Post 101st - What I’ve Learned from My First 100th Articles

Last week, I published my 100th article on No Money Lah.

It took me a little bit more than 2 years to reach this milestone, and I am blissfully proud of this achievement. On that note, if you have read even just one of my articles, thank you so much!

Here’s what I’ve learned from my first 100th articles over the span of 2 years:

#1 The first 100 is not gonna be easy.

Charlie Munger, the business partner to Warren Buffett once said that accumulating “your first $100,000 is a b*tch, but you gotta do it.”

I think this sentiment is highly relatable to any other milestone in our career and life:

- My first 100th article.

- Your first 100th sales.

- Ronaldo’s first 100th goal (it was back in March 2012).

- Anyone’s first 100th public speaking attempt.

These are not going to be easy milestones to reach. You are most likely going to make rookie mistakes, your passion will be tested, and you’ll struggle to reach consistency.

However, in your journey to the 100th, you are most likely going to establish your own style. You’ll get a feel of what works, and what doesn’t.

Even more important, you’ll build a routine, ritual, or system as you reach 100th. Speaking of which…

#2 Having a routine & system is CRUCIAL

I’ve never seen or read of people that reached meaningful milestones in career or life, which they achieved without a proper routine or system.

In the journey to my 100th article, I’ve gone from ‘I’ll write anything that comes to my mind’ to planning ahead of each article in advance. It goes something like this:

Ideation > Research + Storyboard > Draft > Edit > Publish > Newsletter & Social Scheduling

Having a systematic plan and routine helped reduce resistance in execution (eg. out of ideas) and improved my consistency & quality of delivery.

Then again, you’ll likely not get things right on the first try. Experiment with different routines and find the one that fits into your life the best – and keep refining them along the way.

There’s always room for improvement, even after the 100th article.

#3 Even if it’s your passion, you may not like every part of this journey.

And that is OKAY.

I love writing. That’s probably the only reason why I could stick with coming out with 1 or 2 posts consistently nowadays.

But what you probably don’t know is that I either dislike or hate many parts of the processes:

- I dislike the process of thinking about captions (even after running my blog for 2 years).

- I (still) find it overwhelming to reply to comments or messages.

- I hate to edit and design my blog via Wordpress (it sucks).

- I feel devastated when I spent 8 – 16 hours coming out with an article and it ended up in the draft forever.

But hey, life is never perfect, right?

As such, the goal here is not about finding things that you’d 100% love (don’t waste your time). If you can find something that you enjoy doing 70% of the time (and it pays), I think you are in an awesome place in life.

Post 101st onwards: Never take anything for granted.

The good thing with milestones, is that they do not have a limit or stopping point.

Without doubt, your 100th post, 100thsales, 100th speech, and 100th YouTube video is an important milestone.

However, from the 101st onwards, it is the start of another new milestone. Focus on lifting the standards of your game, keep learning, and never take anything for granted.

All in all, regardless of whether this is your first No Money Lah’s article, or your 101st article, thanks for being an important part of this journey!

Here’s to more milestones ahead! :)

Yi Xuan

Reality: Personal Finance is Never Really ‘Personal’

Happy November everyone!

This is crazy. With all the things going on around us, there are only 2 months left in 2020 – time certainly flies regardless of what’s happening, don’t you think so?

Alright, back to the topic:

Personal Finance is never really ‘personal’.

When I first started working, my perspective towards money & personal finance used to be very ‘personal’:

I started an emergency fund with the purpose to prepare myself for unexpected incidents in my own life (eg. retrenchment).

I looked into my own insurance coverage to see if I was well-protected.

As I grow up (I am 26 this year), I realize that it is not enough:

My parents are stepping into retirement age. If I am lucky, I might get into a relationship and start my own family down the road. So, I started to ask more questions:

· How much cash am I able to fork out if something were to happen to my family members & loved ones? (eg. medical expenses & care, surgery)

· Are my family members well-insured? Do they lack any specific coverage as they step into retirement age?

· Should I start to save & invest more to prepare for my own family in the future?

Some of you might come from a family background with high financial literacy. Your parents are well-insured and have enough for retirement, emergency, and medical care – well, good for you.

For most of us, our parents are either the ones that ASSUME that they are financially equipped BUT in reality, they are not (especially insurance coverage). Else, they are not ready at all to face any financial & health emergencies and conditions.

If you fall into either of these categories, I highly recommend you to start asking questions and shifting your view of personal finance from just you to a bigger picture.

Start looking into your emergency fund and savings. Do you have enough liquidity to support any emergency needs in your family?

Chances are you might have saved enough for yourself, but not for your family.

Dig out your family members’ insurance policies. Reach out to a proper & reliable financial planner. Are your parents well-insured?

Chances are your parents might be (severely) underinsured. It could be because they have always assumed that they have enough, or their own insurance agents are doing a bad job in following up with them (p.s. I have a very bad experience with how my parents’ agents do follow-ups).

Here’s the reality:

The less financially aware your loved ones are, the less ‘personal’ your personal finances are going to become.

But not all hope is lost. Here’s the silver lining:

The earlier you realize and accept that personal finance is never really ‘personal’, the better.

This means that you can start taking action and plan your financials in a more holistic way, instead of just for yourself. (eg. allocate more to emergency fund, spend rationally, invest)

If you are lucky, you can detect financial weaknesses in the people you care about earlier and do something about it.

Simply put, you can prepare ahead for financial needs that would otherwise catch you off-guard if you ASSUME things are all alright and are not prepared for incidents other than yourself.

Hopefully this week’s newsletter is enough to trigger some awareness in you, as this is something that I am personally going through as an adult as well.

As always, if things ever feel overwhelming to you (it was to me), please seek out help from a proper financial planner (I get help from them too!). Check out my experience working with a licensed financial planner and get a free consultation session – click HERE for more info.

Till next week!

Yi Xuan

Make Better Investment & Financial Decisions in Uncertain Times. (Part 1)

It’s crazy how all of us have been a better decision-maker in just about anything other than money-related scenarios in life:

-

Science experiment at High School (assuming you listened in class):

Experiment: Does salt make water boil faster?

Hypothesis 0 (H0): Salt makes water boil faster.

Hypothesis 1 (H1): Salt has no effect in making the water boil faster.

Fixed Variable: Size of the boiling tube, Amount of water in each trial, Temperature of the room.

Independent Variable: The amount of salt added to the water (g)

Dependent Variable: The time taken to boil the water to 100°C

Outcome: Salt has a negligible impact on getting water boiled faster. (Okay… I googled it)

Decision: Stop adding salt just to boil the water in the future.

-

Trying to see if our crush has the same feeling towards ourselves:

Experiment: Does Annie has the same feeling towards me as I have towards her?

Hypothesis 0 (H0): Yes, she has.

Hypothesis 1 (H1): Friendzoned.

Fixed Variable: My looks.

Independent Variable: Time and effort taken in this pursuit.

Dependent Variable: Whether she has a crush on me.

Action: Confess.

Outcome: She said I am just a good friend.

Decision: Stay single until I meet the next girl that’ll make my heart pikpok pikpok.

However, this is what goes through the mind of most people when ‘investing’ in a company in the stock market:

Action: Investing in a company in the stock market.

Subconscious Mindset: “The ONLY outcome from this investment is that it will make me a lot of money.”

--

Here’s my point:

From high-school science experiments to even the lamest part of our relationship life, we have a set of rather similar decision-making processes (sometimes made subconsciously).

This includes setting up hypotheses: IF X happens THEN I’ll do Y. IF A happens THEN I’ll do B.

This includes having a set of variables (Fixed, Independent, Dependent) in place while making our decisions.

Simply put, we come to a decision with the understanding (or acceptance) that there are uncertainties in the outcome of our decisions, AND there are things beyond our control or knowledge in every decision that we make.

In these decisions, we embrace uncertainties and a lack of complete information and control in our execution.

But not so much when it comes to investing.

When it comes to investing, most people yearn for absolute certainty (eg. “how many percent of return can you guarantee for my investment?”). The fact that the market and business are even more dynamic and uncertain makes seeking absolute certainty a suicidal act for investors.

--

So this leaves us with 4 takeaways from this week’s newsletter:

- Have a proper process in place for your decision-making when it comes to any financial and investing decisions. (I share about them in great depth in my REIT investing sharing session)

- Focus on the process, not the outcome. In a small sample size of one or two decisions, the quality of your decisions should not be measured by the quality of the outcome – luck could play an unexpected role in a small sample size of decisions (ie. You could get lucky with bad decisions, or pure unlucky with good decisions).

- Treat every decision as a hypothesis. This leaves you the capacity to be proved wrong (or right) and still be able to recover (fast) and learn from your mistakes.

- Trying to look for absolute certainties in a market full of human emotions and uncertainties is a bad, bad idea.

Hope this week’s newsletter is thought-provoking!

Till next week :)

p.s. Do you like Part 1 of this decision-making newsletter? Let me know by leaving a comment in the comment section below, and if the responses are good, I’ll come out with Part 2: Luck in decision-making!

OCBC Flex Review: A Must-Get High-Interest Savings Account (...Just One Problem)

Okay, if you are here, you are most likely keen to find out if Flex (previously FRANK), a high-interest savings account from OCBC, is suitable for you.

Right of the bat, if you are still indecisive, I’d say – go open an account!

Frank by OCBC Main Features/Highlights

- Save Pot & Spend Pot feature: Adjust your money accordingly when you want to save or spend.

- Earn interest up to 1.8% per annum for money saved on Save Pot + 0.3% per annum for money in Spend Pot.

- No typical FD lock-in period & withdrawal penalty. Minimum account balance & initial deposit of RM20 (extremely low barrier of entry).

- No forex mark-up while spending foreign currencies online (just like BigPay)

- Debit card & online banking function. Withdraw money at no extra charges from any ATM by OCBC (Malaysia, SG, Indonesia, HK & Macau)

- Capital is protected by PIDM up to RM250,000.

- Account Opening Reward: Get an RM20 additional cash reward in your account when you sign up using my referral code 3AFMJA, and deposit a minimum of RM20 in your account within 15 days from sign up!

Save Pot & Spend Pot – How Do They Work?

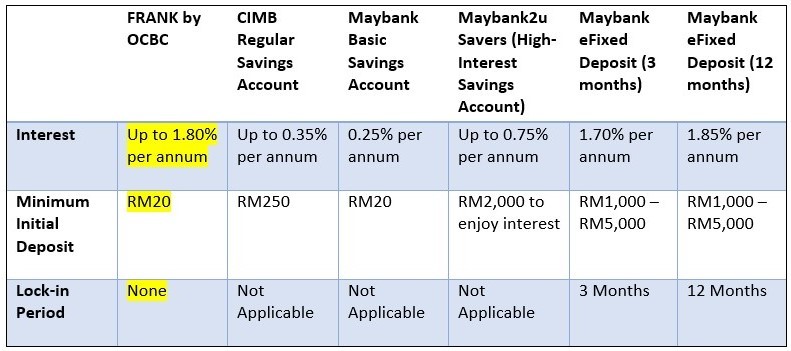

Here’s a table that’ll give you a clear idea of why FRANK is such a unique offering in the market now:

Obviously, the main thing that attracted me to open a FRANK account is the FD-like interest that OCBC offers (1.80% at this moment) - without the restrictions imposed by typical FD products.

How do they work, actually? Pretty simple, to be honest.

Just think of the Save Pot and Spend Pot as 2 piggybanks for different purposes.

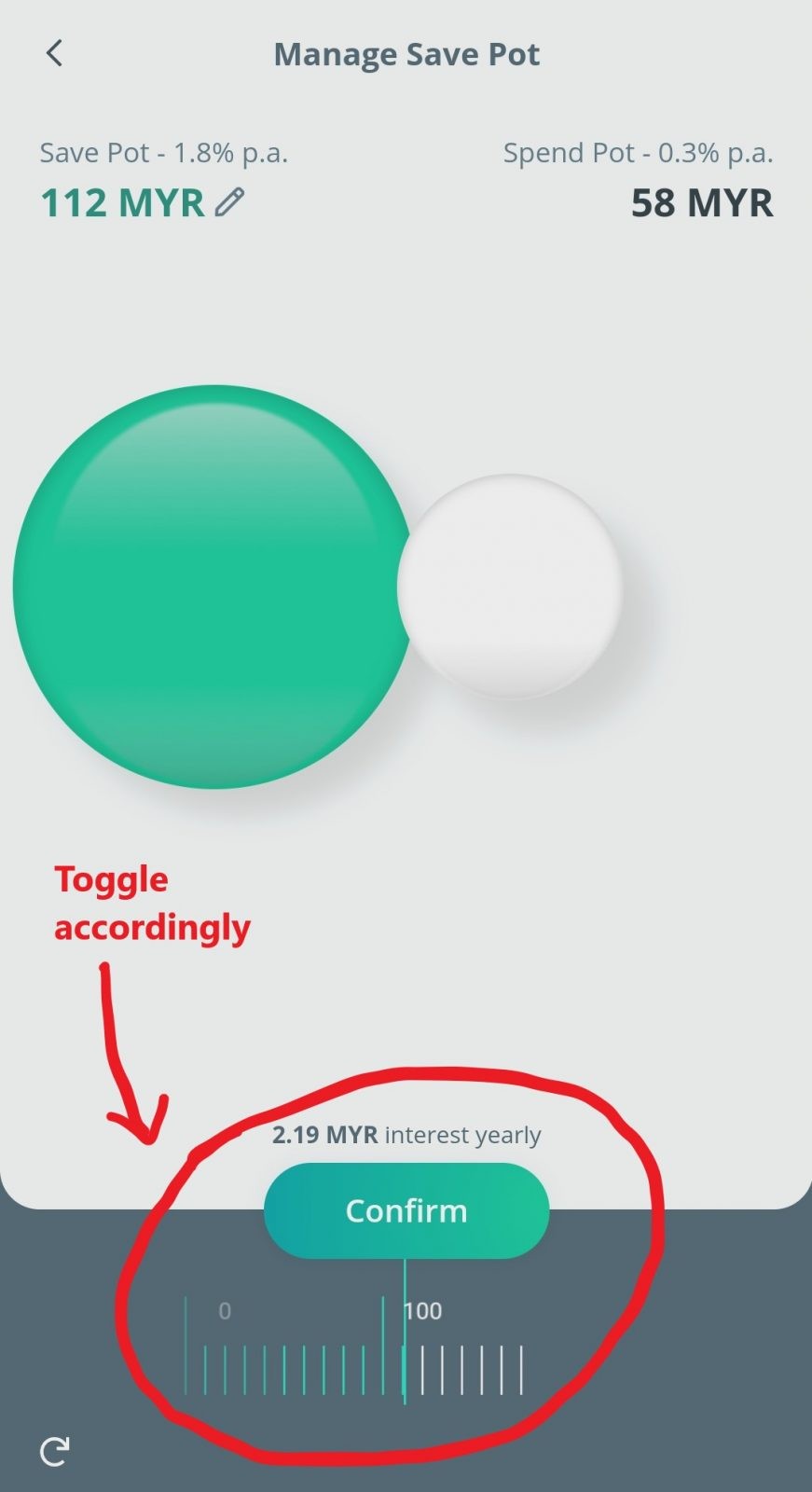

Essentially, in the OCBC mobile app, you are able to toggle your deposits between the money you want to save (a.k.a. the Save Pot), and the ones you are ready to spend (a.k.a. the Spend Pot).

The main difference between the Save Pot and Spend Pot is:

- You’ll earn 1.80% interest for money saved in the Save Pot, BUT you cannot withdraw or spend the money in it until you toggle/allocate them to the Spend Pot.

- You can spend the money in the Spend Pot, BUT you’ll only earn 0.30% of interest for the money in it. (p.s. You can toggle/relocate the unused money back to Save Pot to enjoy higher interest.)

One thing that you need to bear in mind is that the interest is accrued daily based on the day-end balance (normally at 9pm) of your account, and will be paid out every month end.

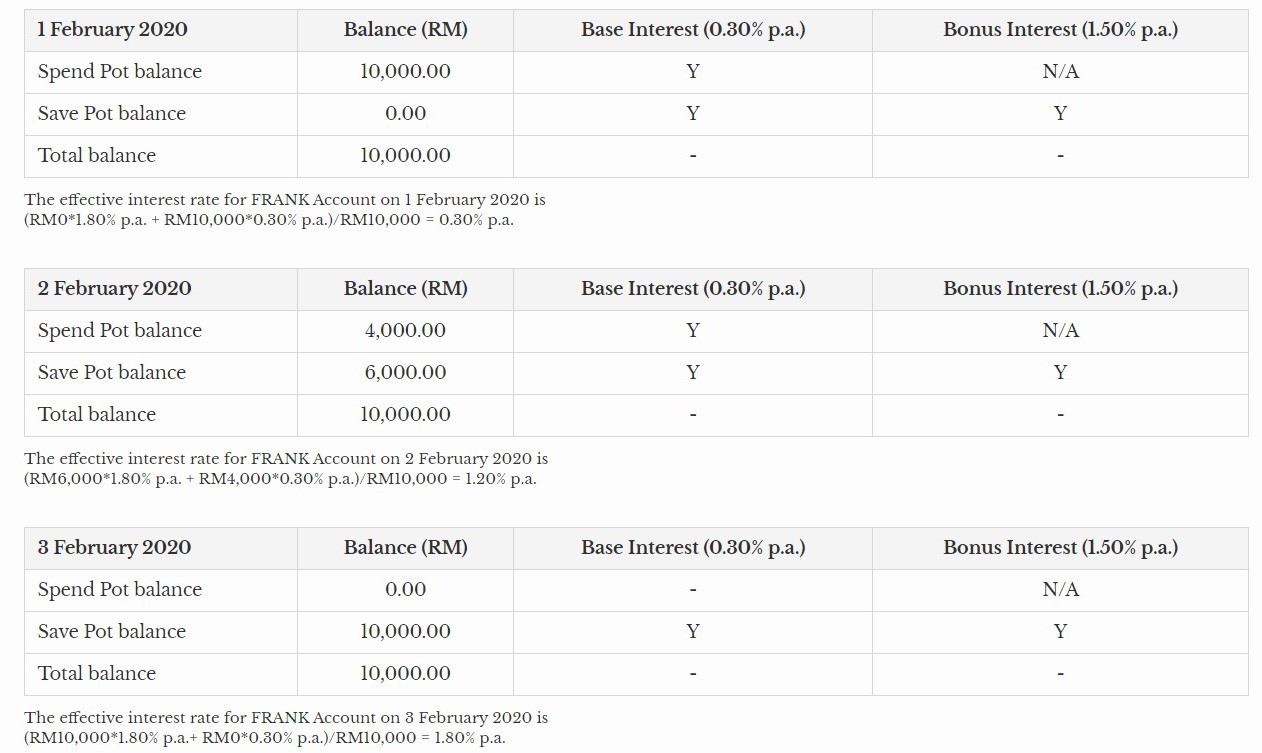

Simply put, what this means is that the interest in either of your pots is calculated daily based on the balance in each pot by 9pm daily, as shown below:

Personally, I think this Save Pot & Spend Pot idea is brilliant. This is because it’ll make users think twice before spending impulsively as they may lose the extra interest earned with their savings.

Who is this for?

As you have read above, FRANK is a truly unique offering from OCBC. By offering FD-like interest and the convenience of a typical savings account, FRANK is a must-get for:

a. Students (18 y/o & above) and adults that are looking for high-interest savings account with truly competitive interest rate.

b. People that are held back by conventional Fixed Deposit (FD) restrictions (eg. High deposit requirement, long lock-in period, withdrawal penalty), and are looking for a Fixed Deposit (FD) alternative.

c. People that transact in foreign currencies a lot, and travelers looking for a BigPay alternative.

d. People that are looking to manage their personal finances better.

How to Open a FRANK Account?

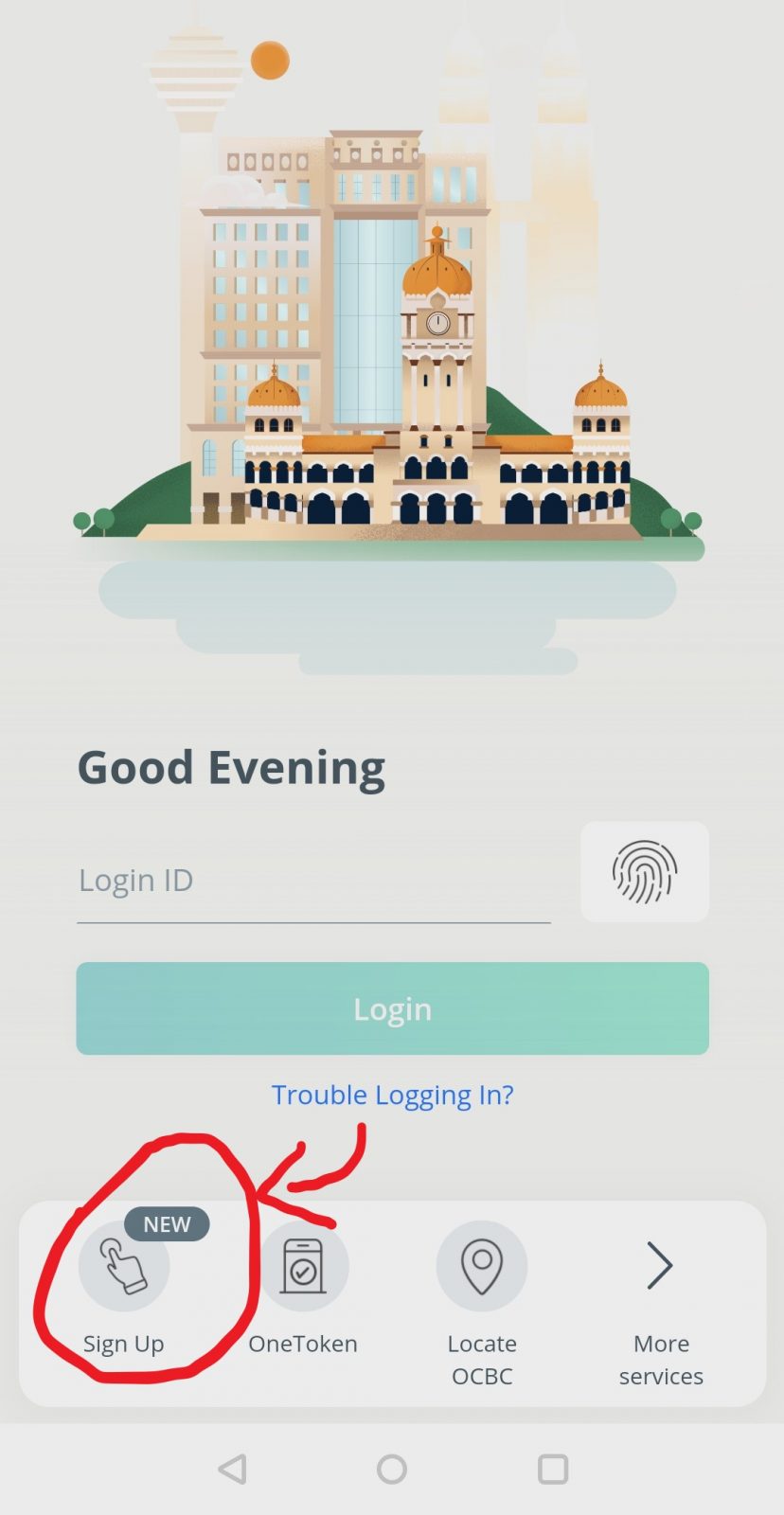

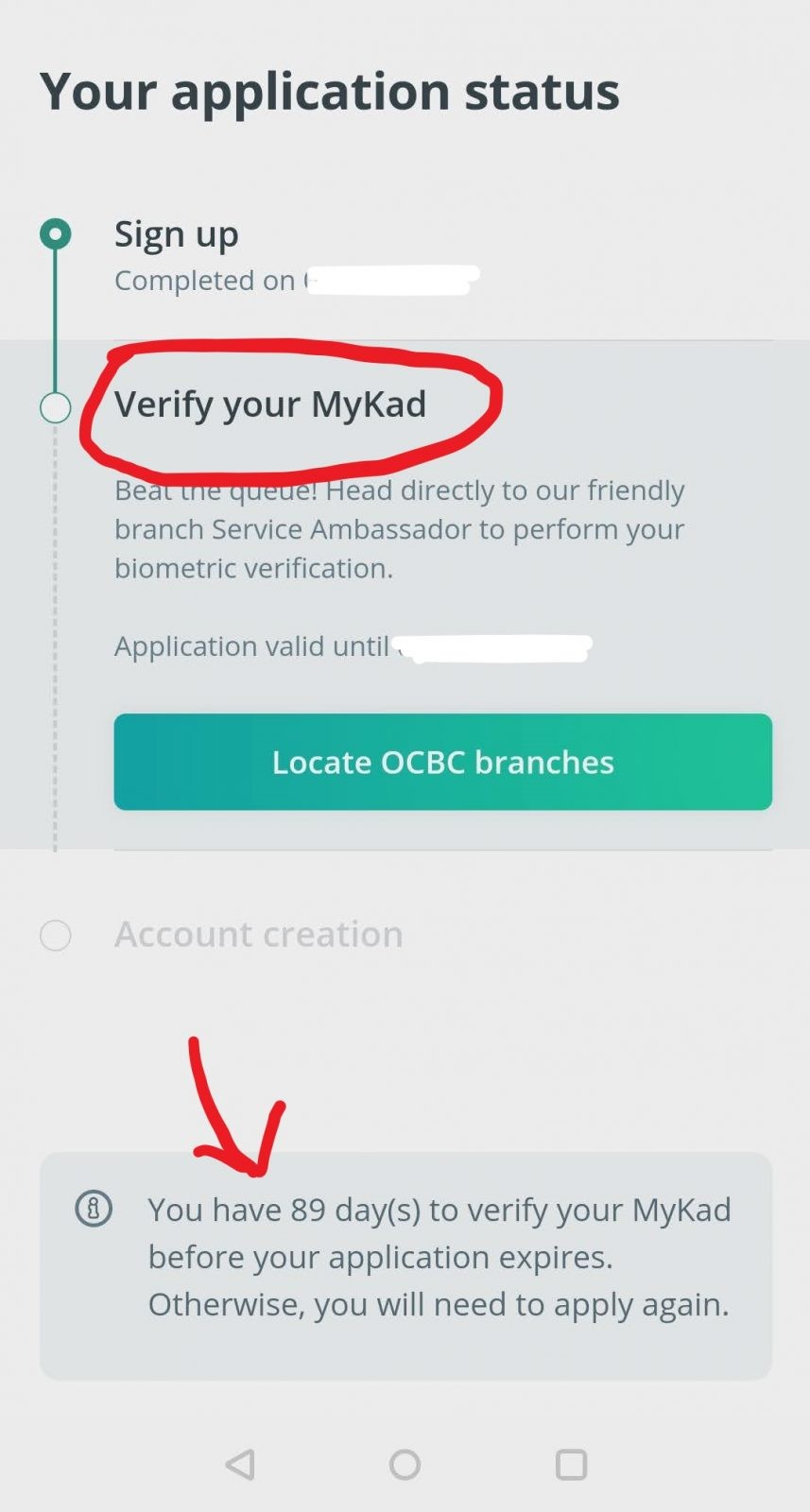

Step 1: Install the OCBC Malaysia Online Banking app HERE. Upon starting the app, click the ‘Sign Up’ button at the bottom left corner.

Step 2: Follow the steps to sign up for FRANK.

Step 3: Visit your nearby OCBC branch within 90 days to verify your identity & activate your account.

Step 4: Activate your debit card & online banking HERE after you are done with Step 3 (alternatively, you can also get the service agent in the branch to help you out too).

Step 5: Deposit a minimum of RM20 within 90 days to fulfill the minimum account opening balance.

Close Competitors

Having creating content in the personal finance space for about 2 years now, I can only identify 2 close (but not similar) competitors to FRANK, namely:

1. StashAway Simple

StashAway Simple is a money management offering from my favorite robo-advisor StashAway.

Essentially, StashAway Simple invests your money in extremely low-risk money market funds for FREE (ie. StashAway does not charge management fees for this), which will in turn give you relatively higher returns compared to conventional Fixed Deposits.

The downside relative to FRANK as a savings solution: Withdrawal of funds from Simple will take time to be processed. Hence, FRANK may be a better choice to place the money that you could withdraw and spend whenever necessary.

I love StashAway Simple, and is personally using it as well. Check out my StashAway Simple Review HERE.

2. BIMB Dana Al-Fakhim from BEST Invest

BIMB Dana Al-Fakhim is also a money market fund from BEST Invest (a fund management app by Bank Islam).

In short, you can also expect the returns from this fund to generally beat the interest from conventional FD offerings.

The downside relative to FRANK as a savings solution:

- Withdrawal of funds from BEST Invest will also take time to be processed. Hence, FRANK may be a better choice to place the money that you could withdraw and spend whenever necessary.

- Also, typical fund management fees are applicable for BIMB Dana Al-Fakhim (rightfully so because it is still a fund)

I am also putting my savings in BIMB Dana Al-Fakhim. Check out my other writings on it HERE.

Ultimately, the reason why I say these are close competitors, but NOT similar, is because they exist for different purposes:

For me, StashAway Simple and BIMB Dana Al-Fakhim are great for savings for the longer term, while FRANK is awesome to place my money whenever I am in need of liquid cash as it also provides the convenience of debit card and online banking.

Sustainability Issue: Get Prepared for a Potential Brutal Issue from FRANK

FRANK by OCBC is truly a refreshing offering to see in the ever-boring realm of FD and savings account products.

However, I think there is a more important conversation for us to have on FRANK. For this, it is essential for us to understand how Fixed Deposits (FDs) works and why they even exist.

In short, products like FDs exist because banks need the liquidity or cash to give out as loans. As such, banks are willing to pay out interests for the money that are locked in FDs because, in return, they can loan the money out at a higher rate.

However, unlike conventional FDs, FRANK advertises an FD-like interest rate (1.80%), BUT without the conventional lock-in period and withdrawal penalty.

Using some common sense and logic, it is only natural for me to question the sustainability of this return (or interest) advertised by FRANK because it is, from my understanding, a loss-making endeavor.

Reason being, how can a bank deliver an FD-like interest rate without locking in clients’ money for a specific period of time (and thus lending them out as higher interest loans)?

Putting Malaysia’s interest rate fluctuation aside, I am quite biased that this advertised interest rate by FRANK will not stay for long and will soon be adjusted lower. That said, only time can tell and hopefully, I am wrong on this matter.

No Money Lah’s Verdict

All in all, at the point of writing this article, FRANK by OCBC is definitely a no-brainer for everyday consumers like you and me.

Although I question the sustainability of the advertised interest rate, but having to enjoy FD-like rates (for now) alongside the convenience of a savings account is truly fantastic.

In short, I think this is a brilliant financial offering for most people and I think you’ll certainly like what you are getting.

Are you planning to open a FRANK account after reading this article? Feel free to share with me in the comment section below!

Account Opening Reward - Open Your FRANK account today!

Good news!

Get an RM20 additional cash reward in your account when you sign up using my referral code 3AFMJA, and deposit a minimum of RM20 in your account within 15 days from sign up! (p.s. valid until 30/6/2021)

WFH: 3 Hacks to Maintain Productivity & Balance at Home!

Dear friend,

Working from home (WFH) is really a norm that requires some getting used to.

Even as someone that has been WFH for 2 years, I still find it challenging to be productive & balance my life at times (to make things worse, I am a workaholic).

Fortunately, I’ve developed 3 techniques that have been serving me well especially in this crazy year of 2020. For the record, these WFH techniques have helped me to:

- 1. Maintain my blog with at least 1 – 2 articles/week.

- 2. Produce 2 videos/week on my newly established Tik-Tok channel.

- 3. Train consistently for at least 2 hours/day as a developing trader, PLUS;

- 4. Exercise for 30 mins everyday.

- 5. Squeeze in a 20 mins power nap everyday.

- 6. Catch up on my favorite Youtube videos daily.

In this week’s newsletter, let’s explore these 3 techniques one by one:

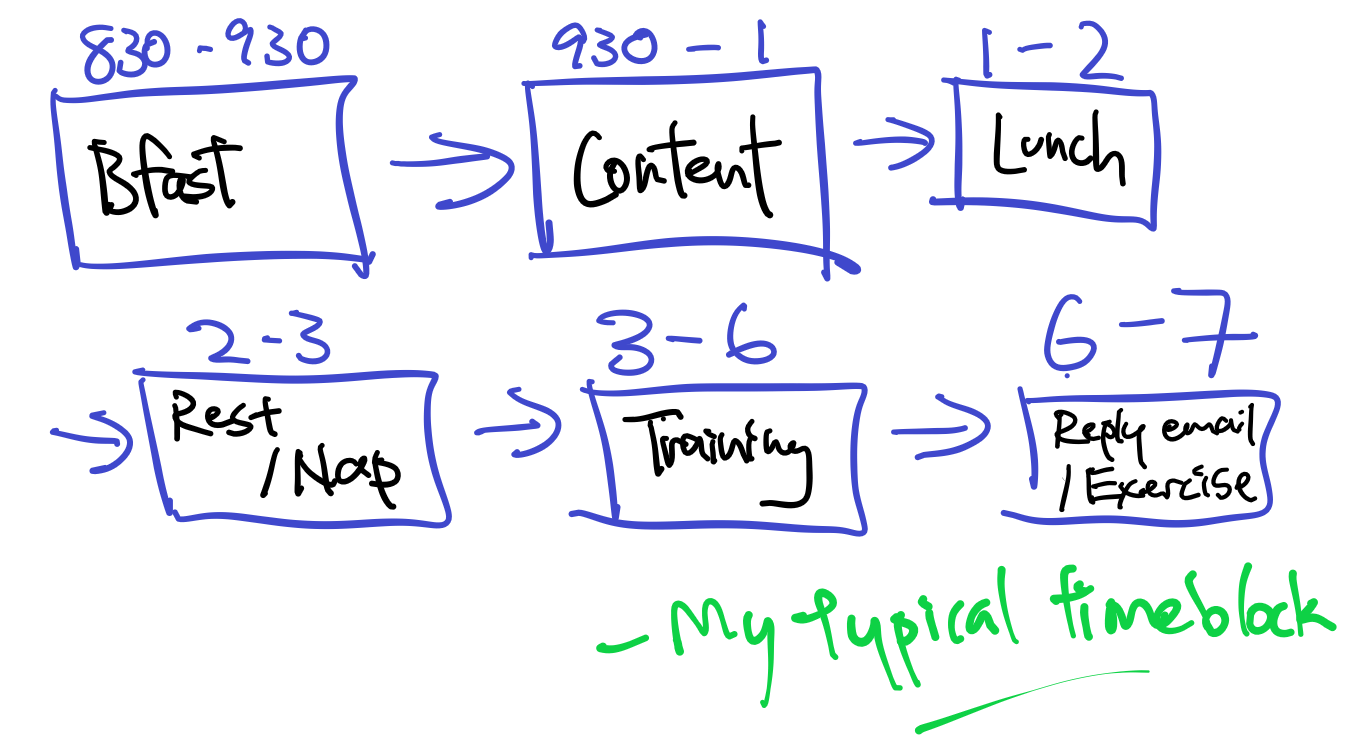

#1 Intention: Be Intentional with Your Time

WFH makes it extremely easy for our work to eat into our personal life. Hence, it is crucial for us to be intentional with how we use our time.

The best way to do so is to plan our day by breaking it down into multiple time blocks.

Essentially, you’d want to allocate each time block to a specific work (eg. meeting, reply to emails) or personal to-do (eg. rest, exercise, social media, meals) so you’ll always be aware of what you are doing with your time.

Ultimately, just think of your time (24 hours) as a currency where you have to budget for different purposes everyday.

#2 Cue: Build Your Cue for Work and Personal Life

At times (actually very often), we’ll still get distracted by different things at home (eg. Youtube & Social Media), even after having everything planned out beforehand.

As such, it is important for us to reinforce our planned schedule by having a cue for both work and personal endeavors.

As an example, while working, I’ll be wearing an active noise-canceling headphone as a cue for me to work. The headphone will be used purely for work and nothing else (eg. entertainment) – and will be put away after work.

#3 Transition: Allow Breaks & Transition in Between Work and Personal Life

Lastly, it is important for us to have a specific focus for the day. Generally, the lesser things you have to focus on for the day, the more productive you’d get.

I’ve also found that having breaks & transition in between focuses make me more productive and retain information better.

This may sound counterintuitive, but I am actually more productive at home if I slot in a power nap in between focus/task-switching for the day.

So here you go: 3 techniques that I personally use to help improve my balance and productivity while WFH – definitely give them a try!

Do you have any ideas/tips that have improved your WFH experience? Feel free to share with me at the comment section below!

Till next week (and stay safe)!

Yi Xuan

Case Studies: 4 REITs I am Watching Right Now

First thing first:

This is NOT a freaking buy/sell recommendation.

The purpose of this article is to share my personal thought process on these REITs, and hopefully provide you some alternative insights and/or head start in your research.

It is my strongest suggestion that you do not follow what I have written in this post blindly, as this will only pause and even reverse your growth as an investor.

Do your own research, form your own narrative, and make your own investment decision.

With that, let’s start.

Criteria

There are several basic criteria on why these are the REITs in my watchlist.

Let’s go over them briefly:

1. Healthy Balance Sheet.

Balance Sheet health tells us a lot about how a company is managing its liabilities (eg. debt) relative to its assets.

As such, REITs with a healthy balance sheet are most likely in a good financial state, and hence able to sustain their business during volatile periods like right now.

Generally, a REIT with a healthy balance sheet should have a Current Ratio > 1.0 and Gearing Ratio < 0.40.

To learn more about the most important things that I look into when investing in REITs, click HERE

2. Decent probability to sustain and even thrive during/after the pandemic.

This means any REIT in this list is in the business where they are able to survive/thrive this pandemic and grow upon recovery.

3. Around 2 – 5 years investment horizon.

Depending on the REIT in this list, my investment horizon is generally in a medium to medium-long term period. Barring any fundamental shift in business nature, some of them could go even longer.

Again, I am a firm believer that both business and market are dynamic.

With that in mind, there is no reason not to be adaptable and shift accordingly as the market and business evolve (or gone obsolete) with time.

4 REITs I am Watching Now:

1. IGB REIT (Aggressive)

IGB REIT is a retail REIT with notable properties under its portfolio – Mid Valley & The Gardens.

-

Opportunities/What I Like:

IGB REIT may present an excellent long-term opportunity due to its exposure to prime malls (ie. Mid Valley & The Gardens).

As such, historically, Mid Valley & The Gardens have always been well-occupied with a strong tenant base. As of Financial Year (FY) 2019, both Mid Valley & The Gardens were 99% occupied.

With its respectable balance sheet, they are most likely able to brace through this pandemic storm.

Another question that I always get is the threat that e-commerce poses towards retail REITs. Personally, I think e-commerce will certainly shift the retail landscape and retail REITs will have to adjust accordingly.

In this case, I think malls like Mid Valley and The Gardens have been positioning themselves well towards recreation/experience-based consumers where the main reason people go to these malls is not so much to buy vegetables, but to meet up, makan, and have a good time with family and friends.

As a REIT with malls that cater to recreational purposes, I am confident that IGB REIT will experience a strong business recovery post-pandemic. (read: Malaysians cannot stand staying at home forever)

-

Risks:

Without a doubt, the retail business is going to experience turbulence in this short to medium term period. No one can tell for sure when this pandemic will come to an end.

Having known this, the tenancy status for IGB REIT for FY2020 and FY2021 is crucial as we may see less-capable tenants closing down or discontinuing their tenancies. This can get worse if we get another wave of outbreaks which will deal a huge blow to retailers and IGB REIT’s earnings.

Also, I am not in favor of IGB REIT’s share price. Since the March sell-down, the share price has gone back to near pre-selldown level of around RM1.70 – RM1.80.

For me, I think the market may be way too optimistic about the speed of retail recovery and hence I think the price right now does not justify the downside/risks in IGB REIT.

-

TLDR:

In short, I am confident with the long-term business recovery prospect of IGB REIT, but the short-term turbulence and bloated share price are something to take note of.

Hence, this makes the overall risk package of IGB REIT rather aggressive at this moment in time.

2. KIP REIT (Moderately Aggressive)

KIP REIT is also a retail REIT with its flagship KIP Malls under its portfolio.

-

Opportunities/What I Like:

Unlike IGB REIT that runs recreational retail malls, KIP REIT runs neighborhood-centric retail malls that focus on providing everyday essentials to nearby communities.

This means that in the face of Covid-19, KIP REIT will be more resilient compared to IGB REIT as the demand for essential items will always be there.

In addition, KIP REIT’s solid balance sheet also keeps them in a good position to brace through this storm.

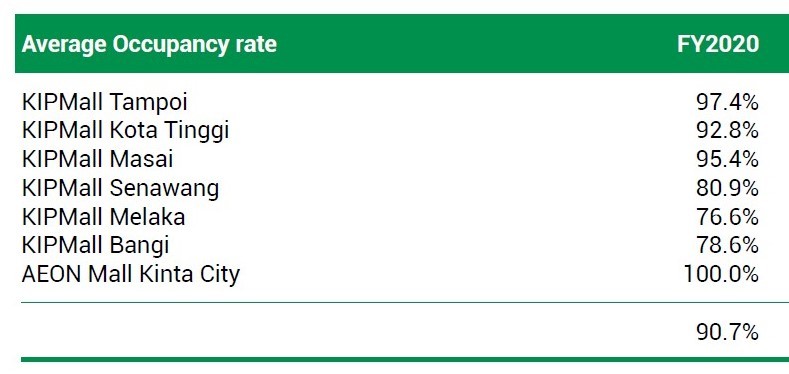

Lastly, for FY2020, the top 3 revenue contributing malls for KIP REIT stands at a healthy occupancy rate of more than 90% (Tampoi, Masai, AEON Kinta City). Of all, AEON Kinta City Mall is being locked in with a master lease until 2026, ensuring stable earnings moving forward.

-

Risks:

One obvious risk for KIP REIT is its lower than ideal occupancy rate for several malls (ie. KIP Mall Melaka and Bangi) for FY2020.

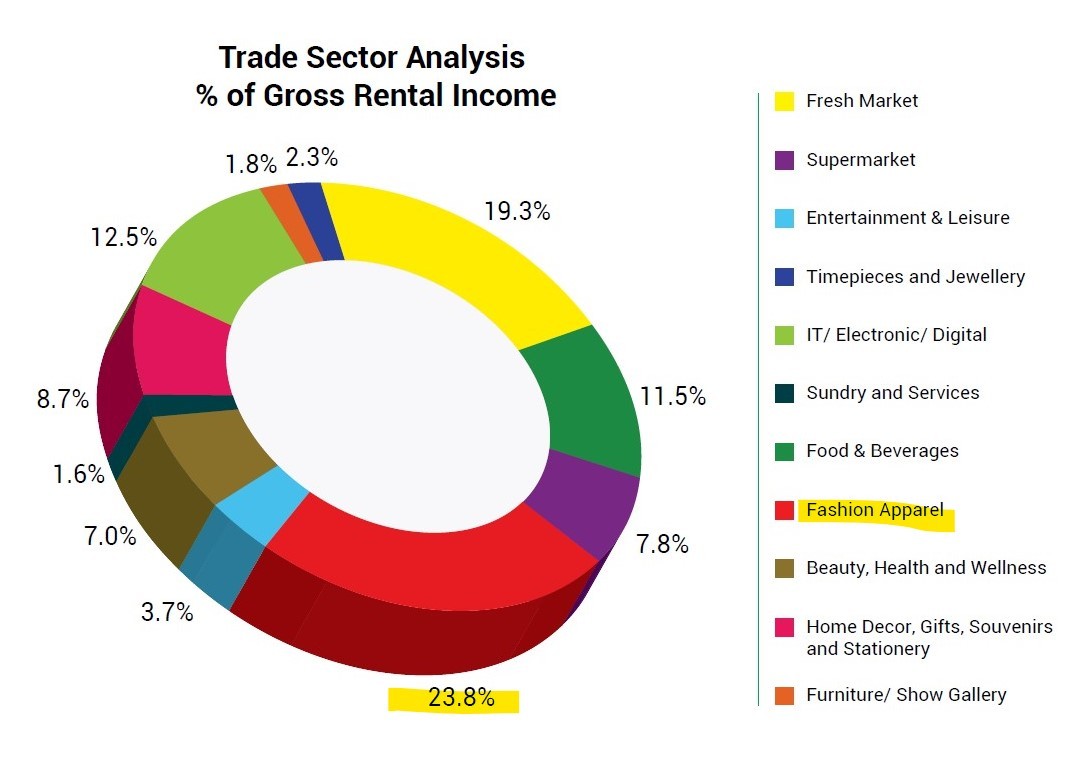

In addition, even though KIP Malls generally serve essential needs, I spotted a potential weakness in the tenancy structure. A notable one is fashion apparel tenants make up nearly 24% of KIP REIT’s rental income for FY2020.

In other words, KIP REIT is still exposed to typical retail risk in this pandemic as they have tenants that are also in the non-essential segment/business background.

Finally, on a long-term basis, the potential growth prospect for KIP REIT’s neighborhood-centric business model may be limited and less exciting compared to the likes of IGB REIT.

-

TLDR:

At the present, KIP REIT is a more resilient option for retail REIT, but they are still exposed to the underlying retail risks to some extent.

Hence, I’d categorize KIP REIT as moderate-aggressive risk at this point in time.

3. MQ REIT (Moderate)

MQ REIT is mainly an Office REIT with minor exposure to the retail and car-park space.

-

Opportunities/What I Like:

Screening through MQ REIT’s financial report, it is not hard to find what to like with MQ REIT.

An obvious one is that it’s tenancy status that consists of notable names like Shell, BMW, Tesco, Google, and more. This generally implies the quality of tenants and overall income stability.

Aside from that, MQ REIT has a strong Weighted Average Lease Expiry (WALE) of around 4 years. Essentially, this tells us about the stable tenancy status of MQ REIT to some extent.

Lastly, compared to the historical price movement, MQ REIT seems to have some upside space to grow further.

-

Risks:

For FY2020, about 19% of MQ REIT’s Net Lettable Area (NLA) is due for renewal. With this current challenging sentiment, there are surely uncertainties involved with tenancy renewal.

Also, being in the (boring) office space business, I honestly think that there is a lack of growth stimulus in the space in the long-term.

Just don’t expect this REIT to flip your wealth over multiple times when you invest in it.

-

TLDR:

Overall stable outlook should the management is able to retain their existing tenants. As such, I’d categorize MQ REIT within the moderate risk profile.

4. Atrium REIT (Moderate)

Atrium REIT is an industrial REIT that basically owns or manages warehouses, factories, and logistic facilities.

-

Opportunities/What I Like:

With the acquisition of Atrium Bayan Lepas 2 in FY2019, Atrium REIT has experienced growth in earnings for FY2020 despite the pandemic.

Also, the common thing with industrial REITs is that their tenants are usually locked in for multiple years, ensuring steady revenue for a long period of time. This is especially helpful for Atrium REIT to sustain themselves even in this challenging climate.

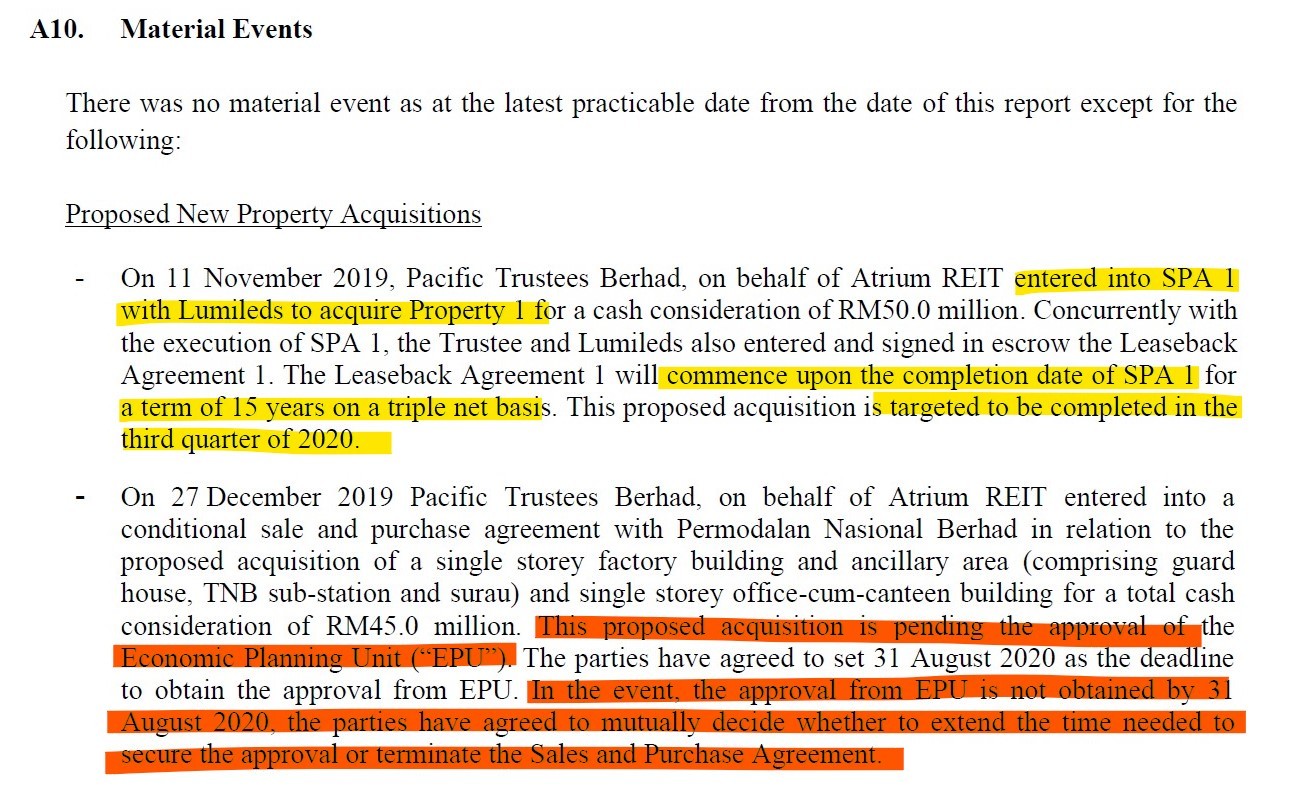

In addition, there are also planned acquisitions for Atrium REIT for FY2020 which will further boost the growth of the company moving forward (highlighted in Yellow).

p

-

Risks:

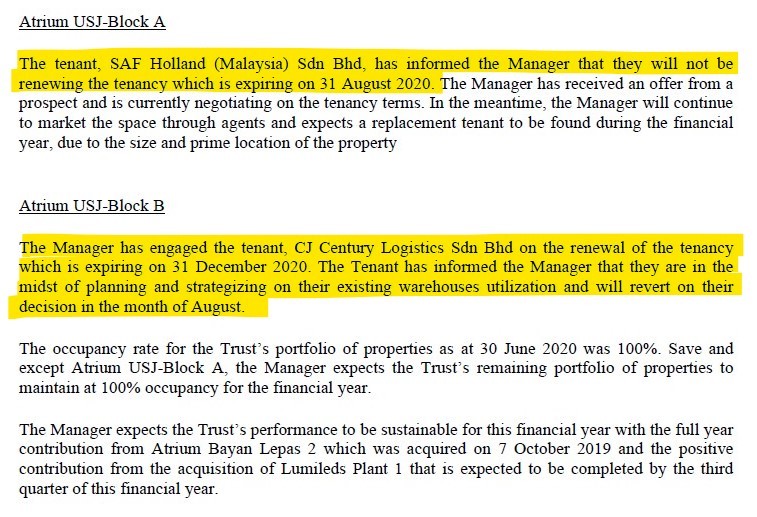

Risk of planned acquisition not going through, as shown above (highlighted in Orange) :

Risk of tenancy renewal, as shown below:

-

TLDR:

With the master lease business model, Atrium REIT stands out to me as one of the very few REITs with a stable growth outlook even during Covid-19. Considering the risk of tenancy renewal, I am of the opinion that this REIT would be more of moderate risk investment at this point in time.

No Money Lah’s Verdict

So here you go – the 4 REITs that I am watching right now, and the thought process behind each of them.

Hopefully this article has been helpful to you, and again, please do your own research before investing!

Love to hear your thoughts too – what are the REITs that you are watching at the moment and why?

Feel free to share with me at the comment section below!

p.s. This article is written on the 8th of October 2020 and will NOT be updated going forward. On that note, I usually share my latest and most updated thoughts with my private REIT investing community for FREE on a monthly basis.

“How do I get access to this community?” Glad you asked.

Essentially, the ones that have attended my REIT sharing session will have full access to the community. If you are keen, you can sign up for my 2021 REIT Investing Sharing Session waitlist HERE and be the first to be notified when the registration is opened!

5 Ideas to Financially Prepare Ourselves for Another Round of Pandemic Outbreak

Dear friends,

Some of you may not like to read this but I hope you can read on.

The growing number of Covid-19 cases recently is worrying. We’ve managed to flatten the curve from June to early September, but as you can see below, we are revisiting March – April level of daily cases lately.

Let’s be realistic:

There is a need for us to financially prepare for another round of outbreak. Here are some actions that we can take:

--

1. Build Up/Replenish Your Emergency Fund

Now’s a good time to revisit your emergency fund and see if it is enough to sustain your lifestyle in case life takes an unexpected dip in the coming months.

Whenever possible, maintain at least a 3-month (or more) emergency fund buffer for peace of mind.

I’ve written an article on building an emergency fund. Check it out HERE.

--

2. Review Your Personal Finances/Reduce Non-Essential Expenses (and protection)

It’d also be wise for you to give your personal financial state a thorough review.

What are some of the expenses that you can cut down (eg. Subscriptions)? Are you still paying for any insurance plans that may be overlapping or obsolete at this stage of your life?

In short, it is time to seriously cut down on unnecessary expenses.

--

3. Review Your Investment Portfolio

If you have been involved in the stock market for the past months AND you do not know what you are actually doing, it’s a good time to re-evaluate your approach.

Luck can only stay with you for that long.

--

4. Be very careful about taking up new financial commitment

Mortgage & loans may seem cheap right now – ASSUMING your earning power is still the same for the next few months.

What if life takes an unexpected dip (a.k.a. Pay cut/retrenchment)?

The point is, be careful not to burden yourself with unnecessary new financial commitments unless you have some buffer in place.

--

5. Increase Your Income

Selling pre-loved or unused items on platforms like Carousell is a good place to start.

--

BONUS: If things seem overwhelming to you, seek help.

First thing first, there’s nothing wrong to get help with your finances.

Personally, I have engaged a personal financial planner to assist me in my personal finances since late last year and it has been extremely helpful for me.

A personal financial planner is MORE than just insurance. It involves things like asset management, investment, estate planning, and yes, insurance, and more.

Like myself, I’d highly recommend for you to engage one to get your finances in place.

I’ve written about my experience working with my own personal financial planner, and you can also get a consultation session absolutely FREE today. More details HERE.

--

Wishing you the best, and stay safe!

p.s. I am writing this on impulse because I have a strong urge that people need to read this. Hence, please understand that this is NOT a comprehensive list. Some ideas may or may not apply to you depending on your situation, but feel free to take what’s useful to you.

p.p.s. Do you have any other ideas on how to prepare financially for another round of outbreak? Please share with me at the comment section below – I’ll update the article accordingly so it can help more people!

p.p.p.s. Share this with your friends & family members if you think they can benefit from this reminder!

How to Become Indispensable in Your Career and Life

Every now and then we see news and articles highlighting the jobs that'll be displaced by AI in the near future.

But WAIT. This ain't it.

Read on, please.

"If we can write down your job description, then we can find someone cheaper to do it. The fact is, that someone may not even be a person. So that means we need to teach kids to eagerly do things that cannot be written down."

- Seth Godin

When I came across this quote from Seth Godin (one of my favorite authors), I was intrigued.

I asked myself:

What is the kind of job descriptions that could not be written down, or even if they are written down, are extremely hard to replicate or execute consistently? (read: SOP)

Think 'bout that for a moment. Then, cross-check with the 10 things that I got in mind in the list below:

- 1. Showing Empathy & Compassion

- 2. Greeting people with a warm, genuine smile. (You can include this in official SOPs, guess how many will follow?)

- 3. Giving a firm handshake. (don't do that now though)

- 4. Giving hugs (don't do this now too)

- 5. Become a good listener

- 6. Negotiate & finding middle ground.

- 7. Having critical & unique foresight.

- 8. Making hard, discretionary & grey area decisions.

- 9. Having a strong ethic.

- 10. Expressing love and passion.

As I'm writing this down, something struck me:

Your in-paper job descriptions do not define you. Your personalities & perspective do.

You may, or may not agree with all the things I mentioned on the list, and that's totally fine.

What I am hopeful for, is we can all agree that there are certain perspectives or qualities that are unique to each individual.

These qualities of us are something that could not be easily replicated by a cheaper counterpart (ie. labor), or be replaced by AI (at most, they complement us).

In short, our unique human qualities & perspective make us indispensable in work and in life.

And we got to nurture those qualities to our (future) kids.

BUT...

Before we teach these to our kids, don't you think we have to first practice/build up these qualities first?

p.s. What other qualities do you think should be on the list? Share with me by replying to this post!

Love to hear from you!

Lessons I Learned In Search of Perfection (2nd Anniversary Special)

It took me almost a year to design and release No Money Lah (330 days, to be exact).

I was looking to build a slick & perfect website back then until I realize that there’s no way I could do it as an amateur.

As a result, I launched whatever on hand on 23rd September 2018. It served me well for almost 2 years until I gave it a slight (and still imperfect) visual and backend upgrade recently.

Lesson #1: At the start of any endeavor, chase momentum, not perfection.

It took me a long time to think about what to write as my first blogpost on No Money Lah.

Back then, I was eager to write a blog post that’d become a hit on social media with likes and shares.

I was stuck with the ideal of writing the perfect first article. And with my mind totally blank, I eventually decided to write something, anything, and pushed it out.

Looking back, that first post was shit - but I am glad that I delivered.

Then, regardless of how I feel about my writings, I made it a point to deliver at least an article every week (okay, almost every week).

2 years & 90 imperfect articles later, I consistently have 13,000 – 20,000 blog views every month.

But that’s not the point.

The point is, it’s not about the number of views, likes, and shares anymore (I rarely keep track of ‘em). Writing has become a fulfilling routine of my life, and art that I enjoy sharing with my friends & readers on a weekly basis.

Lesson #2: Delivering at 80% consistently is still (much, much) better than struggling for 100% occasionally.

“When you first adopt the discipline of shipping (delivering), your work will appear to suffer. There’s no doubt that another hour, day, or week would have added some needed polish.

But over time – rather quickly, actually – you’ll see that shipping becomes part of the art and shipping makes it work.”

- Seth Godin (Linchpin)

So here’s the thing:

Lesson #3: Your first blogpost will suck. Your first video on YouTube will look and sound terrible. Your first public-speaking speech will be mediocre at best.

And heck, even your following attempts would be highly imperfect.

But by delivering at 80% consistently every time, you are allowing your ‘80%’ to eventually surpass your initial imaginary 100% that you have in mind.

Just start, and get going. The adventure would be so much fun and satisfying.

No Money Lah turns 2 today!

What an amazing 2-year journey!

Regardless if you have been a reader from the start, or just recently got to know my blog, thank you so much and I can’t wait to keep delivering interesting and useful content to you.

Here’s to more awesome years ahead!

It’s Never Too Late

The past few days were nothing but inspiring.

I’ve done reading a book of how the author (a Malaysian) retire with financial freedom at 55-year-old even though he only started to plan for his retirement in his 40s.

A fresh retiree came and joined my online REIT investing sharing session (which normally make up of a younger crowd)

An 84-year-old lady emailed me on how she can open an online stock trading account.

Most often, we relate age with our ability to do or pursue certain things in life. As we grow past a certain age in life, we tend to build up self-limiting thoughts like:

“It’s too late to start a business in my 30s/40s.” (Anthony Tan was 30 when he founded Grab)

“I’m too old to start my own Youtube/Tik-Tok channel.” (follow mine HERE)

“It’s hard for me to get fit like how I used to back in university.” (I am guilty of that)

Some people are ‘old’ in age but live life with openness and grace. Many are ‘young’ in age but live a life full of self-limiting excuses.

If any, one thing that is certain in life is that we cannot stop or pause aging.

However, another thing that is certain in life is we have a choice to remain nimble and learnable.

As you are reading this, an 84-year-old lady has started her online investing journey.

If you are still hesitant about trying something out in life, consider this my supportive push to you – it is never too late to get started.

Till next week!