Tiger Brokers Review: Affordable & Reliable Way to Invest in the Singapore, US and Hong Kong Stock Market!

In this article, let's look at my review of Tiger Brokers, a broker that provides affordable access to foreign stock market, while having strong regulations in place.

As an investor, I have always been looking for the most affordable way to invest in the overseas stock market.

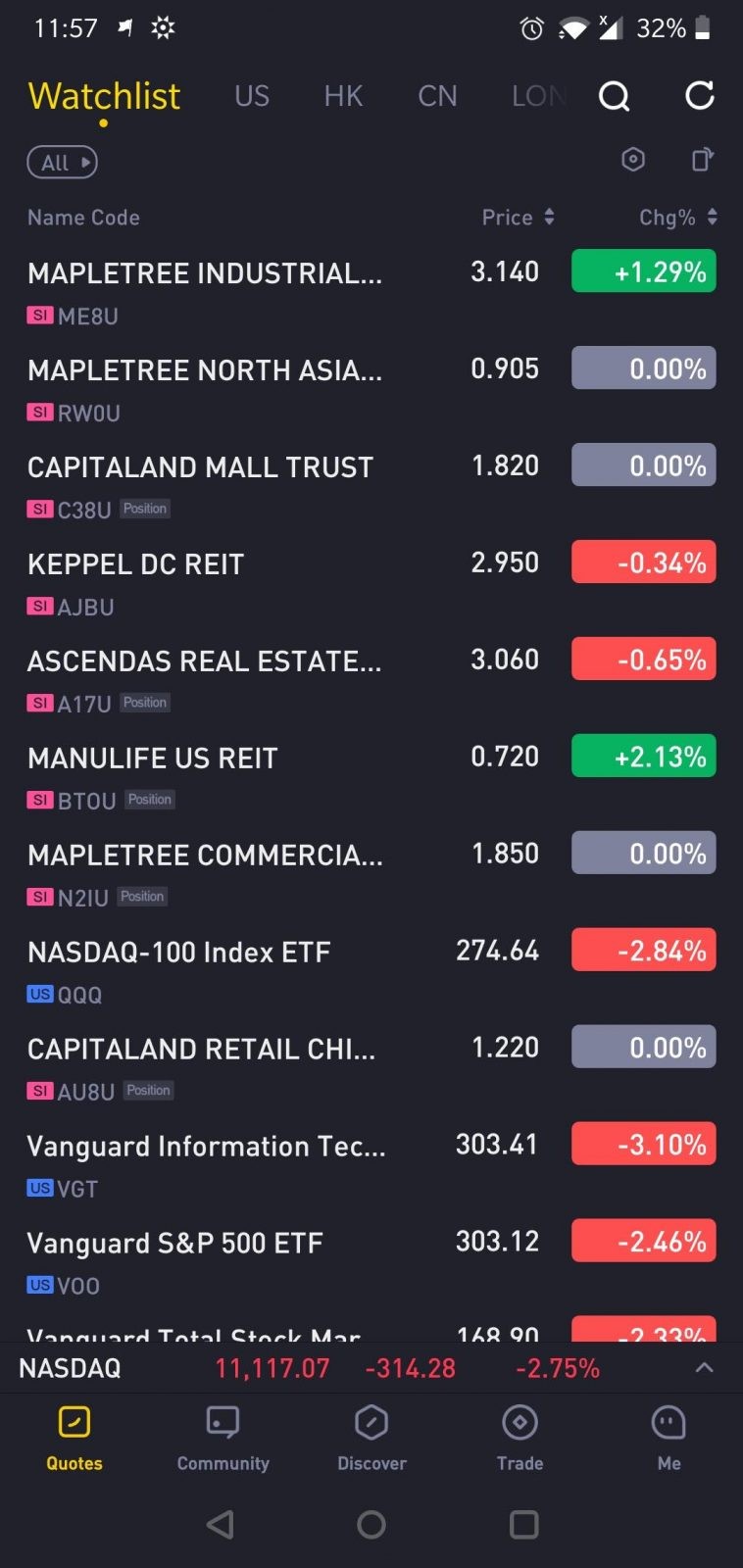

This is especially true for me as a Real Estate Investment Trust (REIT) enthusiast, as having affordable access to Singapore, Hong Kong and the US stock market will allow me to invest in many attractive REITs globally.

At the same time, I also have concerns about the regulatory issue of foreign brokers, which of course relates to the safety of my funds.

Tiger Brokers come in to fit my needs nicely. Here's my updated review of Tiger Brokers after using it for more than 2 years:

p

Tiger Brokers Highlights:

- Exposure to different markets & instruments with just one account. (Singapore, US, Hong Kong, Australia & China stock market, Futures, Warrants & Options)

- Highly competitive and attractive fees.

- 100% online account opening & management. No visit to the branch is required.

- Strong regulatory background + company is publicly listed on NASDAQ.

--

[PROMO] Commission-free trades + Free stocks!

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 - USD888

p

Open A Tiger Brokers Account Today!

Tiger Brokers Regulation – How is Your Money Protected?

Let’s address the main concern of most investors when it comes to choosing a foreign broker – is it regulated by a proper/respected authority?

When it comes to their operation in Southeast Asia, Tiger Brokers is regulated by the Monetary Authority of Singapore (MAS), with a Capital Markets Services License to operate a legal brokerage business. Globally, Tiger Brokers is also regulated by the respective authorities from the US (SEC), Australia (ASIC), and New Zealand (FSPR) as well.

In short, Tiger Brokers is a well-regulated broker by proper authorities and is definitely way better than the brokers registered in some random African countries.

In regard to money/capital protection, there is strict segregation of clients’ capital and assets apart from Tiger Brokers’ own capital:

- Clients’ Capital: Kept by DBS Commercial Bank

- Clients’ Investment Assets:

- Singapore Stocks: Held by DBS Custodian Bank

- US Stocks: Held by Interactive Brokers

- HK Stocks: Held by Interactive Broker

To summarize, Tiger Brokers is held by a high standard of regulations and accountability towards clients’ assets and capital. As such, I have no problem recommending Tiger Brokers to fellow investors looking to invest in foreign markets.

Tiger Brokers Fees/Commission Comparison – Amazing Value & Highly Competitive Fees

Ultimately, what landed me on Tiger Brokers is its highly competitive commission.

While there are local brokers that offer exposure to foreign markets, they are super expensive (high barrier of entry), and the fee details are rarely available on their official websites (not transparent at all). As someone looking to invest affordably in the Singapore, US, and Hong Kong market, Tiger Brokers is certainly worth considering.

Below is the commission comparison table of Tiger Brokers alongside some other equally regulated (by MAS of Singapore) alternatives:

|

2022 Fees charged by respective brokers* |

Tiger Brokers (SG) |

Moomoo (SG) |

POEMS Starter by Phillip Securities (SG) |

Maybank Global Investing (Malaysia)*** |

|

Singapore Market |

0.03%, or min. SGD1.00/trade |

0.06%, or min. SGD2.49/trade |

0.08%, or a minimum of SGD 10/trade**. (**No minimum charge until 31/12/2022) |

SGD25, or minimum 0.40%/trade – whichever is higher. |

|

US Market |

USD 0.005/share, or a minimum of USD 1.00/trade. |

USD 0.01/share, or a minimum of USD 1.99/trade. |

Flat USD 3.88/trade |

SGD25, or minimum 0.40%/trade – whichever is higher. |

|

Hong Kong Market |

0.03%, or a minimum of HKD 8/trade. |

0.03%, or a minimum of HKD 18/trade. |

0.08%, or a minimum of HKD 30/trade. |

N/A |

*Stated are fees charged by the brokers themselves. Please note that there are also additional (albeit minimal) fees charged by the respective exchanges in a transaction. (More details HERE) ***Based on my best research since I cannot find any official foreign stock fee structure from local brokers’ website. If you are interested, do approach your respective local brokers for more info.

Tiger Brokers Options Trading Pricing

In addition to stocks, Tiger Brokers also offers options trading at an affordable pricing of USD 0.65 per contract for US options!

Open A Tiger Brokers Account Today!

How to Open a Tiger Brokers Account?

a. Account Types

There are 2 types of trading accounts offered by Tiger Brokers, namely:

- Margin Account (eligibility: 21 – 65 y/o)

Margin Account supports margin trading and short selling (intraday leverage up to 4x; overnight leverage up to 2x).

- Cash Upfront Account (eligibility: 18 – 75 y/o)

Cash Account only allows trading stocks with cash. Margin trading and short selling are unavailable.

In short, you invest or trade with what you have deposited in your account.

If you are below 21 y/o currently, you can open a Cash Upfront Account first, then upgrade to a Margin Account once you reach 21, along with a full-time job.

p

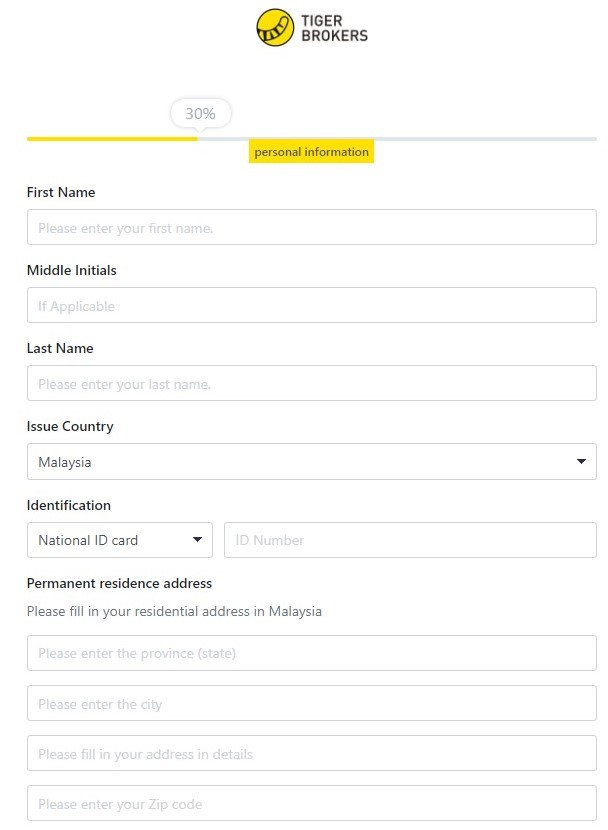

b. Account Opening Process

The account opening process does take some time, but it is simple & straightforward. Spare around 15 – 20 minutes to prepare the documents needed to smoothen your account-opening process.

If this is your first time opening a foreign brokerage account, I highly recommend you to follow the steps below – as I’ll explain some potential terms that you may not be familiar with:

Step 1: Prepare for the Documents/Details

- Nationality/Full Name/Current Residential Address/Citizenship/Date of Birth/IC Information

- Employer’s name and address

- Details of assets and income

- Investment objectives and experience

- Proof of Identity (IC/Passport)

- Proof of Residential Address (IC/Residential Estate Certification/Utility Bills - eg. Water/Phone Bill within the past 6 months, showing your full name & address)

- Bank Statement (issued within the past 6 months, showing your full name & address)

Step 2: Open a Tiger Brokers Account

Click HERE to use my Tiger Brokers referral link so you can enjoy account opening rewards!

When you click on the referral link, the rewards will be automatically applied and you can start your account opening process.

p

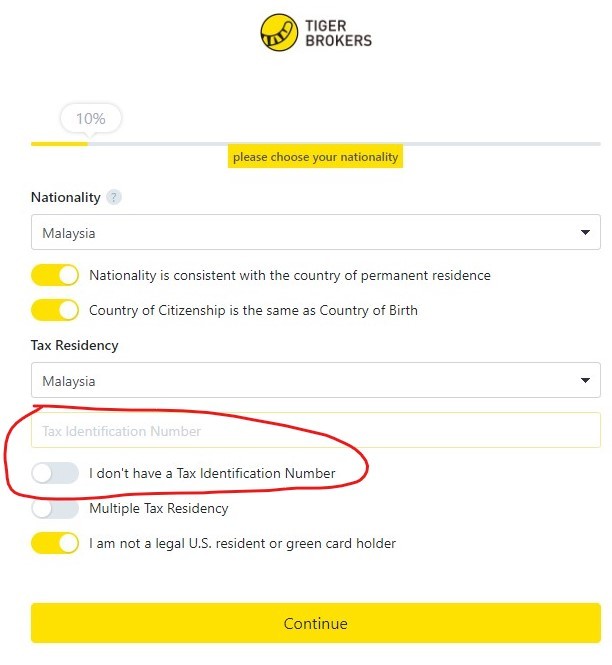

Step 3: Key in Your Nationality & Tax Residency Country.

Tax Identification Number (TIN) is your local tax number. If you are still studying, or do not have an account yet, just tick ‘I don’t have a TIN’ and state your reasoning.

p

Step 4: Key in Your Personal Info & Employment Details.

p

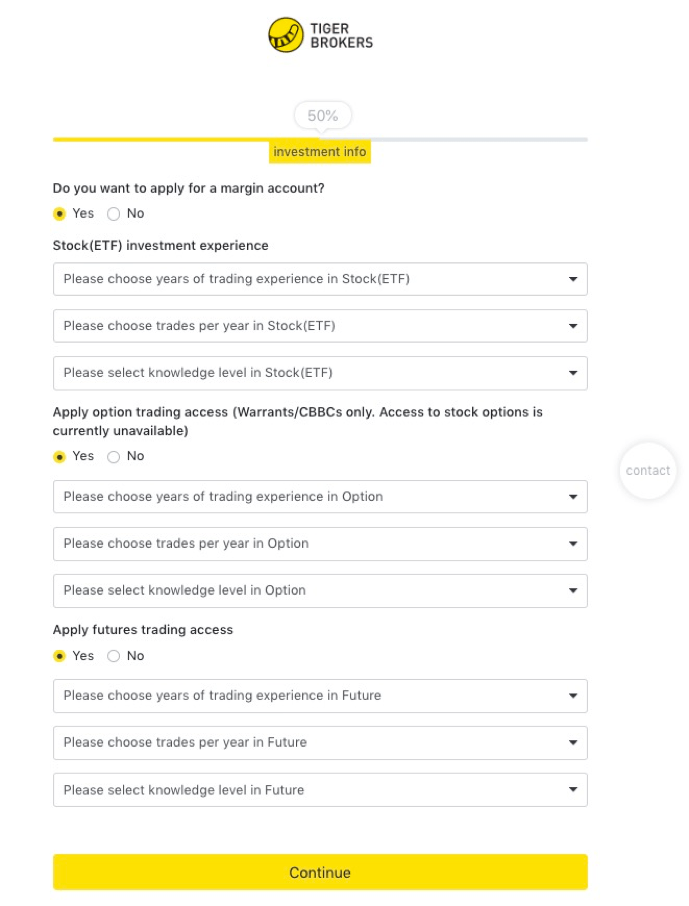

Step 5: Decide if you want to open a Margin Account or a Cash Account.

Also, decide if you need access to instruments like Futures and Warrants (p.s. just tick ‘No’ if you don’t know what these are).

p

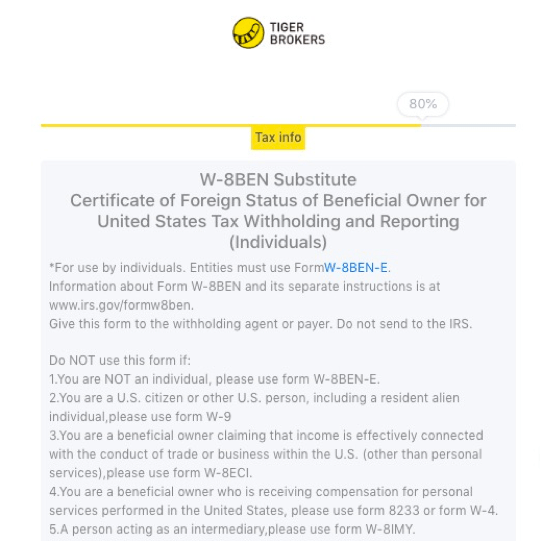

Step 6: Read and proceed after you agree to the conditions of the W8-Ben form*.

*What is W-8Ben form?

Filling in the W-8 Form is a requirement by the US Inland Revenue Service for account holders to declare that the beneficiary owner of the amount received from US sources is not of US origin. For clients who want to trade the U.S. markets, they will need to complete this form.

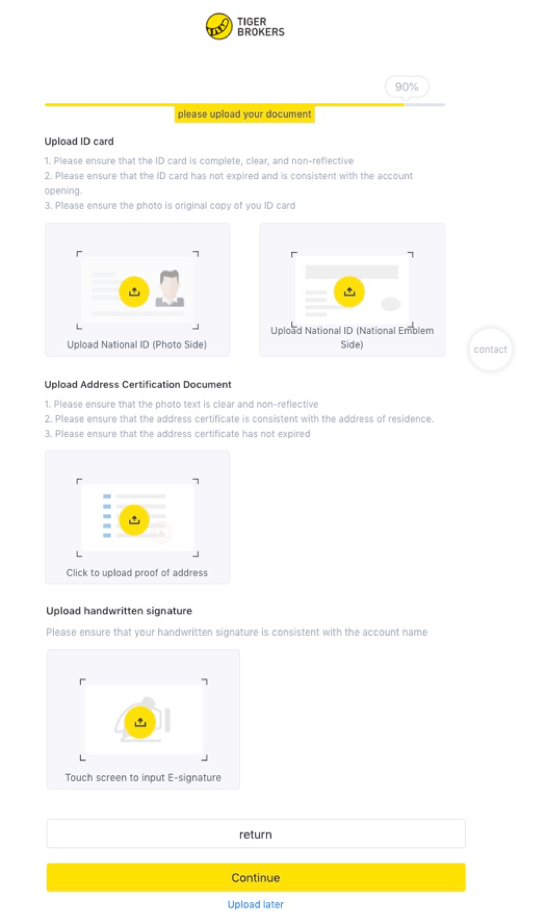

Step 7: Upload the necessary documents.

p

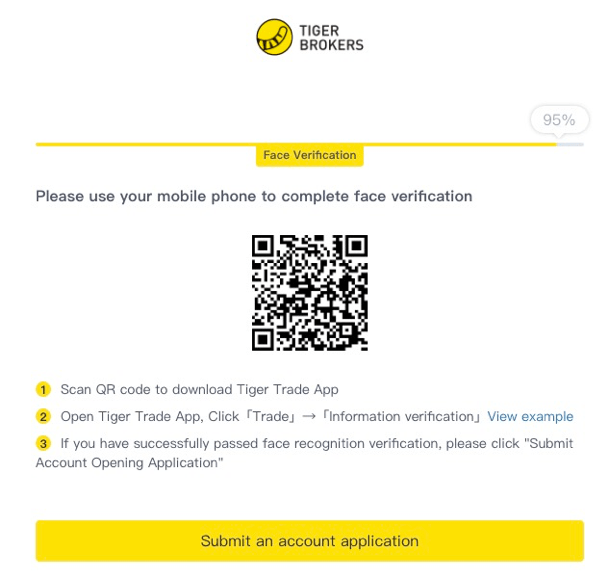

Step 8: Verify your identity by scanning your face. Follow the steps as shown below:

Step 9: You are done!

Generally, the account will be opened within 1 to 3 business days after the account opening application is submitted.

You will receive an SMS & email notification upon a successful account opening. Alternatively, you may log in to Tiger Brokers' official website to check your account opening status.

How to Fund Your Tiger Brokers Account

After your account is approved and opened, the next thing that you’d want to do is to fund your account. There are 2 main ways for you to fund your Tiger Brokers account:

Method 1 (recommended): Funding Tiger Brokers via a Singapore Bank Account (CIMB SG)

The first, and my recommended way to fund your Tiger Brokers account is through a Singapore bank account.

The deposit experience is fast, and you'll also save on the expensive intermediary banking fees (SGD20/USD30) that incur when you use FTT via a Malaysia bank account.

Check out my detailed guide on:

- How to open a Singapore bank account online

p - How to fund your Tiger Brokers account via a Singapore bank account

The whole process may take some time but trust me, the savings are going to be worth it.

Method 2: Funding Tiger Brokers via Foreign Telegraphic Transfer (FTT) through Malaysia banks

In the following section, I'll show you how to fund your Tiger Brokers account via FTT through local banks. That said, I do not recommend this method due to expensive intermediary banking fees (SGD20/USD30) per transfer.

If this is your first time, the process may be a little intimidating for you so I’ve created a step-by-step for you below:

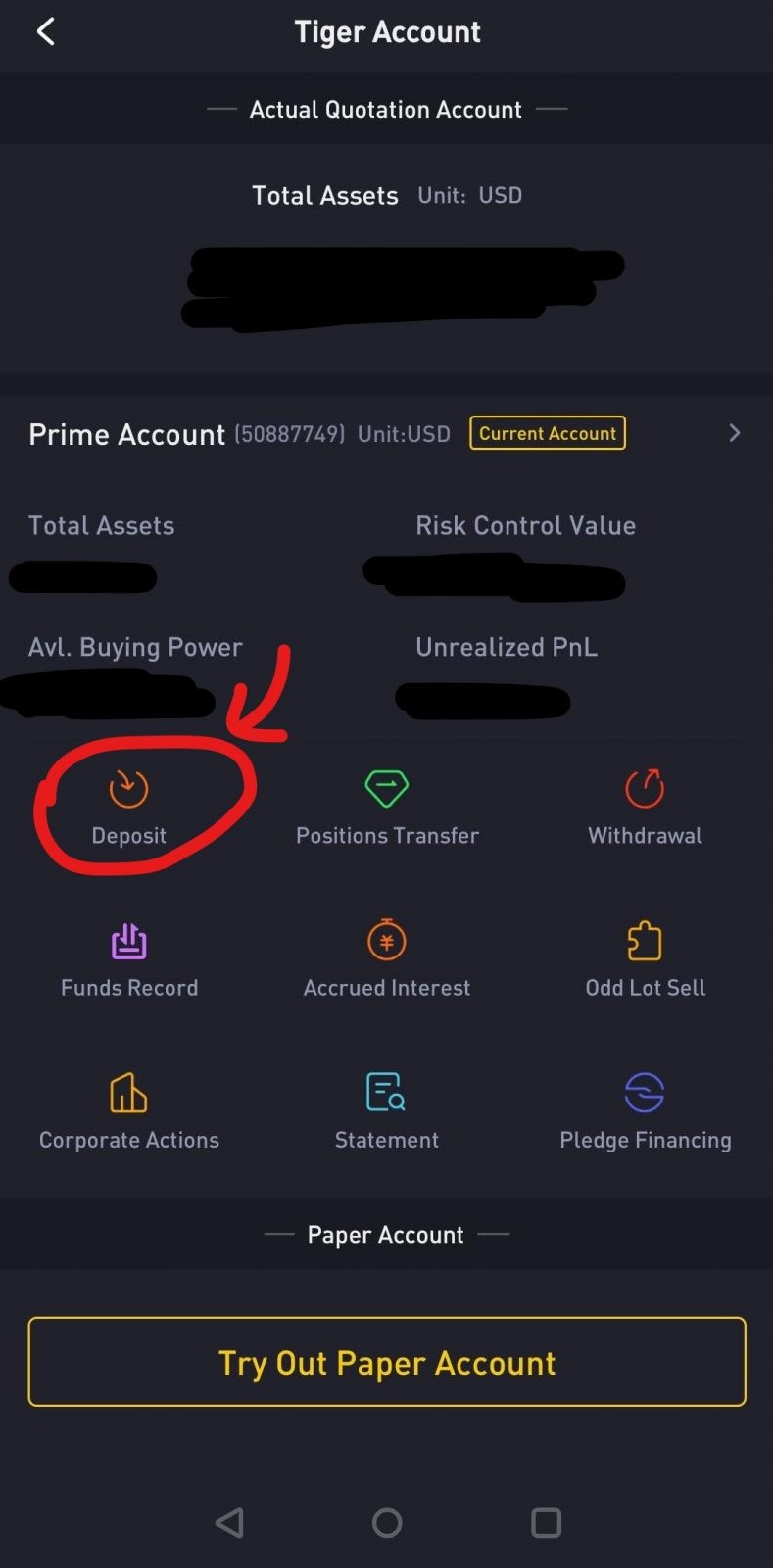

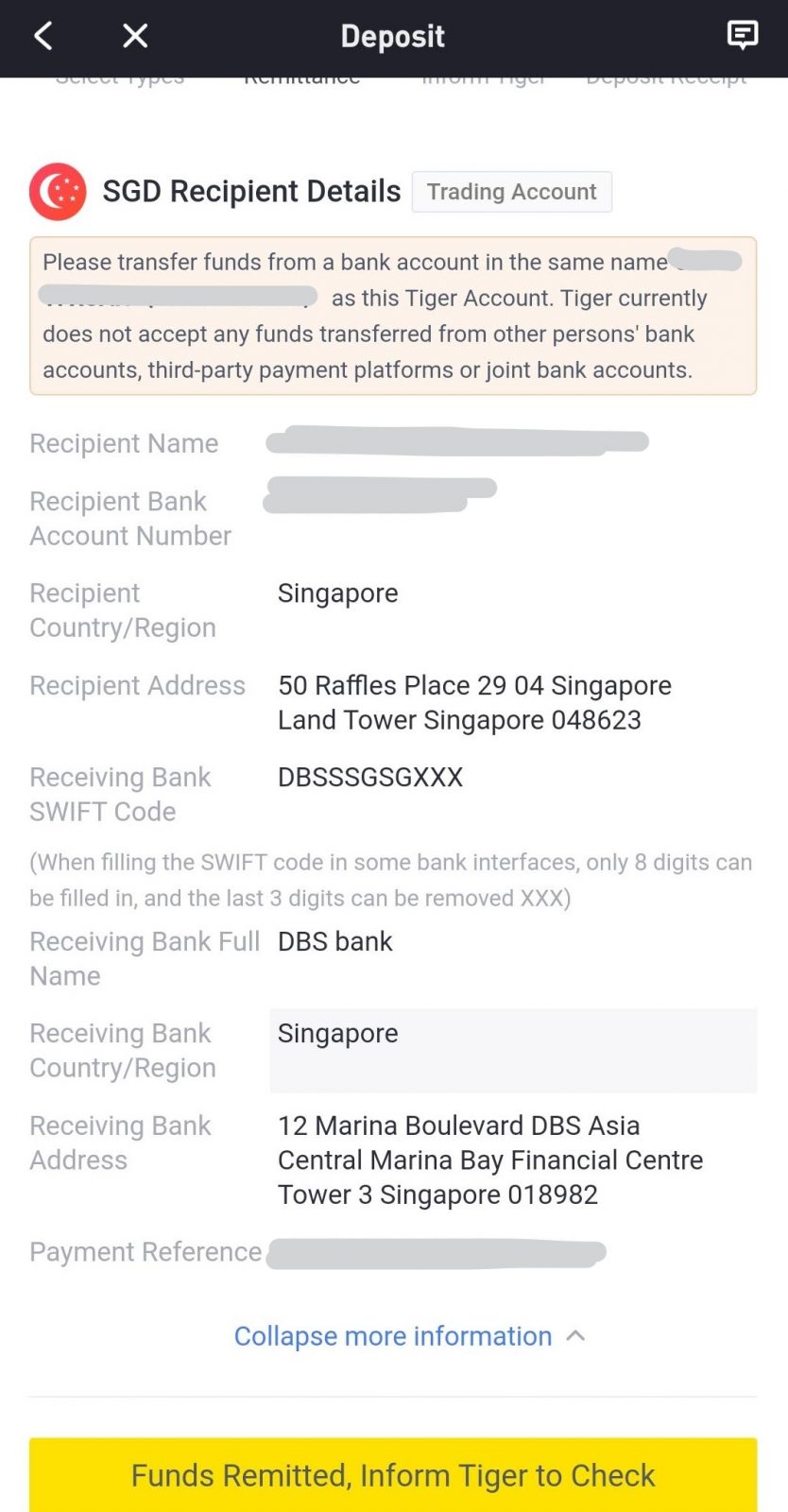

Step 1: Open your Tiger Brokers app

Step 2: Select ‘Me’ at the bottom right corner > Tiger Account

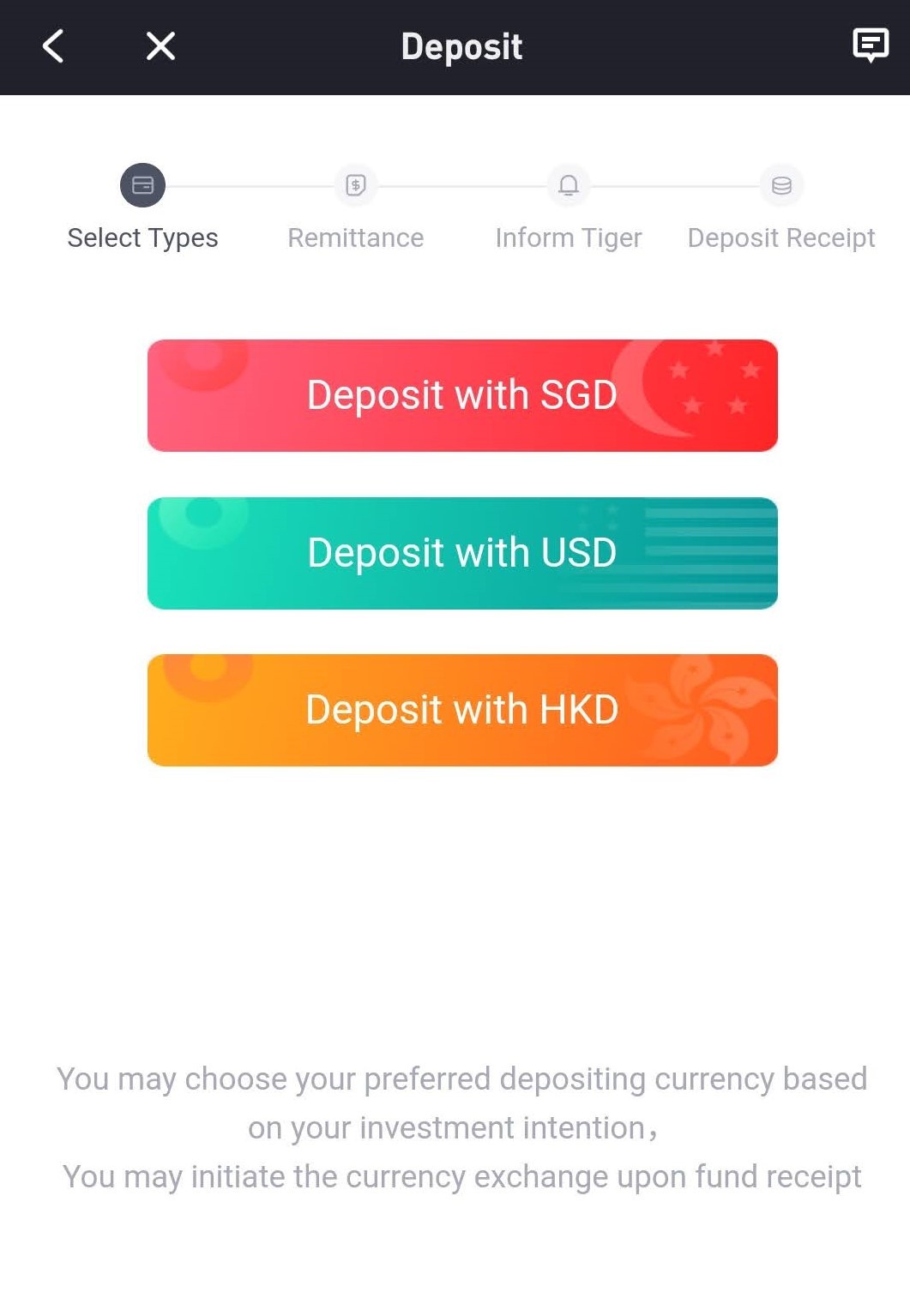

Step 3: Select ‘Deposit’

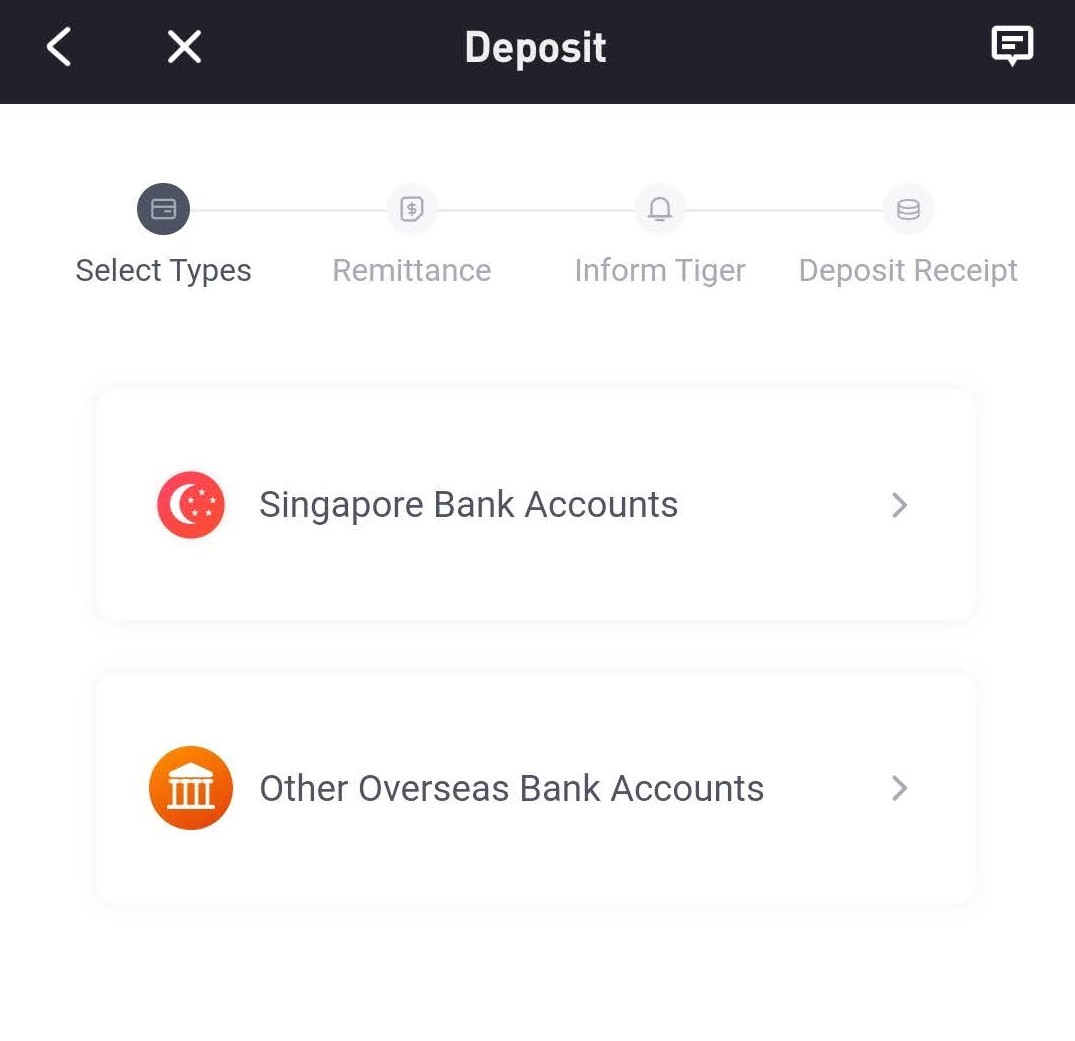

Step 4: Select to deposit in the currency of your choice (SGD/USD/HKD).

Step 5: Select ‘Other Overseas Bank Accounts’

Step 5: Select ‘Other Overseas Bank Accounts’

Step 6: You’ll be shown the remittance/transfer details.

Remember to key in the payment reference correctly when you do your transfer in Step 7!

Step 7: Do the remittance from your bank via FTT.

A standard FTT fee will be charged for every FTT transfer. Aside from that, there are 2 things to take note of:

- Generally, the transfer will take between 1 – 3 days but from my experience, it only took several hours for my deposit to reflect in my Tiger Brokers account.

p - For all these FTT transfers, Tiger Brokers do not charge for the whole funding process. However, our banks’ appointed intermediary bank will be charging a clearance fee (varies according to banks). For me (Maybank FTT), it is SGD20 for SGD transfers and $30 for USD transfers.

In short, the total cost for my FTT transfer via Maybank is (1) Standard FTT fee + (2) SGD20 (SGD transfer)/$30 (USD transfer). Again, this is NOT a fee from Tiger Brokers but it's a clearance fee charged by the banks.

As you can see, this is the reason why I do not recommend funding your Tiger Brokers account via local FTT. Instead, save on these fees by checking out my guide on how to fund your Tiger Brokers account through a Singapore bank account.

p

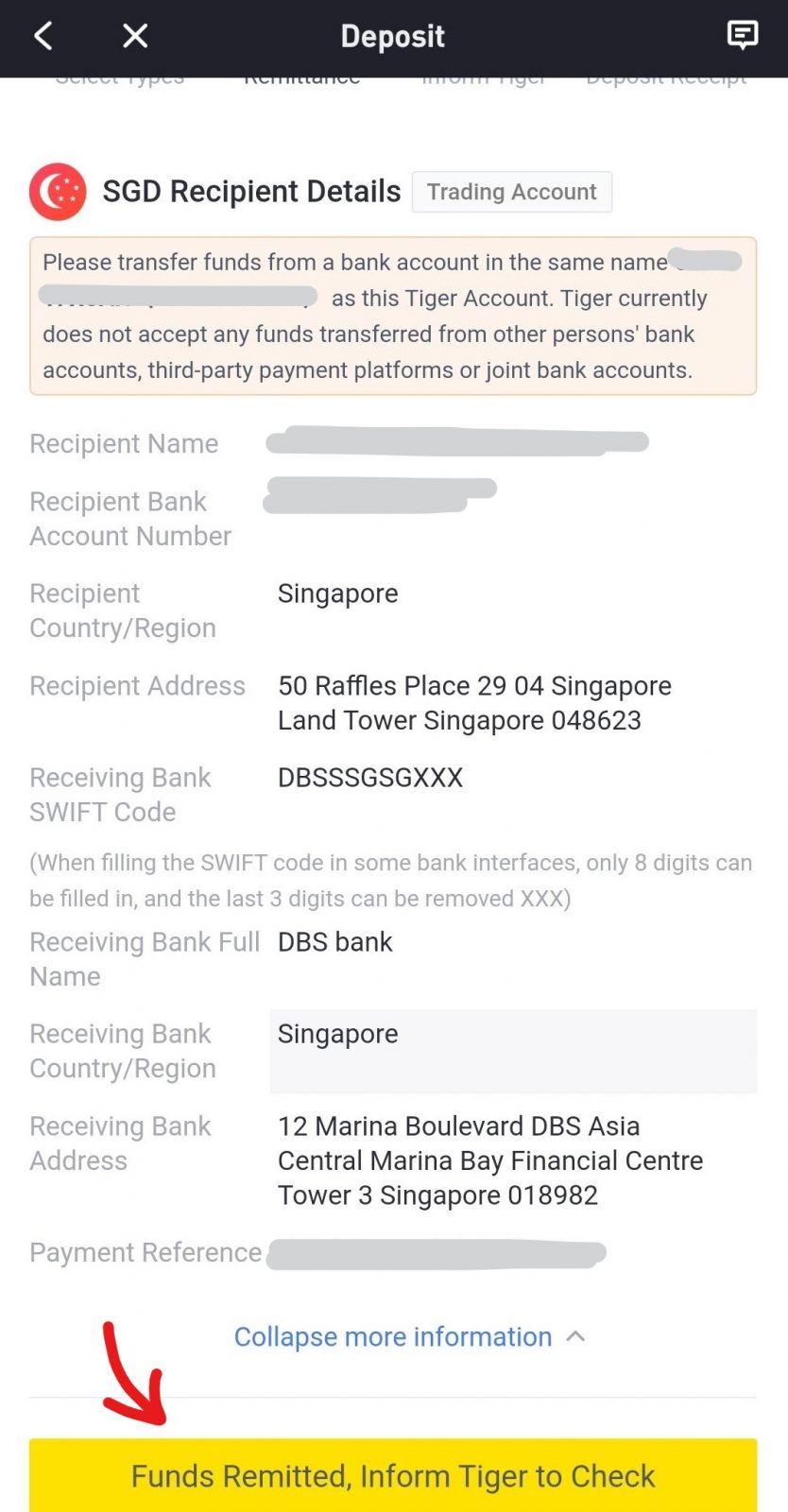

Step 8: Inform Tigers Broker to check for your deposit upon transfer + upload transfer receipt

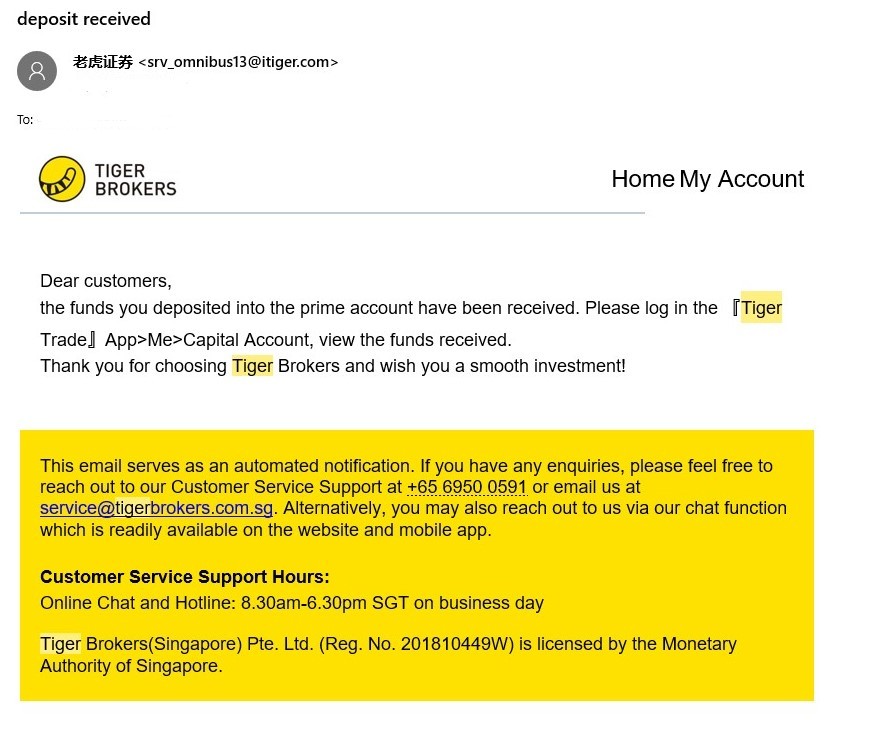

Step 9: You are done! You will receive an email once your deposit is accepted.

How to withdraw from Tiger Brokers

Personally, I'd recommend withdrawing your funds from Tiger Brokers via a Singapore bank account, for several key reasons:

- Direct withdrawal to a local bank (non-SG banks) will incur an expensive intermediary banking fee of around SGD35 (SGD withdrawal) or USD25 (USD withdrawal). In comparison, there are no fees on withdrawal to a Singapore bank account.

p - Direct withdrawal to a local bank (non-SG banks) can take about 1 - 3 days. On the other hand, withdrawal to a Singapore bank account (during business hours) can happen within the same day (though officially it mentions 1-3 business days).

Again, if this is your first time planning to open a foreign stock account, just know that these caveats (fees) on deposit & withdrawals apply to all foreign stock brokers, not just Tiger Brokers. That's why I highly recommend opening a Singapore bank account if you are planning to invest overseas.

READ: How to withdraw funds from Tiger Brokers to a Singapore bank account

Who Should Open a Tiger Brokers Account?

As a whole, Tiger Brokers offers investors exposure to various foreign markets at an affordable package, while retaining the much-needed regulatory aspects at the same time.

As such, Tiger Brokers is suitable for:

1. Investors with some experience in the local stock market, and are looking to diversify to (either/or) the Singapore, US, Hong Kong, China, and Australia market at an affordable rate.

2. Investors that are currently using expensive local brokers to invest overseas, and are looking for a more competitive rate to reduce investing cost.

3. Investors that are ready to invest in foreign markets and want their broker to be regulated by proper authorities.

My Tiger Brokers Experience + Things to Improve

Having used Tiger Brokers for almost 2 years now, my experience with them has been largely decent.

Execution of trades is smooth and fund transfers are also easy. That aside, I’d want to focus this discussion on 3 particular parts of Tiger Brokers: the mobile app, desktop app & customer support.

(a) Tiger Trade Mobile App

For the most part, I love the mobile app from Tiger Brokers. The interface is relatively simple and intuitive, and most of the functions you need are easy to navigate and find.

Personally, even as someone that does not execute trades on mobile apps (I still prefer web/desktop), I find the design language of the mobile app better than the desktop interface.

(b) Tiger Trade Desktop App

Personally, when it comes to execution, I still prefer to stick with the desktop/web app of my brokers.

That said, at first glance, Tiger Brokers' desktop app can be a tad more daunting than its mobile counterpart. This is because the layout tends to be more informative compared to the mobile app.

In other words, new investors may get overwhelmed at first. There is some learning curve involved, but it is definitely manageable – and you’ll come to appreciate the layout once you are familiar with how everything works.

(c) Customer Support

There are 2 ways to reach out for help to Tiger Brokers, namely via their hotline (tel:+65 6950 0591) or email support ([email protected]).

I have been using the email support service for inquiries many times (personal inquiries & also in preparation for this article), and the response time has been decent. Generally, most of my emails during working hours are responded to within an hour or 2, or else they’ll be replied to on the next day.

One thing that I hope could be improved though, is how they explain/clarify questions. There are instances where when I asked about a more technical issue/jargon, and was replied with a more expanded (not simplified) explanation.

With businesses going online nowadays, I think it is more important than ever for companies to invest in improving customer support, especially in understanding customers’ perspectives and providing simplified support to inquiries.

p

(d) Can't access or log in to your Tiger Brokers account/platform?

Lately, several readers have reached out to me with an issue where they are unable to log in to their Tiger Brokers account/platform.

Personally, I do not have this problem but I am made aware that this is an issue with selected internet providers (eg. Unifi) that randomly blocked out certain sites for no logical reasons.

To solve this problem, simply download a VPN application on your computer and phone (eg. Proton VPN, Windscribe, and many more). Then use the VPN software to connect to another country.

Once you have done that, accessing your account shouldn't be a problem anymore.

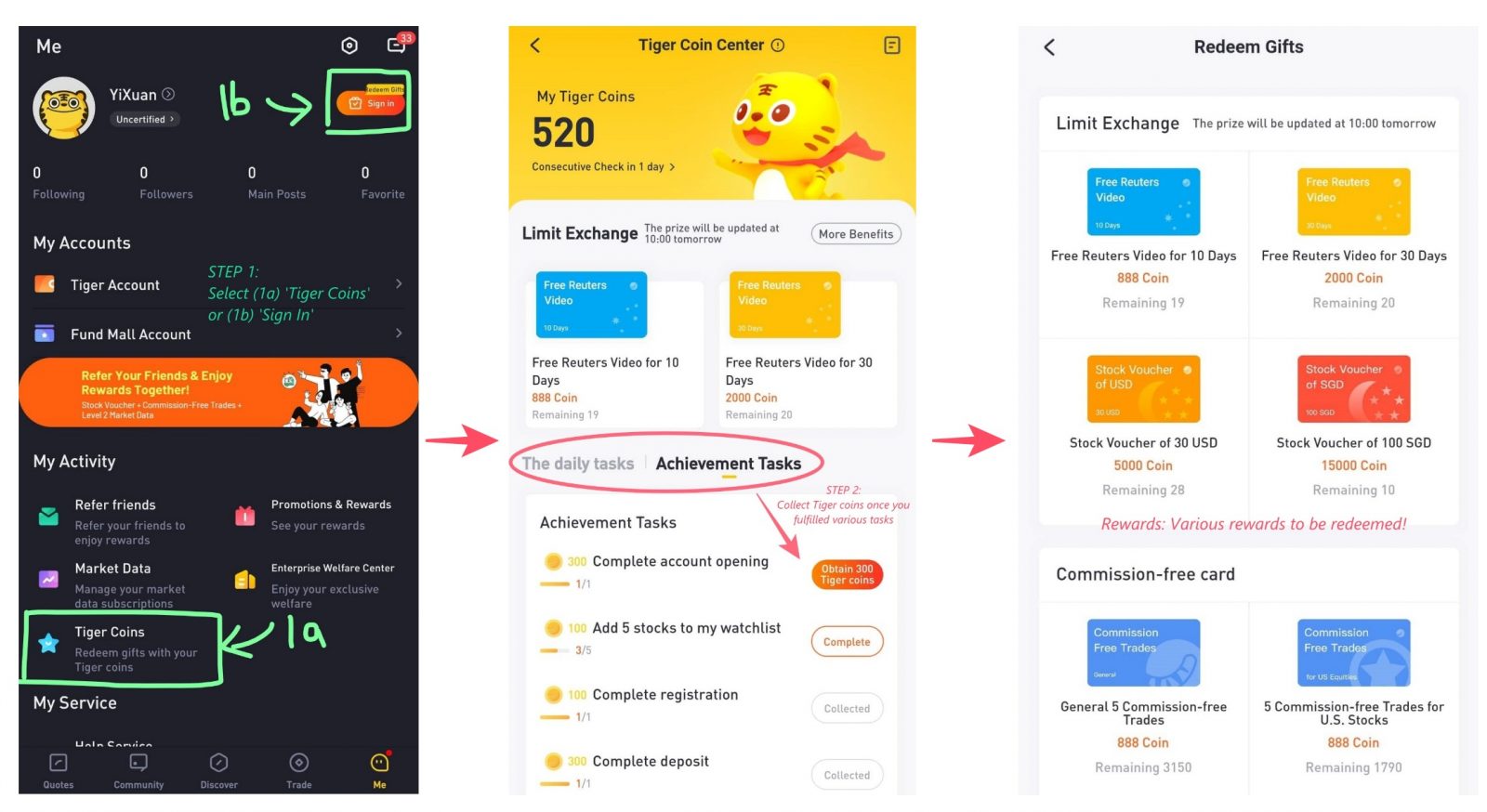

Tiger Coins - Tiger Brokers' Built-In Reward System

Tiger Brokers has recently launched its built-in reward system - Tiger Coins, where you can collect when you complete certain tasks.

With Tiger Coins, you can redeem attractive rewards from Stock Vouchers to commission-free trades!

No Money Lah’s Verdict

So here you go – my in-depth review of Tiger Brokers!

As someone looking to gain exposure in foreign markets, Tiger Brokers is truly a decent overall package that offers highly competitive fees with solid regulatory backing.

Having invested via Tiger Brokers for almost 2 years now, Tiger Brokers is my go-to broker for foreign stock investments and I have no problem recommending them to investors that is keen to gain foreign market exposures – all without paying expensive commissions.

If you have any questions on Tiger Brokers, feel free to leave a question in the comment section below! Constructive feedback are welcomed as well :)

Tiger Brokers Referral Link

Planning to open an account?

Click the button below to use my Tiger Brokers referral link, and get the following when you open a new account (promo ending on 15/4/2024)!

a. Account Opening Rewards:

- (i) Unlimited commission-free trades for HK, SG, and China A-Shares for 365 days.

- (ii) Unlimited commission-free trades for US stocks for 180 days.

b. Account Funding Reward (Initial Deposit of SGD300 or more):

- (i) USD10 of Apple fractional shares (NYSE: AAPL)

c. Account Funding Reward (Initial Deposit of SGD1,000 or more + execute 5 BUY trades):

- (i) USD30 of Apple fractional shares (NASDAQ: AAPL)

- (ii) Get 1x free stock valued between USD8.8 - USD888

Open A Tiger Brokers Account Today!

READ: How to make your first trade on Tiger Brokers?

Disclaimer:

This post contains affiliate link(s). As always, I’d only recommend tools and financial solutions that I personally use AND/OR are interesting & provide unique value to my readers. Every article takes a long time and effort to write and when it comes to financial solutions, I’ll only invest time in writing about good and relevant products.

Complete Guide: How to deposit funds to Interactive Brokers (IBKR) via Wise, Instarem, and SG Bank

In this post, let's explore the cheapest and most efficient ways to deposit funds into your Interactive Brokers (IBKR) account.

This guide is suitable for non-US residents (eg. Singapore, Malaysia, and more) - any questions feel free to leave them in the comment section at the end of this post!

RELATED:

--

p.s. A word to fellow readers:

Dear friends, if you find this post helpful, I'd appreciate it if you can click on the button below to learn about IBKR via IBKR's official site.

Doing so will help the earn the blog a small fee at no extra cost to you.

This will help supporting the blog in creating more useful content - thanks in advance my friends!

Best ways to deposit/fund your IBKR account

There are 3 key ways to fund your IBKR account, namely through (i) Direct transfer from Wise balance, (ii) Direct ACH funding via Instarem, or (iii) Funding your IBKR account through a Singapore (SG) bank account.

Method #1: Funding your IBKR account from Wise balance (Easiest)

This is my preferred way to fund my own IBKR account as I find it the most straightforward method (though not necessarily the cheapest).

Fees incurred:

- Wise transfer fee

- Currency exchange rate

Pre-requisite: Open a Wise account and make a deposit to your Wise balance

Before you begin, be sure to open a Wise account first if you do not have an account.

Be sure to use my Wise referral link below and get a free transfer on your first 500 GBP (~RM2600) transfer!

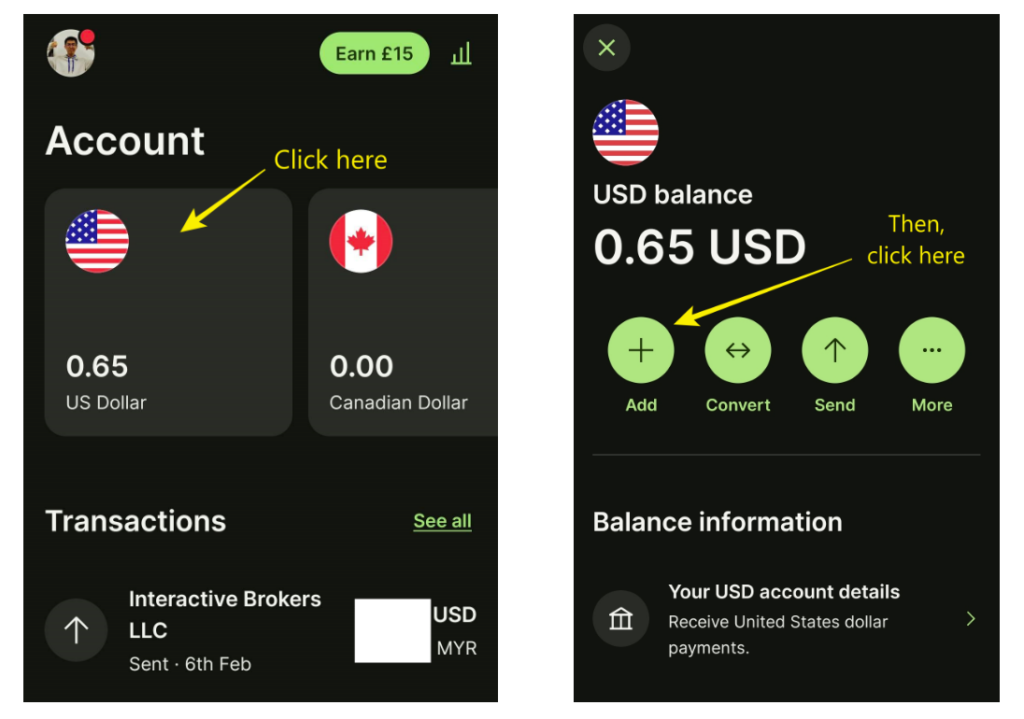

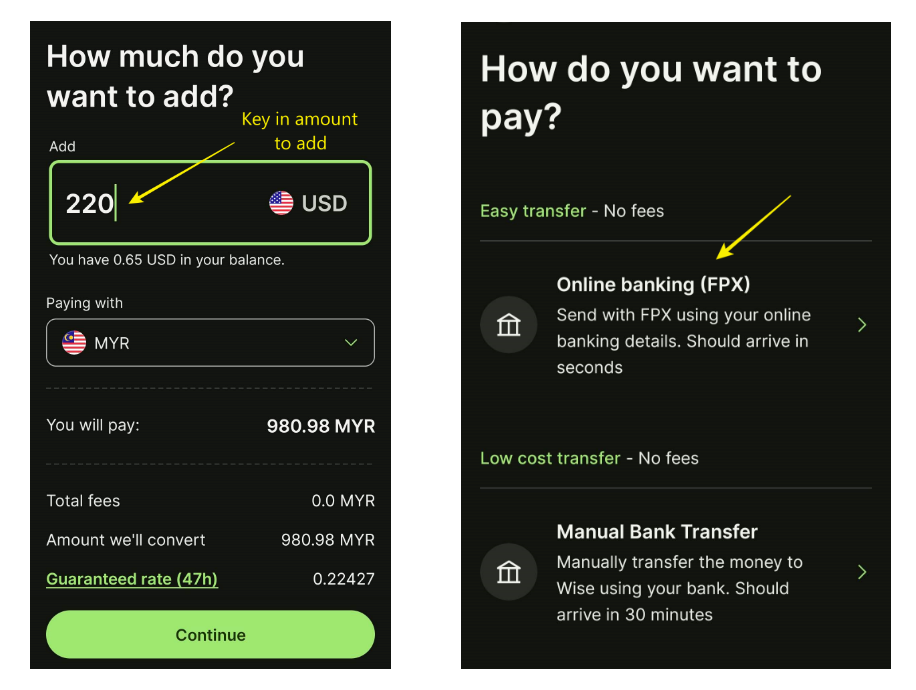

Step 1: Fund your Wise account

Firstly, log in to your Wise account. Select the currency that you'd like to fund your IBKR account and click 'Add'.

Then, key in the amount you'd like to add, and proceed to fund your Wise account via FPX through your own bank account.

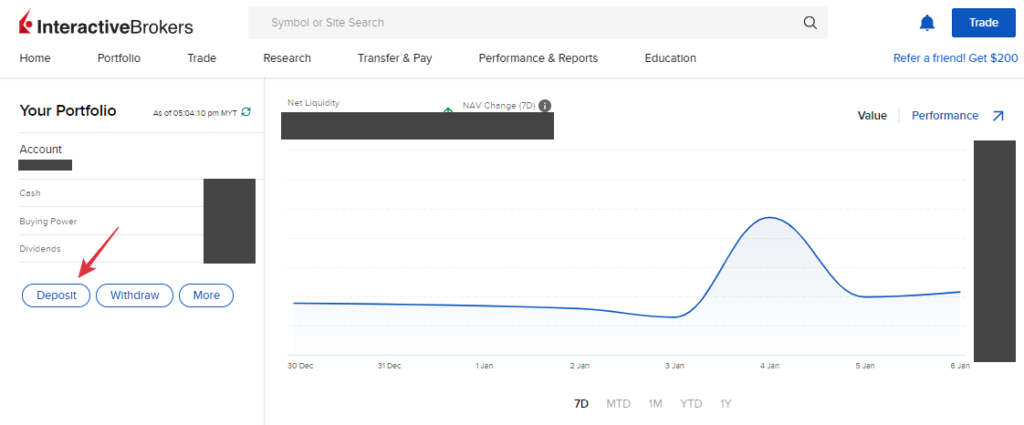

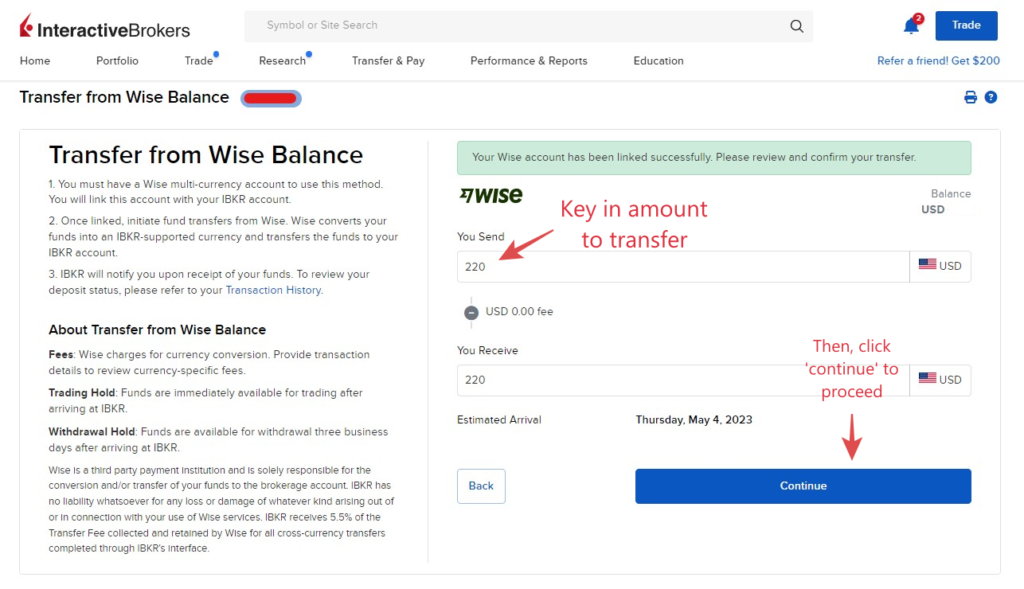

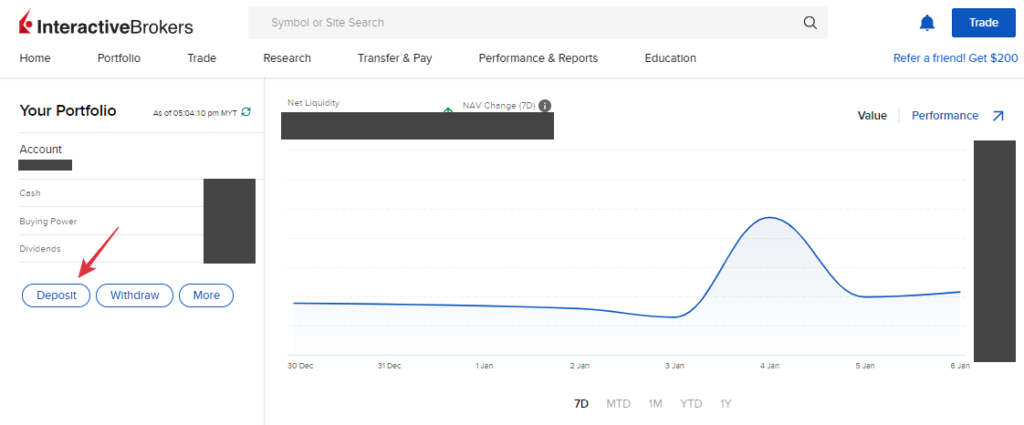

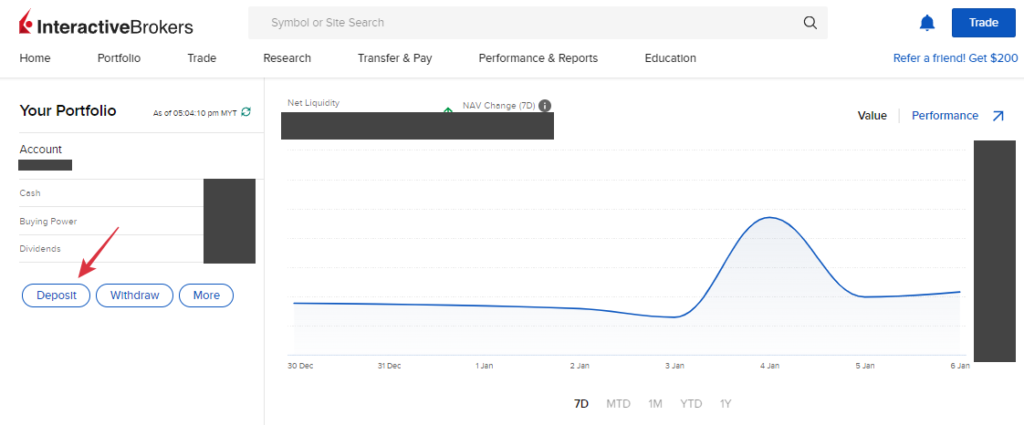

Step 2: Log in to your IBKR account, select 'Deposit'

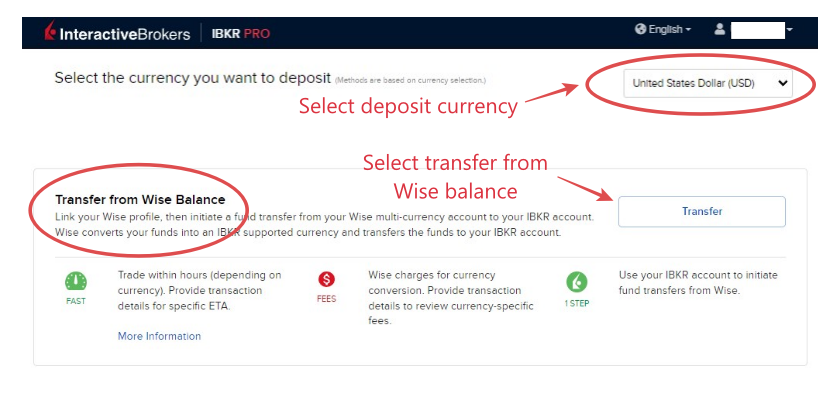

Select your deposit currency (for me, I choose USD), and select 'Transfer from Wise Balance'.

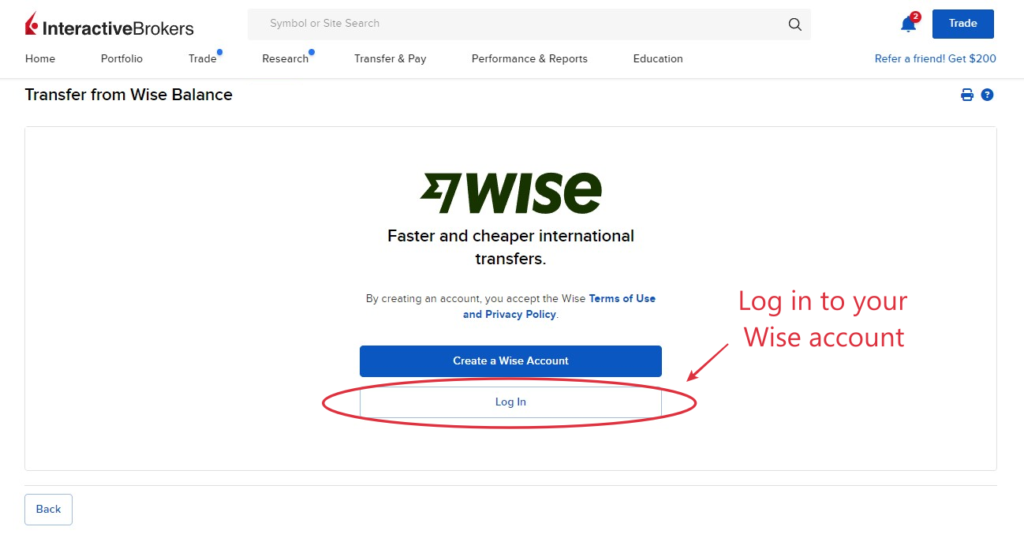

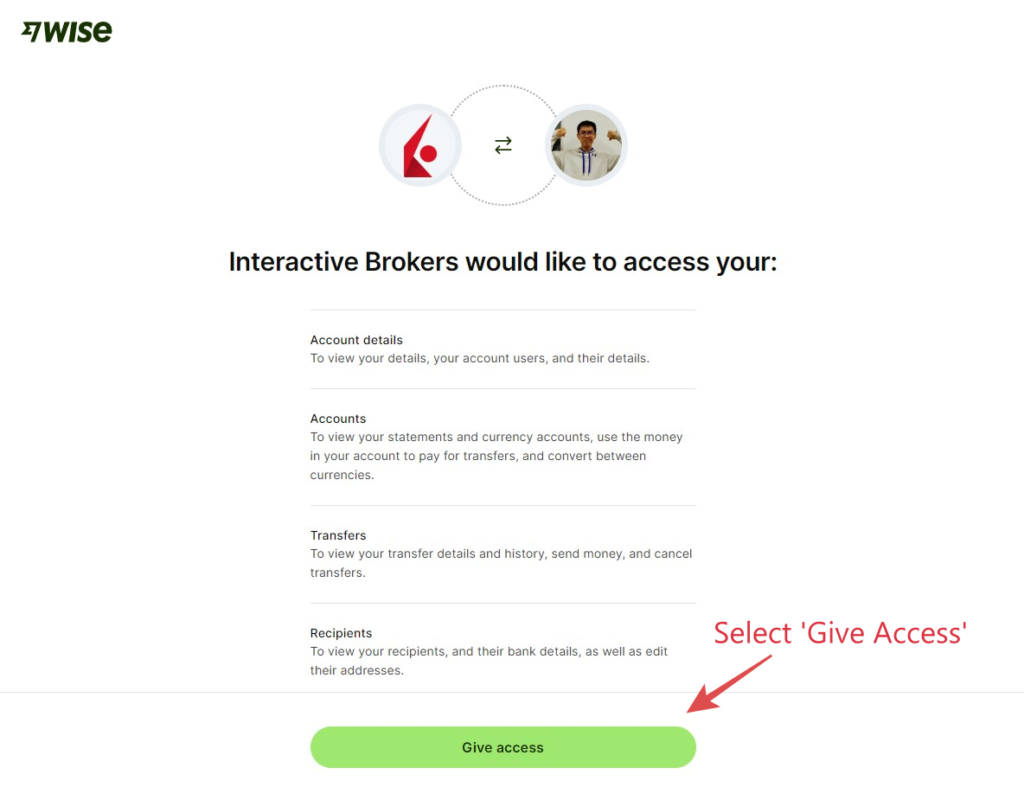

Step 3: Log in to your Wise account and proceed to transfer your funds

Once your Wise and IBKR accounts are linked, you can proceed with your fund transfer.

Step 4: Transfer done - now just wait for your funds to reach your IBKR account.

From personal experience, it usually takes about 1 working day for the funds to reach my IBKR account.

Method #2: Funding your IBKR account through direct ACH funding via Instarem (Cheapest)

Meanwhile, funding your IBKR account via Instarem is the cheapest option. Don't worry, the funding steps are quite simple as well.

Fees incurred:

- Instarem transfer fee

- Currency exchange rate

Pre-requisite: Open an Instarem account

Before you begin, be sure to open an Instarem account first if you do not have an account.

Open an Instarem account via my referral link by clicking on the button below, and get 200 InstaPoints (worth RM12) which can be redeemed for your money transfer (no min. transaction amount required)!

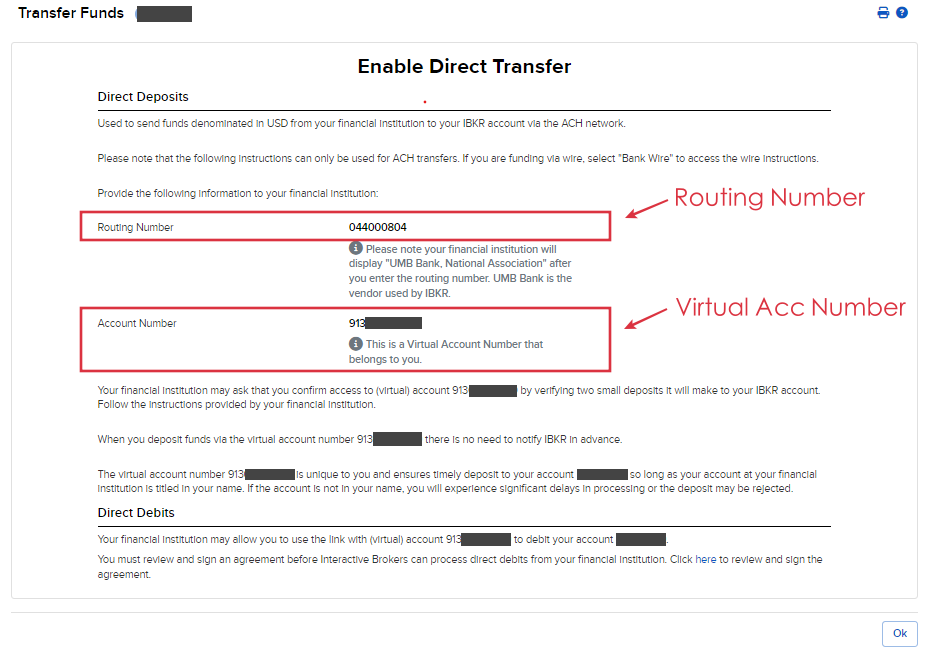

Step 1: Log in to your IBKR account, select 'Deposit'

Step 2: Select your deposit currency, then opt for 'Direct ACH Transfer from your Bank'

In this example, I am using USD as my deposit currency. But the method should work for other currencies.

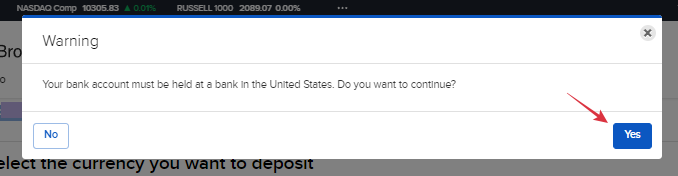

A warning pop-up will appear, saying that you must deposit from a US bank account - just proceed by choosing 'Yes'.

Step 3: You'll get 3 key info - a Routing Number, Virtual Account Number, and IBKR's address (address is not displayed in the screenshot below)

Take down these details. In the next step, you will need to use these details to initiate your Instarem transfer.

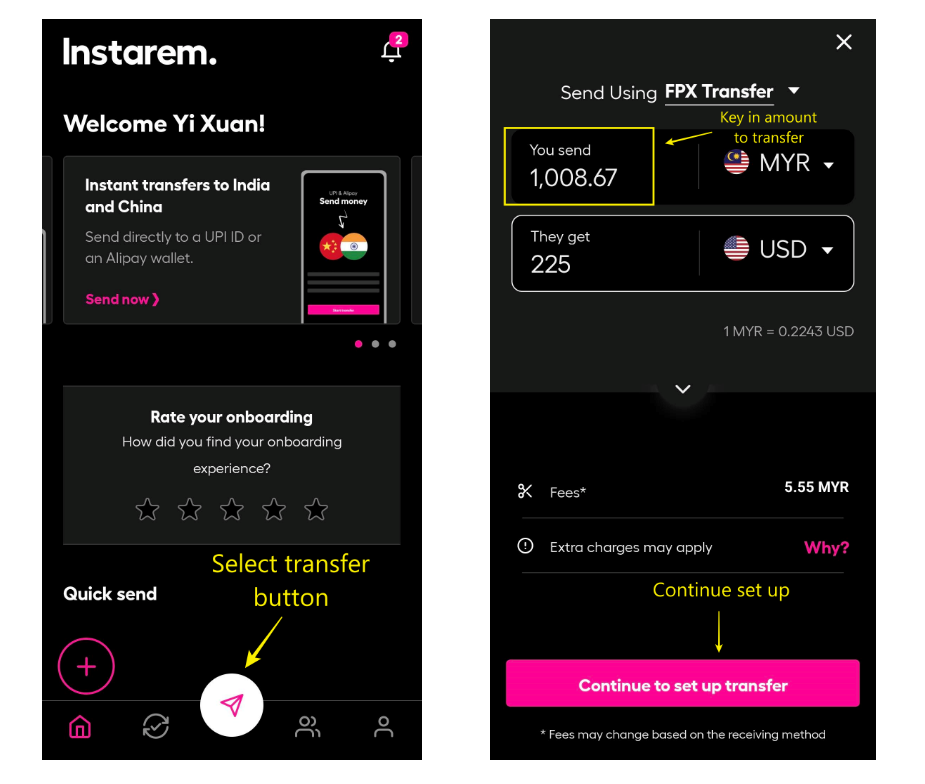

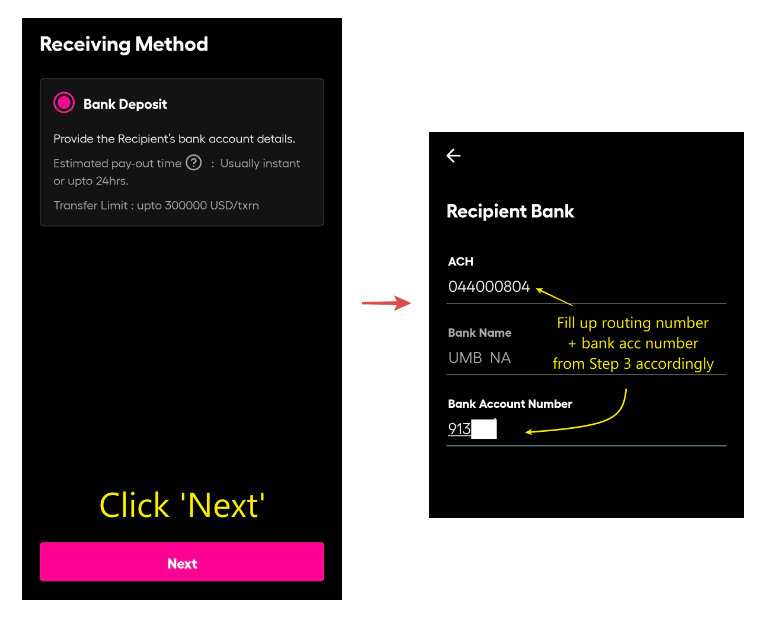

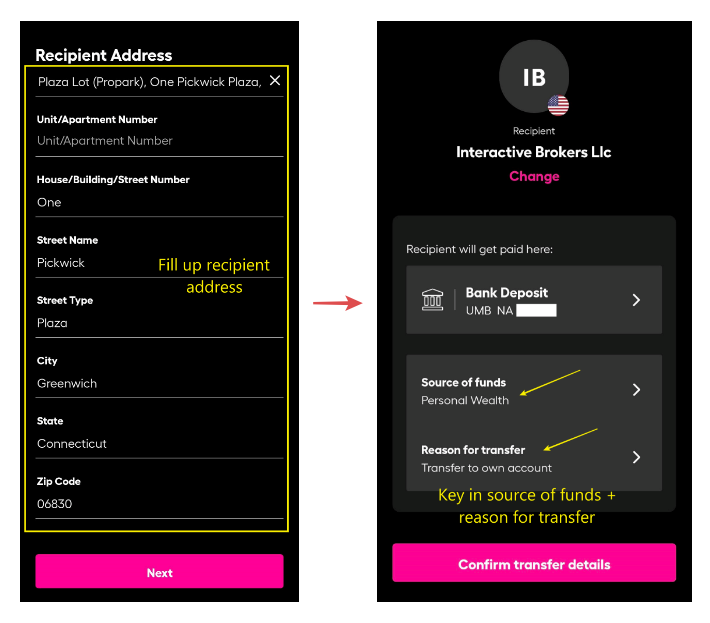

Step 4: Log in to your Instarem account and begin initiating your transfer

Step 5: Transfer done - now just wait for your funds to reach your IBKR account.

From personal experience, it usually takes about 1-2 working days (sometimes even faster) for the funds to reach my IBKR account.

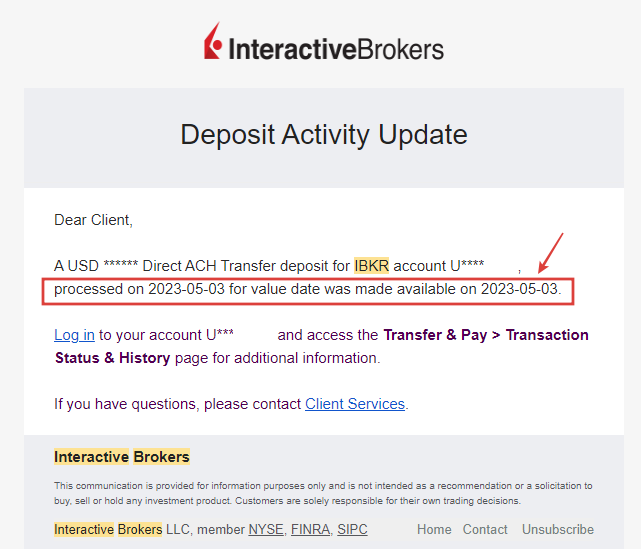

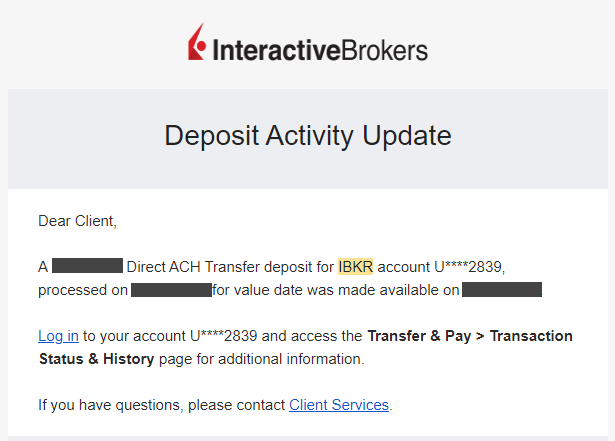

Once the funds are deposited in your IBKR account, you will receive an email update from IBKR.

Method #3: Funding your IBKR account through SGD via a Singapore Bank (eg. CIMB SG)

The 2nd method is an alternative for Singaporeans and Malaysian users with a Singapore bank account.

Fees incurred:

- IBKR currency conversion rate, if you want to convert your SGD to USD in IBKR

- IBKR currency conversion fee (~USD2.00 - 2.50), if you want to convert your SGD to USD in IBKR

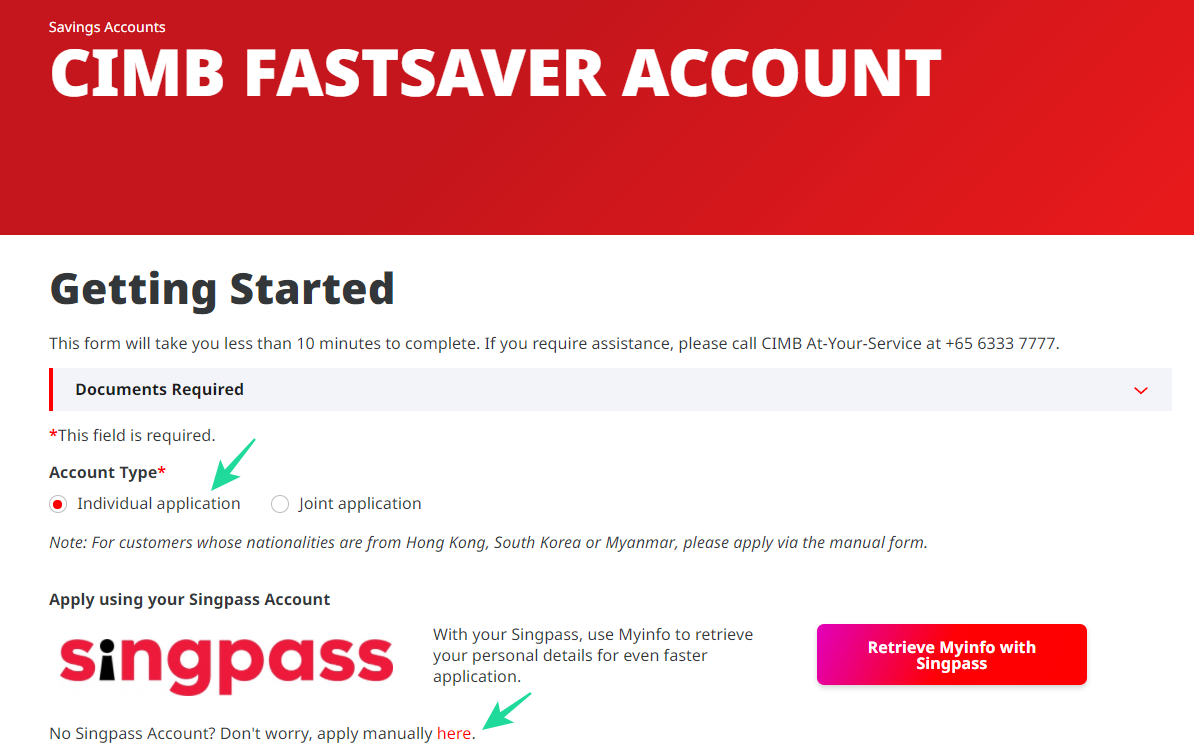

Pre-requisite: Open a Singapore bank account (CIMB SG)

For Malaysians that wish to open a Singapore bank account, you can consider opening a CIMB SG account, which can be done 100% online.

RELATED: Guide - How to open a CIMB SG account online

Step 1: Log in to your IBKR account, select 'Deposit'

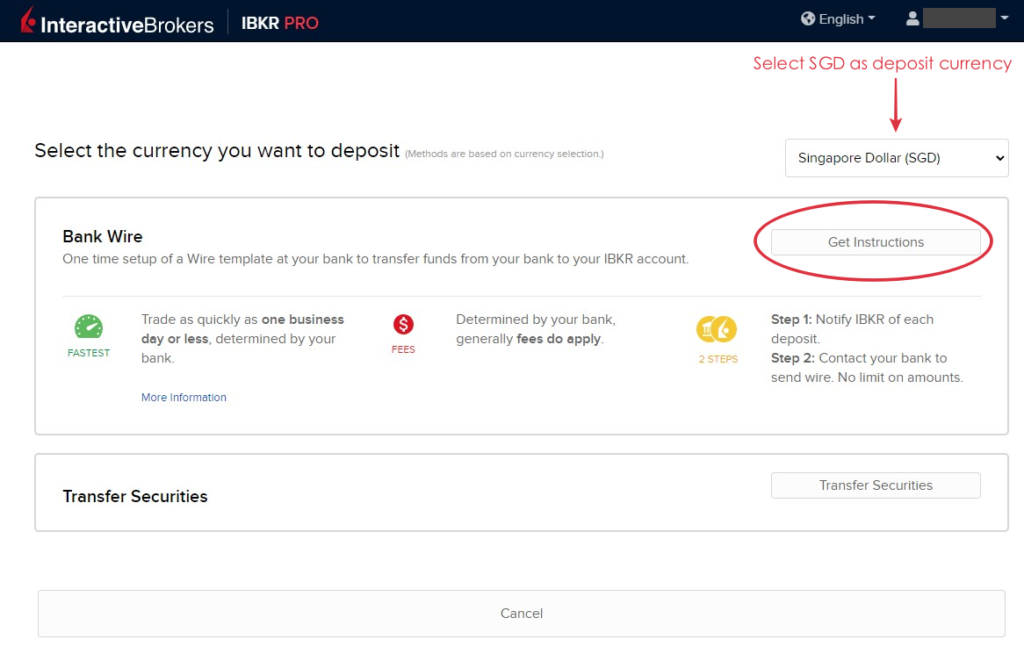

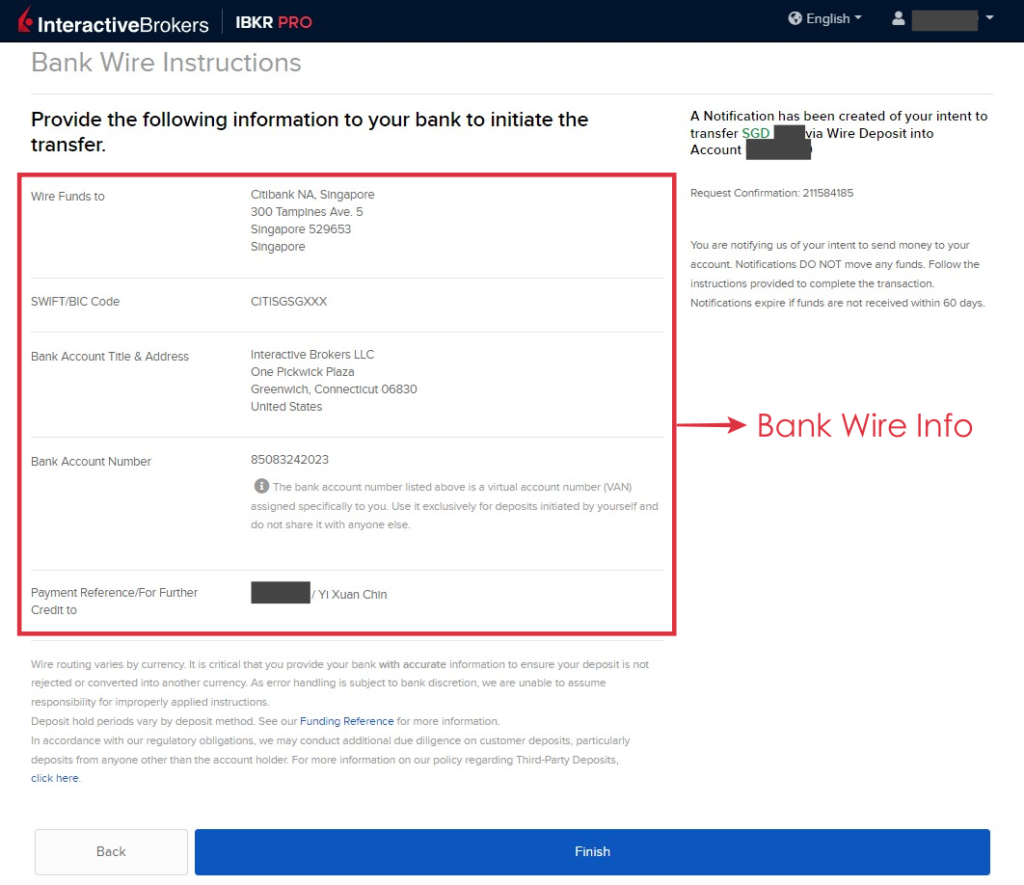

Step 2: Select SGD as deposit currency, and get instructions for 'Bank Wire'

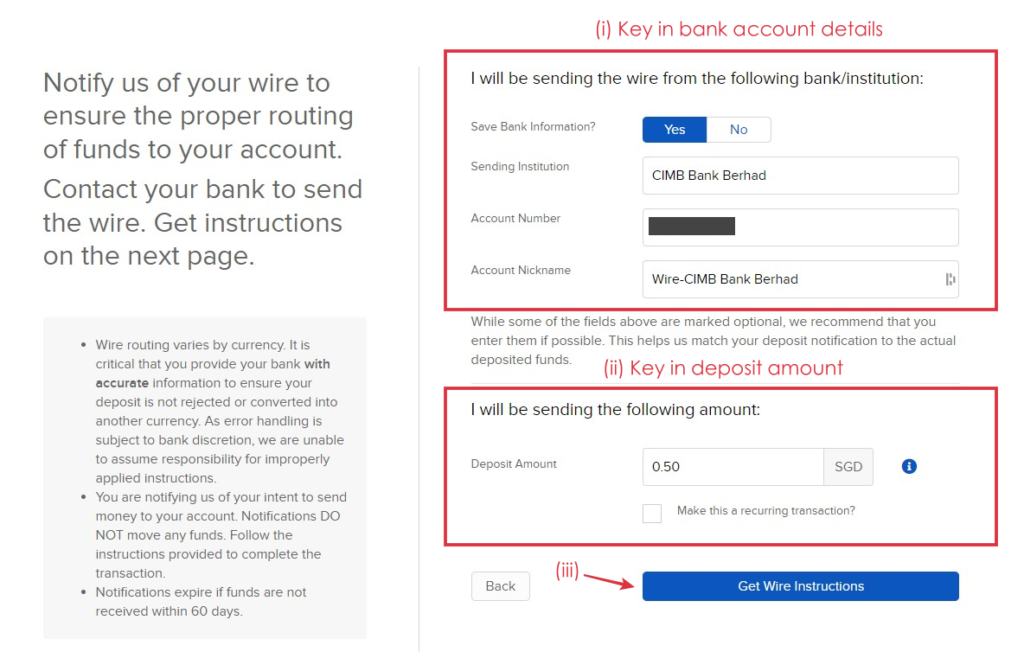

Step 3: Key in your SG bank account details and the amount you wish to deposit

Step 4: Initiate transfer from your SG bank account

Use the bank wire instructions from IBKR to make your transfer from your SG bank account.

Log in to your bank account to initiate transfer.

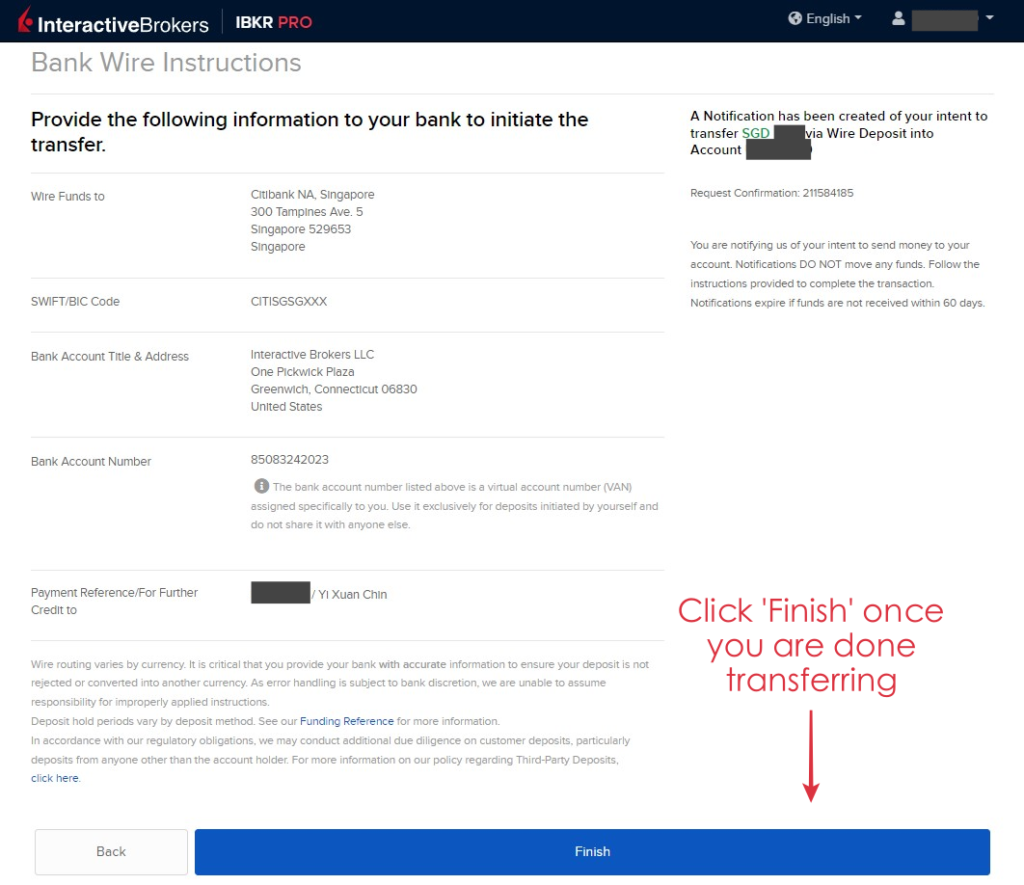

Step 5: Return to your IBKR account and click 'Finish'.

That's all - now you just have to wait for your funds to arrive in your IBKR account.

From personal experience, it usually takes about 1-2 working days for the funds to reach my IBKR account.

Once the funds are deposited in your IBKR account, you will receive an email update from IBKR.

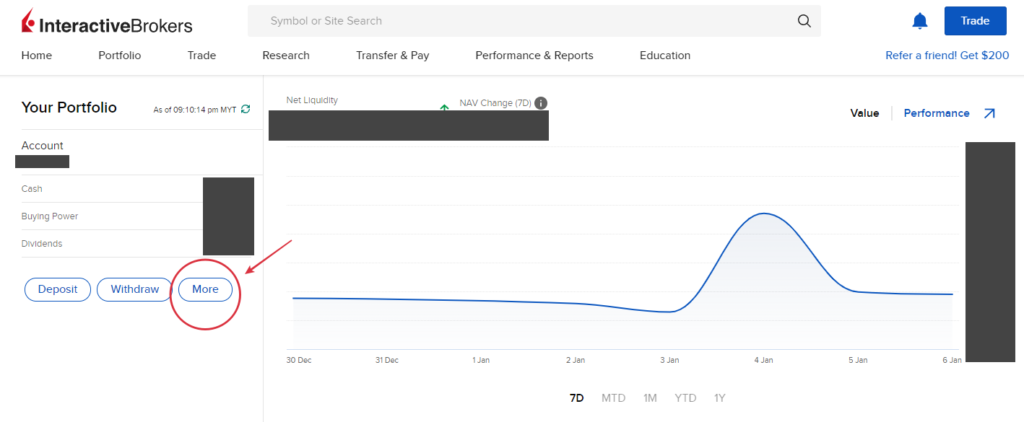

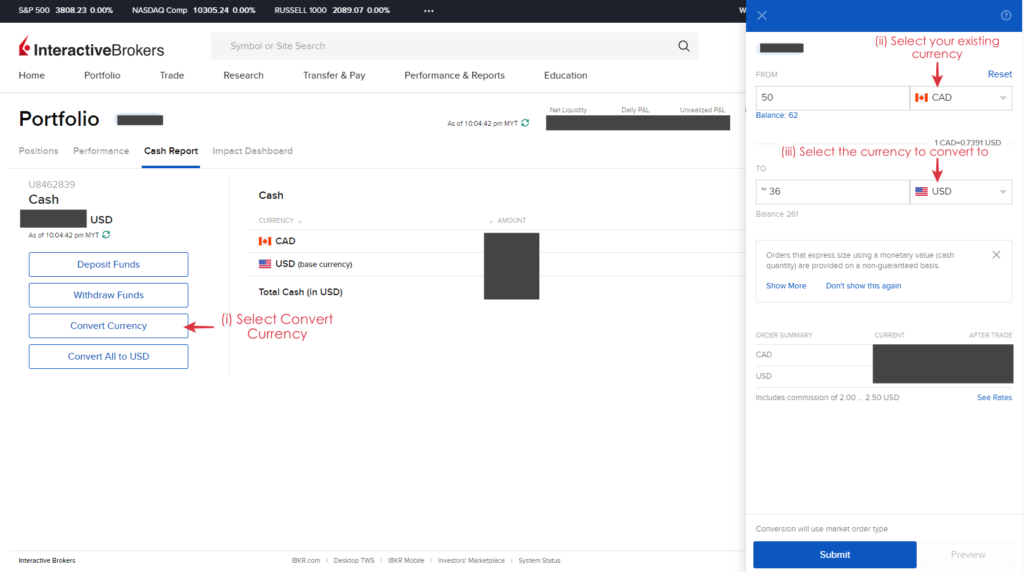

Step 6: Convert SGD to USD in IBKR

If you want to convert your SGD to USD in IBKR to trade USD-denominated stocks, you can do so with the currency conversion feature in IBKR for a small fee.

In your IBKR dashboard, select 'More'.

Use your existing currency balance to convert to USD.

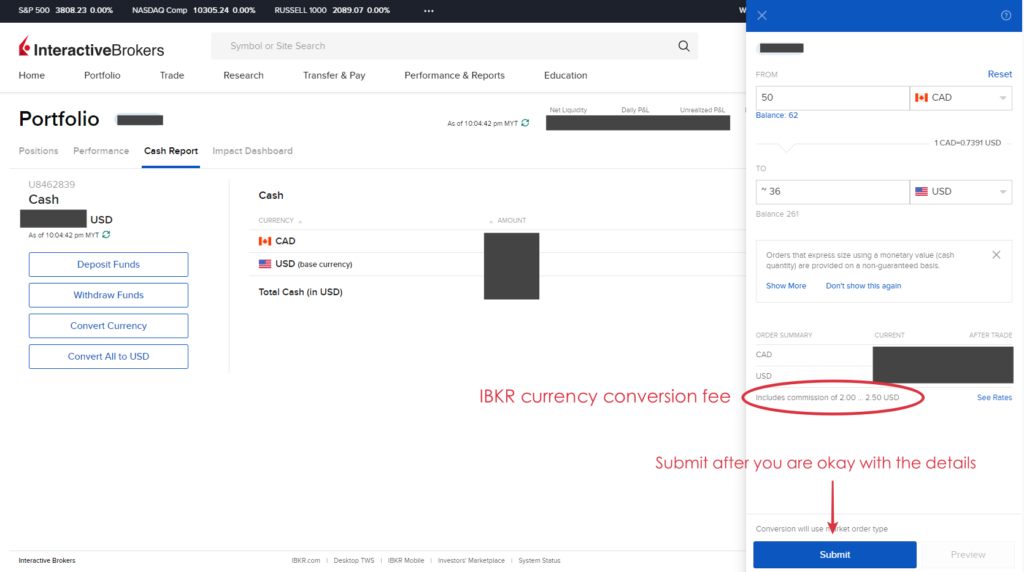

There will be a currency conversion fee/commission of around USD2.00 - USD2.50.

Verdict - Funding your IBKR account is never easier

With platforms like Wise and Instarem, it is extremely convenient to fund your IBKR account at a minimal fee.

Do you have any other tips on how to fund your IBKR account? Feel free to leave your tips and thoughts in the comment section below!

Disclaimer:

This review is purely based on my personal experience and is updated as of the time of writing.

This article may contain affiliate links that will earn the blog a small fee if you click on them. This comes at no extra cost to you as a reader.

Guide: How to open a CIMB Singapore account for Malaysians

In this guide, I want to share how you can open a Singapore bank account online, without visiting physical branches in Malaysia or Singapore. In particular, this guide is about opening a CIMB Singapore FastSaver account online.

So, let’s get straight into the topic!

p

Highlights of CIMB SG FastSaver Account:

- The only way for Malaysians to open a Singapore bank account through fully online application. A Shariah-compliant version to the conventional FastSaver account is also available.

p - Minimum initial deposit of SGD1,000

p - No minimum balance needed

p - No monthly fees

Why open a Singapore Bank Account?

There are many reasons why one would have access to a Singapore bank account:

- It could be that your work requires you to receive or transact via SGD.

p - Most international stock brokers accept deposits/funding via SGD, and not Malaysian Ringgit (MYR). While you can still fund your broker via foreign telegraphic transfer (FTT) on your local bank account, it incurs expensive FX conversion and intermediary banking fees.

Documents Needed & Expectation

To start, it is best for you to have the following details with you:

- Your Malaysia IC

- Your Tax Identification Number (TIN)

- A CIMB Malaysia account

- SGD1,000 worth of MYR

If everything is smooth, the whole registration process will take about 2 weeks. Hence, be patient and please note that this is not something you can settle in a day.

Opening a CIMB Malaysia Account

To open a CIMB SG FastSaver account, you will first need an existing CIMB Malaysia account.

If you already have a CIMB Malaysia account, skip this part and move on to the next section.

Otherwise, you can open a CIMB Savings account easily online. Check out my step-by-step guide to register for a CIMB Savings Account below.

READ: Step-by-step guide to open a CIMB Savings Account (without going to bank!)

[Update 17/2/2022: It seems like CIMB has reactivated the online account opening of CIMB Octosavers Account-i for non-CIMB customers (it was paused prior to this). Feel free to proceed and open your account online!]

Opening a CIMB SG FastSaver Account

Step #1: Register for your account online

i. Check out the details of CIMB FastSaver account. Once you are done, proceed to complete the application form online.

p

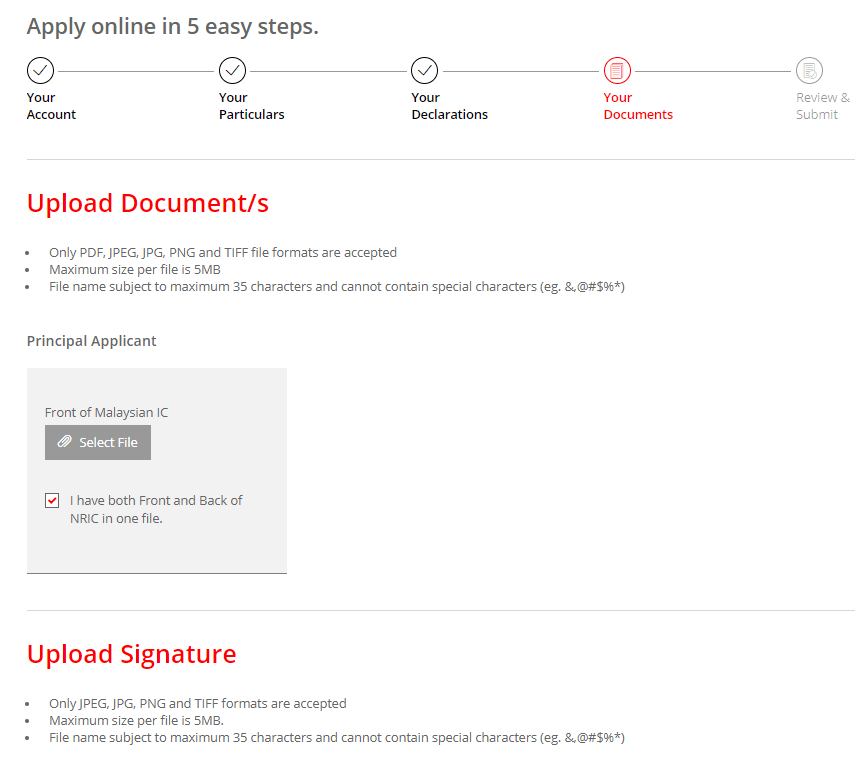

ii. During the registration process, you are required to:

- Upload a copy of your IC.

- Provide your Tax Identification Number (TIN) if you are a taxpayer (ie. You pay tax to LHDN).

- Upload your e-signature.

p

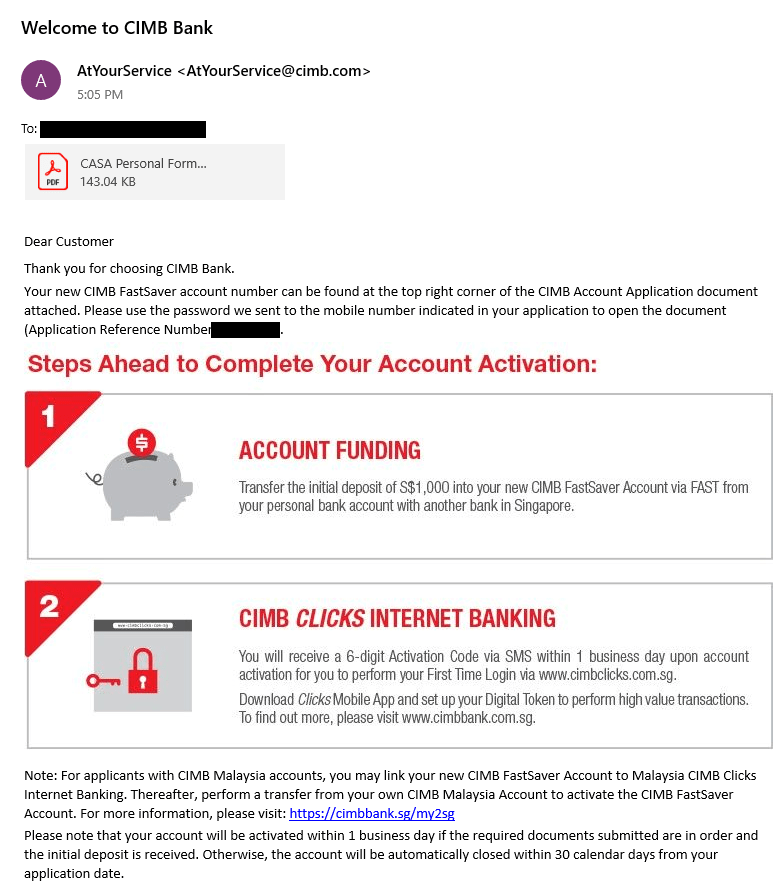

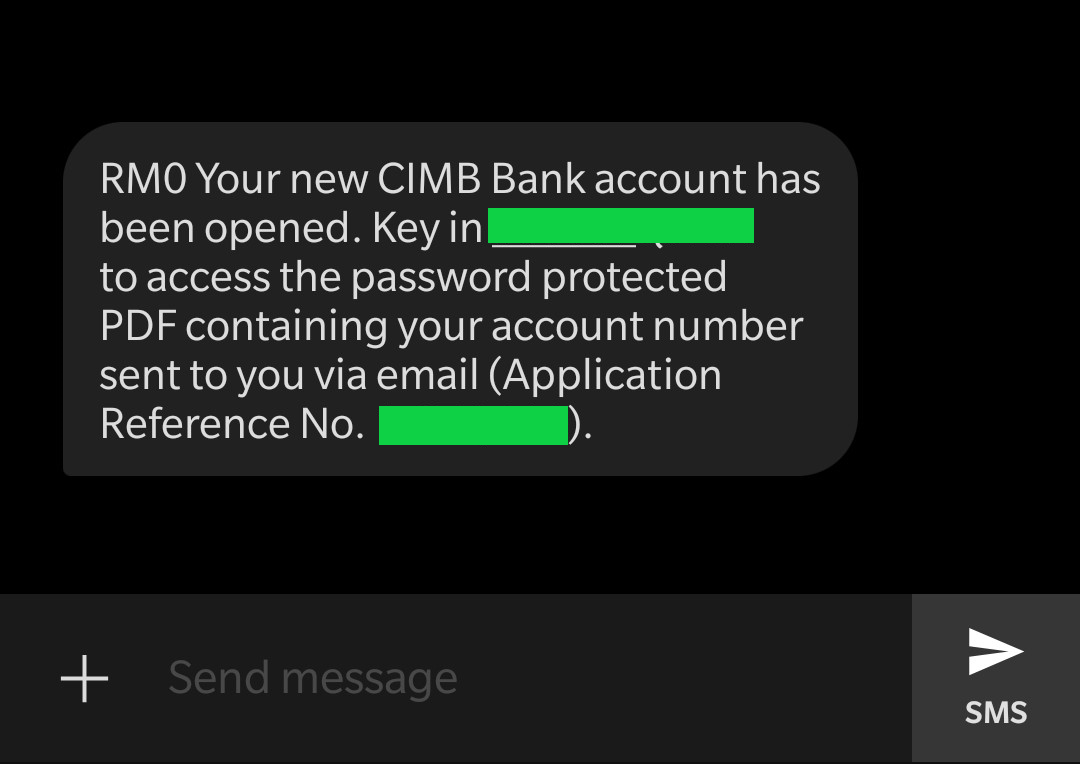

iii. Once you are done, you’ll receive an email containing (1) a password-protected PDF, and (2) the next action steps.

At the same time, you’ll also receive an SMS from CIMB SG containing the password to unlock the PDF file. Once you open the PDF, you’ll find details of your account number.

p

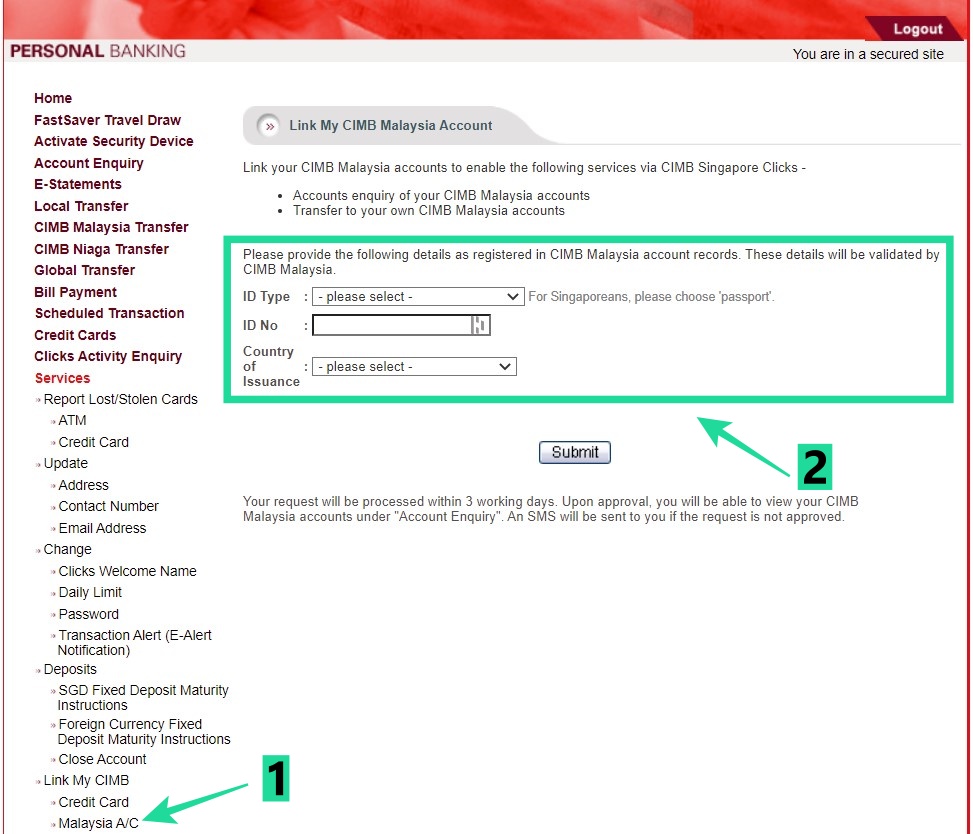

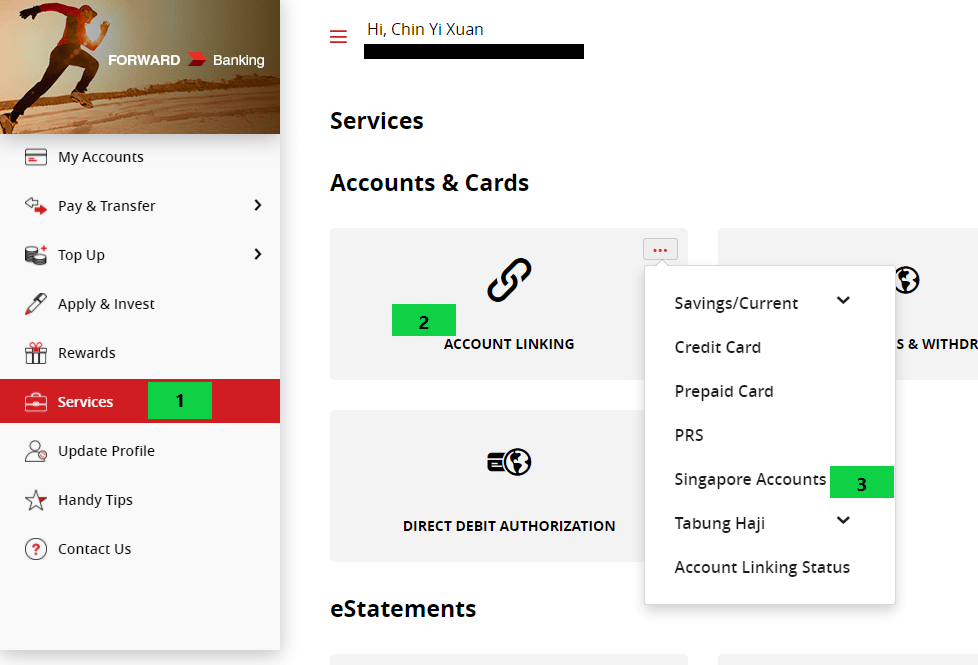

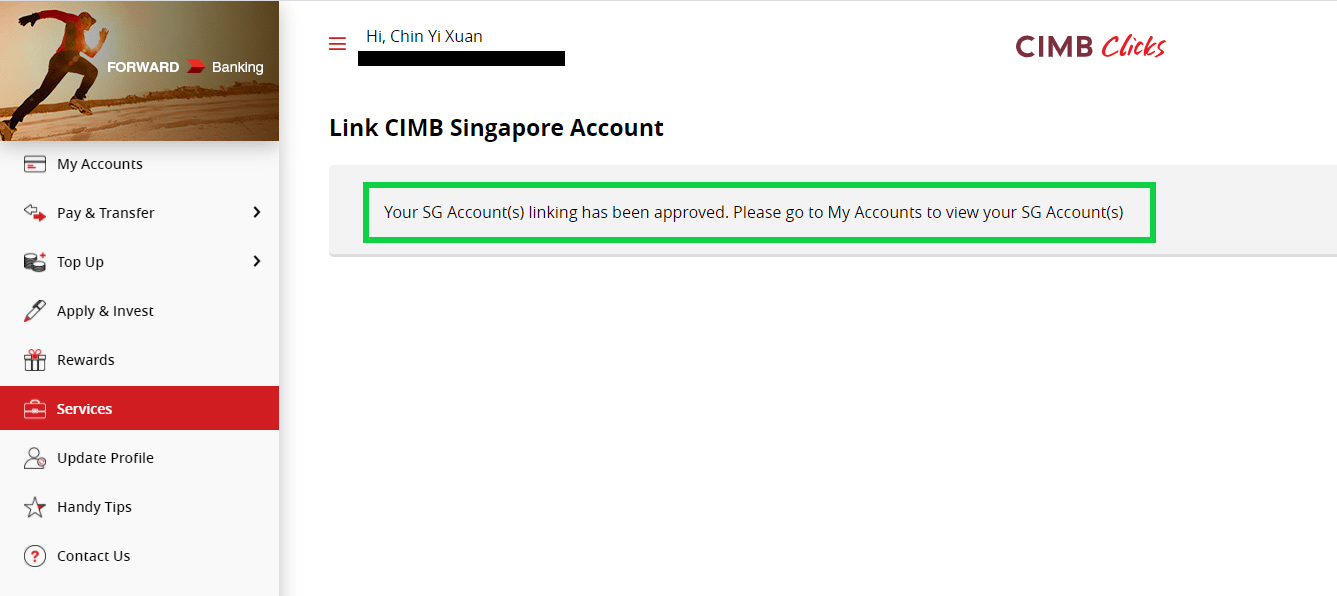

Step #2: Link your Singapore account

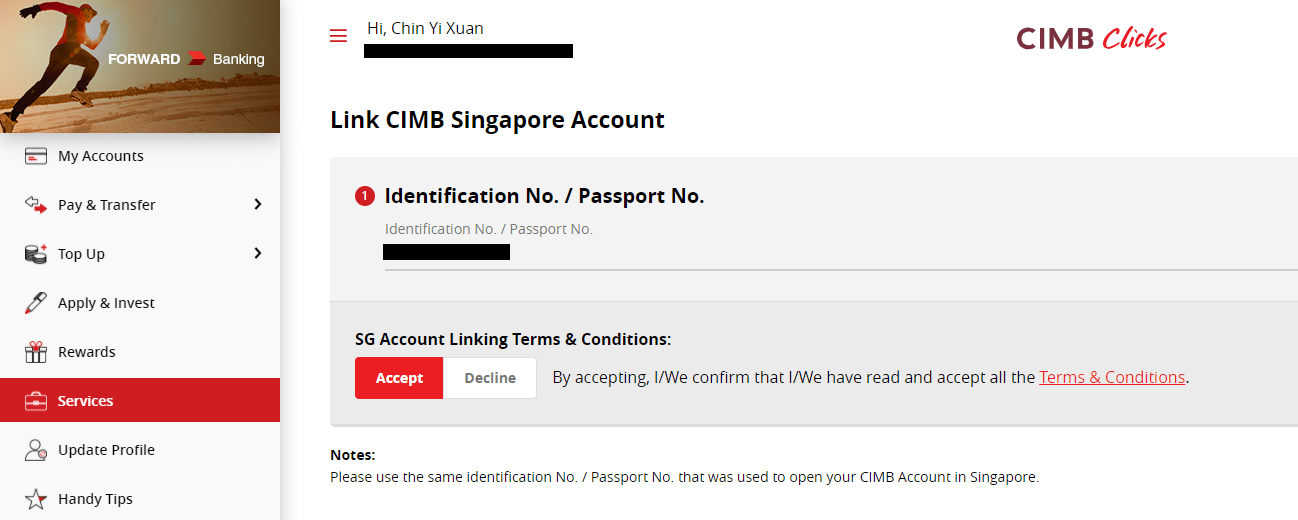

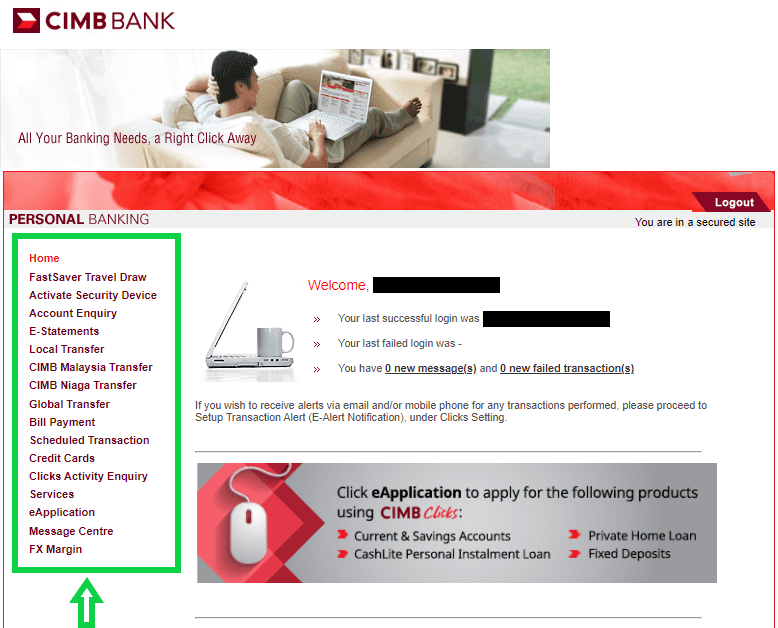

i. Proceed to link your CIMB SG FastSaver account to your CIMB Clicks Malaysia. Once you log in to CIMB Clicks, under ‘Services’, select ‘Singapore Account’ under the Account Linking section.

p

ii. Next, key in your IC number. (Note: Please remove the dash '-' while keying in your IC)

p

iii. Upon submission of your account linking request, it’ll take about 1-2 working days to get approved. To check the approval status, click ‘Singapore Account’.

Note: If you check your linking request it shows you the input screen again (like what you saw in Step 2ii), this means your application has been rejected.

In this case, contact the customer service of CIMB Malaysia and let them know that you need to have this account linked in order to perform an ASEAN Transfer for e-KYC verification requested by CIMB SG.

p

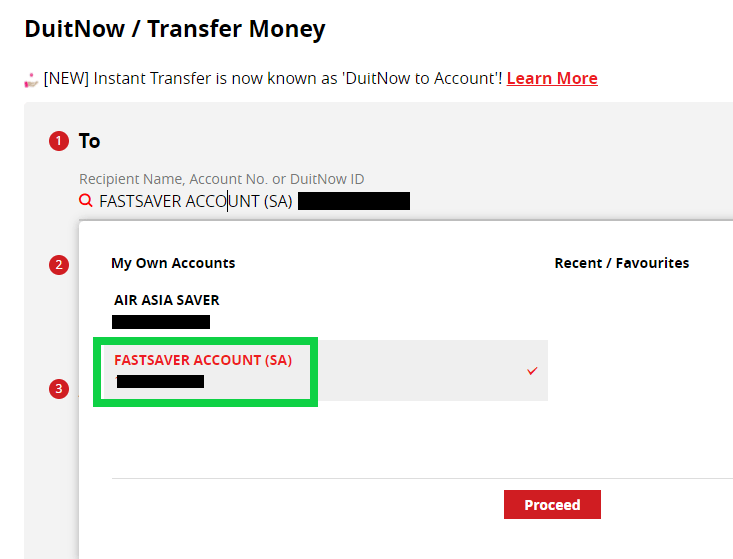

Step #3: Perform an initial transfer

Once your account linking is approved in Step 2, move on to perform an initial transfer of SGD1,000 via your CIMB Malaysia account.

For this step, it is also possible for you to perform a small initial transfer of, say, SGD10 via your CIMB Malaysia account, and the rest (SGD990) via platforms like Wise (details HERE). This will help you save on the FX rates.

[Update Feb 2024: Some readers have reached out to me as CIMB SG states that the initial transfer of SGD1,000 needs to come directly from CIMB MY. As per my update, you can certainly do a small initial transfer (eg. SGD10) via CIMB MY, and the rest via Wise to save on FX rates.

The initial transfer (regardless of amount) acts as a standard Know-Your-Customer (KYC) process - so as long as your 1st transfer is from CIMB MY, you can still fund the rest via Wise.]

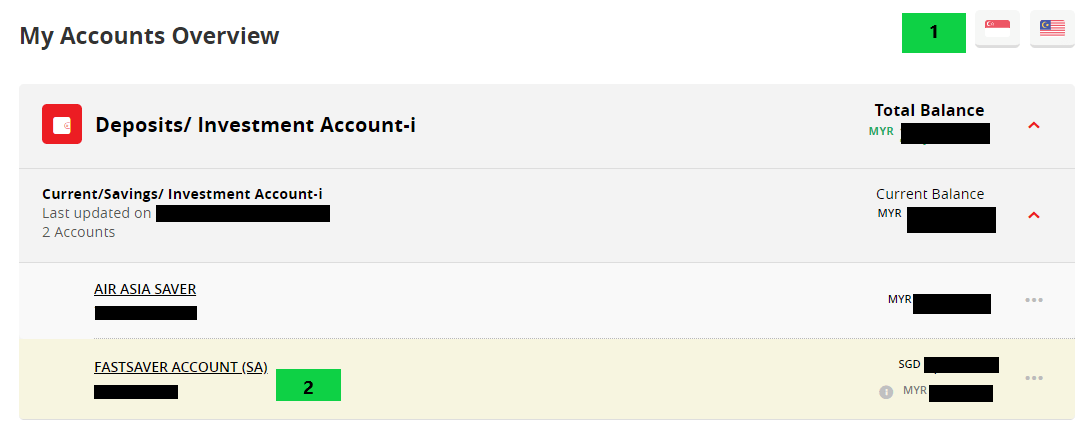

Once you are done, you can view your CIMB SG account balance by clicking the Singapore flag icon.

p

Step #4: Application verification

Once you have done your initial deposit in Step #3, the next thing to do is to wait for verification on CIMB SG's end. Meaning, you'll have to:

- Expect a call from CIMB SG (ie. +65 number) to verify your identity and the purpose of opening an account. They'll ask questions like your IC number and how are you planning to use the CIMB SG account.

p

It took about 3 business days for me to receive this verification call from the day I performed my initial deposit in Step #3.

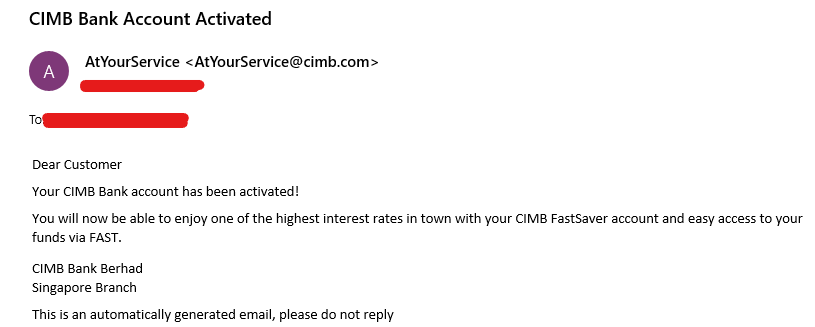

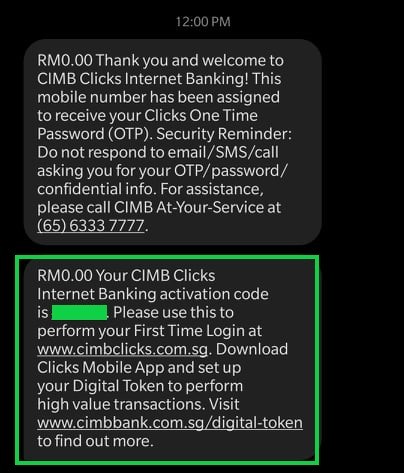

p - After the call, you'll have to wait for CIMB SG's end to process your verification. This wait is longer as it took about 7 business days for me to receive my (a) account activation email & (b) SMS for my CIMB SG activation code (more on this in Step #5).

p

p

All in all, be prepared that Step #4 will take about 10 business days of waiting. During this period, I got several email reminders from CIMB SG that I have not completed my CIMB SG application, claiming that (1) I have yet to transfer my initial deposit (I have done so), or (2) I did not provide valid documents for account opening (I did).

If you have done everything mentioned in the email, just ignore the email and wait for the verification call from CIMB SG. If the wait is too long be sure to call or email CIMB SG for help.

p

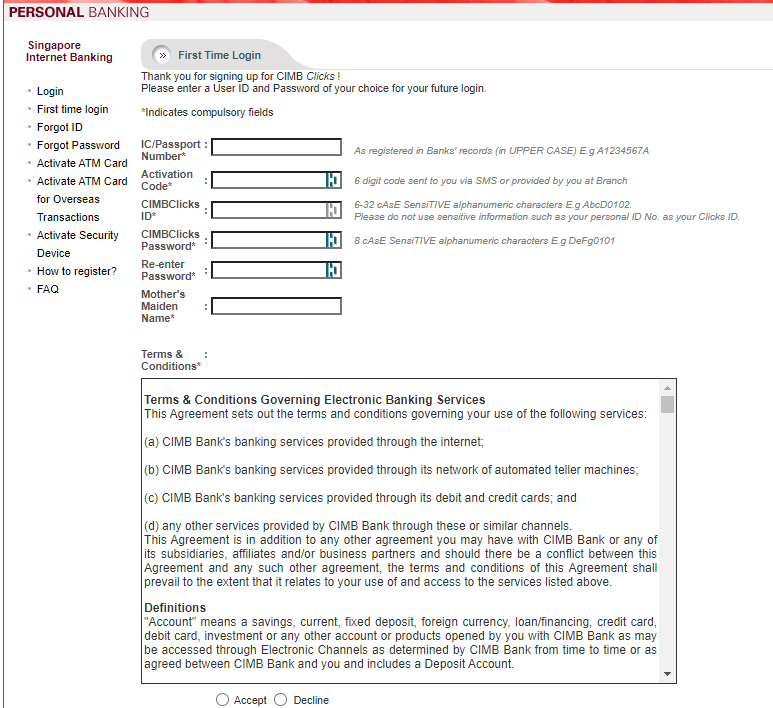

Step #5: CIMB SG First-time login

Finally, now that your CIMB FastSaver account is activated, it is time to log in to CIMB SG to initiate your first-time login. In Step #4, you should have received an SMS containing an activation code for CIMB Clicks (SG). Now:

- Go to CIMB Clicks SG. Click 'First Time Login'.

p - Create your username & password for CIMB Clicks SG, and key in the activation code that you got from Step #4 here.

p

CIMB Clicks SG - Create username & password p

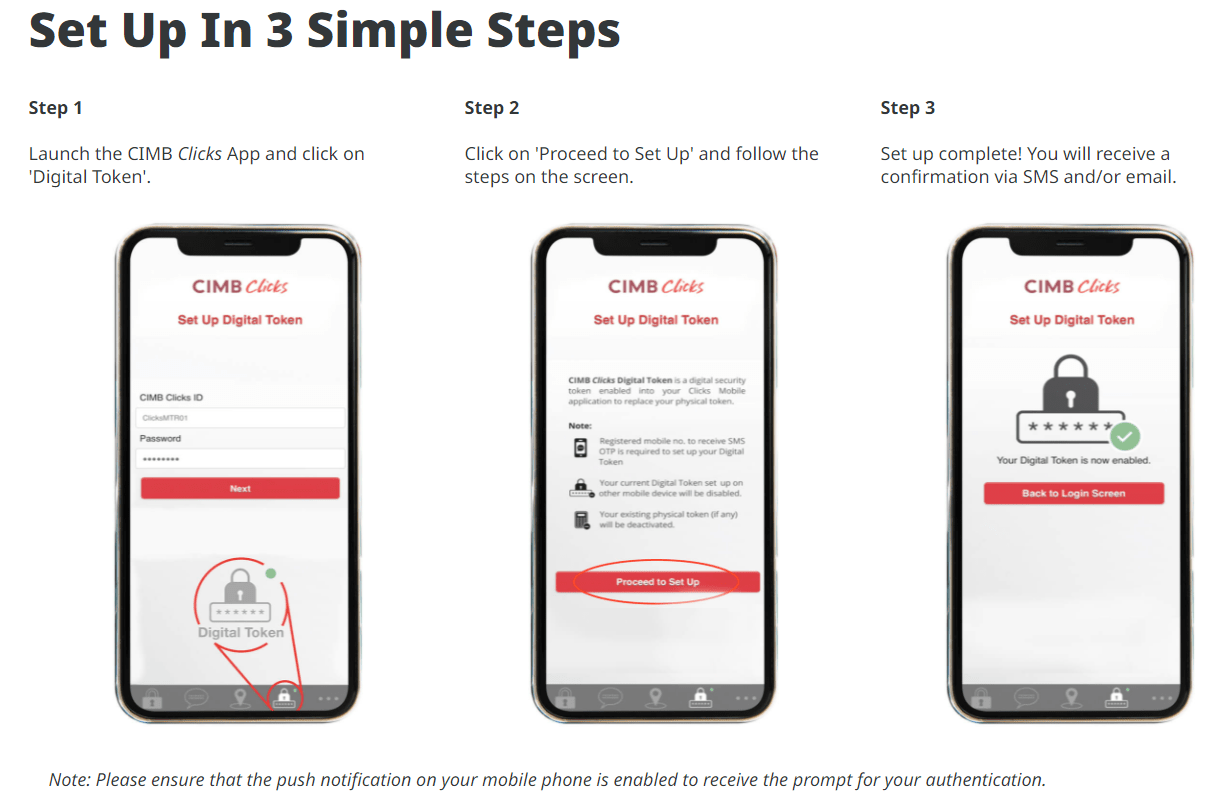

- Once you are done, download the CIMB Clicks SG app to activate your Digital Token. Setting this up is important so you can proceed with future transactions.

OKAY, now you have a fully functional Singapore bank account! The CIMB SG Clicks interface has a really outdated design but it gets the job done for any simple transfers and transactions.

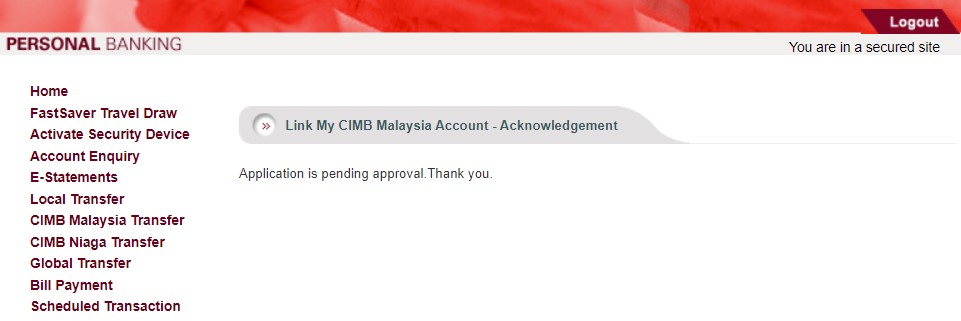

Withdrawing funds from CIMB SG to CIMB Malaysia

Withdrawing funds from CIMB SG back to your CIMB Malaysia account is easy.

Step 1: Link your CIMB Malaysia account with CIMB SG

p

Step 2: Wait about 3 working days for the linking to be approved.

Step 3: Head over to 'CIMB Malaysia Transfer' > 'To My CIMB A/C' and proceed with your withdrawal.

Wise: A cheaper way to add funds to your CIMB SG Account (+ Referral Link!)

[Update April 2022: Some readers have reached out to me as CIMB SG states that the initial transfer of SGD1,000 needs to come directly from CIMB MY. As per my update, you can certainly do a small initial transfer (eg. SGD10) via CIMB MY, and the rest via Wise to save on FX rates.

The initial transfer (regardless of amount) acts as a standard Know-Your-Customer (KYC) process - so as long as your 1st transfer is from CIMB MY, you can still fund the rest via Wise.]

--

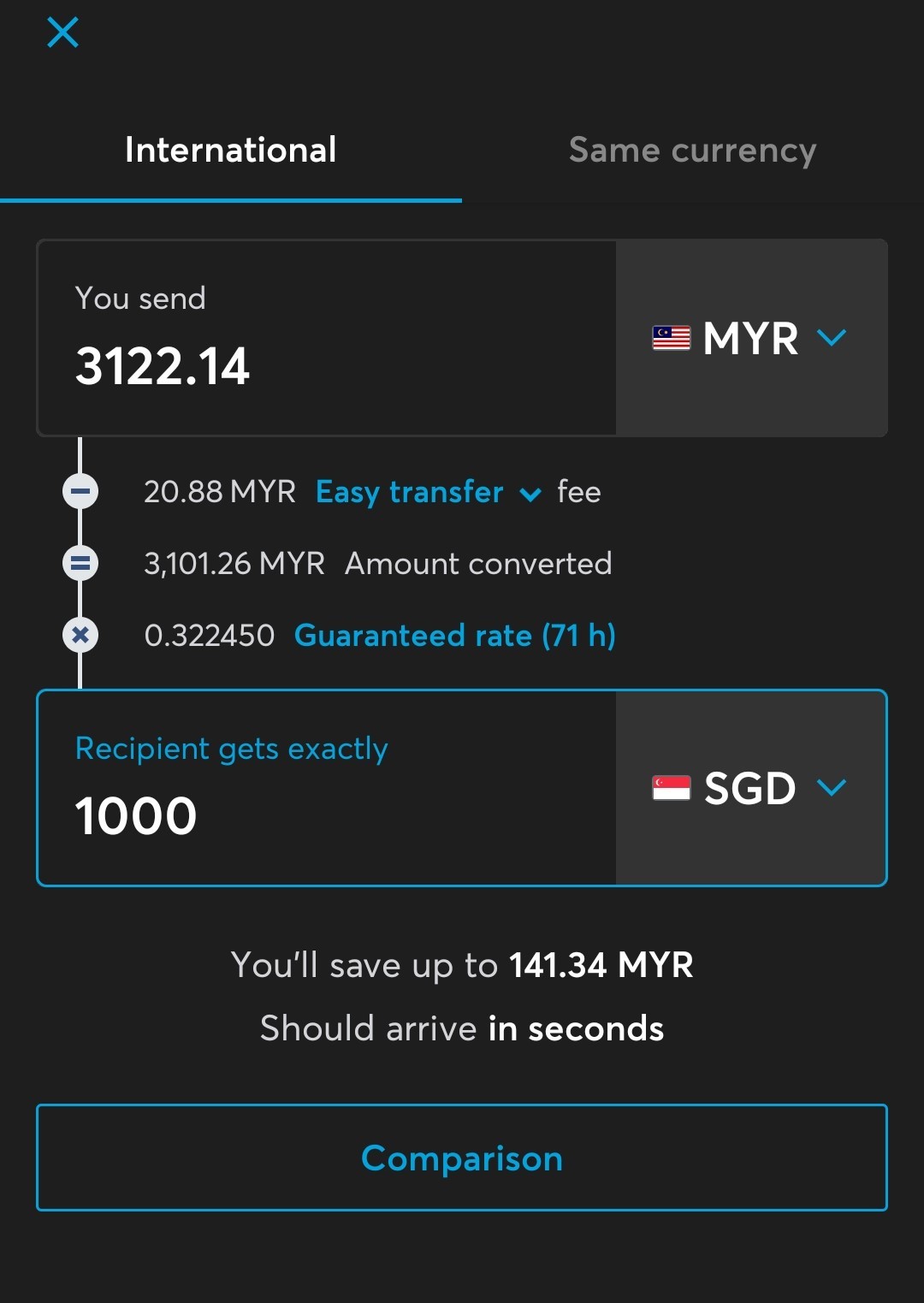

Now that you have opened your CIMB SG account, it is likely you'll need to keep transferring funds to this account in the near future. For our initial deposit, we are required to fund our CIMB SG account via CIMB Malaysia, which incurs a more expensive FX conversion rate.

For better savings, I highly recommend that you do a small initial transfer (eg. SGD10) via CIMB MY, and the rest (SGD990) via Wise to save on FX rates.

For all future fundings, you can go through platforms like Wise to get a cheaper FX rate. Use my Wise referral link and get a fee-free transfer of up to 500 GBP (~RM2,900) in your first transfer!!

Open a Wise account and get a free transfer today!

FX Rate Comparison: CIMB RM3,148.50 = SGD1,000 vs Wise RM3122.14 = SGD1,000

p

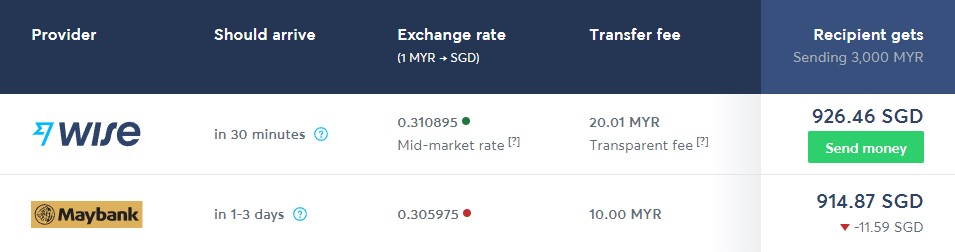

Rate Comparison: Check out the rates between Wise and our local banks below (RM3,000 to SGD):

Open a Wise account and get a free transfer today!

How to use your Singapore bank account to fund your foreign stock broker/accounts

One major benefit of having a Singapore bank account is many foreign brokers accept the SGD currency compared to MYR. In other words, you can save on the expensive FX and intermediary banking fees by funding your broker via a Singapore bank account.

Check out this guide on how I fund (and withdraw) my go-to foreign stock broker, Tiger Brokers and Singapore robo-advisor Syfe with my CIMB SG account!

ALSO READ: Tiger Brokers review

ALSO READ: Syfe Robo-Advisor Review

No Money Lah's Verdict

So here you have it - a detailed guide on how to open a Singapore bank account for Malaysians!

CIMB FastSaver is the easiest way for you to open a Singapore bank account at the moment, and I highly recommend opening an account especially if you look to fund your overseas stock brokerage account.

Before you go, remember to use my Wise referral link and get a fee-free transfer of up to 500 GBP (~RM2,900) in your first transfer! As a disclaimer, No Money Lah will get a small referral reward if you use my referral link, which will help the blog and keep producing useful content like this one!

If you find this guide useful, please share it with your friends & family too!

Disclaimer:

This article is accurate as of the time of writing. Please let me know if you notice any changes to the process and I'll update this guide accordingly.

This article also contains referral link that will reward No Money Lah on every successful referral. This will help sustain the blog so I can keep producing quality guides and content like this.

A thought on Social Media & Self-Esteem

I think the major challenge of the parents of our generation is to figure out how to teach our kids to not take social media too seriously, and how to not let social media influence their ego and self-esteem.

And most importantly, how to build confidence without having to rely on social media for self-validation.

Back then, I studied in a high school full of kids from really wealthy family backgrounds (children of big figures, business person, etc).

Funnily, I'm not aware of most of them until many years later via social media.

Aside from the fact that my peers are really well-taught & low profile with their backgrounds, I think a big part is social media was still really new back then.

Looking back, I'm grateful that my teenage years are pretty much clear from the social media scene that we living in today.

As a kid from the M40 group, I could make friends with anyone without feeling overwhelmed by the differences in our backgrounds. And there's less pressure trying to catch/copy the latest material stuff & trends, and instead allowing my curiosity to prosper.

I think the major challenge of the parents of our generation is to figure out how to teach our kids to not take social media too seriously, and how to not let social media influence their ego and self-esteem.

And most importantly, how to build confidence without having to rely on social media for self-validation.

Gonna be a tricky hurdle given how even we, supposedly mature adults, are equally influenced by social media anxiety as well, don't you think?

Why figuring out what's important to you in life is so crucial

Knowing what I want also means I can truly be happy for other people's wins in life without being sour.

Why? Because there's no point comparing to someone else's life that you do not see yourself living.

My recent revelation: You gotta spend time thinking about what's important to you.

Knowing your priorities will tone down a lot of the anxieties that we have in our adulthood life.

I spent my 20s figuring out that (i) PEACE of mind + (ii) pursuing my CURIOSITY are things I value A LOT.

For me, peace of mind means I don't rush myself into a relationship just because most of my best friends got engaged/married last year. (9 weddings, no joke)

It also means I don't/stop investing in things that can disturb my mental peace (eg. Properties ![]() , individual stocks), regardless of what my peers/other Youtubers are doing.

, individual stocks), regardless of what my peers/other Youtubers are doing.

It also means I don't take up financial commitments simply because my peers are doing 'em. (![]()

![]() )

)

Letting go of FOMO granted me the peace to pursue my genuine curiosity in work and life - be it the market, learning about love/relationship, traveling, and more without feeling guilty or I'm 'later' in my adulthood life than the peers around me.

Finally, knowing what I want also means I can truly be happy for other people's wins in life without being sour.

Why? Because there's no point comparing to someone else's life that you do not see yourself living.

Life's more fruitful and less overwhelming when there are clear priorities, cheers.

How to invest in the S&P500 Index for non-US residents (via Ireland-Domiciled ETFs)

Are you looking for a (simple) investment that has proven itself over the past few decades?

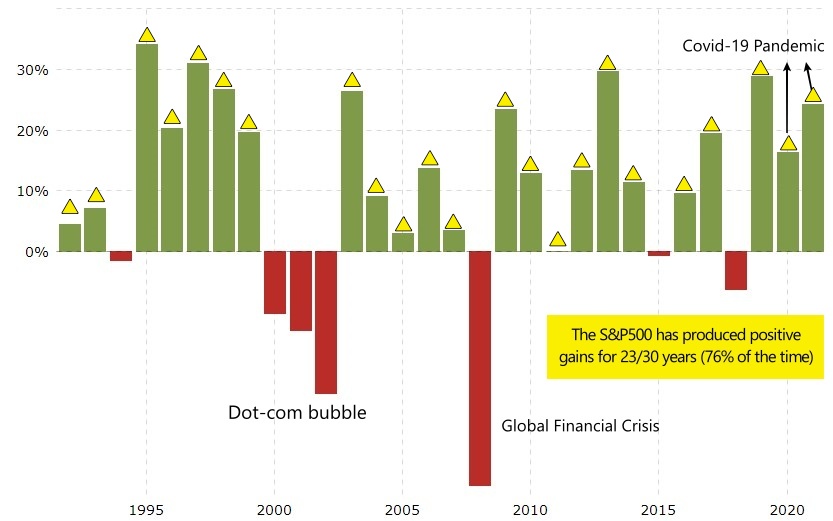

How about one that makes money 76% of the time over the past 30 years?

The S&P500 index is perhaps one of the best testaments for simple, yet practical investment that has withstood the test of time (AND financial crises, AND Covid-19).

But what exactly is the S&P500, and how can you (as a non-US resident) invest in the S&P500 index?

In this post, let’s explore how you can invest in the S&P500, and the things that you need to know before investing in it!

Before this, here are some related posts that you may want to read:

- Interactive Brokers (IBKR review): Invest in the global market including Ireland-domiciled ETF!

- Malaysians’ guide to ETF investing

- Are you a dividend investor? Here are the best dividend-paying ETFs in Malaysia!

p

What is the S&P500 Index?

The S&P500 index is a stock market index that has been tracking the performance of the top 500 largest US-listed companies since 1957.

Just like how the KLCI and STI are used to measure the performance of the Malaysian and Singapore stock markets respectively, the S&P500 is commonly used as a proxy to the US stock market.

In fact, since the US stock market is so dominant, the S&P500 is sometimes considered as THE stock market.

So, what are the key companies within the S&P500 index?

Apple, Microsoft, Amazon, Meta (formerly Facebook), Alphabet, Berkshire Hathaway, and JP Morgan – just to name a few.

Essentially, by investing in the S&P500, you’ll get exposure to the finest companies in the US stock market.

But is there more to the S&P500? In the section below, let me show you some surprisingly impressive feats about the S&P500 index!

Time-tested Performance: Why invest in S&P500

In 2020, Warren Buffett stated that “for most people, the best thing to do is to own the S&P 500 index.”

Personally, I think there are solid reasons to this statement. Here are 2 indications of why the S&P500 is a great long-term investment:

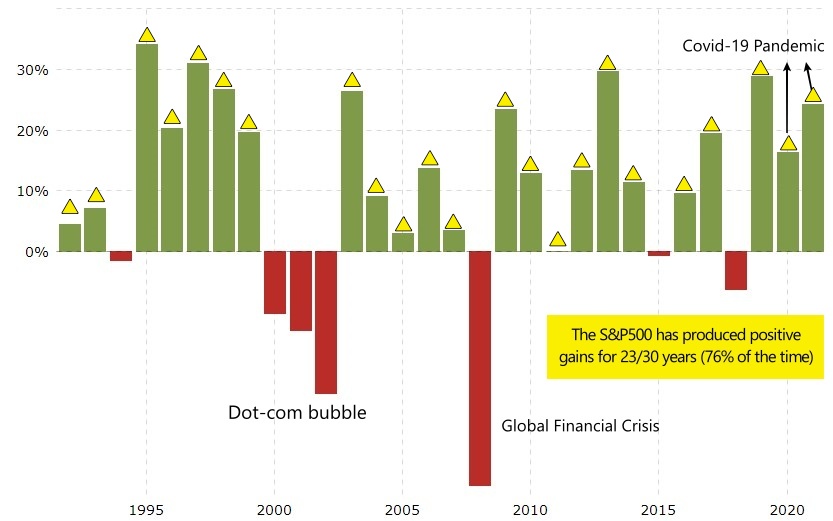

#1 The S&P500 produced gains 76% of the time over the past 30 years.

Over the past 3 decades (1992-2021), the S&P500 has ended up higher in 23 out of 30 years. This makes up to gains 76% of the time*!

That, ladies & gentlemen, is just you investing your money passively without having to manage them at all! Not sure 'bout you, but I think that's a fantastic deal relative to the effort required!

*Important: Past performance is NOT indicative of future performance.

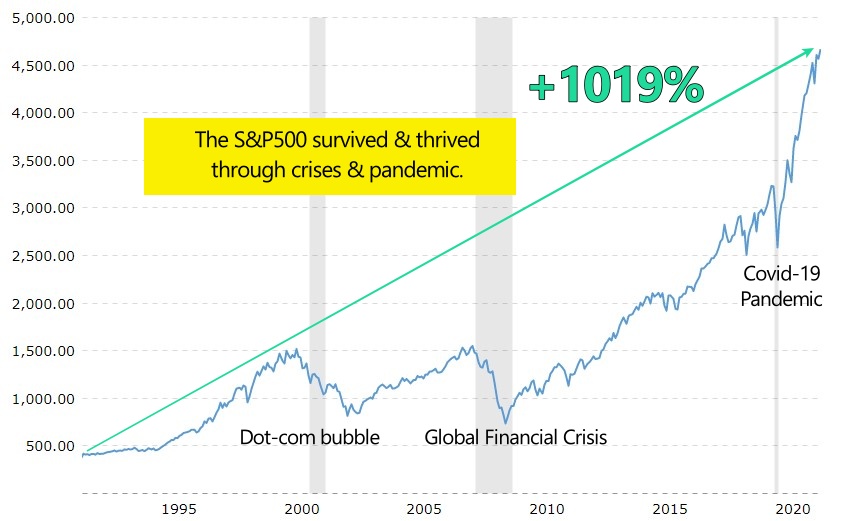

#2 The S&P500 has grown by 1019%* over the past 30 years.

This translates to an 8.38% in annualized return (ie. 8.38% yearly COMPOUNDED return over the past 3 decades!)

*1992 to 2021

Now, if #1 and #2 aren’t good enough, consider this:

Over the past 3 decades, the S&P500 has survived the dot-com bubble (2000), global financial crisis (2008), the Covid-19 pandemic crisis (2020), many other smaller crises – and STILL grown by 1019%!

In other words, the S&P500 has not just overcome the biggest financial and health crises of the past decades, but still managed to thrive coming out of them.

If you are looking for a simple AND reliable way to grow your wealth, I am pretty sure the time and crises-tested S&P500 could find its place in your portfolio.

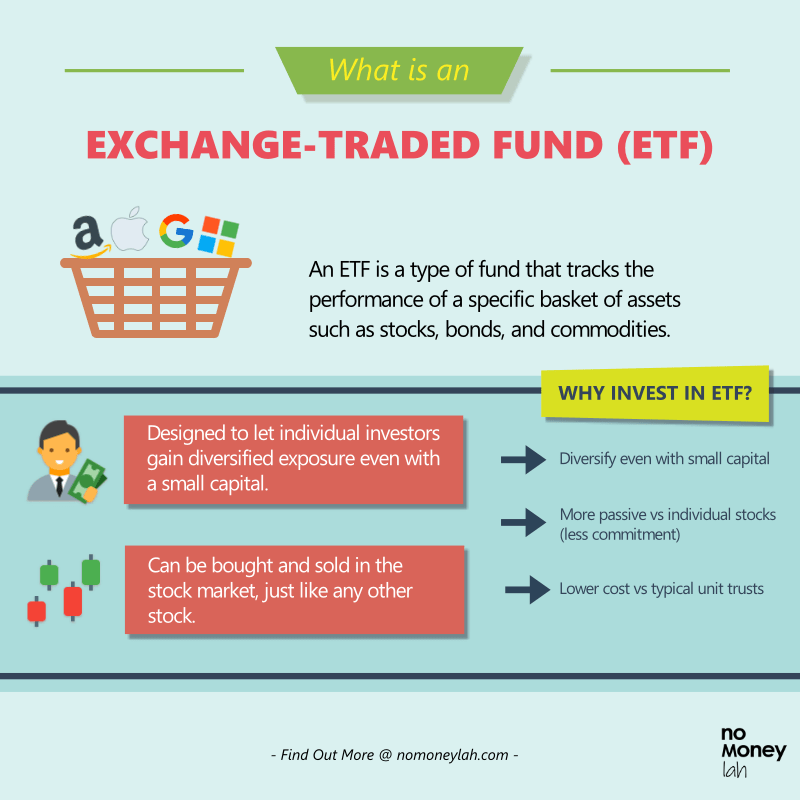

How to invest in S&P500 Index as a non-US resident

As an investor, we cannot invest directly in the S&P500 index.

Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs).

An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.

In other words, you can buy/sell ETFs just like how you buy or sell stocks.

Before we proceed, as a non-US resident, it is not viable for us to invest in US-listed ETFs for the long-term due to tax reasons. More on why and what you can do about it in the following section.

RELATED READ: Guide to ETF Investing

Withholding & estate tax for investing in the US stock market

In the US, there are many popular S&P500 ETFs, such as:

- SPDR S&P 500 ETF (ticker: SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

These ETFs are especially popular among US investors as they track the performance of the S&P500 index closely.

However, it is not recommended for non-US residents (eg. investors from Malaysia or Singapore) to invest long-term in the US-listed S&P500 ETFs (eg. VOO, SPY, IVV).

Why?

-

Withholding Tax on Dividends

As countries without tax treaty with the US, non-US residents investing in the US stock market are taxed 30% on dividends received.

So, let’s say you received $100 in dividends, you’ll only end up getting $70 due to withholding tax.

This is certainly not ideal if we invest in US-listed stocks or ETFs that pay out dividends.

Check the list of countries with tax treaty with the US HERE.

-

Estate tax

There is also a 40% estate tax in the US for foreign investors.

So, let’s say I pass away with $1 million worth of stocks, $400k will go to the US government, and only $600k will be received by my appointed nominee.

Ireland-Domiciled ETFs: The best S&P500 ETFs for non-US residents

Well, does that mean we are not able to invest in the S&P500 after all?

Not exactly. There are ways to go around this:

The easiest way for non-US investors (eg. Malaysians, Singaporeans) to invest in the S&P500 index is through Ireland-Domiciled ETFs.

Why?

Because Ireland-Domiciled ETFs benefit from the US-Ireland tax treaty of only 15% withholding tax on dividends. This is significantly lesser compared to the 30% withholding tax of US-listed ETFs.

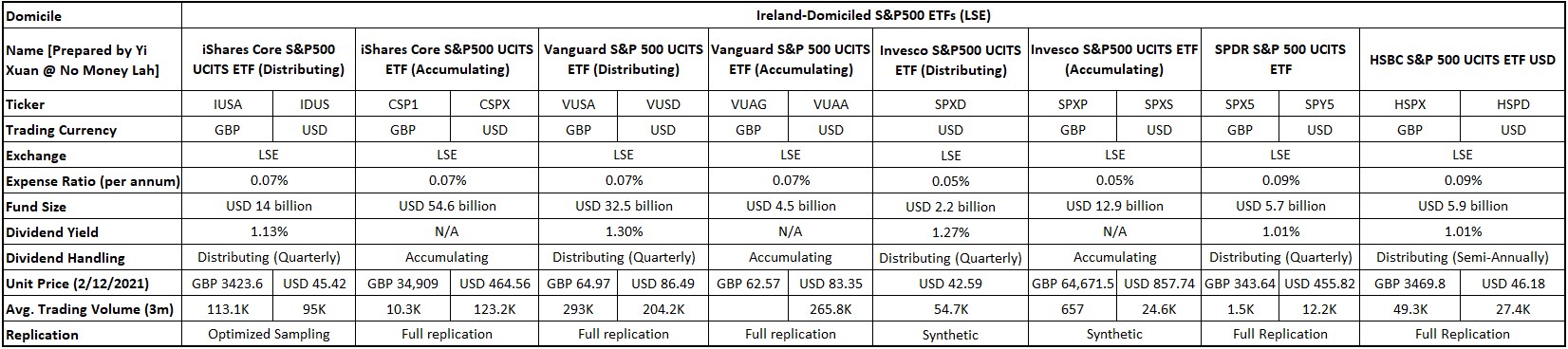

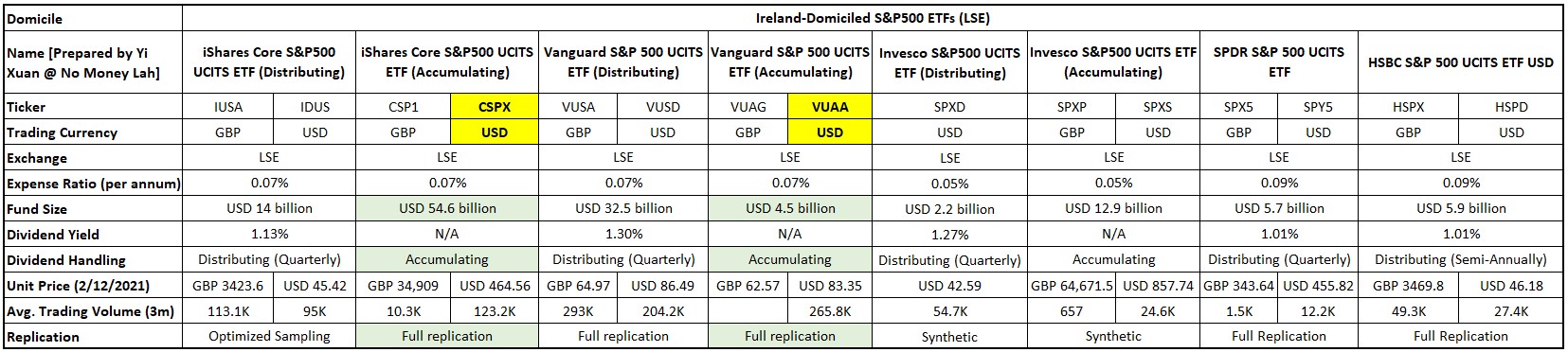

(a) How many Ireland -Domiciled S&P500 ETFs are there?

The following are 8 Ireland-Domiciled S&P500 ETFs are ETFs listed in the London Stock Exchange (LSE) that tracks the S&P500 index.

Don’t worry, let me simplify this table and tell you which S&P500 ETFs are the best among all:

In the table above, there 6 things that you need to pay attention to:

(1) Trading Currency:

Most ETFs can be bought either in GBP or USD. Personally, I’d go for USD-denominated ETFs as USD is still the go-to global currency.

(2) Expense Ratio:

ETF providers charge a small annual management fee for their ETFs. In this case, all ETFs have a very low expense ratio so the difference is negligible.

(3) Fund Size:

In general, an ETF with a larger size fund size is a good indicator of the ETF’s durability as well as its popularity. Larger ETFs can also make use of economies of scale to lower their costs.

So, ETFs like CSP1 and CSPX are the obvious winner here. That said, other ETFs are also fairly respectable in size (billions) so you’ll be in good place regardless of which S&P500 ETF you select.

(4) Dividend Handling:

There are 2 approaches on how these ETFs manage dividends:

- Distributing: Your dividends are redistributed to you.

- Accumulating: Your dividends are reinvested automatically.

Choosing to invest in either ETF is your personal preference. Personally, I’d go for Accumulating ETFs as I want my dividends to be re-invested automatically, so I can compound my returns more efficiently.

(5) Unit Price:

Some ETFs are larger in terms of per unit share price. As an example, CSPX is USD 400+/share while VUAA is USD 80+/share.

If your investment capital is small, ETFs with smaller per unit price like VUAA would provide you more flexibility to invest in the S&P500.

(6) Trading Volume:

Here’s something that you may not know - the trading volume of an ETF has a minimal indication of the ETF’s liquidity.

Rather, it is the trading volume of the underlying component companies that truly affect the liquidity of an ETF (for S&P500 it’d be companies such as Apple, Microsoft etc.)

Hence, it’s okay to not put too much weightage into the trading volume of an ETF in our decision-making process.

(b) Which is the best Ireland-Domiciled S&P500 ETF?

Considering all the key factors, personally, I think CSPX or VUAA are the best Ireland-Domiciled S&P500 ETFs among all. Here are why:

- Both CSPX and VUAA are denominated in my preferred currency, USD.

- Both CSPX and VUAA have a very minimal expense ratio of 0.07%/annum.

- Both CSPX and VUAA will reinvest my dividends automatically (accumulating).

- Both CSPX and VUAA use a full replication approach. Meaning, I’ll get the most accurate representation of the S&P500 index when I invest in either of them.

- CSPX is the larger ETF compared to VUAA, but it has a larger per-unit price. This makes it less flexible to invest in it with a smaller capital.

- On the other hand, VUAA is a smaller ETF. However, it has a smaller per unit price, which is easier for investors to invest with a small capital.

Regardless, I think either ETFs are great for you to gain exposure in the S&P500 index.

Recommended broker to invest in Ireland-Domiciled S&P500 ETFs: Interactive Brokers (IBKR)

To invest in Ireland-Domiciled S&P500 ETF, you’ll need to have a broker with access to the exchange where the ETF is listed.

In this case, all the ETFs that we discussed are listed on the London Stock Exchange (LSE).

For this, I use Interactive Brokers (IBKR) to invest in Ireland-Domiciled S&P500 ETFs listed in the LSE. In fact, IBKR gives investors access to 150 markets in more than 33 countries! (US, Hong Kong, China, Japan, UK, Singapore, Europe, and more!)

In my opinion: IBKR is a no-brainer for investors looking to gain access to global markets at a low commission.

RELATED READ: Interactive Brokers Long-Term Review

Open an Interactive Brokers (IBKR) account today:

Click the image below to explore Interactive Brokers' Low Commission:

No Money Lah's Verdict

So, what do you think? Isn't the S&P500 amazing, given how it has withstood the test of time and crises?

For me, I genuinely think that the S&P500 is a great long-term investment, be it as a standalone investment, or being part of a long-term investment portfolio.

Remember, if you want to invest in Ireland-Domiciled ETFs, be sure to check out Interactive Brokers for global market access at a competitive price!

Disclaimers

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Guide & Tips: How to withdraw funds from Interactive Brokers (IBKR) via Wise

In this post, let’s explore how to withdraw the funds from your Interactive Brokers (IBKR) account via Wise.

This is the fastest and most convenient way to withdraw funds from your Interactive Brokers (IBKR) account.

This guide is especially suitable for non-US residents (eg. Singapore, Malaysia, and more) – any questions feel free to leave them in the comment section at the end of this post!

RELATED:

Part 1: Withdraw funds from Interactive Brokers (IBKR) via Wise

In this guide, I will demonstrate how to withdraw USD from my IBKR account via Wise. Using Wise to withdraw funds from IBKR is the fastest and most convenient method.

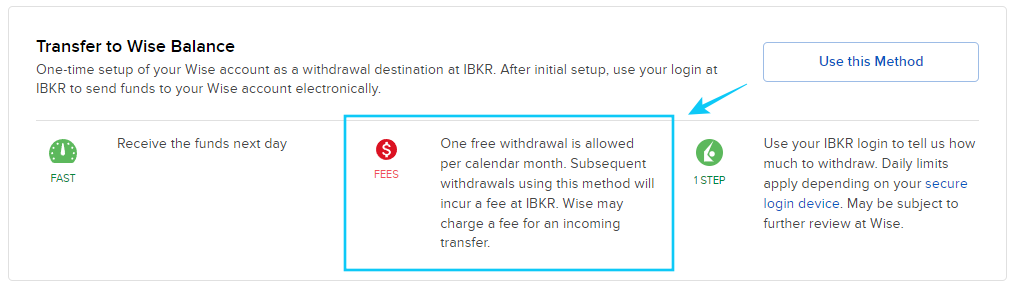

Perk: 1x FREE Wise withdrawal every month

What's great about withdrawal with Wise is that 1x FREE withdrawal is allowed every calendar month.

Hence, you do not have to pay additional fees if you only withdraw occasionally from your IBKR account.

Any subsequent withdrawal within a calendar month will have a small charge of USD 1.

Overall fee/cost involved for IBKR to Wise withdrawal:

- Part 1: IBKR to Wise withdrawal: 1x FREE withdrawal every calendar month, USD 1 for each subsequent withdrawal.

- Part 2: Wise to local bank account: Exchange rate + Wise fee.

Pre-requisite: Open a Wise account and make a deposit to your Wise balance

Before you begin, be sure to open a Wise account first if you do not have an account.

Be sure to use my Wise referral link below and get a free transfer on your first 500 GBP (~RM2600) transfer!

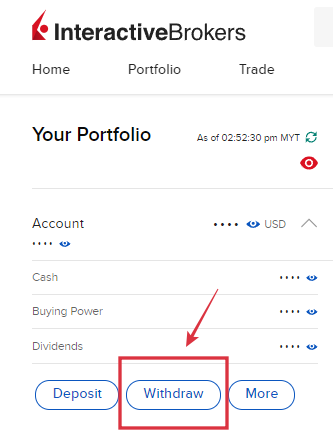

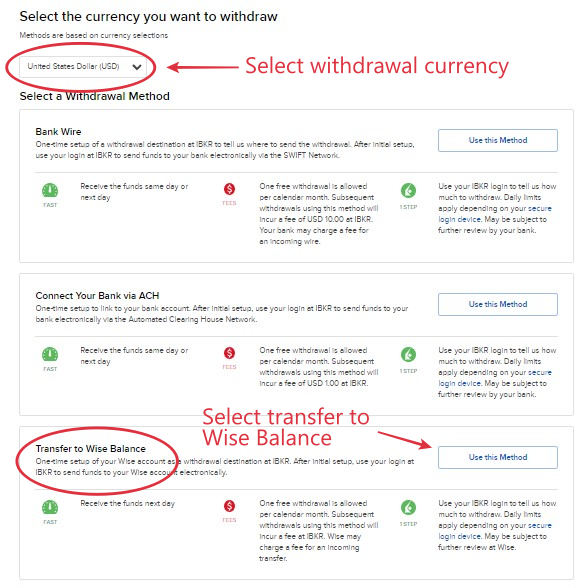

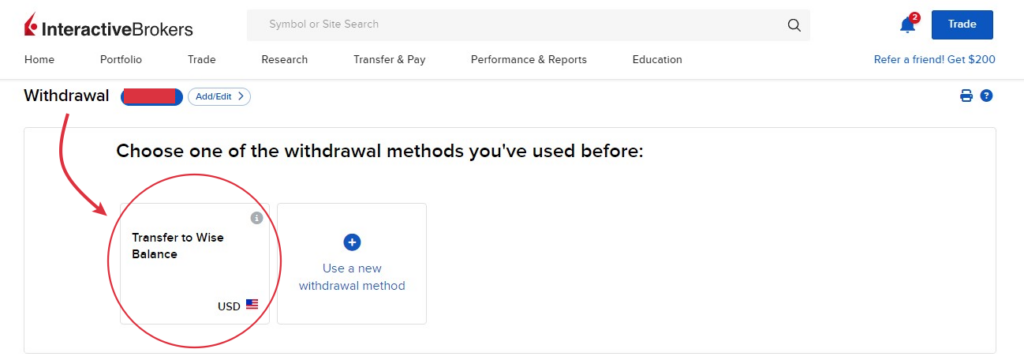

Step 1: Log in to your Interactive Brokers (IBKR) account, and select 'Withdraw'

Step 2: Select your withdrawal currency (USD, for this example), and select 'Transfer to Wise Balance'.

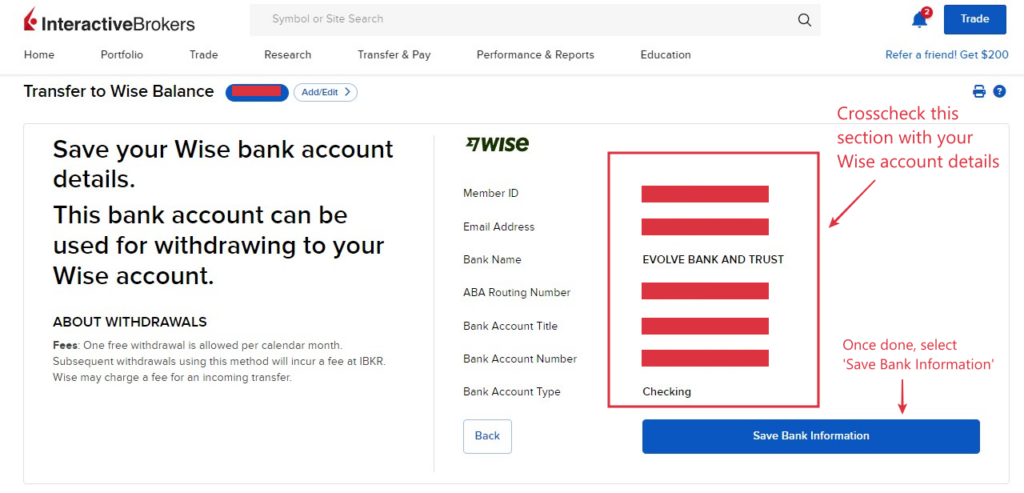

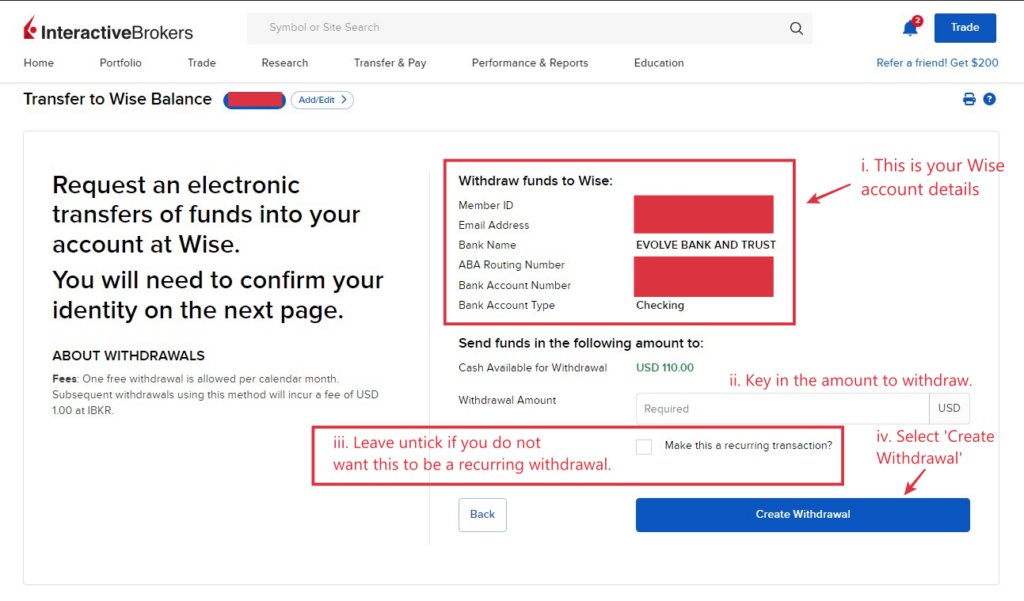

Step 3: Cross-check your Wise account details before proceeding.

Step 3 will be a one-time process. Once done, you will be able to skip this step in all your future IBKR-Wise withdrawals.

[Note for new Wise-IBKR users] If this is your first time using Wise with your IBKR account, you might not see the screenshot above. Don't worry, there is just an additional step that requires you to connect your Wise account with IBKR first, and you will be good to go.

To learn more about how to connect your Wise account to IBKR, check out Step 3 of my Wise-IBKR deposit guide HERE.

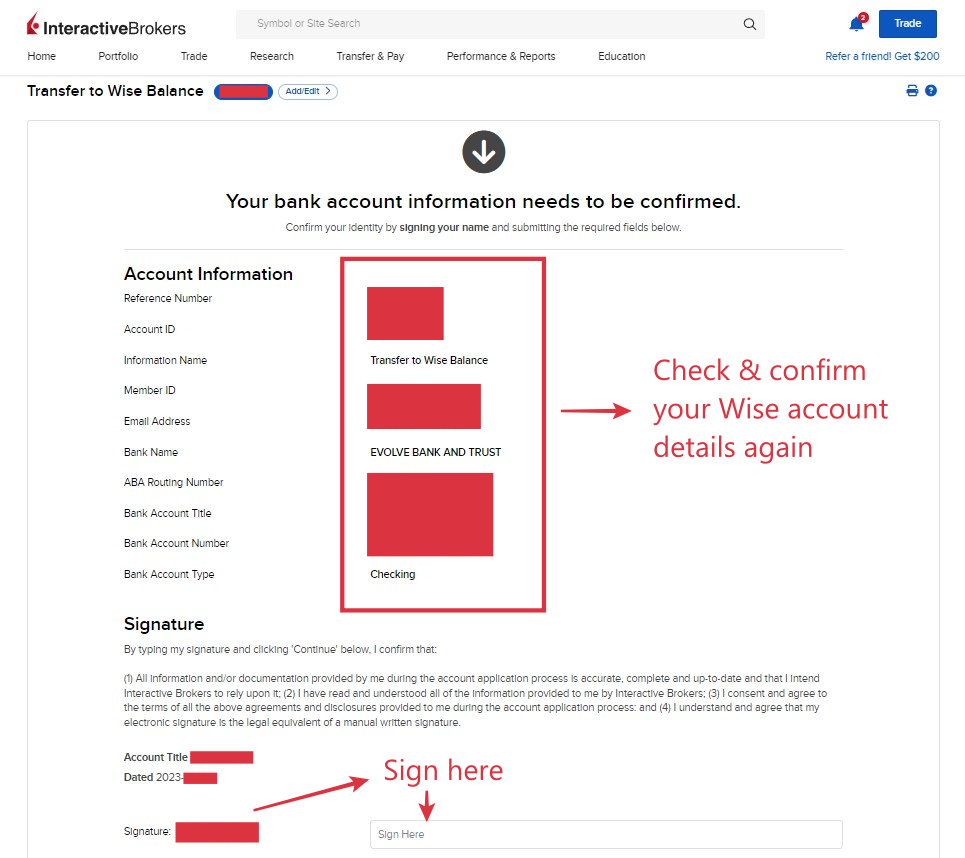

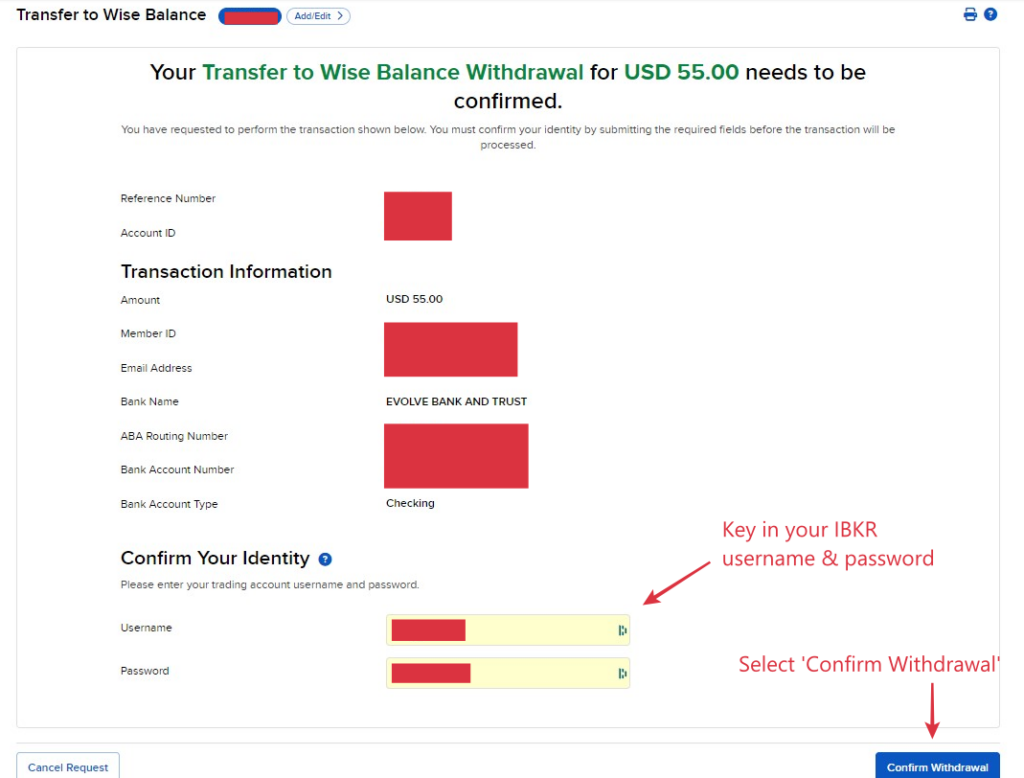

Next, you will be required to check and confirm your Wise account details again. Once done, leave your signature AND username & password to confirm the details.

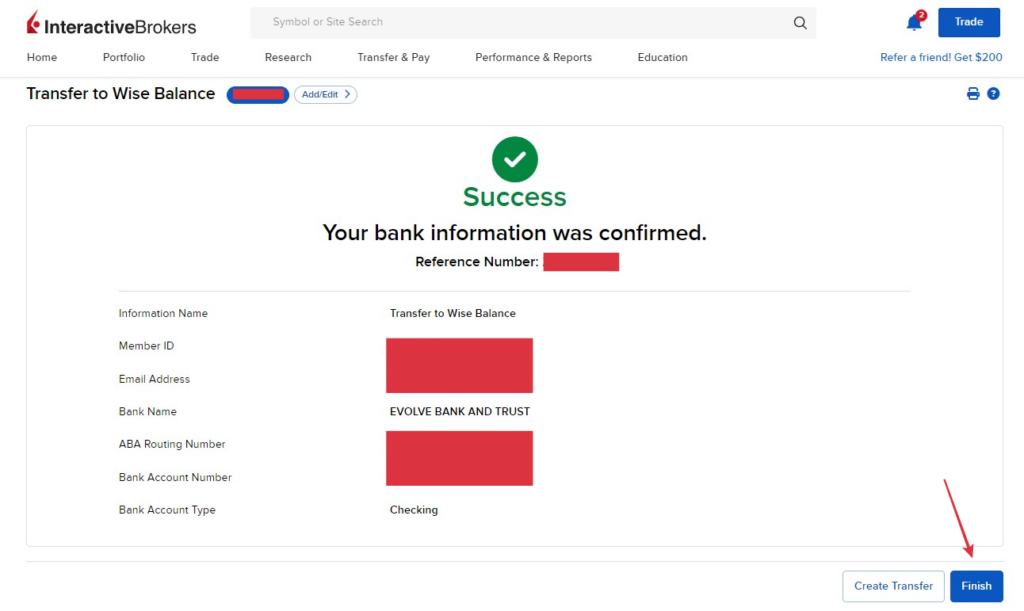

Then, you'll be shown that your Wise bank account details have been confirmed. Select 'Finish'.

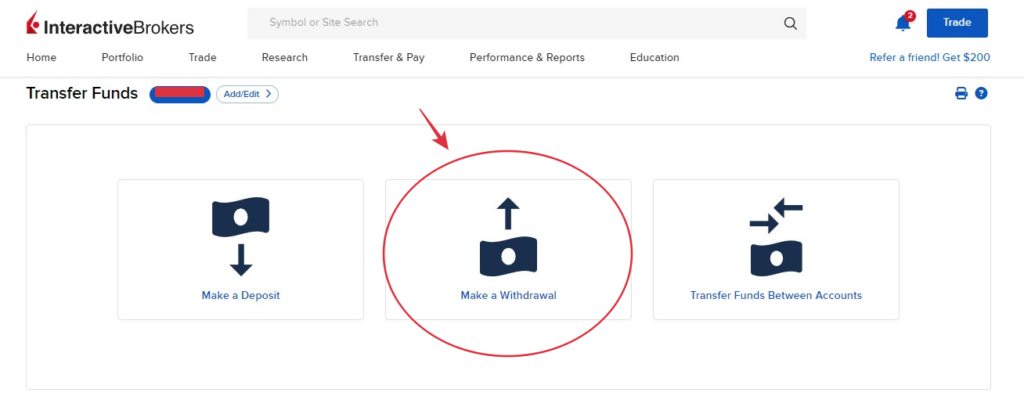

Step 4: Proceed with our IBKR withdrawal via Wise

Select 'Make a Withdrawal'.

Select 'Transfer to Wise Balance'.

Proceed to key in the amount you want to withdraw from your IBKR account.

For this demonstration, I will withdraw USD 55 from my account.

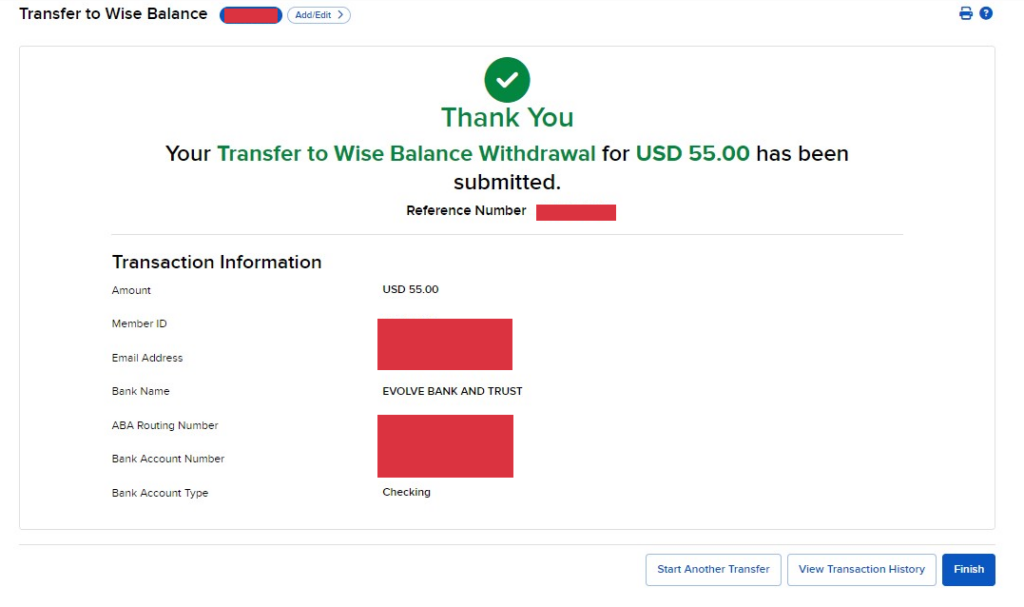

You will be shown the screen below once your IBKR-Wise withdrawal is done:

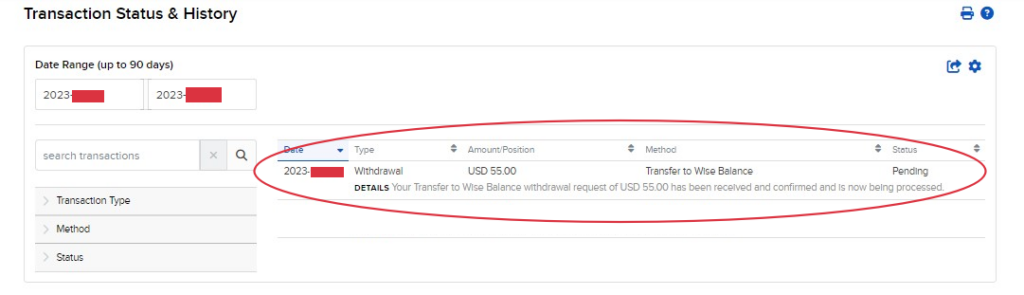

Step 5: Check your Wise withdrawal status under 'Transaction Status'

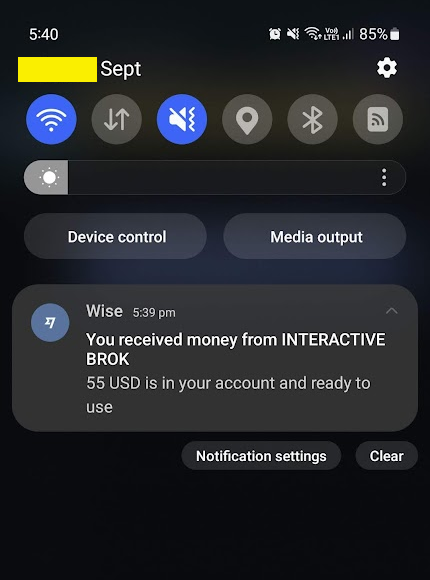

Step 6: Money arrived at your Wise account

It took about 1 working day for the withdrawal to reach my Wise account

Part 2: Transfer money from your Wise account to your bank account

Once your fund reaches your Wise account, the next thing is to transfer the fund back to your local bank account in your local currency.

For my case, I will have to convert & transfer my USD 55 IBKR withdrawal to Malaysian Ringgit (MYR) in order to send it back to my local bank account. But this method should work for most other currencies.

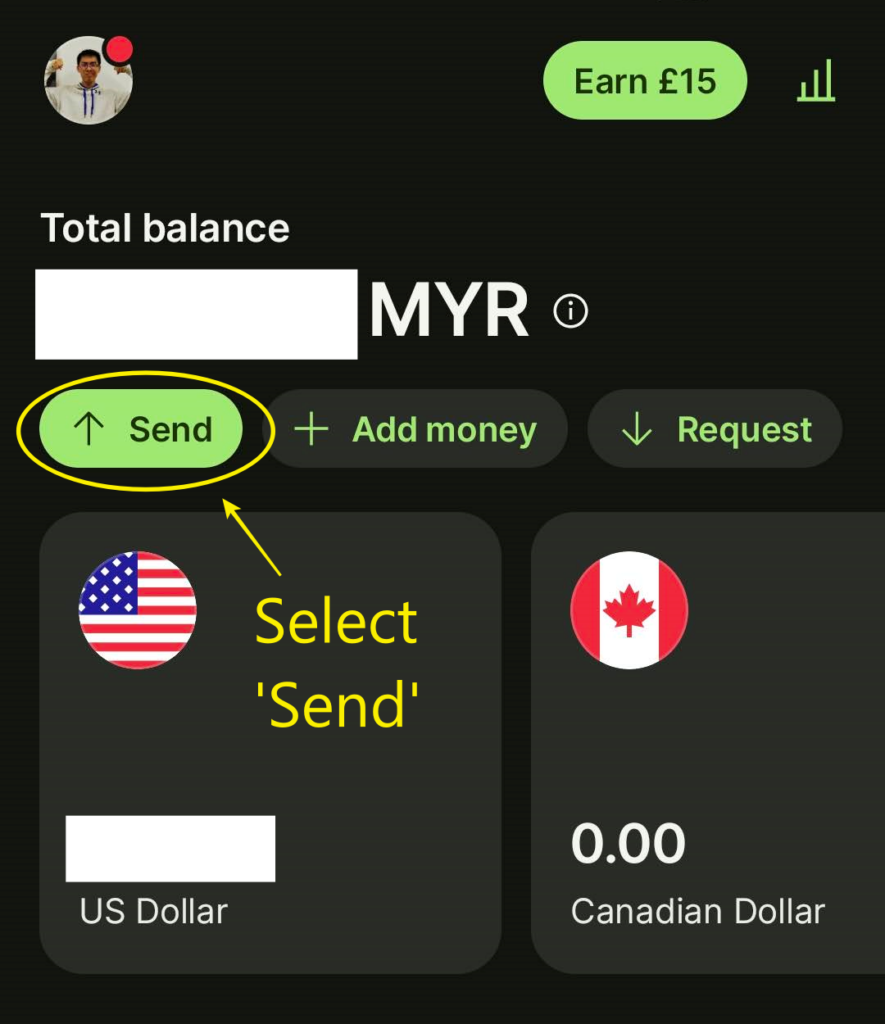

Step 1: Log in to your Wise account, and select 'Send'

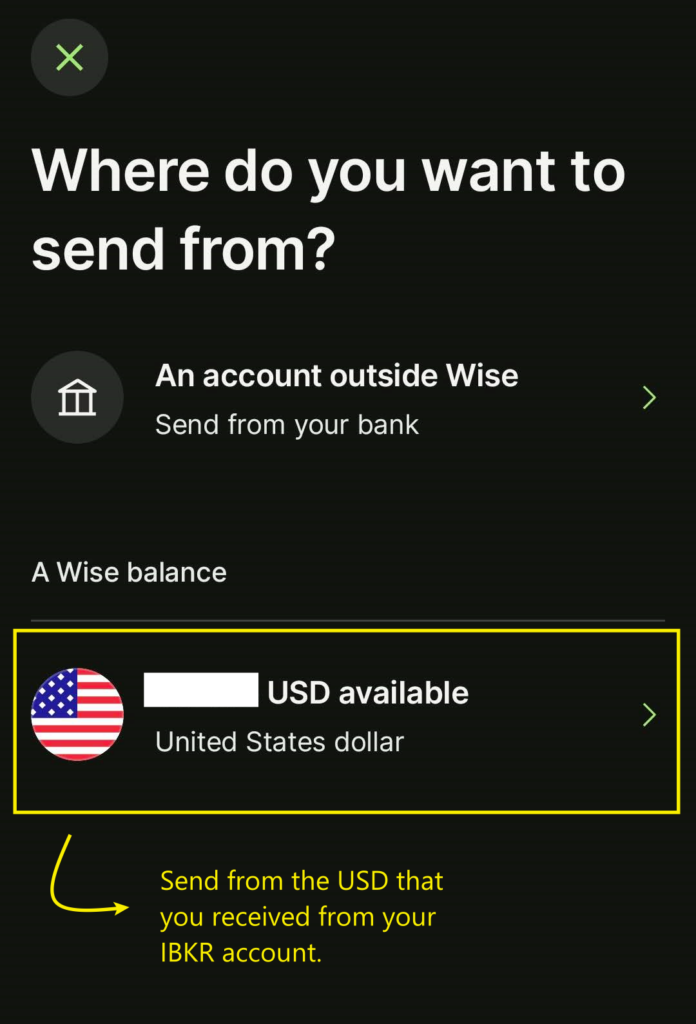

Step 2: Choose to send money from your Wise balance (USD)

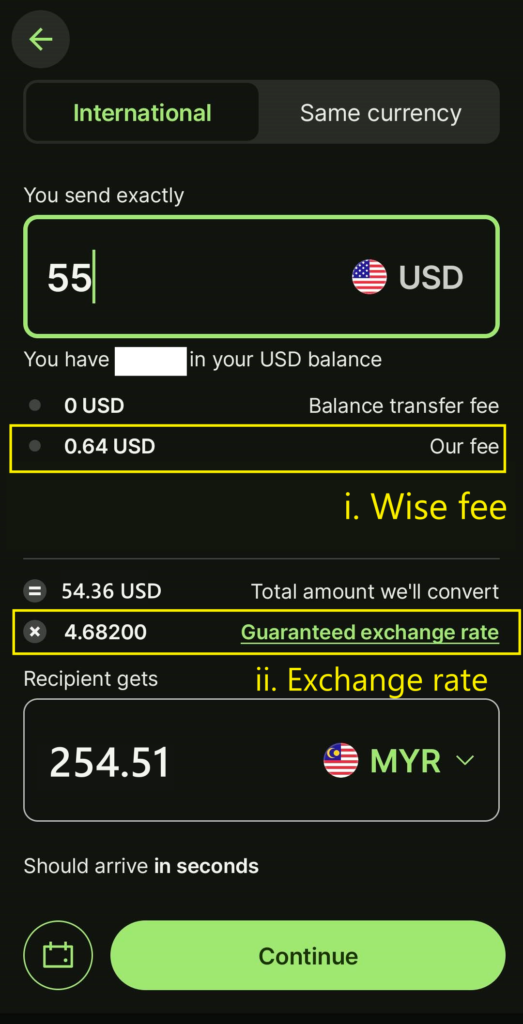

Step 3: Determine your transfer amount, check for the fees incurred (Wise fee + Exchange rate), and select 'Continue'

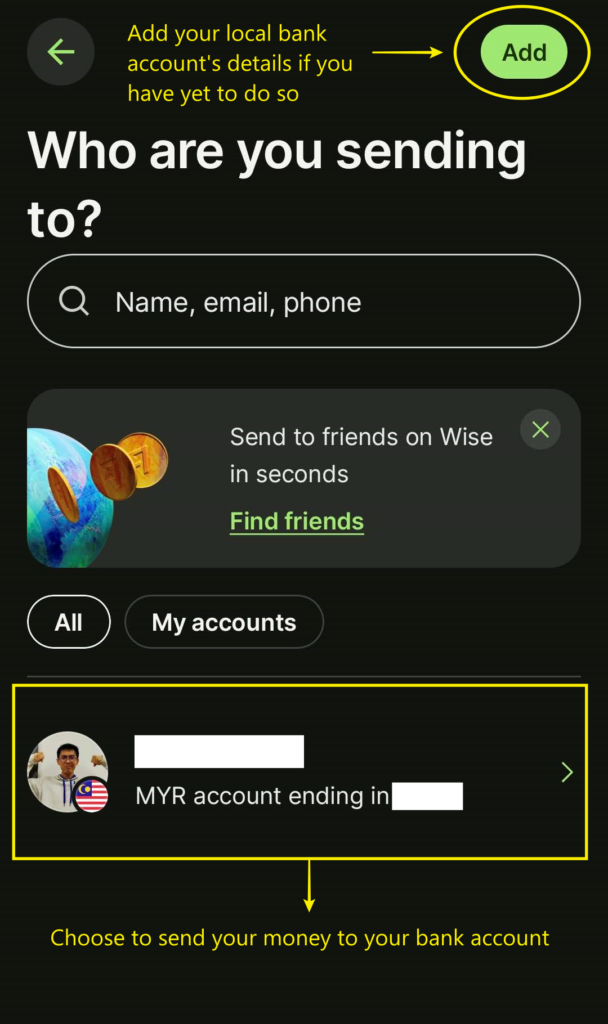

Step 4: Choose to send money to your local bank account.

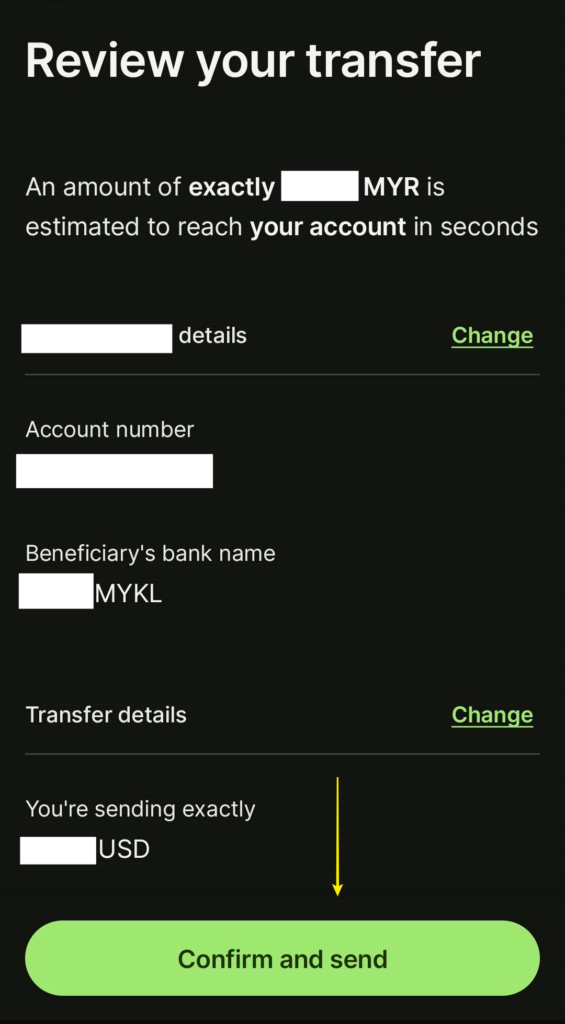

Step 5: Review and confirm your transfer. You should receive your transfer in your bank account immediately once done.

Verdict - Withdrawing from your IBKR account is never easier

With platforms like Wise, it is extremely fast & convenient to withdraw from your IBKR account.

Do you have any other tips on how to withdraw from your IBKR account? Feel free to leave your tips and thoughts in the comment section below!

Disclaimer:

This review is purely based on my personal experience and is updated as of the time of writing.

This article may contain affiliate links that will earn the blog a small fee if you click on them. This comes at no extra cost to you as a reader.

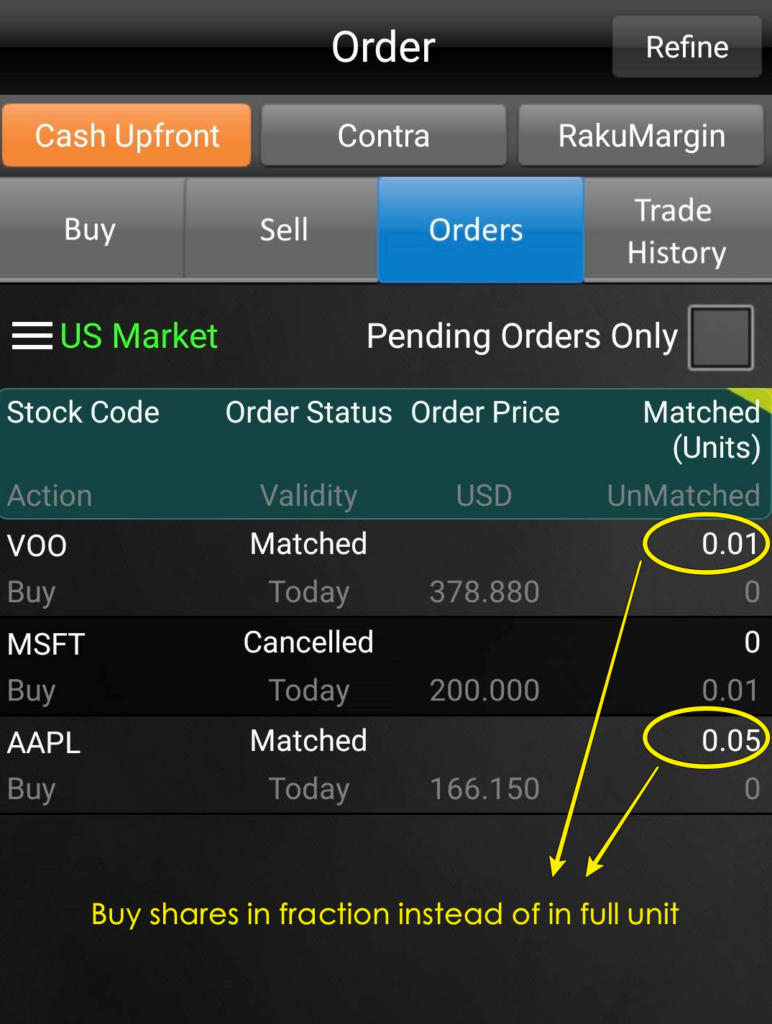

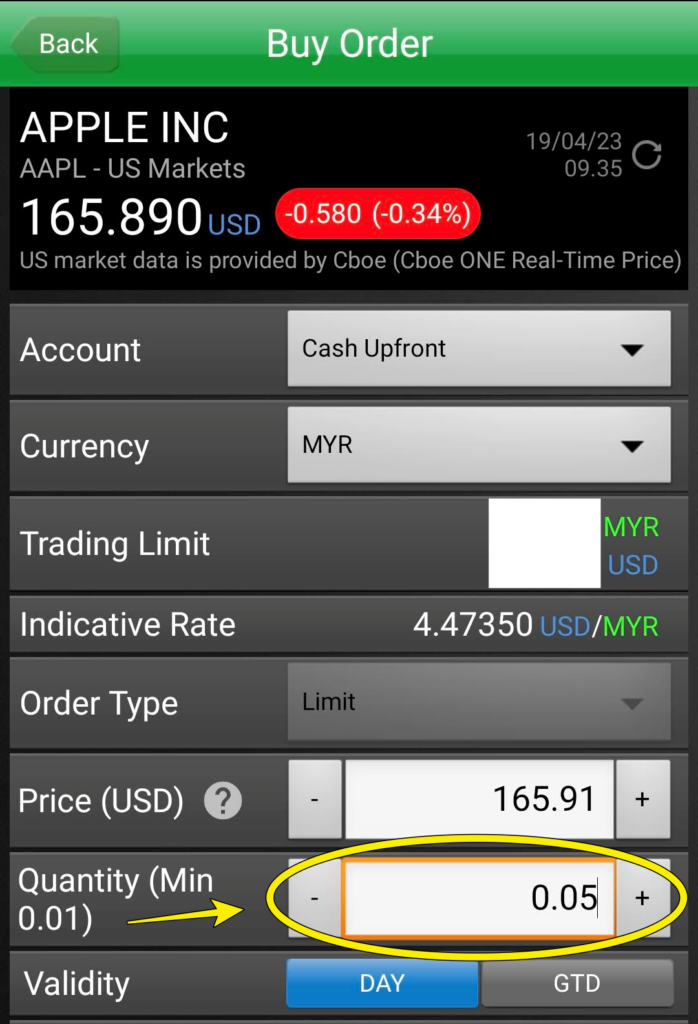

Rakuten Trade Fractional Shares Trading Overview + FAQ: Buy a slice of your favorite US stocks!

Have you ever looked at a US stock (eg. Apple, Microsoft), and found it too expensive to buy for your budget?

Fred not, as Rakuten Trade is the FIRST Malaysia-regulated broker that released the much-awaited fractional share trading for US stocks! This is a rare feature even among global stock brokers these days.

This is a major news for investors as fractional share trading makes investing in US stocks more capital-friendly and flexible.

So, what is fractional trading all about? Should you consider buying fractional shares? Let’s find out!

RELATED POSTS:

What is Fractional Share Trading?

Essentially, fractional shares allow investors to own a portion of a whole share of a stock. (imagine getting a slice of pizza, instead of the whole piece)

As an example, 1 full unit of Apple share may cost $170. With fractional trading on Rakuten Trade, you can buy Apple shares for as small as 0.01 unit for just $1.70 (0.01 units * $170).

When you invest in fractional shares, you receive the same benefits as the other investors with full shares.

In other words, you’ll make gains when the stock price rises, as well as dividends should the stock you own pay them.

Why should you consider fractional share trading?

#1 Own popular stocks regardless of your investing budget

When I first started investing, I was not able to buy the shares of US-listed companies like Apple and Microsoft as their share price were simply too high for me to afford.

With fractional shares, investors can now buy a portion of the full share regardless of their capital.

From as small as 0.01 units of fractional shares, owning the shares of big companies is easier than ever on Rakuten Trade!

#2 Build a diversified portfolio regardless of your capital

With fractional trading on Rakuten Trade, it is also possible to build a diversified portfolio even with small capital.

For instance, let's say you have RM200/month (~USD 44.45)** to invest, you can easily build an Apple-Tesla-Microsoft portfolio with fractional trading:

| Stocks | Fractional Units | Share Price (USD)* | Capital (USD) |

| Apple | 0.08 | 175.05 | 14 |

| Tesla | 0.08 | 176.89 | 14.15 |

| Microsoft | 0.05 | 318.52 | 15.93 |

| Total (USD) | 44.08 |

As you can see, the sky is the limit when it comes to how you can use fractional share trading to form your ultimate portfolio!

3 things about fractional share trading on Rakuten Trade

#1 Fractional shares are offered for selected US stocks & ETFs

Users of Rakuten Trade can now buy fractional shares of selected US stocks and ETFs on Rakuten Trade.

This means fractional units of major names like Apple, Microsoft, Tesla, and ETFs like the S&P500 (VOO) and Nasdaq-100 (QQQ) are all available.

The slight limitation though, is that the list of fractional tradable share list is subject to change tentatively every quarter. Users can't buy a particular share in fractions once it is removed from the list.

Note: US shares priced below USD 1/unit are only tradeable in a whole unit.

#2 Buy and sell in small units

Buy US stocks or ETFs from as small as 0.01 units and sell them at 0.0001 units.

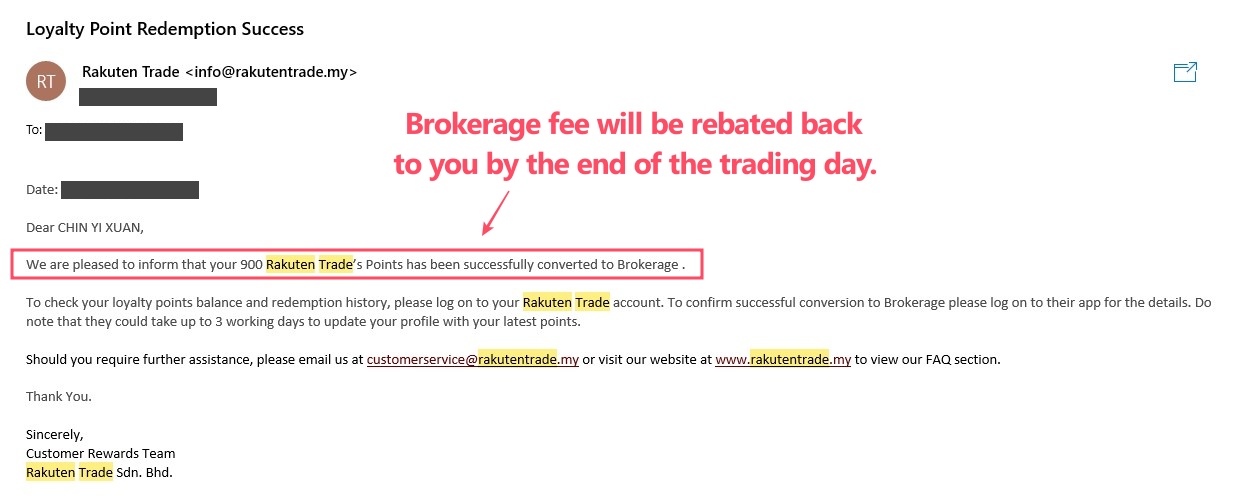

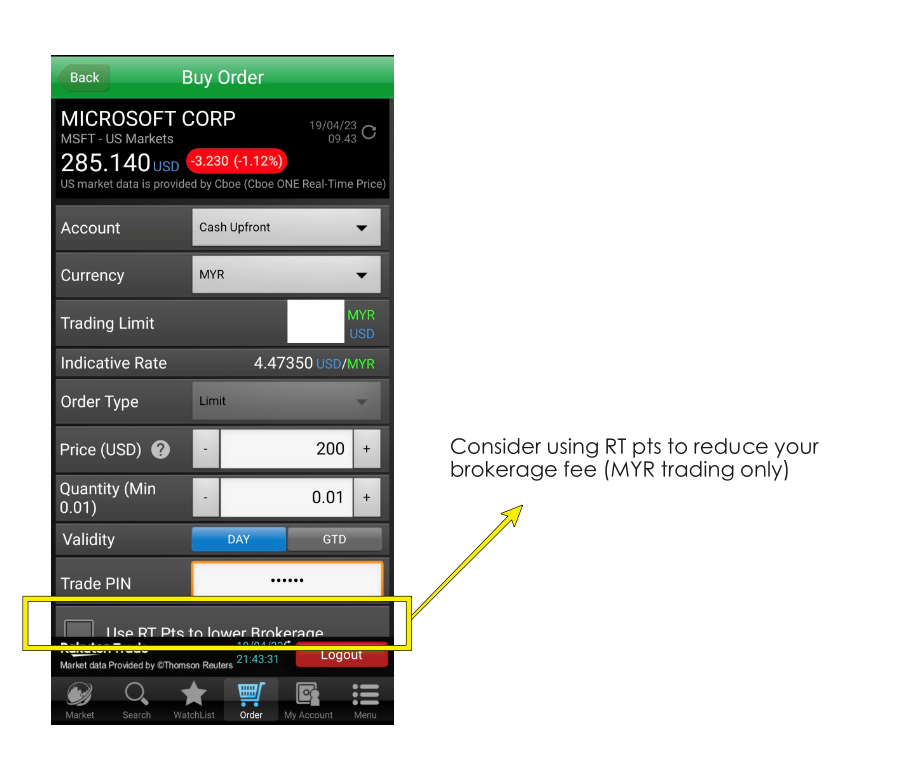

#3 Tips: Earn & Use RT Points to offset your brokerage fees

While buying fractional shares on Rakuten Trade, it is also possible for you to offset your brokerage fee via RT points when you trade in MYR.

Meanwhile, for every RM1 brokerage fee spent, you will earn 1 RT Point (equivalent to RM0.01 brokerage fee)!

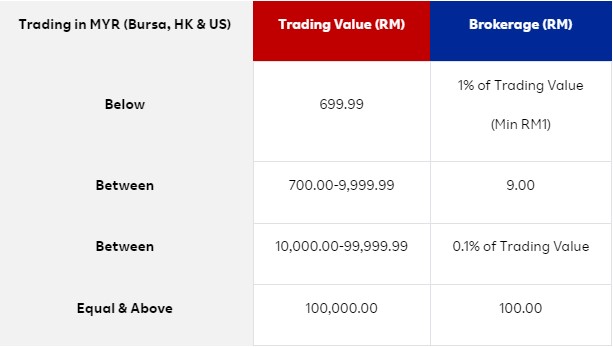

Fees while buying fractional shares on Rakuten Trade

In line with the launch of fractional shares, Rakuten Trade has adjusted its fee structure to make it more flexible and fee-friendly for users.

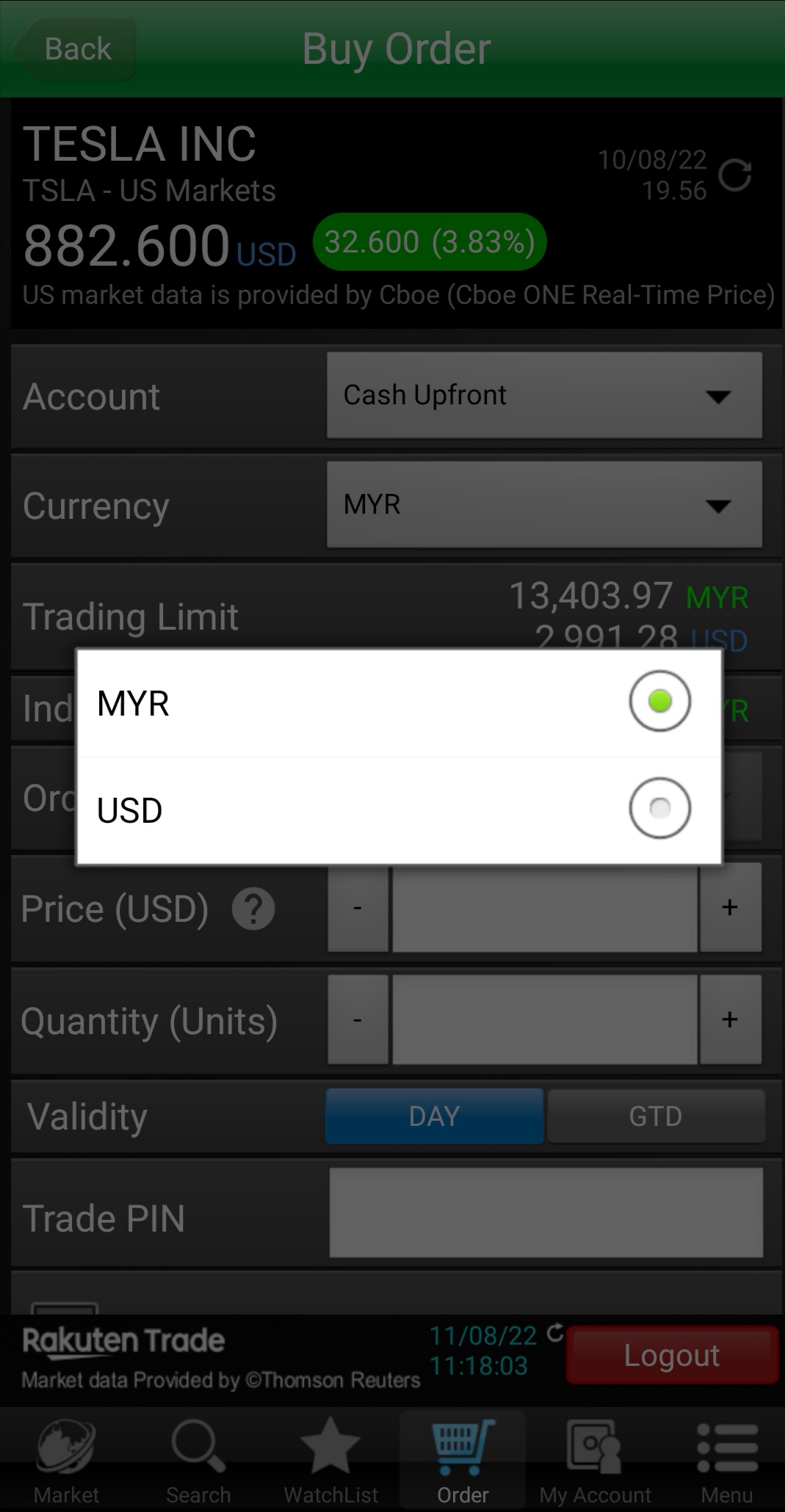

Rakuten Trade users have the flexibility to use either MYR or USD to trade US stocks:

Rakuten Trade brokerage fee in MYR:

Rakuten Trade brokerage fee in USD:

When to use MYR or USD to buy US stocks?

Whether to use MYR or USD to buy US stocks depends on your trading value.

I have compiled the different scenarios of trading value and which is a better currency to use to trade:

| Trading Value (RM/USD) | Fee (RM) | Fee (USD)* | Use |

| RM100 ($22.2) | 1.00 | 1.88 (RM8.46) | RM |

| RM500 ($111.1) | 5.00 | 1.88 (RM8.46) | RM |

| RM700 ($155.6) | 9.00 | 1.88 (RM8.46) | USD |

| RM1,000 ($222.2) | 9.00 | 1.88 (RM8.46) | USD |

| RM5,000 ($1111.1) | 9.00 | 1.88 (RM8.46) | USD |

| RM10,000 ($2222.2) | 10.00 | 2.22 (RM10) | RM or USD |

| RM20,000 ($4444.4) | 20.00 | 4.44 (RM20) | RM or USD |

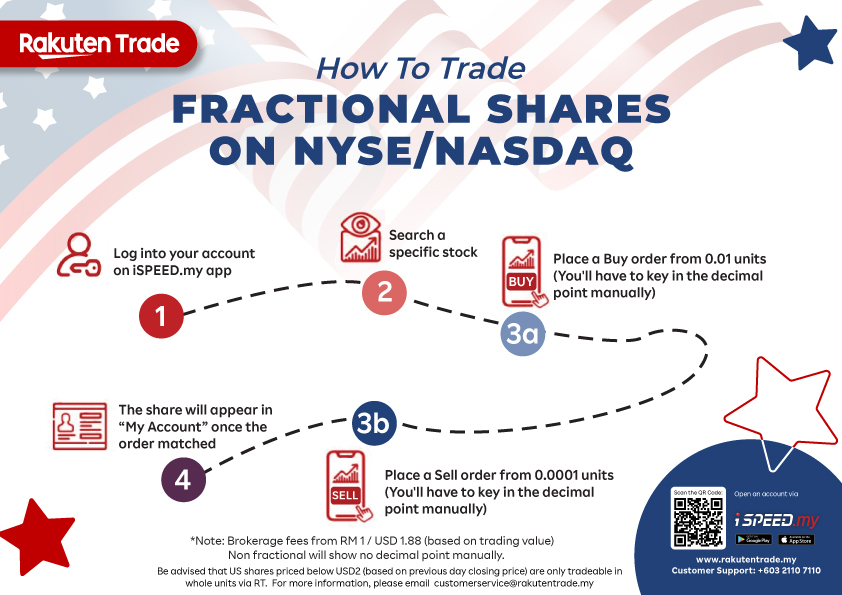

How to buy fractional shares on Rakuten Trade

For new Rakuten Trade users OR users that HAVE NOT activated foreign share trading, proceed to Step 1.

For existing Rakuten Trade users, please proceed to Step 2.

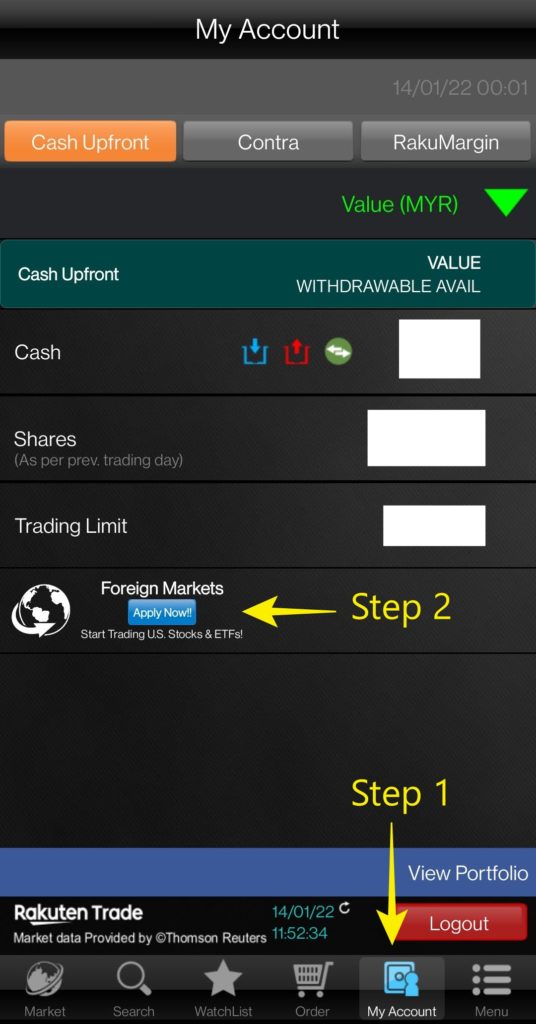

Step 1: Register for a Rakuten Trade account & activate foreign stock trading

If you are new, you’ll have to sign up for a Rakuten Trade Cash Upfront account.

Consider using my Rakuten Trade referral link by clicking the button below, and you’ll get 1000 RT points (RM10) which can be used to offset your brokerage fee!

If you need help, click HERE for my step-by-step guide to open a Rakuten Trade account.

Step 1b: Activate foreign share trading on Rakuten Trade:

Once your account is activated, log in to your Rakuten Trade account either via the website or Rakuten Trade’s iSpeed app.

You can locate the Foreign Trading activation button easily within the Rakuten Trade platform.

If you need help, click HERE for my step-by-step guide to activate foreign share trading on Rakuten Trade.

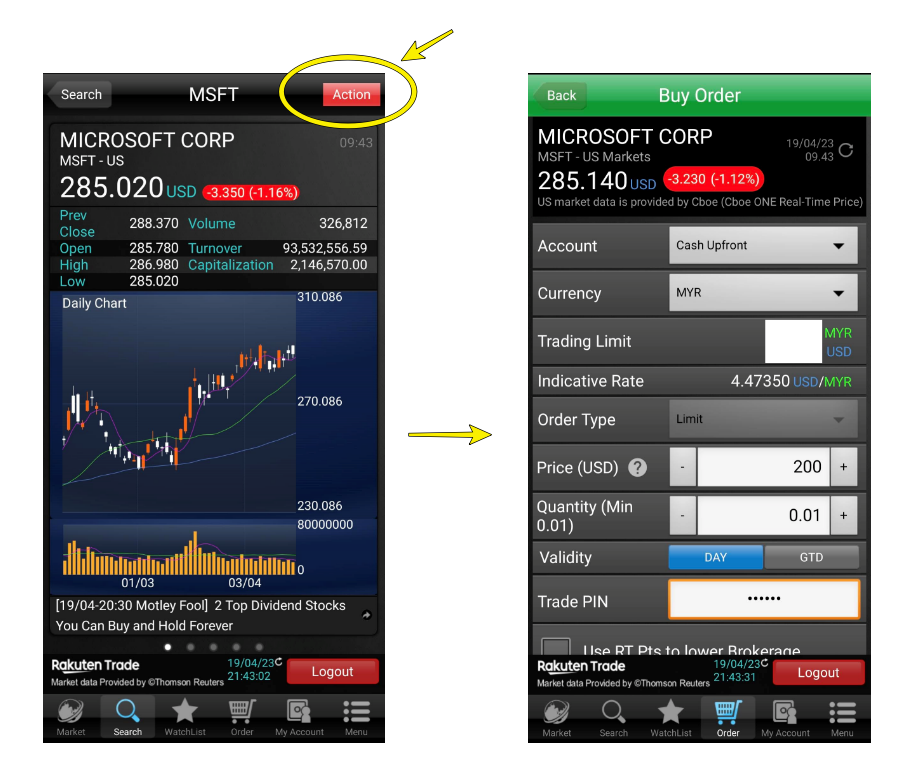

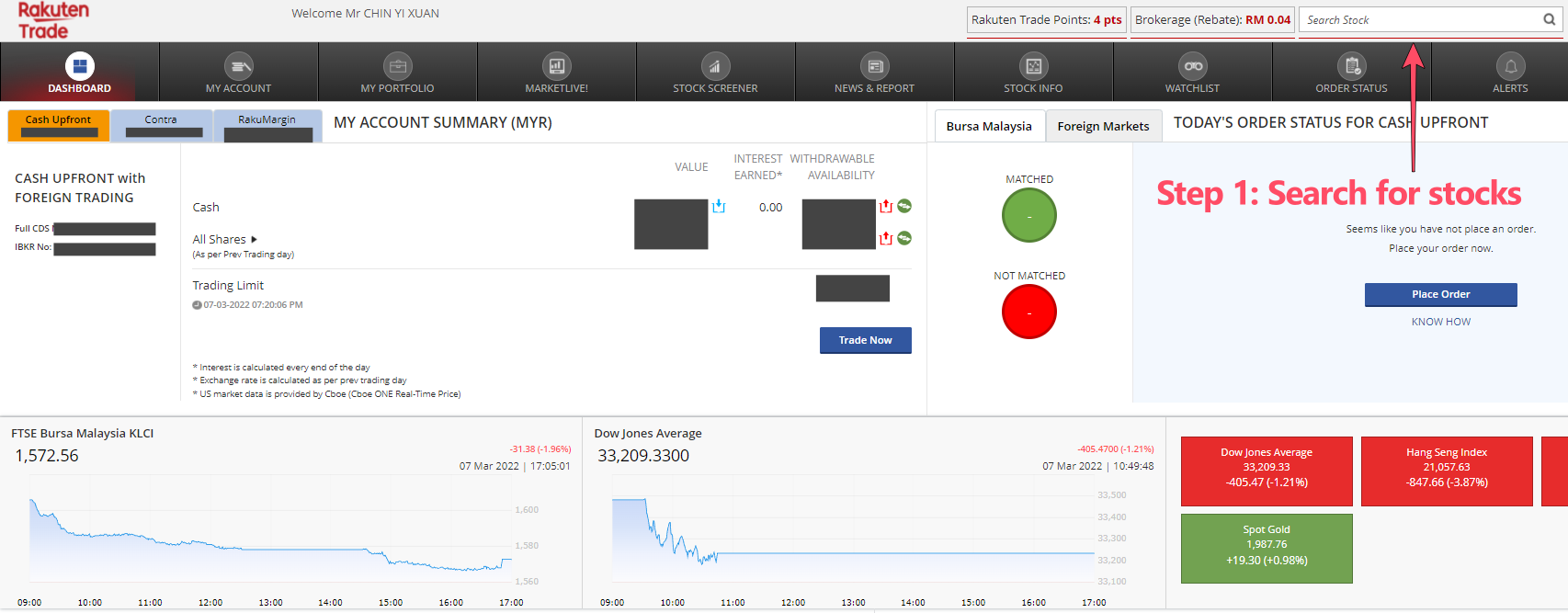

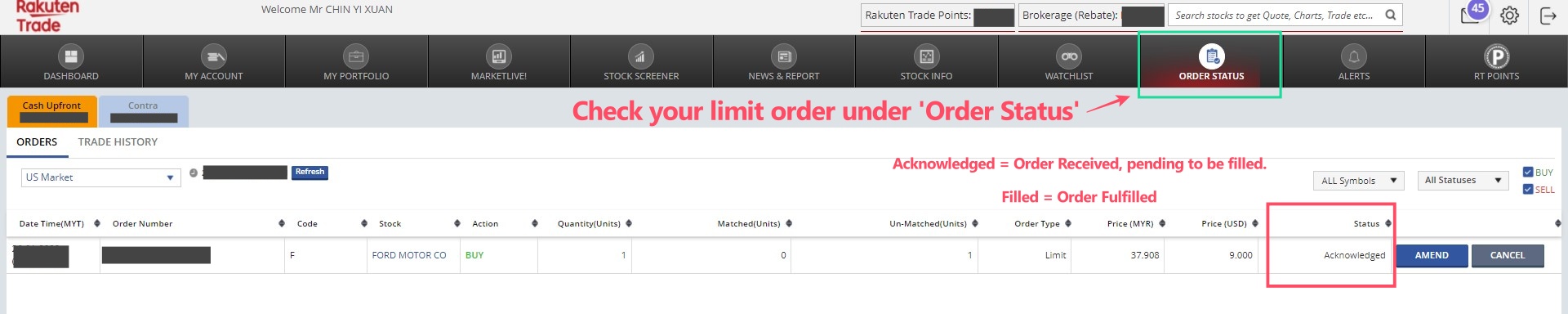

Step 2: Search for the US-listed stocks you want to buy

Step 3: Fill in the details of your trade

To know whether the stock you want to trade is eligible for fractional trading, just look at the 'Quantity' row - you will spot the lowest minimum unit is 0.01.

For a full guide (eg. what is 'limit order' and 'validity') on how to buy your first US share on Rakuten Trade, click HERE.

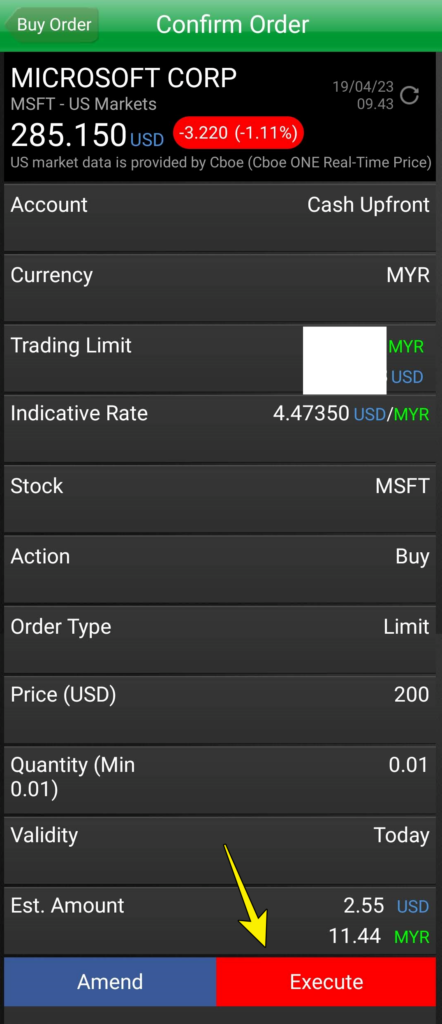

Step 4: Once done, confirm and execute your trade

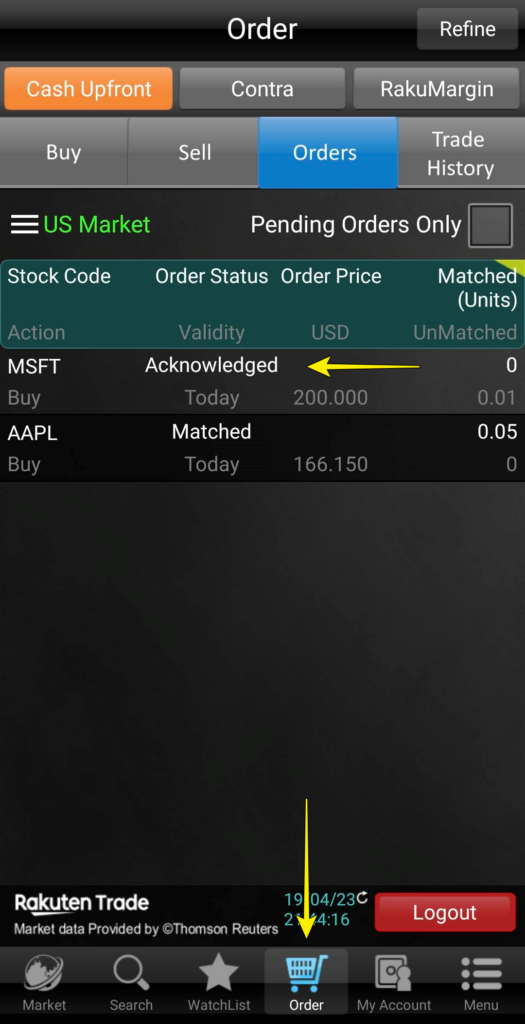

You can check the status of your order and/or amend them under the 'Order' section:

Summary: Build your portfolio with fractional trading on Rakuten Trade!

With the launch of fractional share trading, Rakuten Trade makes US stock investing more accessible, especially for Malaysians with small capital.

This is an amazing feature that I foresee more Malaysian investors will take advantage of in their investing journey!

Will you give fractional trading a try? Let me know in the comment section below!

Rakuten Trade Fractional Shares FAQ

Q1: Why invest in fractional shares?

Fractional shares make it possible for investors like you and me to own a fraction of popular US stocks that are usually too expensive to buy in full units.

Q2: Is fractional trading applicable to Exchange-Traded Funds (ETFs) on Rakuten Trade?

Yes. It is possible to invest in fractional units of popular ETFs available on Rakuten Trade such as VOO (S&P500) and QQQ (Nasdaq-100).

Q3: Can I receive dividends on my fractional shares?

Yes.

Q4: Can I sell my fractional shares?

Yes. The selling process is similar to the selling of a full unit of share.

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

The information stated above is based on my personal experience and for purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

Guide: How to buy your first US share via Rakuten Trade (+Tips & Tricks!)

Rakuten Trade has recently released their much anticipated US stock trading service.

In fact, thanks to Rakuten Trade’s affordable fee structure, it is the only Malaysia-regulated broker that I’d recommend for Malaysians who want to invest in the US stock market.

In this guide, let me share with you (step-by-step) how to buy your first US share on Rakuten Trade!

Also, I’ll show you some tips & tricks to familiarize yourself with the jargon on the platform!

Before you proceed, here are some related posts that might interest you:

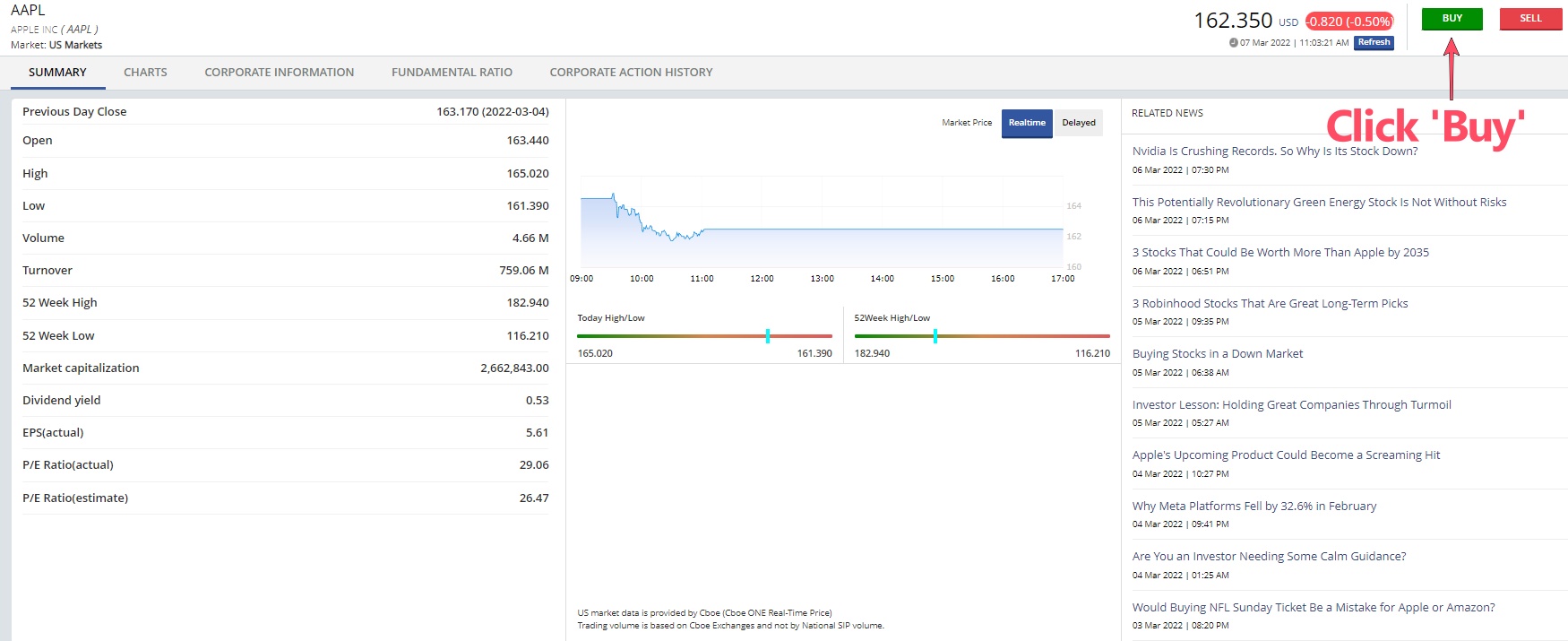

How to buy your first US share on Rakuten Trade (+tips)

Note: The following steps are the same regardless of whether you use Rakuten Trade’s web platform or iSpeed app to buy US stocks.

Step 1: Search for stock/ticker & decide to buy shares in MYR or USD

Log in to your Rakuten Trade account. Then, search for the name or ticker of the stocks/ETF that you want to invest in.

Then, decide if you want to execute your trade using MYR or USD. You can refer to my guide HERE to learn when is the best time to use MYR or USD.

READ MORE: Rakuten Trade USD trading feature – trade using MYR or USD!

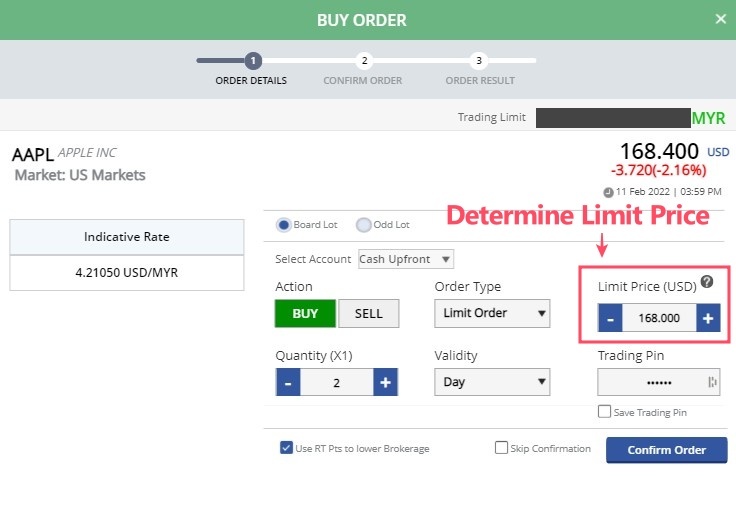

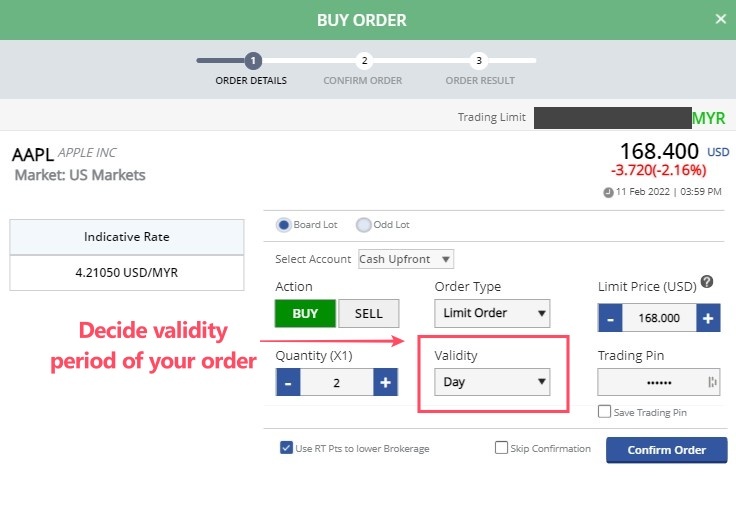

Step 2: Decide on your limit order price

Buy Limit Order allows investors to line up their orders to buy shares at a specific price or better. At the moment, it is the only execution method on Rakuten Trade.

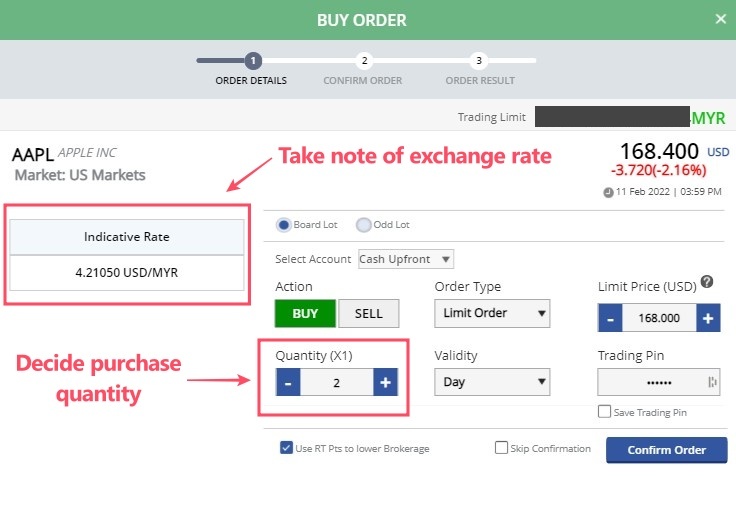

Example: As shown in the screenshot, Apple’ share price is $168.40.

- If you want to buy Apple shares at a lower price, let’s say $168.00, then set your limit price to $168.00. Essentially, what you are doing is telling the system that ‘Execute Buy Order if the price drops to $168.00 or less’

- Tips: If you want to buy Apple shares directly at $168.40, then set your limit price at $168.40. Usually, for most shares with enough liquidity, you should most likely be able to buy at the price without issue.

Step 3: Decide quantity to buy + mindful of the indicative exchange rate

Next, decide on the number of shares that you want to buy.

Tips: Some shares are denominated in x1 units, while some are in x100 units, so do be mindful of it! Before you execute your order, it is helpful to know that on Rakuten Trade, you can invest in US stocks using MYR or USD.

Hence, do take note of the exchange rate for your transaction. The rate is updated daily, quoted by Rakuten Trade’s foreign exchange provider. There is usually a minor spread between the rate offered compared to what you found on Google.

Step 4: Decide the validity period of your order

Validity decides how long your buy order will stay relevant until it expires. Under validity, there are 2 options:

- Day: Your limit order will be canceled automatically by the end of the trading day if it is not filled. No commissions will be charged for the canceled order.

- Good-till-date (GTD): Your limit order will remain active until a specified date of your choice. Select GTD if you want your limit order to stay active for a longer period of time.

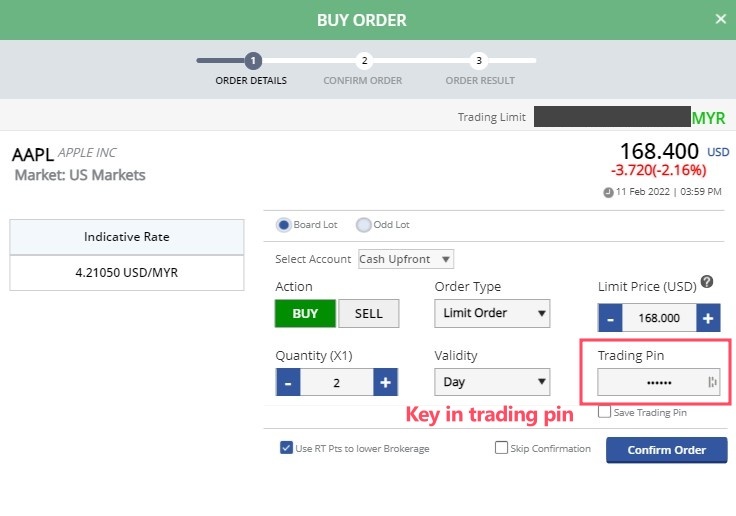

Step 5: Key in trading pin

Key in your Rakuten Trade trading pin to approve the order. Click ‘Confirm Order’ and your order will be processed – that’s it!

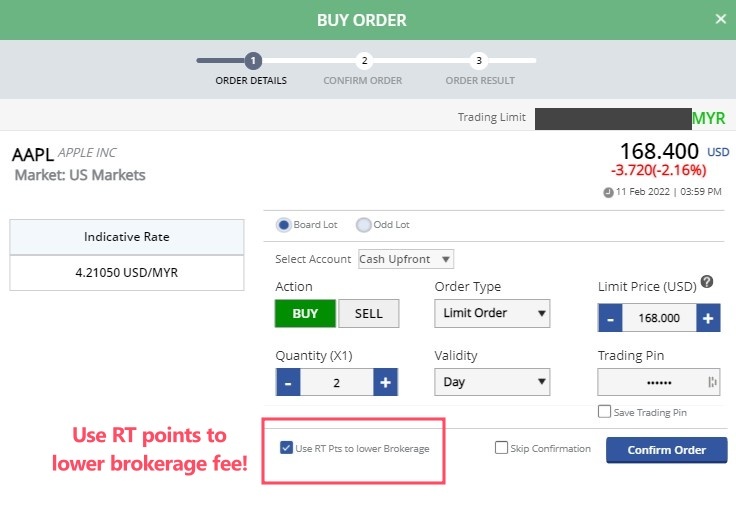

Tips: Use RT Points to offset brokerage fee

RT points are points that are rewarded when you open an account, fund your account, and place a trade.

If you have existing RT points, you can select the option to use your points to offset the brokerage fee. This feature is only available if your limit order’s validity is set to Day instead of GTD.

Note: You’ll still pay for the brokerage fee when your order is filled, but it’ll be rebated back to your account by the end of the trading session.

p.s. If you are planning to open a Rakuten Trade account, definitely consider using my referral link by clicking the button below!

Open a Rakuten Trade Account Today!

Must-Know: US Stock Market Operating Hours

Barring holidays or special circumstances, the US stock market opens between 9:30am to 4:00pm eastern time (ET) in the US.

As Malaysians, there are 2 things that we need to know while investing in the US stock market:

- Malaysian time is 12 hours ahead of the US.

- Daylight Savings Time (DST): DST is the time of the year when the US market adjusts their clocks to move an hour of daylight from the morning to the evening.

What does DST mean to Malaysian investors?

- In 2024, DST will start on 10th March. During DST, the US stock market will begin at 9:30pm Malaysia time.

- Meanwhile, DST will end on 3th November 2024. After DST ends, the US stock market will begin at 10:30pm Malaysia time.

No Money Lah's Verdict

So there you have it – how to buy your first US stock on Rakuten Trade!

If this is your first time investing in US stocks on Rakuten Trade, I hope this buying guide has been helpful to you!

For more personal finance and investing content, consider subscribing to my FREE newsletter.

Open a Rakuten Trade Account Today!

Disclaimer:

This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

The information stated above is based on my personal experience and for the purpose of sharing such experience only. It is not intended as professional investment advice. Please contact Rakuten Trade for more information.

What is Rights Issue and How to deal with it? (with Example Calculation)

So, you invested in a company in the stock market and one day, you received a notification about rights issue by the company. What exactly is a rights issue and what should you be doing with it?

Let’s address this in this article:

A rights issue is an action by companies to raise capital – be it for expansion, debt repayment, and so on.

Through rights issue, a company allows investors to purchase additional shares at a discounted price. The number of additional shares that can be bought depends on how many shares an investor owns.

p

Highlights of a Rights Issue

- Rights issue is a process where companies raise funds for various purposes (eg. acquisition) by offering equities at a discounted price. It is an alternative to methods like taking up debt which comes with interest payments.

- The number of additional shares that an investor can buy is in proportion to the investor’s existing shareholding.

- Rights issue is optional. This means that an investor can choose whether to take up the offer (a.k.a. subscribe), or to ignore the rights issue.

p

However, ignoring a rights issue will cause the investor’s existing share value to become diluted after the release of additional shares into the market. (Just imagine adding more water to your Ribena drink)

p

Example - How to calculate a Rights Issue?

Step 1: Before you proceed, find out the following details first:

- How many shares do you own in the company?

- What is your average acquisition price for this investment?

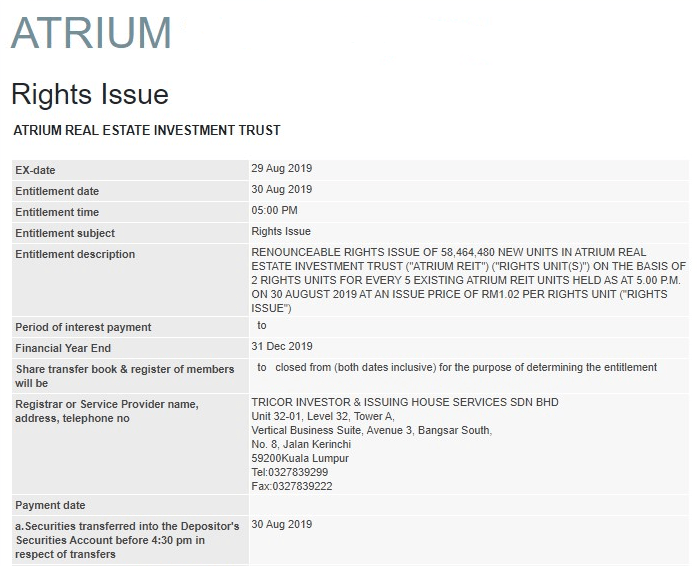

So, let’s use an example from Atrium REIT, an industrial REIT that manages warehouses and manufacturing facilities. Let’s say I own 1000 shares of Atrium REIT, with an average acquisition price of RM1.05 per unit.

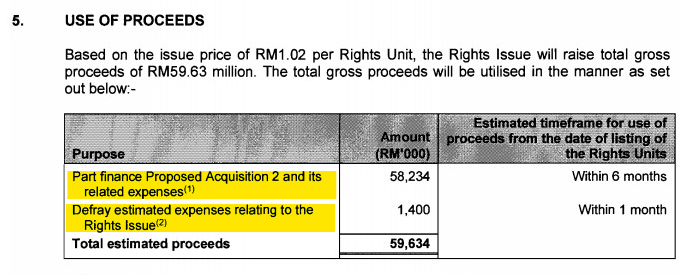

Then, Atrium REIT announces a rights issue, as seen below:

Step 2: Entitlement Ratio & Issue Price

At first glance, things seem to be a little intimidating, but don’t worry – you just need 2 pieces of info from the screenshot above:

- Entitlement Ratio: How many rights do investors get to subscribe in proportion to their existing shareholding?

p

In this example, the ratio is 2:5. Meaning, for every 5 shares you owned in the company, you are entitled to buy 2 additional shares.

p - Issue Price: At what price is the company offering the rights?

p

In this example, the issue price is RM1.02/unit. The issue price is usually offered at a discount relative to the market price to entice existing investors to subscribe to the rights issue.

p

Step 3: Now that we have all pieces of info that we need, we can proceed with the calculation.

a. What’s the initial value of my portfolio (before rights issue)?

= Total shares owned at the start x Average acquisition price

= 1000 shares x RM1.05

= RM1050

b. How many units of right am I eligible to subscribe?

= Total shares owned at the start x Entitlement Ratio

= 1000 shares x (2/5)

= 400 shares

c. How much do I need to subscribe to all 400 shares from this rights issue?

= Total shares I am eligible to subscribe x Rights offering price

= 400 shares x RM1.02

= RM408

d. Total portfolio value after rights subscription:

= Initial portfolio value + Value of Rights Issue

= RM1050 + RM408

= RM1458

e. Theoretical acquisition price after rights issue:

= Total portfolio value after rights subscription/Total shares owned after rights subscription

= RM1458/1400 units

= RM1.041

Notice that I mentioned the acquisition price per share as ‘theoretical’. This is because the market fluctuates up or down upon rights issue depending on market sentiment.

If the rights issue is received with positivity, then an increase in share price upon rights issue means that investors will benefit from capital appreciation. If the rights issue is not perceived well by the market, then the share price will drop and investors’ capital will depreciate.

In this example, I’ll need a total of RM408 to subscribe to all my rights issue. Subscribing to this rights issue allows me to prevent dilution to my existing share value. It is also a good way for me to dollar cost average into companies that I am already investing in.

(Note that you can also choose to subscribe partially to your rights. Meaning, for whatever reason (eg. lack of capital) if you do not want to subscribe to the full rights issue of 400 units, you can choose to only subscribe to 200 units, and so on.)

p

What’s the impact of not subscribing to the rights issue?

So, let’s say I decide not to subscribe to Atrium REIT’s right issue above, how would it impact my share value?

Total impact of not subscribing to the rights issue:

= (Theoretical acquisition price after rights issue x Initial shares owned) - Total portfolio value IF I subscribe to rights issue

= (RM1.041 x 1000 shares) – RM1458

= RM1041– RM1458

= - RM417

This means that the value of my shareholding on Atrium REIT would be diluted by RM417 if I do not subscribe to the rights issue.

p

Should You Subscribe to a Rights Issue? (+ tips)

Essentially, subscribing to a rights issue allows you to buy shares in the company that you are investing in at a discounted price.

If you are investing in a company for the long-term and the company requires additional capital for expansion, it’d be logical to take on the rights issue. Doing so will prevent the dilution of your existing shares in the company while preparing you to enjoy any potential reward from the expansion in the future.

As such, a tip here is to ALWAYS have additional cash prepared in your brokerage account so you can respond to a sudden rights issue in your investing journey.

On the contrary, if a company is under huge debt, and it announces a rights issue to repay the debt, it is wise to think twice before subscribing to the rights issue. If the market doesn’t perceive this rights issue positively, chances are you might lose more by taking up the rights.

p

How to Subscribe to Rights Issue?

Subscribing to a rights issue is a simple process. Just remember that you’d need to have enough funds in your brokerage account to subscribe to a rights issue!

Below are how you can do so via Rakuten Trade (Malaysia market) and Tiger Brokers (Singapore, US, HK, Australia, and China market):

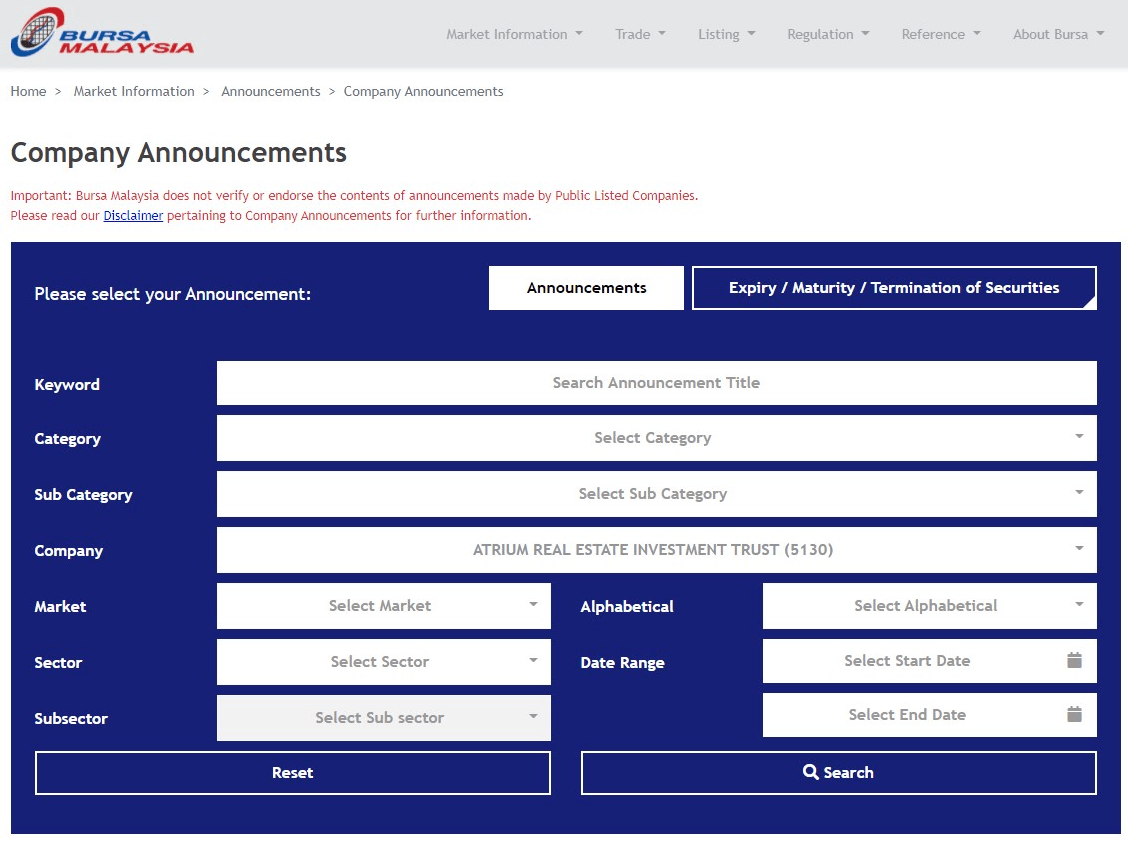

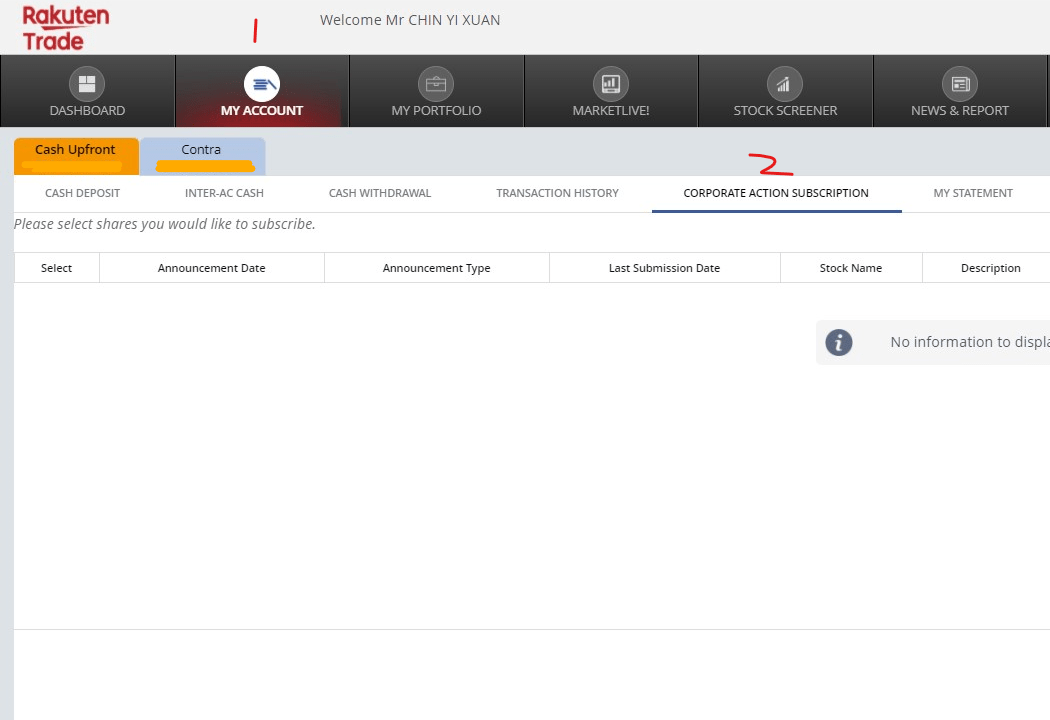

a. Subscribing to Rights Issue via Rakuten Trade (Malaysia stock market)

- Step 1: If you are eligible for a rights issue, you will receive an email notification from Rakuten Trade.

- Step 2: To subscribe to the rights issue, log in to your Rakuten Trade account. Then, under ‘My Account’, select ‘Corporate Action Subscription’.

- Step 3: Follow the instructions shown to subscribe to the rights issue.

- Step 4: You will receive your additional shares in your brokerage account on the stated entitlement date.

(eg. For the Atrium REIT example above, it’d be on 30th August 2019)

READ MORE: How to Build Your Powerful Bursa Stock Screener on Rakuten Trade?

p

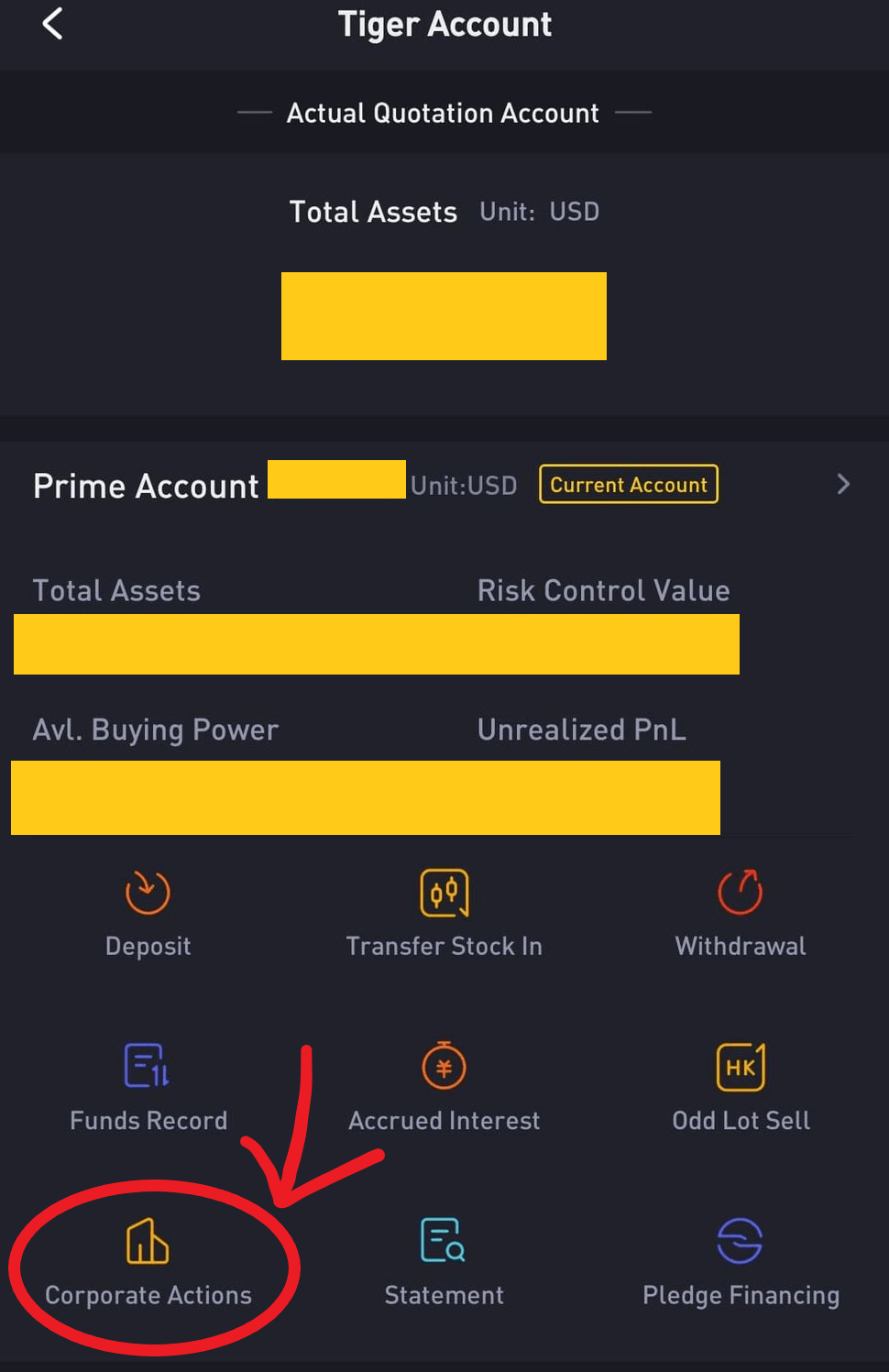

b. Subscribing to Rights Issue via Tiger Brokers (Singapore, US, HK, Australia, and China stock market)

- Step 1: If you are eligible for a rights issue, you will receive an email/app notification from Tiger Brokers.

- Step 2: To subscribe to the rights issue, log in to your Tiger Brokers app. Then, under ‘Tiger Account’, select ‘Corporate Actions’.

- Step 3: Follow the instructions shown to subscribe to the rights issue.

- Step 4: You will receive your additional shares in your brokerage account on the stated entitlement date.

READ MORE: Tiger Brokers review - the broker I use to invest in the SG, US and HK stock market!

P

No Money Lah’s Verdict

Hopefully this article sheds some light for you about rights issue!

Ultimately, it is just one of the many ways companies raise funds for their business objectives. As an investor, it is important for us to know how to calculate and deal with rights issue when we are eligible it.

What are some other corporate actions that you want me to cover? Feel free to share with me in the comment section below!

Keen to Open Your First Stock Investing Account?

Check out my preferred brokers for the local and overseas market below:

a. The broker I use to invest in Malaysia stock market: Rakuten Trade (Read my review HERE)

(Use my referral link HERE with the code NOMONEYLAH to open an account, and receive 1000 RT points upon successful account activation!)

b. The broker I use to invest in the overseas stock market (SG, US): Tiger Brokers (Read my review HERE)

(Use my referral link HERE to open an account, and receive account opening rewards like commission-free trades and stock vouchers upon successful account activation and funding!)