4 things to do immediately as a scam victim! (+1 last way if nothing works)

Financial scams are getting out of control these days.

We hear worrying cases such as scam calls pretending to be from government agencies or banks, and worse, people's hard-earned money is stolen from their banks without even receiving an OTP.

In this guide, let's find out what you should do immediately in the unfortunate event that you become a scam victim. I've also included 1 final method if you've tried everything and nothing works.

If you find this post useful, consider subscribing to my FREE weekly personal finance & investing newsletter! I’d really appreciate it if you can share this post with your family and friends too!

Useful guides:

- Guide: What to do if scammers stole money from your credit/debit card

- Guide: 12 practical ways to protect yourself from financial scams

p

What to do if you find out that you got scammed?

In the unfortunate event that you fell for a scam, here are 4 things you should do IMMEDIATELY:

Step 1: Remember, it is NOT the time to blame yourself!

Stay composed and proceed to the steps below as provided by Bank Negara Malaysia (BNM).

Step 2: Call your bank’s 24-hour fraud line and report the incident immediately.

Request for your card/bank account to be halted to avoid further unauthorized transactions.

Please find the 24-hour fraud hotline for Malaysia banks below. You can also Google for your bank's most updated hotline:

- Maybank: +603 5891 4744

- CIMB Bank: +603 6204 7788

- Public Bank: +603 2177 3555

- HSBC Bank: +603 8321 5400

- OCBC Bank: +03 8317 5200

- UOB Bank: +03 2612 8121

- Ambank: +03 2178 8888

- Citibank: Can't find a dedicated fraud hotline (or it is really not obvious lol). You can try contacting Citibank HERE.

- Standard Chartered Bank: Call the number on the back of your bank card or on your bank statement.

Banks are given a maximum of 60 days to investigate a dispute.

Step 3: Contact the following numbers (Malaysia):

- The Commercial Crime Investigation Department (CCID) Scam Response Centre at 03-2610 1559/1599

- BNMTELELINK at 1-300-88-5465

These organizations will facilitate immediate measures for CCID to coordinate with BNM and banks to help protect affected accounts.

Step 4: Lodge a police report to facilitate the investigation.

Can you get your money back if they are stolen/scammed from your bank account?

At this point, you’ve done everything you can. Since banks are given 60 days to investigate your case, the only thing you can do is wait.

Whether you are able to get a refund is highly dependent on the investigation process of your bank, and if they’d categorize your case as an ‘unauthorized transaction’.

Like it or not, you’ll really need a boost of luck at this stage.

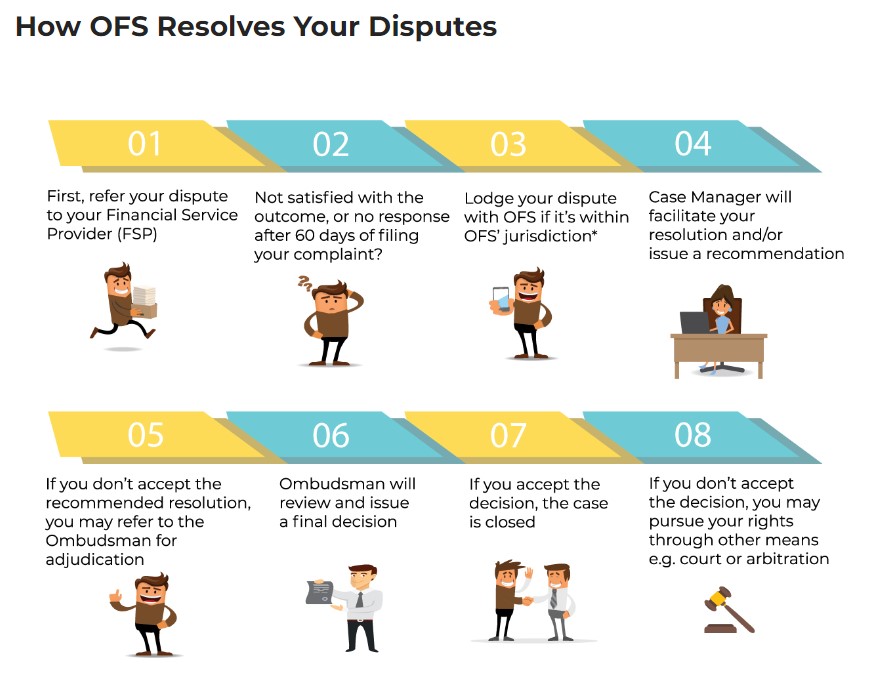

That said, if you are unhappy with the final investigation result, you can file a dispute with the Ombudsman for Financial Services (OFS).

One Final Step: What is Ombudsman for Financial Services (OFS) and how it can help you

OFS is a special non-profit organization approved by BNM to provide dispute resolution between consumers/businesses and financial services.

OFS is a special non-profit organization approved by BNM to provide dispute resolution between consumers/businesses and financial services.

If you've tried everything and nothing works, OFS is where you should go to. The mandate of OFS is to resolve disputes via facts/evidence without taking sides.

The jurisdiction of OFS:

OFS accepts disputes which involve monetary losses that fall within the following limits:

- Up to RM250,000 for banking products and insurance claims.

- Up to RM10,000 for motor 3rd party property damage insurance/takaful claims.

- Up to RM25,000 for cases involving unauthorized transactions through channels such as internet & mobile banking, ATM, or unauthorized cheques.

Check out the infographics below on how OFS resolves a dispute. For more info, check out OFS official site HERE.

Financial Scam FAQs:

Q1: Will Perbadanan Insurans Deposit Malaysia (PIDM) protect my money from scams?

A: No. PIDM only protects consumers in the case where their members (eg. banks) go bankrupt. They do not provide coverage from scams.

Q2: Will I be able to get a refund if my money is stolen from my bank?

A: It is highly dependent on your bank’s investigation on your case, so I can’t give you’re a sure answer. Do your best to provide all the info you have to assist the investigation.

Q3: What should I do if I am not happy with the final investigation result from my bank?

A: Lodge a report to Ombudsman for Financial Services (OFS). OFS is established to help resolve disputes between consumers/businesses and financial services. Check out the prior section of this article for more info.

Verdict: We need more robinhoods against scammers.

Truthfully, seeing all the news of people falling to scams left me helpless and frustrated.

There are so many people losing their hard-earned savings to scammers everyday, yet our banks and regulators are WAYYY too slow and passive in handling the matter.

If your money has been unfortunately stolen by scammers while reading this, please know that this is not the end of the world. Remember, there are always people that love you – they’ll help you get through this together.

If there’s any comfort in this, there are ethical hackers cum Youtubers like Scammer Payback and Scambaiter that are returning the ‘favor’ to the scammers – letting them taste their own medicine. We certainly need more people like them.

I hope this guide is helpful and lastly, screw the scammers, and may they die in pain.

If you find this post useful, consider subscribing to my FREE weekly personal finance & investing newsletter!

Disclaimers

This guide is produced with my own best effort and research.

Always refer to the official guideline from your bank and official Bank Negara Malaysia (or your respective central banks for my fellow foreign readers) for the latest scam prevention info.

[Sponsored Post] Versa Invest Review: Designed to beat the market!

If you are looking for a better savings alternative to Fixed Deposit (FD), Versa Cash from Versa is an excellent cash management solution that I reviewed last year.

Since then, Versa Cash has been my go-to app to store my savings.

This year, Versa has introduced Versa Invest – the latest investment solution designed to beat the market!

What do I mean by beating the market - or rather, how? In this review, let’s find out more about Versa Invest!

p

What is Versa Invest + Safety of funds

Versa Invest is a new investment solution within the Versa app that offers users diverse access to top funds globally with just a single investment.

Versa Invest is a partnership between Versa and Affin Hwang Asset Management (AM). In other words, all Versa Invest portfolios are designed & managed by the fund managers from Affin Hwang AM.

As a result, you can manage both your savings (via Versa Cash) and investments (via Versa Invest) in just a single app within Versa.

Regulation & Safety of funds

As a company that provides financial services, Versa is regulated by the Securities Commission of Malaysia. This ensures that Versa operates under the guideline of the authority.

Meanwhile, your funds are held in a separate trust account in CIMB Commerce Trustee Bhd. for Versa Invest. This protects you from the unlikely event that Versa goes bankrupt, as customers' funds are unmingled with Versa.

For the most updated product & regulation info, please visit Versa Invest and Versa Cash's product pages.

Highlights of Versa Invest

#1 Versa Invest is designed to beat the market

In my opinion, the main highlight of Versa Invest is that it is positioned to ‘beat the market’.

How so? What makes Versa Invest different from all the existing robo-advisors?

To start with, Versa Invest’s portfolios are designed to be actively managed.

Meaning, depending on market conditions, Versa Invest (through Affin Hwang AM) can deploy users’ money in a combination of active and passive global funds.

Some of these funds include global funds from Vanguard, Blackrock, and Affin Hwang’s very own funds.

In other words, Versa Invest has the flexibility & diversity to invest in active funds when they are well-positioned to beat the market, while shifting to passive funds (eg. The S&P500 ETF) when the market favors them.

This investing approach separates Versa Invest from other robo-advisors in the market that generally only invest in passively managed ETFs.

#2 Gain exposure to premium funds at an affordable fee

Another benefit of investing in Versa Invest compared to typical unit trust is its relatively low fees to gain exposure to premium global funds.

As a user, you do not pay any fees to Versa while investing via Versa Invest. Instead, you only pay fees to fund managers:

You do not need to fork additional money to pay for these fees as they are charged on your invested amount (or Net Asset Value, NAV) monthly.

What’s amazing is unlike other unit trusts, there are no sales and withdrawal fees. This means all your investments are 100% invested to maximize your returns.

| Annual Management Fee | 1% per annum |

| Sales Charge | 0% |

| Redemption Fee | 0% |

| Trustee Fee | 0.04% per annum |

#3 Low barrier of entry to premium funds globally

Unlike conventional unit trust with a high barrier of entry from RM1,000 to RM10,000, Versa Invest makes it easy for users to gain exposure to premium global funds.

In this case, the minimum investment amount for Versa Invest is just RM100. This makes it easy to invest in a diversified global portfolio even if you are starting with a small capital.

#4 Hedge against currency fluctuation

Worried about currency fluctuation while investing globally?

To reduce currency risk, Versa Invest uses derivatives such as forward contracts & swaps to manage fluctuations in the exchange rate.

In other words, you can invest with peace of mind knowing that you have minimal exposure to currency fluctuations!

3 Different Versa Invest portfolios

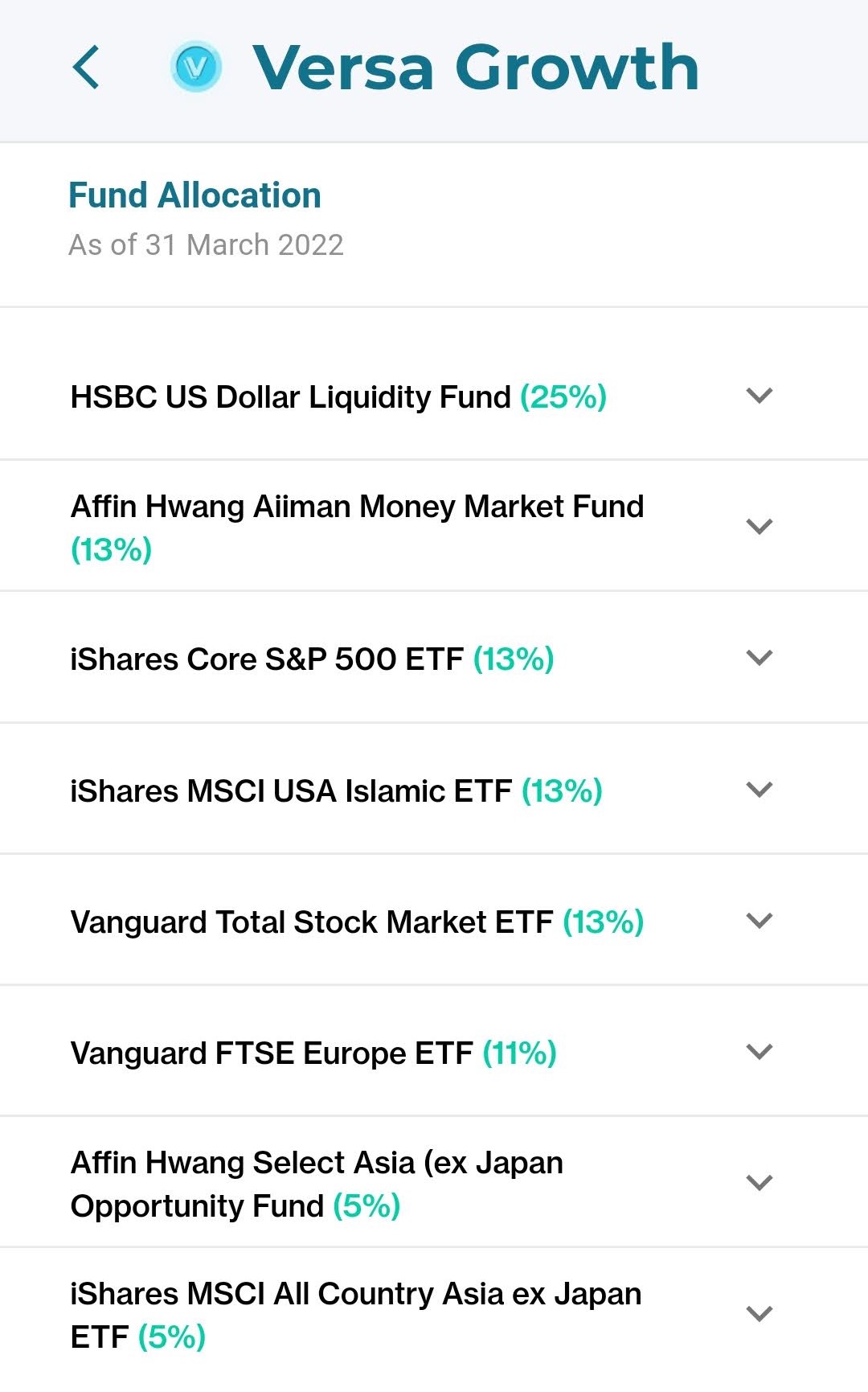

There are 3 portfolios within Versa Invest for users of different risk preferences.

i. Versa Growth

Versa Growth is crafted for higher returns over the long term – suitable if you have a higher risk tolerance.

For time being, Versa Growth’s portfolio is mainly made up of equities (60%), followed by bonds (38%), and cash (2%).

Through Versa’s back-tested data, Versa Growth recorded an average annual return of 15.7% over the past 3 years.

For your reference, I compare the returns between the stock market (S&P500) relative to Versa Growth from 2019 to 2021 in the table below:

| Returns | S&P 500 (Total return) | Versa Growth (Back-tested return) |

| 2021 | 28.71% | 77% |

| 2020 | 18.40% | 56.3% |

| 2019 | 31.49% | 14.5% |

Feel free to find out more about Versa Growth HERE.

[Important] Past returns and back-tested data are NOT indicative of future returns.

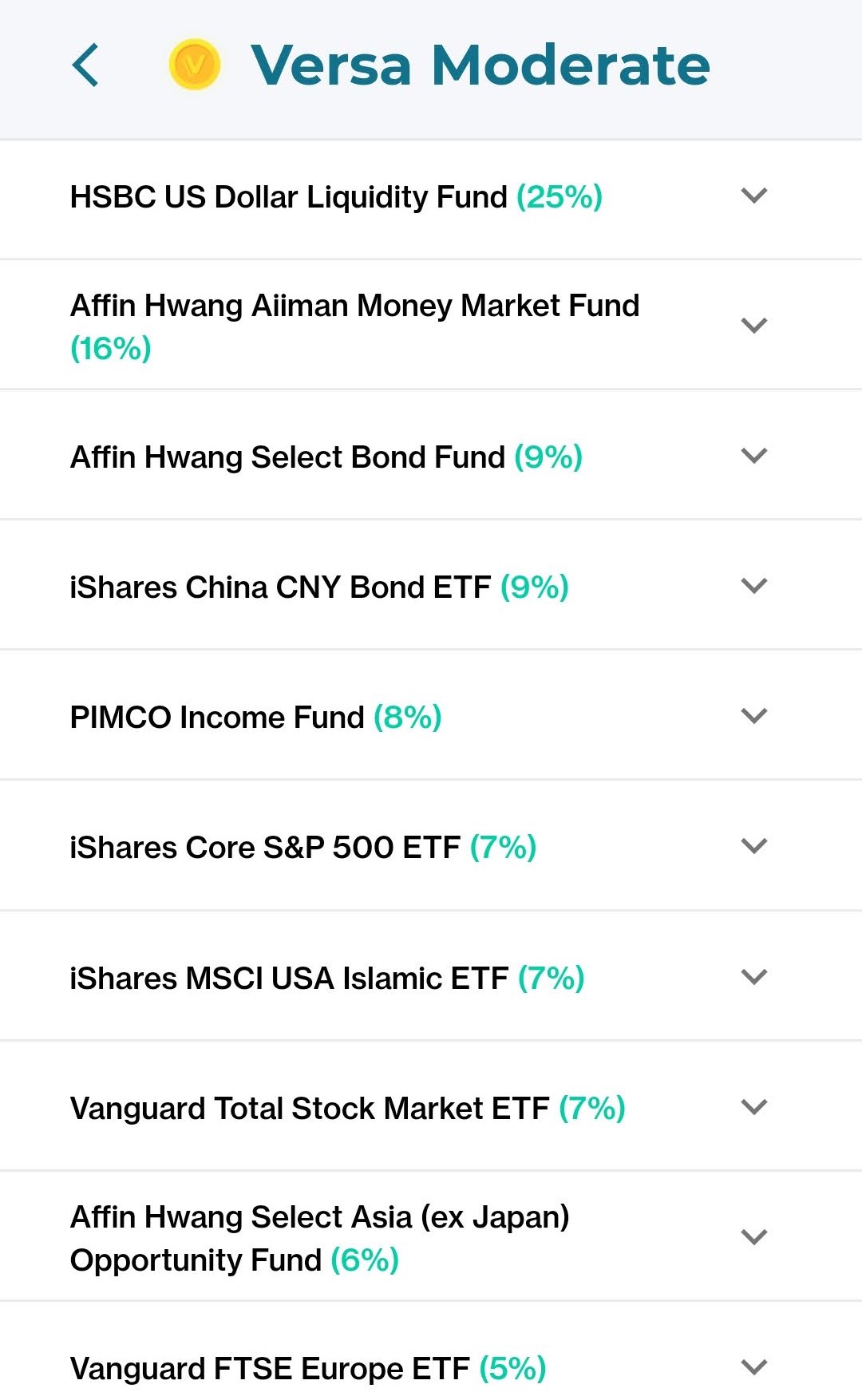

ii. Versa Moderate

Versa Moderate is designed for users looking for a more stable growth with smaller swings. It is suitable if you desire a more stable (hence less aggressive) returns on your investments.

Versa Moderate portfolio is mainly made up of bonds (67%), followed by equities (32%), and cash (1%).

In Versa’s back-tested data, Versa Moderate recorded an average annual return of 9.1% over the past 3 years.

For your reference, I compare the returns between the stock market (S&P500) relative to Versa Moderate from 2019 to 2021 in the table below:

| Returns | S&P 500 (Total return) | Versa Moderate (Back-tested return) |

| 2021 | 28.71% | 41.3% |

| 2020 | 18.40% | 26% |

| 2019 | 31.49% | 11.3% |

Feel free to find out more about Versa Moderate HERE.

[Important] Past returns and back-tested data are NOT indicative of future returns.

iii. Versa Conservative

Versa Conservative, I believe, is for users with a smaller tolerance for up and down swings. As of this writing, it has not been launched – I’ll be sure to update this section when it is up!

My personal thoughts on Versa Invest

#1 I love the ease to save and invest within the Versa app itself

I think the beauty of innovative financial products is their ability to make users’ financial life easier and seamless.

Through the Versa app, users can save and get rates on par with FD with Versa Cash, while investing for higher returns via Versa Invest.

If you are looking to manage your savings and investments in a place, Versa is a great choice.

And did I mention that I really enjoy the user interface (UI) of the Versa app?

Point of improvement: I hope to see Versa integrate an auto-debit feature where I can automate my investments from Versa Cash to Versa Invest on a periodic (eg. monthly) basis.

#2 Can Versa Invest outperform the market in the long run?

Personally, I think it is fresh and bold that Versa Invest is introduced as an investment solution positioned to beat the market.

It shows that the team behind Versa must be confident in Versa Invest to deliver massive value to users. Indeed, the back-tested data from 2019 – 2021 has shown that Versa Invest did outperform the market.

However, can the outperformance be replicated in reality – over a long-term horizon?

I think only time can tell if Versa Invest can withstand the test of time and the market.

Things you need to know + Risk of investing via Versa Invest

Here are 2 things you need to know before you start using Versa Invest:

- Versa Invest is not Shariah-compliant.

- Similar to any form of investment, expect market volatility while investing via Versa Invest.

If you are okay with larger swings in your portfolio, Versa Growth is a good choice.

Meanwhile, if you cannot withstand large swings in your portfolio, it’s best to try out the Versa Moderate portfolio instead.

That said, don't worry as you’ll go through a risk assessment process during registration where you answer a few simple questions – and Versa will suggest the best portfolio for you!

Exclusive Versa Invest & Versa Cash Promo Code: VERSANML4

In collaboration with Versa, No Money Lah is bringing an exclusive deal for new users that are keen to start saving or investing with Versa!

Use my dedicated Versa referral code – VERSANML4, and you will get RM10 credited into your account* when you successfully make a minimum deposit of RM100 or more. That’s an instant 10% return on your investment.

Open Your Versa Account HERE.

Sign Up for a Versa account today!

How to start investing via Versa Invest?

- New Versa Users: Install the Versa app at Google Playstore or Apple Appstore and create an account.

- Existing Versa Cash Users: Update your Versa app to the latest version. Then, activate the Versa Invest feature by clicking on the 'Invest Now' button in the app.

Sign Up for a Versa account today!

Side Note: Use Versa Cash as a low-risk alternative to Fixed Deposits (FD)!

Are you looking for a savings alternative to Fixed Deposits, or prefer a (very) low-risk approach to store your funds?

If that's the case, you can consider using Versa Cash, which gives you a projected return of 2.50% annually!

Find out more about my review on Versa Cash HERE.

Disclaimers

This article is brought to you in collaboration with Versa. For the most updated info, please visit Versa Invest and Versa Cash's product page.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

Delayed Gratification

When I was 9, I came across my first most desired ‘big purchase’ as a boy – THE Nintendo Gameboy.

Vividly, I remember stopping by every game store, staring at the super cool Gameboy behind the glass cupboard every time when me and family were out in the mall.

The thing is, my dad didn’t buy me the GameBoy at 9, nor when I was 10 (or 11).

Instead, he made me save for it.

So, everyday for the next few years, I saved up at least 50% (or more) of my daily lunch money of RM2.

Instead of buying the delicious fried chicken and Vitagen like most of my schoolmates would do, I’d just stick with the bread that I brought from home daily.

When my friends were playing the latest Pokemon (it was Pokemon Red, I think), I would sit by their side to watch them play (#envy).

It was definitely not fun.

But by 12, I’ve saved up something close to 200 bucks (if I recall correctly) – which was a huge amount for me as a boy (and enough for the Gameboy, I guess?).

Funnily enough, that was the UPSR year (the ultimate exam for secondary school entrance) – and I managed to get 6As (out of 7).

So finally, after 4 long years, at 12 (towards the end of the year), my dad actually got me the Gameboy as a reward – and I get to keep my hard-earned (big) savings.

4 years is certainly a long wait for me as a kid.

But in hindsight, I think the most valuable thing I’ve gained is the ability to hold on to gratification better since I was a boy.

Not surprisingly, this has helped me a ton in my self-employment and personal finance journey:

- You don’t start a blog/Youtube channel/business and expect money to start pouring in the next day.

- You can’t invest for 1 year and expect the dividends to cover your living expenses.

- And surely, you won’t become a pro by trying to achieve too many things in one go.

As many good things in life come in a compounding manner, there will be a grind in the journey where it seems like nothing is progressing – even when you have put in all your effort (eg. Saving RM1 everyday for a Gameboy, or sitting through a bear market)

So – here’s my personal reflection:

Patience & effort may not always lead us to the most amazing things in life (wealth, health, relationships).

But patience & effort most certainly PRECEDE them to begin with.

Bear Market: Your Guide to Surviving the Bloodbath

It has not been a good time if you are investing in 2022.

As of Friday (13/5), the US stock market (ie. The S&P500 index) is down by over 16% from all-time highs. Meanwhile, the tech-focused Nasdaq 100 index is down by about 25% from its high.

Personally, my growth-focused Exchange-Traded Fund (ETF) portfolio dropped over 14% in the past 3 months.

In addition, a portion of my dividend-focused ETFs in the Freedom Fund has shed about 14% in value so far:

Seeing my investments down to this extent is not pleasant, but it is not the end of the world either.

Seeing my investments down to this extent is not pleasant, but it is not the end of the world either.

In this post, I want to share with you several important insights on the stock market – and hopefully, this will boost your confidence to stay the course in this long game!

If you like this post, consider subscribing to my FREE weekly newsletter where I'll share all things I learn about personal finance & investment with you!

p

#1 A bear market is not forever

Technically, a bear market is described as a market dropping over 20% from the all-time high.

While we are not there yet for the S&P500 index, I think we are close enough for me to call a bear market right now.

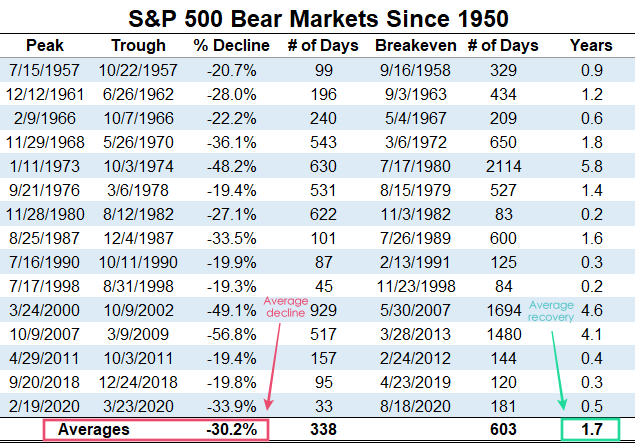

I can’t tell for sure how long a bear market will last – but they do come to an end eventually. Let’s take a look at the history:

Over the 15 bear markets in the past, the average decline was about 30%, where the market generally took under a year to reach the bottom.

The recovery from the bottom? On average, a little more than 1 ½ year.

- That said, the last 3 bears recovered relatively quickly.

- 8 out of the 15 bears recovered within a year.

- The worst bears were in 1973-1974, 2000-2002, and 2007-2009 which all took more than 4 years to recover.

I’m not certain how this one will play out – but as you can see, the market always recovers.

#2 Win by staying invested for the long term

For the last 95 years (1926 – Feb 2022), the US stock market (S&P500 index) has produced an average of 10 – 11% annually.

In fact, there has never been a 20-year period in the market where it is down on a nominal basis:

In other words, if you have a long-term time horizon, you are almost certainly going to see gains with your investments.

In other words, if you have a long-term time horizon, you are almost certainly going to see gains with your investments.

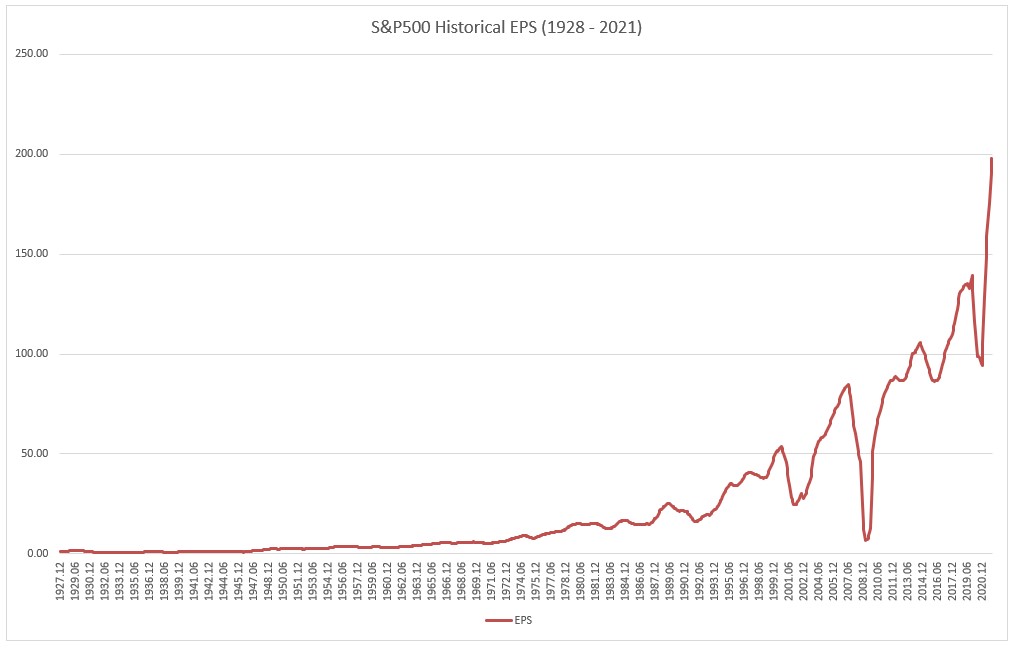

#3 Why does the market go up in the long run?

Why does the stock market go up in the long run?

One of the biggest reasons is because the economy grows and companies earn more money.

In the 1920s, the earnings per share (EPS) for the S&P 500 was $1.11 while companies paid out $0.78 per share in dividends.

By the end of 2021, those numbers were $197.87 and $60.40 respectively.

Simply put, over the past 90+ years, earnings on the US stock market have grown by 6% annually, while dividends have grown 5% per year.

When you invest in the stock market, you are investing your money in assets that produce income on your behalf. This means you get to participate in the growth and innovations that come with it.

My Bear Market Survival Guide

If you are feeling miserable from this bear market, hopefully what you’ve read so far can give you a big picture perspective on your investing journey.

Below are 3 things that I’m personally practicing in this bear market:

#1 Stick to a long-term investment routine

Having an investment routine helps especially in times of chaos.

Since I cannot predict when a bear market will end, I will continue sticking to my investment routine (ie. Dollar Cost Average X amount monthly) knowing that I will be buying income-producing assets at a discount.

Remember, the market favors those who stay on course in the long run.

#2 Never invest the money you need in order to gain something you want

This is so important:

Avoid investing in such a way that your ability to put food on the table depends on the returns of your investments in the coming month:

- We cannot tell when a bear market will end.

- A new low can go lower!

- A bear market may lead to a recession - don't use the money you saved up for rainy days to invest!

#3 I will not let my investment performance affect how I look at myself

Your life is not defined by your investments. Neither is net worth because it is a poor definition of success in life.

Reflect and find meaning in your life outside of your portfolio. Eating and living healthier is a good place to start.

Useful Resources & Guide

- How to invest in the S&P500 index as a non-US resident.

- ETF investing guide - getting started!

- Learn dividend investing

Disclaimers

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

[Sponsored Post] How to invest during high inflation? (with data & evidence)

Inflation is hitting us hard in life.

If you have been spending on everyday goods, I’m sure you’d have noticed that things are getting (a lot) more expensive.

As an example, in January, the average price of chicken in Malaysia rose by 13.6% from RM8.40/kg to RM9.54/kg compared to a year before. Furthermore, eggs and milk prices also went up by 13.5% and 3% respectively not too long ago.

Heck, my favorite chicken rice now costs 50 cents more.

Unfortunately, this is not an illusion.

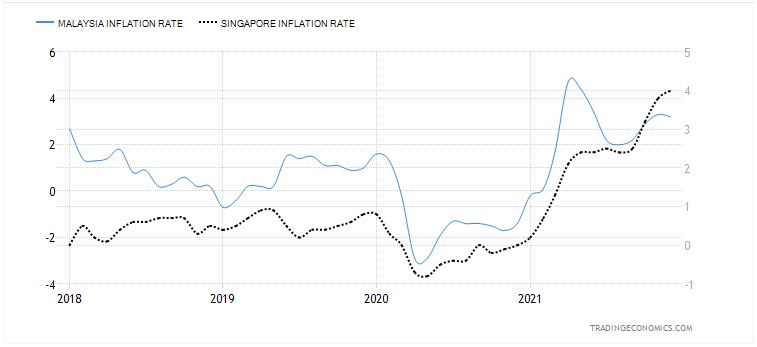

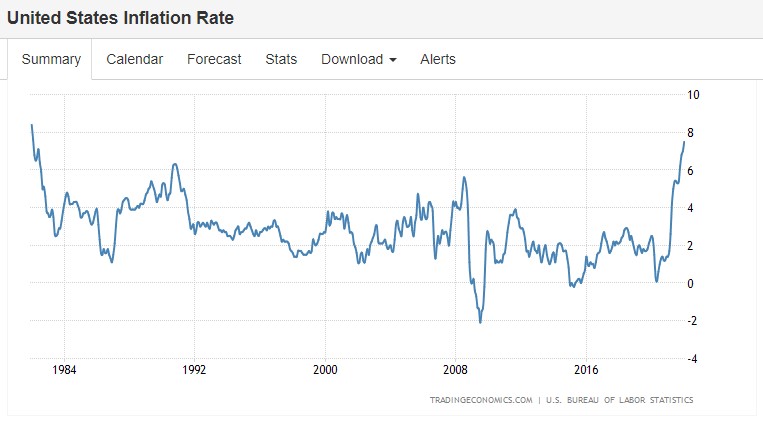

- In Malaysia and Singapore, we are experiencing the highest inflation in 4 years since 2018.

- Even crazier, the US recorded an inflation rate of 7.5%, the highest since 1982.

Isn’t this mad, given how our income hasn’t been able to keep up with inflation at all?

For sure, inflation will erode the value of our cash. So, the BIG question now is: how should we invest during periods of high inflation?

Let’s dive into the data – I am confident you’ll find it useful!

p

A note before we start

Before we start, do note that I’ll be using data from the US because:

- The US is the largest market in the world, anything big that happens in the US creates ripples globally. These data will give us a good representation of what to expect.

- It is very hard to gather long-term data on various asset classes in Malaysia… so yeah.

Which asset classes perform best during inflation?

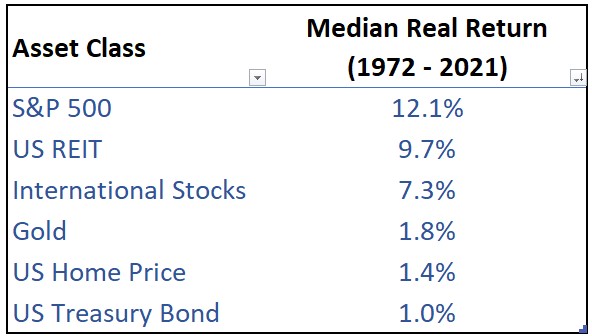

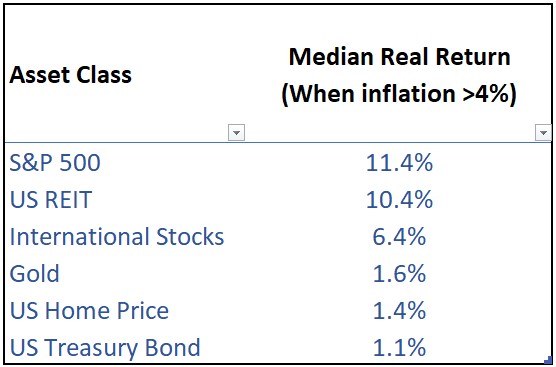

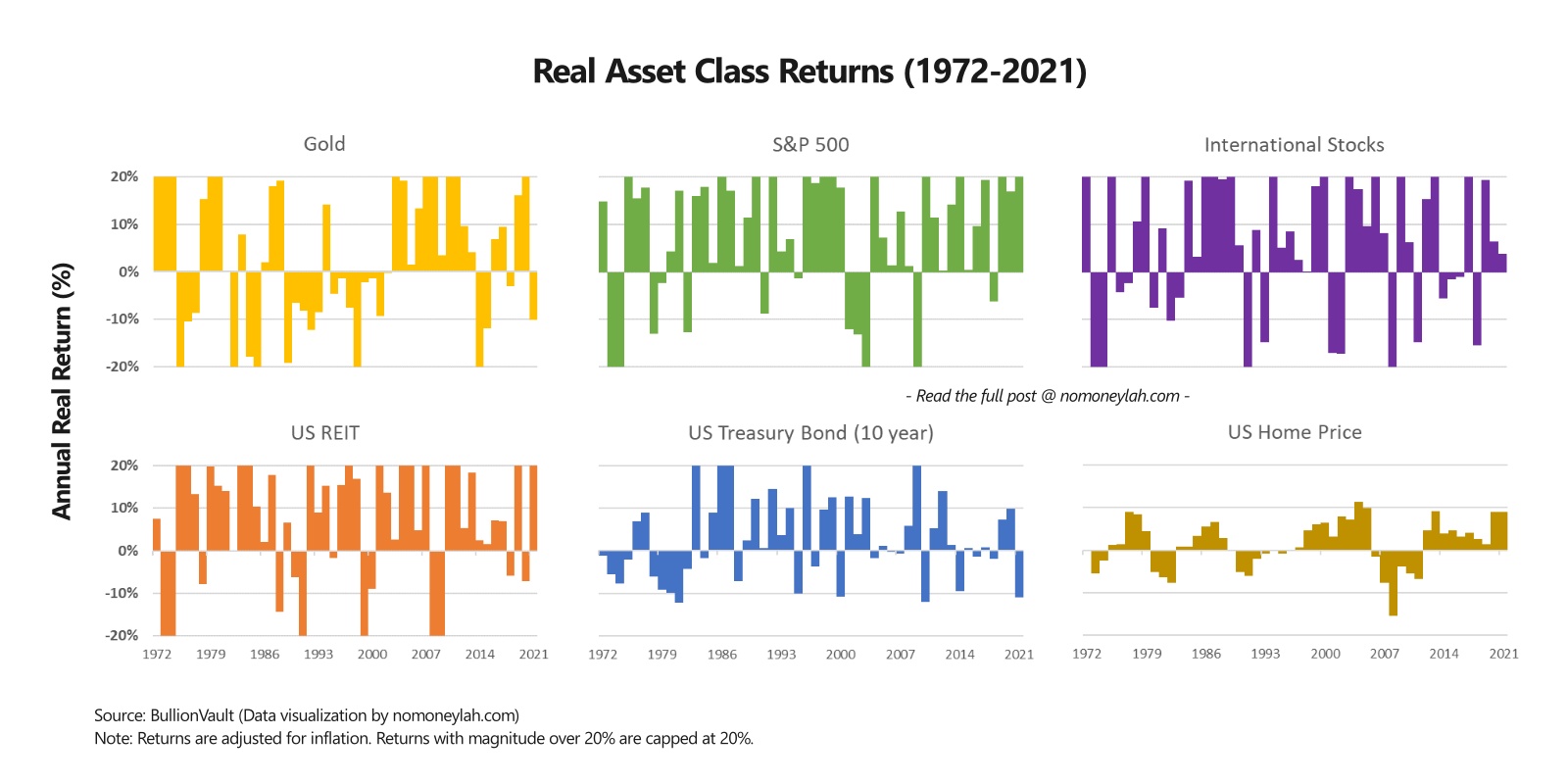

To begin, let’s look at the inflation-adjusted (‘real’) annual returns of 6 different asset classes from 1972 to 2021.

To ensure that you can visualize the performance of these assets, I’ve capped all returns at 20% (-20%):

Here are several key takeaways from the chart above:

- Firstly, you may notice is certain assets are more volatile (Gold, S&P500, International Stocks, REITs) than others (US Treasury Bond, US home price).

- Moreover, asset classes with higher volatility tend to achieve higher real returns compared to assets with low volatility. You can observe this clearer in the table below, where I summarize the median real return of all 6 asset classes from 1972 to 2021:

- As you can see, equities (S&P500, International stocks) and REITs come in top, followed by gold, and ending with US Treasury Bond, and US home prices.

The interesting thing about this table is gold. Despite the huge volatility of gold (big swings up & down), it produced a subpar real return. Even if we use average real return (instead of median), gold still failed to outperform equities and REITs. In other words, this tends to go against the assumption that gold is a superior hedge against inflation.

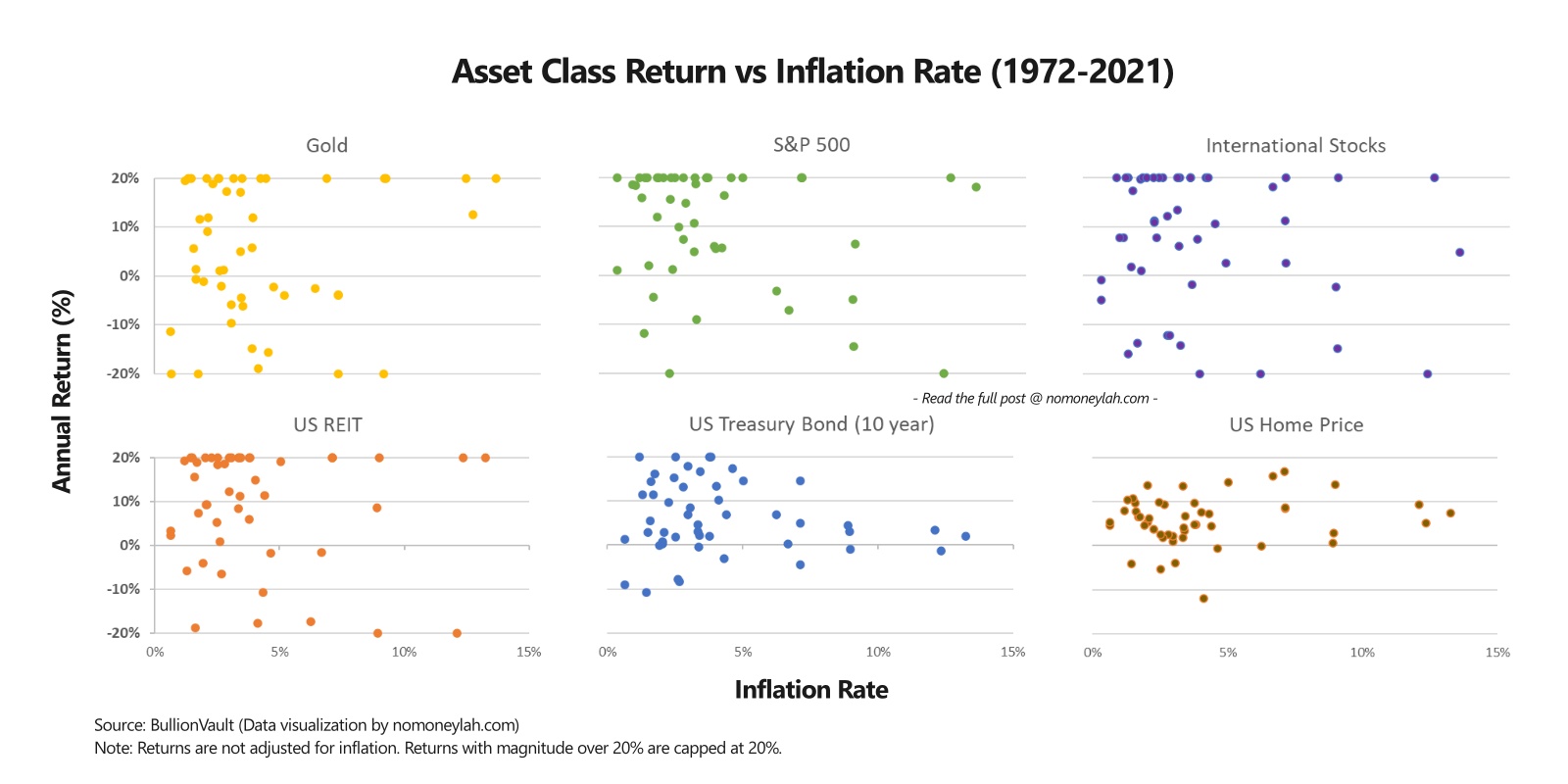

To dive further, I plot the non-inflation-adjusted returns of all 6 asset classes against the inflation rate from 1972 to 2021:

As you can see, the assets that performed the best against inflation (especially when it is higher), are also those that tend to be more volatile (S&P500, International stocks, REITs, gold).

That said, volatility is just part of the story here. Reason being, if we filter the returns to only include years where inflation exceeds 4% (1973 to 1982, 1985, 1988 to 1991, 2008, 2021), gold still fails to impress:

In other words, gold might not be a superior inflation hedge as many assumed it’d be.

What should an investor do during high inflation?

So, what should most investors do when inflation is rising?

According to data: Buy equities, REITs, or physical real estate.

From what we've seen so far, we can interpret that equities (S&P500, International stocks), and real estate (REITs, housing) tend to preserve their value, even during periods of high inflation.

- In a way, this makes sense because these equities, REITs, and real estate are all based on monetary payments made to businesses or landowners. Hence, when payments go up during inflation, the value of these assets should go up as well.

- Generally, businesses are able to preserve their value during inflation as they can pass on inflation (through higher prices) to customers (that’s us, lol). This may not be true for all businesses, but inflation isn’t as scary for stocks as you might have thought it’d be.

- As for investment in physical properties, if your mortgage is FIXED instead of floating, then you are in a good place to be a debtor during high inflation periods.

- Why? Because with inflation, the value of your fixed payment (eg. RM2000/month) will shrink in real terms (a.k.a. when adjusted for inflation) with time. Again, FIXED mortgage payment, not floating.

In comparison, assets that offer fixed payments to investors (eg. Bonds) tend to underperform during high inflation periods.

- With inflation, the value of each fixed payment eroded, which impact the overall value of bonds as well.

Is Crypto a good hedge against inflation?

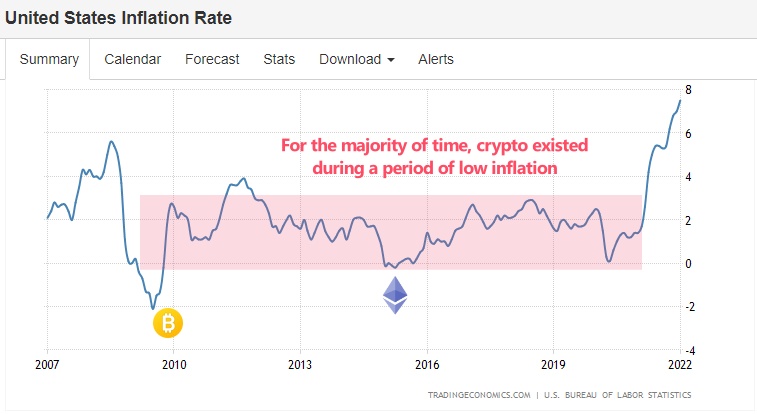

So, are cryptocurrencies like Bitcoin, Ether (ETH), and Ripple (XRP) good hedge against inflation?

To be honest, we have no clue due to a lack of data. Since cryptocurrencies only existed mainly during times of low inflation (2009 onwards), it is hard to tell what they will do now that inflation is on the rise.

Since there is no historical reference on crypto, a good gauge for a crypto investor to ask is: Does the crypto provides value to the owners? If you think it provides value (yet it is still undervalued), and such value continues to rise, then it may have a chance to outperform inflation.

Verdict: The One Thing that Always Outperforms Inflation

Regardless of stocks, real estate, gold, or crypto, there is one thing that will always protect your wealth against inflation – own things that provide value to humans.

If you own things that people want, no matter what’s happening in the world, the assets you own will likely retain their value (and even better, grow in value).

Hence, the question that you should focus on and ask is: are you owning assets that provide value to people?

If you find this post insightful, consider subscribing to my FREE newsletter.

Useful Resources

If you find this post insightful, here are several useful resources to get you going:

- Guide: How to invest in the S&P500

- Guide: How to invest in Singapore REIT ETF for consistent dividends

- Guide: How to make $1,000/month in passive income via REIT investing

This post is sponsored by ProsperUs by CGS-CIMB.

Check out my full review on ProsperUs by CGS-CIMB HERE on how you can start your investment journey.

ProsperUs by CGS-CIMB is a regulated broker from Singapore that gives investors access to 30+ exchanges in more than 8 countries. (US, Hong Kong, China, Japan, UK, Singapore, Malaysia, Europe, and more!)

In addition, ProsperUs offers multiple instruments from stocks, ETFs, futures, options, Forex, and CFDs. This is great for investors looking to diversify across different asset classes.

Exclusive ProsperUs Referral Code – MONEY20

If you are thinking to give ProsperUs a try, here’s something exclusive to No Money Lah readers – you will not find this anywhere else!

From today till 30/6/2024, key in my exclusive promo code ‘MONEY20’ while you register, and get FREE cash credits up to SGD100 when you open a ProsperUs account:

Tier Initial funding within 30 days of account set up Trades Executed Cash Credits

1 Minimum SGD500 – SGD2,999 Minimum 3 trades executed SGD10

2 Minimum SGD3,000 – SGD14,999 Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD30 (Deposit SGD3000 or more + Min. trades fulfilled)

3 SGD15,000 or more

Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD100 (Deposit SGD15,000 or more + Min. trades fulfilled)

Click HERE to view the full T&C of this referral reward.

Open a ProsperUs Account Today!

Disclaimers

The assets mentioned in this post are represented by:

- US Stock Market: The S&P500 index

- Bonds: US 10-year Treasury Bond

- International Stocks: MSCI EAFE (Europe, African, Far East) Index

- REIT: FTSE NaREIT All REITs total return index

- US Home Price: S&P/Case-Shiller Home Price Series

- Gold

This article is brought to you in collaboration with ProsperUs by CGS-CIMB.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link.

CIMB Octosavers Account-i: Open a Malaysia savings account, 100% online!

Opening a savings account in Malaysia has always been a troublesome experience. At some point, you’ll have to visit the bank to activate your account and collect your debit card.

Luckily, that’s not the case anymore with CIMB OctoSavers Account-i, where we finally get a 100% digital online account-opening experience.

In this quick guide, let’s go through all you need to know about CIMB OctoSavers Account-i, and how to open an account online!

Highlights of CIMB Octosavers Account-i

CIMB OctoSavers Account-i was launched by CIMB Bank Bhd and CIMB Islamic Bank Bhd in August 2021. It is the bank's first all-digital Islamic savings account that comes together with the new CIMB OctoDebit MasterCard.

In other words, with CIMB OctoSavers Account-i, you do not need to visit a physical bank branch to open a savings account at all!

- Fully digital: Account opening & onboarding process of Octosavers Account-i are done entirely online, while the debit card will be mailed to customers.

- Annual fee waiver: No annual fees for Debit Card

- Eligibility: Malaysians 18-year-old and above with MyKad can open an account

- Protected by PIDM up to RM250,000

- Profit rates of 0.30% per annum for account balances above RM3,000

- Shariah-compliant

How to open a CIMB Octosavers Account-i for new CIMB customers:

[Update 17/2/2022: It seems like CIMB has reactivated the online account opening of CIMB Octosavers Account-i for non-CIMB customers (it was paused prior to this). Feel free to proceed and open your account online!]

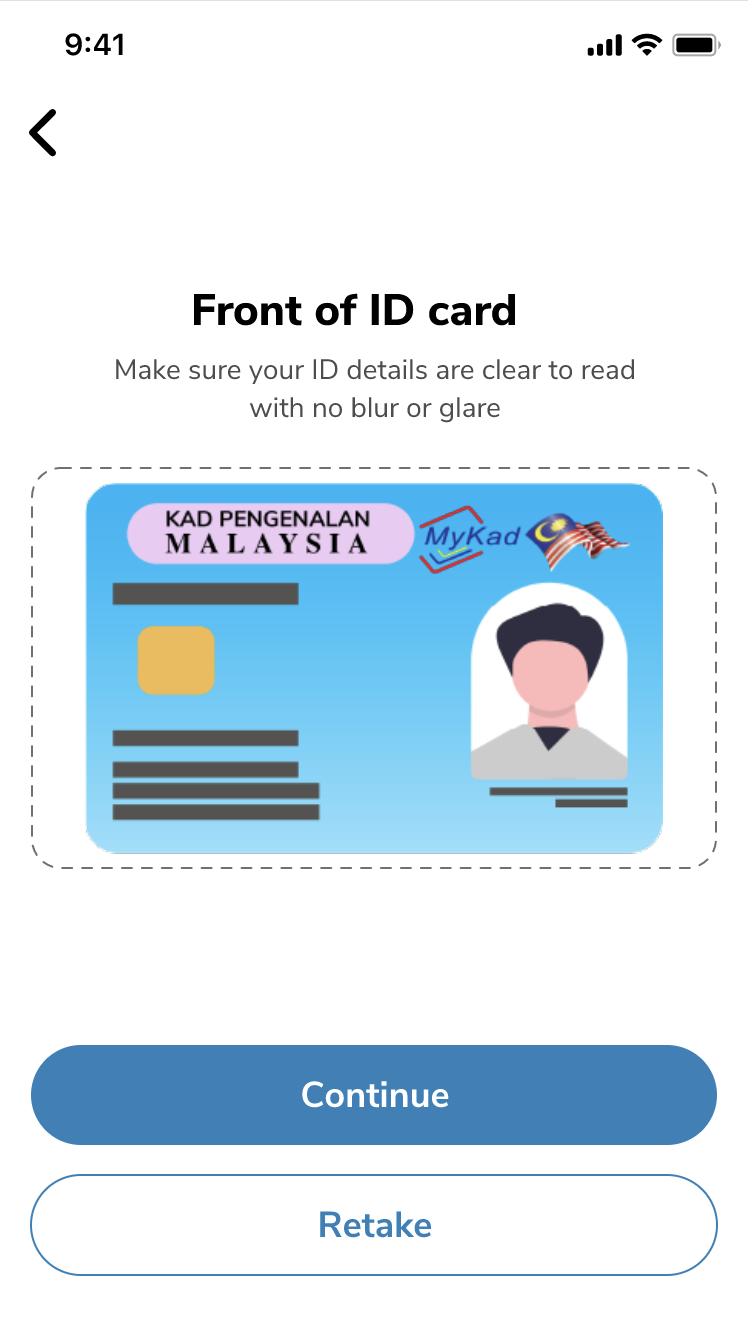

Step 1: Download the CIMB Apply app HERE

Step 2: Select ‘Open a new account and fill in your contact details

Step 3: Fill in the account opening application form

For identification purposes, you’ll be required to scan your IC and do a simple facial recognition process.

Aside from that, you need to provide personal details (eg. Address, employment details), which is a normal procedure for the application of most financial services.

Step 4: Transfer a minimum initial deposit of RM20

Please note that this RM20 transfer needs to be from another bank account under your own name.

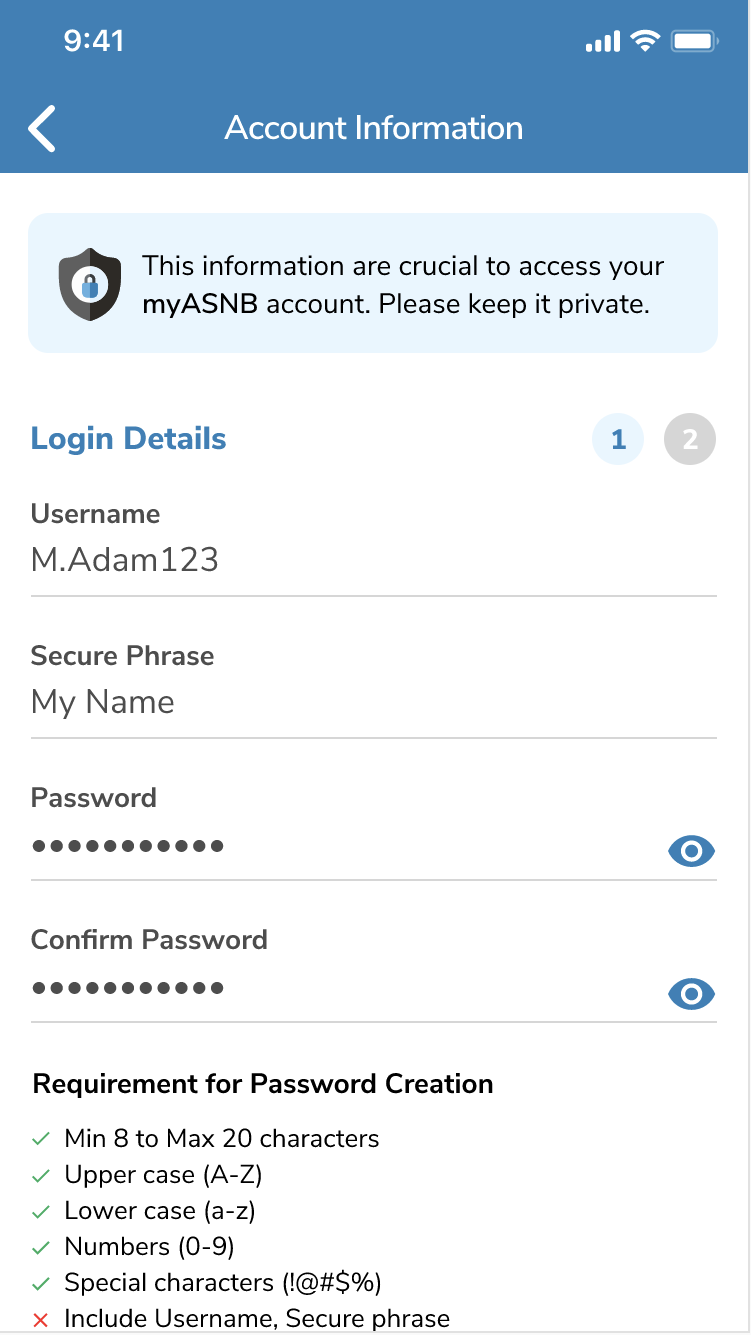

Step 5: Create your CIMB Clicks login credentials

CIMB Clicks is CIMB’s platform where you activate your OctoDebit Mastercard and manage your transactions to and from your savings account.

In this final step, you’ll need to create things such as your CIMB Clicks user ID and password.

Step 6: Successful account creation!

Once you have completed all the steps, you will have your CIMB OctoSavers account created. You will receive an SMS upon successful application.

Within 7 – 14 working days, your Octo Debit Mastercard will also be mailed to the mailing address that you filled in during the application process.

Until then, you will not be able to operate your new account as you’ll need to activate your debit card first.

How to activate Octo Debit Mastercard

Once you receive your Octo Debit Mastercard, it is time to activate your Debit Card.

- Step 1: Firstly, you must sign on the signature panel at the back of the Octo Debit Card

- Step 2: Download the CIMB Clicks app

- Step 3: Log in to CIMB Clicks using your Clicks ID and password

- Step 4: Click ‘Yes, activate now’ when you are prompted to activate your debit card. Or under ‘Current/Savings, click ‘Activate Card’

- Step 5: Enter the 16-digit number of the Octo Debit card

- Step 6: Create your 6-digit Debit Card PIN and re-enter your 6-digit Debit Card PIN.

- Step 7: Request and enter the TAC code sent to your mobile number via SMS

Once you are done with the steps above, you can now use your CIMB Octosavers Account-i for online transactions!

Link your Octo Debit MasterCard to savings account for ATM cash withdrawals

There could be times where you will need to withdraw cash from ATM. Before you do so, be sure to link your debit card to your CIMB Octosavers Account-i:

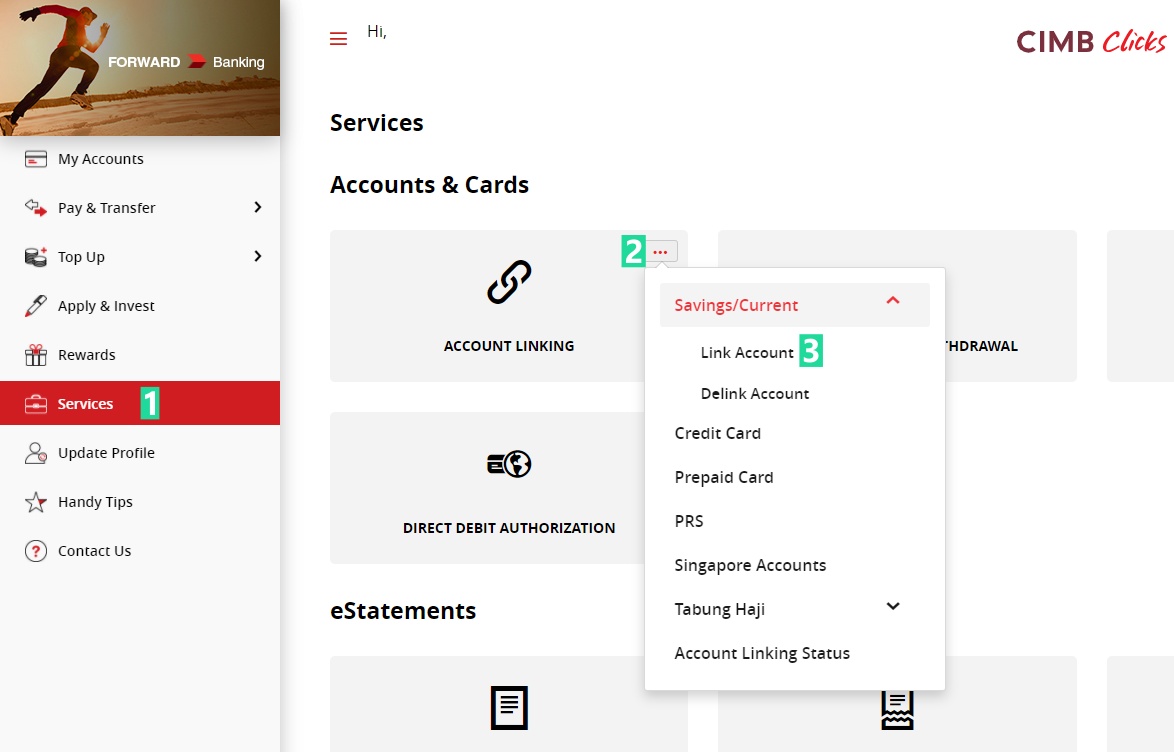

- Step 1: Log in to CIMB Clicks

- Step 2: Go to ‘Services’

- Step 3: Select ‘Account Linking’. Under ‘Savings/Current’, select ‘Link Account’

- Step 4: Select your CIMB Octosavers Account-i account and click the ‘Submit’ button

Truly 100% online account-opening experience for CIMB SG

In the past, for Malaysians to open a Singapore bank account via CIMB SG (the easiest way), you’d have to first have a CIMB Malaysia account. If not, you’ll have to visit a physical CIMB branch to activate your CIMB Malaysia account and collect your debit card.

Now, with the ability to open a CIMB Malaysia savings account online, you can complete all the processes at your own convenience at home!

READ: Step-by-step guide on how to open a Singapore bank account -100% online.

No Money Lah’s Verdict

Having to open a savings account online is a much-needed innovation in the financial services sector.

As such, I am glad to see CIMB stepping up its game to offer users a fully digital online account opening experience. I certainly hope to see other banks follow suit to offer a more digital experience within their services.

Meanwhile, do let me know your experience opening a CIMB Octosavers Account-i!

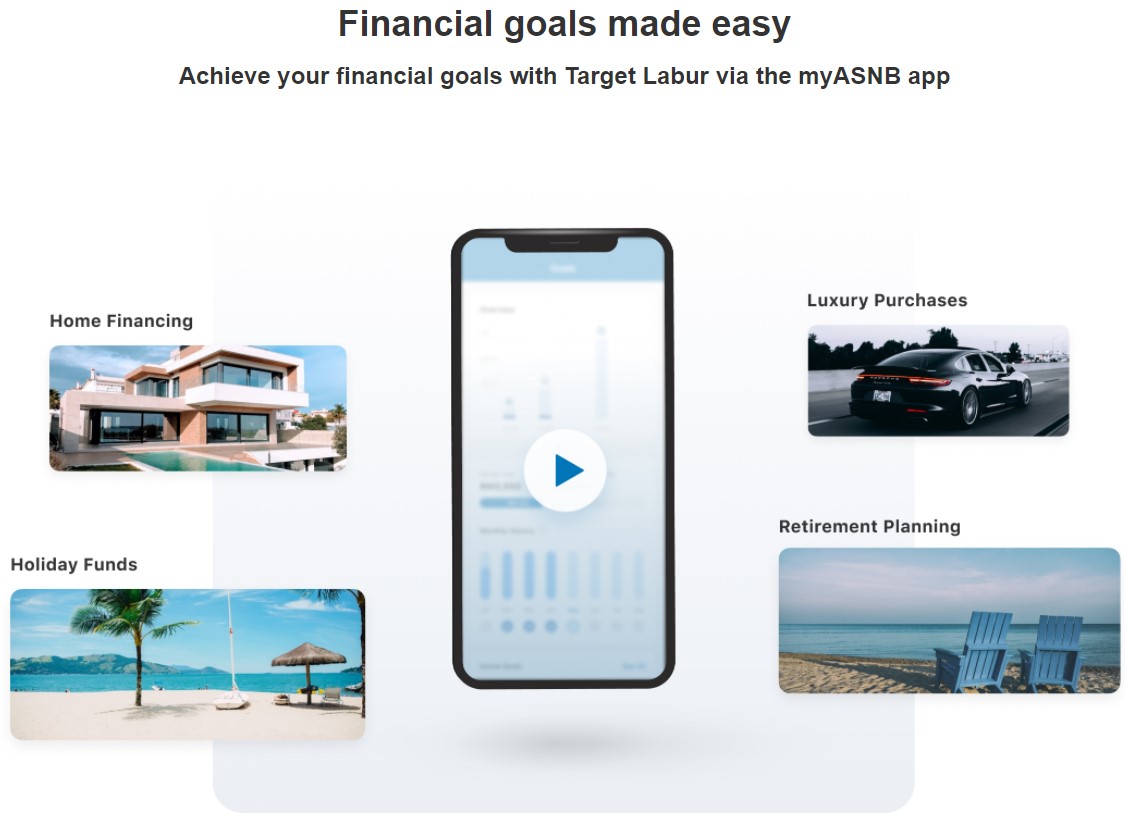

[Sponsored Post] How to use ASNB Target Labur to achieve your financial goals!

Do you have a financial goal in mind, and would like some form of accountability to help you achieve the goal?

If your answer is a YES, I think you will like the new Target Labur feature from ASNB!

RELATED READ: What is ASNB and how to invest in it?

p

What is Target Labur from ASNB?

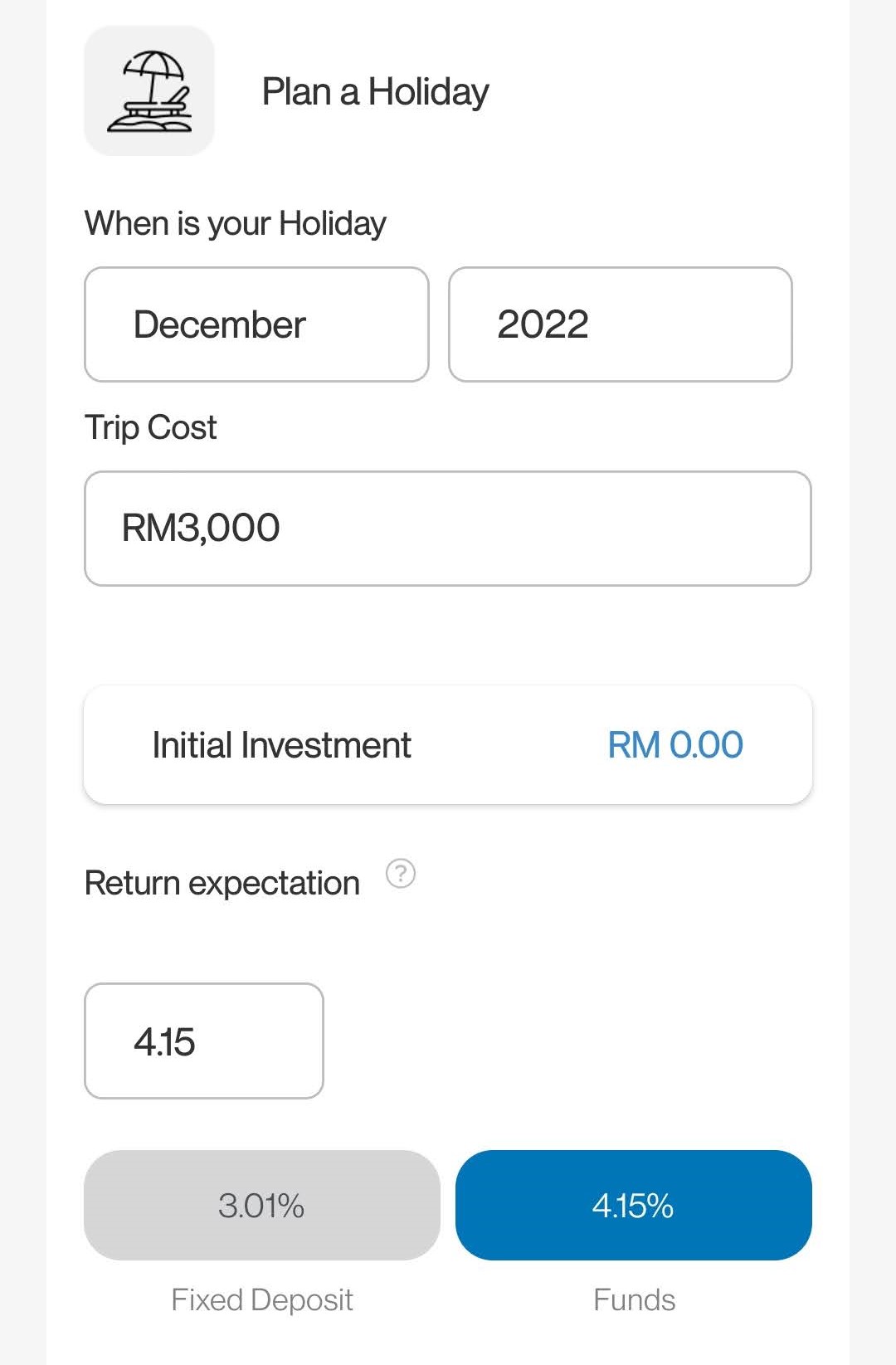

ASNB Target Labur is a goal-based investing feature within the myASNB app.

Through Target Labur, you can plan your financial goals, where you'll be given suggestions on how much to invest monthly in their goals.

In addition, you are able to track the progress of your goals easily with Target Labur to stay accountable to your goals.

Through Target Labur, ASNB aims to encourage more Malaysians to build healthier investing habits and achieve their financial goals.

How to use ASNB Target Labur?

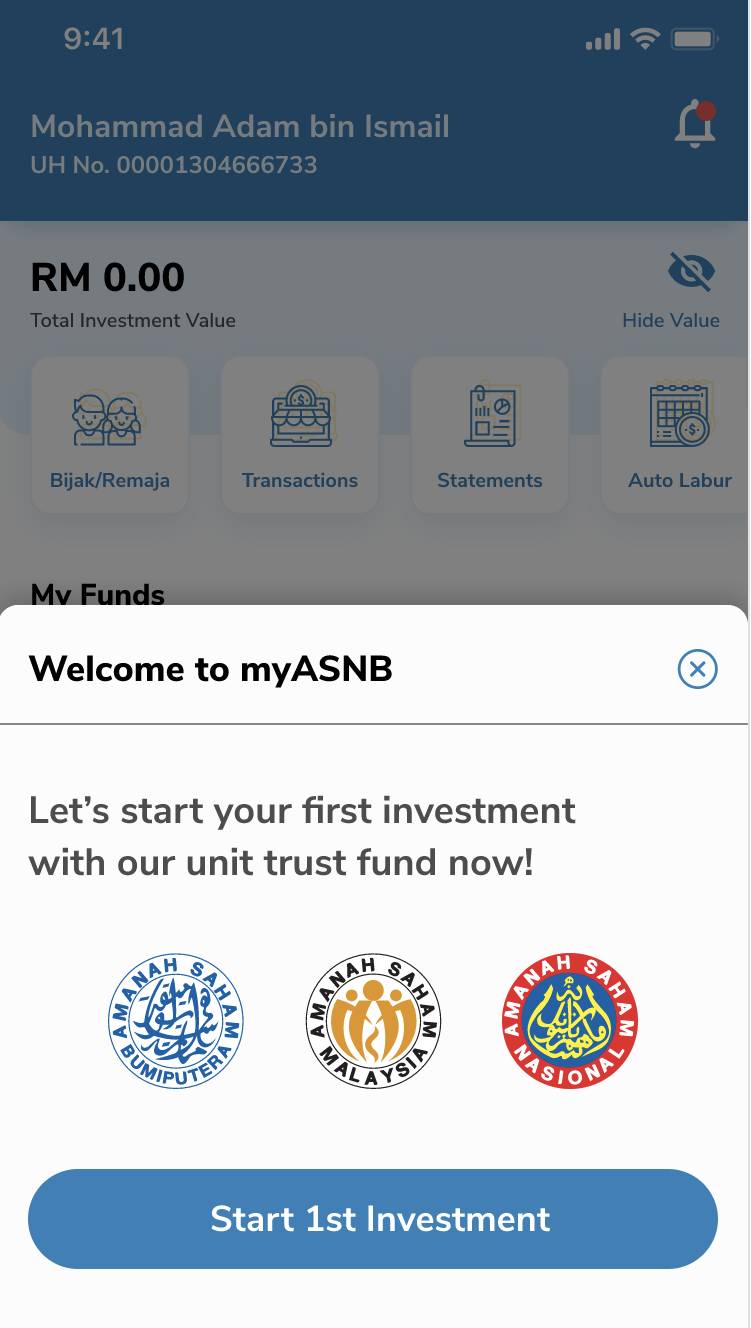

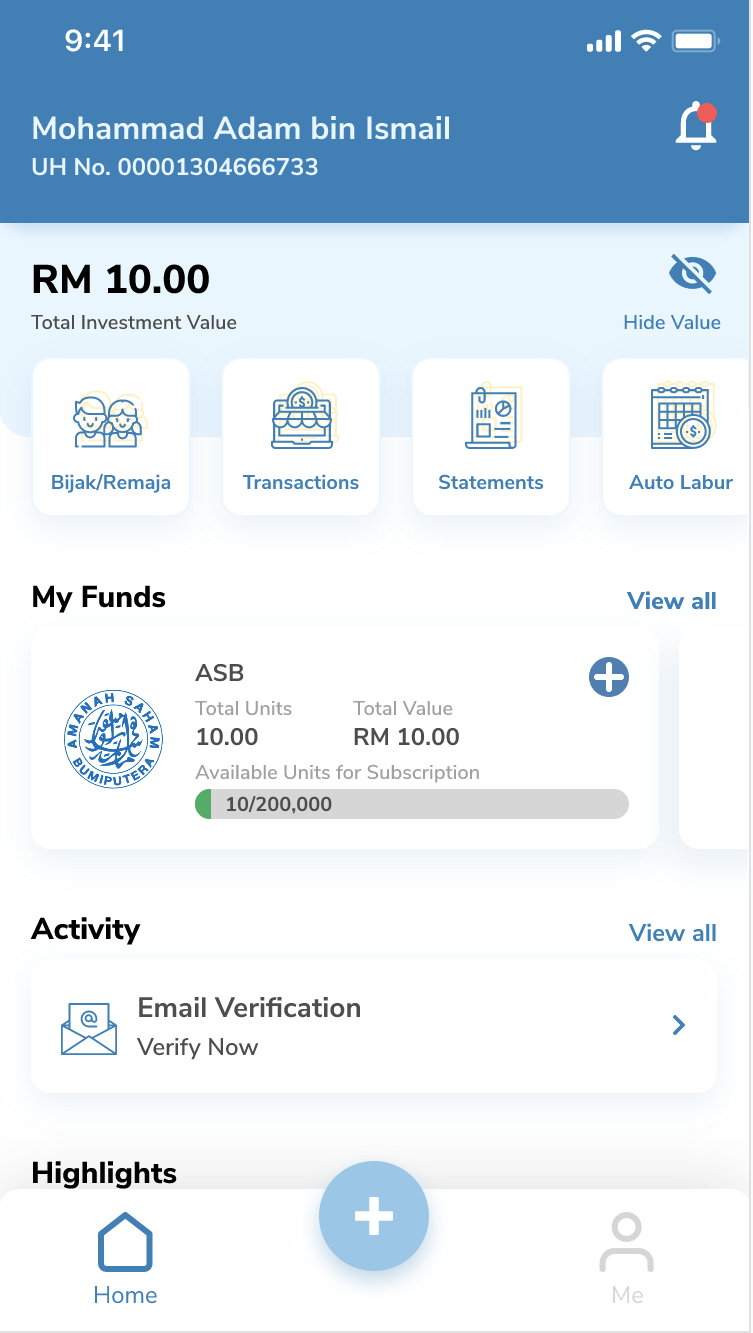

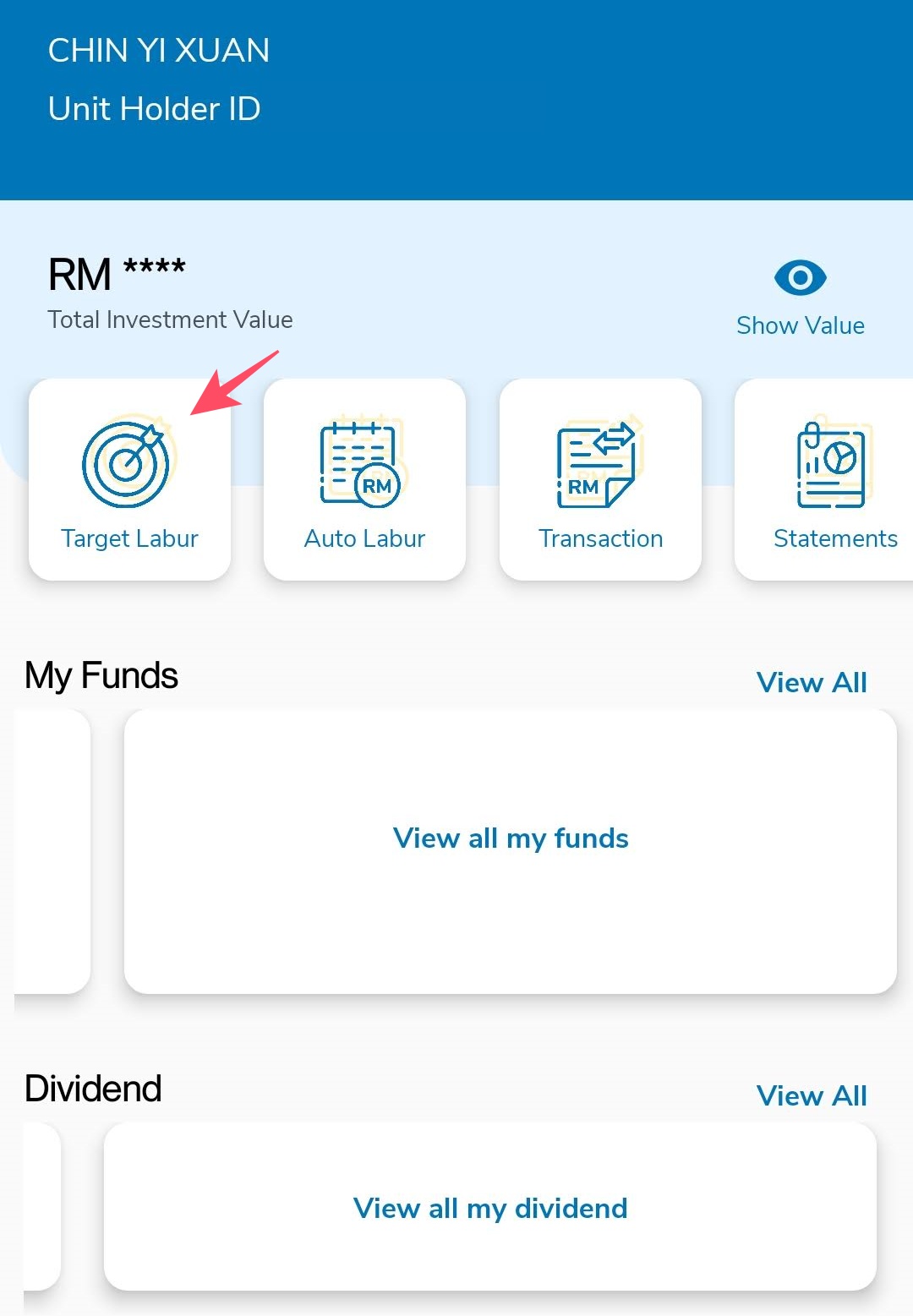

ASNB Target Labur is open to all investors of ASNB funds within the myASNB portal or app.

- If you are totally new to ASNB (ie. Have not purchased any ASNB fund before), proceed to download the myASNB app to open an ASNB account. Once you have opened an account and purchased your first ASNB fund, you will be able to use the Target Labur feature.

- If you are an existing ASNB investor that does not have a myASNB account yet, definitely download the myASNB app and complete a short e-KYC process. Once that is done, you will be able to access the Target Labur feature.

Next, let’s go through how to use the Target Labur feature:

Step 1: Click on Target Labur in your myASNB app

Step 2: Select a suggested goal, or feel free to create your own customized goal!

Step 3: Key in the target amount & date to achieve your goal.

Then, set a return expectation for your investments. Do note that this is only a reference, and does not serve as an indication of future returns.

Step 4: You will be given suggestions on how much to invest monthly based on your goals.

This suggestion is made based on certain key factors and assumptions. I highly recommend you to read them up by clicking on the ‘basis of calculation’ section.

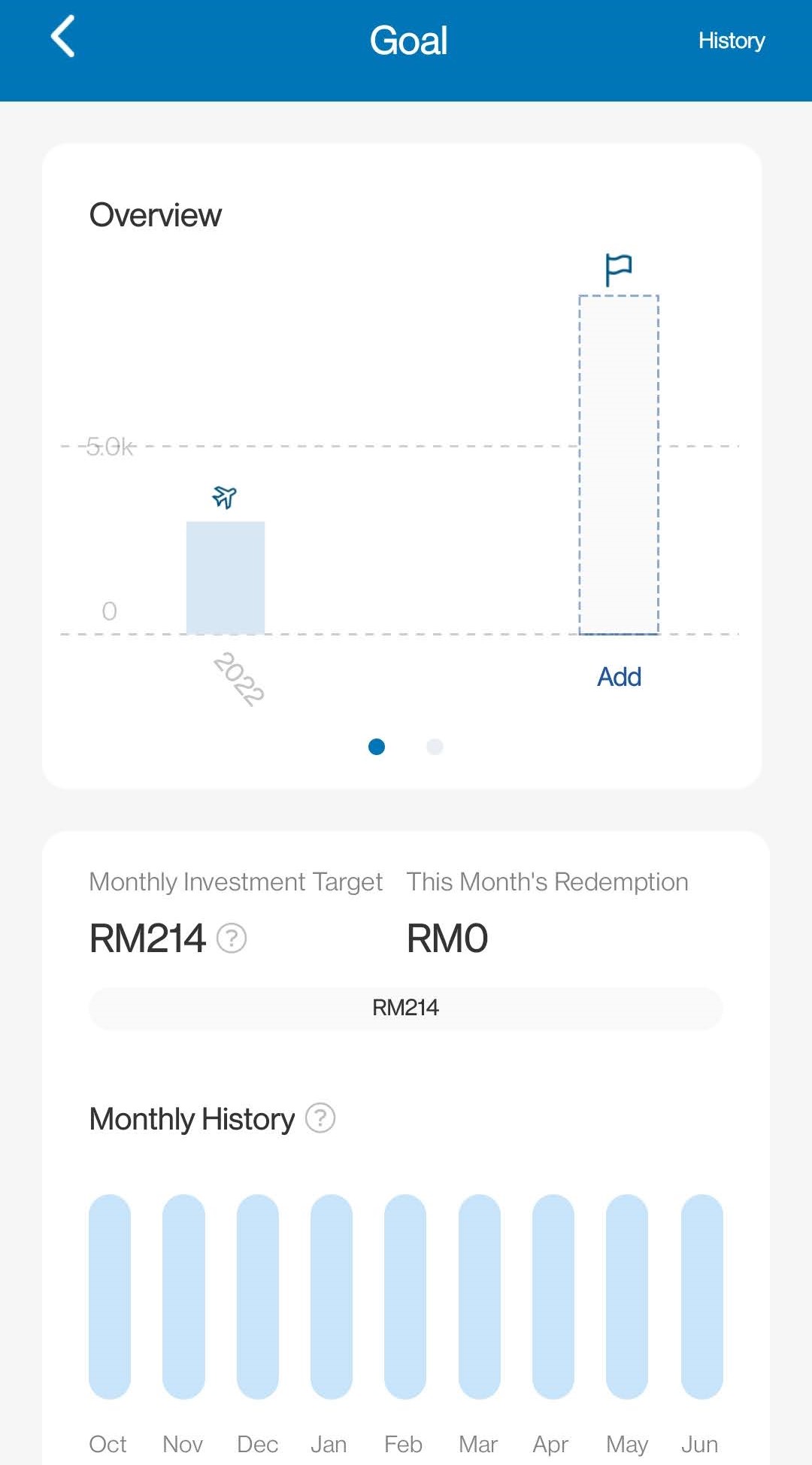

Step 5: Once you have started your goal, you will be able to track your progress easily through the myASNB app.

If you need a tutorial on ASNB Target Labur, definitely watch their tutorial HERE.

#JomLabur Campaign – Win attractive prizes through Target Labur!

Looking to start achieving your financial goals with ASNB Target Labur?

Now’s the best time to do so as you stand a chance to win attractive prizes worth up to RM200,000!

From 8th October 2021 to 31st March 2022, ASNB is running a #JomLabur campaign to encourage Malaysians to use the Target Labur feature in the myASNB app.

It’s really easy to participate in the #JomLabur campaign:

- Create 2 goals worth at least RM5,000 each via the Target Labur feature in the myASNB app.

- Winners will be randomly selected in accordance with the terms and conditions of this campaign.

You can learn more about the terms & conditions of the #JomLabur campaign HERE.

No Money Lah’s Verdict

ASNB has been a go-to investment for many Malaysians. With the introduction of the Target Labur feature, it’ll certainly help encourage a better investing habit among us all.

ASNB Target Labur FAQ

- Is it mandatory for ASNB investors to use the Target Labur feature?

Target Labur is a facility within the myASNB app aimed at encouraging healthy investment habits. It is not mandatory for myASNB app users or ASNB investors to use the Target Labur feature.

- Is there a limit on the number of goals you can create?

There is no limit to the number of goals a person can create, though the maximum target value per goal is fixed at RM100,000,000.

- Can I redeem the funds once it is allocated to Target Labur?

Allocation does not mean ‘locking in’ - you are in complete control of your funds and can redeem as necessary, in accordance with redemption policies.

- If I delete a goal in Target Labur, will I lose my investments allocated to it?

Deleting a goal does not impact your investments in ASNB products. Deleting a goal simply allocates it to general savings or allows you to allocate your investments to other goals.

Disclaimers:

Target Labur investing is only for the purpose of simulation, and should not be construed as investment advice or financial planning. This facility is designed to assist you in determining the appropriate monthly investment in order to achieve your financial targets.

ASNB is not responsible/liable and does not guarantee the accuracy of the figures calculated. The figures calculated are for illustration only and shall not be regarded as recommendations or solicitations towards the buying or selling of ASNB’s products. Investors are advised to read and understand the Electronic Prospectus(es) and its Supplementary Prospectus(es) (if any) as well as the Product Highlight Sheet prior to making any investment decision. If in doubt, please consult a professional advisor

[Sponsored Post] Guide: How to make $1,000/month passive income from dividends via REIT?

Having a reliable passive income in life is the financial goal of many people (including myself).

However, most passive income streams require a conscious effort to maintain. Rarely do we see passive income that is completely, well, passive.

One of those rare exceptions is dividends from investing. In my opinion, dividends are the closest thing to pure passive income that you can get in life.

Once your money is invested in companies that pay dividends, they work for you while you are sleeping, eating, and exercising. And you get paid income in the form of dividends – how amazing is that?

In this post, I want to explore the idea of making $1,000/month* of passive income in the form of dividends, via Real Estate Investment Trusts (REITs). (*In our respective home currency)

Is it possible to make $1,000 in passive income from dividends via REITs? How much do we need? How long will it take?

p

Quick introduction to dividends & REIT

A dividend is a form of return that companies agree to distribute to their shareholders. Here are some things you need to know about dividends:

- Dividends are not compulsory. Certain companies pay dividends while some companies can choose not to do so.

- Dividends are generally paid either monthly, quarterly, semi-annually, or annually (depending on a company’s distribution policy).

- There are 2 ways to look at dividends: Distribution Per Unit (DPU), and Dividend Yield (DY).

- Distribution Per Unit (DPU) refers to the absolute amount per share that is being paid to shareholders. So, if you own 5000 shares of a REIT that pays a DPU of $0.05, then you’ll get a total dividend of $250 (5000 shares*$0.05/unit).

- Dividend Yield (DY) refers to the percentage (%) of DPU relative to the price of the share (DY = (DPU/Price)*100). So, let’s say a REIT pays a DPU of $0.05 and the share price is $1.00/unit, then the dividend yield would be 5% [($0.05/$1.00)*100]

When it comes to dividends, REITs can be a good choice:

- REITs are unique companies in the stock market that allow investors to earn dividends by investing in income-generating properties.

- These properties can range from shopping centers, offices, factories, warehouses, data centers and more!

- REITs usually pay at least 90% of their income back to shareholders in the form of dividends. By investing in REITs, we are able to receive stable and (usually) higher-than-average dividends on a regular basis.

- There are 2 main ways to invest in REITs. One is to invest in individual REITs, and the other is to invest in REIT Exchange-Traded Funds (ETFs).

RELATED POST: 5 Singapore REIT ETFs to invest in for consistent dividends!

Expectation Setting: Why $1,000?

Now, before we proceed, it’ll be helpful to know that dividend investing is a long journey - especially if we start off with small capital.

The reality is that dividend investing is capital intensive. For most people, it’s not something that can be achieved overnight.

However, in my opinion, a $1,000/month dividend is a realistic milestone target. With the power of compounding (more on this later), most people can achieve a respectable dividend income in life.

Some investors may think an extra $1,000 is too little.

But remember this: the extra $1,000 is close to passive. Plus, an additional $1,000/month means an extra $12,000/year! For many, it could mean better quality groceries, better meals, a new phone – and certainly more choices in life.

Execution: How to start & how long will it take?

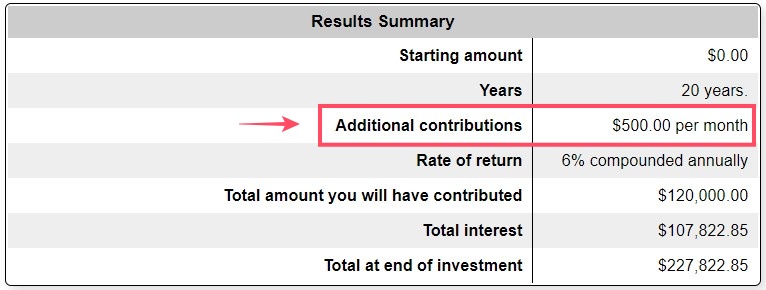

To begin, let’s assume we are starting exactly from nothing. Here's what we are doing to do:

- Contribute $500 monthly into REITs. Investors can decide to either invest in individual REITs, or in REIT ETFs that track the performance of a diversified REIT portfolio.

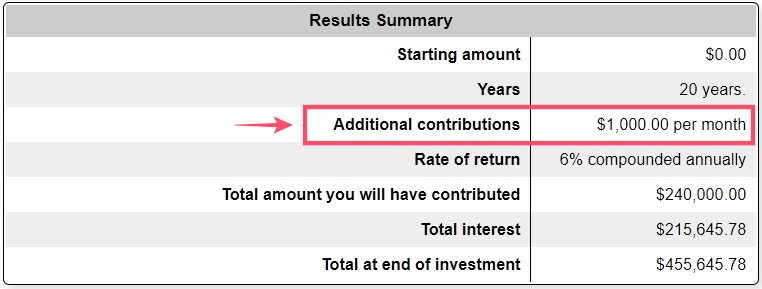

- We'll assume an annual dividend yield of 6%. This is realistic, and is in line with Singapore REIT's average dividend yield.

Compound our return: All dividends received are reinvested into our REIT portfolio until we reach $12,000 in yearly dividends (ie. $1,000/month).

Compound our return: All dividends received are reinvested into our REIT portfolio until we reach $12,000 in yearly dividends (ie. $1,000/month).- NOTE: The calculations below are hypothetical and can deviate from real-life performance. In addition, the calculations below do not take into account of potential capital growth, which may impact actual real-life performance.

So, given a 6% annual yield, how long will it take for us to reach a total of $12,000 in yearly dividends?

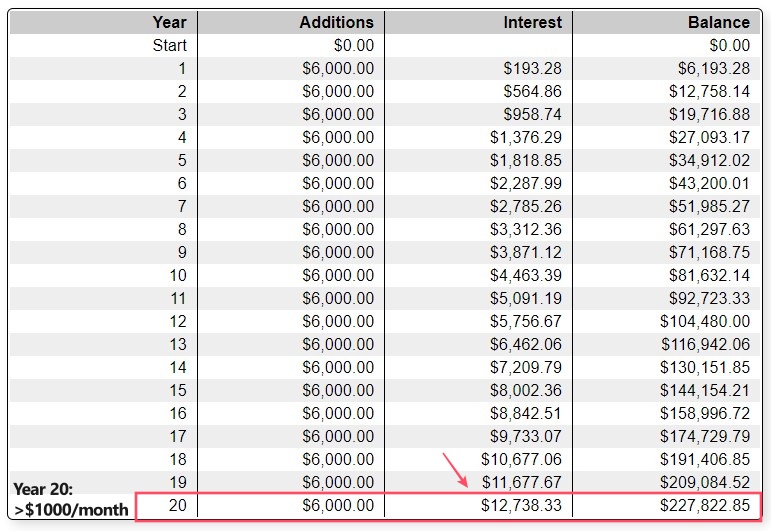

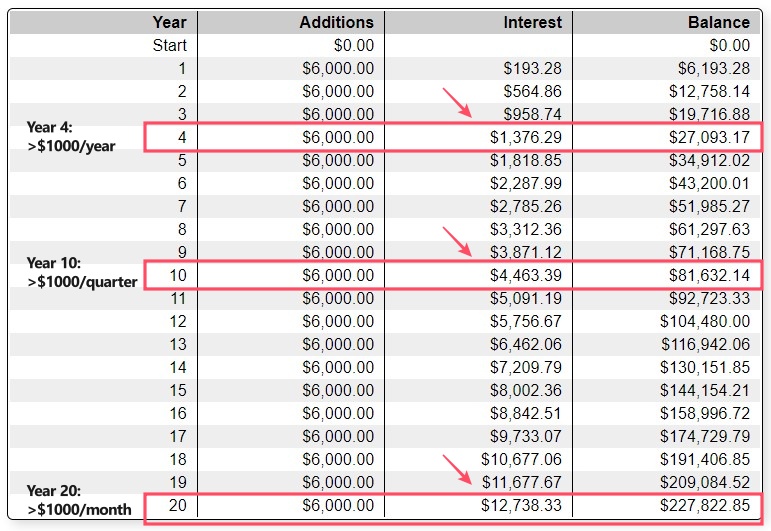

From the table below, it will take 20 years before we reach more than $12,000 in yearly dividends. Another insight that we can extract from this is that we’ll need about $200,000 in capital to achieve such a feat.

Twenty years is certainly a long time. But what if we can invest more on a regular basis?

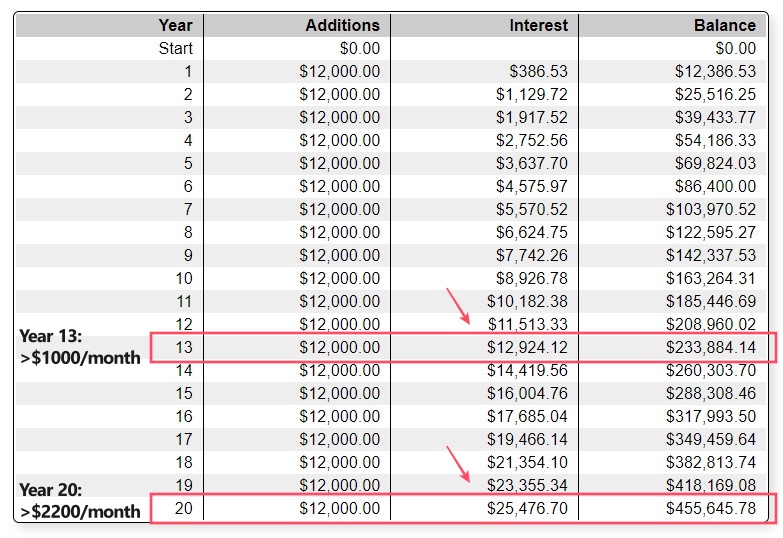

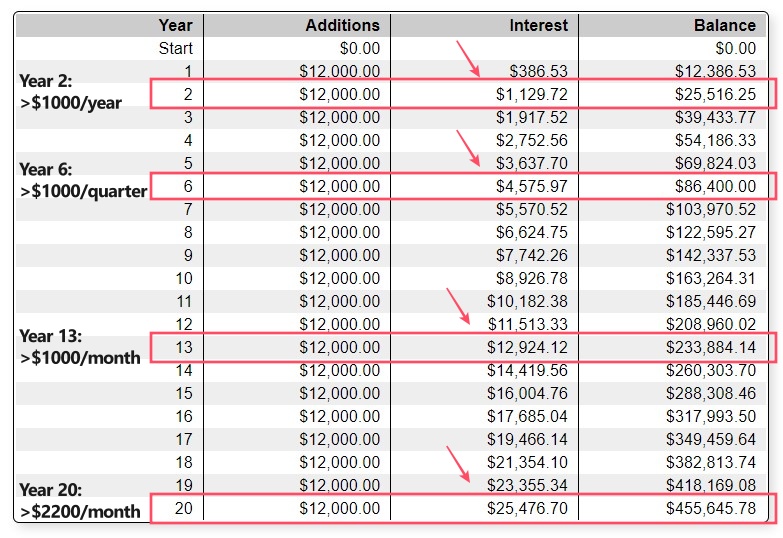

Below, let’s find out how long it’ll take for us to achieve $12,000 in yearly dividenda if we contribute $1,000/month instead of $500:

From the table below, with a $1,000 monthly contribution, it’ll take about 13 years for us to achieve more than $12,000 in yearly dividends.

By year 20, we’d be getting more than $25,000 in yearly dividends, which is more than $2,000/month!

Note: All tables/calculations are done using the Compound Interest Calculator from Bankrate.com

Lesson & Mindset: Aiming for small, achievable milestones

So, what are some key takeaways from this post?

- Capital is required to build a meaningful passive income via dividends. As an example, to achieve $12,000 in yearly dividends, a capital of about $200,000 is required at a 6% annual yield.

- That said, everyone can start building towards their desired dividend income even with small capital. Of course, the more capital we can contribute to our REIT portfolio, the faster we’ll be able to achieve our goals.

- It’s crucial that we reinvest our dividends. Letting our returns compound will make our dividend investing journey exponentially faster.

Now, while 13 or 20 years might seem to be a long journey, it is actually very realistic from the perspective of long-term investing. In this era, I think we are too ingrained in the idea of achieving something fast, that we forget the importance of growing our wealth step-by-step.

That said, it is helpful to break down our progress into small, achievable milestones, as shown below:

- Short-term milestone: $1,000 in yield per year

- Medium-term milestone: $1,000 in yield per quarter

- Long-term milestone: $1,000 in yield per month

By breaking down our goal into smaller milestones, it’ll make our investing journey much more meaningful. Below is the breakdown of each milestone using the same execution assumptions from the previous section:

(a) By investing $500/month, we can hit $1,000/year in dividend income by Year 4 and $1,000/quarter by Year 10.

(b) By investing $1,000/month, we can hit $1,000/year in dividend income by Year 2 and $1,000/quarter by Year 6.

The reward of compounding investment and patience?

A stream of reliable and passive income that requires almost no effort on our end – how awesome is that?

Resources: Want to learn more/invest in REITs & REIT ETFs?

There are 2 main ways to invest in REITs. One is to invest in individual REITs, and the other is to invest in REIT Exchange-Traded Funds (ETFs).

Both REITs and REIT ETFs are listed on the stock market and can be bought just like ordinary shares.

Useful resources:

- I’ve written an article on Singapore REIT ETFs, which I think you’ll find helpful. Check out my guide on Singapore REIT ETFs HERE.

- To start investing in REITs or REIT ETFs, you will need a reliable broker. Check out my full review of ProsperUs by CGS-CIMB HERE for more details.

- In addition, I’ve written multiple articles on REITs as well. Definitely check out my REIT articles HERE.

2 other REIT investing methods that I did not cover in this post

In this post, I’ve covered the simplest way to invest in REIT to build towards our dividend milestones:

By investing in REITs or REIT ETFs and re-investing the dividends, anyone can build towards a reliable passive dividend income to supplement their wealth.

Now, are there faster ways for you to achieve your dividend goals? Of course, there are!

Here are 2 other methods that I did not cover in this post:

#1 Taking margin financing to invest in REITs:

In simple terms, borrowing money to invest in REITs.

Just like taking a loan to buy physical properties, margin financing provides leverage to investors to own a bigger number of REITs with relatively small capital.

This can be a risky move as investors are exposed to the risk of margin call. Personally, I am not familiar with this approach and hence not able to write much about it.

#2 Covered Call Strategy:

This is an approach where investors can boost their dividend yield by selling call options on the stocks that they own to another investor.

That said, this approach involves options, which I personally have little knowledge of. I’ll study this further and cover this topic sometime in the future.

This post is sponsored by ProsperUs by CGS-CIMB.

Check out my full review on ProsperUs by CGS-CIMB HERE on how you can start your investment journey.

ProsperUs by CGS-CIMB is a regulated broker from Singapore that gives investors access to 30+ exchanges in more than 8 countries. (US, Hong Kong, China, Japan, UK, Singapore, Malaysia, Europe, and more!)

In addition, ProsperUs offers multiple instruments from stocks, ETFs, futures, options, Forex, and CFDs. This is great for investors looking to diversify across different asset classes.

Exclusive ProsperUs Referral Code – MONEY20

If you are thinking to give ProsperUs a try, here’s something exclusive to No Money Lah readers – you will not find this anywhere else!

From today till 30/6/2024, key in my exclusive promo code ‘MONEY20’ while you register, and get FREE cash credits up to SGD100 when you open a ProsperUs account:

Tier Initial funding within 30 days of account set up Trades Executed Cash Credits

1 Minimum SGD500 – SGD2,999 Minimum 3 trades executed SGD10

2 Minimum SGD3,000 – SGD14,999 Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD30 (Deposit SGD3000 or more + Min. trades fulfilled)

3 SGD15,000 or more

Minimum 3 trades executed SGD20 (Deposit SGD3000 or more), OR

SGD20 + SGD100 (Deposit SGD15,000 or more + Min. trades fulfilled)

Click HERE to view the full T&C of this referral reward.

Open a ProsperUs Account Today!

Disclaimers

This article is brought to you in collaboration with ProsperUs by CGS-CIMB.

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

This post may contain promo code(s) that afford No Money Lah a small amount of commission (and help support the blog) should you sign up through my referral link

[Sponsored Post] Guide: Invest in Singapore REIT ETFs for passive dividend income!

Real Estate Investment Trusts, or REITs are unique companies in the stock market that allow investors to earn dividends by investing in income-generating properties.

These properties can range from shopping centers, offices, factories, warehouses, data centers and more!

By investing in REITs, we are able to receive stable and (usually) higher-than-average dividends on a regular basis.

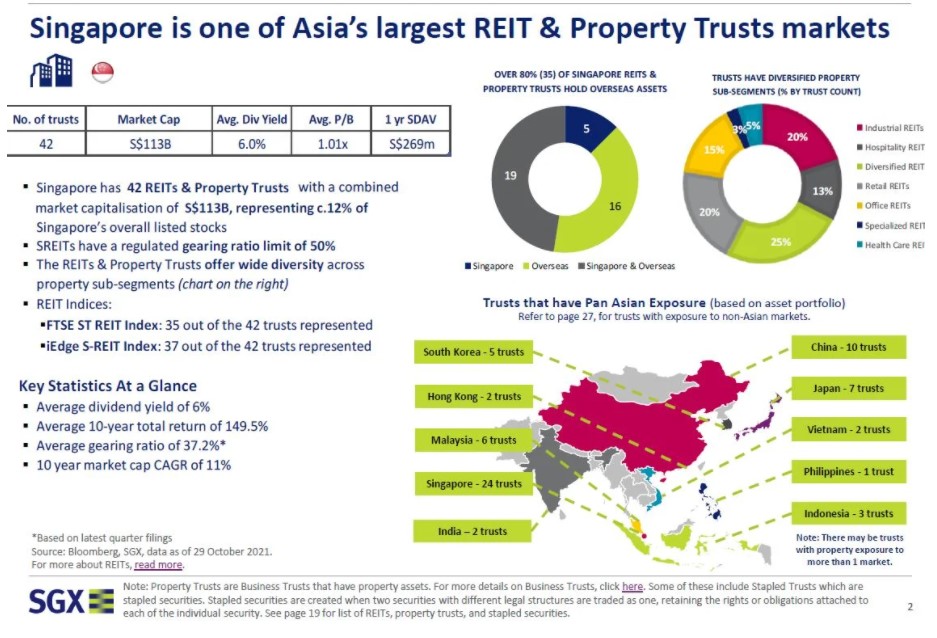

When it comes to REITs, the Singapore REIT market is one of the most established REIT markets in Asia with 42 listed REITs generating an annualized growth of 11% in the past 10 years.

p

What is a REIT ETF + 5 REIT ETFs listed in Singapore

There are 2 main ways to invest in REITs. One is to invest in individual REITs, and the other is to invest in REIT Exchange-Traded Funds (ETFs).

Both REITs and REIT ETFs are listed in the stock market and can be bought just like ordinary shares.

For this post, I’ll focus on the REIT ETFs listed in Singapore.

ETF is an instrument that tracks the performance of an index. In this case, a REIT ETF tracks the performance of a REIT index.

There are 5 Singapore-listed REIT ETFs, namely:

- Phillip SGX APAC Dividend Leaders REIT ETF (SGD: BYJ | USD: BYI)

- NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI)

- Lion-Phillip S-REIT ETF (SGD: CLR)

- CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU)

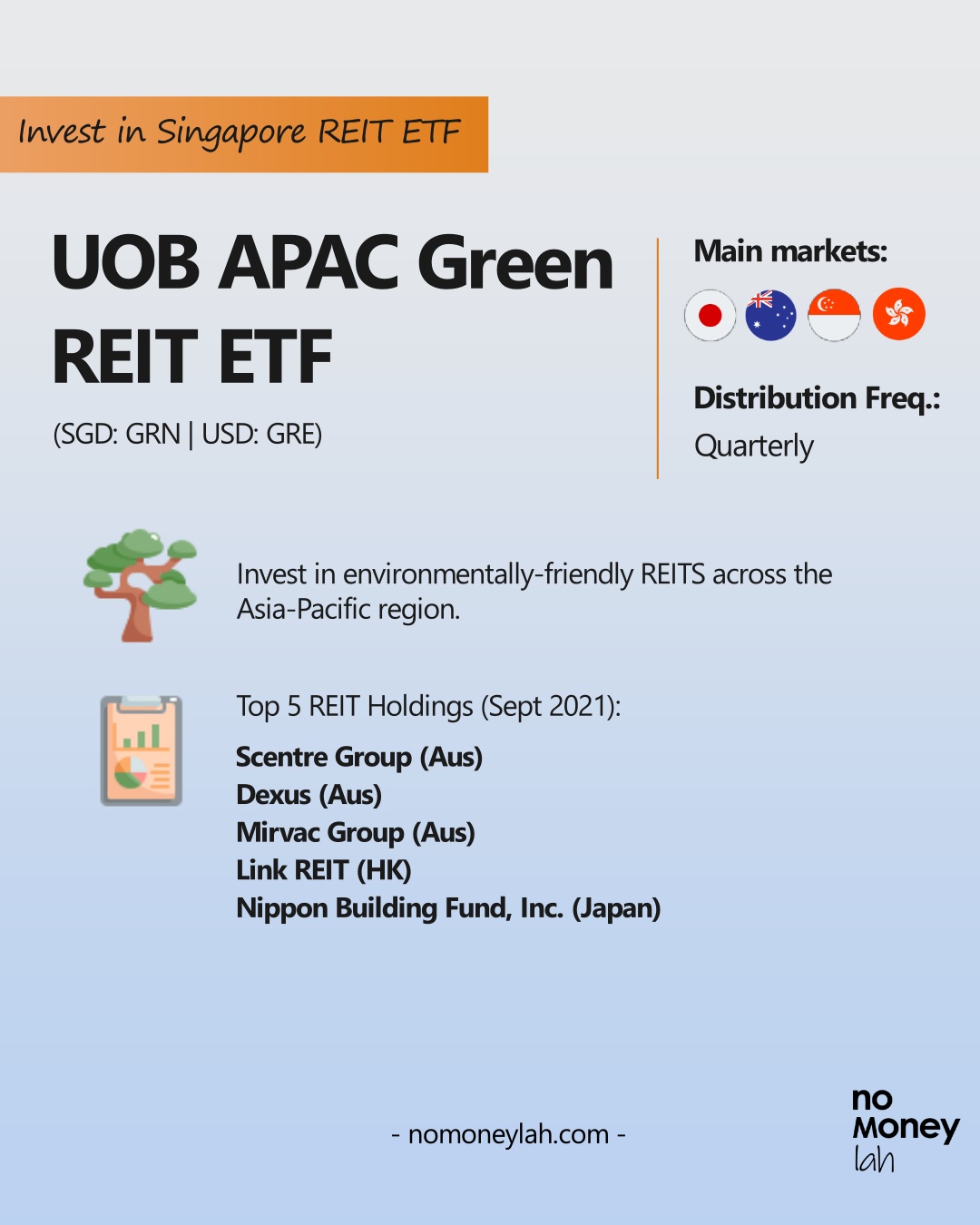

- UOB APAC Green REIT ETF (SGD: GRN | USD: GRE)

Why Singapore-listed REIT ETF?

In general, investing in REIT ETFs brings several advantages to investors compared to investing in individual REITs:

#1 Investors get to invest in a diversified REIT portfolio via REIT ETFs.

This helps to mitigate individual company risk.

p

#2 Investors get to invest passively via REIT ETFs.

A REIT ETF will rebalance on a regular basis to include quality REITs and exclude REITs that do not fulfill the filtering criteria (or methodology) of the index.

As such, investors do not have to spend time picking individual REITs. By design, REIT ETFs will filter for quality REITs based on their methodologies.

p

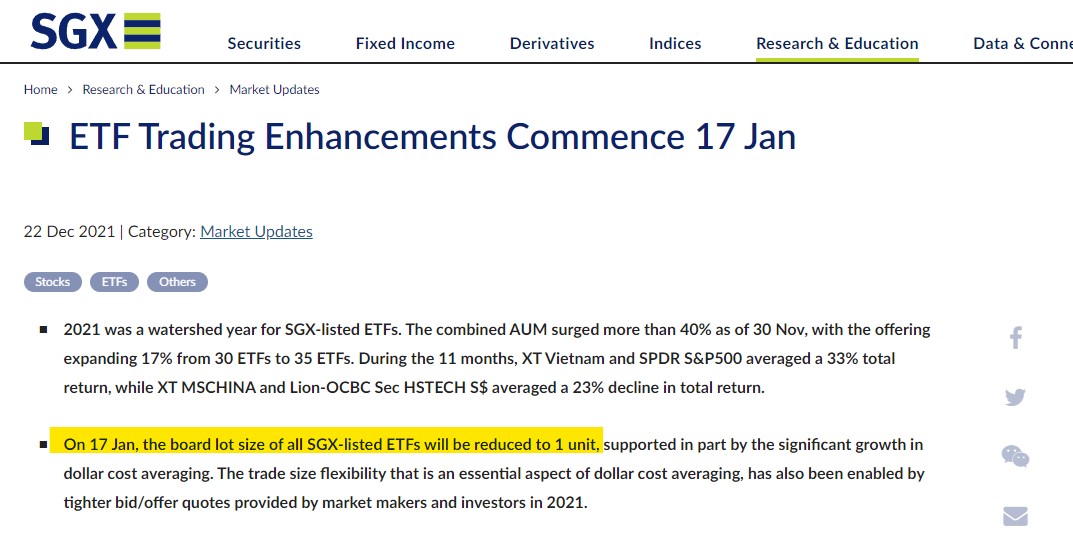

#3 NEW: Start investing in REIT ETFs from as small as 1 unit!

Starting 17th January 2022, investors can invest in all Singapore-listed ETFs starting from just 1 unit!

Previously, there is a minimum purchase requirement of 5 to 100 units of shares.

This is an initiative from the Singapore Stock Exchange (SGX) to provide more flexibility to investors to invest in ETFs, and this is certainly welcoming.

So, let’s say Lion-Phillip S-REIT ETF is priced at SGD 1.05/share, our minimum investment would be 1 unit, which is a total capital requirement of SGD 1.05.

In the following section, let me do an overview of all 5 REIT ETFs in Singapore:

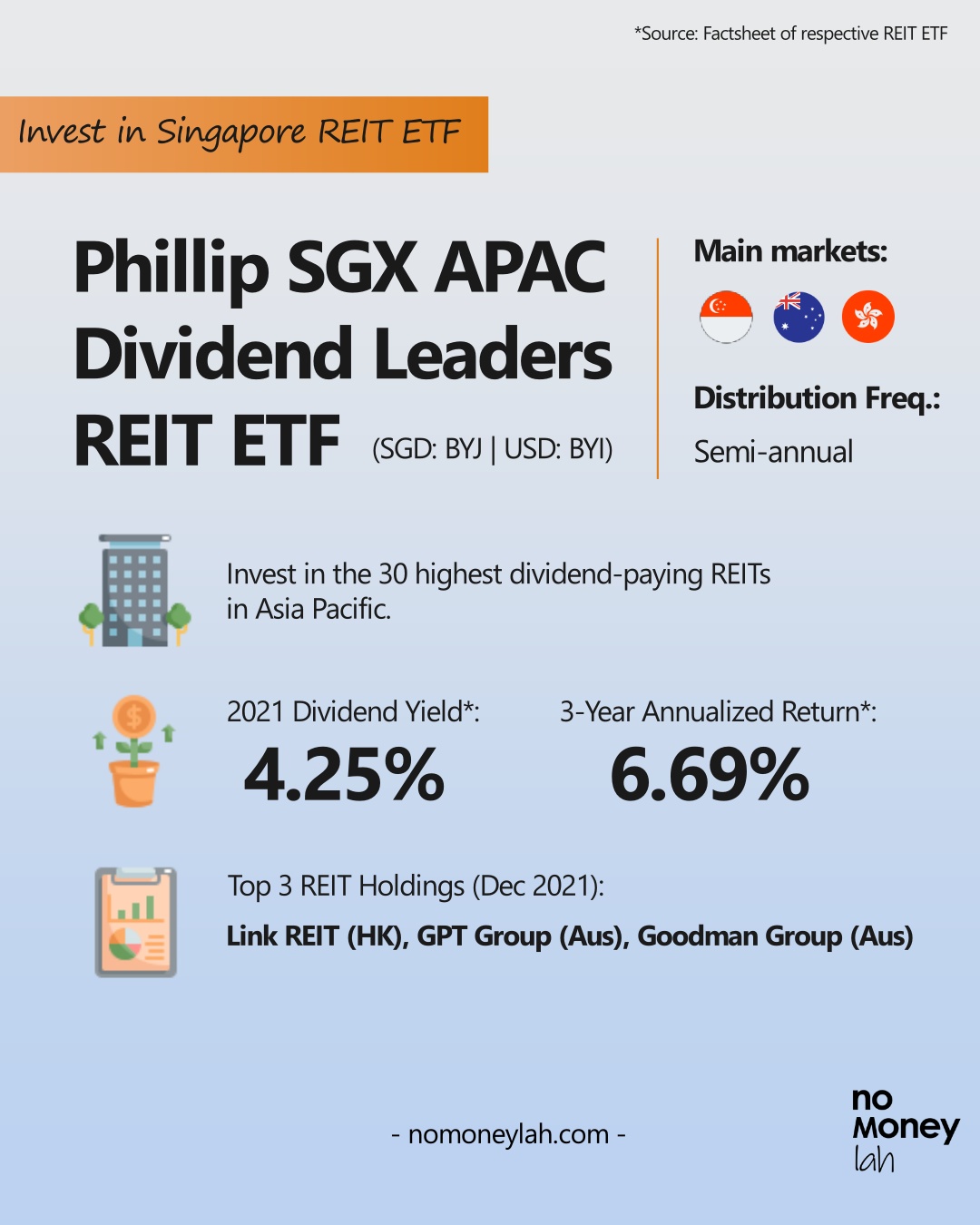

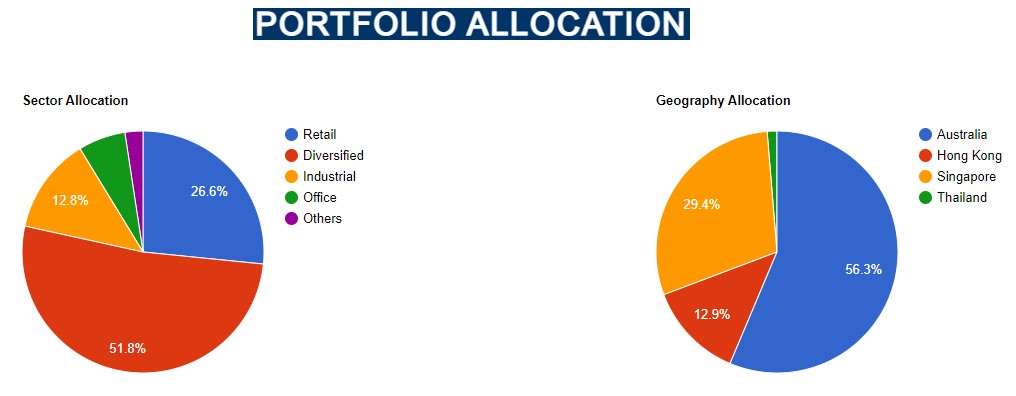

#1 Phillip SGX APAC Dividend Leaders REIT ETF (SGD: BYJ | USD: BYI)

The Phillip SGX APAC Dividend Leaders REIT ETF is an ETF that tracks the iEdge APAC ex Japan Dividend Leaders REIT Index. It is an index that comprises of the 30 highest dividend-paying REITs in the Asia Pacific.

The Phillip SGX APAC Dividend Leaders REIT ETF is listed in October 2016. It is the oldest among the 5 REIT ETFs in Singapore.

In terms of methodology, this ETF filters and weights REITs according to the total dividends paid in the past 12 months. By doing so, it aims to enhance the returns of conventional market-cap weighted ETFs.

Phillip SGX APAC Dividend Leaders REIT ETF tracks 30 REITs, mainly from Australia, Singapore, and Hong Kong.

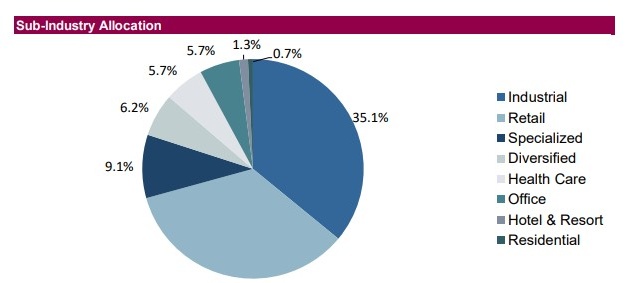

As for section allocation, Diversified REITs formed about half of the ETF allocation.

The table below shows the top 10 REIT holdings of the Phillip SGX APAC Dividend Leaders REIT ETF:

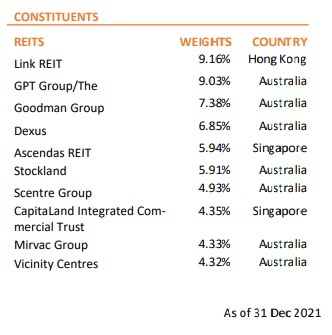

#2 NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI)

NikkoAM-StraitsTrading Asia Ex Japan REIT ETF is an ETF that tracks the FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index.

It is an index that tracks the performance of qualifying REITs from China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, and Thailand.

That said, as of November 2021, most of the REIT holdings of this ETF are focused on Singapore and Hong Kong REITs, with retail and industrial REITs forming the majority.

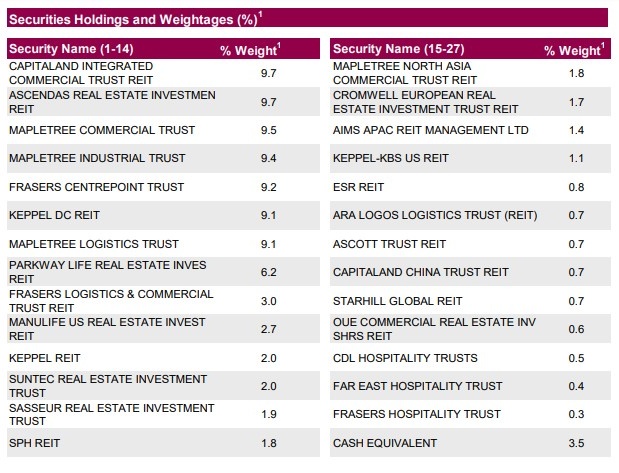

Below are the top 10 REIT holdings of NikkoAM-StraitsTrading Asia Ex Japan REIT ETF:

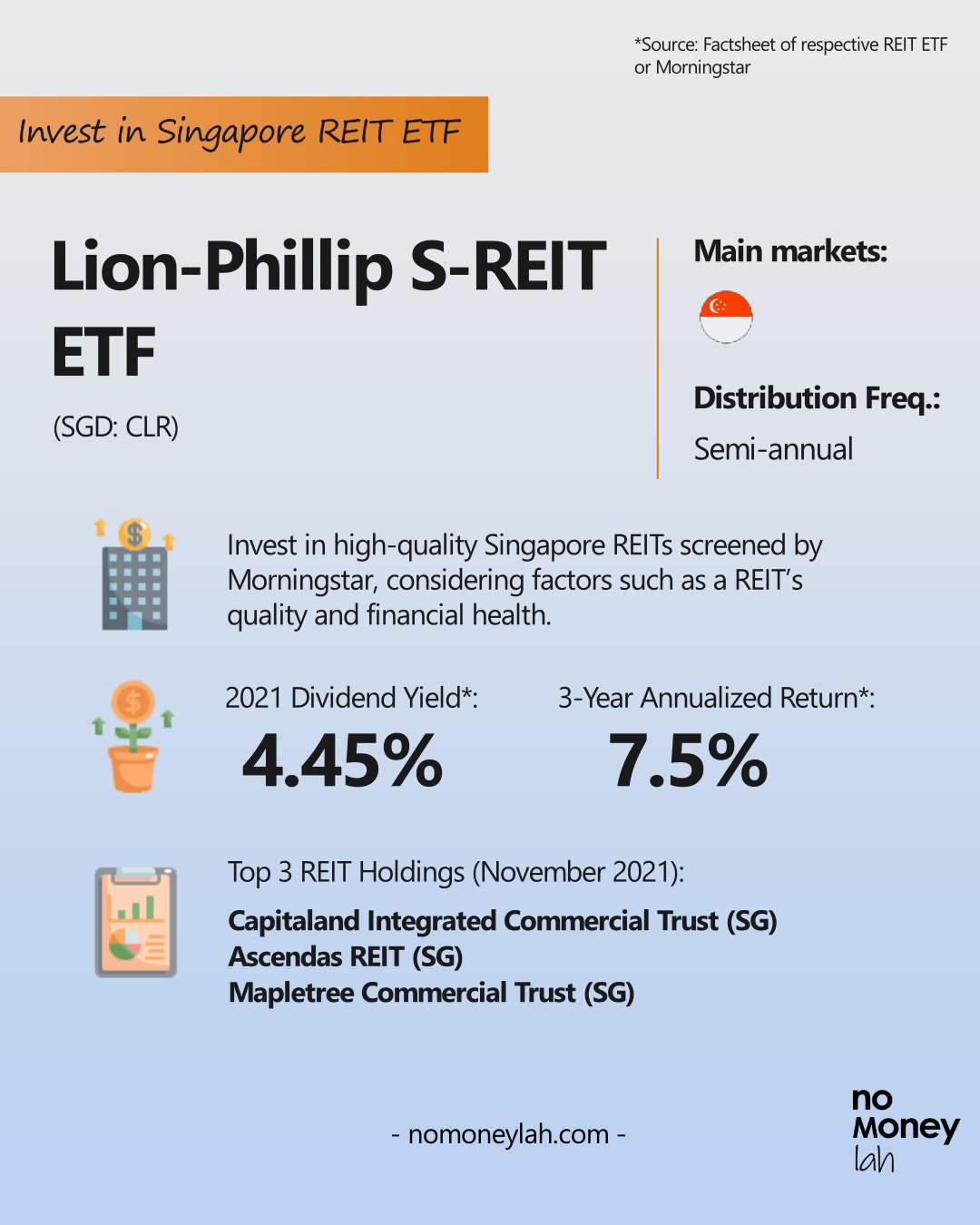

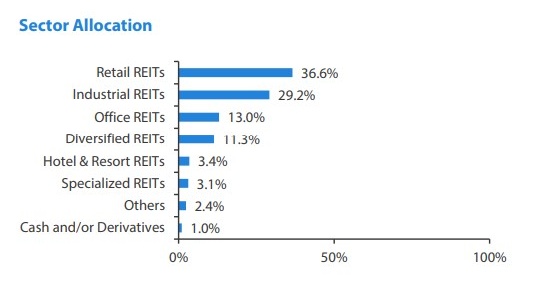

#3 Lion-Phillip S-REIT ETF (SGD: CLR)

The Lion-Phillip S-REIT ETF is an ETF that tracks the Morningstar Singapore REIT Yield Focus Index. It is an index that invests in high-quality Singapore REITs (S-REITs) screened by Morningstar.

In terms of methodology, the index is designed by Morningstar Research Pte. Ltd. to screen for high-yielding REITs, taking into account of factors such as a REIT’s quality and financial health.

As for the sector breakdown, the ETF is mainly made up of industrial and retail REITs (as of Nov 2021).

The table below shows the S-REIT holdings of the Lion-Phillip S-REIT ETF (as of Nov 2021):

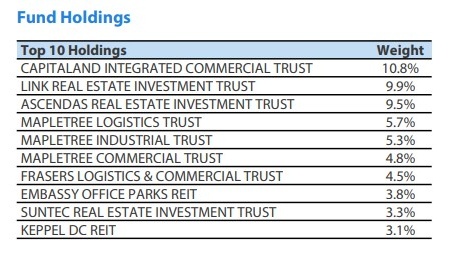

#4 CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU)

CSOP iEdge S-REIT Leaders Index ETF is a S-REIT ETF that tracks the iEdge S-REIT Leaders Index. It tracks the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange (SGX).

As for the methodology, this ETF employs a liquidity-adjustment strategy.

Essentially, what this strategy does is it’ll only capture S-REITs with high investors’ interest, fund flows, and REITs that are most relevant to the latest sector rotation.

As such, the REITs tracked by the ETF are always the most relevant REITs according to the market condition.

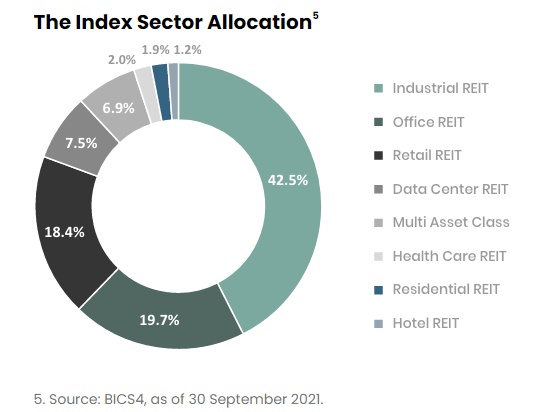

As for the sector breakdown, the ETF is mainly made up of industrial REITs.

Below are the top 10 REIT holdings of the CSOP iEdge S-REIT Leaders Index ETF:

READ: Check out my detailed writeup on CSOP iEdge S-REIT Leaders Index ETF HERE

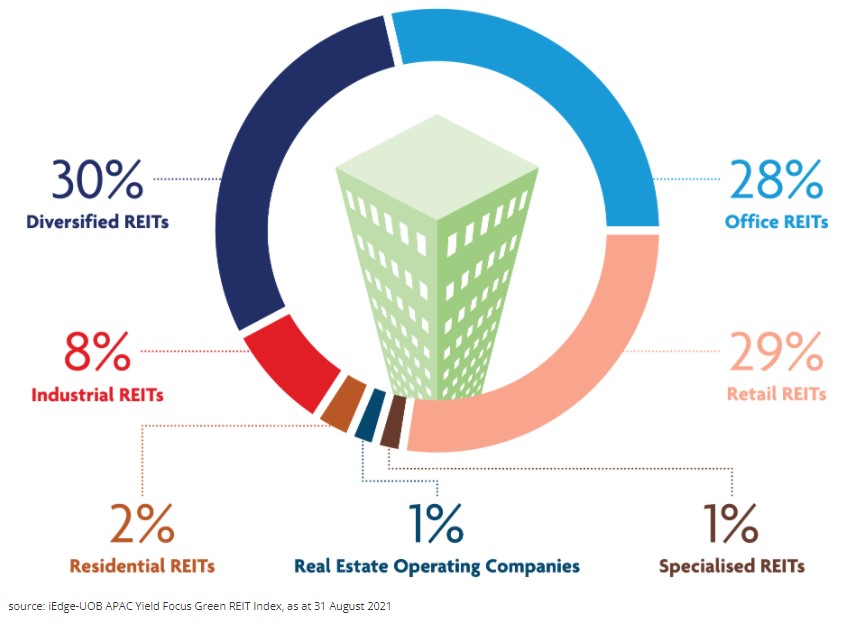

#5 UOB APAC Green REIT ETF (SGD: GRN | USD: GRE)

The UOB APAC Green REIT ETF mirrors the iEdge-UOB APAC Yield Focus Green REIT index, which aims to allow investors to invest in environmentally-friendly REITS.

Listed in the SGX on 23rd November 2021, this REIT ETF is the newest addition to the REIT ETFs in Singapore.

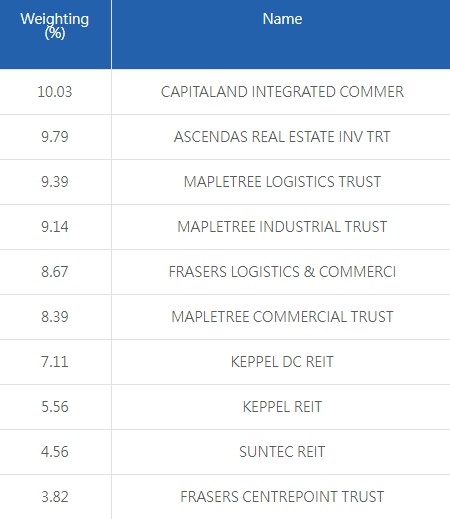

The UOB APAC Green REIT ETF contains 50 REITs listed across the Asia-Pacific region, with Japan (40%), Australia (36.6%), and Singapore (15.7%) REITs being the majority REIT holdings.

Below are the top 10 holdings of the ETF, as of 30th September 2021:

Singapore-listed REIT ETFs comparison

| Phillip SGX APAC Dividend Leaders REIT ETF | NikkoAM-StraitsTrading Asia Ex Japan REIT ETF | Lion-Phillip S-REIT ETF | CSOP iEdge S-REIT Leaders Index ETF | UOB APAC Green REIT ETF | |

|---|---|---|---|---|---|

| Ticker | BYJ (SGD), BYI (USD) | CFA (SGD), COI (USD) | CLR (SGD) | SRT (SGD), SRU (USD) | GRN (SGD), GRE (USD) |

| Underlying Index | iEdge APAC ex Japan Dividend Leaders REIT Index | FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index | Morningstar Singapore REIT Yield Focus Index | iEdge S-REIT Leaders Index | iEdge-UOB APAC Yield Focus Green REIT Index |

| Main REIT market exposure | Australia, HK & Singapore | Singapore & HK | Singapore | Singapore | Japan, Australia, Singapore & HK |

| Listing Date | 20/10/2016 | 29/3/2017 | 30/10/2017 | 18/11/2021 | 23/11/2021 |

| Unit Price (18/1/2022) | SGD 1.396 | SGD 1.061 | SGD 1.05 | SGD 0.953 | SGD 0.956 |

| Fund Size (18/1/2022) | SGD 18.31 million | SGD 341.87 million | SGD 236.23 million | SGD 82.10 million | SGD 82.24 million |

| No. of Holdings | 30 | 43 | 27 | 28 | 50 |

| Expense Ratio | 1.16% | 0.60% | 0.60% | 0.60% | Management fee: Currently 0.45% p.a.; Maximum 2% |

| Distribution Frequency | Semi-annual | Quarterly | Semi-annual | Semi-annual | Quarterly |

| 2021 Dividend Yield (Respective factsheets/Morningstar) | 4.25% | 4.27% | 4.45% | N/A** | N/A** |

| 3-year annualized return* | 6.69% (SGD) | 4.45% (SGD) | 7.5% (SGD) | N/A** | N/A** |

**Info not available as this REIT ETF is newly listed.

How to choose the best REIT ETF?

From the table above, it seems like each REIT ETF is closely similar to each other. Below, let me share with you some personal pointers that I think one should consider when selecting a REIT ETF:

-

REIT exposure

Do you want a REIT portfolio that is focused on Singapore REITs (S-REITs), or REIT exposure across Asia (eg. Singapore, Australia, Hong Kong, Japan)?

Certain REIT ETFs such as Lion-Phillip S-REIT ETF (SGD: CLR) and CSOP iEdge S-REIT Leaders Index ETF (SGD: SRT | USD: SRU) offer dedicated exposure to S-REITs, while the remaining offer exposure to REITs across Asia.

p

-

Fund size

In general, an ETF with a larger size fund size is a good indicator of the ETF’s durability as well as its popularity.

Larger ETFs can also make use of economies of scale to lower their costs.

In this aspect, ETFs like NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD: CFA | USD: COI) and Lion-Phillip S-REIT ETF (SGD: CLR) are the obvious winner here.

p

-

Expense Ratio

ETF providers charge a small annual management fee for their ETFs. In this case, most ETFs have a low expense ratio (<1.00%) so the difference is negligible.

Of all, Phillip SGX APAC Dividend Leaders REIT ETF has the highest expense ratio of 1.16%, which is a tad higher than the other REIT ETFs in the list.

p

-

Methodology

How a REIT ETF select and filter for REITs is also important.

As an example, the Lion-Phillip S-REIT ETF (SGD: CLR) screens for high-yielding REITs by taking into account of factors such as a REIT’s quality and financial health.

Selecting the right REIT ETF methodology will require investors to go through the prospectus of the REIT ETF.

p

-

Consistency/Growth in Distribution (DPU)

A key benefit of investing in REIT ETF is to receive consistent dividends.

As such, it is healthy to find out if the Distribution Per Unit (DPU) of each REIT ETF has been consistent, or better, growing over the past years.

The table below displays the DPU of each REIT ETF from 2018 to 2020:

| Phillip SGX APAC Dividend Leaders REIT ETF (USD) | NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGD) | Lion-Phillip S-REIT ETF (SGD) | |

|---|---|---|---|

| 2021 | 0.03069 | 0.0468 | 0.048 |

| 2020 | 0.0273 | 0.0578 | 0.0499 |

| 2019 | 0.0492 | 0.0494 | 0.0492 |

| 2018 | 0.0341 | 0.04691 | 0.0348 |

Note:

(1) Dividend Yield = (DPU/Price)*100

(2) The remaining REIT ETFs do not have historical DPU as they are newly listed in late 2021

Kickstart your investment in REIT ETFs today!

To start investing in Singapore-listed REIT ETFs, you will have to use a broker with access to the Singapore stock market. Check out my full review on ProsperUs by CGS-CIMB HERE for more details.

Disclaimers

This post is produced purely for sharing purposes and should not be taken as a buy/sell recommendation. Past return is not indicative of future performance. Please seek advice from a licensed financial planner before making any financial decisions.

[Sponsored Post] What is ASNB and How to Invest in It?

ASNB unit trust funds are funds that are managed by Amanah Saham National Berhad (ASNB), a wholly-owned subsidiary company of Permodalan Nasional Berhad (PNB). It was established on 22 May 1979 to manage the Funds launched by PNB.

In short, ASNB is a unit trust management company with decades of experience.

p

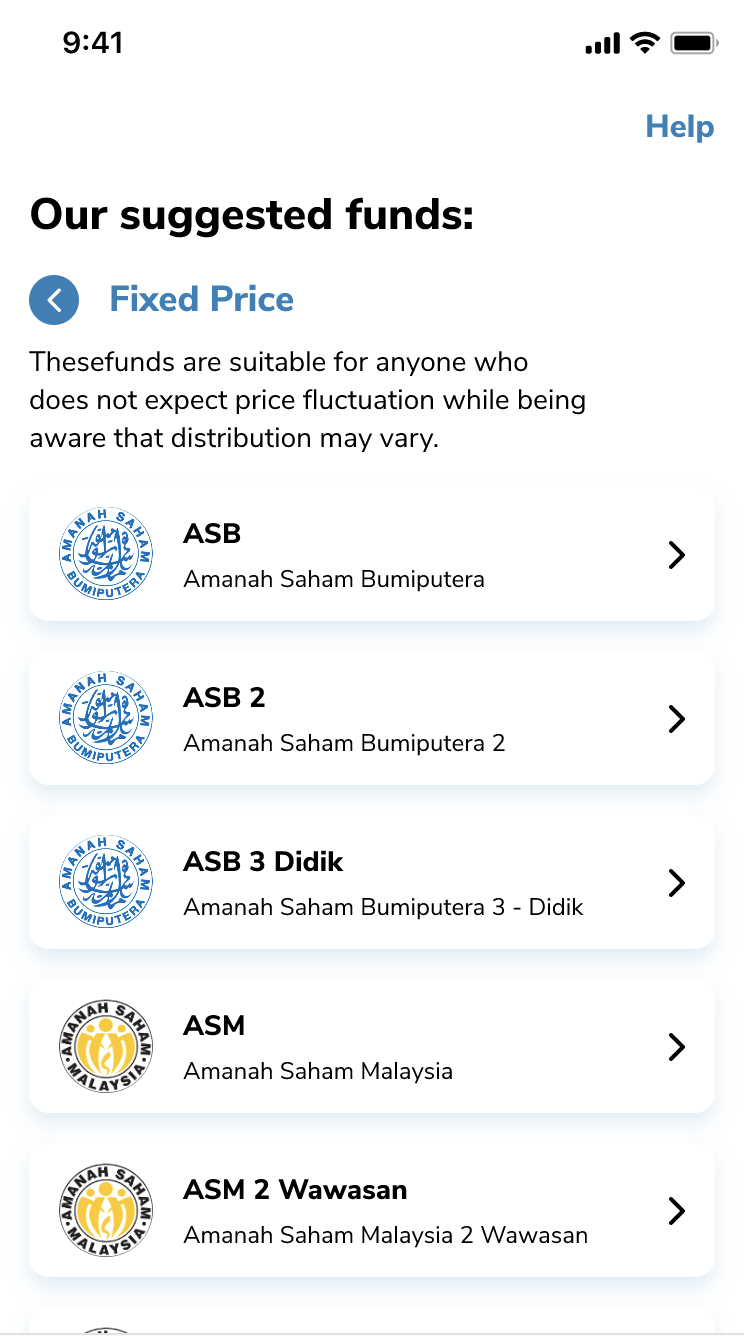

ASNB Fixed Price Fund & Variable Price Funds

As of the time of writing, there are a total of 16 funds offered by ASNB. Of all, there are 6 Fixed Price Funds and 10 Variable Price Funds:

p

| Fixed Price Funds | Variable Price Funds |

|---|---|

| Amanah Saham Bumiputera (ASB) | Amanah Saham Nasional (ASN) |

| Amanah Saham Bumiputera 2 (ASB 2) | ASN Equity 2 |

| Amanah Saham Bumiputera 3 - Didik (ASB 3 Didik) | ASN Equity 3* |

| Amanah Saham Malaysia (ASM)* | ASN Equity 5* |

| Amanah Saham Malaysia 2 – Wawasan (ASM 2 Wawasan)* | ASN Equity Global* |

| Amanah Saham Malaysia 3 (ASM 3)* | ASN Imbang 1* |

| ASN Imbang 2* | |

| ASN Imbang 3 Global* | |

| ASN Sara 1* | |

| ASN Sara 2* |

Differences between ASNB Fixed Price Funds and Variable Price Funds

p

| ASNB Fixed Price Funds | ASNB Variable Price Funds | |

|---|---|---|

| Value | Fixed @ RM1/unit | Varies according to the Net Asset Value (NAV) |

| Sales Charge | 0% | 1.75% - 5% |

| Return | Annual dividend payout | Annual dividend payout & capital gain (ie. Selling Price > Buying Price) |

Essentially, Variable Price Funds are similar to other unit trusts in the market.

As the name suggests, Variable Price Funds are funds that will fluctuate in value in accordance with market movement.

This also indicates that there’s a potential for higher gains and losses. That said, do remember that past performance is not indicative of future performance.

In terms of fees, Variable Price Funds have a sales charge between 1.75% to 5%, depending on the channel of purchase.

On the other hand, ASNB’s Fixed Price Funds are more unique.

For one, the value of the funds is fixed at RM1/unit no matter the market condition. In addition, there is also no sales charge (yes, 0%) for all 6 Fixed Price Funds.

Benefits of ASNB Fixed Price Funds

In the past, I have been receiving many requests to cover ASNB Fixed Price Funds. In this section, let’s explore the benefits of these funds as they are seriously one-of-a-kind.

Personally, I am genuinely happy to see that out of the 6 Fixed Price Funds, 3 (ASM, ASM 2, ASM 3) are actually open to all Malaysians, and I am delighted for good reasons:

#1 ASNB Fixed Price Funds’ Unit value is fixed at RM1/unit

Currently, all ASNB Fixed Price Funds are sold at RM1/unit.

This is a unique and convenient feature of Fixed Price Funds as you can plan your purchase without worrying about sudden price swings.

p

#2 ASNB Fixed Price Funds pay decent dividends

ASNB Fixed Price Funds are well-accepted by fellow Malaysians for good reasons. One of them is because they are able to deliver decent dividends over the long term.

As an example, for the financial year (FY) 2020, all Fixed Price Funds were able to deliver dividends of 4% and above despite the challenging market condition.

| Fixed Price Fund | Distribution Per Unit (sen) - FY2020 | Dividend Yield - FY2020 |

|---|---|---|

| Amanah Saham Bumiputera (ASB) | 5.00 (including bonuses) | 5% |

| Amanah Saham Bumiputera 2 (ASB 2) | 4.75 | 4.75% |

| Amanah Saham Bumiputera 3 - Didik (ASB 3 Didik) | 4.25 | 4.25% |

| Amanah Saham Malaysia (ASM) | 4.25 | 4.25% |

| Amanah Saham Malaysia 2 – Wawasan (ASM 2 Wawasan) | 4.00 | 4.00% |

| Amanah Saham Malaysia 3 (ASM 3) | 4.00 | 4.00% |

p

#3 Dividends earned is not taxable

In other words, you do not have to worry about tax filing.

p

#4 ASNB Fixed Price Funds have no sales charge

Another highlight feature of Fixed Price Funds is there is no sales charge. Meaning, you do not have to pay any sales fee if you purchase new units.

That said, some funds such as ASB 2 and ASM 3 have full discretion to charge a 1% sales fee – just saying.

p

#5 On-The-Spot Redemption

You can withdraw your investments and get your money immediately (either via cash/cheque/bank transfer).

On the other hand, online redemptions of up to RM1,000 a month are now available via myASNB portal and myASNB app.

What you need to know + Risks of investing in ASNB Funds

One thing that we have to keep in mind is that there are no investments that are 100% risk-free. Here are what you need to know before investing in ASNB Funds:

#1 Market Risks and Interest Rate Risk

The returns & performance of both ASNB Variable and Fixed Price Funds are subject to the fluctuation of the market and interest rate.

Specifically for Fixed Price Funds, while the unit value remains fixed at RM1/unit, dividend payout may fluctuate in accordance with the funds’ exposure to market movements and interest rate.

p

#2 Your Capital is not Protected by PIDM

Just like any instruments with exposure to the capital market, your money is not protected by Perbadanan Insurans Deposit Malaysia (PIDM) if ASNB goes bankrupt.

p

#3 Availability of Funds

For ASM Funds, there is a quota capped to non-bumi. When the quota is fully filled, you may have a hard time trying to buy the funds (unless someone lets go of their units).

p

#4 Withdrawal Limits

Online redemptions via myASNB portal and myASNB app are available, but are only up to RM1,000 a month.

Any withdrawal of funds with value above RM1,000 must be made over the counter at ASNB’s branches and agents.

How to open an ASNB account & invest in ASNB Funds

Opening an ASNB account used to be something that has to be done physically via ASNB branches or agents (eg. Most banks).

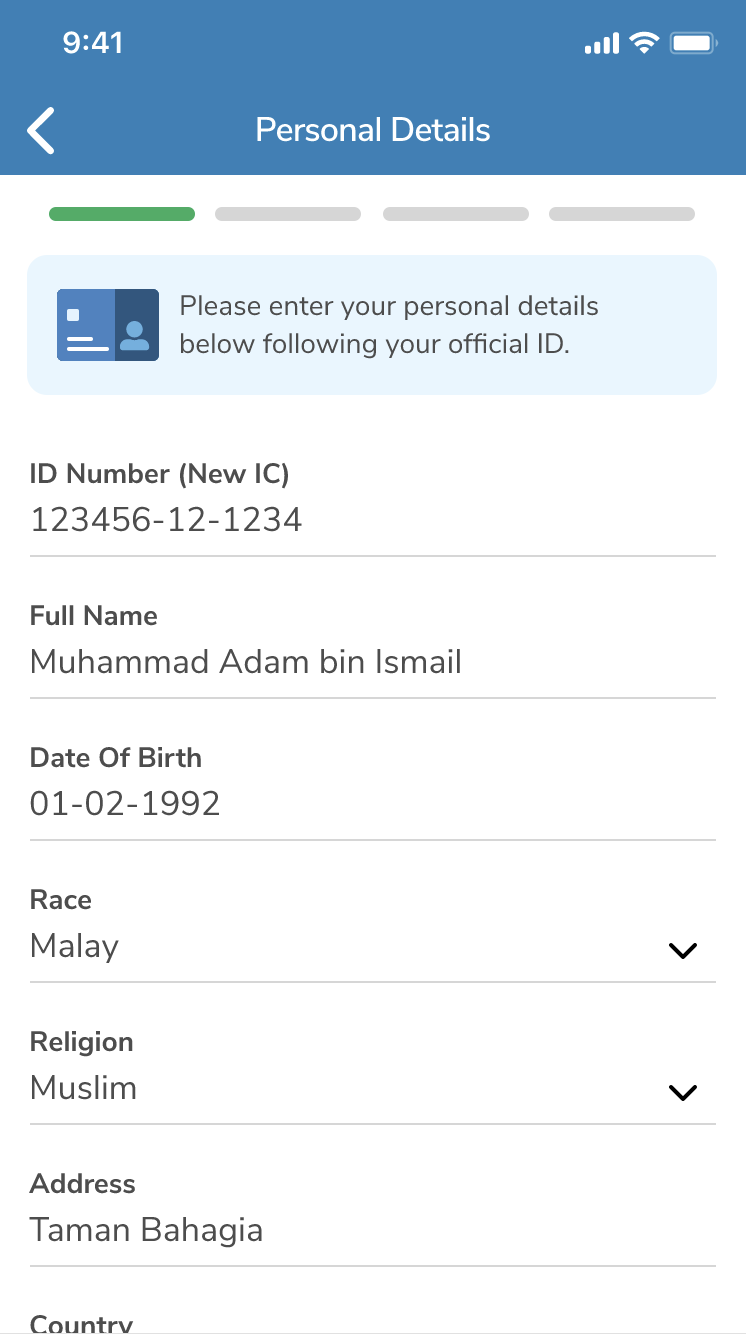

Just introduced in 2021, new ASNB accounts can be opened digitally via the myASNB app! Here’s how you can open your ASNB account via myASNB app:

-

Step 1: Download & install the myASNB app

-

Step 2: Register for your ASNB account by keying in your personal details.

[Note: If you are unable to get your OTP while trying to register for the myASNB app, consider contacting the customer service number for ASNB at 03 – 7730 8899 or email them at [email protected] where they'll assist you on the matter.]

-

Step 3: Take a photo of your IC and complete the video selfies for verification purposes.

-

Step 4: Setup your username & password.

-

Step 5: You are done! Now, proceed to buy your first ASNB units.

-

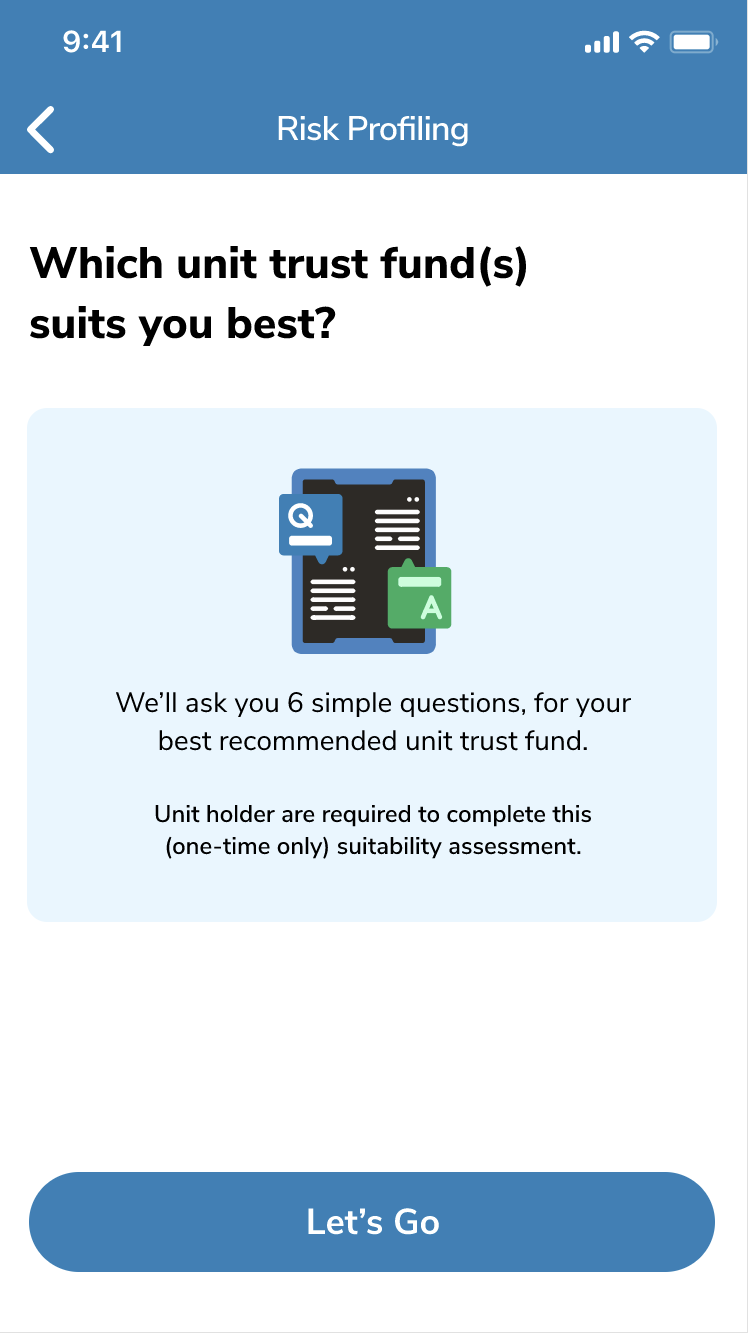

Step 6: As a first-time user, you are required to complete a one-time-only risk assessment.

Doing so, ASNB will suggest funds according to your risk profile.

-

Step 7: Make an initial investment of RM10.00 via FPX online banking or selected e-wallets.

-

Step 8: Now, you have successfully purchased your first ASNB units!

Feel free to add on to your units via the myASNB portal and/or app, with a minimum additional investment of RM100.

If you need more details, check out the official ASNB webpage regarding mobile registration and onboarding HERE for instructions and FAQs.

There’s also a tutorial video available on ASNB’s YouTube channel HERE.

No Money Lah’s Verdict

In my opinion, ASNB has certainly built up the habit of consistent investing among fellow Malaysians.

Now that new users can open an ASNB account online, it makes it even more accessible for Malaysians to invest and grow their wealth.

Are you investing in ASNB funds at the moment? If not, are you looking to start investing in ASNB funds now that everything can be done online?

Feel free to let me know by leaving your thoughts in the comment section below!

Disclaimers:

This article is written in collaboration with ASNB.

Investing involves risks and past return is not indicative of future performance. Please seek a licensed financial planner before making important financial decisions.

The Replacement Master Prospectus of ASNB dated 1 February 2020, Prospectus of ASN Imbang (Mixed Asset Balanced) 3 Global dated 16 September 2020 and Prospectus of ASN Equity Global dated 1 September 2021, (“Prospectuses”), have been registered with the Securities Commission Malaysia.

Please read and understand the content of the Prospectuses together with the Product Highlights Sheets which are available at the ASNB website (www.asnb.com.my), branches, and agents. Unit will be issued upon receipt of the registration form referred to and accompanying the Prospectuses. Before investing, please consider the risk of investing as well as the fees and charges involved. Unit prices and distribution payable, if any, may go down as well as up. The past performance of a fund should not be taken as indicative of its future performance.

Disclaimer Statement on Advertisement of ASNB Products and Related Services: In accordance with the Guidelines on Advertising for Capital Market Products and Related Services, all advertisements and promotional materials produced by ASNB are reviewed by Compliance Department, Permodalan Nasional Berhad and do not require review from the Securities Commission Malaysia.