ETF: Best China ETFs in Malaysia!

Imagine investing in a country where the everyday people are spending almost 2x as much compared to the everyday people in the US.

How can you benefit from this massive spending power and growth?

In this post, let’s talk about how you can invest in China through 3 Malaysia-listed ETFs (TradePlus S&P New China Tracker, VP-DJ Shariah China A-Shares 100 ETF, Principal FTSE China 50 ETF) and their respective performances!

Before this, here are some related posts that you may want to read:

- What is ETF, and Malaysian's Guide to ETF investing!

- Best Dividend-Paying ETFs in Malaysia for CONSISTENT Passive Income!

- All you need to know on how to open a stock investing account in Malaysia!

p

Context: China growing middle class (and massive spending power)

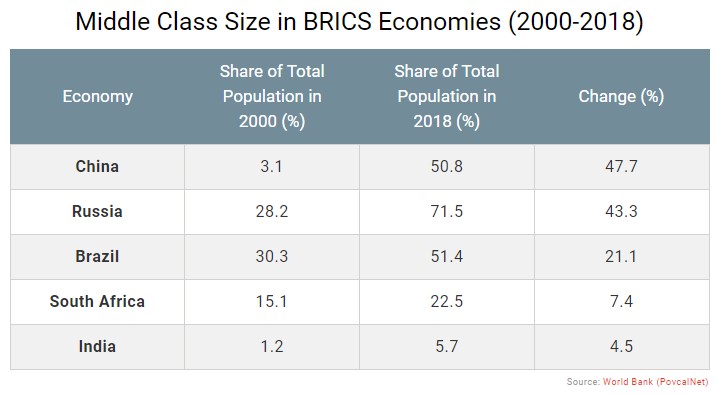

China is a country with a huge population. Of all, the Chinese middle class makes up half (50.8%) of China’s population.

Before you continue, I want you to take a moment, and guess how massive is the Chinese middle class.

Done?

As of 2016, there is about 730 million middle class in China. For the record, that’s about 697x the whole Malaysian population!

Now, a random middle-class Chinese may not be able to spend much. But with 730 million of them (again, 697x the whole Malaysia), this creates a HUGE consumption power, and business opportunities.

In 2020, China's middle class recorded consumption of $7.3 trillion (12 zeros, you're welcome), which is almost double what the US's middle class has spent.

Here’s one more thing you need to know: China’s middle class is expected to keep growing, and reach about 1.2 billion in 2027!

So, how can you ride and invest in the growth of this huge consumption powerhouse?

Let’s find out with our very own Malaysia-listed China ETFs!

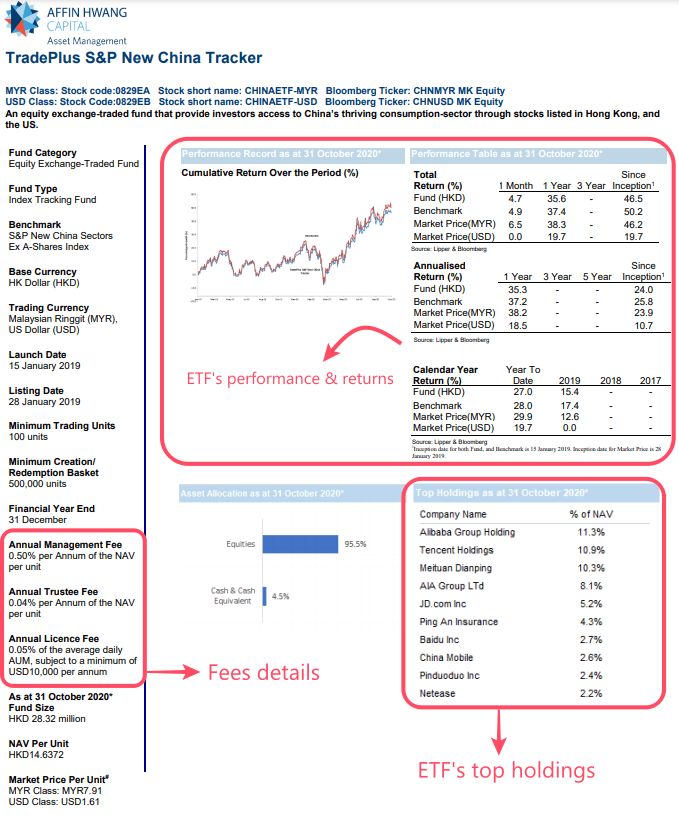

ETF #1 TradePlus S&P New China Tracker (CHINAETF-MYR)

TradePlus S&P New China Tracker (or CHINAETF-MYR) is a Malaysia-listed ETF that provides investors exposure to Chinese companies (listed in HK and US) within the consumption and service-orientated industries.

- CHINAETF-MYR (Stock Code: 0829EA) was listed and started trading in Bursa Malaysia in 2019.

- Underlying index: CHINAETF-MYR tracks the S&P New China Sectors Ex A-Shares Index through full replication strategy to ensure minimal tracking error.

- Annual Fees: 0.59% of Net Asset Value (NAV)

- Annual Management Fee: 0.50%

- Annual Trustee Fee: 0.04%

- Index License Fee: 0.05%

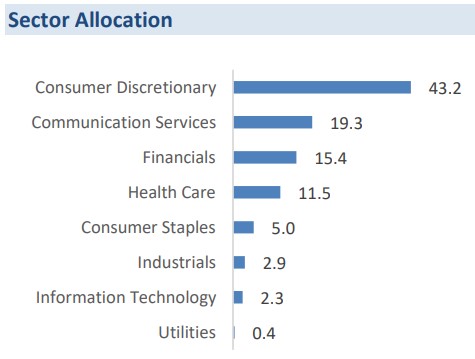

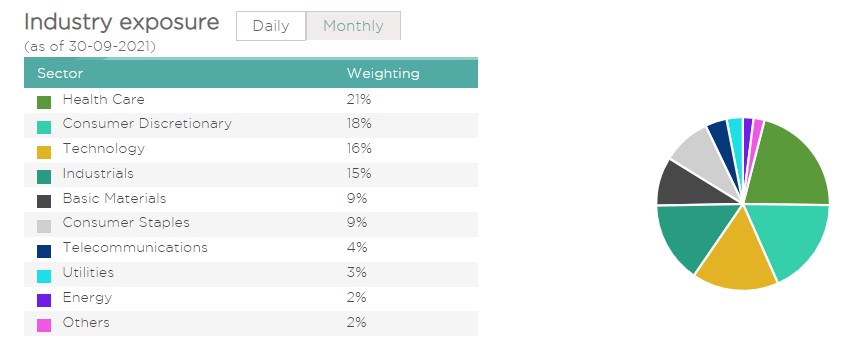

Sector exposure of TradePlus S&P New China Tracker

Essentially, investing in CHINAETF-MYR provides investors exposure to Chinese businesses that grow on increasing consumer spending.

Through CHINAETF-MYR, you’ll mainly gain exposure to companies from the consumer discretionary (43%), communication services (19%), and financial sector (15%).

Given the growth of China’s middle class, the CHINAETF-MYR can be an attractive opportunity for investors looking to ride on the growing consumer market.

Notable companies/holdings of TradePlus S&P New China Tracker

As of August 2021, the top 10 holdings of CHINAETF-MYR include companies such as AIA Group, Tencent, Alibaba, and Meituan Dianping.

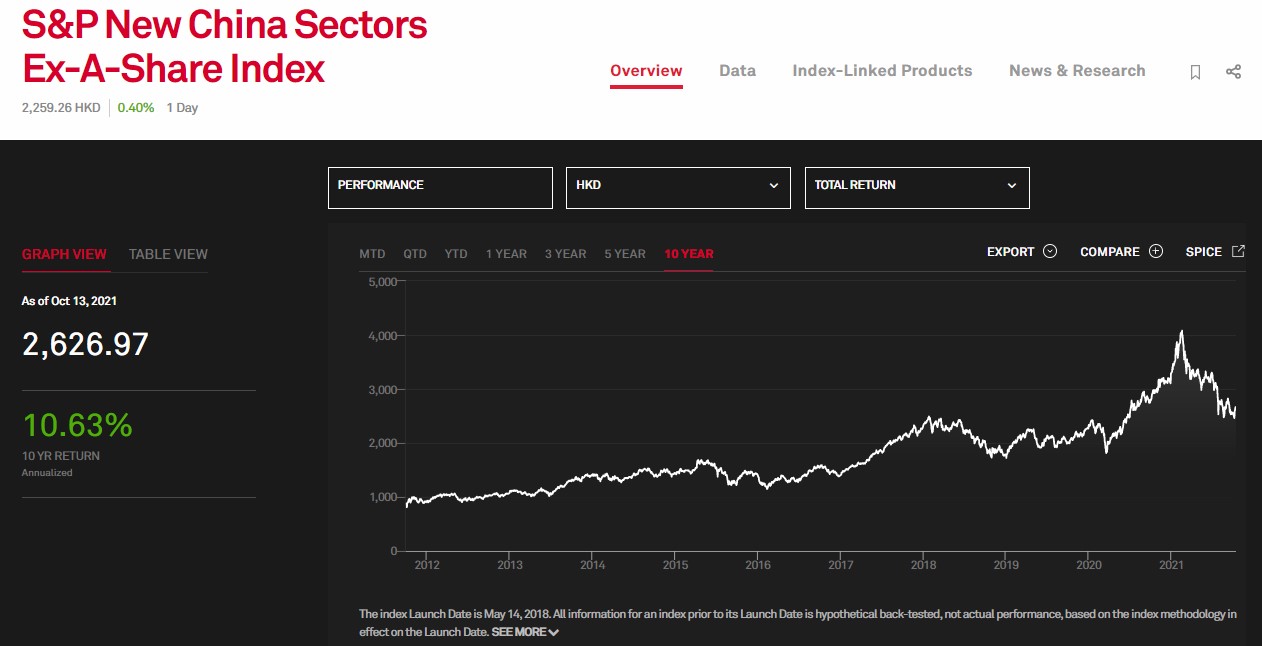

Performance of TradePlus S&P New China Tracker

Since CHINAETF-MYR is listed in 2019, there is very limited historical data on the past performance of the ETF.

That said, the back-tested performance of the S&P New China Sectors Ex A-Shares Index (ie. The underlying index of CHINAETF-MYR) can be a good reference for us:

Over a 10-year period (2011 – 2021), the S&P New China Sectors Ex A-Shares Index has grown by roughly 200%, translating to an annualized return of 10.63%.

In other words, on average, your capital would have increased by 10.63% every year if you invested in the S&P New China Sectors Ex A-Shares Index since 2011.

ETF #2 VP-DJ Shariah China A-Shares 100 ETF (0838EA)

The VP-DJ Shariah China A-Shares 100 ETF is a Malaysia-listed ETF that provides exposure to the top 100 largest & most liquid Shariah-compliant shares that are listed in China.

- VP-DJ Shariah China A-Shares 100 ETF (Stock Code: 0838EA) was listed and started trading in Bursa Malaysia in 2021.

- Underlying index: 0838EA tracks Dow Jones Islamic Market (DJIM) China A-Shares 100 Index through full replication strategy to ensure minimal tracking error.

- Annual Fees: 0.70% of Net Asset Value (NAV)

- Annual Management Fee: 0.60%

- Annual Trustee Fee: 0.06%

- Index License Fee: 0.04%

Investing in China A-Shares

Unlike TradePlus S&P New China Tracker which invests in Chinese shares listed in HK and US, the VP-DJ Shariah China A-Shares 100 ETF invests directly in Chinese stocks listed in the Shanghai and Shenzhen Stock Exchange (a.k.a. A-shares).

Generally, investing in China A-Shares reflects exposure to Chinese companies that are less well-known globally, and usually more domestically focused in their business.

While China A-shares may not be as popular, the benefits can be interesting to certain investors.

As an example, A-shares tend to experience a smaller impact from global risks (eg. Geopolitical, global pandemic) as most businesses generate revenues domestically.

With that in mind, China A-shares ETFs can be a good diversification vehicle for investors with exposure, especially in the US market.

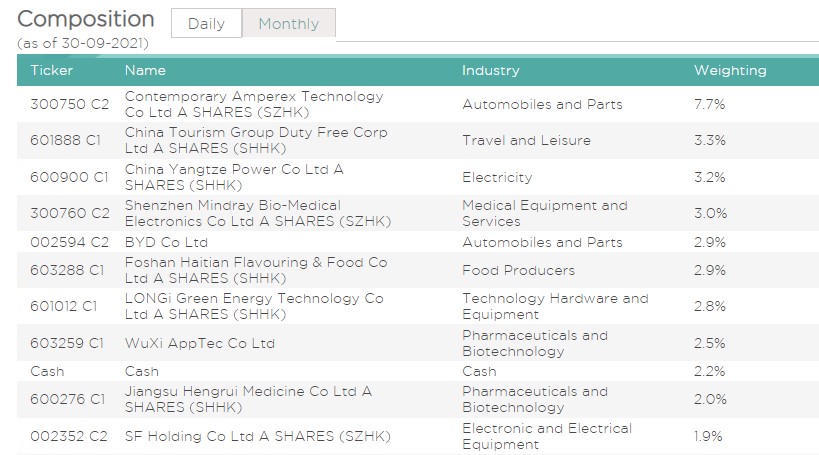

Sector Exposure of VP-DJ Shariah China A-Shares 100 ETF

As a whole, 0838EA has a balanced and diversified exposure to sectors such as healthcare (21%), consumer discretionary (18%), technology (16%), and industrials (15%).

Notable Companies/Holdings of VP-DJ Shariah China A-Shares 100 ETF

Investing in China A-shares can be unfamiliar to most investors as most companies are not as well-known globally. I’ll do a brief introduction to some of the notable companies in this ETF:

As of September 2021, the top 10 holdings of 0838EA include companies such as:

- Contemporary Amperex Technology Co. (CATL): CATL is one of the dominant battery manufacturers in the EV industry, with association with big names like Toyota, Volkswagen, Volvo, and more.

- China Tourism Group Duty Free Corp.: A Chinese company involved in travel agencies and duty-free businesses.

- China Yangtze Power Co. (CYPC): CYPC is involved in the businesses of hydropower generation, power distribution & sales, and overseas power plants operation & management. With a total installed capacity of 45.495 GW, the company is the largest listed electric power company in China and the largest listed hydropower company globally.

- Shenzhen Mindray Bio-Medical Electronics Co.: Mindray is China’s largest medical equipment manufacturer, with a presence around the world. It is a company that makes medical equipment such as patient-monitoring and life-support systems and ultrasound machines.

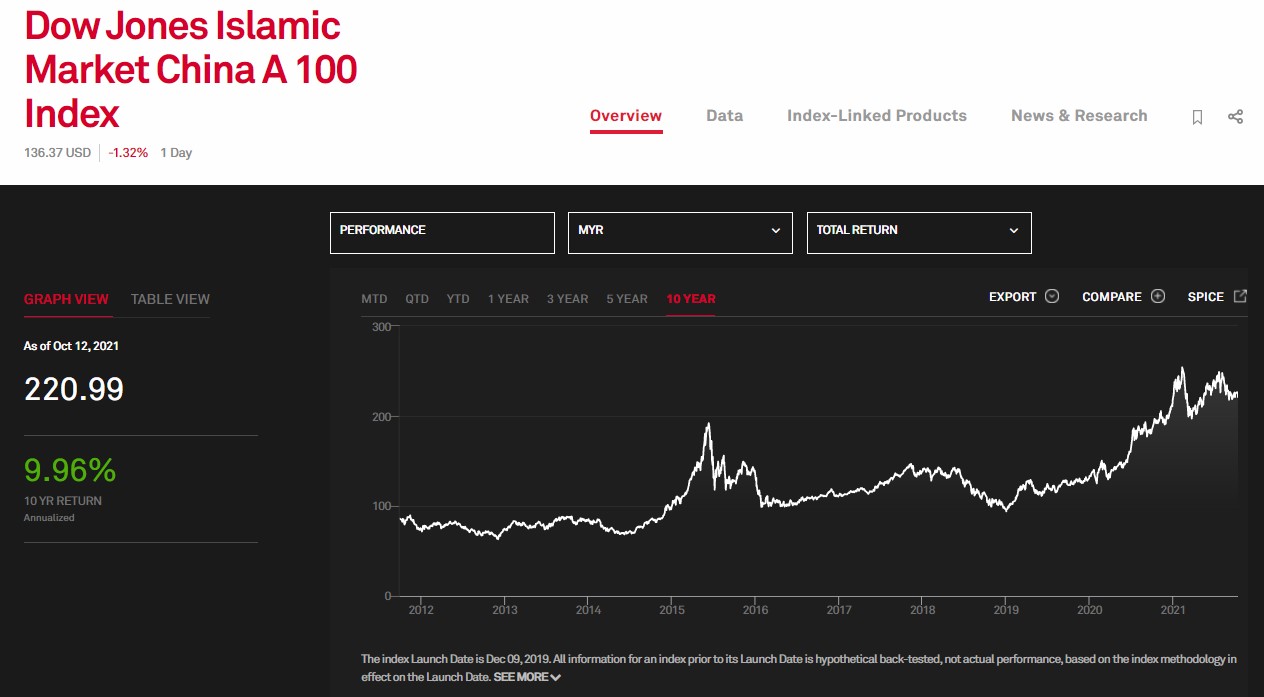

Performance of VP-DJ Shariah China A-Shares 100 ETF

Since 0838EA is listed in 2021, there is very limited historical data on the past performance of the ETF.

That said, the back-tested performance of the Dow Jones Islamic Market (DJIM) China A-Shares 100 Index (ie. The underlying index of 0838EA) can be a good reference for us:

Over a 10-year period (2011 – 2021), the DJIM China A-Shares 100 Index has grown by roughly 157%, translating to an annualized return of 9.96% per year.

In other words, on average, your capital would have increased by 9.96% every year if you invested in the DJIM China A-Shares 100 Index since 2011.

ETF #3 Principal FTSE China 50 ETF (CIMBC25)

Listed in 2010, the Principal FTSE China 50 ETF (or CIMBC25) is the longest Malaysia-listed ETF with China exposure.

- CIMBC25 (Stock Code: 0823EA) tracks the FTSE China 50 Index either via full replication strategy or representative sampling strategy.

- Through CIMBC25, investors get exposure to the 50 largest and most liquid Chinese stocks listed in Hong Kong.

- Annual Fees: 0.72% of Net Asset Value (NAV)

- Annual Management Fee: 0.60%

- Annual Trustee Fee: 0.08%

- Index License Fee: 0.04%

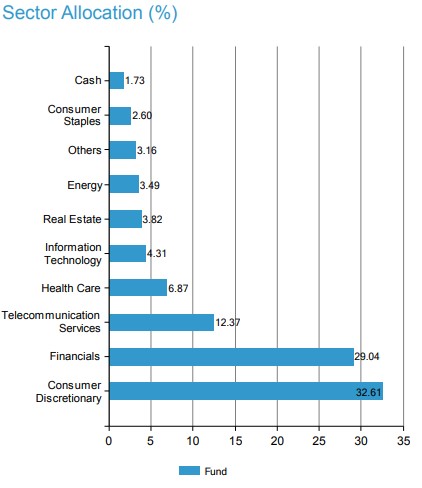

Sector Exposure of Principal FTSE China 50 ETF

Investors that invest in CIMBC25 gain exposure to 3 main sectors, namely Consumer Discretionary (33%), Financials (29%), and Telecommunication Services (12%).

In many ways, there is a huge resemblance between investing in CIMBC25 relative to TradePlus S&P New China Tracker that we discussed earlier. In short, both ETFs focus on sectors that is highly dependent on consumerism.

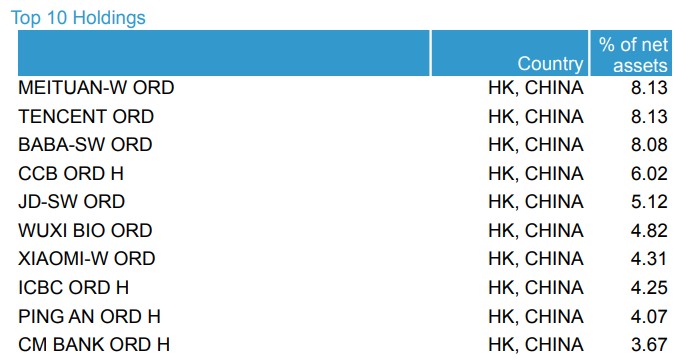

Notable Holdings/Companies of Principal FTSE China 50 ETF

CIMBC25 allows investors to gain exposure to the big names in China. As of August 2021, the top 10 companies held by the ETF includes Alibaba, Tencent, Meituan Dianping, Xiaomi, and more:

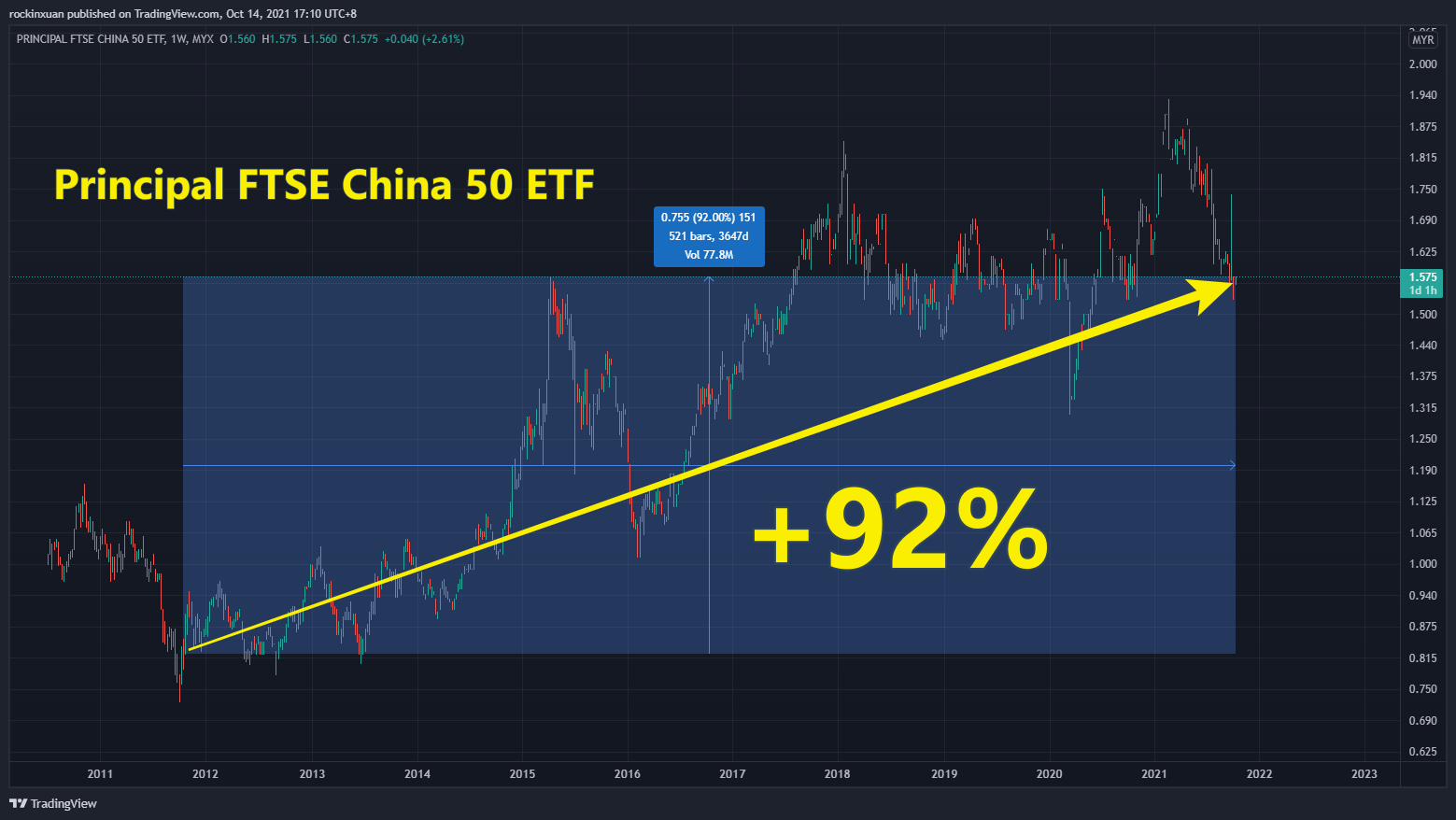

Performance of Principal FTSE China 50 ETF

Unlike the previous ETFs in this article, CIMBC25 is listed in 2010, which means we have enough historical data on the past performance of the ETF.

Looking at the chart, the CIMBC25 ETF has grown by 92% over the past 10 years (2011 – 2021). This translates to an annualized return of 6.64% per year.

In other words, on average, your capital would have increased by 6.64% every year if you invested in the FTSE China 50 ETF since 2011.

Which Malaysia-listed China ETF is the best?

So, which Malaysia-listed China ETF should you invest in if you are keen to ride on the huge potential of the China market?

Personally, I think there is no absolute ‘best’ ETF in this case. Rather, it is finding the ‘right’ ETF as per your investing goals and needs:

- If you are looking to invest in China for the first time, the TradePlus S&P New China Tracker (CHINAETF-MYR) or Principal FTSE China 50 ETF (CIMBC25) can be a good start.

Both ETFs have similar resemblance where they have huge exposure to consumer-heavy industries (ie. Consumer Discretionary, Financials).

In addition, both ETFs are holding companies that most of us are familiar with, such as Alibaba, Tencent, and JD.com.

When it comes to annual fees, TradePlus S&P New China Tracker (0.59%) is slightly lower compared to Principal FTSE China 50 ETF (0.72%).

As for past performance, TradePlus S&P New China Tracker* displayed a better return (+200%) relative to Principal FTSE China 50 ETF (+92%) over the past 10 years (2011 – 2021).

That said, it should be noted that past performance is not indicative of future returns.

[*Backtested results of the underlying index]

- If you have a deeper understanding of the domestic Chinese business environment, and/or looking for a relatively low-correlation diversification from a US-heavy portfolio, the VP-DJ Shariah China A-Shares 100 ETF can be a decent choice with exposure to China A-shares.

How to invest in Malaysia-listed ETFs?

Investing in ETF is similar to buying/selling stocks. You can invest in Malaysia-listed ETFs via stock brokers that allow access to the Bursa Malaysia stock market, such as Rakuten Trade.

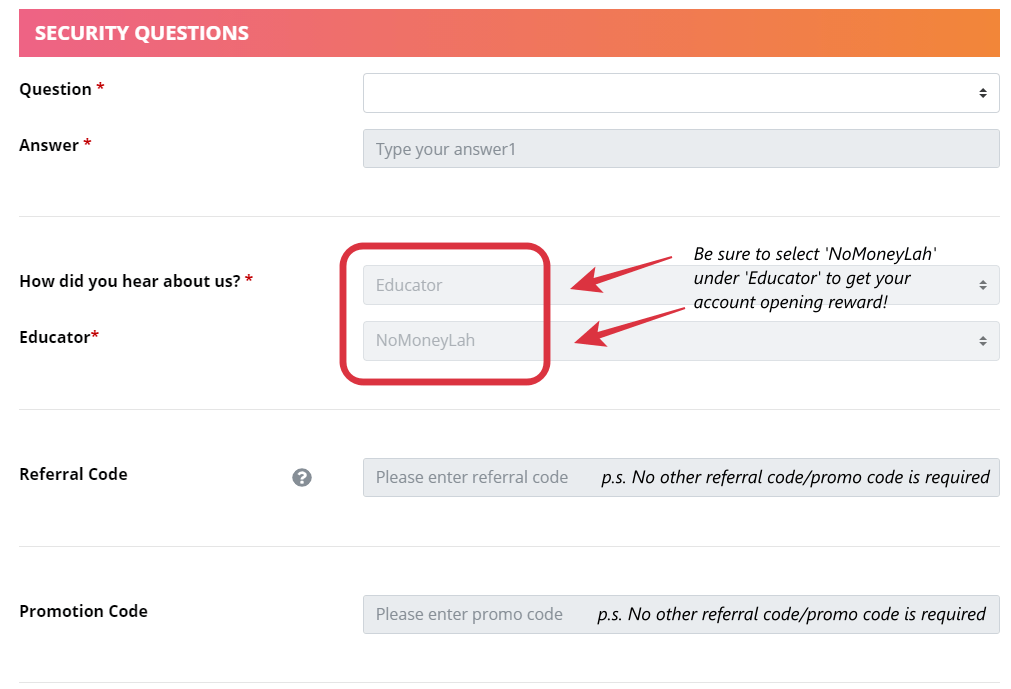

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

No Money Lah’s Verdict

So, there you have it – a detailed overview of Malaysia-listed China ETFs!

Personally, I think China is definitely going to grow in the coming future, despite regulatory risks from the Chinese government.

Moreover, I think this is where China ETFs shine compared to individual companies, as ETFs can help in reducing company-specific risk.

Regardless, what do you think? Will you allocate certain portion of your capital for exposure in China?

Feel free to share with me in the comment section below!

Disclaimers

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain affiliate links that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

ETF: Best Dividend-Paying ETFs in Malaysia

Are you looking to invest for passive income in the form of consistent dividends? Then this post is for you!

In this week’s post, let’s explore several Malaysia-listed Exchange-Traded Funds (ETFs) that focus on paying investors consistent dividends.

As a focus, I’ll talk about TradePlus MSCI Asia Ex-Japan REITs Tracker, Malaysia’s 1st REIT ETF launched to provide consistent, higher-than-average dividends for investors.

In addition, I’ll also briefly discuss several other locally listed dividend ETFs as well at the end of this article.

Before this, here are some posts that you might find useful:

- Best China ETFs in Malaysia

- Guide: Invest in Singapore REIT ETF for consistent dividends!

- Malaysians Guide to ETF Investing!

p

Why invest in ETFs instead of individual companies?

First, let’s briefly understand why one should invest in ETF instead of individual companies:

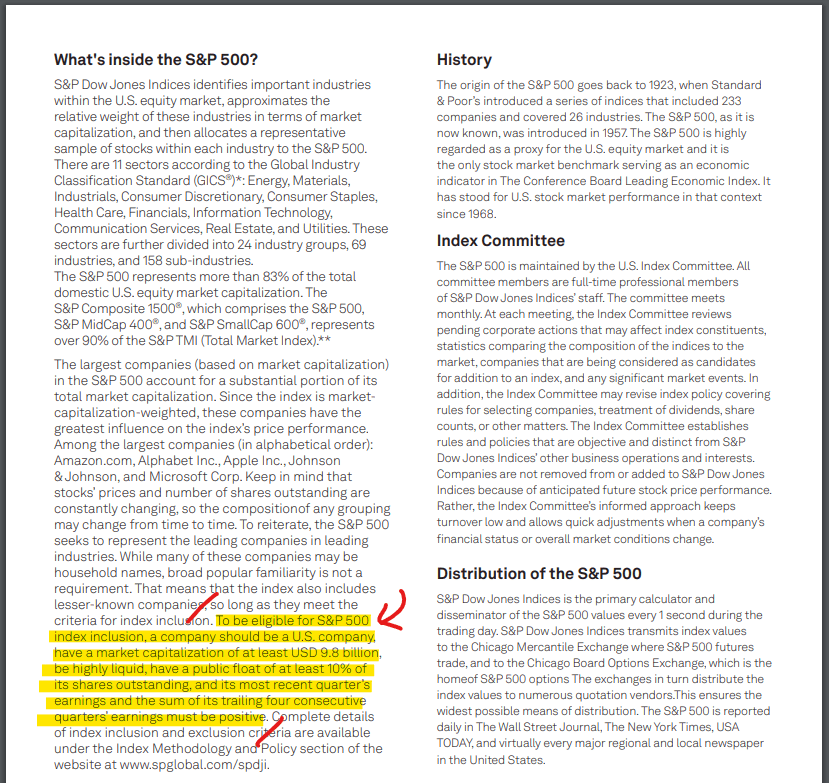

ETFs are listed in the stock market, and hence can be bought and sold just like any stocks. Since ETF tracks the performance of a basket of stocks, it presents 3 main benefits:

- No individual company risks: Since ETF tracks a basket of stocks, a single company that is underperforming or faces regulatory issues has minimal impact on the performance of an ETF as a whole.

- Filter for quality companies: Usually, when we say that an ETF ‘tracks a basket of stocks’, it means the ETF is tracking a specific index (eg. S&P 500, KLCI).

p

To become part of an index, listed companies will need to fulfill specific criteria. Hence, by design, this ensures the addition of qualified companies in an index, and the removal of unqualified companies. - Passive in nature: In general, investing in ETFs requires less work and commitment compared to individual stocks. Since an index already has a selection criterion in place, filtering of companies (ie. Rebalancing) is done on a consistent basis.

p

In other words, investors that invest in ETFs can take a more passive approach in their investing journey (and enjoy life) instead of having to keep up with the financials of individual companies.

Essentially, if you are busy with work and life, I highly recommend for you to check out ETFs over stocks for long-term investments.

READ MORE: Malaysian’s Guide to invest in ETF

ETF #1: TradePlus MSCI Asia Ex-Japan REITs Tracker (AXJ-REITSETF) Overview

Launched in July 2020, the TradePlus MSCI Asia Ex-Japan Reits Tracker (or AXJ-REITSETF) is Malaysia’s 1st REIT ETF. It aims to provide consistent and high dividends for investors through exposure to quality REITs:

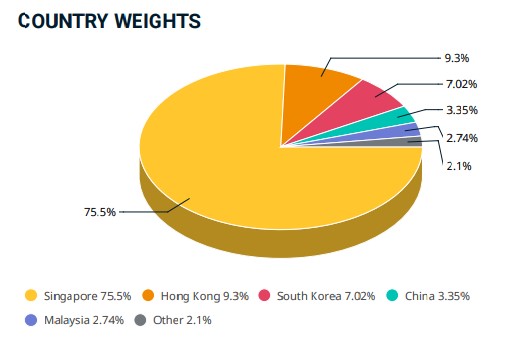

- AXJ-REITSETF tracks REITs that pay consistent and high dividends from the MSCI AC Asia ex-Japan IMI index.

- In other words, when you invest in AXJ-REITSETF, you will get exposure to a basket of quality REITs from developed Asian countries (HK and SG), and emerging markets such as China, India, Indonesia, Korea, Malaysia, Pakistan, the Philippines, Taiwan, and Thailand.

- Dividend payout is done on a quarterly basis (ie. 4 times a year)

READ MORE: What is REIT and why invest in them?

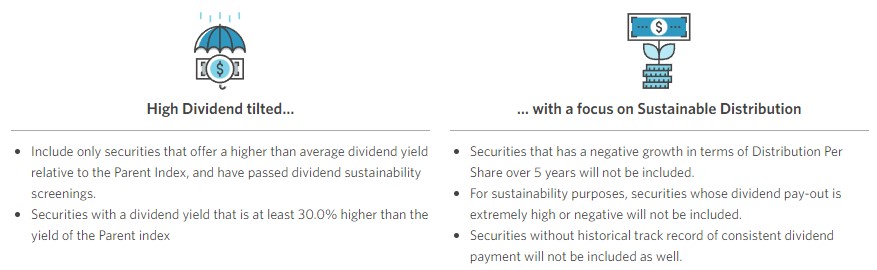

How are the REITs selected?

The REITs from AXJ-REITSETF are selected from the MSCI AC Asia ex-Japan IMI index, an index that tracks the performance of stocks across developed and emerging markets in Asia.

There are a few filtering requirements for a REIT to be selected:

- Offers a higher-than-average dividend yield

- Have a consistent track record of dividend payout

Furthermore, to ensure the quality REIT selection, the following REITs will also be filtered out:

- REITs with negative growth in terms of Distribution Per Unit (DPU) over 5 years will not be included.

- For sustainability purposes, REITs whose dividend pay-out is extremely high or negative will not be included.

- REITs without a historical track record of consistent dividend payment will not be included as well.

Filtering is a great feature of an index. Reason being, it sets criteria to automatically include qualified companies, and remove companies that do not meet the required criteria of an index.

Simply put, when investing in an index-tracking ETF, you’ll not need to worry about one specific company (or in this case, REIT) turning bad – they’ll simply be replaced once they do not fulfill the filtering criteria.

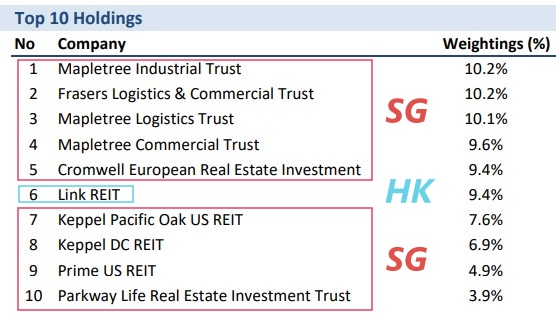

What’s in the TradePlus MSCI Asia ex-Japan REITs Tracker?

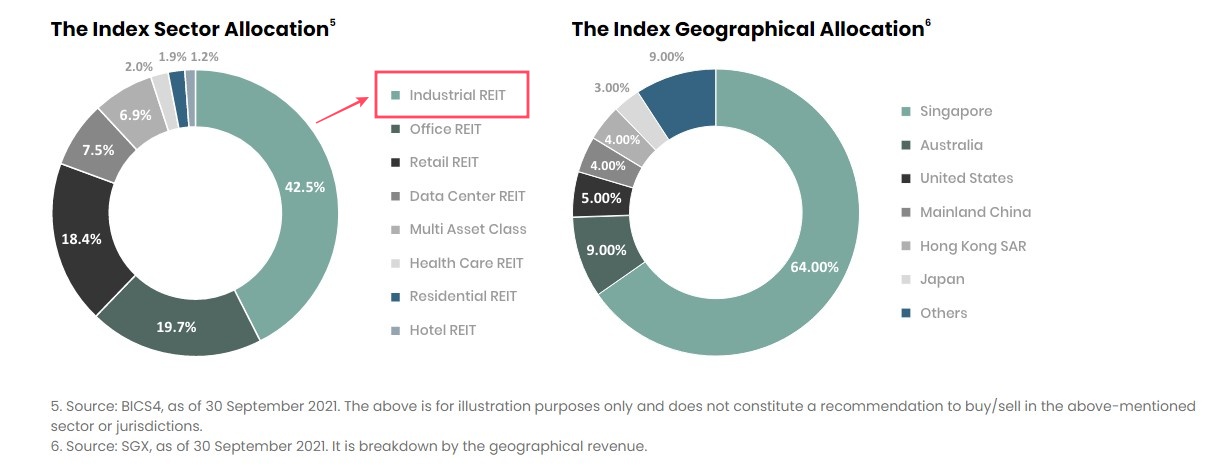

As of August 2021, the top 10 REIT holdings within the AXJ-REITSETF are mainly Singapore REITs. This is not surprising, given that Singapore is one of the most mature REIT markets in Asia:

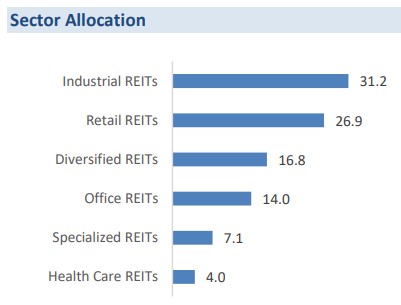

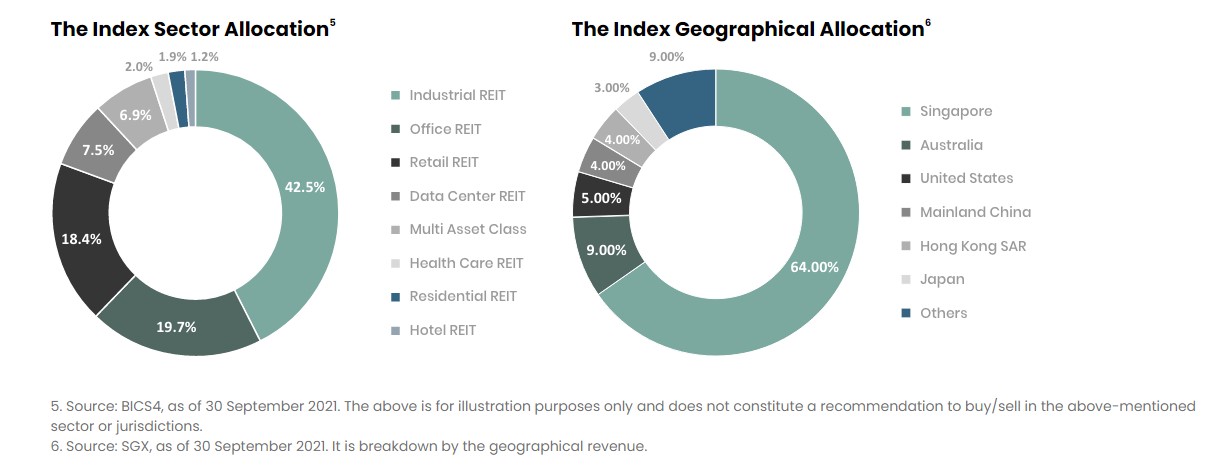

As for sector allocation, industrial REITs and retail REITs make up 58.1% of the overall allocation:

READ MORE: Introduction to Singapore REIT (SREIT) and why invest in SREIT?

Performance & Dividend Yield of TradePlus MSCI Asia ex-Japan REITs Tracker

Since AXJ-REITSETF is a newly listed ETF (July 2020), there is no historical data on the past performance of the ETF.

However, you can find the back-tested performance of its underlying index as a reference. Just remember that back-testing performance is not indicative of future performance:

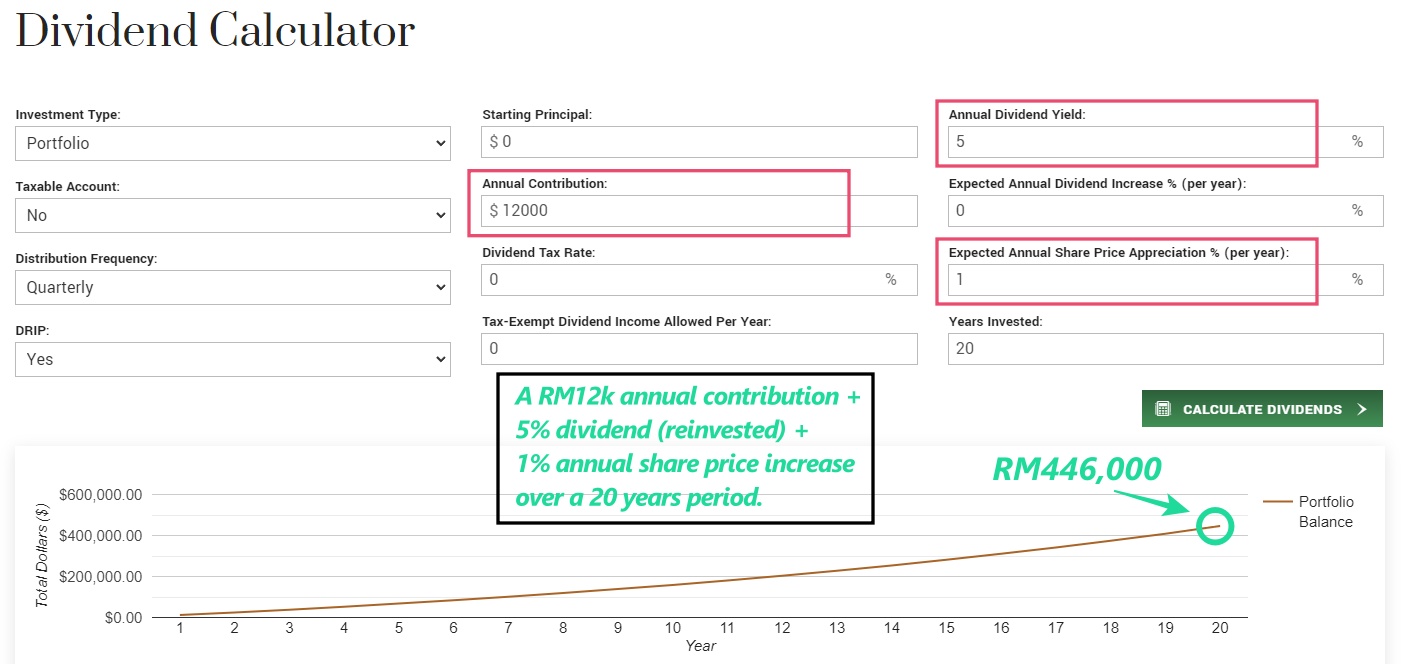

In my opinion, purely from the perspective of price returns (ie. Capital gains), AXJ-REITSETF is certainly not impressive. With 5-year and 10-year annualized returns of 1.66% and 7.13% respectively, this ETF is not ideal if you are specifically looking for capital growth.

That said, if you are looking for consistent high dividend payout (ie. Passive income) from your investment, AXJ-REITSETF can be a suitable choice:

As of September 2021, the underlying index of AXJ-REITSETF generates a dividend yield of 5.54%*, which is definitely higher than the average dividends payouts in the equity market.

In short, from my understanding of REITs, I am fairly confident that you can expect between 4 – 5% of annual dividend yield from AXJ-REITSETF.

*While it is not clearly specified in the document, I’d assume this is a rolling 12-month dividend yield

A word on the performance of dividend investing:

While approaching dividend investing, it is also helpful that you adjust your expectation to the returns of your investment.

As an example, by nature, as a real estate business, REITs generally have more moderate growth in price. Hence, you probably should not invest in REITs with the expectation of huge capital gains.

However, REITs pay stable and higher-than-average dividends, which can be attractive if you are building a passive income from your investment over the long term.

Understand your goals, and adjust your expectations accordingly.

How to invest in TradePlus MSCI Asia ex-Japan REITs Tracker?

Investing in ETF is similar to buying/selling stocks. Below, you can find the details of this ETF:

| ETF | Ticker/Symbol | Currency | Annual Fees | Min. Unit per Transaction |

| TradePlus MSCI Asia ex Japan REITs Tracker (AXJ-REITSETF) | 0837EA | MYR | Management Fee: 0.50%

Trustee Fee: 0.04% Index License Fee: 0.015% Total: 0.555% of Net Asset Value |

100 |

You can invest in AXJ-REITSETF via stock brokers that allow access to the Bursa Malaysia stock market, such as Rakuten Trade.

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Another thing that you need to know about TradePlus MSCI Asia ex-Japan REITs Tracker

AXJ-REITSETF uses a full replication strategy to track its underlying MSCI AC Asia ex Japan IMI / Equity REITs Custom High Dividend Tilted Capped Index.

Meaning, you are getting close to perfect replication of an index with the least tracking error.

READ MORE: 3 different replication strategies in ETFs!

2 more Malaysia-listed ETFs that pay decent dividends

There are 2 more Malaysia-listed ETFs that pay consistent and decent dividends. That said, their past and potential dividend yield aren’t as attractive as AXJ-REITSETF, but feel free to explore further regardless!

ETF #2 MyETF MSCI Malaysia Islamic Dividend (MyETF-MMID/0824EA)

The MyETF MSCI Malaysia Islamic Dividend (MyETF-MMID) is an ETF that mirrors the performance of the MSCI Malaysia IMI Islamic High Dividend Yield 10/40 Index.

This is an index that tracks Shariah-compliant companies listed in Bursa Malaysia with higher-than-average dividend yields.

Below are the Distribution per unit (DPU) and Dividend Yield of MyETF-MMID over the 3 most recent financial years:

| Financial Year (FY) | Distribution Per Unit (DPU) (sen) | Dividend Yield (%) |

| 2017 | 2.81 | 2.37 |

| 2018 | 2.76 | 2.38 |

| 2019 | 2.96 | 2.57 |

READ MORE: What are distribution per unit (DPU) and dividend yield (DY)?

ETF #3 Principal FTSE ASEAN 40 Malaysia ETF (CIMBA40/0822EA)

The Principal FTSE ASEAN 40 Malaysia ETF (CIMBA40) is an ETF that mirrors the performance of the FTSE/ASEAN 40 Index.

This is an index that tracks the largest 40 companies by full market value listed on the stock exchanges of Indonesia, Malaysia, the Philippines, Singapore, and Thailand.

Below are the Distribution per unit (DPU) and Dividend Yield of CIMBA40 over the 3 most recent financial years:

| Financial Year (FY) | Distribution Per Unit (DPU) (sen) | Dividend Yield (%) |

| 2019 | 6.85 | 3.59 |

| 2020 | 5.87 | 3.79 |

| 2021 | 6.18 | 3.86 |

No Money Lah's Verdict

So, there you have it – 3 Malaysia-listed ETFs that pay consistent and decent dividends!

If you are looking to generate passive income (dividends) through your stock investments, dividend-paying ETFs is certainly an option you can consider.

I hope you find this article helpful, and if you have any questions, feel free to let me know in the comment section below!

Disclaimer:

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain affiliate links that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

Malaysian’s Guide to Invest in ETF

Say you’d want to start investing, but you have a few concerns below:

-

- You do not have much time and commitment to actively manage your investment.

- You are not familiar with reading financial reports from companies.

- You do not have a lot of capital to start investing.

If you belong to one or more of the descriptions above, learning about ETF WILL make your investing journey much easier and fruitful! Afterall, in my opinion, more Malaysians should certainly explore what ETF can offer in their investing journey.

p

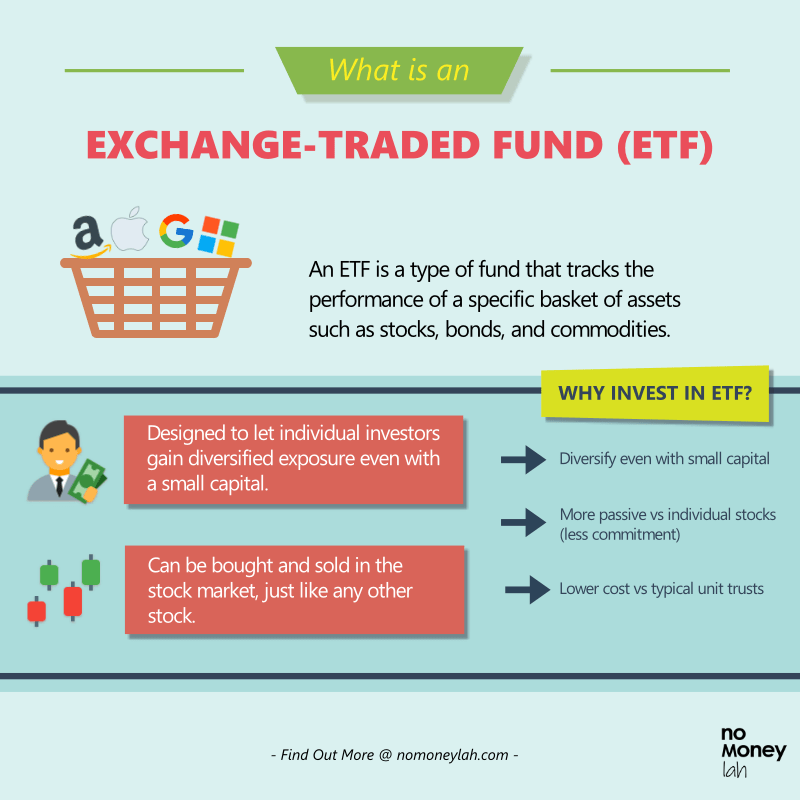

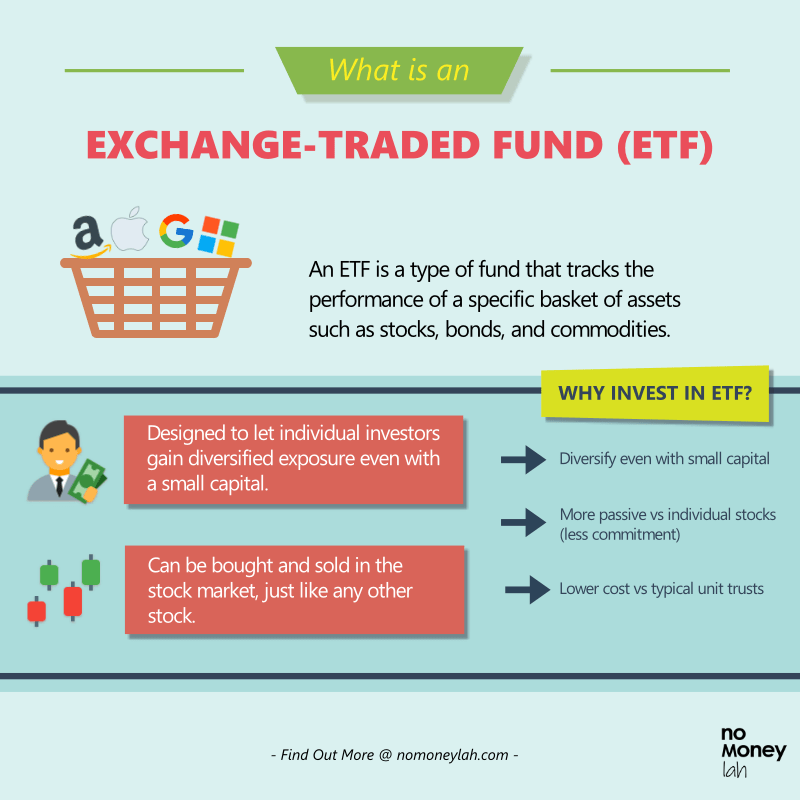

What is an ETF?

Exchange-Traded Fund, or ETF, is an investment vehicle that tracks the performance of a specific basket of asset classes such as stocks, bonds, and commodities:

- As an example, the CSPX or VUAA ETFs are ETFs that track the performance of the S&P 500 index. Since investors cannot invest in an index directly, investing in the CSPX or VUAA ETF allows investors to gain exposure to the S&P 500 index – ie. The performance of the 500 largest listed companies in the US.

p - An ETF is traded just like any stock in the stock market. This means that if you have a stockbroker, you can buy and sell ETF on your own during market hours.

Why Invest in ETF?

ETF is an amazing investing instrument for new and experienced investors alike, for several key reasons below:

#1 Diversified Exposure even with limited capital (vs individual stocks)

Unlike owning the shares of an individual company, ETFs hold a basket of assets mainly with the goal of tracking the performance of an index.

By doing so, ETFs allow investors to gain diversified exposure to the market even with a small capital.

As an example, say, an investor has a strong conviction towards the US stock market. Instead of buying up individual shares of companies like Microsoft, Apple, and Amazon (which can be capital demanding), one can invest in the CSPX or VUAA ETF instead.

This is because the CSPX or VUAA are ETFs that track the S&P500 index.

So, with 1 unit share of the VUAA ETF (~USD85.58/share as of the time of writing, equivalent to about RM360), an investor can now gain exposure to a basket of top US top listed companies.

p

#2 Passive in Nature – ie. Less Commitment (vs individual stocks)

Investing in individual companies is no easy task. Doing so requires active commitment from investors to keep up with the progress and financials of the particular company.

Let’s say if you are holding the shares of 20 individual companies. Assuming you are a (rare) responsible investor, then you’d always have to be aware of the financials and updates of the 20 companies – that’s a lot of work if you have a full-time work and family commitment!

With ETF, investors can take a more passive approach towards their investment portfolio. Reason being, ETFs track the performance of an index (eg. S&P 500, KLCI). By nature, an index already has a set of selection criteria in place - where only certain companies can become a component of an index.

Hence, on a consistent basis, the index will rebalance itself by removing or adding new companies that fulfill the criteria into the component of the index.

As such, investors that invest in ETFs can take a more passive approach in their investing journey (and enjoy life) instead of having to keep up with the financials of individual companies.

p

#3 Competitive Cost (vs unit trust)

Generally, ETFs have low annual management fees when compared to unit trusts. This makes ETFs more affordable to invest in and maintain in the long run.

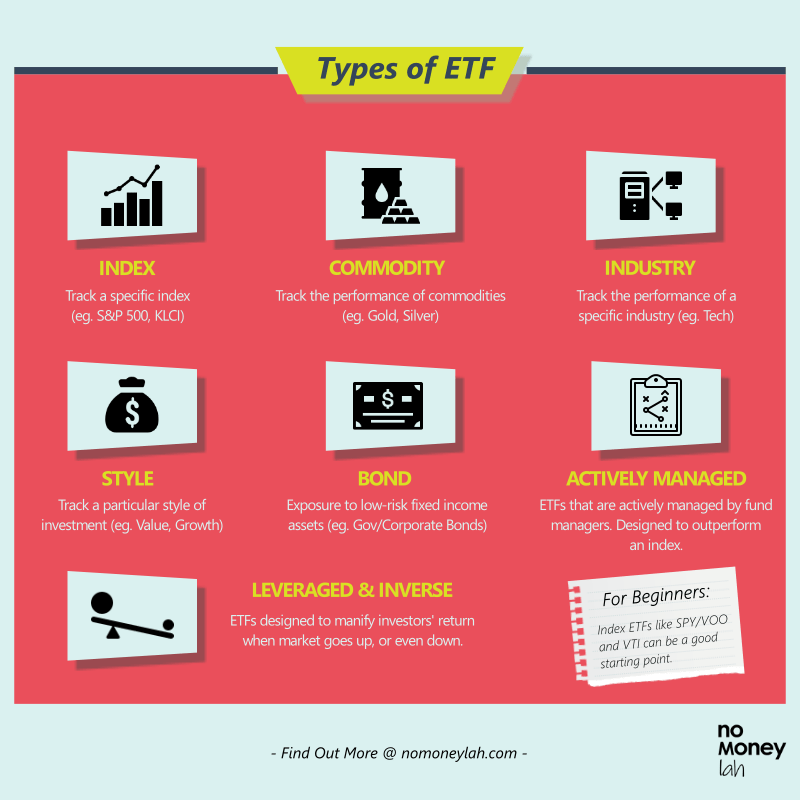

Different kinds of ETFs (+ Which one is for total beginners?)

An amazing thing about ETF is there are many types of ETFs in the market. Hence, depending on your conviction or interest, you can always find the suitable ETF investment for you in the market:

#1 Index ETF

An index ETF is an ETF that tracks the major index in the market (eg. S&P500, KLCI index).

An index ETF is the most well-known and easiest to understand ETF in the market. In my opinion, an index ETF that tracks a major index, is the most suitable for beginners to get started with.

A good example of an Index ETF is the iShares Core S&P 500 UCITS ETF (CSPX), or Vanguard S&P 500 UCITS ETF (VUAA). Both CSPX and VUAA track the S&P500 index, which reflects the performance of the 500 largest listed companies in the US.

More tips on things that you need to know while selecting an ETF later in this article.

p

#2 Commodity ETF

What if you want to have exposure to gold and/or silver in your portfolio – but have no interest to hold physical gold or silver bars at home?

A commodity ETF can do just that because it tracks the price of a specific underlying commodity, such as gold, silver, crude oil, and more.

Some examples are the TradePlus Shariah Gold Tracker (0828EA), SPDR Gold Shares ETF (GLD), and iShares Silver Trust (SLV).

p

#3 Industry ETF

Industry ETFs allow investors to gain exposure to a specific industry. It can be a broad-based industry diversification (eg. Tech sector), to a hyper-niche business segment exposure (eg. Work from home technologies).

Examples of industry ETFs are:

- Vanguard Information Tech ETF (VGT) – Exposure to the return of stocks in the information technology sector.

- CSOP Hang Seng TECH Index ETF (3033) – Exposure to the top 30 listed Chinese tech companies in the Hang Seng stock exchange.p

- Direxion Work From Home ETF (WFH) – Exposure to companies that stand to benefit from an increasingly flexible work environment. (eg. Cloud Technologies, Cybersecurity, Remote Communications)

p

#4 Style ETF

Style ETFs make it easy for investors to track a particular investment style.

Investment-style ETFs include value and growth. This is a great choice for investors that want to do a specific style of investing, but do not have time to study specific companies.

Examples of style ETFs are:

- TradePlus DWA Malaysia Momentum Tracker (MY-MOMETF) - Provide investors access to Malaysian stocks with high momentum movement in terms of pricing.

- Vanguard S&P Mid-Cap 400 Value ETF (IVOV) – Provide exposure to the US’s S&P MidCap 400 Value Index, an index made up of value companies from the S&P 400.

- Vanguard Growth ETF (VUG) – Provide exposure to US’s largest growth stocks (eg. Apple, Microsoft, Amazon).

p

#5 Bond ETF

Bond ETFs open up the opportunity for investors to invest in low-risk fixed-income assets like government or corporate bonds – even with a small capital size.

Examples of Bond ETFs are:

- ABF Malaysia Bond Index Fund (0800EA) - Provide exposure to Ringgit denominated government and quasi-government debt securities.

- Schwab Intermediate-Term U.S. Treasury ETF (SCHR) – Provide exposure to the low-risk US Treasuries with remaining maturities of 3 to 10 years.

p

#6 Actively Managed ETF

Unlike most ETFs which are passively managed (ie. Tracks an index), Actively Managed ETFs are ETFs that are actively handled by fund managers.

These ETFs are designed with the goal to outperform an index, but they also come with higher management fees as a result.

Examples of Actively Managed ETFs are:

- ARK Active ETFs from ARK Invest (ARKK, ARKQ, ARKW, ARKG, ARKF) – These are very popular ETFs among investors because they invest in highly innovative and future-proof industries.

p

#7 Leveraged & Inverse (L&I) ETF

L&I ETFs are unique and risky ETFs that allow investors to make the most out of an upside or downside move:

- Leveraged ETF like the Kenanga KLCI Daily 2x Leveraged ETF (0834EA) allows investors to make/lose around 2x the impact for every point that the KLCI moves.

- Inversed ETF like the Kenanga KLCI Daily (-1x) Inverse ETF (0835EA) allows investors to profit when the KLCI index goes down (and lose money when the KLCI index moves up).

For this, the L&I ETFs use leverage and derivative products (eg. Futures) to achieve their outcome/goal. Out of all the ETFs, I’d recommend novice/beginners to stay out of the L&I ETFs until they understand how leverage and derivative works.

What Do You Need to Know Before Investing in ETF?

#1 Must-Know: How does an ETF track its underlying index?

As you start to explore the world of ETFs, you’ll start to notice that there are many ETFs out there that track the same index. (eg. Both CSPX and VUAA ETFs track the S&P 500 index)

But why? Why are there so many ETFs that are doing the same thing in the market? We’ll explore several reasons, but one of them is due to the way these ETFs track their underlying index.

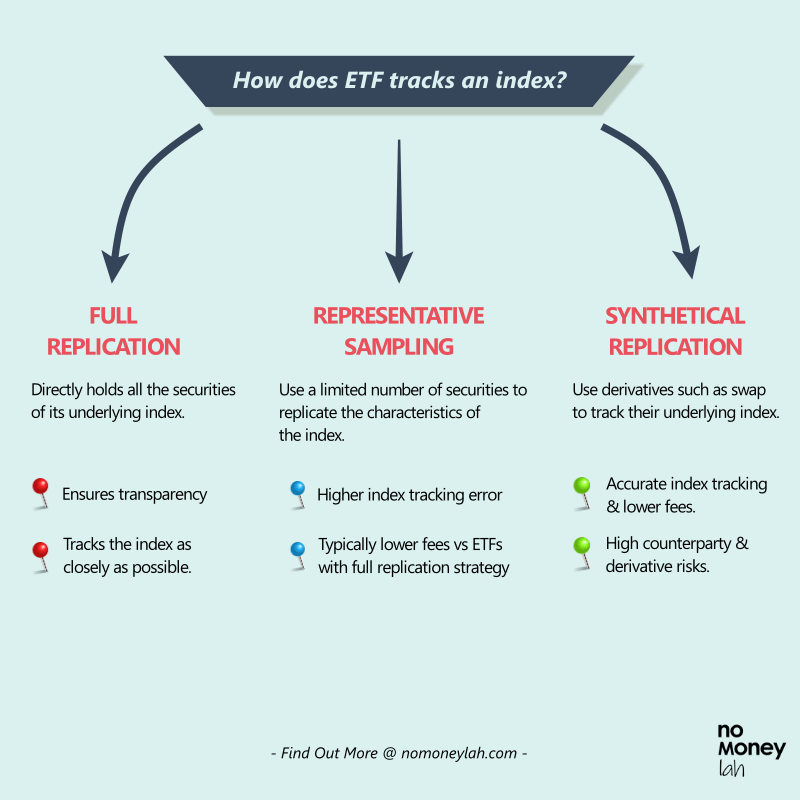

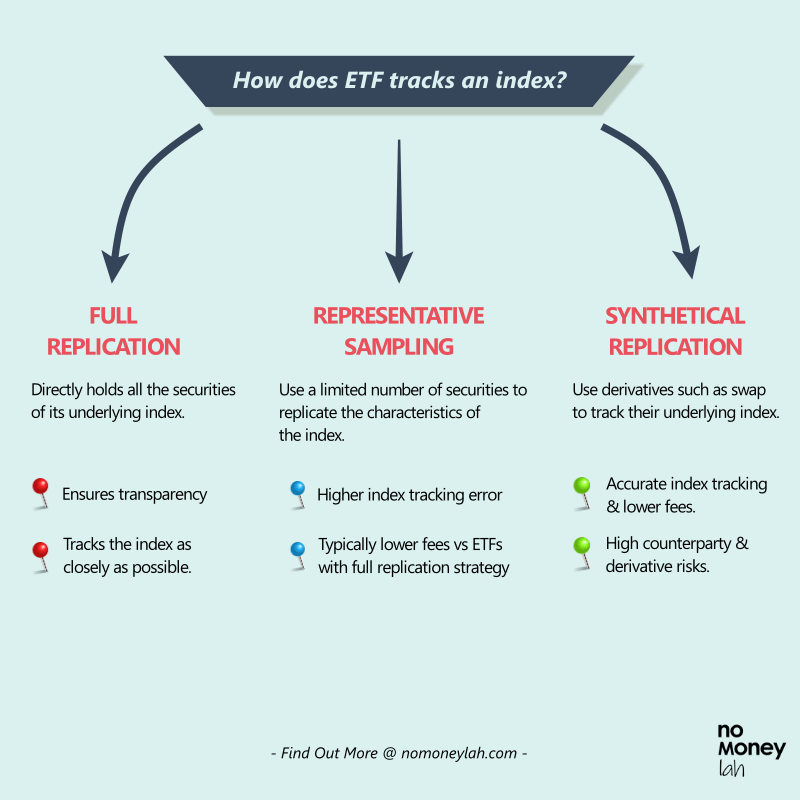

There are 3 major ways an ETF could track its underlying index:

a. Full/Physical Replication Strategy:

An ETF with a full replication strategy directly holds all the securities of its underlying index. This means that if an index has a 20% weightage in Apple, then the ETF will hold an equal proportion of Apple shares in its portfolio.

As a result, this transparent approach ensures that the ETF tracks the performance of the index as closely as possible. However, ETFs with a full replication strategy would normally incur slightly higher fees.

p

b. Representative Sampling Strategy

An ETF with representative sampling strategy creates a portfolio using a limited number of securities to replicate the characteristics of the index.

This approach is normally used due to taxation reasons, or when there’s limited liquidity in individual companies, making it hard for a full replication.

Compared to a full replication ETF, a representative sampling ETF tend to have a bigger margin of tracking error to its underlying index.

That said, the fees involved are usually more affordable too.

p

c. Synthetical Replication Strategy

Synthetic ETFs are handy when it is hard to directly gain access to the securities of a specific market. (eg. Developing countries’ stock market)

Instead of owning company shares directly, Synthetic ETFs use derivatives such as swap to track their underlying index. The benefits from this are (1) an effective tracking of the underlying index, and (2) the cost of investing in them is also lower.

However, without going too technical, Synthetic ETFs are relatively riskier than the other ETFs mentioned above due to counterparty and derivative risks.

#2 Must-Know: Fees & Expenses (Expense Ratio)

While investing in ETFs, you have to be aware that there will be an additional annual fee involved aside from your usual brokerage fees and stamp duty while transacting in the stock market.

This fee is what we call an Expense Ratio. Usually expressed as a percentage (%), the expense ratio is a combination of management & operational fee required to maintain and rebalance the ETF.

That said, the expense ratio of ETF (0.05% - 1.00%) is usually lower compared to unit trusts (0.50% - 2.00%). Reason being, most ETFs are passively managed - ie. They track the index, hence there is no need for the fund manager to actively research or analyze stocks.

a. Another thing you need to know is how ETFs expense ratio is deducted:

As an example, let’s say an ETF has an annual expense ratio of 0.30. This means the ETF manager would deduct 0.30% from the ETF’s assets on an annual basis.

In other words, if the ETF’s total return during a year is 10%, then the net return for the investors would be 9.70% (or $3 for every $1,000 invested).

p

b. ETF Fees ≠ The lower the better

ETFs with the lowest expense ratio are not always the best ETF to buy. It is crucial for you to compare apples-to-apples.

For example, make sure you are comparing the ETF that tracks the same index. Also, do take note of the replication strategy used – a full replication ETF usually has a higher expense ratio compared to an ETF with representative sampling strategy.

#3 Must-Know: Read the ETF’s factsheet/prospectus before you invest

How can you find out if which replication strategy an ETF is using? Or what’s the expense ratio of the ETF? How about the latest stock holdings of the ETF?

To do so, the most straightforward way is to go to the ETF’s official website and download the ETF’s factsheet and prospectus.

How to Invest in ETF?

Method 1: Investing on your own

Investing in ETF requires you to have a stock brokerage account, because you can buy and sell ETFs in the stock market like any other listed company.

For Malaysia-listed ETFs, I’d recommend Rakuten Trade. Check out my full review on Rakuten Trade HERE.

For overseas-listed ETFs (eg. US, SG, HK), my go-to broker would be Tiger Brokers. Check out my full review on Tiger Brokers HERE.

As for overseas-listed ETFs in the UK and Europe (eg. Ireland-Domiciled ETFs), I'd be using ProperUs from CGS-CIMB. Check out my full review on ProsperUs HERE.

STEP-BY-STEP: How to invest in your first overseas stock via Tiger Brokers?

STEP-BY-STEP: How to invest in your first Malaysian stock via Rakuten Trade?

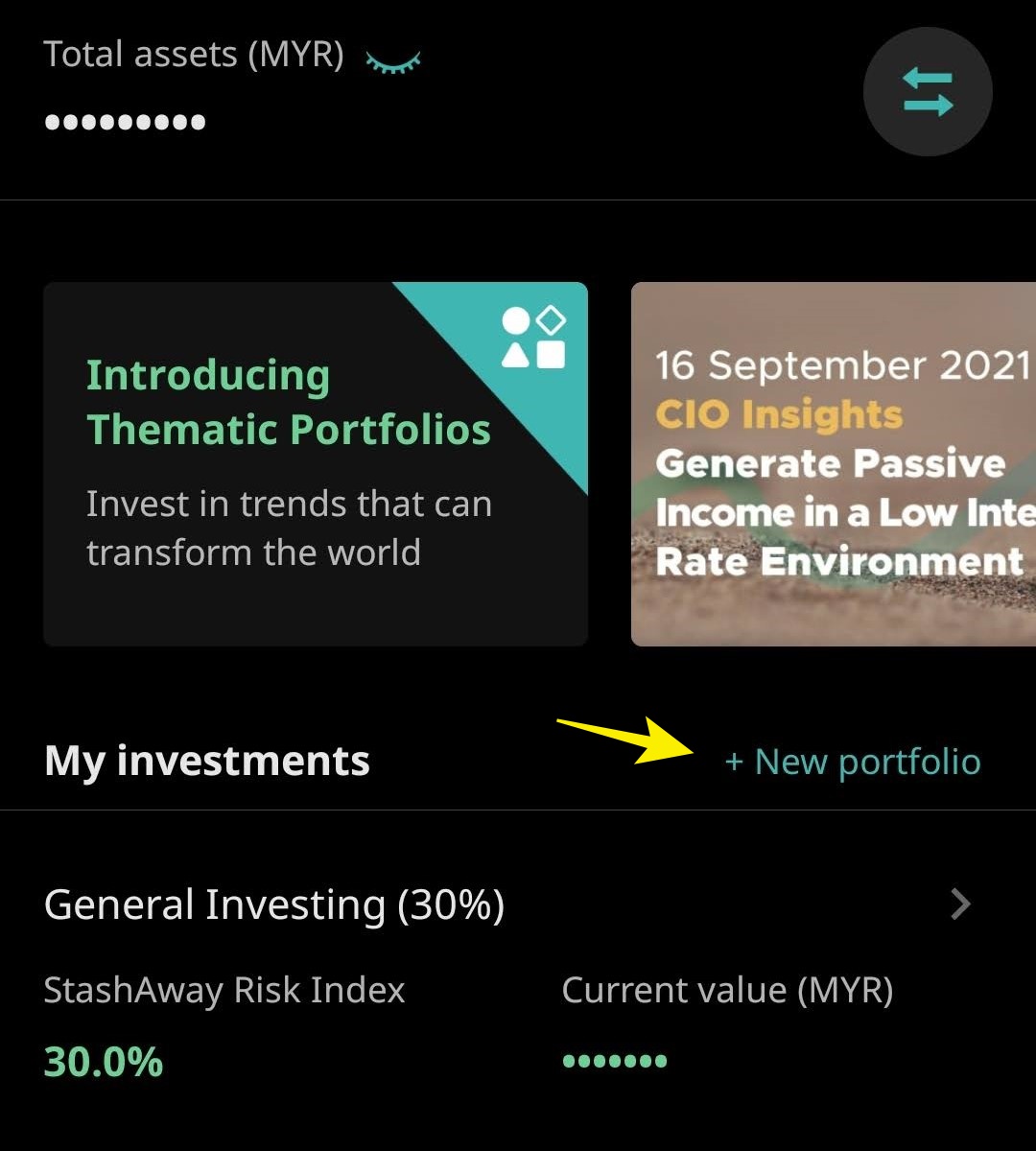

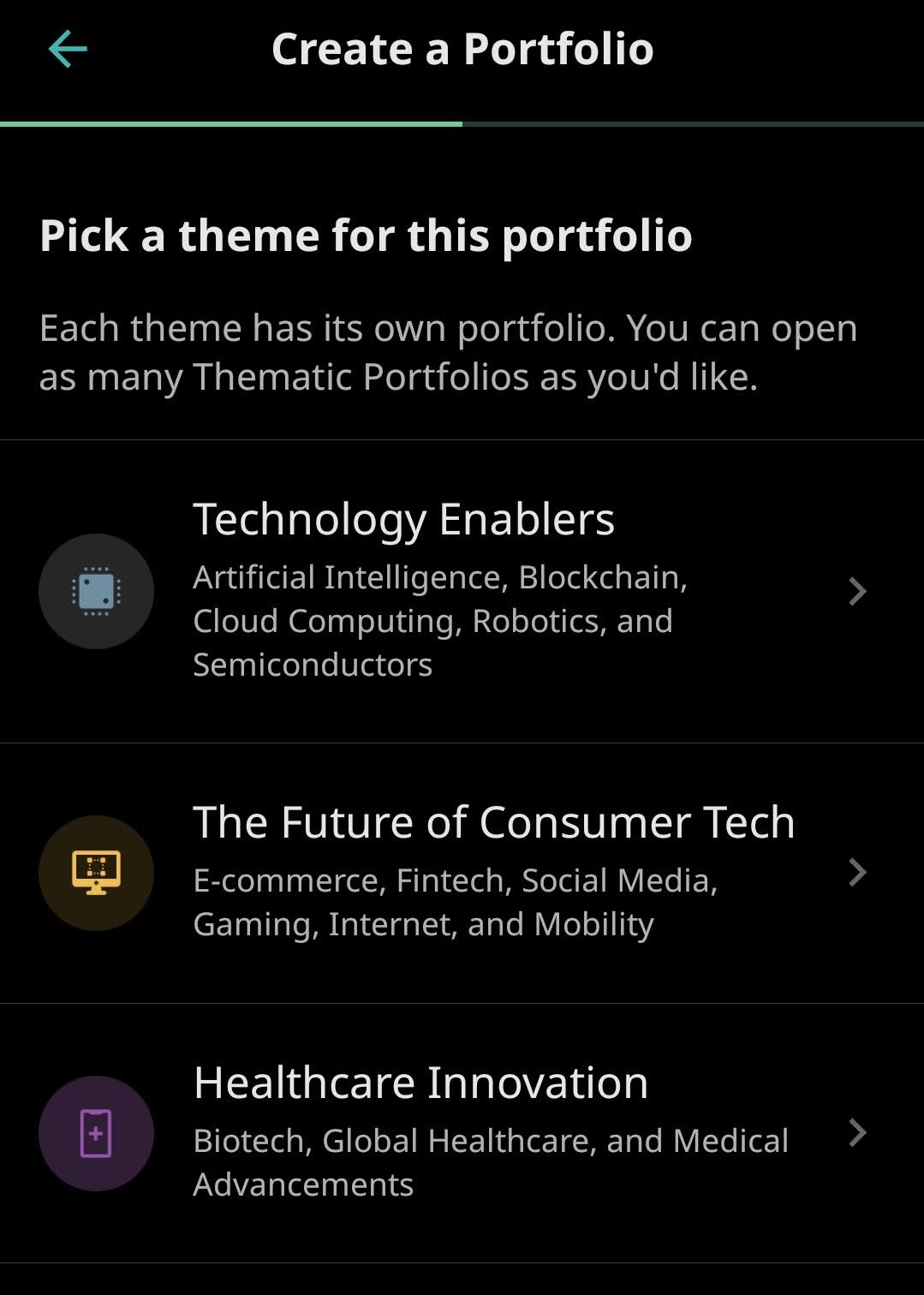

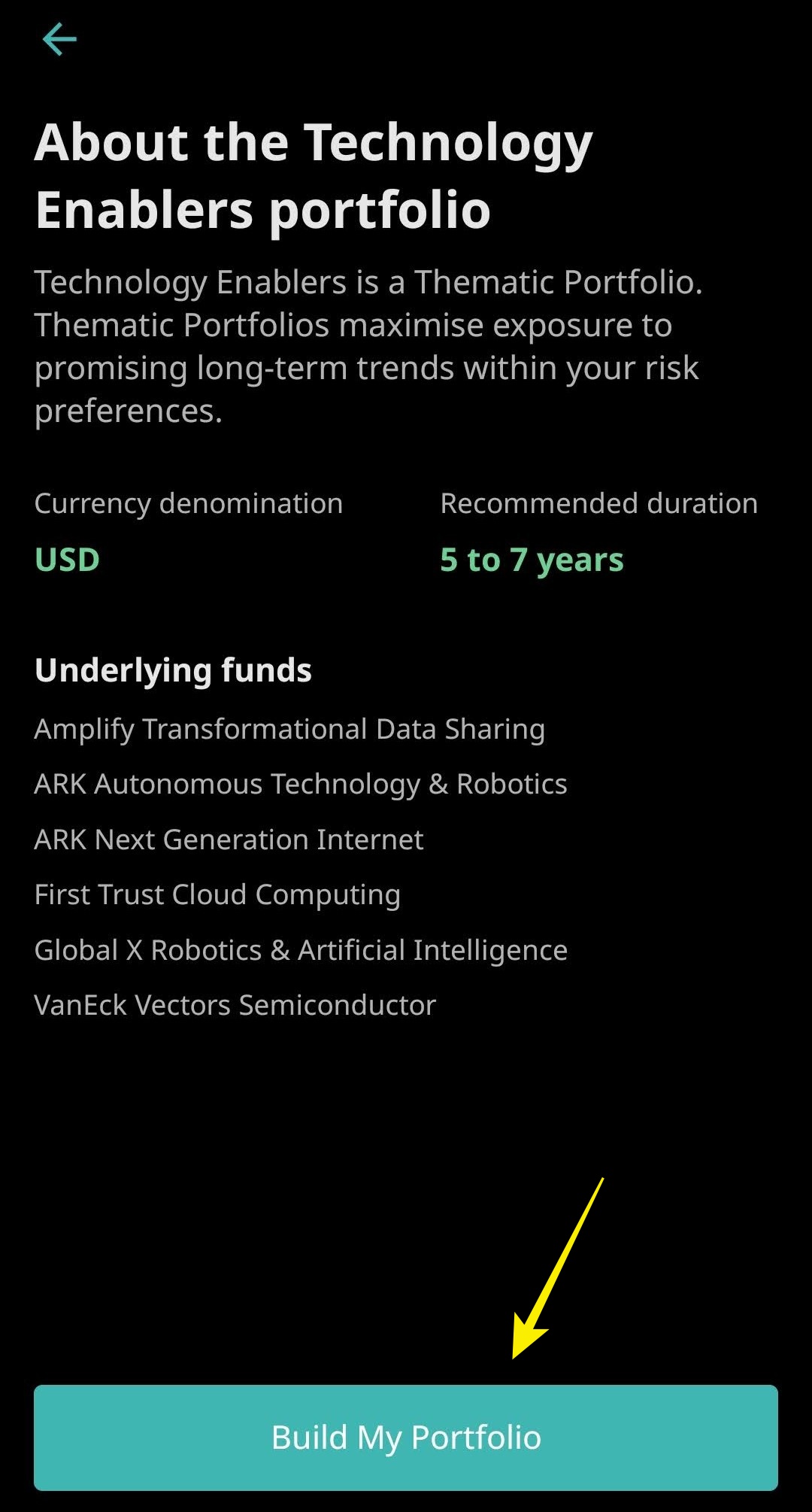

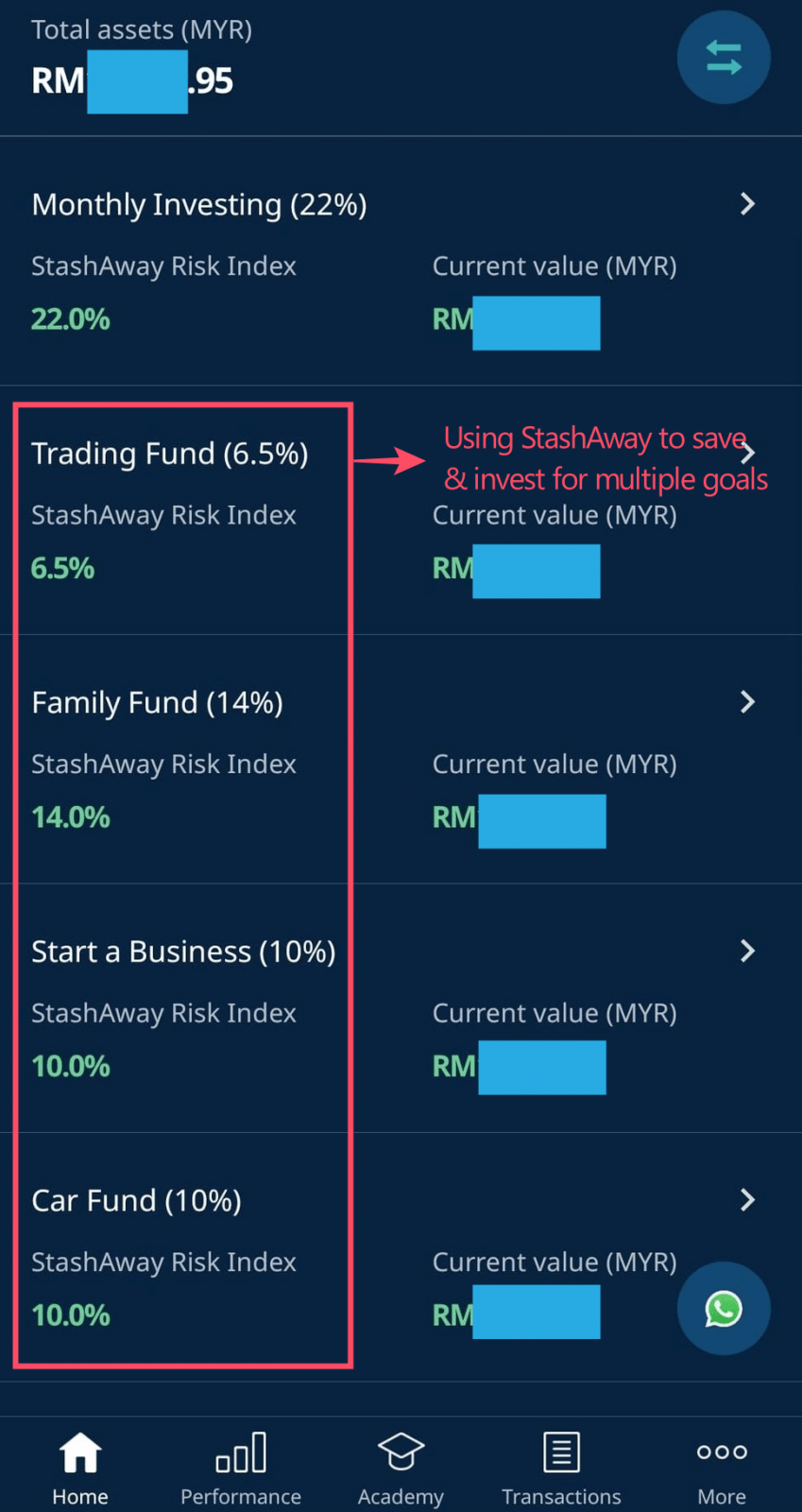

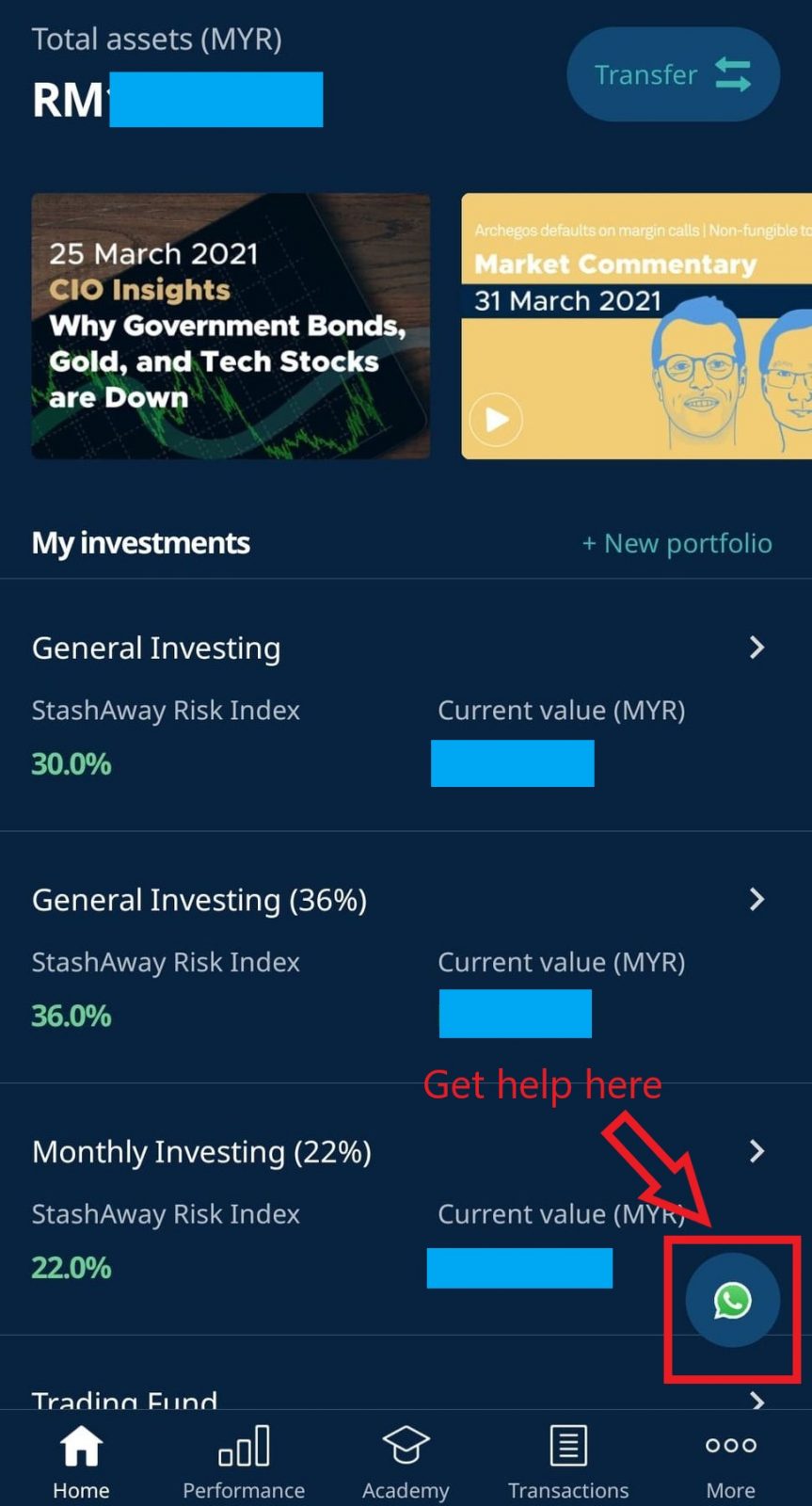

Method 2: Investing passively via Robo-Advisors

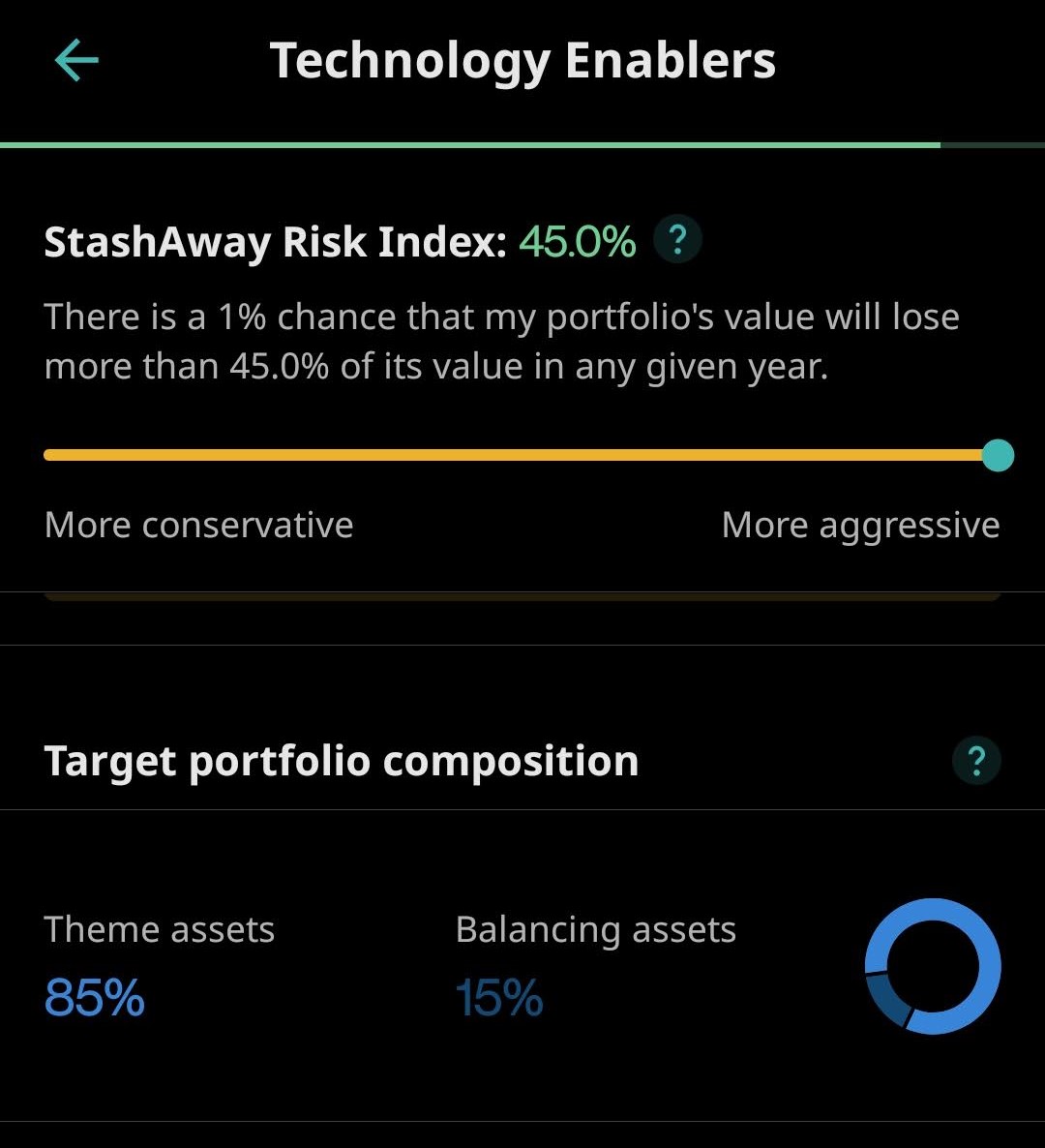

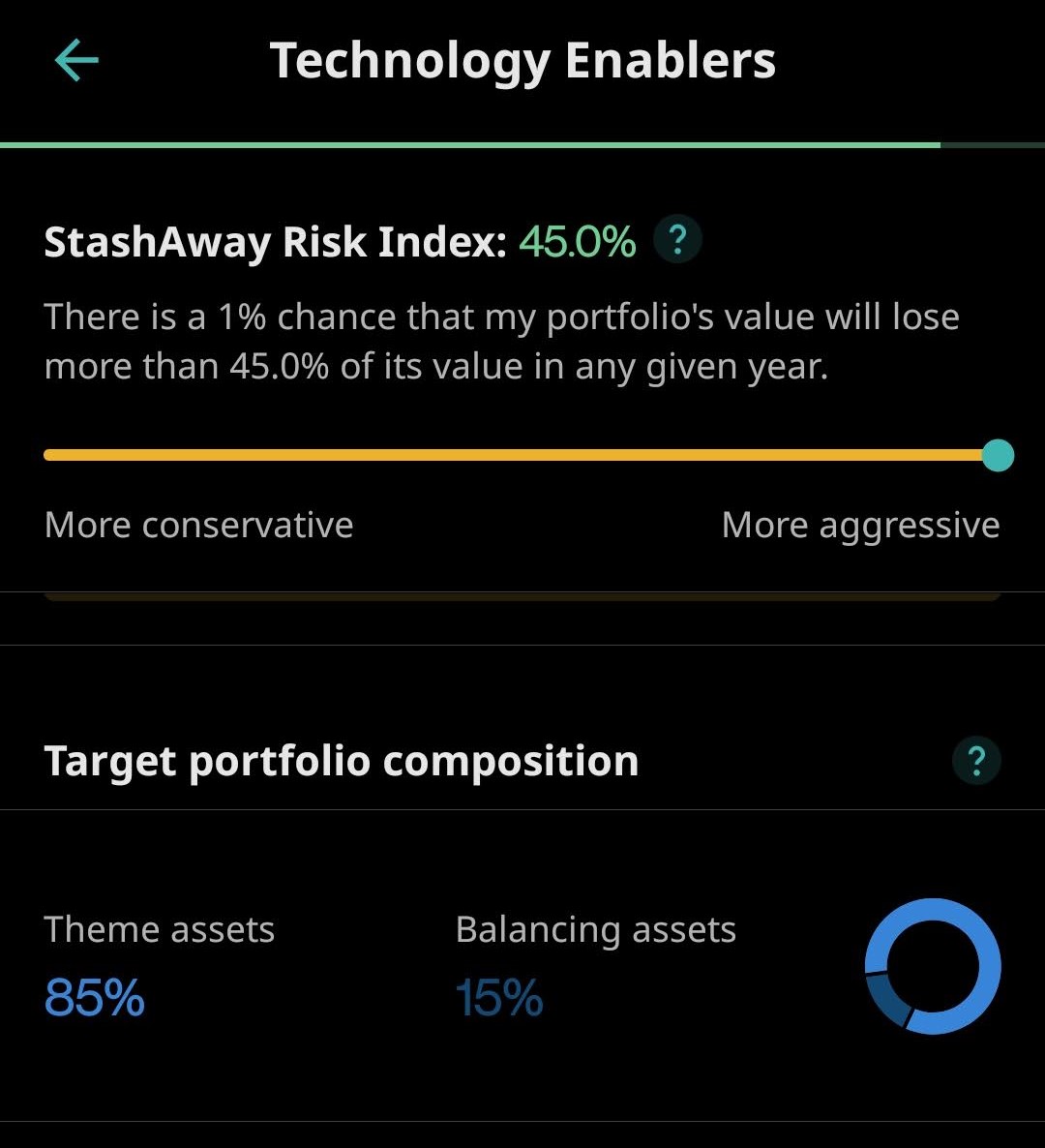

If you are tight on time, or are not interested to choose your own ETFs, then opting for robo-advisors like StashAway, Syfe, and Wahed are great investment alternatives.

Generally, robo-advisors invest utilize ETFs to help you construct your investment portfolio based on your risk profile. The good thing is once you set up everything then you can just deposit and let the platform does the investment on your behalf. The downside is you do not have much say over which ETF to buy after setting your initial risk profile.

READ: Wahed Robo-Advisor Review

READ: Syfe Robo-Advisor Review

Getting Started: Investing in Malaysia-listed ETFs

If you are just getting started with ETF investing, or are thinking to invest on a consistent basis, here's a list of ETFs to get you started:

At the moment, there are 20 ETFs listed in the Malaysian stock market. These ETFs allow investors to diversify to not just local stocks, but also foreign stock markets (US, China, ASEAN), as well as commodities like gold. For more information on Malaysian listed ETFs, click HERE.

That said, for starters, consider finding out more on:

- Best dividend-paying ETFs listed in Malaysia!

- Best performing Malaysia-listed ETF (coming soon!)

- Best Malaysia-listed ETF to gain exposure in China

Getting Started: Investing in overseas-listed ETFs

There are hundreds and thousands of ETFs all over the world to choose from, and it can be overwhelming especially for new investors.

Hence, if you are new, I'd suggest starting out with index ETFs, such as ones that track the S&P500 index. Once you are more experienced, you can consider some other types of ETFs.

- How to invest in the S&P500 index for non-US residents

- Guide: Invest in Singapore REIT ETFs for consistent dividends!

Who Should Invest in ETF?

- New/novice investors looking to build a long-term investing routine, such as investing on a monthly basis. Index ETFs such as the CSPX or VUAA (Ireland-Domiciled S&P500 ETFs) are a great start.

p - Investors that are bullish towards certain sectors in the market can look to Industry ETF to add exposure to their portfolio. (eg. Tech sector ETFs – VGT, QQQ, 3033)

p - Investors with time constraints who would like to invest passively should definitely consider ETFs over individual stocks.

p - Investors with a small investment capital can look to diversify their investments via ETF.

No Money Lah’s Verdict

So here you go! If you are totally new and would like to start investing, I hope this article has been helpful!

In my opinion, new investors should absolutely consider ETF (especially major index ETFs) as it is a great solution for investors to get diversified exposure to the investing world at a small capital.

Are you planning to invest in ETFs soon? Or if any, do you have any questions about ETF?

Feel free to let me know in the comment section below!

Disclaimers

This article is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

How to Create Your Own Powerful Bursa Stock Screener (+ Bonus Ideas!)

A stock screener is usually used by investors to help filter through hundreds of stocks, in order to identify the ones that fit into their predetermined criteria.

In this article, I’ll be sharing how you can create your own powerful Bursa stock screener, alongside 3 ideas to get you started.

For this, I’ll be using the built-in stock screener from Rakuten Trade’s web platform. There are many screeners out there, but Rakuten Trade’s screener is certainly one of the most comprehensive & customizable screeners that I’ve ever come across – plus it’s free to all Rakuten Trade users so that’s a no-brainer.

If you are looking to open a stock investing account, or want to experience Rakuten Trade’s powerful stock screener, definitely check out my detailed account-opening guide HERE.

Features & Highlights of Rakuten Trade Stock Screener

- Powered by Thomson Reuters, a global company that provides insights and information to professionals of various fields, including the stock market.

- Highly customizable & comprehensive filtering criteria from Stock Types, Companies' Scale, Financials, Estimates & Technicals.

- Real-Time: Financial filters (eg. P/E Ratio) that consider stock price into calculation are updated on an hourly basis. Technical filters (eg. MACD, RSI) are also updated hourly. This could be helpful to investors/traders are involved with real-time decision-making.

Read Also: 4 underrated features on Rakuten Trade that can help you make better investment decisions!

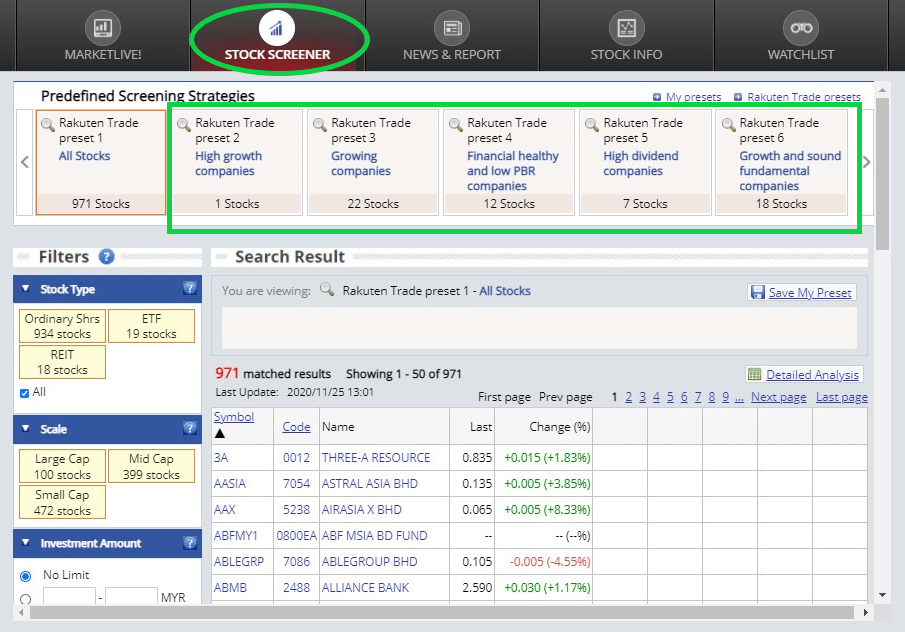

Rakuten Trade Stock Screener Interface & Guide

Rakuten Trade Stock Screener is easily accessible to every Rakuten Trade’s investor. Once you are a Rakuten Trade user, simply login to your Rakuten Trade account or register for a new Rakuten Trade account and you’ll be able to spot it right away (refer to screenshot below).

One awesome thing about this screener is that it also comes with several presets (eg. High Growth Companies, High Dividend Companies) where you can filter through stocks right away – neat stuff for fellow investors!

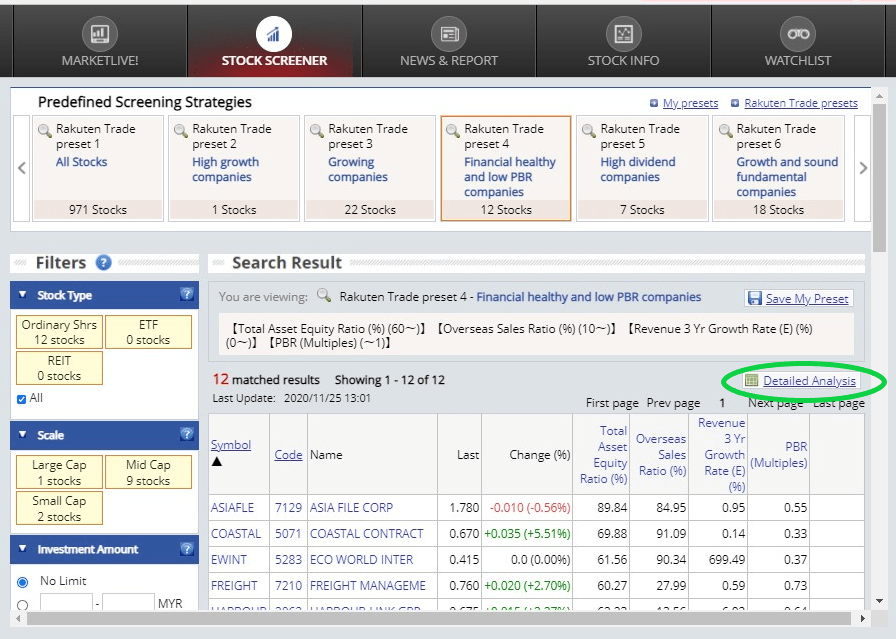

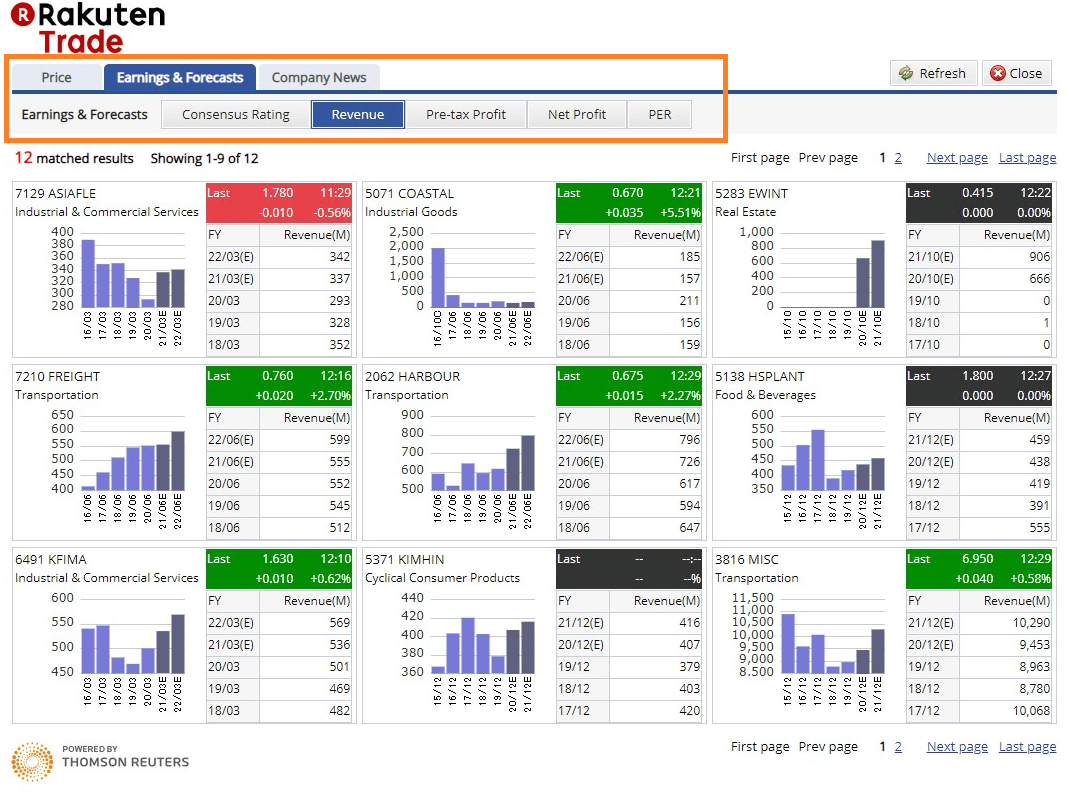

In addition, every filter also comes with the ‘Detailed Analysis’ feature. Clicking on this feature allows you to compare all filtered stocks from various perspectives (eg. Consensus Rating on earnings & forecasts, Forecasts on Revenue and Profit, Company news, and more)

Read also: Check this out before opening your stock investing account!

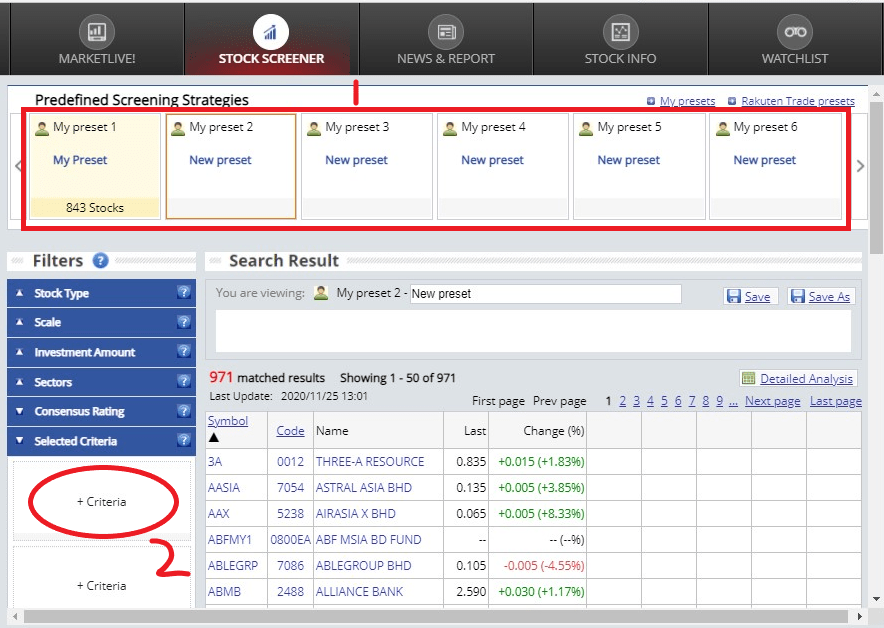

How to Customize Your Own Stock Screener?

Now, perhaps you have some specific filtering criteria in mind, and you want to find out if there are any companies that fulfill these conditions.

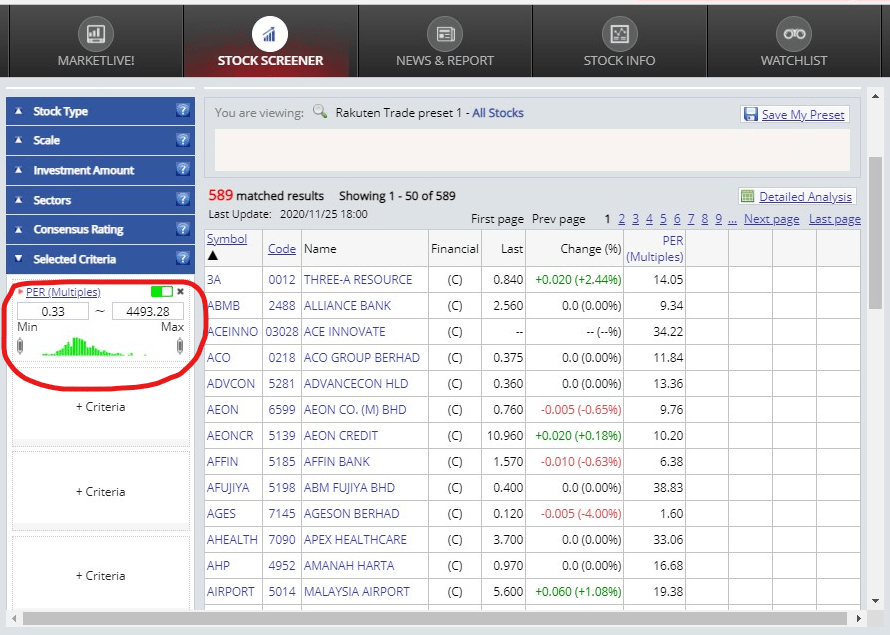

Step 1: To start customizing your own stock screener, simply click on any ‘My Preset’ section, then click ‘+ Criteria’ (refer to the screenshot below).

Step 2: Select your filtering criteria from the list, then adjust the min/max value accordingly.

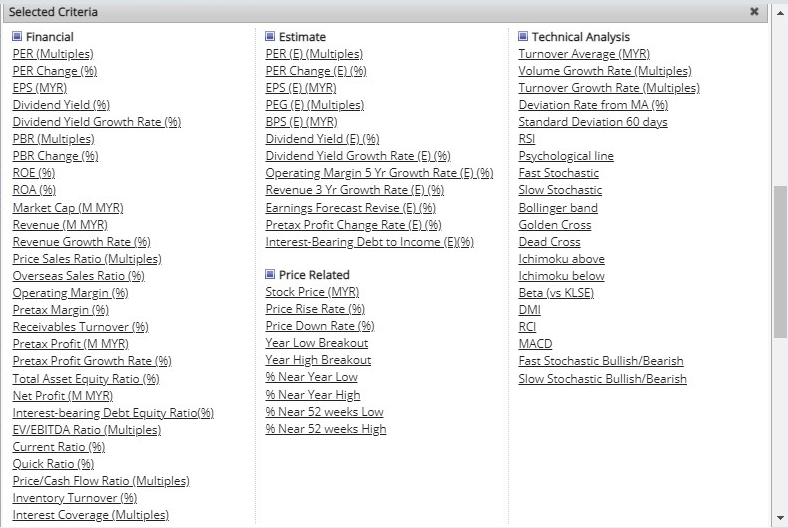

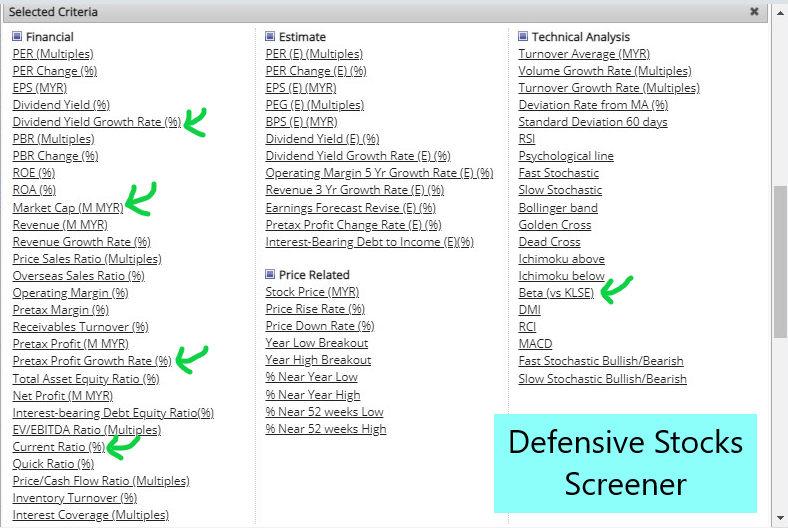

Filtering criteria:

- 1. Financials: Allow you to specify the companies that fulfill certain financial-related criteria (eg. PE Ratio, Market Cap, Revenue Growth)

- 2. Estimate: Allow you to specify companies with their future financial capability according to analysts’ estimates or forecasts.

- 3. Price Related: Allow you to filter stocks base on the price level of the stocks.

- 4. Technical Analysis: Allow you to filter for stocks that fulfill certain conditions via technical indicators.

Step 3: Rakuten Trade Stock Screener allows up to 5 customizable criteria. Once you are done, save your filter by clicking ‘Save My Preset’.

3 Stock Screener Ideas for Different Investing Style

If you are a little overwhelmed on which filtering criteria to choose, or simply looking for some ideas, keep reading.

In this section, I’ll be sharing with you 3 stock screener ideas that can help you get started. Simply choose the ones that suit your investing style the most:

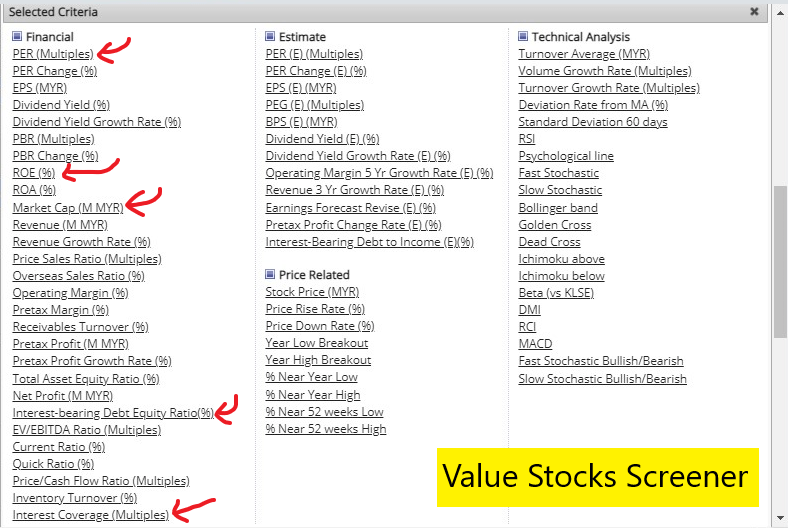

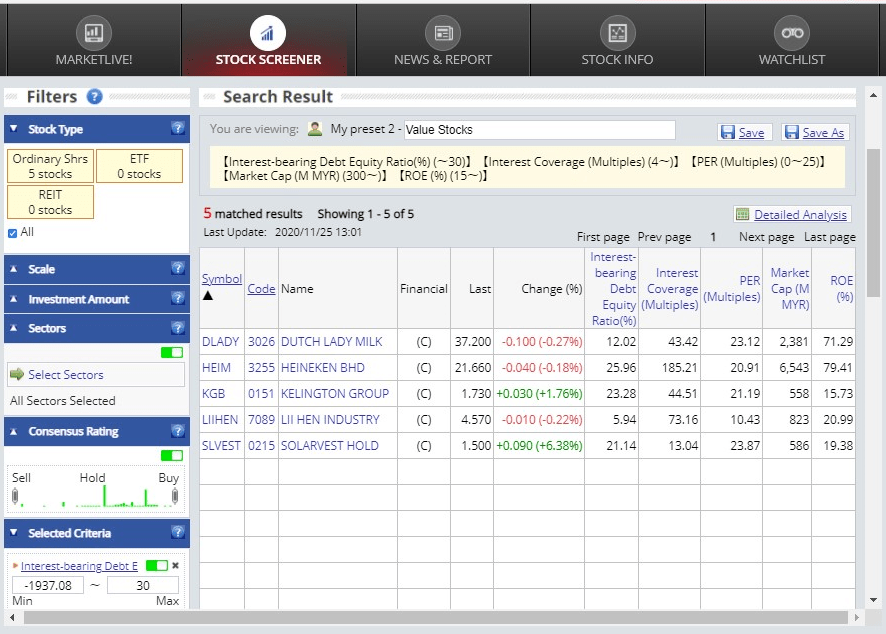

i. Value Stocks Screener

Value stocks screener allows investors to filter for stocks that are relatively undervalued, while having a strong potential upside in the future.

Criteria:

- Market Cap: Min. RM300 million [companies with respectable size]

- Interest-bearing Debt Equity Ratio (%): Max. 30% [ensure healthy leverage]

- Return of Equity (ROE %): Min. 15% [ensure business generates income for the company]

- PE Ratio (PER Multiples): Max. 25x [avoid relatively overpriced companies]

- Interest Coverage (Multiples): Min. 4x [reduce risk of bankruptcy due to loan interests]

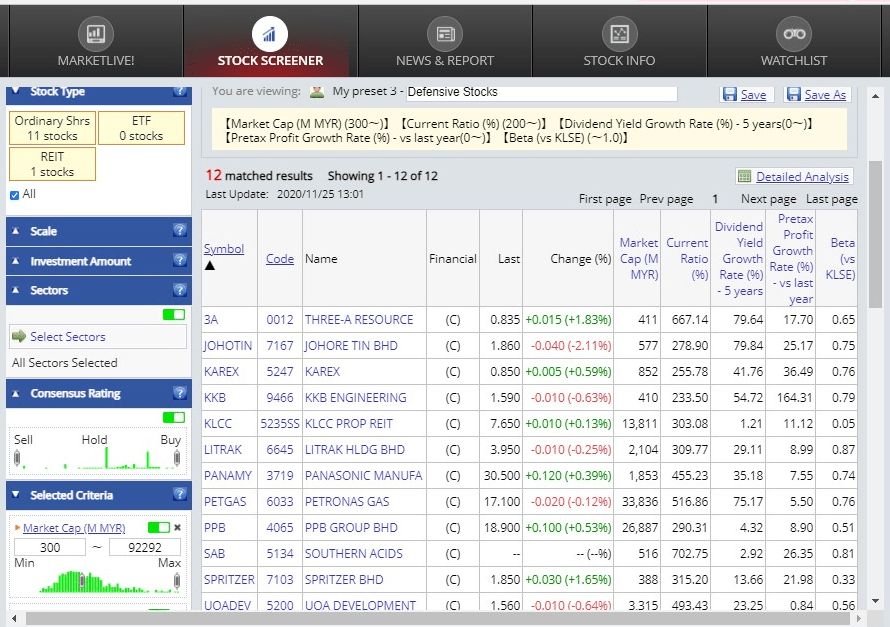

ii. Defensive Stocks Screener

Defensive stocks screener allows you to filter for stocks with a relatively stable business model and hence less volatile in nature.

Criteria:

- Market Cap: Min. RM300 million [companies with respectable size]

- Current Ratio (%): Min. 200% [companies with healthy liquid assets over liabilities]

- Dividend Yield Growth Rate (%) [5 years]: Min. 0% [companies with dividend growth]

- Pre-Tax Profit Growth Rate (%) [vs last year]: Min. 0% [companies with profit growth]

- Beta: Max 1.0 [companies that are equal/less volatile compared to the main index]

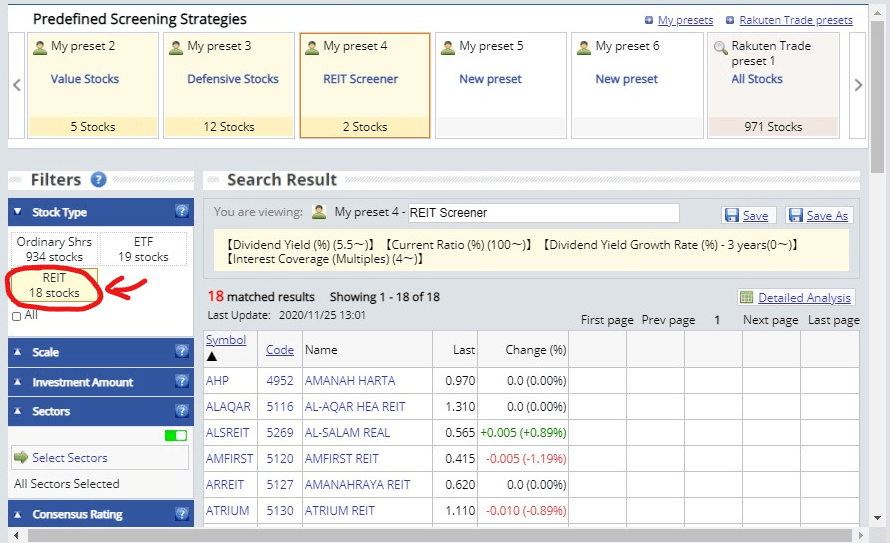

iii. REITs Screener

This REITs Screener enables you to filter for stocks that are financially balanced short & long-term, while returning a decent dividend yield.

Firstly, under ‘Stock Type’, unselect ‘Ordinary Shares’ and ‘ETF’. This means any criteria chosen will only be filtering for REITs.

Criteria:

- Dividend Yield (%): Min. 5.5% [REITs that pay respectable dividends]

- Dividend Yield Growth Rate (%) [3 years]: Min. 0% [REITs with dividend growth]

- Current Ratio (%): Min. 100% [companies with healthy liquid assets over liabilities]

- Interest Coverage (Multiples): Min. 4x [reduce risk of bankruptcy due to loan interests]

READ: Important Caveats Before Using a Stock Screener

There are several caveats that I want to clarify before you proceed:

Firstly, stocks filtered from a stock screener DOES NOT mean it is worth investing in right away. Filtering is just an initial phase of your research, and more thorough research needs to be done to ensure it fits into your investing strategy.

Secondly, stocks that are left out of your filter DOES NOT mean it is not worth investing in. Not all criteria are suited to be used in every stock. As an example, a 25x PE Ratio may be undervalued to a stock from industry A but a similar multiple could be expensive to another stock from industry B.

Apply a bit of critical thinking and take your filters with a pinch of salt.

Lastly, all my stock screening criteria are just for reference purposes. Feel free to tweak the criteria according to what you feel logical and makes sense to you.

No Money Lah’s Verdict

So here you go: How you can build your own powerful stock screener and 3 ideas to get you started!

In my opinion, Rakuten Trade Stock Screener is highly underrated as it is certainly more powerful and customizable than many free screeners on the internet.

If you are looking for investing ideas or direction in your stock-picking journey, hopefully this has been helpful to you!

Do you have other ideas/filtering criteria to be added to a stock screener? Feel free to share with me in the comment section below!

Rakuten Trade Referral Link for New Users

If you are keen to open a Rakuten Trade account, consider using my referral link below! For that, you'll get:

- 1000 Rakuten Trade (RT) points worth RM10 to offset your brokerage fee.

- + 150 RT points when you deposit a min. of RM1,000 within 5 days.

- + 1000 RT points when you transfer your shares from other brokers to Rakuten Trade.

- + 1x brokerage fee rebate when you place your 1st trade within 30 days after your account is activated.

Aside from that, Rakuten Trade users get +1 RT point for every RM1 brokerage paid! Click HERE for the full T&C on RT points.

Open a Rakuten Trade Account Today!

Open A Rakuten Trade Account Today!

Disclaimer: This post contains affiliate links, which afford No Money Lah a small referral (and in return, support this blog) if you sign up for an account using my referral link.

My 2-year experience with a Licensed Financial Planner in Malaysia

For 2 years, I’ve been engaging a licensed financial planner to advise me on my personal finances.

Personally, it has been a fruitful journey as my finances have improved significantly compared to where I was 2 years ago.

But what is a licensed financial planner? How exactly does a financial planner help in your finances?

In this post, I’d actually like to share my financial planning journey with you in 2021. Doing so, I think you’ll have a taste of what I’ve learned, and perhaps, find out if you need a financial planner (or not).

OK, let’s get started!

p

Quick recap: What is a financial planner

So, what is a licensed financial planner, and who is qualified to be called a licensed financial planner?

Essentially, a licensed financial planner has in-depth qualifications, namely:

- Capital Market Service Representative License, issued by the Securities Commission (SC): To conduct licensed financial planning in Malaysia – as such, be called a ‘financial planner’.

- Financial Adviser Representative (FAR) License, issued by Bank Negara Malaysia (BNM): Allows a financial planner to recommend insurance products from any insurance company.

On the other hand, the qualification of most insurance agents would stop at the Pre-Contract Examination for Insurance Agents (PCEIA) & Certificate Examination in Investment-linked Life Insurance (CEILI) papers. These are the papers that insurance agents have to take in order to start offering insurance solutions for one particular insurance company.

In essence, a financial planner offers a complete service in all aspects of personal finance relative to an insurance agent.

How it works

Personally, I have been working with my financial planners – Stev and Catherine from Wealth Vantage Advisory (WVA) for 2 years now. WVA is a licensed financial advisory firm in Malaysia.

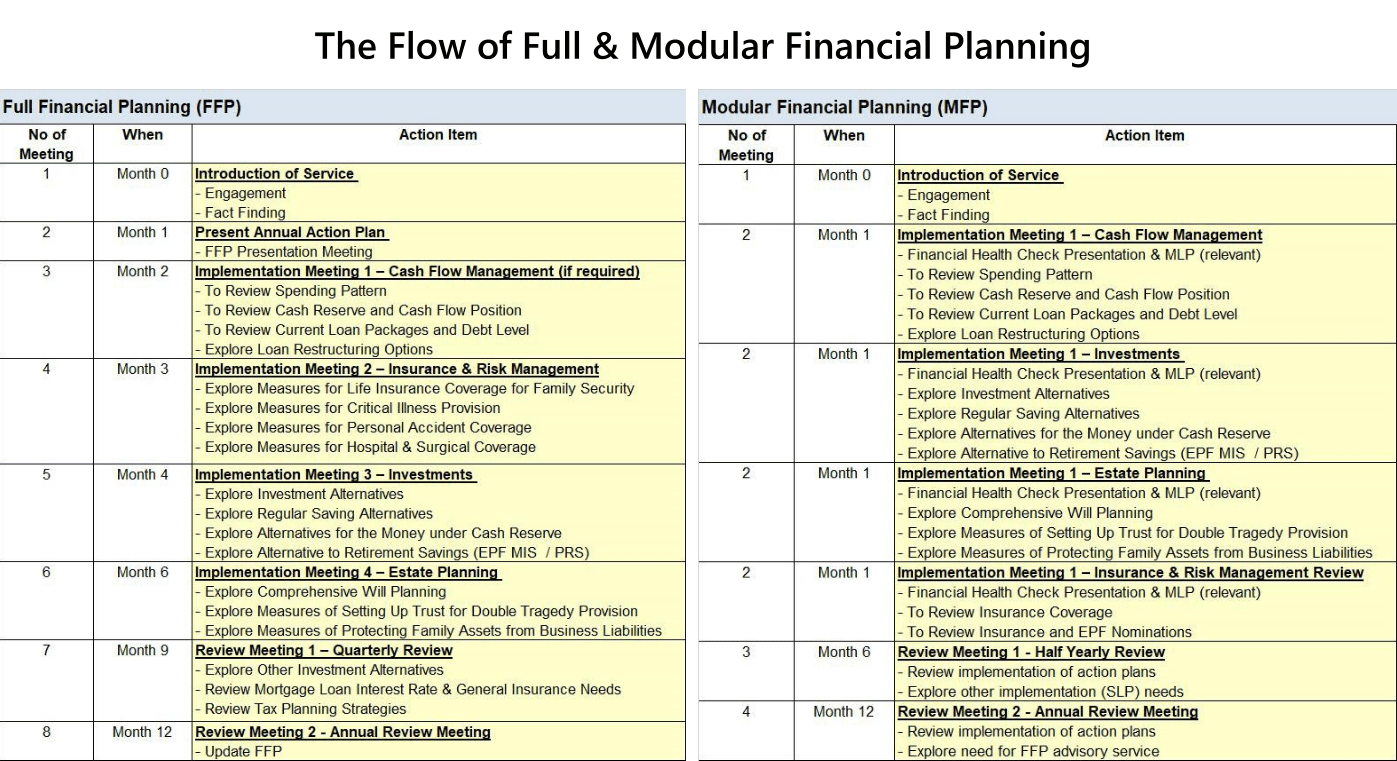

Engaging a financial planner is a process that involves 3 key stages: Fact-finding, Implementation, and Follow-Up Review Meetings. I’ll explain more about each process in the following section.

Depending on your needs, there are 3 ways you can work with a licensed financial planner from WVA, namely:

- Comprehensive Financial Health Check (FHC): You’ll go through a comprehensive fact-finding process with your financial planner. Then, you’ll be presented with analysis and report of your overall financial state with recommendations for improvement.

- Modular Financial Planning (MFP): You’ll get everything from the FHC above. PLUS, you can choose to focus on EITHER Investment/Insurance/Estate Planning and your financial planner will support you in the implementation for 1 full year.

- Full Financial Planning (FFP): You’ll get everything from the FHC. PLUS, your financial planner will support you in the implementation of ALL aspects of your personal finances (Investment + Insurance + Estate Planning) for 1 full year.

For me, I’ve opted for the MFP package (investment) back in 2020. You can read about my journey and takeaways HERE.

As for 2021, I have opted for the FFP package. This is where my financial planner, Stev and Catherine guided me in all aspects of my finances (investment, insurance, estate planning).

My financial planning journey in 2021

Engagement/Fact-Finding phase (October 2020):

My FFP journey actually started back in October 2020 as I do my 2021 financial planning with Stev and Catherine.

This is where I discuss my goals, and update my latest financial details such as my existing insurance coverage, financial commitments, financial figures with my financial planner.

[Useful Tip]: Back when I engaged Stev and Catherine for the first time, I felt a little uncomfortable sharing my financial figures with them. But they have been very professional and treated my information with utmost privacy.

Implementation – Financial Report Presentation + Cashflow & Investment (December 2020):

Before the end of 2020, I was presented with my full financial report. This is a 20+ pages financial report that gives me an overview of my financial state in 2020 as well as action plans for 2021.

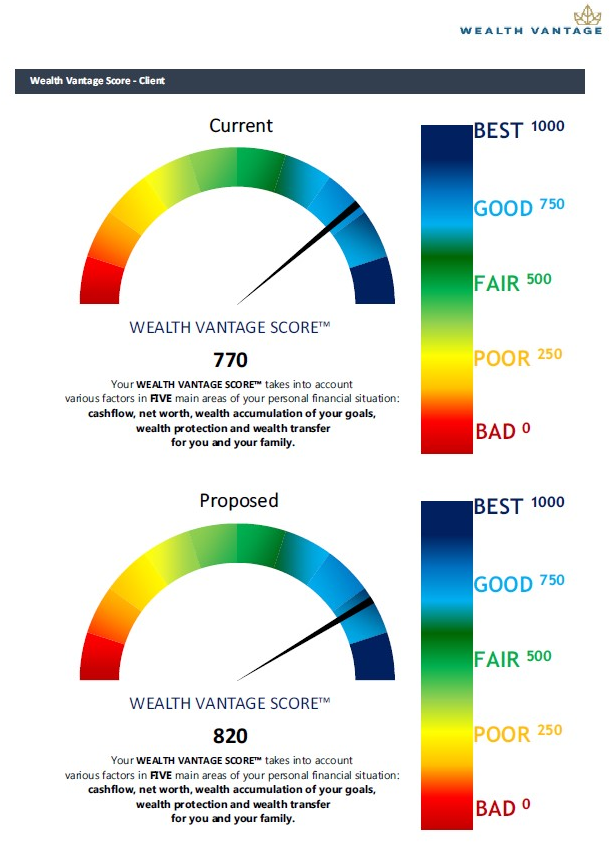

I am also shown my Wealth Vantage Score, a visual gauge of my financial state, and target progress for the year: With the details provided during our engagement session, Stev and Catherine are aware of my financial context. Hence, they are able to provide advice/action plans that are customized to my situation. Several key implementations that I have to make for 2021 include:

With the details provided during our engagement session, Stev and Catherine are aware of my financial context. Hence, they are able to provide advice/action plans that are customized to my situation. Several key implementations that I have to make for 2021 include:

- Investment: Rebalance investment assets to more equities (I was too heavy on REITs)

- Tax: Contributing to PRS for tax relief

- Insurance: Patch insurance coverage shortfall: I was given several choices on the best insurance packages to choose from

- Cashflow & emergency fund: Streamlining emergency funds

Implementation – Insurance & Risk (March 2021):

This quarterly follow-up is mainly about insurance & risk management.

In the previous meetup, Stev has suggested a list of best-in-value insurance plans for my current phase in life:

I got to choose which insurance packages to go for. Ultimately, I opted for:

- Life: AIA A-Life Protect Term Life Insurance

- Medical: AIA A-Life Link 2 medical card

- Critical Illness: AmMet Life Healthcare Secure

All in all, my insurance coverage would cost me around RM3,600/year, translating to RM300/month. Given my life circumstances, I think this is a decent all-around insurance package.

Working with financial planners like Stev is a great thing, as they are not tied to a single insurance company. As such, they can recommend products from different insurance companies, ensuring the best-in-value coverage for clients.

Implementation – Estate Planning (June 2021):

This quarterly follow-up is mainly about estate management. Stev gave me an overview of estate management – will writing, trust establishment etc.

This session gave me an in-depth understanding of planning for the people that we care for upon our demise.

However, I was too caught up with work so I was unable to implement my estate planning in 2021.

Will definitely follow through with my estate planning implementation and will write about it in 2022.

Quarterly & Annual review (September & October 2021)

Towards the 4th quarter of the year, it’s time for an in-depth annual review. Several key highlights of our annual review include:

- Analyze growth and progress for 2021 – how much my net worth has grown.

- Anticipated changes in commitments in 2022, if any.

- Planning + goals for 2022 – Is my current financial routine (eg. Investments, insurance) matching up with my goals, and if any refinement is needed in 2022.

- Action plan for 2022:

- Stev guided me on tax optimization (eg. EPF & PRS contribution amount) in line with the newly released budget.

- Also advised me on shifting some of my current investment funds to better ones.

- EPF nomination (which I’ve been procrastinating on)

- Setting up a will and/or trust in 2022

My takeaways from engaging a licensed financial planner

-

A licensed financial planner gives you direction & clarity in all aspects of your finances

A financial planner can (and is qualified) to answer all your questions about money & finances.

- How can you maximize your tax reliefs in line with Budget 2022?

- How can you better organize your investments for inflation?

- How much % of crypto should you have in your portfolio (according to your risk preference)?

- How can you better plan for your first property purchase?

- And literally anything money-related.

In other words, a financial planner can tell you how exactly you can organize your money in the most efficient way.

In my time writing about personal finance, I noticed many people tend to just emphasize on investment. However, personal finance is more than investing.

There are things like insurance, estate planning, to making necessary adjustments to your overall finances as you transition to a different phase in life.

If you are looking for guidance for one or all aspects of your finances – certainly speak to a licensed financial planner!

p

-

What a licensed financial planner won’t do

A licensed financial planner should not be recommending products from only ONE company.

Since they are not tied to a single company, they are able to filter through the market and customize deals that suit you the best. This applies to insurance or investment products like unit trust.

In addition, a financial planner should not force you to buy/sign up for something that you are not comfortable with.

p

-

A good routine helps make the best use of your time with a financial planner

Having a good financial routine will help make each meeting with your financial planner more efficient.

As an example, I always track my finances every month (eg. Expenses, Assets, Liability). So, prior to a meeting with Stev, I’ll always update him with my latest figures. Moreover, if I have any questions, I’ll always take note of them ahead of our meeting.

Doing so, Stev is always kept up-to-date with my financials and hence, able to give me to most accurate guidance according to my life context.

Essentially, think of your relationship with your financial planner like a student and coach. Let's say you sign up for a guitar class but do not practice outside of the class. Every session, your coach will have to go through the basics again because you cannot recall what you've learned the previous week.

However, if you can prepare ahead by practicing, each class will be more fruitful and you’ll reap more benefit out of your time.

The idea is the same when you engage a financial planner. It takes two hands to clap.

The most helpful things in my time engaging a licensed financial planner

-

Insurance

As much as I like doing research on my own personal finances, insurance is one aspect that I have a hard time researching.

The jargon in insurance can be complex and this makes it hard for me to compare insurance products.

Guidance from a licensed financial planner is greatly helpful as they are not tied to a single insurance company. As such, they are able to customize the best insurance plan to fit the client’s needs.

-

Tax optimization

As a self-employed, tax is one of the personal finance topics that I need more guidance in.

With the help of a financial planner, I get to make the best out of the tax reliefs offered in each budget announcement.

-

Estate planning

Estate planning such as will writing is also a topic that I am not entirely familiar with. With the help from Stev, I get in-depth knowledge on what to do

Should you engage a financial planner?

In the past, I used to think I can handle my finances all by myself. And hey, it used to be alright.

But with time, there are many aspects of my life that require my attention:

- Managing my career as a self-employed.

- Taking up responsibilities in the family.

Over time, I realized that I cannot handle everything. Engaging a financial planner for the past 2 years has allowed me to use my time to focus on things that really matter to me.

Are you in a position in life where you have too much on your plate? In this case, a financial planner can be a massive help to keep your finances in place.

Moreover, I am confident that a financial planner will add massive value to you if:

- You have tried DIY your finances but still feel overwhelmed.

- You want to prepare your finances for the next phase in life (eg. marriage, retirement), but not sure how.

- You need help to organize your finances in place (investments, insurance, estate planning etc).

Yes, there are charges to engage a financial planner. But trust me, this will be an investment that’ll give you returns and peace of mind in multiple folds.

Verdict: Is a financial planner worth it?

In the past 2 years, I have received my financial planning package, complimentary from Wealth Vantage Advisory (WVA), a licensed financial advisory firm in Malaysia.

WVA offers 3 financial planning packages, namely:

- Comprehensive Financial Health Check (FHC): RM300

- Modular Financial Planning (MFP): RM1,500

- Full Financial Planning (FFP): RM3,000

Recap:

- FHC offers a comprehensive report on your financial state with action plans for improvement.

- MFP is essentially FHC + your financial planner will support you in the implementation in ONE aspect of your finance (insurance, investment, estate planning) for 1 full year.

- FFP is FHC + your financial planner will support you in the implementation of ALL aspects of your finance (insurance, investment, estate planning) for 1 full year.

Would I still sign up for a financial planner if I have to pay for the service?

For me, it is a solid yes.

The past 2 years have been life-changing as I dedicate my time and energy to build up my career as a self-employed. Without the guidance from Stev and Catherine in multiple aspects of my finances, I wouldn’t have the confidence to pursue my career wholeheartedly.

Yes, it is not the cheapest service in the world. But the value and professionalism that I gained from my financial planning journey have been one of the main reasons why I can pursue what’s important in life without having to hold back.

I am sure it’ll add massive value to many of you too.

More on my journey as I step into Year 3 of my financial planning journey. Talk soon!

Get Your First Financial Consultation Session Today – FREE OF CHARGE!

If you are keen to explore how a licensed financial planner can help with your finances, this is for you:

I am working together with Wealth Vantage Advisory to bring a FREE Financial Consultation Session to all No Money Lah’s readers!

When you sign up for this FREE consultation session, you will learn more about your overall financial state. Not only that, you can gauge if a Financial Planner is going to add value in the pursuit of your financial goals.

Regardless, it is 100% FREE and you have zero obligations to take up the service if it is not suitable for you. Plus, you are doing your finances a favor for the year to come!

You can sign up for your FREE financial consultation session by clicking on the button below.

Sign Up for Your FREE Consultation Session Here!

Disclaimers

This article is made possible through a collaboration with Wealth Vantage Advisory. Special thanks to Stev and the team for making this collaboration such an impactful one.

Wealth Vantage Advisory did not receive copy approval rights on this article – that means they are reading this article for the first time, right alongside you. 🙂

p.s. This post contains affiliate links, which afford No Money Lah a small referral if you sign up for any paid services.

CSOP iEdge S-REIT Leaders Index ETF: Invest in this ETF for stable dividend yield!

Are you looking to invest for stable & reliable dividend yield? If yes, I'm sure you'll like this post - read on!

For dividend investors, REIT has always been a solid choice due to its nature of consistent dividend pay-outs and lower price swings relative to normal stocks.

In particular, Singapore REIT (SREIT) has always been well received by investors. Why?

Singapore’s attractive tax conditions (0% withholding tax on dividends), coupled with SREIT being one of the largest REIT markets in Asia Pacific make SREIT a favorite among investors’ portfolios.

What if there is a way for us to invest in all leading SREITs at once? Wouldn’t it be amazing?

In this post, let’s explore CSOP iEdge S-REIT Leaders Index ETF, a REIT Exchange-Traded Fund (ETF) that allows you to invest in all leading SREITs at once!

Before this, here are some related posts that you may want to read:

- REIT: What is REIT and why invest in them?

- Introduction to Singapore REIT: Why I invest in SREIT!

- Full guide to ETF Investing!

p

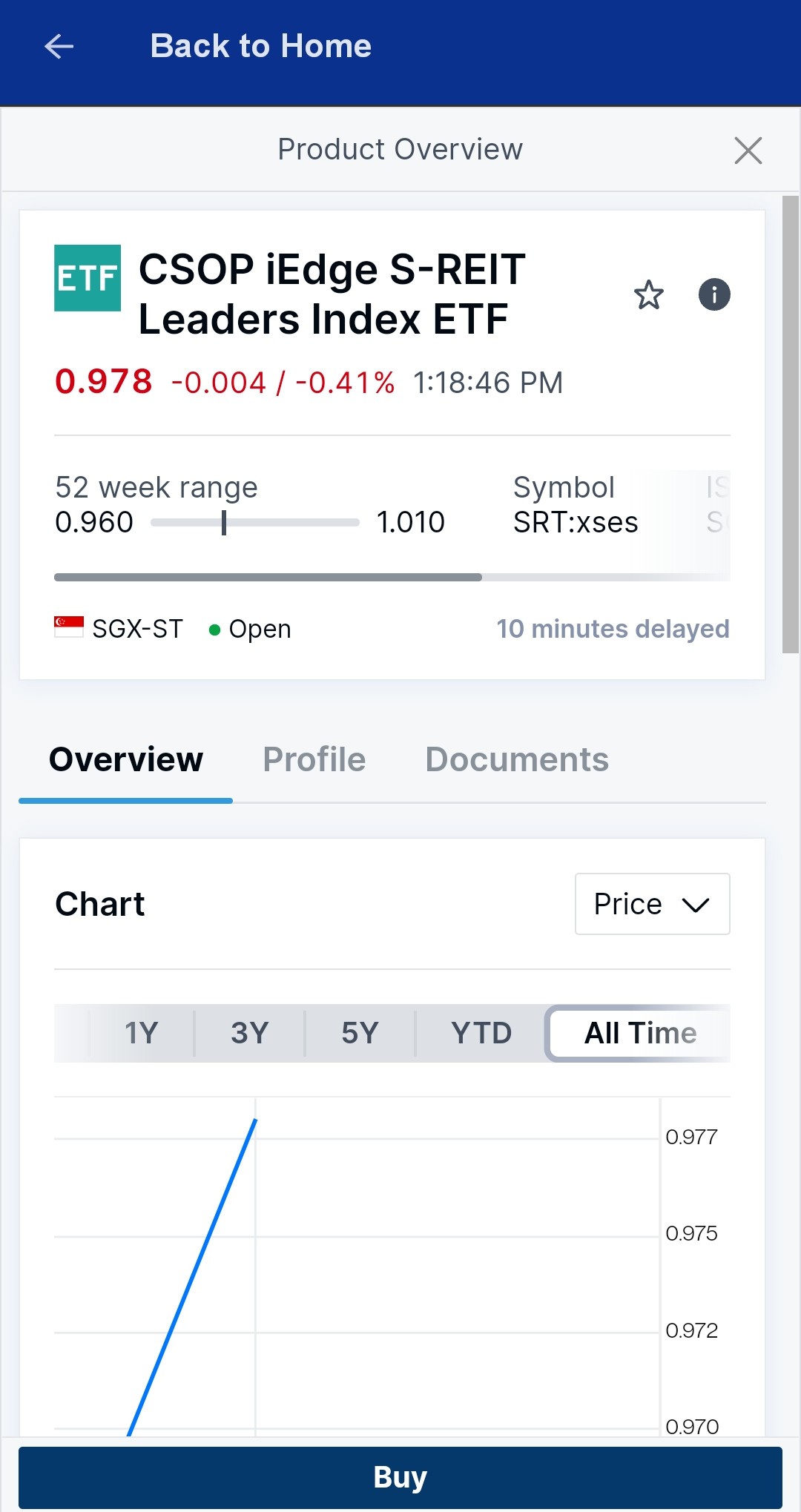

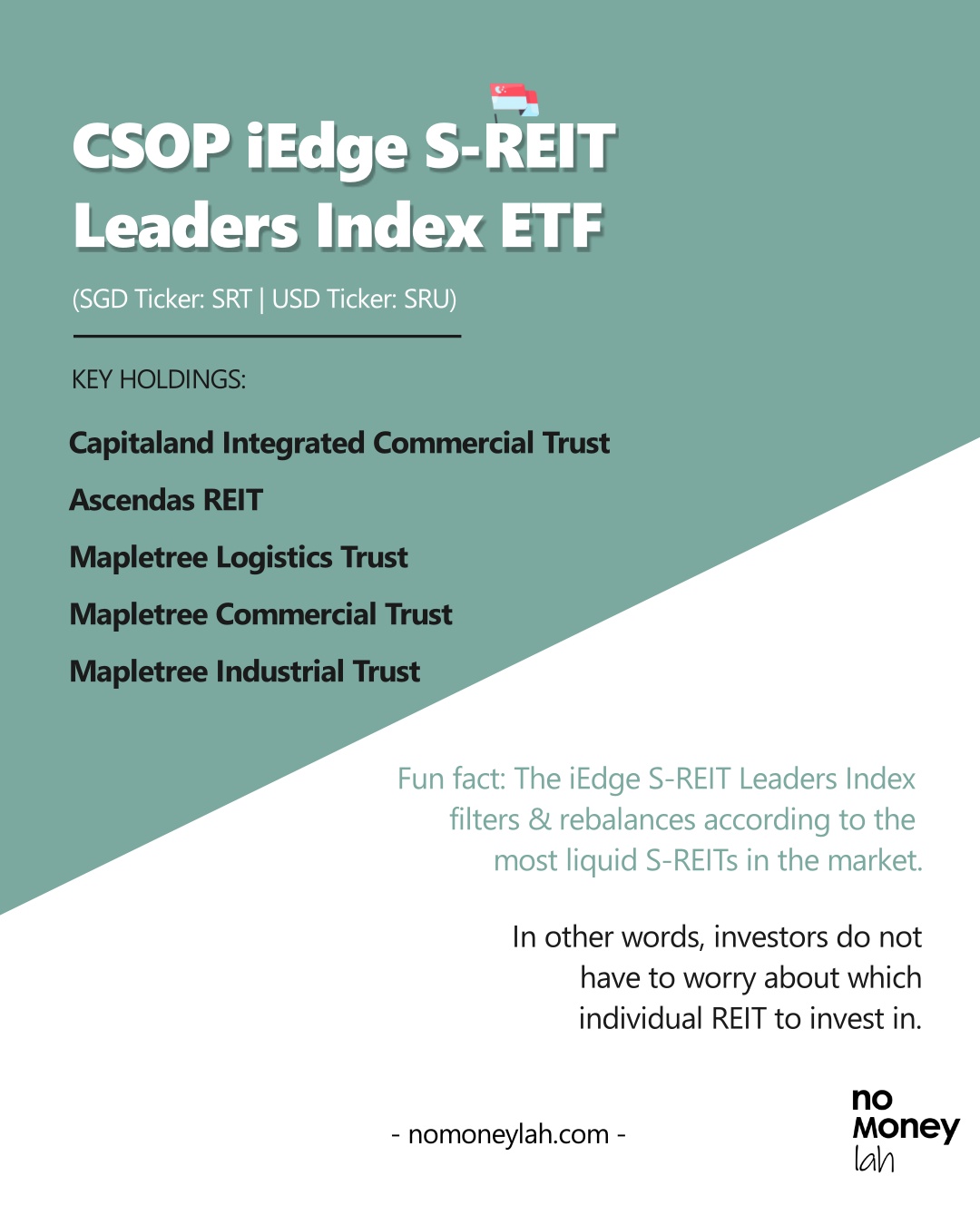

Highlights of CSOP iEdge S-REIT Leaders Index ETF

- CSOP iEdge S-REIT Leaders Index ETF is a Singapore-listed REIT ETF that tracks the iEdge S-REIT Leaders Index. (SGD Stock Code: SRT | USD Stock Code: SRU)

- With SRT/SRU, investors get to invest in a basket of most liquid SREIT listed in the Singapore Stock Exchange (SGX), with consistent dividends and relatively low volatility.

- CSOP iEdge S-REIT Leaders Index ETF is a solid choice for investors looking for stable & competitive dividend yield, as well as investors looking to hedge against inflation.

Recap: An ETF is an instrument that tracks the performance of an index. ETFs can be bought & sold just like usual shares in the stock market.

What is the iEdge S-REIT Leaders Index?

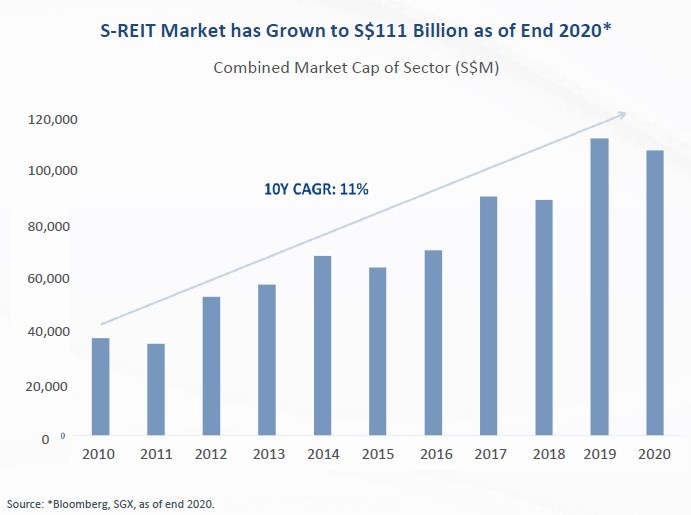

Launched in 2014, the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange (SGX).

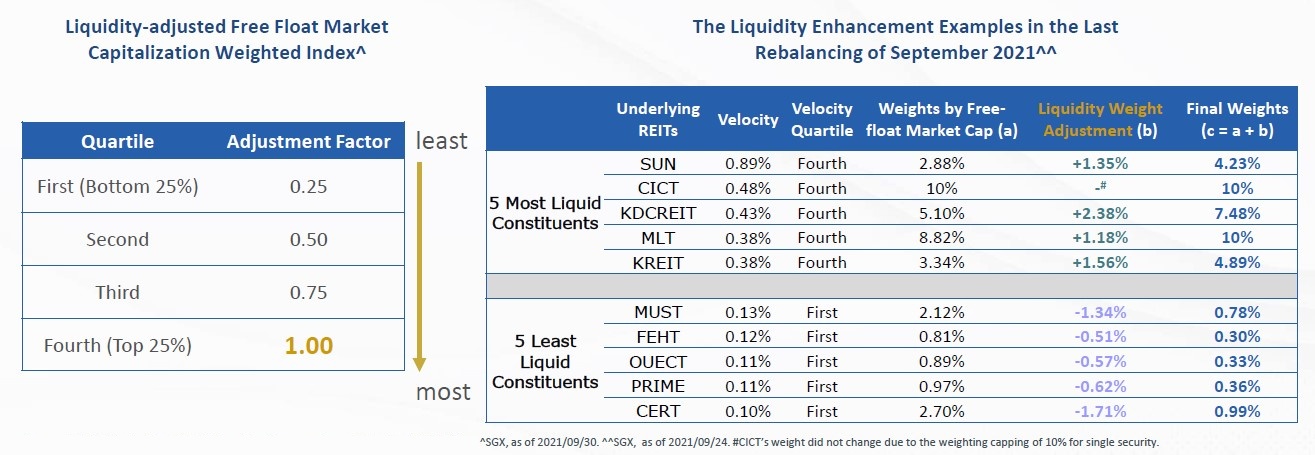

To ensure that the REITs tracked by the index are the most liquid REITs, the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy.

Essentially, what this strategy does is it'll only capture SREITs with high investors’ interest, fund flows, and REITs that are most relevant to the latest sector rotation.

In other words, the REITs tracked by the iEdge S-REIT Leaders Index are always the most relevant REITs according to the market condition.

As an example, with the ongoing pandemic, industrial REITs become an important part of the index (>40%), considering the strong market interest with REITs involved with logistics, warehousing, and manufacturing.

In short, when compared to the conventional market-cap weighting strategy in other ETFs, the iEdge S-REIT Leaders Index is more robust and versatile to shifts in market conditions.

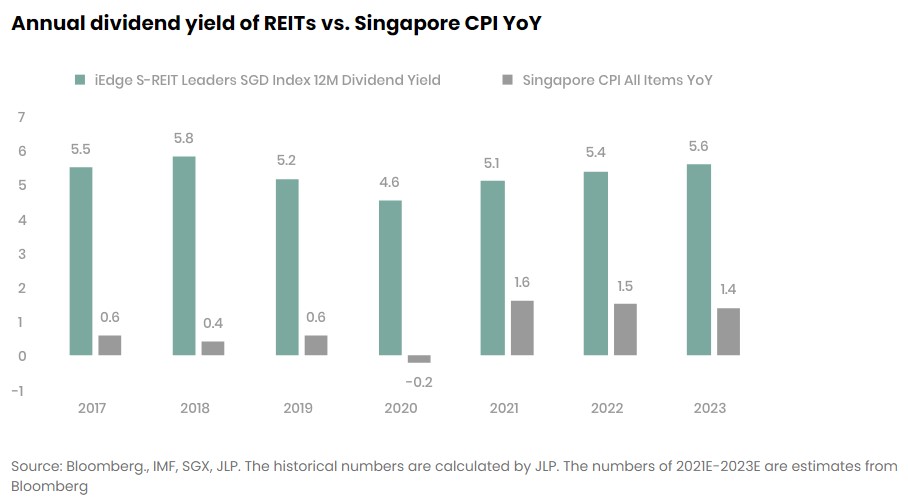

iEdge S-REIT Leaders Index Dividend Yield & Performance

So, how did the iEdge S-REIT Leaders Index perform over the years?

From 2017 to 2021, the iEdge S-REIT Leaders Index has been generating consistent annual dividend yield of 4.6% - 5.8%.

Furthermore, it is projected to generate 5.4% and 5.6% yield for 2022 and 2023 respectively. In other words, the yield can be a great hedge against rising inflation as well.

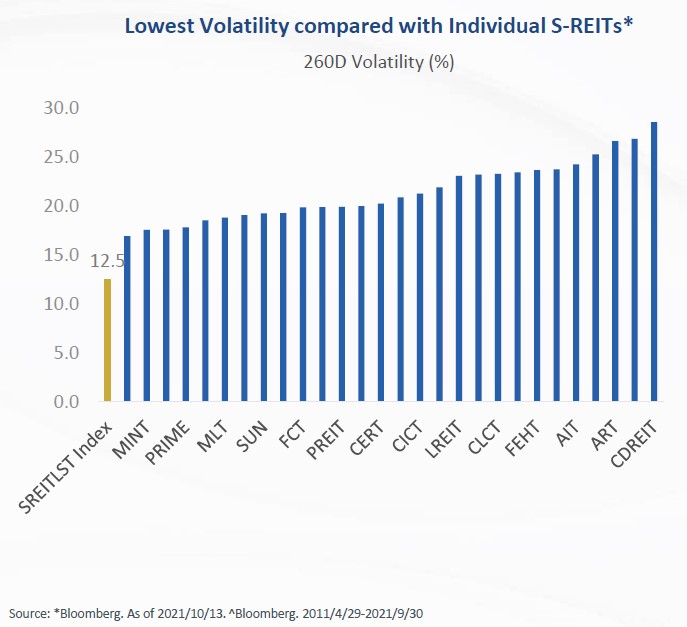

When compared to other REIT indexes, the iEdge S-REIT Leaders Index recorded the highest 5-year annualized return of 8.37%. In addition, it also has the highest expected dividend yield of 5.4% in 2022, with relatively low volatility.

In other words, the iEdge S-REIT Leaders Index is one of the most competitive REIT indexes in the market that takes into account of volatility.

Invest in the CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT/USD: SRU)

As for all indexes, we cannot invest directly in them. Instead, we can invest in an index via ETFs that track the performance of the index.

Similarly, we can invest in iEdge S-REIT Leaders Index via the CSOP iEdge S-REIT Leaders Index ETF.

The CSOP iEdge S-REIT Leaders Index ETF is listed in the SGX on 18/11/2021, in SGD (ticker: SRT) and USD (ticker: SRU) respectively:

p

| CSOP iEdge S-REIT Leaders Index ETF | |

|---|---|

| Ticker | SRT (SGD), SRU (USD) |

| Unit Price (9/12/2021) | SGD 0.976 | USD 0.716 (minimum transaction of 10 units) |

| Ongoing Expense Ratio | ~0.60% annually |

| Fund Size | SGD 114 million |

| Dividend Distribution | Semi-annually (in SGD) |

| ETF Rebalancing | Semi-annually (March & September) |

| Replication Approach | Replication strategy |

Advantages of investing in CSOP iEdge S-REIT Leaders Index ETF vs individual SREITs

The iEdge S-REIT Leaders Index displayed several advantages compared to investing in individual SREITs. Here are 3 of them:

Firstly, investors get to diversify their REIT exposure with a small capital instead of just one or two.

This is a capital-efficient way to invest in a diversified REIT portfolio.

Secondly, by design, the iEdge S-REIT Leaders Index filters & rebalances according to the most liquid SREITs in the market.

In other words, investors can invest passively and do not have to worry about which REIT to invest in.

Lastly, the iEdge S-REIT Leaders Index also shows more stability compared to individual SREITs.

Top holdings of CSOP iEdge S-REIT Leaders Index ETF (SRT/SRU)

As of the time of writing, there are 28 SREITs that are made up of the ETF's holdings. Each individual REIT holding is capped at 10%.

As of the time of writing, there are 28 SREITs that are made up of the ETF's holdings. Each individual REIT holding is capped at 10%.

Here are the top and notable REIT holdings of SRT/SRU:

-

Capitaland Integrated Commercial Trust (CICT) [10.04%]

CICT is the first and largest REIT listed on SGX with a market cap of SGD 13.5b as of August 2021.

CICT owns and invests in quality income-producing assets primarily used for commercial (including retail and/or office) purposes, located predominantly in Singapore.

Notable properties: Plaza Singapura, The Atrium @ Orchard

-

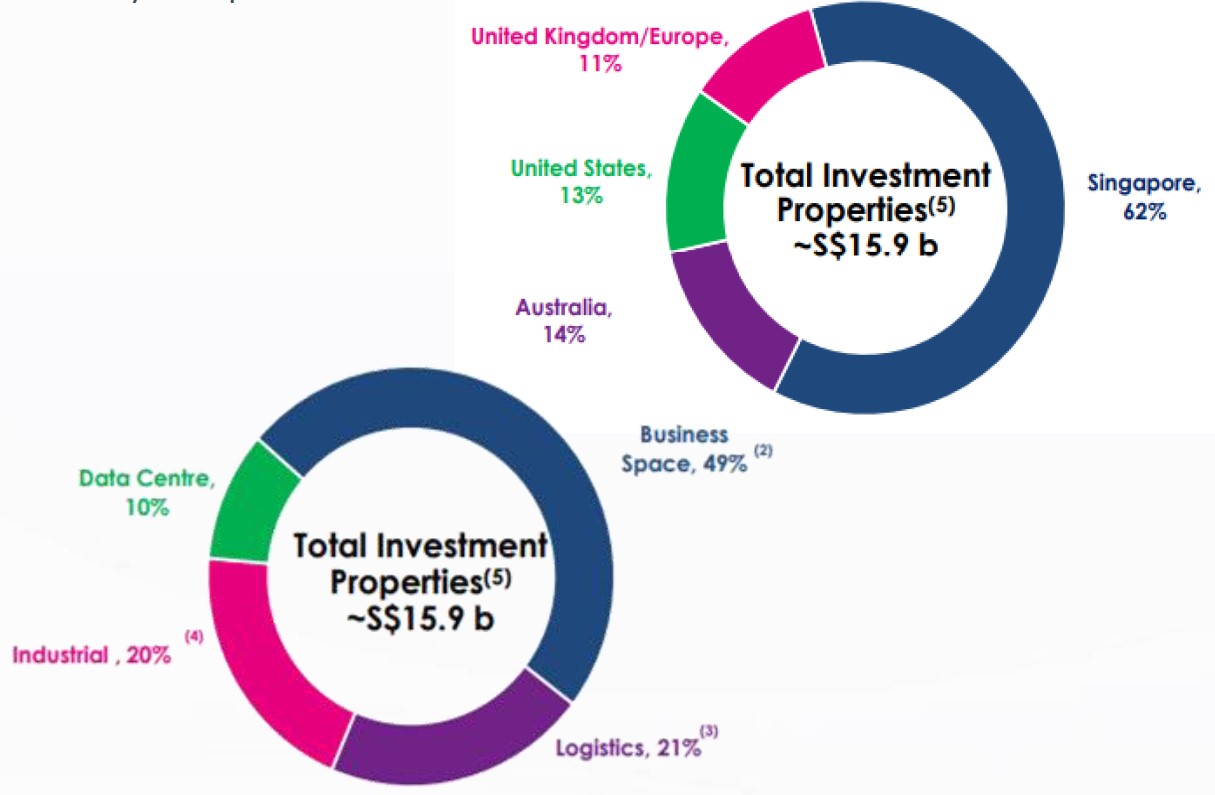

Ascendas REIT [9.90%]

Ascendas REIT is Singapore’s first and largest listed business space and industrial REIT with a ~SGD15.9b portfolio.

Its portfolio is diversified across 4 segments including business spaces, logistics and distribution, industrial properties, and data centers.

By geographical diversification, Ascendas REIT invests in properties across Singapore, Australia, the US, and UK/Europe.

-

Mapletree Logistics Trust (MLT) [9.39%]

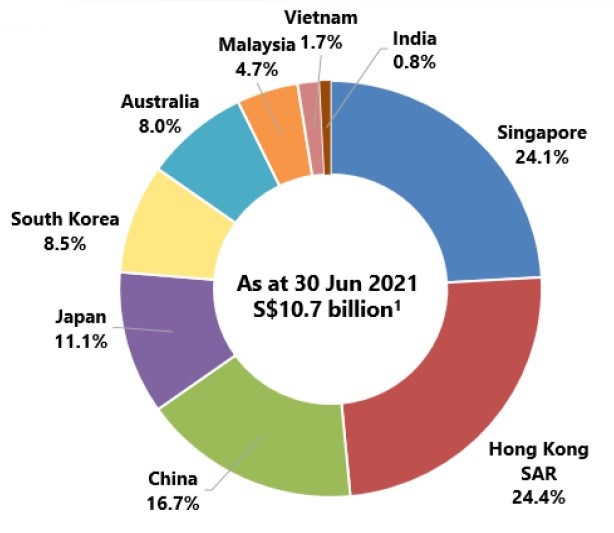

MLT is Singapore’s first Asia Pacific-focused logistics real estate investment trust with an asset under management of SGD10.7b as of Jun 2021.

MLT invests in a diversified portfolio of quality, well-located income-producing logistics real estate in Singapore, Hong Kong, China, Japan, South Korea, Australia, Malaysia, Vietnam, and India.

p.s. Click HERE for the most updated REIT holdings of CSOP iEdge S-REIT Leaders Index ETF

Risks of CSOP iEdge S-REIT Leaders Index ETF

Similar to all REIT investments, there are several key risks that you need to take note of while investing in CSOP iEdge S-REIT Leaders Index ETF:

#1 Interest Rate Risk

Since REITs are real estate businesses that make use of loans for financing, swings in interest rate can impact REIT to a certain extent.

Generally, an increase in interest rate will increase the operating cost for REITs due to a hike in interest repayment. As a result, this will reduce the underlying profit of REITs.

#2 Income Risk

REITs are also susceptible to changing market conditions. As an example, hospitality REITs that own hotels may thrive during holiday seasons, but could take a blow in their revenue during non-peak days.

Fortunately, CSOP iEdge S-REIT Leaders Index ETF copes with this by adjusting its REIT holdings (semi-annually) with the most liquid and relevant REITs, which captures investors' interest and fund flows.

Who should invest in CSOP iEdge S-REIT Leaders Index ETF

- For investors looking to invest for stable, and higher than average dividend yield.

- Investors looking to hedge against inflation.

- Investors looking for a capital-efficient way to invest in a diversified SREIT portfolio with exposure to quality local & global real estate.

My Recommended Broker to Invest in CSOP iEdge S-REIT Leaders Index ETF:

The CSOP iEdge S-REIT Leaders Index ETF is not listed locally. Instead, it is being traded in the Singapore stock exchange in either SGD (ticker: SRT) or USD (ticker: SRU).

The CSOP iEdge S-REIT Leaders Index ETF is not listed locally. Instead, it is being traded in the Singapore stock exchange in either SGD (ticker: SRT) or USD (ticker: SRU).

As such, you’ll need a reliable stock broker with access to the Singapore stock exchange in order to invest in this ETF.

If you need a reliable stock broker, I’d highly recommend ProperUs to you. ProsperUs is a regulated broker from CGS-CIMB, with global access to 30+ different stock exchanges (US, SG, HK, China, Japan, Malaysia, UK, Canada, and more!).

In addition, with ProsperUs, you get access to a variety of instruments such as stocks, ETFs, mutual funds, futures, options, FX, and CFD!

Check out my full review on ProsperUs HERE.

p.s. From today till 30/9/2023, key in my exclusive promo code ‘MONEY20’ while you register, and get a FREE SGD50 cash top-up & up to RM300 e-wallet credits when you open a ProsperUs account! More details and T&C HERE.

No Money Lah’s Verdict

As a whole, the CSOP iEdge S-REIT Leaders Index ETF is a great option for investors looking to invest for stable and higher-than-average yield.

Considering SREIT being one of the most established REIT market in Asia, investors can diversify into a portfolio of quality real estate even with a small capital.

Do you have any questions on the CSOP iEdge S-REIT Leaders Index ETF? Feel free to let me know your thoughts & questions in the comment section below!

About CSOP Asset Management

I first discovered the iEdge S-REIT Leaders Index through CSOP Asset Management (AM).

If you have been investing purely in the Malaysia or US market, it is likely that you have not heard of CSOP AM before. However, CSOP AM is huge in the China & Hong Kong market:

Established in 2008, CSOP AM is the first offshore entity established by a regulated Chinese asset manager with Hong Kong’s Securities & Futures Commission (SFC) type 1 (dealing in securities), type 4 (advising on securities) and type 9 (asset management) licenses.

With this background, CSOP AM manages the biggest renminbi (RMB) equity & fixed income ETF listed in offshore China.

In 2019, CSOP AM sets up their office in Singapore, with the goal to bring their expertise closer to Southeast Asia’s investors (psst… that’s us).

Disclaimer

The purpose of this post is purely for sharing and should NEVER be taken as a buy/sell recommendation. Please do your own research AND/OR reach out to a licensed financial planner before making any investment decision.

TradingView – The Ultimate Setup Guide for the BEST (& FREE) Stock Charting Platform!

Not all stock charts in your financial platform are made the same.

Some are barebone without any proper functions. Some look pathetic like they are built in the early 2000s. Even worse, many of these ‘meh’ charting services cost a fortune to use!

Well, at least that’s the case until TradingView joins the party.

Beginners or experienced investors alike, TradingView is one of the best charting platforms available in the market now. It is my go-to platform for all things chart – stocks, cryptocurrencies, ETFs, foreign currencies, and more.

In this comprehensive guide, let me guide you through how you can set up your charts on TradingView, and how to navigate around this amazing charting platform!

p

TradingView Highlights:

- TradingView is an extremely user-friendly & customizable web-based charting platform (ie. No downloads/installation needed).

p - It offers access to stock charts for various markets (eg. Malaysia, US, Singapore, Hong Kong, China, and more), cryptocurrencies, commodities, ETFs, foreign currencies, and more.

p - The Basic version of TradingView is FREE to use. That said, users can subscribe to unlock additional value & features from the platform.

How to Set Up TradingView for the First Time

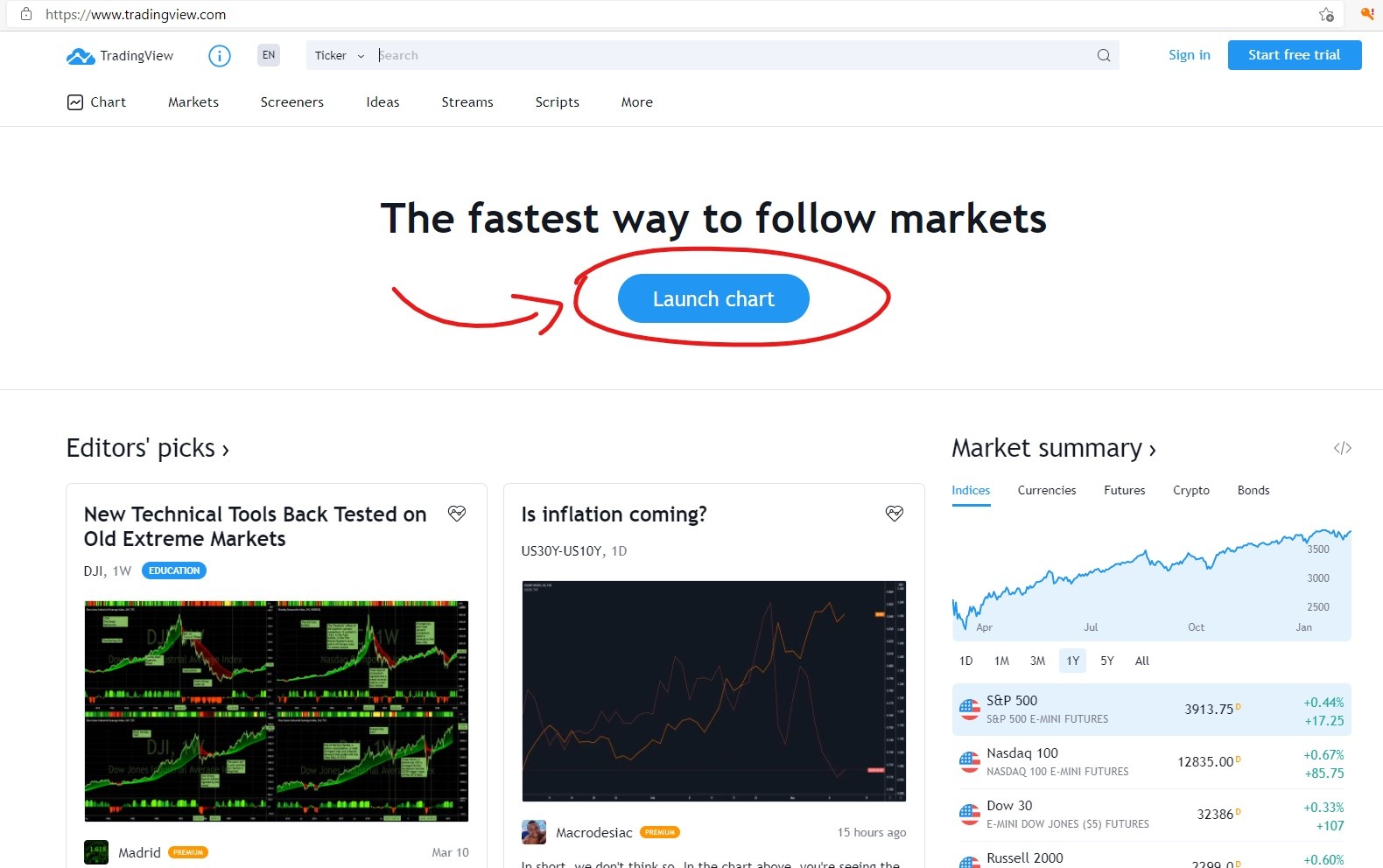

To start, visit TradingView’s main site HERE. Then, click ‘Launch Chart’.

p

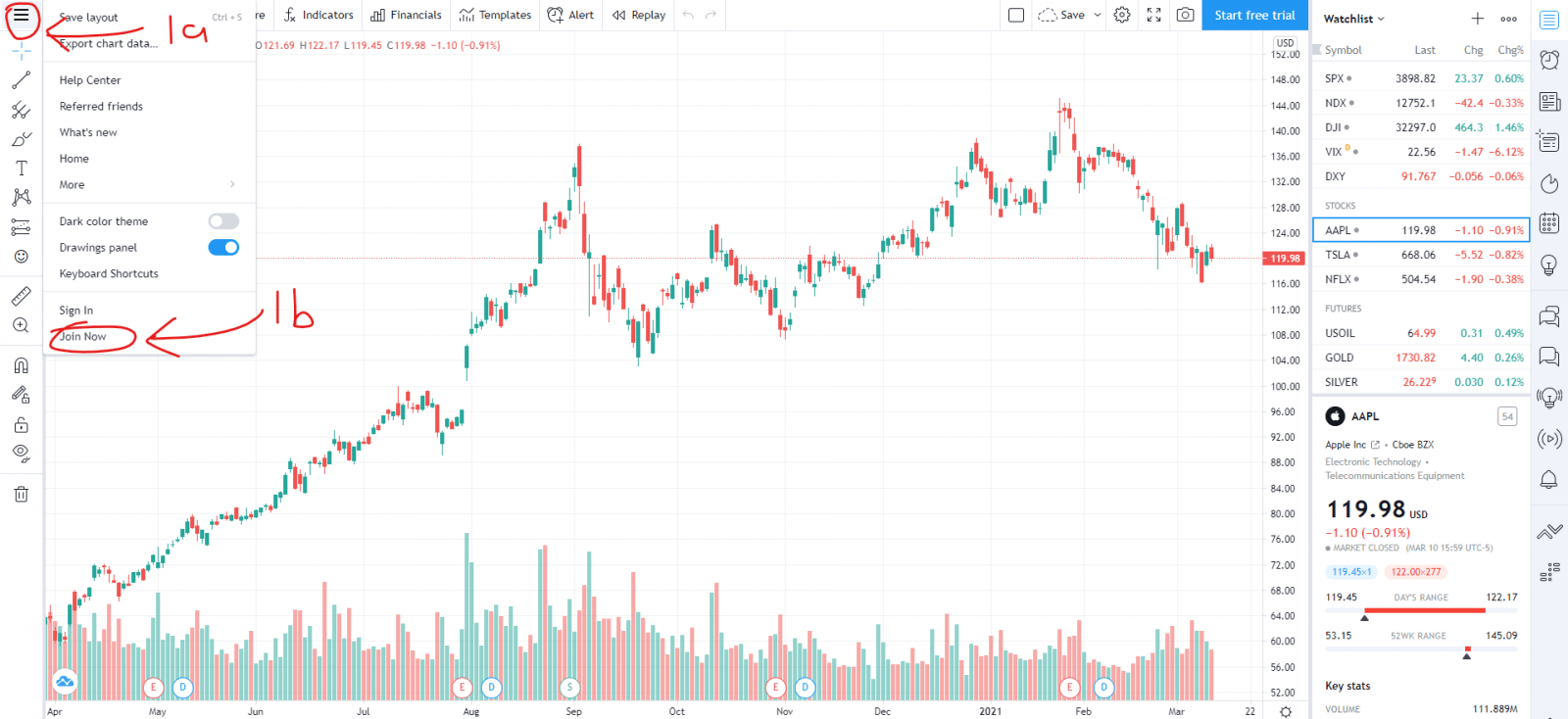

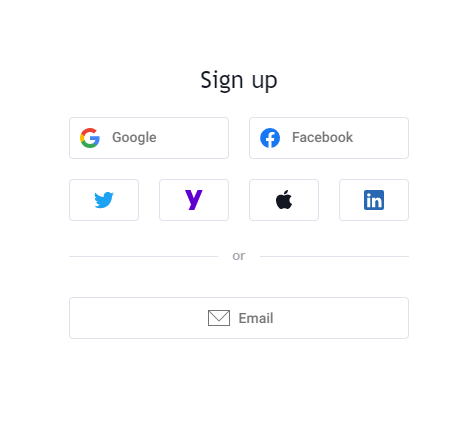

Step #1: Sign Up for a TradingView account by clicking ‘Join Now’.

Creating an account is important because it allows you to save your chart watchlist & setup later.

p

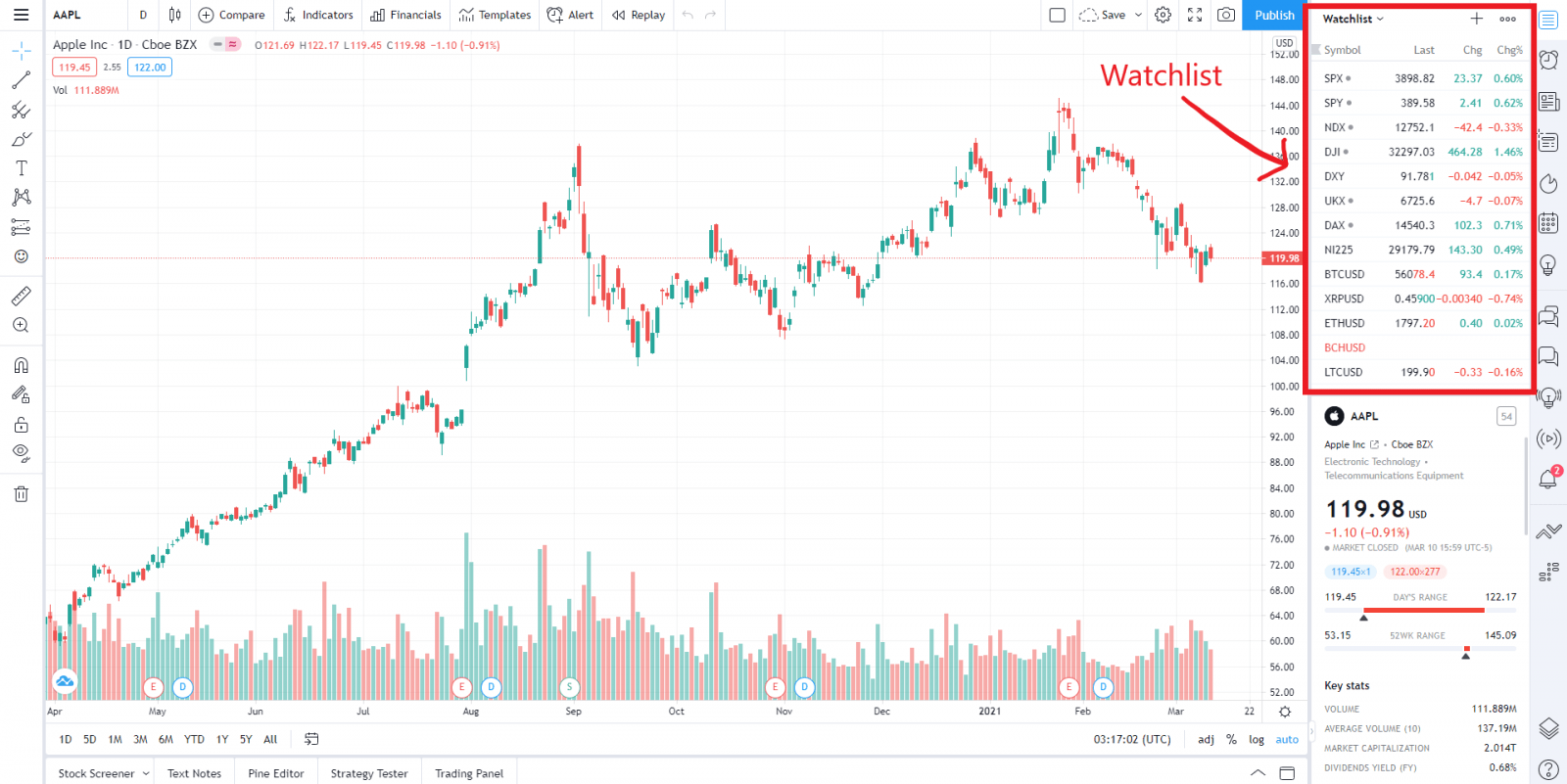

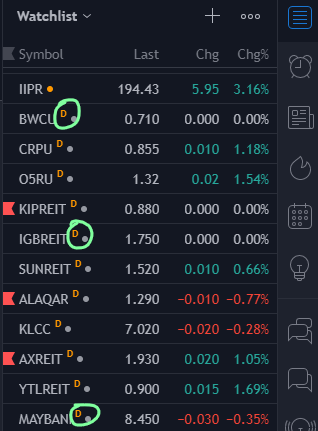

Step #2: Create a watchlist.

Once you got your account, the first thing you can do is to add some stocks to your watchlist:

p

Initially, the watchlist section may come with a list of stocks/securities that might not be useful to you. So, let’s clean that up first, shall we?

To do so, click on the 3-dot dropdown list at the top right corner (2a), and click ‘Clear List’ (2b).

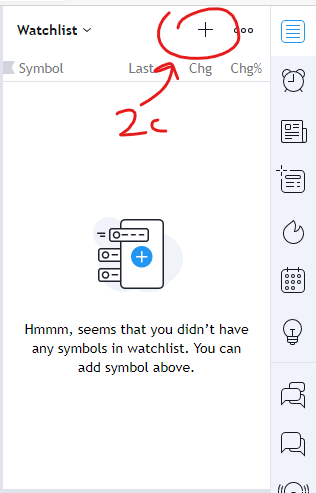

Once this is done, click on the ‘+’ button to start adding stocks (or any other charts) to your watchlist:

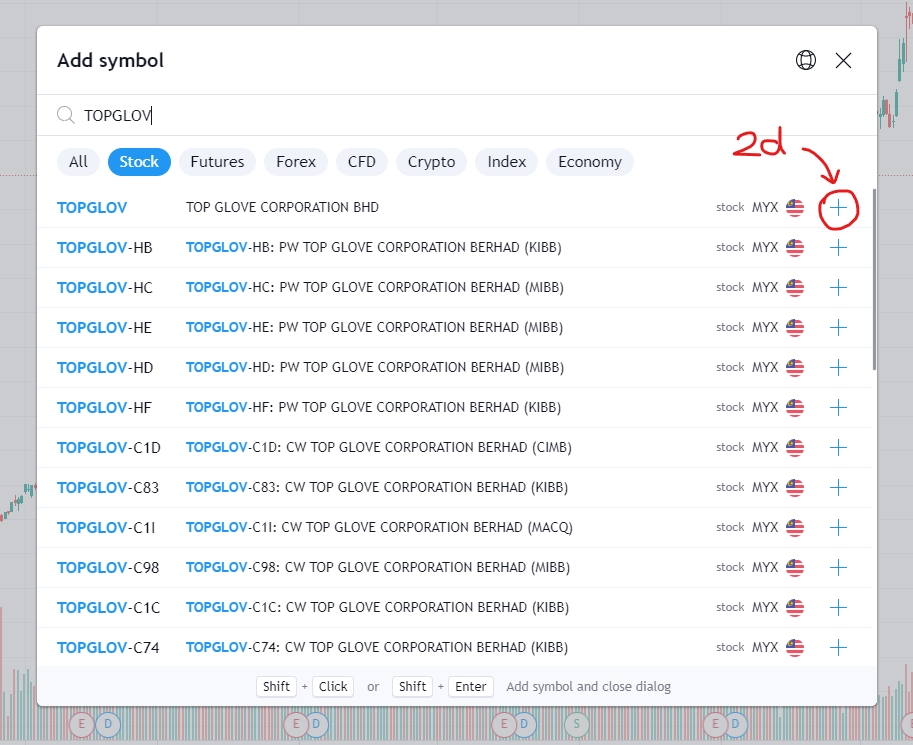

Search for the stocks that you want, and click the ‘+’ button to add them to your watchlist.

p

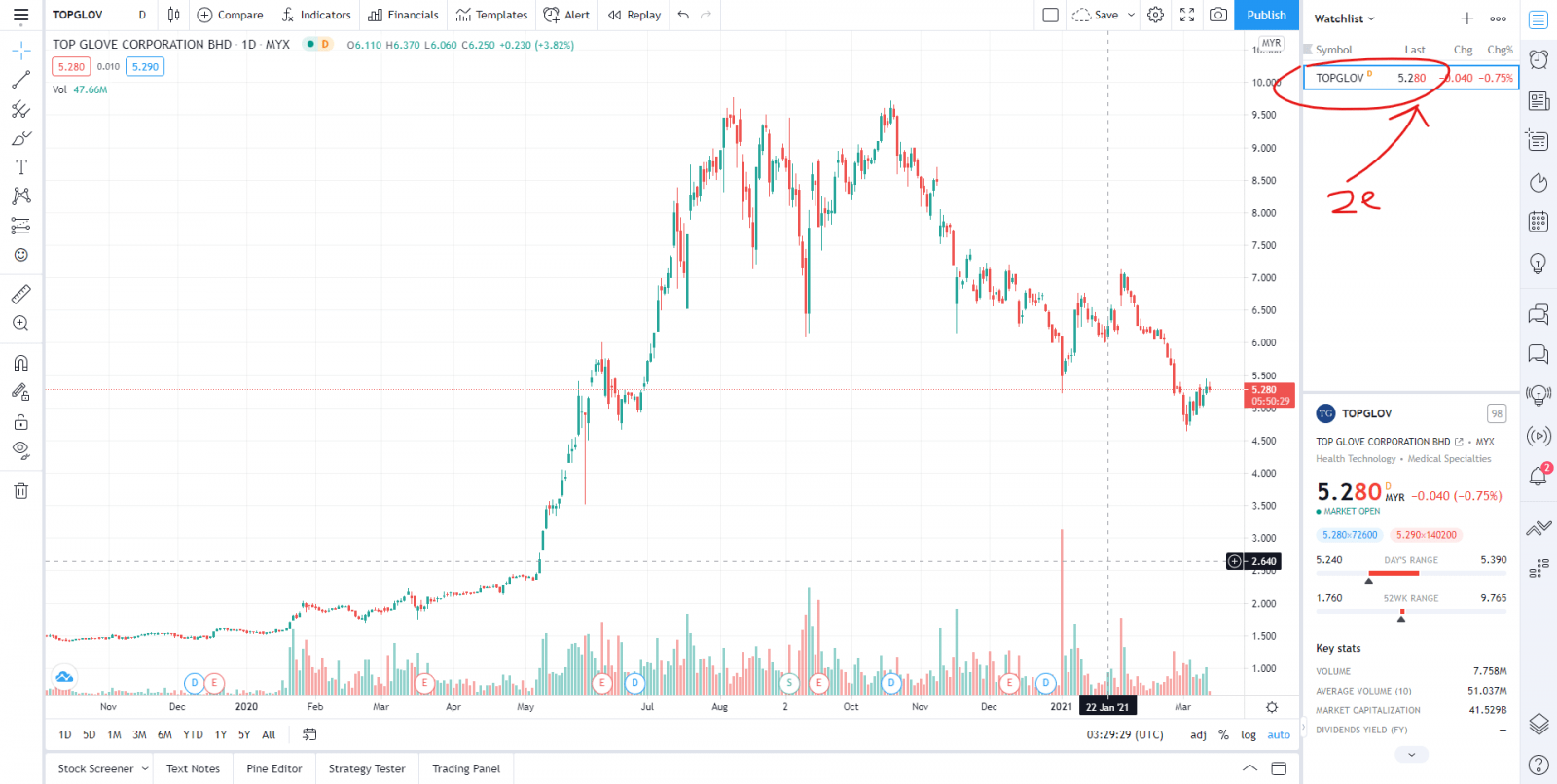

Finally, click on any stock in your watchlist to open up the stock chart. From here, we’ll explore the main functions of TradingView that you can start using.

p

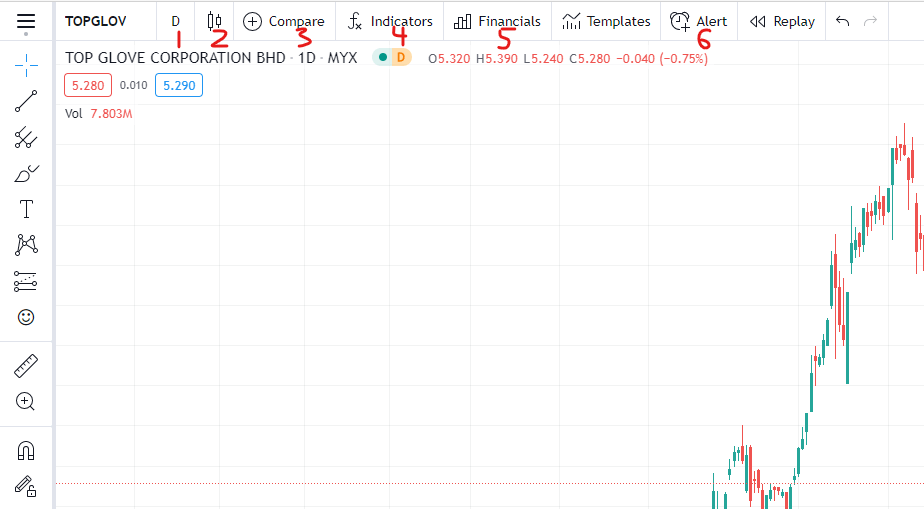

Key Features of TradingView

TradingView offers many neat and powerful features that investors of any level would come to appreciate. I’ll briefly go through some of the main features – feel free to explore them on your own!

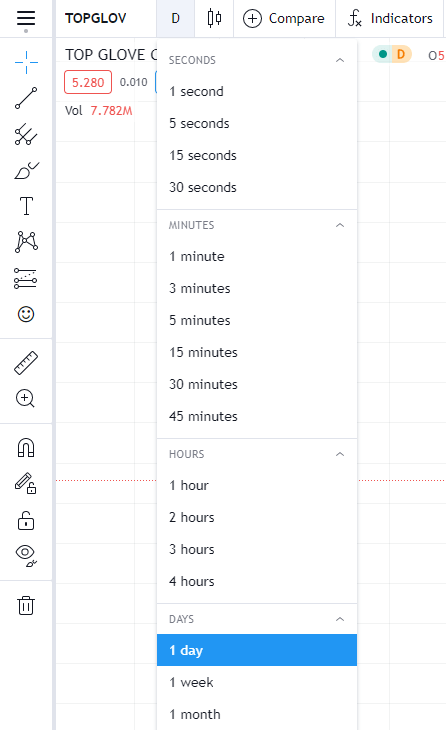

- Timeframe – Change the timeframe of your chart from the default Daily to Monthly/Weekly and even smaller timeframes like Hourly, and even Minutes!

p

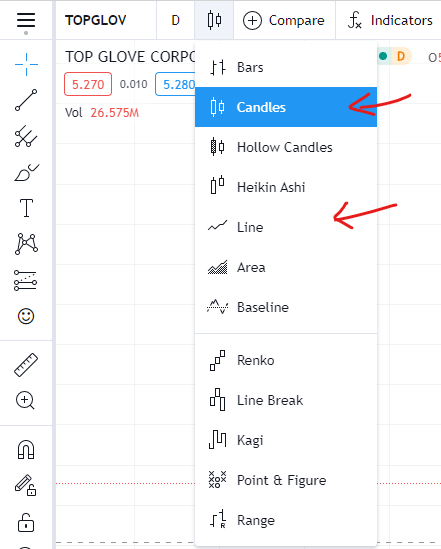

View your charts in different timeframes. - Candle Types – Modify your charts from the typical Japanese Candlesticks to other styles like Bar or Line charts, and more!

p

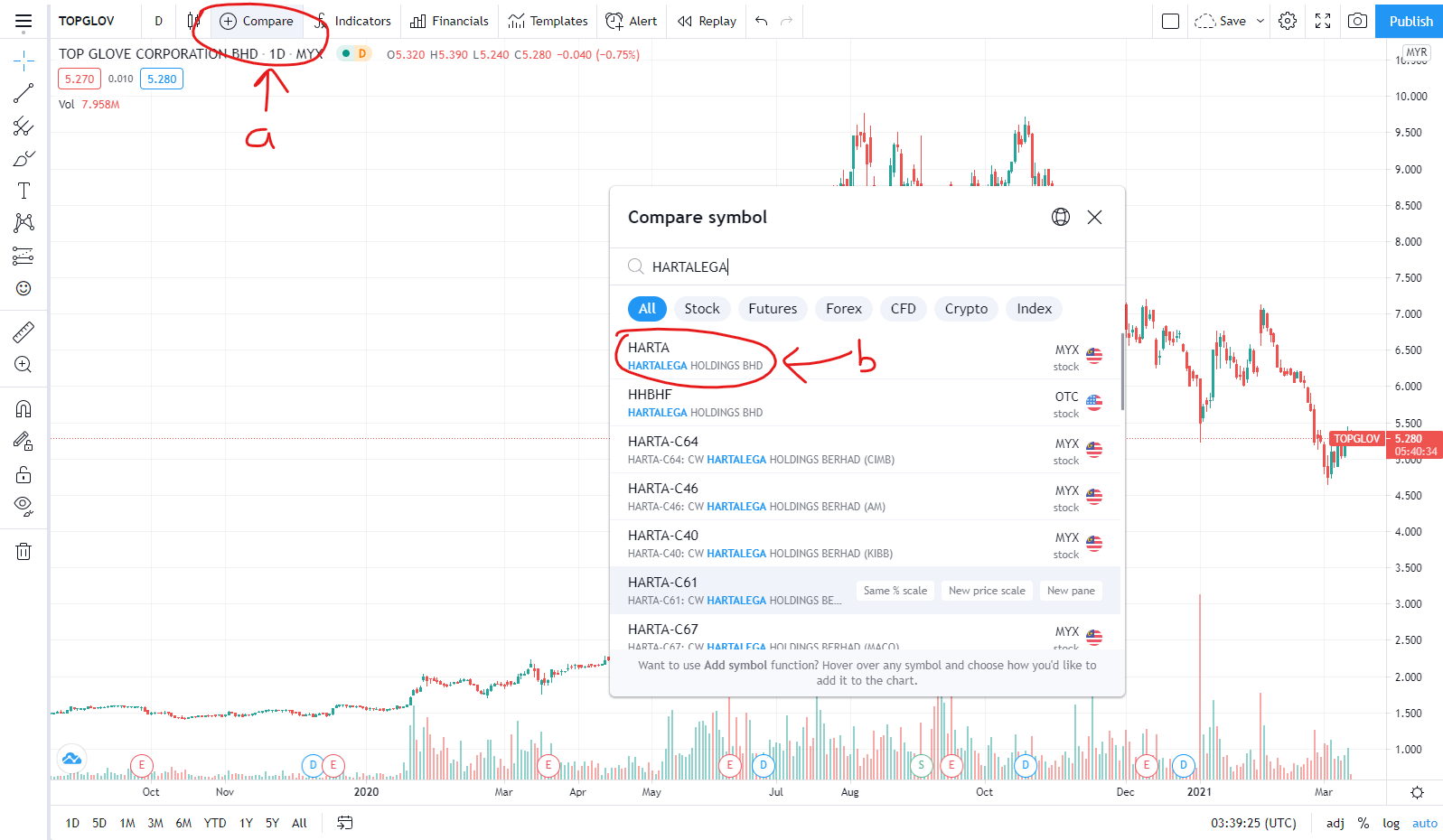

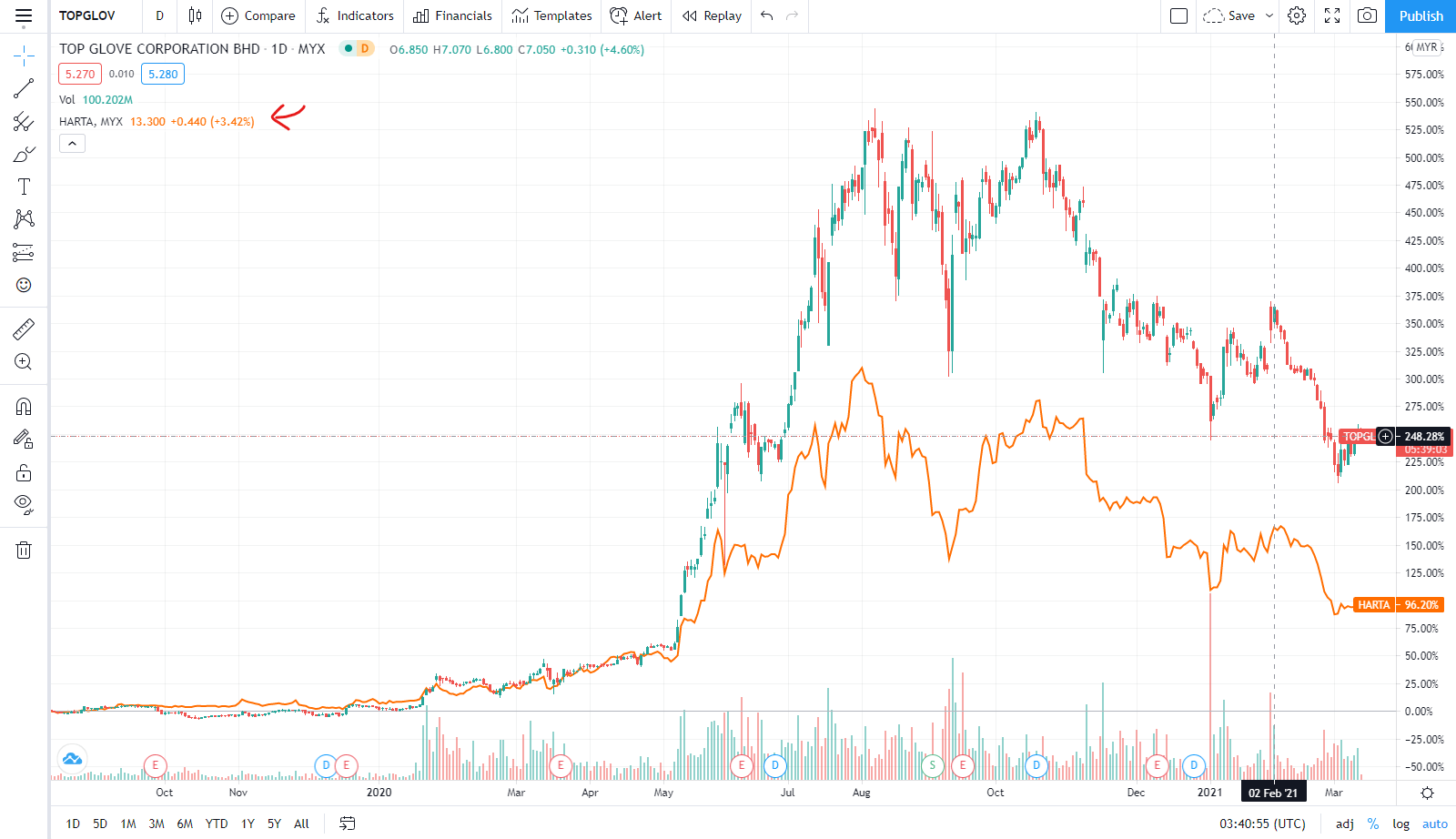

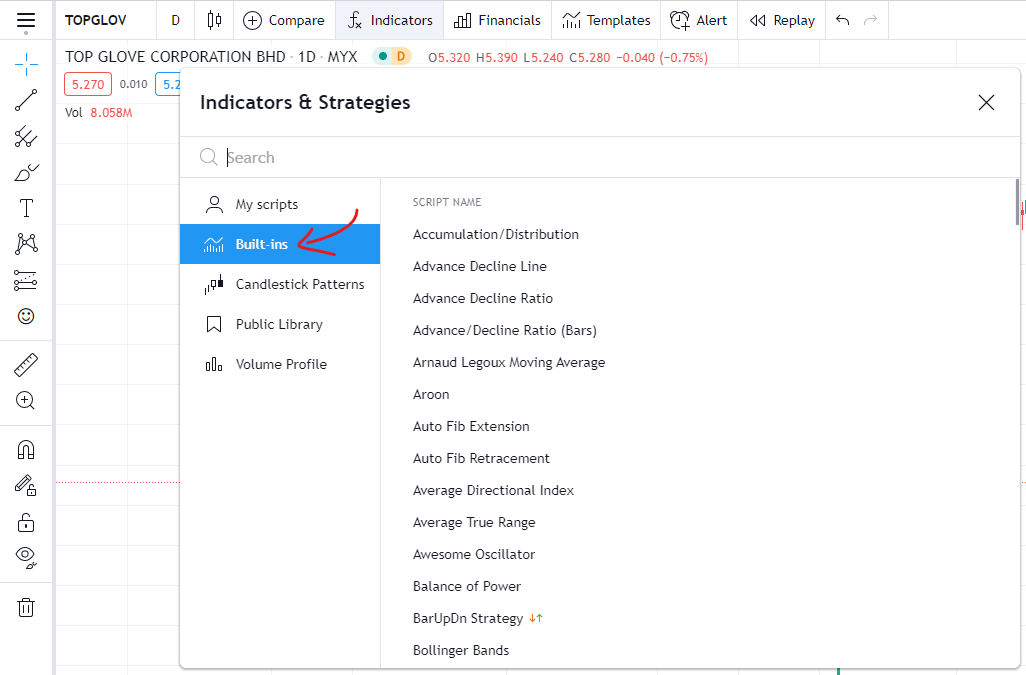

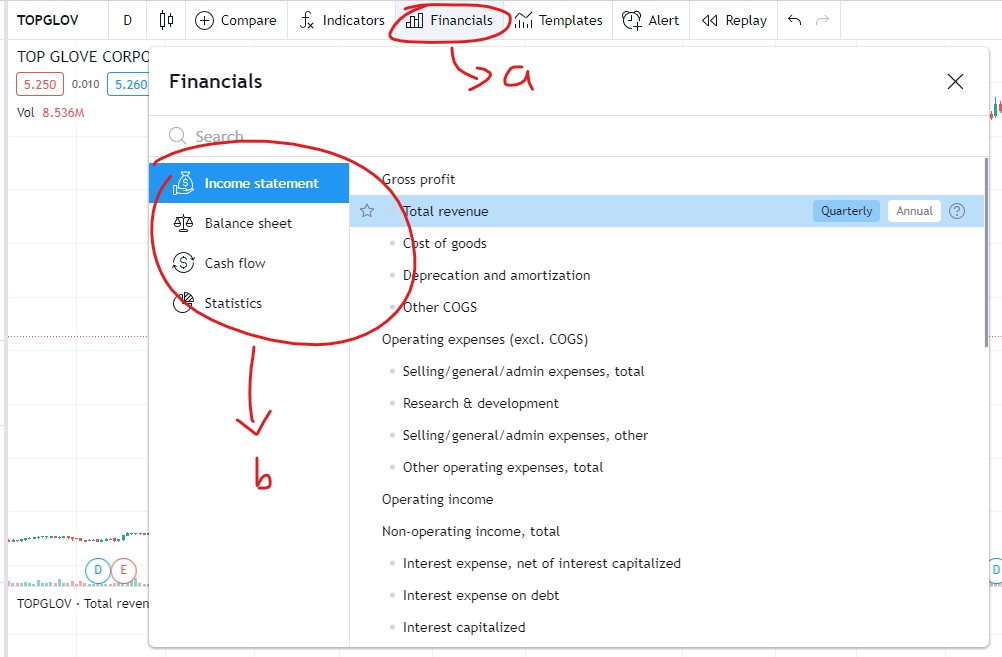

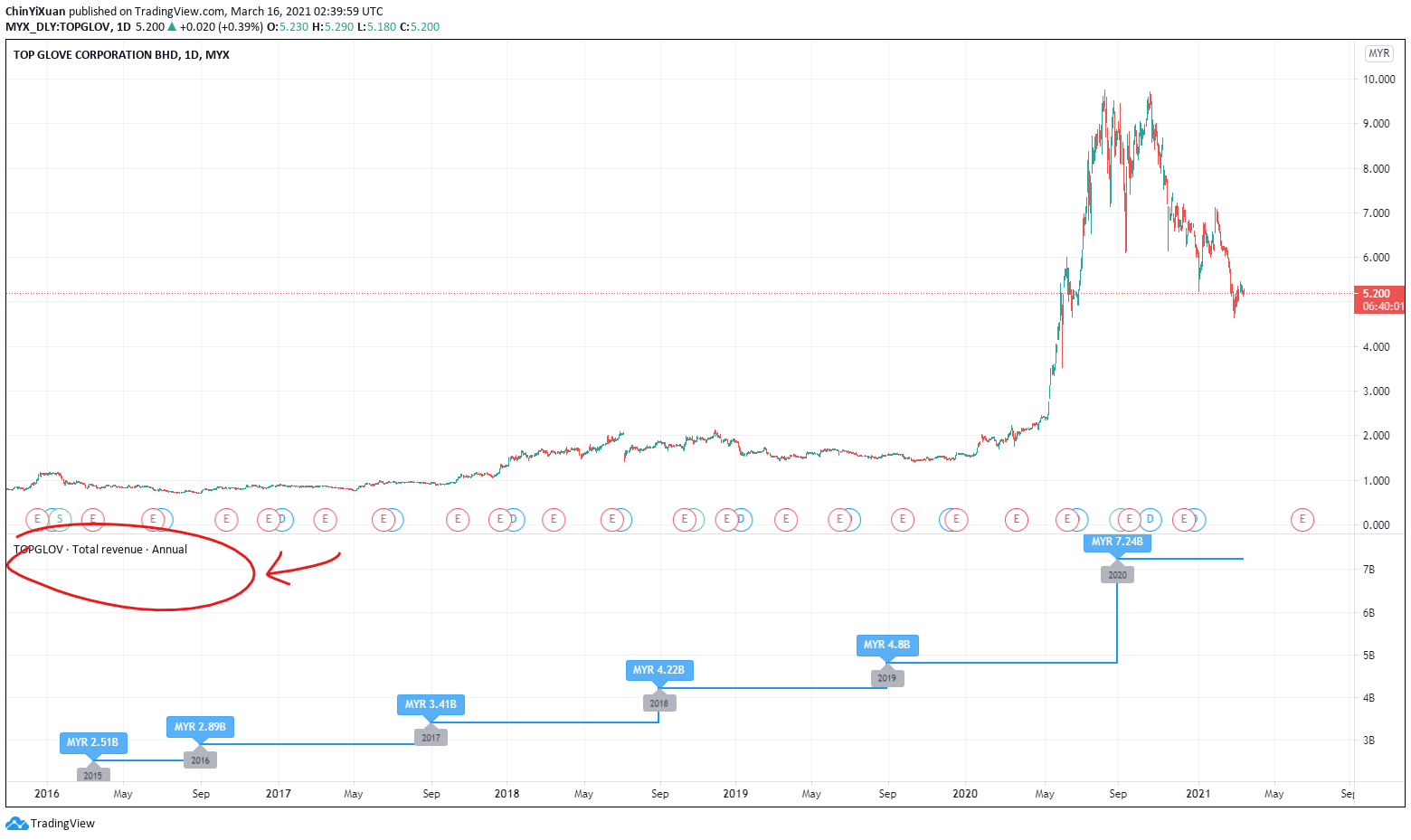

- Compare – Want to put stocks with similar business models side-by-side? You can do just that on TradingView!

p

(a) Click ‘Compare’, then enter the name of the stock that you want to compare.

Use the 'Compare' function to see if stocks are correlated to each other. p

(b) Now you have the performance of 2 or more stocks on the same chart! This feature is especially useful if you want to see if there is any price movement correlation between the stocks.

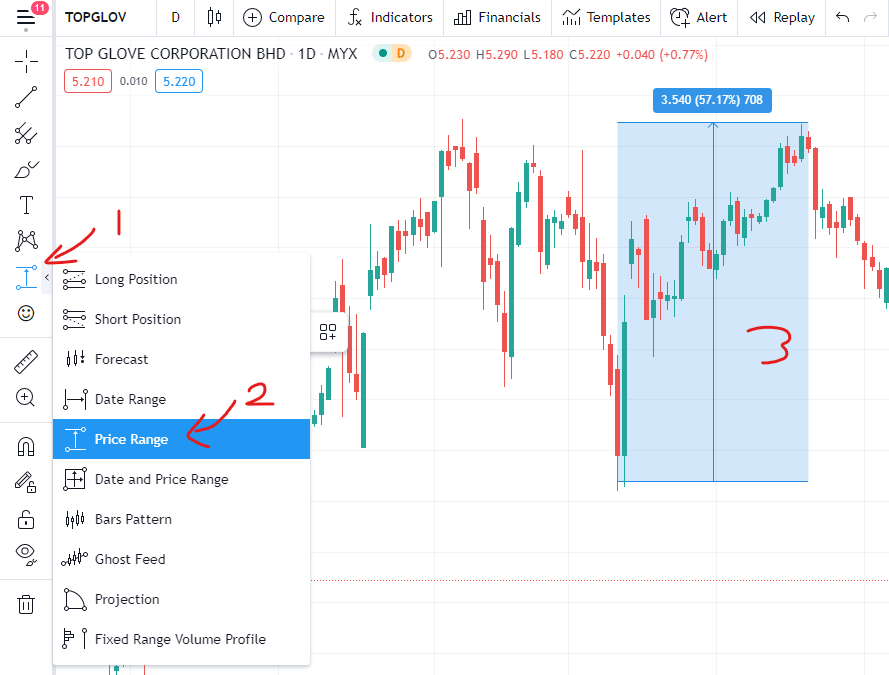

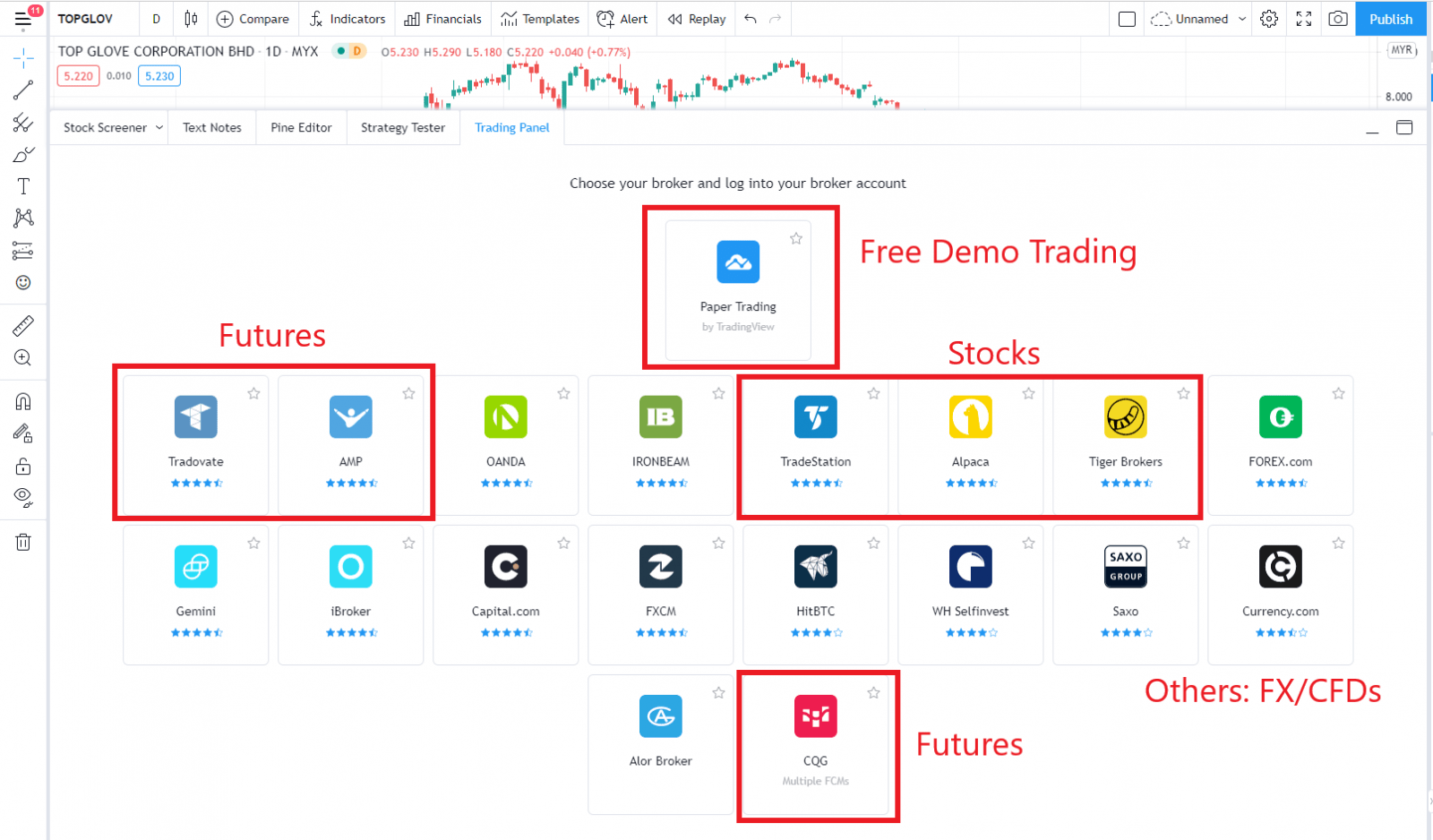

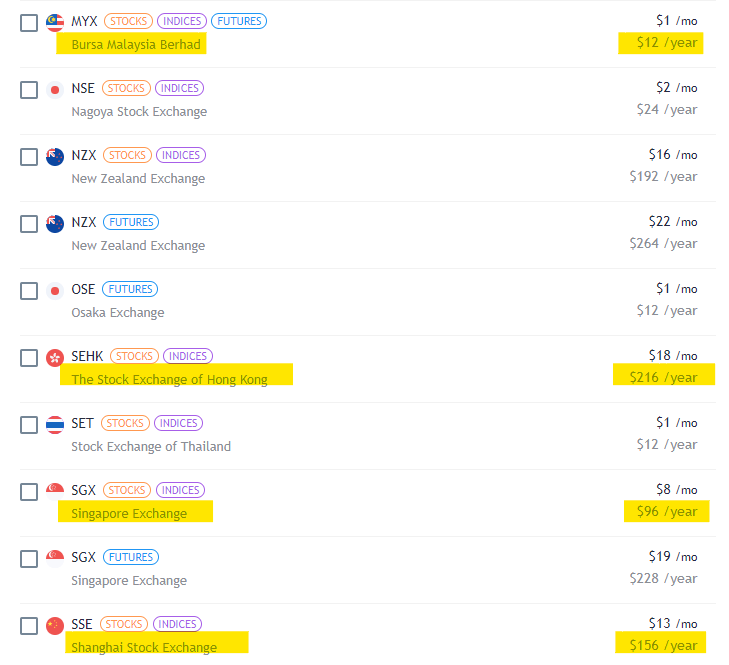

Now you can compare the price movement of stocks with clarity! p