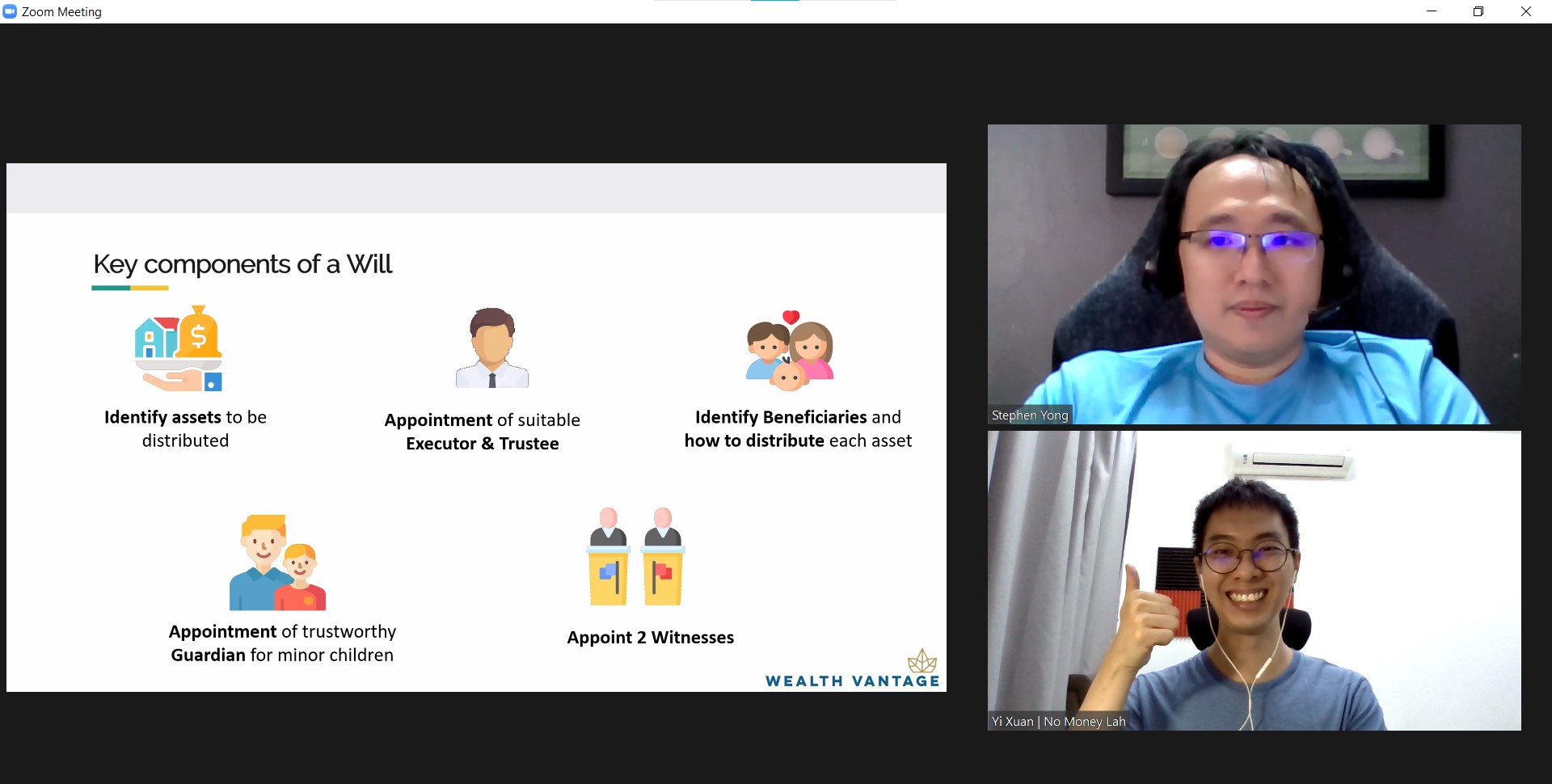

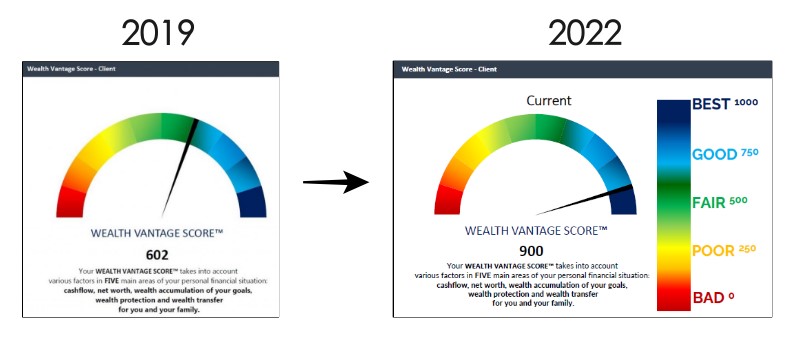

I am also shown my Wealth Vantage Score, a visual gauge of my financial state, and target progress for the year:

Then, Stev and I will discuss my goals for the new year, and if there are any changes required in my financial routine to adjust to my goals.

With guidance from Stev, here are some examples of adjustments made to my financial routine include:

- Increasing my EPF contribution for tax relief

- Switching my PRS fund to a better-performing fund

- Reducing my exposure to REIT (real estate investment trust) and channel to other sectors/asset classes (based on my risk profile)

An important goal that we set back then for 2022 is to establish a will as a legal asset distribution document should anything happen to me.

(B) Implementation of financial plan (Throughout 2022)

Then, throughout the year, Stev guided me with the implementation of my plan, especially on a few things:

-

Writing my will

Writing a will is my main financial planning goal in 2022, and we spent about 8 – 9 months getting it done.

Throughout the year, Stev introduced me to will-writing and guided me through the whole process (eg. what assets to include, drafting).

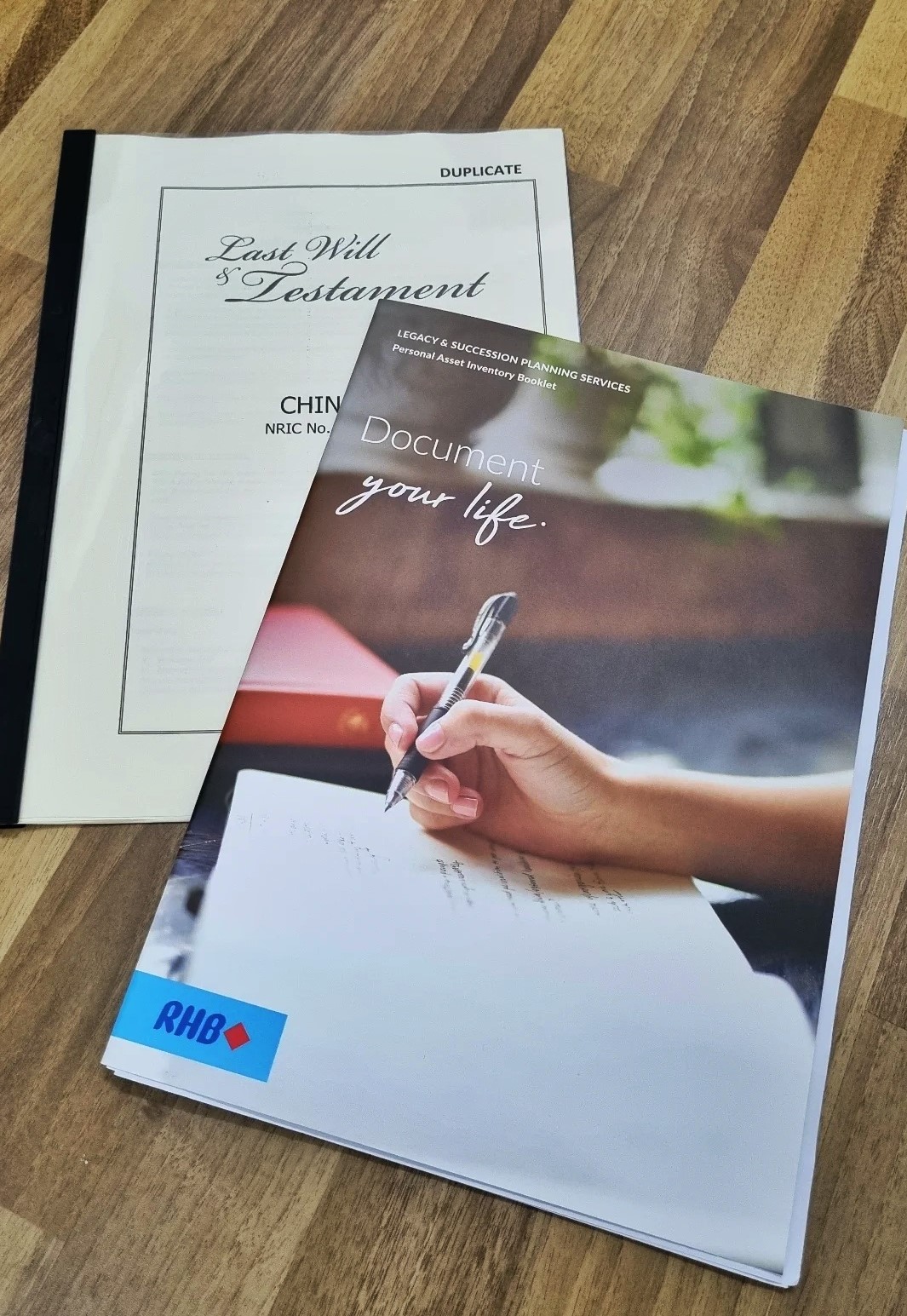

Since the cost of will-writing is not transparent online, Stev used his expertise as a financial planner to help me to filter and select the best-value-for-money service.

After comparing different providers (eg. Rockwills, RHB Trustee), we ended up going with RHB Trustee.

Getting my will done is certainly a key milestone in my financial planning process. Now, I know my assets will be distributed legally as per my wish should something happens to me.

LEARN MORE: My will-writing experience + how much I spent.

-

Navigating a challenging 2022 bear market

2022 has been a challenging time for most investors.

As we entered a bear market – triggered by various factors such as war, and inflation spike followed by interest rate hikes, it is a mentally tough time to invest.

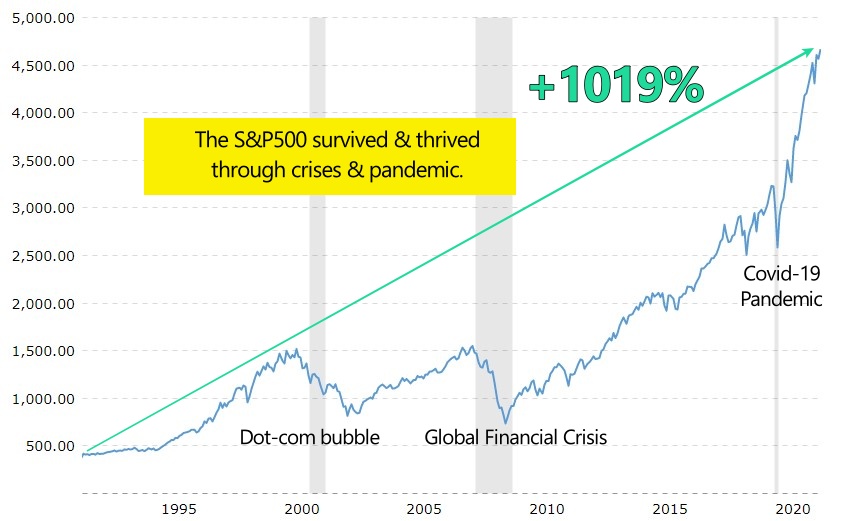

Fortunately, Stev as my mentor has kept my worries at bay by constantly reminding me of the benefits of investing long-term.

(C) Follow-Ups

-

Tax Planning

Stev also helped me look through how I can best optimize my taxes (very helpful especially for me as a self-employed)

-

Investment planning + market outlook

We also have constant chats and discussions about the market outlook throughout the year and how we can best adapt to the market.

As WVA’s financial planning client, I also had the chance to attend Wealth Vantage Advisory’s inaugural financial planning symposium.

p.

(D) Annual Review (September – November 2022)

September is when we begin our annual review as me and Stev sat down to review my progress for the year.

It is at this time (Q3) that Gabriel, the firm's new up-and-coming rising star financial planner, joined Stev to guide me in my finances.

This is where we talk about my goals for the new year and if there are any adjustments required to my financial routine.

3 lessons I learned from my financial planner & Results

-

Focus on the big picture and think long term

2022 has been a challenging year for most investors. That said, Stev has taught me to focus on the big picture and keep a long-term view of my wealth-building journey.

In fact, my overall financial health (cashflow, net worth, protection) has made a major improvement in 2022 compared to late 2019, when I first started working with Stev.

Check out my WVA Score - a visual of how Stev measures my overall financial wealth in 2019 vs 2022:

-

Consistency is key

As a mentor, Stev also reminded me of the importance of being patient and consistent in my journey.

There was a short period in 2022 where I was discouraged about my wealth-building journey and Stev let me see what was possible if I stay consistent in my journey.

-

Good defense always comes before strong offense

In my 3 years working with a financial planner, I realized the importance of building a solid foundation before anything else.

This means having the proper defense in place, such as insurance protection, savings & emergency fund so I can focus on pursuing my priorities in life without worries.

How it works (Financial Planning Packages & Pricing)

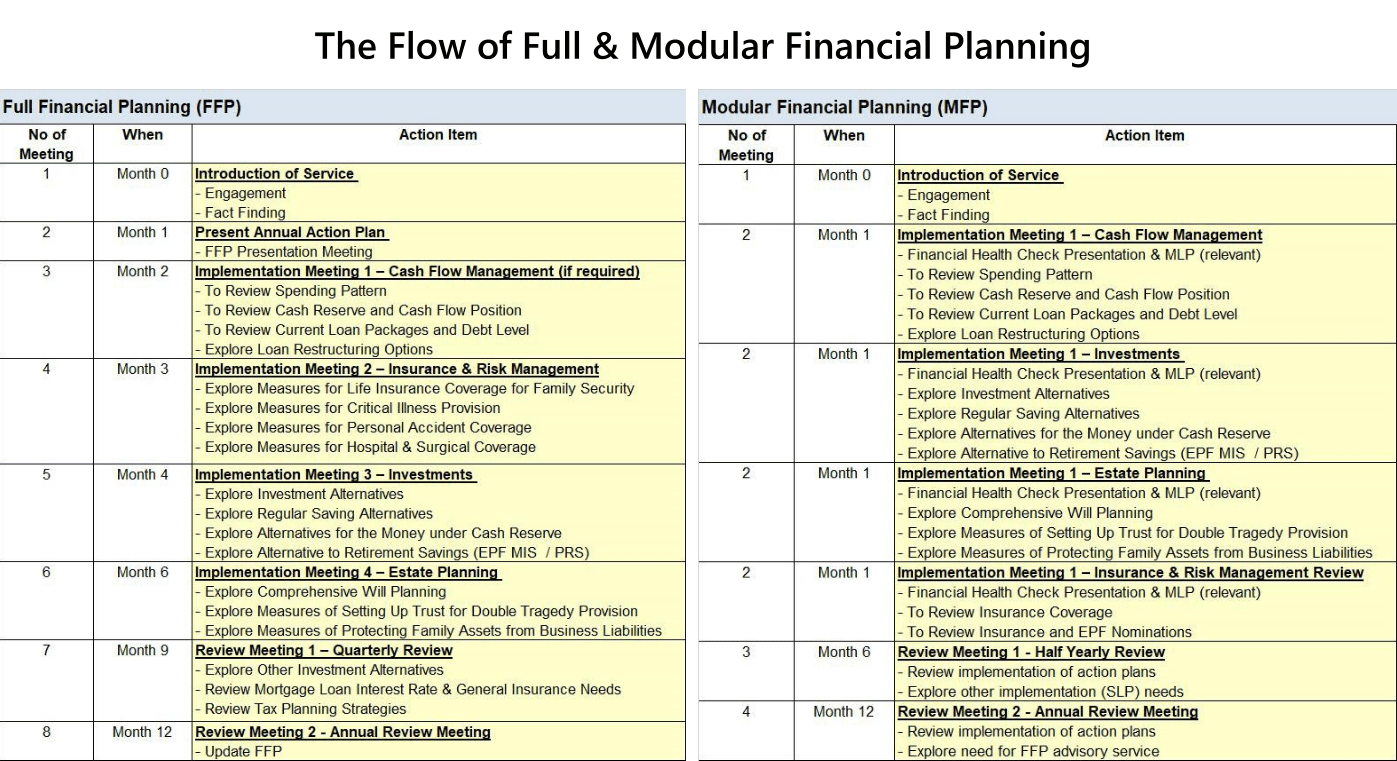

Depending on your needs, there are 3 ways you can work with a licensed financial planner from WVA, namely:

-

Package #1: Comprehensive Financial Health Check (FHC)* [RM300]

Financial Health Check offers a comprehensive report on your financial state with action plans for improvement.

You’ll go through a comprehensive fact-finding process with your financial planner.

Then, you’ll be presented with an analysis and report of your overall financial state with recommendations for improvement.

[*Note: FHC package is only offered to readers that signed up through my exclusive Free Financial Consultation session link]

-

Package #2: Modular Financial Planning (MFP) [RM1,500]

Modular Financial Planning is essentially a combination of comprehensive Financial Health Check (FHC) + your financial planner will support you in the implementation of ONE aspect of your finance (insurance, investment, estate planning) for 1 full year.

-

Package #3: Full Financial Planning (FFP) [RM3,000]

Full Financial Planning is a combination of comprehensive Financial Health Check (FHC) + your financial planner will support you in the implementation of ALL aspects of your finances (insurance, investment, estate planning) for 1 full year.

Below, you can find the whole flow of MFP and FFP:

Personally, I’ve opted for the Modular Financial Planning (MFP) package (investment) back in 2020.

Since 2021, I have been on the Full Financial Planning (FFP) package. This is where my financial planner, Stev has guided me in all aspects of my finances (investment, insurance, and estate planning).

You can read about my experiences below:

- 2020: My 1st year engaging a financial planner (Modular Financial Planning - MFP)

- 2021: My 2-year experience with a financial planner (Full Financial Planning - FFP)

Sign Up for a FREE Consultation Session Here!

Should you engage a financial planner in Malaysia?

For me, engaging a financial planner like Stev gives me a sense of security.

With Stev as a mentor & guide, I can go on to pursue different life goals without worries – as there is always someone looking over my shoulder when it comes to my finances.

So, here’s a question for you:

Do you have important priorities in life that you want to pursue or dedicate time to without having to always worry about your financial status:

“Do I have enough insurance coverage?”

“Am I investing right?”

“Can I retire with what I am earning now?”

If yes, engaging a financial planner can bring massive benefits to your life.

Specifically, I am confident that a financial planner will add massive value to you if:

- You have tried to DIY your finances but still feel overwhelmed.

- You want to prepare your finances for the next phase in life (eg. marriage, retirement), but not sure how.

- You need help to organize your finances in place but you are unsure how or too busy to begin (investments, insurance, estate planning etc).

Yes, there are charges to engage a financial planner. But trust me, this will be an investment that’ll give you returns and peace of mind in multiple folds.

3 tips on how to get maximum value while engaging a financial planner:

#1 Be open with your financial planner:

Financial planners are licensed to guide you in your finances. They can only help if you are willing to be open and honest about your financial conditions/challenges, and goals.

#2 Know your goal/intention:

Engaging a financial planner can be massively helpful if you have a clear financial goal (eg. Retirement/Building a family). This gives your financial planner a direction to design a financial plan that is best fit for you.

#3 Keep your financial routine in check:

It is also helpful if you have the habit of tracking + updating your finances on a routine basis. This help in reducing the time that your financial planner has to spend on gathering the information required to devise your financial plan.

[EXCLUSIVE] Get Your First Financial Consultation Session – FREE OF CHARGE!

If you are keen to explore how a licensed financial planner can help with your finances, this is for you:

I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

- When you sign up for this FREE consultation session, you will learn more about your overall financial state.

- Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

Sign Up for Your FREE Consultation Session Here!

No Money Lah’s Verdict

And there you go – my personal long-term experience engaging a financial planner!

For me, engaging a financial planner helped me put my finances in place. As a result, it allows me to pursue my career and life priorities without worries.

Having Stev and Gabriel as my financial planner, friend, and mentor is one of the best decisions I’ve made in my financial planning journey.

Are you in a position in life where you want to pursue your priorities without being held back by money matters?

In this case, I am sure engaging a financial planner can yield massive benefits for you.

Sign Up for Your FREE Consultation Session Here!

Disclaimer

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

SCHD Review: 3 reasons why this is my favorite US Dividend ETF to hold long-term!

The beauty of dividend investing is we continue to receive dividends regardless of market conditions.

What if there’s something better? What if your investment pays you MORE dividends as time goes by?

With dividend ETFs such as Schwab US Dividend Equity (SCHD), this is certainly possible.

In this post, let us look at SCHD, and 3 key reasons why it is my favorite dividend ETF to hold for the long term in my Freedom Fund!

--

p.s. Looking to learn dividend investing? My ultimate guide to dividend investing is coming REAL soon! Sign up HERE to be the first to know when it is ready and enjoy extra perks & discounts!

p.

Quick Recap: What is an ETF & why dividend ETF?

Exchange-Traded Fund (ETF) is essentially low-cost funds listed in the stock market, where you can buy and sell just like stocks.

Simply put, ETFs are funds that track the performance of a basket of assets (eg. Stocks, bonds, commodities).

As such, dividend ETFs are ETFs that track a basket of dividend-paying assets, such as stocks and bonds.

Why invest in dividend ETFs?

Dividend ETFs make it easy for investors to gain diversified exposure to a basket of dividend-paying stocks (or other assets), without having to pick individual stocks.

The diversified nature of ETFs significantly reduces the impact should a single company perform badly.

LEARN MORE: Introduction to Exchange-Traded Fund (ETF)

What is SCHD?

Schwab US Dividend Equity (SCHD) is a dividend ETF listed in the US stock market since 2011.

SCHD tracks the Dow Jones U.S. Dividend 100 Index, which measures the performance of fundamentally solid US-listed companies with a track record of consistent dividend payment.

Key info:

- ETF manager: Charles Schwab

- Holdings: US-listed stocks

- Expense Ratio: 0.06% per annum

- Dividend payout: Quarterly

3 key reasons why I invest in SCHD

#1 SCHD has a strong track record of growing dividend payout

Since its inception in late 2011, SCHD has recorded a 10-year streak of increasing distribution (even as Covid broke out in 2020!).

Even more impressive, despite a challenging 2022, SCHD managed to grow its distribution per unit (DPU) compared to the prior year:

Why is SCHD’s growing dividend payout so attractive long term?

Assuming that you invested a $1,000 one-off in SCHD in January 2012, the annual dividend that you’d receive would grow from $31.30 in 2012 to $113.88 in 2021. (Considering dividend reinvested)

Why is this significant?

Because if we were to translate the dividend amount ($) to yield on cost (%), this means your dividend yield from the $1,000 investment would grow from an initial 3.13% in 2012 to 11.39% in 2021!

[IMPORTANT] It is important to note this discussion is a reference to the past, and past performance is NOT indicative of future returns.

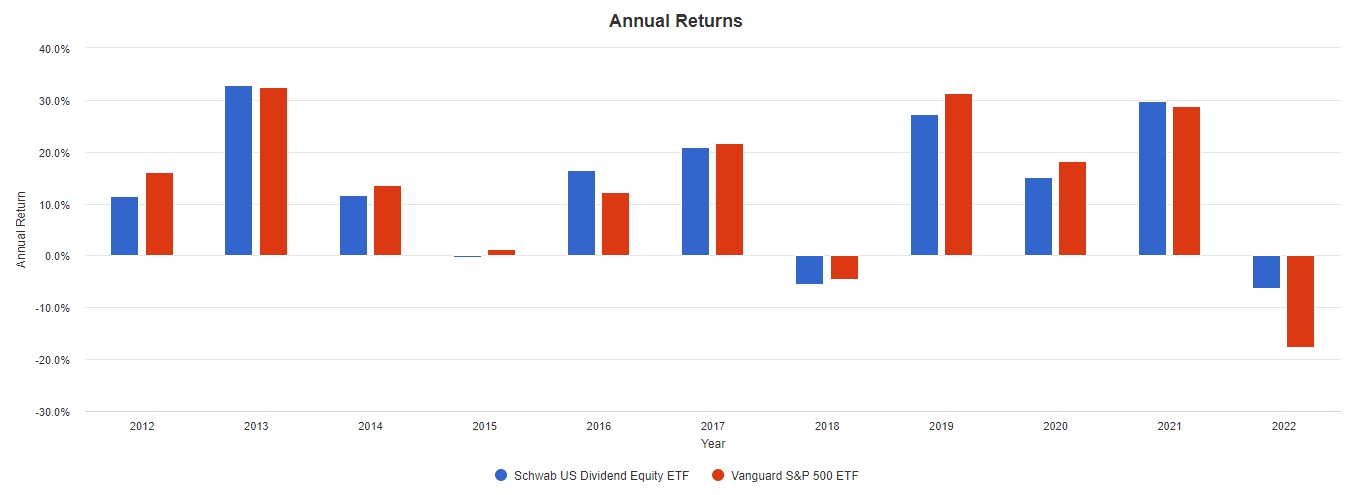

#2 Solid Overall Performance (SCHD vs S&P500)

SCHD not only shines with its impressive track record of growing dividends. With a 10-year annualized return of 13.40% (as of 31/10/2022), SCHD’s overall performance has also been also solid for the past decade.

In fact, SCHD's return slightly outperformed the S&P500 (which represents the largest 500 US-listed companies) which achieved a 10-year annualized return of 13.10%.

p.

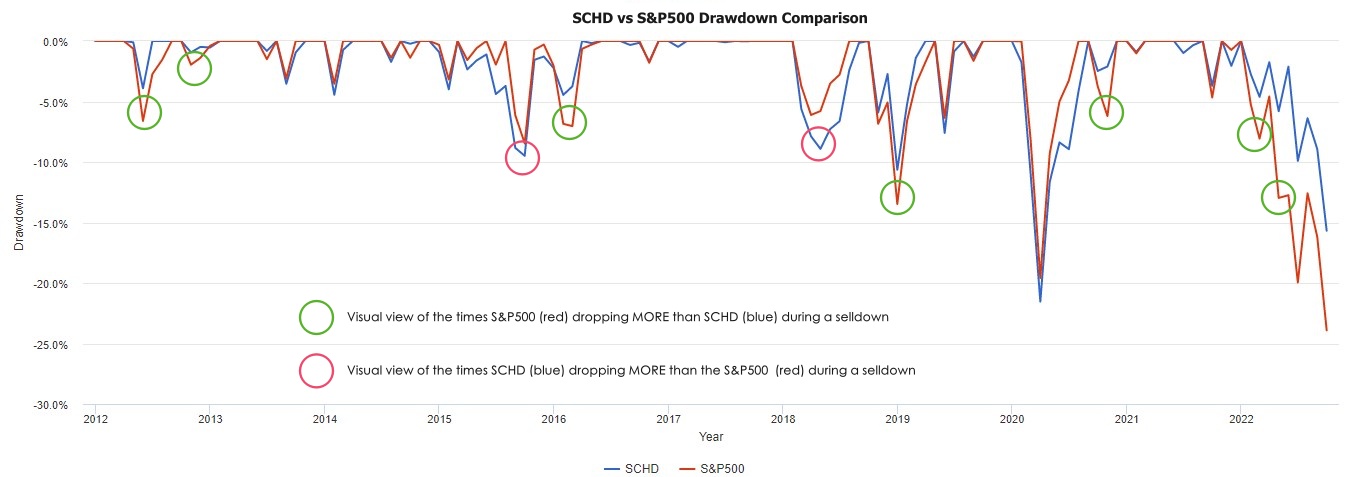

#3 Relatively Low volatility

On top of both key reasons stated above, SCHD also produced returns at relatively lower volatility than the stock market (S&P500).

Beta measures the volatility of a stock in comparison with the market (usually the S&P500) as a whole.

As of 31/10/2022, SCHD recorded a 10-year beta of around 0.9 (source: Yahoo finance), which means SCHD is about 10% less volatile than the S&P500 (beta: 1.0) in the past 10 years.

In other words, investors that invested in SCHD enjoyed better returns without experiencing swings as volatile as the overall market in the past 10 years.

SCHD Holdings

SCHD’s relatively stable volatility nature has a lot to do with the type of stocks that it held. How does it know which stocks to include?

SCHD tracks the Dow Jones U.S. Dividend 100 Index. Essentially, stocks are filtered based on the following criteria:

- Dividend payout: Minimum 10 consecutive years of dividend payments.

- Size of the company: Minimum Float Adjusted Market Cap of $500 million.

- Liquidity: Minimum three-month Average Daily Volume of Trading of $2 million.

Then, qualified stocks are further ranked as per the following criteria:

- Dividend yield

- 5-year dividend growth rate

- Company’s financial health (ie. Free cashflow vs debt)

- Return on equity (ROE)

As a result, companies that are qualified and have higher weightage in SCHD holdings are usually companies with strong financial health that have a solid track record of dividend payout.

Top 10 holdings of SCHD:

As of 31/10/2022, SCHD holds about 103 stocks. The top 10 companies make up >40% of SCHD holdings:

Top 5 Sector Exposure of SCHD

In addition, SCHD filtering method also means companies that qualified are commonly found in more stable sectors, such as the financials and industrial sectors.

2 Things/risks to know while investing in SCHD:

At a glance, SCHD is a pretty balanced dividend ETF with 103 holdings across different sectors. That said, here are 2 key things we need to know while investing in SCHD:

#1 Geographical risk

SCHD offers 100% exposure to US-listed companies. This means any domestic/international US-related events & conflicts will influence the performance of SCHD.

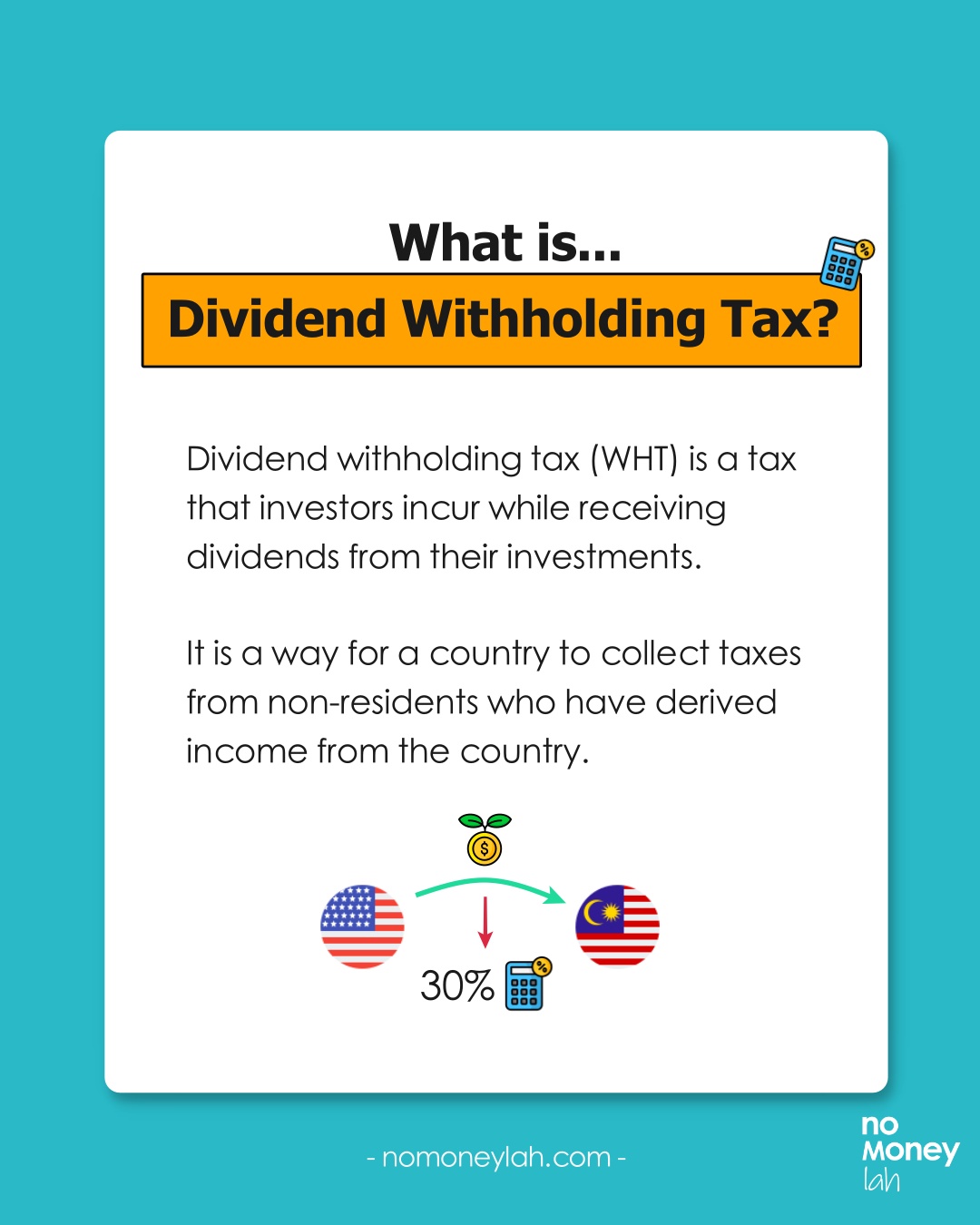

#2 Dividend withholding tax (WHT) for non-US residents

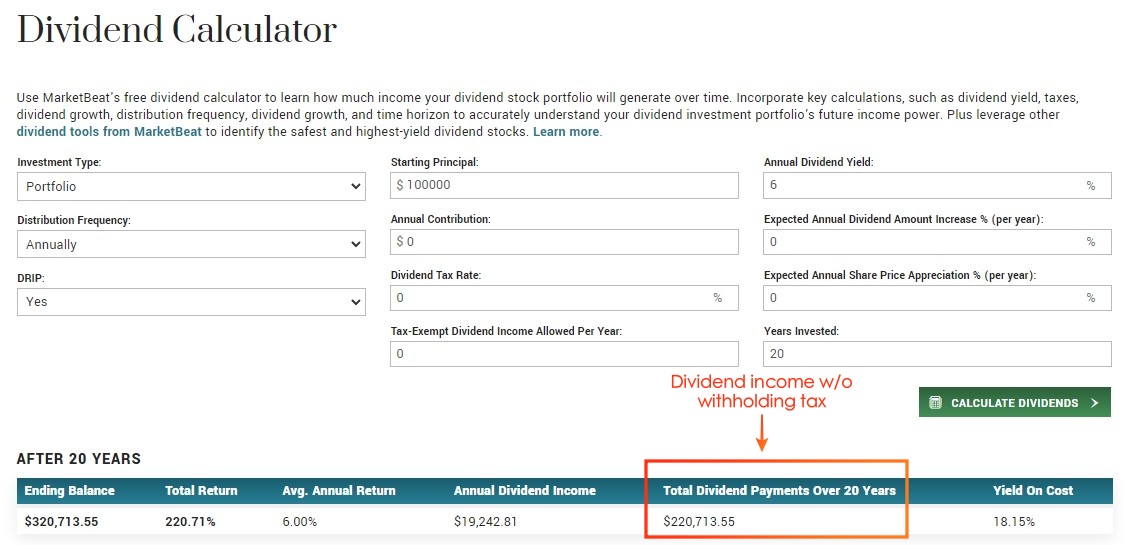

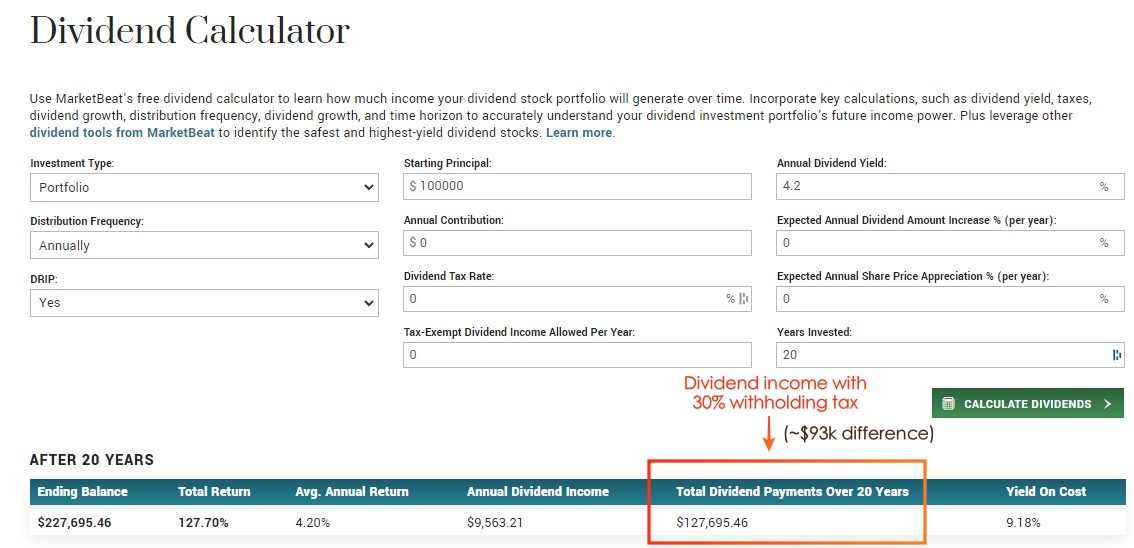

For foreign investors that invest in US-domiciled ETFs such as SCHD, there is a dividend withholding tax (WHT) for dividend payouts. As an example, there is a 30% dividend WHT for investors from Malaysia and Singapore.

Example: 3.5% dividend yield – 30% WHT = 2.45%

Personally, while this is not ideal, I still find SCHD’s solid track record of increasing dividend payout outweighs the dividend withholding tax factor. It is the only US-domiciled dividend ETF that I wouldn’t mind investing in.

LEARN MORE: A guide to Dividend Withholding Tax (WHT) - all you need to know!

Who should invest in SCHD

SCHD is a dividend ETF with a solid track record of growing dividends, while providing respectable growth opportunities at the same time.

In my opinion, SCHD would fit well with:

- Long-term investors (>10 years of time horizon) looking to invest for a steady & reliable stream of dividend income.

- Dividend investors with portfolios in Malaysia and/or Singapore stocks and are looking for diversified & stable exposure to the US stock market.

How to invest in SCHD?

Investing in SCHD is easy as there are many brokers that offer access to the US stock market.

Malaysian investors can consider Rakuten Trade, a regulated broker in Malaysia that offers access to the US stock market.

READ MORE: Rakuten Trade US Stock Trading Review

🎁 Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

No Money Lah’s Verdict

So, how do you like SCHD?

As a dividend investor with about 15 – 20 year time horizon, I think SCHD is a gem thanks to its track record of increasing dividends (even more so in a challenging 2022!).

I hope this review has been helpful!

If you like to learn more about dividend investing, I am excited to share that my ultimate guide to dividend investing is coming REAL soon! Sign up HERE to be the first to know when it is ready and enjoy extra perks & discounts!

Disclaimers

Any of the information above is produced with my own best effort and research.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

15 Career & Life Lessons I Learned as a Self-Employed Blogger for 5 Years

No Money Lah turns 5 this year!

If you were to tell me that someone you know is making a living running a blog many years ago, I’d be rolling my eyes in front of you.

In fact, this was what actually happened when my mom told me about the son of her colleague that makes his living through blogging.

“This is absurd. Is it sustainable? Why not go get a proper job?”

But fast forward to the present: I’ve been self-employed running my blog, No Money Lah for close to 5 years, writing all things personal finance and investing.

In this post, I want to share some reflections on the career & life lessons that I’ve learned in the past 5 years.

I hope you find this a good read as much as it is a good reflection for me!

p.s. If you like what you read, consider subscribing to my free weekly newsletter as I will cover more quality content on personal finance and investing!

p.

How are you doing?

“Can you make money blogging?”

When it comes to making a living, I consider myself very fortunate & lucky as I actually managed to make a relatively okay (not a lot, but OK) living out of my blogging income.

That said, the first 2 years of my self-employed journey were challenging.

I left my first full-time job which paid me RM4.5k/month. I wasn’t able to earn much from blogging (I wasn’t even sure how). I had to become a part-time table tennis coach on the side to supplement my income.

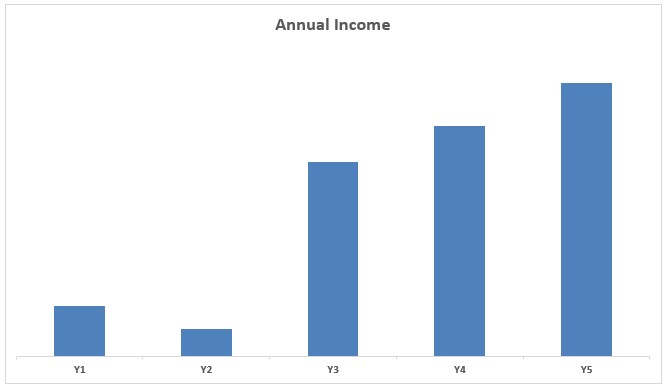

But with time, with strokes of luck, and by actually staying long enough in the game (+ learning along the way), breakthroughs & opportunities finally came in my 3rd year:

So, for friends that are curious, I am doing alright. Not wealth-breaking, but good enough for me to sustain my investment and savings routine while having extra left to spend on people and things that matter to me in life.

Now, on to the lessons that I’ve learned (and still learning) in the past 5 years:

On business & career

- Instead of tell, show. If you are good at something, show the world your work instead of spending time telling people how good you are. Most can talk, few can execute.

- Pursue curiosity, not passion. The ability to be intrigued and curious is what makes life interesting. Screw finding your passion – start with what makes you curious. What are some problems in your life that you are intrigued to solve?

- Don’t be shy, show your work (and progress). Your first few projects will suck and it is alright. No one gets it perfect at the start. One B+ article is always better than the A+ idea that stays in your head. (reminder to self)

- Be a specialist – you win nothing when you try to get everyone as your customer.

- Ethics above everything else. Be honest + transparent upfront. Be clear on what you can or cannot deliver.

- Good read: Linchpin by Seth Godin.

On falling behind in life

- Define your self-worth or the society (eg. Instagram, friends & colleagues, bosses, family members) will do it for you.

- What we see on social media is the curated version of people’s lives, not the whole of them. The more you want your life to resemble what others are showing on social media, the more miserable you are in real life.

- When overwhelmed, spend less time on social media. The mental peace you gain from a social media diet is massive.

- It’s never about catching up in life because there is nothing to catch up on. It’s about finding peace with where you are now, and the thrill of pursuing your full potential as a person. Changing how we look at life is so important.

On money & wealth

- Can you be happy with less? The ability to find satisfaction in simple, little things in life is a superpower to sustainable happiness that many do not have.

- Having the foresight to plan ahead in life is crucial. From buying your first car, planning for a family & kids, aging parents, and your own retirement, to unexpected incidents such as retrenchment – there are so many expenses in life that’d catch you off guard if you are not prepared ahead.

- One of the worst feelings in life is to be at the mercy of others. The best feeling in life is knowing that you have choices. Proper financial planning can give you both dignity and freedom in life.

- The biggest measure of wealth is not having luxury cars or watches. It is the ability to do what you want, when you want, with who you want, for as long as you want. It is the highest dividend money pays.

- Good read: The Psychology of Money by Morgan Housel.

On time & priority

- Time is more precious than money. We all know this, but isn’t it crazy how we think twice (and thrice) when people try to borrow money from us, yet be so generous when people ask us for ’10 minutes of our time’? Definitely something to ponder about.

- When we say ‘Yes’ to someone's agenda, we closed up the doors to something else. Likewise, when we say ‘No’, we opened up the doors for us to explore something else. Set your priorities right in life (eg. family, health, career, relationship, etc) so you have a clearer guide on what to and what not to dedicate time to.

- Good read: Atomic Habits by James Clear

On the biggest challenges that I face

- With everything written above, let me be clear that I am still internalizing these lessons and I still mess up every now and then.

- (Bad) Routine & Habit: In my self-employed journey, I find it the hardest to maintain a disciplined routine. I still find it difficult to sleep early at night which always causes me to become unproductive in the morning. I don’t like my overreliance on binging Youtube as an escape whenever I am stressed or faced with problems at work.

- Feeling guilty for not working: As a self-employed, I always feel guilty whenever I am not spending time on work. Ironically, I get burnout a lot whenever I overwork and this causes my productivity to go down as I use Youtube as an escape during work.

No Money Lah’s Verdict

So there you have it – the lessons I learned & the challenges that I face in my self-employed journey.

I hope you find this post helpful as I did while reflecting on my journey!

If you like what you read, consider subscribing to my free weekly newsletter as I will cover more things on personal finance and investing!

p.

My will-writing experience in Malaysia

So, I’ve decided to create my own will at 28.

The idea of dying is a scary one – but it’s the only certain thing in life.

In this post, let’s explore will writing in Malaysia:

How does a will work? Is will-writing complicated? How much does it cost? What do you need to know while looking to create your own will?

Let’s find out!

p

Useful terms used in will-writing:

- Estate: Property and assets of a person after he/she passes away

- Executor: The person that you appoint legally to execute your will

What is a will?

A will is a legal document where you decide what happens to your assets (or ‘estate’) once you pass away.

Essentially, through a will, you get to legally appoint someone as an executor of your will to ensure that your assets go to the appropriate people.

“Haiya, I don’t own a lot of things so I do not need a will.”

“I am still young so I do not need a will yet.”

Regardless of how many assets you own or your age, a will is still an important document to own. This makes sure that your assets get distributed smoothly to the people you care for after you pass away.

In Malaysia, there are 2 types of will: Wasiat for Muslims and Will for non-Muslims. For this post, I will focus namely on my research and personal experience on will-writing as a non-Muslim. Feel free to find out more about Wasiat HERE.

Why I write my will at 28 (+ when you should write a will)

From the surface (or from movies & dramas), writing a will seems to be done by the super-rich people with a lot to pass down.

In fact, writing a will is such a taboo in Asian families. I recalled a story where my grandparents (when my grandfather was still alive) were actually angry when the topic of will-writing is being raised in the family.

Ironically, writing a will isn't so much for the people that write it. It's for the people that they care - where they do not have to go through sh*t in order to distribute the assets of the deceased (more on this in the next section).

Personally, I am by no means super rich. But I am lucky to have accumulated some assets from my working years so far.

Hence, it's only responsible that I have my own will so my family does not need to go through the trouble (mentally + legally) to get my assets if I die one day.

So, when should you write a will?

Just like investment & retirement planning, writing a will is part of personal finance. It is an aspect that you should not ignore - not for yourself, but for the people that you care for.

As such, the best time to write a will is when you start to own assets like cash, stocks, properties, business, and so on.

More so, you should seriously consider creating a will if you have a family that depends on you.

Why is a will important? (+ what if we die without a will)

A will is important because it acts as a legal document that determines how your assets get distributed.

Without a will, a combination of all of the scenarios may happen after your demise:

#1 Family members fighting over the inheritance of your assets

A legal will help avoid any potential family feuds or drama upon your demise.

#2 You don’t get to decide on the inheritance of your assets

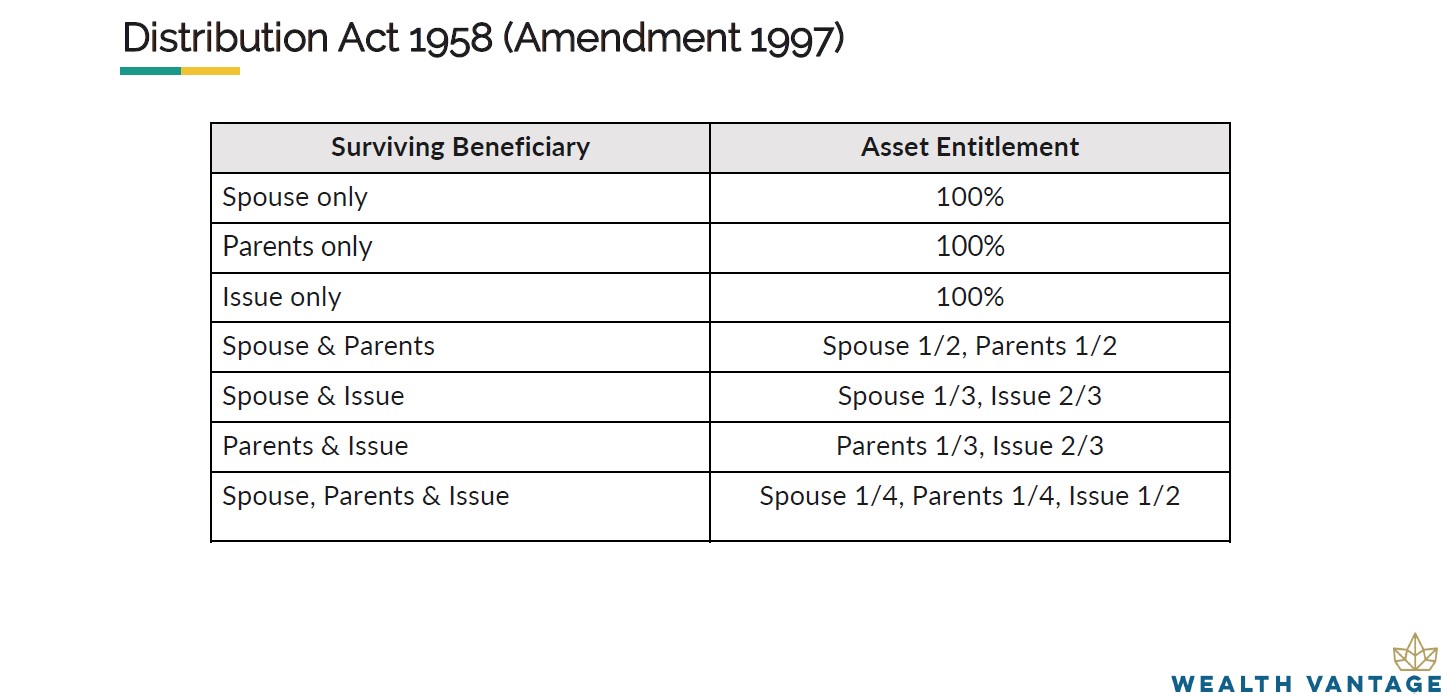

If you die without a will, your assets will be distributed according to the Distribution Act 1958 (refer to the table below). This means you will never get a say on how your assets get distributed.

#3 It will take a LONG time for your assets to be distributed to the people you care

Without a will, it may take years for your assets to be distributed due to all the additional legal procedures involved. This will be a problem especially if you are the breadwinner of your family and your dependents are not able to access your assets.

Where to write a will?

Method #1: Write a will on your own for free (not recommended)

You do not need special qualifications to write a legally-binding will on your own.

The Malaysian Wills Act 1959 has very simple requirements for a legal will. Namely, it must be signed by you and two witnesses who cannot be beneficiaries. However, unless you have extremely simple wishes, it may not be easy to clearly list all the ways you may want to distribute your assets.

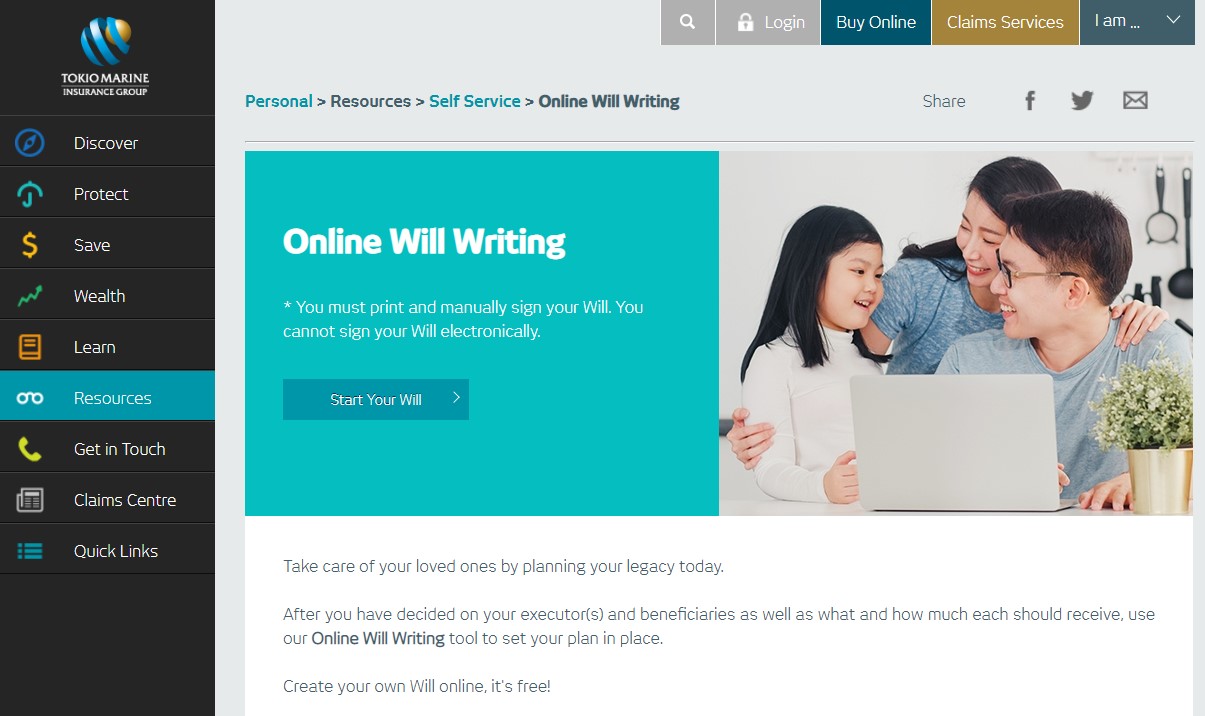

You can also write a will for free via the templates provided on sites such as Tokio Marine. Again, this is more suited if you have a very simple requirement.

Also, bear in mind the legal technicalities that your executor will need to go through to execute your will. In addition, this method does not provide you with the facility to store your will.

Method #2: Write your will via will-writing services

Will can also be created via will writing services. This is a good choice if you plan to create a more detailed will. Many will-writing companies will also guide you through the will-writing process.

In addition, will-writing services usually come with the option to appoint a professional will executor and custody to secure your will at additional charges.

Examples of will writing services in Malaysia are:

- Rockwills

- Maybank Trustee Berhad

- CIMB Trustee Berhad

- Amanah Raya Trustee

To be honest, I have no idea which will-writing service is the best for my needs. Price is one consideration, but the quality of service is also crucial. Hence, I moved on to Method #3 when I plan to write my will.

Method #3: Will writing guidance from Personal Financial Planner

With so many will-writing services available, which is the best for you? How can you create a will that meets your needs, yet fulfills your budget?

If you need non-bias guidance in estate planning (including will writing), engaging a financial planner can be highly helpful.

Personally, I've gotten guidance from my financial planner from WealthVantage Advisory, Stev when it comes to creating my will. The benefits of creating my will with the guidance of my financial planner include:

- Unlike agents, financial planners are not attached to a single will-writing company. Hence, they can help clients to search for the most suitable will-writing service that best serves the needs of clients.

- Financial planners are also licensed in estate planning, which includes will-writing. This means they have all the knowledge to guide clients through the will creation process.

- Since my financial planner, Stev, has been working with me on all aspects of my finances, he’ll have a clearer idea of my financial situation (eg. My goals, assets, liabilities). This makes it much easier for us to work on the will creation.

Through Stev’s guidance, I’ve decided to create my will via Rockwills.

We are in the midst of getting my will done so I'll update this article as it goes!

[FREE PERK] Get a FREE financial consultation session today and see how a financial planner can add value to your financial journey - including will-writing! Scroll till the end of this article for more info!

Will-writing process (UPDATED: My overall experience now that I am done!)

In this section, let's explore the step-by-step process of will creation. Under the Wills Act in Malaysia, anyone with the basic requirement below can write a valid will:

- At least 18 years old at the time of writing the will.

- In a sound mind.

- A will that is produced in writing and signed.

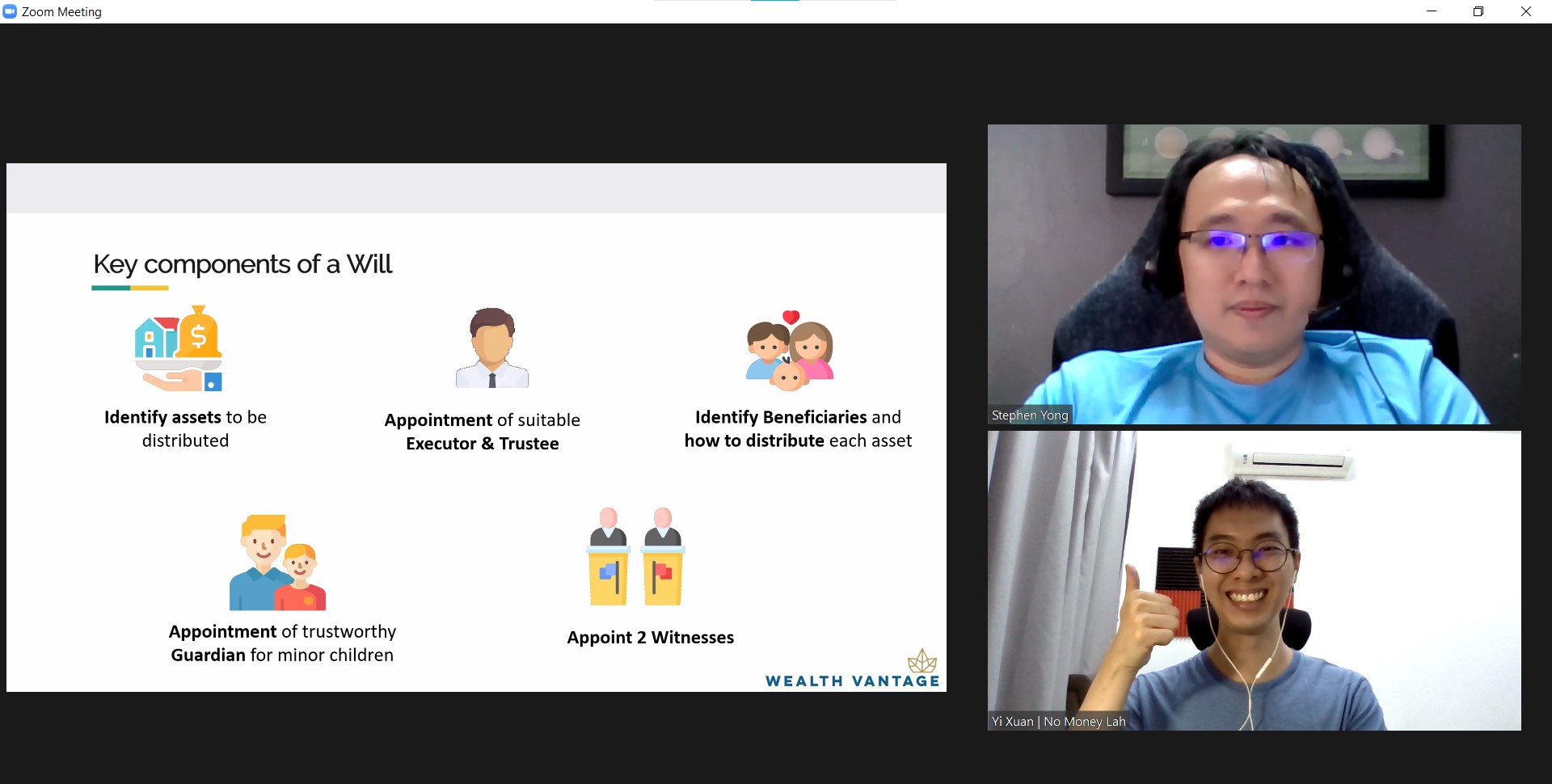

Step 1: Identify assets to be distributed and your beneficiaries

Firstly, identify the assets that you own. Assets can be things like:

- Movable assets: money, stocks, PRS, and EPF.

- Immovable assets: properties or land.

- Alternate assets like cryptocurrencies.

In the meantime, you should also consider how you wish for the assets to be distributed. Identify your beneficiaries and collect their names & IC numbers.

[Side note] Since cryptocurrencies like Bitcoin don’t leave a trail, it is best to include instructions on how to access them in your will.

Step 2: Appoint your executor

Next, appoint a legal executor of your will. An executor’s role is to make sure that your will is carried out accordingly.

An executor is anyone that is 18 years old or older. You can appoint up to 4 executors, though that is not necessary.

Specifically, an executor will need to:

- Identify and locate your will

- Apply for grant of probate from the court. When a person is granted the grant of probate, he/she is legally allowed to administer your assets upon your death.

- Identify the list of your assets.

- Pay off any of your debts/liabilities & taxes.

- Distribute assets as per your will

Throughout this process, your executor will also take the role of a trustee. Essentially, a trustee is responsible to hold your assets (and keeping a proper record & account of them) on behalf of your beneficiaries until the distribution is completed.

Good to consider:

Now that you understand the role of an executor, it might not be a good choice to appoint your family members or best friend as an executor.

Why?

Because dealing with the work of an executor is a real burden when you consider that the people close to you would be grieving when you pass away. Furthermore, the work can be complex, and not everyone has such expertise to handle the tasks.

As such, it might be a better choice to appoint a professional executor from a will-writing company (eg. Rockwills) as they have the expertise needed to deal with the workload of an executor.

[Side Note] For completion’s sake, an executor can also be the beneficiary of your will. However, as mentioned above, it might not be a good choice to appoint someone close to you as an executor due to emotional and expertise reasons.

Step 3: Appointment of guardian

If you have children under 18, you will have to appoint a guardian for them. This person will take care of your children in the unfortunate event that both you can your spouse pass away until they turn 21 years old.

If you don’t appoint a guardian, it will be up to the court to name someone that they think is appropriate.

Step 4: Create your will + Appoint 2 witnesses

Now that you gathered all the information needed, you can proceed to create your will through online will-writing services or a trust company (eg. Rockwills).

If you engage a financial planner like myself, they will provide you with an unbiased opinion on which will-writing company to go with.

Once your will is created, you will have to sign the will in the presence of 2 witnesses. A witness must be anyone 18 years old and above who is NOT your spouse or beneficiary.

[Side Note] From my understanding, due to the pandemic, this process of will-signing with witnesses around does not need to happen in a physical setting and it can happen virtually.

Step 5: Keep your will in a safe place

That it! Now that your will is created and signed, keep your will in a safe and secured place. Also, you should let your appointed executor know where you place the will.

Normally, if you go with any will-writing services (eg. Rockwills, Maybank Trustee), you'll be given the option to store your will safely under the custody of the company. I'd recommend doing so, as you'll ensure that your will is safe from being damaged or tampered.

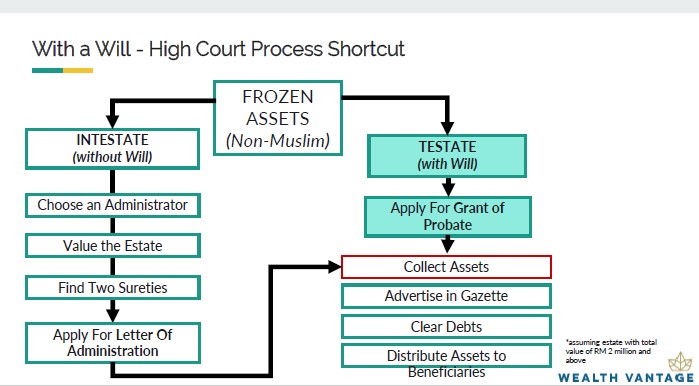

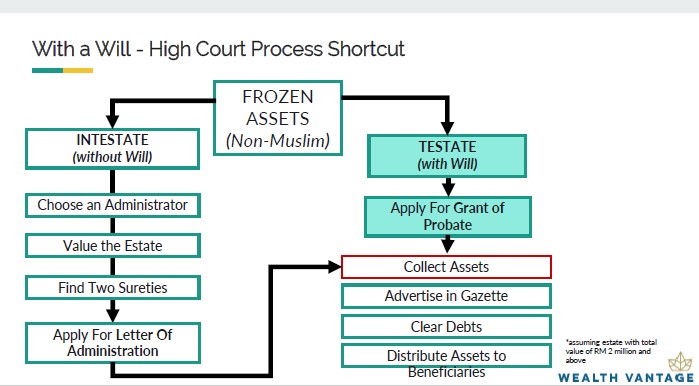

What happens after you die with a legal will?

Curious about how a will is executed in the event of your death? Here’s how:

When you pass away, your assets will be frozen. With a legal will, the executor of the will then has to go on with the following steps:

- Identify and locate your will

- Apply for a grant of probate from the court. When a person is granted the grant of probate, he/she is legally allowed to administer the assets of the deceased. This is the key to speeding up the process of asset distribution to your beneficiaries.

- Identify the list of your assets.

- Advertise in Gazette (ie. Posting on newspaper/social media)

- Pay off any of your debts/liabilities & taxes.

- Distribute assets as per your will

As you can see, if you die without a will, there will be no legal executor to apply for grant of probate. This results in a long and tedious process in an effort to get your assets distributed.

The cost of writing a will (UPDATED: How much did I spend?)

There is no one fixed cost for will-writing as everyone's needs/wishes are different.

Below are a few elements that go into the cost of will-writing. Do note that this is a rough estimation based on my observation – please refer to the respective source for the most accurate pricing:

Cost #1: Creating a will

Creating a will is free if you use platforms like Tokio Marine or write your own will.

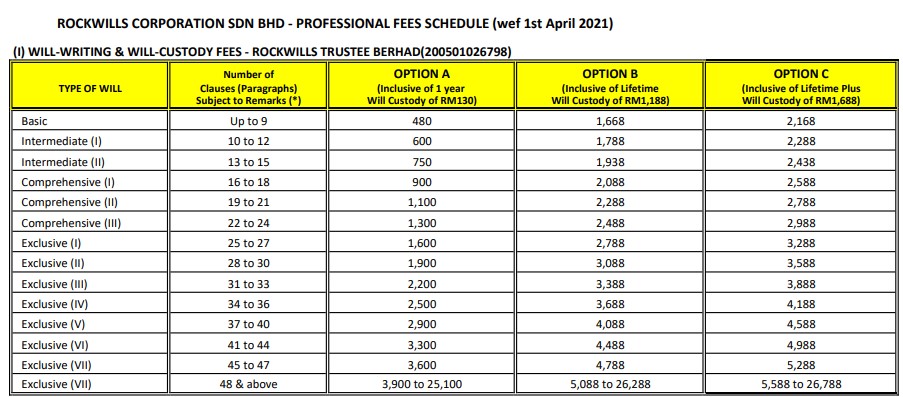

That said, I'd highly recommend that you consider going with will-writing services. Price usually starts at RM300+ via will-writing services depending on the number of clauses. Rockwills, for example, starts with a basic 9 clauses package. Then, the more clauses you have, the higher the cost.

Cost #2: Custody service to store a will

You can certainly skip this cost by keeping your will in a place where you feel safe (from being damaged or tampered).

Otherwise, will-writing services like Rockwills and Maybank Trustee would normally offer lifetime custody of your will at about RM900 – RM1000+.

Cost #3: Appointment of a professional will executor

You are free to select anyone as an executor.

However, due to the complex legal work that an executor needs to do, I'd highly recommend going with professional executors like the ones offered directly by will-writing companies.

Usually, it's a one-time payment, starting from RM100+.

How much did I spend?

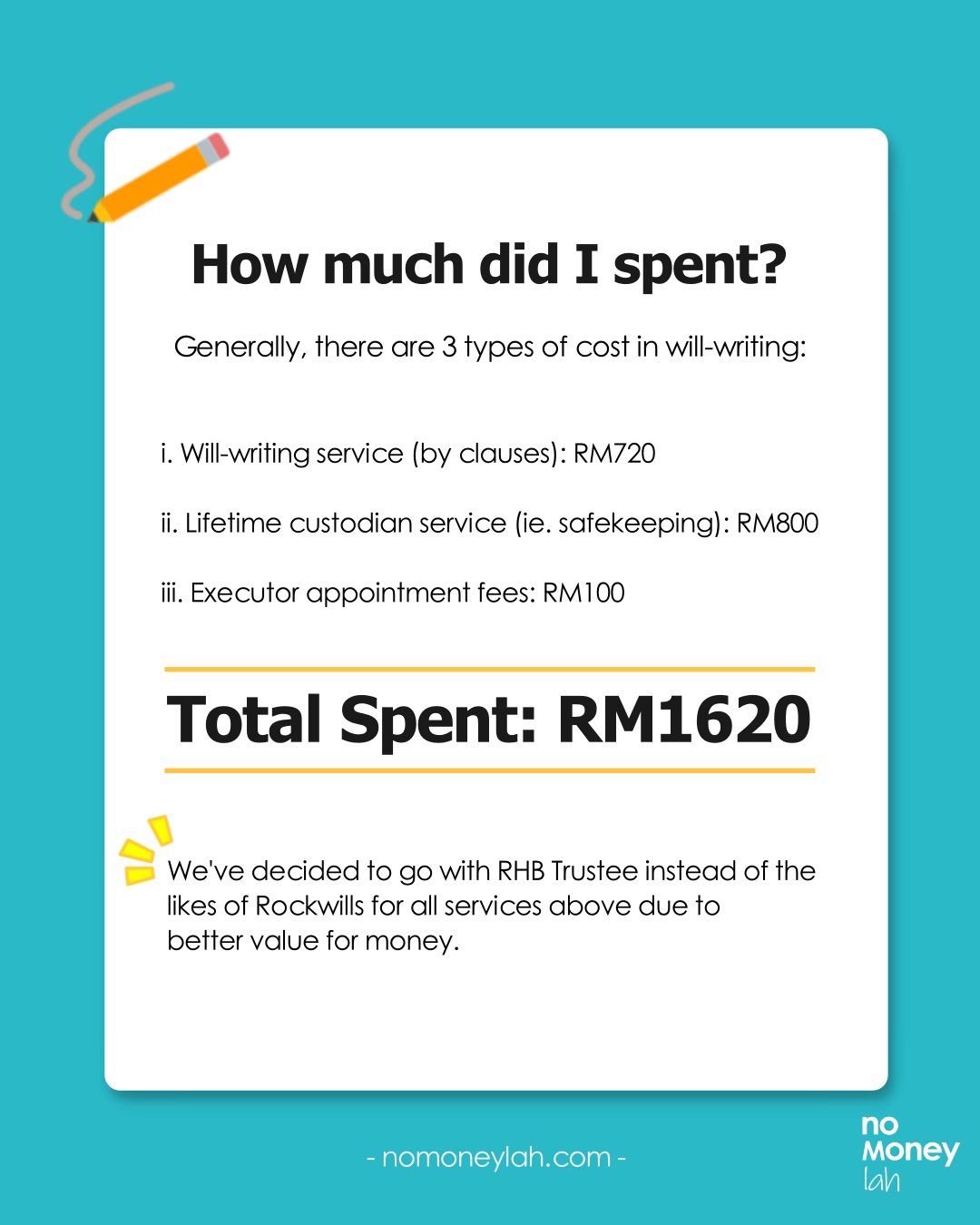

After taking into account all the costs above, I spent a total of RM1620 for my will.

Me and my financial planner, Stev decided to go with RHB Trustee instead of the likes of Rockwills due to better value for money.

Will-writing FAQs

Where should I keep my will?

Will-writing services would usually offer additional custody service for your will at an additional charge.

Otherwise, you should look for a safe place to store your will – make sure to let your executor knows where you are placing your will!

Can I change the details/clauses of my will?

Yes, you can change the details of your will anytime. That said, if you use will-writing service, there is usually a charge depending on how many clauses you are changing within the will.

Can a will become invalid?

You can revoke your own will whenever you wish. A will is revoked/become invalid when:

- A new will is written, whereas the old will is going to be revoked automatically.

- Alternatively, you can revoke a will without writing a new one by making a written statement in the presence of 2 witnesses.

- Marriage or remarriage. Divorce does not automatically revoke a will.

- A will is physically destroyed by you with the intent to revoke it. Do note that accidental destruction by a third party will not revoke a will.

- A non-Muslim who converts to Islam, his/her will becomes invalid. Reason being, estate distribution will automatically follow the Faraid distribution method.

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

Personal finance is a huge topic. It includes investment, savings & retirement, insurance, and yes, estate planning like will-writing.

If you are planning to get guidance in all aspects of your personal finance, this is for you:

I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

Sign Up for Your FREE Consultation Session Here!

Disclaimers

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

Recession & Layoffs: 6 Personal finance strategies for 2023

2022 has thus far been challenging and we are beginning to feel the pinch.

So, I’m sure you have seen news of massive layoffs from Shopee lately.

In fact, retrenchments (or at least a slowdown in hiring) is now happening globally as companies look to cut cost in this uncertain time.

Companies like Shopify, Robinhood, and Snap have reduced their workforce by at least 10% in the past few months.

In this post, let's explore 6 personal finance strategies that I think we should be prepared/mindful of in this uncertain time.

Are we good? What can we do to prepare?

Personally, I am inclined to believe that most Malaysians are still financially sound – judging from the car sales figure from Proton.

However, I think the risk of more retrenchments coming in Q4 2022 & 2023 is getting higher as time goes by.

Question is, what can we do to prepare?

Play strong defense

#1 Have an emergency fund

Stash up cash to weather through at least 6 to 12 months of period without income.

Personally, I'd recommend putting your cash in very low-risk money market funds such as Versa Cash, KDI Save, or StashAway Simple. They offer interest on par with Fixed Deposit (FD), yet the flexibility to deposit & withdraw anytime without penalty - perfect in case of unexpected incidents.

#2 Protect your cashflow

Food for thought - Protecting your cashflow comes not from your current employment, but from knowing that you have the skills to make a living regardless of where you go.

Now’s a good time to reassess your edge in the workforce.

#3 Keep expenses low

With interest rate hikes not stopping anytime soon, it is crucial to keep our commitments (loans, debts) & expenses manageable.

This means taking into account of potential interest rate hikes + chances of short-term unemployment before taking up additional commitments.

Be aggressive (once your defenses are built)

#4 Invest

If you have extra gunpowder (ie. Cash), now’s a good time to start accumulating quality assets.

Since the stock market tends to rise with time, I’m decently confident that we’ll all reap the reward as a long-term investor.

I genuinely think that this is the time of our generation – be sure not to miss it!

LEARN MORE: What is S&P500 & how to invest in it?

#5 Start a project/business

Got a project or business idea that you always wanted to try?

You have nothing to lose if you begin – lay the foundation now, survive this challenging period, and watch it flourish with time.

#6 Learn/upskill

Never a bad thing to improve and equip ourselves with new skills, right?

Finding your edge in the workforce in challenging times

What is edge?

I think there is a misperception that having a Professional paper/Masters/PHD means one has an advantage over the others, and hence deserves higher pay.

The thing is, it is never about your academic qualifications. It is about how much VALUE you can bring to the table by having these qualifications.

Especially in challenging times, this USUALLY refers to how you can bring in more opportunities and/or profits to the team.

Let’s consider the paragraph above as we reflect on our role and contributions to our team & organization.

Highly recommendation books

3 books I’d highly recommend from our discussion today:

-

Linchpin by Seth Godin

A book talking about how to become indispensable in your career.

-

So Good They Can’t Ignore You by Cal Newport

A book on the mindsets and approaches to building a great career.

-

The 4-Hour Workweek by Tim Ferriss

A book that’ll change your perspective on conventional employment and career path.

No Money Lah’s Verdict

With the outlook becoming more uncertain with time, I think it is crucial for us to always be financially prepared for unexpected bumps in the months to come.

I am of the firm belief that every crisis offers us a chance to become a better person – be it in our career or finances.

We just need to prepare ahead.

As always, I hope you enjoy the read and if you have any questions, I am just a comment or email away!

Disclaimers

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

[Sponsored] 14 Dividend Investing Terms You Need to Know as an Investor!

Dividends offer a great way to build passive income from investing. Given time and the compounding effect, dividends can grow exponentially.

In this post, let me go through the key dividend-related terms/jargon!

p

#1 Dividend

Dividends are essentially a way that companies distribute their earnings to their shareholders.

By doing so, dividend creates a way for shareholders to receive income from their investments. In other words, as an investor, you receive a profit split from the company that you invest in via dividends.

That said, it is not compulsory for most companies to pay dividends.

Certain companies, especially growth-focused companies (eg. Tesla) may prefer to re-invest the profits to grow the business rather than paying them out to investors as dividends.

For consistent dividends, investors may look for stocks and Real Estate Investment Trusts (REITs) with a consistent dividend payout history, or dividend-focused Exchange-Traded Funds (ETFs).

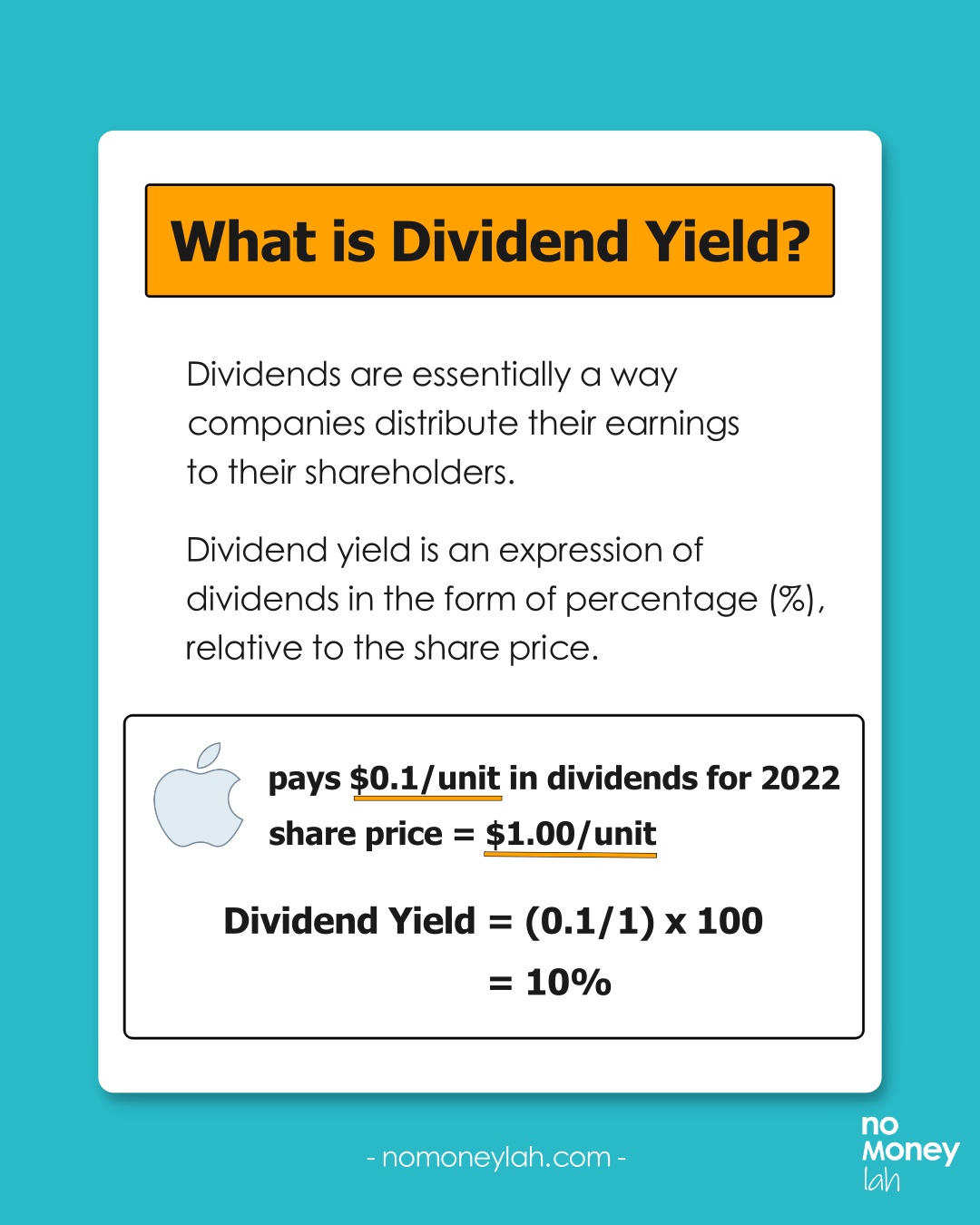

#2 Dividend yield (DY)

Dividend yield is an expression of dividends in the form of percentage (%), relative to the share price.

The calculation for dividend yield is as below:

Dividend Yield = (Annual Distribution Per Unit (DPU)/Price) x 100

Example calculation for dividend yield:

Company A pays a total DPU of $0.10 for 2022. Company A’s share price is $1.00 per unit.

As such, the dividend yield is 10%. [($0.1/$1) x 100]

Important:

Avoid investing in a company just because of its high dividend yield! Since DY is formulated by DPU divided by Price, a high DY may be due to a high DPU (generally good), and/or a drop in share price (mostly a bad thing).

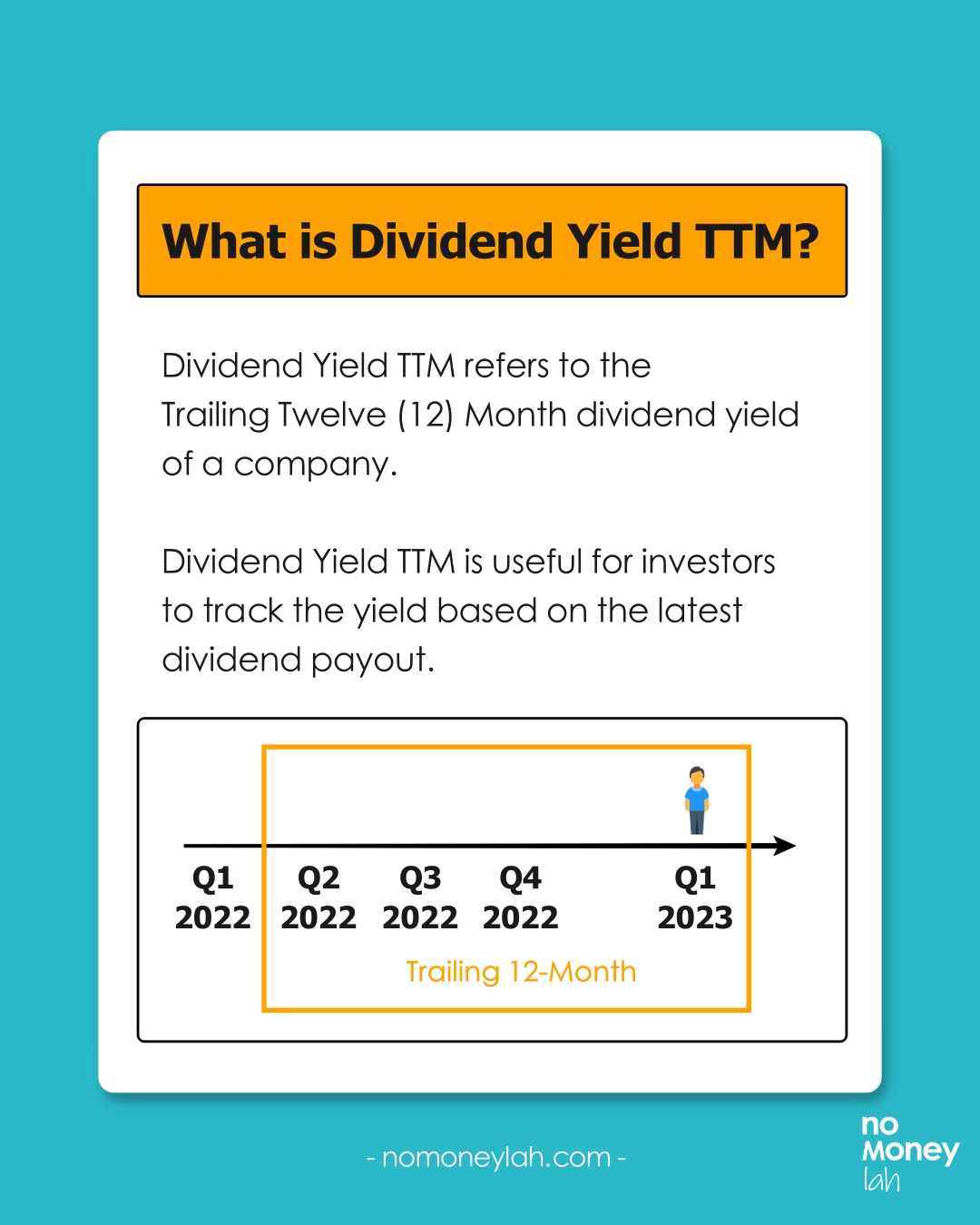

#3 Dividend yield TTM

Dividend yield TTM refers to the Trailing Twelve (12) Months' dividend yield of a company.

Dividend TTM is useful for investors to track the yield based on the latest dividend payout.

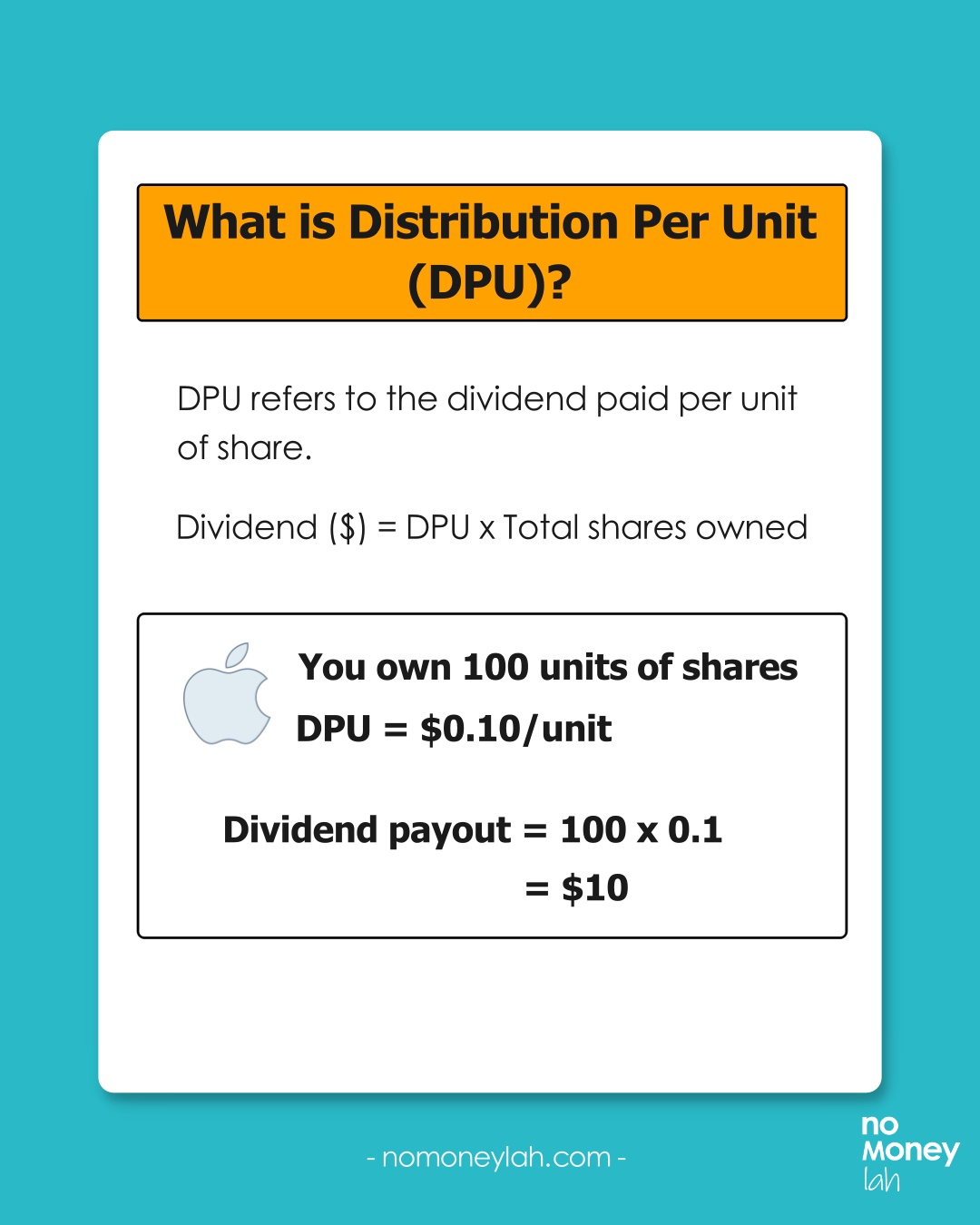

#4 Distribution per unit (DPU)/Distribution per share (DPS)

DPU, or DPS refers to the dividend paid per unit of share.

So, let’s say you have 100 units of Apple shares and Apple distributes a DPU of $0.1/unit. How much in dividends will you get?

The answer is $10 (100 units x $0.1).

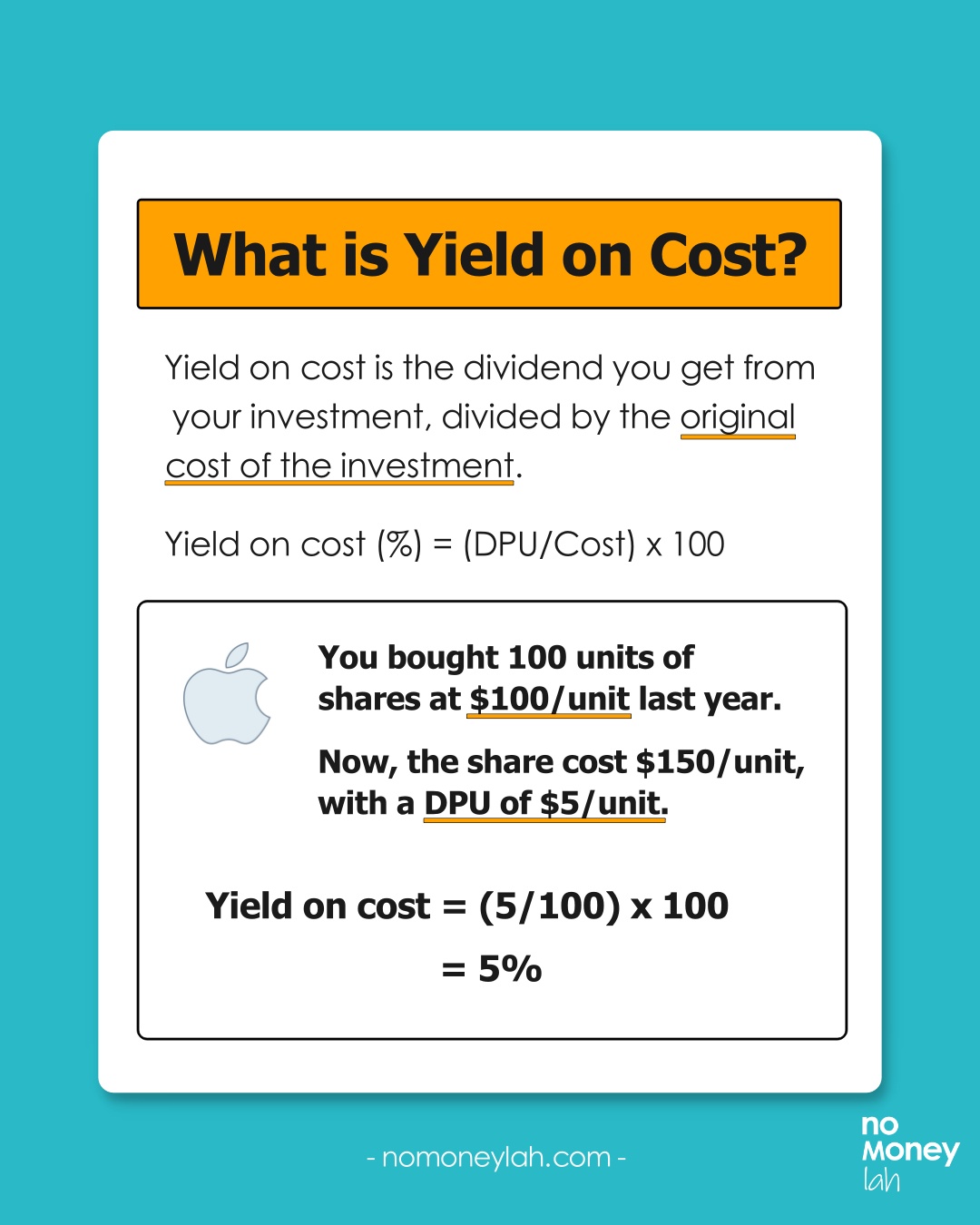

#5 Yield on cost

Yield on cost is the dividend you get from your investment, divided by the original cost of the investment.

Yield on cost = (Annual DPU/Cost of investment) x 100

As an example, you bought 100 units of Apple shares at $100/unit. Now, the share price is $150/unit and has a DPU of $5.

- What's the dividend yield? The dividend yield would be 3.33% ($5 dividend divided by the current $150/unit price).

- How about your yield on cost? In this case, the yield on cost would be $5 DPU divided by your original cost of $100/unit, 5% [($5/$100) x 100].

What if you bought additional shares in between?

Let’s say you bought another 100 units of shares at $120/unit, your cost basis would be:

- ((100 shares x $100) + (100 shares x $120))/200 shares = $110/unit (new cost basis)

Hence, the new yield on cost would be $5 divided by $110, or 4.55% [($5/$110) x 100].

#6 Dividend growth rate (DGR)

Dividend growth rate (DGR) refers to the growth in a dividend payout of a company over a period of time.

Let’s say Company X pays a DPU of $2 in 2021 and $3 in 2022. The DGR would be 50%. (($3 - $2)/$2) x 100).

What if you want to calculate DGR over multiple years (eg. 2018 to 2022)?

| Year | DPU | DGR |

| 2018 | $1.00 | - |

| 2019 | $1.20 | 20% |

| 2020 | $1.70 | 41.7% |

| 2021 | $2.00 | 17.6% |

| 2022 | $3.00 | 50% |

From the table above, there are 2 ways to calculate DGR from 2018 to 2022:

Method 1: Arithmetic Mean DGR

Arithmetic Mean DGR = (DGR1 + DGR2 + DGR3…+DGRn)/n

Arithmetic Mean DGR from 2018 to 2022: (20% + 41.7% + 17.6% + 50%)/4 = 32.33%

*n = Number of periods where dividend growth rates are provided

Method 2: Compounded DGR

Compounded DGR = [((DPUn/DPU0)^(1/n))-1] x 100

Compounded DGR from 2018 – 2022: [(($3/$1)^(1/5))-1] x 100 = 24.57%

*n = Number of years

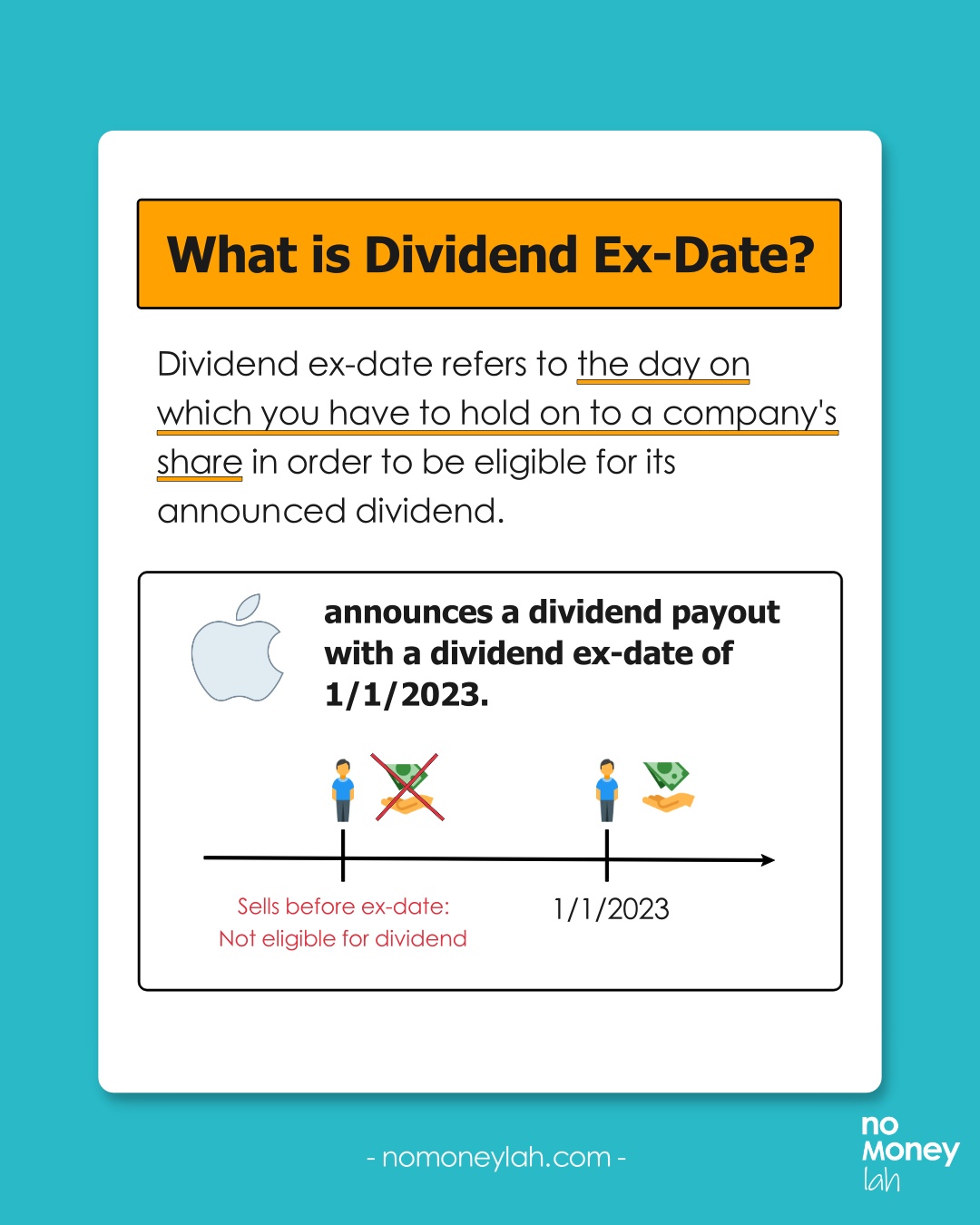

#7 Dividend growth streak